Overview

In this article, we explore the seven states projected to have the best real estate markets in 2025. We understand how challenging it can be to navigate the housing market, and we’re here to support you every step of the way. Each state, including California, Texas, and Florida, is highlighted for its unique characteristics and growth potential.

We delve into median home prices, market trends, and investment opportunities, illustrating how factors like job growth and demographic shifts contribute to their appeal for homebuyers and investors. By focusing on these aspects, we aim to empower you with the knowledge needed to make informed decisions in your home-buying journey.

As you consider your options, remember that understanding these markets can help you find the right fit for your family’s needs. We know how important it is to feel confident in your choices, and we’re here to guide you through this process with compassion and expertise.

Introduction

As the real estate landscape evolves, we understand how daunting it can be to navigate the changing market. Certain states are emerging as prime destinations for investment and homeownership in 2025. From California’s vibrant tech hubs to Texas’s affordable markets, prospective buyers and investors are presented with a wealth of opportunities.

This article explores seven states poised for real estate success, highlighting the unique advantages each location offers. We also address the challenges that come with navigating these dynamic markets.

Which state will capture the attention of savvy investors and first-time homebuyers alike? We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Solutions for Homebuyers

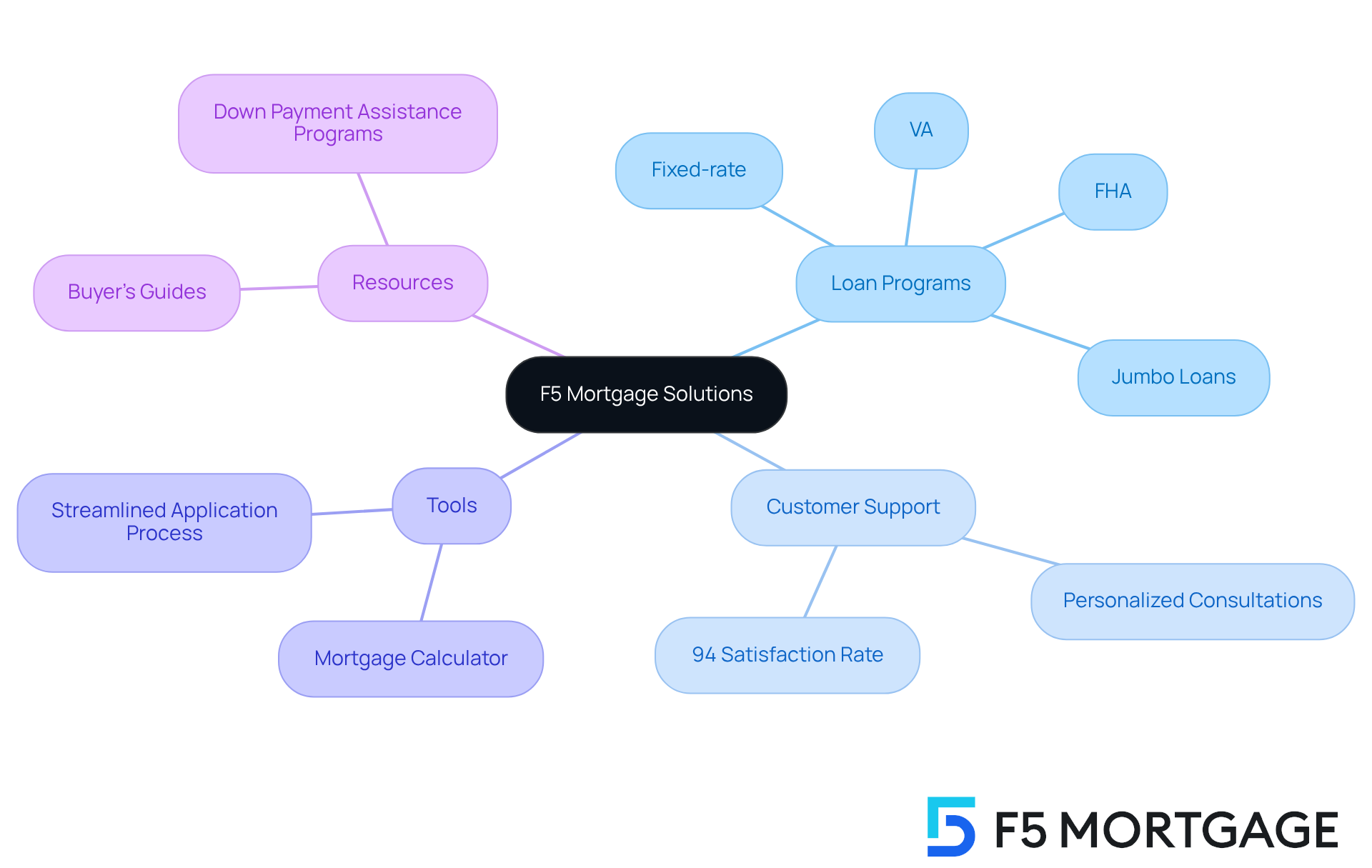

At F5 Lending LLC, we understand how challenging the financing sector can be. That’s why we provide personalized consultations tailored to each client’s unique needs. With access to a diverse range of loan programs—including fixed-rate, FHA, VA, and jumbo loans—we ensure you receive competitive rates and terms. Our user-friendly mortgage calculator simplifies the process, enabling you to make informed decisions quickly. This dedication to outstanding service has helped over 1,000 families navigate the complexities of purchasing and refinancing properties, achieving an impressive customer satisfaction rate of 94%.

Imagine being pre-approved for a mortgage in under an hour. F5 Mortgage’s streamlined application process makes this a reality, making it an ideal choice for first-time homebuyers and families looking to upgrade or refinance. We emphasize a no-pressure guidance approach, ensuring you feel supported and informed throughout your mortgage journey. Furthermore, we offer valuable resources such as detailed buyer’s guides and down payment assistance programs designed for specific states, empowering you at every stage of the process. We’re here to support you every step of the way.

