Overview

Navigating the world of FHA loans in Florida for 2025 can feel overwhelming, but we’re here to help. This article aims to provide essential insights that will guide you through the process. We understand the challenges you may face when considering:

- Eligibility criteria

- Loan limits

- Mortgage insurance costs

- The application process

By addressing these key factors, we hope to empower you to make informed decisions about financing your home.

As you explore your options, remember that understanding these details can significantly impact your journey as a prospective homebuyer. We want you to feel confident and supported every step of the way. With the right information, you can approach the mortgage process with clarity and assurance.

Take a moment to reflect on your needs and concerns. We know how challenging this can be, but with the right insights, you can navigate the complexities of FHA loans. Our goal is to provide you with the knowledge necessary to move forward with confidence and peace of mind.

Introduction

In the ever-changing landscape of Florida’s housing market, we understand how daunting it can be for prospective homebuyers to navigate the complexities of FHA loans. These loans offer the possibility of reduced down payments and accessible financing options, presenting a unique opportunity for families eager to secure their dream homes. However, with the requirements and limits set to shift in 2025, it’s important to be aware of the challenges and advantages that may arise. This article explores seven essential insights about FHA loans in Florida, empowering you with the knowledge needed to embark on this complex yet rewarding journey with confidence.

F5 Mortgage: Your Partner for FHA Loans in Florida

At F5 Mortgage LLC, we understand how daunting the mortgage process can be, especially for families navigating their options for an FHA loan in Florida. As a top independent mortgage brokerage with a strong emphasis on FHA loan Florida financing, we prioritize personalized consultations. This ensures that you receive tailored guidance and competitive rates that align with your unique financial situation.

We leverage user-friendly technology to streamline the mortgage process, empowering families to explore their options with ease and secure optimal financing solutions. With partnerships with over twenty leading lenders, we provide a diverse selection of FHA loan Florida financing options. For instance, families can benefit from limits of:

- $557,000 in Miami-Dade County

- $560,000 in Palm Beach County

- $555,000 in Broward County

Our commitment to your satisfaction and accessibility positions F5 Mortgage as a trusted partner. We want to highlight the FHA loan Florida’s Section 203(h) program, which offers 100% financing for eligible homeowners looking to rebuild or purchase a new home—especially valuable for families affected by disasters. With a minimum score requirement of 580 for a 3.5% down payment, we ensure that potential borrowers are well-informed about eligibility criteria.

We encourage families to utilize helpful resources such as mortgage calculators and down payment assistance programs, easing financial burdens along the way. This comprehensive approach underscores our dedication to supporting you in achieving your homeownership dreams. Remember, we’re here to support you every step of the way.

FHA Loan Requirements in Florida: Key Criteria for 2025

In 2025, to qualify for a down payment of just 3.5%, the FHA loan Florida criteria require a minimum score of 580. For those with scores between 500 and 579, a larger down payment of 10% is necessary. We understand that navigating these requirements can feel overwhelming, but it’s important to know that applicants must also provide:

- Proof of steady income

- A valid Social Security number

- Evidence of lawful residency

Ideally, keeping your debt-to-income ratio below 43% is advisable, although some lenders may be willing to accommodate higher ratios based on your overall financial situation.

Familiarity with these criteria is crucial for prospective homebuyers like you to assess your eligibility for FHA financing effectively. It’s worth noting that the average credit score of applicants for an FHA loan Florida hovers around 620, which indicates that these options are available for first-time purchasers and individuals with lower credit profiles. Remember, we’re here to support you every step of the way as you explore these opportunities.

FHA Loan Limits in Florida: What You Need to Know for 2025

In 2025, FHA loan Florida financing limits are set to vary significantly by county, with the baseline limit established at $524,225 for single-family residences. In high-cost areas like Monroe County, this limit can rise dramatically to $967,150, reflecting the increasing home prices throughout the state. Understanding these limits is essential for prospective purchasers of an FHA loan in Florida, as they determine the maximum amount available for funding a home purchase.

For instance, in Baker County, the FHA borrowing limit for a one-unit property is $580,750, while Alachua County maintains the baseline limit of $524,225. We know how challenging it can be to navigate these financial details, so it’s important for buyers to verify the specific limits in their desired counties. This ensures they are considering properties that align with their financial capabilities.

With the median home price in Florida around $392,000 at the end of 2024, the FHA loan Florida limits provide a crucial framework for homebuyers. They empower families to approach the market with confidence, knowing they have the necessary information to make informed decisions. We’re here to support you every step of the way as you explore your options.

