Overview

The VA streamline refinance offers veterans a range of benefits that can truly make a difference in their lives. With lower monthly payments, reduced closing costs, and a simplified application process, we understand how these advantages can provide immediate financial relief. Imagine saving an average of $150 to $300 each month! This not only eases your current financial burden but also contributes to long-term stability.

Navigating this process can feel overwhelming, but rest assured, it requires minimal documentation and no appraisal. We know how challenging this can be, and we’re here to support you every step of the way. By taking advantage of this opportunity, you can focus on what truly matters—your family and your future.

Consider this: with the VA streamline refinance, you’re not just making a financial decision; you’re investing in peace of mind. Let us help you explore these options and empower you to make the best choice for your situation.

Introduction

Navigating the financial landscape can be particularly challenging for veterans, especially when it comes to managing mortgage payments. We know how overwhelming this can feel. Fortunately, the VA streamline refinance program offers a powerful solution, enabling former service members to reduce their monthly payments and achieve greater financial stability.

But what exactly are the specific advantages of this refinancing option? How can it transform the financial future of those who have served?

This article delves into the seven key benefits of VA streamline refinance, revealing how veterans can leverage this opportunity to enhance their economic well-being. We’re here to support you every step of the way.

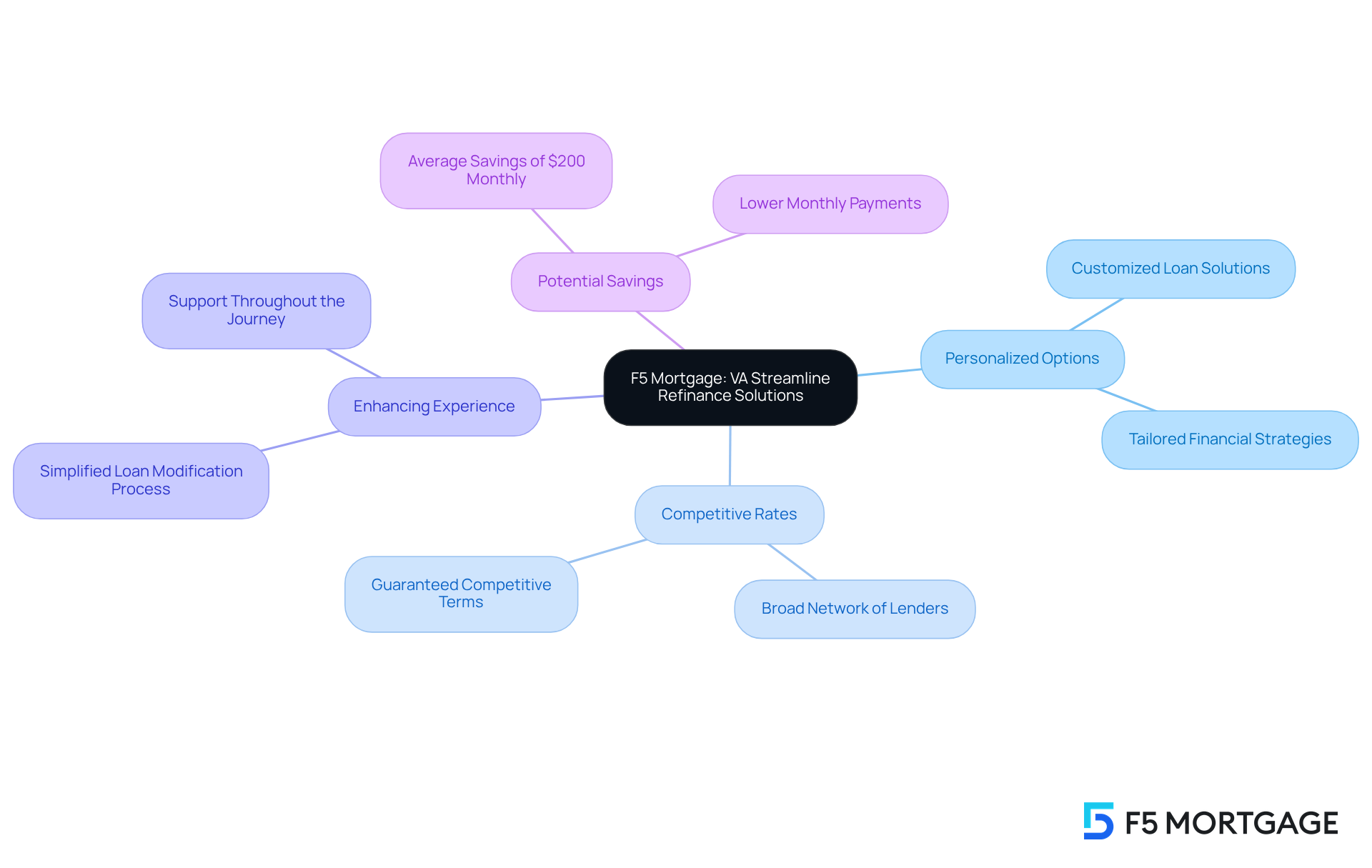

F5 Mortgage: Personalized VA Streamline Refinance Solutions

At F5 Mortgage, we understand how challenging it can be for service members to navigate the complexities of refinancing. That’s why we excel in providing customized options for a VA streamline refinance that are tailored to meet your specific needs. By leveraging a broad network of lenders, we guarantee competitive rates and terms that align with your financial objectives.

This personalized approach not only simplifies the loan modification process but also significantly enhances your overall experience. Independent mortgage brokers like us play a crucial role in helping former service members like you find their way through refinancing, often resulting in substantial savings.

Imagine saving an average of $200 monthly on your mortgage payments. This is what individuals can anticipate when using a VA Streamline refinance, making it an appealing choice for those looking to ease their financial burden. As VA mortgage expert Shirley Mueller notes, “This program allows borrowers to secure a better rate and lower monthly payments with minimal effort, all while keeping their existing VA loan intact.”

Our commitment to your satisfaction and our customized service positions F5 Mortgage as a reliable partner in your journey toward financial stability. We’re here to support you every step of the way.

