Overview

We understand how challenging it can be to navigate the world of credit scores, especially when you’re aiming to secure a conventional loan. This article offers essential tips to help you improve your credit score, highlighting the importance of a strong credit history in obtaining favorable mortgage terms.

To enhance your financial profile and increase your chances of loan approval, consider implementing strategies such as:

- Making timely bill payments

- Managing your credit utilization

- Familiarizing yourself with how credit scores are calculated

Each of these steps plays a crucial role in building a solid credit history.

By taking these actionable steps, you can empower yourself in the mortgage process. Remember, we’re here to support you every step of the way as you work towards your financial goals.

Introduction

Navigating the world of conventional loans can feel overwhelming, especially when it comes to understanding credit scores. We know how challenging this can be. A solid credit score is not merely a number; it serves as the key to unlocking favorable mortgage terms and interest rates.

In this article, we will explore essential tips designed to empower you to boost your credit score, enhance your financial profile, and ultimately improve your chances of securing a conventional loan.

But what are the most effective strategies to elevate your credit score? How can personalized consultations make a meaningful difference in your journey? We’re here to support you every step of the way.

F5 Mortgage: Personalized Consultations for Conventional Loan Credit Scores

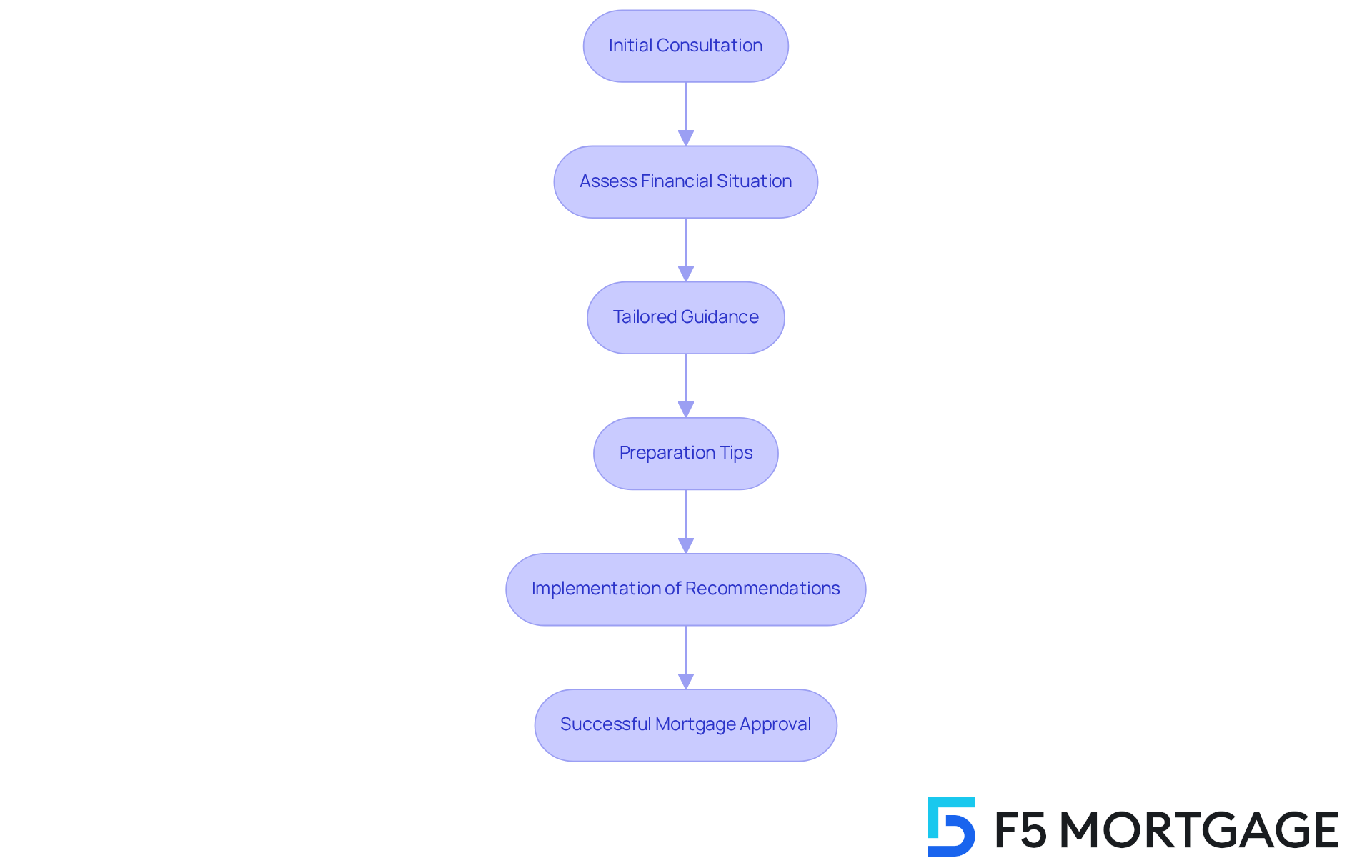

At F5 Mortgage, we understand how challenging navigating traditional borrowing evaluations can be. Our customized consultations form the foundation of our approach, helping clients gain clarity on their unique financial situations. Our skilled brokers work closely with families, providing tailored guidance that focuses on improving their financial standing and maximizing borrowing options.

This individualized approach empowers our clients with the knowledge they need, significantly enhancing their chances of securing favorable loan terms. Success stories abound, with many families experiencing transformative outcomes through our personalized support. One client shared, “The group at F5 Mortgage assisted me in recognizing particular financial issues, resulting in a substantial rise in my rating and successful mortgage approval.”

By centering our efforts on each client’s specific needs, we ensure they feel supported and informed throughout the mortgage journey. This ultimately leads to better financial decisions and successful homeownership. Additionally, our streamlined application process allows for quicker turnaround times, which is essential in today’s competitive market.

Clients have praised our team for their attention to detail and commitment to making the process easy and worry-free, as reflected in numerous 5-star reviews. For families preparing for a mortgage consultation, we recommend gathering all financial documents and being aware of your current conventional loan credit score. This preparation can significantly enhance the effectiveness of the consultation and improve your chances of obtaining favorable financing terms. We’re here to support you every step of the way.

