Overview

Home loan mortgage brokers play a vital role for families, offering personalized financing solutions that truly understand individual financial situations. We know how challenging this can be, and brokers provide expert guidance along with access to a wide range of loan options tailored to your needs.

Not only do brokers simplify the mortgage process, but they also negotiate better terms on your behalf. Imagine having someone in your corner, advocating for you and your family. They offer emotional support and education, ensuring you feel empowered and informed throughout your journey to homeownership.

Ultimately, this support leads to increased satisfaction and cost savings for families navigating the complexities of buying a home. We’re here to support you every step of the way, helping you make informed decisions that align with your goals.

Introduction

The journey to homeownership can often feel like navigating a labyrinth of complex options and daunting paperwork. We know how challenging this can be, especially for families stepping into this significant milestone for the first time. Home loan mortgage brokers play a crucial role in simplifying this process. They offer tailored guidance and support that can transform a stressful experience into a manageable one.

But what exactly makes these brokers indispensable? As families strive to secure the best financing options while minimizing costs, understanding the true value of a mortgage broker could be the key to unlocking a smoother path to their dream home.

F5 Mortgage: Your Independent Partner for Personalized Home Loan Solutions

F5 Lending stands out as an independent brokerage committed to offering personalized financing solutions through home loan mortgage brokers. We understand how daunting the mortgage process can be, and unlike conventional home loan mortgage brokers, we prioritize your needs and preferences. This tailored approach ensures that you receive customized loan options through home loan mortgage brokers that align with your unique financial situation and homeownership dreams.

Our independence empowers families to explore flexible payment plans, including:

- fixed-rate

- adjustable-rate

- interest-only options

This adaptability is crucial for managing finances effectively while pursuing your homeownership aspirations. At F5, we focus on your satisfaction by collaborating with home loan mortgage brokers to simplify the loan process and make it as smooth as possible.

One of the significant advantages of partnering with F5 Mortgage is our extensive network of home loan mortgage brokers. This network enables us to help you find the best possible terms and rates for your refinancing needs. We also emphasize exceptional customer support, providing you with a dedicated loan advisor who will assist you throughout the lending journey. This personalized support is particularly beneficial for first-time homebuyers, ensuring you fully understand your loan terms and receive proactive guidance.

Clients consistently praise our team for their outstanding service, with testimonials highlighting the seamless and stress-free experience we strive to provide. To further assist families in planning their homeownership journey, we offer an easy-to-use loan calculator, available for Arizona residents. This tool helps you explore your options and make informed decisions about your financing solutions.

With a steadfast commitment to exceptional service and customized solutions, F5 Lending is here to support you every step of the way as you navigate the complexities of financing your home.