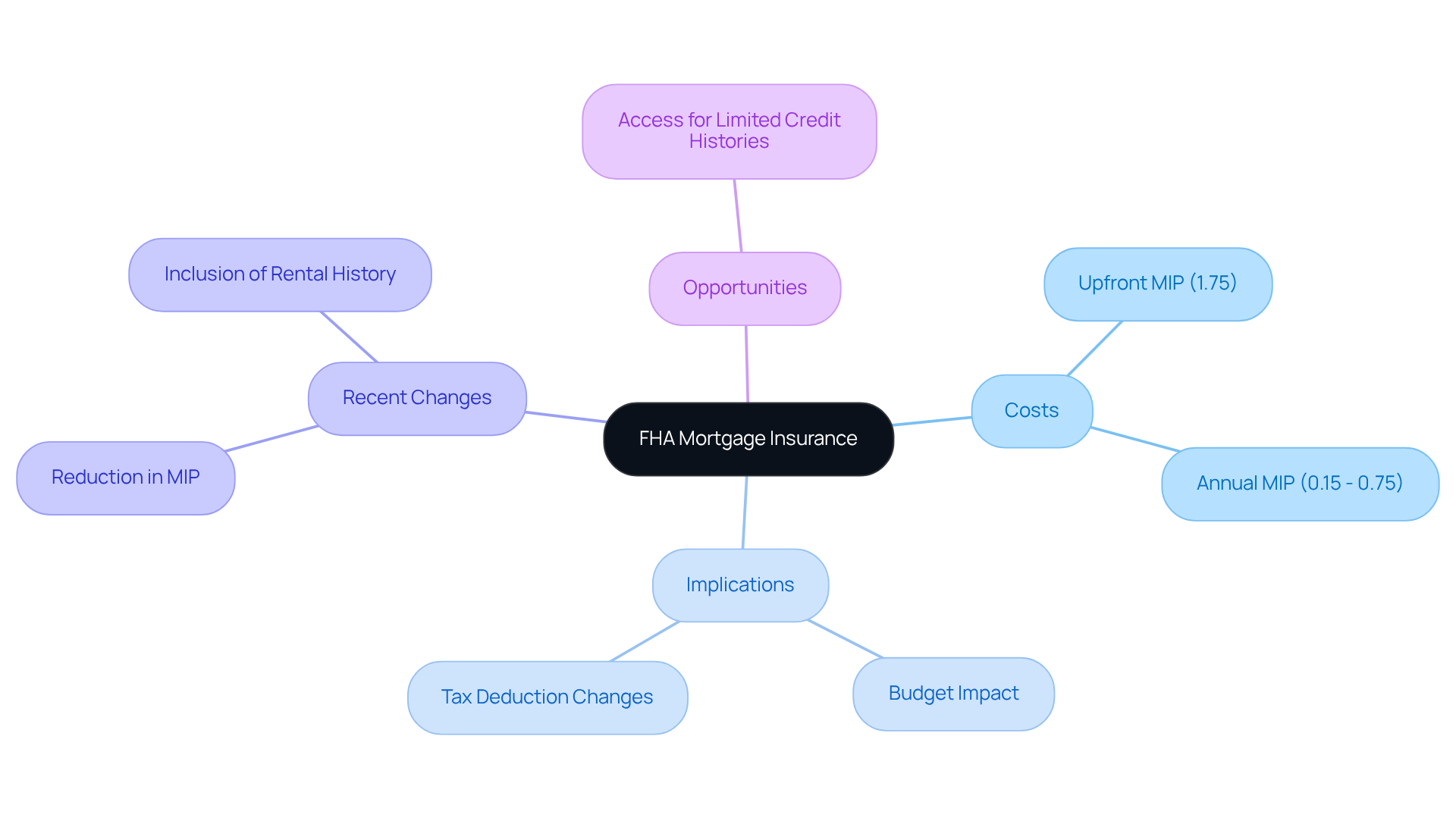

FHA Mortgage Insurance: Costs and Implications for Florida Borrowers

FHA mortgages come with both upfront and annual mortgage insurance premiums (MIP), and we know how important it is to understand these costs. As of 2025, the upfront MIP is set at 1.75% of the amount borrowed, while the annual MIP varies from 0.15% to 0.75%. This variation depends on the amount borrowed and the loan-to-value (LTV) ratio. While this insurance protects lenders in case of borrower default, it also adds to the overall expense of your mortgage. It’s essential for borrowers to factor these costs into their budget, as they can significantly affect monthly payments.

In the past, MIP was tax-deductible, but it is no longer deductible, which is a crucial consideration for your financial planning. Recent changes in FHA underwriting policies now allow for positive rental history to be included in credit evaluations. This could open doors for those with limited credit histories, making it easier for more individuals to access FHA loans. This shift aims to support families in achieving homeownership, especially in markets like Florida, where the FHA loan Florida can help address affordability concerns.

In March 2023, the FHA announced a reduction in mortgage insurance premiums, designed to improve affordability for borrowers. Understanding how a larger down payment (10% or more) can affect your MIP payments is also vital; it can shorten the payment term to 11 years instead of the entire loan period. Financial analysts emphasize that while MIP increases the costs of an FHA loan in Florida, it also creates opportunities for many who might otherwise struggle to qualify for conventional funding. As the housing market continues to evolve, grasping the nuances of MIP will be essential for borrowers navigating their options in 2025. We’re here to support you every step of the way.

