Overview

Navigating the world of mortgages can be daunting, and we know how challenging this can be. Many families seek ways to lower their monthly mortgage payments, and there are several strategies that can help:

- Refinancing your mortgage

- Making extra payments

- Utilizing down payment assistance programs

By refinancing, you may be able to reduce your interest rates, which can lead to substantial savings over time. Additionally, making extra contributions can lower your principal balance, further easing your monthly financial burden. These strategies are not just theoretical; they are backed by evidence showing their effectiveness in making homeownership more affordable.

We’re here to support you every step of the way. By exploring these options, you can take control of your financial future and create a more sustainable path to homeownership. Remember, every small step you take can lead to significant savings in the long run.

Introduction

Navigating the complexities of home financing can often feel like an uphill battle. We know how challenging this can be, especially when it comes to managing monthly mortgage payments. With interest rates projected to remain high, many homeowners are seeking effective strategies to alleviate their financial burdens. This article explores nine actionable methods that can lead to significant reductions in mortgage payments, empowering you to take control of your financial future. But what are the hidden challenges and opportunities that could make or break these strategies? We’re here to support you every step of the way.

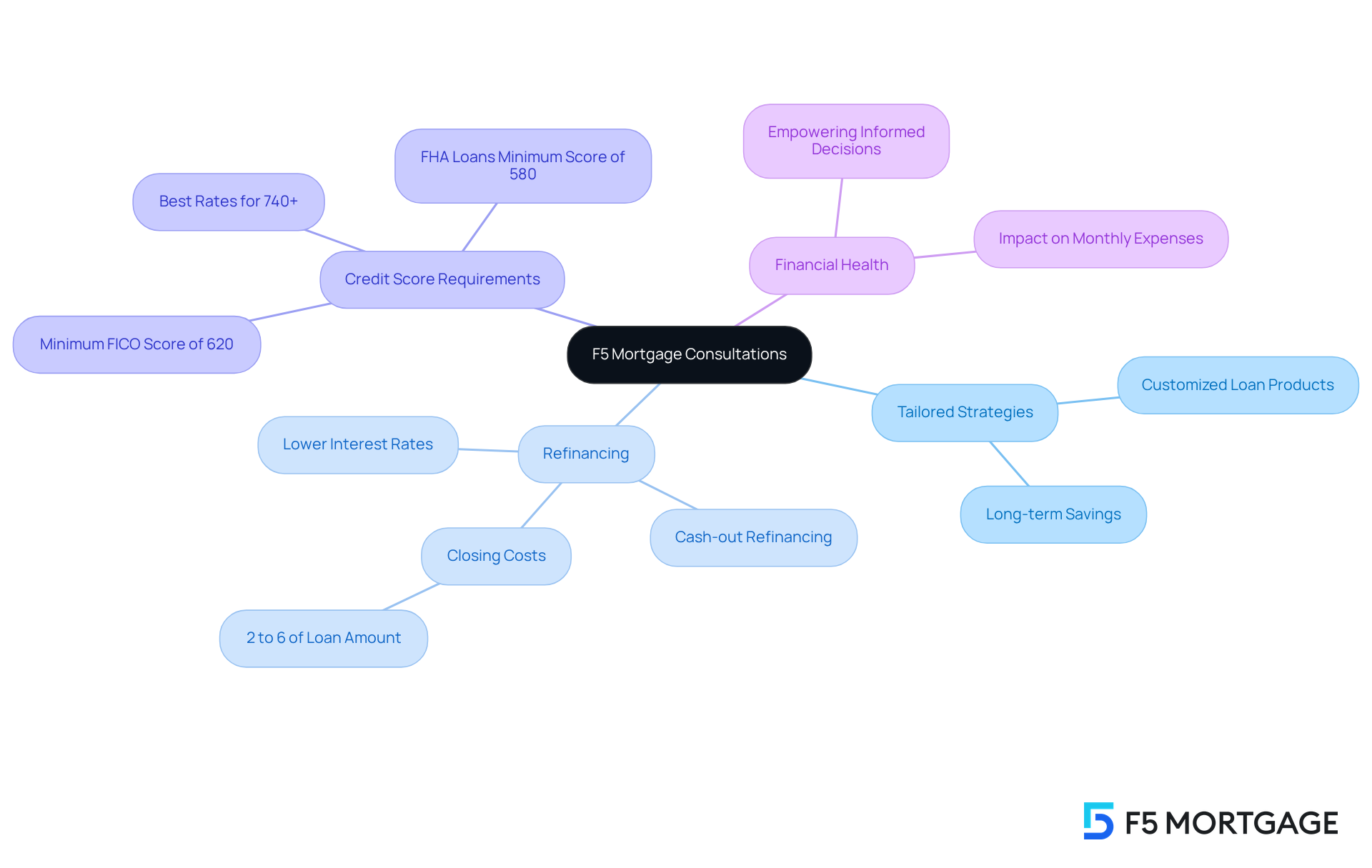

F5 Mortgage: Personalized Consultations for Payment Reduction

At F5 Mortgage, we understand how overwhelming it can be to manage your monthly mortgage payment. That’s why we offer tailored consultations designed to help you discover effective strategies to reduce those payments. By taking the time to assess your unique financial circumstances, we can suggest customized loan products or modifications that align with your specific goals.

This personalized approach not only educates you about your options but also empowers you to make informed decisions that can lead to significant long-term savings. For instance, refinancing may offer opportunities to lower your interest rates, especially with the typical US home loan interest rate projected to be 6.93% in 2025.

Additionally, understanding the minimum credit score requirements for refinancing—usually a FICO score of 620—can help you evaluate your eligibility and its potential impact on your monthly expenses. Our commitment to personalized service ensures that you receive the information and resources needed to navigate the complexities of home financing.

Ultimately, we aim to lower your monthly mortgage payment as well as enhance your overall financial health. As highlighted by PwC, “94% of banking executives believe that personalization is critical to establishing customer trust in the digital age.” This underscores the importance of our tailored approach, and we’re here to support you every step of the way.

