Overview

In 2025, families can look forward to an increase in conventional loan limits, reaching $806,500 for one-unit properties. This change is designed to provide greater financial flexibility, especially as housing prices continue to rise. We understand how challenging this can be, and these new limits aim to assist families in securing higher financing amounts.

Moreover, this increase is not just about numbers; it represents a significant step towards encouraging homeownership. By alleviating common financial hurdles, particularly for first-time buyers in competitive markets, we hope to empower families to take that important step toward owning a home. We’re here to support you every step of the way, ensuring you have the resources needed to navigate this process with confidence.

Introduction

In 2025, families navigating the mortgage landscape find themselves at a pivotal moment. The Federal Housing Finance Agency (FHFA) has announced significant increases in conventional loan limits. With new limits set at $806,500 for one-unit properties, and even higher in high-cost areas, the opportunity for families to secure financing for their dream homes is more attainable than ever.

However, we know how challenging this can be. As property values continue to rise, families face the pressing question: how can they effectively leverage these new limits while avoiding the pitfalls of a competitive housing market? This article delves into ten key insights designed to empower families to make informed decisions and thrive in the evolving landscape of home financing.

We’re here to support you every step of the way.

F5 Mortgage: Competitive Conventional Loan Options for 2025

At F5 Mortgage LLC, we understand how challenging navigating the mortgage landscape can be, especially for families in 2025. That’s why we offer a diverse range of competitive traditional financing options tailored specifically to your unique needs. Our focus is on providing personalized service, ensuring you have access to fixed-rate loans, FHA loans, VA loans, and jumbo loans designed just for you.

As an independent broker, we work for you—not the lenders. This means you can trust that we’re committed to securing the most favorable rates and terms available. With access to over two dozen leading lenders, we simplify the process of finding the best mortgage options, which is crucial in today’s market where the average purchase price for properties has reached $512,800.

Our user-friendly mortgage calculator makes it even easier for you to estimate your potential payments, empowering you to make informed decisions. And with mortgage rates currently at a 10-month low, now is the perfect time to take advantage of lower monthly payments, making homeownership more accessible than ever.

Many of our satisfied clients have shared their positive experiences with us, praising our exceptional service and unwavering support throughout the mortgage process. At F5 Mortgage, we are dedicated to providing outstanding service and competitive options, distinguishing ourselves as a reliable ally for families maneuvering through the intricacies of purchasing and refinancing properties in 2025. We’re here to support you every step of the way.