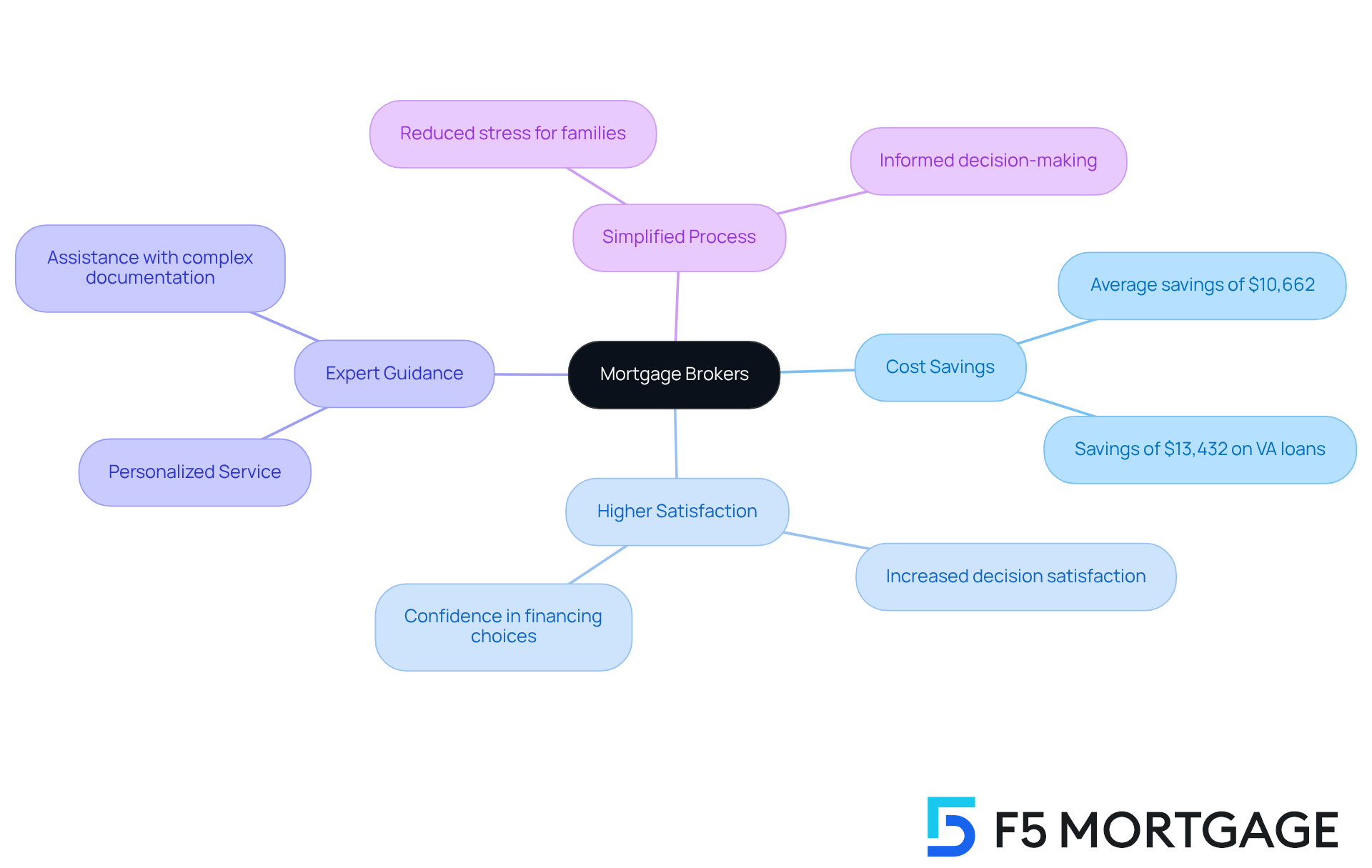

Simplify Your Mortgage Journey with Expert Guidance from Brokers

Navigating the mortgage landscape can feel overwhelming, especially for first-time homebuyers. We understand how challenging this can be. Home loan mortgage brokers, such as those at F5 Mortgage, offer invaluable expert guidance that simplifies the entire process. They help families understand various financing options, assist with complex documentation, and keep clients informed at every step. This support not only reduces stress but also empowers families to make confident decisions about their financing choices.

Research shows that consumers save an average of $10,662 over the life of a loan when working with independent loan brokers compared to retail lenders. Moreover, families who use brokers report higher satisfaction and confidence in their decisions, highlighting the brokers’ role in enhancing the overall loan experience. By offering personalized service and tailored advice, home loan mortgage brokers are essential in guiding families through their mortgage journey, making the process more accessible and less daunting. We’re here to support you every step of the way.

Access Diverse Loan Options Tailored for First-Time Buyers

We understand that first-time homebuyers often face unique challenges, including a limited understanding of available financing options. At F5 Financing, we are committed to providing access to a diverse range of financing solutions, such as:

- FHA products

- VA products

- Fixed-rate options

All specifically tailored to meet the needs of first-time purchasers.

Imagine being able to explore options that allow for down payments as low as 3% or even 0% for certain loans. This means that families can discover suitable solutions that fit their financial situation. By collaborating with home loan mortgage brokers, you can explore these customized options and benefit from F5’s vast network of agents.

We know how challenging this can be, but we’re here to support you every step of the way. Together, we can make homeownership not only achievable but also hassle-free. Let’s take this journey together and find the best financing options for your family.

