Overview

Yes, we understand how challenging it can be to buy a home with bad credit. However, it is indeed possible by exploring specific mortgage options like FHA and VA loans, which are designed for individuals with lower credit scores. These loans can open doors to homeownership, providing hope and opportunity.

It’s important to remember that while these options exist, they may come with higher costs. This means understanding your credit situation is crucial. We encourage you to seek assistance from mortgage brokers who can guide you through the process. Their expertise can significantly enhance your chances of securing financing, helping you take that important step toward your dream home.

We’re here to support you every step of the way as you navigate this journey.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for those facing the challenges of bad credit, typically defined as a score below 580. We understand how daunting these barriers can seem, often leaving many to question whether owning a home is truly within reach.

However, there is hope. This article explores various strategies and options available for individuals with poor credit ratings, shedding light on how you can still secure financing and achieve your dream of homeownership.

What steps can you take to overcome these challenges? What financial tools exist to help turn your dream of owning a home into reality? We’re here to support you every step of the way.

Understand Bad Credit and Its Impact on Home Buying

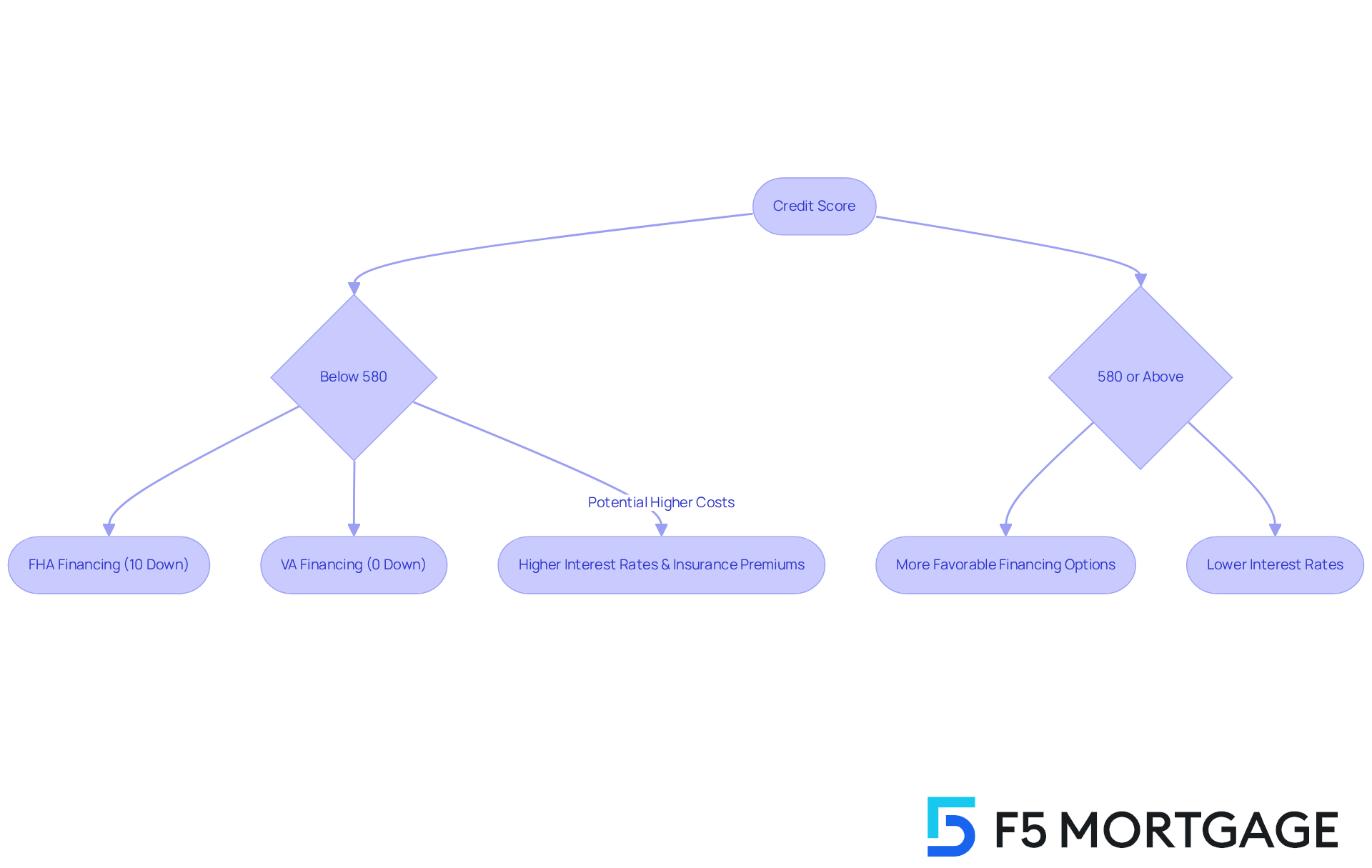

