Overview

We understand how challenging navigating the mortgage landscape can be. In this article, we explore ten key benefits of a 15-year fixed mortgage for homeowners. This option not only offers lower overall interest costs but also allows for quicker loan payoff and greater financial predictability.

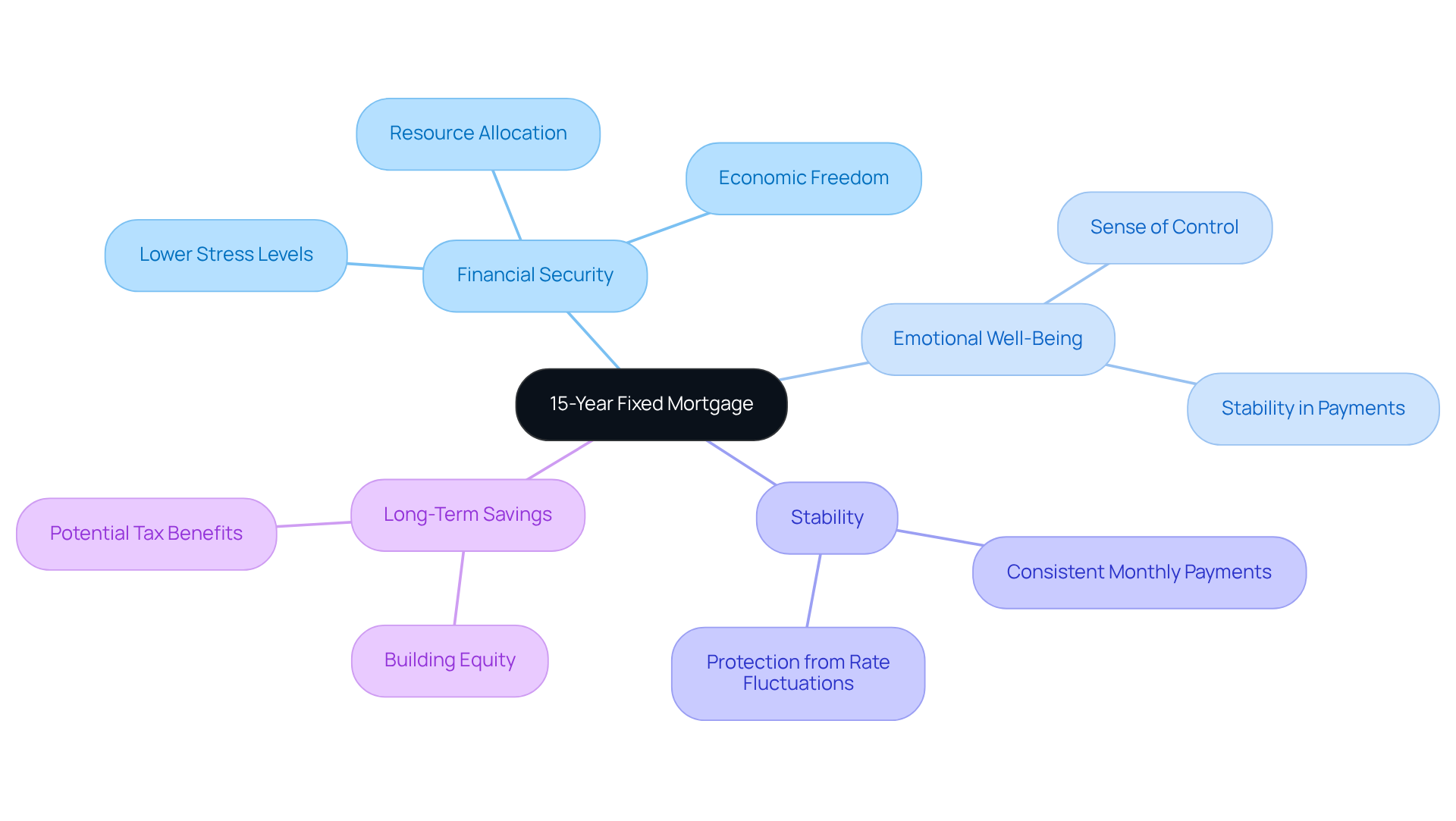

Imagine the relief of knowing that your monthly payments are stable, leading to improved financial security and peace of mind. Homeowners can save significantly on interest, build equity faster, and enjoy a sense of control over their financial future.

We’re here to support you every step of the way as you consider this path. By choosing a 15-year fixed mortgage, you are taking a proactive step towards a more secure financial future for your family.

Introduction

The landscape of home financing is rapidly evolving, and we know how challenging this can be for many homeowners. The choice between a 15-year fixed mortgage and its longer-term counterparts can be pivotal. This option not only promises lower monthly payments but also accelerates equity building, offering significant savings on interest costs. Yet, a crucial question remains: is the 15-year fixed mortgage the ultimate solution for achieving financial peace of mind? Or does it come with trade-offs that could complicate your financial landscape?

Exploring the myriad benefits of this mortgage type reveals how it can transform the homeownership experience. For families aiming for stability and growth, it can be a compelling choice. We’re here to support you every step of the way as you navigate these important decisions.

F5 Mortgage: Personalized Service and Competitive Rates for 15-Year Fixed Mortgages

F5 Mortgage sets itself apart in the lending sector by offering tailored consultations that address each client’s distinct economic situation. We know how challenging this can be, and with partnerships covering more than two dozen leading lenders, the brokerage ensures competitive rates for a 15 year fixed mortgage. This makes it a superb choice for families looking to secure their financial future.

This dedication to client satisfaction is reflected in the streamlined application process, which offers pre-approval in under an hour. This empowers clients to confidently advance in their home-buying journey. F5 Mortgage provides a variety of services, including customized loan programs and expert advice throughout the financing process.

With a of 94% and over 1,000 families assisted, F5 Mortgage’s focus on delivering exceptional service and competitive rates positions it as a trusted ally in achieving homeownership dreams. As George, a pleased customer, expressed, “My primary concern was to guarantee my family was safeguarded against the existing loan obligation throughout the loan duration.” This sentiment underscores the importance of financial security, which F5 Mortgage actively supports through tailored solutions.