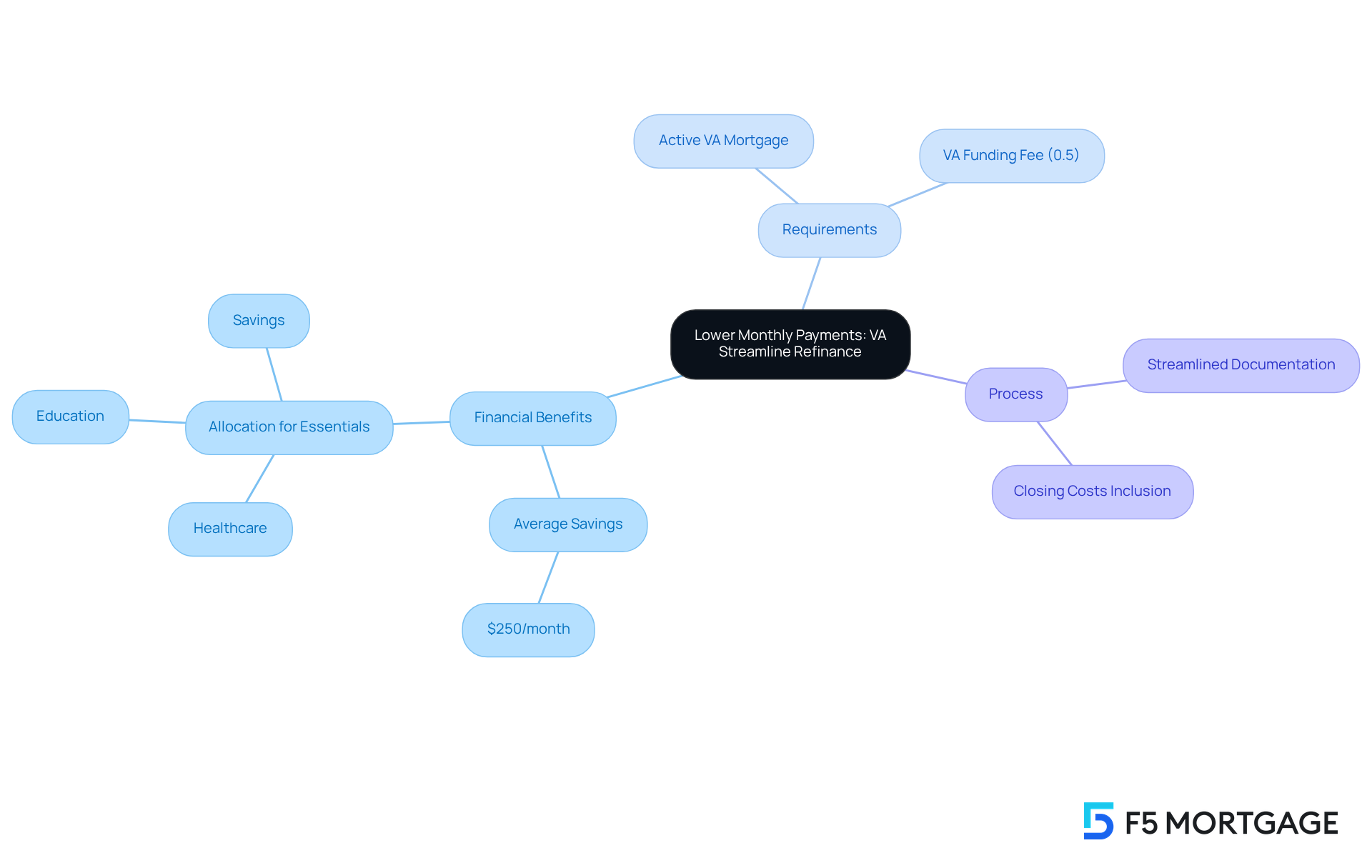

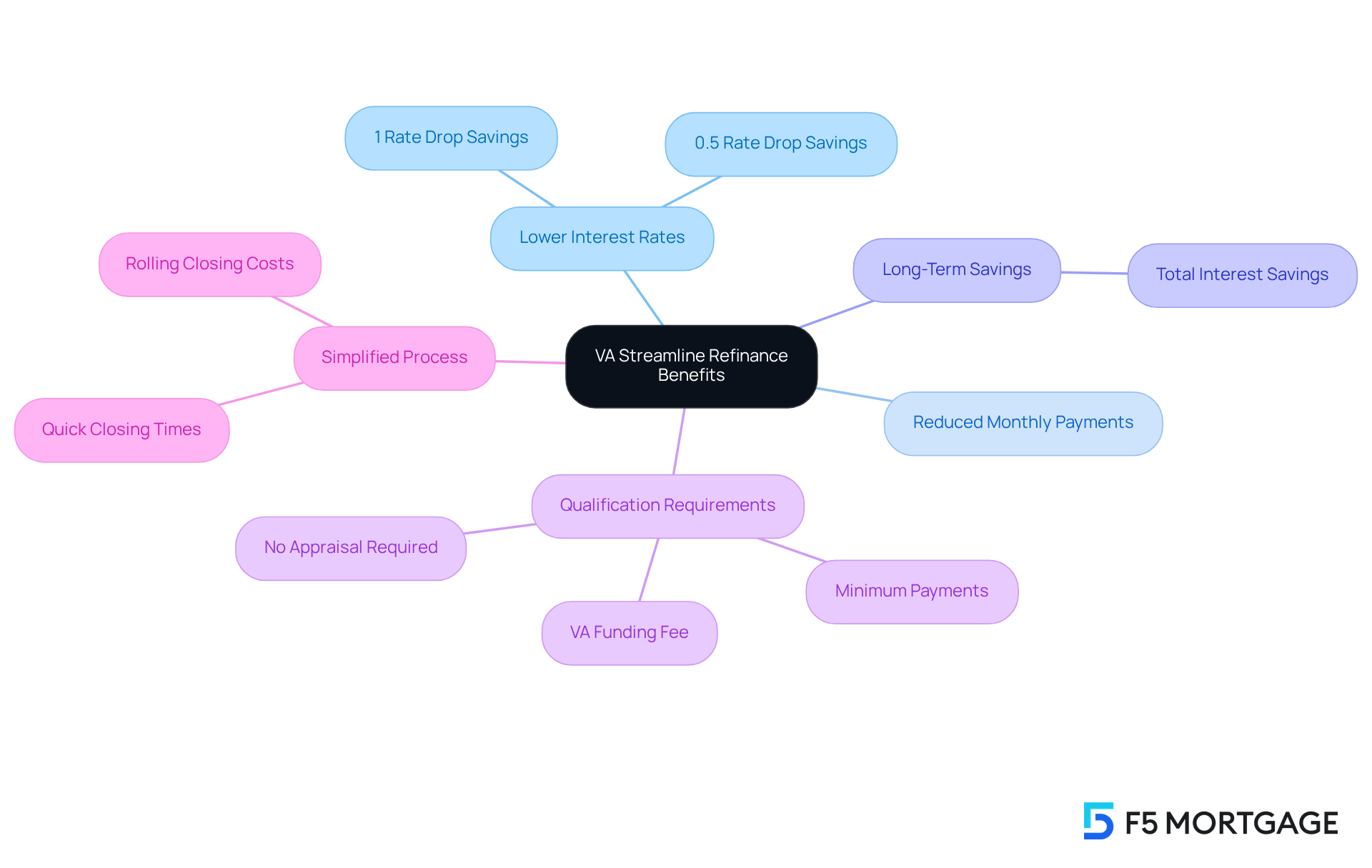

Lower Monthly Payments: Financial Relief Through VA Streamline Refinance

VA streamline refinance options offer service members a significant opportunity to ease their monthly mortgage burdens. We understand how challenging financial commitments can be, and by securing a lower interest rate, former service members can significantly reduce their monthly payments. This change can be life-changing for those facing financial difficulties or striving for greater economic stability. For instance, many veterans report saving an average of $250 each month after refinancing their loans. This newfound financial relief allows them to allocate resources toward essential expenses like healthcare, education, or savings.

Such support is vital, especially for those navigating the complexities of life after service. Financial advisors often emphasize that these savings can lead to improved overall financial health, empowering veterans to invest in their futures with renewed confidence. Moreover, the VA streamline refinance program allows homeowners to include closing costs and fees in the loan balance, minimizing upfront expenses.