Navigating poor credit ratings, typically defined as a score below 580, can feel overwhelming. We understand how challenging this can be, especially when it makes you wonder, can you buy a home with bad credit, which limits your mortgage options. Lenders often perceive low financial ratings as indicators of higher risk, which can lead to increased interest rates or even denials of financing. It’s crucial to understand how your financial rating affects your journey to homeownership and whether you can buy a home with bad credit. It not only determines your eligibility but also outlines the types of financial assistance available to you and the interest rates you might encounter.

For example, FHA financing often provides a lifeline for individuals with lower credit scores, raising the question of can you buy a home with bad credit, as it allows those with scores as low as 500 to qualify with a 10% down payment. Additionally, VA financing offers a significant advantage, enabling qualified veterans and active-duty service members to purchase a home with 0% down. However, it’s important to note that these financial options may come with higher mortgage insurance premiums, potentially increasing your overall expenses.

Looking ahead to 2025, average interest rates for borrowers with poor financial ratings are projected to range from 6.5% to 7.5%, which can significantly impact your monthly payments. By being aware of these factors, including the advantages of VA and FHA loans, you can better strategize your approach to home buying and address the question of whether you can buy a home with bad credit. Remember, we’re here to support you every step of the way, helping you improve your financial outcomes and achieve your dream of homeownership.

