Overview

This article addresses the essential facts about cash-out mortgages for families, focusing on the benefits, risks, and the process involved. We know how challenging financial decisions can be, and understanding cash-out refinancing is a crucial step. This option allows homeowners to access their home equity for various needs, such as:

- Home improvements

- Debt consolidation

However, it’s important to recognize the potential risks involved, including:

- Increased debt

- The possibility of foreclosure

By being aware of these factors, families can make informed financial decisions that best suit their needs. We’re here to support you every step of the way as you navigate this process.

Introduction

Navigating the world of mortgages can often feel overwhelming. We understand how challenging this can be, especially for families seeking financial solutions that align with their unique needs. Cash-out refinancing presents an intriguing opportunity for homeowners to tap into their home equity. This can offer a pathway to fund home improvements, consolidate debt, or cover educational expenses.

However, with potential benefits come important considerations and risks that families must carefully evaluate. What are the essential facts that can guide families in making informed decisions about cash-out mortgages? How can they leverage this financial strategy effectively? We’re here to support you every step of the way as you explore these options.

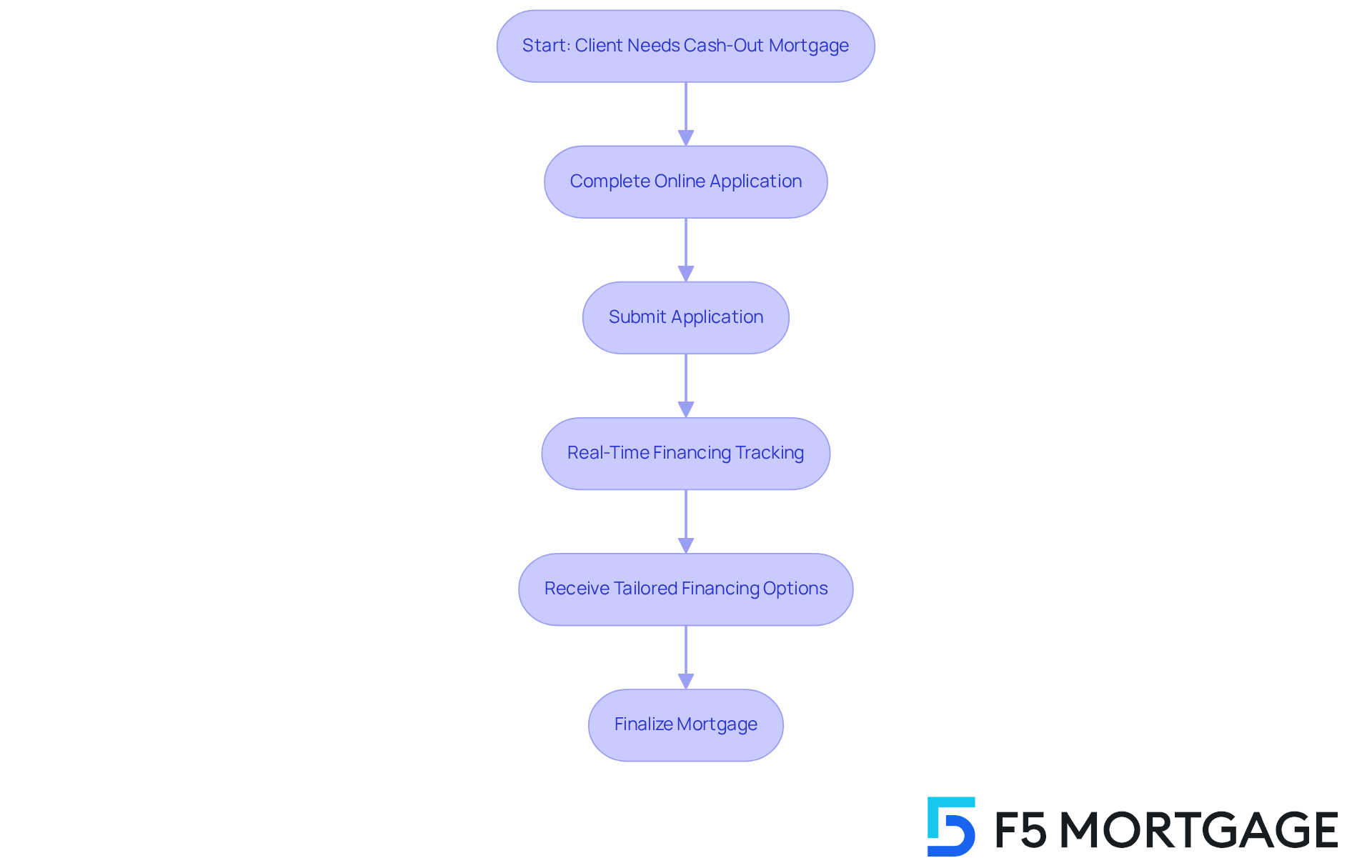

F5 Mortgage: Your Partner for Cash-Out Mortgage Solutions

At F5 Mortgage LLC, we understand how challenging the mortgage process can be. As a prominent independent mortgage brokerage, we are dedicated to providing households with competitive cash-out mortgage solutions. Every interaction with our clients is an opportunity for us to earn your trust and become a true partner in meeting your mortgage needs.

We prioritize your satisfaction by leveraging our extensive network of lenders and innovative technology. Our user-friendly online application platform and real-time financing tracking are designed to provide you with tailored financing options that address the unique requirements of families looking to refinance or purchase a home.

Our commitment to exceptional service is reflected in the positive feedback we receive from clients. We are here to support you every step of the way, ensuring that you navigate the complexities of a cash out mortgage transaction smoothly and confidently, all while valuing your time and money.

