Overview

Choosing a home mortgage broker for your family upgrade can be a game-changer. We know how challenging this can be, and having someone by your side who understands your needs is invaluable. Mortgage brokers offer personalized consultations, diverse mortgage options, and expert negotiation skills that simplify the home financing process.

Brokers like F5 Mortgage truly enhance client experiences. They provide tailored financial solutions that cater to your unique situation, streamline communication, and advocate for better loan terms. This support makes the journey to homeownership smoother and more efficient, allowing you to focus on what truly matters—creating a loving home for your family.

Let us guide you through this process. With the right broker, you can feel confident that you have someone who cares about your financial well-being and is committed to helping you achieve your dreams. We’re here to support you every step of the way.

Introduction

Navigating the intricacies of home financing can feel overwhelming for families seeking to improve their living situation. We understand how challenging this can be. Choosing a home mortgage broker offers a valuable opportunity to simplify this process, providing tailored solutions that align with your unique financial goals and circumstances. Yet, with a multitude of options available, how can families ensure they are making the best choice for their needs?

Exploring the compelling reasons to partner with a mortgage broker not only highlights the advantages of expert guidance but also reveals the potential pitfalls of attempting to navigate the complex world of home buying alone.

We’re here to support you every step of the way.

F5 Mortgage: Personalized Consultations for Tailored Home Financing

At F5, we understand how challenging navigating the process can be. That’s why we excel in offering , preferences, and goals. This personalized approach ensures that whether you’re a first-time buyer or looking to , a home mortgage broker can provide financing options that fit seamlessly with your needs.

Our dedicated team of loan officers, including specialists skilled in managing and immigration statuses, is here to support you every step of the way. By gaining a deep understanding of your individual circumstances, we can recommend the most suitable loan products as your home mortgage broker, significantly enhancing your home financing experience.

In a market where has seen a decline, our as a home mortgage broker is essential. We know how important it is for families to feel understood and supported. With over 1,000 households assisted and a remarkable , F5 demonstrates the effectiveness of our approach, establishing ourselves as a reliable partner in .

Clients have shared their appreciation for our exceptional service, highlighting the stress-free experience and , often occurring in under three weeks. This commitment to client-centric solutions positions F5 as a leader in the industry, dedicated to enhancing home buying opportunities for families through a home mortgage broker. We’re here to support you every step of the way, ensuring your journey is as smooth and rewarding as possible.