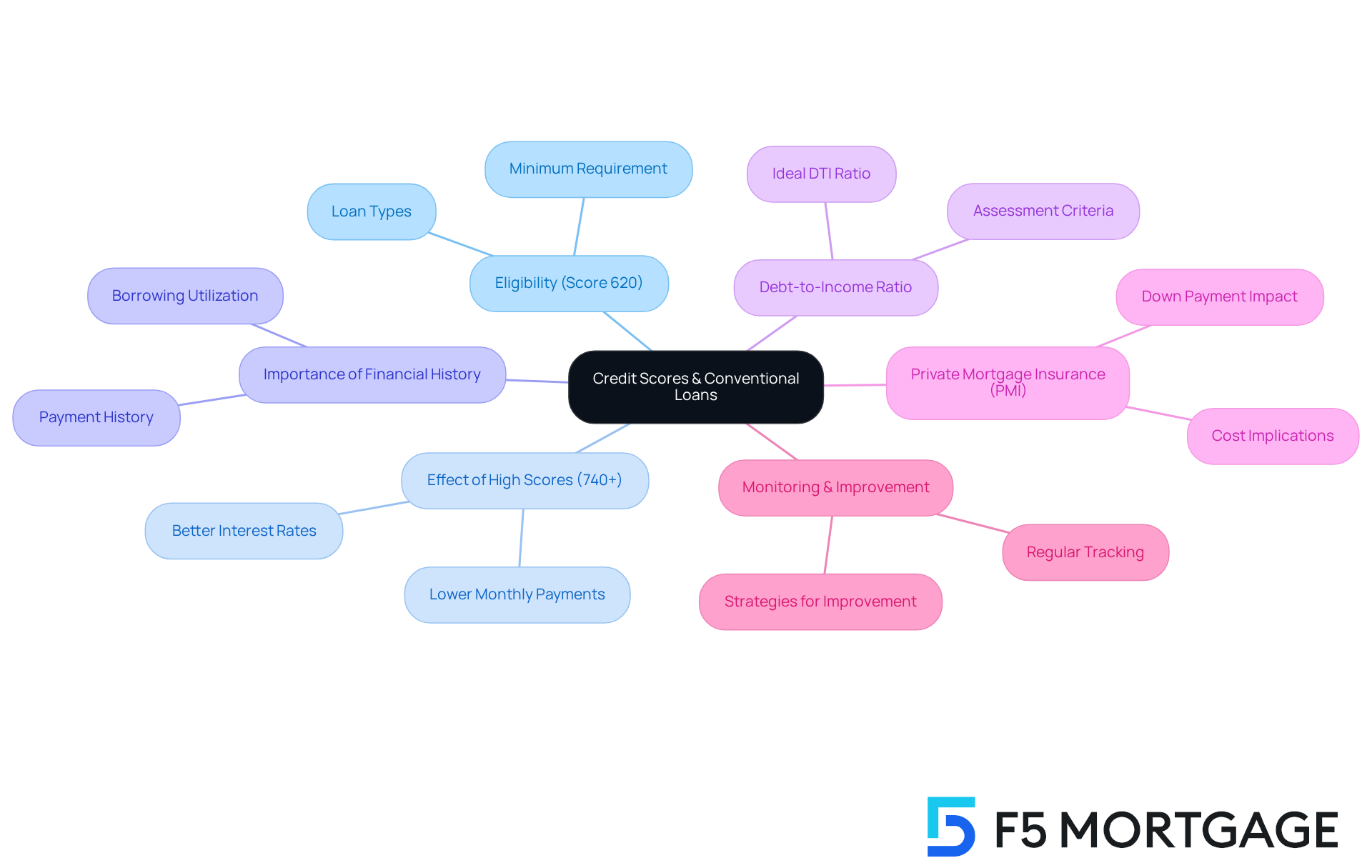

Minimum Credit Score Requirements for Conventional Loans

To be eligible for a traditional mortgage, most providers require a conventional loan credit score of at least 620. We understand how challenging this can be, especially when navigating financial decisions. Borrowers with better ratings often enjoy increased chances of approval and access to more favorable interest rates, while those with lower ratings may face higher costs. For instance, a financial rating in the mid-to-high 700s can greatly enhance loan conditions, making a significant difference in your mortgage journey.

Consistently reviewing your financial ratings is essential for understanding your position and pinpointing areas for improvement. Many lenders necessitate a minimum conventional loan credit score of 620, although some may enforce stricter criteria based on personal situations, such as a history of foreclosure or bankruptcy. This can feel overwhelming, but we’re here to support you every step of the way.

F5 Mortgage offers useful tools and resources to help clients evaluate their ratings and create plans to improve them. By taking proactive steps, you can ultimately achieve better mortgage choices and find peace of mind in your financial future.

