Overview

This article is dedicated to helping families identify the top DSCR (Debt Service Coverage Ratio) lenders who can support their journey to upgrade their homes. We understand how challenging this process can be, and it’s crucial to explore tailored financing options that focus on property income instead of personal income. By doing so, families can secure more favorable loan terms, allowing them to navigate the mortgage process with confidence.

With the right support from independent brokers like F5 Mortgage and others, families can feel empowered every step of the way. We’re here to guide you through this journey, ensuring that your unique needs are met and that you have the resources necessary to make informed decisions. Remember, you are not alone in this process; we are here to support you and help you achieve your dream home.

Introduction

Upgrading your home can feel overwhelming, especially when navigating the complex world of financing. Traditional mortgage options often don’t meet the unique needs of families like yours. That’s where Debt Service Coverage Ratio (DSCR) loans come in—an innovative solution that prioritizes property income over personal financial history, making home financing more accessible.

As you explore this evolving market, it’s essential to identify the right DSCR lenders who can offer tailored solutions that fit your specific circumstances. We understand how challenging this can be, and we’re here to support you every step of the way. In this article, we’ll delve into the top DSCR lenders ready to empower families on their home upgrade journeys, providing insights into their unique offerings and advantages.

F5 Mortgage: Your Independent Partner for Competitive DSCR Loan Solutions

F5 Mortgage LLC stands out as a caring independent brokerage, committed to providing competitive financing options tailored for families through DSCR lenders. We understand how challenging the mortgage process can be, which is why we utilize a diverse network of over twenty lenders to offer that meet the unique financial situations of each client. This approach not only increases the chances of securing favorable terms but also ensures a smooth experience throughout the mortgage journey.

As we look ahead to 2025, the landscape for independent mortgage brokers is changing, with a greater focus on technology and client-centered services. F5 Financing exemplifies this shift by leveraging advanced tools that allow for quick loan quotes and efficient processing, often closing loans in less than three weeks. This rapid turnaround is essential for families eager to upgrade their homes without unnecessary delays.

Our dedication to client satisfaction is reflected in our impressive customer satisfaction rate of 94%. Families can confidently navigate the complexities of home financing, knowing they have a supportive partner in F5.

At F5, our dedicated team approach ensures that clients receive comprehensive assistance throughout the refinancing process. Successful instances of financing through DSCR lenders via our brokerage illustrate our capability to serve families looking to expand their living spaces or invest in rental properties. By offering tailored consultations and a variety of financing options, we empower clients to make informed choices that align with their homeownership goals.

In a competitive market where independent brokers are regaining influence, F5 stands out by prioritizing relationships and utilizing technology to enhance the client experience. This combination of personalized service and creative solutions positions F5 Mortgage as a significant partner for families looking to improve their homes through mortgage options. We invite you to arrange a customized consultation to explore the loan options that best suit your household’s needs.