Clients such as Ruth Vest and Artie Kamarhie have commended the team for their outstanding service and attention to detail. They emphasize how F5 Mortgage’s tailored approach makes the loan process seamless and hassle-free. We’re here to support you every step of the way.

Lower Monthly Payments: Enjoy Reduced Financial Burden with a 15-Year Fixed Mortgage

One of the main advantages of a 15 year fixed mortgage is the possibility of reduced monthly payments compared to longer-term options. While the payments might be higher than those of a 30-year loan, choosing a 15 year fixed mortgage allows homeowners to . This ultimately lowers the total interest paid over the lifetime of the financing.

We know how challenging it can be to manage finances, and this option can significantly alleviate the monetary burden on families. By reducing total interest, families can allocate resources to other important areas, such as savings or education. We’re here to support you every step of the way as you consider your financial future.

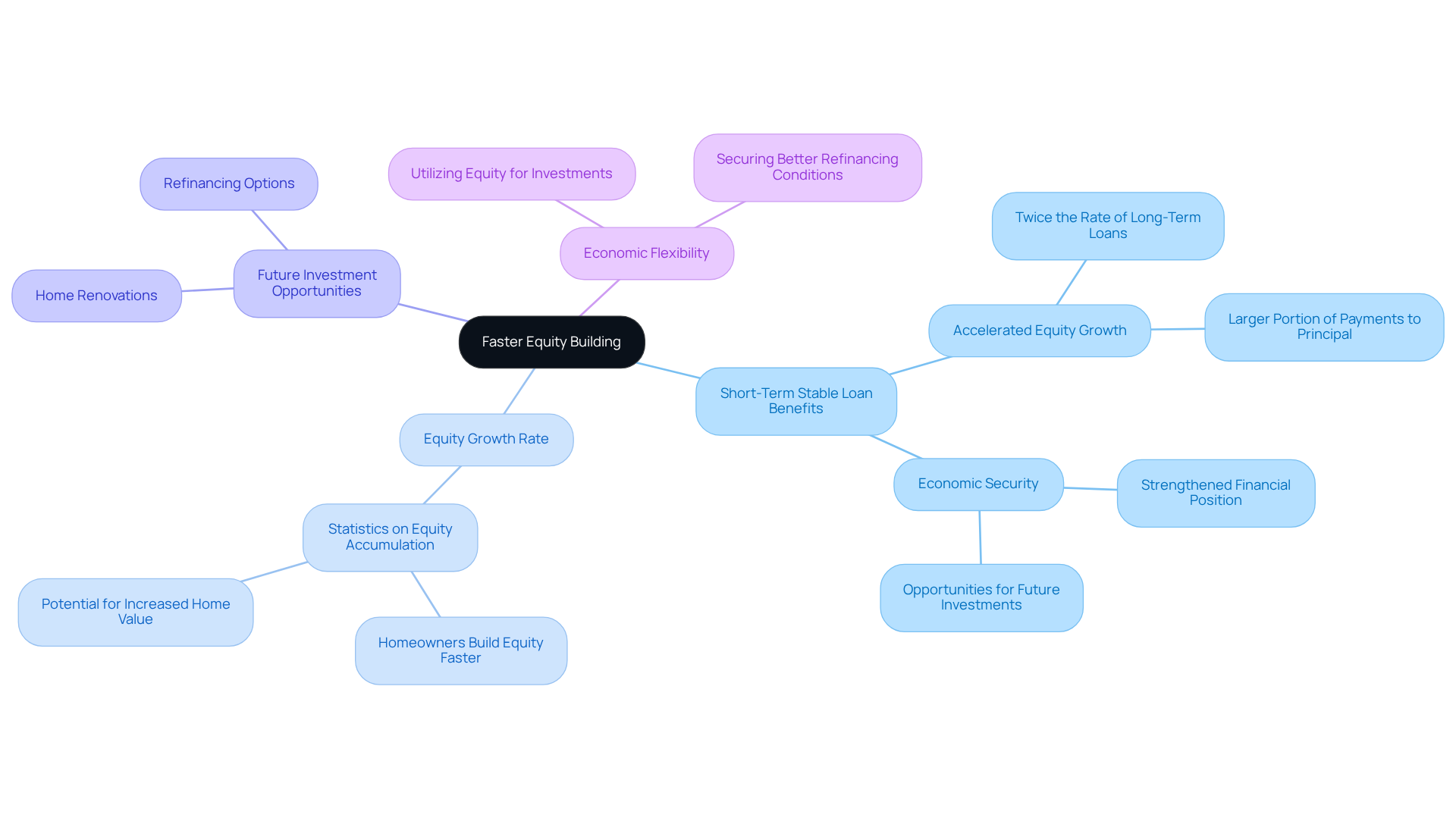

Faster Equity Building: Accelerate Your Investment with a 15-Year Fixed Mortgage

If you’re a homeowner looking to build equity faster, a short-term stable loan could be the solution you need. This type of loan allows you to accumulate equity much more quickly than a long-term loan. With each payment, a larger portion goes toward your principal balance, helping you sooner.

We understand how important economic security is for families. This accelerated equity growth not only strengthens your financial position but also opens doors for future investments, such as home renovations or refinancing options. In fact, statistics reveal that homeowners with short-term stable loans can build equity at a rate that is often twice that of their long-term counterparts. This makes it an attractive option for those looking to enhance their investment.

Real estate specialists emphasize that quicker equity growth can lead to increased economic flexibility. This means you can utilize your equity for additional investments or secure better refinancing conditions. Ultimately, choosing a short-term stable loan can be a strategic decision for homeowners eager to improve their financial outlook. We’re here to support you every step of the way as you navigate your options.

