Overview

Navigating the world of home loans can be overwhelming, and we understand how challenging this can be. This article sheds light on conventional loans, exploring their key characteristics, requirements, and the benefits they offer to borrowers like you.

Conventional loans are typically provided by private lenders, which means they often come with specific criteria. For instance, they require a minimum credit score and down payment. Many homebuyers prefer these loans because of their flexibility and the potential for lower overall costs compared to government-backed loans.

We’re here to support you every step of the way, helping you understand how these loans can fit into your homebuying journey. By recognizing your needs and concerns, we aim to empower you with the knowledge to make informed decisions. Let’s explore how conventional loans could be a great option for you.

Introduction

Understanding the landscape of conventional loans is crucial for families aiming to achieve homeownership. We know how challenging this can be, and with a significant portion of homebuyers opting for these financing options, grasping their key features and requirements can empower you to make informed decisions.

However, the complexities surrounding credit scores, down payments, and loan limits can create confusion and uncertainty. We’re here to support you every step of the way. How can families navigate these challenges to secure the best possible financing for their dreams? Together, we can explore the options available to you.

F5 Mortgage: Your Trusted Partner for Conventional Loans

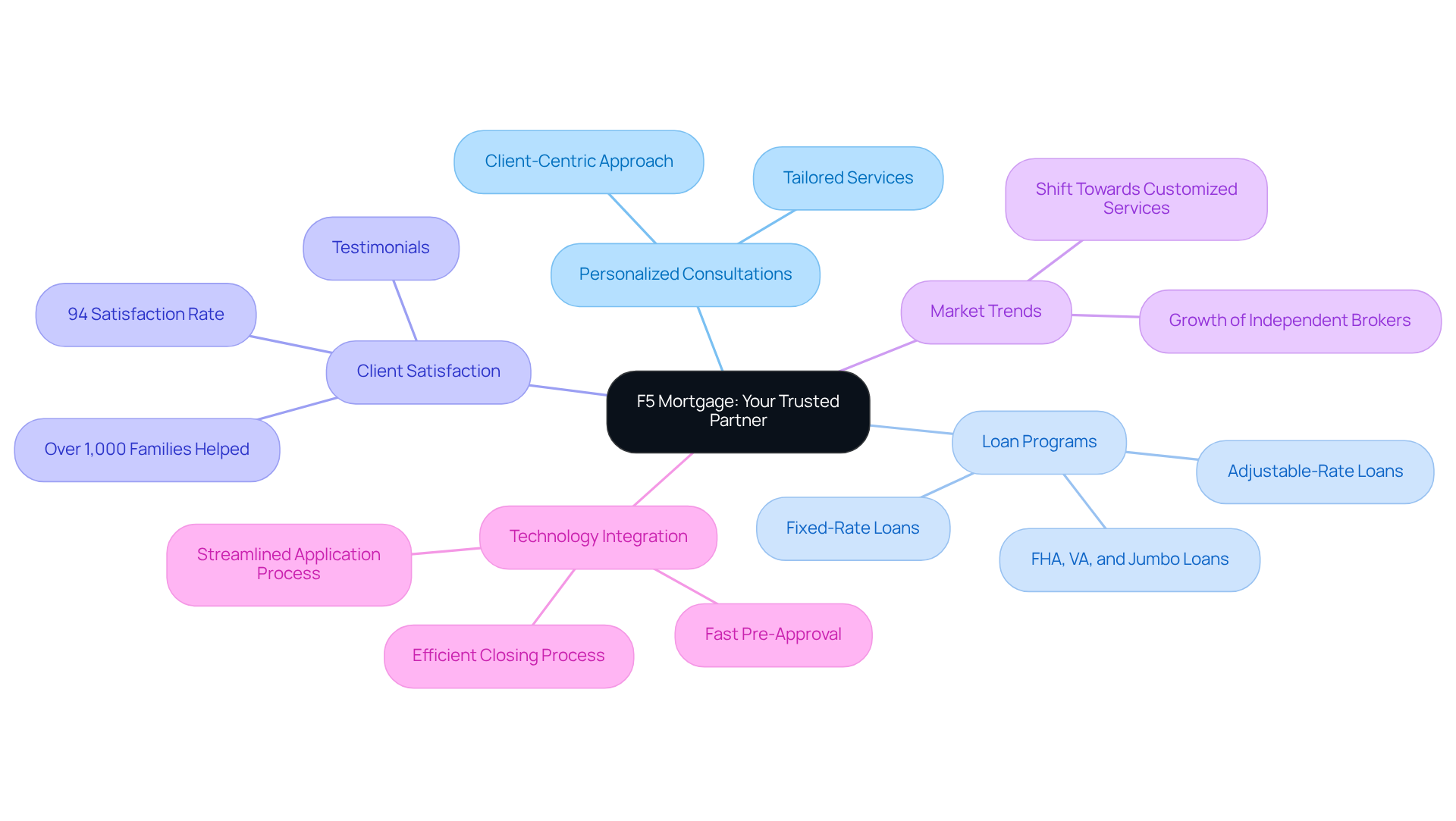

F5 Mortgage LLC stands out as a leading independent brokerage, particularly in the realm of conventional loans. We understand how overwhelming the mortgage process can feel, which is why we prioritize personalized consultations. Our approach allows us to tailor our services to meet the diverse financial needs of our clients. This not only enhances the customer experience but also ensures that families secure the most suitable financial options available.

With access to a wide array of loan programs, including fixed-rate and adjustable-rate options, F5 Mortgage is devoted to providing and exceptional service for conventional loans. This commitment reinforces our reputation as a trustworthy ally for families navigating the complexities of financing.

Looking ahead to 2025, independent loan brokers are projected to capture a significant share of the market, reflecting a growing preference for customized service over traditional lending methods. This trend highlights the importance of partnering with brokers like F5 Mortgage, where client satisfaction is our top priority. We are proud to share that we have achieved a remarkable 94% satisfaction rate among the families we serve. Testimonials from clients underscore our dedication to a hassle-free financing process, with many praising our team’s outstanding communication and problem-solving skills. One client remarked, “F5 Mortgage handled my financial needs exceptionally well… Even my title company stated that F5 was on the ball.”