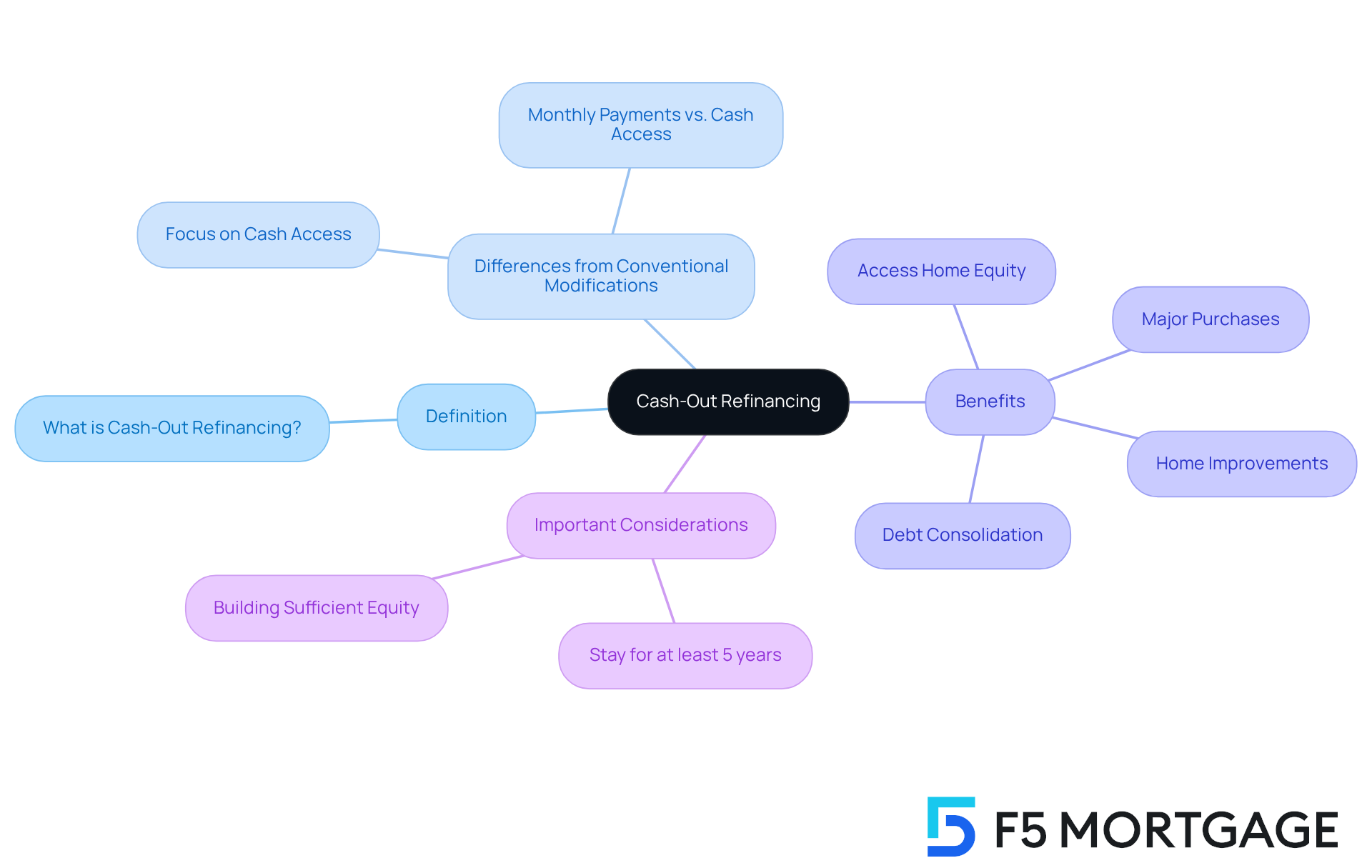

Understanding Cash-Out Refinancing: Definition and Differences

A cash out mortgage modification is a beneficial financial strategy that allows homeowners to replace their existing mortgage with a new, larger loan, converting the difference into cash. We understand how overwhelming financial decisions can be, and this option stands apart from conventional loan modifications, which typically focus on reducing monthly payments or interest rates. With a cash out mortgage, homeowners can access their home equity for various needs, such as home improvements, debt consolidation, or major purchases.

Recognizing this distinction is vital for families evaluating their loan modification choices. It’s commonly advised that homeowners plan to stay in their residence for at least five years before pursuing a cash out mortgage. This timeline is crucial, as it allows families to build sufficient equity, ensuring that their investment yields returns and maximizes the benefits of a cash out mortgage.

We know how challenging this can be, but with the right information and support, you can make informed decisions that benefit your financial future. We’re here to support you every step of the way as you navigate this process.

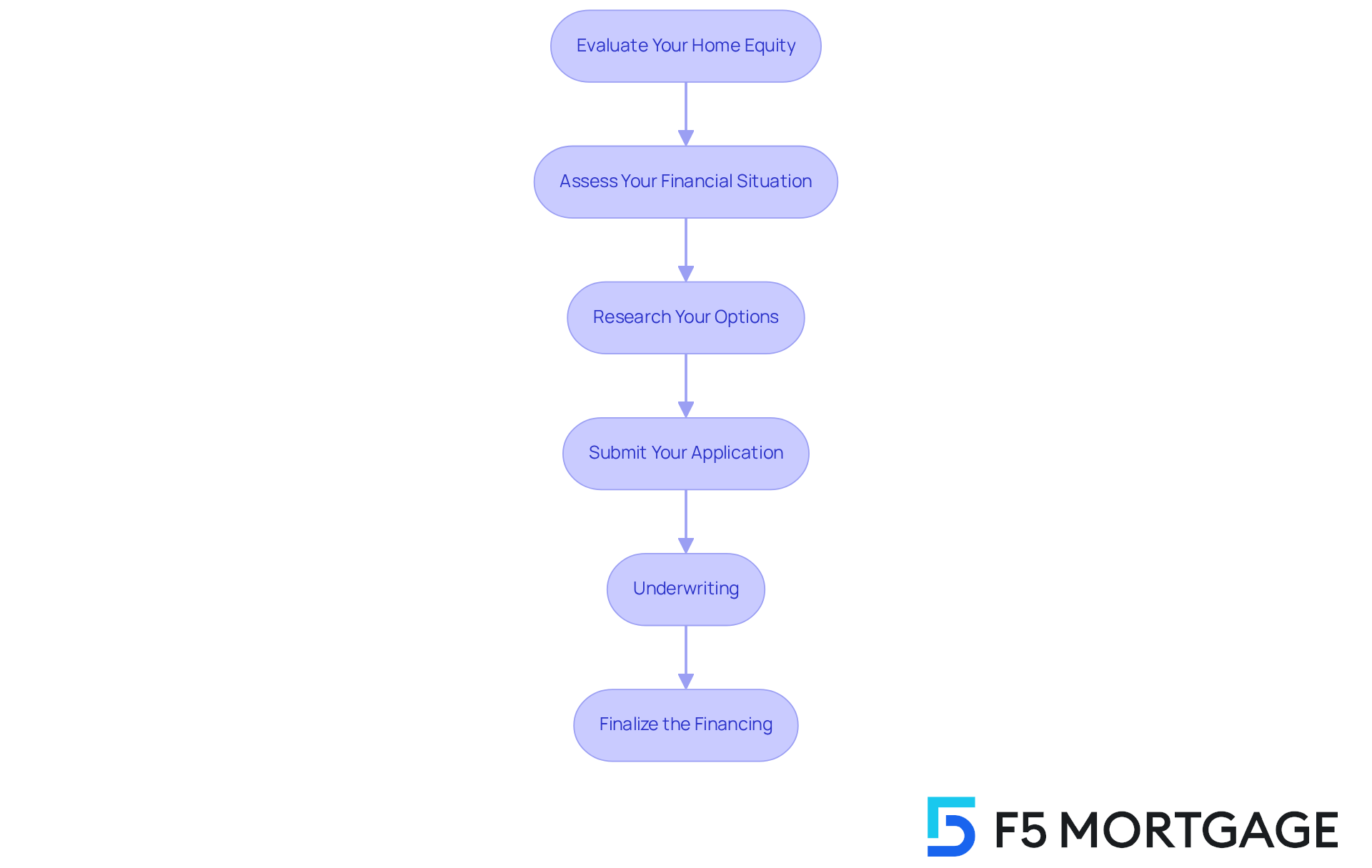

How Cash-Out Refinancing Works: A Step-by-Step Guide

-

Evaluate Your Home Equity: We understand how important it is to know your financial standing. Start by determining how much equity you have in your home—simply subtract your mortgage balance from your home’s current market value. This crucial step influences your loan options and the potential for a cash out mortgage amount, helping you make informed decisions.

