Overview

Securing a pre-approved home loan can feel overwhelming, but we know how challenging this can be. This article outlines five essential steps to help you navigate the process with confidence.

- Understanding the mortgage pre-approval process is crucial.

- Gather the required documentation to ensure you’re prepared.

- Once you have your documents ready, it’s time to apply for pre-approval.

- Remember, comparing lenders and offers is vital to find the best fit for your needs.

- Finally, we address common pre-approval issues, providing practical advice to troubleshoot any challenges that may arise.

Each step is designed to empower you, emphasizing the importance of preparation and informed decision-making. By following these steps, you can enhance your likelihood of approval and secure favorable loan terms in a competitive housing market. We’re here to support you every step of the way as you embark on this journey to homeownership.

Introduction

Navigating the home buying process can feel overwhelming, especially when it comes to securing a mortgage pre-approval. We understand how challenging this can be. This essential step not only clarifies your budget but also enhances your credibility in a competitive market, making your offers more appealing to sellers.

By grasping the steps to successfully obtain a pre-approved home loan, you can position yourself for a smoother purchasing experience. However, what happens when unexpected challenges arise during the pre-approval process? Exploring these critical steps and potential pitfalls can empower you to overcome obstacles and achieve your homeownership goals. We’re here to support you every step of the way.

Understand Mortgage Pre-Approval

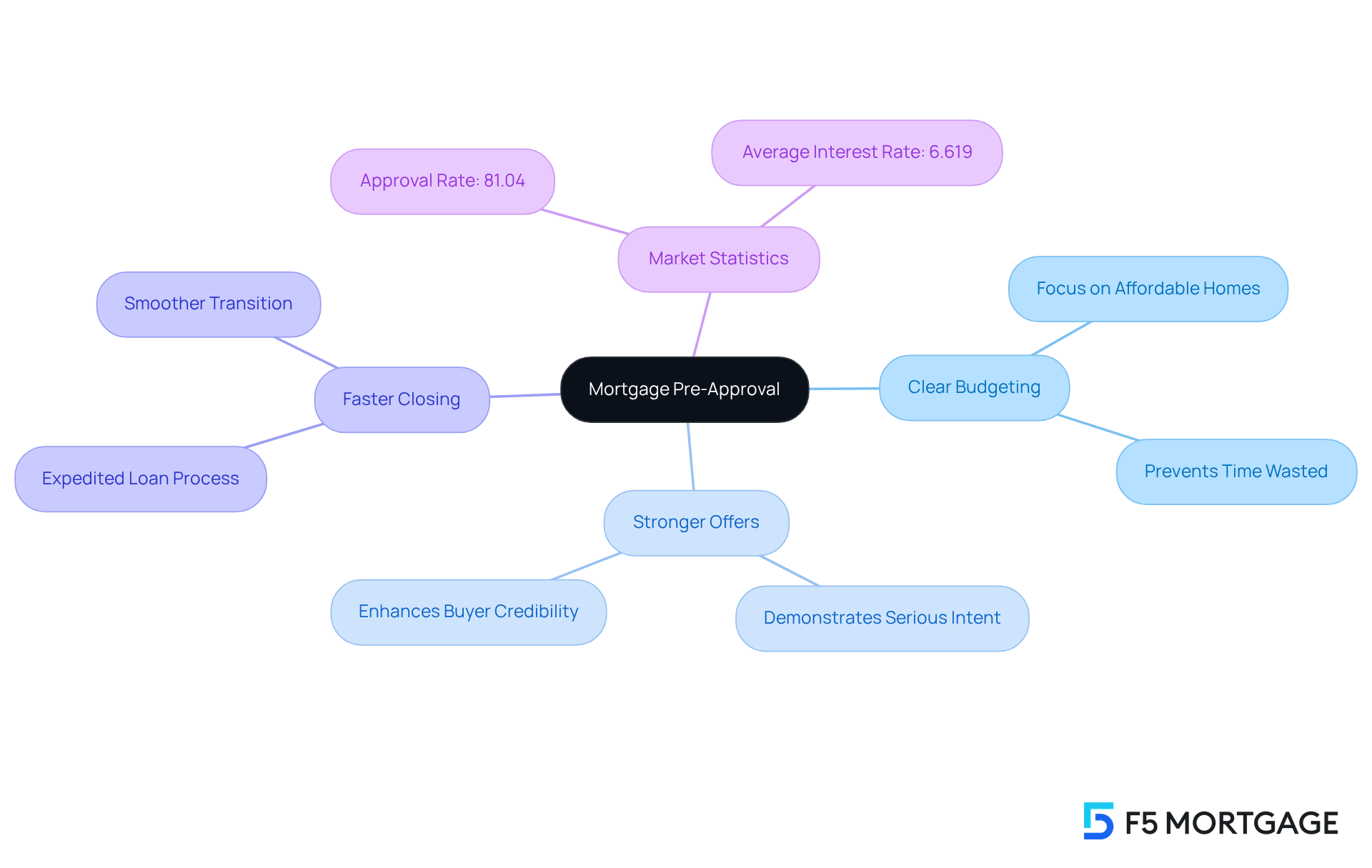