FHFA Announces New Conventional Loan Limits for 2025

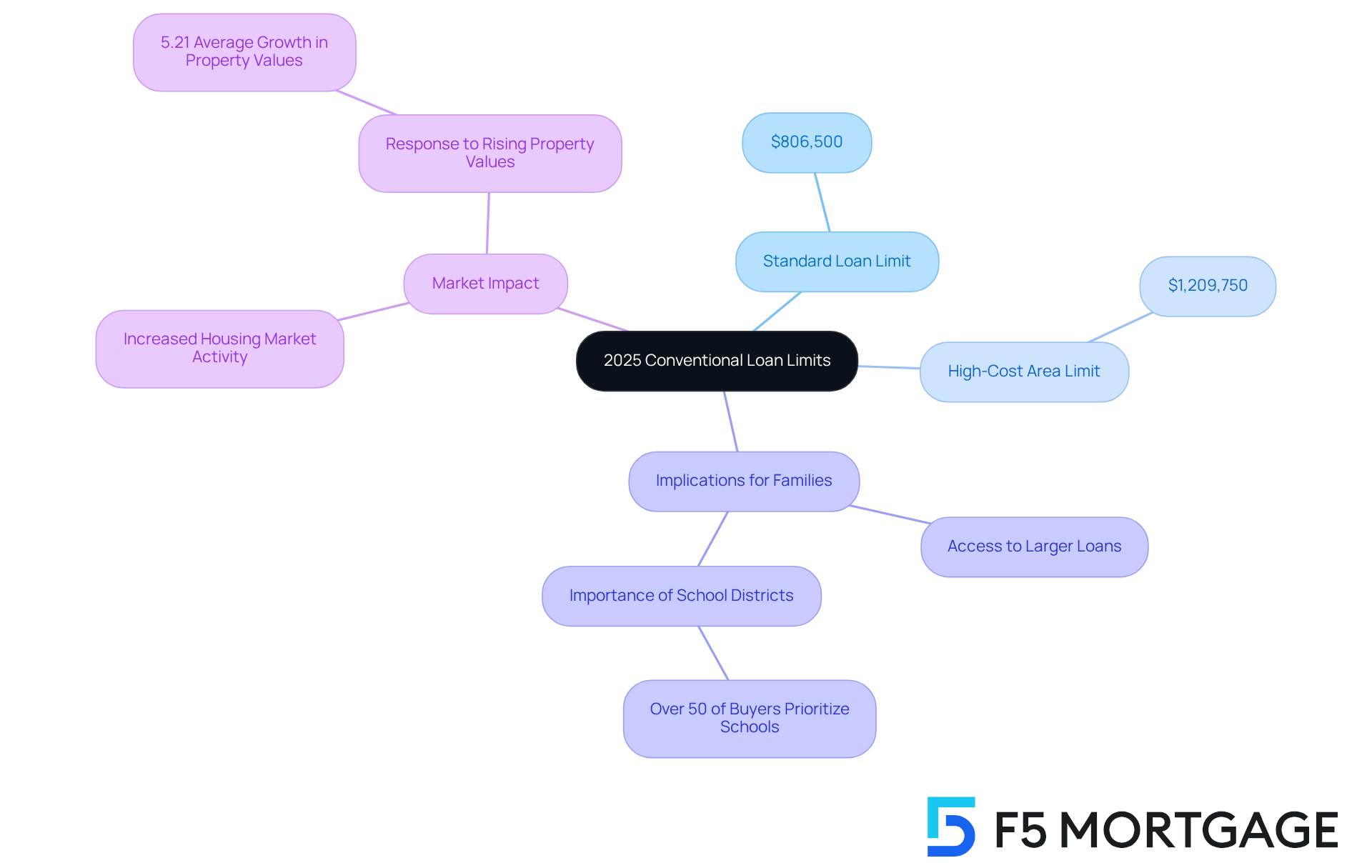

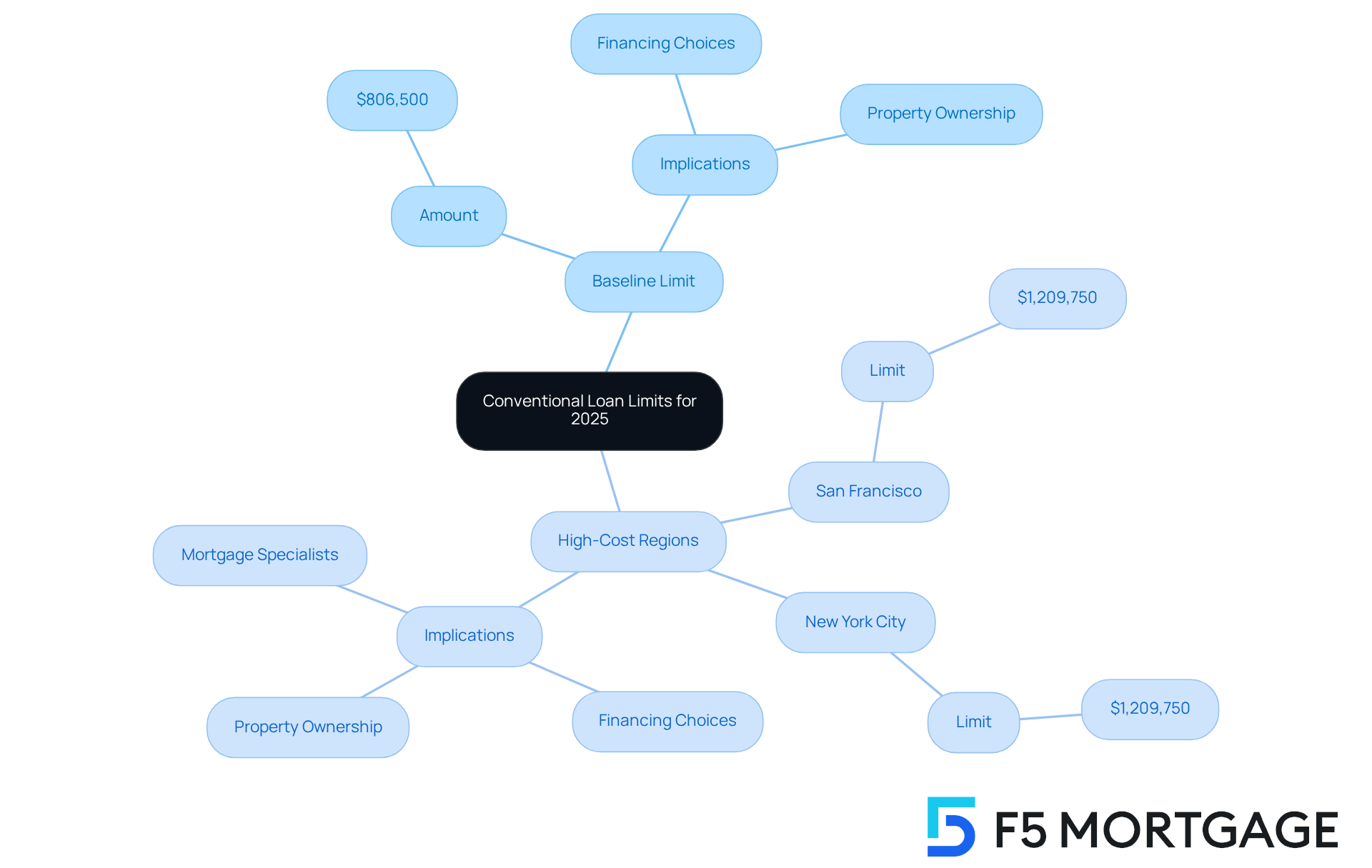

In 2025, the Federal Housing Finance Agency (FHFA) has set the conventional loan limits for one-unit properties at $806,500, reflecting a 5.2% increase from the previous year. This change is crucial for families looking to finance more expensive homes while enjoying favorable loan conditions.

In high-cost areas, the conventional loan limits increase to $1,209,750, providing greater flexibility for homebuyers in these markets. This increase not only highlights the rising property values—averaging a 5.21% growth between the third quarters of 2023 and 2024—but also aims to assist families navigating the complexities of property financing.

For instance, families in regions experiencing significant housing growth can now secure larger credit amounts. This makes it easier to purchase homes in desirable school districts, a priority for over half of buyers with children. The new thresholds are expected to invigorate the housing market, allowing more families to access or improve their position within it. Ultimately, this promotes a more dynamic real estate environment where families can thrive.

