Overview

Navigating the world of DSCR loan rates can feel overwhelming for homebuyers. We understand how challenging this can be. The main factors that influence these rates include:

- Market conditions

- Borrower creditworthiness

- Property type and location

- Lender policies

Each of these elements plays a crucial role in determining the terms and costs associated with DSCR loans.

By understanding these factors, homebuyers can secure more favorable financing options. It’s essential to evaluate each aspect within the context of the current economic landscape. This knowledge empowers you to make informed decisions, ensuring that you are well-equipped to tackle the mortgage process with confidence.

Remember, we’re here to support you every step of the way. Taking the time to assess these influences can make a significant difference in your homebuying journey.

Introduction

Navigating the complexities of Debt Service Coverage Ratio (DSCR) loan rates is a crucial step for homebuyers in today’s competitive mortgage landscape. We understand how challenging this can be, especially as economic conditions shift and lender policies evolve. The factors influencing these rates can significantly impact your financing opportunities, and we’re here to support you every step of the way.

What challenges do borrowers face in securing the most favorable terms? How can you leverage your financial profile to enhance your chances? This article delves into the ten key elements that shape DSCR loan rates, empowering you to make informed decisions in your home financing journey. Together, let’s explore these vital aspects and help you achieve your homeownership dreams.

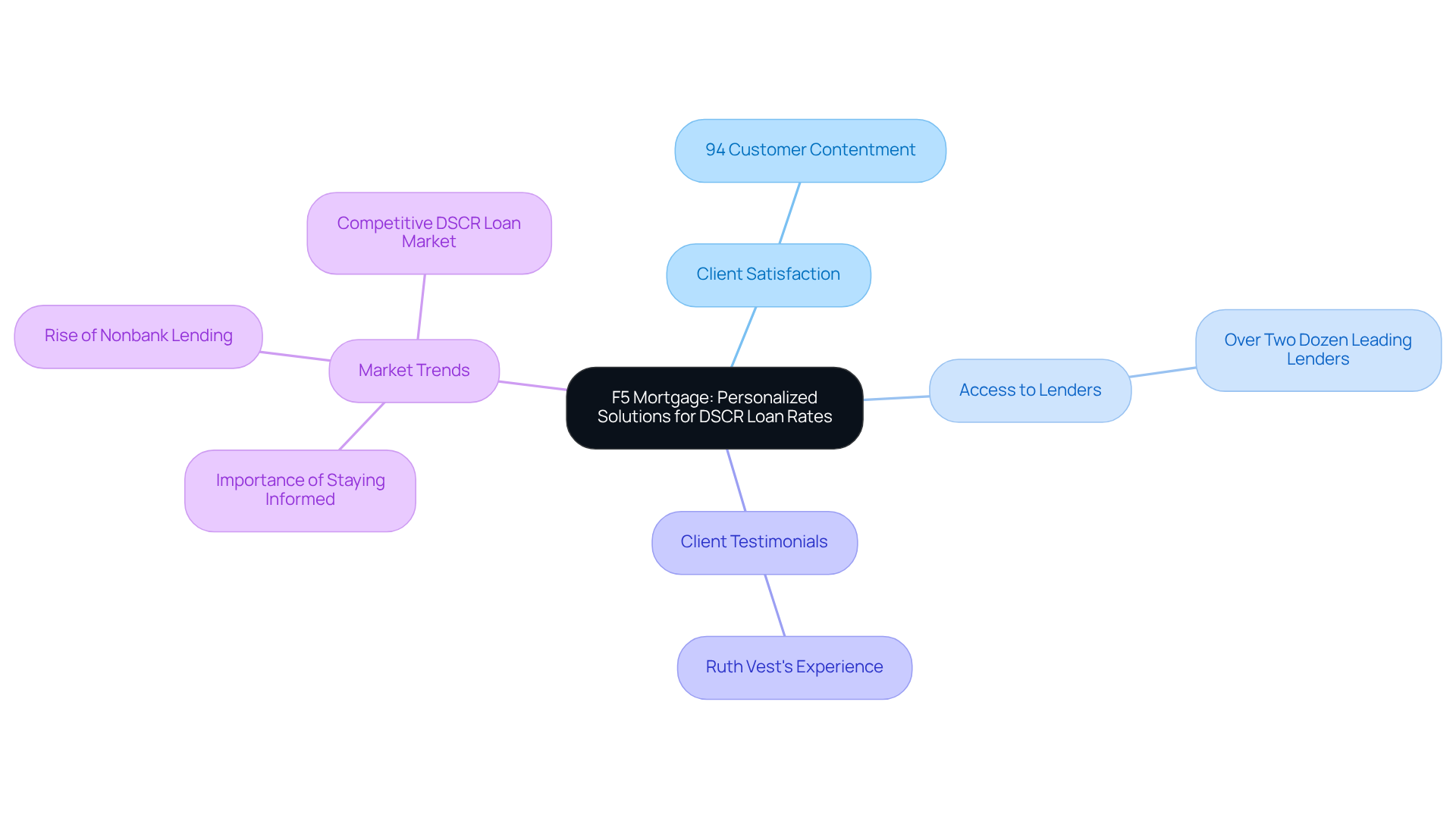

F5 Mortgage: Personalized Solutions for Competitive DSCR Loan Rates

At F5 Mortgage LLC, we understand how challenging navigating the mortgage brokerage industry can be. That’s why we set ourselves apart by offering customized solutions specifically designed for clients seeking financing with DSCR loan rates. By taking the time to truly comprehend each client’s financial situation, we provide tailored consultations that clarify the intricacies of DSCR financing.

Our client-focused approach not only enhances satisfaction levels—boasting an impressive 94% customer contentment—but also ensures that borrowers secure competitive terms aligned with their investment goals. With access to a diverse network of over two dozen leading lenders, we simplify the process for clients to find the most suitable financial solutions for their unique needs.

Clients like Ruth Vest have praised our team for our outstanding service, sharing, “F5 Mortgage managed my financial requirements remarkably well.” Others have noted how our personalized consultations lead to advantageous outcomes in securing competitive DSCR loan rates. We emphasize the importance of exploring various financing options to ensure you receive the most favorable terms.