California: The Golden State’s Thriving Real Estate Market

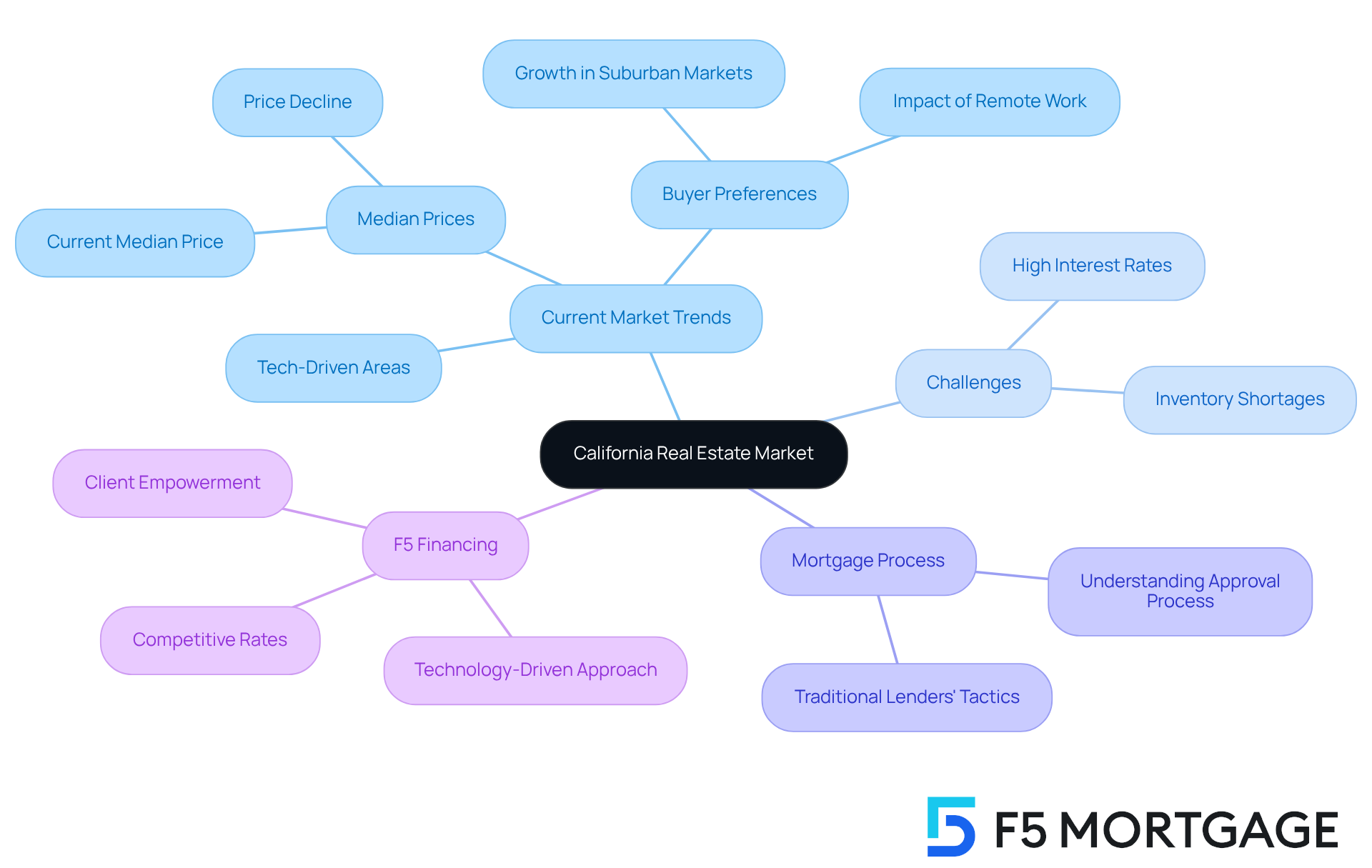

California is recognized as one of the states with the best real estate market, thanks to its diverse economy and strong demand for housing. We know how challenging it can be to navigate this market, especially with high interest rates and inventory shortages. Yet, cities like Los Angeles and San Francisco are considered states with the best real estate market, remaining attractive for investors due to their potential for appreciation.

Currently, the median property price in California is expected to stabilize around $775,058, reflecting a slight decline of 1.2% over the past year. However, the long-term outlook remains positive. As remote work trends continue to influence buyer preferences, we anticipate growth in tech-driven areas and suburban markets.

For families looking to upgrade their homes, understanding the mortgage approval process is crucial. It determines eligibility for a loan and can significantly impact your homeownership journey. Traditional lenders often use hard sales tactics and provide biased information, which can intimidate borrowers and lead to poor decisions.

In contrast, F5 Financing offers a refreshing approach. By leveraging technology, they provide ultra-competitive rates without the hassle of aggressive sales tactics. With F5 Mortgage’s commitment to transparency and client empowerment, achieving homeownership becomes a stress-free experience. We’re here to support you every step of the way.