Impact of 2025 Loan Limits on First-Time Homebuyers

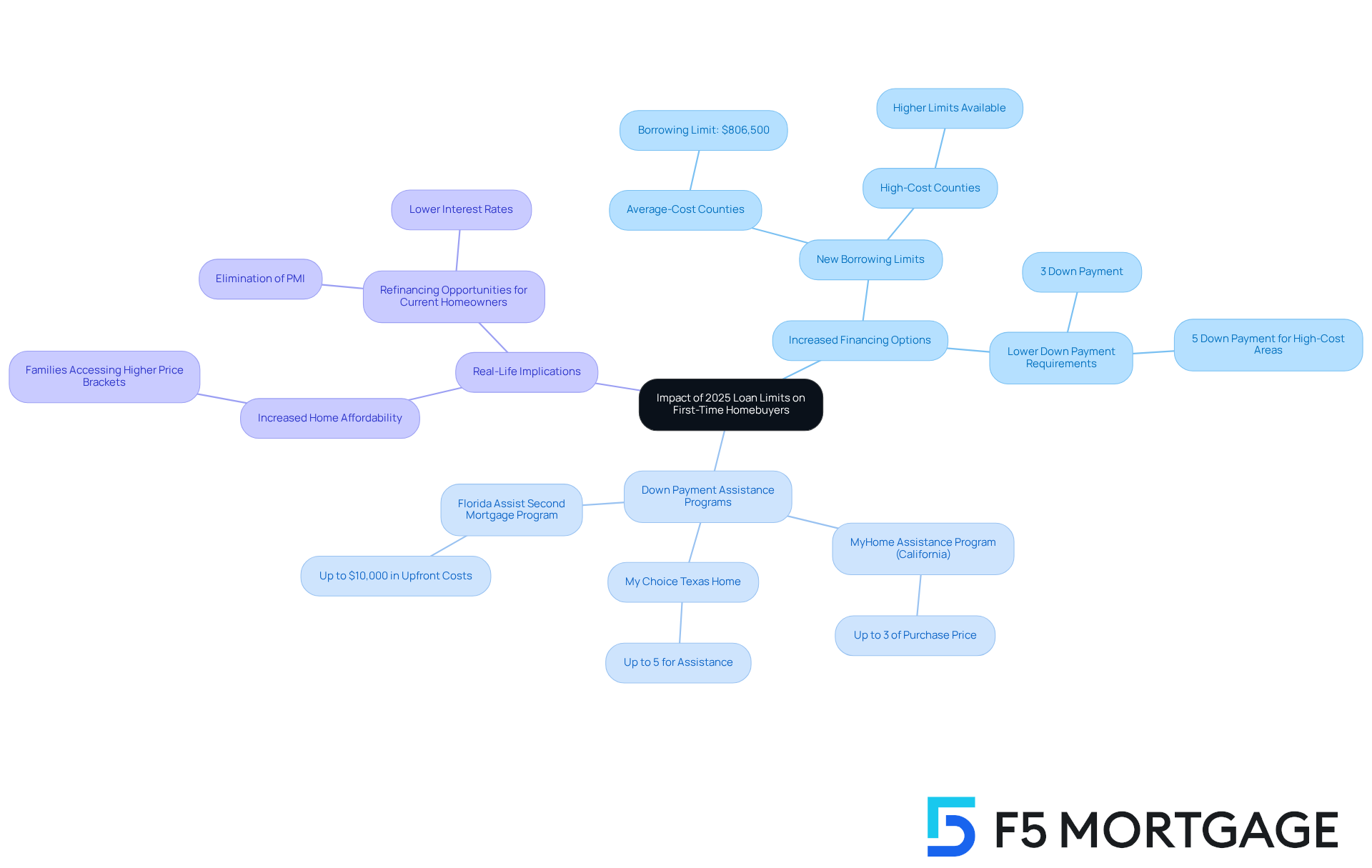

The rise in conventional loan limits in 2025 presents substantial benefits for first-time homebuyers, allowing them to access more financing options while remaining within conforming boundaries. This change is particularly significant as it alleviates common financial hurdles associated with property acquisitions, enabling first-time buyers to explore options in higher price brackets. With the average home price expected to rise, these new limits create crucial opportunities for families to secure their first homes.

For instance, first-time homebuyers in average-cost counties can now borrow up to $806,500 with a down payment as low as 3%, compared to the 20% typically required for jumbo loans. This shift not only makes homeownership more attainable but also encourages families to invest in neighborhoods they may have previously thought were out of reach. Additionally, F5 Mortgage offers various down payment assistance programs that can further enhance these opportunities. For example:

- The MyHome Assistance Program in California provides up to 3% of the home’s purchase price.

- The My Choice Texas Home program offers up to 5% for down payment and closing assistance.

- In Florida, programs like the Florida Assist Second Mortgage Program provide up to $10,000 in upfront costs, further supporting homebuyers.

Industry specialists observe that the rise in conventional loan limits is a positive development for purchasers navigating today’s challenging market. As one specialist noted, ‘Increased conforming borrowing thresholds, which are tied to conventional loan limits, are positive information for home purchasers in today’s unpredictable market,’ highlighting the importance of these changes in fostering homeownership.

Real-life examples illustrate this trend. Families who previously faced challenges due to high property costs are now discovering pathways to ownership through these improved financing options. The increased borrowing thresholds empower first-time buyers to overcome financial obstacles, transforming the dream of homeownership into reality in 2025. Moreover, current homeowners with large mortgages may also benefit by refinancing into standard mortgages under the new thresholds, allowing them to take advantage of lower interest rates and reduced monthly payments. With the support of F5 Mortgage’s down payment assistance programs, families can navigate the home buying process with greater confidence and satisfaction.