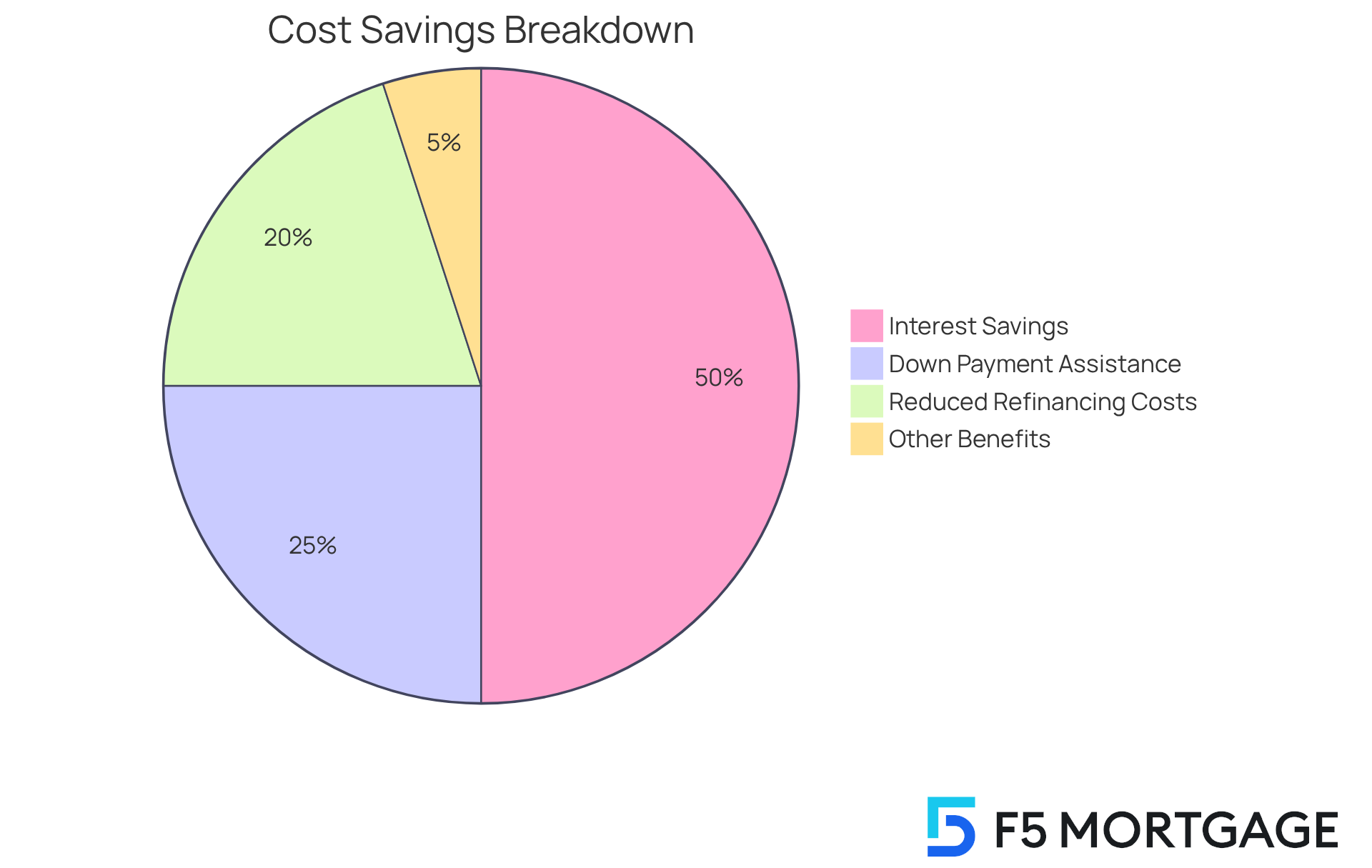

Save Money with Competitive Rates Offered by Mortgage Brokers

One of the most significant benefits of working with home loan mortgage brokers like F5 is the potential for considerable cost savings, especially when refinancing in Colorado. We understand how challenging this process can be, and our home loan mortgage brokers at F5 utilize a vast network of lenders to compare rates and identify the most competitive options available. This ability can lead to substantial savings throughout the duration of a financial agreement, which is essential for households striving to manage their payment obligations efficiently. For instance, refinancing a home in Colorado typically incurs costs between 2% and 5% of the total loan amount. However, with F5 Mortgage’s assistance, households can navigate down payment assistance programs that may significantly reduce these expenses.

Additionally, brokers can customize financing solutions to accommodate distinct financial circumstances, ensuring that households obtain the most favorable terms. This personalized approach not only enhances financial health but also alleviates the stress associated with navigating the services of home loan mortgage brokers. By securing competitive rates, families can allocate more resources toward other essential expenses, such as education or home improvements, ultimately contributing to their overall financial well-being.

To illustrate, consider a household that collaborated with F5 Mortgage. They were able to refinance their home and save over $10,000 in interest payments over the life of their loan. This example underscores the tangible benefits that mortgage brokers can provide. Furthermore, financial advisors often emphasize that working with home loan mortgage brokers can lead to better rates due to their ability to negotiate and access exclusive lender offers, further enhancing the financial advantages for families. We’re here to support you every step of the way.

