Overview

The article highlights the importance of VA mortgage affordability calculators for families looking to upgrade their homes. We understand how challenging this journey can be, and these calculators are designed to assist you in evaluating your financial readiness. By considering key factors such as income, debts, interest rates, and potential homeownership costs, these tools empower families to make informed decisions about their mortgage options. We’re here to support you every step of the way, ensuring that you feel confident in your choices.

Introduction

Navigating the complexities of home financing can be a daunting task for families looking to upgrade their living situations. We understand how challenging this can be. However, with the right tools, families can demystify the process and make informed decisions about their mortgage options.

This article explores ten VA mortgage affordability calculators that not only simplify budgeting but also empower families to assess their financial readiness for homeownership.

How can these calculators transform the daunting task of securing a mortgage into a manageable and informed journey? We’re here to support you every step of the way.

F5 Mortgage: User-Friendly VA Mortgage Affordability Calculator

At F5 Mortgage, we understand how challenging the home buying process can be. That’s why we’ve developed a user-friendly VA mortgage affordability calculator designed to help households assess their financial readiness for purchasing a new home. This valuable tool considers essential factors like income, existing debts, and current interest rates—keeping in mind that these rates are illustrative and may fluctuate based on your credit score and market conditions.

Moreover, our calculator offers estimates for property tax rates and homeowners insurance, providing a comprehensive overview of what you can realistically afford. With an intuitive interface, even first-time homebuyers can navigate the calculator with ease, making it an essential resource in your journey toward homeownership.

By utilizing the VA mortgage affordability calculator, you can gain clarity on your budget, which empowers you to make informed decisions that align with your financial situation. We know how important it is to secure a loan that fits your needs, and our calculator can help enhance your chances of approval. With options for low down payments—some as low as 0%—and a focus on understanding debt-to-income ratios, including a maximum DTI ratio of 43%, you can feel more prepared for the mortgage approval process.

Additionally, we offer personalized assessments from our Home Loan Specialists, who are here to support you every step of the way. Together, we can navigate the complexities of home buying and make your dream of homeownership a reality.

Chase: Comprehensive VA Loan Calculator for Payment Estimates

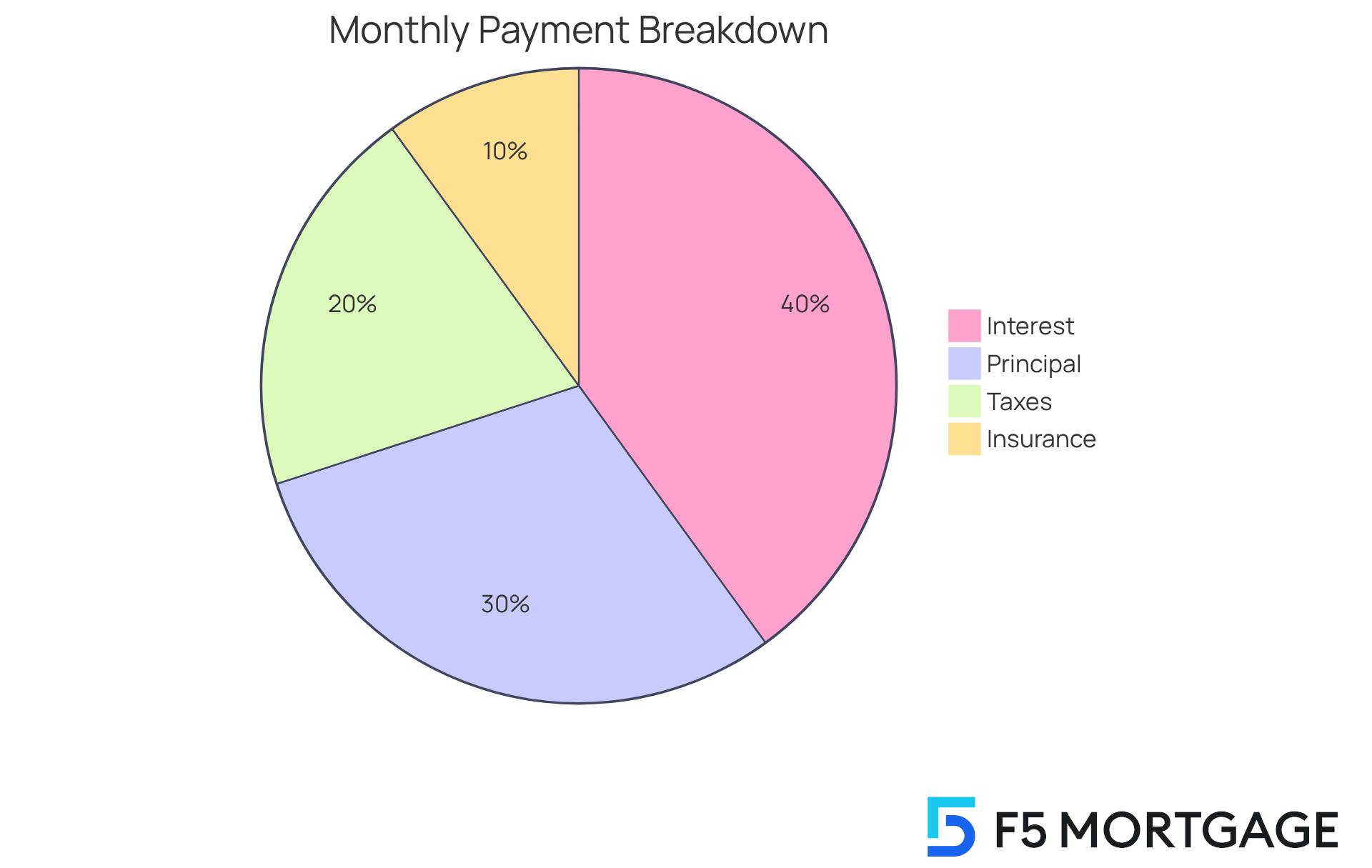

At F5 Mortgage, we understand how challenging navigating financial obligations can be for families. That’s why we offer a strong VA mortgage affordability calculator that provides comprehensive estimates of monthly costs, including principal, interest, taxes, and insurance. This invaluable tool helps families grasp their financial responsibilities, empowering them to make informed decisions.