Texas: A Booming Market for Real Estate Investment

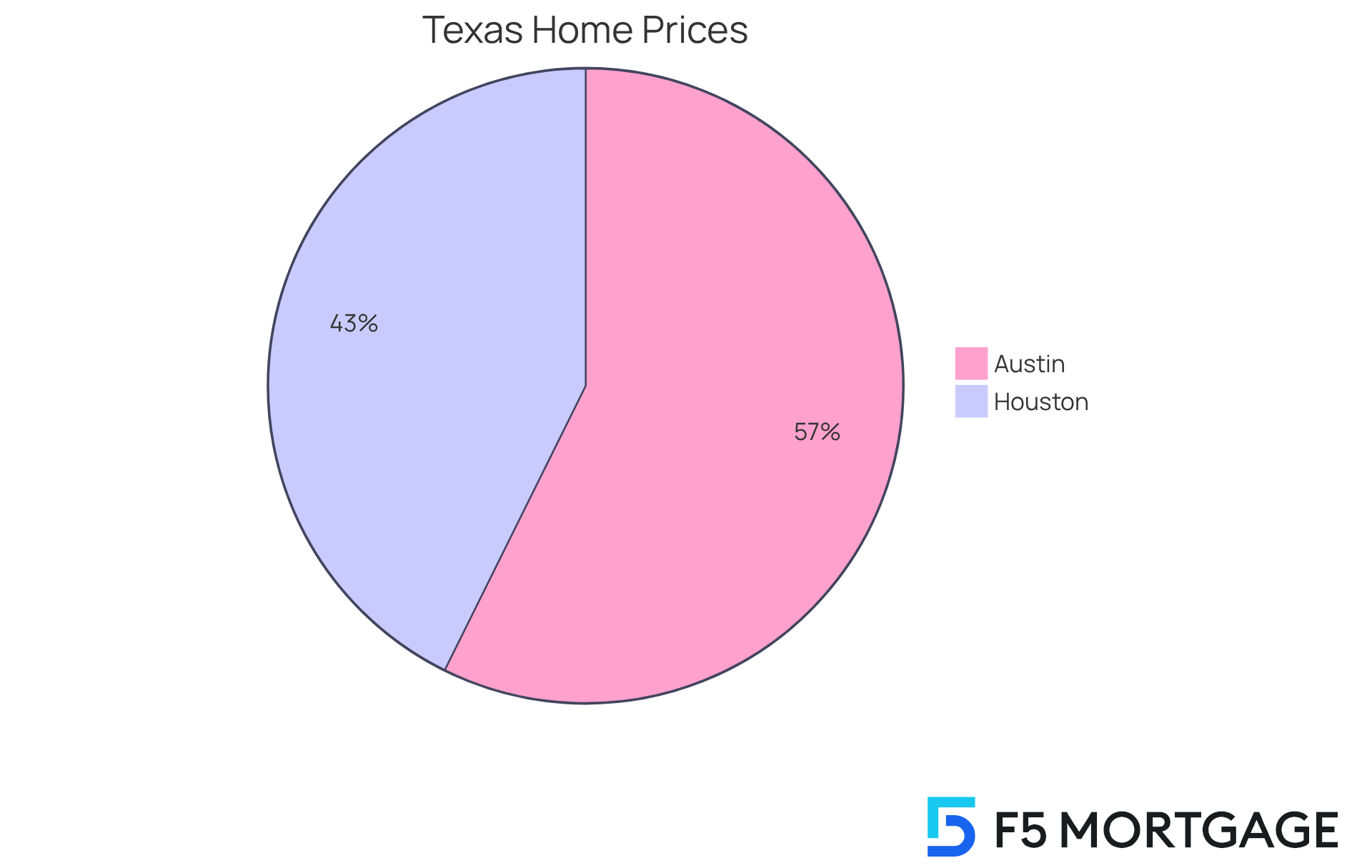

Texas, with cities like McKinney and Austin leading the way, is among the states with the best real estate market, experiencing a remarkable boom. We understand how daunting the housing market can feel, especially for first-time buyers and seasoned investors alike. The state’s affordable housing sector, with median home prices around $450,000 in Austin and $335,000 in Houston, is attracting many families looking for their new home in states with the best real estate market.

F5 Mortgage is here to support you every step of the way. They offer valuable down payment assistance programs, such as the My Choice Texas Home program, which provides up to 5% for down payment and closing costs. This initiative makes homeownership more accessible, helping you achieve your dream of owning a home.

The Texas housing sector is one of the states with the best real estate market, characterized by a steady influx of new residents, driven by job growth and a favorable business climate. By 2025, we anticipate ongoing growth in the market, especially in states with the best real estate market, with an expected rise in single-family permits and a strong rental market. This presents an ideal opportunity for property investment, allowing you to secure your future.

F5 Mortgage is revolutionizing the mortgage experience. By leveraging technology, they offer competitive rates and a stress-free service, empowering you to make informed decisions without the pressure of traditional sales tactics. We know how challenging this can be, but with the right support, you can navigate this journey with confidence.

Florida: A Hotspot for Real Estate Investment Opportunities

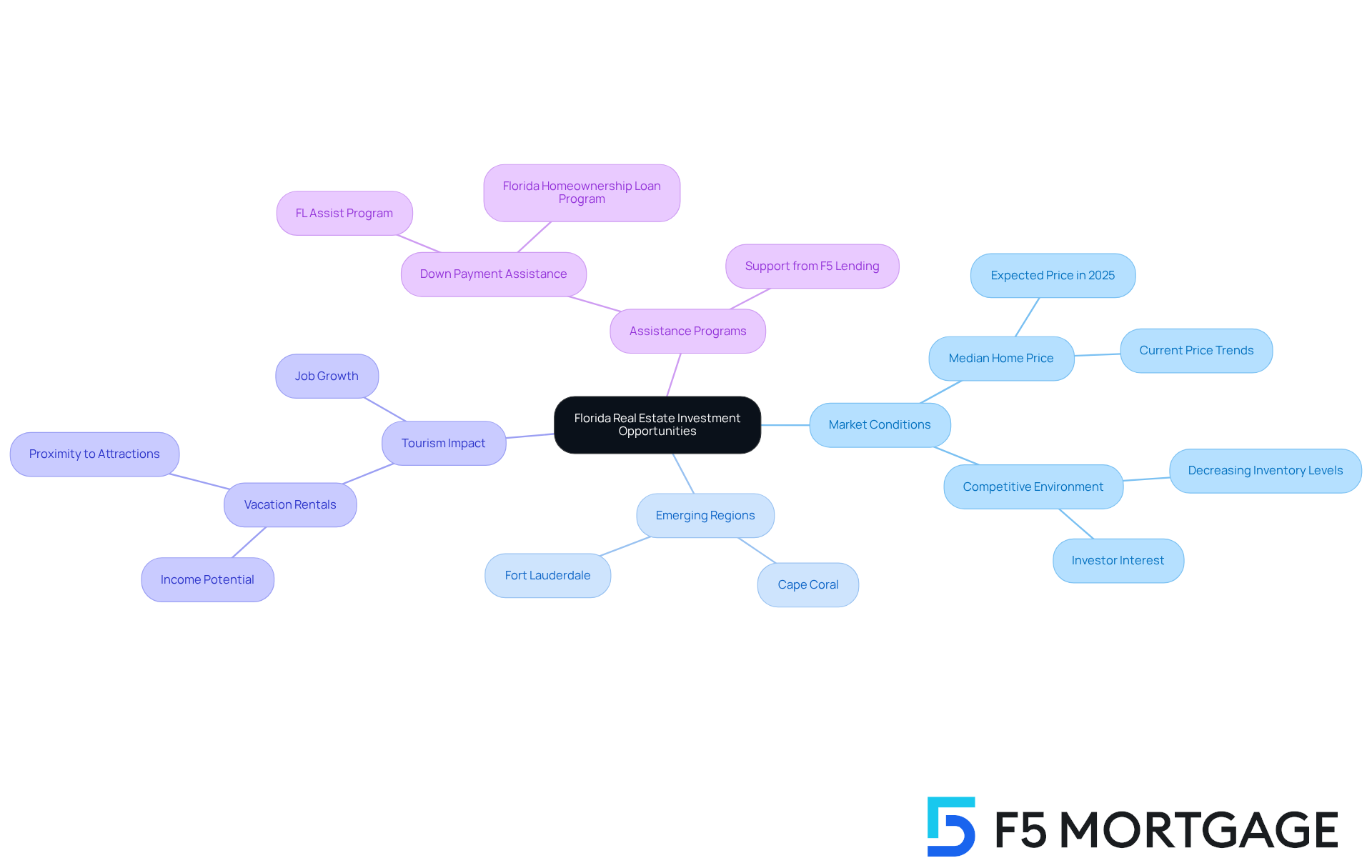

Florida is considered one of the states with the best real estate market, especially in vibrant cities like Miami and Orlando, making it a prime destination for investment. We understand how important it is to find the right place to call home. The state’s appealing climate, along with a growing population and a robust tourism sector, drives demand for both residential and rental properties. As we look ahead to 2025, the median home price in Florida is expected to stabilize around $412,000, reflecting a slight decrease in inventory levels. This trend creates a competitive environment where investors are increasingly exploring emerging regions like Cape Coral and Fort Lauderdale, poised for appreciation due to ongoing development and infrastructure improvements.