As the market for DSCR loan rates evolves, staying informed about the latest trends is crucial for optimizing your investment opportunities. At F5 Mortgage, we’re here to support you every step of the way, ensuring that your home financing experience is as seamless as possible.

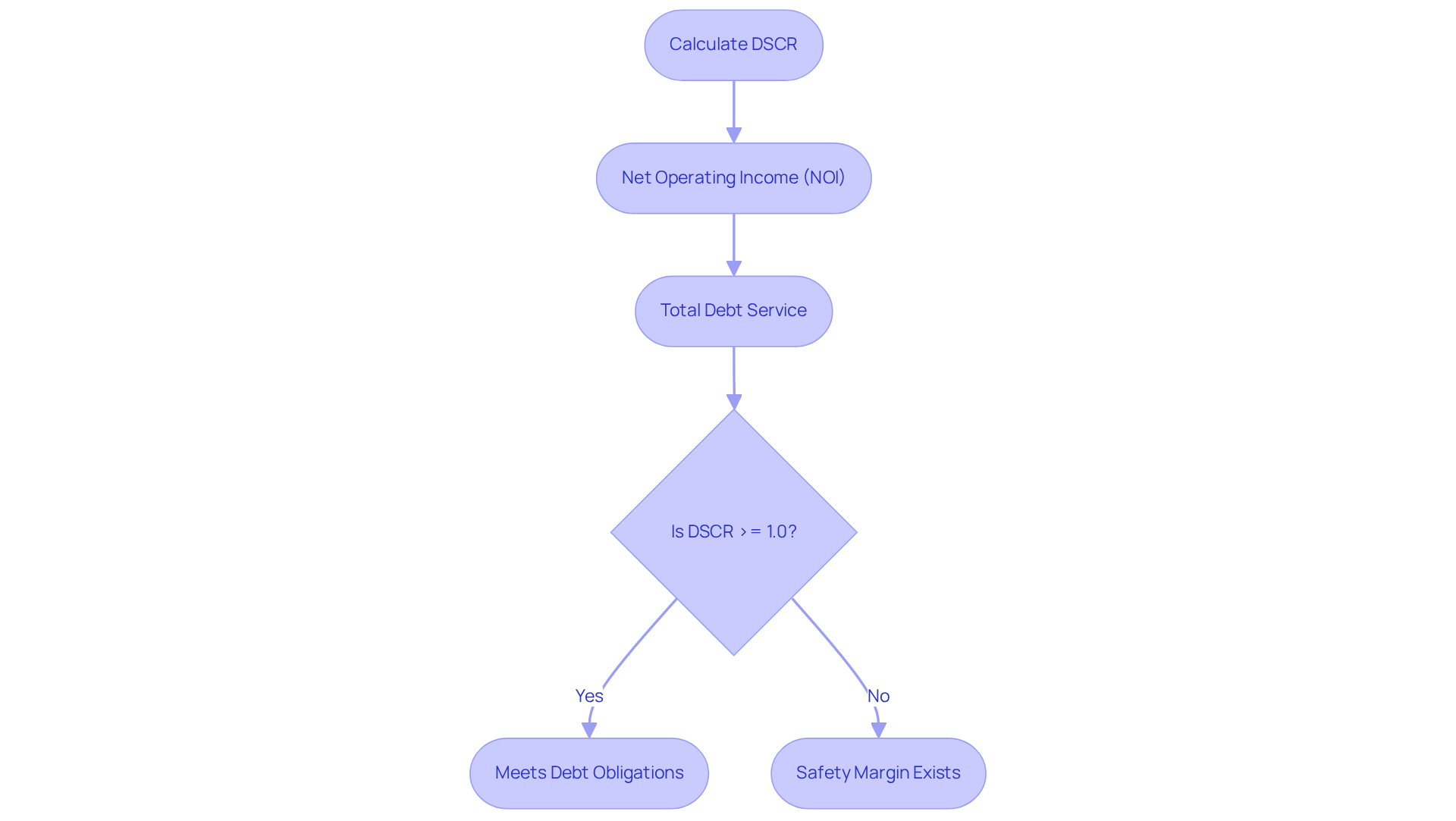

Debt Service Coverage Ratio (DSCR): The Foundation of Loan Assessment

Understanding the Debt Service Coverage Ratio (DSCR) is essential for anyone navigating the borrowing landscape. This vital measure helps lenders assess a borrower’s ability to meet debt commitments. It’s calculated by dividing the net operating income (NOI) of a property by its total debt service, which includes both principal and interest payments.

Imagine a DSCR of 1.0—this means the property generates just enough income to cover its debt obligations. However, a ratio above 1.0 provides a safety margin, reducing risk for lenders. In 2025, many lenders began requiring minimum DSCRs between 1.20 and 1.25, reflecting a growing emphasis on financial stability.

For homebuyers and investors, grasping the nuances of the debt service coverage ratio is crucial. It not only influences borrowing eligibility but also impacts the DSCR loan rates that are offered to borrowers. We know how challenging this can be, and understanding these metrics can empower you in your financing decisions and overall investment strategy. Remember, we’re here to support you every step of the way.

