Overview

The title “10 Essential Facts About 15-Year Fixed Rate Mortgages” highlights important information that families considering this mortgage option should be aware of. We understand how challenging the mortgage process can be, and this article emphasizes that a 15-year fixed rate mortgage can lead to lower overall interest costs and faster equity accumulation. This makes it an appealing choice for families seeking financial stability. By comparing interest rates and outlining the benefits of predictable payments, we aim to provide clarity and support.

We know that making financial decisions can be daunting, but understanding your options is the first step toward empowerment. A 15-year fixed rate mortgage not only helps you save on interest but also allows you to build equity more quickly, which can be a significant advantage for your family’s future. As we explore these facts, keep in mind that we’re here to support you every step of the way.

Introduction

Navigating the world of mortgages can feel overwhelming, especially with the rising interest in 15-year fixed-rate options. These loans not only offer lower interest rates compared to their 30-year counterparts, but they also allow homeowners to build equity more quickly. However, while the appeal of reduced costs and predictable payments is clear, many potential borrowers face the challenge of higher monthly payments and the necessity for a stable financial foundation.

We understand how challenging this can be. What essential factors should families consider before committing to a 15-year fixed-rate mortgage? How can they ensure they are making the right choice for their financial future? By addressing these questions, we aim to empower families to make informed decisions that align with their goals.

F5 Mortgage: Your Partner for 15-Year Fixed Rate Mortgages

At F5 Mortgage LLC, we understand how challenging it can be for families considering a 15 year fixed rate mortgage. That’s why we are dedicated to being your committed ally, offering tailored service and a wide variety of financing choices to meet your unique needs. Our brokerage focuses on customized solutions that align with each client’s distinct financial situation, ensuring a smooth lending experience.

We adopt a client-focused strategy, utilizing advanced technology and transparent communication to guide families throughout the financing process. With a strong emphasis on client education, we empower borrowers to confidently navigate the complexities of home financing. This commitment is reflected in our impressive customer satisfaction rate of 94%, showcasing the effectiveness of our approach in fostering successful partnerships with families.

As the home loan landscape evolves, the trend towards 15 year fixed rate mortgage options continues to gain momentum. Families are drawn to the benefits of reduced interest rates and quicker equity accumulation. Independent brokers like F5 Mortgage play a vital role in enhancing client satisfaction, as we operate solely for you, the borrower. We provide access to competitive offers and personalized assistance, allowing families to make informed decisions that lead to a fulfilling homeownership journey.

As one satisfied client shared, “The team provided patient, step-by-step guidance as a first-time homebuyer, ensuring a smooth and stress-free experience.” We’re here to support you every step of the way, making your home financing journey as seamless as possible.