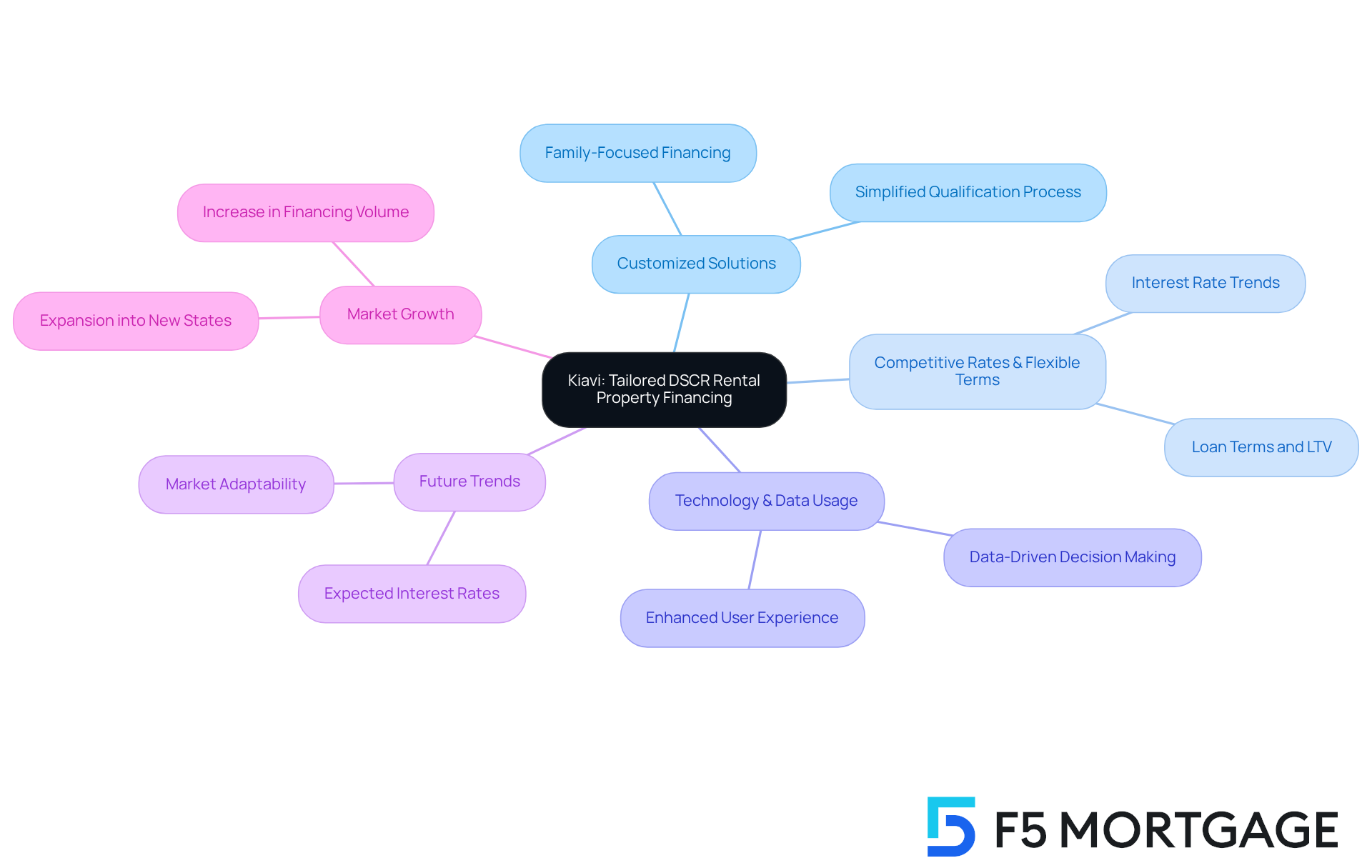

Kiavi: Tailored DSCR Rental Property Financing for Investors

At Kiavi, we understand how challenging it can be to navigate the world of rental property financing. That’s why we focus on offering customized solutions that cater to families looking to invest in rental properties. With and flexible terms, Kiavi empowers investors to qualify for loans like dscr lenders do, based on the rental income generated by the property rather than personal income. This approach not only simplifies the qualification process but also allows families to effectively expand their real estate portfolios.

Looking ahead to 2025, we expect that dscr lenders will offer average interest rates that remain competitive. Factors such as terms, borrower qualifications, and LTV will play a role in this landscape. Our commitment to leveraging technology and data ensures that families can navigate the complexities of rental property financing with ease.

As Rebecca Simanek states, “Kiavi harnesses the power of data & technology to offer residential real estate investors a simpler, more reliable, and faster way to access the capital they need to scale their businesses.” This is more than just a statement; it’s a promise to support you every step of the way.

Moreover, Kiavi’s recent expansion into 13 more states and a remarkable 46% increase in financing volume in 2024 highlight our growing market presence. We are here to prepare families for successful investments in the ever-changing real estate market, ensuring that you have the resources and support you need to thrive.

Griffin Funding: Diverse DSCR Loan Programs for Every Investor

At F5 Home Loans, we understand how challenging the refinancing process can be for families. That’s why we offer an extensive selection of refinancing solutions, including dscr lenders that provide loan programs tailored for households looking to enhance their residences. Our commitment to outstanding customer service means that we’re here to support you every step of the way, ensuring you navigate the refinancing process seamlessly.

With access to more than two dozen lenders, we can provide that suit your needs. Our independent broker status allows us to work for you, not the lenders, helping you secure the best possible terms. Whether you’re looking to take advantage of home appreciation or explore cash-out options, we have the expertise needed to maximize your home equity and enhance your financing opportunities.

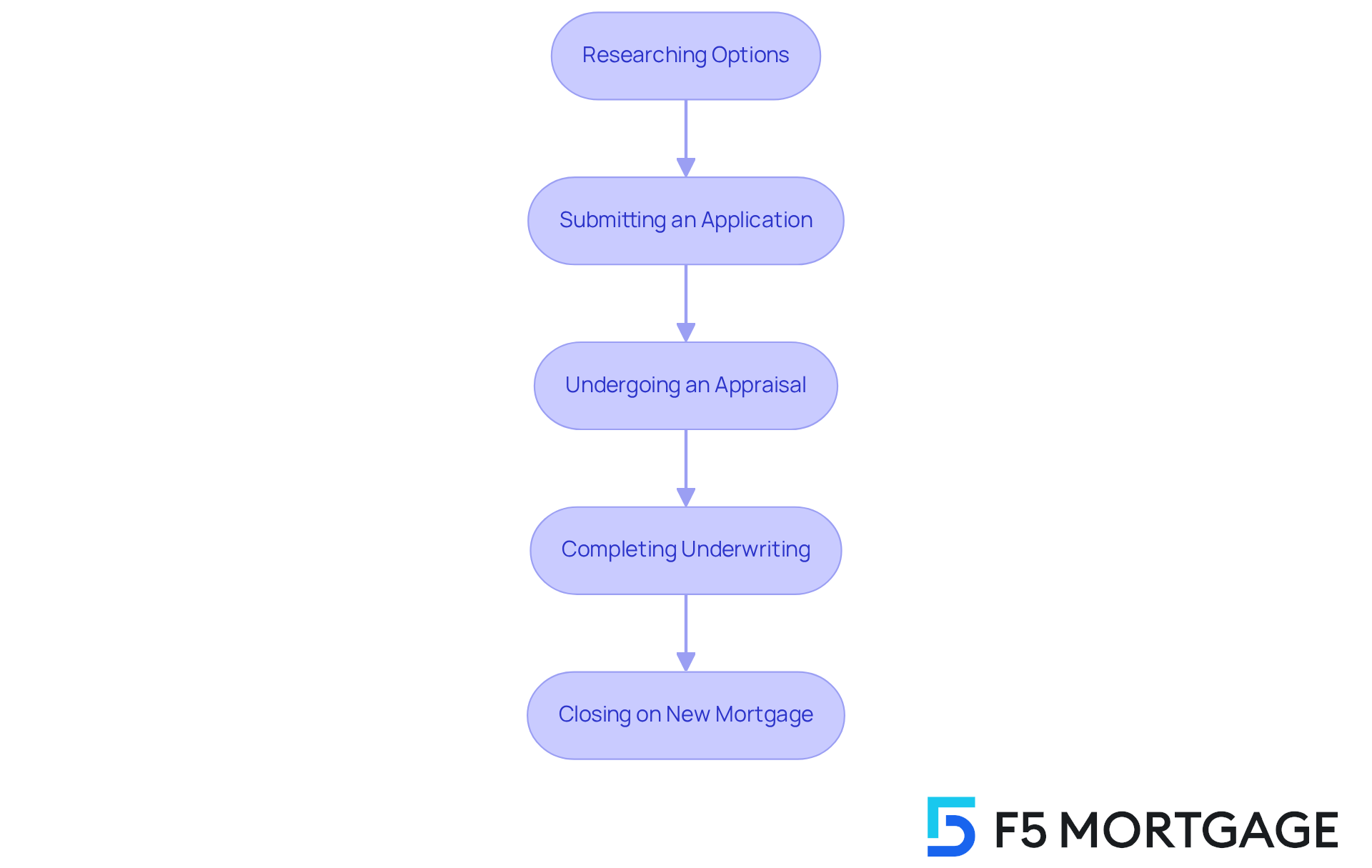

The refinancing process involves several key steps:

- Researching options

- Submitting an application

- Undergoing an appraisal

- Completing underwriting before closing on your new mortgage

We know how important it is to feel supported during this journey, and our devoted assistance is designed to make it as stress-free as possible.

As one pleased client remarked, ‘The team at F5 made the refinancing process simple and stress-free, assisting me at every stage.’ Let us help you turn your refinancing goals into reality, with the care and expertise you deserve.

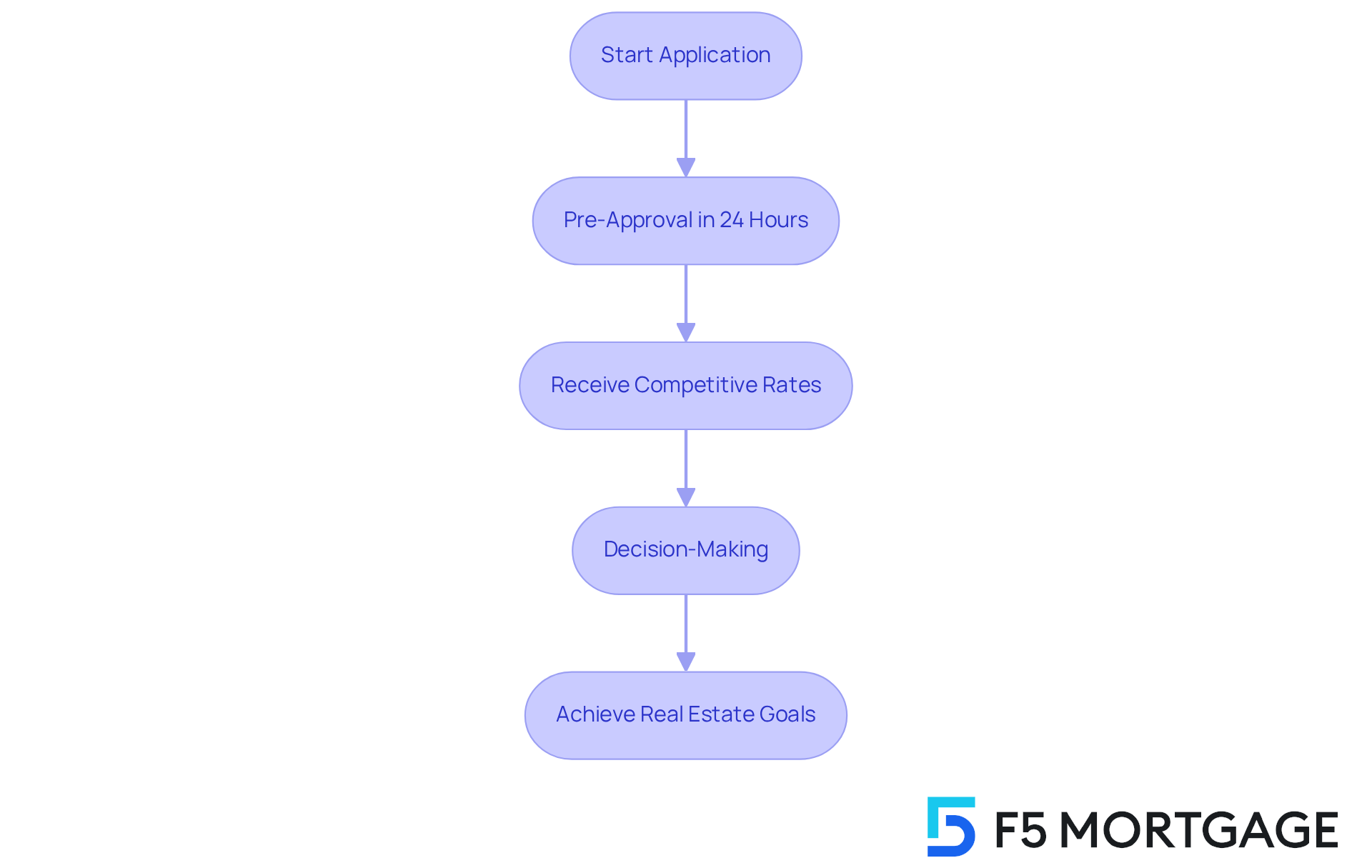

RCN Capital: Fast and Flexible DSCR Loan Solutions for Real Estate Investors

At F5 Mortgage, we understand how challenging it can be to navigate the world of home financing. That’s why we offer quick and adaptable loan options through DSCR lenders specifically designed for households looking to enhance their residences. With our efficient application process, you can obtain in as little as 24 hours. This crucial benefit allows you to seize time-sensitive opportunities in the competitive real estate market.

Our swift response not only aids in prompt decision-making but also empowers you to act decisively when it matters most. We take pride in our technology-driven, consumer-centric approach, which ensures you receive ultra-competitive mortgage rates without the hassle of unwanted hard sales tactics.

By focusing on property cash flow rather than personal income, we streamline the qualification process for households. This approach aligns with the rising trend of cash flow-based qualification for financing through DSCR lenders, which has become increasingly significant in 2025 as families aim to refinance maturing obligations.