Mortgage pre-qualification is a crucial step in your home purchasing journey. We understand how overwhelming this process can be. Here, a financial institution evaluates your monetary situation to determine the amount they are willing to offer. This not only helps clarify your budget but also significantly boosts your credibility as a buyer, making sellers more likely to take your offers seriously. A preliminary approval includes a thorough review of your credit history, income, and debts, resulting in a conditional commitment from the lender.

The key benefits of obtaining pre-approval include:

- Clear Budgeting: Knowing your loan amount allows you to focus on homes within your financial reach, preventing time wasted on properties that exceed your budget.

- Stronger Offers: Sellers tend to favor buyers with a pre approved home loan, as it demonstrates serious intent and financial capability, thereby enhancing your chances of securing your desired home.

- Faster Closing: With a pre approved home loan and much of the paperwork already handled, the loan process can be expedited once you find a home, leading to quicker closings and a smoother transition.

As of July 2025, mortgage lenders accepted 81.04% of applications, highlighting the strong demand for a pre approved home loan in today’s market. We know how competitive the housing market can be. Homes acquired with prior authorization often have a higher success rate in bidding scenarios, as buyers can present their offers with confidence. The typical interest rate for purchase mortgages is at 6.619% as of July 2025, making it even more essential for buyers to obtain a pre approved home loan to navigate the current market effectively. We’re here to support you every step of the way.