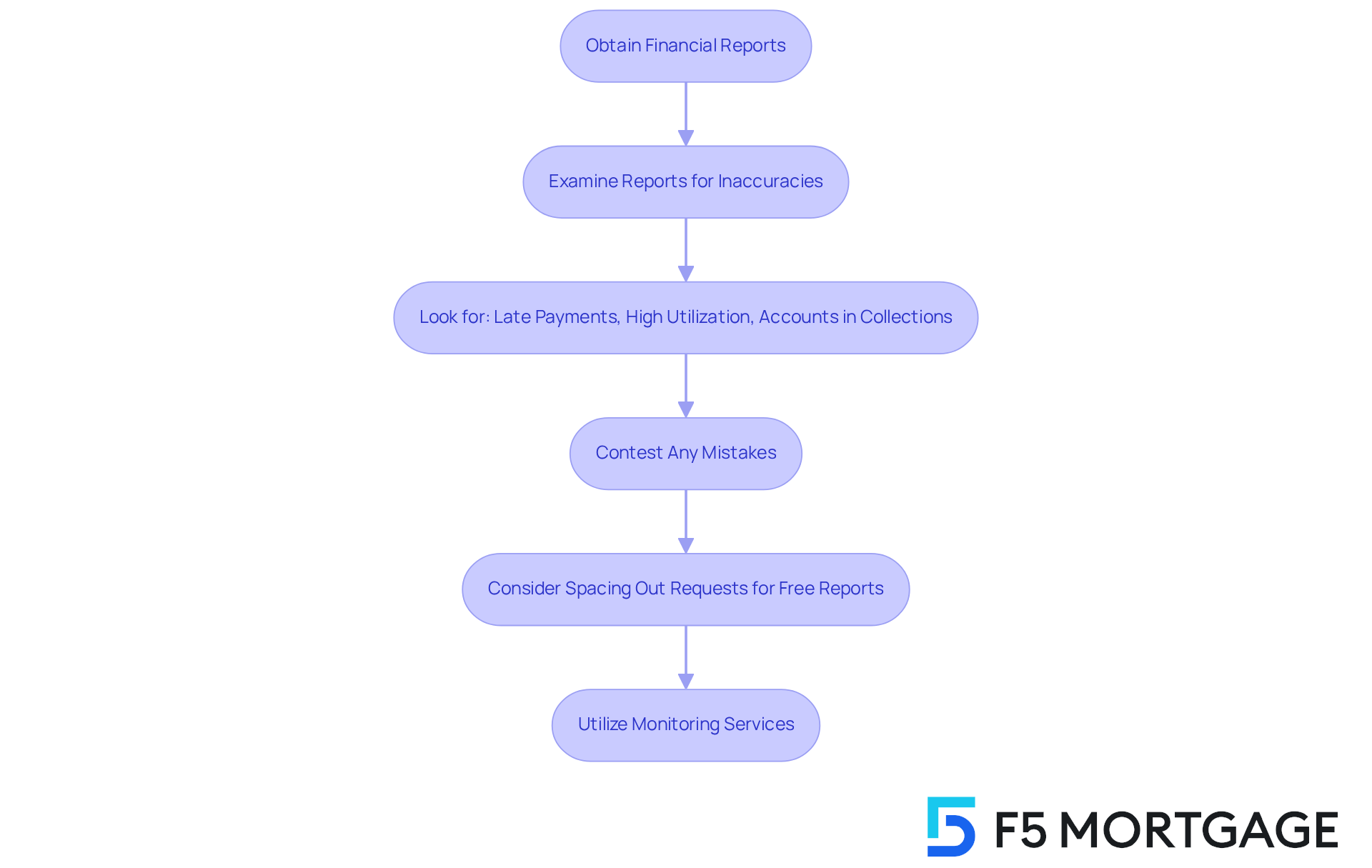

Check Your Credit Score and Report

Begin by acquiring your financial report from the three primary reporting agencies: Experian, TransUnion, and Equifax. We know how challenging it can be to navigate your financial landscape, so it’s important to remember that you are entitled to one free report from each bureau annually at AnnualCreditReport.com. If you’ve been refused financing or insurance within the past 60 days, you are also eligible for another free copy.

As you examine your report, look for any inaccuracies or unfavorable aspects that might be impacting your evaluation. Pay particular attention to:

- Late payments

- High utilization of available funds

- Any accounts in collections

If you discover mistakes, contest them promptly; this can significantly enhance your results.

Consider spacing out your requests for free reports throughout the year. This strategy allows you to track your finances more effectively and stay on top of your financial health. Moreover, think about utilizing monitoring services to keep an eye on your score and receive notifications regarding important changes.

Remember, each person has a distinct financial narrative. Resolving inconsistencies can lead to a significant enhancement in your financial status, which raises the question: can you buy a home with bad credit by ultimately increasing your likelihood of loan approval? We’re here to support you every step of the way in achieving your financial goals.

