Overview

Choosing a good mortgage broker is essential for navigating the mortgage process effectively. We understand how overwhelming this can be. A skilled broker offers personalized consultations, expert negotiation, and access to a variety of loan options tailored to your unique needs. This support can simplify the complexities you face.

Imagine having someone by your side who can secure better rates and educate you throughout the journey. A good broker not only provides guidance but also empowers you, leading to a smoother and more informed home-buying experience. We’re here to support you every step of the way, ensuring you feel confident in your decisions.

Introduction

Navigating the mortgage landscape can feel like a daunting maze for many prospective homebuyers. The complex terms and overwhelming choices can leave you feeling lost and uncertain. We understand how challenging this can be, and that’s where a good mortgage broker comes in. They can be the beacon of light in this intricate process, offering personalized guidance and access to diverse loan options tailored to your individual needs.

But what specific advantages does partnering with a skilled mortgage broker bring? How can it transform your home-buying experience into a smoother journey? In this article, we explore seven compelling reasons why choosing a good mortgage broker is essential for anyone looking to secure their dream home. Together, let’s make this journey less overwhelming and more empowering.

F5 Mortgage: Personalized Consultations for Tailored Solutions

At F5 Home Loans, we understand how challenging navigating the mortgage process can be without a good mortgage broker. That’s why we offer tailored consultations with a good mortgage broker that focus on your unique financial circumstances and homeownership goals. This personalized approach ensures that you receive mortgage solutions perfectly aligned with your specific needs, making your journey smoother and more efficient.

By taking the time to evaluate your individual situation, we can suggest the most appropriate financing options for you with the assistance of a good mortgage broker—whether you’re a first-time homebuyer or looking to refinance. We’re here to , ensuring that you feel confident and informed in your decisions.