Impact of Credit Scores on Interest Rates for Conventional Loans

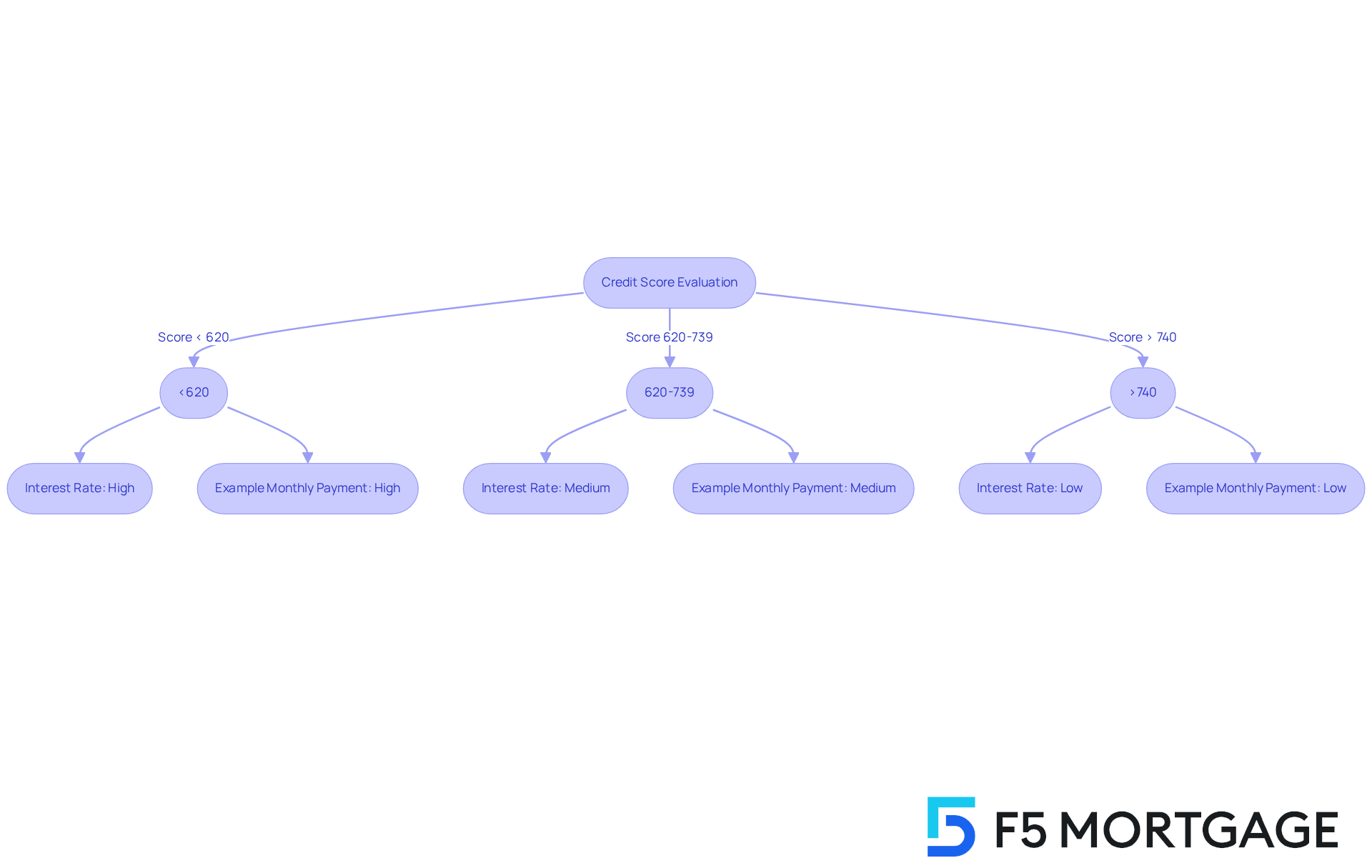

Credit evaluations play a vital role in determining the interest rates available based on the conventional loan credit score. We understand how overwhelming this can be. Generally, a higher financial rating is linked to a lower interest percentage when considering a conventional loan credit score. For example, borrowers with scores exceeding 740 often qualify for the most favorable terms, while those with a conventional loan credit score below 620 may face significantly higher charges or even denial of credit. As of October 2025, the typical 30-year mortgage interest rate stands at 6.34%, with variations based on the conventional loan credit score. Imagine this: an individual with a rating of 740 could secure a rate around 6.83% APR, while someone with a conventional loan credit score of 580 might see a much higher rate. This can lead to substantial differences in monthly payments and overall interest paid throughout the loan’s life.

Improving your conventional loan credit score can lead to meaningful savings. For instance, a borrower with a score of 740 pays about $1,946 each month on a $300,000 mortgage, whereas a borrower with a score of 580 pays around $2,048 monthly. This difference can accumulate to over $55,000 in interest savings over the life of the loan. Financial analysts emphasize that maintaining a positive borrowing history and managing credit utilization effectively can improve mortgage rates, which is crucial for achieving a good conventional loan credit score. As one specialist pointed out, ‘A higher rating could mean a lower monthly payment—and less interest paid throughout your financing journey.’ Therefore, proactive financial management is essential for securing favorable lending conditions, which often depend on the conventional loan credit score, and minimizing overall borrowing costs. We’re here to support you every step of the way in achieving your financial goals.

Conventional Loans vs. Government-Backed Loans: Credit Score Differences

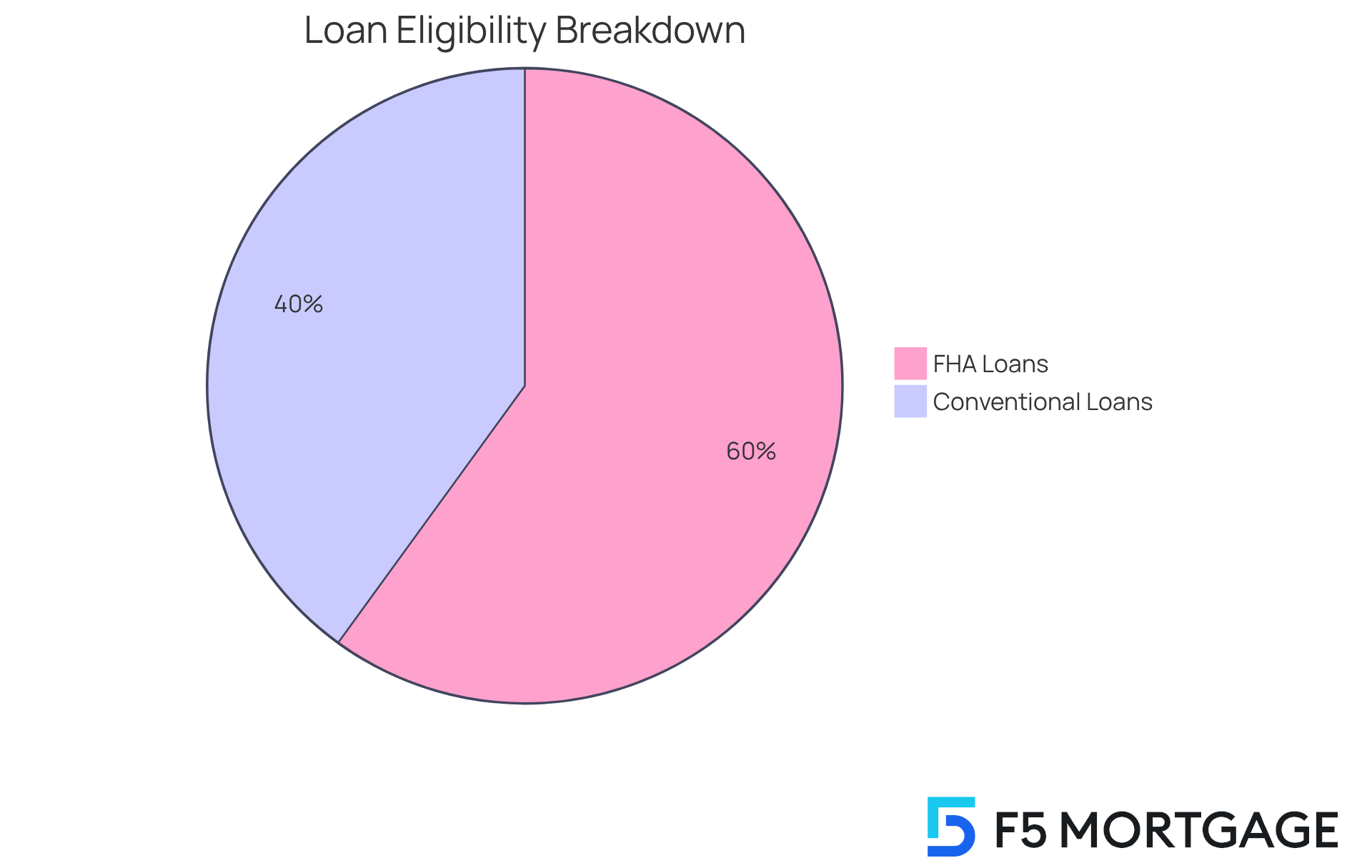

When assessing financing choices, we know how challenging it can be to comprehend the rating criteria. Traditional financing usually requires a minimum conventional loan credit score of 620, which sets a higher benchmark compared to government-supported options like FHA mortgages, accepting ratings as low as 580. This distinction is significant for families considering their financing options. For instance, families with scores in the 500s may find FHA options to be their only feasible choice, as these options are designed to support those with lower financial profiles.