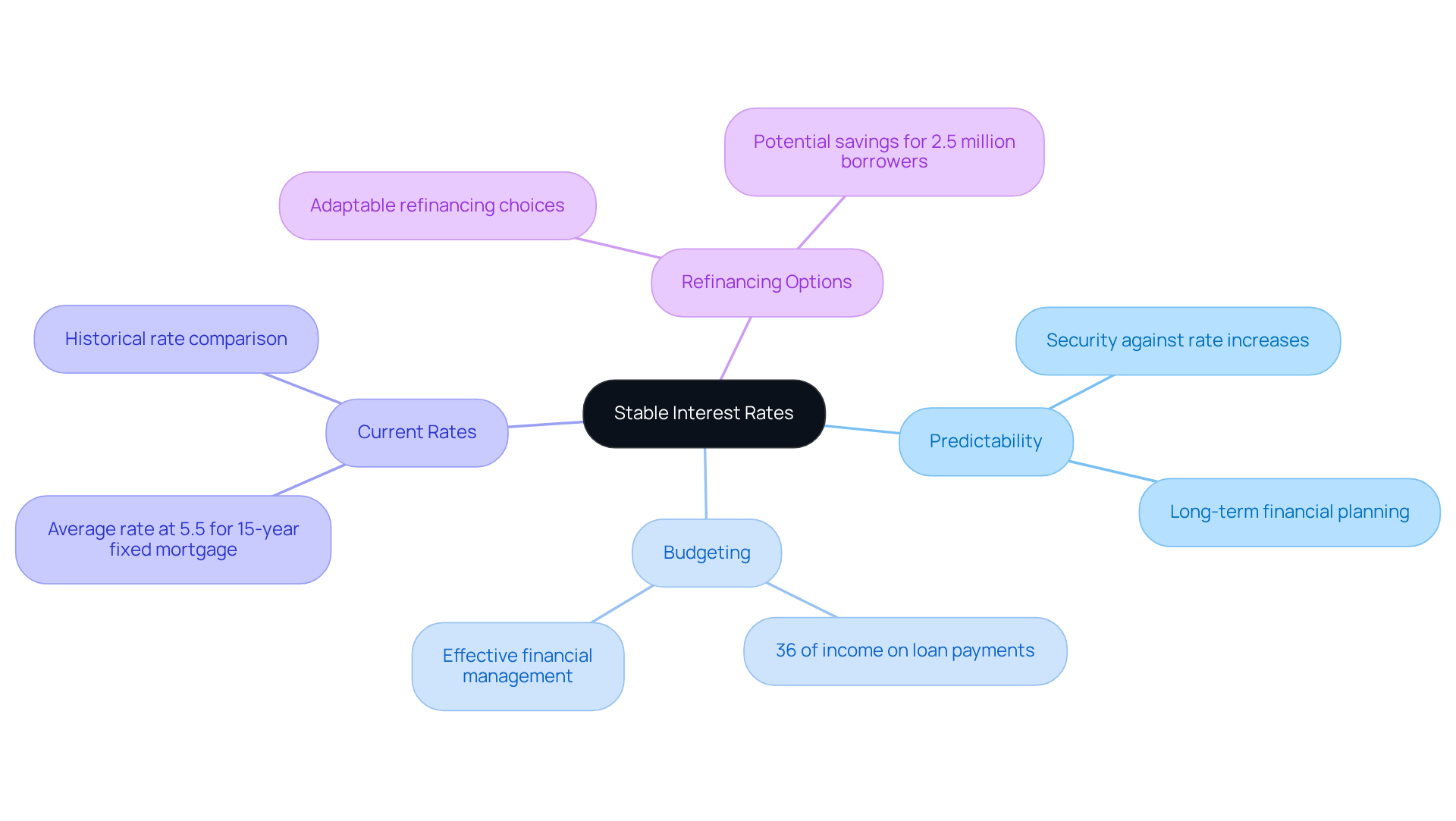

Stable Interest Rates: Secure Your Financial Future with a Fixed Rate Mortgage

A significant benefit of a long-term stable loan is the security it offers. We know how challenging it can be to navigate financial decisions, and for the entire loan term can shield you from future rate increases. This predictability is crucial for effective budgeting, allowing homeowners to plan their finances with certainty regarding monthly payments.

In today’s economic climate, where interest rates have fluctuated significantly, this stability becomes even more valuable. As of mid-2025, the average interest rate for a 15 year fixed mortgage is approximately 5.5%, remaining competitive in relation to historical rates. This means families can manage their budgets without the stress of unexpected payment hikes.

Moreover, with an average household currently allocating approximately 36% of their earnings on loan payments for a median residence, the economic stability provided by a constant rate is especially advantageous. It helps families uphold a consistent household budget amidst increasing living expenses. By securing a fixed rate, homeowners can confidently manage their resources, knowing their payment amounts will remain consistent. This consistency encourages long-term planning and peace of mind.

Furthermore, we’re here to support you every step of the way. F5 Financing provides adaptable refinancing choices that enable homeowners to modify their loan conditions. This could mean lowering monthly payments or removing private loan insurance (PMI) if they meet the criteria. This adaptability can further enhance financial stability, making F5 Mortgage a valuable partner in navigating the complexities of home financing.