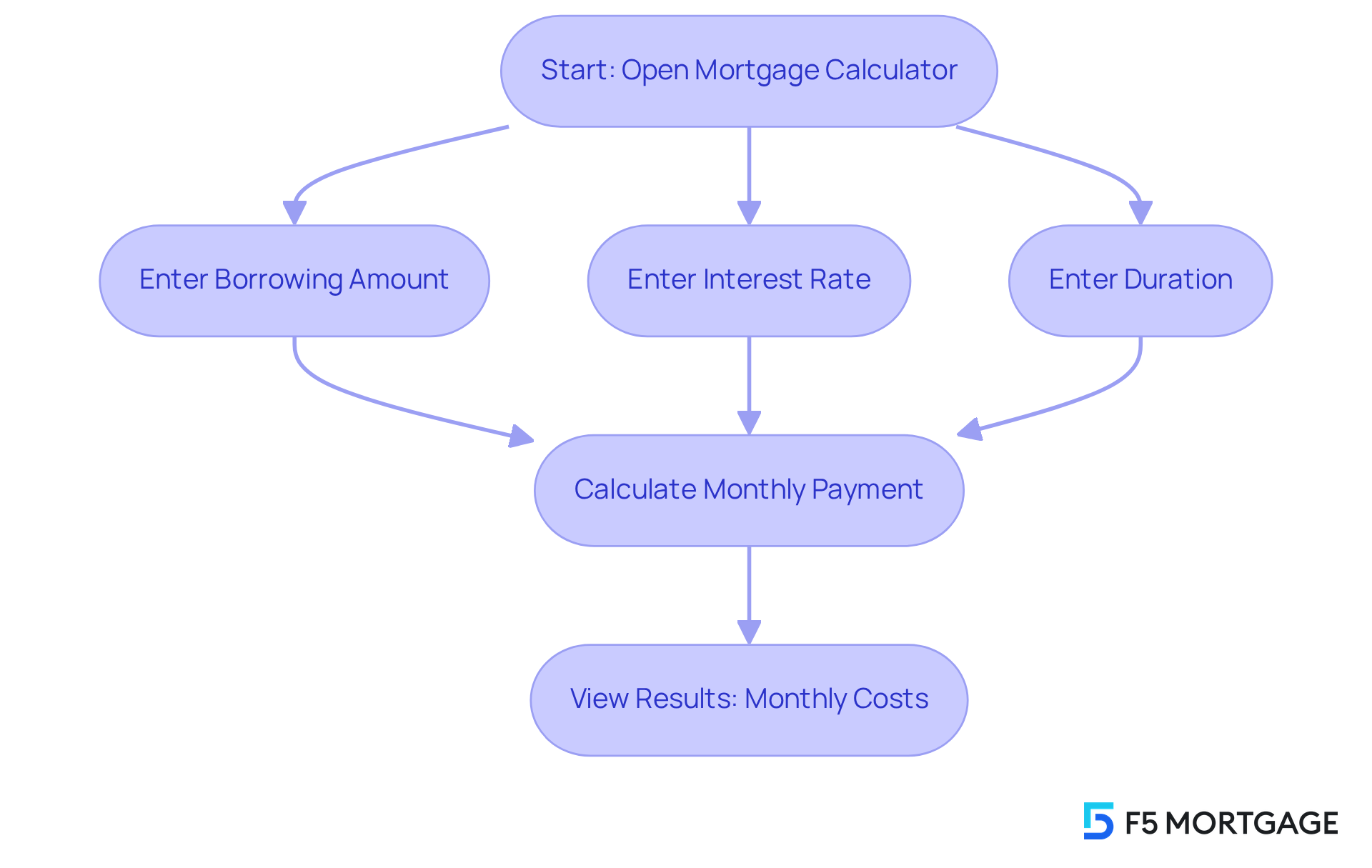

Mortgage Calculator: Analyze Your Payment Structure

We know how challenging navigating your mortgage can be. Using a mortgage calculator can be a helpful step in understanding your current fee structure and exploring different scenarios. By entering various borrowing amounts, interest rates, and durations, you can see how these changes impact your monthly costs. This tool is essential for grasping the effects of refinancing or modifying loan conditions. It empowers you to make informed decisions that could lead to significant savings. Remember, we’re here to support you every step of the way.