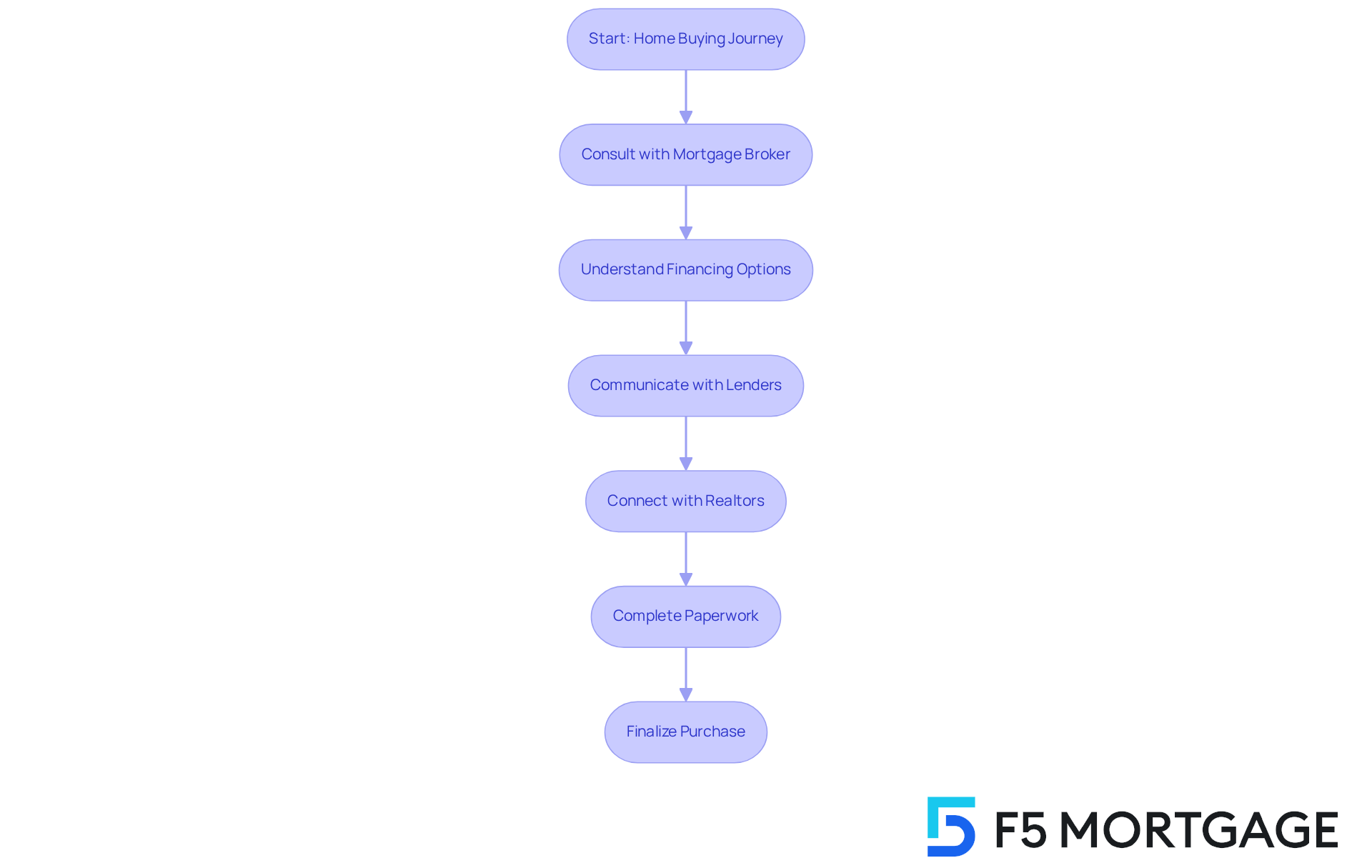

Expert Guidance: How Mortgage Brokers Simplify the Home Buying Process

can feel overwhelming, but like F5 Mortgage are here to help. We understand how challenging this can be, which is why we serve as your invaluable guides. Our team simplifies the myriad of options available, explaining complex terms and assisting with paperwork. By acting as intermediaries between you and lenders, we ensure that communication is clear and that you understand each step, making the entire process less daunting.

At F5 Mortgage, our connects you with , ensuring you find the best home for your family. We know that finding the right home is important, and our extensive network of agents and collaborations with top lenders allows us to secure the tailored to your needs.

Our customers consistently emphasize our . Testimonials highlight our team’s commitment to delivering and providing . Whether you’re a or looking to upgrade, we’re here to . Let F5 Mortgage make your experience seamless and successful.

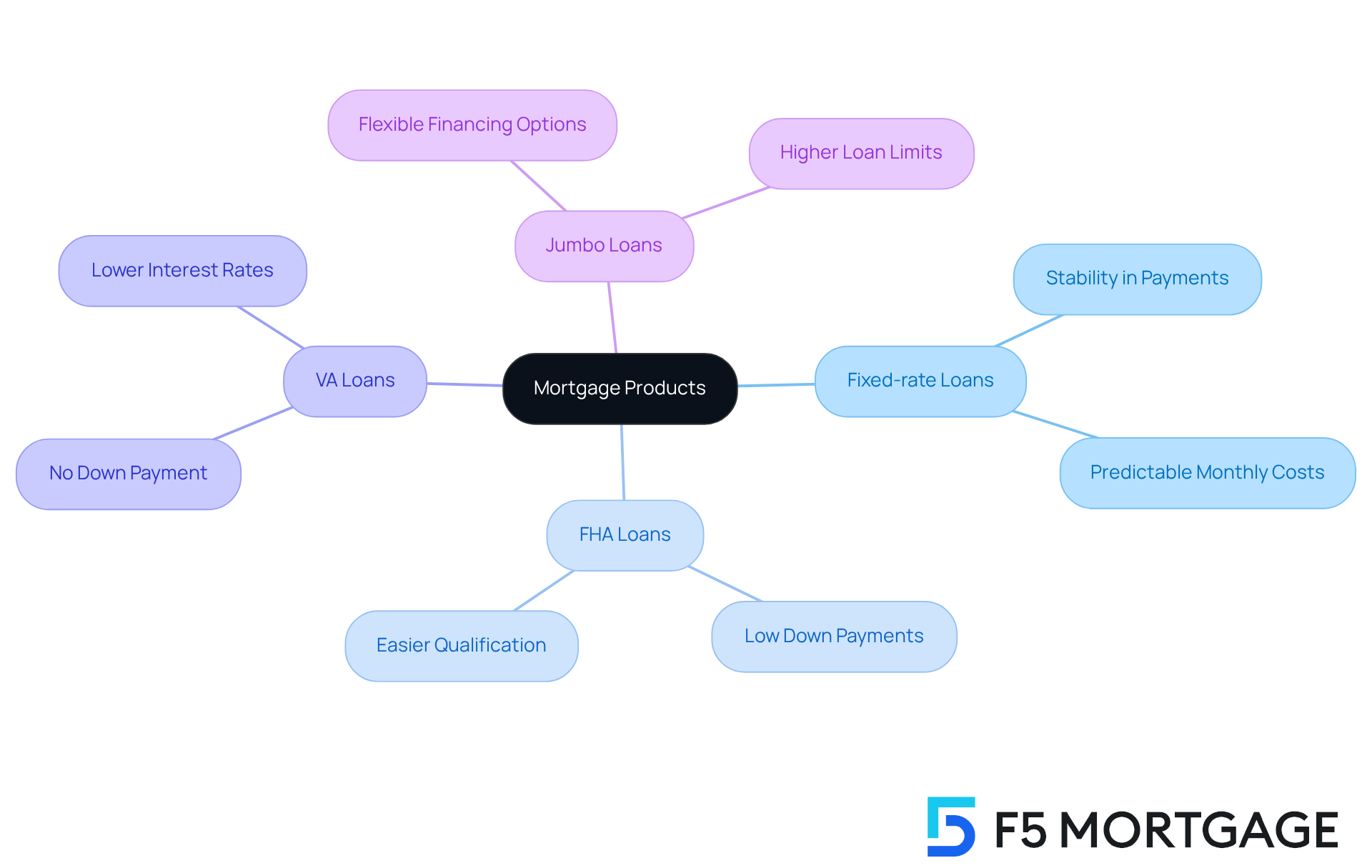

Diverse Options: Access to a Wide Range of Mortgage Products

At F5, we understand that navigating financing options can be overwhelming. That’s why we offer a , including:

This extensive range empowers households to explore various financing solutions and choose the one that best fits their unique financial situations and long-term aspirations.

Current trends show that many families are drawn to fixed-rate loans for the stability they provide in monthly payments. First-time homebuyers often find FHA loans particularly appealing due to their low down payment requirements. For veterans and active-duty service members, VA loans present significant advantages, frequently featuring and no down payment. Meanwhile, jumbo loans cater to those looking to purchase higher-priced homes, offering flexible financing options.