By adjusting different credit amounts and conditions, users can observe how these changes impact their monthly expenses. This feature aids in efficient budgeting and financial planning, which is crucial for families looking to secure their future. As finance experts emphasize, understanding monthly costs is essential for making well-informed choices.

Currently, the typical monthly charge for VA financing showcases competitive rates, with many borrowers enjoying interest rates of 5% or lower. In fact, a significant 56.8% of VA borrowers experienced these favorable rates. Families greatly benefit from these detailed housing payment estimates, as they facilitate improved financial forecasting and help ensure that homeownership remains attainable.

Utilizing our detailed VA mortgage affordability calculator not only streamlines the financing process but also helps households make wise financial choices. With options like FHA mortgages requiring as little as 3.5% down and VA mortgages offering 0% down, F5 Mortgage is dedicated to providing adaptable solutions tailored to meet the needs of families enhancing their homes. We’re here to support you every step of the way.

Navy Federal: VA Loan Calculator with Eligibility and Rate Insights

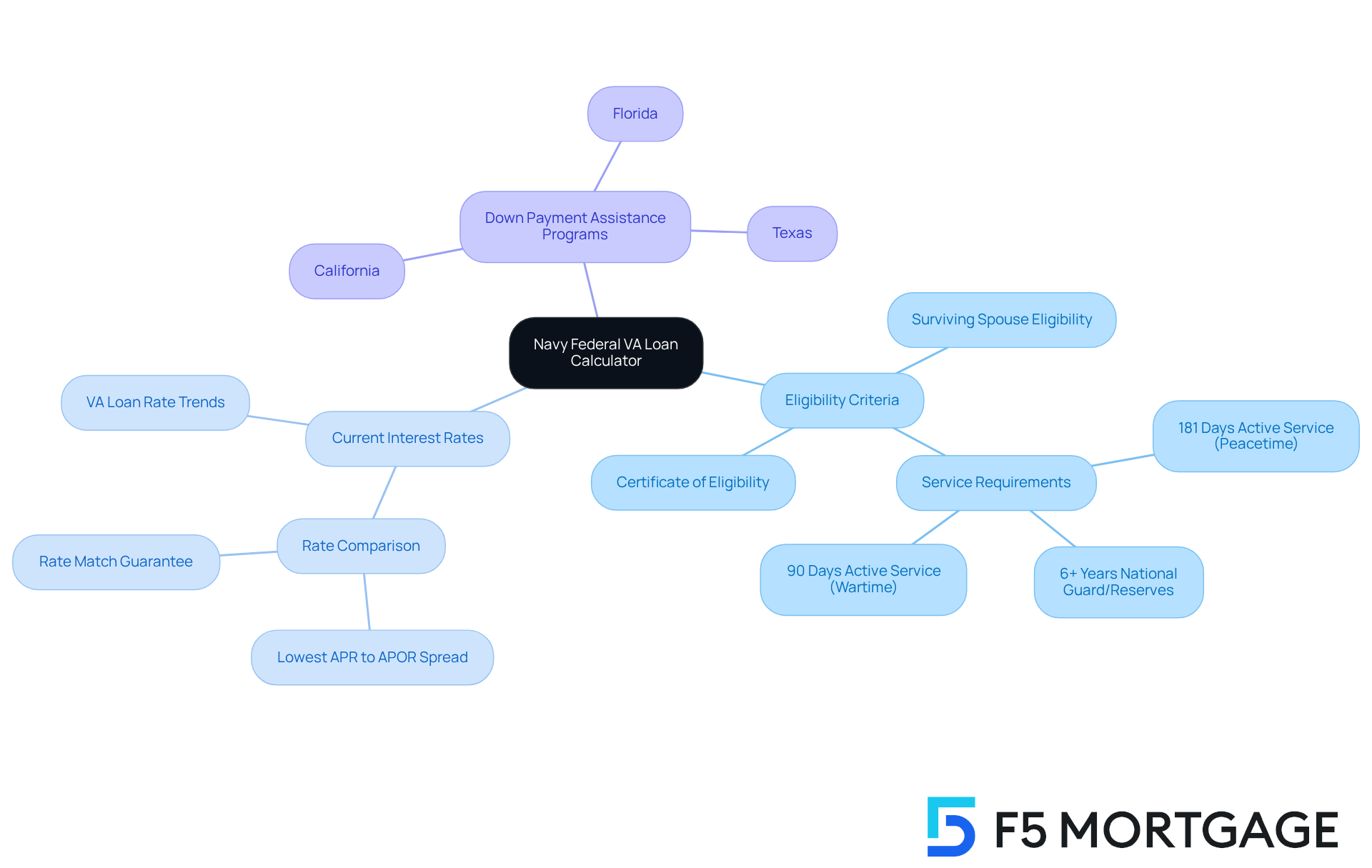

Navigating the world of home financing can be overwhelming, but Navy Federal’s VA financing calculator is here to help. This robust resource combines insights into eligibility criteria with current interest rates and cost estimates, allowing families to use a VA mortgage affordability calculator to evaluate their qualifications for a VA mortgage. Understanding the financial implications of these decisions is crucial, especially when VA loans offer significant benefits like no initial costs and reduced interest rates.