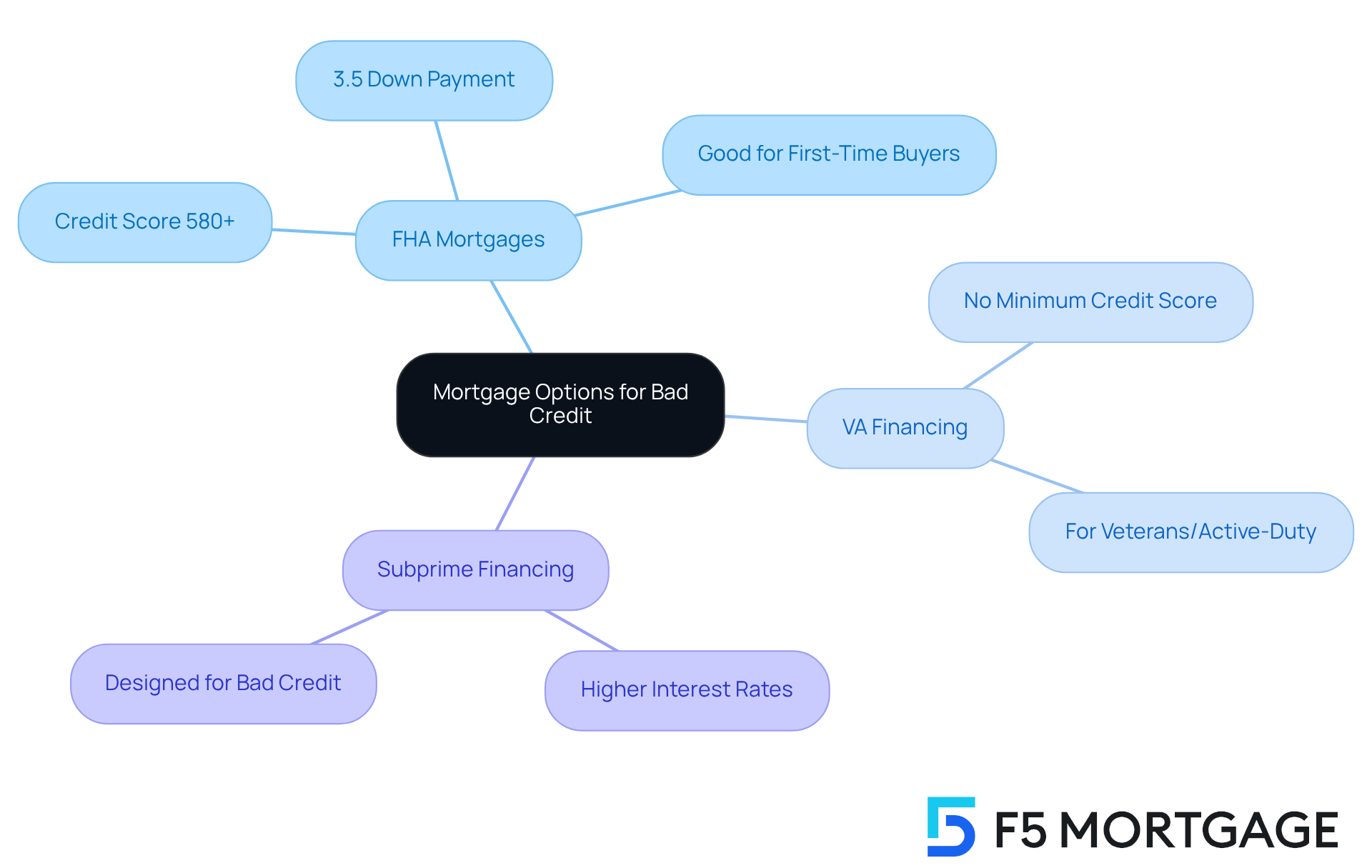

Explore Mortgage Options for Bad Credit

If you’re facing financial challenges, you may be wondering, can you buy a home with bad credit, and rest assured that there are several mortgage options available to help you achieve homeownership. FHA mortgages are particularly noteworthy, allowing credit scores as low as 580 with a down payment of just 3.5%. This accessibility makes FHA financing an appealing choice for first-time homebuyers who may not have substantial savings.

Additionally, VA financing, tailored for veterans and active-duty personnel, does not impose a minimum credit score requirement. This creates a wonderful opportunity for individuals who are asking, can you buy a home with bad credit?.

Moreover, some lenders offer subprime financing specifically designed for those who wonder, can you buy a home with bad credit?. However, it’s important to be aware that these loans often come with higher interest rates, which can increase your overall borrowing costs. To enhance your chances of securing favorable terms, consider exploring local and state initiatives that provide support or unique financing options for first-time homebuyers facing financial difficulties.

Understanding these mortgage options can empower you to make informed decisions. We know how challenging this can be, but with the right information, you can navigate the complexities of home financing effectively. Remember, we’re here to support you every step of the way.