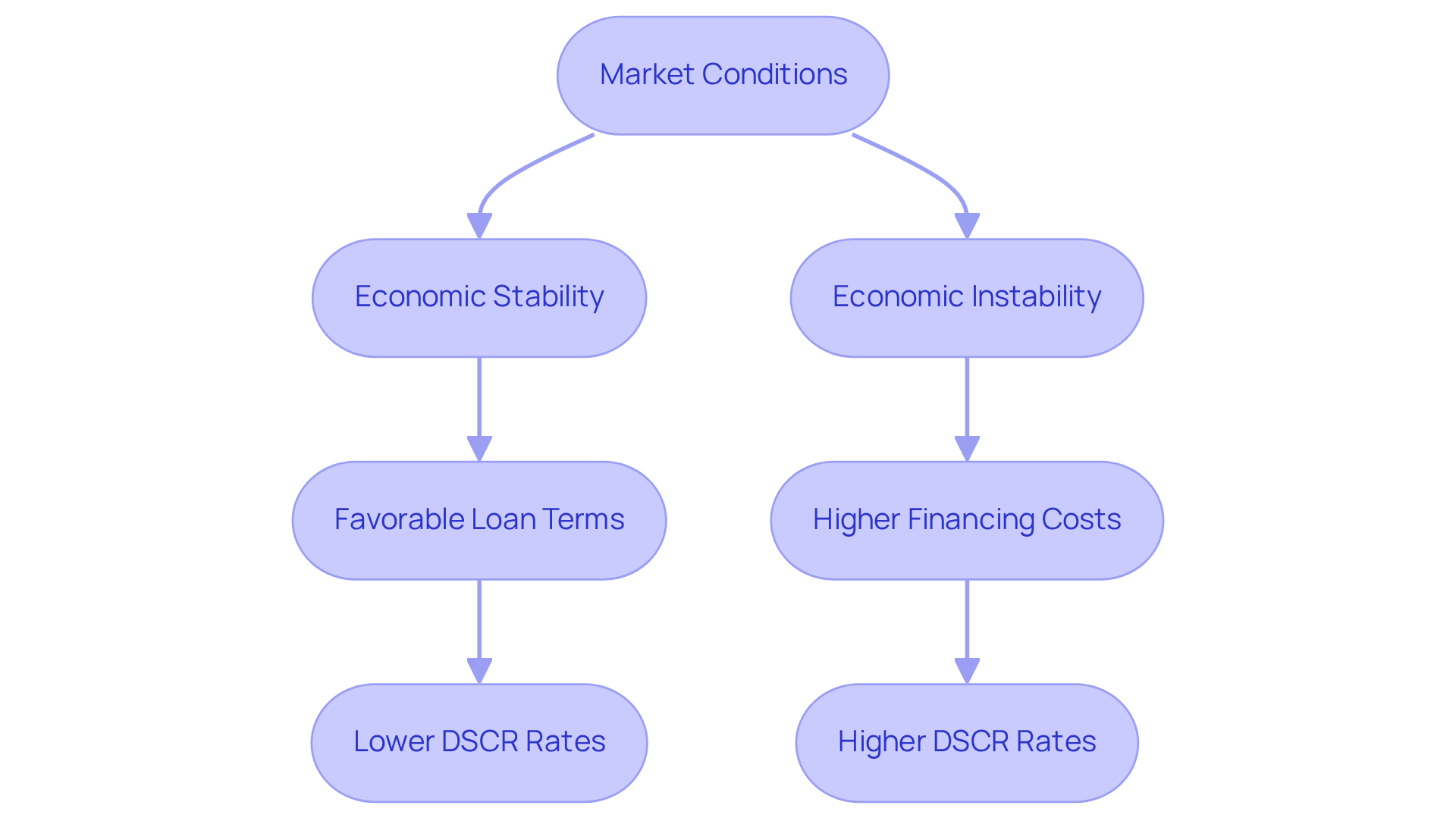

Market Conditions: How Economic Trends Affect DSCR Loan Rates

Market conditions significantly influence the costs associated with dscr loan rates, and we know how challenging this can be. Economic indicators, such as inflation, employment levels, and overall growth, play a role in shaping lender perceptions of risk. For instance, during periods of economic stability, lenders often feel more confident, which can lead to more favorable terms. They trust that individuals have the capacity to repay their debts.

Conversely, in times of economic instability, financing costs may rise as lenders seek to mitigate their risk. Understanding these market dynamics is essential for anyone looking to secure the best dscr loan rates for financing. We’re here to support you every step of the way as you navigate these challenges and work towards your financial goals.

Lender Policies: The Impact of Risk Assessment on DSCR Rates

Lender policies significantly influence the DSCR loan rates, and we understand how overwhelming this can feel. Each lender has unique risk assessment criteria that often include your credit score, the location of the property, and the current economic landscape. For instance, some lenders may require a higher Debt Service Coverage Ratio for specific property types, reflecting their risk appetite. On the other hand, if you have a strong credit history, you might find yourself enjoying more favorable rates.

As we move into 2025, it’s important to note that lenders generally prefer that DSCR loan rates reflect a minimum DSCR of 1.2. This means that your property’s income should exceed its debt obligations by at least 20%, a crucial threshold for securing competitive DSCR loan rates. Additionally, the economic climate can sway lender policies; in a thriving market, lenders may ease their requirements, while in tougher times, they might tighten them. Understanding these nuances can empower you to navigate the lending landscape more effectively, particularly in relation to DSCR loan rates that align with your financial situation.

Utilizing tools like debt service coverage ratio calculators can help you assess your eligibility for DSCR loan rates and make informed decisions, ultimately enhancing your chances of securing favorable financing. If you’re an investor, be prepared to submit 24 months of bank statements and a detailed profit-and-loss report to demonstrate a debt service coverage ratio of 1.3. This highlights the importance of thorough documentation.

Consider the story of a property manager who successfully improved his debt service coverage ratio from 1.1 to 1.4 by renegotiating service agreements and increasing rental prices. This example illustrates practical steps you can take. Remember, a debt service coverage ratio greater than 1 signifies that your income exceeds your debt commitments, emphasizing the importance of considering DSCR loan rates to maintain a healthy ratio.

As of November 2024, the average borrowing cost for DSCR loan rates stands at 7.39%, compared to traditional borrowing costs averaging 6.89%. This insight into current market conditions can be invaluable. Furthermore, the flexibility in paperwork for debt service coverage ratio financing can also assist investors with unconventional income streams, making these options even more appealing. We’re here to support you every step of the way as you navigate this process.