We know how challenging this can be, and that’s why it’s essential to comprehend these elements for informed decision-making. Additionally, families should explore down payment assistance programs available in states like:

- California

- Texas

- Florida

These programs can provide valuable support for upfront costs.

As families navigate the intricacies of home financing, this comprehensive perspective empowers them to make confident choices about their loan options. Remember, we’re here to support you every step of the way.

US Bank: VA Mortgage Calculator for Qualification Assessment

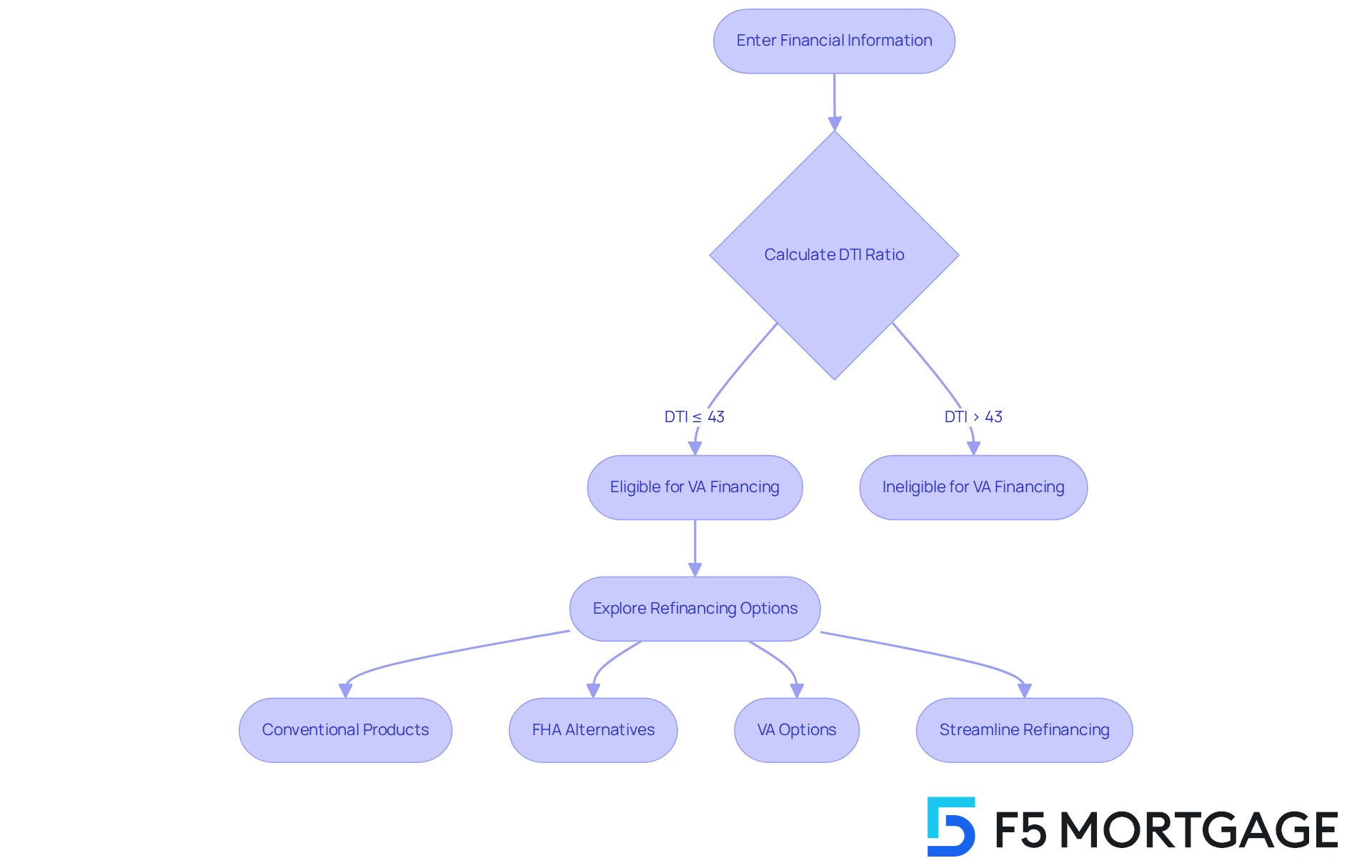

At F5 Mortgage, we understand how challenging the mortgage process can be for families. That’s why we offer a VA mortgage affordability calculator designed to help you evaluate your qualifications. By entering your financial information, you can easily determine if you meet the necessary standards for a VA financing option.

Understanding your Debt-to-Income (DTI) ratio is crucial. Typically, a maximum of 43% is required for home financing, including VA options. This tool, the VA mortgage affordability calculator, is especially beneficial for families who are uncertain about their eligibility, as it clarifies what is needed to secure financing and helps avoid common application pitfalls, such as misreporting income or debts.

Moreover, F5 Mortgage is here to assess your financial situation and ensure you are well-prepared for mortgage approval. We provide guidance on various refinancing choices available in Colorado, including:

- Conventional products

- FHA alternatives

- VA options

- Streamline refinancing possibilities

Remember, we’re here to support you every step of the way.