Moreover, F5 Mortgage has successfully assisted over 1,000 families in realizing their homeownership dreams, further demonstrating our commitment to client success. As Ryan McCallister, the CEO of F5 Mortgage, emphasizes, ‘Our mission at F5 is to offer our clients the best loan experience from beginning to end, and utilizing industry-leading technology is an essential aspect of that.’ We also provide pre-approval in under an hour, and most financing options close in less than three weeks, making us a compelling choice for families looking to improve their homes.

If you’re ready to explore your financing options, we invite you to reach out to F5 Mortgage today. Together, we can begin your journey toward homeownership.

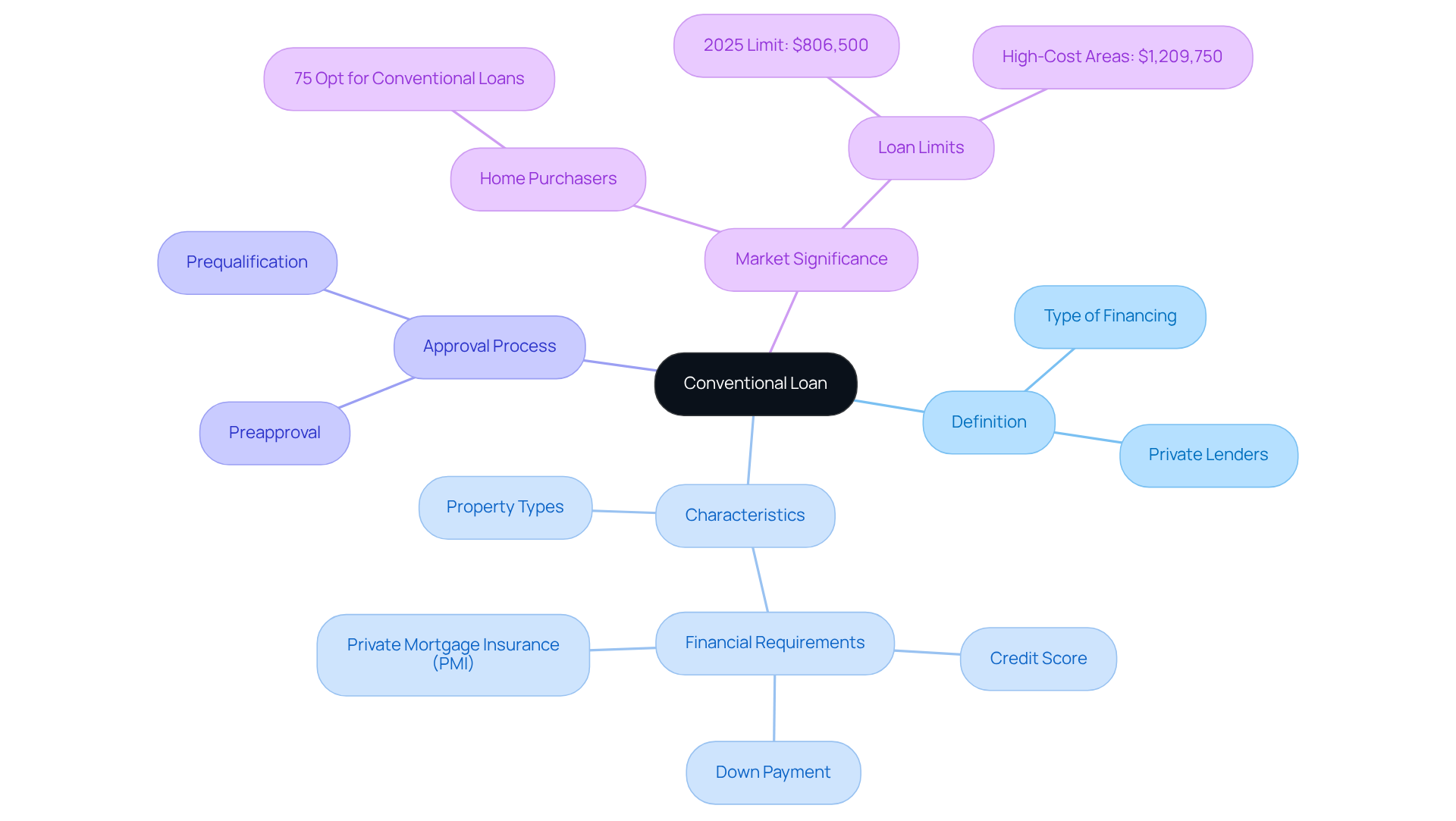

What Is a Conventional Loan? Understanding the Basics

A conventional loan is a type of financing that many families consider, but it’s important to understand what it entails. Unlike government-supported loans, conventional loans are typically provided by private lenders and can be used for various property types. We know how challenging this can be, especially when dealing with conventional loans that often come with stricter financial requirements and may require a larger down payment.

For families with good credit and stable income, conventional loans can be a viable option. Understanding the loan approval process is essential. This involves a lender reviewing your financial details to determine if you qualify for a loan. This endorsement, often referred to as ‘preapproval‘ or ‘prequalification,’ gives you an estimate of your borrowing amount, interest rate, and potential monthly costs. Knowing these details can significantly influence your financing choices.

In fact, about 75% of home purchasers opt for conventional loans, highlighting their significance in the mortgage market. We’re here to support you every step of the way as you navigate this journey toward .