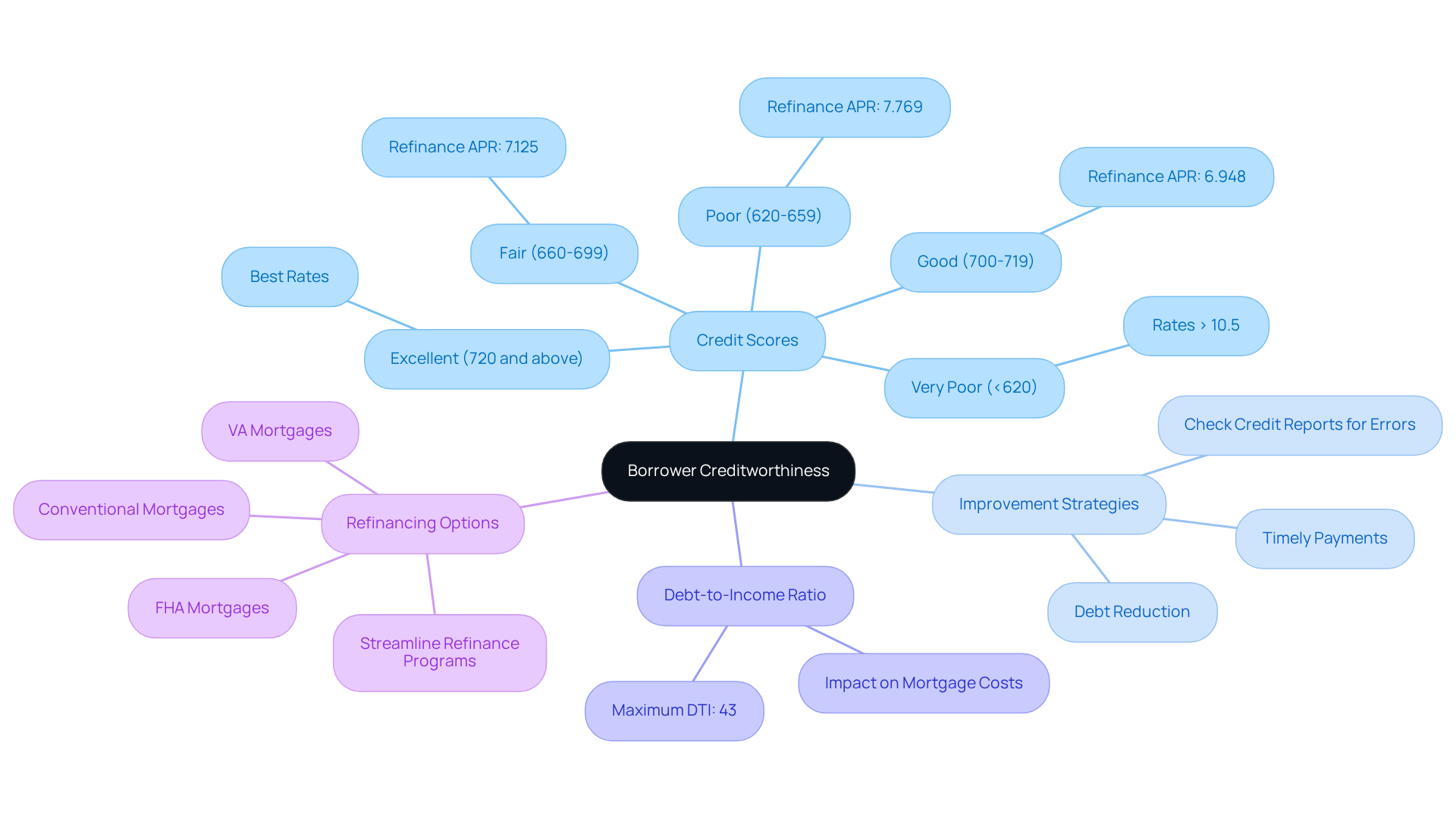

Borrower Creditworthiness: Evaluating Financial Health for Better Rates

Understanding your creditworthiness is essential when navigating the complexities of dscr loan rates pricing. We know how challenging this can be, and lenders carefully evaluate credit scores, credit history, and overall financial health to assess the risks involved in lending to you. Typically, a higher credit score is linked to lower borrowing costs, reflecting a decreased likelihood of default. For instance, individuals with excellent credit scores (720 and above) often enjoy significantly better rates, while those with scores below 640 may encounter rates exceeding 10.5%. This stark difference underscores the importance of actively managing your credit profile.

To enhance your credit score, consider implementing effective strategies such as:

- Making timely bill payments

- Reducing existing debts

- Regularly checking your credit reports for errors

Financial consultants emphasize that even small improvements in your credit score can lead to more favorable borrowing conditions. For example, a borrower with a score of 718 could see benefits from a slight increase, potentially qualifying for a lower interest tier.

Additionally, grasping the Debt-to-Income (DTI) ratio is vital, as a maximum of 43% DTI is generally required for home financing. This ratio, which compares your current debt to your income, can significantly impact your mortgage costs. As we look ahead to 2025, with current debt service coverage ratios ranging from 7.5% to 10.5%, understanding the nuances of creditworthiness and DTI is crucial for homebuyers aiming to optimize their financing options. These factors directly influence the terms and costs associated with your dscr loan rates for mortgage funding.

Moreover, if you’re a Colorado resident, you have various refinancing choices available, including:

- Conventional mortgages

- FHA mortgages

- VA mortgages

- Streamline Refinance Programs

Each option comes with specific eligibility criteria that can affect your overall costs. We’re here to support you every step of the way as you explore these opportunities.