We’ve seen successful pre-approval stories from families just like yours, demonstrating how our financial products can effectively enhance investment portfolios. This reinforces the importance of swift pre-approval in achieving your real estate goals. Remember, we’re here to support you every step of the way.

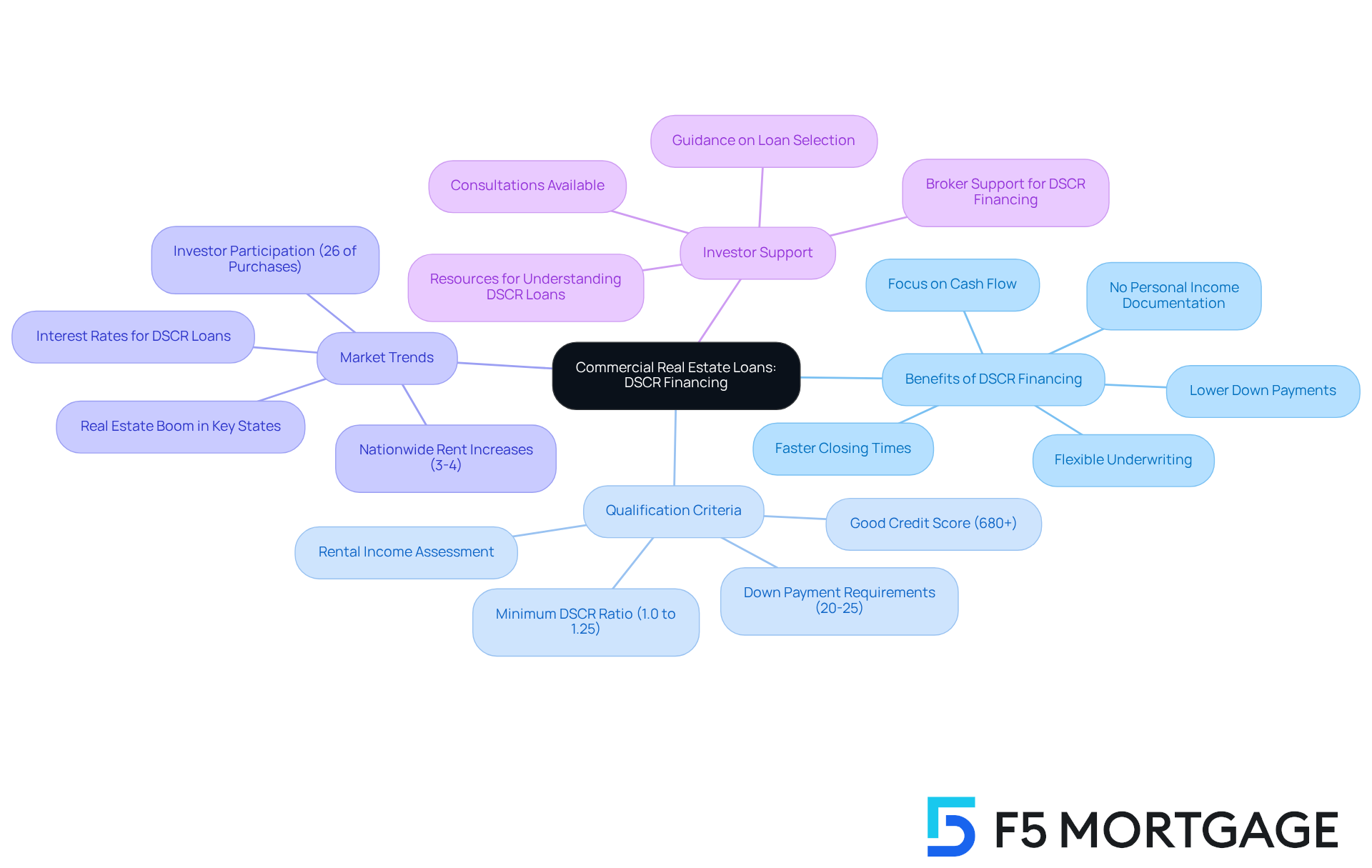

Commercial Real Estate Loans: Specialized DSCR Financing for Commercial Properties

For households contemplating commercial real estate investments, we understand how daunting this process can be. That’s why [specialized financing options for DSCR lenders](https://insulacapitalgroup.com/real-estate-investment-how-dscr-loans-enable-growth-in-the-commercial-property-market) are available through F5 Mortgage. These financial products focus on the income generated by commercial properties, allowing investors to qualify based on cash flow rather than personal financial history. This flexibility opens up new opportunities for families looking to diversify their investment portfolios and capitalize on the lucrative commercial real estate market.

In 2025, nationwide rents have seen an increase of approximately 3-4% year-over-year, creating favorable conditions for investors. To qualify for business Debt Service Coverage Ratio financing, households typically need to demonstrate a . This ensures that the property’s income sufficiently covers its debt obligations. Such lenient qualification criteria offered by DSCR lenders make loans particularly appealing for families eager to enter the commercial real estate sector, as they can harness the cash flow potential of their investments without the strict requirements of traditional financing.

As you navigate this evolving landscape, understanding cash flow requirements and trends in commercial real estate will be crucial. We’re here to support you every step of the way in making informed investment decisions.

Park Place Finance: Personalized DSCR Loan Services with Competitive Rates

At F5 Mortgage, we understand how challenging it can be to navigate the world of home financing. That’s why we distinguish ourselves with tailored mortgage services designed to meet your unique needs. Our competitive rates attract families looking to invest in their real estate dreams.

Our dedicated team of experts is here to support you every step of the way. We collaborate closely with you to identify your specific needs, crafting customized loan solutions that simplify the mortgage process. This dedication to tailored service not only builds trust but also enhances your overall experience as you explore your financing options.