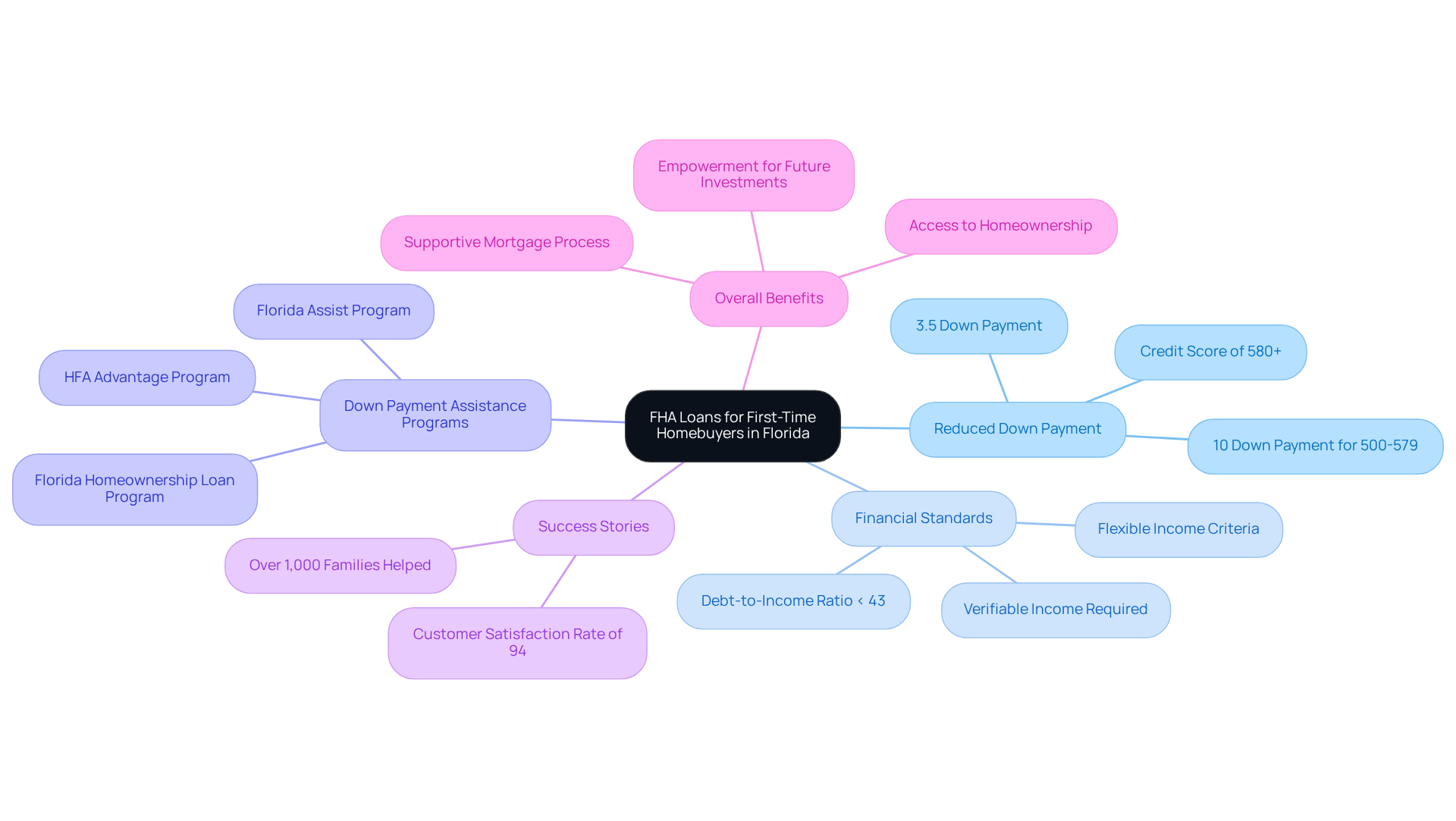

FHA Loans for First-Time Homebuyers in Florida: Advantages and Opportunities

FHA loan Florida provides substantial benefits for first-time homebuyers. We know how challenging this journey can be, and these loans can make a significant difference. With reduced down payment criteria and adaptable financial standards, borrowers can secure these mortgages with just a 3.5% down payment if they have a credit score of 580 or higher. This makes the dream of homeownership more achievable for many families.

In 2025, the typical down payment remains manageable, thanks to various down payment assistance programs. These programs provide crucial financial support, helping buyers navigate the initial costs of purchasing a home more easily. We’re here to support you every step of the way as you explore these options.

Success stories abound, with many families realizing their dreams through FHA financing. Numerous mortgage experts emphasize the advantages of these loans, noting that they not only enable access to housing but also empower purchasers to invest in their futures. The combination of lower upfront costs and supportive programs positions the FHA loan Florida as a viable and appealing choice for first-time buyers. We understand that taking this step is significant, and we’re committed to helping you find the right path to homeownership.