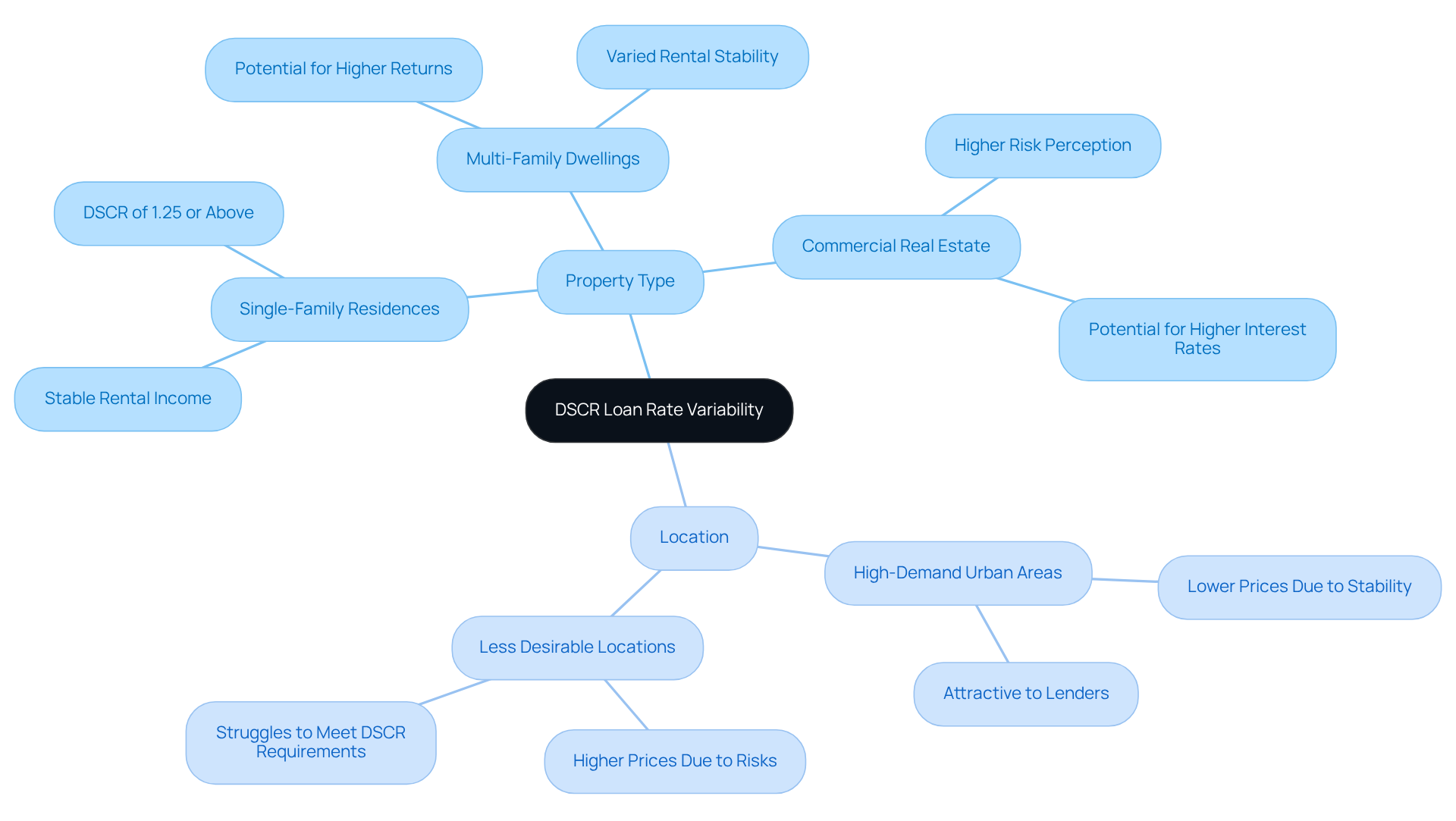

Property Type and Location: Their Role in DSCR Loan Rate Variability

The type and location of a property can greatly impact your DSCR loan rates, and we know how challenging this can be. Properties in high-demand urban areas often command lower prices because of their potential for stable rental income. In contrast, properties in less desirable locations may face higher prices due to perceived risks. Additionally, different property categories—like single-family residences, multi-family dwellings, or commercial real estate—can also influence costs. It’s crucial for you to consider these factors when seeking funding, as lenders frequently have specific criteria regarding which property categories qualify for advantageous financing conditions.

For instance, single-family residences in prosperous areas may yield a Debt Service Coverage Ratio of 1.25 or above. This indicates reduced risk for lenders, which could lead to better terms for you. Currently, the DSCR loan rates typically range from 6.5% to 8.5%, which is often 1% to 2% higher than traditional loans. On the other hand, properties with less stable rental income, such as those in declining markets, may struggle to meet the minimum debt service coverage ratio requirements, resulting in higher interest rates. Understanding these dynamics is essential for you as a borrower aiming to secure the best financing options.

Furthermore, most DSCR lenders offer up to 80% LTV on stabilized properties, which can significantly influence your financing decisions based on property type and location. Incorporating insights from real estate experts can deepen your understanding of how these elements interact and ultimately affect financing costs. Remember, we’re here to support you every step of the way as you navigate this process.