We recognize that Florida’s thriving tourism industry significantly impacts the housing market. Vacation rentals near popular attractions can generate substantial income, making this an attractive option for savvy investors. The combination of favorable economic conditions and a steady influx of new residents positions Florida as one of the states with the best real estate market for those seeking long-term growth in their property portfolios.

Moreover, F5 Lending is here to support you with exceptional down payment assistance programs, making homeownership more attainable. Programs like FL Assist offer up to $10,000 as a deferred second mortgage for VA, FHA, USDA, and conventional loans, while the Florida Homeownership Loan Program provides similar assistance. Families upgrading their homes can truly benefit from these resources, ensuring a smoother and more supportive home financing journey.

We know how challenging this can be, and clients have expressed their satisfaction with F5 Financing, as shown by their 5/5 star reviews on platforms like Google and Lending Tree. To take advantage of these programs, we encourage potential homebuyers to reach out to F5 Mortgage. Together, we can explore your options and find the best fit for your financial needs.

New York: Diverse Real Estate Options for Every Investor

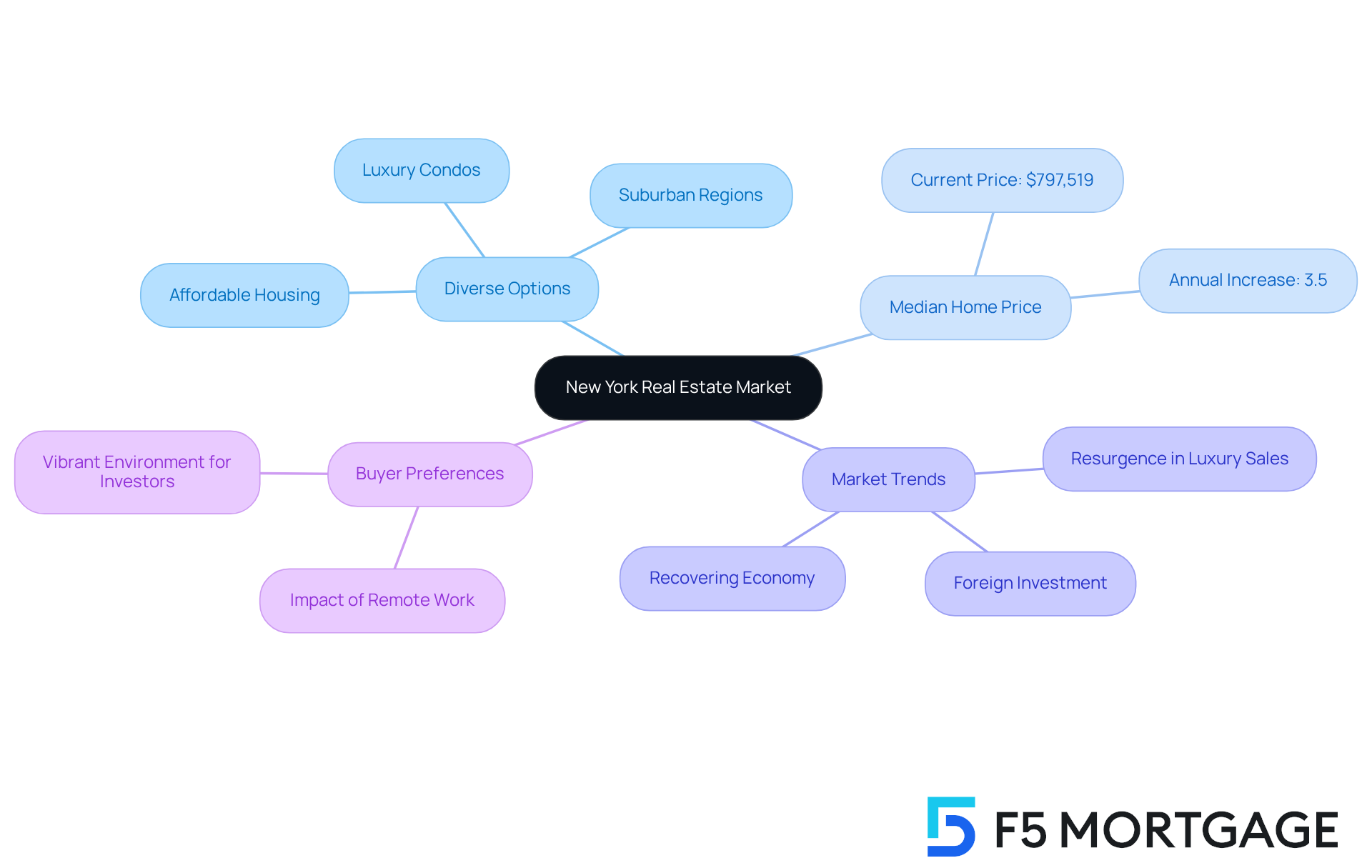

New York’s real estate sector is a tapestry of diverse options, catering to various needs—from luxury condos in Manhattan to affordable housing in upstate regions. As we look ahead to 2025, the median home price in New York stands at approximately $797,519, reflecting a modest 3.5% increase from the previous year. This rise signals a resurgence in luxury sales, particularly in Brooklyn and Manhattan, fueled by foreign investment and a recovering economy.

We understand how challenging it can be to navigate this market, especially with the growing popularity of suburban regions as remote work shapes buyer preferences. This shift makes New York a vibrant environment for investors and families alike. In this evolving landscape, F5 Mortgage shines by leveraging technology to offer ultra-competitive mortgage rates, all without the pressure of hard sales tactics.

We’re here to support you every step of the way. Our dedication to openness and client empowerment ensures that potential buyers can confidently navigate the complexities of New York’s real estate market. Together, we can help you make informed choices that align with your financial objectives.