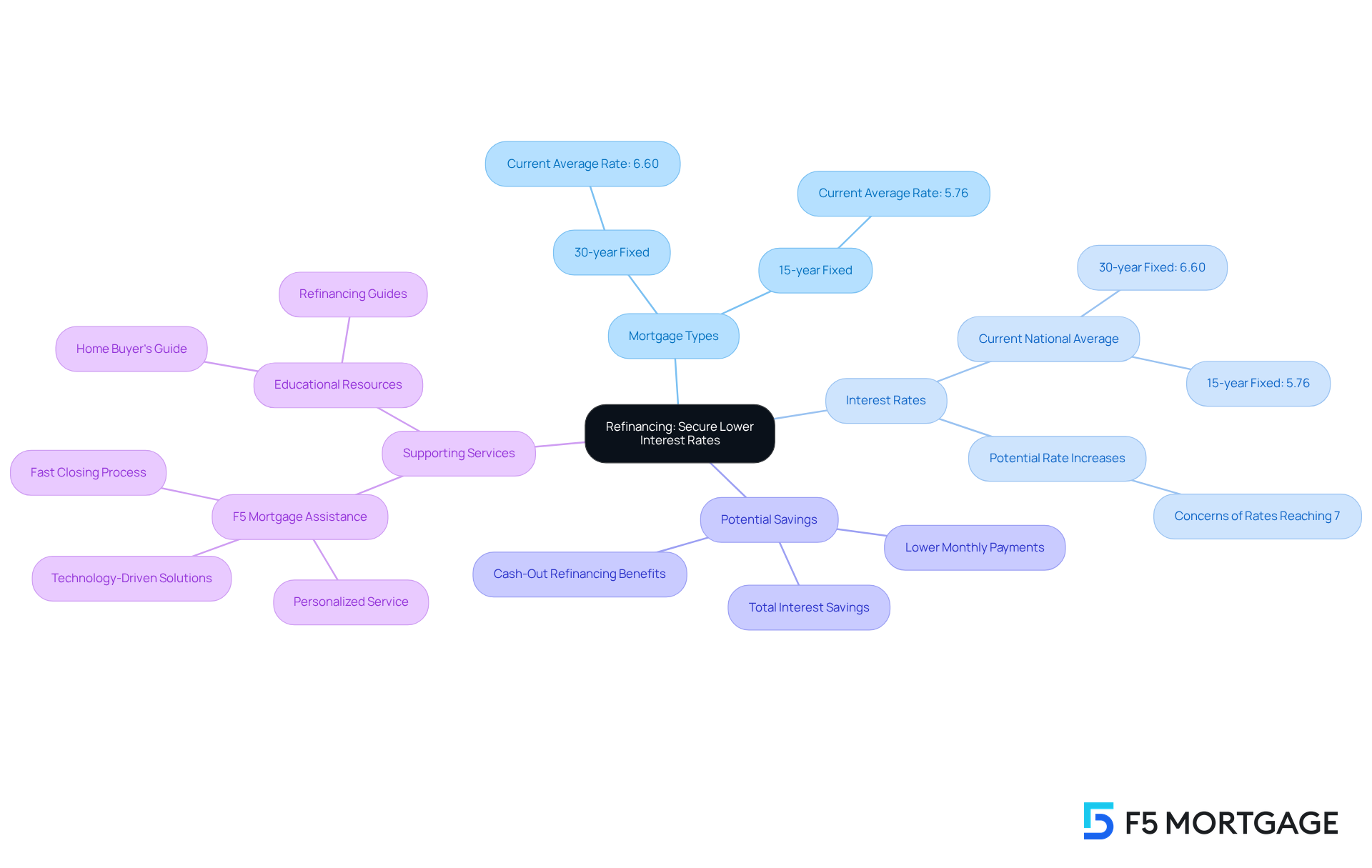

Refinancing: Secure Lower Interest Rates

Refinancing presents a valuable opportunity to lower your monthly mortgage payment by securing a more favorable interest rate. We understand that navigating these financial decisions can be overwhelming, especially when current market rates are significantly lower than your existing rates. This situation can lead to substantial savings for you. As of July 22, 2025, the national average interest rate for a 30-year fixed mortgage is 6.60%, while the average for a 15-year fixed mortgage stands at 5.76%. Financial analysts highlight that even a modest reduction in interest rates can lead to considerable long-term savings, making refinancing a viable option for many homeowners. For instance, Zillow emphasizes that refinancing to a shorter duration can significantly decrease the overall interest paid throughout the mortgage period.

At F5 Mortgage, we are dedicated to supporting you during the refinancing process. We want to ensure you are well-informed about potential savings and related expenses, including closing costs that typically range from 2% to 6% of the loan amount. By leveraging cutting-edge technology and providing personalized service, F5 Mortgage helps you navigate the complexities of refinancing, ultimately leading to more manageable monthly costs.

Many successful refinancing stories exist, with numerous clients reporting that their lower monthly mortgage payments have positively impacted their financial situations. Homeowners who transitioned from a 30-year mortgage to a 15-year mortgage often enjoy significant interest savings over the life of the loan. This shift not only reduces your monthly mortgage payment but also speeds up your journey to homeownership without the burden of debt.

In summary, refinancing can be a powerful tool for homeowners looking to strengthen their financial stability. With the right support from F5 Mortgage, you can confidently achieve your goals and take control of your financial future.

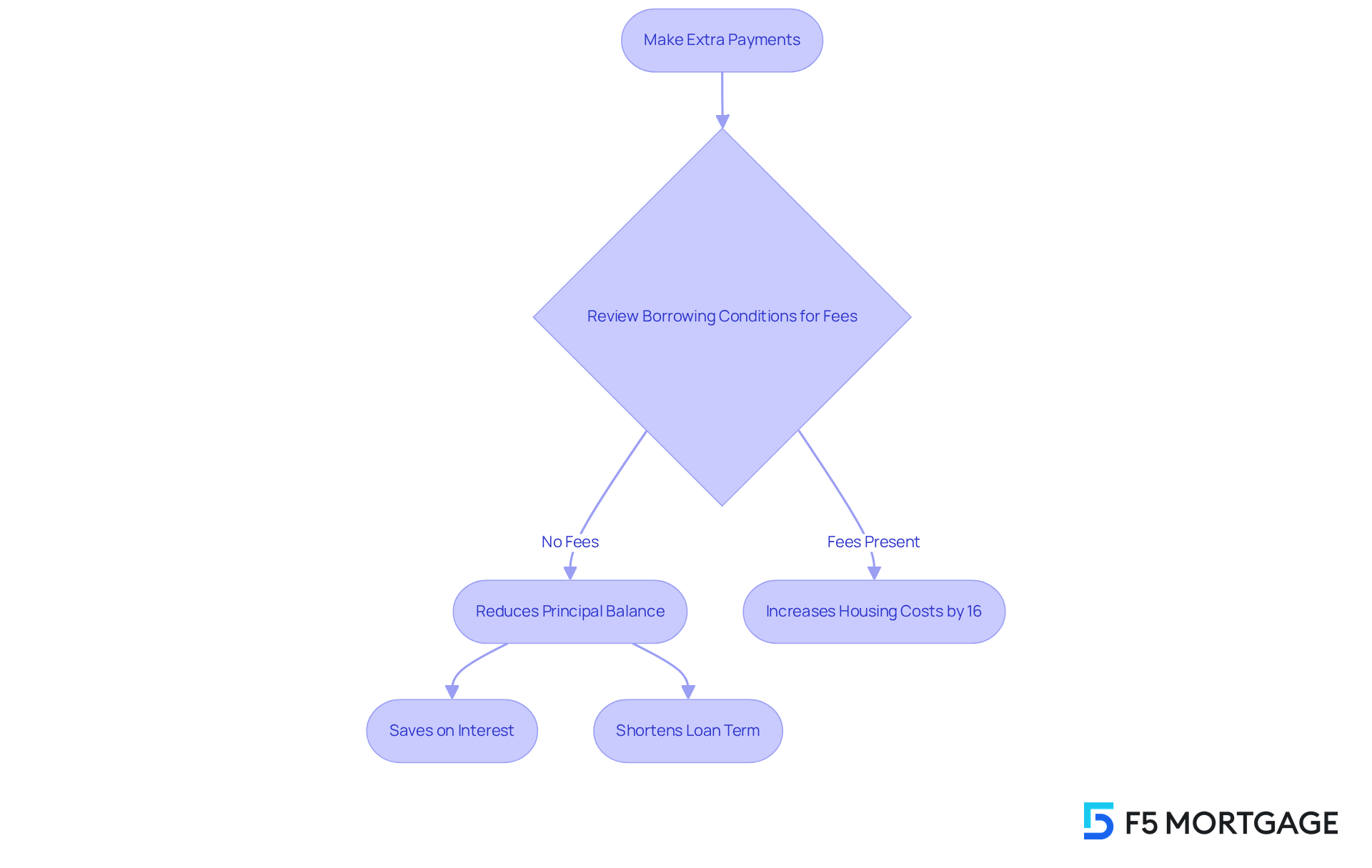

Extra Payments: Reduce Principal Balance

Making additional contributions toward your loan can significantly reduce your principal amount, leading to considerable savings over time. Even small extra contributions, like $50 or $100 each month, can add up, lowering the total interest paid and ultimately shortening your loan term. For instance, a homeowner with a $400,000 mortgage at a 3.5% interest rate could save around $41,000 and cut their mortgage duration by five years by making just two extra contributions each year.

