Overview

This article is dedicated to helping families navigate the essential facts about California Jumbo Loans as they consider upgrading their homes. We understand how challenging this process can be, and we aim to provide you with the key requirements, benefits, and unique challenges associated with jumbo loans.

By highlighting these important factors, we hope to empower you to make informed decisions in California’s competitive real estate market. Understanding these elements is crucial for your journey, and we’re here to support you every step of the way.

As you explore your options, remember that you are not alone. Many families face similar challenges, and together, we can find solutions that work for you. Let’s dive into the world of jumbo loans and discover how they can help you achieve your dream home.

Introduction

Navigating the California housing market can feel overwhelming, especially for families eager to upgrade their homes amidst rising property values. We understand how challenging this can be. That’s why grasping the nuances of CA jumbo loans is vital for those seeking financing tailored to their unique needs. This article explores ten essential facts about these loans, illustrating how they can empower families to realize their homeownership dreams while addressing the complexities of large-scale financing.

What are the key advantages and potential pitfalls of jumbo loans? How can families position themselves to seize this financial opportunity? We’re here to support you every step of the way.

F5 Mortgage: Your Partner for Competitive California Jumbo Loans

At F5 Mortgage LLC, we understand how challenging it can be to secure the right financing for your home. As a leading independent mortgage brokerage in California, we focus on ca jumbo loans that truly address the needs of families looking to enhance their residences. With a strong commitment to client satisfaction, we offer and a diverse selection of financing options tailored to meet your unique financial needs. Did you know that about 40% of households in California are now choosing independent mortgage brokers for large mortgages? This choice reflects the tailored assistance and expertise we provide, especially in a market where many lenders require a minimum credit score of 700.

What sets F5 Mortgage apart is our dedication to personalized consultations. We connect you with top lenders, ensuring you receive optimal financing solutions for your high-value property. Our commitment to utilizing cutting-edge technology streamlines the mortgage process, empowering you to navigate the complexities of large-scale financing with confidence. It’s important to note that lenders typically require substantial cash reserves covering at least 12 months of mortgage payments. This is where our knowledgeable brokers come in, guiding you through every step.

Client testimonials speak volumes about the exceptional service we provide. Families have shared their experiences, praising our friendly, patient guidance and meticulous attention to detail, which makes the mortgage process smooth and stress-free. Countless households in California have realized their homeownership dreams through our customized ca jumbo loans services.

By choosing F5 Mortgage, you benefit from a streamlined application process, expert guidance, and a focus on securing the best possible terms for your investment. We’re here to support you every step of the way, positioning F5 Mortgage as a trusted partner in your journey toward upgrading your family home.

Jumbo Loan Requirements: What You Need to Qualify in California

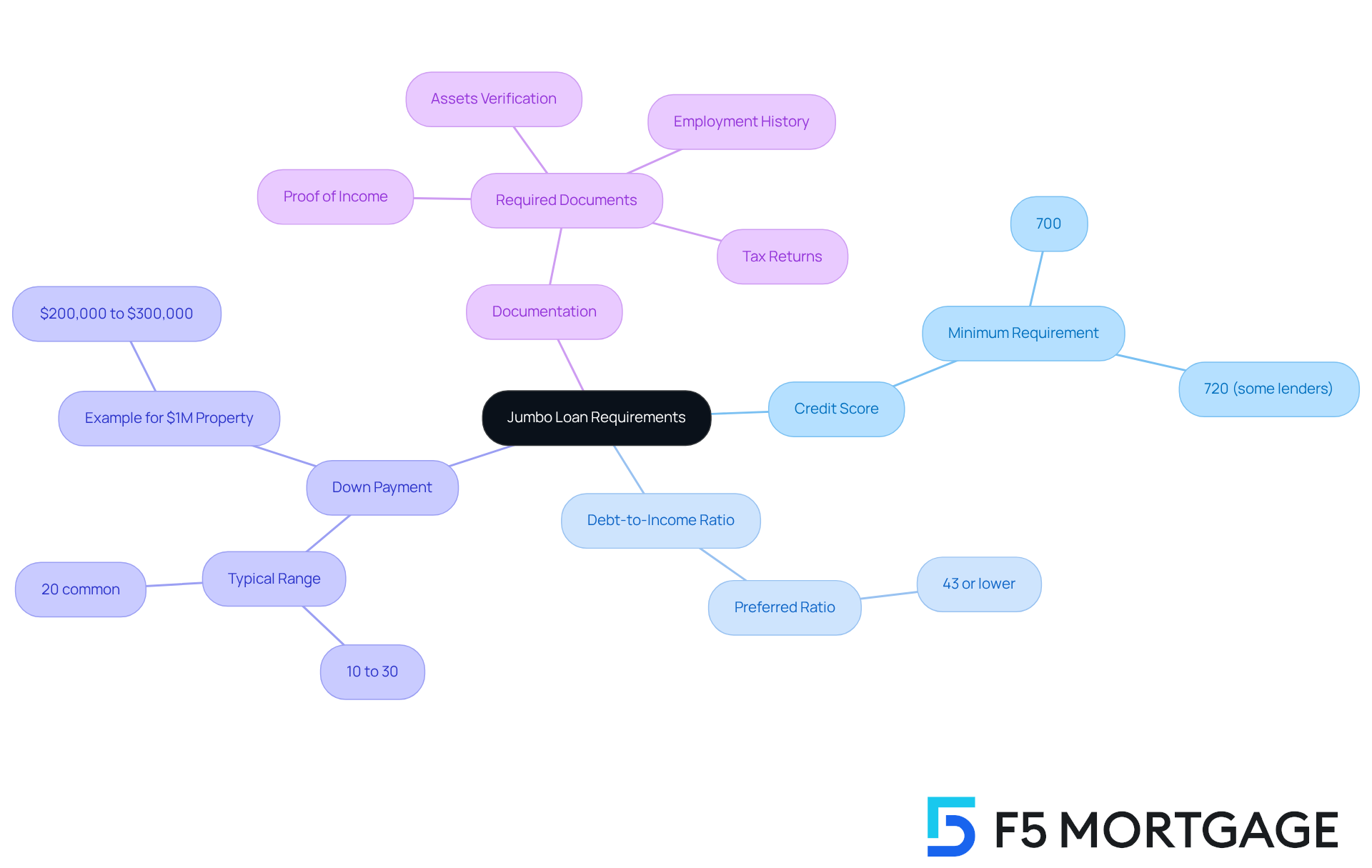

Qualifying for ca jumbo loans in California can feel overwhelming, but understanding the key criteria is the first step toward homeownership. We know how challenging this can be, and we’re here to support you every step of the way. Generally, borrowers need a minimum credit score of 700, though some lenders may require scores of 720 or higher based on the loan amount. Additionally, a debt-to-income (DTI) ratio of 43% or lower is preferred, helping ensure that you can manage your monthly payments effectively.