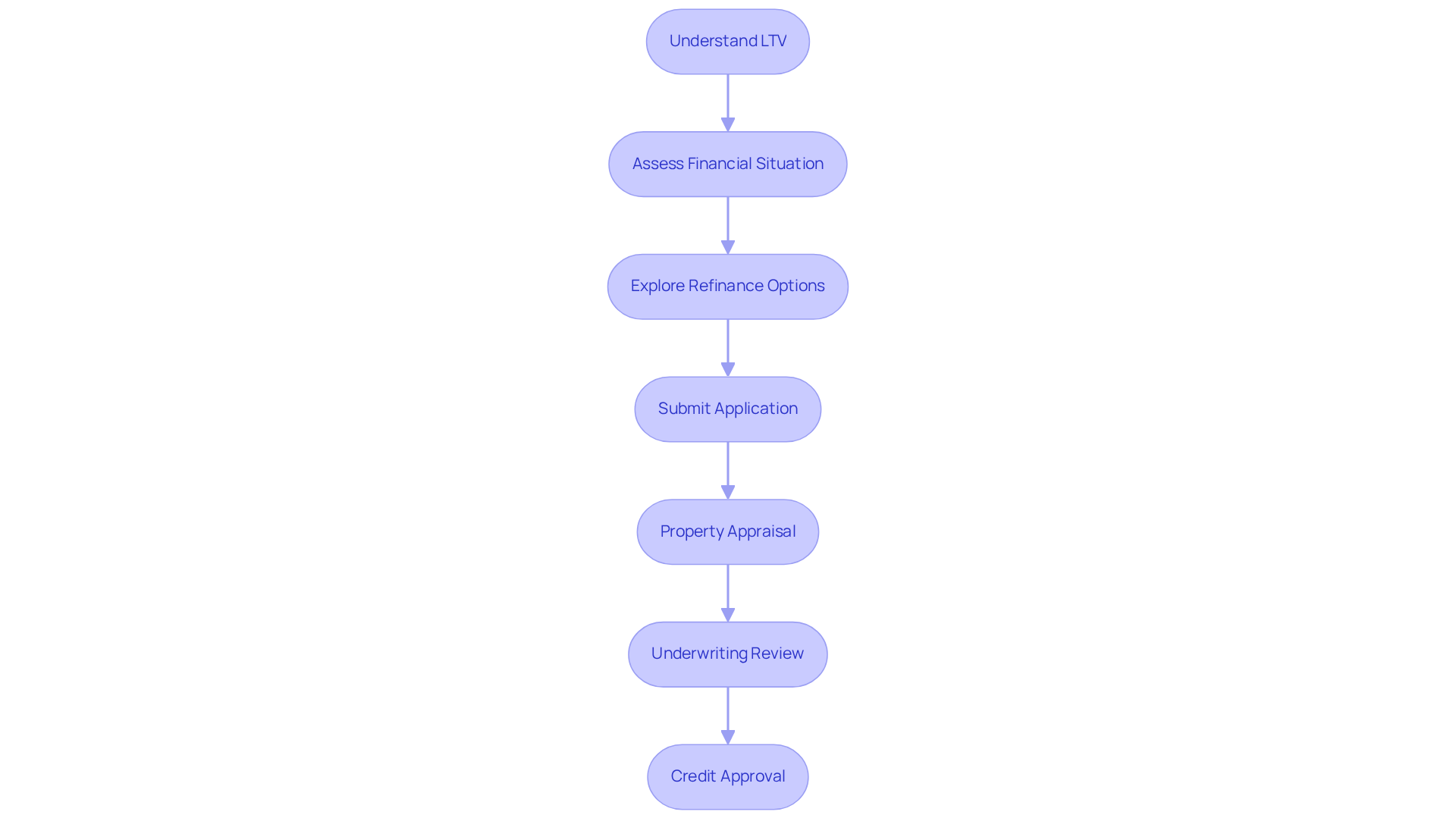

Loan-to-Value Ratio (LTV): Understanding Its Influence on DSCR Rates

Understanding the Loan-to-Value Ratio (LTV) is crucial for anyone navigating the mortgage landscape. This pivotal metric helps lenders assess the risk associated with a mortgage. Simply put, LTV is calculated by dividing the borrowed amount by the property’s assessed value. A lower LTV indicates that you have a larger equity share in your home, which often leads to better interest rates. For instance, if your LTV is below 80%, you may be seen as a lower risk, opening the door to the best financing options available.

However, a higher LTV can signal greater risk to lenders, potentially resulting in increased interest rates. As you contemplate refinancing your mortgage with F5 Mortgage, grasping your LTV becomes essential. After taking a close look at your financial situation and exploring your refinance options, you’ll submit an application that includes your property details and financial documents.

Next, an appraisal will determine your property’s current value, directly impacting your LTV. The underwriting process will then review your loan application, credit history, debt-to-income ratio, and other requirements to finalize your credit approval. As we move through 2025, the implications of LTV on mortgage costs are increasingly significant, with many lenders adjusting their offerings based on this ratio.

Mortgage brokers emphasize that maintaining a lower LTV not only boosts your chances of securing favorable terms but also reflects your financial stability. Moreover, LTV is key in shaping financing terms, as lenders evaluate the risk associated with the property’s value relative to the borrowed amount. Ultimately, understanding and managing your LTV is vital for optimizing your mortgage financing options. We know how challenging this can be, but we’re here to support you every step of the way.