Gather Required Documentation

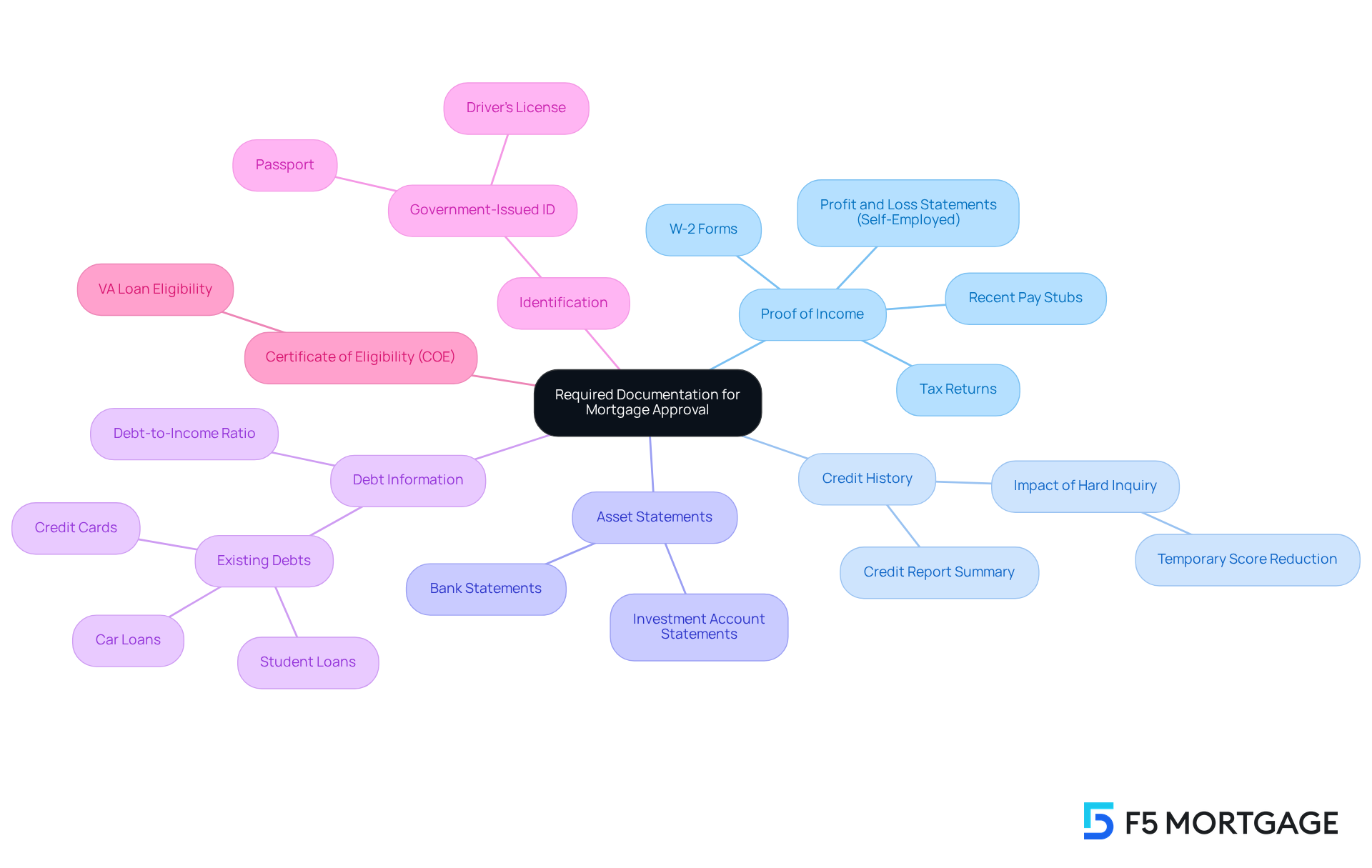

To obtain mortgage approval in advance, we know how essential it is to compile several key documents that reflect your financial stability. Here’s a comprehensive checklist of the most commonly required items:

- Proof of Income: Include recent pay stubs, W-2 forms, or tax returns. If you’re self-employed, you may need to provide additional documentation like profit and loss statements. Lenders will also confirm your income and employment history, typically requiring two years in the same job or industry.

- Credit History: While lenders will pull your credit report, having a summary of your credit history can be beneficial in understanding your creditworthiness. Just a heads up—be aware that the thorough inquiry associated with the initial approval may temporarily reduce your credit score by a few points.

- Asset Statements: Gather bank statements and investment account statements to demonstrate your savings and available assets.

- Debt Information: Provide details about any existing debts, such as credit cards, student loans, or car loans. This information is crucial for calculating your debt-to-income ratio.

- Identification: A government-issued ID, such as a driver’s license or passport, is necessary to confirm your identity.

- Certificate of Eligibility (COE): If applying for a VA loan, include your COE to confirm eligibility.

Having these documents organized and ready can significantly streamline the application process. In fact, you could potentially reduce the time taken to gather everything to as little as one day if all required items are in order. This preparation not only accelerates the process of obtaining a pre-approved home loan but also establishes you as a serious buyer in the eyes of sellers, improving your chances of a successful home purchase. Remember, loan approval letters are generally valid for 60 to 90 days, so keep this in mind as you navigate your home buying journey. We’re here to support you every step of the way.