On the other hand, families with stronger credit histories may benefit from options that consider their conventional loan credit score. These often come with lower overall expenses and the possibility to bypass private mortgage insurance (PMI) if they can provide a down payment of 20% or more. We understand that every family’s situation is unique, and exploring all available options is essential.

In addition to traditional and FHA options, Colorado residents have access to VA programs, offering advantageous mortgage terms and a simplified application process for military personnel and their partners. Furthermore, the Colorado Streamline Refinance Loan is an excellent choice for existing FHA borrowers looking to lower their interest rates quickly and conveniently.

Mortgage specialists highlight the importance of matching financing options with personal financial circumstances. As one specialist pointed out, “The kind of mortgage that’s most suitable for you relies on various elements, including your financial profile, down payment, and amount borrowed.” This insight emphasizes the need for borrowers to evaluate their financial status and objectives carefully.

Statistics show that a considerable percentage of borrowers are eligible for FHA financing due to its more flexible financial criteria, making it attainable for individuals facing financial difficulties. In contrast, traditional financing options may provide better rates for individuals with higher financial evaluations, but they often depend on a conventional loan credit score, requiring a more substantial financial profile. By understanding these differences, clients can make informed decisions that best suit their needs, ensuring a smoother path to homeownership. We’re here to support you every step of the way.

The Role of Private Mortgage Insurance (PMI) and Credit Scores

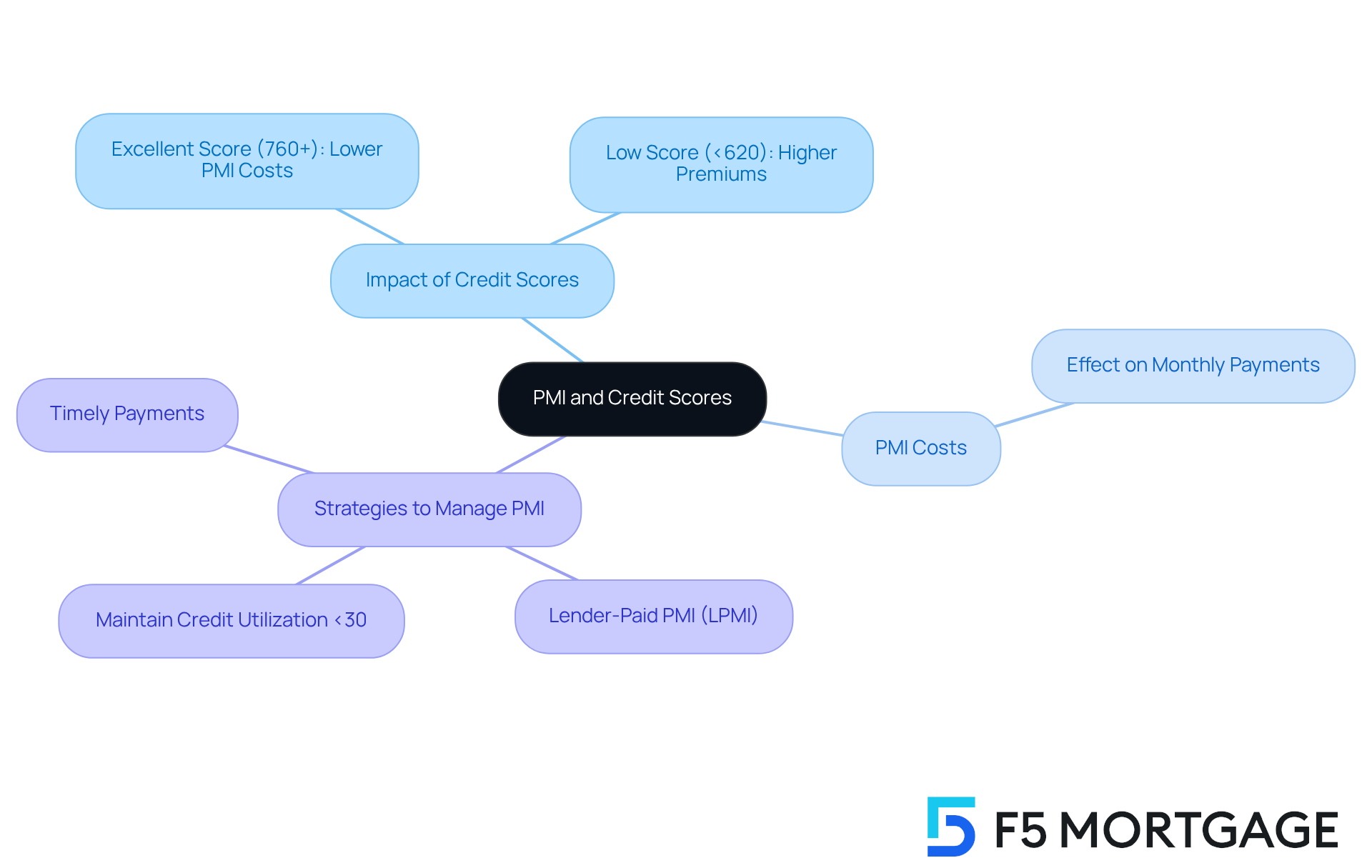

Private Mortgage Insurance (PMI) plays a crucial role in conventional financing, especially when the down payment is less than 20%. We know how challenging this can be, particularly for borrowers with a lower conventional loan credit score, as PMI premiums can be significantly higher, increasing overall borrowing costs. Understanding PMI is essential, as it can greatly impact your monthly mortgage payments. For instance, borrowers with an excellent conventional loan credit score (typically 760 and above) often enjoy lower PMI costs, while those with a conventional loan credit score below 620 may encounter much higher premiums or limited loan options.

