Overview

This article offers essential insights into FHA loans in Georgia, specifically designed for families striving for affordable homeownership options. We understand how challenging this journey can be, and we want to highlight the benefits of FHA loans, including:

- Low down payment requirements

- Flexible credit standards

It’s crucial to choose the right lender and to be aware of the associated costs and requirements. By doing so, you can navigate the mortgage process more effectively and with greater confidence. We’re here to support you every step of the way.

Introduction

Navigating the world of home financing can feel overwhelming, especially for families eager to secure a place they can truly call their own. We understand how challenging this can be. FHA loans in Georgia have become a beacon of hope for many, offering low down payment options and flexible credit requirements that make homeownership more attainable than ever. Yet, with various lenders and programs available, how can families ensure they are making the best choice for their financial future? This article explores seven key insights about FHA loans in Georgia, providing valuable information designed to empower families as they confidently embark on their homeownership journey.

F5 Mortgage: Your Trusted Partner for FHA Loans in Georgia

At F5 Mortgage LLC, we understand how overwhelming the mortgage process can be. As a leading independent mortgage brokerage in Georgia, we focus on helping families like yours achieve their homeownership dreams through an FHA loan in Georgia. Our commitment to client satisfaction means we offer personalized consultations and a diverse range of financing options tailored to your unique needs.

Navigating the complexities of FHA financing doesn’t have to be daunting. Our streamlined application process is designed to make your journey toward homeownership as smooth as possible. We know how challenging this can be, and we’re here to .

Current trends indicate that the FHA loan in Georgia is particularly beneficial for households, thanks to low down payment requirements and flexible credit score standards. This accessibility opens doors for first-time homebuyers and those with unique financial situations, allowing you to explore a wider array of housing options.

At F5 Mortgage, we have built successful partnerships with top lenders, which enhances our ability to offer competitive rates and terms. These collaborations not only expand your choices but also reinforce our reputation as a trusted partner in your home buying journey. As you strive to improve your living conditions, know that F5 Mortgage is dedicated to simplifying the FHA loan in Georgia process, making us an essential resource for achieving your homeownership aspirations.

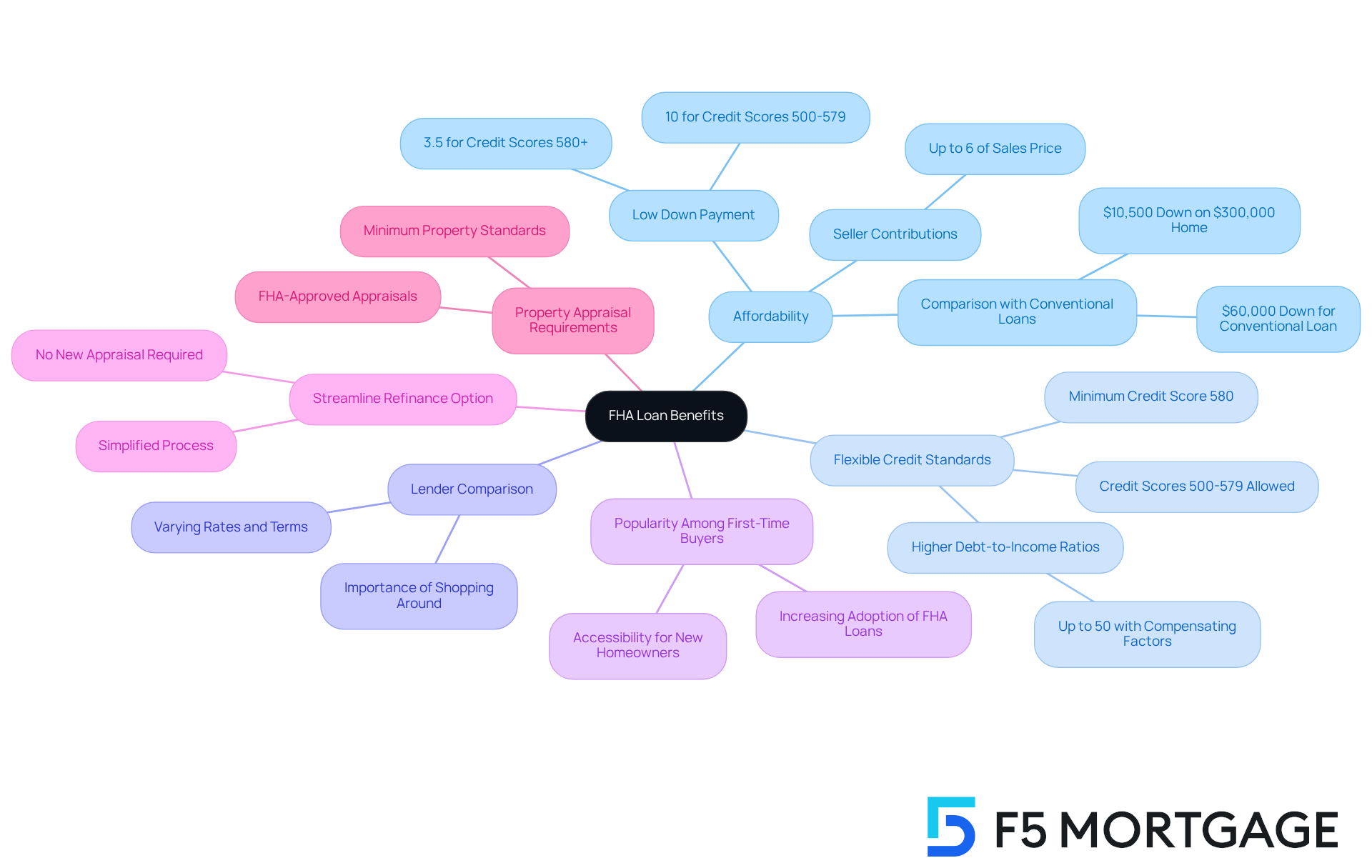

FHA Loan Benefits: Affordable Homeownership Options in Georgia

FHA financing offers a wealth of benefits, making an FHA loan in Georgia a wonderful option for families. With , these financial products significantly lower the barrier to homeownership. For instance, if you’re looking at a $300,000 house in Marietta, you would only need $10,500 upfront, compared to $60,000 required for a traditional mortgage. This affordability is especially beneficial for first-time homebuyers who may not have substantial savings.

Moreover, FHA loans feature flexible credit score standards, allowing borrowers with scores as low as 580 to qualify for the minimum deposit. Even those with scores ranging from 500 to 579 can secure financing with a 10% down payment, making homeownership attainable for individuals with less-than-perfect credit histories. This flexibility is crucial in today’s competitive housing market, where many households are in search of viable financing options.