However, we know how challenging it can be to manage housing costs, as this strategy may increase them by approximately 16%. At F5 Mortgage, we encourage our clients to consider using any surplus funds, such as tax refunds or bonuses, to make additional contributions that can help reduce their monthly mortgage payment, which can total $3,600 or $300 per month. This approach not only reduces monthly costs but also accelerates your journey toward financial independence.

Financial specialists emphasize that indicating additional contributions toward the principal balance is crucial for optimizing savings. Before making these contributions, homeowners should review their borrowing conditions for any prepayment fees. By adopting this approach and utilizing loan calculators to assess the impact of additional contributions, you can take control of your debt and achieve your financial goals more efficiently. We’re here to support you every step of the way.

Longer Loan Terms: Lower Monthly Payments

Choosing a longer financing term can significantly lower your monthly mortgage payment, making homeownership more attainable for families like yours. While this method often results in greater total interest paid throughout the duration of the loan, it allows for a more manageable monthly mortgage payment. We understand that lengthening repayment terms can improve affordability, especially for families facing budget limitations or those anticipating future financial changes, such as starting a family or investing in education. Reduced monthly expenses enhance cash flow, providing you with greater flexibility in your financial planning.

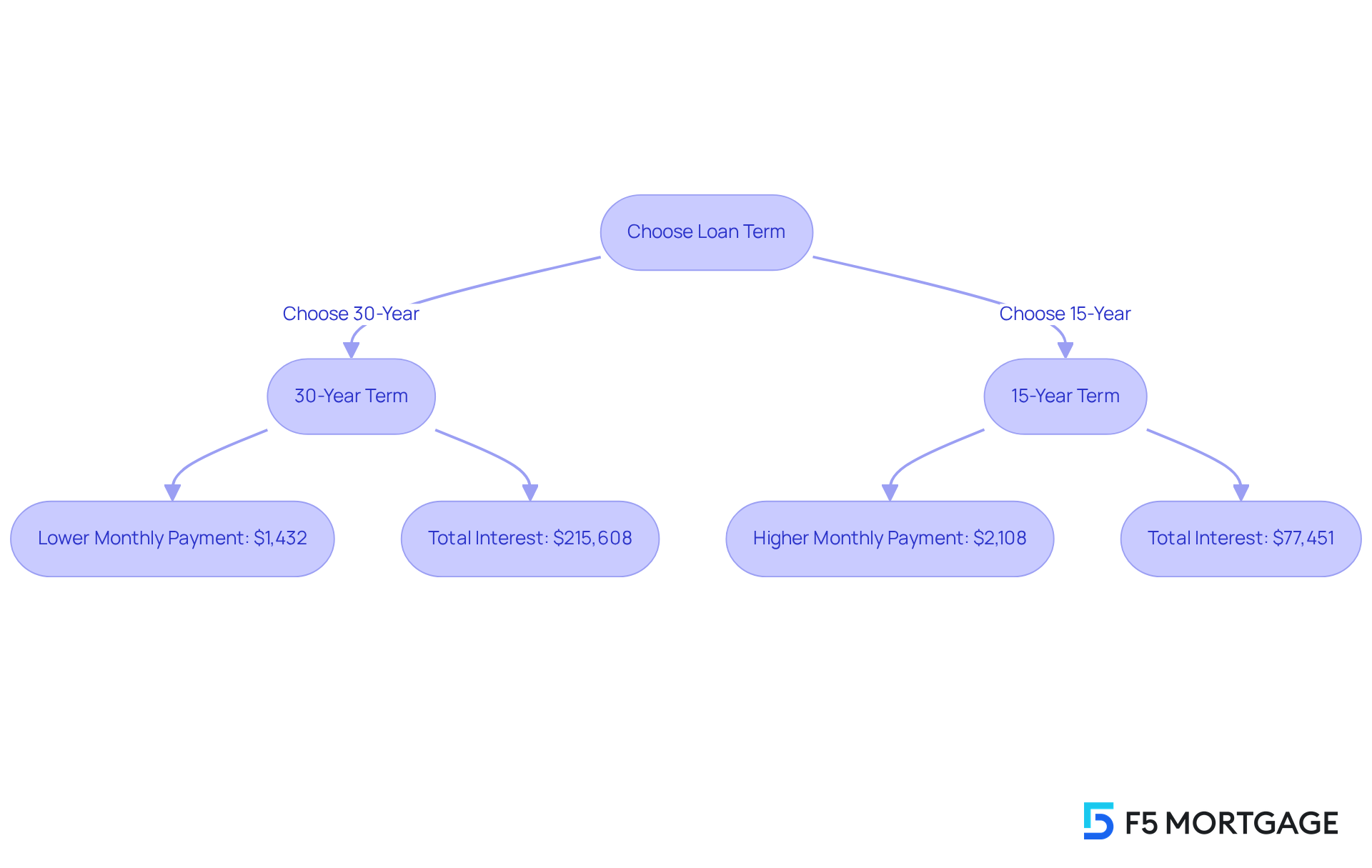

For instance, consider a 30-year fixed-rate home financing of $300,000 at 4%. This results in a monthly payment of roughly $1,432, compared to around $2,108 for a 15-year loan at 3%. This difference clearly illustrates how longer terms can ease the monthly mortgage payment, providing families with greater financial flexibility.

However, it’s crucial to think about the long-term implications. A 30-year mortgage can accumulate around $215,608 in interest, while a 15-year term at a lower rate results in about $77,451 in interest paid. This trade-off highlights the importance of assessing your personal financial situation and long-term goals when choosing a financing term.