At F5 Mortgage, we are here to support you every step of the way in navigating these complexities. Through personalized consultations, we help clients explore effective strategies to minimize PMI costs. One option is lender-paid PMI (LPMI), which eliminates monthly PMI payments in exchange for a slightly higher interest rate. This could be beneficial for some borrowers. Additionally, maintaining a credit utilization ratio below 30% and making timely payments can help improve your credit score, potentially leading to lower PMI premiums.

Understanding these dynamics is vital for clients seeking the best mortgage terms. As mortgage experts emphasize, a higher conventional loan credit score not only increases your chances of loan approval but also qualifies you for better rates and lower upfront costs. By leveraging these insights, F5 Mortgage empowers you to make informed decisions, ultimately leading to a more affordable mortgage experience.

Understanding Credit Score Calculations for Conventional Loans

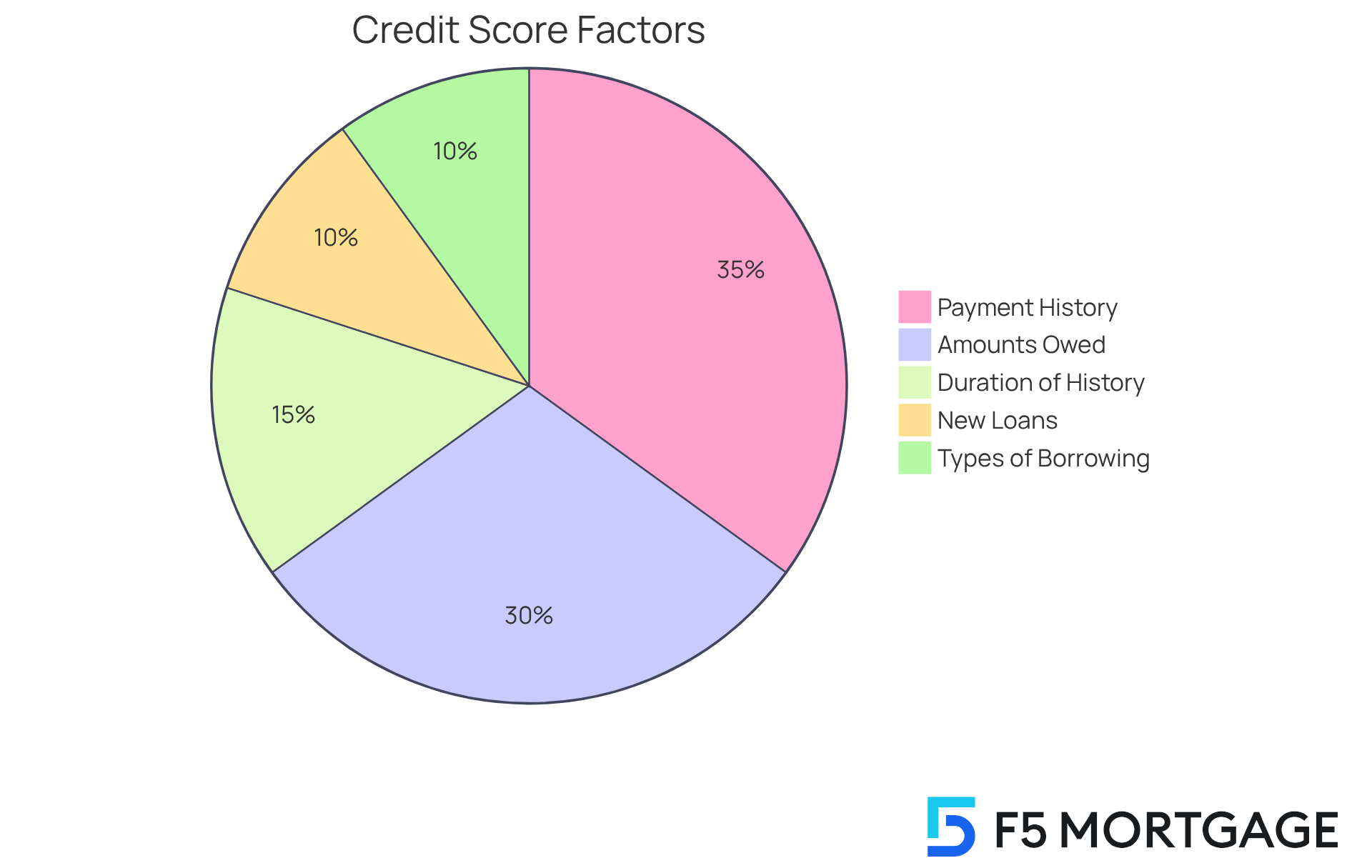

Understanding your credit rating is essential, and it’s influenced by several key factors, including the conventional loan credit score, which encompasses:

- Payment history (35%)

- Amounts owed (30%)

- Duration of borrowing history (15%)

- New loans (10%)

- Types of borrowing utilized (10%)

We know how challenging it can be to navigate these elements, but focusing on them can significantly enhance your results. For example, improving your payment history is crucial; timely payments can lead to substantial increases in your credit score, showcasing your creditworthiness.