North Carolina: Emerging Market with Strong Growth Potential

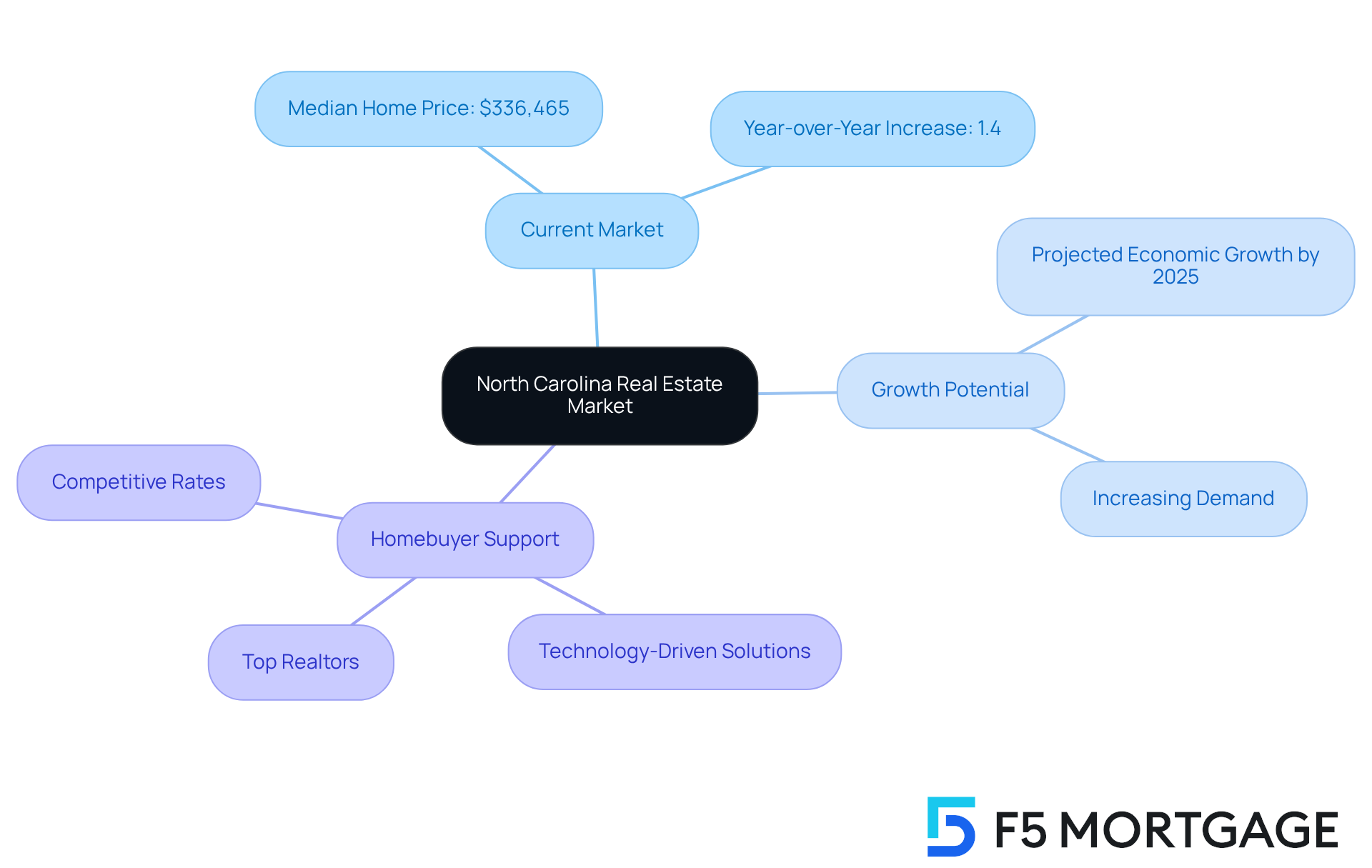

North Carolina is emerging as one of the states with the best real estate market, with cities like Charlotte and Raleigh experiencing significant growth. We understand that navigating the housing market can be overwhelming, especially with the median home price currently around $336,465 and a modest year-over-year increase of 1.4%. However, the favorable business climate and the steady influx of new residents in the state are driving demand for housing, placing it among the states with the best real estate market, making this an exciting time for potential homebuyers.

As we look ahead to 2025, North Carolina’s economy is projected to continue its upward trajectory. This presents a wonderful opportunity for investors seeking long-term growth and rental revenue. At F5 Mortgage, we’re here to support you every step of the way in this flourishing environment. Our transparent, technology-driven mortgage solutions empower homebuyers like you to make informed decisions.

We know how challenging this process can be, which is why we focus on connecting you with top realtors who provide the best guidance throughout your home-buying journey. Our commitment is to secure competitive rates and deliver a stress-free service, helping you achieve homeownership with ease. Let us be your partner in this important milestone, ensuring you feel confident and supported every step of the way.

