Overview

We know how challenging it can be to navigate financial options, especially when it comes to home equity lines of credit (HELOCs). Currently, interest rates are around 8%, which can significantly influence your decision to use this flexible borrowing option for needs like renovations or debt consolidation.

It’s important to understand that these rates are variable, depending on factors such as credit scores and economic conditions. By recognizing these dynamics, you can make informed choices that support your financial well-being.

We’re here to support you every step of the way, ensuring you feel empowered in managing your finances effectively.

Introduction

Understanding the dynamics of Home Equity Lines of Credit (HELOCs) is essential for homeowners looking to leverage their property’s value. We know how challenging this can be, especially with average HELOC interest rates hovering around 8%. Many are discovering the potential benefits of this financial tool for purposes like home improvement and debt consolidation. However, the complexities of HELOCs—including variable rates, repayment structures, and the impact of personal credit scores—pose significant challenges.

How can homeowners navigate these intricacies to make informed financial decisions that align with their goals? We’re here to support you every step of the way.

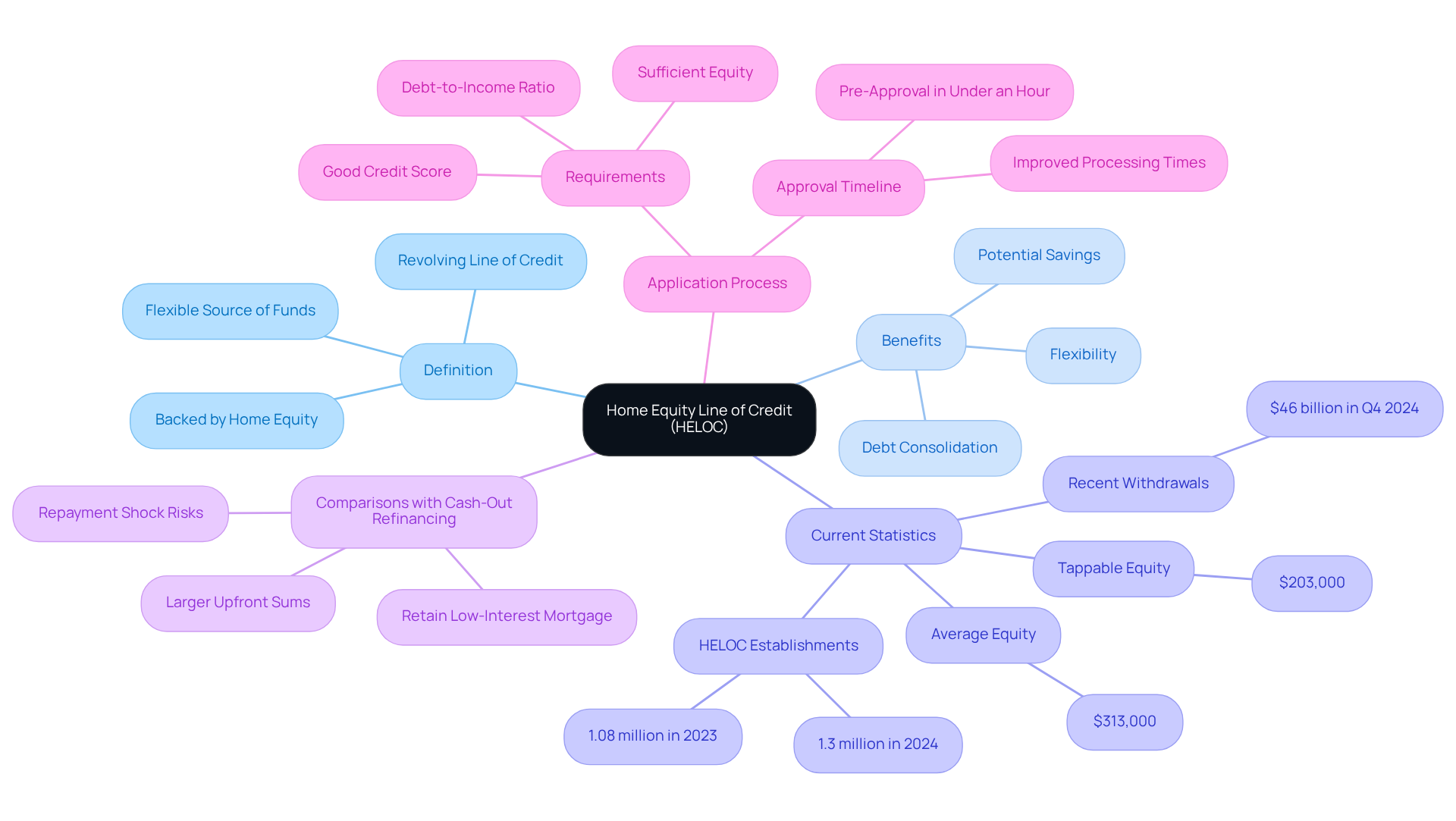

Define Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a revolving line of credit backed by the equity in your home, allowing you to borrow against the value of your property. This financial tool provides a flexible source of funds for various needs, such as home renovations, debt consolidation, or significant purchases. Think of it like a credit card; you can access funds as needed, up to a predetermined limit.

As of 2025, the average homeowner has around $313,000 in equity, with about $203,000 considered tappable. This means you can access substantial funds without needing a lump-sum loan. In the fourth quarter of 2024 alone, U.S. mortgage holders withdrew $46 billion in home equity. This reflects a growing trend of families utilizing HELOCs for better financial management.

With , HELOCs are becoming increasingly popular, especially when mortgage rates are lower. Financial specialists emphasize that HELOCs can be particularly beneficial when borrowing costs exceed those on existing home loans. This makes them a versatile choice for debt consolidation and potential savings on financing.

If you’re considering a larger sum of money upfront, cash-out refinancing is also an option to explore. However, it’s essential to be aware of possible repayment shocks when transitioning from payment-only installments to principal and payment obligations.

Once your application is approved, remember to lock in your mortgage rates. This step is crucial to protect yourself from market fluctuations during the processing period. We know how challenging this can be, but we’re here to support you every step of the way.