Zillow: VA Loan Calculator with Comprehensive Cost Breakdown

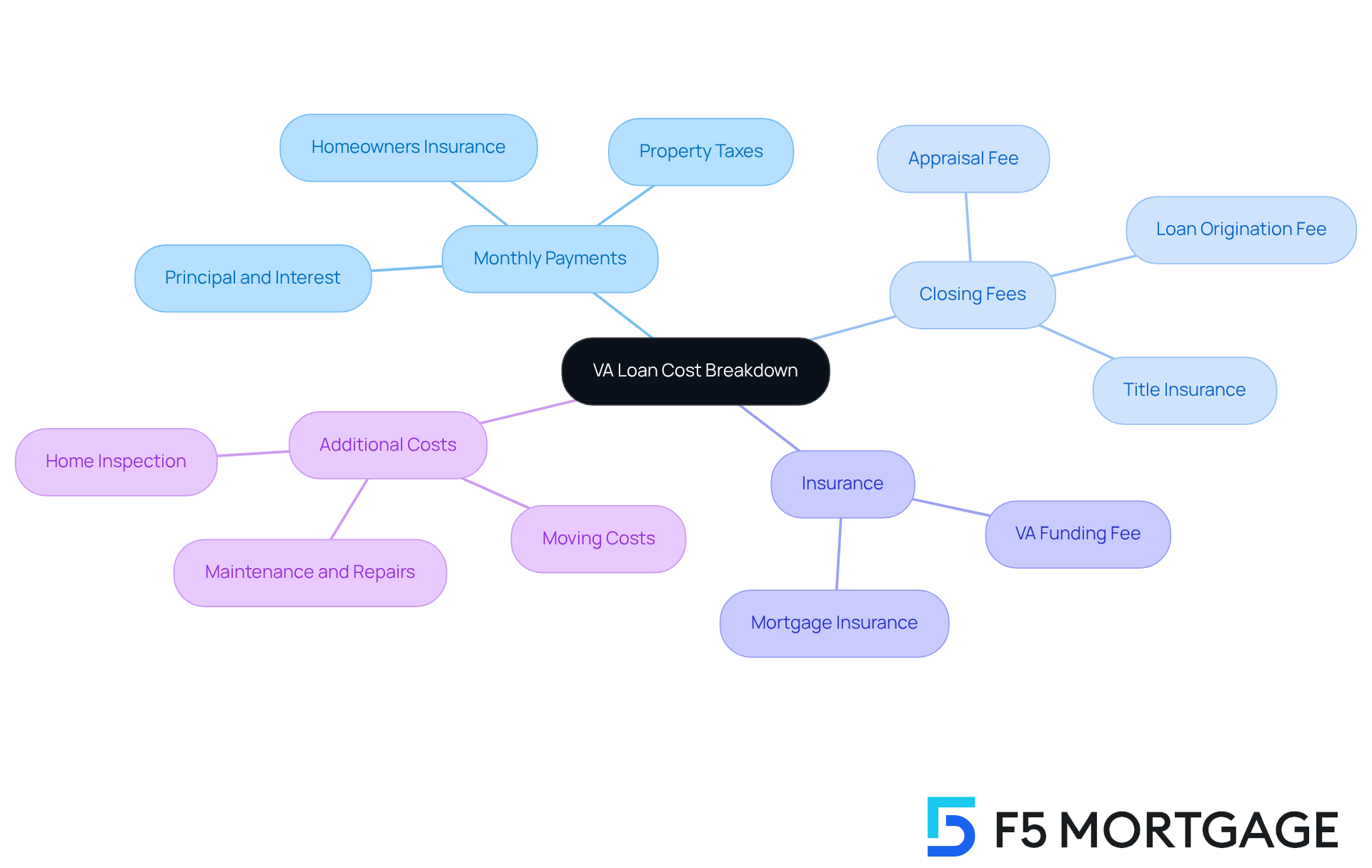

Zillow’s VA loan calculator offers a thorough cost breakdown that goes beyond just monthly payments. It includes essential expenses like closing fees and insurance, providing a transparent view of the total financial commitment required for homeownership. We know how challenging budgeting can be, and this comprehensive detail is crucial for households as they plan their finances.

By understanding all related expenses from the start, families can make informed choices that align with their financial capacities. Grasping the complete picture of home buying costs is vital to avoid future financial strain and ensure a secure investment. To support you in this journey, we encourage you to utilize budgeting tools, including the VA mortgage affordability calculator. These resources can help assess your financial readiness for home buying, including utilizing a VA mortgage affordability calculator to calculate your break-even point for refinancing. This will help you determine how long it will take to recoup costs through savings in monthly payments.

At F5 Mortgage, we are dedicated to empowering households with clear information and tailored assistance throughout this process. Remember, we’re here to support you every step of the way.