Improve Your Credit Score Before Applying

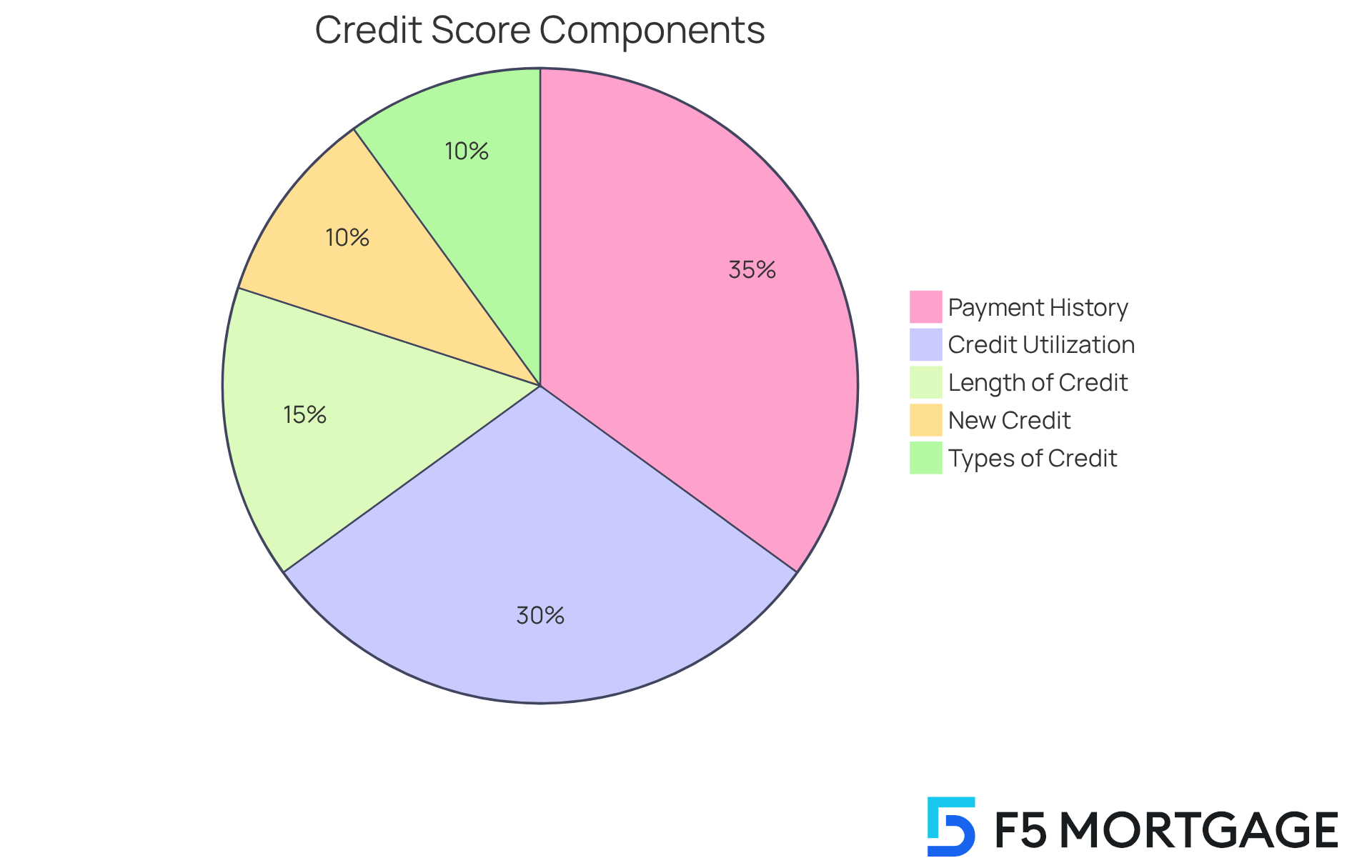

To improve your financial rating, it’s essential to prioritize making timely payments on all your bills. This crucial step constitutes approximately 35% of your financial assessment and is vital for preserving a positive payment history. We understand how challenging this can be, but aiming to reduce your utilization ratio by paying down existing debts can make a significant difference. Try to keep your card balances below 30% of your total limit; ideally, strive for under 10% for optimal results.

Before applying for a mortgage, consider refraining from opening new accounts. New accounts can lead to hard inquiries that may temporarily lower your rating. We’re here to support you every step of the way, so think about becoming an authorized user on a trustworthy individual’s card. This can help you gain from their positive payment history, ultimately assisting in enhancing your rating.

It’s also important to consistently check your financial report for mistakes. Did you know that one in five individuals may have an error that can adversely affect their score? Challenge any inconsistencies you find to ensure your report accurately represents your financial habits. By doing so, you can improve your trustworthiness and boost your likelihood of loan approval.