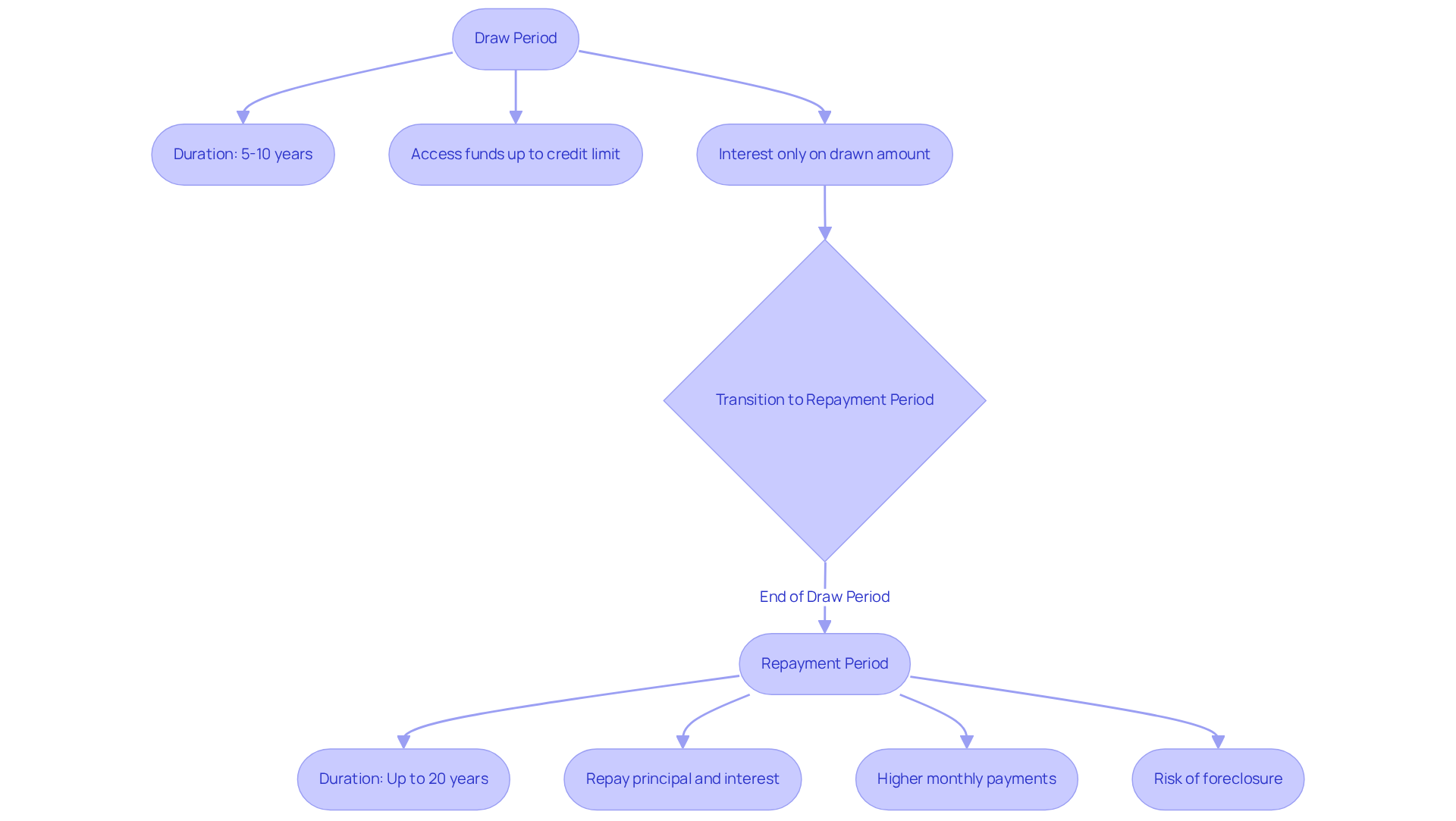

Explain How HELOCs Work

HELOCs are structured in two distinct phases: the draw period and the repayment period. We know how challenging financial decisions can be, so let’s break it down. The draw period typically spans 5 to 10 years, allowing borrowers to access funds up to their credit limit while only paying interest on the amount drawn. This flexibility can be beneficial for ongoing costs, such as renovations or education expenses. However, it’s important to be cautious, as the temptation to overspend can lead to challenges in repayment.

Once the draw period concludes, the loan transitions into the repayment phase, which can last up to 20 years. During this time, borrowers can no longer take out funds and must start repaying both the principal and the accrued charges. This shift can lead to significantly higher monthly payments, especially if only interest payments were made previously. As Shad Elia, CEO of New England Home Buyers, notes, “A borrower’s lack of discipline is frequently a drawback of HELOCs,” highlighting the importance of careful financial management. Sean Murphy, assistant vice president of mortgage operations at Navy Federal Credit Union, adds, “Because you are borrowing against your home, if you can’t make your monthly payments, you risk foreclosure.”

The [current HELOC interest rates](https://f5mortgage.com/understanding-heloc-loan-interest-rates-key-factors-and-strategies) are typically variable, changing with market conditions, which can further complicate repayment planning. As of early 2025, the current HELOC interest rates average around 7.8%, with figures varying from 8% to 10%. Understanding these phases and the associated risks is essential for effective financial management and avoiding unexpected burdens during the repayment period. Furthermore, payments made on a HELOC utilized for home enhancements may be tax-deductible, in accordance with IRS guidelines, making it an appealing choice for funding.

It’s also crucial to be aware that closing costs for HELOCs typically range from 2% to 5% of the credit limit. This is a critical factor to consider as you navigate your options. We’re here to support you every step of the way in making that align with your financial goals.