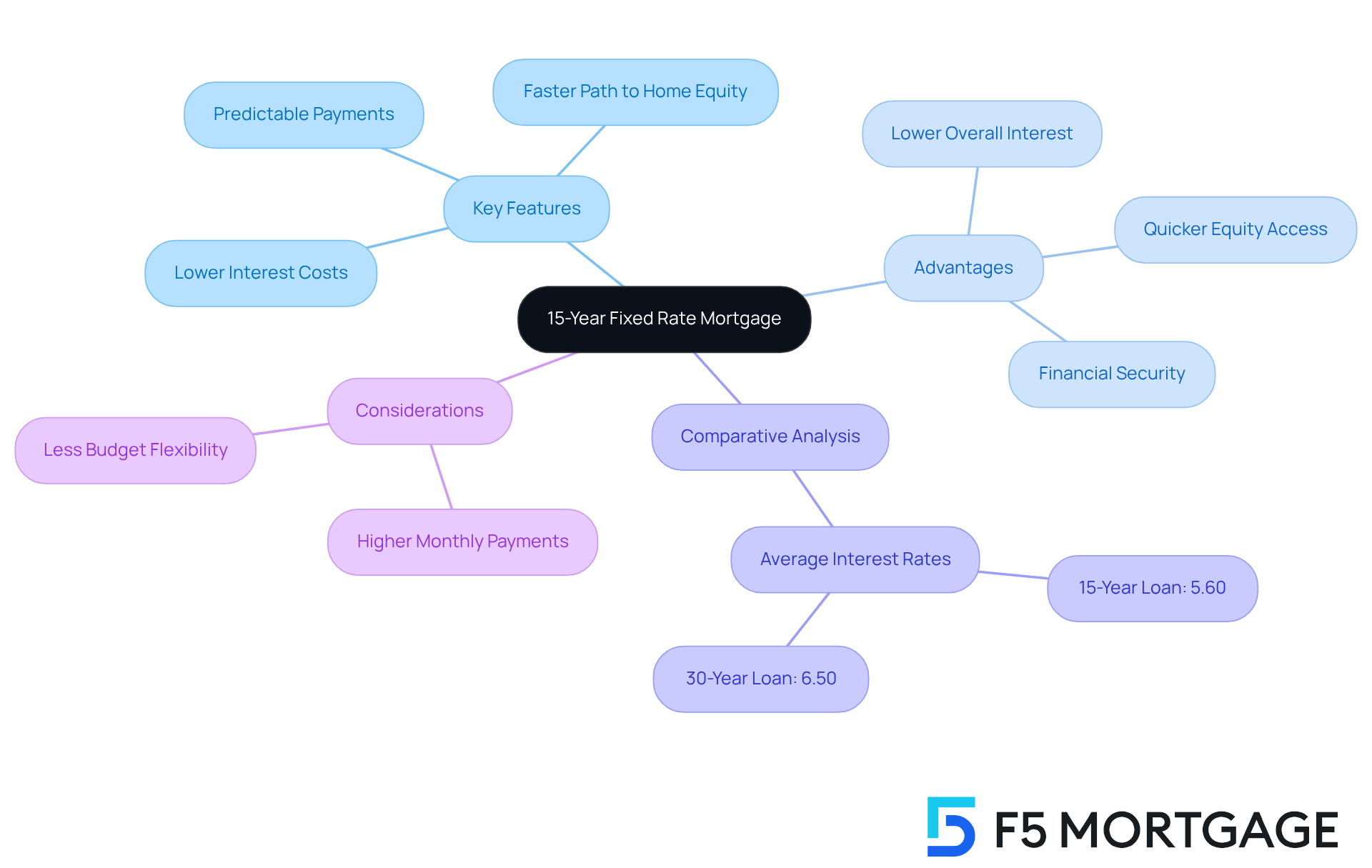

Definition and Key Features of a 15-Year Fixed Rate Mortgage

A fixed-term financing option known as a 15 year fixed rate mortgage allows families to repay the principal over a term of fifteen years at a stable interest percentage. This structure ensures that monthly payments remain consistent, providing predictability for budgeting, which we know can be a challenge. Key features of this mortgage type include:

- Lower Overall Interest Costs: Families typically pay less interest compared to longer-term loans, resulting in significant savings over the life of the loan. As of September 4, 2025, the average interest percentage for a 15 year fixed rate mortgage is 5.60%, which is notably lower than the 6.50% average for a 30-year loan. This makes it an attractive choice for families looking to manage their finances wisely.

- Faster Path to Home Equity: With higher monthly payments, homeowners build equity more quickly. This allows families to access their investment sooner, which can be essential for future financial needs, such as education or medical expenses, through refinancing options.

- Predictable Payments: The fixed interest rate means that families can plan their finances without the worry of fluctuating rates, helping them feel more secure.

Families have effectively used long-term fixed-rate loans to achieve their homeownership goals. For instance, a family refinancing from a 30-year loan to a shorter term can significantly lower their total interest payments, allowing them to settle their home sooner and improve their financial stability. Furthermore, if they acquired their home with less than a 20% down payment, they might have the opportunity to eliminate private insurance through refinancing, especially with rising property values in California.

A financial advisor observes, ‘Selecting a 15 year fixed rate mortgage can lead to a more disciplined repayment strategy, ultimately resulting in a more secure financial future.’