With numerous 5-star reviews reflecting high customer satisfaction, many families have successfully utilized F5’s to achieve their homeownership goals. They appreciate the streamlined process, receiving assistance throughout every step—from application to closing—ensuring you are never alone in your refinancing journey.

As we look to the home loan market in 2025, F5 continues to offer appealing rates. We encourage you to compare rates, terms, and lender reputations to find the best financing for your needs. Remember, we’re here to support you every step of the way.

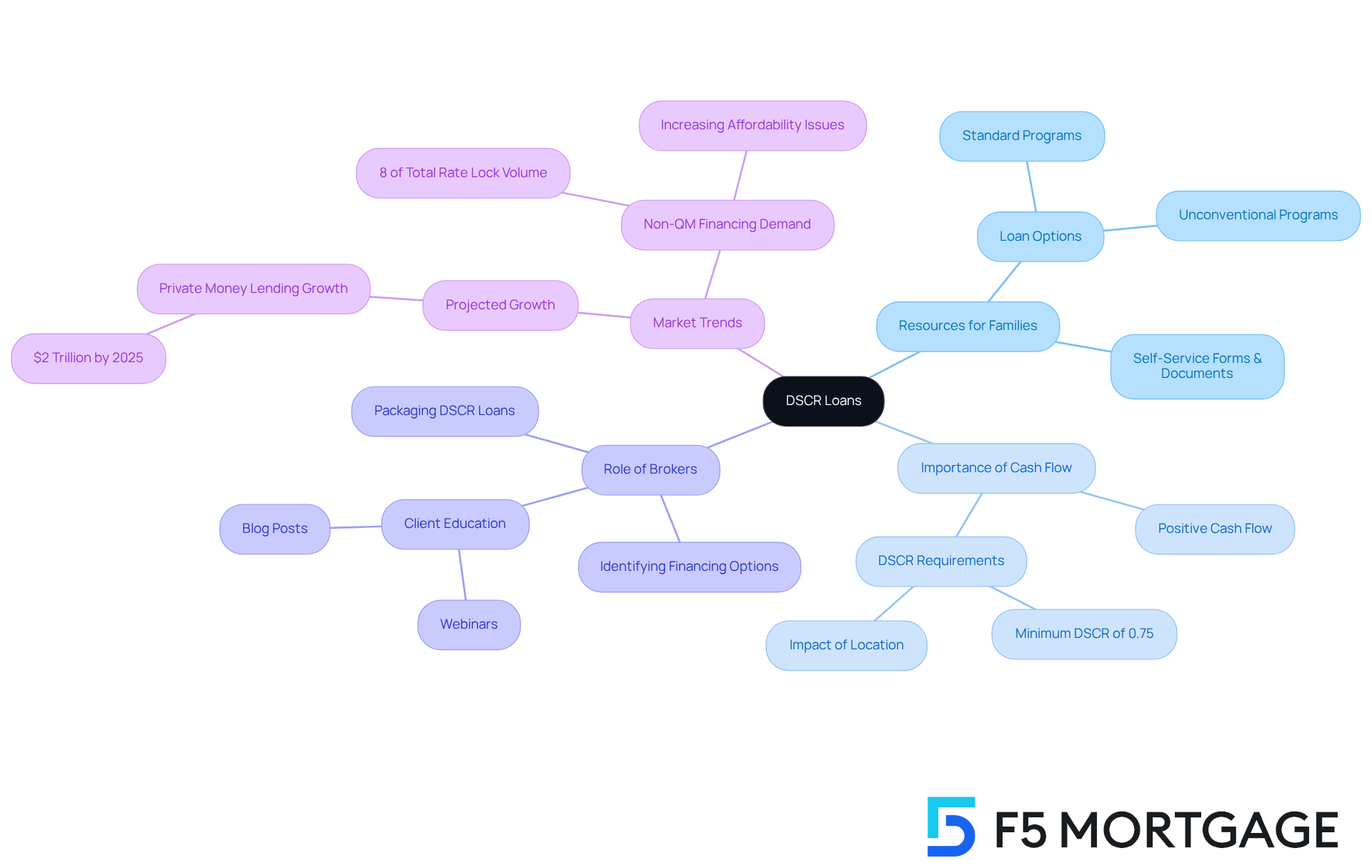

Change Wholesale: Navigating DSCR Loans for Brokers and Investors

At F5 Mortgage, we understand how challenging navigating debt service coverage ratio financing with dscr lenders can be for families. That’s why we excel in providing the essential resources and support tailored to your unique needs. Our platform opens the door to a diverse range of loan options, including both standard and unconventional programs, making it easier for you to find the right financing solution.

We know that ensuring your property generates positive cash flow is crucial to meeting the debt service coverage ratio requirements imposed by dscr lenders, which can vary based on location. By focusing on this aspect, you can significantly enhance your chances of securing favorable terms. Additionally, we’re here to connect you with top realtors in your area, further supporting your journey toward homeownership.

As the demand for financing from dscr lenders continues to grow, it’s important to stay informed about the latest trends and resources available to assist you. With the projected to reach $2 trillion by 2025, understanding the ins and outs of debt service coverage ratio financing is essential for families looking to improve their homes.

Brokers play a vital role in this process, helping you identify the right financing options and navigate the current challenges in securing funding from dscr lenders. Together, we can work towards achieving your homeownership goals, ensuring you feel supported every step of the way.