Comparison of Conventional Loan Limits and FHA Loan Options for 2025

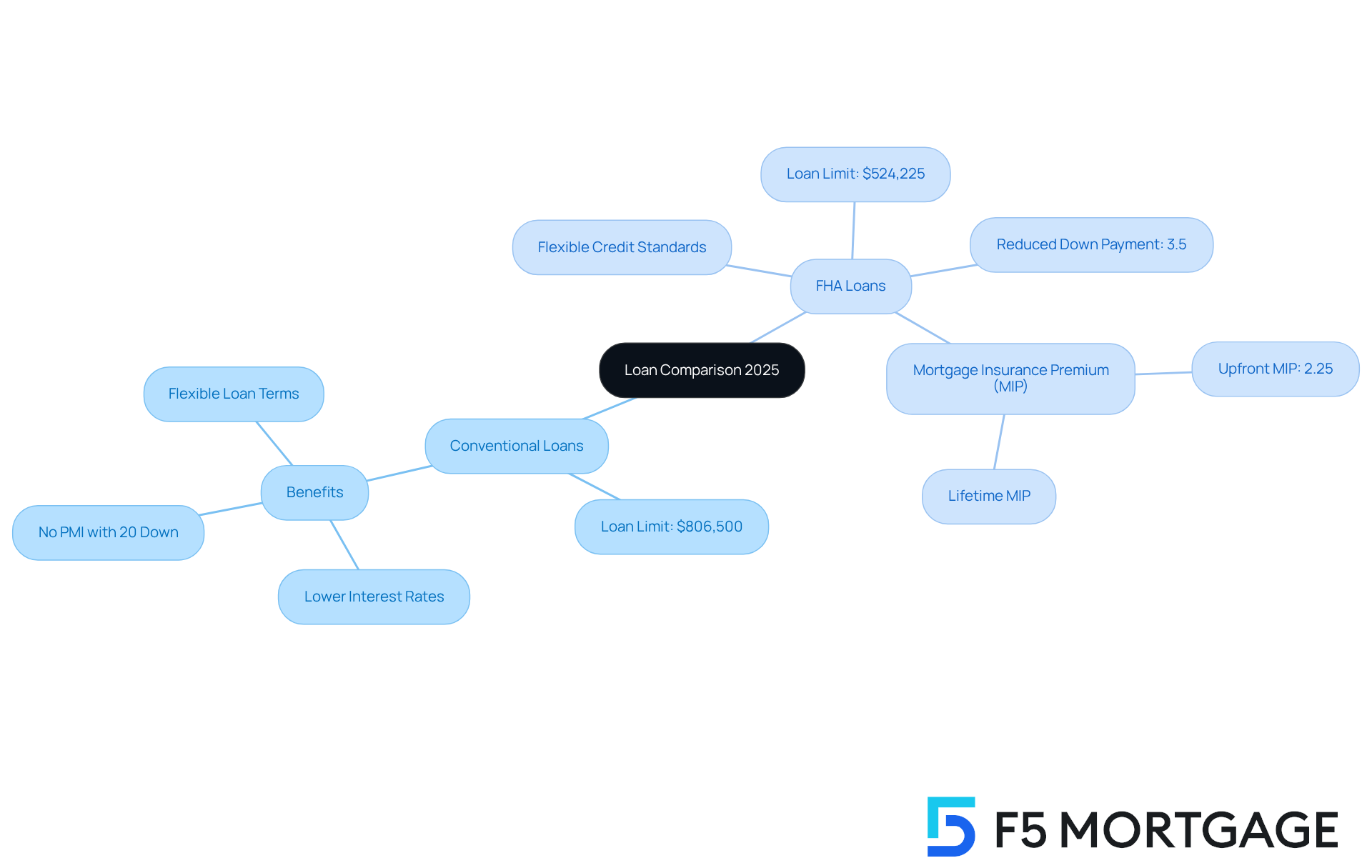

In 2025, families may notice that the conventional loan limits for one-unit properties are set at $806,500. This is considerably greater than the FHA borrowing cap of $524,225 in most regions. This disparity can be quite significant for those aiming to purchase higher-priced homes, as conventional loan limits might provide more benefits in such cases.

However, it’s important to remember that FHA financing comes with its own set of attractive features. With reduced down payment requirements starting at just 3.5% and more flexible credit standards, FHA loans can be a great fit for individuals with limited savings or lower credit scores. We know how challenging this can be, and it’s essential to explore all available options.

As you navigate this decision, take the time to thoughtfully evaluate your financial situation and long-term objectives. Balancing the potential for increased borrowing amounts with the appealing availability of FHA alternatives is crucial. We’re here to support you every step of the way in finding the financing that best fulfills your needs.