Lower Overall Interest Costs: Save Money with a 15-Year Fixed Mortgage

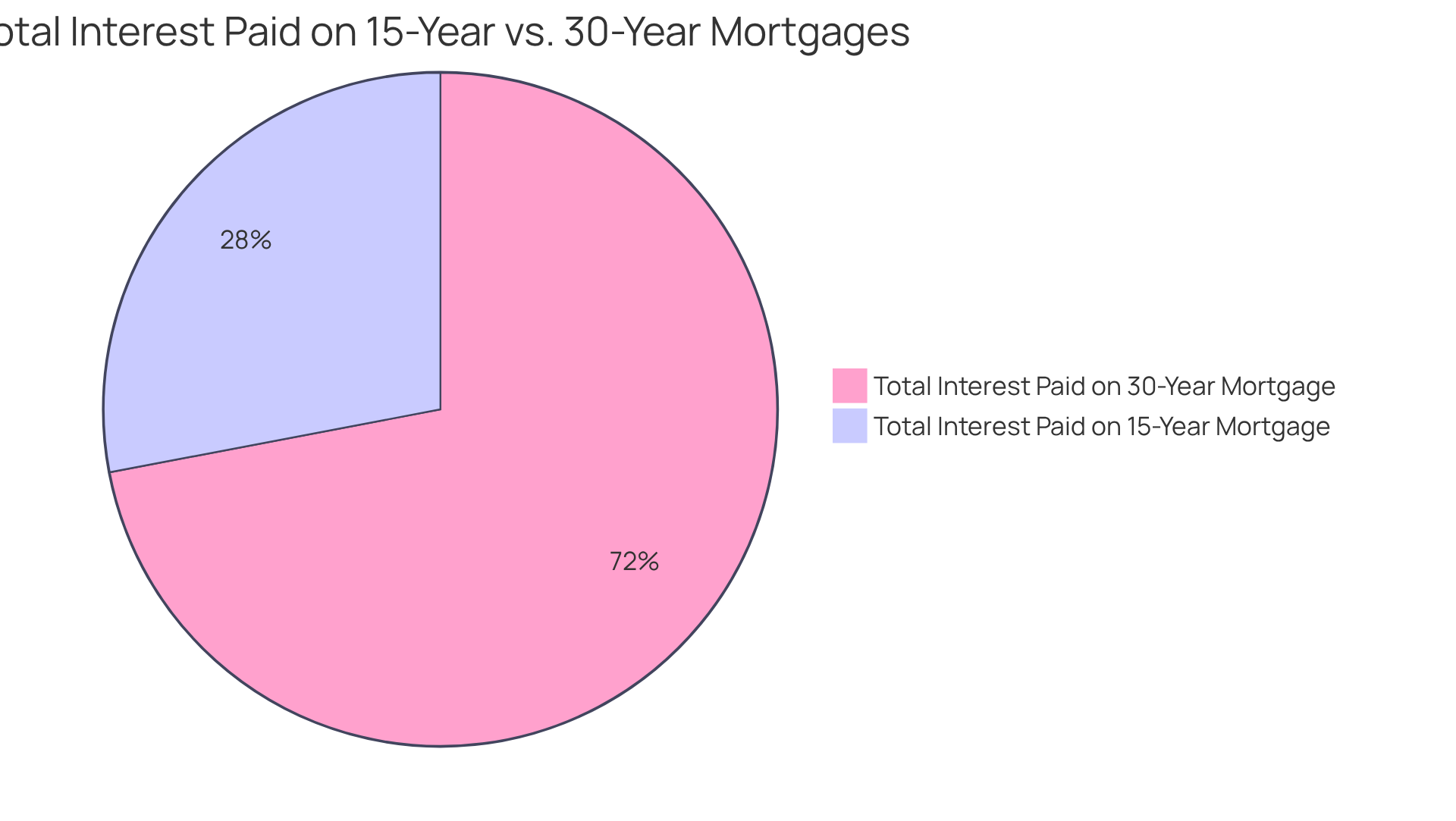

Choosing a 15 year fixed mortgage can lead to significant savings on total interest expenses. By opting for a 15 year fixed mortgage and paying off the loan in half the time compared to a traditional 30-year mortgage, homeowners can save more than $245,000 in interest over the life of the loan. This substantial decrease not only improves the affordability of homeownership but also allows families to direct those savings toward other important financial goals, such as retirement savings or funding education.

Imagine families who invest their interest savings; they can potentially increase their retirement funds or contribute to college savings plans, ensuring a more stable economic future. Financial advisors often highlight the long-term advantages of a 15 year fixed mortgage, pointing out that the lower interest costs associated with this shorter repayment period can lead to increased wealth growth over time.