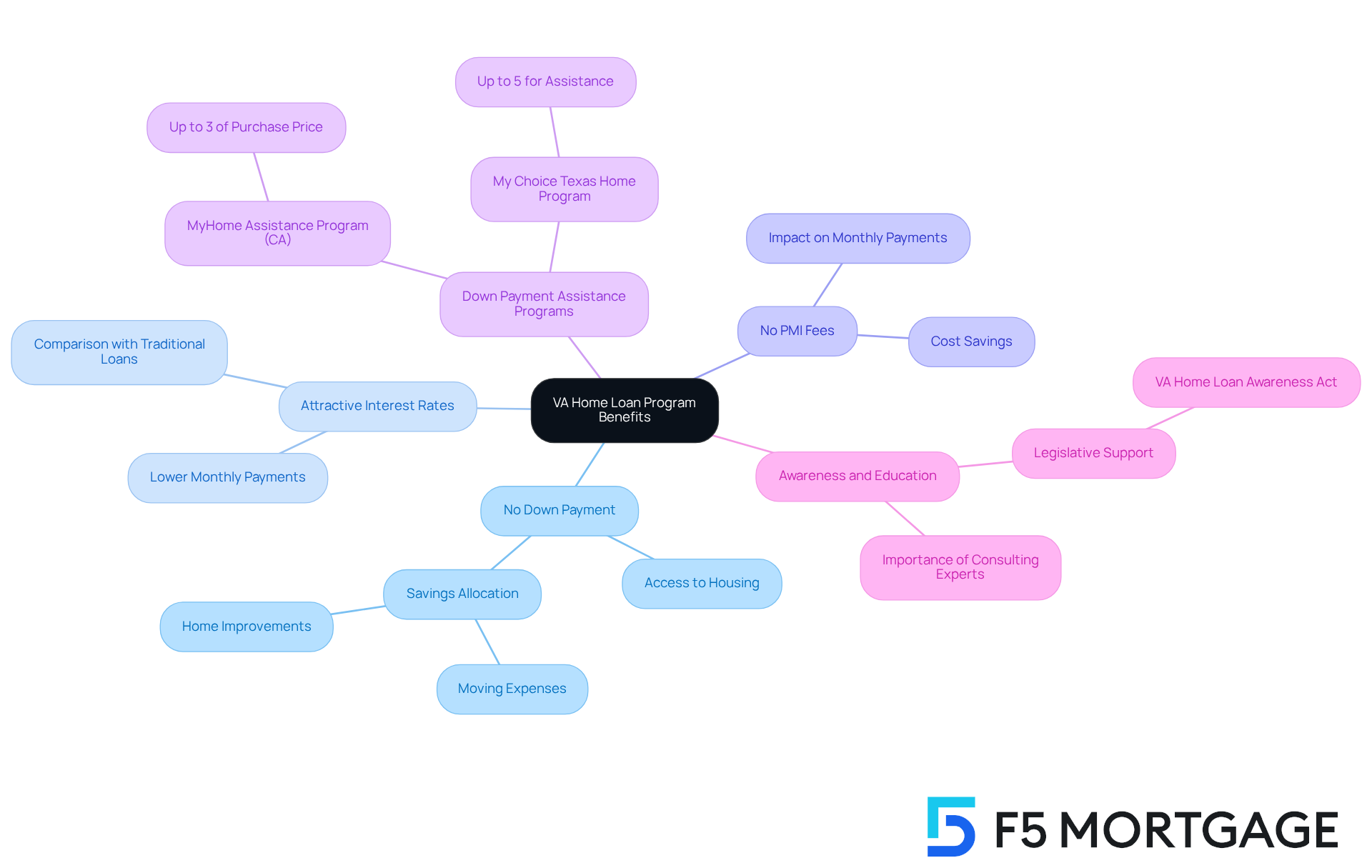

VA Home Loan Program: Key Benefits Impacting Affordability

The VA mortgage affordability calculator illustrates how the VA home loan program offers several crucial advantages that significantly enhance affordability for households. We understand how challenging it can be to enter the housing market, and one of the most impactful features of this program is the lack of initial deposit requirements. This allows families to access housing without the burden of considerable upfront expenses, enabling them to allocate their savings toward other essential costs, like moving expenses or home improvements.

Moreover, the program provides attractive interest rates, greatly reducing monthly housing costs compared to traditional financing options, as one can assess with a VA mortgage affordability calculator. This affordability is further supported by the absence of private mortgage insurance (PMI) fees, which can add hundreds of dollars to monthly payments in conventional loans, according to the VA mortgage affordability calculator. For those who acquired their homes via traditional financing with a down payment of less than 20%, refinancing may present an opportunity to eliminate PMI, especially given the rising home appreciation rates. By leveraging these advantages, families can utilize a VA mortgage affordability calculator to make homeownership more achievable, ultimately increasing their purchasing power.

Experts in the mortgage industry emphasize the importance of these benefits. Richard Blumenthal, Ranking Member of the Senate Committee on Veterans’ Affairs, states, “The VA Home Loan Program offers one of the finest benefits VA has available, and has assisted veterans and their households in building home equity since its inception in 1944.” It’s important to note that only 13% of veterans currently utilize the VA Home Loan benefit, primarily due to a lack of awareness about the program. This statistic highlights the critical need for education regarding the program’s advantages, especially for families considering improvements to their homes.

Additionally, families can explore various down payment assistance programs available through F5 Mortgage. For instance, the MyHome Assistance Program in California offers up to 3% of the home’s purchase price, while the My Choice Texas Home program provides up to 5% for down payment and closing assistance. With these resources combined, households looking to upgrade their homes can navigate the market with greater confidence and less financial strain. To maximize these benefits, we encourage families to consult with a mortgage expert to explore their options and ensure they are making informed decisions.