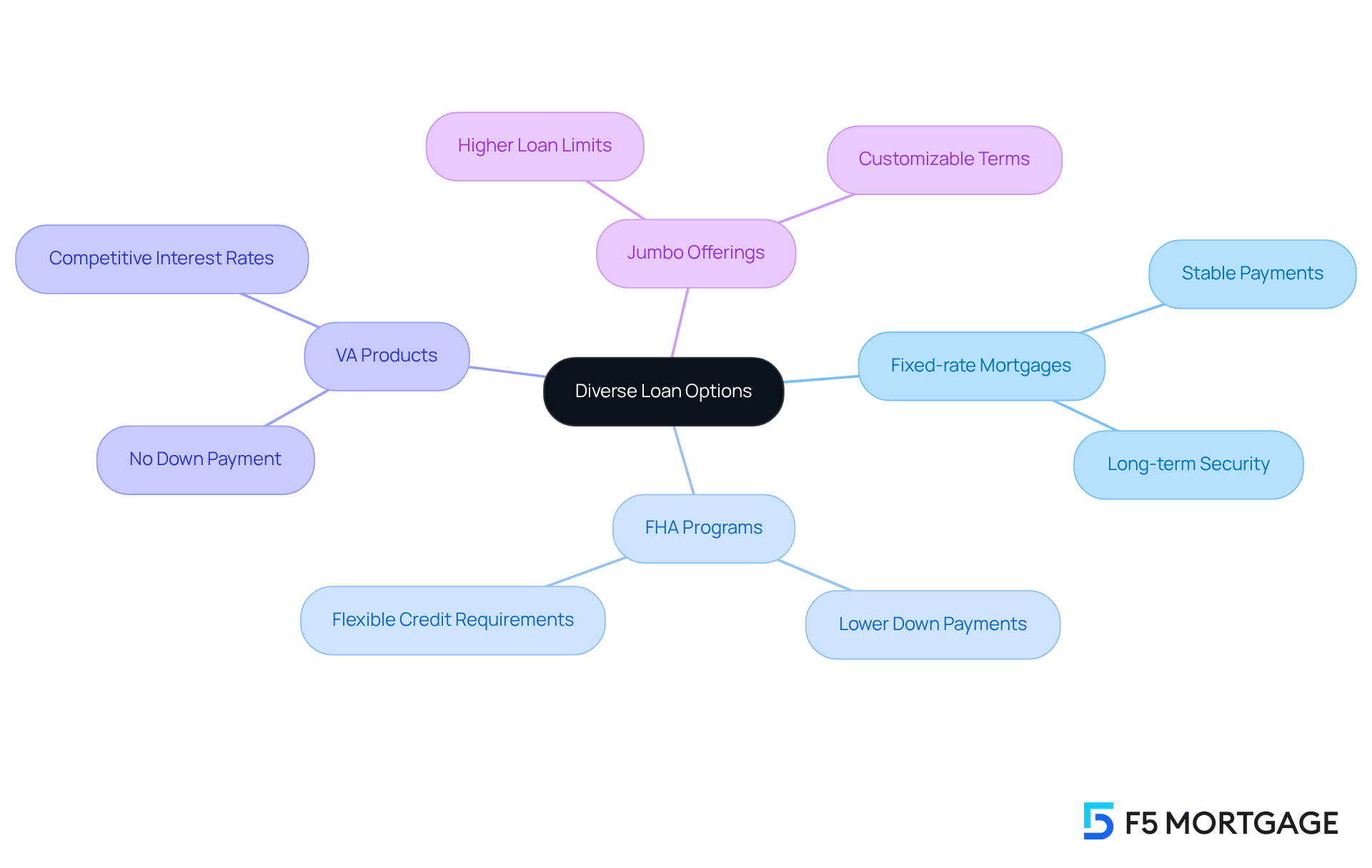

Diverse Loan Options: Access to Fixed-Rate, FHA, VA, and Jumbo Loans

At F5 Financing, we understand that navigating the world of home financing can be overwhelming. That’s why we offer a broad selection of financing options, including:

- Fixed-rate mortgages

- FHA programs

- VA products

- Jumbo offerings

This diversity allows you to explore various financing solutions that align with your unique financial situation and homeownership dreams.

We know how challenging this can be, especially for or experienced investors. By providing multiple choices, we ensure that you can discover a loan that meets your specific needs. Our goal is to support you every step of the way, making the mortgage process as smooth and empowering as possible.

Expert Negotiation: Securing Better Rates and Terms for Homebuyers

We know how challenging the home-buying process can be, and one of the key advantages of collaborating with F5 is their expert negotiation skills. The team is dedicated to securing better rates and terms for homebuyers by leveraging strong relationships with multiple lenders. This approach not only helps you conserve funds on your home loan but also ensures that you receive conditions tailored to your financial goals.

Imagine the difference effective negotiation can make in the overall cost of homeownership. With F5 by your side, you can feel confident that you are getting the , allowing you to focus on what truly matters—creating a home for your family. We’re here to support you every step of the way, guiding you toward a brighter financial future.