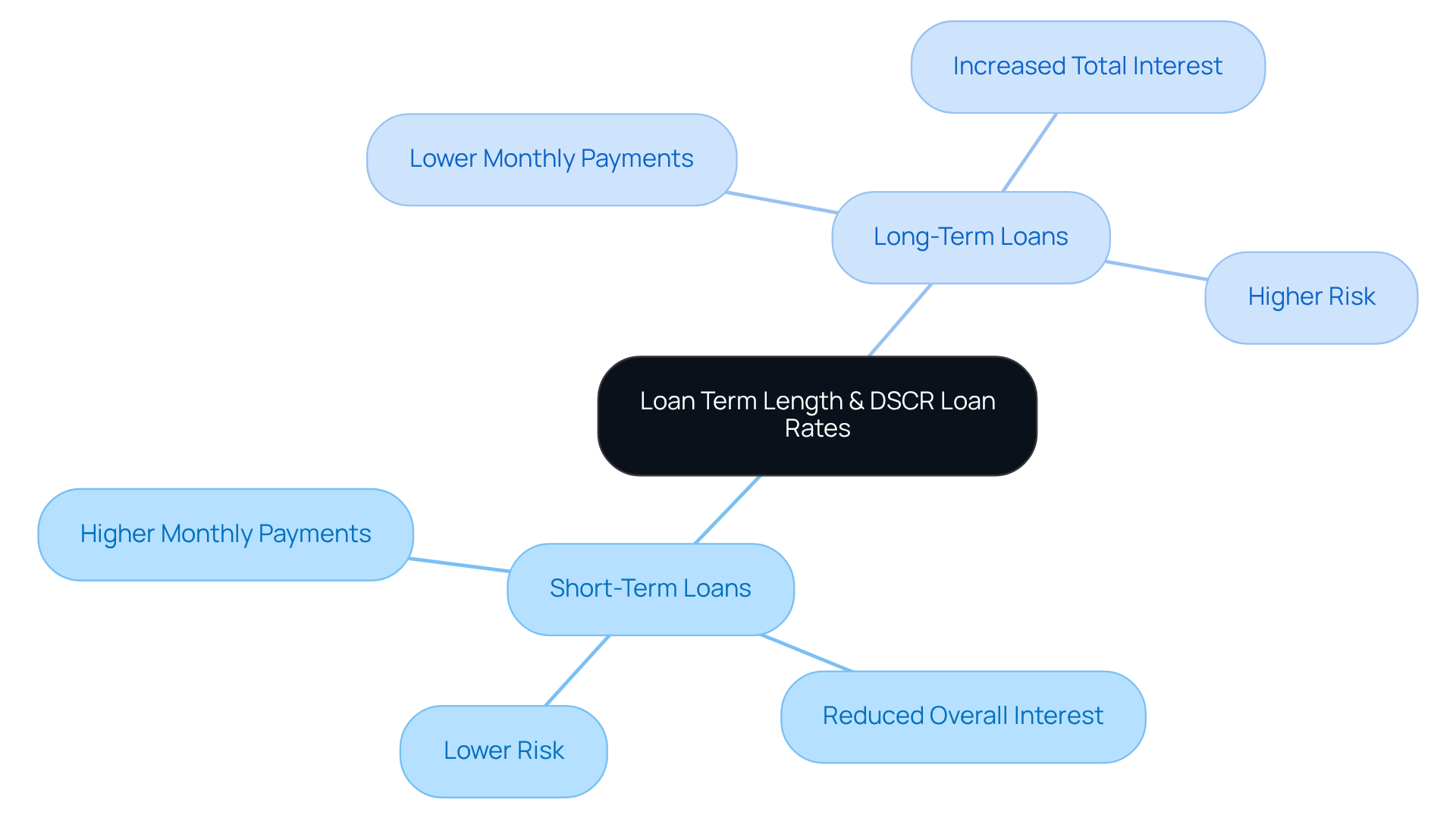

Loan Term Length: How It Affects DSCR Loan Rate Calculations

The duration of the borrowing period can significantly influence your DSCR loan rates. We know how challenging it can be to navigate these decisions. Typically, shorter borrowing periods come with higher monthly payments but reduced overall interest expenses. In contrast, extended terms may provide lower monthly payments at the cost of increased total interest paid over time. Lenders frequently modify terms depending on the estimated risk linked to various duration lengths. For example, a 15-year loan may have a lower interest cost compared to a 30-year loan due to the diminished risk of default over a shorter duration.

In 2025, competitive DSCR loan rates for shorter terms are anticipated to vary from 7.25% to 8.25%. This makes them an appealing choice for borrowers seeking to reduce interest expenses. Additionally, a 15-year fixed-rate mortgage allows homebuyers to own their home in half the time of a traditional mortgage, further emphasizing the benefits of shorter terms.

At F5 Mortgage, we partner with over two dozen top lenders to ensure that you receive the best possible rates and terms tailored to your needs. Our tailored concierge services mean that we manage the whole process for you, assisting you through the application and coordinating your term selections with your long-term financial objectives. Financial advisors often recommend reflecting on your life stages when choosing a financing term. For instance, younger homebuyers with higher incomes may prefer shorter terms to pay off their homes before significant life expenses arise, such as college tuition for their children. Conversely, those with fluctuating incomes might opt for longer terms to maintain lower monthly payments, even if it means paying more in interest over time.

Ultimately, it’s important to assess your financial circumstances and goals when evaluating DSCR loan rates for the financing period. This choice can greatly affect your total mortgage expenses and cash flow management. Notably, most credits at F5 Mortgage finalize in under three weeks, offering an efficient process for those contemplating shorter financing terms. Additionally, these types of financing usually feature a stable interest for 30 years, which is significant for borrowers assessing various borrowing alternatives. Remember, we’re here to support you every step of the way.