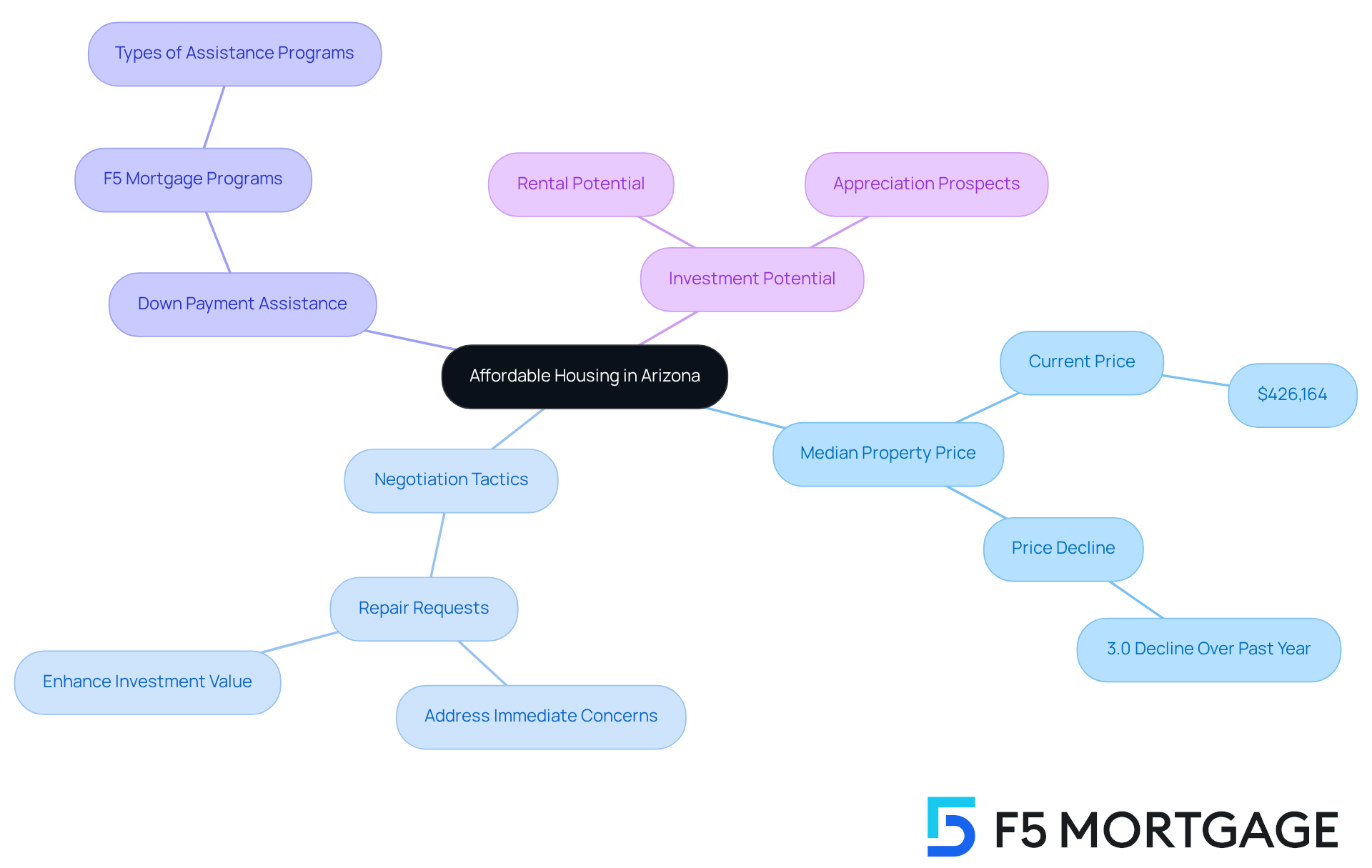

Arizona: Affordable Housing and Rising Demand

Arizona’s real estate sector offers a unique opportunity for families seeking affordable housing options, particularly in vibrant cities like Phoenix and Tucson. The median property price in Arizona is around $426,164, reflecting a slight decline of 3.0% over the past year. However, we know how challenging this can be, and there’s good news: the market is expected to recover as demand continues to rise, driven by an influx of new residents looking for budget-friendly alternatives.

Homebuyers in Arizona can take advantage of negotiating repair requests with sellers. This common practice not only addresses immediate concerns but can also enhance the value of your investment. We’re here to support you every step of the way in navigating these conversations.

Additionally, F5 Mortgage offers various down payment assistance initiatives, which can significantly ease the financial burden for families eager to improve their living situations. Arizona is recognized as one of the states with the best real estate market for investors seeking properties with promising rental potential and appreciation prospects. With the right support, you can make informed decisions that lead to a brighter future for you and your family.

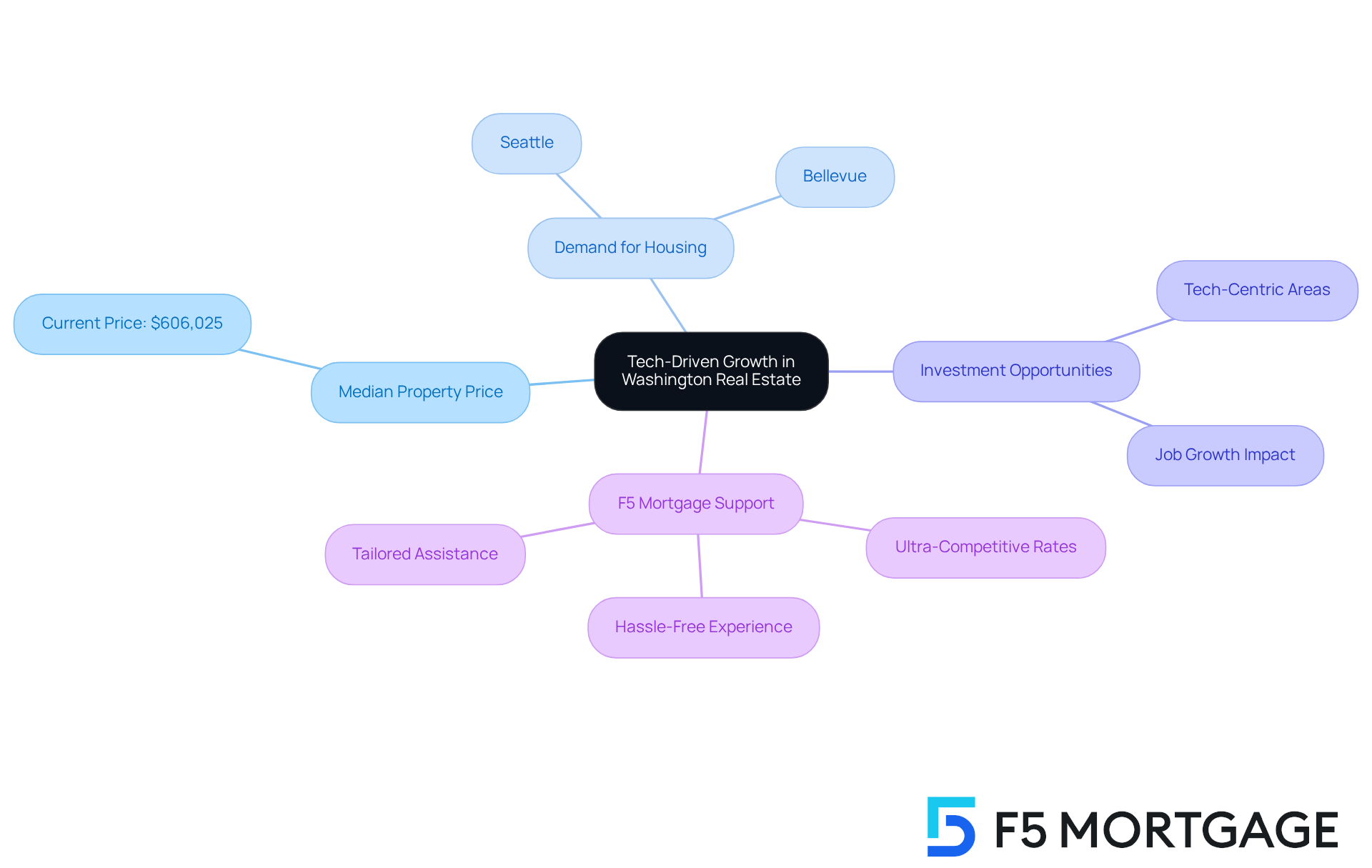

Washington: Tech-Driven Growth Fuels Real Estate Demand

Washington’s real estate sector is experiencing robust growth, largely thanks to the state’s thriving tech industry. We understand how challenging it can be to find the right home, especially with cities like Seattle and Bellevue seeing heightened demand for housing. Currently, the median property price in Washington stands at around $606,025. The market is characterized by restricted inventory and elevated demand, particularly for single-family residences.