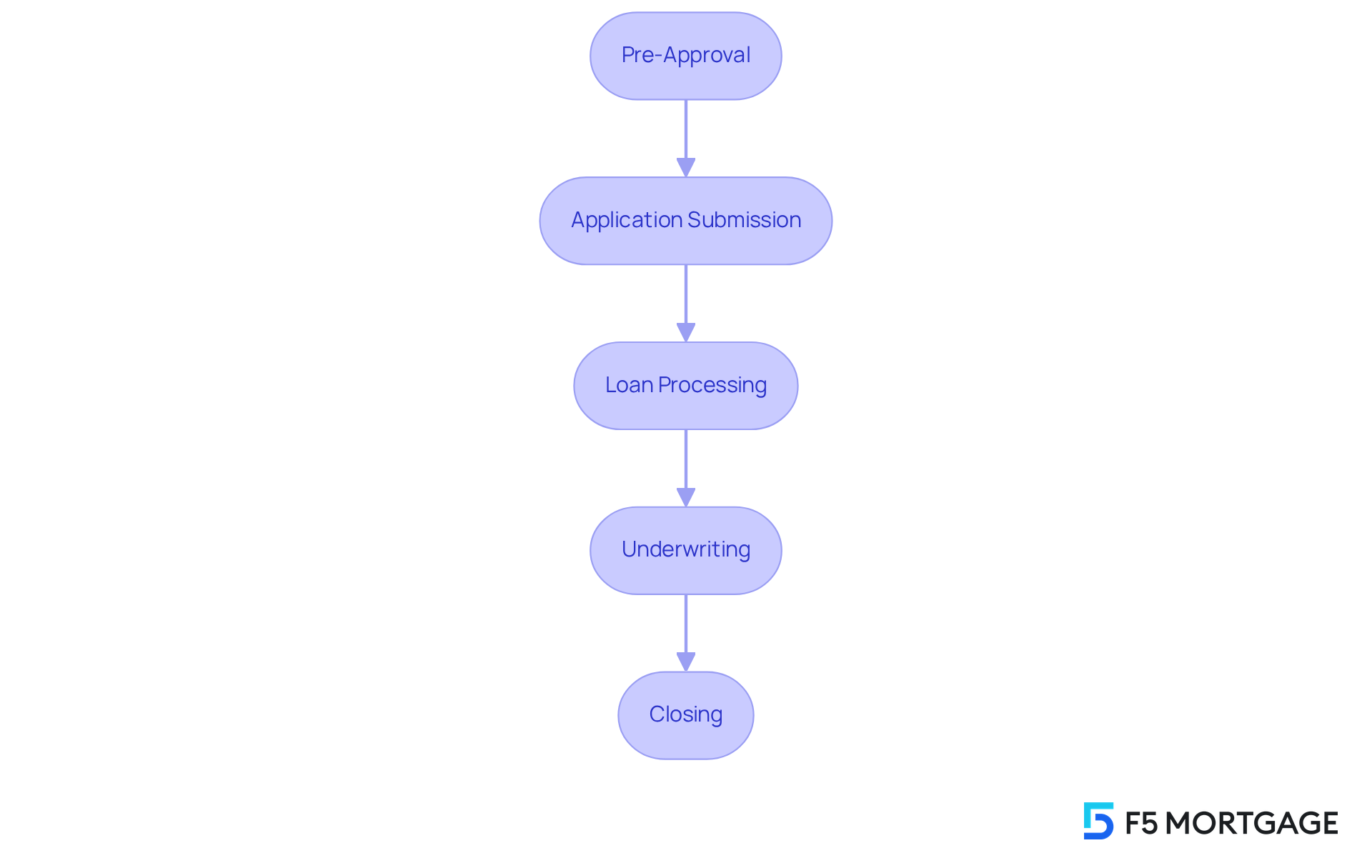

Simplified Process: Navigating the Complexities of Mortgage Financing

At F5 Mortgage, we understand how challenging the financing process can be. That’s why we are committed to streamlining it for you. By offering clear direction and compassionate assistance at every stage, we help you navigate the often intricate world of financing with confidence.

From pre-approval to closing, we ensure that you comprehend each step of the journey. Our goal is to minimize confusion and anxiety, allowing you to focus on what truly matters. This dedication to transparency and support empowers you to make .

We know how important it is to feel understood and supported, and we’re here for you every step of the way. Let us guide you through the process, so you can achieve your homeownership dreams with ease.