To qualify for the Interest Rate Reduction Refinance Loan (IRRRL), borrowers must have an active VA mortgage that has been open for at least seven months. Additionally, a VA funding fee of 0.5% is required, which can also be incorporated into the loan amount. The streamlined process of VA Simplified loan modification not only reduces documentation requirements but also alleviates the stress often associated with traditional loan modification methods. This makes it an appealing option for servicemen and women looking to improve their financial situations. We’re here to support you every step of the way as you explore these beneficial options.

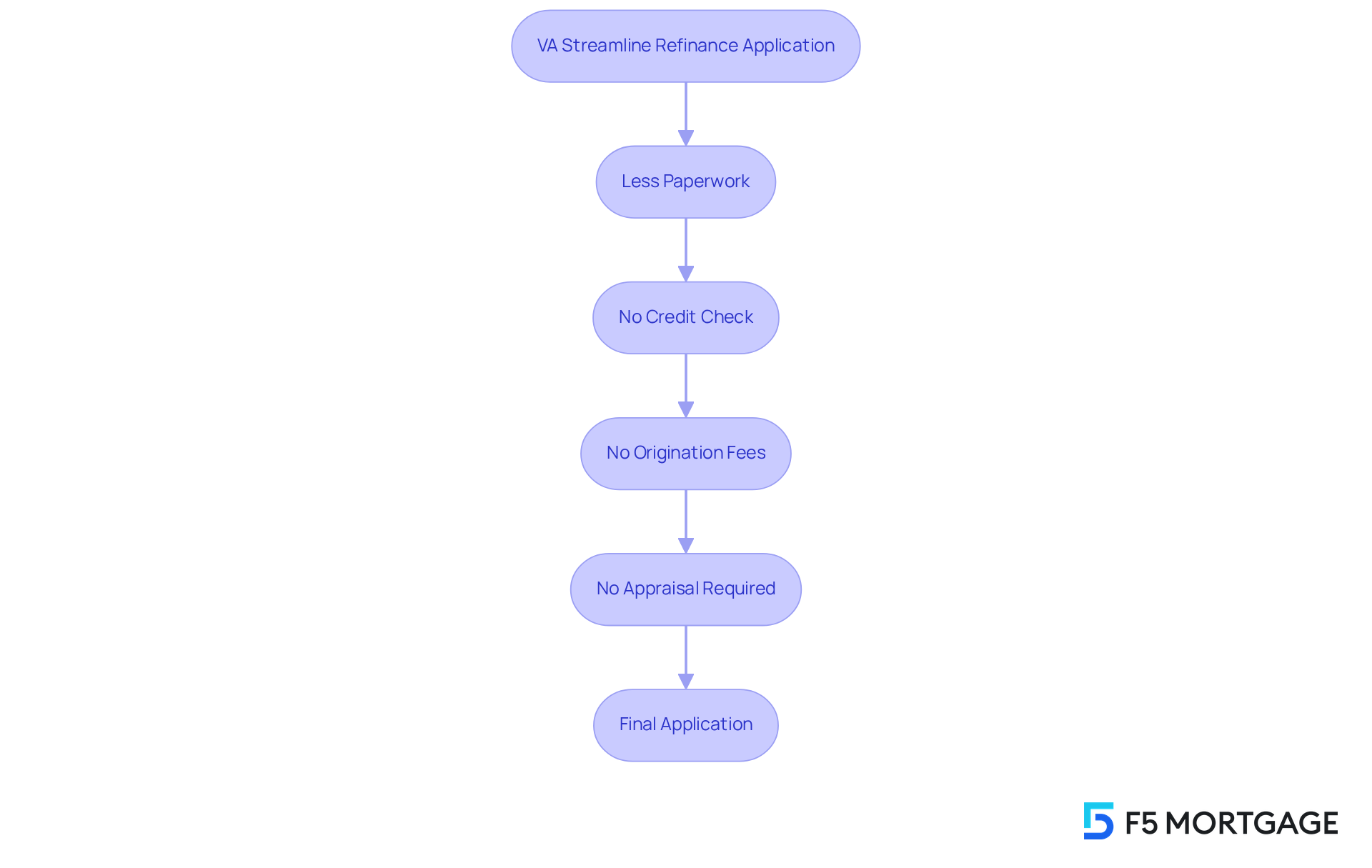

Simplified Process: Quick and Easy VA Streamline Refinance Application

Navigating the VA streamline refinance process can feel overwhelming, but it’s designed to be fast and simple, ensuring that service members can manage their applications with ease. Unlike conventional loan modification methods, the VA option typically requires less paperwork and fewer procedures. This makes it especially accessible for those who may feel daunted by the complexities of obtaining a new loan.