As we look ahead to 2025, Washington stands out as one of the states with the best real estate market, offering a strong investment opportunity, especially in tech-centric areas where job growth continues to drive housing demand. In this competitive landscape, F5 Mortgage is here to support you every step of the way. They leverage advanced technology to offer ultra-competitive mortgage rates, all without the hassle of hard sales tactics or biased information that traditional lenders often employ.

For families looking to enhance their residences, F5’s tailored assistance and clear approach guarantee a hassle-free experience as you navigate the intricacies of financing your property. We know how important it is to feel supported during this process, and with F5, you can be confident in making informed decisions.

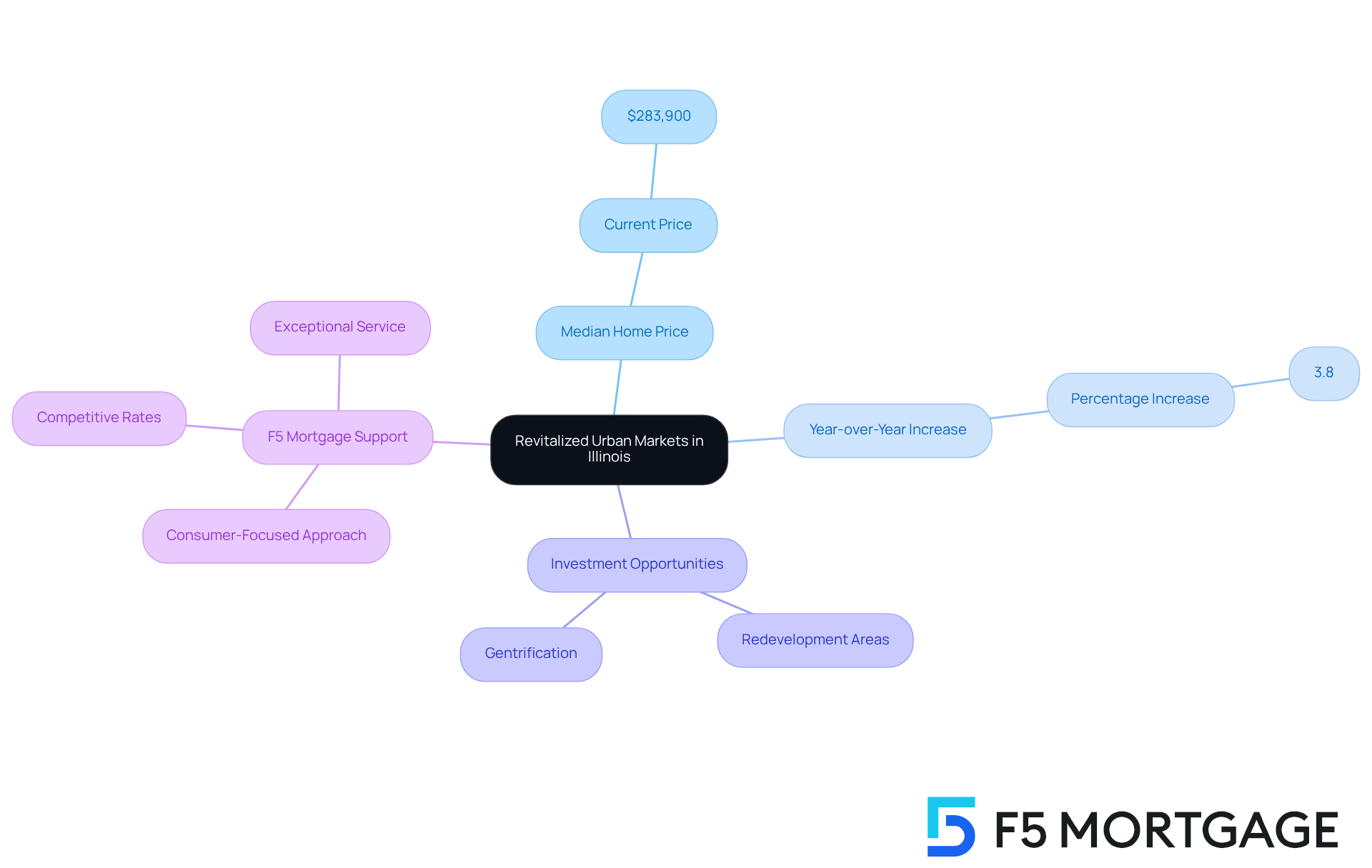

Illinois: Revitalized Urban Markets for Real Estate Investors

Illinois is experiencing a revitalization of its urban markets, especially in Chicago and its surrounding suburbs. We understand how challenging it can be to navigate the housing market, but the median home price in Illinois is approximately $283,900, with a year-over-year increase of 3.8%. As the state continues to recover from economic challenges, many investors are discovering opportunities in neighborhoods that are undergoing redevelopment and gentrification.

As we look ahead to 2025, Illinois is one of the states with the best real estate market for investment. There is significant potential for both appreciation and rental income in these revitalized urban areas. With F5’s technology-driven, consumer-focused approach, homebuyers can traverse this landscape with confidence and ease.

Imagine being able to negotiate repairs with sellers and fully comprehend loan disclosures, ensuring a stress-free experience. F5 Mortgage is here to empower families like yours to achieve homeownership in this thriving market. You can benefit from competitive rates and exceptional service, knowing that we’re here to support you every step of the way.