Conventional Loan Requirements: What You Need to Qualify

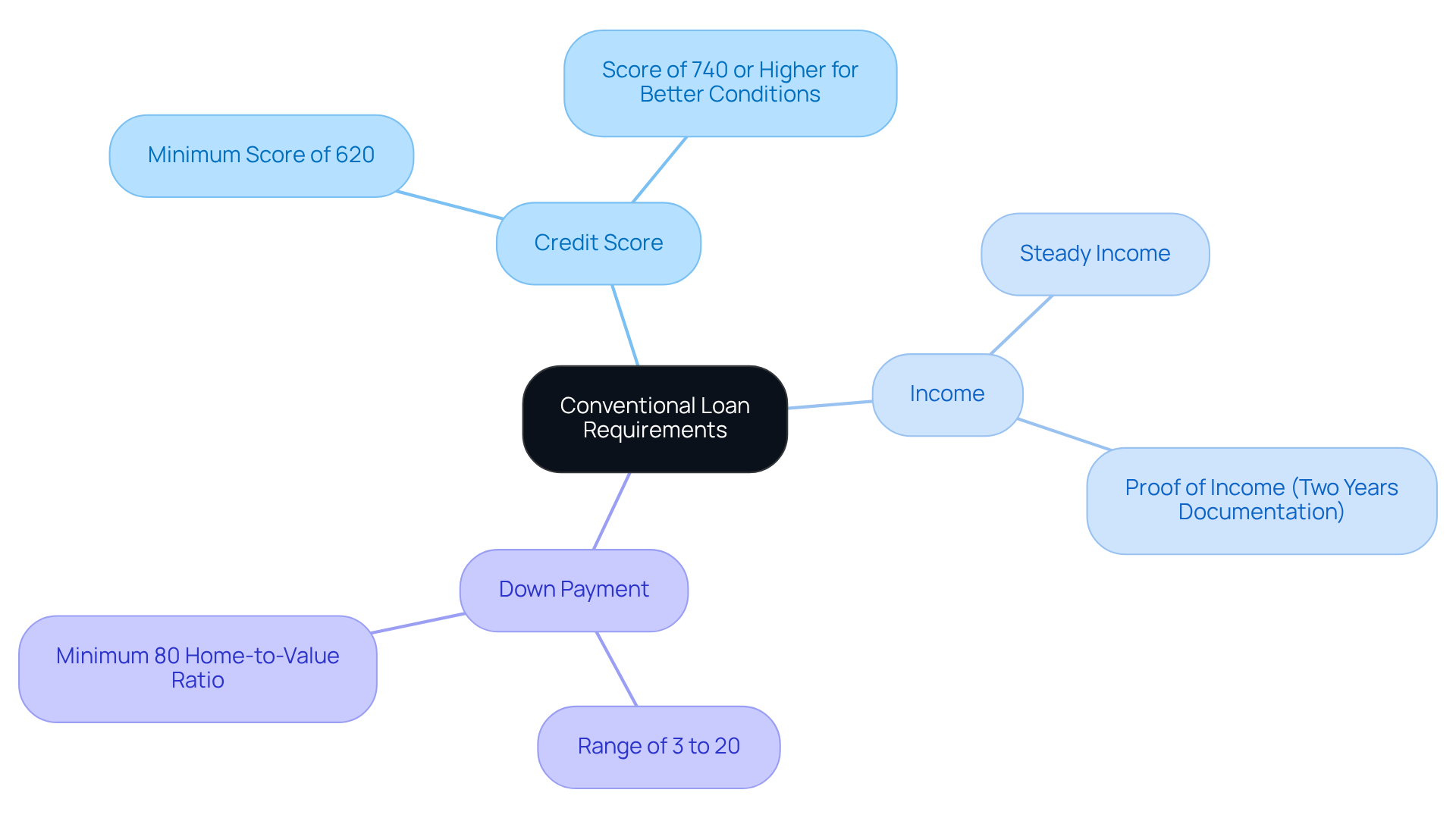

Navigating the world of conventional loans can feel overwhelming, but we’re here to support you every step of the way. To qualify, borrowers typically need:

- A minimum credit score of 620

- A steady income

- A down payment that ranges from 3% to 20% of the home’s purchase price

It’s important to understand that lenders also look at your debt-to-income (DTI) ratio, which ideally should stay under 43%. This can help you secure favorable financing conditions and interest rates.

Looking ahead to 2025, the average score for traditional borrowers is expected to be around 670. This highlights the importance of maintaining a strong financial profile. For instance, if your credit score is 740 or higher, you may be eligible for reduced down payments and more attractive interest rates.

Lenders often require proof of consistent income, typically demonstrated through two years of documentation, such as pay stubs and tax returns. Additionally, many lenders ask homeowners to maintain a minimum 80% home-to-value ratio. This means you should have paid down at least 20% of your initial mortgage amount, or your property must have appreciated in value.

This thorough assessment process is designed to ensure that you are and capable of managing your mortgage obligations effectively. Remember, we know how challenging this can be, but with the right preparation and understanding, you can confidently take the next steps toward homeownership.