AHLend: Insights on DSCR Loans vs. Traditional Financing for Investors

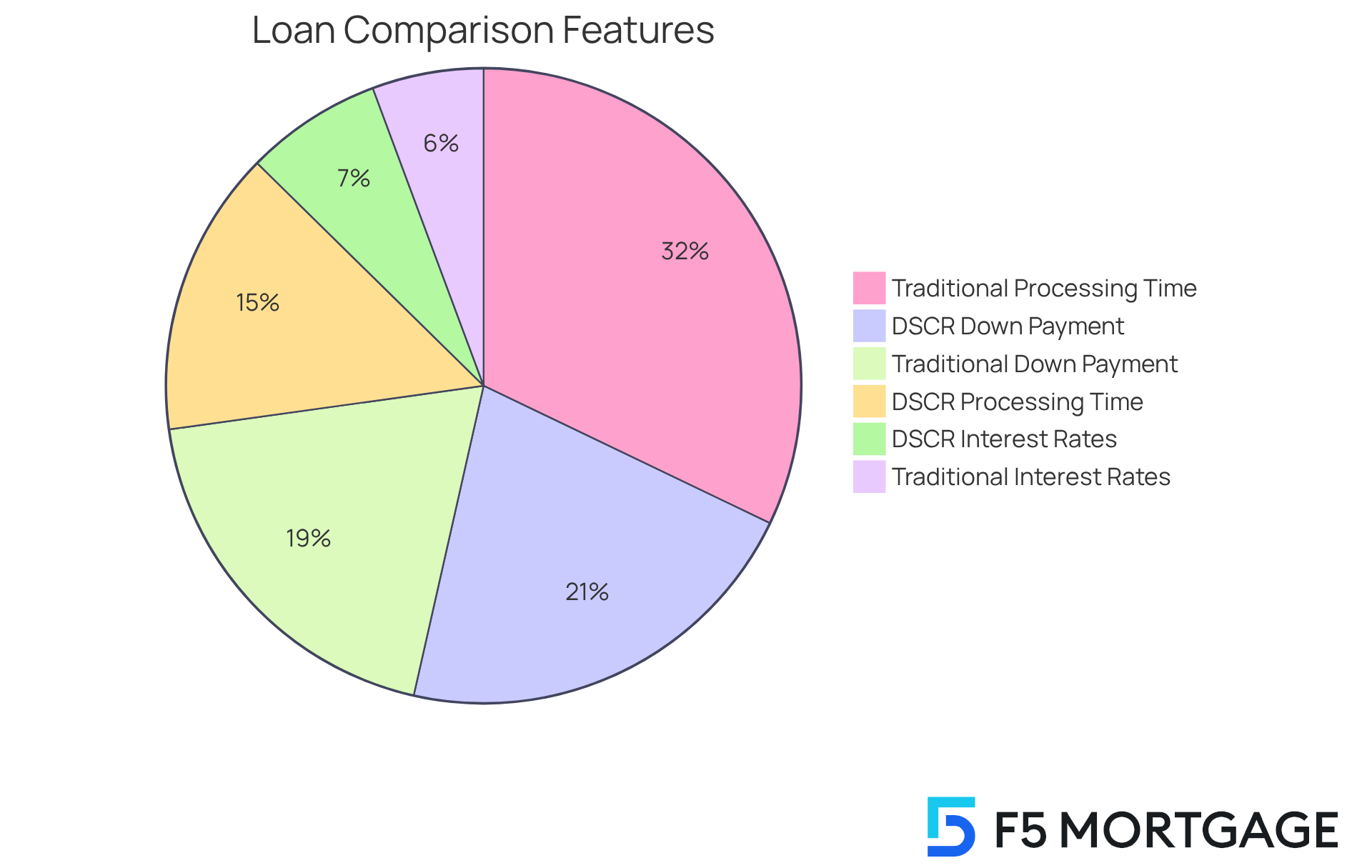

At F5 Mortgage, we understand how challenging it can be to navigate financial decisions, especially when it comes to choosing the right mortgage option. That’s why we provide vital information about the differences between debt service coverage ratio financing offered by dscr lenders and conventional funding alternatives. For households like yours, considering financial strategies is crucial.

Unlike conventional financing options that heavily rely on your individual financial background, dscr lenders consider the income generated by the property itself. This property-focused approach allows dscr lenders to qualify investors based on cash flow rather than personal income, making it particularly beneficial for families with unique financial situations, such as self-employed borrowers.

In 2025, you’ll find competitive debt service coverage ratio interest rates ranging from 7.25% to 9.00%. This offers a viable alternative for those who may not meet the stringent requirements of traditional financing. We know how important it is to find the best deal possible, which is why F5 Mortgage partners with over twenty leading lenders. We often finalize financing with dscr lenders in just 14 to 20 days—much faster than the typical 30 to 45 days required for conventional financing. This speed and flexibility empower families to seize opportunities in a competitive market.

Additionally, these financing options usually require a down payment of 20-30%. This is a significant consideration for families looking to improve their homes or invest in rental properties. With our commitment to and personalized concierge services, you can navigate your financing options with confidence and ease. We’re here to support you every step of the way.