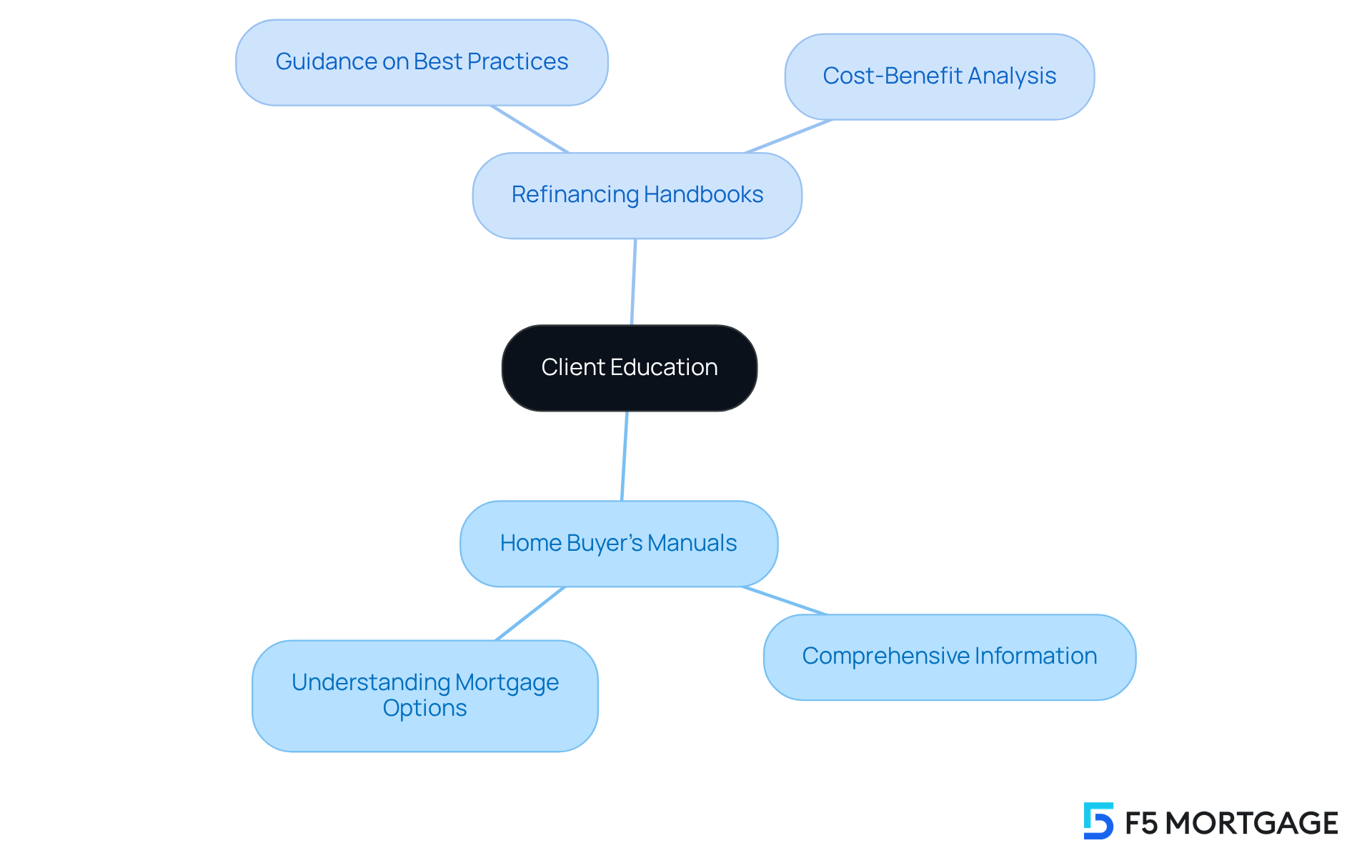

Client Education: Empowering Homebuyers with Knowledge and Resources

At F5 Financing, we understand how challenging navigating the mortgage landscape can be. That’s why we place a strong emphasis on customer education. We provide valuable resources, such as:

- Comprehensive home buyer’s manuals

- Refinancing handbooks

to help you feel informed and empowered. By equipping you with the information you need, we enable you to traverse the loan landscape with confidence.

This educational approach not only helps you understand your options but also fosters a sense of trust and openness in the mortgage process. We’re here to , ensuring that you feel secure in your decisions. Together, let’s make the journey toward homeownership a positive and informed experience.