Gather Required Documentation for Mortgage Application

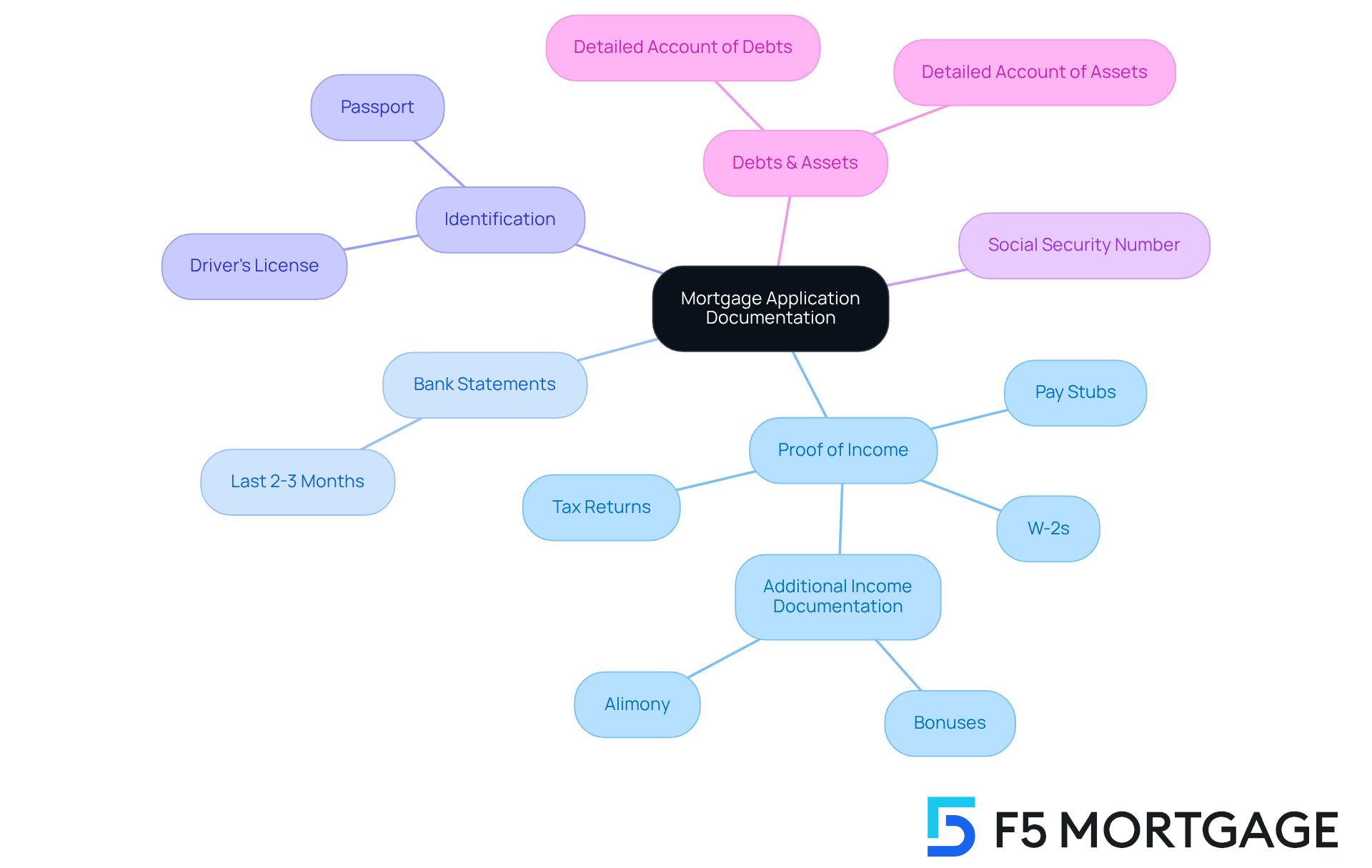

When applying for a mortgage, we know how challenging this can be, and gathering the right documents is essential for a smooth approval process. The required documentation typically includes:

- Proof of income, such as pay stubs, W-2s, or tax returns

- Bank statements for the last two to three months

- Identification, like a driver’s license or passport

- Social Security number

- Documentation of any additional income, including bonuses or alimony

- A detailed account of your debts and assets

Organizing these documents in advance can significantly expedite your application. Research shows that over a third of American consumers have discovered mistakes in their reports, which can delay approval. Therefore, examining your financial report for inaccuracies before submitting your application is crucial.