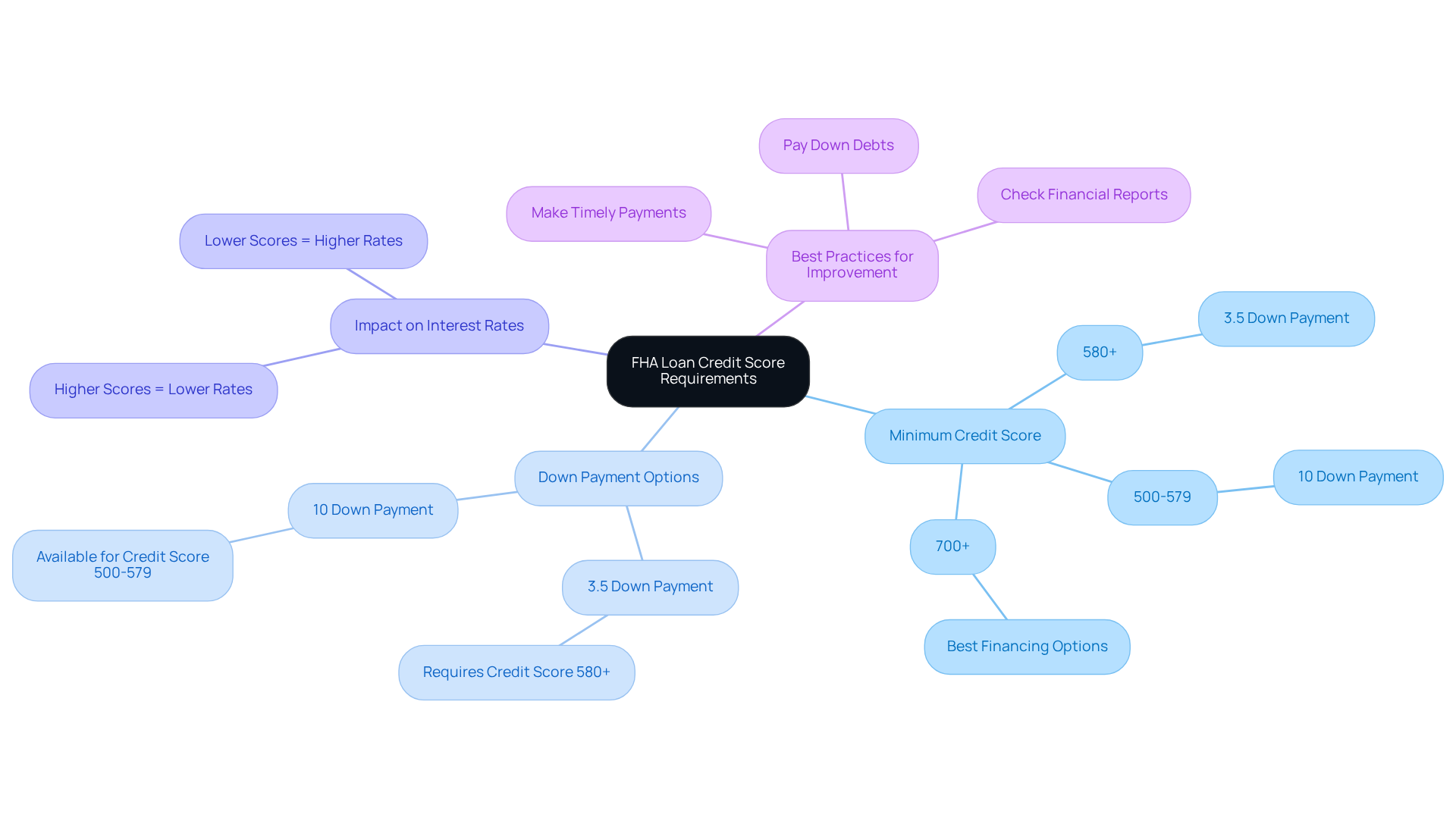

Minimum Credit Score for FHA Loans in Florida: What to Aim For

Navigating the FHA loan Florida process can feel overwhelming, but we’re here to support you every step of the way. To qualify, individuals should aim for a minimum credit score of 580 to take advantage of the favorable 3.5% down payment option. If your score falls between 500 and 579, don’t lose hope—while you’ll need to provide a larger down payment of 10%, you can still qualify. Remember, a robust financial rating is crucial; it influences not only your borrowing eligibility but also the interest rates offered by financial institutions.

For instance, individuals with scores of 700 or above typically secure the most favorable financing options. In contrast, those with lower scores might face elevated rates. We know how challenging this can be, so it’s recommended that prospective applicants frequently check their financial reports and correct any inconsistencies before applying for an FHA mortgage.

Real-life examples show that individuals who actively work on improving their credit scores—by paying down debts or making timely payments—have successfully transitioned from higher interest rates to more favorable terms. This highlights the tangible benefits of maintaining good credit. Additionally, be aware that bank statements for a minimum of the last 30 days are necessary during the FHA application process.

As the FHA financing landscape evolves in 2025, understanding these dynamics will be essential for you as you seek to optimize your home funding options. As financial specialist Abby Badach Doyle states, ‘Typically, it’s simpler to qualify for an FHA loan Florida than for a conventional one.’ This underscores the importance of credit scores in mortgage financing, and we’re here to help you navigate this journey.