Apply for Pre-Approval

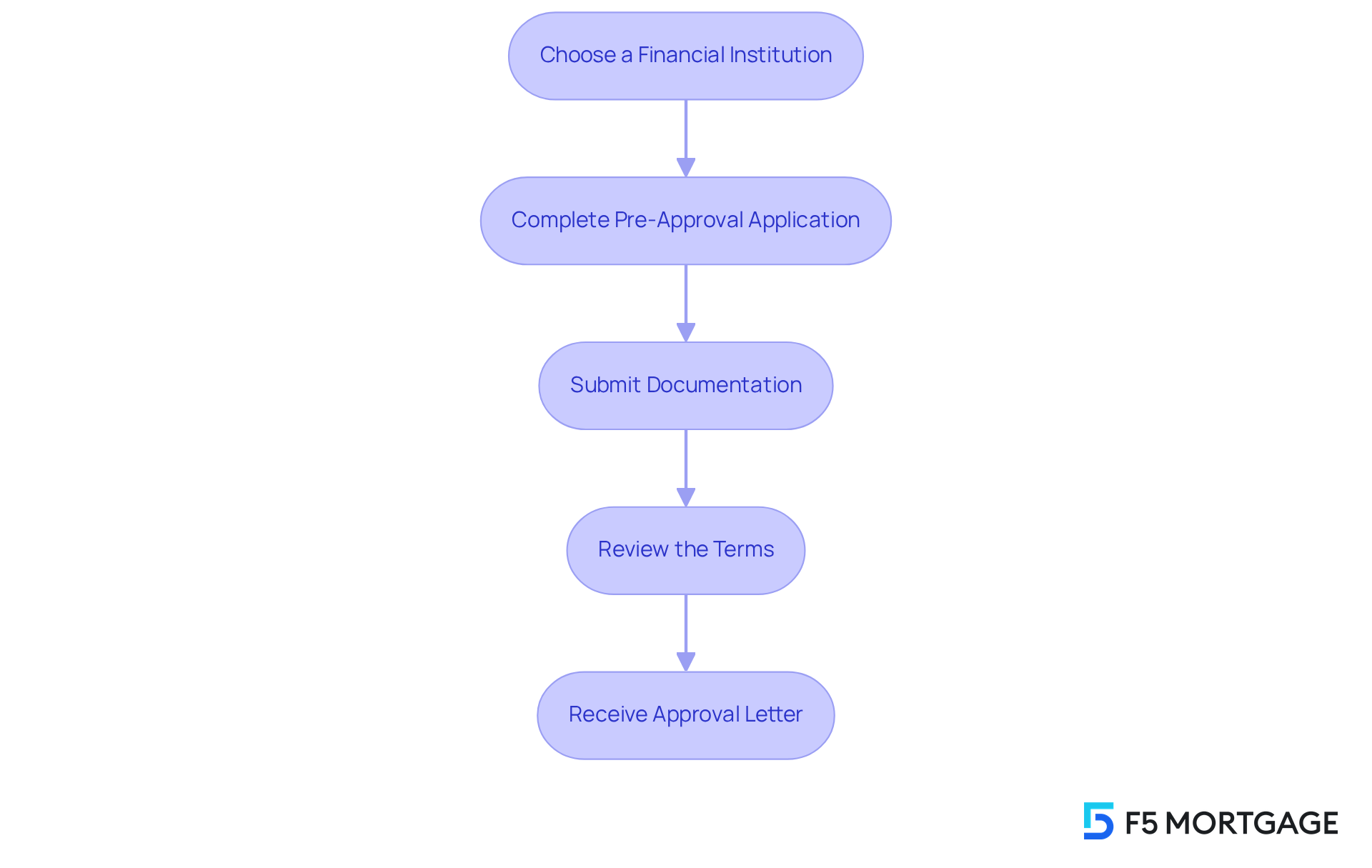

Securing mortgage pre-approval can feel overwhelming, but by following these essential steps, you can navigate the process with confidence:

Choose a Financial Institution: Start by researching and selecting a provider that offers competitive rates and personalized service. F5 Mortgage stands out for its commitment to client satisfaction, competitive rates, and a diverse range of loan options, making it an excellent choice for homebuyers like you.

Complete the application for a pre approved home loan by filling out the form from your chosen financial institution. It’s crucial to provide accurate and comprehensive information about your financial situation. We know how challenging this can be, but remember that research shows 80% of candidates have investigated the process before their first interaction with a lender. Being prepared can make a significant difference.

Submit Documentation: Attach all necessary documents to your application. Common requirements include proof of income, credit history, and asset verification. A complete submission helps avoid delays in processing, allowing you to move forward more swiftly.

Review the Terms: After submission, the lender will review your application and may request additional information. Be ready to respond promptly to any inquiries. This proactive approach can expedite the approval process and alleviate any concerns you may have.

Receive your pre approved home loan approval letter: If your application is accepted, you will receive a letter outlining the loan amount you are eligible for. This letter is a powerful tool when making offers on homes, demonstrating your financial readiness to sellers and giving you peace of mind.

By understanding these steps and selecting a financial institution that prioritizes your needs, you can navigate the approval process with assurance. Remember, comparing financial institutions can lead to significant savings. Many borrowers discover they can save thousands by exploring their options. As Jill Burgess, a leading mortgage officer, wisely states, “First-time homebuying isn’t a flashy space. It has the reputation of taking twice as long for half the volume of deals.” We’re here to support you every step of the way.