-

Assess Your Financial Situation: Take a moment to review your credit score, income, and debt-to-income ratio. This understanding is vital, as it ensures you meet lender requirements. By grasping these factors, you can better gauge your eligibility for competitive mortgage solutions that suit your family’s needs.

-

Research Your Options: After assessing your financial situation, it’s time to explore your refinance options. While refinancing with your current provider is a possibility, comparing various lenders and financing alternatives can help you find the best rates and conditions for your cash out mortgage. We know how overwhelming this can feel, but we’re here to support you every step of the way.

-

Submit Your Application: Completing the application process is an essential step. Gather necessary documentation, such as income verification and property details, to initiate this process. This is where the appraisal begins, allowing the lender to assess your property’s current value and ensuring everything is in order.

-

Underwriting: Once you’ve submitted your application, the lender will carefully review your financing application, credit history, debt-to-income ratio, and assets during the underwriting process. This thorough examination is crucial for completing your credit approval, and we understand it can be a tense time.

-

Finalize the Financing: Congratulations! Once approved, you’ll complete the cash out mortgage for the new financing. This involves settling your existing mortgage and receiving the cash difference at closing. After finalization, your new lender will take over your original loan, and your monthly payments will be directed to them. Remember, this process is designed to benefit you, and we’re here to ensure you feel confident every step of the way.

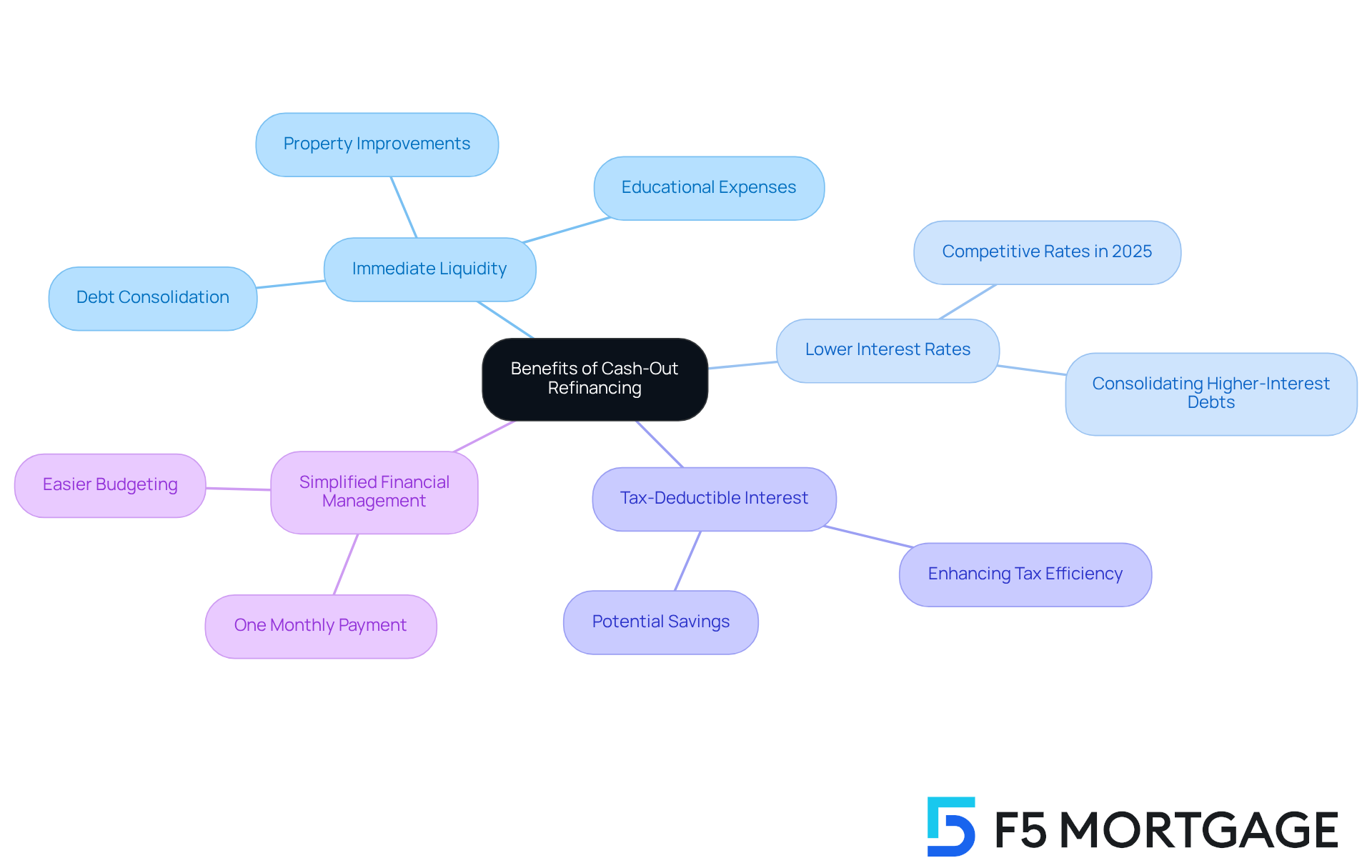

Benefits of Cash-Out Refinancing: Why It Might Be Right for You

A cash out mortgage offers property owners a valuable opportunity to restructure their finances and access a lump sum of money. This can be utilized for various purposes, such as:

- Making property improvements

- Covering educational expenses

- Consolidating debt

Not only does this financial strategy provide immediate liquidity, but it also empowers families to invest in their homes or manage other financial obligations with confidence.

One of the key benefits of a cash out mortgage is the potential for lower interest rates compared to traditional borrowing methods, like personal loans or credit cards. In 2025, homeowners can anticipate finding competitive rates that make this option particularly attractive for those looking to consolidate higher-interest debts into a single, manageable payment.

Moreover, the interest paid on a cash out mortgage may be tax-deductible, offering additional financial advantages. This could lead to significant savings, especially for households striving to enhance their tax efficiency while managing their mortgage.