We understand how valuable your time is, and this efficiency not only saves time but also alleviates stress for borrowers. Many veterans have shared their experiences of a seamless and hassle-free process when utilizing the VA Simplification option. They often finalize their applications without needing extensive documentation or evaluations.

Statistics reveal that the VA loan process demands considerably less paperwork compared to traditional methods, which frequently involve extensive credit checks and income verification. Notably, the VA refinance option does not require a credit check, while traditional refinancing often does. This streamlined approach has led to numerous success stories, with individuals expressing satisfaction with the ease of the process and their ability to secure lower interest rates quickly.

Additionally, the VA Simplified refinance comes with benefits such as no origination fees and typically no appraisal required, further easing the journey. Overall, the VA streamline refinance option is a supportive choice for former service members looking to simplify their mortgage refinancing experience. We’re here to support you every step of the way.

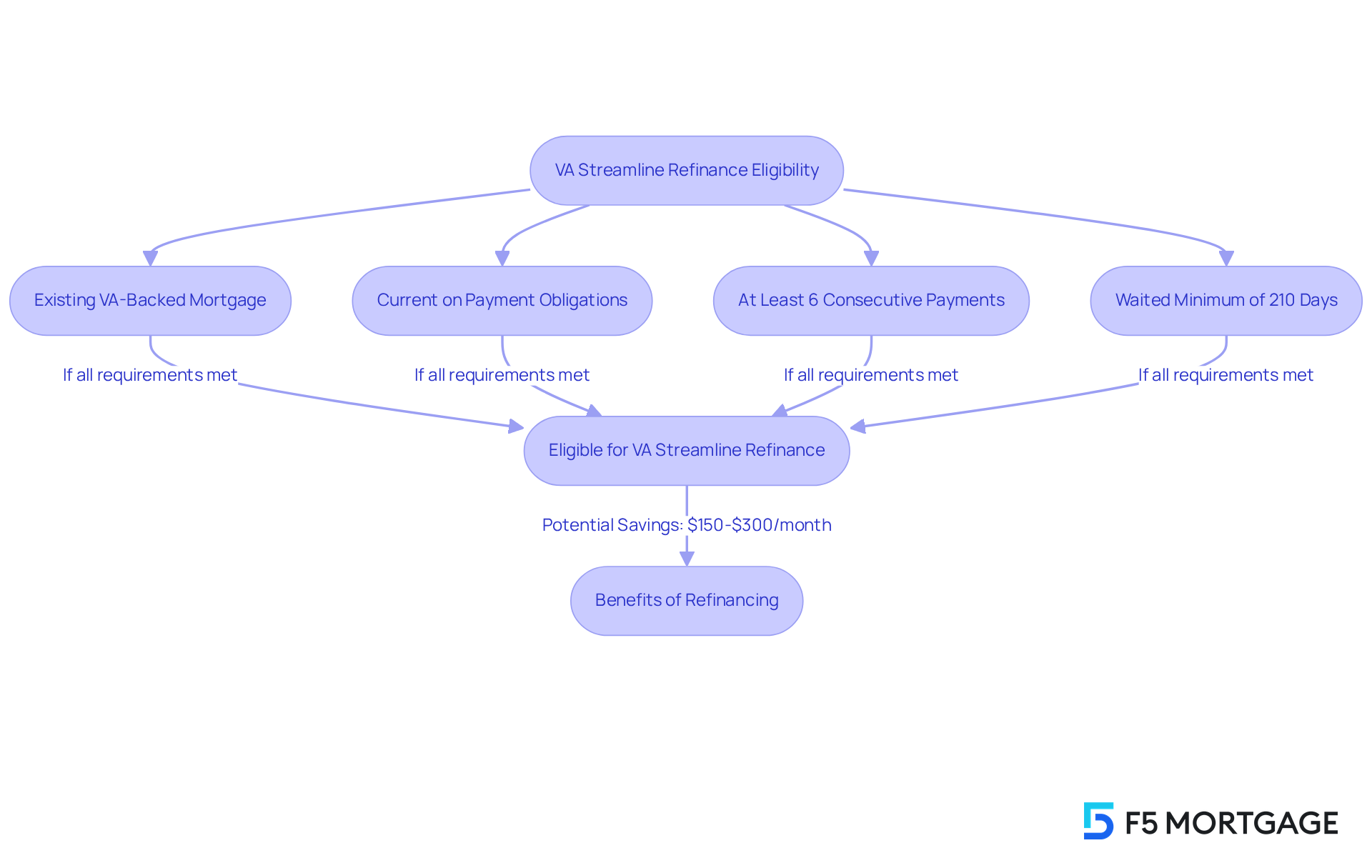

Eligibility Requirements: Who Can Benefit from VA Streamline Refinance?

We understand how challenging navigating mortgage options can be, especially for former service members. To qualify for a VA streamline refinance, you need to have an existing VA-backed mortgage and remain current on your payment obligations. Additionally, it’s important to have made at least six consecutive monthly payments on your initial borrowing and to have waited a minimum of 210 days from the closing date of that borrowing. The good news is that in most cases, no evaluation is necessary, and closing costs can be included in the loan. This makes the loan modification process much more attainable and beneficial for those who qualify.

Statistics show that a significant number of former service members qualify for the VA streamline refinance, which often leads to substantial savings. For instance, many can save between $150 to $300 each month by refinancing through the VA Interest Rate Reduction Refinance Loan (IRRRL) program. This could mean more financial breathing room for you and your family.

Many former service members find themselves in situations where they can benefit from the VA streamline refinance option—whether they’ve recently moved to lower interest rates or are looking to reduce their monthly payments without the burden of extensive paperwork. As we look ahead to 2025, the eligibility criteria remain unchanged, allowing you to take advantage of favorable market conditions.

Mortgage specialists emphasize that the VA refinance option is particularly advantageous for veterans aiming to improve their financial situation with minimal hassle. As one expert noted, “If current rates are lower than your existing VA loan rate, this option allows you to reduce your payment efficiently.” This highlights not only the program’s accessibility but also the potential benefits for those who meet the requirements. Remember, we’re here to support you every step of the way.