Experts in the lending sector emphasize the importance of understanding the diverse loan choices available through a . They recognize that families can significantly benefit from the assistance of a home mortgage broker who offers that align with their specific financial circumstances. For example, a family upgrading to a larger home might discover that a VA loan offers the most favorable terms, while another may prefer the lower initial costs associated with an FHA loan. By partnering with F5, families can confidently navigate these choices, ensuring they make informed decisions that support their dreams of homeownership. We know how challenging this can be, and we’re here to .

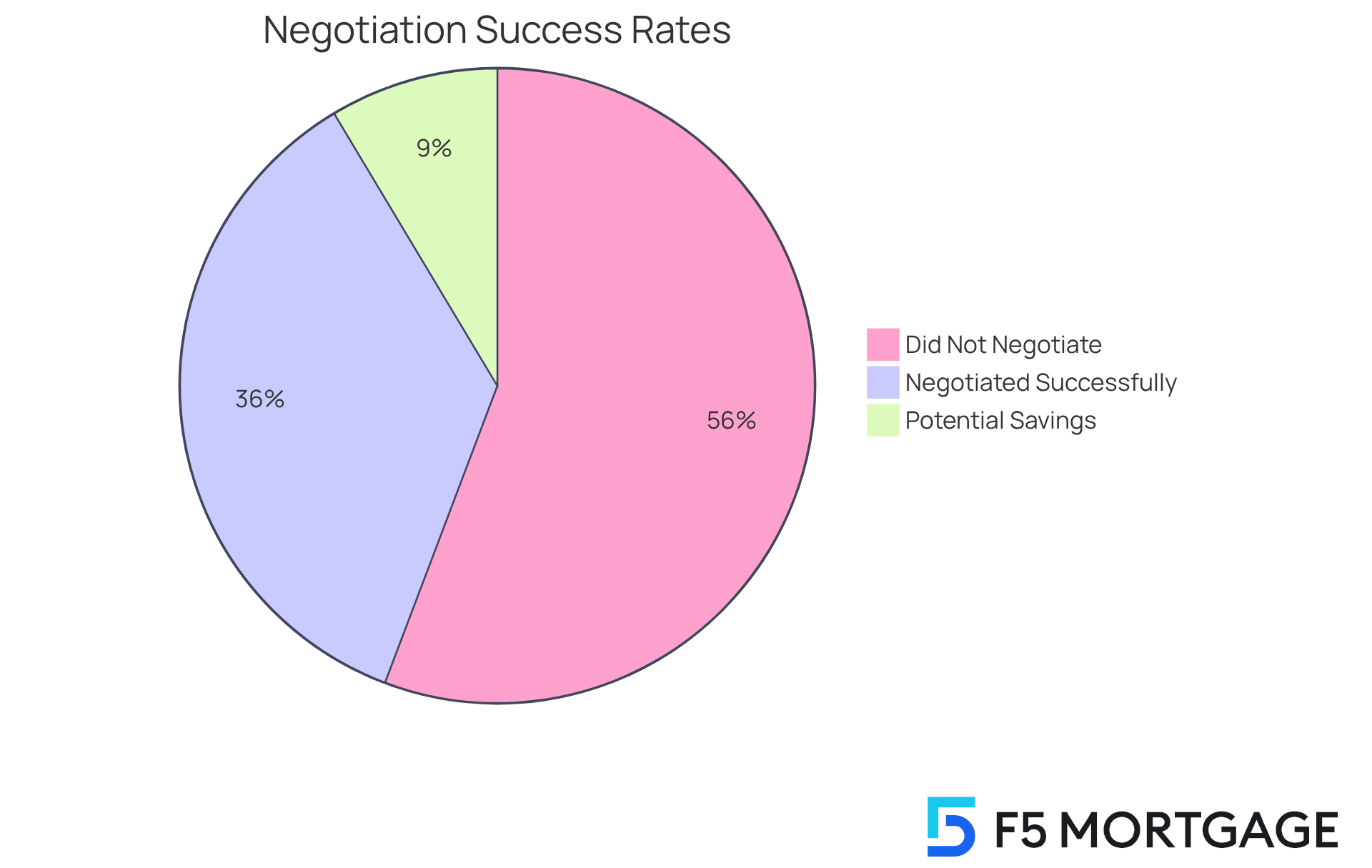

Negotiation Power: Brokers Advocate for Better Mortgage Terms

A significant advantage of collaborating with a loan broker is their on behalf of clients. At , our brokers utilize their extensive industry knowledge and established connections with lenders to secure more favorable loan terms, like and reduced fees. This advocacy can lead to substantial savings over the life of a loan. For instance, households can save approximately $9,400 over five years by negotiating just a 0.5% difference in interest rates on a $375,000 loan.

Moreover, loan brokers are adept at helping individuals navigate complex financial situations, ensuring they receive that align with their budgetary limits and . The impact of is clear—only 39% of homebuyers successfully negotiated their initial APR or refinance rate, highlighting the on your side.

Financial advisors consistently stress the importance of broker advocacy, noting that it not only but also empowers families to make informed decisions throughout the mortgage process. As one satisfied client, Ruth Vest, shared, “F5 handled my financial needs exceptionally well… They delivered better options than the lender I was working with.” This sentiment resonates with many who have experienced the and exceptional service that F5 offers, making the smoother and more rewarding.

Furthermore, F5 Home Loans provides quick and adaptable loan rates, ensuring that families can effortlessly realize their dream of homeownership. We know how challenging this can be, and we’re here to support you every step of the way.