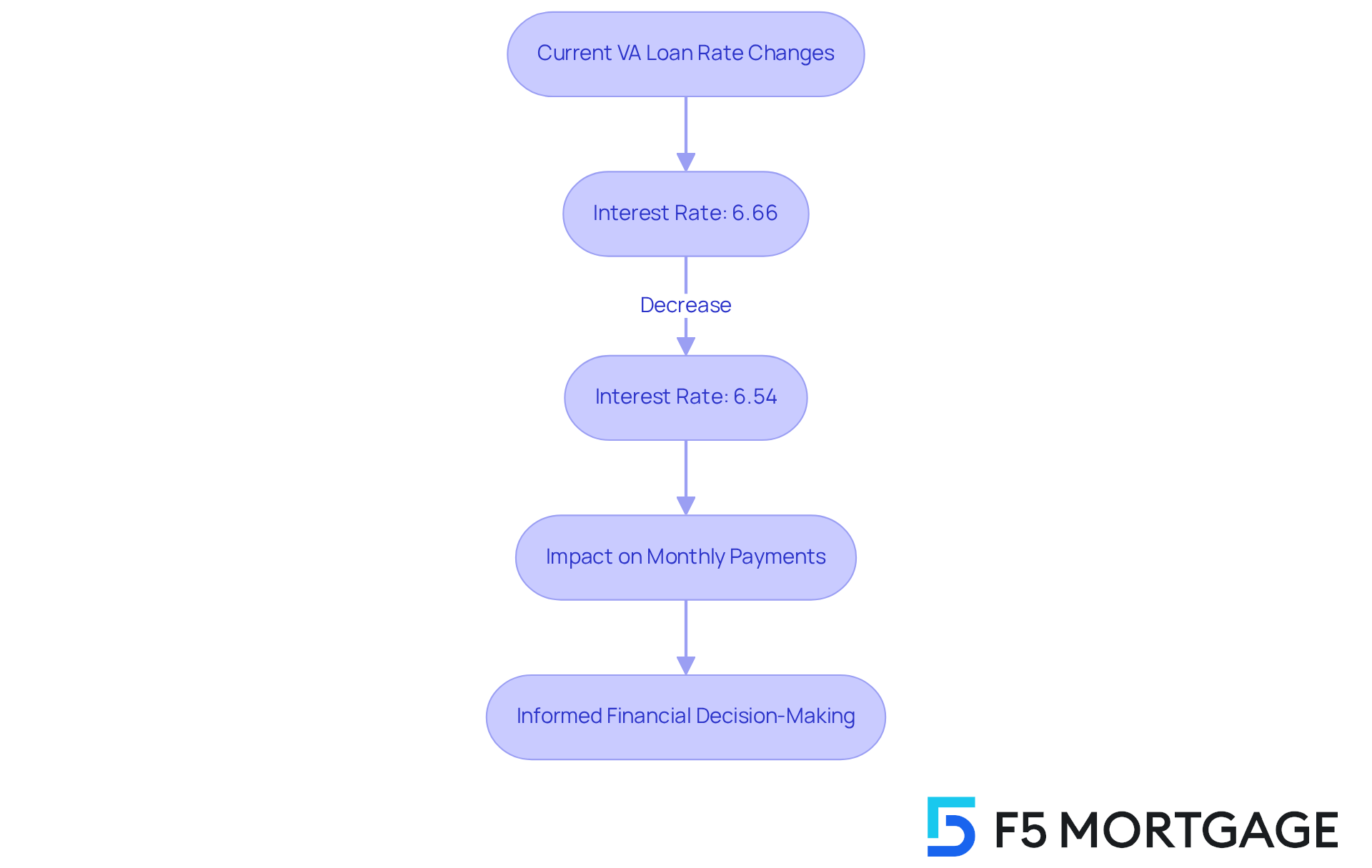

Current VA Loan Rates: Essential for Accurate Affordability Calculations

Staying informed about current VA loan rates is essential for your financial well-being. We know how challenging it can be to navigate these fluctuations, as even minor changes can significantly impact your monthly payments. For example, the national average 30-year VA loan interest rate recently decreased to 6.54%, down from 6.66%. This quick shift illustrates the importance of being aware of the latest rates.

To ensure your financial assessments are as precise as possible, we encourage families to regularly consult reliable sources for the most up-to-date information. This proactive approach empowers you to make informed choices about your financing options, ultimately enhancing your ability to manage homeownership expenses effectively.

Financial analysts stress that understanding the relationship between interest rate fluctuations and the VA mortgage affordability calculator is crucial. This knowledge directly affects the total cost of borrowing and your monthly financial responsibilities. Remember, we’re here to support you every step of the way as you navigate this journey.