However, it’s important to consider potential drawbacks, such as higher monthly payments and less budget flexibility, which may pose challenges for some families. Additionally, with the possibility of further loan interest decreases into 2026, families should stay informed about their options as they plan for the future.

To explore customized loan solutions and refinancing alternatives that suit your family’s needs, consider reaching out to F5 Mortgage today. The combination of reduced costs and quicker equity appreciation makes the long-term fixed loan an appealing choice for many families aiming to enhance their homes.

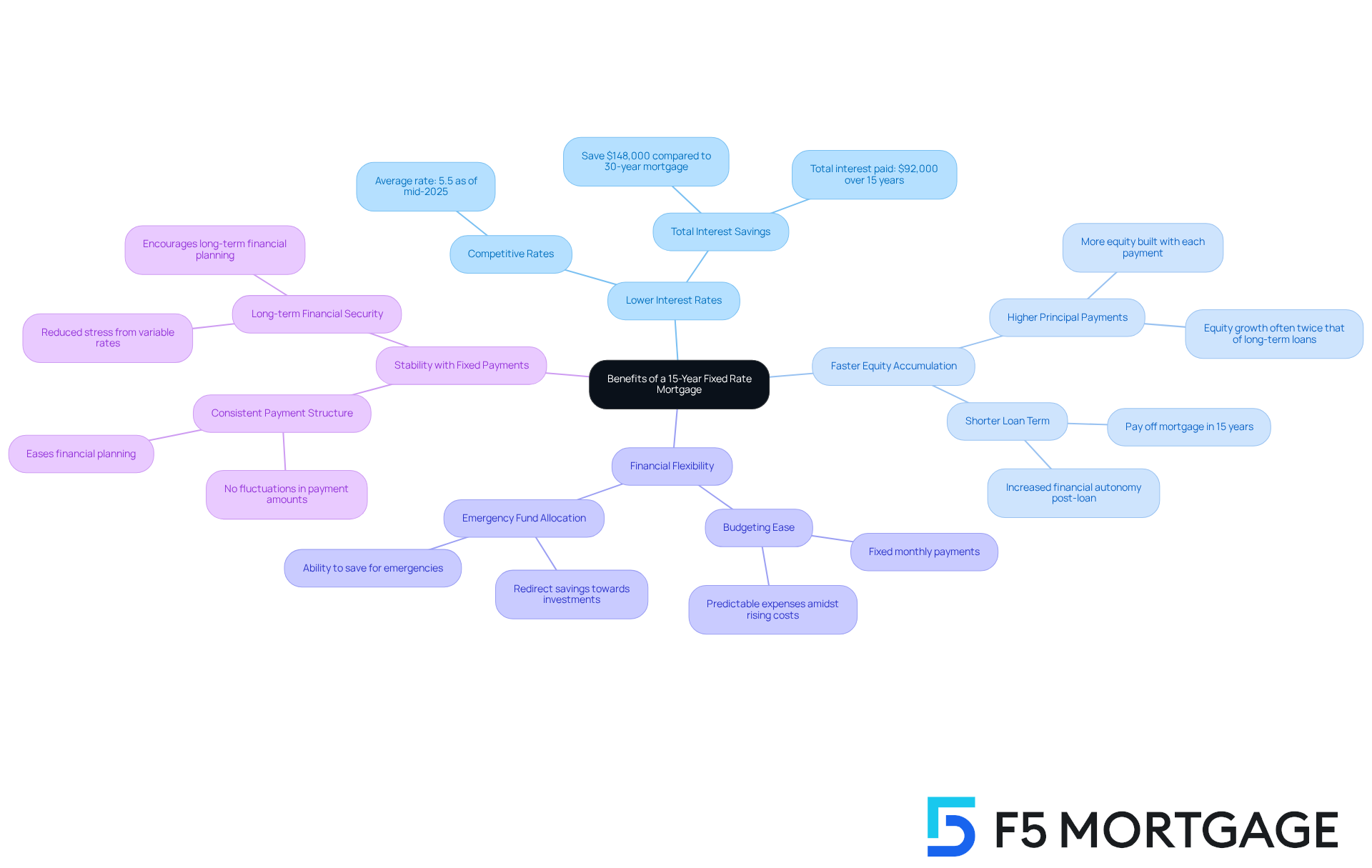

Benefits of a 15-Year Fixed Rate Mortgage

Are you considering a mortgage? A 15 year fixed rate mortgage could be the right choice for you. This option, a 15 year fixed rate mortgage, usually provides lower interest rates than 30-year loans, which can result in significant savings over time. We understand how important it is to make the right financial decisions for your family.

With F5, you can enjoy quick and adaptable financing solutions that help you achieve homeownership more efficiently. Imagine accumulating equity more quickly, providing you with increased financial flexibility. This loan type allows you to build a secure future for your loved ones.

Moreover, the stability offered by the 15 year fixed rate mortgage allows for fixed monthly payments, making it easier to plan your finances. We know how challenging this can be, and that’s why F5 Mortgage is dedicated to providing exceptional service. Our team ensures that those who prioritize long-term savings and financial security receive personalized support throughout the process. We’re here to support you every step of the way.

Disadvantages of a 15-Year Fixed Rate Mortgage

While a 15 year fixed rate mortgage offers many advantages, it also presents some challenges. One significant drawback is the higher monthly payments compared to a 30-year loan, which can put pressure on your finances. We understand how challenging this can be, especially for first-time homebuyers or those with tighter budgets. The shorter financing term means there’s less time to spread out the costs, making it potentially less attainable for some families.

At F5 Mortgage, we’re here to support you every step of the way. We recognize that every borrower has unique financial needs. That’s why we offer a broad selection of financing programs tailored to your situation. You can choose from standard options like conventional and FHA products, as well as nontraditional alternatives such as adjustable-rate financing and interest-only products. Even if one lender says no, remember that you still have choices available to you. We’re committed to helping you find the right solution for your journey.