Additionally, being proactive in providing clear and complete documentation can demonstrate your preparedness to lenders. This can lead to quicker approvals. For instance, borrowers who submit well-organized applications often experience faster processing times. Some lenders even report average closing times as short as 28 days. By ensuring all necessary documents are ready, you can navigate the complexities of loan approval with greater confidence and efficiency.

Work with Mortgage Brokers and Lenders

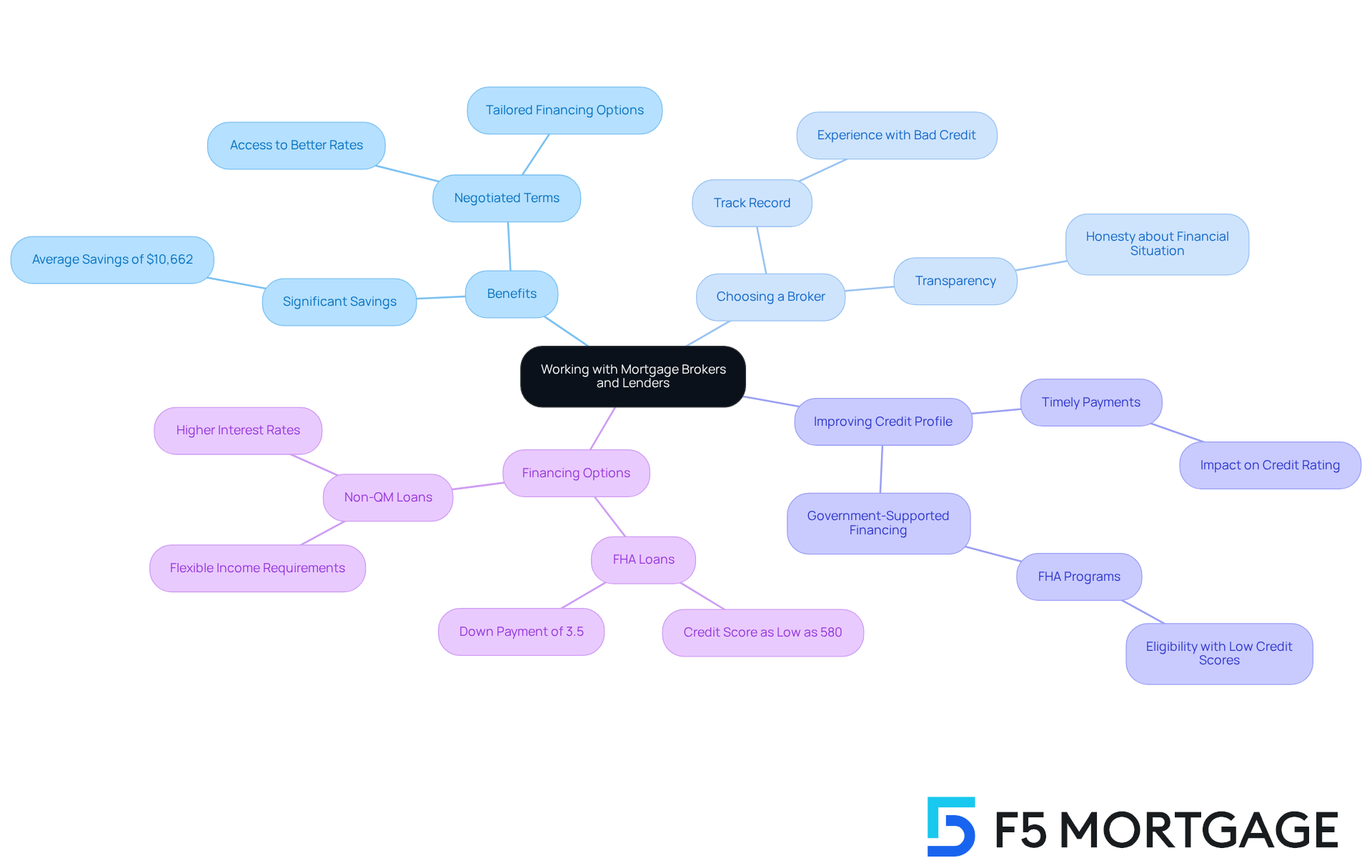

Engaging with a mortgage broker can help individuals understand how they can buy a home with bad credit, making it a game-changer for those facing these challenges. Brokers have access to a wide variety of lenders, which allows them to identify financing options that might not be easily available to you. They excel at negotiating favorable terms and rates on your behalf, leading to significant savings over the life of your loan. In fact, studies show that consumers save an average of $10,662 when they work with independent mortgage brokers compared to traditional lenders.