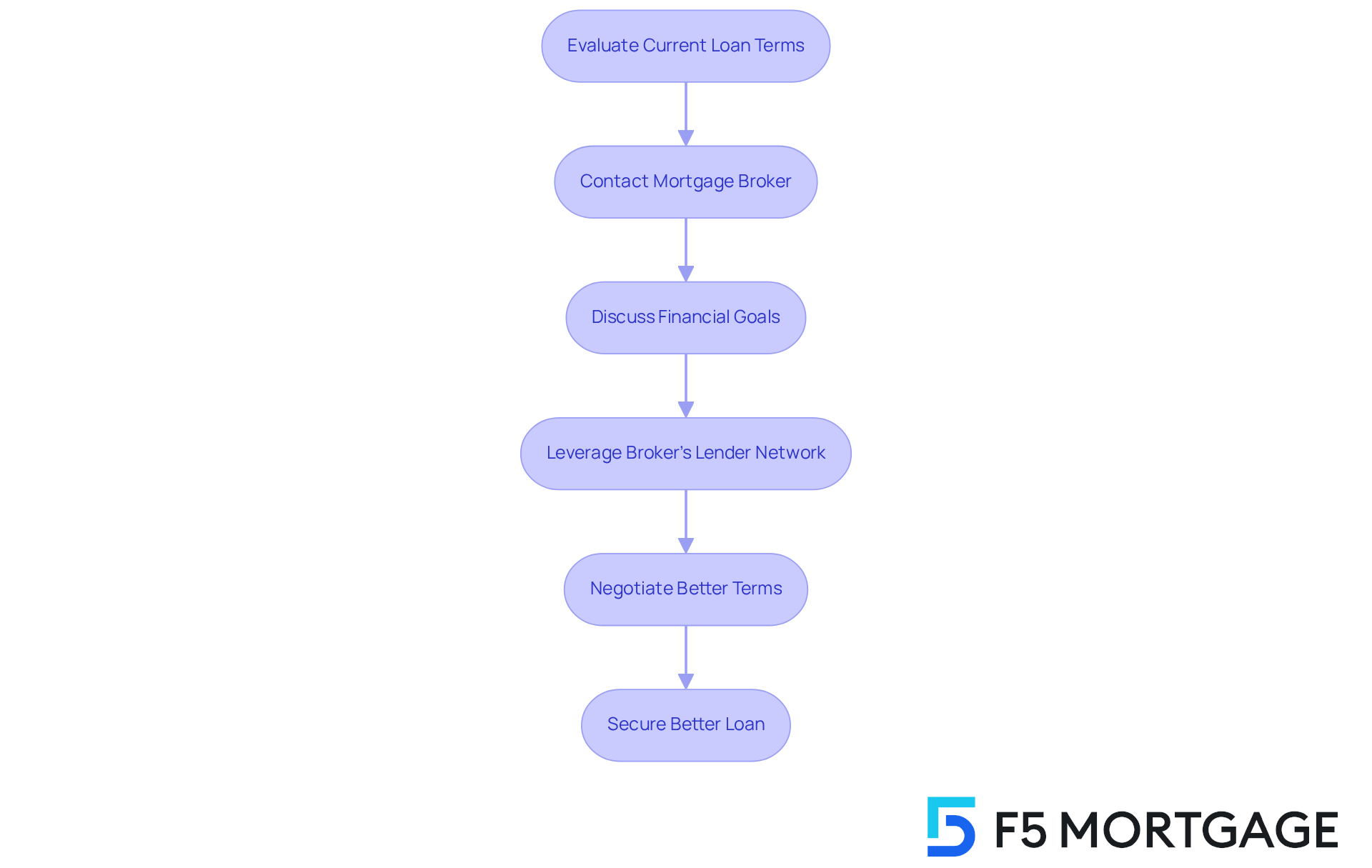

Negotiate Better Terms with the Help of a Mortgage Broker

Home loan mortgage brokers are not only negotiators; they are advocates who prioritize your best interests. At F5 Mortgage, we understand how challenging this process can be. As independent brokers, we work solely for you, not the lenders. This means we can truly focus on your needs.

By leveraging our extensive network of over two dozen lenders, our brokers can negotiate better terms tailored to your household’s financial goals. Imagine securing lower interest rates and reduced fees that align with your family’s needs. With a dedicated team approach, including access to a loan officer and an account manager, we ensure you receive unparalleled support throughout the refinancing journey.

This advocacy can lead to a more manageable loan by working with home loan mortgage brokers, unlocking lower rates and flexible terms that enhance your home financing experience. We’re here to support you every step of the way. To get started, consider evaluating your current loan terms. Contact our team today to explore how refinancing could benefit you and your family.