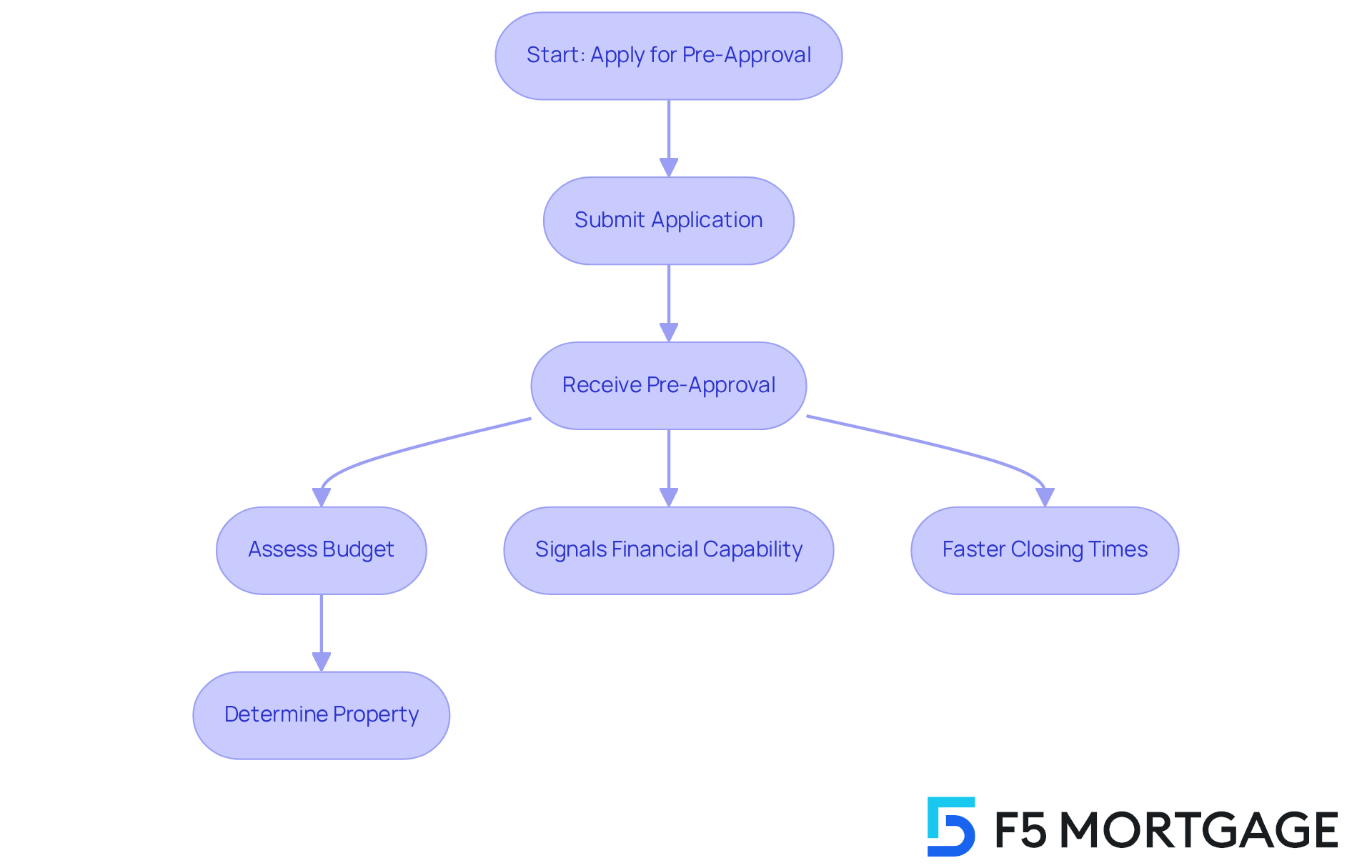

Streamlined Pre-Approval: Quick Access to Mortgage Financing

At F5 Mortgage, we understand how overwhelming the mortgage process can feel. That’s why we excel in offering a streamlined , typically completed in under an hour. This rapid access to to quickly assess their budget and act decisively when they discover a suitable property.

not only clarify borrowing limits but also position clients as serious contenders in the competitive housing market. This significantly enhances their chances of . Real estate professionals emphasize that being pre-approved signals to sellers that buyers are financially capable and ready to proceed, making offers more appealing.

Statistics reveal that buyers with pre-approval letters are prioritized by sellers, as it indicates fewer obstacles in the closing process. In high-demand areas, pre-approved buyers often experience faster closing times, allowing them to move into their new homes without unnecessary delays. This combination of speed and credibility makes a crucial step in the home-buying journey.

Clients have commended F5 for their , with testimonials emphasizing the and expertise offered throughout the process. Many have observed how our dedicated team at F5 Financial, including loan officers like Jeff and Ryan, ensures that every detail is managed efficiently, making the experience smooth and worry-free.

We know how challenging this can be, and our not only improves satisfaction but also emphasizes the significance of like F5 Financial for your household’s funding requirements. We’re here to support you every step of the way.