A substantial down payment is also essential, typically ranging from 20% to 30% of the property’s purchase price. For instance, if you’re looking at a $1 million property, that means a down payment of $200,000 to $300,000. Preparing for this financial commitment can feel daunting, but knowing what to expect can ease some of that stress.

Lenders will often ask for comprehensive documentation, including proof of income, assets, and employment history, such as recent pay stubs and tax returns. Families seeking financing for high-value properties should be ready to demonstrate their financial stability and reliability. Understanding these criteria is vital for navigating the , where ca jumbo loans are often necessary to secure homes in high-cost areas. By ensuring you meet these standards, you can position yourself favorably in your quest for homeownership.

California Jumbo Loan Limits: Understanding Conforming Thresholds

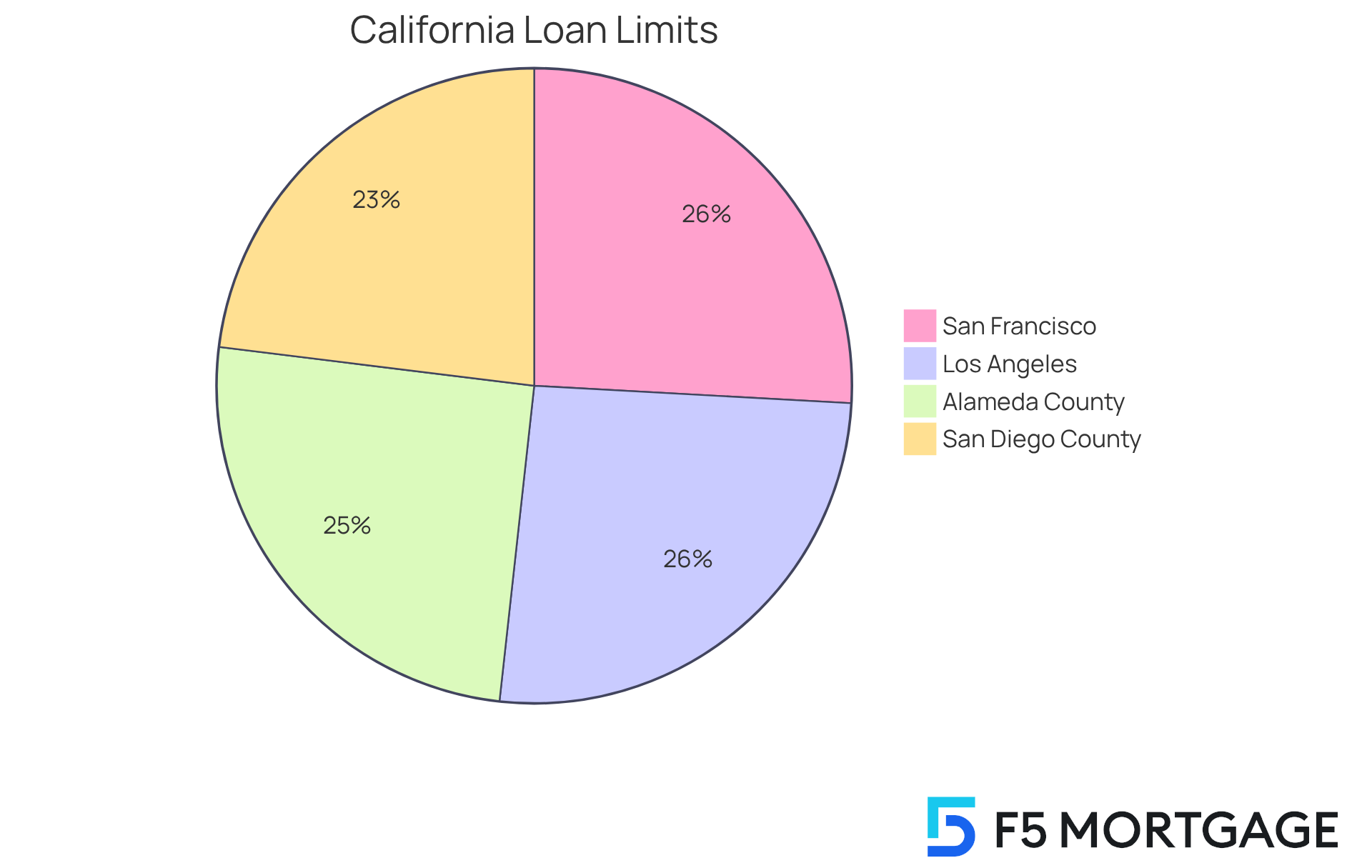

In 2025, the conforming mortgage limit for a single-family residence in most areas of California is set at $806,500. However, we understand that in high-cost areas like San Francisco and Los Angeles, this limit can escalate to $1,209,750. For families seeking to buy homes in California’s competitive real estate market, ca jumbo loans are classified as large-scale financing when they exceed these limits. This type of financing is crucial for those looking for properties valued above the conforming limits, as it often involves elevated credit scores and more substantial down payments.

Comprehending these limits is vital for families to make informed choices in their home-buying journey, especially in areas where property prices have surged. This reflects the broader trend of rising home values throughout the state. We know how challenging this can be, and we encourage families to evaluate various lenders to discover the best ca jumbo loans financing options available.

F5 Mortgage stands out in this regard, offering a range of financing programs, competitive rates, and personalized service designed to meet your unique needs. As an independent broker, F5 Mortgage streamlines the process by connecting families with the right lenders, ensuring they secure the best possible terms.

Requirements and limits can vary significantly across different counties:

- Alameda County has a limit of $1,178,750

- San Diego County sits at $1,077,550

This variability makes it crucial to leverage F5 Mortgage’s expertise in navigating these complexities. We’re here to .