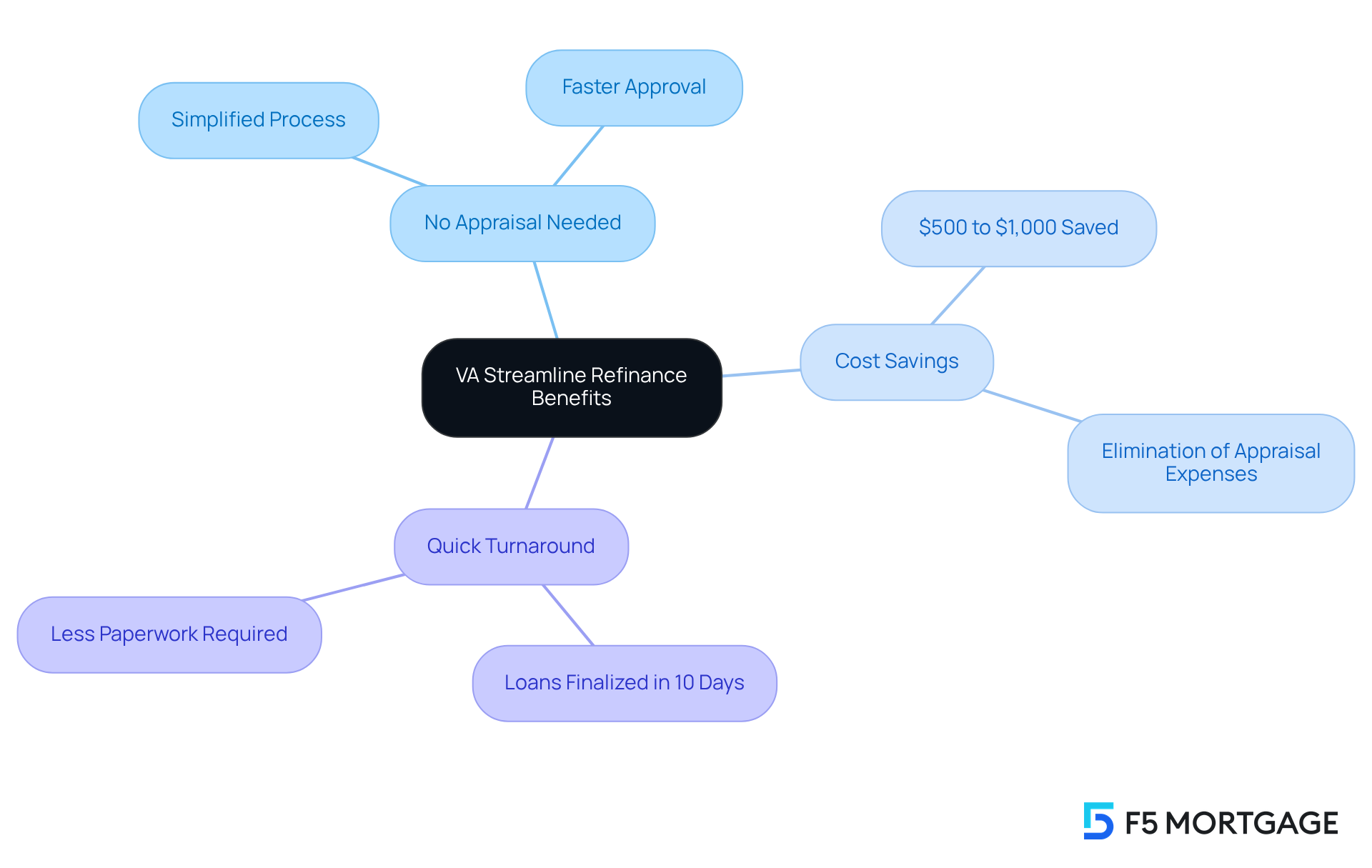

No Appraisal Needed: Accessing VA Streamline Refinance Benefits

One of the most significant advantages of a VA streamline refinance is that it eliminates the need for a home appraisal. We know how challenging the loan modification process can be, and this feature not only speeds things up but also removes the often burdensome appraisal expenses, which can range from several hundred to a few thousand dollars. By skipping this step, former service members can quickly access their loan benefits, leading to substantial savings.

For instance, consider the story of one individual who successfully refinanced a $600,000 mortgage. They were able to lower their monthly payments significantly without facing any appraisal charges. Financial experts highlight that by avoiding the appraisal, borrowers can save anywhere from $500 to $1,000. This makes the VA streamline refinance process not only more accessible but also more cost-effective.

Moreover, the simplified process allows former service members to finalize their loans in as little as 10 days. This quick turnaround further enhances the appeal of the VA refinance. With a combination of reduced expenses and faster timelines, the VA streamline refinance stands out as an excellent choice for service members looking to lessen their mortgage costs. We’re here to support you every step of the way as you consider this beneficial option.

Reduced Closing Costs: Save More with VA Streamline Refinance

Navigating the world of loans can be daunting, especially for former service members. VA streamline refinance loan modifications often come with reduced closing costs compared to traditional loan options. Many lenders understand the financial challenges faced by veterans and permit them to incorporate closing costs into the new loan total. This flexibility significantly reduces out-of-pocket expenses, allowing you to save more money upfront.

We know how challenging this can be, and we’re here to support you every step of the way. By making the refinancing process more financially manageable, you can focus on what truly matters: your future. Take advantage of these options and consider how they can benefit you and your family.