Credit Score Impact: How It Affects Your Conventional Loan Approval

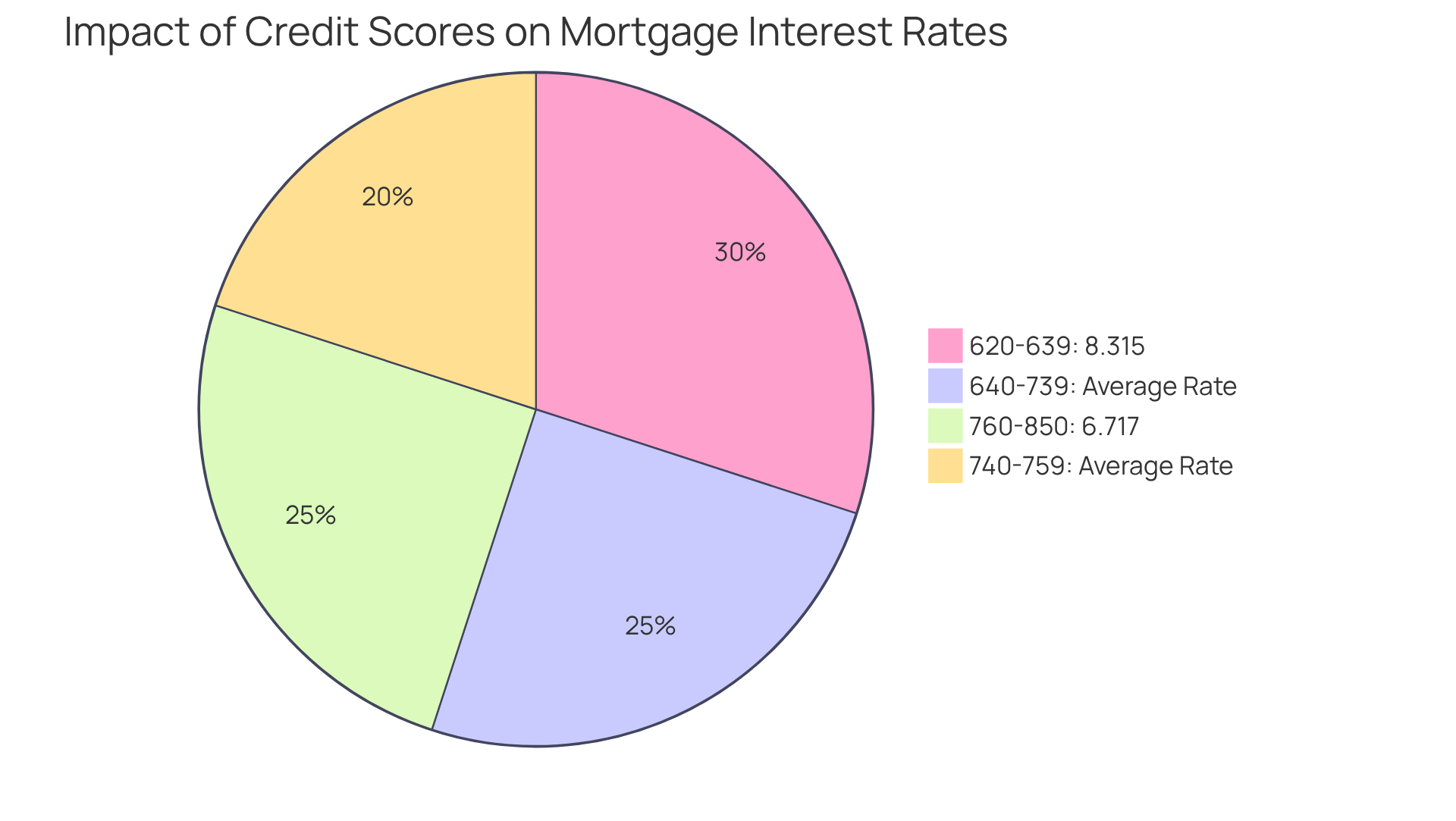

Your plays a vital role in determining your eligibility for conventional loans. We understand how daunting this can feel. A score of 620 is the minimum requirement, but it’s important to know that higher scores can lead to better interest rates and borrowing conditions. Borrowers with scores above 740 may qualify for the most favorable rates, while those with lower scores might face higher costs or challenges in securing a loan. For instance, borrowers with scores between 760 and 850 may observe average interest rates of approximately 6.717%, which is the current average for a 30-year fixed-rate loan as of July 15, 2025. Conversely, those with scores between 620 and 639 could face rates as high as 8.315%. This disparity emphasizes the importance of maintaining a strong financial profile.

Boosting your financial rating can significantly enhance your mortgage options. We know how challenging this can be, but there are effective approaches to consider. Regularly checking your financial report for mistakes, managing your utilization ratio to stay under 30%, and ensuring timely payments can all lead to improved loan conditions. Financial specialists emphasize that a steady history of timely payments is essential, as payment history accounts for 35% of your score. As Lindsay Miles observes, “A steady history of timely transactions aids in establishing robust creditworthiness, while repeated or recent late payments can reduce your score.”

Furthermore, the resumption of student loan payments may impact many borrowers’ credit ratings, potentially affecting their mortgage qualifications. Hundreds of thousands of borrowers will be affected by the change in student debt payment reporting, which could push many into near-prime or subprime status. Understanding how to navigate these changes is crucial for securing conventional loans as a financing option. By actively working to enhance your score, you can improve your chances of qualifying for a mortgage with favorable terms, ultimately saving thousands over the life of the loan. Additionally, lower credit scores may require larger down payments and could lead to mandatory Private Mortgage Insurance (PMI), increasing overall financial strain. Thus, maintaining a strong credit profile is essential for prospective homebuyers, and we’re here to support you every step of the way.