Benefits of Jumbo Loans: Why They Matter for California Homebuyers

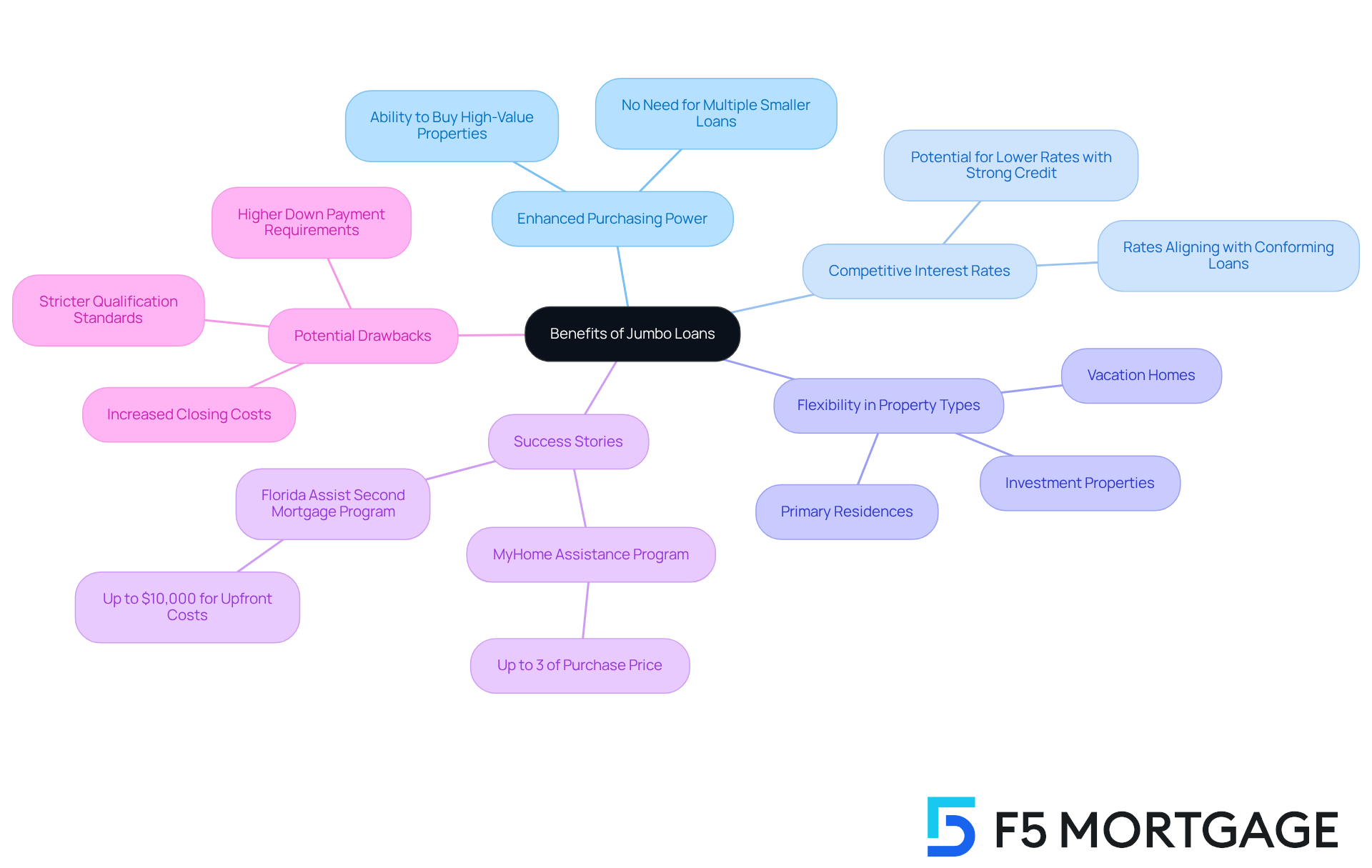

CA jumbo loans present significant benefits for California homebuyers, particularly in enhancing their purchasing power. We understand how challenging it can be to find a home in desirable areas, and these allow families to secure residences without needing multiple smaller credits. This makes jumbo mortgages an appealing choice for those looking to improve their living situation.

As average interest rates for large mortgages become increasingly competitive—often closely aligning with conforming mortgage rates for borrowers with strong credit profiles—families can secure favorable financing terms. This flexibility in property categories is essential, enabling funding for primary residences, vacation homes, and investment real estate. It’s vital for households striving to find their ideal home in a competitive market.

Success stories abound, with many families utilizing large mortgages alongside down payment assistance programs. For instance, the MyHome Assistance Program in California provides up to 3% of the home’s purchase price, while the Florida Assist Second Mortgage Program offers up to $10,000 for upfront costs. These programs highlight the strategic importance of large mortgages in achieving homeownership goals.

However, it’s important for prospective borrowers to recognize potential drawbacks, such as increased closing costs and fees associated with large mortgages, which can add to the financial obligation involved. As home prices continue to rise, families navigating California’s dynamic real estate landscape find CA jumbo loans to be a crucial resource. Remember, we’re here to support you every step of the way.