Homeowners can simplify their financial management with just one monthly payment by consolidating debt through a cash-out mortgage. This streamlined approach not only helps in budgeting but also alleviates the stress of juggling multiple debts. For families focused on improving their financial security, a cash-out mortgage can be a thoughtful choice to consider.

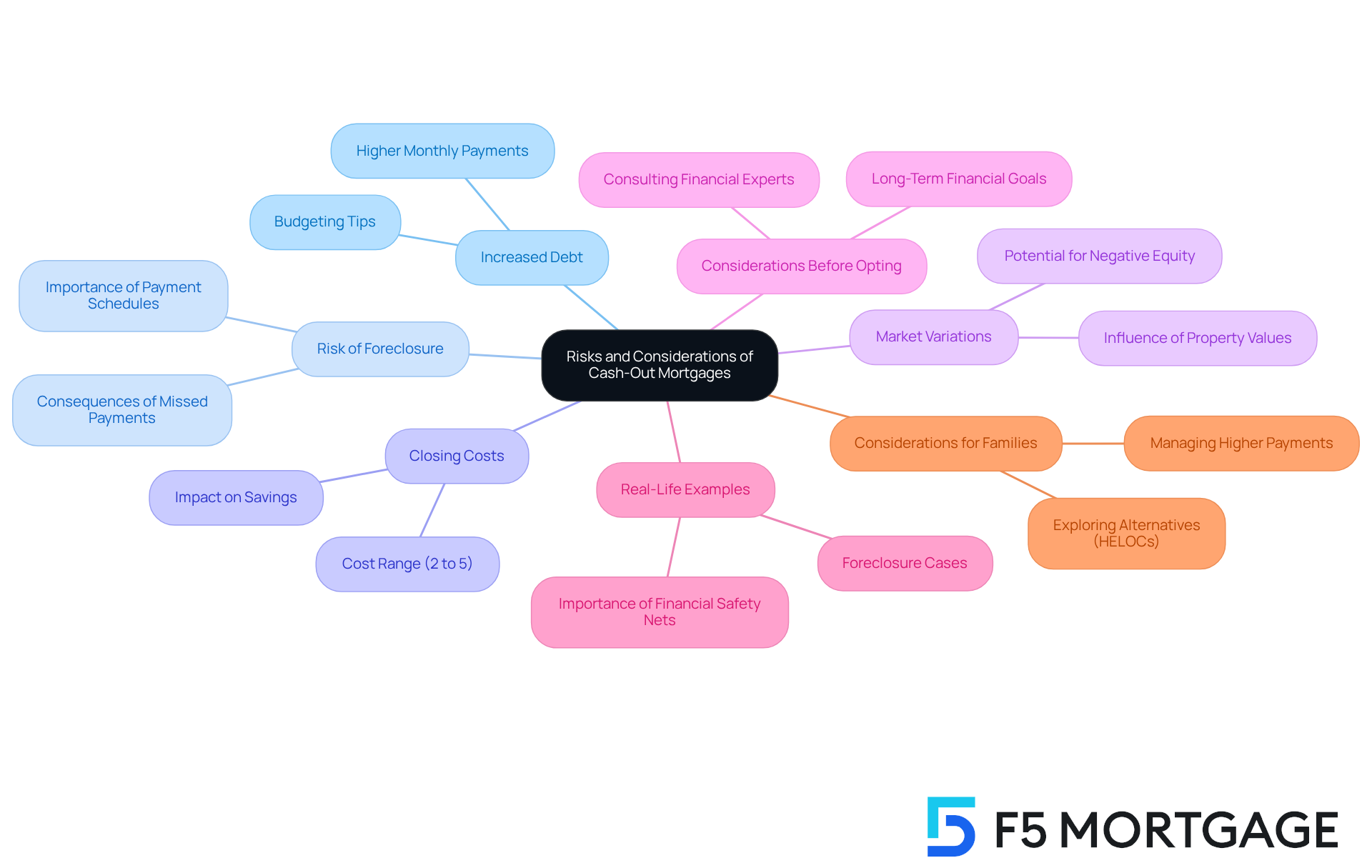

Risks and Considerations: What to Watch Out For

-

Increased Debt: We understand that choosing a cash out mortgage can raise your total mortgage amount, potentially leading to higher monthly payments. This increase in debt load requires careful budgeting to ensure that your household can manage financial responsibilities comfortably. While recent reductions in mortgage rates in Colorado may make restructuring loans appealing, it’s crucial to remain vigilant about the overall debt accumulated.

-

Risk of Foreclosure: Like any mortgage, failing to keep up with payments on a cash out mortgage refinance can result in foreclosure, putting your homeownership at risk. Foreclosure rates have shown a concerning trend, especially among borrowers who have opted for a cash out mortgage. This highlights the importance of maintaining consistent payment schedules to protect your home.

-

Closing Costs: Cash-out refinancing usually involves closing costs that range from 2% to 5% of the borrowing amount. These costs can significantly impact the overall savings you expect from utilizing the equity in your home. It’s essential for families to factor these expenses into their financial planning. While these costs are typically lower than those for purchasing a property, they are higher than charges associated with HELOCs or property equity loans.

-

Market Variations: The housing market can fluctuate, influencing property values. A decline in property values may lead to negative equity, where your mortgage balance exceeds the worth of your home. It’s important for families to consider the potential for market changes when deciding to cash out mortgage, as this could affect their long-term financial stability.

-

Considerations Before Opting for a Cash Out Mortgage: Before proceeding, families should evaluate their long-term plans and financial goals. Understanding the implications of increased debt and the potential risks of foreclosure is crucial. Consulting with financial experts can provide valuable insights into the risks associated with cash out mortgage restructuring. Additionally, families should contemplate the advantages of restructuring loans, such as reduced interest rates and possible tax benefits, which can enhance your financial situation.

-

Real-Life Examples of Foreclosure Risks: There have been instances where families who chose cash-out options faced foreclosure due to unforeseen circumstances, like job loss or medical emergencies. These cases underscore the importance of having a financial safety net and a clear repayment strategy, particularly when using a cash out mortgage to navigate unexpected challenges.

-

Considerations for Families: Families should assess their ability to manage higher monthly payments and the potential impact on their overall financial health. It’s wise to explore options such as home equity lines of credit (HELOCs) or home equity financing, which may offer more flexibility and reduced expenses in certain situations. Cash-out mortgage options could offer a lower interest rate than credit cards or personal financing, making it a potentially beneficial choice depending on your personal circumstances.