When selecting a broker, it’s essential to prioritize those with a solid track record of assisting clients who have faced similar financial hurdles. Being transparent about your financial situation is crucial; this honesty enables brokers to tailor their recommendations to suit your needs effectively. Additionally, it’s wise to consult multiple lenders to compare offers, ensuring you find the best possible fit for your unique circumstances.

Brokers can also provide valuable insights into how to improve your financial profile. For example, they can guide you on the importance of making timely payments, as missed mortgage payments can impact your credit rating for up to nine months. Furthermore, they can help you explore government-supported financing options, such as FHA programs, which often have more flexible eligibility requirements. With a credit score as low as 580, you might qualify for an FHA loan with a down payment of just 3.5%.

In summary, leveraging the expertise of a mortgage broker can significantly enhance your chances of securing a mortgage, which raises the question: can you buy a home with bad credit? Their ability to navigate the complexities of the lending landscape and advocate for you can make a world of difference in your home-buying journey. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the journey to homeownership with bad credit may seem daunting, but it is indeed possible. We understand how challenging this can be. Recognizing the impact of a low credit score on mortgage options is crucial, as it shapes not only eligibility but also the financial assistance available. By exploring various loan programs, such as FHA and VA financing, individuals can uncover pathways to homeownership even with less-than-ideal credit ratings.

Key insights discussed throughout this article highlight the importance of:

- Checking your credit report

- Improving your score

- Gathering the necessary documentation for a mortgage application

Engaging with mortgage brokers can provide invaluable support, helping to identify suitable lenders and negotiate better terms. Each step you take to enhance your financial health and understand available options brings you closer to achieving your homeownership dreams.

Ultimately, the journey of buying a home with bad credit is one of perseverance and informed decision-making. By taking proactive steps to enhance your credit scores and exploring diverse mortgage options, potential homeowners can overcome barriers and make their dream of owning a home a reality. Embrace the resources available, and take charge of your financial future, as the path to homeownership is within reach.

Frequently Asked Questions

What is considered bad credit?

Bad credit is typically defined as a credit score below 580.

How does bad credit affect home buying?

Bad credit can limit mortgage options, lead to higher interest rates, and may result in denials of financing. It affects eligibility and the types of financial assistance available.

Can you buy a home with bad credit?

Yes, it is possible to buy a home with bad credit, particularly through programs like FHA financing, which allows individuals with scores as low as 500 to qualify with a 10% down payment.

What are the benefits of FHA financing for those with bad credit?

FHA financing provides a pathway for individuals with lower credit scores to qualify for a mortgage, allowing for a down payment as low as 10% for scores starting at 500.

Are there options for veterans with bad credit?

Yes, VA financing allows qualified veterans and active-duty service members to purchase a home with 0% down, which is a significant advantage for those with bad credit.

What should I know about interest rates if I have bad credit?

Average interest rates for borrowers with poor credit ratings are projected to range from 6.5% to 7.5%, which can significantly impact monthly payments.

How can I check my credit score and report?

You can obtain your financial report from the three primary reporting agencies—Experian, TransUnion, and Equifax. You are entitled to one free report from each bureau annually at AnnualCreditReport.com.

What should I look for in my credit report?

When reviewing your credit report, pay attention to late payments, high utilization of available funds, and any accounts in collections.

What can I do if I find inaccuracies in my credit report?

If you discover mistakes in your credit report, contest them promptly, as resolving inconsistencies can enhance your credit status.

How can I monitor my credit score effectively?

Consider spacing out your requests for free reports throughout the year and utilize monitoring services to keep track of your score and receive notifications about important changes.