Jumbo Loans vs. Conforming Loans: Key Differences Explained

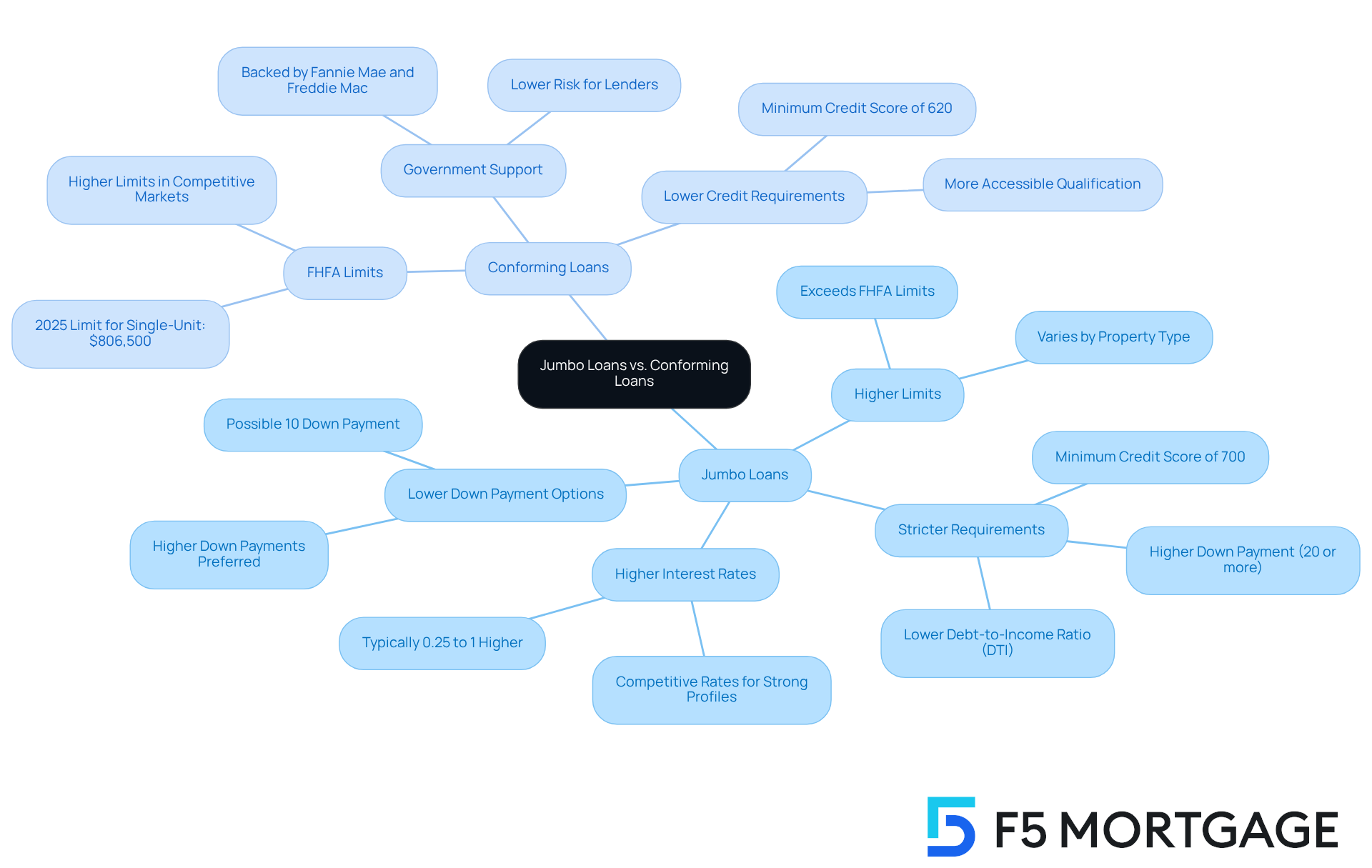

Understanding the differences between large-scale financing and conforming mortgages is crucial for families looking to make informed decisions. The Federal Housing Finance Agency (FHFA) sets specific limits, and for 2025, the conforming borrowing limit for a single-unit property is $806,500. While conforming mortgages adhere to these limits, jumbo loans exceed them, making them an essential option for families aiming to purchase higher-priced properties in competitive markets such as California.

Jumbo mortgages often come with stricter credit and income requirements. Typically, a minimum credit score of 700 is expected, although some lenders might consider scores as low as 660 or 680 in certain situations. Additionally, large-scale mortgages usually necessitate larger down payments, commonly around 20%. However, under specific circumstances, some lenders may approve down payments as low as 10%.

Unlike conforming mortgages, which benefit from government-sponsored support, large loans generally carry slightly higher interest rates due to the increased risk for lenders. Yet, for borrowers with strong financial profiles, jumbo mortgages can also offer . We understand how overwhelming these choices can be, and comprehending these distinctions is essential for households exploring their mortgage options, as they significantly influence affordability and approval prospects.

To enhance your chances of securing jumbo loans, strive to maintain a low debt-to-income ratio, ideally under 36%. Seeking advice from mortgage professionals can also provide tailored assistance, ensuring you feel supported every step of the way. Remember, we’re here to help you navigate this journey with confidence.