Compare Lenders and Offers

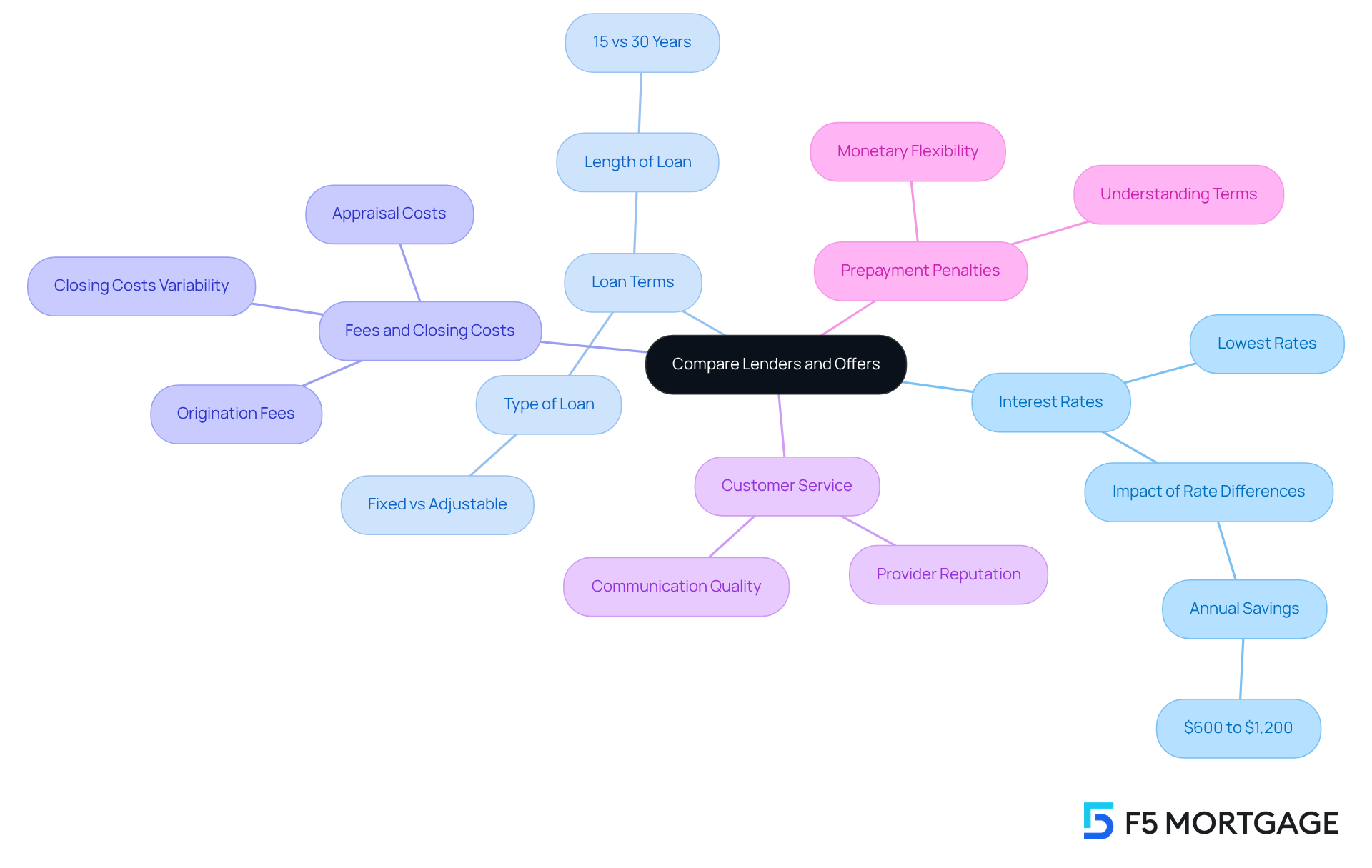

Once you obtain pre-approved home loan letters from different financial institutions, we know how essential it is to compare their proposals effectively. Here’s how to evaluate your options:

- Interest Rates: Seek the lowest interest rates available. Even a minor difference can lead to substantial savings over the life of the loan, impacting both monthly payments and total costs significantly. Freddie Mac estimates that those who compare various financial institutions could save between $600 and $1,200 annually.

- Loan Terms: Assess the length of the loan, such as 15 versus 30 years, and the type of loan, whether fixed or adjustable. These choices can influence your financial strategy and long-term planning.

- Fees and Closing Costs: Scrutinize all associated fees, including origination, appraisal, and closing costs. These costs can fluctuate significantly among financial institutions and impact your overall budget.