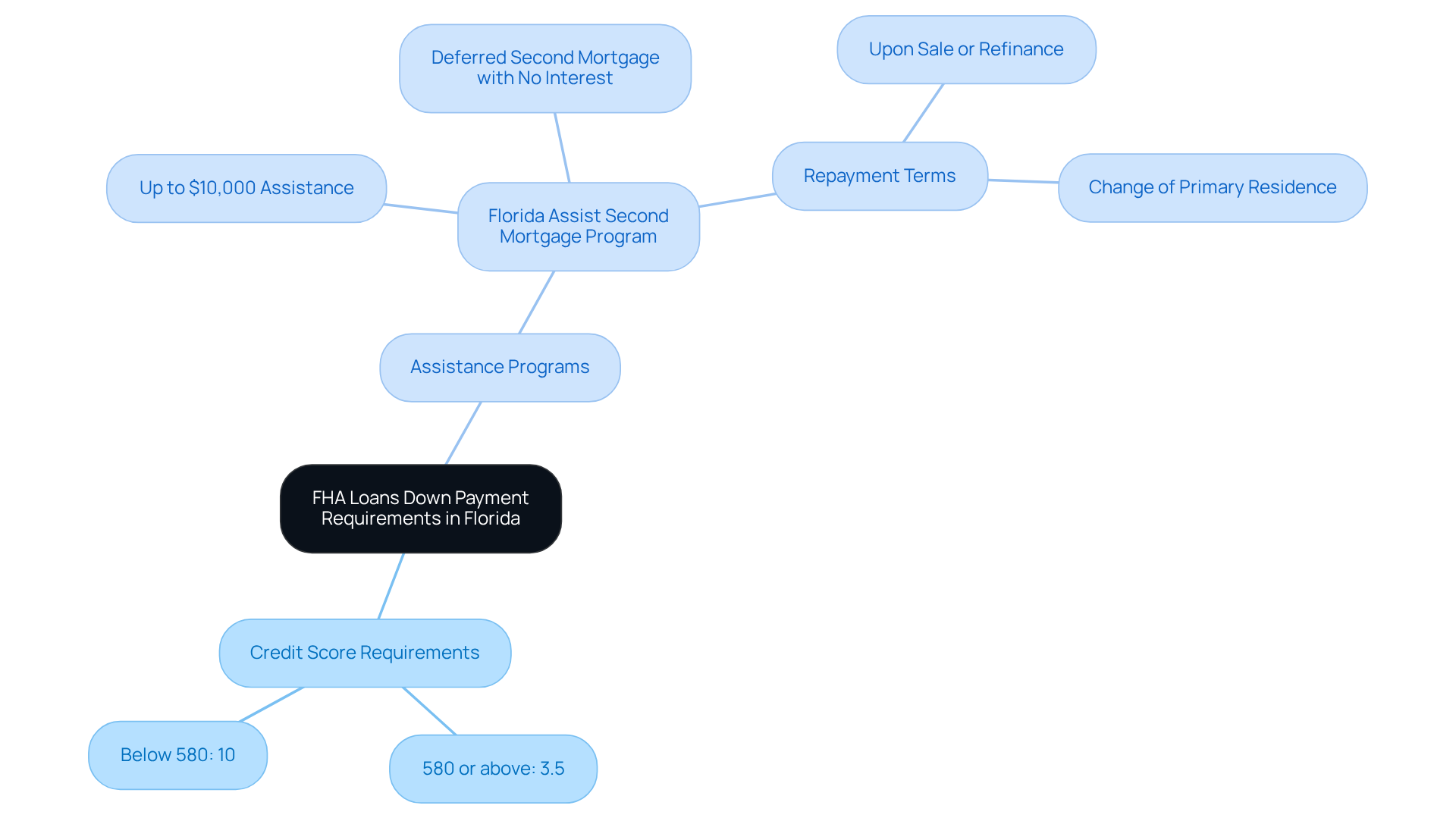

Down Payment Requirements for FHA Loans in Florida: Understanding Your Options

In Florida, we understand how challenging it can be to navigate the world of homeownership. For those considering an FHA loan in Florida, a minimum down payment of 3.5% is required for individuals with a credit score of 580 or above. If your score is below this threshold, a down payment of 10% will be necessary. Fortunately, various down payment assistance programs are available to help qualified individuals alleviate these costs.

For instance, the Florida Assist Second Mortgage Program offers up to $10,000 in financial assistance for down payments or closing costs. This support is structured as a deferred second mortgage with no interest, allowing individuals to repay the assistance only when they sell, refinance, or stop using the home as their main residence. This can significantly ease the financial burden of purchasing a home, making it more accessible for families.

Typically, the down payment for an FHA loan in Florida is around 3.5%. However, with the right support, many families can manage their finances more efficiently. Mortgage advisors emphasize the importance of understanding these options, as they can provide crucial support in achieving homeownership. Additionally, potential homebuyers should consider negotiating with sellers for repairs or upgrades as part of their offer, which can further enhance their purchasing experience.

By leveraging available resources, prospective homeowners can navigate the complexities of financing and make informed decisions that align with their financial goals. Remember, we’re here to support you every step of the way.