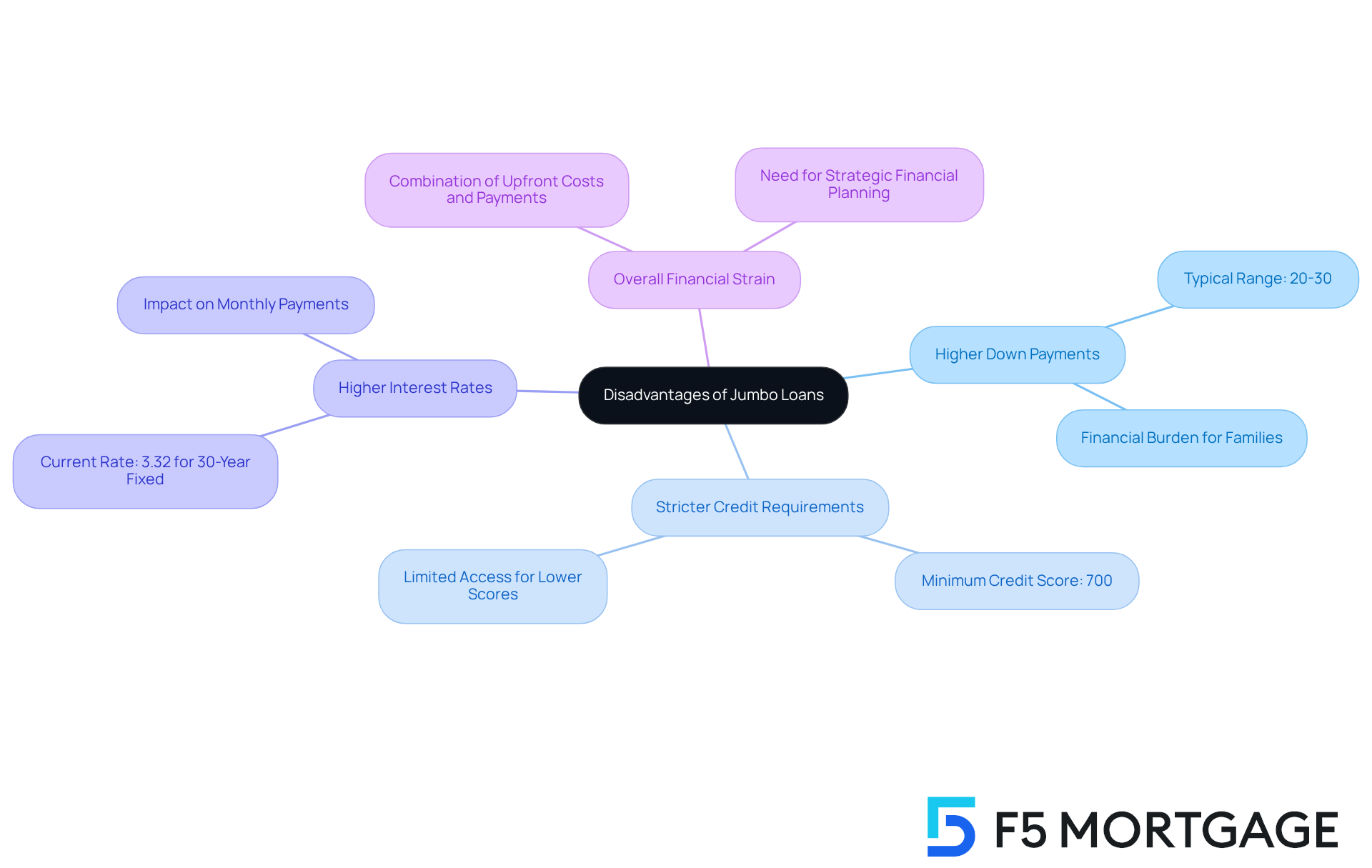

Disadvantages of Jumbo Loans: What to Consider Before Applying

Ca jumbo loans can offer distinct benefits, but they also come with challenges that families must navigate. One of the most significant hurdles is the requirement for higher down payments, typically ranging from 20% to 30% of the property’s purchase price. We know how challenging this can be, as this substantial upfront cost can create a considerable financial burden for many families, especially those looking to upgrade their homes.

Additionally, the more stringent credit criteria associated with large mortgages mean that individuals with credit scores under 700 might find it difficult to qualify. This can restrict access for certain prospective homeowners, adding to the stress of the home-buying process.

Interest rates for large mortgages are often higher than those for standard ones, further increasing the overall expense of borrowing. For instance, the typical interest rate for a 30-year fixed large mortgage is currently around 3.32%, which is higher compared to lower rates for conforming mortgages. This disparity can significantly impact monthly payments and long-term financial planning.

Families should also be aware that the financial consequences of these credits extend beyond just the down payment and interest rates. The combination of higher upfront costs and ongoing payments can strain budgets. Therefore, it is essential to weigh these factors carefully before pursuing ca jumbo loans as a financing option. Understanding the is crucial for families aiming to make informed decisions in their home-buying journey. We’re here to support you every step of the way.

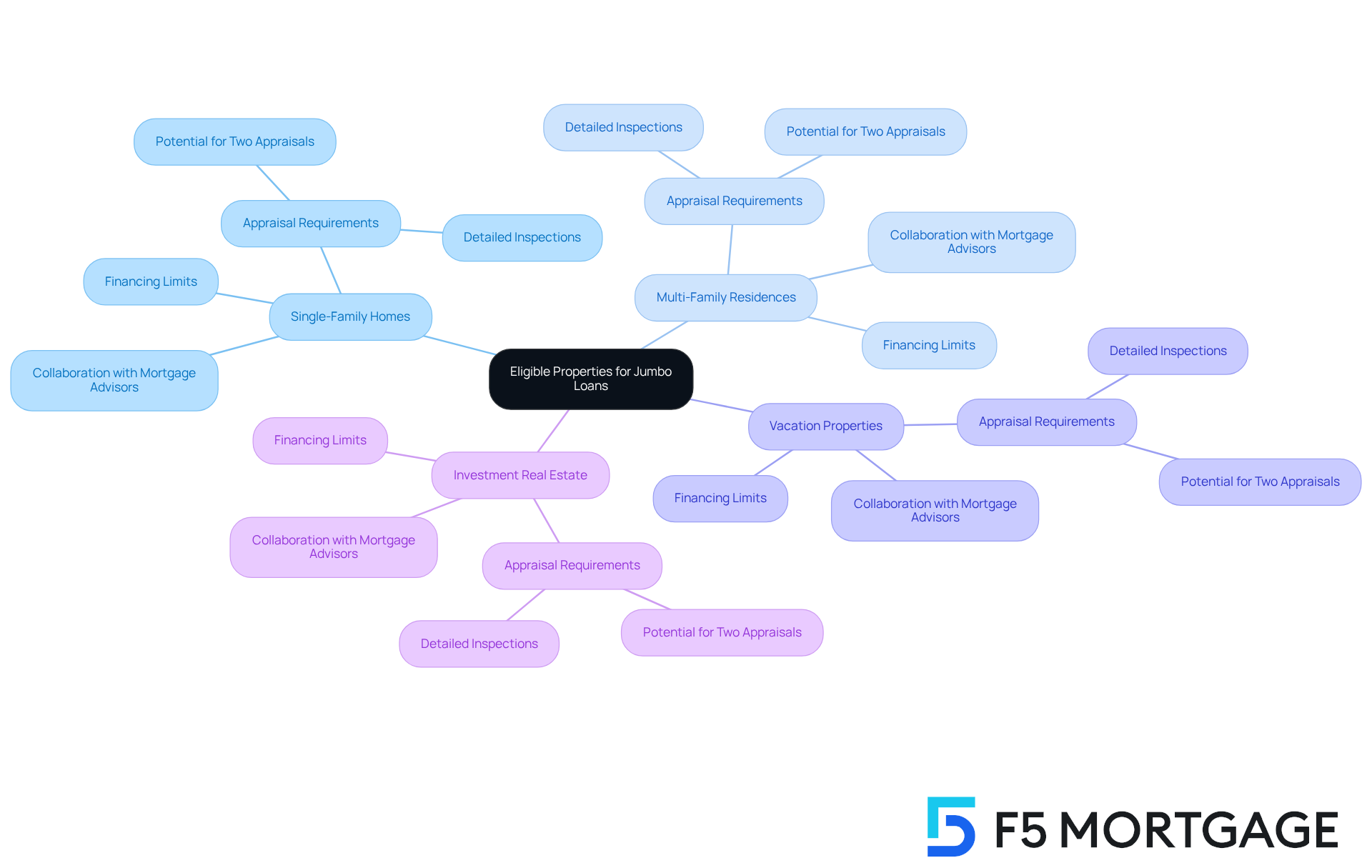

Eligible Properties for Jumbo Loans: What You Can Buy

Jumbo financing opens doors to a wide range of property types, including single-family homes, multi-family residences, vacation properties, and investment real estate. We understand how overwhelming it can be to qualify for such financing, especially since the property must be situated in an area where the financing amount exceeds the , set at $806,500 for most regions in 2025. In high-cost areas like California, where the median property price hovers around $884,000, CA jumbo loans are becoming increasingly vital for many buyers.