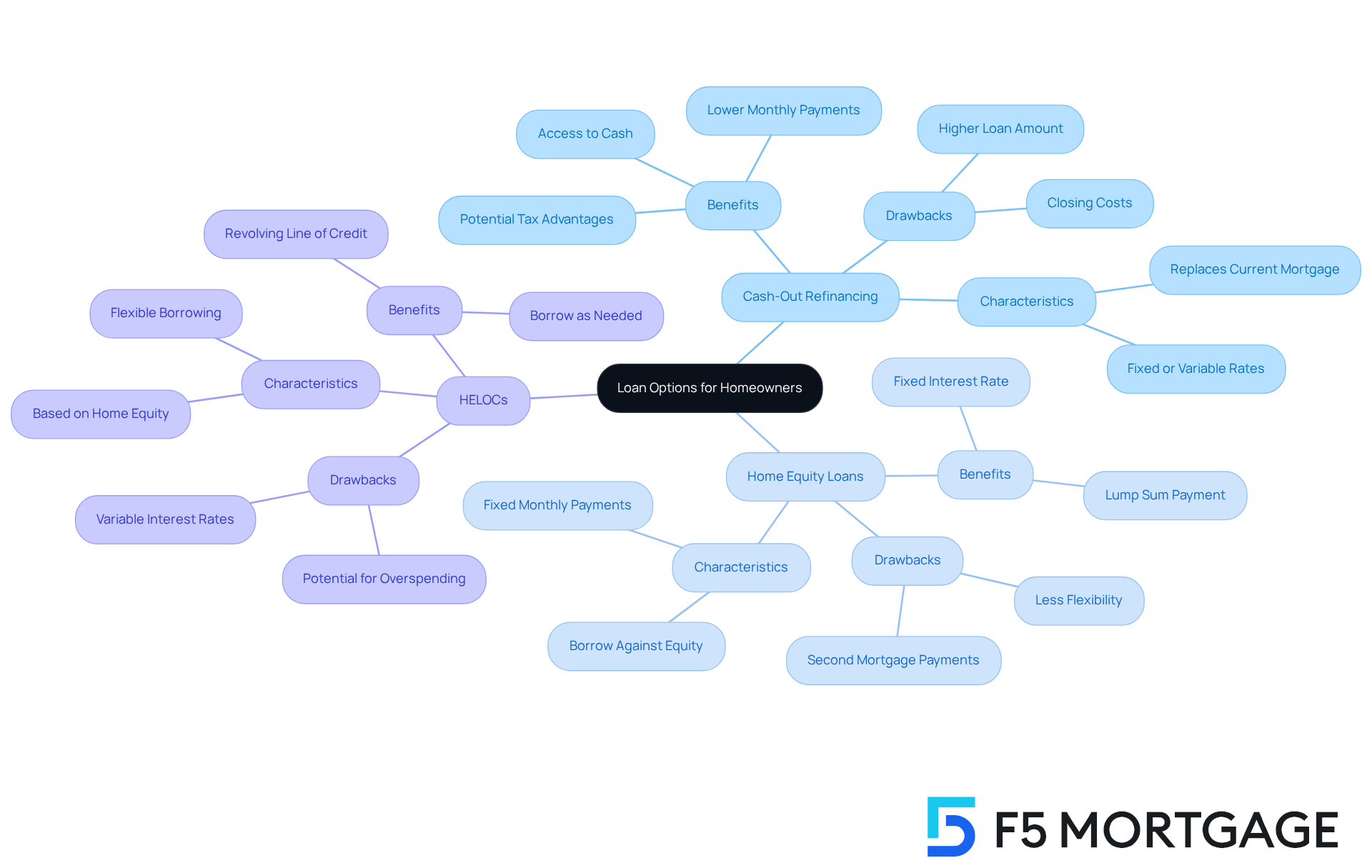

Cash-Out Refinancing vs. Alternatives: Home Equity Loans and HELOCs

Cash-out refinancing, also known as a cash out mortgage, can be a valuable option for homeowners looking to access cash while replacing their current mortgage with a new, larger amount. This approach is especially beneficial for Colorado homeowners, as recent declines in mortgage rates for 30-year and 15-year fixed loans create an opportune moment to consider refinancing. By taking advantage of these reduced interest rates, families can lower their monthly payments and obtain funds for renovations or unexpected expenses.

Many property owners have built substantial equity in their homes, making a cash out mortgage a practical choice to finance renovations or bolster an emergency fund. However, it’s important to understand the alternatives available.

An equity loan serves as a second mortgage, allowing homeowners to borrow against their equity, typically with a fixed interest rate and monthly payments. While this option can provide a lump sum for larger projects, it may lack the same flexibility as cash-out refinancing.

On the other hand, a Home Equity Line of Credit (HELOC) offers a revolving line of credit based on home equity, enabling homeowners to borrow as needed, often with variable interest rates. Each of these options comes with its own set of benefits and drawbacks, making it essential for families to assess their financial goals and needs carefully.

Additionally, restructuring your mortgage can offer potential tax advantages, further enhancing financial benefits. With the Colorado housing market continuing to grow and property taxes and insurance costs on the rise, understanding these loan options can empower families to make informed decisions about their financial future.

To explore your loan modification choices and find the best solution for your needs, we invite you to utilize our F5 Mortgage calculator today. We know how challenging this can be, and we’re here to support you every step of the way.