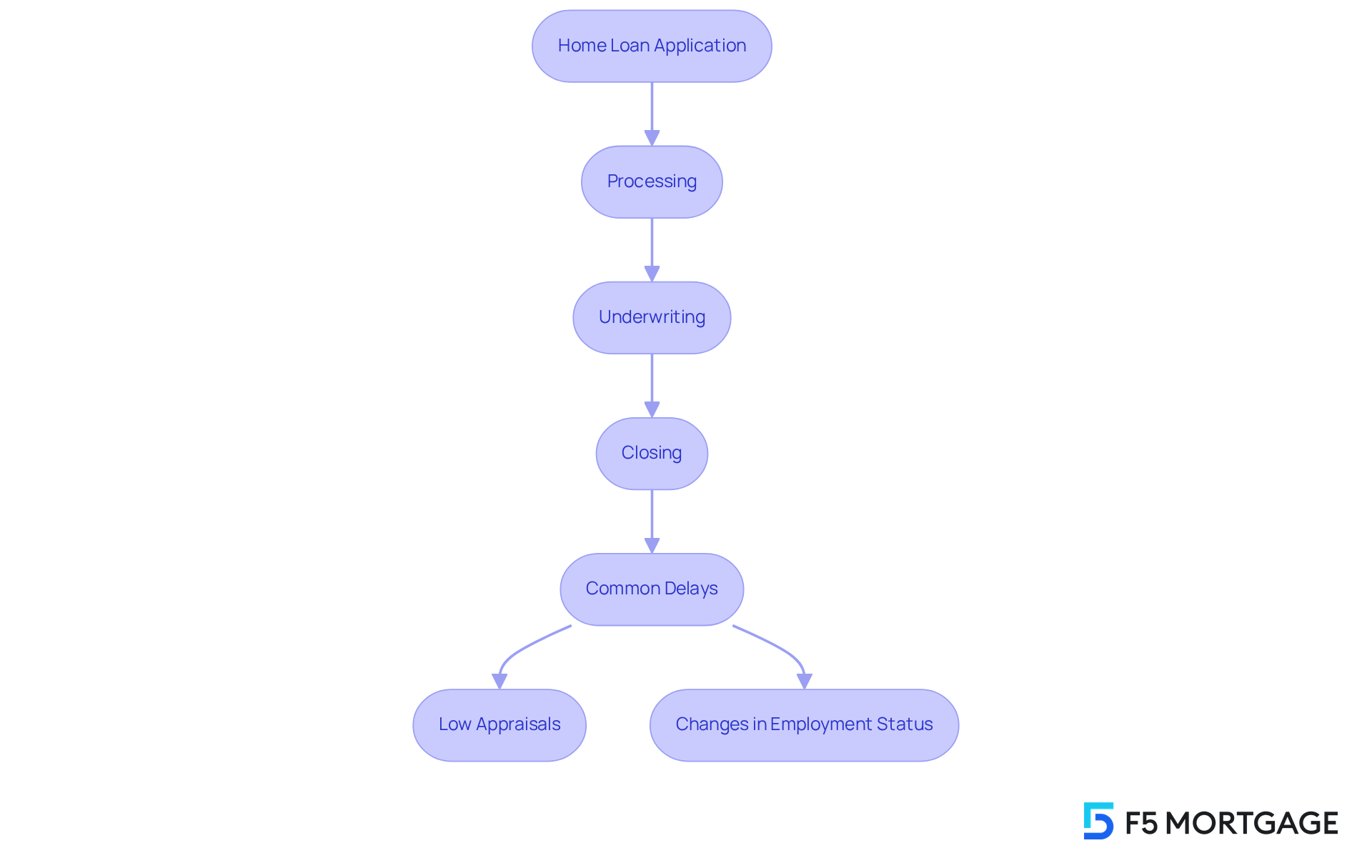

Fast Closings: Efficient Processes for Quick Home Purchases

At F5 Financing, we understand how important it is for families to navigate the home buying process smoothly. That’s why we are proud of our swift closing procedures, with most loans concluding in under three weeks. This efficiency is particularly beneficial in competitive markets, where homes can receive multiple offers within just days. By simplifying the closing process, we help individuals avoid delays, enabling a seamless transition to homeownership.

Did you know that the average closing time for conventional loans is around 47 days? FHA loans typically take about the same time. Real estate professionals, like Victoria Araj, emphasize the importance of quick closings in today’s market, stating, “Closing in 30 days is ideal.” By prioritizing speed, F5 Home Loans not only addresses the urgent needs of our customers but also positions them advantageously in a fast-paced environment, contributing to a more satisfying home buying experience.

However, we know how challenging this can be, and it’s essential for customers to be aware of common causes of closing delays. Factors such as:

- Low appraisals

- Changes in employment status

can affect the overall timeline. We’re here to support you every step of the way, ensuring that you have the knowledge and resources needed to .

Personalized Service: Tailoring Solutions to Individual Client Needs

At F5 Mortgage, we understand how challenging the mortgage process can be without a good mortgage broker. That’s why personalized service is at the heart of our approach. Our dedicated team takes the time to truly comprehend each customer’s unique financial situation and homeownership goals. This allows us to tailor financing solutions that meet your specific needs.

We want you to feel valued and supported throughout your . Our personalized focus not only helps you navigate the complexities of securing a mortgage but also fosters a sense of confidence and reassurance. As you move forward, know that we’re here to assist you every step of the way.

By prioritizing your needs, we aim to enhance your experience and satisfaction. Together, we can work towards achieving your homeownership dreams, ensuring that you feel empowered and informed throughout the entire process.