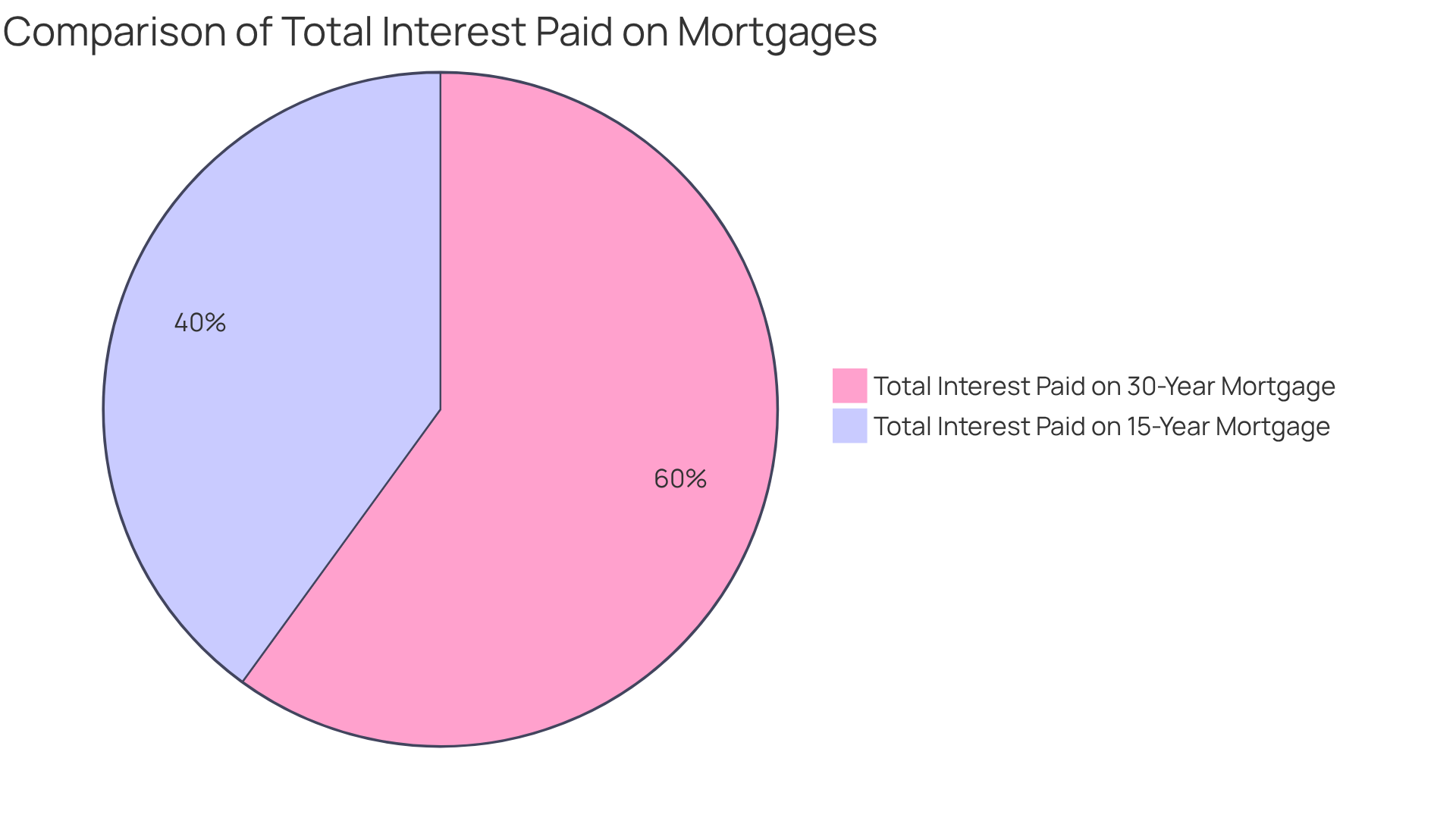

As of March 2025, the total interest paid on a short-term loan averages $155,974, compared to $401,204 for a long-term loan. This stark contrast highlights the economic benefits of this option. However, we know how challenging it can be to qualify for a long-term loan, as it typically requires stronger financials due to the higher monthly payments.

By selecting a long-term stable loan, homeowners not only save funds but also create opportunities for more strategic monetary planning. We’re here to support you every step of the way as you .

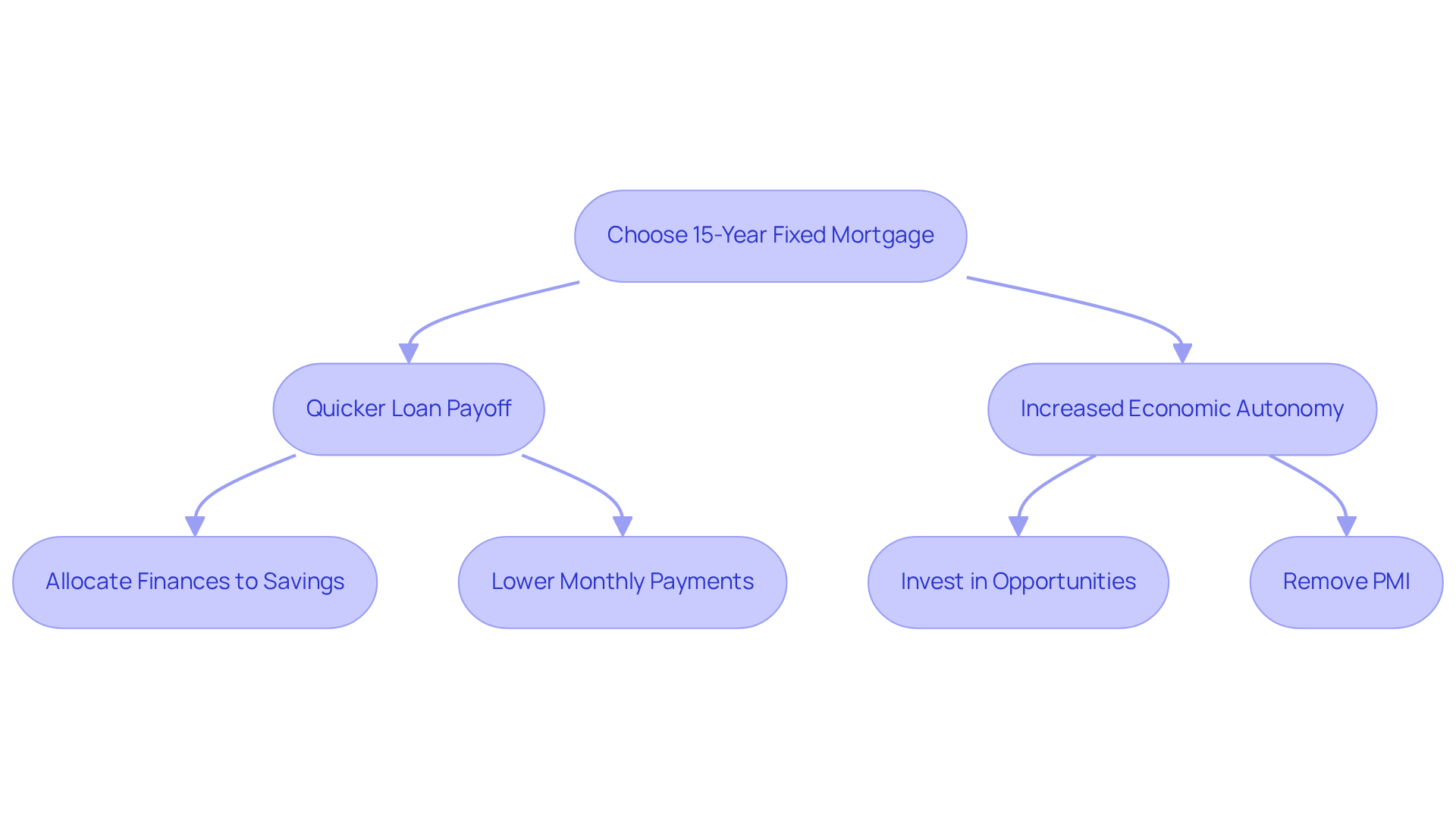

Quicker Loan Payoff: Achieve Financial Freedom Sooner with a 15-Year Fixed Mortgage

Choosing a 15 year fixed mortgage can help you achieve economic independence much quicker than a conventional 30-year loan. We understand how challenging it can be to manage housing debt, and by opting for a 15 year fixed mortgage, you can eliminate that burden in just 15 years. Imagine reallocating your finances toward savings, investments, or other life aspirations once your loan is settled. This expedited repayment not only improves your economic security but also promotes stability, allowing you and your family to focus on long-term objectives without the strain of continuous loan payments.

Property owners who opt for a 15 year fixed mortgage often find increased economic autonomy. Once your obligations are settled, you can invest in opportunities that arise, paving the way for a brighter financial future. With F5 Mortgage, families can explore and technology-driven refinancing options. These options allow you to modify your loan rate and term, potentially lowering monthly payments or removing private insurance (PMI). This approach enhances your financial flexibility and provides peace of mind as you navigate your mortgage journey. We’re here to support you every step of the way.