Lenders often have specific criteria regarding the property’s condition and value, which can add to the complexity of the process. Detailed appraisals are typically required to ensure accurate valuations. For example, properties may need thorough inspections, and in some cases, two appraisals may be necessary to confirm their worth. Additionally, refinancing a large mortgage can come with its own set of challenges, including higher closing costs that usually range from 2% to 5% of the mortgage amount.

If you’re a family looking to finance a new home, it’s crucial to work closely with your mortgage advisor at F5 Mortgage. We know how challenging this can be, and we’re here to support you every step of the way. This collaboration is essential, as it helps navigate the intricacies of CA jumbo loans financing process, ensuring you can secure the funding needed for your dream home. Moreover, the dedicated team at F5 Mortgage is committed to helping families find their ideal residence and get their offers accepted, making the journey to homeownership not only attainable but also encouraging.

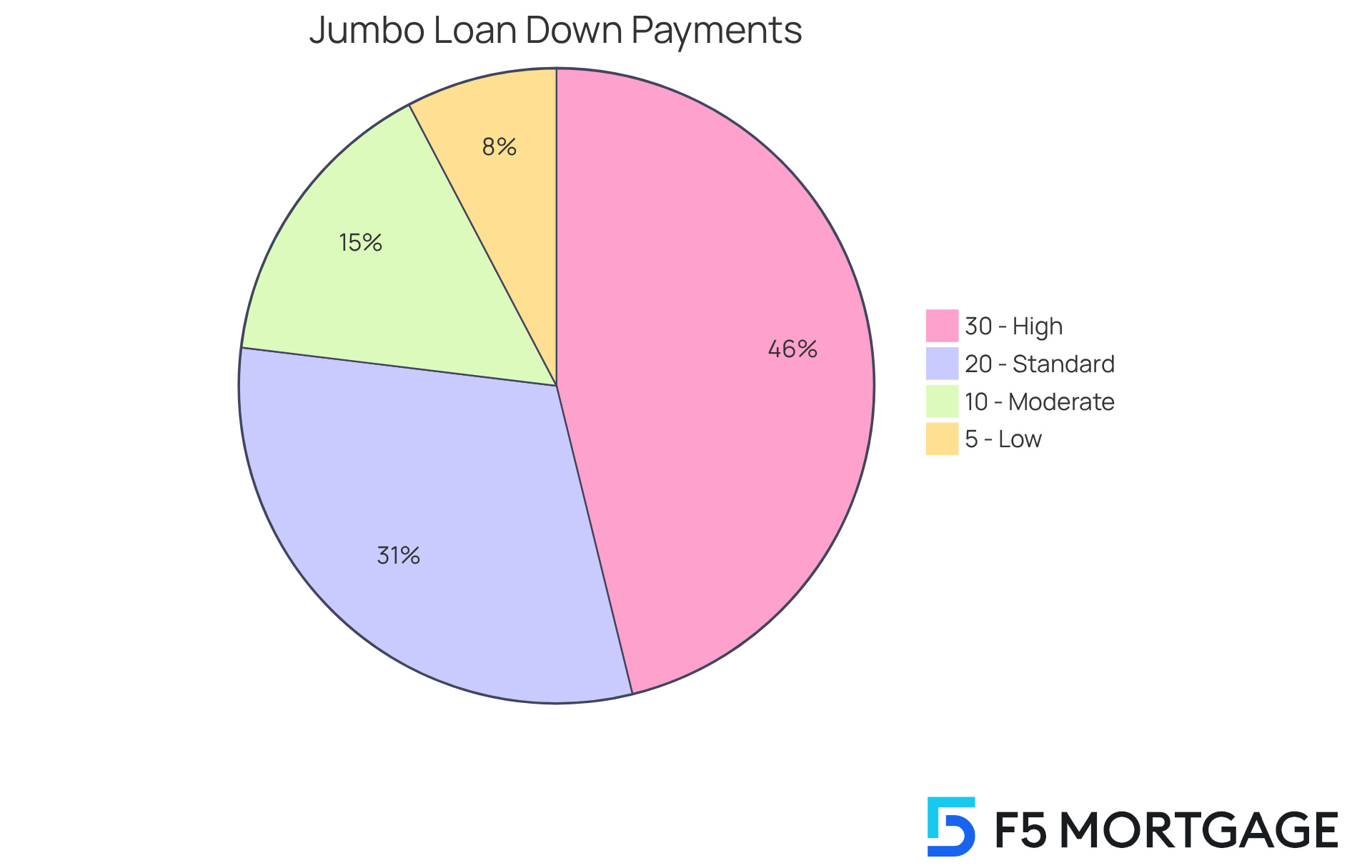

Down Payment Requirements: How Much You Need for a Jumbo Loan

When considering a large mortgage, it’s important to understand the down payment criteria, which typically range from 20% to 30% of the purchase cost. However, we know how challenging this can be, and many lenders are now offering more flexible options. You might find or even 5%, depending on your credit profile and overall financial situation.

For families looking to buy homes in expensive areas like California, ca jumbo loans and these reduced down payment initiatives can be a game changer. They significantly alleviate the financial strain of homeownership, helping you move closer to your dream home without overwhelming your budget. It’s essential to assess your financial readiness and collaborate with a mortgage broker who can help you determine the best down payment strategy for your needs.

According to industry insights, a growing number of lenders are embracing these lower down payment alternatives. This shift reflects a broader trend in the mortgage market, making ca jumbo loans more accessible to a wider range of buyers. We’re here to support you every step of the way as you navigate this process and find the right solution for your family’s needs.