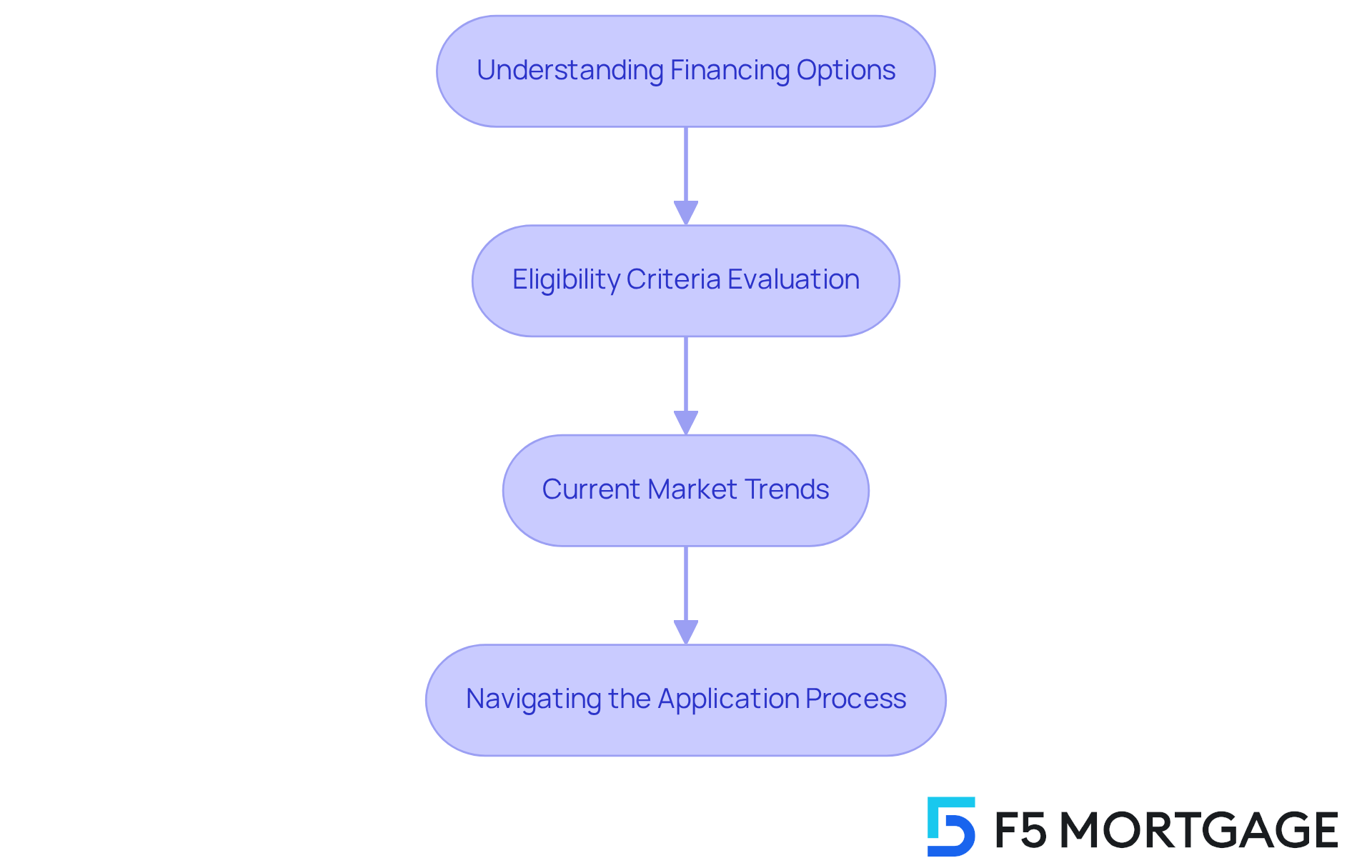

Easy Street Capital: Comprehensive DSCR Loan Guidance for Investors

At Easy Street Capital, we understand how challenging it can be for households considering financing options from DSCR lenders. Our skilled team is here to provide essential assistance, offering comprehensive advice on the application process. We ensure that you grasp each step involved in obtaining financing, so you never feel lost.

We clearly outline the eligibility criteria for DSCR lenders, which helps you evaluate your qualifications and make informed decisions. It’s important to know that current trends show a growing interest in financial products from DSCR lenders, especially as the housing market continues to evolve.

With our support, you can confidently . We’re dedicated to maximizing your opportunities for successful home upgrades, empowering you every step of the way. Remember, we’re here to support you, and together, we can turn your aspirations into reality.