Case studies have shown that borrowers must thoroughly evaluate their financial circumstances and long-term objectives when selecting a financing duration. Extended periods provide reduced monthly mortgage payments but lead to higher overall interest expenses. At F5 Mortgage, we are committed to assisting you in navigating these decisions. We offer tailored consultations to evaluate the advantages and disadvantages of extending loan terms. By collaborating with over twenty leading lenders, F5 Mortgage ensures you obtain customized solutions that fit your financial needs, empowering you to make informed decisions throughout your loan process.

Cost Awareness: Identify Savings Opportunities

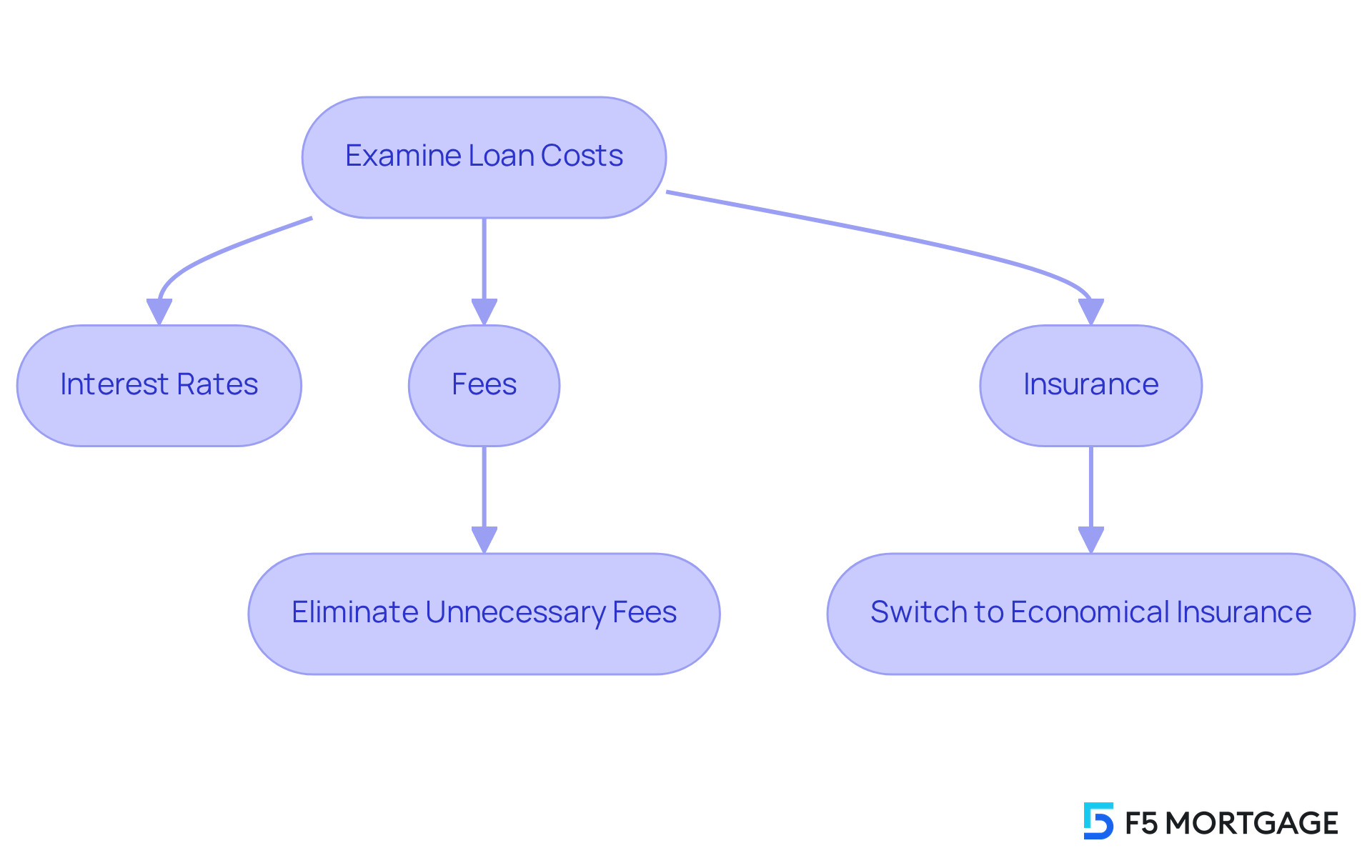

We know how challenging managing loan costs can be. Clients should maintain awareness of their expenses by examining all elements of their loan, including interest rates, fees, and insurance. By identifying areas where they can reduce expenses—like eliminating unnecessary fees or switching to a more economical insurance policy—individuals can free up funds to put towards their monthly mortgage payment.

At F5 Mortgage, we’re here to support you every step of the way. We offer resources to help you understand these expenses and discover potential savings opportunities. Together, we can make the mortgage process smoother and more manageable for you and your family.