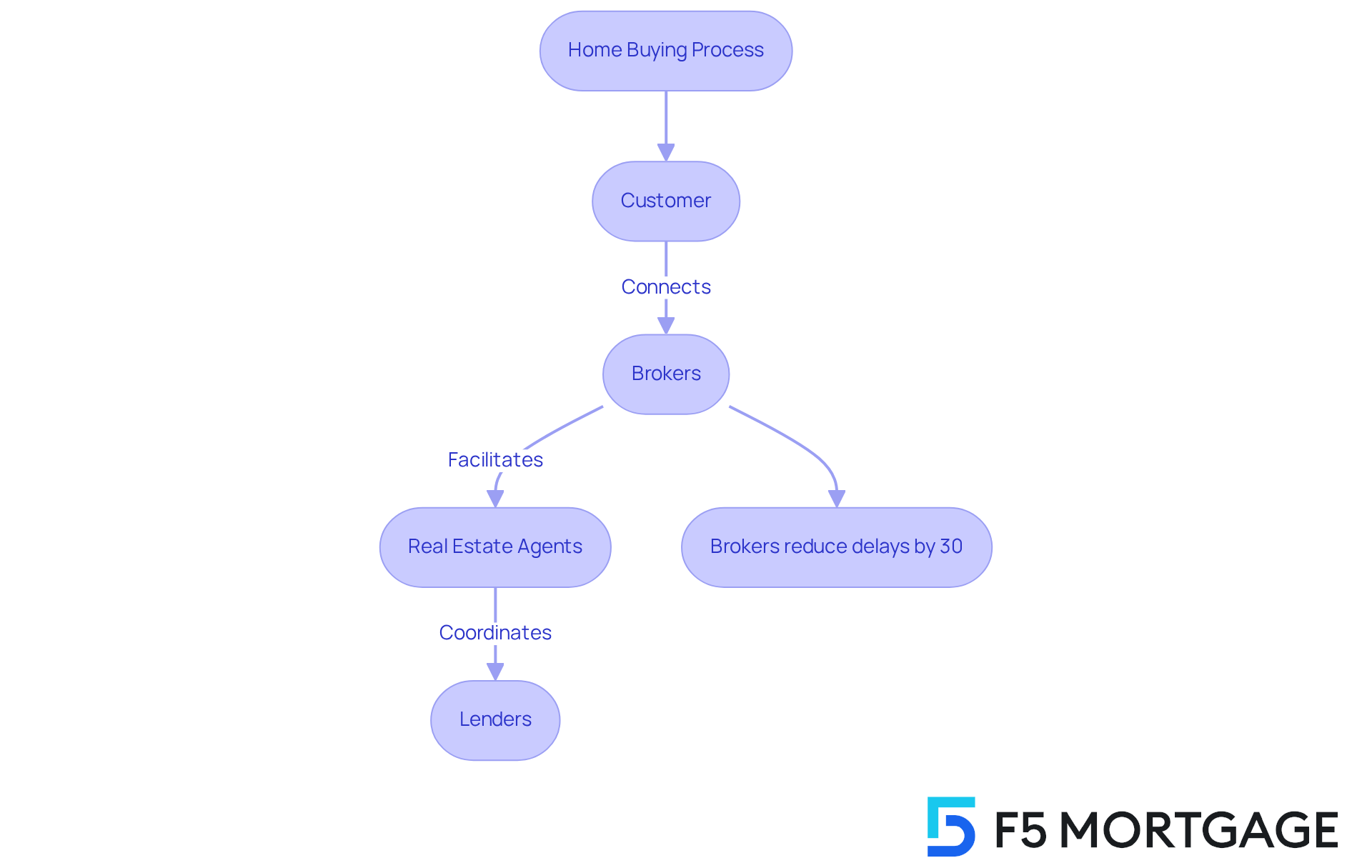

Coordinated Support: Brokers Liaise with Your Homebuying Team

serve as a vital link in the property purchasing process, connecting real estate agents, lenders, and customers. We understand how challenging this can be, and our centralized communication streamlines the process, significantly reducing the chances of miscommunication and delays. Data shows that enabled by brokers can lessen home buying delays by as much as 30%. This allows families to focus on choosing their new residence instead of managing intricate details.

Industry leaders emphasize that brokers not only provide but also foster open discussions. This ensures that all parties remain aligned throughout the transaction. At F5 Funding, we know how important it is to have to streamline the loan process. Our goal is to guarantee a for our customers.

Our dedication to supporting households without pressure empowers them to select what feels right for them. As one pleased customer remarked, ‘.’ This proactive strategy, combined with our outstanding customer service, enhances the efficiency of the .

Our clients consistently praise our team for their and , often under three weeks. We’re here to support you every step of the way, making the overall even better.

Time-Saving Benefits: Brokers Handle Complex Mortgage Applications

Navigating the can feel overwhelming, especially for families looking to improve their homes. We understand how challenging this can be. That’s where F5 s come in, alleviating this burden by expertly managing the complexities involved. They take care of the paperwork, gather necessary documentation, and ensure that all requirements are met. This greatly reduces the stress linked to loan applications. With this , families can save time and focus on their home search and other essential aspects of their lives, knowing that their loan application is in the hands of .

F5 Mortgage employs a systematic method for handling loan applications, ensuring that each step is conducted efficiently. This includes:

- Thorough assessments of financial situations

- Tailored loan options

- Proactive communication throughout the process

Many homebuyers face common challenges during the mortgage application journey, such as and . By collaborating with a home mortgage broker, families can navigate these hurdles more effectively. Financial experts emphasize that a home mortgage broker is especially beneficial for , offering guidance and support throughout the process. This helps clients avoid lenders with hidden fees or unfavorable terms. Ultimately, this extensive support results in a smoother and more efficient loan experience. We encourage families to consult with a home mortgage broker to receive .