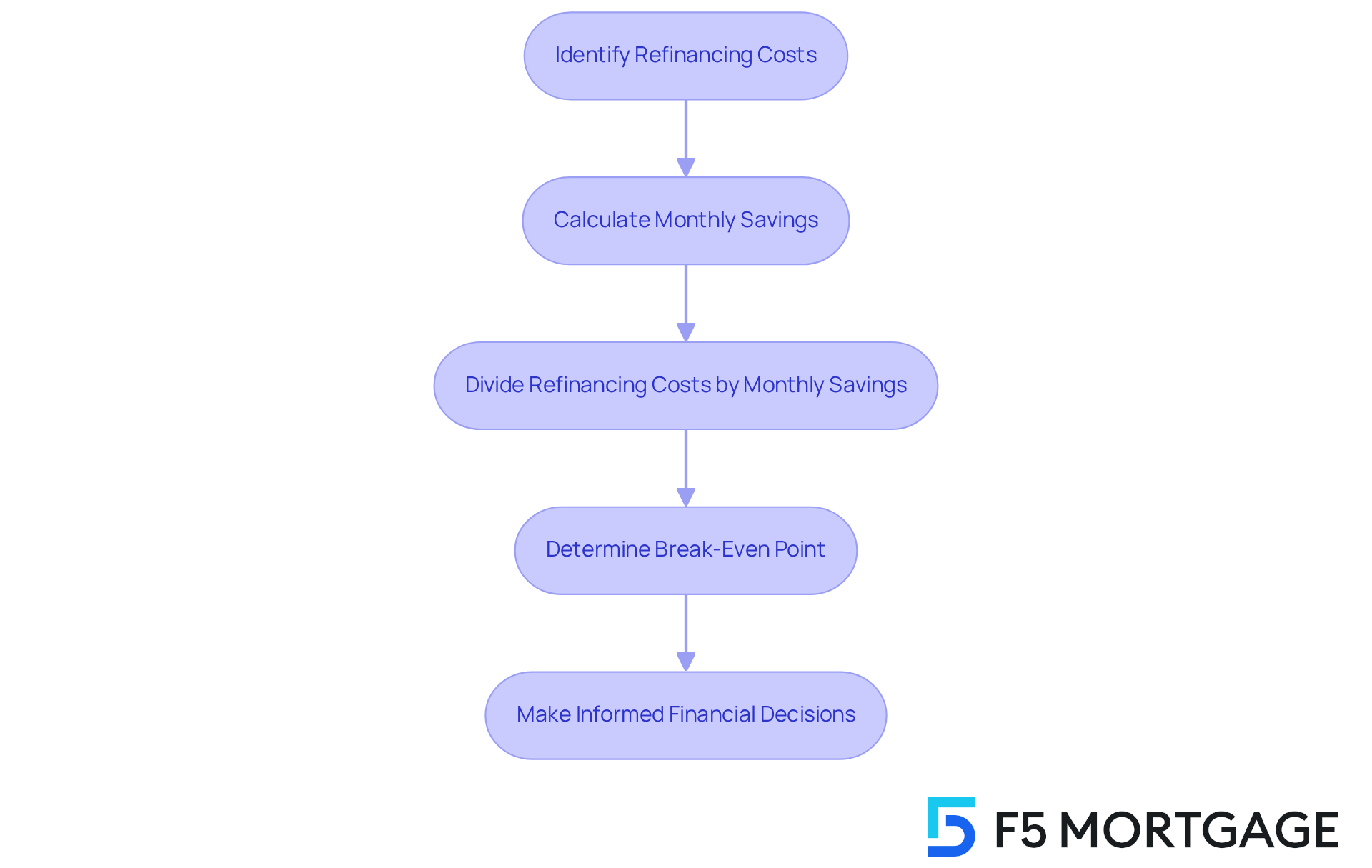

Monthly Payment Calculation: A Core Feature of VA Mortgage Calculators

VA mortgage affordability calculators are essential tools for families, assisting them in determining their monthly costs based on important factors such as loan amount, interest rate, and loan duration. Understanding these calculations is vital for families to grasp their financial responsibilities and ensure they can manage their loan payments effectively. By utilizing the VA mortgage affordability calculator, families can make informed decisions about their borrowing capacity, paving the way for a more secure financial future.

We know how challenging navigating mortgage responsibilities can be, and financial advisors emphasize the importance of understanding monthly obligations, especially for families looking to upgrade their homes. Additionally, determining the break-even point for refinancing is a crucial consideration. To find this break-even point, families should follow these steps:

- Identify refinancing costs, which include all closing fees and expenses related to refinancing, such as origination fees and appraisal costs.

- Calculate monthly savings by subtracting the new monthly payment from the current monthly payment.

- Divide the refinancing costs by the monthly savings to discover how many months it will take to break even.

With average loan amounts for VA financing often exceeding $300,000, utilizing a VA mortgage affordability calculator can significantly impact budgeting and long-term financial planning. Families are encouraged to use the VA mortgage affordability calculator to confidently navigate their loan journey, knowing that F5 Mortgage is committed to transparency and personalized service. We’re here to support you every step of the way.