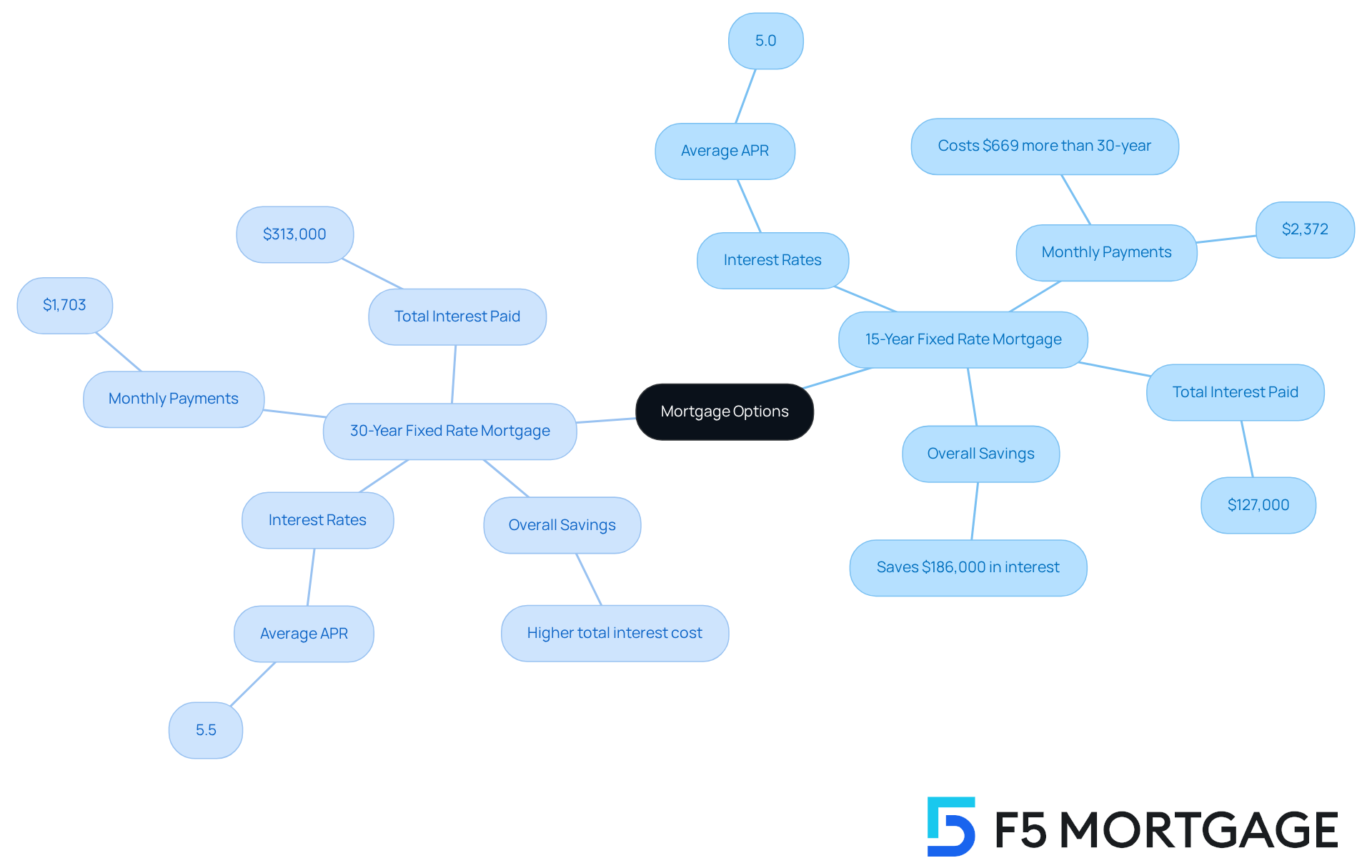

15-Year vs. 30-Year Fixed Rate Mortgages: Key Differences

Understanding the differences between a 30-year fixed-rate option and a shorter-term loan can feel overwhelming, but we’re here to support you every step of the way. The main distinctions lie in the duration, monthly payments, and overall financial impact. Shorter-term loans often come with lower interest rates, enabling borrowers to pay off their debts more quickly and save significantly on interest—averaging about $186,000 less over the life of the loan compared to a longer-term option.

However, it’s important to consider that this benefit comes with higher monthly payments, which can be a financial strain for many families. For instance, a loan structured as a 15 year fixed rate mortgage with a 5.0% interest rate results in a monthly payment of approximately $2,372. In contrast, a 30-year loan at 5.5% incurs a monthly payment of around $1,703. This means the 15 year fixed rate mortgage costs $669 more each month than the 30-year option, making the latter’s lower payment structure more attainable for families. This allows you to allocate resources toward other expenses or investments.

Yet, the trade-off is a higher total interest cost. Over 30 years, borrowers might pay over $313,000 in interest. Grasping these essential distinctions is vital as you explore your financing options and align your choices with your financial goals. By comparing rates, costs, and terms from various lenders, including F5 Mortgage, you can ensure you find competitive rates and personalized service that meet your needs. Consulting with a loan expert can provide customized guidance based on your unique financial circumstances, helping you make informed decisions that best suit your family’s future.