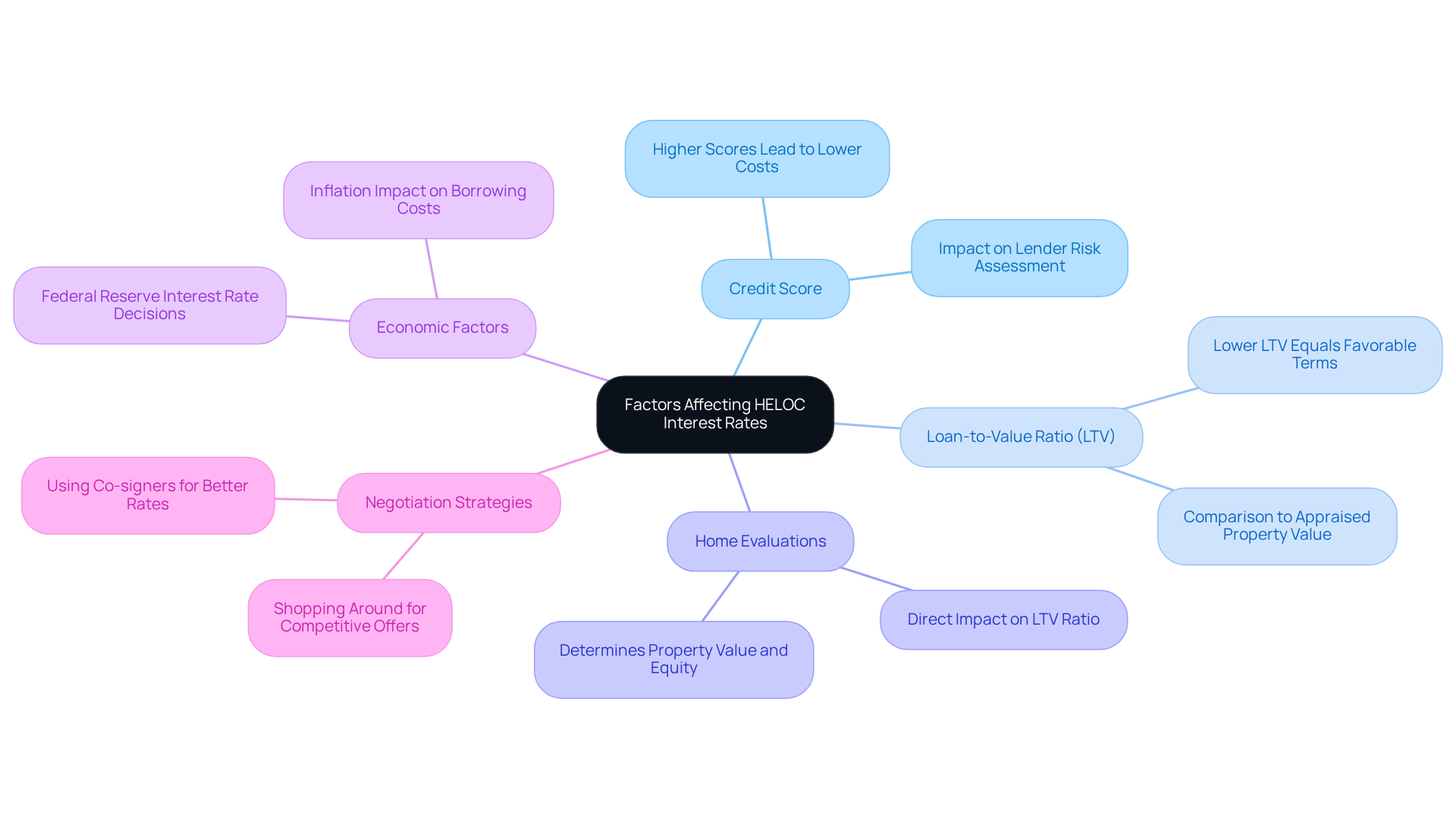

Analyze Factors Affecting HELOC Interest Rates

When considering a Home Equity Line of Credit (HELOC), it’s important to understand that several factors can influence the costs involved. We know how challenging this can be, especially when you’re trying to make the best financial decisions for your family. Your plays a significant role; generally, a higher score means lower borrowing costs, as it indicates to lenders that you present less risk. Additionally, the loan-to-value (LTV) ratio, which compares the amount you wish to borrow to the appraised value of your property, is crucial. A lower LTV ratio often leads to more favorable terms, which can make a big difference in your overall expenses.

Home evaluations are also essential, as they help determine your property’s value and equity, directly impacting your LTV ratio and the associated costs. Furthermore, economic factors, such as the Federal Reserve’s interest rate decisions and inflation, can lead to fluctuations in the current HELOC interest rates. Staying informed about these elements is vital for making sound financial choices. For instance, the national average HELOC APR is currently 6.64%, with loans featuring a 10-year repayment period averaging 7.57%, and those with a 20-year repayment term averaging 7.71%.