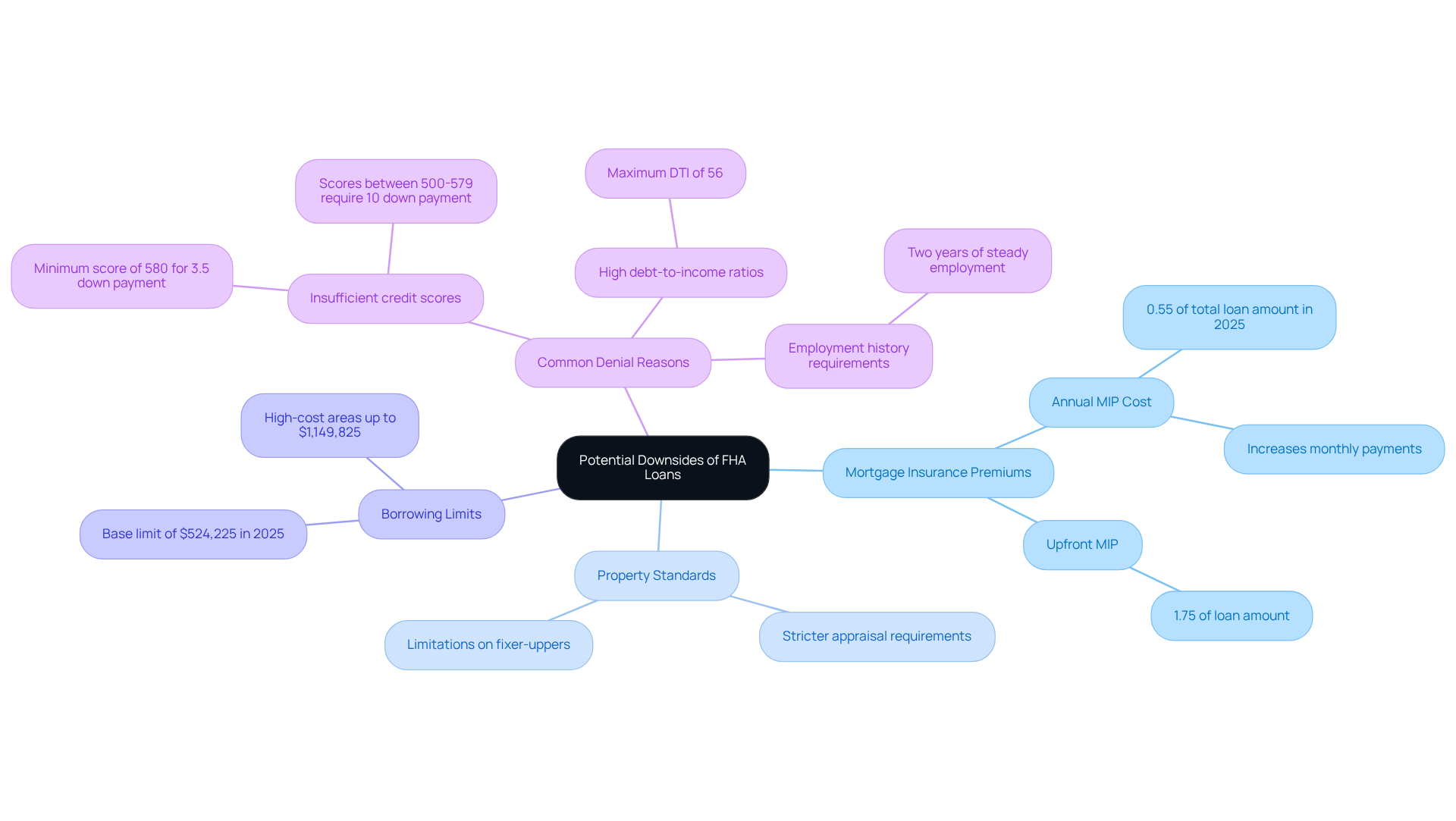

Potential Downsides of FHA Loans in Florida: What to Consider

While FHA loan Florida offers various advantages, they also present specific challenges that prospective applicants should thoughtfully evaluate. One primary concern is the requirement for mortgage insurance premiums (MIP), which can significantly elevate monthly payments. In 2025, borrowers can expect to pay approximately 0.55% of the total borrowed sum each year in MIP, contributing to the overall expense of homeownership. This financial burden can be particularly impactful for first-time buyers or those with limited budgets.

Moreover, FHA mortgages impose stricter property standards, requiring that homes meet certain safety and livability criteria. This requirement can limit options for buyers interested in fixer-uppers or properties needing repairs, as homes must be appraised by an FHA-approved appraiser to ensure compliance with these standards.

Additionally, FHA mortgages have maximum borrowing limits that vary by county, with a base amount of $524,225 for single-family residences in 2025. In high-cost areas, these limits can reach up to $1,149,825, which may restrict purchasing power for buyers seeking homes in competitive markets.

Common reasons for FHA loan Florida denials include insufficient credit scores, which must be at least 580 for a 3.5% down payment, and high debt-to-income ratios exceeding the allowable limits. Borrowers must also demonstrate a steady employment history for at least two years, which can be a hurdle for self-employed individuals or those with gaps in employment.

Understanding these potential drawbacks is crucial for individuals to make informed choices. By comprehending these factors, you can effectively evaluate your alternatives when considering an FHA loan Florida offers. We’re here to support you every step of the way.