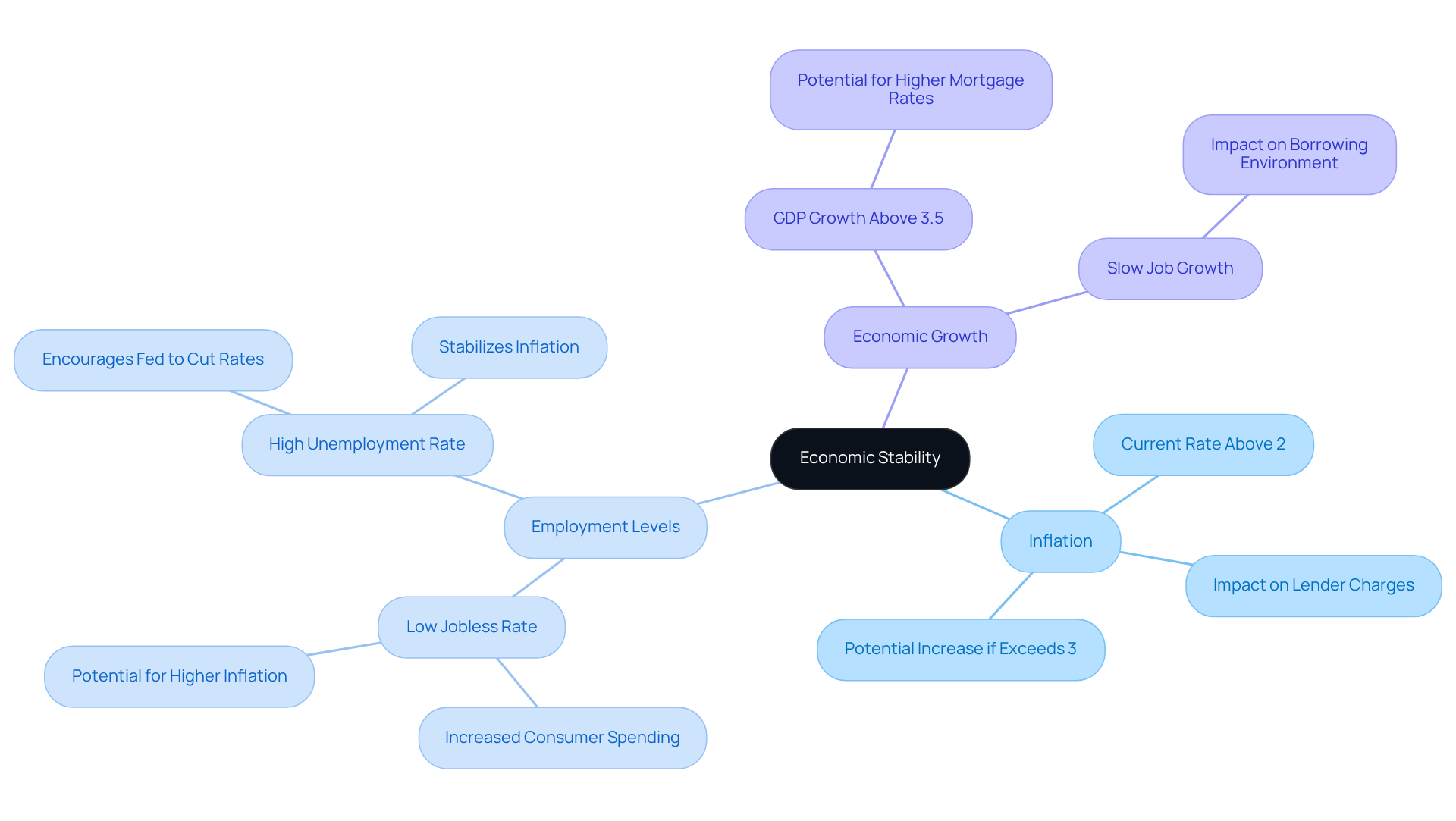

Economic Stability: Its Influence on Future DSCR Loan Rates

Economic stability is essential in influencing the future of dscr loan rates. We understand how challenging it can be to navigate this landscape, especially with key factors like inflation, employment levels, and overall economic growth impacting lender confidence. This, in turn, affects the offers made. For instance, when inflation remains above the Federal Reserve’s goal of 2%, as it does now, lenders may adjust charges to account for heightened risk. Recent data suggests that mortgage costs are anticipated to stay between 6.875% and 7.125% this summer, reflecting the current economic climate.

Employment levels also play a crucial role. A persistently low jobless percentage can lead to increased consumer spending, which may drive inflation higher. Conversely, a growing unemployment level is often seen as a necessary factor for managing inflation, potentially encouraging the Fed to reduce the Federal Funds interest. Experts indicate that if the unemployment percentage falls below 4%, it could result in increased mortgage interest levels, further complicating the borrowing environment.

In a stable economic environment, lenders are more inclined to offer advantageous dscr loan rates, as the risk of borrower default decreases. However, during times of economic instability, like the recent slow job growth and inflationary pressures, lenders may increase charges to mitigate potential risks. We’re here to support you every step of the way, so it’s crucial for borrowers to remain vigilant about these economic trends. Understanding their implications can empower you to make informed financing decisions and navigate the complexities of the mortgage market effectively.

Lending Environment: The Competitive Landscape of DSCR Loan Rates

The borrowing landscape for financing is becoming increasingly competitive, particularly for dscr loan rates, with numerous providers vying for market share. We understand how challenging it can be to navigate these options. This heightened competition often leads to more favorable dscr loan rates for individuals seeking loans, as lenders may lower their offers to attract customers. For instance, as of late 2024, the average debt service coverage ratio interest stands at 7.39%. However, savvy borrowers can find dscr loan rates as low as 6% by exploring various alternatives.

The emergence of alternative lending platforms has broadened options for those in search of loans. This allows families to easily compare prices and terms. By actively investigating their choices and leveraging this competitive environment, borrowers can secure loan terms that align better with their financial goals. Industry experts highlight that properties with a Debt Service Coverage Ratio (DSCR) above 1.1 typically qualify for the most favorable dscr loan rates. This underscores the importance of understanding how competition among lenders can influence overall borrowing costs, particularly dscr loan rates.

Unlike traditional lenders, who may rely on intimidation tactics and a shroud of secrecy to maximize profits, F5 Mortgage is committed to providing transparent, consumer-friendly service. As the market evolves in 2025, it will be essential for investors to stay informed about lender dynamics to optimize their financing strategies. For families looking to upgrade their homes, F5 Mortgage ensures a stress-free experience, encouraging them to explore their options and make informed decisions. We’re here to support you every step of the way.

Conclusion

Understanding the myriad factors influencing DSCR loan rates is essential for homebuyers seeking to make informed financing decisions. We know how challenging this can be, and this article highlights the significance of the Debt Service Coverage Ratio (DSCR) alongside various elements that affect loan rates. These include:

- market conditions

- lender policies

- borrower creditworthiness

- property type and location

- Loan-to-Value (LTV) ratios

- loan term lengths

- overall economic stability

Each of these factors plays a crucial role in determining the rates available to borrowers, impacting their overall financial health and investment strategies.

Key insights reveal the importance of maintaining a strong credit profile and understanding the implications of market dynamics on loan rates. As lenders adjust their offerings based on economic trends and borrower risk assessments, being proactive and informed can lead to securing more favorable terms. Additionally, the competitive landscape of lending means that borrowers have more options than ever, allowing them to shop around for the best rates aligned with their financial goals.

In conclusion, navigating the complexities of DSCR loan rates requires a comprehensive understanding of the various influencing factors. It is vital for borrowers to remain vigilant and informed about these elements, as they can significantly impact financing decisions. Engaging with knowledgeable mortgage professionals, like those at F5 Mortgage, can provide the personalized support necessary to optimize loan terms and enhance overall satisfaction in the homebuying process. By taking charge of one’s financial journey, homebuyers can unlock the potential for successful investments and secure their financial futures.

Frequently Asked Questions

What is F5 Mortgage and what do they offer?

F5 Mortgage LLC specializes in providing customized solutions for clients seeking financing with Debt Service Coverage Ratio (DSCR) loan rates. They focus on understanding each client’s financial situation to offer tailored consultations that clarify DSCR financing.

What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) is a measure used by lenders to assess a borrower’s ability to meet debt commitments. It is calculated by dividing the net operating income (NOI) of a property by its total debt service, which includes both principal and interest payments.

Why is understanding DSCR important for borrowers?

Understanding DSCR is crucial for borrowers as it influences their borrowing eligibility and the DSCR loan rates they may be offered. A higher DSCR indicates a greater ability to cover debt obligations, which can lead to more favorable loan terms.

How do market conditions affect DSCR loan rates?

Market conditions, influenced by economic indicators such as inflation and employment levels, significantly impact DSCR loan rates. During stable economic periods, lenders may offer more favorable terms, while in unstable times, financing costs may rise as lenders seek to mitigate risk.

What is the customer satisfaction rate at F5 Mortgage?

F5 Mortgage boasts an impressive 94% customer satisfaction rate, reflecting their client-focused approach and the effectiveness of their personalized consultations.

How does F5 Mortgage support clients in securing competitive DSCR loan rates?

F5 Mortgage supports clients by offering access to a diverse network of over two dozen leading lenders and emphasizing the exploration of various financing options to ensure clients receive the most favorable terms aligned with their investment goals.

What feedback have clients provided about F5 Mortgage?

Clients have praised F5 Mortgage for their outstanding service and personalized consultations, noting that these lead to advantageous outcomes in securing competitive DSCR loan rates.