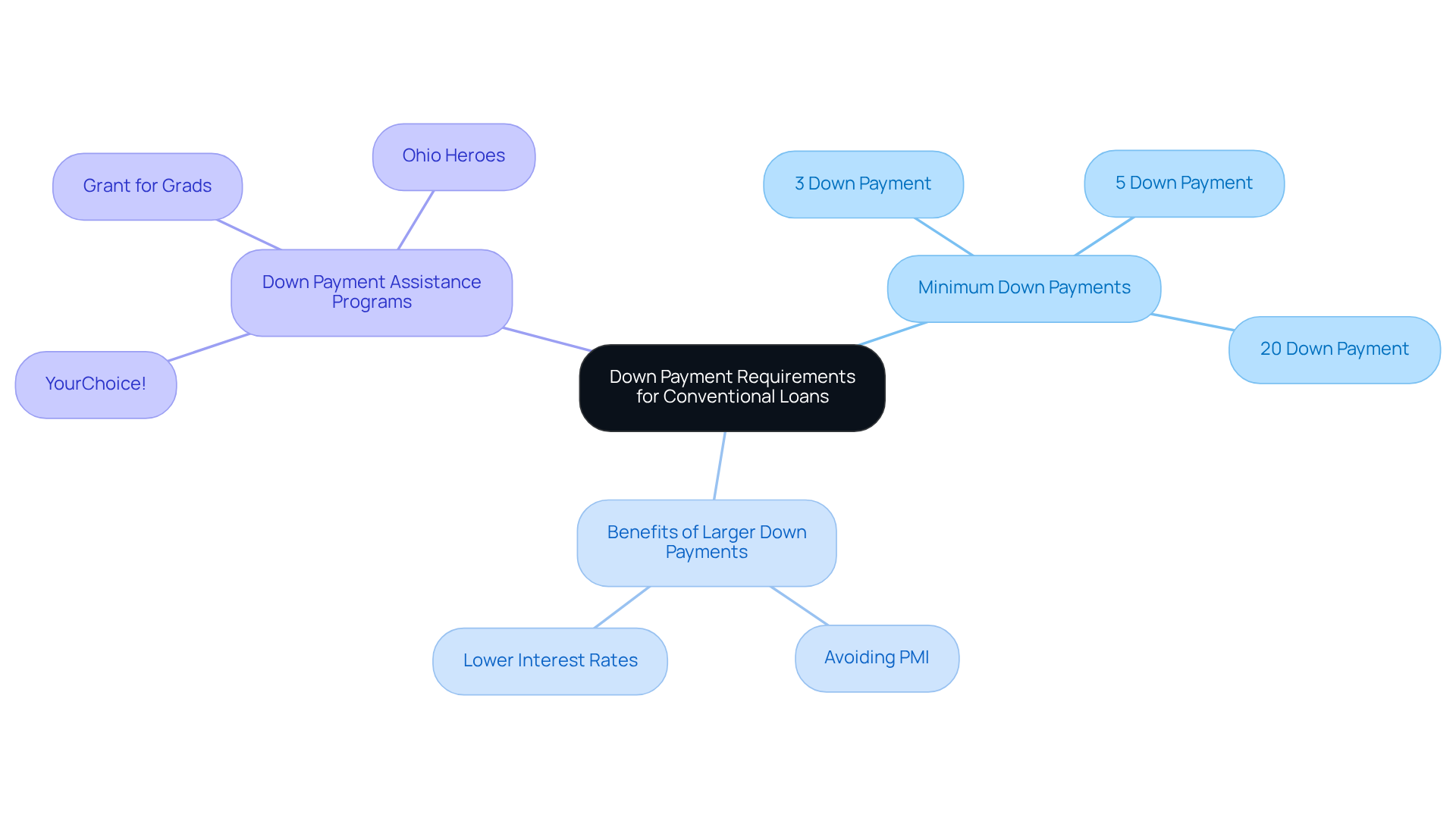

Down Payment Requirements: What to Expect with Conventional Loans

We know how challenging it can be to navigate the world of home loans. Conventional loans typically require a down deposit of at least 3%, although many lenders prefer a minimum of 5%. Making a larger initial deposit not only helps you avoid private mortgage insurance (PMI) but can also lead to lower interest rates. For instance, if you can provide a down deposit of 20% or more, you can eliminate PMI entirely, which can significantly reduce your monthly payments.

Programs like conventional loans, such as the Conventional 97, are designed to support qualified buyers by allowing them to purchase a home with just 3% down. This makes homeownership more attainable, especially for first-time buyers who may feel overwhelmed by the process. Additionally, Ohio offers various down deposit assistance programs, such as:

- YourChoice!

- Grant for Grads

- Ohio Heroes

These initiatives can help ease the upfront costs associated with buying a home, guiding you on your journey to homeownership.

Recent advancements in down deposit assistance programs further empower buyers, providing additional pathways to ownership without the burden of PMI. As industry experts suggest, opting for a larger down payment can be a strategic choice, enhancing your financial stability and reducing long-term costs related to mortgage insurance. We’re here to support you every step of the way, helping you make that align with your goals.

Conventional Loans vs. Government-Backed Loans: Key Differences

Conventional loans stand apart from government-backed alternatives like FHA and VA options in several significant ways. We understand that navigating these choices can feel overwhelming. Unlike government-insured financing, conventional loans generally require higher credit scores, often stipulating a minimum FICO score of 620. However, they do allow down payments as low as 3%, which can be more appealing than FHA options that necessitate at least 3.5%. While government-supported financing is designed to serve a broader array of borrowers with more flexible qualification standards, can offer lower overall expenses and increased adaptability in terms and conditions for those who meet the more stringent criteria.

In 2024, traditional financing represented over 77% of all home loans initiated, highlighting its appeal among buyers. This reflects a growing interest in conventional loans. Analysts note that traditional mortgages provide benefits like the ability to bypass private mortgage insurance (PMI) if a borrower can provide a down payment of 20% or greater, leading to substantial savings over time. Furthermore, traditional financing often offers more choices for property categories, including vacation residences and investment assets, which are generally not qualified for government-supported financing.

For example, a borrower with a strong credit profile and sufficient savings may choose conventional loans to benefit from lower interest rates and flexible terms. On the other hand, those with lower credit scores or limited savings might find FHA or VA options more accessible due to their easier qualification standards. Ultimately, the decision between traditional and government-supported financing depends on your personal financial situation and long-term goals. We’re here to support you every step of the way as you make this important choice.