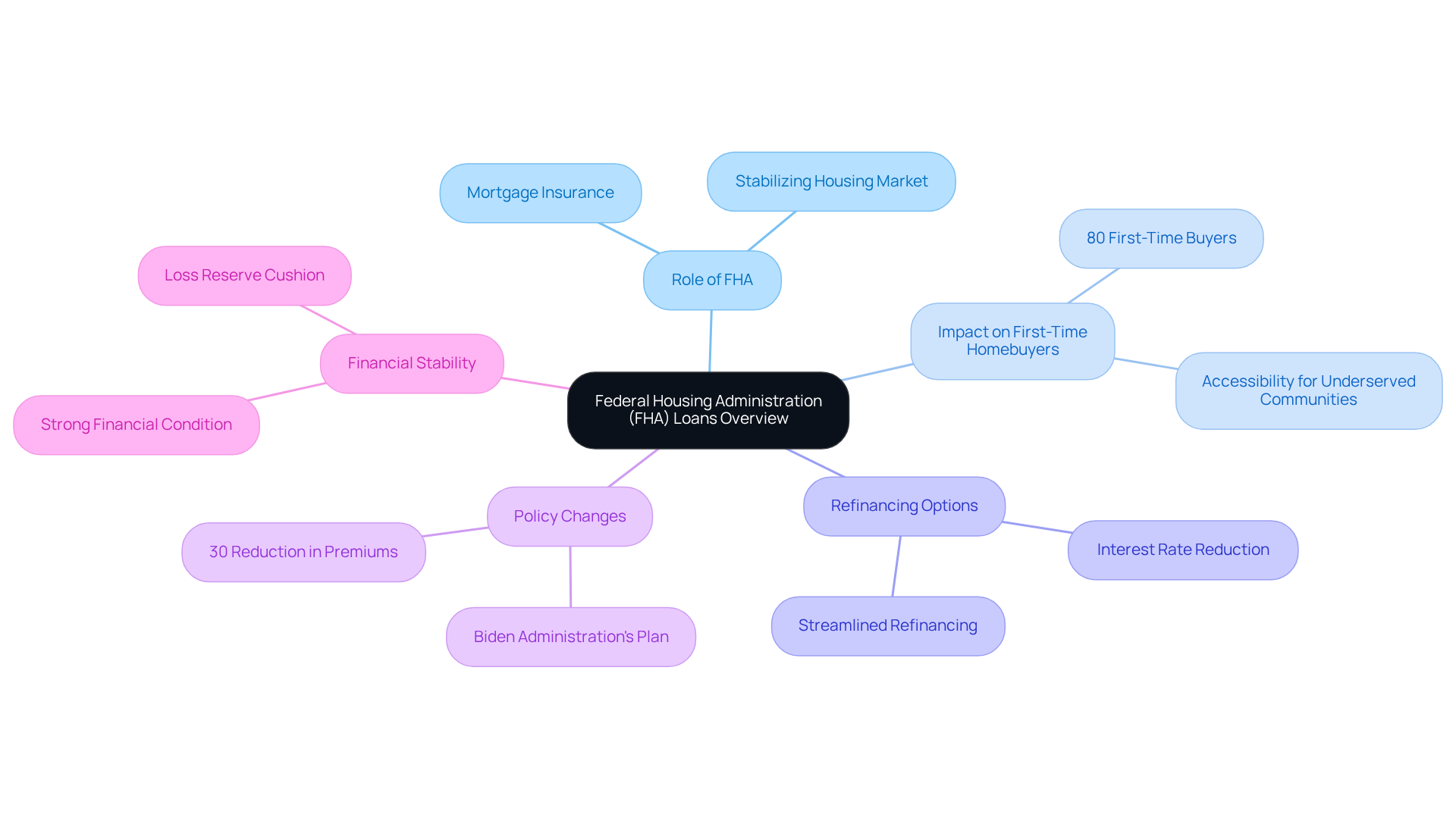

The Role of the Federal Housing Administration in FHA Loans: An Overview

The Federal Housing Administration (FHA) plays a crucial role in the FHA financing program by providing mortgage insurance to lenders. This insurance safeguards lenders from losses if individuals fail to repay their loans, enabling them to offer more advantageous conditions to homebuyers. Established during the Great Depression, the FHA aims to make homeownership accessible to a broader range of Americans, particularly those with lower credit scores or limited savings. Notably, over 80% of FHA participants are first-time homebuyers, underscoring the FHA’s significant impact on accessibility for new buyers.

In Colorado, homeowners have various refinancing choices, including the FHA loan Florida programs, which are especially advantageous for those aiming to reduce their interest rates or switch from an adjustable-rate mortgage to a fixed rate. The FHA’s streamlined refinancing options provide a quick and easy method for current FHA clients to secure improved rates and reduced monthly payments.

By guaranteeing financing, the FHA aids in stabilizing the housing market and motivates lenders to provide credit to individuals who might otherwise be refused. In 2025, FHA insurance claims in Colorado are expected to reflect the program’s ongoing impact, as it continues to support first-time homebuyers and those in underserved communities, thereby fostering greater financial inclusion and stability in the housing market.

Additionally, the Biden administration’s recent plan to reduce mortgage insurance premiums by 30% is anticipated to benefit approximately 850,000 borrowers, saving families an average of $800 annually. This reduction is especially significant for first-time home purchasers, making the FHA loan Florida options even more appealing.

The FHA is currently in a strong financial condition, with a loss reserve cushion more than five times the mandated level, which enhances the credibility of its insurance program. However, potential layoffs within the FHA could affect processing times and the perception of FHA financing in the market.

In summary, the FHA’s role in the mortgage insurance landscape is pivotal, particularly for first-time homebuyers and those in underserved communities. The anticipated changes in mortgage insurance premiums and the current financial stability of the FHA further emphasize its importance in promoting homeownership accessibility.

At F5 Mortgage, we know how challenging this can be, and we pride ourselves on our client-centric approach, ensuring that families receive the support they need to navigate these options effectively. Our clients have expressed their satisfaction with our services, highlighting our expertise and commitment to helping them achieve their homeownership goals.