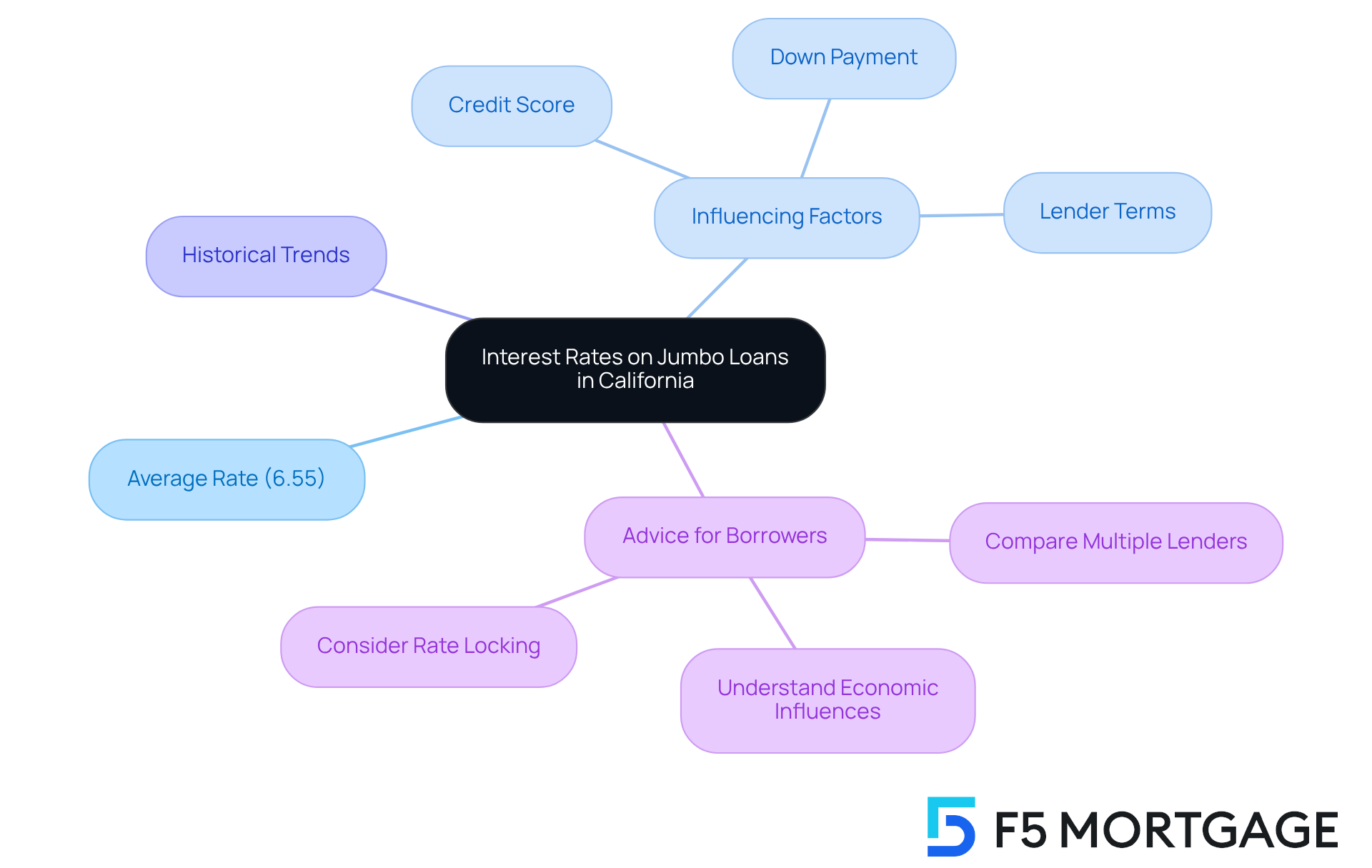

Interest Rates on Jumbo Loans: What to Expect in California

As of late September 2025, we understand that navigating the mortgage landscape can feel overwhelming. The average interest rate for a 30-year fixed large mortgage in California is about 6.55%. However, this rate can fluctuate based on several factors, such as your credit score, down payment, and the specific terms set by lenders.

Families seeking to obtain a large mortgage should be proactive in their search. Rates can differ greatly among lenders, and we know how challenging this can be. For instance, if you have a strong credit profile and a substantial down payment, you may find more favorable rates available to you.

Historical trends show that large mortgage rates have become more competitive compared to traditional loans. This makes it crucial for you to evaluate offers carefully. Additionally, external economic factors, such as inflation and market conditions, can influence these rates. Staying informed about these dynamics empowers families to make better financial decisions when upgrading their homes. We’re here to as you embark on this important journey.