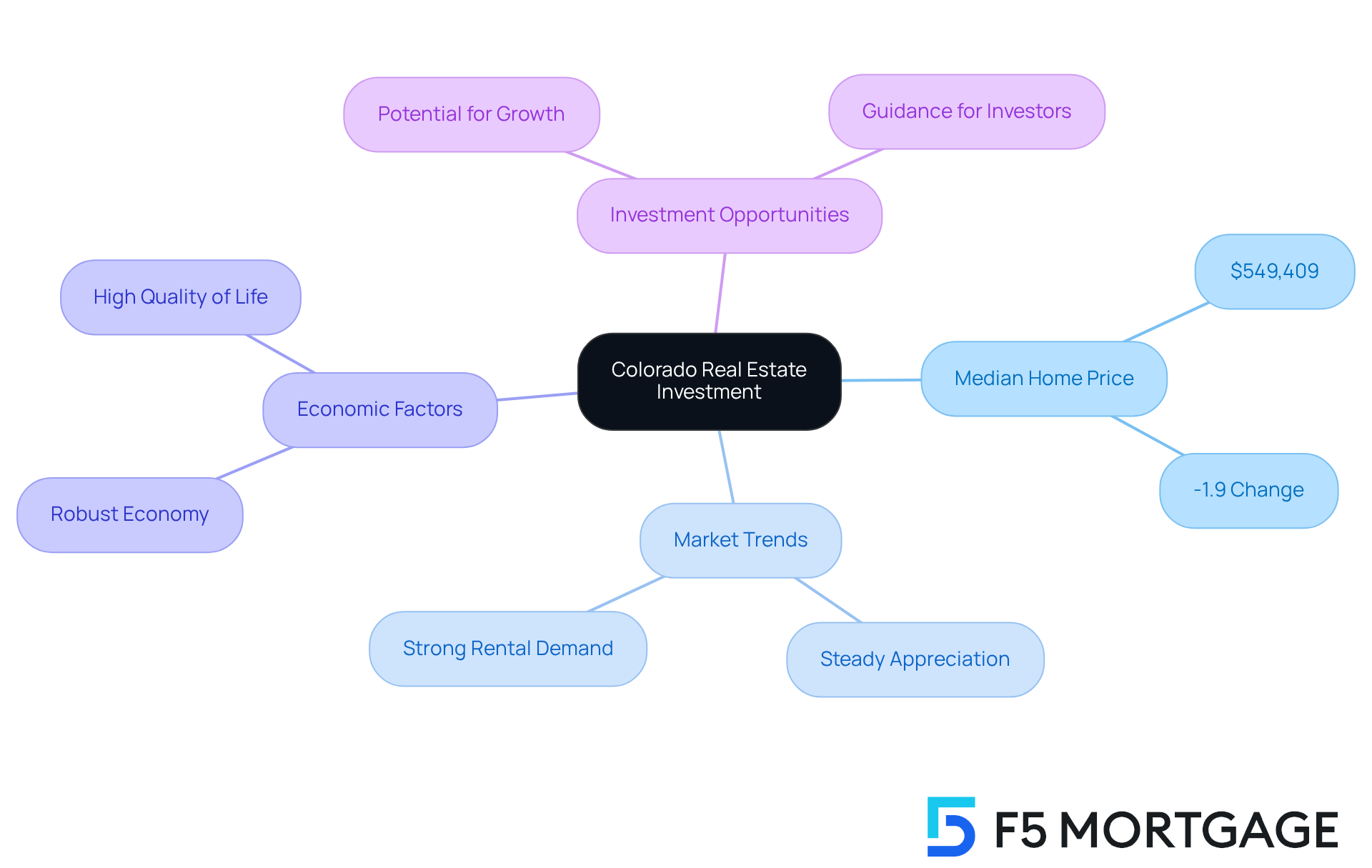

Colorado: A Desirable Location for Real Estate Investment

Colorado is among the states with the best real estate market for investment, particularly in cities like Denver and Colorado Springs. We know how challenging it can be to navigate the housing market, but the current median home price in Colorado is approximately $549,409, reflecting a slight decrease of 1.9% over the past year. Despite this, the state’s robust economy and high quality of life continue to attract new residents, which drives demand for housing.

As we look ahead to 2025, Colorado is among the states with the best real estate market, presenting a compelling opportunity for investors seeking properties in a market characterized by steady appreciation and strong rental demand. We’re here to support you every step of the way as you consider your investment options. This is a time filled with potential, and with the right guidance, you can make informed decisions that align with your goals.

Conclusion

The exploration of the best real estate markets for 2025 highlights the dynamic nature of the housing landscape across various states. Each region offers unique opportunities, driven by factors such as economic growth, population influx, and changing buyer preferences. We understand how challenging it can be to navigate these complexities, which is why understanding these markets is crucial for prospective homebuyers and investors.

Key insights reveal that states like:

- California

- Texas

- Florida

continue to attract attention due to their robust economies and diverse housing options. Meanwhile, emerging markets in:

- North Carolina

- Revitalized urban areas in Illinois

present promising avenues for investment. With the support of personalized mortgage solutions from F5 Mortgage, potential buyers can confidently explore their options, ensuring they make informed decisions tailored to their financial needs.

As the real estate landscape evolves, it becomes increasingly important for buyers and investors to stay informed about market trends and opportunities. Engaging with knowledgeable professionals and leveraging resources like down payment assistance programs can significantly enhance the home-buying experience. Embracing this journey with the right support can lead to successful investments and fulfilling homeownership, paving the way for a prosperous future in the real estate market.

Frequently Asked Questions

What services does F5 Mortgage provide to homebuyers?

F5 Mortgage offers personalized consultations, access to various loan programs (including fixed-rate, FHA, VA, and jumbo loans), a user-friendly mortgage calculator, and resources like buyer’s guides and down payment assistance programs.

How quickly can I get pre-approved for a mortgage with F5 Mortgage?

You can be pre-approved for a mortgage in under an hour thanks to F5 Mortgage’s streamlined application process.

What is F5 Mortgage’s customer satisfaction rate?

F5 Mortgage has achieved an impressive customer satisfaction rate of 94%, helping over 1,000 families with purchasing and refinancing properties.

How does F5 Mortgage differ from traditional lenders?

F5 Mortgage emphasizes a no-pressure guidance approach and leverages technology to provide ultra-competitive rates without aggressive sales tactics, making the homeownership experience more transparent and empowering for clients.

What are the current trends in California’s real estate market?

California’s real estate market is strong, with a median property price expected to stabilize around $775,058. The market is influenced by remote work trends, leading to growth in tech-driven areas and suburban markets.

What assistance does F5 Mortgage offer for homebuyers in Texas?

F5 Mortgage provides down payment assistance programs, such as the My Choice Texas Home program, which offers up to 5% for down payment and closing costs, making homeownership more accessible.

What is the median home price in Texas cities like Austin and Houston?

The median home price in Austin is around $450,000, while in Houston, it is approximately $335,000.

What is the outlook for the Texas real estate market?

The Texas real estate market is expected to continue growing, with a steady influx of new residents and job growth. By 2025, there is anticipated growth in single-family permits and a strong rental market, presenting opportunities for property investment.