When considering FHA financing, it’s important to compare lenders, as different institutions may offer varying rates and terms. F5 Mortgage stands out with competitive rates and personalized service, making it a solid choice for families looking to navigate their mortgage options effectively.

Recent trends indicate that FHA mortgages are gaining popularity among first-time homebuyers, as they provide a pathway to homeownership without the burden of large down payments or strict credit criteria. Additionally, sellers can contribute up to 6% of the sales price toward the buyer’s closing costs, further alleviating financial strain. The combination of lower initial costs, flexible credit standards, and appealing interest rates makes the FHA loan in Georgia a practical solution for families aspiring to purchase their dream homes.

Furthermore, the FHA streamline refinance option simplifies the refinancing process by eliminating the need for a new appraisal, making it easier for homeowners to reduce their interest rates. Lastly, properties financed through FHA mortgages must undergo an appraisal by an FHA-approved professional to ensure they meet minimum property requirements, a crucial aspect of the home buying journey. We understand how challenging this process can be, and we’re here to support you every step of the way.

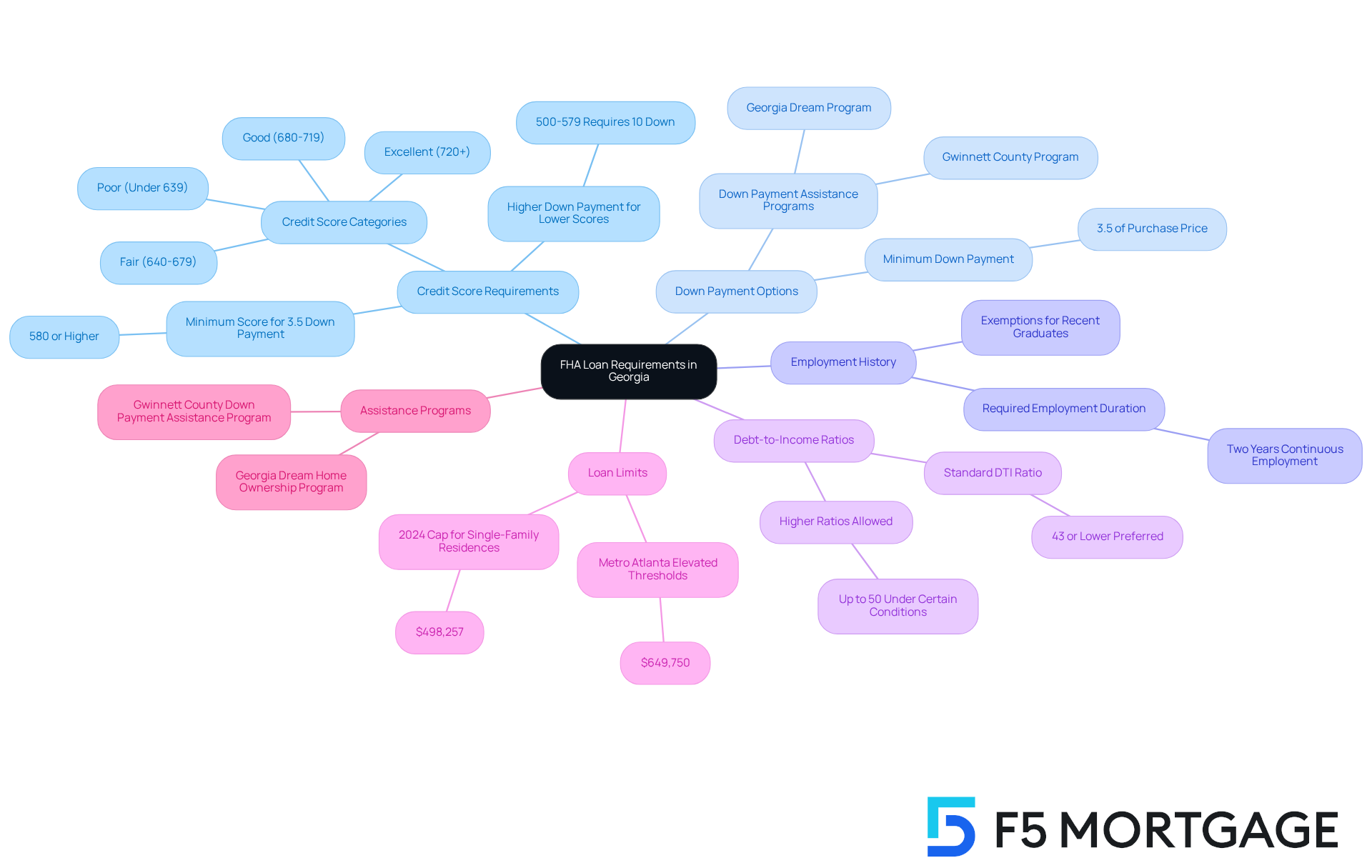

FHA Loan Requirements: What You Need to Qualify in Georgia

In Georgia, we understand how challenging it can be to qualify for an FHA loan in Georgia. Typically, this requires a minimum credit score of 580 to take advantage of the beneficial 3.5% down payment option. However, if your credit score falls between 500 and 579, you can still qualify, though it will necessitate a larger down payment, usually between 5% and 10%. It’s important to note that applicants must also show a stable employment history, generally needing two years of continuous employment, and maintain a debt-to-income ratio of 43% or lower. Some lenders may even consider ratios up to 50% under certain conditions. By managing existing debts effectively, families can secure more competitive mortgage rates, making this an essential step in the process.

The limits are specific for an FHA loan in Georgia. For instance, the 2024 cap for single-family residences is set at $498,257, while certain metro Atlanta regions have elevated thresholds reaching $649,750. Additionally, FHA financing requires both an upfront mortgage insurance premium (UFMIP) of 1.75% and an annual mortgage insurance premium (MIP) that ranges from 0.45% to 1.05%. It’s crucial to remember that properties funded through FHA mortgages must be primary residences and meet safety standards to ensure they are safe and sound for occupancy. We know that families facing credit score challenges can successfully navigate these requirements by focusing on improving their financial profiles. Regular bill payments and reducing existing debt can significantly enhance credit scores.

Mortgage specialists emphasize the importance of understanding these standards, as they are vital for households striving to obtain an FHA loan in Georgia and achieve homeownership. Moreover, there are several down payment assistance initiatives available, such as:

- The Gwinnett County Down Payment Assistance Program

- The Georgia Dream Home Ownership Program

These programs are designed to support families with their down payments. With the right preparation and assistance, many households can overcome initial challenges and fully embrace the .