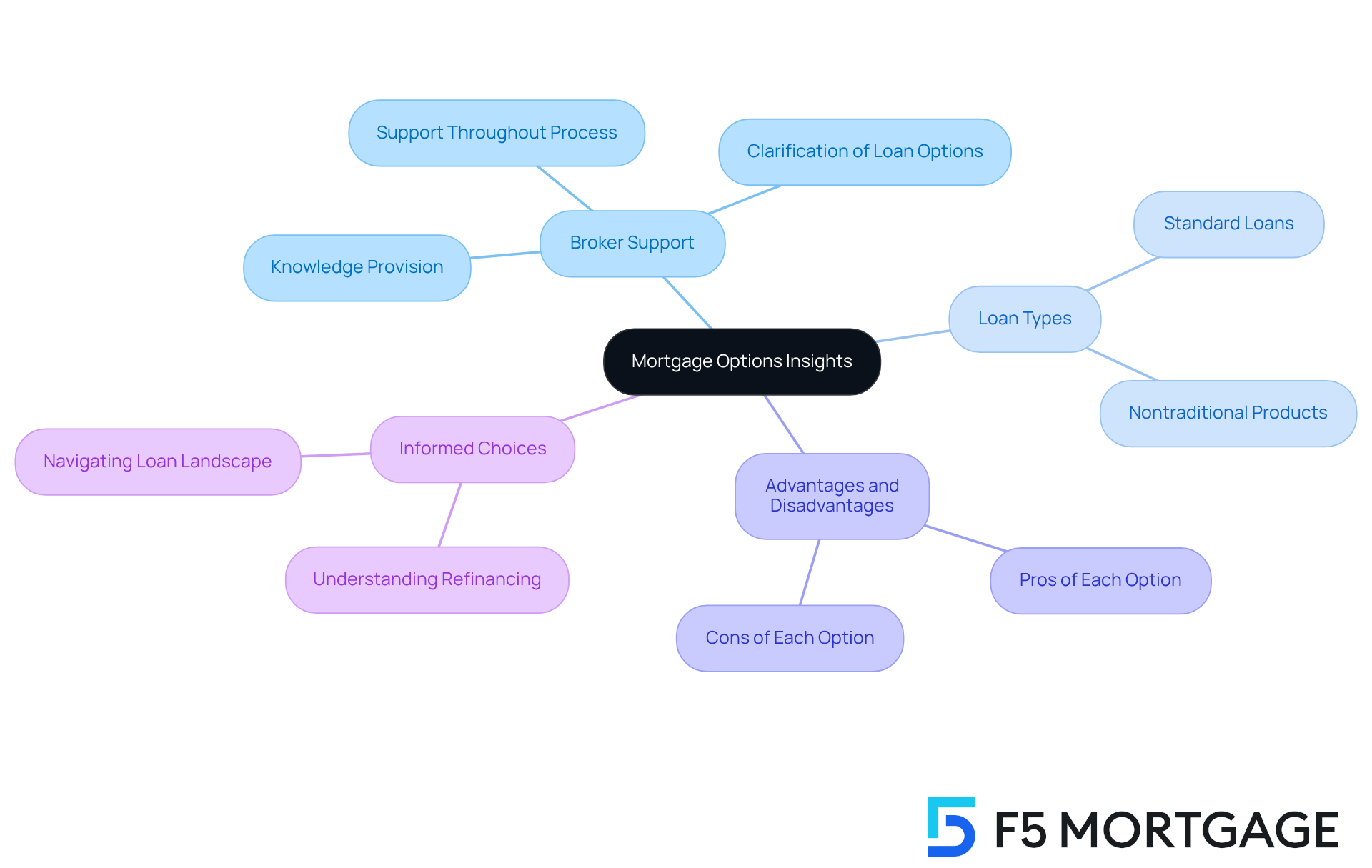

Gain Valuable Insights and Education on Mortgage Options

Collaborating with a broker like F5 Finance offers a significant advantage: the invaluable knowledge they provide throughout the financing process. We understand how challenging this can be, so our brokers take the time to clarify various loan options, including both standard and nontraditional products. They explain the advantages and disadvantages of each, ensuring you feel supported and informed.

This educational approach empowers families to make informed choices, helping you select the right loan for your unique situation. By understanding your options, including the refinancing process and potential expenses, you can navigate the loan landscape with confidence. Remember, we’re here to support you every step of the way, ensuring you feel secure in your decisions.