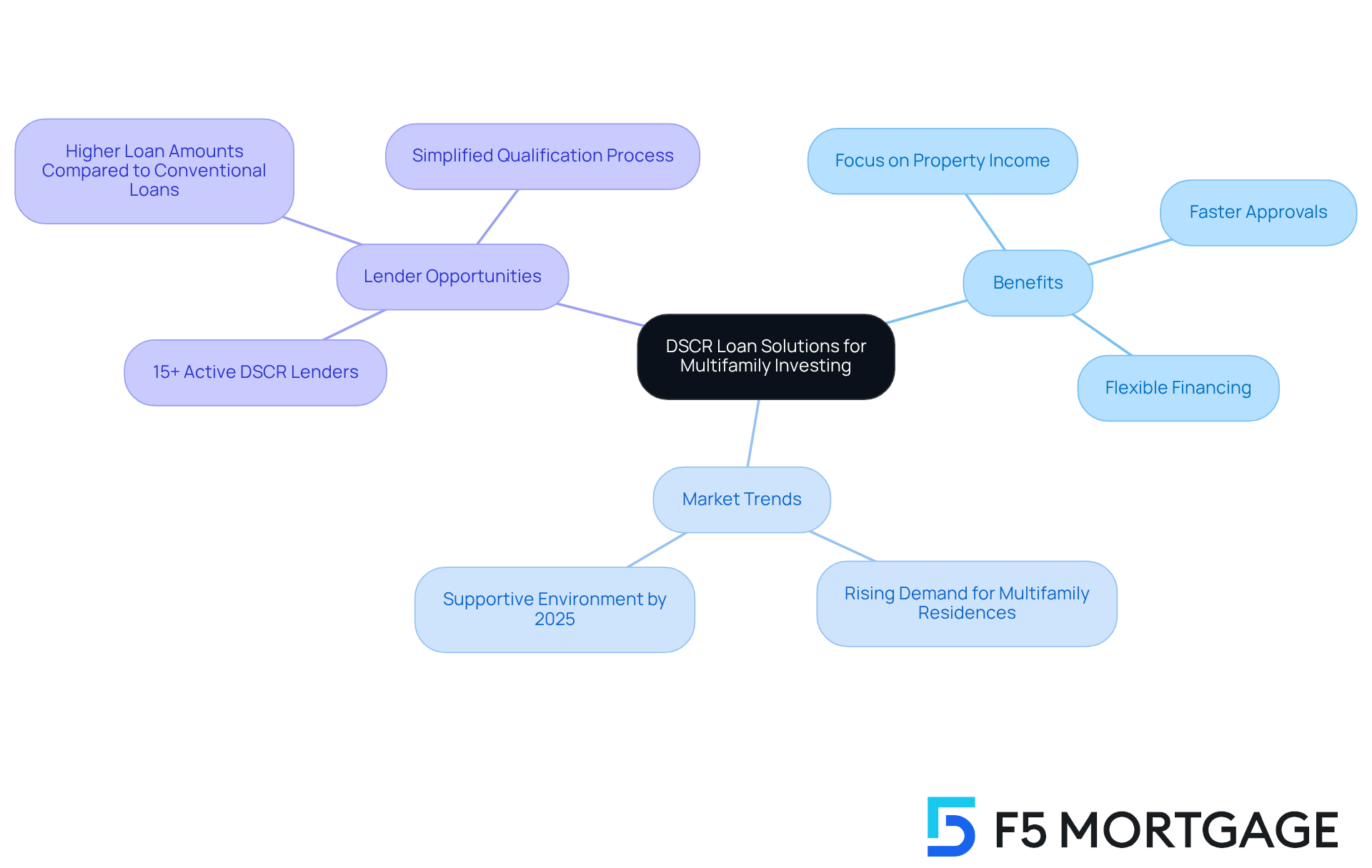

Multifamily.loans: Tailored DSCR Loan Solutions for Multifamily Investing

At Multifamily.loans, we understand how challenging it can be to navigate the world of financing, especially for families looking to invest in multifamily properties. Our specialized financing solutions provided by DSCR lenders focus on the income generated by the property rather than the personal financial background of the borrower. This approach empowers households to utilize their investments efficiently and seize opportunities in a growing market.

As the demand for multifamily residences continues to rise, families can take advantage of this trend by utilizing DSCR lenders. This option streamlines the qualification process, leading to faster approvals, which can be a significant relief for many. Looking ahead to 2025, families investing in multifamily properties can expect a supportive environment, with numerous lenders offering competitive conditions and increased financing amounts compared to traditional options.

This flexibility allows households to expand their property portfolios without the usual constraints of conventional financing. By concentrating on property cash flow, these financing options enable families to make informed investment choices, ensuring they can navigate the evolving real estate market with confidence. As Max Chera aptly puts it, “Debt Service Coverage Ratio loans are a potent financing resource for real estate investors aiming to expand their rental property collection.”

Moreover, with over 15 active DSCR lenders in the DSCR space in 2025, families have abundant opportunities to explore and invest in multifamily properties. We’re here to support you every step of the way, helping you and make decisions that align with your financial goals.

Conclusion

Exploring the top DSCR lenders opens up a world of opportunities for families eager to enhance their homes and invest in real estate. Lenders like F5 Mortgage, Kiavi, and Griffin Funding are dedicated to offering customized financing solutions that truly consider the unique financial situations of each household. This innovative approach not only makes the loan process easier but also empowers families to reach their homeownership dreams with confidence.

As you read through this article, you’ll discover key insights that highlight the benefits of DSCR loans. These loans focus on property cash flow instead of personal income, allowing for more flexible qualification criteria. In this ever-changing real estate landscape, lenders such as RCN Capital and Multifamily.loans provide vital resources and support, ensuring homeowners can seize favorable market conditions. The emphasis on personalized service and quick processing times marks a significant shift towards a more client-centered mortgage experience.

In conclusion, as the interest in DSCR loans continues to grow, we encourage families to explore these financing options to improve their living spaces or invest in rental properties. Staying informed about the latest trends and utilizing the expertise of these top lenders can greatly influence your financial decisions. By taking proactive steps today, households can position themselves for success in the competitive real estate market of 2025 and beyond. We know how challenging this journey can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What does F5 Mortgage specialize in?

F5 Mortgage specializes in providing competitive financing options tailored for families through DSCR lenders, focusing on customized solutions that meet unique financial situations.

How does F5 Mortgage enhance the mortgage process for clients?

F5 Mortgage utilizes a diverse network of over twenty lenders to increase the chances of securing favorable terms and ensuring a smooth mortgage experience for clients.

What is the customer satisfaction rate of F5 Mortgage?

F5 Mortgage boasts an impressive customer satisfaction rate of 94%.

How quickly can F5 Mortgage close loans?

F5 Mortgage can often close loans in less than three weeks, providing a rapid turnaround for families eager to upgrade their homes.

What approach does F5 Mortgage take to assist clients during the refinancing process?

F5 Mortgage employs a dedicated team approach to provide comprehensive assistance throughout the refinancing process, offering tailored consultations and a variety of financing options.

What is Kiavi’s focus in rental property financing?

Kiavi focuses on offering customized solutions for families looking to invest in rental properties, allowing them to qualify for loans based on the rental income generated by the property rather than personal income.

How does Kiavi utilize technology in its services?

Kiavi leverages technology and data to simplify the qualification process for rental property financing, ensuring families can navigate the complexities with ease.

What recent developments have occurred at Kiavi?

Kiavi has recently expanded into 13 more states and experienced a 46% increase in financing volume in 2024.

What refinancing solutions does Griffin Funding provide?

Griffin Funding offers an extensive selection of refinancing solutions, including loan programs tailored for households looking to enhance their residences through DSCR lenders.

What steps are involved in the refinancing process with Griffin Funding?

The refinancing process with Griffin Funding involves researching options, submitting an application, undergoing an appraisal, and completing underwriting before closing on the new mortgage.

How does Griffin Funding support clients during the refinancing process?

Griffin Funding is committed to outstanding customer service, ensuring clients feel supported throughout the refinancing journey to make it as stress-free as possible.