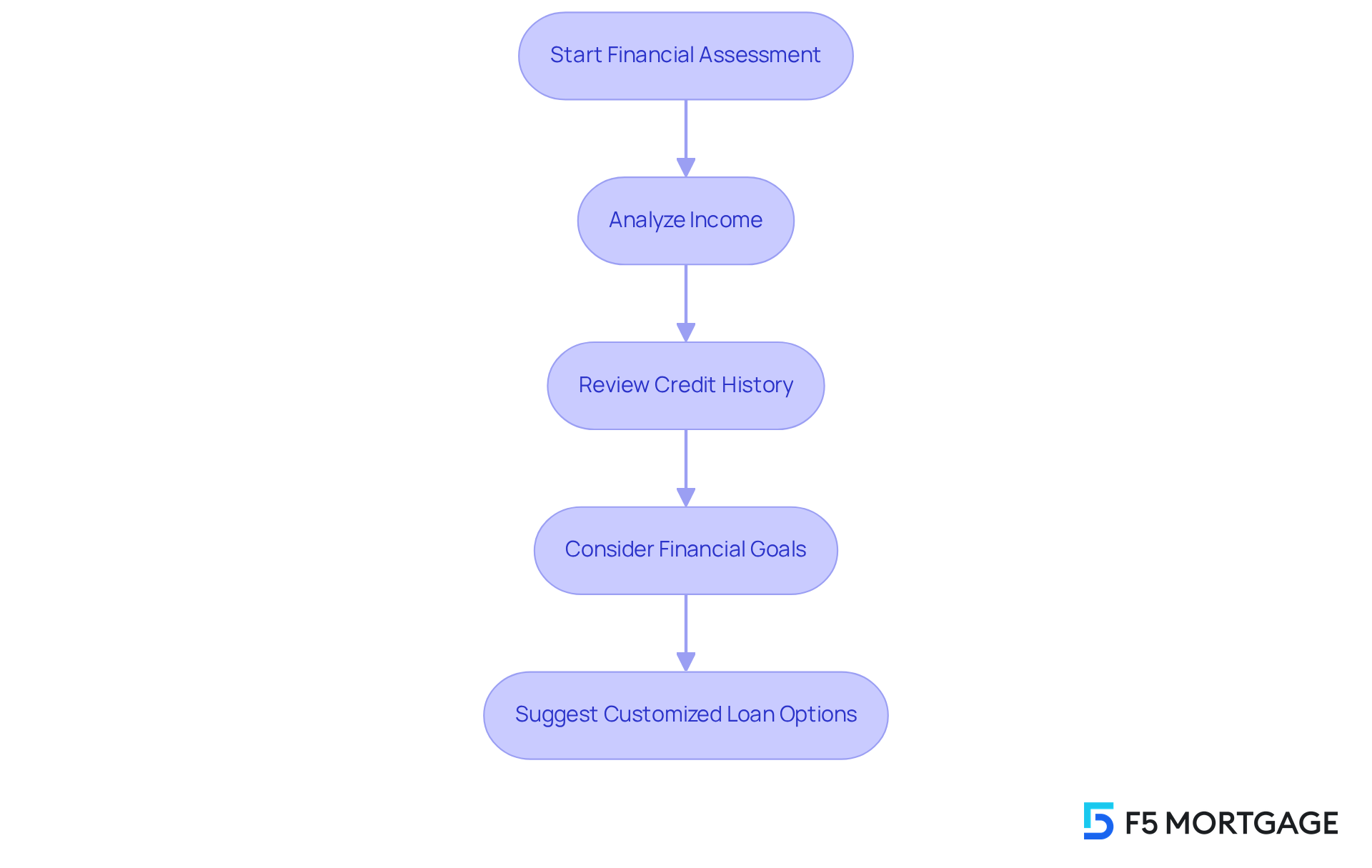

Financial Assessment: Evaluating Unique Situations for Better Outcomes

At F5, we understand how challenging navigating financial decisions can be. That’s why we conduct comprehensive financial assessments to evaluate each individual’s unique situation. This process involves a careful analysis of your income, credit history, and financial goals. By grasping the complexities of your financial landscape, we can suggest customized loan options tailored just for you. Our aim is to improve your chances of successful loan approval and secure advantageous terms. We’re here to , ensuring that you feel confident in your choices.