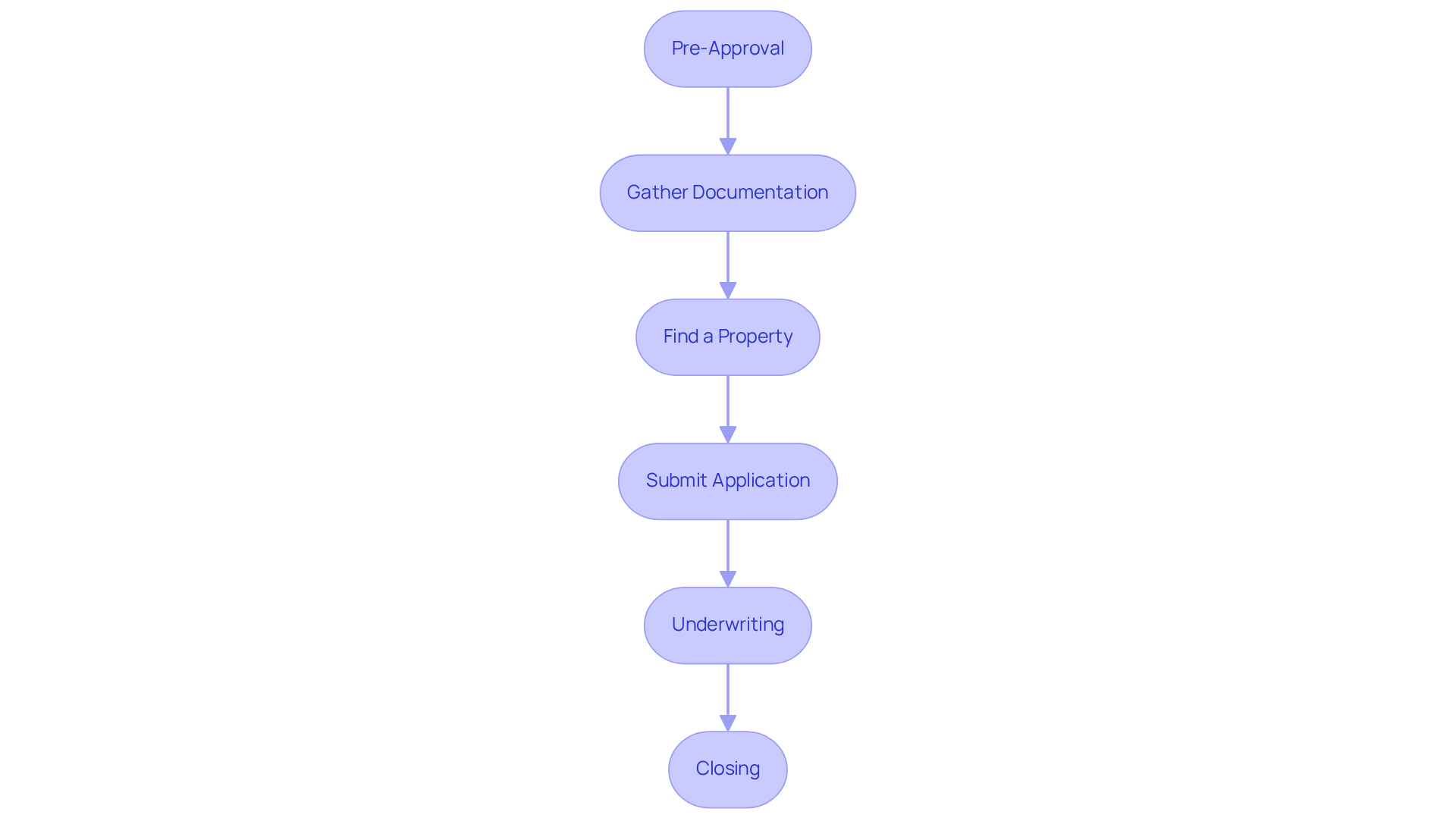

Navigating the FHA Loan Process in Florida: A Step-by-Step Guide

Navigating the FHA loan Florida financing process can feel overwhelming, but with a systematic approach, you can ensure a smooth experience. We know how challenging this can be, so let’s walk through the essential steps together.

-

Pre-Approval: Start by obtaining pre-approval from an FHA-approved lender. This not only helps you understand your budget but also strengthens your position when making an offer on a home.

-

Gather Documentation: Compile necessary documents, such as income verification, tax returns, and credit history. This preparation is crucial as it expedites the application process and reduces stress.

-

Find a Property: Work with a knowledgeable real estate agent to identify homes that meet FHA standards. This ensures that the properties you consider are eligible for financing, making your search more efficient.

-

Submit Application: Complete the funding application with your lender, providing all required documentation. This step is vital for moving forward in the process and helps keep everything on track.

-

Underwriting: The lender will review your application and assess the property to ensure it meets FHA guidelines. This stage is critical for determining credit approval, and we’re here to support you through it.

-

Closing: Once approved, finalize your financing and close on your new home. FHA mortgages generally finalize more quickly than traditional mortgages, averaging about 47 days. This can significantly shorten the waiting time for you as a purchaser.

By understanding these steps, first-time homebuyers can navigate the FHA loan Florida application process more effectively. Remember, we’re here to support you every step of the way, reducing stress and enhancing your chances of success.

Conclusion

Navigating the complexities of FHA loans in Florida for 2025 opens up a significant opportunity for prospective homebuyers, especially first-time purchasers. We understand how challenging this can be, and with lower down payment requirements, competitive interest rates, and a focus on accessibility, FHA loans serve as a vital tool in making homeownership attainable for many families. The insights shared throughout this article highlight how understanding the intricacies of these loans can empower you to make informed decisions that align with your financial goals.

Key points discussed include essential eligibility criteria, such as the minimum credit score and down payment requirements, as well as diverse loan limits across various counties in Florida. Additionally, we examined the implications of mortgage insurance premiums and the potential downsides of FHA loans, underscoring the importance of thorough financial planning. By leveraging available resources and programs, you can navigate the FHA loan process with confidence, ensuring that you are well-equipped to secure the financing you need.

Ultimately, the FHA loan program stands as a beacon of hope for many aspiring homeowners in Florida. As the housing market evolves, staying informed about these financing options is crucial. Engaging with knowledgeable mortgage professionals like F5 Mortgage can provide invaluable support and guidance, making your journey to homeownership smoother and more achievable. Embracing these opportunities not only fosters your financial stability but also contributes to the broader goal of enhancing homeownership accessibility across the state.

Frequently Asked Questions

What services does F5 Mortgage offer for FHA loans in Florida?

F5 Mortgage LLC specializes in FHA loans in Florida, providing personalized consultations, competitive rates, and a diverse selection of financing options through partnerships with over twenty leading lenders.

What are the FHA loan limits in Florida for 2025?

In 2025, the FHA loan limits vary by county. The baseline limit is $524,225 for single-family residences, while high-cost areas like Monroe County can have limits as high as $967,150. For example, Baker County’s limit is $580,750, and Alachua County maintains the baseline limit.

What are the eligibility requirements for FHA loans in Florida?

To qualify for an FHA loan in Florida, applicants must have a minimum credit score of 580 for a 3.5% down payment. Those with scores between 500 and 579 require a 10% down payment. Additionally, applicants must provide proof of steady income, a valid Social Security number, and evidence of lawful residency.

What is the Section 203(h) program offered by FHA loans in Florida?

The Section 203(h) program offers 100% financing for eligible homeowners looking to rebuild or purchase a new home, particularly beneficial for families affected by disasters.

What is the recommended debt-to-income ratio for FHA loan applicants?

It is advisable for applicants to keep their debt-to-income ratio below 43%, although some lenders may accommodate higher ratios based on the overall financial situation of the applicant.

What resources does F5 Mortgage provide to assist families in the mortgage process?

F5 Mortgage encourages families to utilize helpful resources such as mortgage calculators and down payment assistance programs to ease financial burdens during the mortgage process.

How does F5 Mortgage ensure a user-friendly mortgage process?

F5 Mortgage leverages user-friendly technology to streamline the mortgage process, allowing families to explore their options easily and secure optimal financing solutions.