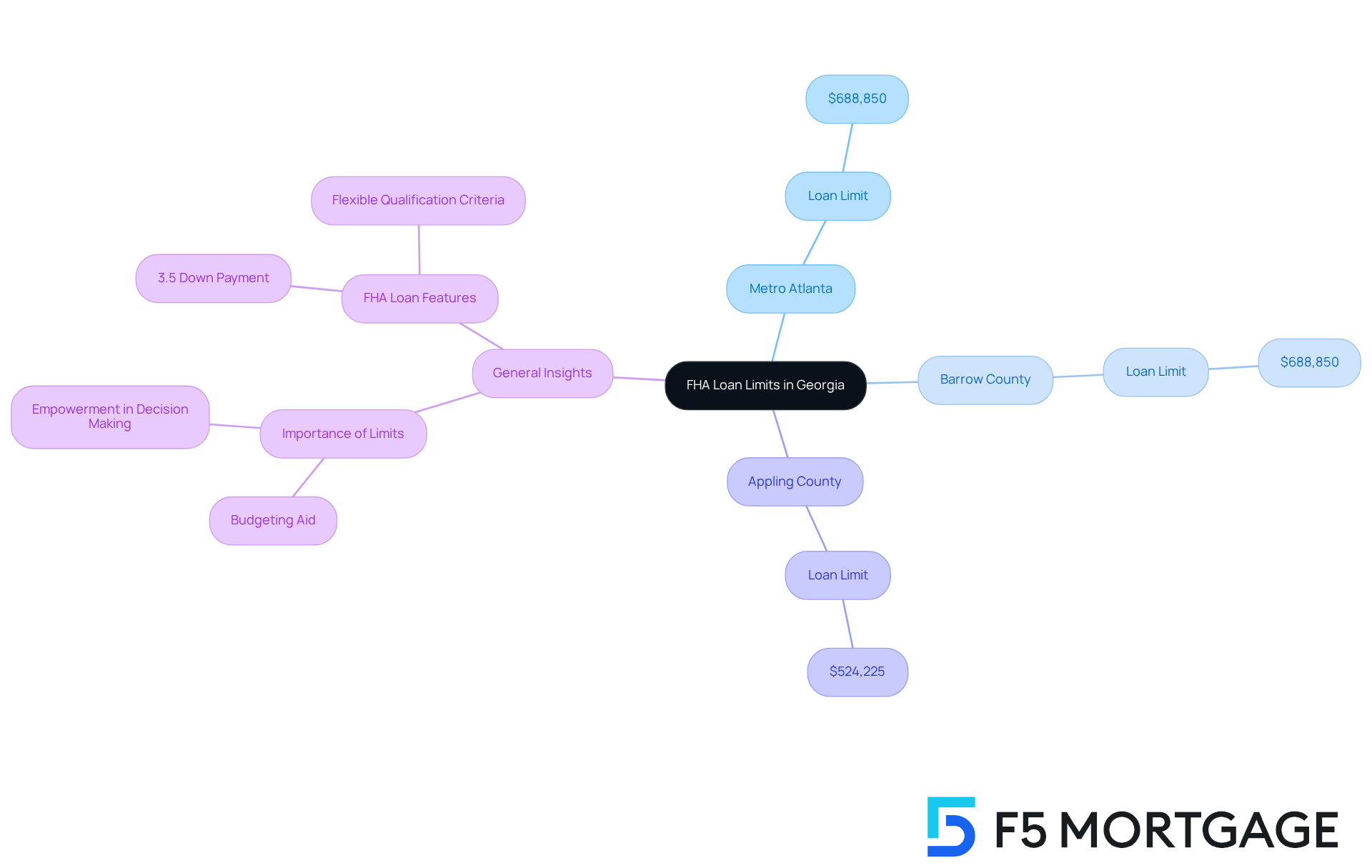

FHA Loan Limits: Understanding Georgia’s Financial Boundaries

In 2025, the [FHA loan in Georgia](https://f5mortgage.com/7-key-insights-on-fha-loan-down-payment-requirements-for-2025) will be structured to meet the diverse needs of housing markets throughout the state. At F5 Mortgage, we understand how important transparency and client empowerment are for families navigating this journey. Most counties set the limit for single-family homes at $524,225, but in higher-cost areas, especially in metro Atlanta, these limits can rise significantly to $688,850.

This differentiation is crucial for households as they plan their home acquisitions. For instance, families looking to purchase in Barrow County can access a limit of $688,850, which provides greater flexibility in selecting a suitable home. Conversely, in counties like Appling, where the limit is $524,225, families may need to adjust their expectations accordingly.

Understanding these limits not only aids in budgeting but also empowers families to make informed decisions in their home-buying journey, especially when looking into an FHA loan in Georgia, particularly in high-demand areas. We know how challenging this can be, but at F5 Mortgage, we leverage technology to offer . Our goal is to make the process as stress-free and transparent as possible, allowing families to focus on realizing their homeownership dreams.