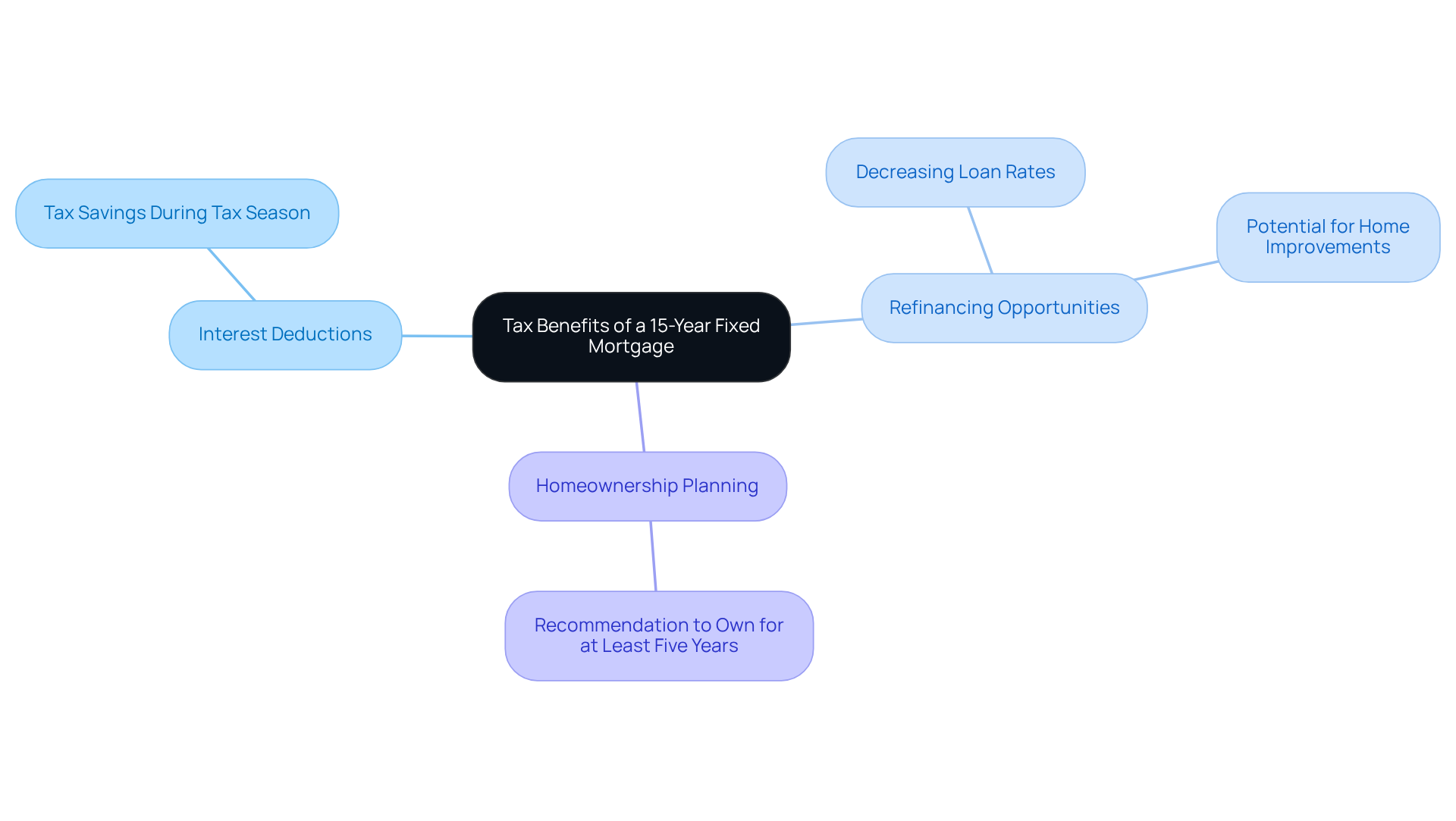

Tax Benefits: Maximize Your Savings with a 15-Year Fixed Mortgage

As a property owner with a 15 year fixed mortgage, you can unlock valuable tax advantages, especially through interest deductions. We know how challenging financial management can be, and the interest you pay on your loan is often tax-deductible, leading to significant savings come tax season. This benefit can make the overall cost of homeownership more manageable and appealing, particularly for families looking to optimize their resources.

Moreover, refinancing your loan can also provide tax benefits, as the interest on a new loan may still be deductible. With the recommendation to own a home for at least five years before it truly pays off, families can thoughtfully .

Currently, as loan rates in Colorado are decreasing, refinancing options present a wonderful opportunity to lower monthly payments and access funds for home improvements. This not only enhances your living space but also amplifies the financial benefits of owning a home. At F5 Mortgage, we’re here to support you every step of the way as you navigate these exciting possibilities.