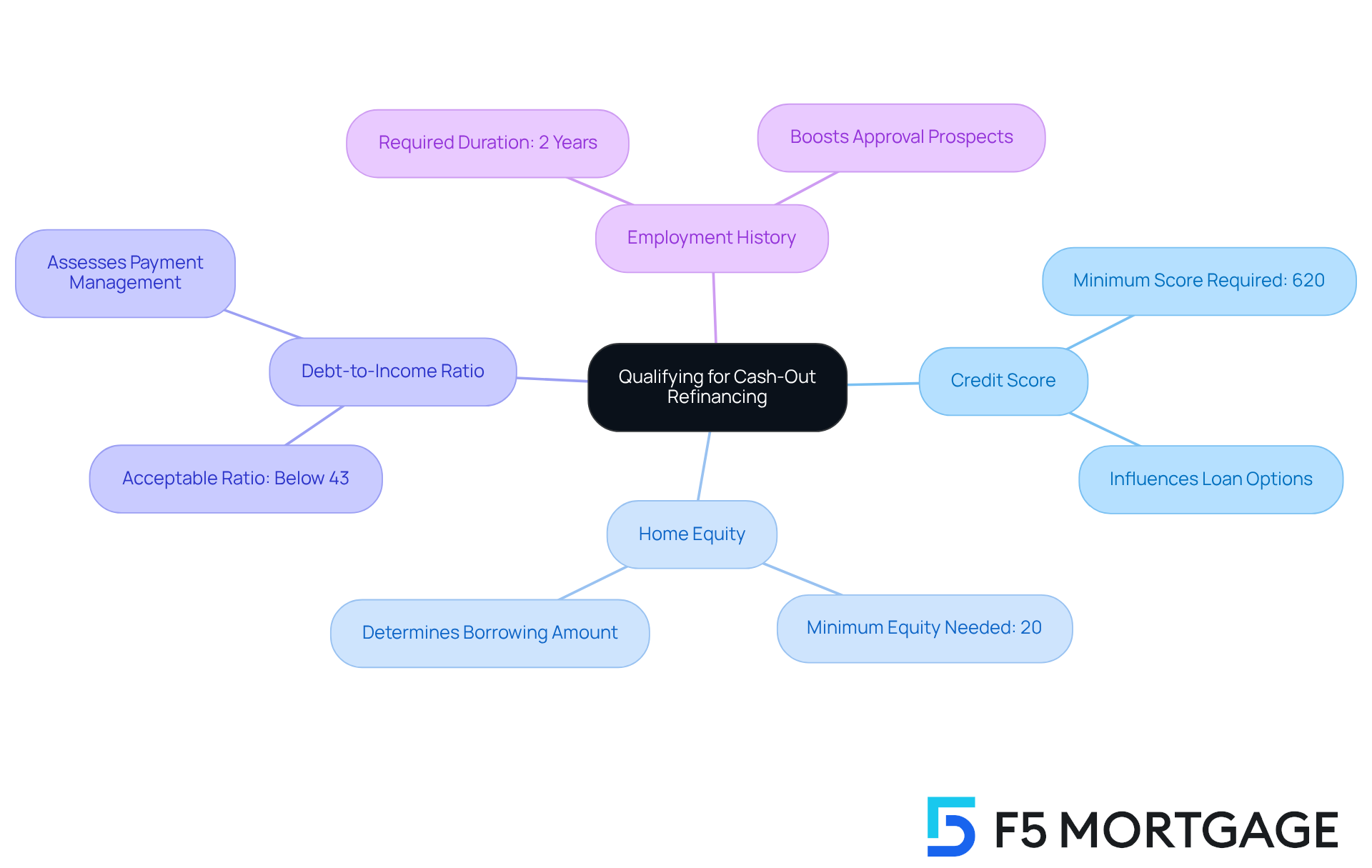

Qualifying for Cash-Out Refinancing: Key Requirements

-

Credit Score: We understand how important your credit score is in this process. Most lenders typically require a minimum score of around 620 to qualify for a cash out mortgage. When a lender endorses your application, it signals that they see you as a strong candidate for a mortgage, which can positively influence your loan options.

-

Home Equity: It’s crucial to know that homeowners usually need at least 20% equity in their home to be eligible for refinancing. This equity plays a vital role in determining how much you can borrow during the loan restructuring process, particularly if you opt for a cash out mortgage, giving you the opportunity to take control of your financial future.

-

Debt-to-Income Ratio: We know how concerning financial ratios can be, but a low debt-to-income ratio—generally below 43%—is essential for approval. Lenders look at this ratio to assess your ability to manage monthly payments, and maintaining a healthy balance can significantly enhance your chances of securing a loan.

-

Employment History: Lenders often seek a stable employment history, typically requiring at least two years of consistent income. A strong employment background not only boosts your approval prospects but also broadens your credit options, helping you feel more secure in your financial journey.

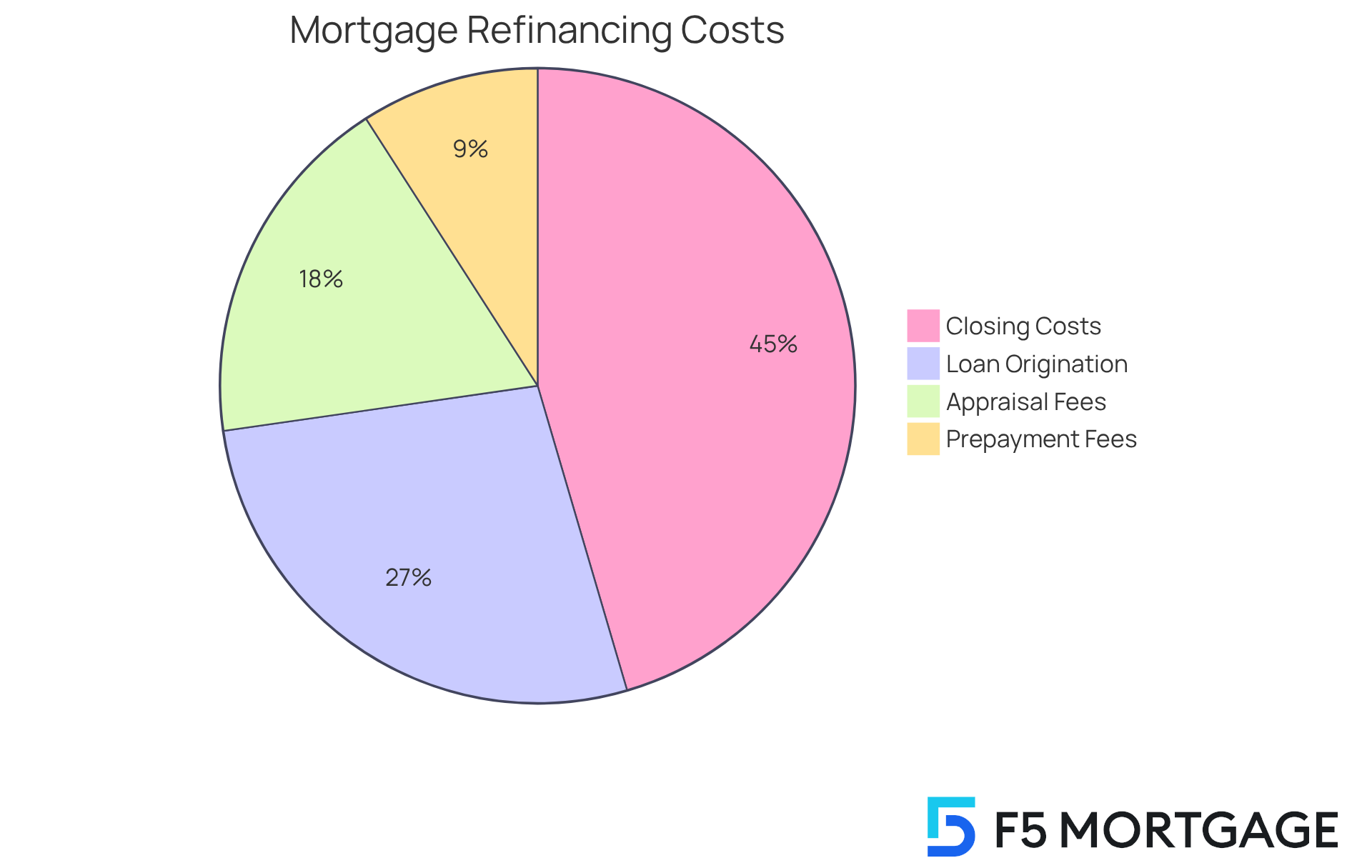

Costs and Fees: Understanding Financial Implications

Cash-out mortgage refinancing can often seem daunting, particularly with closing expenses ranging from 2% to 5% of the mortgage amount. This can add up quickly. For example, if you’re refinancing a property in Denver valued at $500,000, you might face closing costs of up to $25,000. We understand how overwhelming this can be. Fortunately, many Colorado homeowners can take advantage of down payment assistance programs designed to help alleviate these costs.