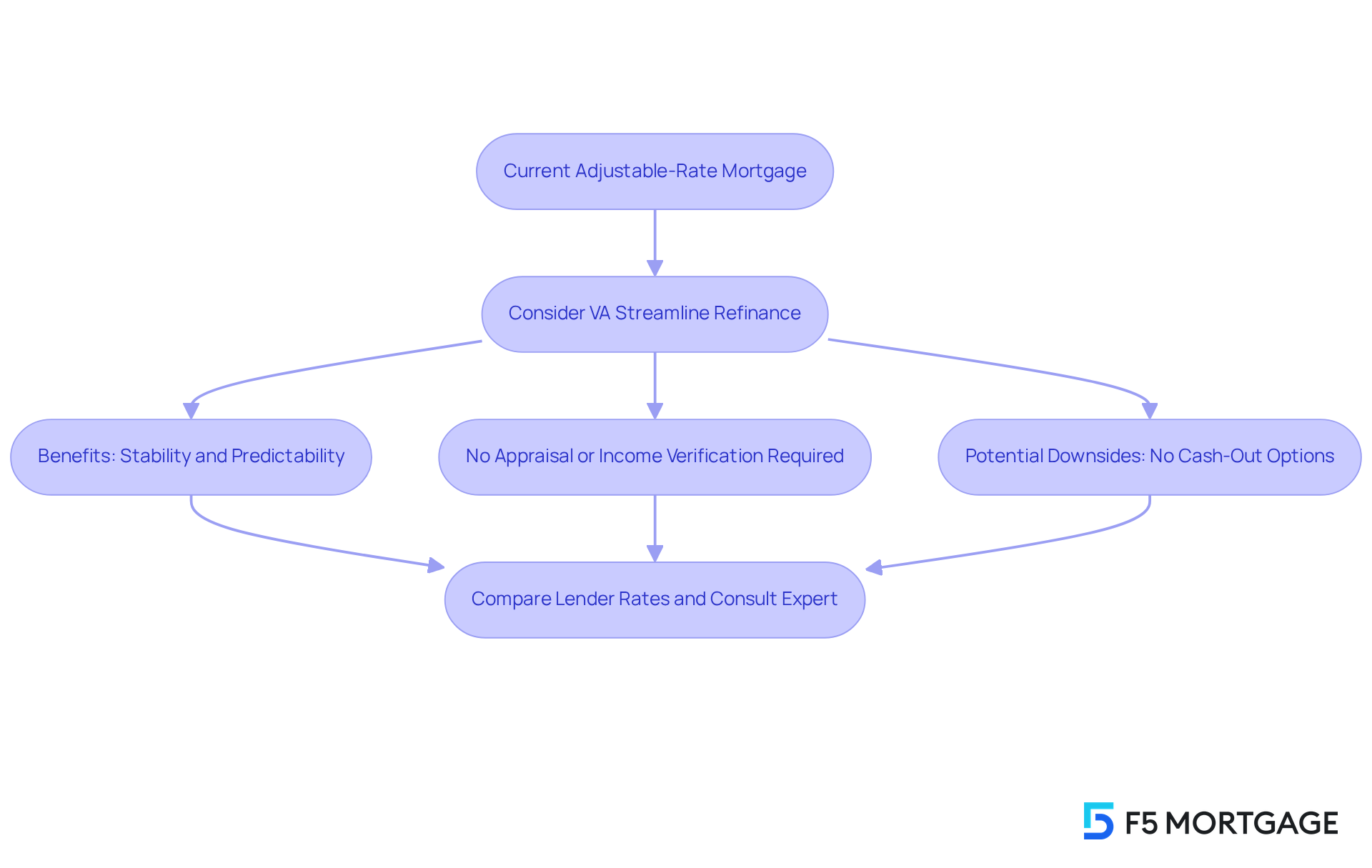

Fixed-Rate Transition: Stability with VA Streamline Refinance

For former service members currently holding an adjustable-rate mortgage (ARM), the VA streamline refinance presents a valuable opportunity to transition to a fixed-rate mortgage. This change not only brings stability and predictability to monthly payments but also shields service members from potential interest rate increases in the future. By securing a fixed rate, former service members can plan their finances effectively, steering clear of unexpected payment fluctuations that could disrupt their budgets.

The benefits of fixed-rate mortgages extend beyond mere payment stability; they play a crucial role in the financial security of former service members, enabling improved long-term financial planning. As we look ahead to 2025, with interest rates fluctuating, the fixed-rate mortgage stands out as a reliable choice, ensuring that service members can maintain consistent payments and protect their financial well-being.

To illustrate these advantages, consider that as of July 16, 2023, the national average 30-year fixed VA mortgage rate was reported at 5.79%. This figure highlights the dependability of fixed-rate options in today’s market. Additionally, Michael Bernstein, co-founder of LendFriend Mortgage, shares that ‘the VA streamline refinance, formally known as the VA Interest Rate Reduction Refinance Loan (IRRRL), is a low-cost, no-hassle way for veterans to take advantage of better rates—without the typical refinance headache.’

Veterans should also be aware that the VA streamline refinance process does not require an appraisal or income verification, making it a straightforward option. However, it is essential to consider potential downsides, such as the inability to access cash-out loan options through this choice.

For those looking to move forward with the VA refinance, we encourage you to compare rates from various lenders and consult with a mortgage expert. This proactive approach can help ensure the best possible outcome for your financial future.

Improved Loan Terms: Long-Term Benefits of VA Streamline Refinance

VA streamline refinance provides service members a valuable opportunity to secure better financing conditions, including lower interest rates and reduced monthly payments. We know how challenging financial burdens can be, and these enhancements not only provide immediate relief but also pave the way for significant long-term savings. For example, a decrease of just 0.5% in interest rates can lead to substantial savings over the life of a mortgage. In fact, a reduction of 1% could save veterans an average of $318,861 in total interest on a $250,000 mortgage at a 6.5% interest rate compared to higher rates.

Additionally, the VA funding fee for Interest Rate Reduction Refinance Loans (IRRRLs) is typically 0.5% of the amount borrowed, which is an important consideration for borrowers. To qualify for refinancing with VA Interest Rate Reduction, veterans must have made at least six consecutive monthly payments on their initial mortgage. The absence of appraisal requirements and the ability to roll closing costs—typically ranging from 3% to 5% of the loan amount—into the loan further simplify the process. This makes VA streamline refinance an attractive option for individuals seeking to enhance their financial situation.

By taking advantage of these benefits, former service members can strategically position themselves for financial security and long-term savings. It’s important to recognize the value of a VA streamline refinance as a wise financial choice. As one underwriter noted, ‘The VA Simplified Refinance is intended to lower obstacles related to loan adjustments, making it easier for former service members to achieve their financial goals.’ We’re here to support you every step of the way in this journey.