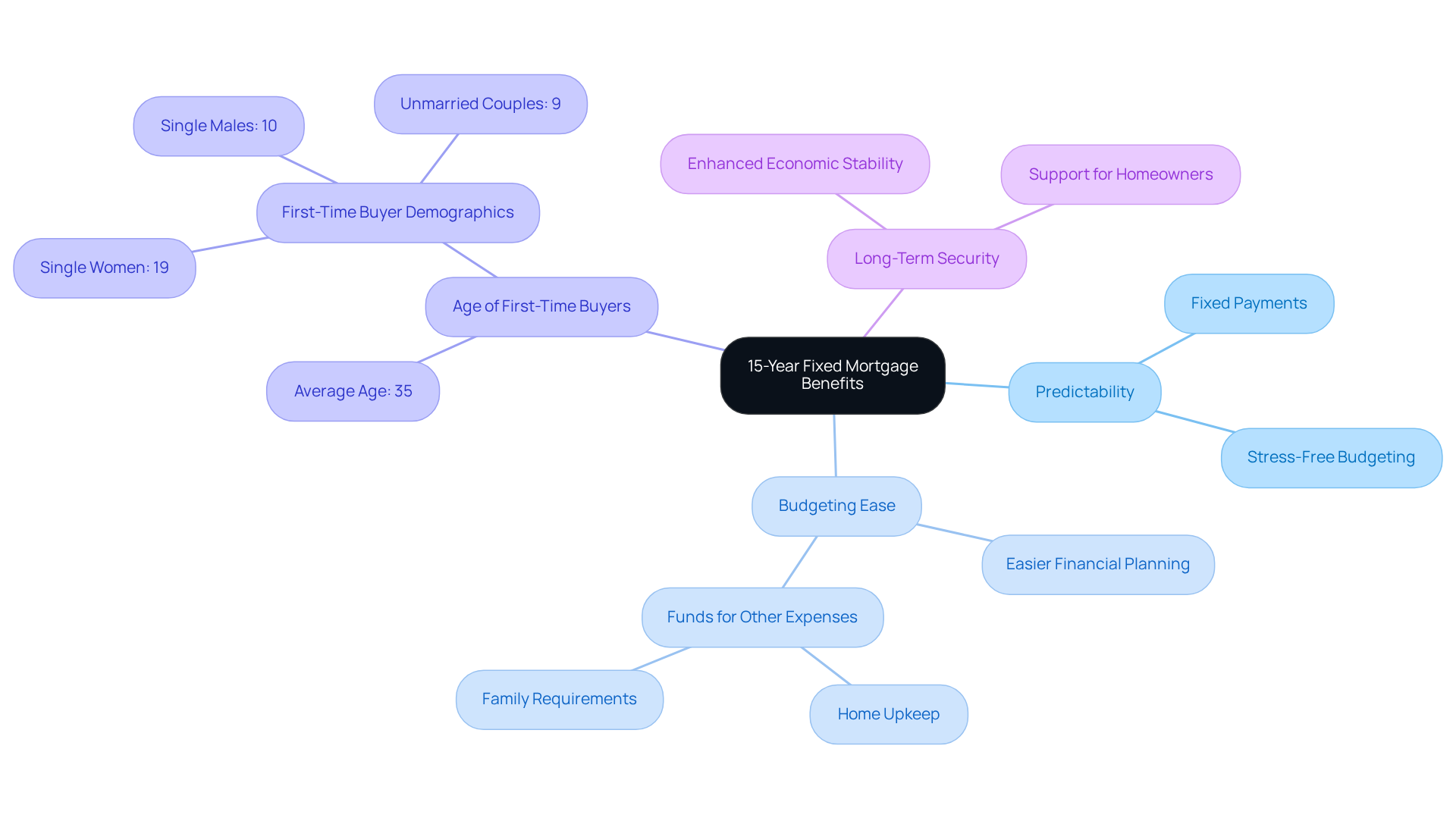

Ideal for First-Time Homebuyers: A 15-Year Fixed Mortgage Offers Predictability

For first-time homebuyers, a 15-year stable mortgage can provide a reassuring sense of predictability. We know how challenging this can be, and with fixed monthly payments, homeowners can effectively budget without the stress of fluctuating interest rates. This stability is especially beneficial for those entering the housing market, as it enables them to handle their obligations confidently.

In 2023, the average first-time homebuyer was 35 years old, often managing substantial monetary choices for the first time. The reliability of a 15 year fixed mortgage as a stable loan payment can ease budgeting, allowing new homeowners to set aside funds for other necessary expenses, such as home upkeep and family requirements.

Real estate specialists highlight that this predictability not only assists in budgeting but also enhances long-term economic security. We’re here to support you every step of the way, making it an attractive choice for those starting their .