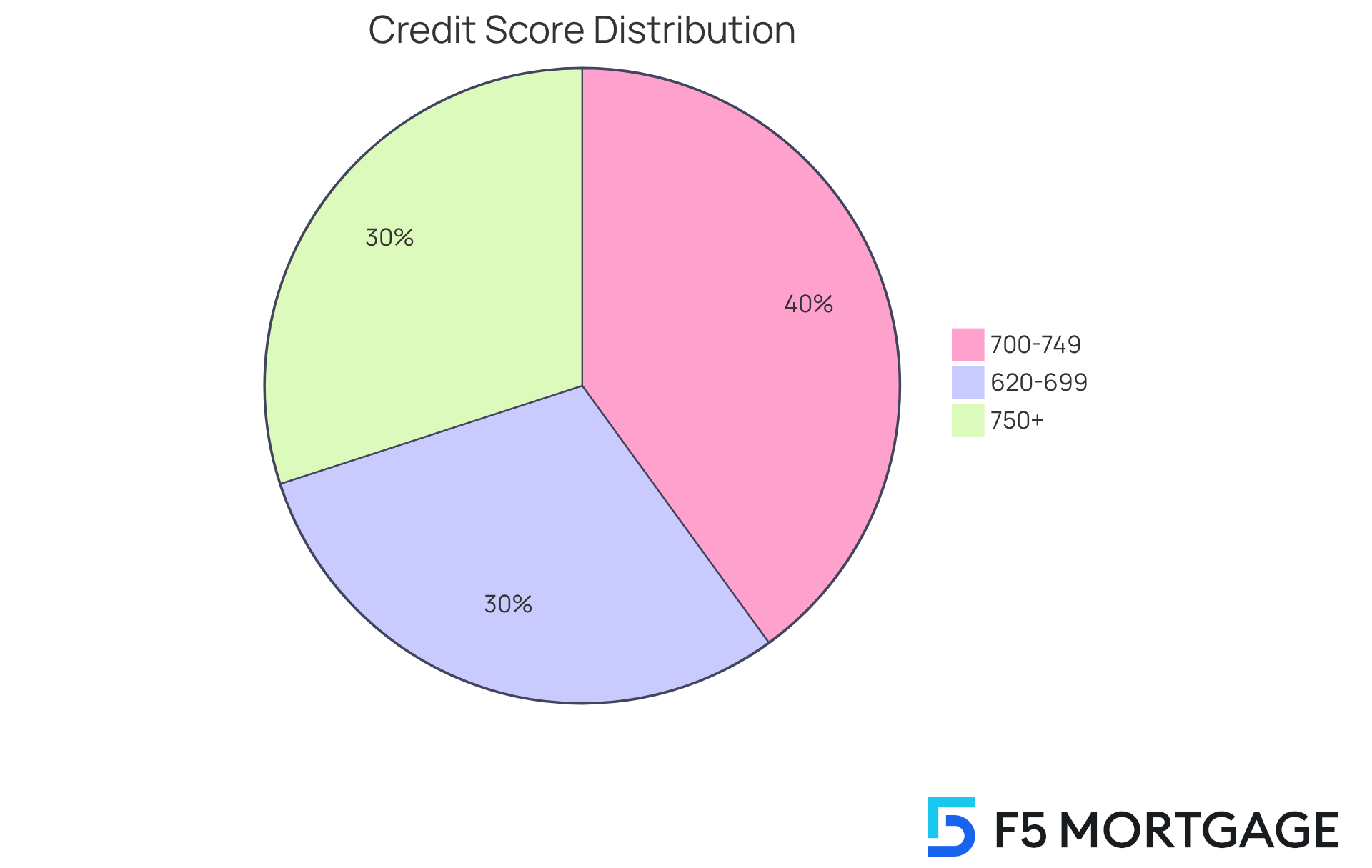

If your credit score falls between 700 and 749, this range is indicative of a conventional loan credit score, making you a reliable borrower and opening doors to favorable interest options. It’s also important to grasp the Debt-to-Income (DTI) ratio. Generally, a maximum DTI of 43% is needed for mortgage applications. A better DTI can lead to more competitive mortgage rates, so managing your existing debts relative to your income is vital.

At F5 Mortgage, we’re here to support you every step of the way. We offer customized resources and consultations to help you create effective strategies for enhancing your credit score, particularly focusing on the conventional loan credit score and managing your DTI, ensuring you’re well-prepared for the application process.

For Colorado residents, there are various refinancing options available, including:

- Conventional mortgages

- FHA mortgages

- VA mortgages

Each with specific eligibility requirements. Remember, even minor adjustments in these areas can lead to improved borrowing conditions and lower interest rates. It’s crucial to understand and actively manage your financial profile, and we’re here to guide you through it all.

Debunking Common Myths About Credit Scores and Conventional Loans

Many myths persist about ratings and their significance in obtaining a conventional loan credit score. We understand how confusing this can be for families. A common misunderstanding is that reviewing your financial rating can adversely affect it; however, this is simply not true. Reviewing your own rating is categorized as a soft inquiry, which does not impact your financial standing.

Furthermore, many believe that having a conventional loan credit score is a requirement for loan approval. In reality, lenders consider various factors beyond just financial evaluations, including income, employment history, and debt-to-income ratio. For instance, while the national average FICO rating was 717 in late 2023, borrowers with ratings in the low 600s may still qualify for a mortgage, provided they demonstrate financial stability in other areas.

At F5 Mortgage, we are committed to dispelling these myths through education. We know how challenging this can be, and we want to ensure you are equipped with accurate information to navigate the mortgage landscape confidently. By addressing these misconceptions, you can approach the home-buying process with greater assurance and clarity. Remember, we’re here to support you every step of the way.