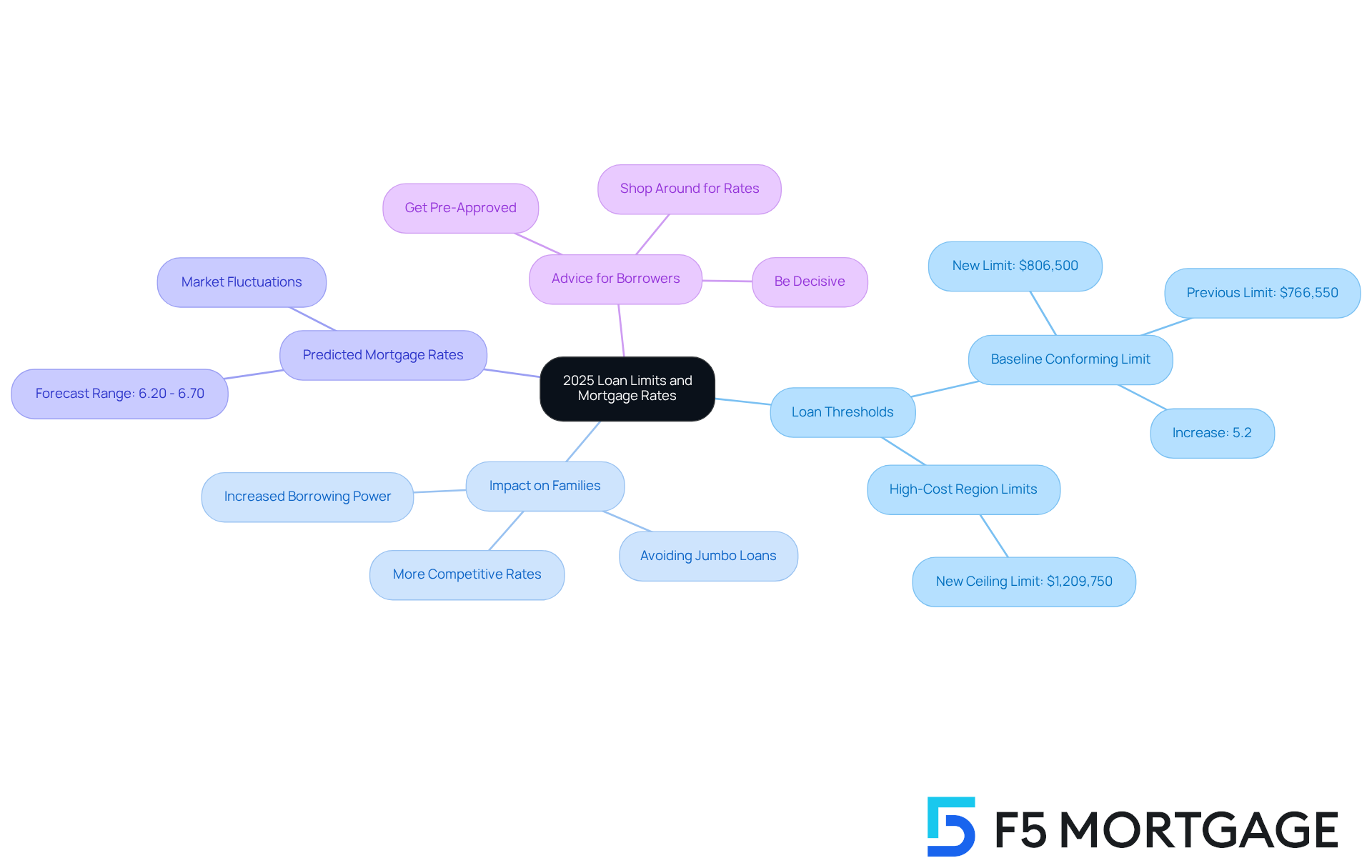

How 2025 Loan Limits Influence Mortgage Rates

The raised loan thresholds for 2025 are set to positively influence mortgage rates, creating a more advantageous environment for families pursuing traditional loans. We know how challenging this can be, and the baseline conforming threshold has risen to $806,500, reflecting a 5.2% increase from the prior amount of $766,550. As more borrowers meet the new criteria, lenders are likely to become more competitive, which could lead to lower rates. This change enables households to avoid large financing options, typically associated with elevated interest rates, thus making homeownership more attainable.

For families in high-cost regions, the conventional loan limits for one-unit properties are set at $1,209,750. This allows them to secure financing without the added strain of higher rates linked to jumbo loans. F5 Mortgage partners with over two dozen top lenders to ensure that families receive the best deal available, whether that means the lowest rates or the fastest closing times. As we navigate these changes together, specialists foresee that as demand levels off, lenders might present more appealing rates, especially as the market adapts to these new boundaries.

Economists predict that mortgage rates could range between 6.20% and 6.70% by the end of 2025, contingent on economic conditions and inflation trends. Families should remain vigilant about market fluctuations and consider locking in rates when they are favorable. Indecision could lead to missed opportunities in a competitive housing market. As Rick Sharga observes, delaying too much in deciding to submit an offer can result in spending more for the property or even missing out on it completely. We’re here to support you every step of the way.