Market Insights: Brokers Offer Valuable Knowledge on Trends

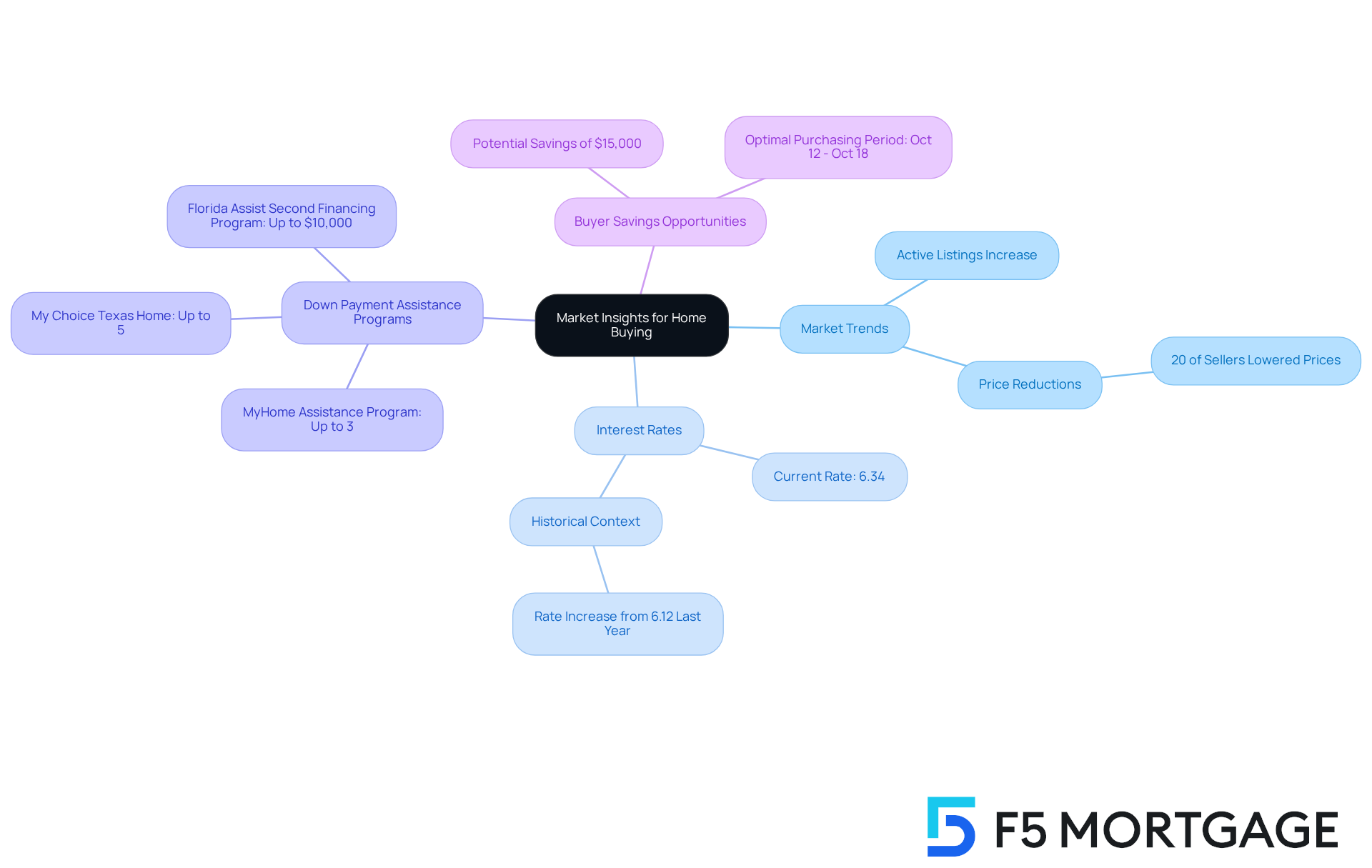

At F5, we understand how daunting the home buying process can be. Our possess a deep understanding of current market trends, providing you with essential insights that can shape your home buying strategies. By examining key elements such as , , and local market dynamics, we empower families like yours to make .

For instance, with the average long-term loan rate recently increasing to 6.34% from 6.12% a year prior, understanding these changes is crucial. This knowledge can assist you in negotiating more advantageous terms through F5’s . Additionally, families can benefit from various available through F5. Programs like the MyHome Assistance Program in California offer up to 3% of the home’s purchase price, while the My Choice Texas Home program provides up to 5% for down payment and closing assistance. In Florida, initiatives such as the Florida Assist Second Financing Program can provide up to $10,000 in initial expenses.

Consider this: buyers are poised to save over $15,000 on average during the from October 12 to October 18. This makes it crucial to leverage the expertise of a home mortgage broker during this time. Families who have consulted with our home mortgage broker often report increased confidence in their purchasing decisions. This illustrates the in a complex market.

With almost 20% of recently and active listings increasing by 17% compared to last year, our home mortgage broker can assist you in identifying the best opportunities. We’re here to support you every step of the way, ensuring you navigate the housing market effectively.