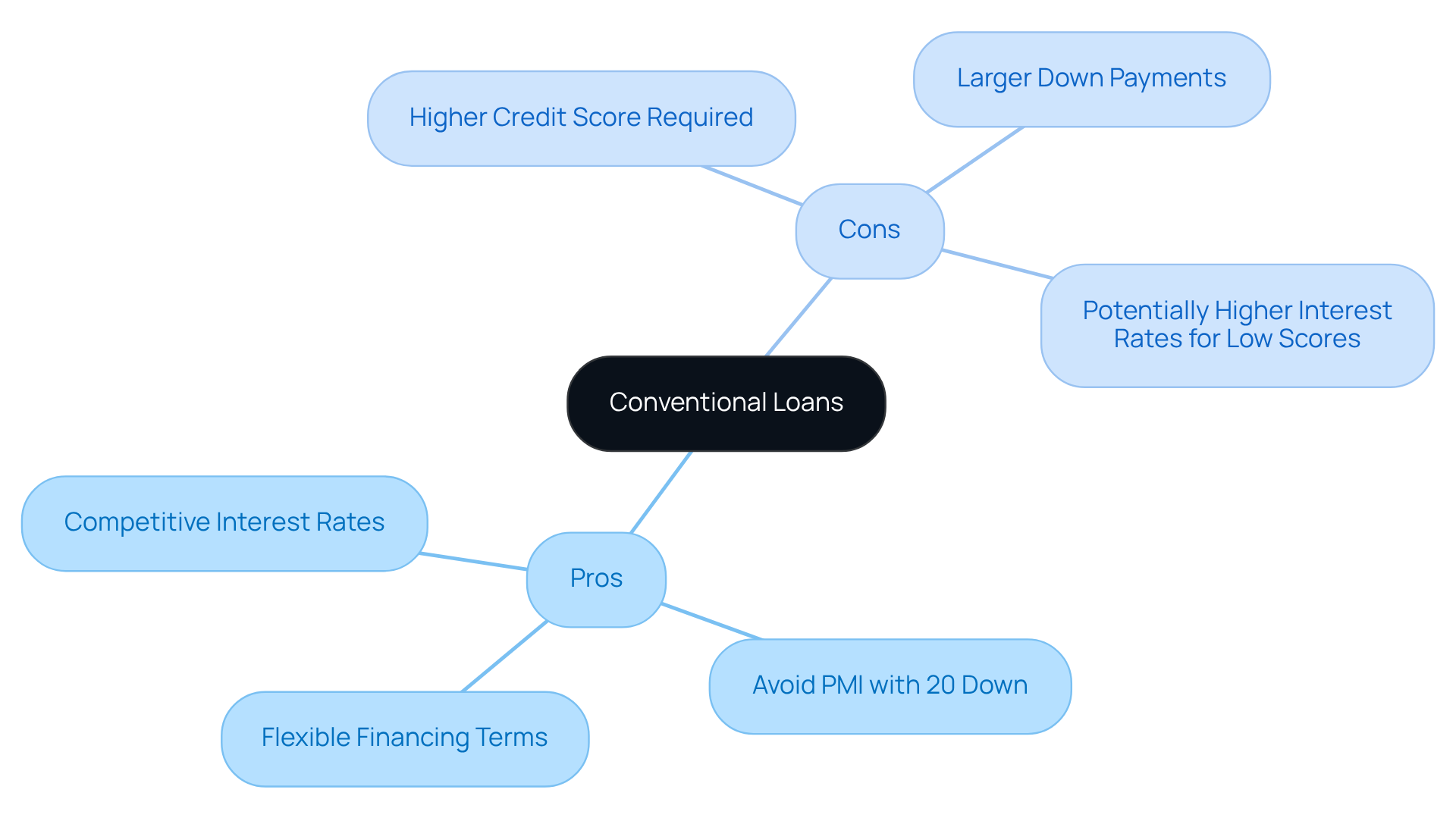

Pros and Cons of Conventional Loans: Weighing Your Options

When considering a mortgage, provide several advantages that can be quite appealing. For instance, they often come with competitive interest rates, and if you can contribute 20% as a down payment, you may avoid private mortgage insurance (PMI). This flexibility in financing terms can really help families like yours find a suitable solution.

However, it’s important to be aware that conventional loans may require higher credit scores and larger down payments compared to government-backed loans. If you have a lower credit score, you might also face higher interest rates. We understand how challenging this can be, and weighing these factors is crucial for making an informed decision.

Ultimately, we’re here to support you every step of the way as you explore your mortgage options. By considering both the benefits and the potential challenges, you can empower yourself to choose the best path forward for your family.