Negotiation: Secure Better Loan Terms

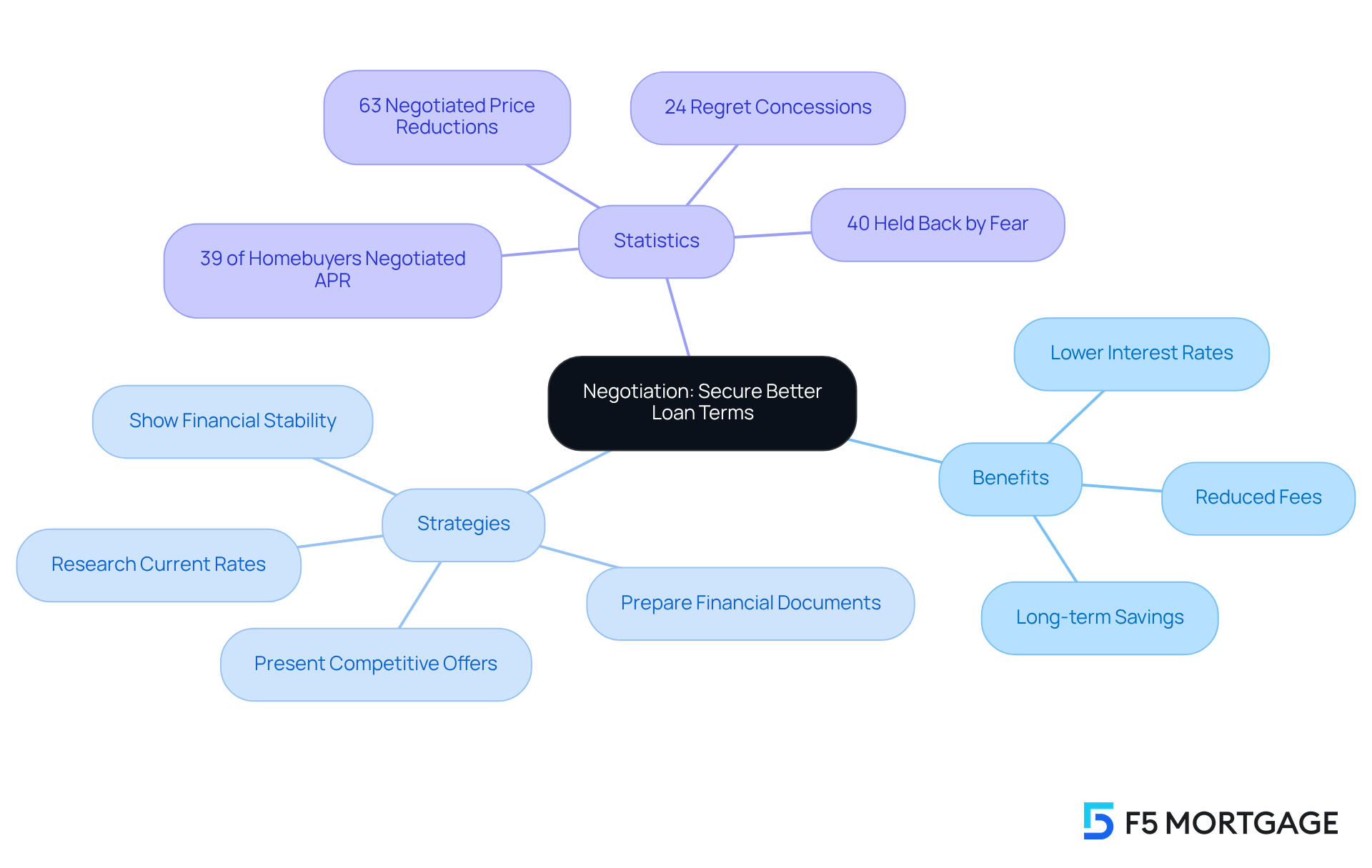

Homebuyers, we understand how challenging it can be to navigate financing options. It’s essential to actively negotiate your financing conditions with lenders to maximize your financial benefits. By presenting competitive offers and showcasing your financial stability, you can often secure lower interest rates and reduced fees. For instance, negotiating just a quarter-point decrease on a $350,000 home financing could save you roughly $57 on your monthly mortgage payment—adding up to over $20,000 in savings throughout the financing period.

As Jacob Channel, Senior Economist at LendingTree, wisely points out, “If you effectively negotiate a reduced rate — even a modest one of about a quarter of a percentage point — you could potentially save tens of thousands of dollars in interest throughout the duration of your financing.” This highlights the significant impact negotiation can have on your overall costs.

At F5 Mortgage, our expert team is here to support you every step of the way. We provide customized strategies and guidance to help you secure the most advantageous mortgage terms possible. Notably, only 39% of homebuyers negotiated their initial APR or refinance rate, which indicates a substantial opportunity for those who take the initiative.

Additionally, 63% of homebuyers have successfully negotiated home price reductions, further emphasizing the importance of negotiation in the home buying process. Financial experts encourage you to approach lenders with confidence and clarity. Prepare your financial documents and research current rates before initiating negotiations. Together, we can ensure that you make the most informed decisions for your future.