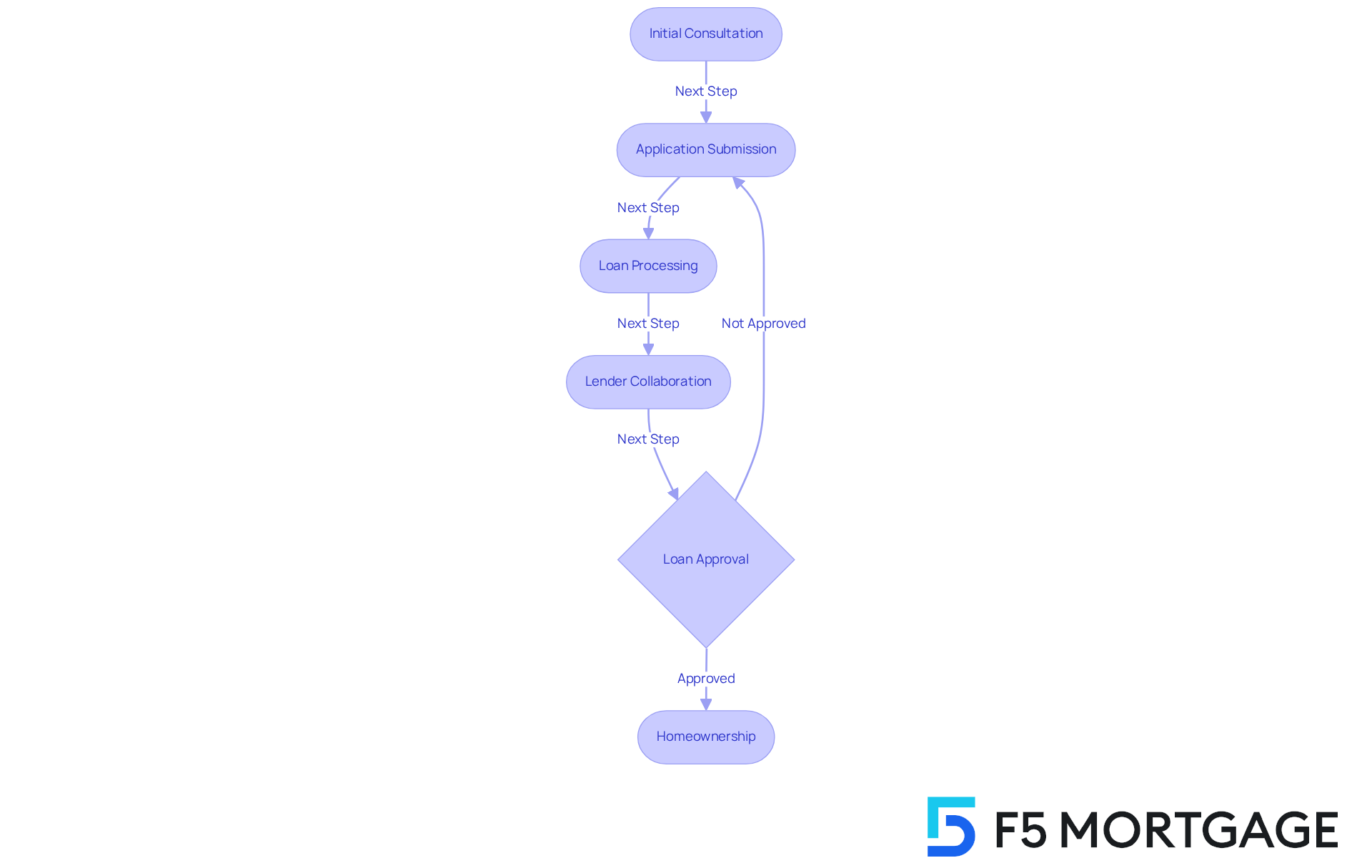

How to Apply for an FHA Loan in Georgia: A Step-by-Step Guide

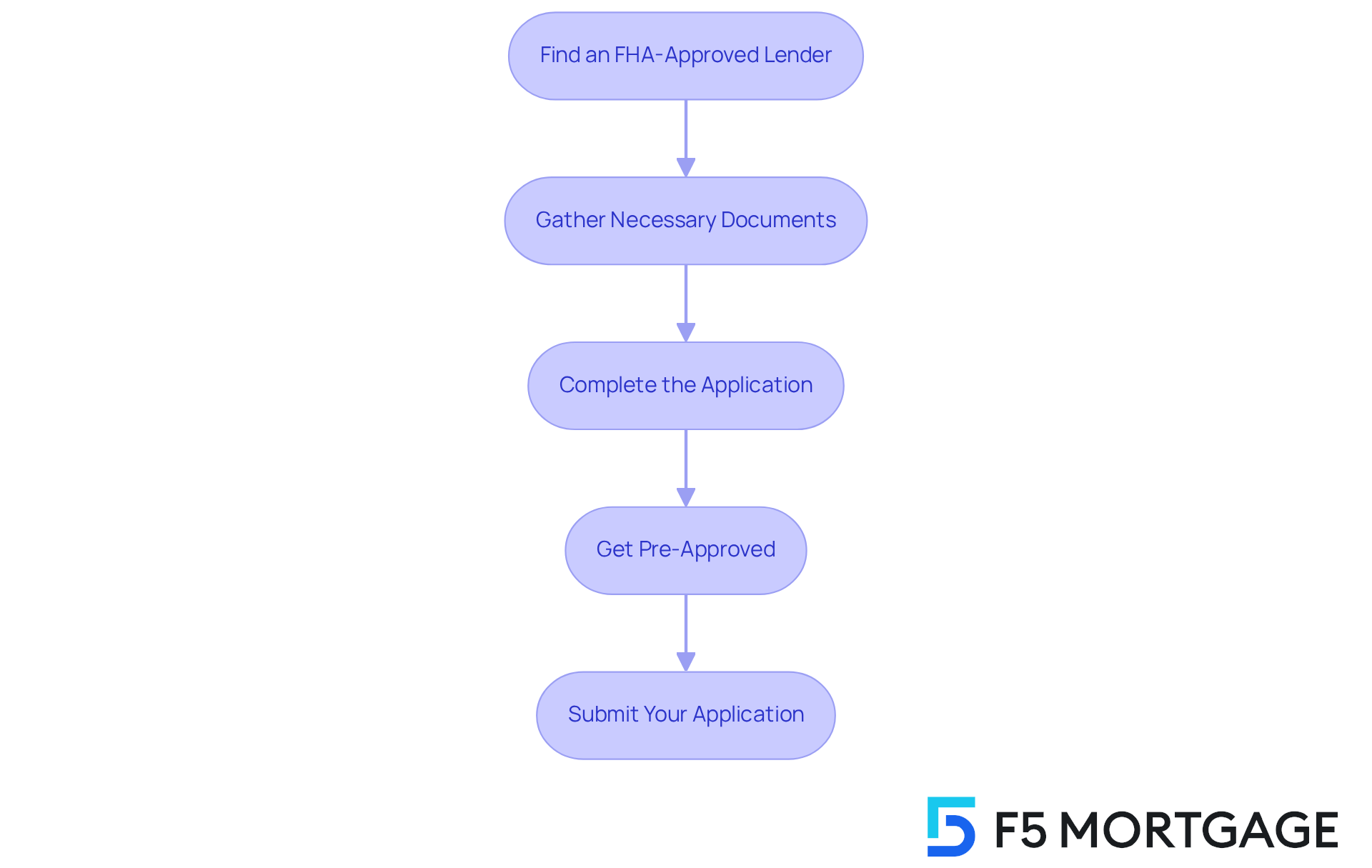

Applying for an FHA loan in Georgia may feel overwhelming, but we are here to support you throughout the entire process. By following these essential steps, you can ensure a smoother process:

- Find an FHA-approved lender: Start by investigating lenders who specialize in FHA financing. This is crucial since not all lenders are authorized to provide these financial products.