Down Payment Assistance Programs and 2025 Loan Limits

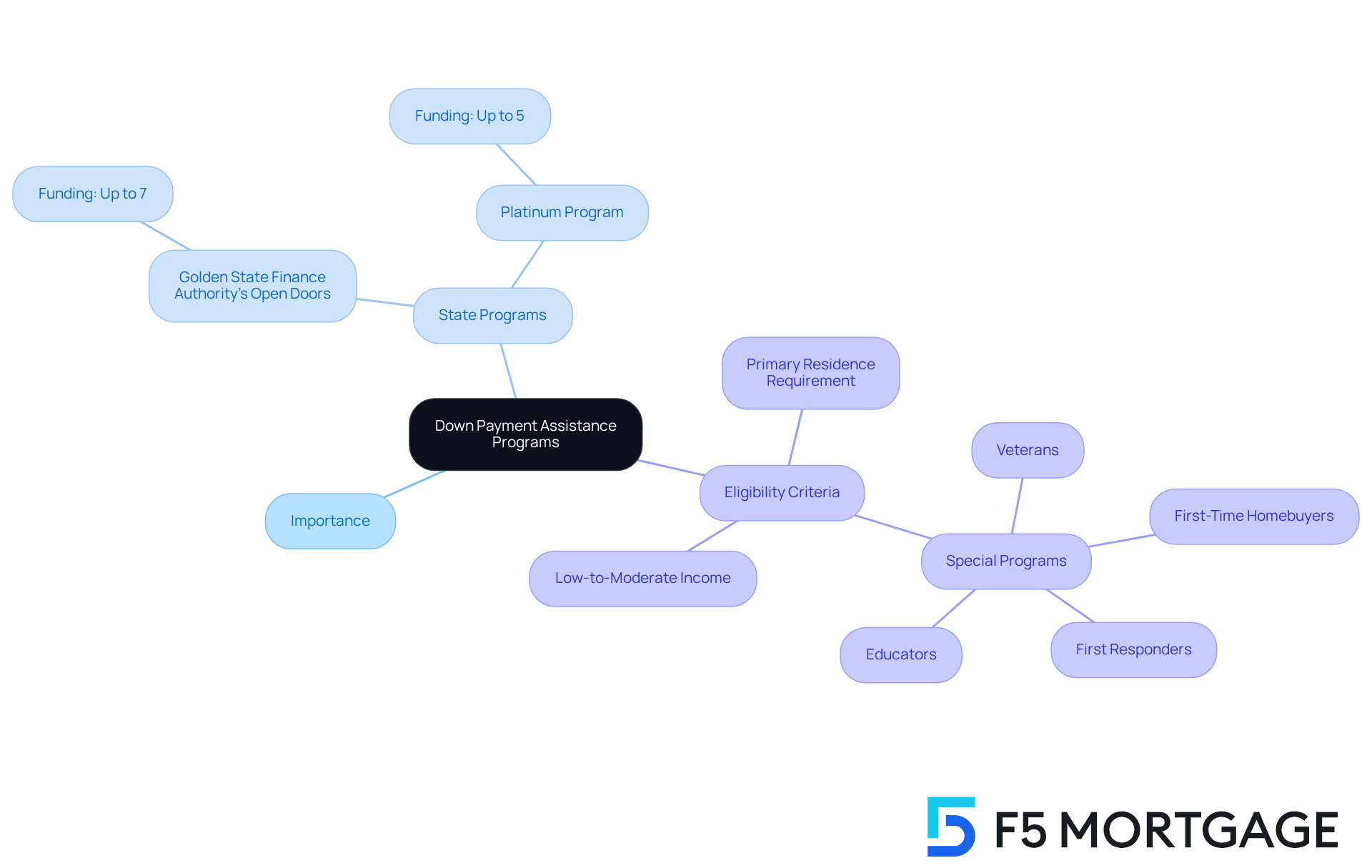

With the new conventional loan limits established, down payment assistance programs are more essential than ever for families aiming to buy homes. We know how challenging this can be, but numerous states, such as California, offer programs that provide grants or low-interest financing to assist with down payments. For instance, the Golden State Finance Authority’s Open Doors program provides up to 7% of the primary loan amount toward closing costs, while its Platinum Program covers up to 5%. Families should explore these options to maximize their purchasing power and reduce upfront costs.

It’s important to recognize that most down payment assistance programs are accessible to purchasers with low-to-moderate income, and specific income thresholds may differ by county. Furthermore, properties must be acquired and utilized as primary residences to be eligible for down payment assistance. First-time homebuyers, veterans, first responders, and educators may also qualify for specialized assistance programs, further enhancing their opportunities for homeownership. We’re here to support you every step of the way as you navigate this journey.

Challenges Borrowers Face with New Conventional Loan Limits

While the new borrowing thresholds offer increased capacity, we know how challenging this can be for certain borrowers. Households may still face difficulties with elevated home prices in competitive markets, making it tough to find homes that fall within the conventional loan limits. Additionally, the expanded borrowing ability could lead to higher debt-to-income ratios, complicating the approval process.

To navigate these challenges effectively, we encourage households to collaborate closely with mortgage brokers like F5 Mortgage. They can provide valuable insights into your financial profile and connect you with top realtors in your area. Understanding the debt-to-income ratio is crucial, as a maximum of 43% is typically necessary for home financing. An improved DTI can also lead to more competitive mortgage rates.

At F5 Mortgage, we’re here to support you every step of the way, assisting households in obtaining the best mortgage offers while ensuring you are well-prepared for the approval process.