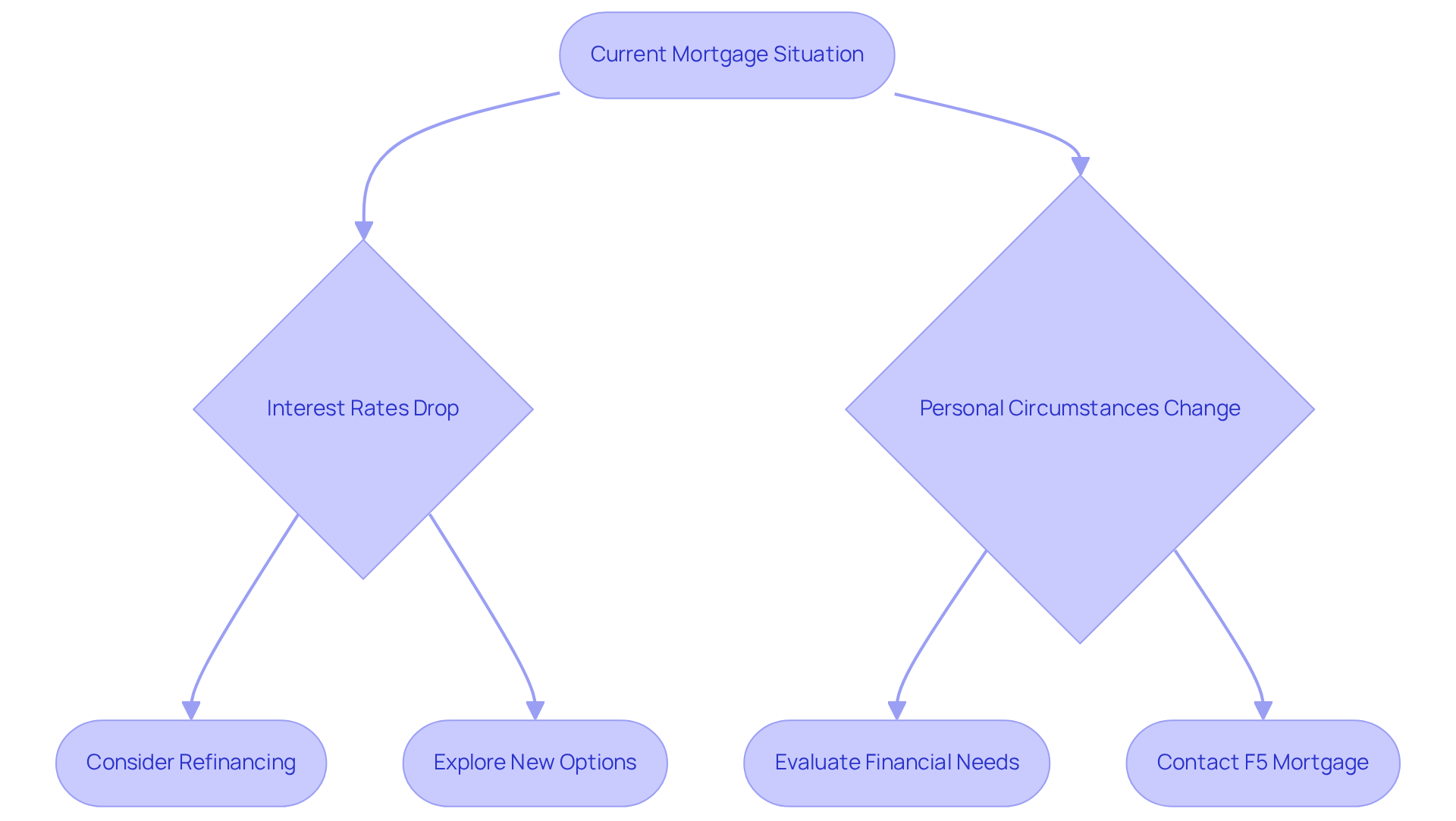

Refinancing Flexibility: Adapt Your Mortgage Strategy with a 15-Year Fixed Loan

A long-term loan offers homeowners the flexibility they need as their economic situation evolves. We understand how challenging this can be; should interest rates drop or personal circumstances change, refinancing could be a valuable option to secure even better terms. With F5 Mortgage, the is not only streamlined but also supported by a dedicated team. This ensures that you have access to competitive rates and expert guidance.

This flexibility empowers you to enhance your loan according to your current needs, allowing you to make the best financial choices consistently. We’re here to support you every step of the way, helping you navigate these important decisions with confidence.

Peace of Mind: Enjoy Financial Security with a 15-Year Fixed Mortgage

A 15 year fixed mortgage provides homeowners with significant peace of mind by ensuring that monthly payments remain consistent throughout the loan term. This stability not only paves the way toward economic freedom but also alleviates stress and anxiety associated with varying payment amounts. Families can focus on creating their lives and chasing their dreams without the concern of uncertain monetary responsibilities.

At F5, we understand how challenging navigating the loan process can be. We are dedicated to transforming this experience by utilizing technology to offer exceptionally competitive rates without the annoyance of aggressive sales tactics. Our mission is to challenge traditional banking institutions that rely on secrecy and intimidation. Research suggests that homeowners with fixed-rate loans experience lower stress levels compared to those with variable-rate alternatives, as they are protected from the fluctuations of interest rate changes. Families who have opted for a 15 year fixed mortgage frequently express an increased feeling of economic security, enabling them to direct resources toward savings, education, and other long-term objectives.

Financial consultants often emphasize the emotional advantages of consistent loan payments. We know how important it is for families to feel secure in their financial commitments. The reliability of a set loan can greatly improve a family’s overall well-being. This steady monetary commitment fosters a sense of control and stability, which is particularly advantageous for families navigating the complexities of homeownership.

Furthermore, the long-term economic stability offered by a fixed-rate loan can result in significant savings over time. Homeowners can build equity more quickly, contributing to their overall net worth. As families attain economic stability through consistent payments, they can enjoy a more secure and fulfilling lifestyle, free from the burdens of economic uncertainty. At F5 Mortgage, we encourage families to consider their long-term financial goals when choosing between a 15 year fixed mortgage and a 30-year mortgage. We’re here to support you every step of the way to ensure you make the .

Conclusion

A 15-year fixed mortgage presents numerous benefits designed for homeowners who seek financial stability and long-term security. By opting for this mortgage type, families can experience lower monthly payments, faster equity building, and stable interest rates. These elements contribute to a more manageable financial landscape. This choice not only accelerates debt repayment but also significantly reduces the total interest paid over the life of the loan, allowing families to redirect their resources toward other important financial goals.

Key insights throughout this article reveal how a 15-year fixed mortgage can lead to substantial savings and enhanced economic flexibility. From tax benefits to quicker loan payoff, each advantage reinforces the notion that this mortgage type is particularly well-suited for first-time buyers and those who wish to secure their financial future. Moreover, the personalized service provided by F5 Mortgage ensures that clients receive tailored solutions that meet their unique needs, making the home-buying process less daunting and more rewarding.

When considering the long-term implications of homeownership, it becomes evident that a 15-year fixed mortgage is a strategic choice for those aiming to achieve financial independence and peace of mind. Embracing this option fosters a sense of stability and empowers individuals and families to focus on their aspirations without the burden of unpredictable payments. As you weigh your options, the advantages of a 15-year fixed mortgage stand out, encouraging a thoughtful approach to your financial future. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What distinguishes F5 Mortgage from other lenders?

F5 Mortgage offers personalized consultations tailored to each client’s unique financial situation and partners with over two dozen leading lenders to ensure competitive rates for 15-year fixed mortgages.

What is the application process like at F5 Mortgage?

The application process at F5 Mortgage is streamlined, allowing for pre-approval in under an hour, which helps clients confidently move forward in their home-buying journey.

What services does F5 Mortgage provide?

F5 Mortgage provides a variety of services including customized loan programs and expert advice throughout the financing process.

How satisfied are F5 Mortgage clients?

F5 Mortgage has a customer satisfaction rate of 94% and has assisted over 1,000 families, reflecting its commitment to exceptional service.

What are the benefits of a 15-year fixed mortgage?

A 15-year fixed mortgage can lead to reduced monthly payments compared to longer-term options, allowing homeowners to pay off their debt more quickly and lower the total interest paid over the life of the loan.

How does a 15-year fixed mortgage help with equity building?

A 15-year fixed mortgage allows homeowners to build equity faster because a larger portion of each payment goes toward the principal balance, enabling quicker ownership of the property.

What are the financial implications of faster equity building?

Faster equity building strengthens financial security and provides homeowners with increased economic flexibility, allowing them to utilize their equity for investments or secure better refinancing conditions.

How can F5 Mortgage assist families with their financial future?

F5 Mortgage is dedicated to supporting families by offering tailored solutions that enhance financial security and help them navigate their options effectively.