Financial analysts emphasize the importance of understanding the current HELOC interest rates to secure better terms. As Timothy Manni points out, having a strong credit report and substantial property equity can enhance your ability to negotiate favorable HELOC terms. Once your application is approved, working with a lender like F5 Mortgage can protect your mortgage terms from market fluctuations during the processing period. This step is crucial, especially in today’s ever-changing economic landscape. As inflation rises, so do borrowing costs, highlighting the need to remain aware of the broader economic context when considering a HELOC. We’re here to support you every step of the way, helping you navigate these complexities with confidence.

Compare HELOC Rates with Other Loan Options

When considering HELOC fees against other , such as personal loans or home equity financing, it’s important to recognize the challenges you may face. We understand that evaluating costs, repayment terms, and flexibility can feel overwhelming. Typically, HELOCs offer lower fees compared to personal loans because they are secured by your property. However, personal loans can provide quicker access to funds without the need for collateral, which can be a relief when you need money fast.

On the other hand, home equity financing often comes with fixed fees and requires a lump-sum payment, making it less flexible than HELOCs. If you’re looking to enhance your home, adjustable-rate mortgages (ARMs) might be an appealing option. They often have lower initial fees compared to fixed-rate mortgages, leading to more manageable monthly payments. It’s also reassuring to know that caps limit how much interest rates, and consequently your payments, can increase during the ARM period.

As you navigate these options, consider your plans for the property. ARMs can be particularly beneficial if you plan to pay off the loan or sell before the adjustment period begins. Understanding these differences is key to choosing the right financing option that aligns with your financial situation and goals.

Take the first step toward the right mortgage. We’re here to support you every step of the way! Apply online or over the phone. Our team at F5 Mortgage would love to help you secure your adjustable-rate loan today!

Conclusion

Understanding the dynamics of Home Equity Lines of Credit (HELOCs) is crucial for homeowners looking to leverage their property equity effectively. We know how challenging financial decisions can be, and this financial tool offers flexibility and potential savings, especially in light of current interest rates hovering around 8%. By borrowing against home equity, homeowners can manage expenses such as renovations or consolidate debt, making HELOCs a popular choice in today’s financial landscape.

Throughout this article, we’ve outlined the workings of HELOCs, emphasizing the importance of grasping both the draw and repayment phases. Key factors influencing HELOC interest rates, such as credit scores and economic conditions, have also been discussed. By comparing HELOCs with other borrowing options, we highlighted their unique advantages, particularly in terms of flexibility and lower fees when secured against property.

Ultimately, making informed decisions about HELOCs requires careful consideration of personal financial situations and market conditions. As homeowners explore their options, staying updated on current trends and interest rates will empower them to navigate the complexities of financing. Engaging with knowledgeable lenders can further enhance the ability to secure favorable terms, ensuring that homeowners can optimize their financial strategies effectively. Remember, we’re here to support you every step of the way as you make these important decisions.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a revolving line of credit that is backed by the equity in your home, allowing you to borrow against the value of your property for various needs.

How does a HELOC work?

A HELOC works similarly to a credit card; you can access funds as needed up to a predetermined limit, providing a flexible source of funds for purposes like home renovations, debt consolidation, or significant purchases.

What is the average home equity available to homeowners?

As of 2025, the average homeowner has around $313,000 in equity, with about $203,000 considered tappable, meaning that homeowners can access substantial funds without needing a lump-sum loan.

How much home equity was withdrawn by U.S. mortgage holders in the fourth quarter of 2024?

In the fourth quarter of 2024, U.S. mortgage holders withdrew $46 billion in home equity, indicating a growing trend of families utilizing HELOCs for better financial management.

What are the current interest rates for HELOCs?

The current HELOC interest rates are around 8%, making them increasingly popular, especially when mortgage rates are lower.

When can HELOCs be particularly beneficial?

HELOCs can be particularly beneficial when borrowing costs exceed those on existing home loans, making them a versatile choice for debt consolidation and potential savings on financing.

What is cash-out refinancing, and when should it be considered?

Cash-out refinancing is an option to explore if you’re considering a larger sum of money upfront. However, it’s important to be aware of possible repayment shocks when transitioning from payment-only installments to principal and payment obligations.

What should you do once your HELOC application is approved?

Once your HELOC application is approved, it is crucial to lock in your mortgage rates to protect yourself from market fluctuations during the processing period.