Benefits of Using Independent Brokers for 2025 Loan Limit Navigation

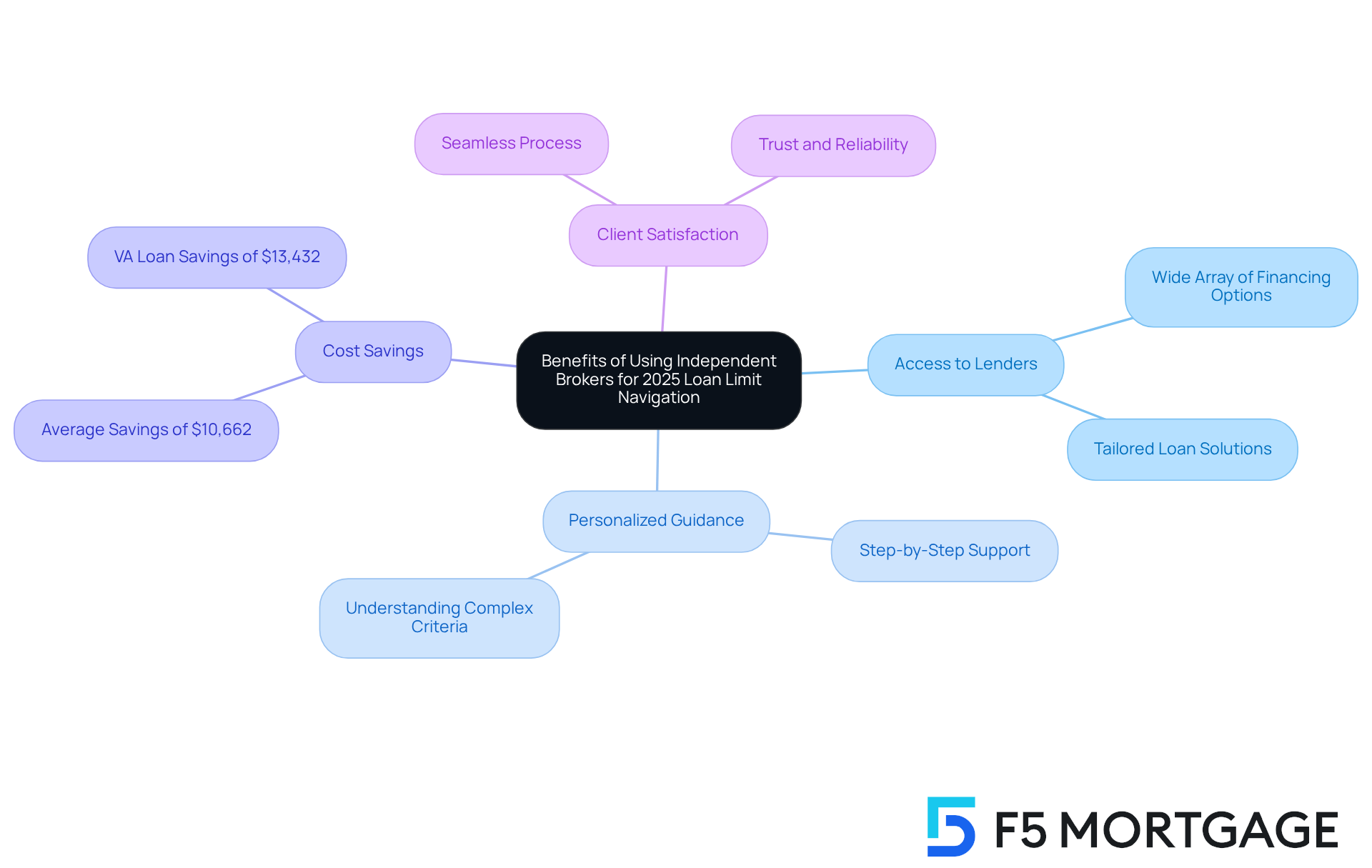

Collaborating with independent mortgage brokers, like F5 Mortgage, can truly benefit households as they navigate the conventional loan limits and the revised borrowing thresholds for 2025. We understand how challenging this can be. Brokers have access to a wide array of lenders and financing options, enabling them to secure the most advantageous rates and conditions tailored to each household’s unique financial situation. This flexibility is crucial, especially as families face different borrowing limits that are determined by conventional loan limits based on their location and financial circumstances.

Moreover, independent brokers prioritize client satisfaction, offering personalized guidance throughout the mortgage journey. This support is essential in helping families understand complex borrowing criteria, ensuring they feel empowered and informed at every step. Industry experts highlight that households working with independent brokers often experience a more seamless process, with many reporting significant savings over the life of their financing. For example, borrowers who utilize independent brokers save an average of $10,662 compared to those who go through retail lenders.

F5 Mortgage exemplifies this commitment to supporting families, providing tailored consultations and resources that simplify the mortgage process. Families have successfully managed their borrowing limits with broker assistance, benefiting from their expertise in identifying suitable financing options that align with conventional loan limits and their financial goals. One inspiring case study featured a family who, with the help of F5 Mortgage, secured financing that not only met their needs but also included a significantly lower interest rate than they initially anticipated. This personalized approach not only enhances the overall experience but also builds a sense of trust and reliability in achieving homeownership dreams. As one satisfied client shared, “If you’re looking for speed & convenience, F5 Mortgage is for you. They have an amazing attention to detail & guided me as a first-time home buyer step by step.

Regional Variations in Conventional Loan Limits for 2025

In 2025, families may notice significant differences in conventional loan limits across various regions. The conventional loan limits are set at a baseline threshold of $806,500 in most areas, but in high-cost regions like San Francisco and New York City, this amount can rise to $1,209,750. We understand how this disparity can impact your decisions, especially if you’re considering relocation or property acquisitions. It directly influences your financing choices and overall financial plan.

For instance, in these expensive regions, where median property values exceed 115% of the baseline threshold, households may qualify for larger financing amounts beyond conventional loan limits. This can make the dream of property ownership feel much more achievable. It’s essential to interact with local mortgage specialists who can help you navigate these regional variations and understand the specific restrictions that apply to your desired areas.

As noted by the Federal Housing Finance Agency (FHFA), the increase in borrowing thresholds reflects the rising property values, which have seen a 5.21 percent boost from the previous year. Staying informed about these changes is key; it empowers you to make knowledgeable choices in your purchasing journey. Remember, we’re here to support you every step of the way.