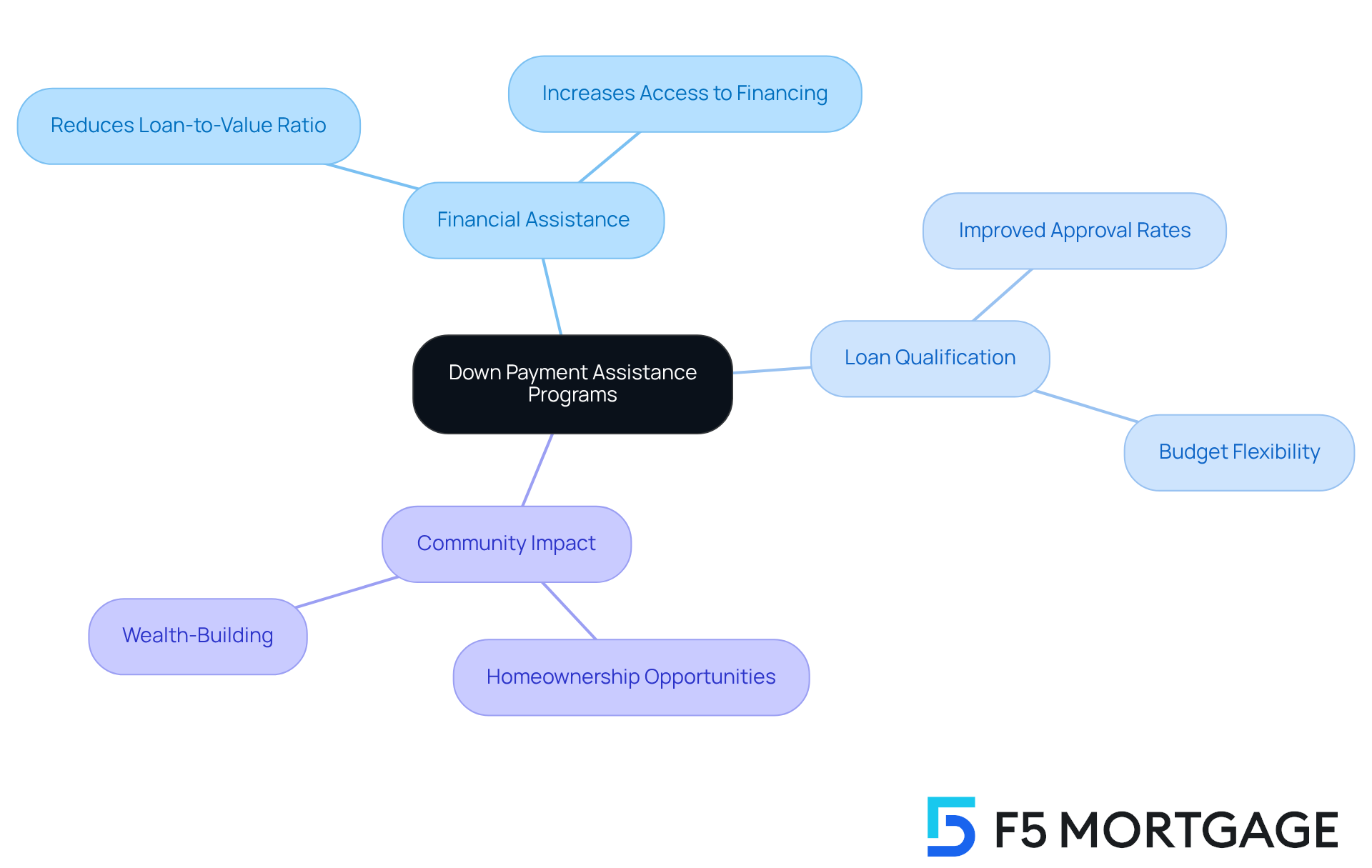

Down Payment Assistance Programs: Enhancing VA Mortgage Affordability

Down payment aid initiatives serve as essential resources for households aiming to improve their affordability using a VA mortgage affordability calculator. By offering financial assistance to cover initial costs, these programs significantly enhance the ability of families to qualify for loans. For instance, down payment aid can lower a homebuyer’s loan-to-value ratio by an average of 6%, making home financing more accessible. This reduction in upfront costs not only increases the likelihood of securing a loan but also allows families to explore options that better fit their budgets.

Housing advocates emphasize the importance of these programs, noting that increased awareness can lead to more families achieving homeownership. In fact, many households have successfully navigated the complexities of the financing process with the help of down payment assistance, and the VA mortgage affordability calculator has been shown to improve approval rates for VA financing. As one advocate shared, “Homeownership is something I never, never, never would have been able to do without the program.”

By exploring the various support options available, families can take meaningful steps toward easing their financial burdens and enhancing their overall affordability. This proactive approach not only supports individual dreams of homeownership but also fosters greater community stability and wealth-building opportunities.

Personalized Mortgage Consultations: Supporting VA Loan Affordability Decisions

At F5 Financing, we understand how challenging it can be to navigate the world of VA financing options. That’s why we emphasize tailored consultations—an essential service designed to help households explore their unique financial situations efficiently. These consultations allow families to receive customized advice aimed at enhancing their loan affordability.

Our dedicated loan officers are here to provide insights into various loan programs, down payment assistance alternatives, and strategies to overcome common obstacles in the financing process. This personalized approach fosters a supportive environment, equipping households with the knowledge they need to make informed decisions aligned with their financial goals.

With a customer satisfaction rate of 94%, families consistently express their gratitude for the individualized guidance they receive. This highlights the vital role of personalized assistance in the financing journey. As one mortgage advisor wisely noted, ‘Understanding each household’s specific requirements is crucial to delivering the best possible mortgage solutions.’

This commitment to personalized service ensures that families feel confident and informed as they embark on their homeownership journey. We’re here to support you every step of the way.

Conclusion

Understanding the intricacies of VA mortgage affordability calculators is crucial for families looking to upgrade their homes. These tools not only provide insight into potential monthly payments but also empower users to navigate the complexities of home financing with confidence. By leveraging the features offered by various calculators, families can assess their financial readiness and make informed decisions that align with their budgetary constraints.

Throughout this article, we’ve highlighted various calculators from reputable sources such as:

- F5 Mortgage

- Chase

- Navy Federal

- US Bank

- Zillow

Each offers unique features that cater to different aspects of the mortgage process, such as eligibility assessments, detailed cost breakdowns, and personalized consultations. We know how important it is to understand current VA loan rates and the benefits of down payment assistance programs. These factors collectively enhance affordability and accessibility for families.

The journey toward homeownership can feel daunting, but utilizing VA mortgage affordability calculators can significantly ease this process. We encourage families to take advantage of these resources and explore the available assistance programs. By doing so, they can enhance their financial literacy, make better-informed decisions, and ultimately achieve their dreams of owning a home. Embracing this proactive approach not only supports individual aspirations but also contributes to the broader goal of fostering community stability and growth.

Frequently Asked Questions

What is the purpose of the VA mortgage affordability calculator at F5 Mortgage?

The VA mortgage affordability calculator at F5 Mortgage helps households assess their financial readiness for purchasing a new home by considering factors like income, existing debts, and current interest rates.

What factors does the calculator take into account?

The calculator considers essential factors such as income, existing debts, current interest rates, property tax rates, and homeowners insurance.

Who can benefit from using the VA mortgage affordability calculator?

First-time homebuyers and families looking to understand their financial responsibilities can benefit from using the calculator.

How does the calculator assist in the mortgage approval process?

By providing clarity on budgeting and understanding debt-to-income ratios, the calculator enhances users’ chances of securing a loan that fits their needs.

What are the typical down payment options for VA mortgages?

VA mortgages can offer low down payments, with some options requiring as little as 0% down.

What additional support does F5 Mortgage provide?

F5 Mortgage offers personalized assessments from Home Loan Specialists to support users throughout the home buying process.

What features does Chase’s VA mortgage affordability calculator offer?

Chase’s calculator provides comprehensive estimates of monthly costs, including principal, interest, taxes, and insurance, and allows users to adjust credit amounts and conditions to see their impact on expenses.

What are the current interest rates for VA financing?

Many VA borrowers enjoy competitive interest rates of 5% or lower, with 56.8% of VA borrowers experiencing these favorable rates.

What benefits do VA loans offer?

VA loans provide significant benefits such as no initial costs and reduced interest rates.

Are there down payment assistance programs available?

Yes, families can explore down payment assistance programs in states like California, Texas, and Florida to help with upfront costs.