- Gather necessary documents: Prepare your financial documents, including tax returns, pay stubs, and bank statements. Having these ready can significantly expedite the process.

- Complete the application: Fill out the financing application with your chosen lender. Accuracy is key to avoid unnecessary delays.

- Get pre-approved: Obtain a pre-approval letter, which typically takes about an hour. This letter clarifies how much you can borrow and strengthens your position when making an offer on a home.

- Submit your application: After receiving pre-approval, submit your application for processing. The complete FHA approval process usually lasts from 30 to 60 days, depending on the lender’s workload and the pace of document submission.

By following these steps, you can streamline your application process for an FHA loan in Georgia and enhance your chances of a successful outcome. We understand how challenging this can be, and real-life examples show that borrowers who maintain and communicate closely with their lenders often navigate the process more efficiently. This leads to quicker approvals and smoother transactions.

FHA Streamline Refinance: Simplifying Your Mortgage in Georgia

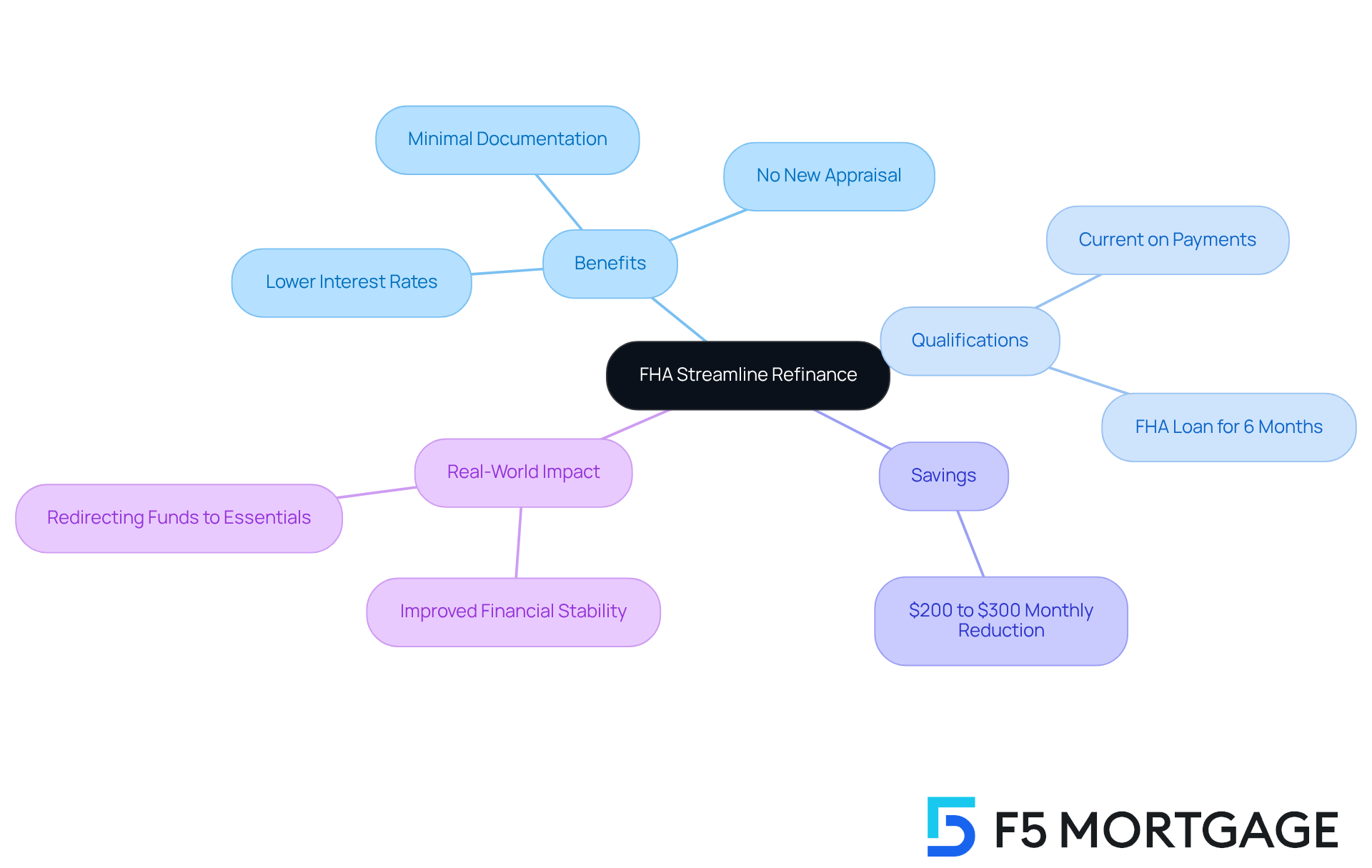

The FHA Streamline Refinance program offers a straightforward solution for current FHA borrowers who wish to lower their interest rates or monthly costs. We understand how overwhelming refinancing can feel, which is why this program is designed with minimal documentation requirements and no need for a new appraisal. This makes it a hassle-free option for those looking to save.

To qualify, borrowers need to be current on their mortgage payments and have held their FHA loan for at least six months. This streamlined process alleviates the complexities often associated with refinancing, allowing families to save money with ease.

In Georgia, many households taking advantage of the FHA loan in Georgia have reported significant savings through the FHA Streamline Refinance program. On average, borrowers can expect to reduce their monthly payments by hundreds of dollars, which can greatly enhance their financial stability. For example, a family refinancing through this program could save around $200 to $300 each month, depending on their loan amount and interest rate reduction.

Real-world stories highlight the program’s effectiveness: numerous families have successfully transitioned to lower rates, resulting in improved cash flow and the ability to redirect funds toward other essential expenses. The FHA Streamline Refinance program not only simplifies the refinancing process but also empowers households to achieve greater financial freedom. We know how important it is to have peace of mind, and is here to support you every step of the way.