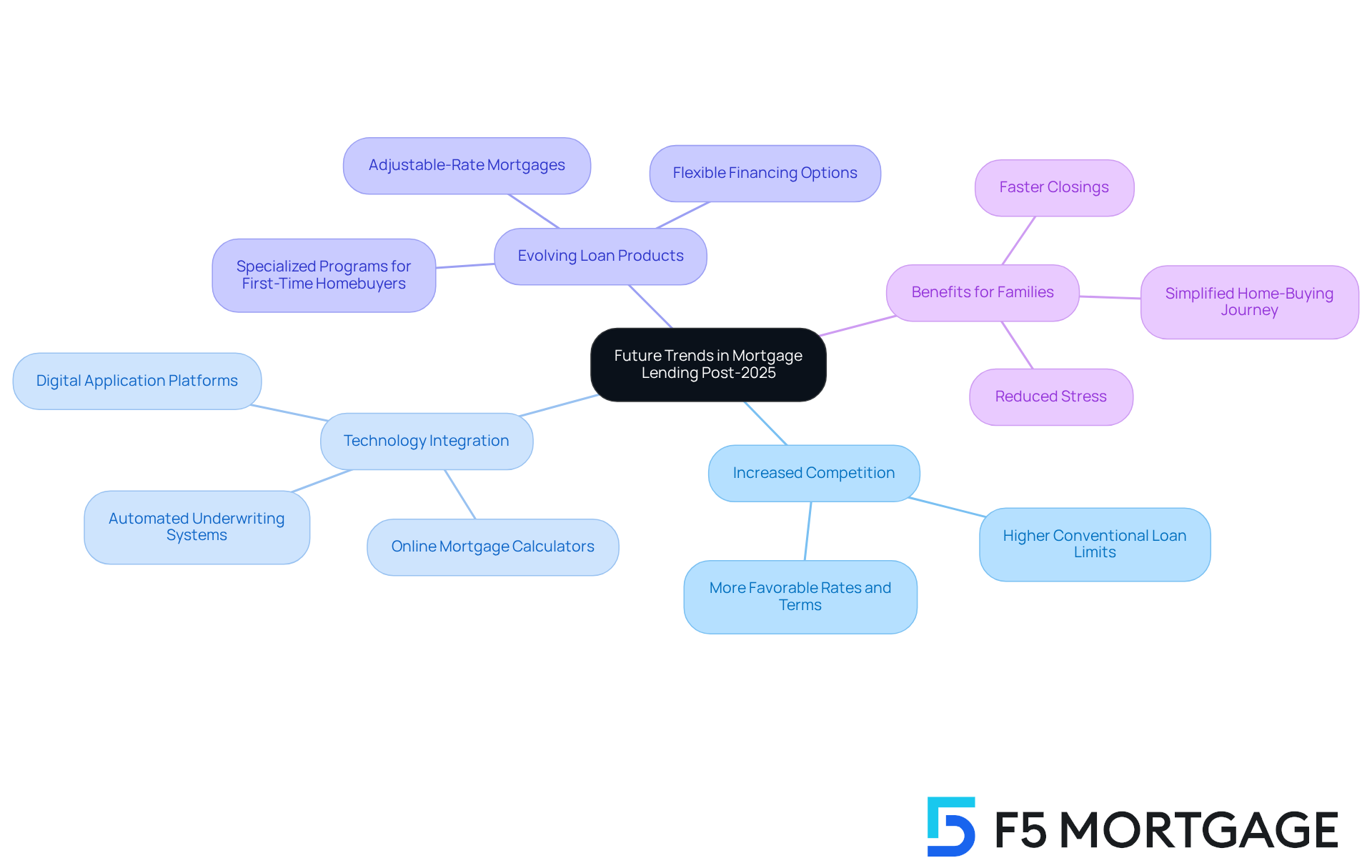

Future Trends in Mortgage Lending Post-2025 Loan Limit Changes

As we look ahead, we know how challenging navigating the mortgage lending landscape can be. Several key trends are poised to shape this landscape in 2025 and beyond, and we’re here to support you every step of the way.

-

With the increase in conventional loan limits, lenders are expected to intensify competition, resulting in more favorable rates and terms for borrowers like you. This competitive atmosphere is likely to assist households seeking to secure financing for their homes.

-

The integration of technology into the mortgage process is another significant trend that can ease your journey. Innovations are simplifying applications and approvals, making it easier for families to navigate the complexities of securing a mortgage. For instance, automated underwriting systems and digital platforms are reducing processing times, allowing for quicker pre-approvals and enhanced customer experiences.

-

Moreover, as housing prices continue to fluctuate, we anticipate a shift in the types of loan products available that adhere to conventional loan limits. Lenders may increasingly offer flexible financing options tailored to accommodate diverse financial situations. This includes adjustable-rate mortgages or specialized programs designed specifically for first-time homebuyers and self-employed individuals.

Families are already experiencing the benefits of these technological advancements. Many have successfully utilized online mortgage calculators and digital application platforms to simplify their home-buying journey. This leads to faster closings and reduced stress. As these trends evolve, you can expect a more accessible and efficient mortgage process, ultimately making homeownership more attainable for you.

Conclusion

As we look ahead to 2025, families have significant opportunities in the evolving landscape of conventional loan limits. The Federal Housing Finance Agency’s decision to raise loan limits to $806,500 for one-unit properties, and up to $1,209,750 in high-cost areas, is a thoughtful response to rising property values. This change aims to enhance accessibility for homebuyers, allowing families to consider homes in desirable locations and fostering a more vibrant real estate market.

These new loan limits empower first-time homebuyers, providing access to financing options that were once beyond reach. With the support of down payment assistance programs and competitive mortgage rates, families can now secure homes with lower initial costs. By collaborating with independent brokers like F5 Mortgage, families can streamline the process, ensuring they receive tailored support and favorable terms that align with their unique financial situations.

As families navigate this changing mortgage landscape, staying informed about these adjustments is crucial. Leveraging available resources can help maximize purchasing power. The increase in loan limits not only signifies a shift in the market but also serves as a call to action. Families are encouraged to take charge of their homeownership journey. By exploring all financing options and seeking expert guidance, they can turn the dream of owning a home into a reality in 2025 and beyond.

Frequently Asked Questions

What mortgage options does F5 Mortgage offer in 2025?

F5 Mortgage offers a diverse range of competitive traditional financing options, including fixed-rate loans, FHA loans, VA loans, and jumbo loans, tailored to meet the unique needs of families.

How does F5 Mortgage assist clients in securing favorable mortgage rates?

As an independent broker, F5 Mortgage works for clients rather than lenders, ensuring they secure the most favorable rates and terms available by accessing over two dozen leading lenders.

What is the average purchase price for properties in 2025?

The average purchase price for properties has reached $512,800.

How can clients estimate their potential mortgage payments?

F5 Mortgage provides a user-friendly mortgage calculator that allows clients to estimate their potential payments, helping them make informed decisions.

What are the new conventional loan limits set by the FHFA for 2025?

The FHFA has set the conventional loan limits for one-unit properties at $806,500, with higher limits of $1,209,750 in high-cost areas.

How do the new loan limits benefit first-time homebuyers?

The increased loan limits allow first-time homebuyers to access more financing options with lower down payments, making homeownership more attainable and enabling them to explore homes in higher price brackets.

What down payment assistance programs does F5 Mortgage offer?

F5 Mortgage offers several down payment assistance programs, including: – The MyHome Assistance Program in California, providing up to 3% of the home’s purchase price. – The My Choice Texas Home program, offering up to 5% for down payment and closing assistance. – The Florida Assist Second Mortgage Program, providing up to $10,000 for upfront costs.

How do the new loan limits impact current homeowners?

Current homeowners with large mortgages may benefit by refinancing into standard mortgages under the new thresholds, allowing them to take advantage of lower interest rates and reduced monthly payments.

What feedback have clients provided about F5 Mortgage’s services?

Many satisfied clients have praised F5 Mortgage for their exceptional service and unwavering support throughout the mortgage process.