Tips for Improving Your Credit Score for a Conventional Loan

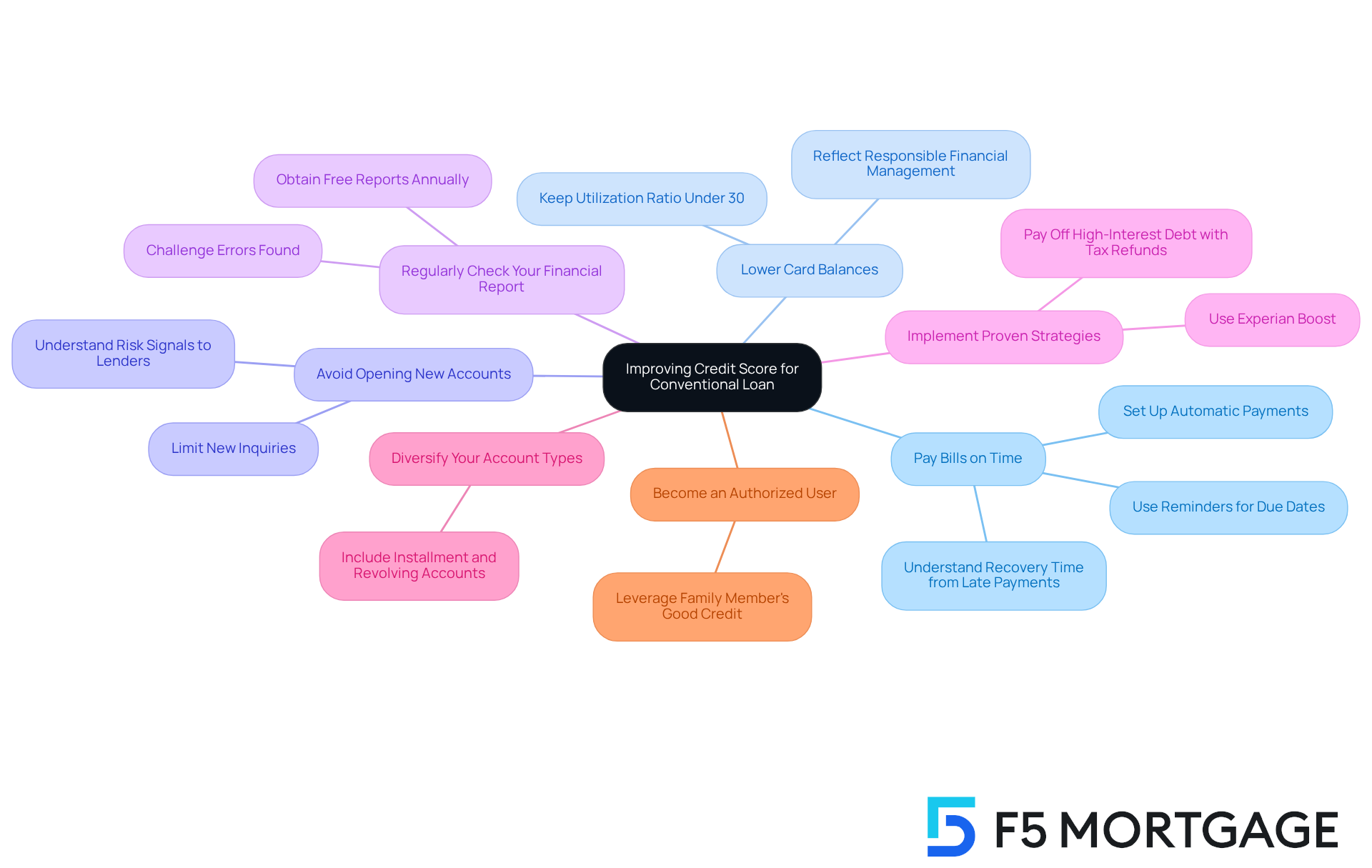

To enhance your credit score for a conventional loan, consider these essential strategies that can make a difference:

-

Pay Bills on Time: We know how challenging it can be to keep track of payments, but prompt payments are essential. Your payment history contributes to about 35% of your financial rating. Setting up automatic payments or reminders can help ensure you never miss a due date. Remember, a late mortgage payment may take about nine months to recover from, highlighting the importance of maintaining a positive payment history.

-

Lower Card Balances: Strive to keep your utilization ratio under 30% of your overall limit. Reducing your balances not only enhances your rating but also reflects responsible financial management. A conventional loan credit score above 670 is typically viewed positively by lenders, which can lead to better mortgage options.

-

Avoid Opening New Accounts: We understand that new inquiries can be tempting, but they can temporarily lower your score. It’s wise to refrain from applying for new financing before seeking a loan, as this can signal risk to lenders.

-

Regularly Check Your Financial Report: Obtain your free financial report yearly from each of the three major bureaus. Examine it for errors and challenge any discrepancies. Rectifying mistakes can lead to significant improvements in your results. Keeping track of your rating enables you to act swiftly if it declines.

-

Implement Proven Strategies: Families who have successfully enhanced their ratings often focus on consistent, smart financial habits. For instance, using tools like Experian Boost can help add qualifying utility and phone payments to your report, potentially improving your score. Additionally, consider using a tax refund to pay off high-interest debt, which can further enhance your financial profile.

-

Diversify Your Account Types: Having a mix of loan accounts, including installment loans and revolving accounts, accounts for 10% of your FICO Score. This diversity can positively impact your financial rating.

-

Become an Authorized User: If you have limited financial history, think about becoming an authorized user on a trusted family member’s card. This can positively influence your financial rating by leveraging their favorable payment history.

By following these suggestions, you can effectively enhance your score before seeking financing, positioning yourself for improved mortgage choices and rates. At F5 Mortgage, we’re here to provide personalized strategies tailored to your unique financial situation, ensuring you navigate the mortgage process with confidence.

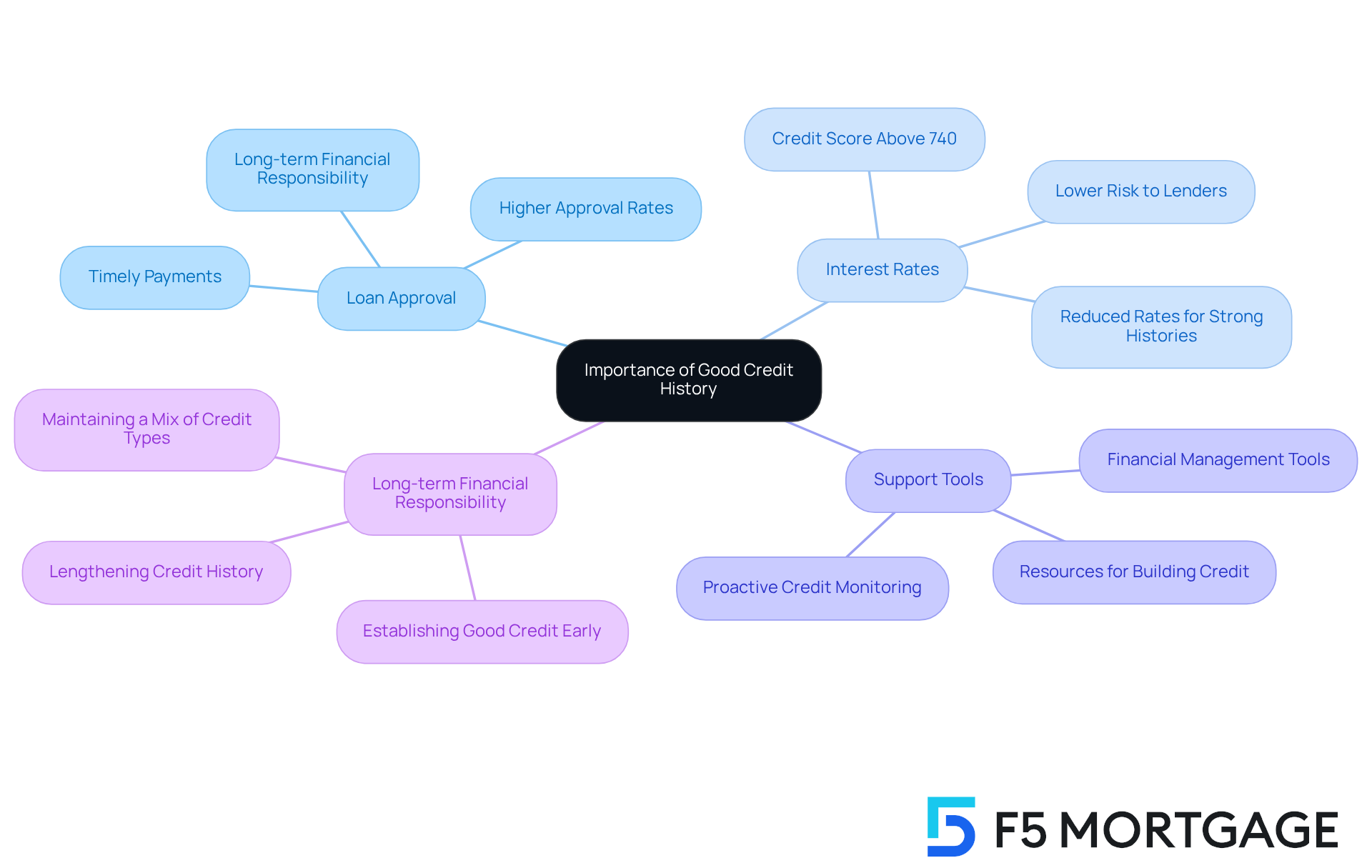

The Importance of a Good Credit History for Conventional Loan Approval

A strong financial history is essential for securing approval for a traditional mortgage, and we understand how challenging this can be. Lenders look for a reliable track record of timely payments and responsible financial management. When you have a solid borrowing history, not only does it increase your chances of loan approval, but it also opens the door to more favorable interest rates. For instance, individuals with a credit score above 740 often qualify for reduced rates, reflecting their lower risk to lenders.