FHA 203(k) Loans: Financing Home Improvements in Georgia

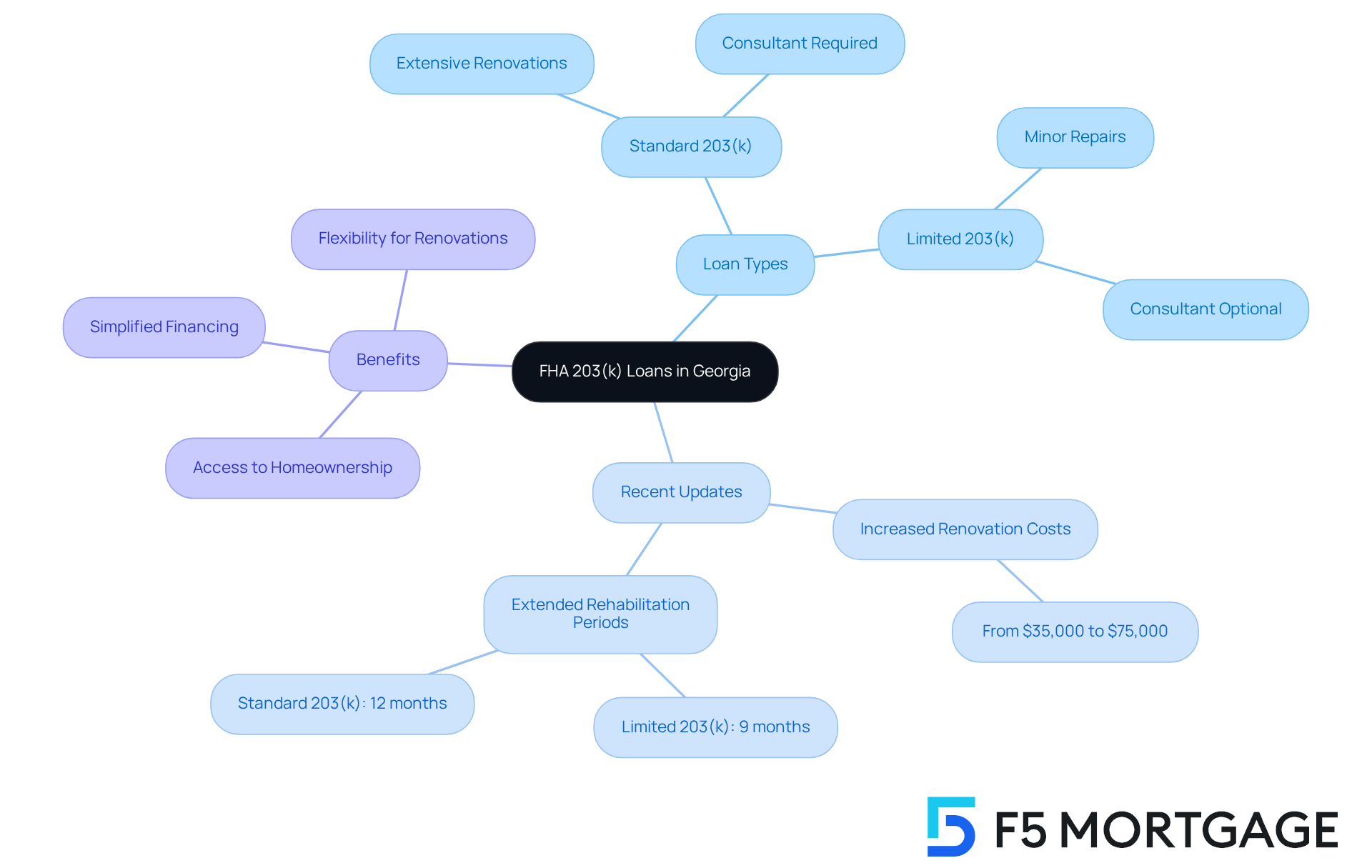

The FHA loan in Georgia, particularly through the FHA 203(k) programs, presents a unique financing opportunity for homebuyers. They enable families to purchase properties that require repairs or renovations, combining the home purchase price with renovation costs into a single mortgage. This approach simplifies the financing process for those eager to create their ideal living space. Borrowers can choose the Standard 203(k) for extensive renovations or the Limited 203(k) for smaller projects, offering essential flexibility tailored to individual needs.

Recent updates to the FHA 203(k) program have made significant strides. The maximum allowable renovation costs under the Limited 203(k) have increased from $35,000 to $75,000, empowering homeowners to undertake more substantial improvements. This change is especially beneficial in a market where renovation costs are rising due to increased material and labor expenses. Additionally, the rehabilitation period for the Limited 203(k) has been extended from six to nine months, while the Standard program now allows up to twelve months for project completion. These adjustments accommodate the modern supply chain challenges that many face.

Successful renovations funded through FHA 203(k) programs highlight their potential. Consider a family in Georgia who utilized an FHA loan in Georgia along with the Limited 203(k) financing option to transform a dated kitchen into a modern, energy-efficient space. This not only significantly enhanced their home’s value but also improved its livability. As HUD Acting Secretary Adrianne Todman emphasized, “Today, we are modernizing and expanding this program, helping both homebuyers and homeowners fix up their homes.” This statement underscores the program’s role in facilitating such transformative projects.

Understanding the nuances of the FHA 203(k) financing program is essential for prospective borrowers. With reduced initial deposit criteria compared to traditional financing options, these agreements . Families contemplating renovations can leverage this program to effectively finance their projects, turning their visions into reality while simplifying the home improvement financing process. We know how challenging this can be, and we’re here to support you every step of the way.

FHA Loan FAQs: Answering Your Top Questions in Georgia

Here are some frequently asked questions about FHA loans in Georgia that we know many families have:

- What is the minimum credit score required? Typically, a score of 580 is needed for the 3.5% down payment option. However, if your score is as low as 500, you may still qualify with a higher initial contribution of 10%. We understand that financial challenges can arise, so it’s suggested to have a consistent 12 months of timely payments before applying for an FHA mortgage. Missing rent or mortgage payments in the previous year can unfortunately disqualify you from FHA approval.

- Can I use gift funds for my down payment? Yes, an FHA loan in Georgia allows the from relatives, making homeownership more attainable for families like yours.

- What types of properties are eligible? FHA mortgages can be used for single-family homes, multi-family dwellings (up to four units), and certain condominiums, provided they meet FHA safety and livability standards. We know how important it is to find the right home for you and your family.

- Is mortgage insurance required? Yes, FHA mortgages require mortgage insurance premiums (MIP) for the life of the loan if your down payment is below 10%. This includes an upfront mortgage insurance premium (UFMIP) and an annual MIP, which can increase your overall borrowing costs. It’s worth noting that an FHA loan in Georgia is particularly beneficial for households; in fact, 82% of all FHA purchase mortgages in 2023 were obtained by first-time buyers.

These FAQs provide crucial information for families considering FHA financing, helping to clarify common misconceptions and guiding you through the process. We’re here to support you every step of the way as you navigate your homeownership journey.