Save Time with Efficient Mortgage Solutions from Brokers

Time is of the essence when it comes to securing a mortgage, and home loan mortgage brokers are aware of how challenging this can be. At F5 Mortgage, our caring home loan mortgage brokers streamline the application and approval process, often achieving pre-approval in under an hour. With user-friendly technology, we enable households to apply online, by phone, or through chat for personalized loan solutions. This efficiency saves valuable time, allowing families to focus on finding their dream home with the assistance of home loan mortgage brokers rather than getting bogged down in paperwork.

Clients like Ruth Vest have shared their positive experiences with us, praising our outstanding service. She declared, ‘F5 managed my financial requirements exceptionally well.’ We understand that every family’s situation is unique, which is why F5 Lending collaborates with home loan mortgage brokers to provide down payment assistance programs that enhance home buying opportunities for families. Our commitment to guiding clients without pressure ensures a stress-free journey toward homeownership. We’re here to support you every step of the way.

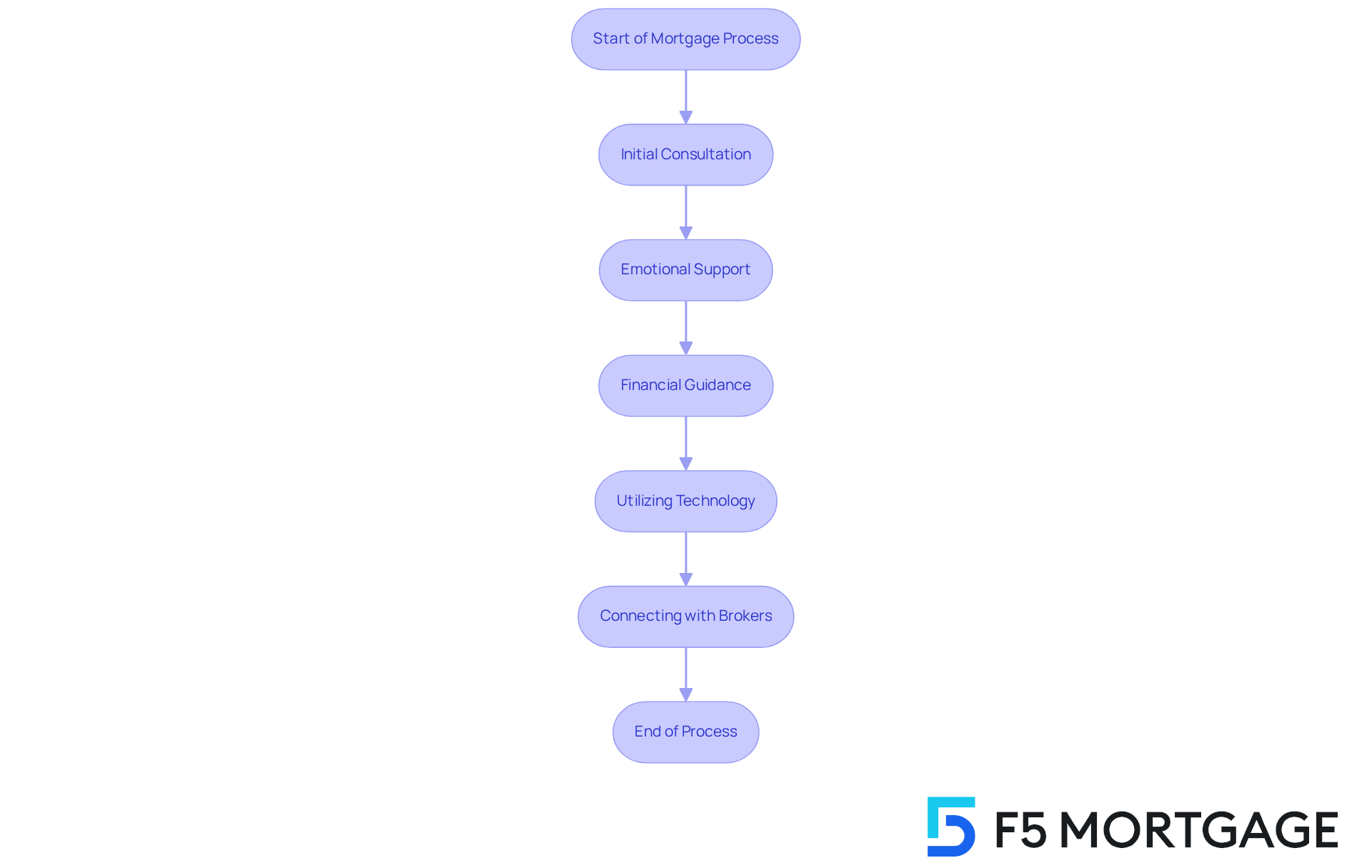

Receive Emotional Support and Guidance Throughout the Process

The mortgage process can be emotionally taxing, especially for first-time buyers. We understand how challenging this can be. At F5 Mortgage, our home loan mortgage brokers offer not only practical assistance but also emotional support throughout this journey. Clients like Ruth Vest have praised our team’s exceptional service, noting how we handle financial needs with expertise and care.