At F5 Mortgage, we’re here to support you every step of the way in developing and maintaining a strong financial history. We provide clients with the necessary tools and resources to achieve this goal. Clients who build robust financial profiles frequently report smoother approval processes and better conditions, highlighting the tangible benefits of proactive financial management.

Typically, the financial history of approved conventional applicants extends beyond five years, underscoring the significance of long-term financial responsibility. By focusing on establishing a strong financial profile, you can enhance your economic opportunities and navigate the mortgage landscape with confidence.

Key Takeaways on Credit Scores and Conventional Loans

Comprehending financial ratings is vital for obtaining a traditional mortgage. We know how challenging this can be, so here are the key takeaways to help you navigate this process:

-

A minimum requirement for eligibility for a conventional mortgage is a conventional loan credit score of at least 620. This threshold is crucial for accessing favorable financing terms.

-

Effect of Elevated Ratings: Superior financial ratings not only improve your likelihood of approval but also result in more favorable interest conditions. For instance, a score of 740 or above can unlock the most competitive rates, significantly reducing overall loan costs.

-

Significance of Financial History: A strong financial history is essential for mortgage approval. Lenders evaluate your payment history, borrowing utilization, and overall financial behavior to determine your reliability as a borrower.

-

Debt-to-Income Ratio: Besides financial ratings, lenders also take into account your debt-to-income (DTI) ratio, which assesses your monthly debt obligations in relation to your gross monthly earnings. A lower DTI ratio indicates better financial health and can improve your chances of approval.

-

Private Mortgage Insurance (PMI): If your down payment is less than 20%, you may be required to pay for PMI, which adds to your monthly expenses. A larger down payment can help you avoid this additional cost.

-

Regular Monitoring and Improvement: Consistently tracking and enhancing your score is essential. Simple actions like timely payments, maintaining old credit accounts, and reducing credit utilization can lead to significant improvements over time.

At F5 Mortgage, we understand that navigating the mortgage process can be daunting. As a broker, we do not service loans directly; instead, the lender your loan closes with will be the one you make payments to. We’re here to support you every step of the way, whether you have questions or need to be pointed to the correct contact. Our commitment to transparency and client empowerment means we guide you through this journey. We leverage technology to provide you with competitive rates while ensuring you receive personalized support without the pressure of hard sales tactics.

Industry specialists highlight that comprehending how your rating influences your mortgage choices is the initial step toward obtaining the best possible deal. Families who have effectively managed the mortgage process often emphasize the significance of preserving a positive rating, which not only aids in approval but also improves their financial adaptability.

As trends show, the average conventional loan credit score among successful applicants hovers around 746, underscoring the importance of striving for a strong credit profile. By focusing on these aspects, F5 Mortgage is dedicated to guiding clients through the complexities of the mortgage process, ensuring a smooth and informed experience.

Conclusion

Understanding the intricacies of conventional loan credit scores is essential for anyone looking to secure favorable mortgage terms. We know how challenging this can be. By grasping the significance of credit ratings, borrowers can navigate the lending landscape with greater confidence and clarity. A well-maintained credit score not only enhances the chances of loan approval but also unlocks better interest rates, ultimately leading to significant savings over time.

Throughout this article, we’ve highlighted key points, including:

- The minimum credit score requirements for conventional loans

- The impact of credit ratings on interest rates

- The differences between conventional and government-backed loans

Strategies for improving credit scores, such as timely payments and maintaining low credit utilization, have also been discussed. These emphasize the importance of a proactive approach to financial management. Furthermore, we’ve addressed the role of private mortgage insurance (PMI) and common myths surrounding credit scores to provide a comprehensive understanding of the mortgage process.

In conclusion, taking the time to improve and monitor credit scores is a crucial step toward achieving homeownership. By leveraging personalized consultations with mortgage experts, borrowers can receive tailored guidance to enhance their financial profiles and navigate the complexities of the mortgage landscape. The journey to securing a conventional loan can be daunting, but with the right knowledge and support, it becomes an attainable goal. Empowerment through education and proactive financial management can transform the mortgage experience, making it smoother and more rewarding for families seeking their dream homes.

Frequently Asked Questions

What services does F5 Mortgage provide for clients seeking conventional loans?

F5 Mortgage offers personalized consultations to help clients navigate traditional borrowing evaluations, providing tailored guidance to improve their financial standing and maximize borrowing options.

What is the minimum credit score required for a conventional loan?

Most providers require a conventional loan credit score of at least 620 to be eligible for a traditional mortgage.

How does credit score affect interest rates for conventional loans?

Generally, a higher credit score is associated with lower interest rates. Borrowers with scores above 740 often qualify for the best terms, while those below 620 may face higher charges or denial of credit.

What are some benefits of improving your credit score before applying for a mortgage?

Improving your credit score can lead to lower interest rates and significant savings over the life of the loan, with better scores resulting in lower monthly payments and reduced overall interest costs.

What should clients prepare before a mortgage consultation at F5 Mortgage?

Clients are advised to gather all financial documents and be aware of their current conventional loan credit score to enhance the effectiveness of the consultation.

How does F5 Mortgage support clients in improving their credit scores?

F5 Mortgage provides tools and resources to help clients evaluate their credit ratings and create plans for improvement, ultimately leading to better mortgage options.

What is the typical 30-year mortgage interest rate as of October 2025?

The typical 30-year mortgage interest rate is 6.34%, but it varies based on the conventional loan credit score.

Can you provide an example of how credit scores impact monthly mortgage payments?

A borrower with a score of 740 pays about $1,946 monthly on a $300,000 mortgage, while someone with a score of 580 pays around $2,048 monthly, highlighting the substantial difference in costs based on credit scores.