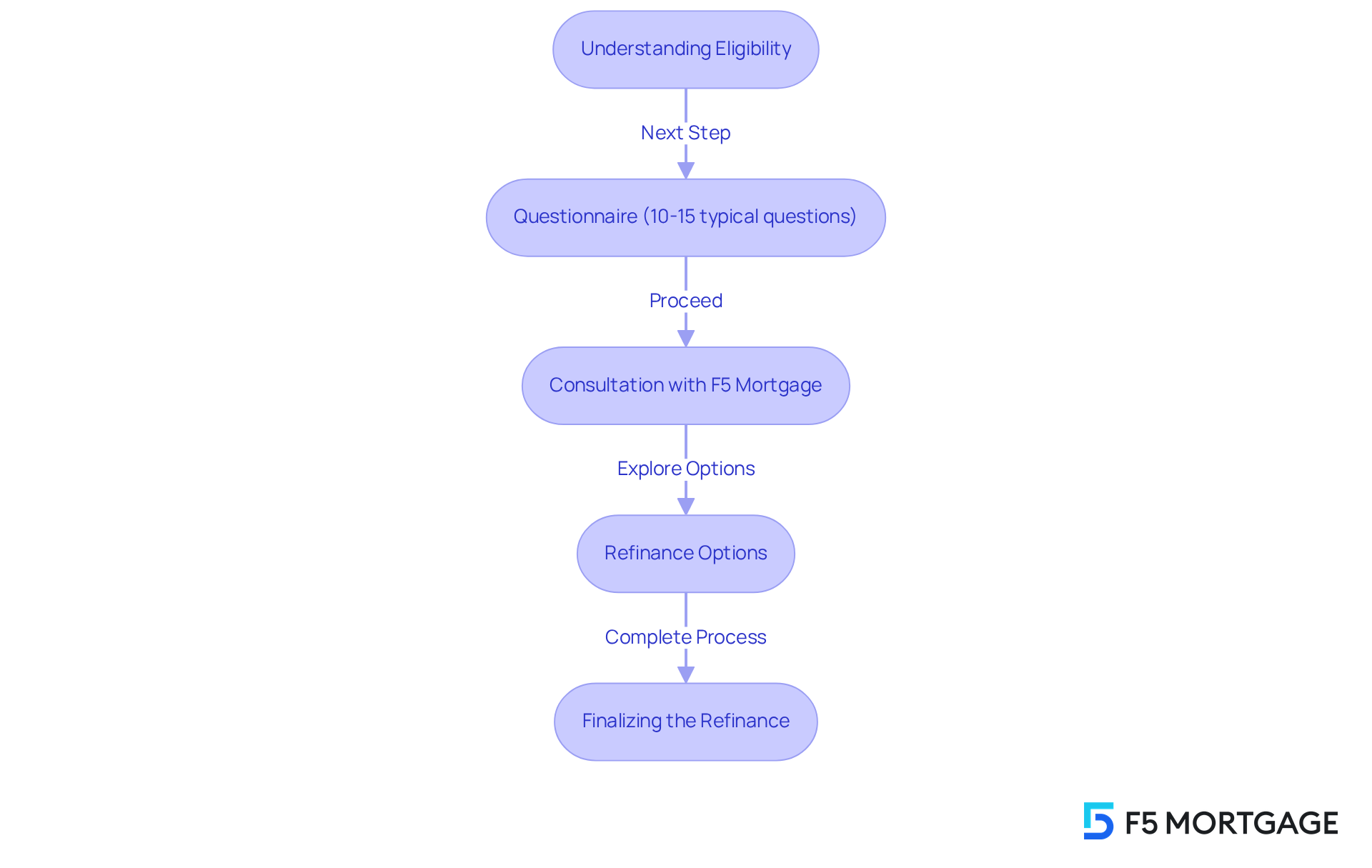

Expert Guidance: Navigating VA Streamline Refinance with F5 Mortgage

Navigating the VA streamline refinance process can indeed be challenging. However, with the expert guidance of F5 Mortgage, service members can approach their refinancing decisions with confidence. We understand how overwhelming this can feel, and that’s why the dedicated team at F5 Mortgage is here to provide personalized assistance. They address the average of 10 to 15 questions service members typically have during this process, such as inquiries about eligibility, interest rates, and the absence of mortgage insurance expenses. This commitment to client education ensures that individuals fully comprehend each step, empowering them to make informed decisions that align with their financial objectives.

For instance, former service member John, who refinanced his VA mortgage with F5 Mortgage, shared how reassured he felt by the comprehensive explanations and support he received. He remarked, ‘Having someone who comprehends the intricacies of VA financing made all the difference for me.’ This sentiment resonates with many former service members who truly value the personalized help that F5 Mortgage offers. It highlights the importance of professional guidance in achieving successful loan restructuring results.

Moreover, the VA streamline refinance offers substantial benefits, including:

- No down payment

- No mortgage insurance costs

This can potentially save individuals up to $100 a month on their mortgage payments. With a focus on VA streamline refinance, F5 Mortgage not only assists former service members in securing advantageous interest rates and conditions but also ensures they utilize their home equity efficiently. This tailored approach has proven invaluable, as former service members navigate the complexities of loan modification with clarity and confidence.

To begin this journey, former service members are encouraged to reach out to F5 Mortgage for a personalized consultation to explore their loan options. We’re here to support you every step of the way.