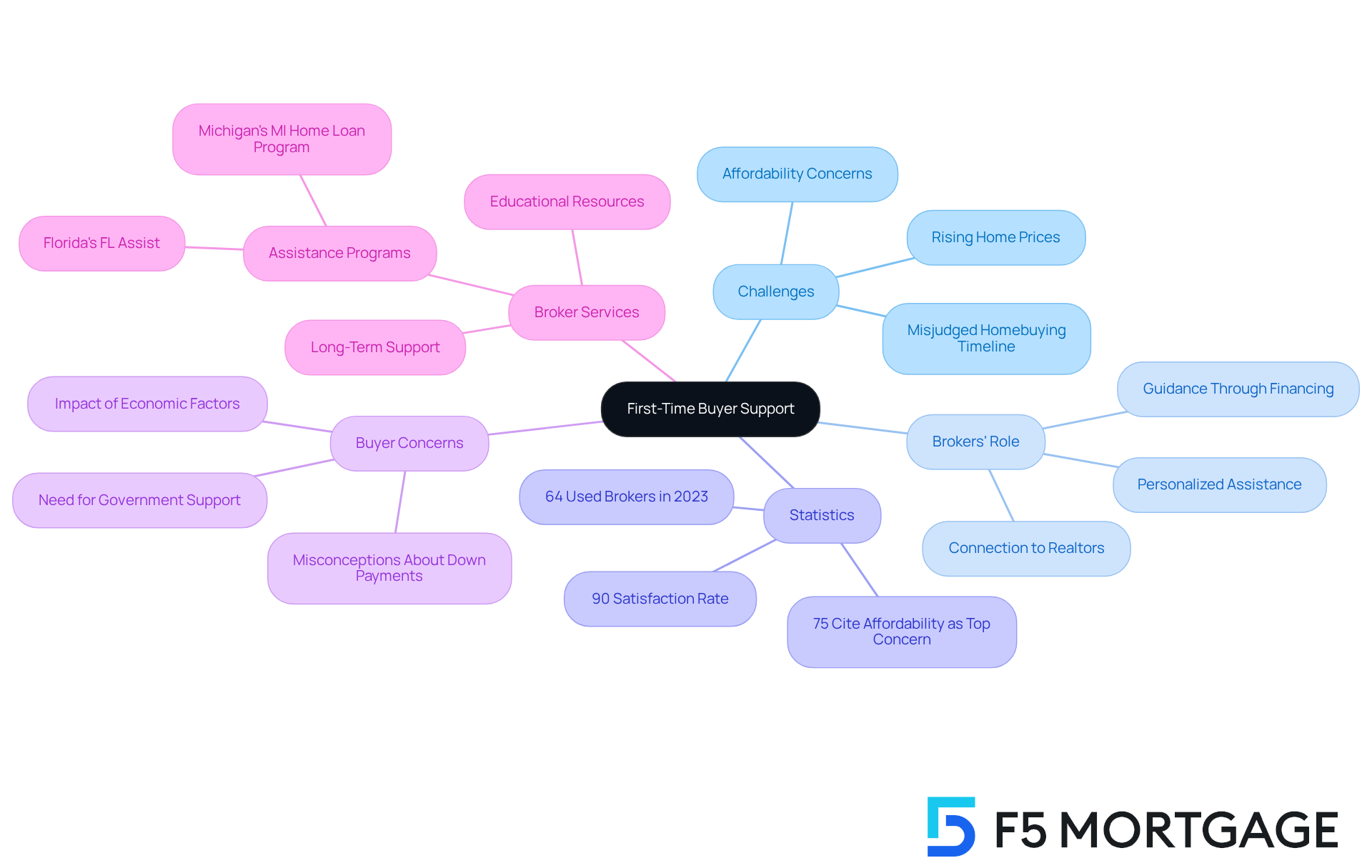

First-Time Buyer Support: Brokers Simplify the Mortgage Journey

At F5 Mortgage, we understand the unique challenges faced by . That’s why we are dedicated to providing that simplifies the financing process. Our plays a crucial role in guiding individuals through this journey, ensuring they fully understand their options and the implications of each choice. This support not only eases anxiety but also empowers buyers to make informed decisions as they .

Recent statistics reveal that 64% of first-time purchasers turned to loan brokers in 2023, a . This trend underscores the growing reliance on amid rising home prices and affordability concerns. Many buyers appreciate brokers for their ability to clarify the application process and assist with paperwork, with 90% expressing satisfaction with their experience.

Successful journeys of first-time homebuyers often showcase how a home mortgage broker can simplify the path to homeownership. Home mortgage brokers assist clients in assessing their financial situations and exploring a range of mortgage options tailored to their needs. This is especially important, as . By offering personalized consultations and access to various loan programs, including like Florida’s FL Assist and Michigan’s MI Home Loan program, brokers ensure that individuals feel supported every step of the way, from pre-approval to closing.

Moreover, F5 Mortgage can connect clients with top realtors, enhancing the overall brokerage experience. As the lending landscape evolves, in helping first-time buyers effectively navigate their options. Their expertise not only enhances the purchasing experience but also fosters lasting relationships, ensuring that customers are well-prepared for their journey into homeownership.