- Customer Service: Consider the provider’s reputation for customer service. An institution recognized for clear communication and responsiveness can enhance your experience and ease the mortgage process.

- Prepayment Penalties: Investigate whether there are penalties for early loan repayment. Understanding these terms is crucial for preserving monetary flexibility in the future.

By carefully evaluating these factors, you can choose the provider that aligns best with your monetary objectives and presents the most beneficial terms. Families who have successfully managed this journey often report significant savings by selecting lenders with lower fees and superior customer service ratings. As financial analysts suggest, ‘Shopping around for a pre approved home loan can lead to better loan terms and lower costs, making it a crucial step in the mortgage journey.

Troubleshoot Common Pre-Approval Issues

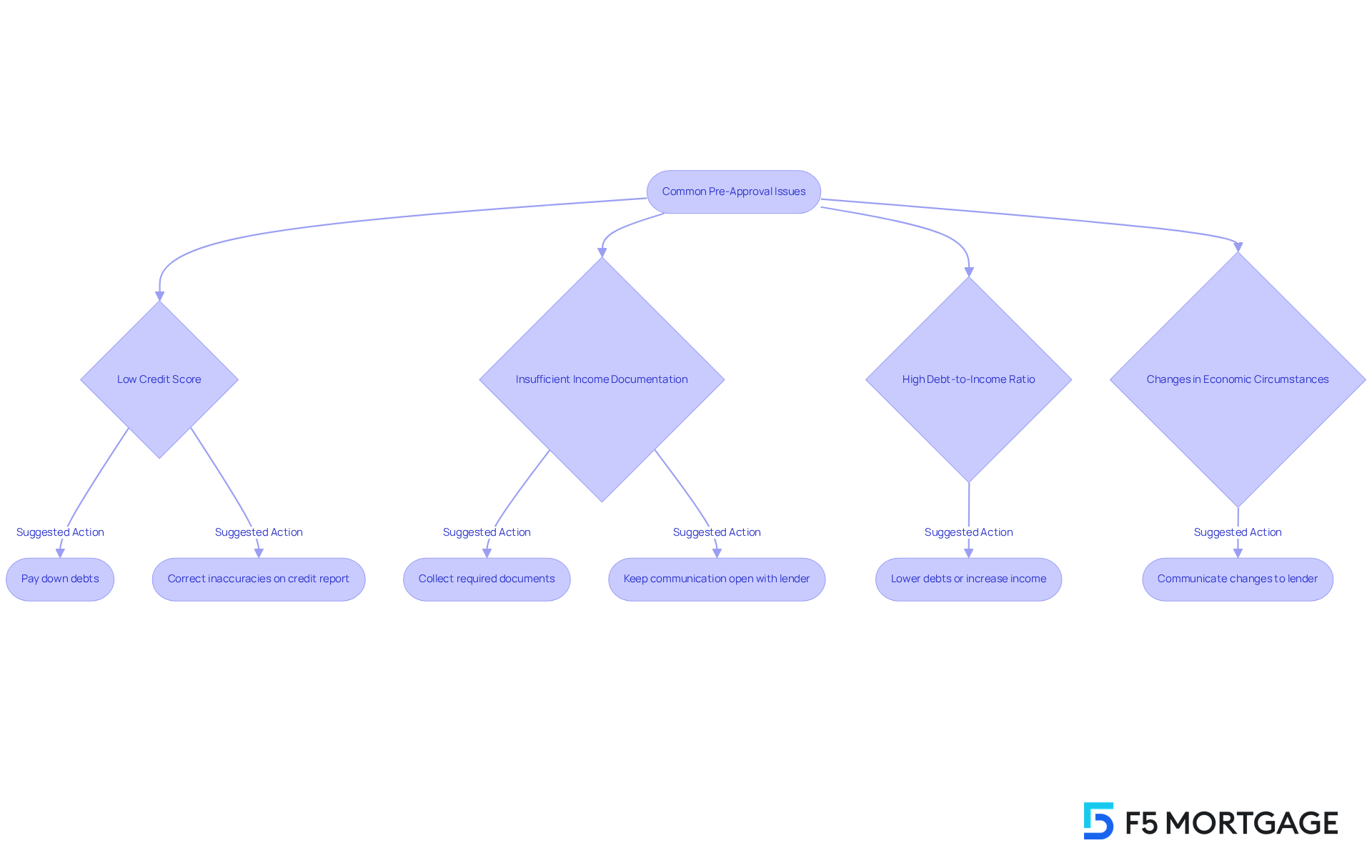

Even with careful preparation, issues can emerge during the preliminary approval process. We understand how challenging this can be, and we want to help you navigate these common problems with effective solutions.