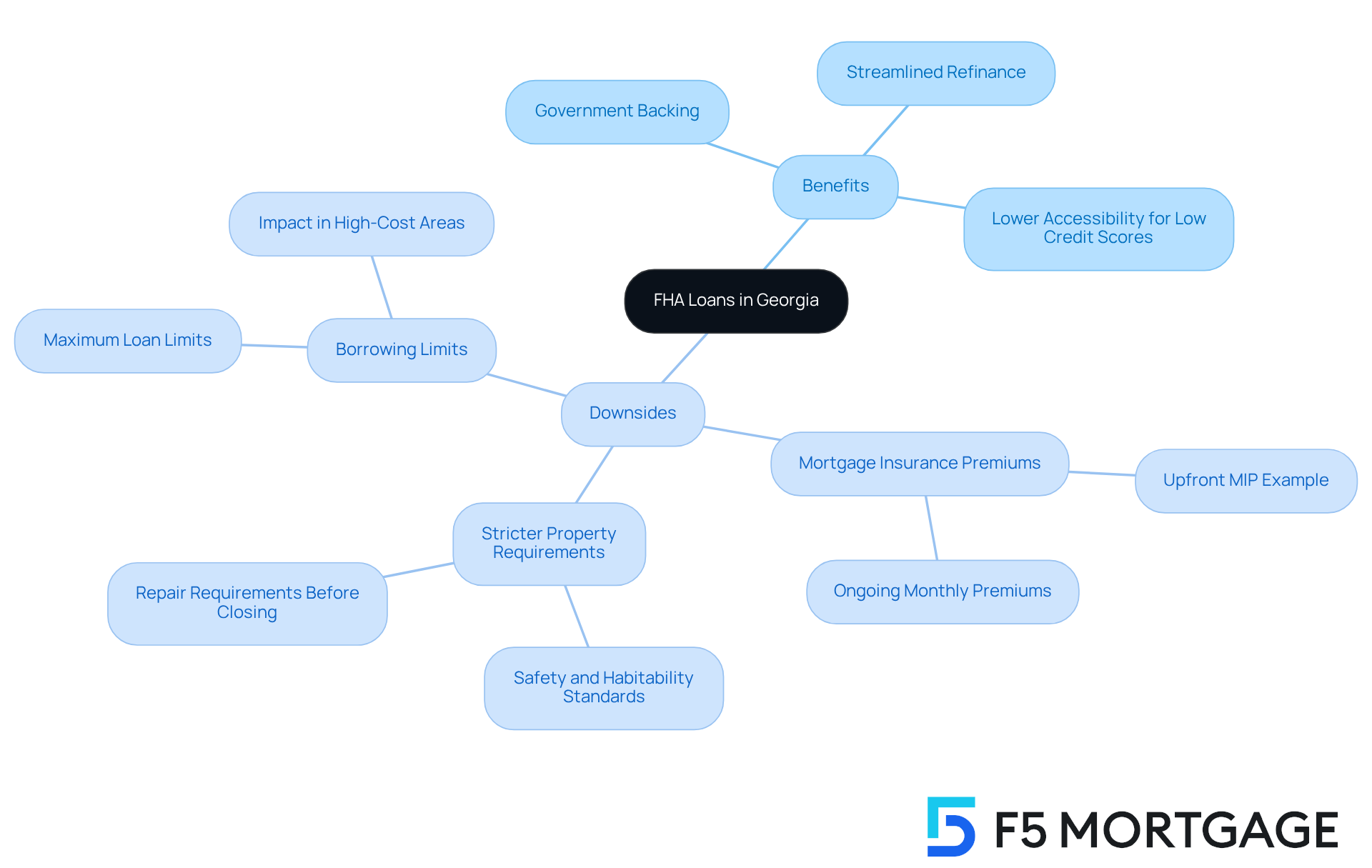

Understanding the Downsides of FHA Loans in Georgia

FHA financing provides numerous benefits, especially for families seeking an FHA loan in Georgia to refinance their mortgages. One significant advantage of an FHA loan in Georgia is that it is backed by the government, making it more accessible for homeowners with lower credit scores. This can be especially important for families managing tight finances. Additionally, the streamlined refinance option for an FHA loan in Georgia allows current FHA borrowers to quickly and easily lower their interest rates, potentially reducing monthly expenses.

However, it’s crucial for families to be aware of the downsides. A primary concern is the mandatory mortgage insurance premiums (MIP), which can considerably increase monthly payments. For example, the upfront MIP for a $300,000 mortgage can total around $5,250, with ongoing monthly premiums adding approximately $250 to the borrower’s costs. This can put a strain on budgets, especially for families already facing financial challenges.

Moreover, FHA financing comes with stricter property condition requirements, which may limit housing options. Homes must meet specific safety and habitability standards, and any repairs identified during the appraisal process must be completed before closing. This can pose a challenge for families interested in .

Additionally, FHA borrowing limits may not be sufficient for families looking to buy in higher-cost areas. In 2025, the maximum credit limit is set at $524,225 in most regions, which may not be adequate in competitive markets. Families might find themselves needing to seek additional funding or consider traditional financing to cover the full purchase price.

As Ashley Harris, a Production Manager, notes, “If you’re purchasing now with the goal of enhancing your finances in the future, an FHA loan in Georgia could be a sensible starting point.” However, it’s essential for families to weigh these challenges against the benefits of FHA mortgages. This includes the option to refinance into a traditional mortgage later to eliminate mortgage insurance. By doing so, families can make informed choices that align with their financial goals, and we’re here to support you every step of the way.