Additionally, partnering with F5 Mortgage allows you to collaborate with top lenders, making it simpler to compare rates and discover the most affordable refinance options available. It’s all about finding the right fit for your needs.

You should also be aware that loan origination fees may apply, which can vary depending on the lender and the loan amount. An appraisal might be necessary to determine the current market value of your property, contributing to the overall expenses. Moreover, some lenders may impose prepayment fees if you decide to pay off your current mortgage early. It’s essential to evaluate these factors thoughtfully as you consider a cash out mortgage for obtaining a new loan. Remember, we’re here to support you every step of the way.

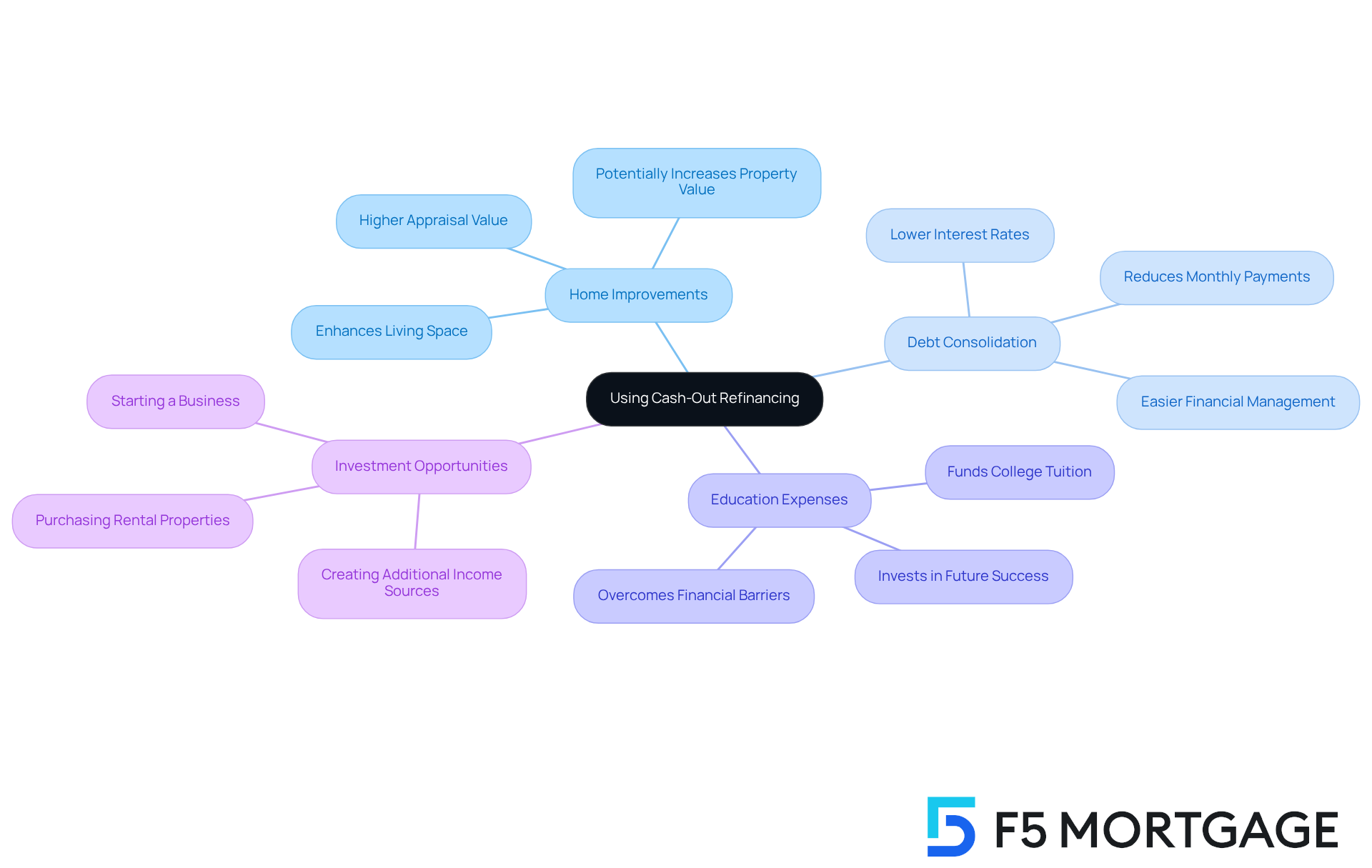

Using Cash-Out Refinancing: Smart Ways to Utilize Your Funds

Utilizing a cash out mortgage can be a strategic method to access the equity in your residence, enabling you to cover various significant expenses. We understand how daunting financial decisions can be, and we’re here to support you every step of the way. Here are some smart ways to utilize your funds:

-

Home Improvements: Consider using the cash to renovate or upgrade your home. This not only enhances your living space but may also increase its value. Refinancing can provide you with the necessary funds to make these enhancements, potentially leading to a higher appraisal value.

-

Debt Consolidation: If you’re feeling overwhelmed by high-interest debts, such as credit cards or personal loans, using a cash out mortgage can help. By restructuring your mortgage, you can often obtain a lower interest rate, reducing your monthly payments and overall interest costs. This makes it easier to manage your financial obligations.

-

Education Expenses: Investing in education is a meaningful way to secure a brighter future for yourself or your loved ones. By utilizing your property equity through loan restructuring, you can fund college tuition or other educational costs, ensuring that financial barriers don’t stand in the way of success.

-

Investment Opportunities: Think about using the funds for investment purposes, like purchasing rental properties or starting a business. With the right strategy for loan restructuring, you can leverage your property equity to create additional income sources or invest in opportunities that promise long-term benefits.

By comprehending the cash out mortgage process in California and the related advantages, households can make informed choices about how to best utilize their options with F5 Mortgage. We know how challenging this can be, but with the right guidance, you can take confident steps toward your financial goals.

Final Thoughts: Is Cash-Out Refinancing Right for You?