A low credit score can hinder your chances of securing a pre-approved home loan. To improve your score, focus on paying down existing debts and correcting any inaccuracies on your credit report. Consistently checking your credit can assist you in remaining aware of your monetary status. As financial expert David Bach emphasizes, “What determines your wealth is not how much you make but how much you keep of what you make.”

- Insufficient Income Documentation: Incomplete income documentation can delay your application. Collect the required documents quickly and keep open communication with your financial institution to clarify any specific requirements. This proactive approach can expedite the process. Moreover, possessing a bank account is usually required for traditional loans, as lenders desire to review monetary history and arrange automatic mortgage payments.

A high debt-to-income ratio may disqualify you from a pre-approved home loan. Consider strategies to lower your existing debts or explore ways to increase your income, such as taking on additional work or negotiating a raise. This can significantly improve your monetary profile. Remember, approximately 10% of mortgage applications in certain regions were declined, often due to high debt-to-income ratios.

- Changes in Economic Circumstances: Any alterations in your economic circumstances, such as job loss or a significant expense, should be communicated to your lender promptly. Clarity is essential, as these changes can affect your approval status. Avoid common mistakes like applying too soon after a rejection or ignoring the reasons for the initial decline.

By proactively addressing these common issues, you can significantly enhance your chances of successfully securing a pre-approved home loan. We’re here to support you every step of the way. Financial experts emphasize that understanding and managing your credit is essential; as one advisor noted, “The journey to financial stability begins with knowing your credit health.” Taking these steps not only prepares you for a pre-approved home loan but also establishes a solid foundation for your future mortgage journey.

Conclusion

Securing a pre-approved home loan is a vital step in your home-buying journey, enhancing both budgeting clarity and your credibility as a buyer. We understand how overwhelming this process can feel, but by grasping the intricacies of mortgage pre-approval, you can navigate the competitive housing market with confidence. This preparation ensures you are ready to make strong offers on the properties you desire. Embracing this proactive approach not only streamlines your home-buying experience but also positions you favorably in the eyes of sellers.

In this article, we outline essential steps to achieve mortgage pre-approval:

- Start by gathering the necessary documentation and applying with a financial institution.

- Compare lender offers and troubleshoot common issues as they arise.

- Key insights emphasize the importance of thorough preparation, understanding loan terms, and actively addressing potential obstacles.

By following these guidelines, you can significantly improve your chances of securing a favorable loan and reaching your homeownership goals.

Ultimately, your journey to homeownership begins with informed decision-making and strategic planning. We know how challenging this can be, but embracing the pre-approval process equips you with the financial insights needed to make informed offers. It also fosters a sense of readiness in a dynamic market. Taking these steps can lead to substantial savings and a smoother transition into your new home, reinforcing the significance of being proactive in the mortgage pre-approval process.

Frequently Asked Questions

What is mortgage pre-approval and why is it important?

Mortgage pre-approval is a process where a financial institution evaluates your financial situation to determine the loan amount they are willing to offer. It helps clarify your budget and boosts your credibility as a buyer, making sellers more likely to take your offers seriously.

What are the key benefits of obtaining mortgage pre-approval?

The key benefits include clear budgeting, stronger offers to sellers, and faster closing processes once you find a home.

What percentage of mortgage applications were accepted as of July 2025?

As of July 2025, mortgage lenders accepted 81.04% of applications, indicating a strong demand for pre-approved home loans in the market.

What is the typical interest rate for purchase mortgages as of July 2025?

The typical interest rate for purchase mortgages is 6.619% as of July 2025.

What documents are typically required for mortgage pre-approval?

Required documents generally include proof of income (pay stubs, W-2 forms, or tax returns), credit history, asset statements (bank and investment accounts), debt information, identification (government-issued ID), and a Certificate of Eligibility (COE) if applying for a VA loan.

How can having the required documentation ready impact the mortgage application process?

Having the required documentation organized can significantly streamline the application process, potentially reducing the time taken to gather everything to as little as one day, and establishes you as a serious buyer.

How long are loan approval letters typically valid?

Loan approval letters are generally valid for 60 to 90 days.