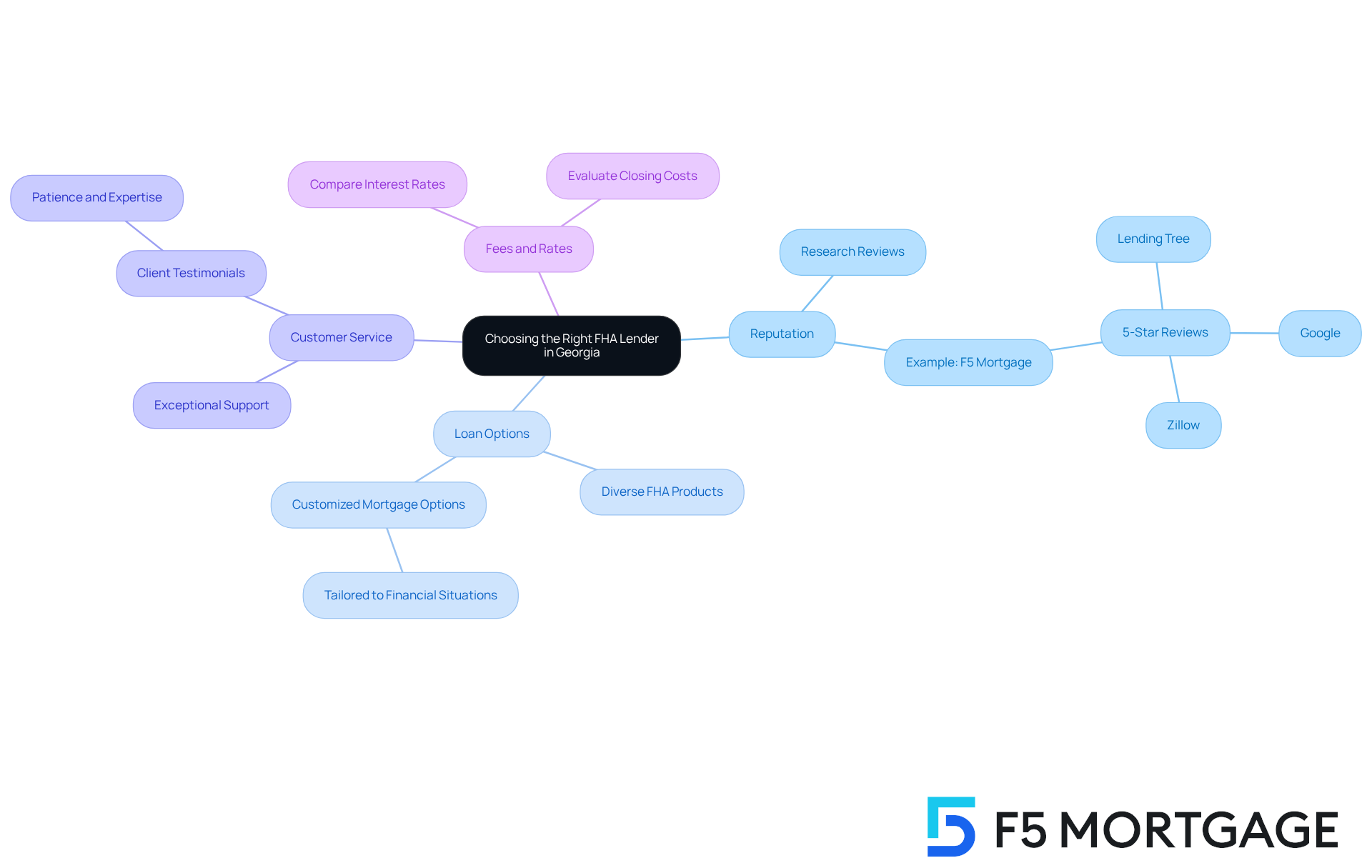

Choosing the Right FHA Lender in Georgia: Key Considerations

Choosing an FHA loan in Georgia can feel overwhelming, but understanding a few key factors can make the process smoother. Reputation is crucial. We know how important it is to find a lender with a solid track record. Researching can help. For example, F5 Mortgage has earned 5-star reviews on platforms like Lending Tree, Google, and Zillow, showcasing their commitment to client satisfaction.

Next, consider Loan Options. It’s essential to find lenders that offer a diverse range of FHA loan in Georgia products tailored to your unique financial situation. F5 Mortgage provides customized mortgage options, ensuring that households can discover the right fit for their requirements.

Customer Service is another vital aspect. Choosing a lender known for exceptional support can truly enhance your experience. Clients have praised F5 Mortgage for their outstanding assistance, with testimonials highlighting the team’s patience and expertise in guiding first-time homebuyers through the process.

Lastly, don’t forget to compare Fees and Rates. Look at interest rates and closing costs among different lenders to find the best deal. By taking these factors into account, families can confidently select the right lender for their FHA loan in Georgia, knowing that we’re here to support you every step of the way.

Conclusion

FHA loans in Georgia offer a wonderful opportunity for families striving to achieve homeownership with greater ease. This financing option stands out due to its low down payment requirements and flexible credit standards, making it especially accessible for first-time homebuyers and those facing unique financial situations. By grasping the nuances of FHA loans, families can navigate the mortgage landscape more effectively and discover a suitable path toward their dream homes.

Throughout this article, we highlight the many benefits of FHA loans, including:

- Competitive rates

- Down payment assistance programs

- The chance to finance home improvements through FHA 203(k) loans

Additionally, the streamlined refinancing process provides current borrowers with a hassle-free way to lower their interest rates, leading to significant savings. However, we must also acknowledge potential downsides, such as:

- Mandatory mortgage insurance premiums

- Stricter property requirements

These factors could impact overall affordability and housing options.

Ultimately, the journey toward homeownership in Georgia can be made simpler through informed decision-making and the right support. We encourage families to explore FHA loan options, consult with trusted lenders, and take advantage of available resources to bolster their financial stability. By doing so, they can not only secure a home that meets their needs but also lay a lasting foundation for their future.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage LLC is an independent mortgage brokerage in Georgia that helps families achieve homeownership through FHA loans. They provide personalized consultations and a range of financing options tailored to individual needs.

What are the benefits of FHA loans in Georgia?

FHA loans offer low down payment requirements (as low as 3.5%), flexible credit score standards, and lower barriers to homeownership, making them especially beneficial for first-time homebuyers and those with unique financial situations.

What are the credit score requirements for FHA loans?

To qualify for the minimum 3.5% down payment, borrowers typically need a credit score of at least 580. Those with scores between 500 and 579 may qualify with a larger down payment of 5% to 10%.

What are the employment and debt-to-income ratio requirements for FHA loans?

Applicants must show a stable employment history of at least two years and maintain a debt-to-income ratio of 43% or lower, although some lenders may consider ratios up to 50% under certain conditions.

What are the FHA loan limits in Georgia?

The 2024 cap for single-family residences in Georgia is set at $498,257, while certain metro Atlanta regions have higher limits reaching $649,750.

What types of mortgage insurance are required for FHA loans?

FHA financing requires an upfront mortgage insurance premium (UFMIP) of 1.75% and an annual mortgage insurance premium (MIP) that ranges from 0.45% to 1.05%.

What properties qualify for FHA loans?

Properties financed through FHA loans must be primary residences and meet safety standards to ensure they are suitable for occupancy.

Are there assistance programs available for down payments in Georgia?

Yes, there are several down payment assistance initiatives available in Georgia, including the Gwinnett County Down Payment Assistance Program and the Georgia Dream Home Ownership Program.

How does F5 Mortgage support clients in the FHA loan process?

F5 Mortgage simplifies the FHA loan process by offering competitive rates, personalized service, and guidance throughout the mortgage journey, ensuring clients feel supported every step of the way.