Down Payment Assistance: Lower Your Loan Amount

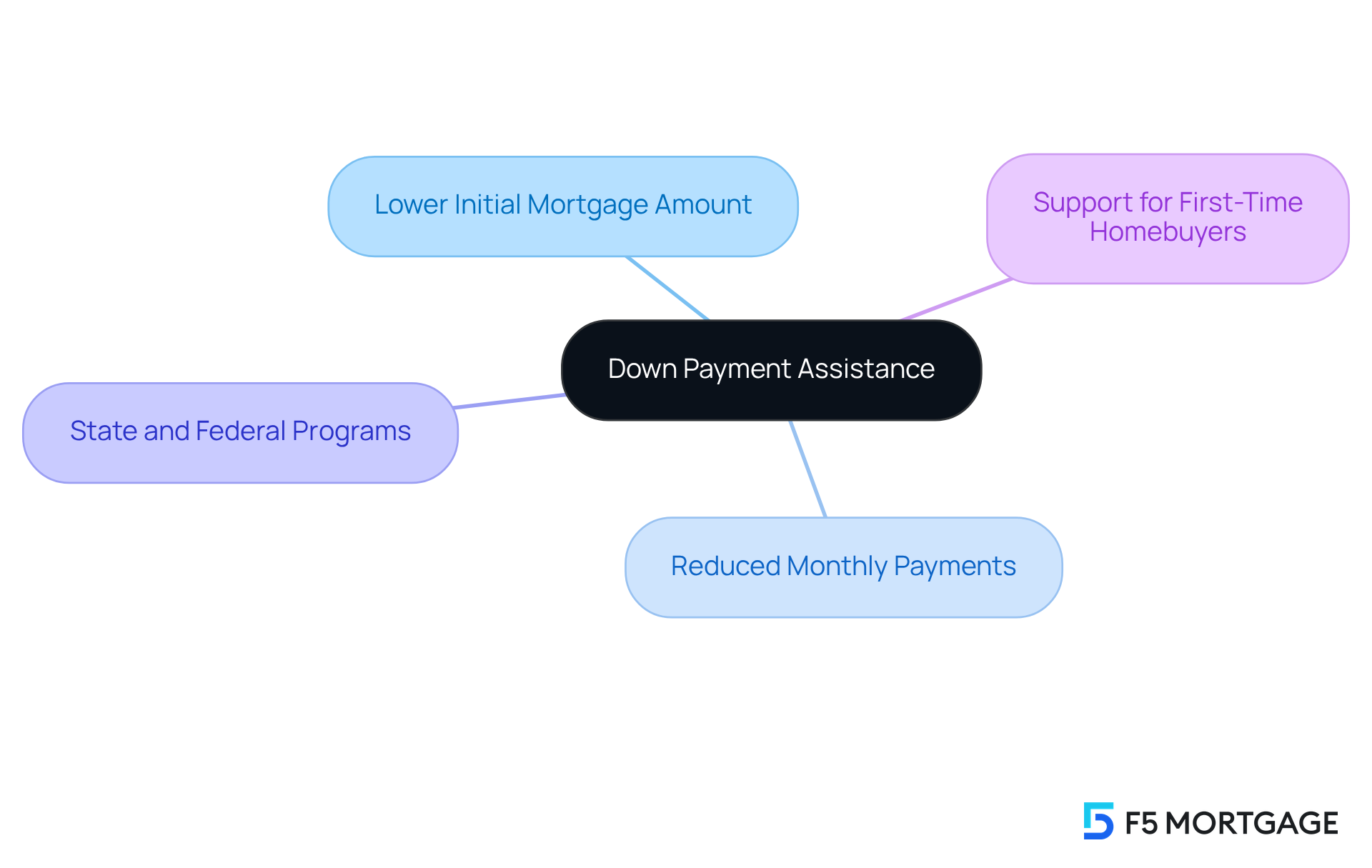

We understand how challenging it can be to navigate the path to homeownership. Utilizing down payment assistance programs can significantly ease this journey by lowering your initial mortgage amount, which directly reduces your monthly mortgage payment. At F5 Mortgage, we are here to support you every step of the way, as we are well-versed in the various state and federal assistance programs available. This ensures that you can access the support you need to make homeownership more affordable. This assistance is especially crucial for first-time homebuyers or those with limited savings, providing a vital stepping stone toward achieving your dream home.

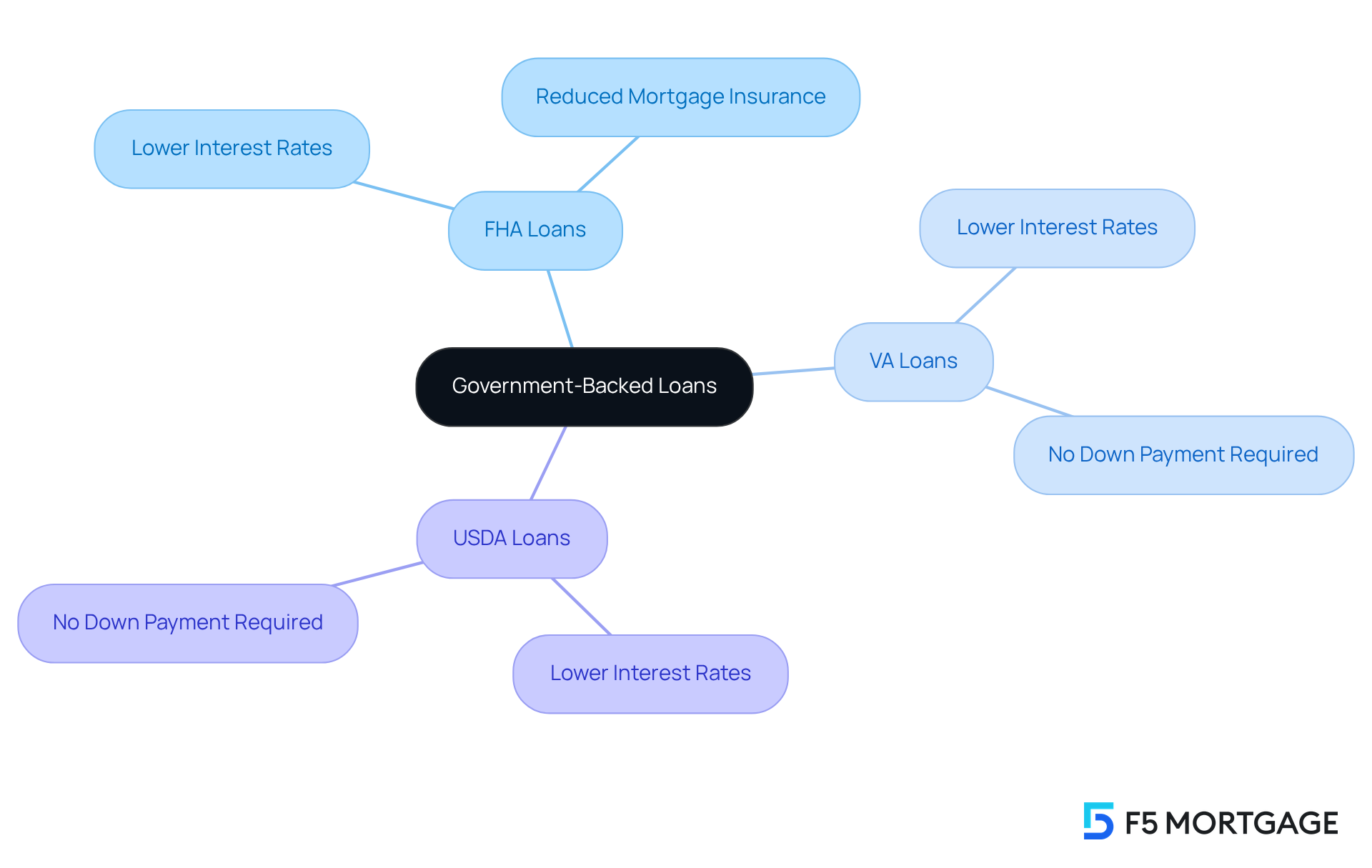

Government-Backed Loans: Access Lower Rates

We understand how challenging the journey to homeownership can be. Government-supported financing options like FHA, VA, and USDA programs can be a beacon of hope, offering lower interest rates and reduced mortgage insurance costs. These financial products are designed to make homeownership more attainable, especially for first-time buyers and those with lower credit ratings.

At F5 Mortgage, we’re here to support you every step of the way. We can help you navigate these options, ensuring you fully comprehend the advantages and eligibility criteria associated with government-backed loans. Let us empower you on this journey toward your dream home.