Understanding Conventional Loan Limits: What You Need to Know

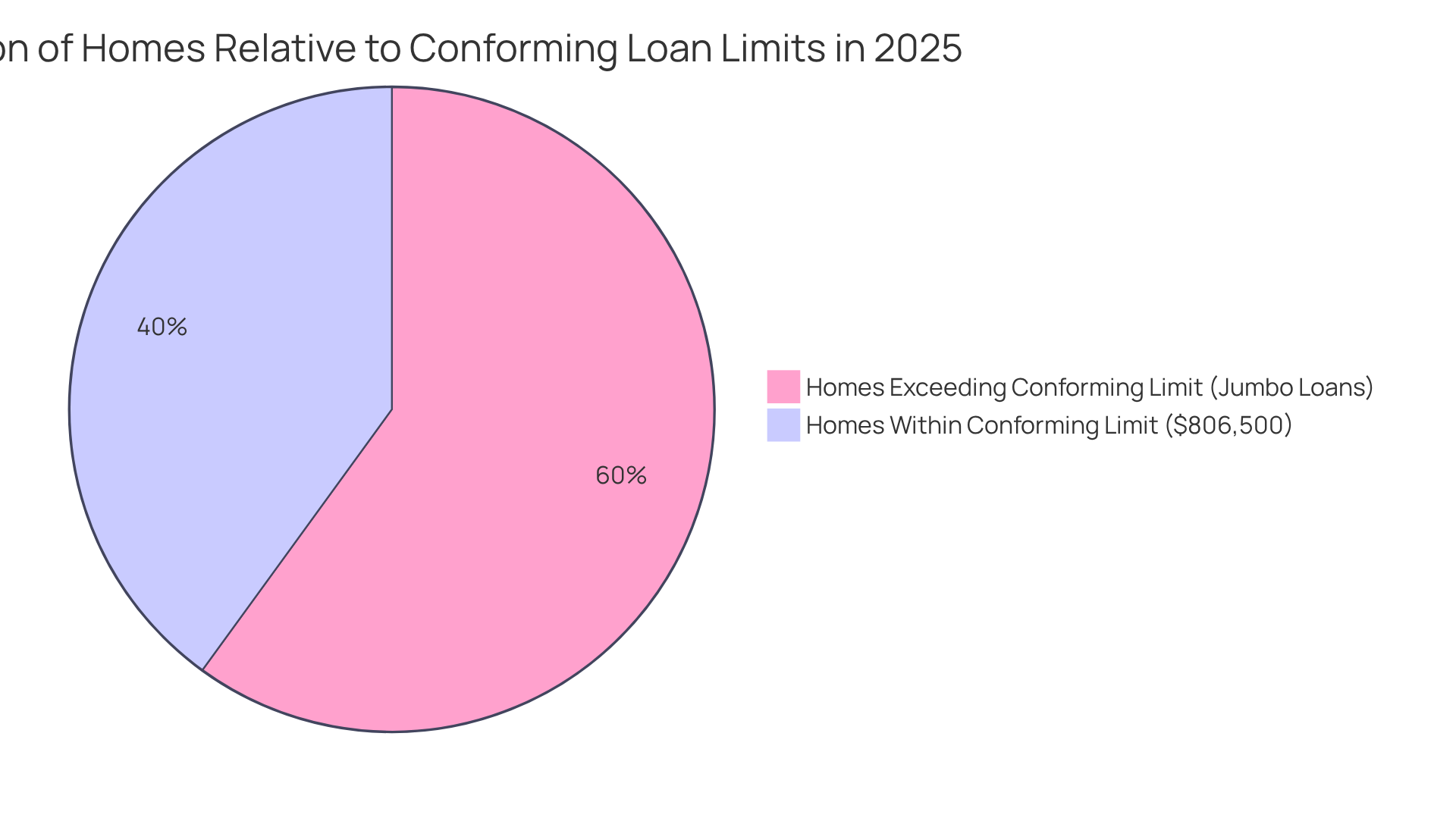

In 2025, the conforming borrowing limit for a single-family residence is set at $806,500 in most regions, with higher thresholds of $1,209,750 in specified high-cost zones. We understand how challenging it can be to navigate these limits, especially for homebuyers. Properties that surpass this threshold require a jumbo mortgage, which often comes with stricter qualification standards and potentially higher interest rates.

Remarkably, a significant percentage of residences are expected to exceed these conforming financial thresholds, particularly in metropolitan areas where housing costs have risen sharply. For instance, in high-cost areas, the borrowing limit for a single-unit home will be $1,209,750, reflecting the ongoing increase in home values.

As Selma Hepp, a chief economist, points out, the current housing market dynamics make it essential for buyers to understand these limits effectively. Borrowers in expensive areas frequently explore alternatives like piggyback financing to stay within conforming thresholds or opt for jumbo financing when necessary. Staying informed about these not only aids in strategic planning for home purchases but also empowers you to make educated decisions in a competitive market. We’re here to support you every step of the way.

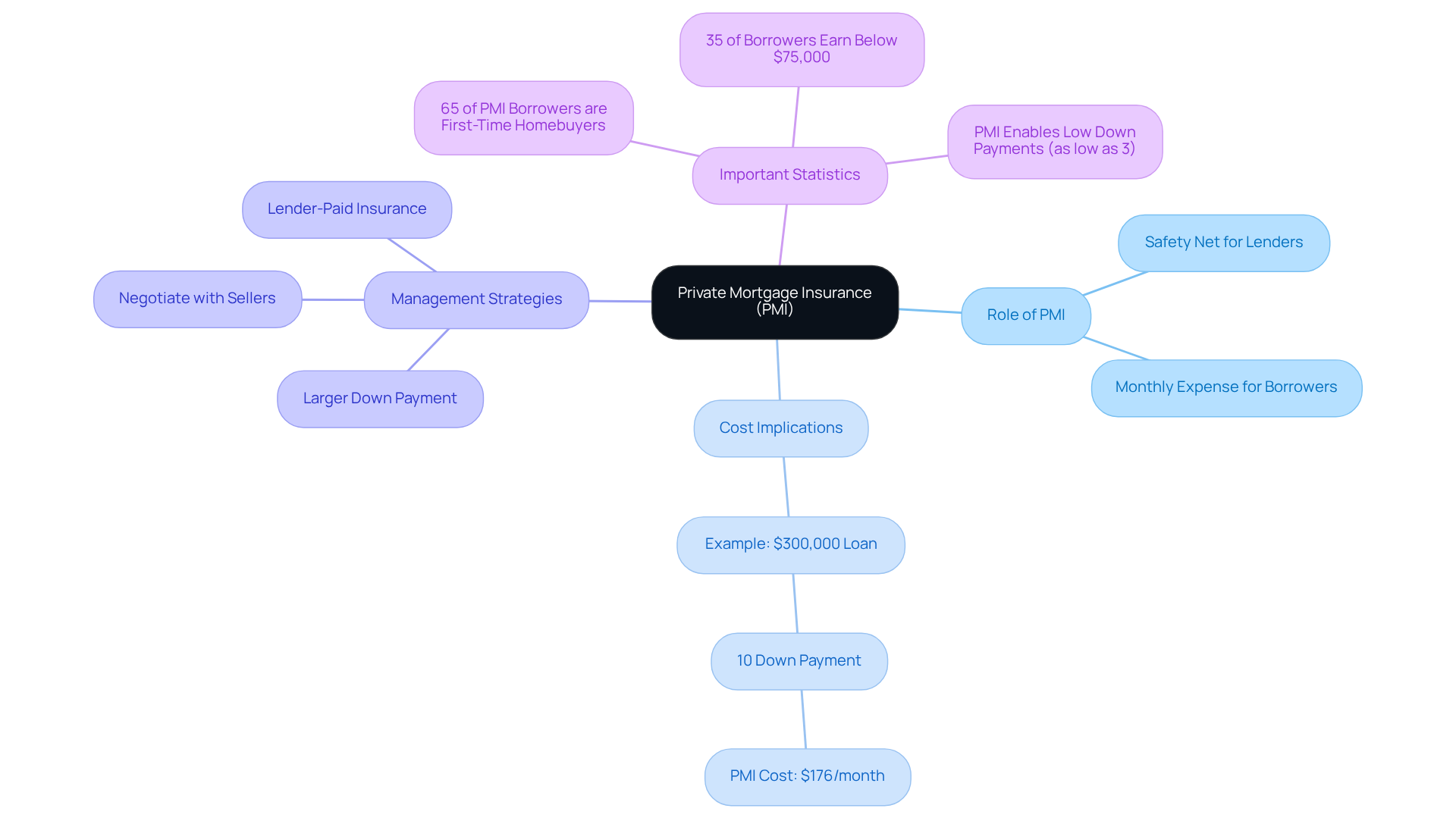

Private Mortgage Insurance: What It Means for Your Conventional Loan

Private loan insurance (PMI) is a crucial element of conventional loans and is often required when the down payment is less than 20%. We know how challenging this can be. PMI serves as a safety net for lenders in case of borrower default, but it also adds an extra monthly expense to your loan. In 2025, about 65% of borrowers using PMI were first-time homebuyers, and nearly 35% of these individuals had annual incomes below $75,000. This highlights PMI’s vital role in making homeownership accessible for those with limited upfront capital.