Enhanced Financial Health: The Comprehensive Benefits of VA Streamline Refinance

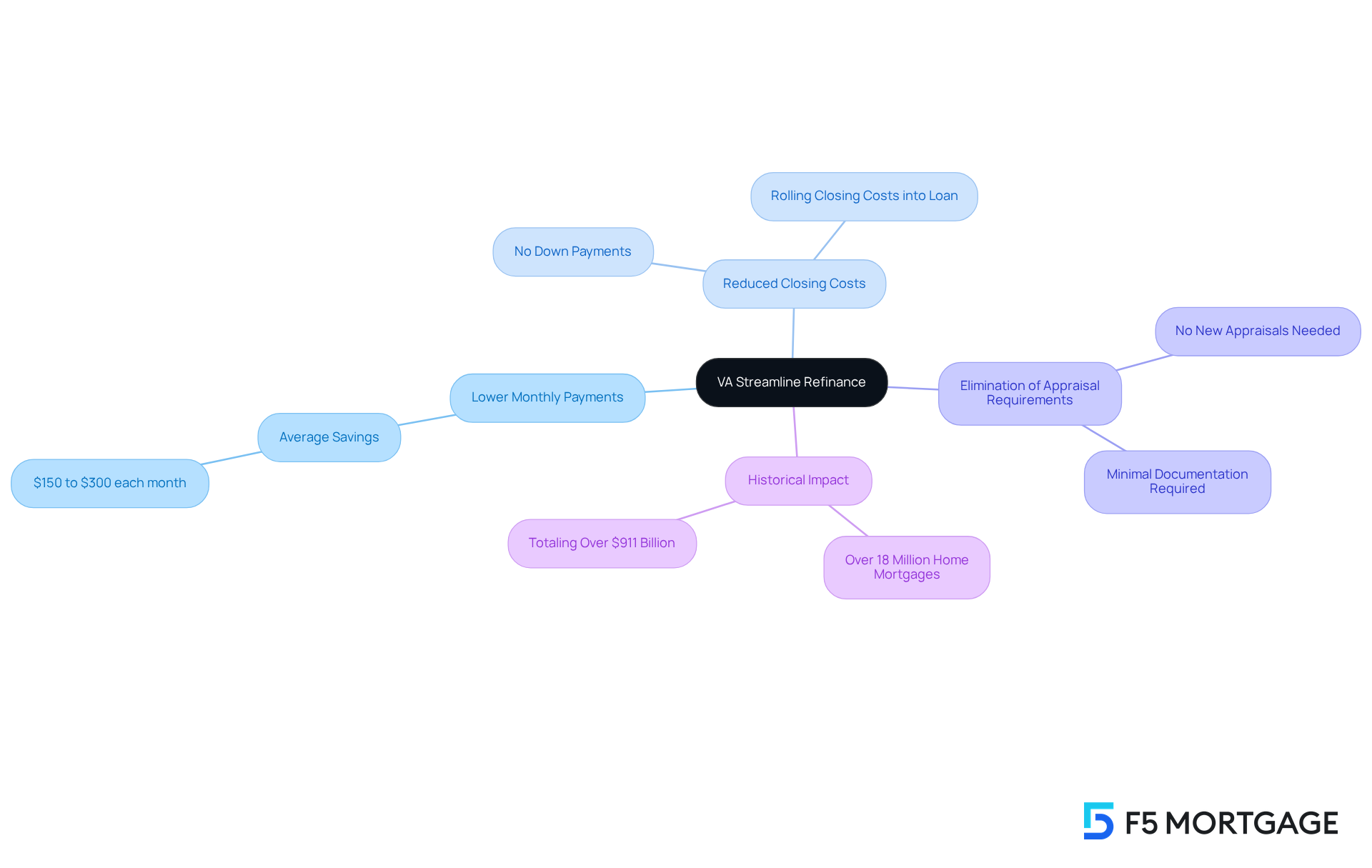

The benefits of a VA streamline refinance can greatly enhance a service member’s financial well-being. We understand how challenging financial decisions can be, and this option is designed to deliver relief and stability. Key benefits include:

- Lower monthly payments

- Reduced closing costs

- Elimination of appraisal requirements

For instance, individuals taking advantage of this refinancing option can save an average of $150 to $300 each month, leading to significant long-term savings.

Moreover, the procedure is efficient, often requiring minimal documentation and resulting in little to no personal expenses. This accessibility makes it a viable option for many former service members. Since its inception, the VA has ensured over 18 million home mortgages, totaling more than $911 billion. This statistic highlights the program’s importance in improving financial security for those who have served.

Former service members can refinance up to 100% of a property’s worth, allowing them to transition from higher-rate conventional financing to more advantageous VA-backed options. This shift can significantly enhance their financial situation. We know that misconceptions about VA loans can be discouraging. Many qualified service members mistakenly believe that altering their loan is excessively complicated. In reality, the VA streamline refinance aims to simplify the process, allowing former service members to benefit from lower interest rates without the typical inconveniences linked to conventional refinancing.

To qualify for a VA streamline refinance, borrowers must have made their last three payments on time. This historic benefit not only aids in reducing monthly payments but also contributes to the overall financial well-being of veterans and their families. We’re here to support you every step of the way, fostering a more secure and prosperous future.

Conclusion

The VA streamline refinance program represents a remarkable opportunity for veterans seeking financial relief and stability. By simplifying the refinancing process, it enables eligible service members to lower their monthly payments, reduce closing costs, and avoid the hassles of traditional refinancing methods, all while preserving their existing VA loan benefits. This streamlined approach not only alleviates financial burdens but also empowers veterans to focus on their futures with renewed confidence.

Key insights reveal the many advantages of the VA streamline refinance, including:

- The removal of appraisal requirements

- Minimal documentation, making it accessible for numerous former service members

- The potential for substantial monthly savings—averaging between $150 and $300—which can lead to improved financial health and greater long-term stability

- Transitioning to fixed-rate mortgages through this program offers predictability in budgeting, protecting veterans from future interest rate fluctuations

Ultimately, embracing the VA streamline refinance can significantly enhance the financial well-being of those who have served. It is essential for veterans to explore this option and consult with experts like F5 Mortgage to navigate the process effectively. By taking proactive steps toward refinancing, veterans can secure a more stable and prosperous financial future, ensuring that their sacrifices are honored with lasting benefits.

Frequently Asked Questions

What is F5 Mortgage’s approach to VA streamline refinance solutions?

F5 Mortgage provides customized options for VA streamline refinancing tailored to meet the specific needs of service members. They leverage a broad network of lenders to offer competitive rates and terms, simplifying the loan modification process and enhancing the overall experience.

How much can service members save with a VA streamline refinance?

Individuals can anticipate saving an average of $200 to $250 monthly on their mortgage payments when using a VA streamline refinance, which can significantly ease their financial burden.

What is the Interest Rate Reduction Refinance Loan (IRRRL)?

The IRRRL is a program that allows borrowers with an active VA mortgage to refinance at a lower interest rate, reducing their monthly payments. To qualify, the existing VA mortgage must have been open for at least seven months, and a VA funding fee of 0.5% is required.

What are the benefits of the VA streamline refinance process?

The VA streamline refinance process is designed to be quick and easy, requiring less paperwork and fewer procedures than traditional loan modifications. It typically does not require a credit check and may not require an appraisal, making it more accessible for service members.

Are there any costs associated with the VA streamline refinance?

While there is a VA funding fee of 0.5%, this fee can be incorporated into the loan amount. Additionally, closing costs and fees can also be included in the loan balance, minimizing upfront expenses for borrowers.

How does F5 Mortgage support service members during the refinancing process?

F5 Mortgage is committed to providing personalized service and support throughout the refinancing journey, helping service members navigate the complexities of the process and achieve financial stability.