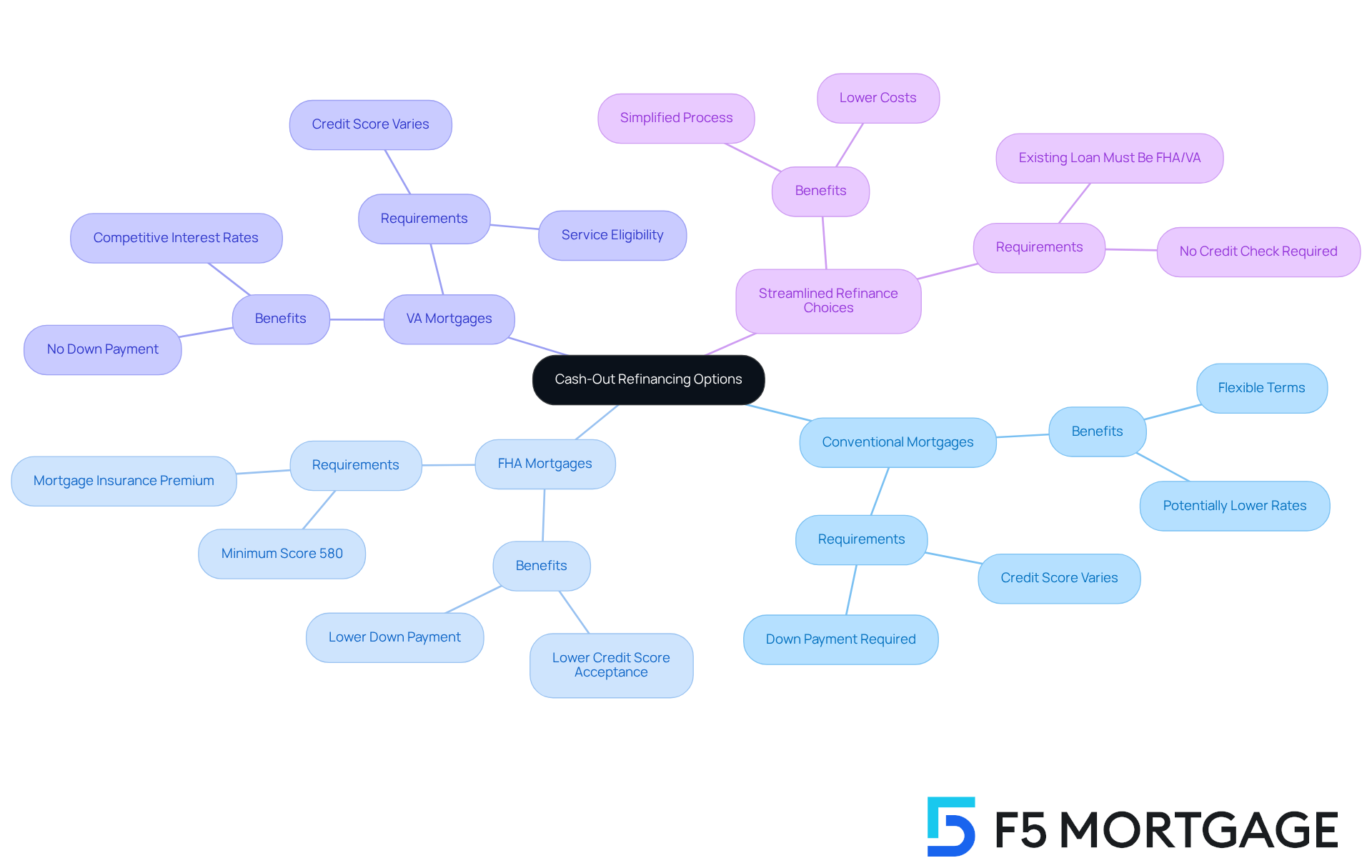

A cash out mortgage modification can be a valuable resource for families looking to tap into their home equity for various needs. We understand how overwhelming the mortgage process can feel, especially in Colorado, where homeowners have a range of refinancing options available. These include:

- Conventional mortgages

- FHA mortgages

- VA mortgages

- Streamlined refinance choices

Each option comes with its own benefits and requirements, making it crucial for families to grasp which type aligns best with their financial goals.

For example, FHA loans are often more accessible for those with lower credit scores, typically requiring a minimum score of 580. On the other hand, VA loans provide favorable rates for military members and their spouses, often without the need for a down payment. However, it’s essential to weigh these benefits against the potential risks and costs involved.

By understanding the process and the smart ways to utilize the funds, families can make informed decisions that suit their circumstances. We know how challenging this can be, which is why consulting with a trusted mortgage broker, like F5 Mortgage, can be incredibly beneficial. They offer personalized insights and support throughout the refinancing journey, ensuring that families choose the best refinancing option for their unique needs.

Conclusion

A cash-out mortgage offers families a valuable opportunity to effectively leverage their home equity. We understand how challenging financial decisions can be, and by grasping the nuances of this financial tool, homeowners can make informed choices that align with their long-term goals. This approach not only provides access to essential funds but also enables families to restructure their financial obligations in a more manageable way.

Throughout this article, we shared key insights about cash-out refinancing, including its definition, benefits, and potential risks. Our step-by-step guide emphasized the importance of evaluating home equity, assessing financial situations, and understanding the costs associated with refinancing. Additionally, comparing it to alternatives like home equity loans and HELOCs highlighted the unique advantages and considerations families must weigh before proceeding.

Ultimately, the decision to pursue a cash-out mortgage should be made with careful consideration of your individual circumstances and financial goals. Engaging with a knowledgeable mortgage broker, such as F5 Mortgage, can provide invaluable support and tailored solutions to navigate this complex process. We encourage families to explore their options and take proactive steps toward achieving financial stability and growth through informed mortgage choices. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage LLC?

F5 Mortgage LLC is an independent mortgage brokerage that specializes in providing competitive cash-out mortgage solutions to households.

What services does F5 Mortgage offer?

F5 Mortgage offers tailored financing options for refinancing or purchasing a home, leveraging a network of lenders and innovative technology. They provide a user-friendly online application platform and real-time financing tracking.

What is a cash-out mortgage?

A cash-out mortgage allows homeowners to replace their existing mortgage with a new, larger loan, converting the difference into cash. This can be used for various needs such as home improvements, debt consolidation, or major purchases.

How does a cash-out mortgage differ from conventional loan modifications?

Unlike conventional loan modifications that focus on reducing monthly payments or interest rates, a cash-out mortgage enables homeowners to access their home equity for cash.

What should homeowners consider before pursuing a cash-out mortgage?

Homeowners are advised to plan to stay in their residence for at least five years to build sufficient equity, which maximizes the benefits of a cash-out mortgage.

What are the steps involved in cash-out refinancing?

The steps include: 1. Evaluate your home equity by subtracting your mortgage balance from your home’s current market value. 2. Assess your financial situation, including credit score, income, and debt-to-income ratio. 3. Research refinancing options by comparing various lenders and financing alternatives. 4. Submit your application with necessary documentation. 5. Undergo the underwriting process where the lender reviews your application and financial history. 6. Finalize the financing by completing the cash-out mortgage and receiving the cash difference at closing.

What documentation is needed to apply for a cash-out mortgage?

Necessary documentation includes income verification and property details.

What happens after the cash-out mortgage is approved?

Once approved, the existing mortgage is settled, and the homeowner receives the cash difference at closing. The new lender then takes over the original loan, and monthly payments are directed to them.