Applying for a Jumbo Loan: Steps to Secure Your Financing

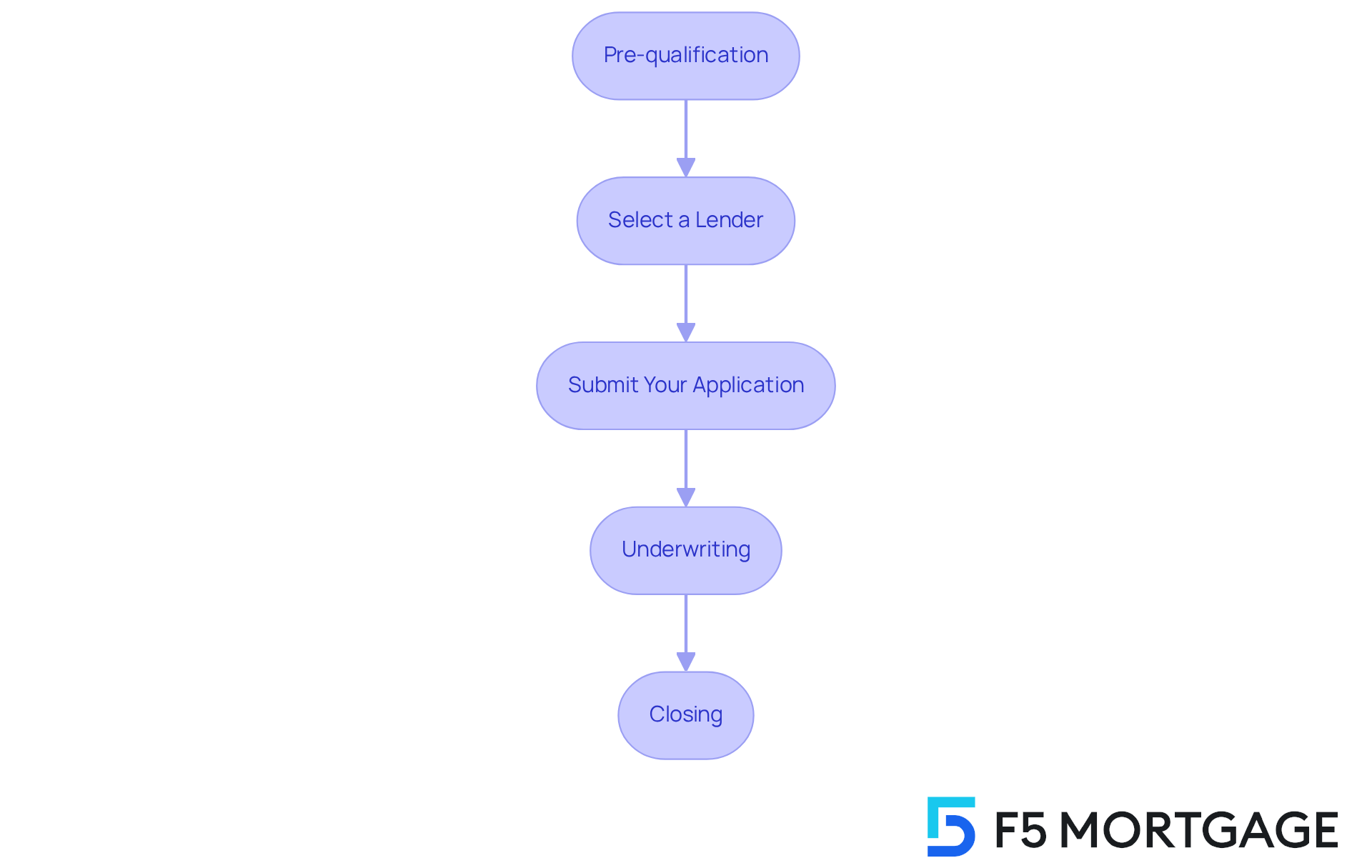

Applying for a large financing option can feel overwhelming, but we’re here to support you every step of the way. Here are several key steps to guide you through the process:

- Pre-qualification: Start by evaluating your financial condition. Gather essential documents like income statements and tax returns. A credit score of at least 700 is ideal; however, some lenders may require a score of 720 or 740 for better terms. It’s also wise to show substantial cash reserves, typically covering six to twelve months of mortgage payments, to demonstrate your financial stability.

- Select a lender: Take the time to investigate and evaluate lenders. Look for one that offers attractive rates and conditions for large-scale financing. F5 Mortgage provides convenient application choices, allowing you to apply online, by phone, or through chat. This flexibility ensures a customized financing solution tailored to your needs.

- Submit your application: Complete the application process by providing all required documentation. Double-check to ensure everything is accurate and up-to-date, as this can make a significant difference.

- Underwriting: The lender will review your application and financial information to determine your eligibility. Keep in mind that manual underwriting may occur due to the increased risks associated with large-scale financing.

- Closing: Once approved, you’ll finalize the financing terms and close on your new home. The typical duration to obtain large-scale financing in California can vary, but many borrowers can expect a timeframe of approximately 30 days from application to closing. This timeline may extend based on specific conditions, such as property verification. Working with a at F5 Mortgage can streamline this process and ensure you meet all requirements.

It’s also important to consider potential drawbacks of jumbo loans, such as higher closing costs and stricter requirements, which can impact your overall financial planning. Remember, we know how challenging this can be, and F5 Mortgage is committed to client support, connecting you with top realtors to help you find and secure your perfect home.

Conclusion

Navigating the complexities of California jumbo loans is essential for families looking to upgrade their homes in a competitive market. These large-scale financing options provide the necessary leverage to secure properties that exceed conforming loan limits. This enables families to fulfill their homeownership dreams, even amidst the challenges posed by high property prices.

This article has outlined key facts about CA jumbo loans, including eligibility criteria, benefits, and potential drawbacks. Understanding the requirements—such as credit scores, down payments, and property types—is crucial for families aiming to make informed decisions. We know how challenging this can be, and the insights shared highlight the importance of working with knowledgeable mortgage brokers like F5 Mortgage. They can guide families through the intricacies of the mortgage process and connect them with tailored financing solutions.

In conclusion, the significance of California jumbo loans cannot be overstated for families aspiring to enhance their living situations. As the real estate landscape continues to evolve, staying informed about current trends, competitive rates, and financing options will empower families to make strategic decisions. Embracing this knowledge not only facilitates the journey to homeownership but also positions families for long-term financial success in an ever-changing market. We’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage LLC is an independent mortgage brokerage in California that specializes in jumbo loans, providing competitive rates and a diverse selection of financing options tailored to meet the unique financial needs of families.

Why are independent mortgage brokers like F5 Mortgage becoming popular in California?

Approximately 40% of households in California are choosing independent mortgage brokers for large mortgages due to the tailored assistance and expertise they provide, especially in a market where many lenders require a minimum credit score of 700.

What sets F5 Mortgage apart from other lenders?

F5 Mortgage is dedicated to personalized consultations, connecting clients with top lenders and utilizing cutting-edge technology to streamline the mortgage process, ensuring clients receive optimal financing solutions for high-value properties.

What are the typical requirements to qualify for a jumbo loan in California?

To qualify for a jumbo loan in California, borrowers generally need a minimum credit score of 700 (or 720 or higher for some lenders), a debt-to-income (DTI) ratio of 43% or lower, and a down payment typically ranging from 20% to 30% of the property’s purchase price.

What documentation is required when applying for a jumbo loan?

Lenders will often require comprehensive documentation, including proof of income, assets, and employment history, such as recent pay stubs and tax returns, to demonstrate financial stability and reliability.

What are the conforming loan limits for jumbo loans in California?

In 2025, the conforming mortgage limit for a single-family residence in most areas of California is set at $806,500. In high-cost areas like San Francisco and Los Angeles, this limit can rise to $1,209,750.

How do jumbo loans differ from conforming loans?

Jumbo loans are classified as large-scale financing that exceeds the conforming loan limits, often requiring elevated credit scores and more substantial down payments compared to conforming loans.

What are the specific conforming loan limits for different counties in California?

The conforming loan limits vary by county: Alameda County has a limit of $1,178,750, and San Diego County has a limit of $1,077,550.

How can F5 Mortgage assist families in navigating the jumbo loan process?

F5 Mortgage offers a range of financing programs, competitive rates, and personalized service, helping families connect with the right lenders to secure the best possible terms for their jumbo loans.