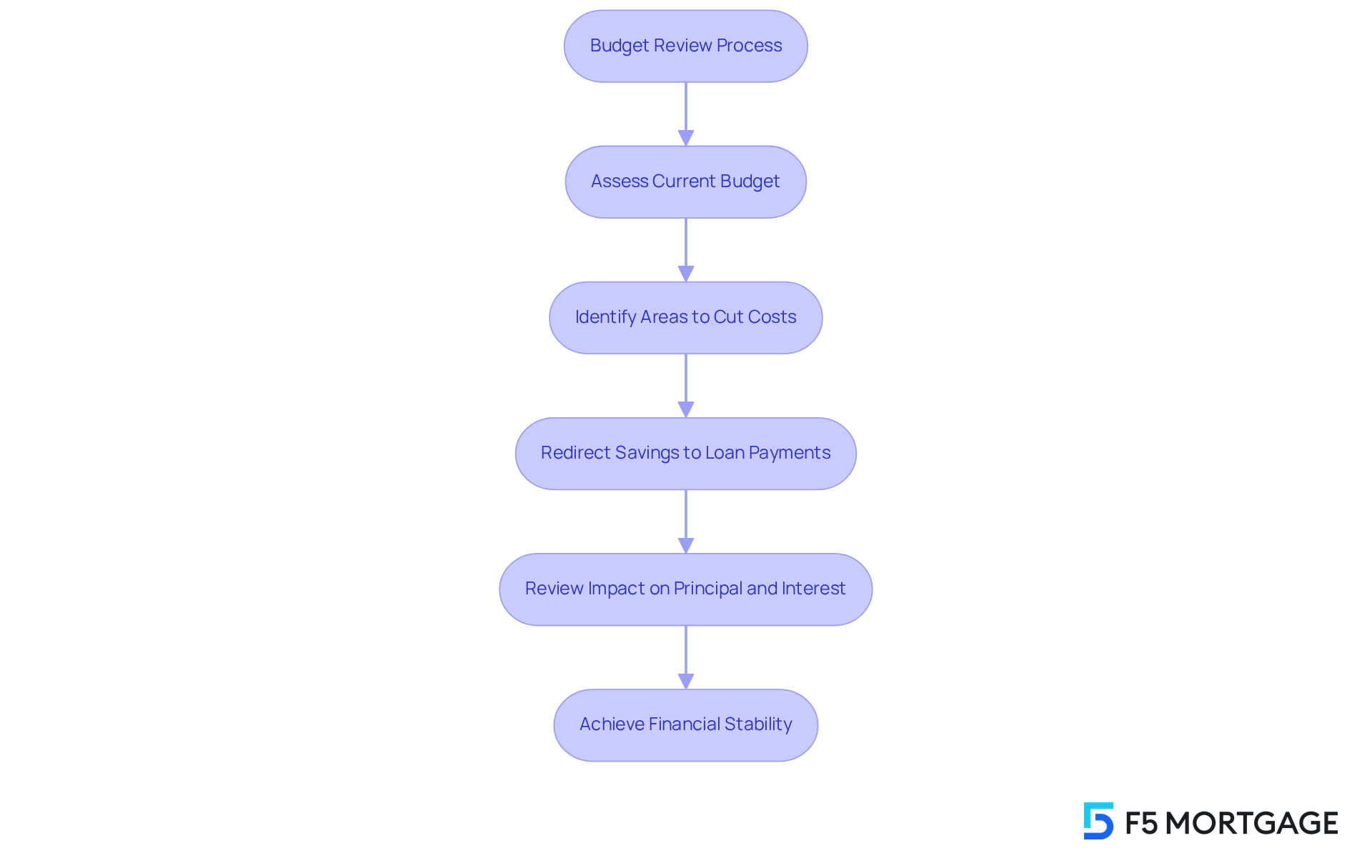

Budget Review: Allocate More Towards Payments

We know how challenging managing a budget can be, but carrying out a routine budget assessment can truly help. It allows individuals to identify areas where they can cut costs and redirect those resources toward their loan contributions. By prioritizing your monthly mortgage payment in your budget, you can decrease your principal balance more swiftly. This not only helps you pay off your loan faster but also results in reduced overall interest expenses.

At F5 Mortgage, we’re here to support you every step of the way. We offer tools and resources designed to assist you in creating and maintaining a budget that aligns with your financial goals. Together, we can navigate this journey and work towards a more secure financial future.

Conclusion

Lowering monthly mortgage payments is a crucial goal for many homeowners seeking financial stability and peace of mind. We understand how challenging this can be. By exploring various strategies—like refinancing, making extra payments, and utilizing down payment assistance programs—you can significantly reduce your financial burden. Each of these techniques not only helps in managing immediate expenses but also contributes to long-term savings and enhanced financial health.

This article highlights several effective methods to achieve lower mortgage payments. Key strategies include:

- Refinancing to secure lower interest rates

- Making additional contributions to reduce principal balances

- Negotiating better loan terms with lenders

Additionally, utilizing tools such as mortgage calculators and maintaining awareness of costs can empower you to make informed decisions. Programs designed to assist with down payments and government-backed loans also play a vital role in making homeownership more accessible.

Ultimately, taking proactive steps to manage your mortgage payments can lead to a more secure financial future. We encourage you to assess your financial situation, seek personalized consultations, and leverage available resources to explore the best options for your unique circumstances. By doing so, you can not only lower your monthly payments but also pave the way toward achieving long-term financial independence and stability. We’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer to help with mortgage payments?

F5 Mortgage offers personalized consultations to help clients discover effective strategies to reduce their monthly mortgage payments. They assess individual financial circumstances to suggest customized loan products or modifications.

How can refinancing benefit homeowners?

Refinancing can lower monthly mortgage payments by securing a more favorable interest rate. Even a modest reduction in interest rates can lead to considerable long-term savings, making it a viable option for many homeowners.

What is the current average interest rate for mortgages?

As of July 22, 2025, the national average interest rate for a 30-year fixed mortgage is 6.60%, while the average for a 15-year fixed mortgage is 5.76%.

What are the minimum credit score requirements for refinancing?

The typical minimum credit score requirement for refinancing is a FICO score of 620.

How can a mortgage calculator assist homeowners?

A mortgage calculator helps homeowners analyze their payment structure by allowing them to enter various borrowing amounts, interest rates, and durations. This enables them to understand how different scenarios impact their monthly costs and make informed decisions.

What are the typical closing costs associated with refinancing?

Closing costs for refinancing usually range from 2% to 6% of the loan amount.

Why is personalization important in mortgage services?

Personalization is critical for establishing customer trust, especially in the digital age. A tailored approach helps clients feel more informed and empowered in their financial decisions, leading to better outcomes.

What impact can refinancing have on the overall financial health of a homeowner?

Refinancing can lead to lower monthly payments and significant interest savings over the life of the loan, enhancing the overall financial health and stability of homeowners.