Once homeowners achieve 20% equity in their property, they can request the removal of PMI, significantly reducing monthly costs. For instance, on a $300,000 loan with a 30-year term and a 7% interest rate, a 10% down payment would lead to PMI costs of approximately $176 each month. Financial planners often advise clients to consider these costs when budgeting for homeownership. As one financial planner wisely noted, “Understanding PMI’s implications on long-term financial health is essential for making informed decisions.”

Borrowers have several strategies to manage PMI costs:

- They can opt for a larger down payment.

- Negotiate with sellers to cover PMI expenses in a buyer’s market.

- Choose lender-paid insurance, where lenders take on PMI costs in exchange for a higher interest rate.

It’s important to remember that PMI is not homeowners insurance; it specifically protects lenders. By staying informed about PMI and its requirements, borrowers can make more strategic decisions that align with their financial goals.

Additionally, PMI can be automatically terminated when the principal balance reaches 78% of the original home value, ensuring that borrowers are not burdened with PMI for the entire duration of the financing. Tracking credit balances and when eligible is a vital step in managing housing expenses. We’re here to support you every step of the way as you navigate these important decisions.

Navigating Conventional Loans: The Role of a Mortgage Broker

Navigating the intricacies of traditional financing can feel overwhelming, but a financial broker is here to be your essential partner in this journey. Brokers, like Alyssa Alberton at F5 Mortgage, bring not only extensive experience but also a personal touch to every interaction. Whether you’re a first-time homebuyer or looking to expand your real estate portfolio, you deserve tailored solutions that meet your unique needs.

With access to a diverse array of lenders, brokers can help identify the most for your financial circumstances. They understand the complexities of various immigration statuses and unique financial situations. Beyond assisting with the often daunting paperwork, they offer vital insights into the housing finance landscape, advocating for you throughout the approval process. This expertise can significantly simplify your financing journey, increasing your chances of securing favorable terms.

In 2025, around 75% of borrowers are anticipated to use loan brokers, highlighting a growing recognition of their importance in the home financing process. Successful partnerships between brokers and clients frequently lead to enhanced outcomes; many clients report smoother transactions and better rates when working with brokers compared to navigating the market independently. As the lending sector evolves, the role of brokers becomes even more vital, especially in assisting clients with the complexities of conventional loans.

At F5 Mortgage, we are dedicated to making your financing process as stress-free as possible. We utilize user-friendly technology to streamline your experience. Our approach emphasizes no-pressure guidance, allowing you to choose what feels right for you. As Marina Walsh, vice president of industry analysis at the Mortgage Bankers Association, notes, “Mortgage servicing has enabled many lenders to stay profitable overall,” underscoring the importance of brokers in navigating these services. Furthermore, with the Mortgage Bankers Association predicting total mortgage originations to rise to $2.3 trillion in 2025, the demand for skilled brokers will likely increase. This makes their role even more critical in today’s economic landscape, and we’re here to support you every step of the way.

Conclusion

Navigating the world of conventional loans can feel overwhelming for families seeking homeownership. These loans, backed by private lenders and featuring varying requirements, provide a flexible financing option for those who meet specific criteria. By understanding the nuances of conventional loans—such as the impact of credit scores and down payment requirements—potential buyers can make informed decisions that align with their financial goals.

Throughout this article, we’ve highlighted key insights to support you on this journey. Maintaining a strong credit profile is crucial, and larger down payments can offer significant advantages. Additionally, the role of mortgage brokers in simplifying the loan process cannot be overstated. With a projected increase in the use of independent brokers, personalized service and tailored solutions are more important than ever. We’ve also clarified the distinction between conventional loans and government-backed options, helping you assess the best financing route for your unique circumstances.

Ultimately, the journey toward homeownership is not just about securing a loan; it’s about making strategic choices that pave the way for long-term financial stability. Engaging with trusted partners like F5 Mortgage can enhance this experience, ensuring your family receives the guidance and support needed to navigate the complexities of conventional loans successfully. As the market continues to evolve, remember that staying informed and proactive will be key to achieving your homeownership dreams. We’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage LLC is an independent brokerage specializing in conventional loans. They prioritize personalized consultations to tailor their services to meet the diverse financial needs of their clients, providing access to various loan programs, including fixed-rate and adjustable-rate options.

What is a conventional loan?

A conventional loan is a type of financing provided by private lenders, not government-supported. It can be used for various property types and often comes with stricter financial requirements, including potentially larger down payments.

What are the requirements to qualify for a conventional loan?

To qualify for a conventional loan, borrowers typically need a minimum credit score of 620, a steady income, and a down payment ranging from 3% to 20% of the home’s purchase price. Additionally, lenders consider the debt-to-income (DTI) ratio, which should ideally be under 43%.

How does the loan approval process work?

The loan approval process involves a lender reviewing your financial details to determine your eligibility for a loan. This process includes preapproval or prequalification, which provides an estimate of your borrowing amount, interest rate, and potential monthly costs.

What is the significance of maintaining a good credit score for conventional loans?

Maintaining a strong credit score is crucial for securing favorable financing conditions. Borrowers with a credit score of 740 or higher may be eligible for reduced down payments and more attractive interest rates. The average score for traditional borrowers is expected to be around 670 by 2025.

How quickly can F5 Mortgage provide pre-approval and close financing options?

F5 Mortgage can provide pre-approval in under an hour, and most financing options can close in less than three weeks, making them a convenient choice for families looking to improve their homes.

What is F5 Mortgage’s satisfaction rate among clients?

F5 Mortgage has achieved a 94% satisfaction rate among the families they serve, reflecting their commitment to providing a hassle-free financing process and outstanding customer service.