Our loan officers, such as Jeff and Jorge, ensure that every step is clear and manageable, making the experience more straightforward. We’re here to support you every step of the way, utilizing intuitive technology to streamline the financing process. This enables households to feel assisted at each stage.

Additionally, we can connect you with top home loan mortgage brokers, which further enhances our commitment to providing a stress-free experience. We want you to feel confident and supported as you navigate this important milestone.

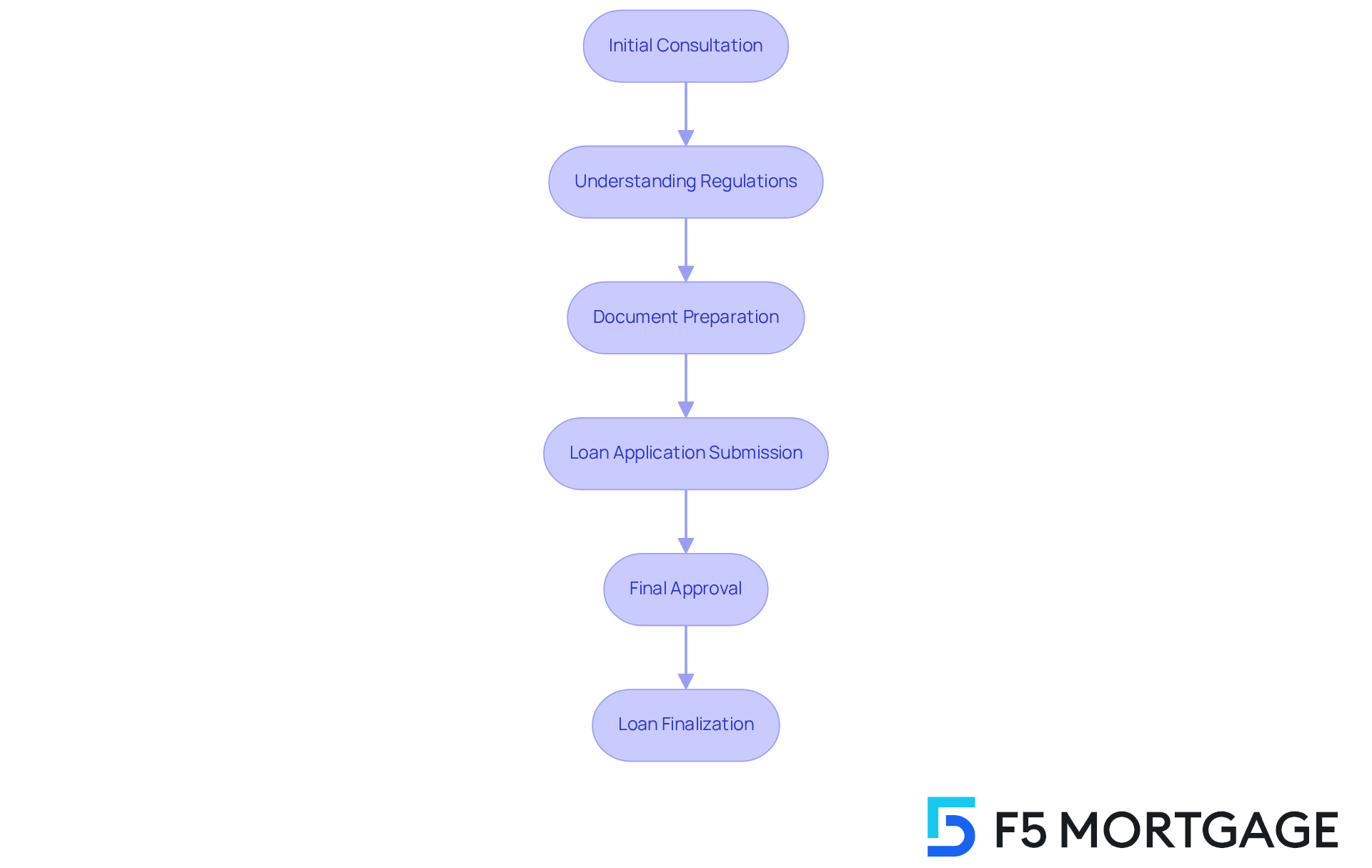

Ensure Compliance and Avoid Pitfalls with Professional Broker Assistance

Navigating the mortgage landscape can be challenging, and we understand how overwhelming it may feel. At F5 Mortgage, our home loan mortgage brokers are not only knowledgeable about the various regulations and compliance requirements, but they also utilize user-friendly technology to simplify the process for households. We know how challenging this can be, which is why we prioritize a no-pressure guidance approach. This ensures that you can make informed decisions without feeling rushed.