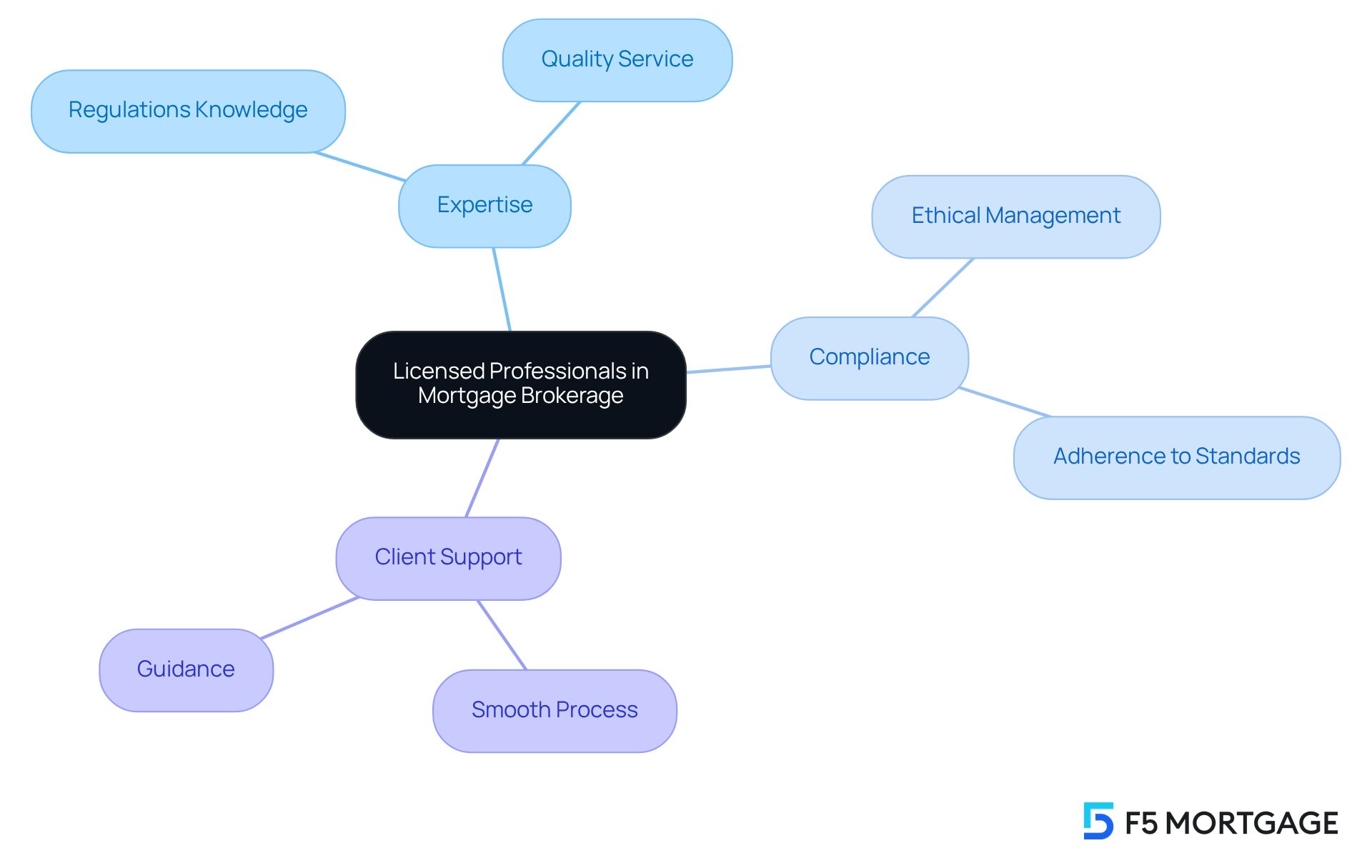

Licensed Professionals: Ensuring Quality and Compliance in Mortgage Brokerage

At F5 Mortgage, we understand how challenging navigating the lending process can be. That’s why we employ licensed experts who are well-versed in the regulations and standards that govern the lending sector. This commitment to professionalism ensures that you receive high-quality service while we adhere to all compliance requirements.

When you collaborate with our , you can rest assured that your loan process is being managed ethically and responsibly. We’re here to support you every step of the way, making your experience as smooth as possible. Trust in our expertise, and let us guide you through this important journey with care and compassion.