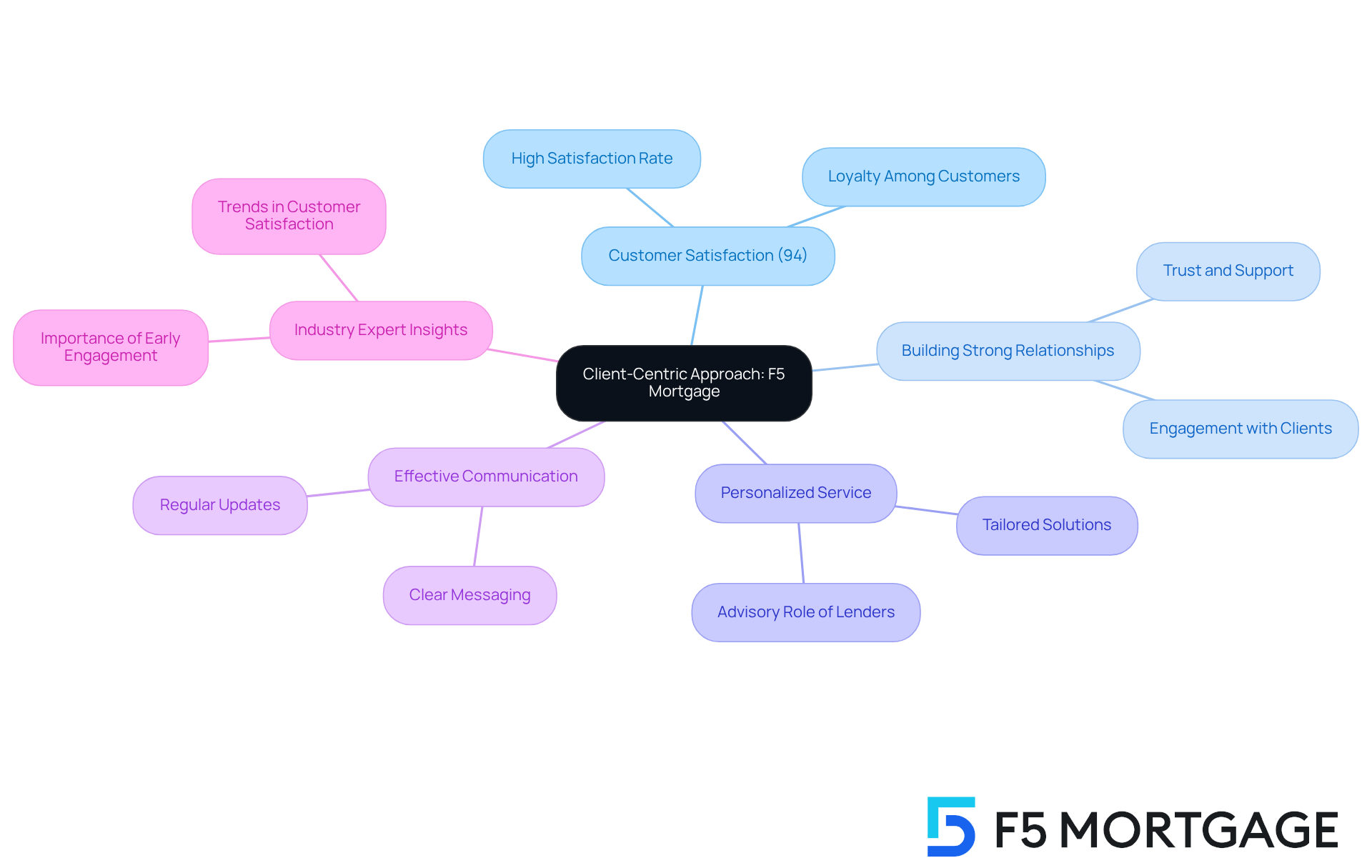

Client-Centric Approach: F5 Mortgage’s Commitment to Satisfaction

At F5, we understand how challenging the process can be for families. That’s why we exemplify a , placing your needs and preferences at the forefront of our financing process. With a remarkable of 94%, we prioritize building , ensuring you feel supported and informed at every stage of your journey.

This steadfast not only sets F5 apart from our rivals but also encourages long-lasting loyalty among our customers. Industry experts highlight that lenders who take on an advisory role and engage with clients early in the home-buying process see . By focusing on and effective communication, F5 Mortgage, your home mortgage broker, effectively addresses the like you.

We’re here to support you every step of the way, reinforcing our reputation as a .

Conclusion

Choosing a home mortgage broker can truly enhance the home buying experience for families. We know how challenging this process can be, and the advantages outlined here show how a dedicated broker can make a difference. From personalized consultations that cater to your unique financial situation to streamlined processes that simplify the often complex mortgage landscape, brokers like F5 Mortgage offer invaluable support.

Their expertise helps you navigate diverse mortgage options and empowers you to make informed decisions that align with your specific needs. Key insights reveal that mortgage brokers provide essential services, such as:

- Negotiating for better terms

- Facilitating quick pre-approval processes

- Coordinating effectively among real estate agents, lenders, and clients

Accessing a wide range of mortgage products ensures that families can find the financing solution that best suits their circumstances.

At F5 Mortgage, the emphasis on a client-centric approach is evident, highlighted by an impressive customer satisfaction rate. This underscores the importance of having a dedicated partner throughout your home buying journey.

Ultimately, leveraging the expertise of a mortgage broker can transform the daunting task of home buying into a smoother, more rewarding experience. Families are encouraged to consider the significant benefits of working with a knowledgeable broker. We’re here to support you every step of the way, ensuring you have the guidance needed to achieve your homeownership dreams effectively. Engaging with a home mortgage broker not only simplifies the process but also enhances your confidence in making one of life’s most important investments.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage offers personalized consultations to help clients navigate the home mortgage process, providing tailored financing options based on each household’s financial situation, preferences, and goals.

Who can benefit from F5 Mortgage’s services?

Both first-time buyers and those looking to enhance their homes can benefit from F5 Mortgage’s services, as they provide support for various financial circumstances and immigration statuses.

What is F5 Mortgage’s customer satisfaction rate?

F5 Mortgage has a customer satisfaction rate of 94%, reflecting their commitment to understanding and supporting families throughout the home financing process.

How quickly can clients expect loan closings with F5 Mortgage?

Clients often experience fast loan closing times, typically occurring in under three weeks.

How does F5 Mortgage simplify the home buying process?

F5 Mortgage simplifies the home buying process by acting as intermediaries between clients and lenders, explaining complex terms, assisting with paperwork, and connecting clients with top realtors in their area.

What types of mortgage products does F5 Mortgage offer?

F5 Mortgage offers a variety of mortgage products, including fixed-rate loans, FHA loans, VA loans, and jumbo loans.

Why are fixed-rate loans popular among families?

Fixed-rate loans are popular among families due to the stability they provide in monthly payments, making budgeting easier.

What advantages do FHA and VA loans offer?

FHA loans are appealing for their low down payment requirements, while VA loans offer benefits such as lower interest rates and no down payment for veterans and active-duty service members.

How can F5 Mortgage help families make informed decisions about mortgage options?

F5 Mortgage provides tailored mortgage options that align with families’ specific financial circumstances, helping them understand their choices and make informed decisions that support their homeownership dreams.