Our expert support is here to help you every step of the way. We take care of all essential documentation, offering you peace of mind and safeguarding you from potential hazards that might lead to costly errors. With our dedication to a hassle-free experience, we strive to finalize loans rapidly—often in under three weeks. This allows you and your family to focus on what truly matters.

Build a Lasting Relationship with Your Mortgage Broker for Future Needs

Establishing a lasting connection with home loan mortgage brokers can be invaluable for families navigating the complexities of homeownership. At F5 Mortgage, we understand how challenging this can be. Every client interaction is an opportunity for us to foster trust and become a true partner in your journey to homeownership.

Our clients have shared their positive experiences, highlighting the personalized guidance our team provides, tailored to their unique financial situations. Experts like Jeff and Alyssa are dedicated to understanding your needs, ensuring you feel supported every step of the way.

As your financial situation evolves, having reliable home loan mortgage brokers means you receive continuous assistance for future loan requirements. Whether it’s refinancing, buying a new home, or exploring additional financing options, we’re here to support you.

Our commitment to a stress-free mortgage process, combined with user-friendly technology and personalized guidance, makes your mortgage experience smoother and more efficient. This relationship not only fosters trust and continuity but also enhances your opportunities for future financing, empowering you to navigate the complexities of homeownership with confidence.

Conclusion

Partnering with home loan mortgage brokers is essential for families navigating the complexities of securing a mortgage. We know how challenging this can be. These brokers provide invaluable support tailored to individual needs, ensuring that the home financing process is not only manageable but also aligned with each family’s unique financial situation and goals.

Throughout the article, we’ve highlighted key benefits of working with mortgage brokers like F5 Lending. From offering diverse loan options and competitive rates to providing expert guidance and emotional support, brokers play a crucial role in simplifying the mortgage journey. They help families save money, negotiate better terms, and avoid potential pitfalls, all while fostering a lasting relationship that can benefit future financing needs.

Ultimately, the significance of engaging with home loan mortgage brokers cannot be overstated. They empower families with the knowledge and resources necessary to make informed decisions. By reducing stress and enhancing confidence in the home buying process, embracing this partnership not only leads to a smoother mortgage experience today but also lays the foundation for successful homeownership in the future. We’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage is an independent brokerage that provides personalized home loan solutions through home loan mortgage brokers. They focus on offering customized loan options tailored to individual financial situations and homeownership goals.

How does F5 Mortgage differ from conventional mortgage brokers?

Unlike conventional mortgage brokers, F5 Mortgage prioritizes the needs and preferences of clients, providing a tailored approach to financing that aligns with their unique situations.

What types of payment plans does F5 Mortgage offer?

F5 Mortgage offers flexible payment plans including fixed-rate, adjustable-rate, and interest-only options.

What advantages does partnering with F5 Mortgage provide?

Partnering with F5 Mortgage allows clients to access an extensive network of home loan mortgage brokers to find the best terms and rates for refinancing. They also emphasize exceptional customer support, providing dedicated loan advisors for personalized assistance.

How does F5 Mortgage support first-time homebuyers?

F5 Mortgage offers personalized support and guidance specifically for first-time homebuyers, helping them understand loan terms and navigate the mortgage process more confidently.

What tools does F5 Mortgage provide to assist clients?

F5 Mortgage offers an easy-to-use loan calculator for Arizona residents, helping them explore financing options and make informed decisions.

How do independent loan brokers like F5 Mortgage benefit consumers financially?

Research indicates that consumers save an average of $10,662 over the life of a loan when working with independent loan brokers compared to retail lenders, along with higher satisfaction and confidence in their financing decisions.

What financing solutions are available for first-time homebuyers through F5 Mortgage?

F5 Mortgage provides access to diverse financing solutions for first-time homebuyers, including FHA products, VA products, and fixed-rate options, with down payments as low as 3% or even 0% for certain loans.