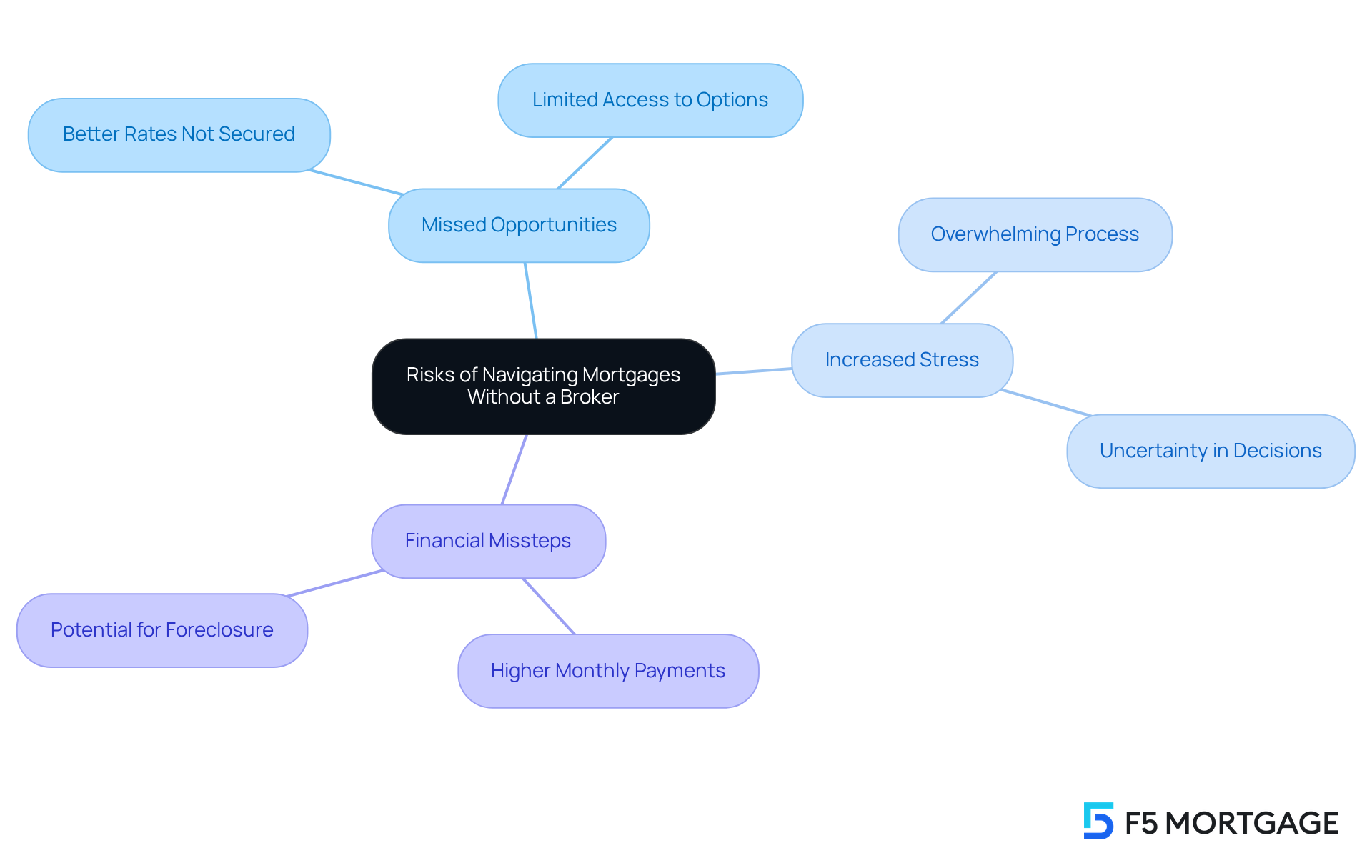

Avoiding Pitfalls: The Risks of Navigating Mortgages Without a Broker

Navigating the loan process can be daunting without the assistance of a good mortgage broker. Many families find themselves facing missed opportunities for better rates, increased stress, and potential financial missteps. At F5 Mortgage, we understand how challenging this can be. That’s why we aim to inform our customers about these risks, highlighting the importance of expert advice from a good mortgage broker in achieving the best financing results.

By understanding the complexities of the mortgage landscape, you can make more informed decisions. We’re here to support you every step of the way, helping you avoid and guiding you towards a brighter financial future. Remember, with the right knowledge and support, you can navigate this journey with confidence.

Conclusion

Choosing a good mortgage broker is pivotal in ensuring a smooth and successful home buying experience. We know how challenging this can be, and with their expertise, personalized service, and diverse loan options, brokers like those at F5 Mortgage provide invaluable support tailored to each client’s financial situation and homeownership goals. This partnership not only simplifies the complex mortgage process but also empowers buyers to make informed decisions that align with their unique needs.

The article highlights several compelling reasons to engage a mortgage broker. Expert negotiation skills can secure better rates, while access to a wide array of loan products and a commitment to client education make a significant difference. By prioritizing personalized consultations and efficient closing processes, F5 Mortgage stands out as a trusted ally in navigating the often daunting landscape of home financing. Each of these elements contributes to a more confident and informed journey toward homeownership.

Ultimately, leveraging the knowledge and resources of a skilled mortgage broker can significantly enhance the home buying experience. Avoiding the pitfalls of navigating the mortgage process alone not only saves time and stress but also positions buyers for financial success. Embrace the opportunity to work with a professional who can guide you through this critical journey, ensuring that your path to homeownership is as rewarding and seamless as possible.

Frequently Asked Questions

What services does F5 Home Loans offer?

F5 Home Loans provides personalized consultations with mortgage brokers to help clients navigate the mortgage process and find tailored solutions based on their unique financial circumstances and homeownership goals.

What types of loan options are available through F5 Financing?

F5 Financing offers a diverse selection of loan options, including fixed-rate mortgages, FHA programs, VA products, and jumbo loans, allowing clients to explore various financing solutions that fit their needs.

How does F5 assist first-time homebuyers?

F5 assists first-time homebuyers by offering tailored consultations, evaluating individual situations, and providing multiple financing options to help them find the best loan for their specific circumstances.

What is the advantage of working with F5 in terms of negotiation?

F5 has expert negotiation skills and strong relationships with multiple lenders, which allows them to secure better rates and terms for homebuyers, ultimately helping clients save money on their home loans.

How does F5 ensure a smooth mortgage process?

F5 ensures a smooth mortgage process by providing personalized support throughout, helping clients feel confident and informed in their decisions, and guiding them toward the best financing options for their goals.