Types of 15-Year Fixed Rate Mortgages Available

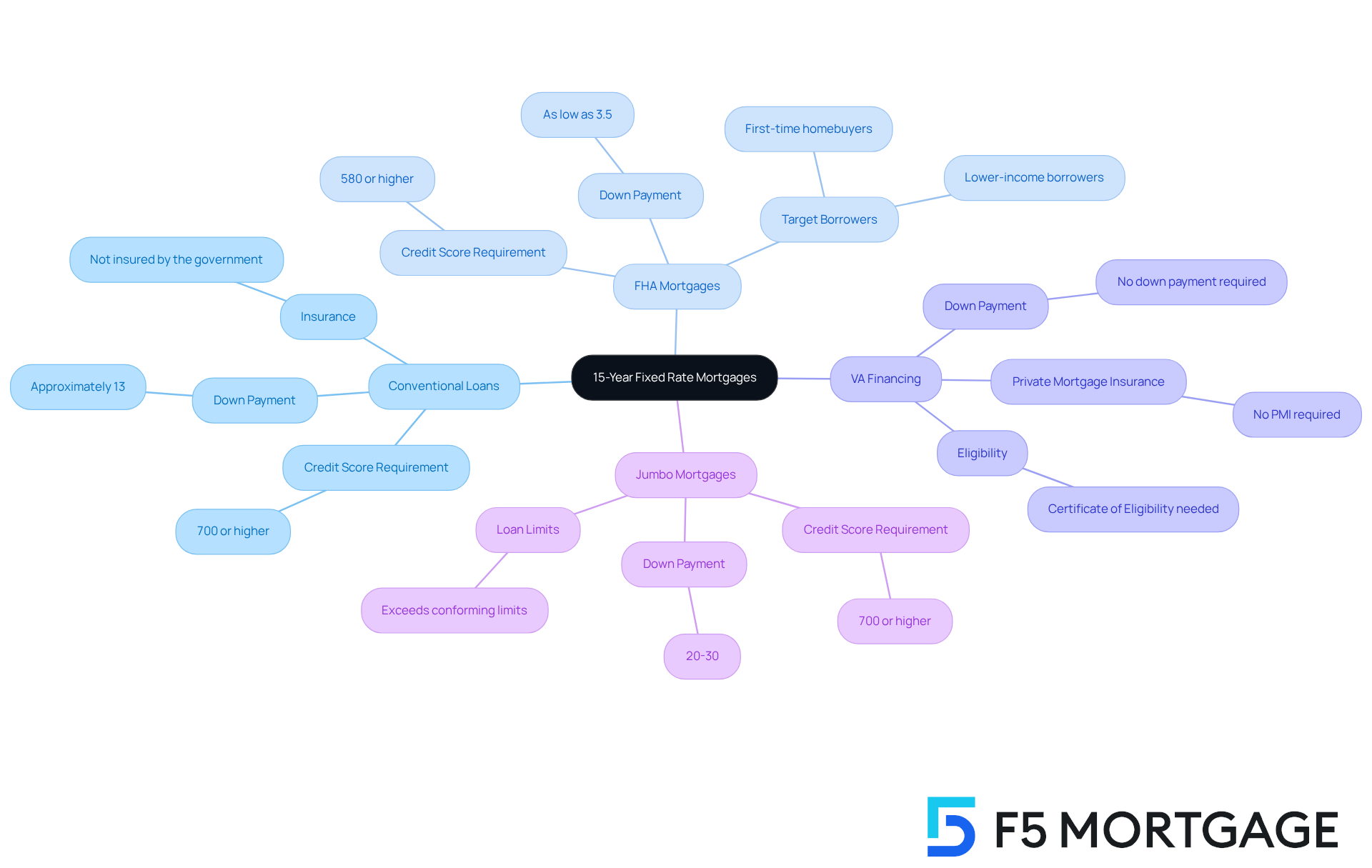

When it comes to securing a mortgage, families often face a range of choices, and understanding these options can be overwhelming. A variety of 15-year fixed rate mortgages are available to meet diverse financial needs, including conventional options, FHA products, VA offerings, and jumbo types.

Conventional Loans: For those with strong financial profiles, conventional loans may be a great fit. These loans are not insured by the government, typically requiring higher credit scores—usually around 700 or higher—and down payments. The initial payment is about 13% of the purchase cost, which highlights the importance of strategic planning for prospective borrowers.

FHA Mortgages: If you’re a first-time homebuyer or have limited savings, FHA mortgages might be the answer. Designed for lower-income borrowers, they allow down payments as low as 3.5% and accept credit scores starting at 580. This accessibility can ease the financial burden for families looking to enter the real estate market.

VA Financing: For veterans and active-duty military members, VA financing offers unique advantages. With no down payment and no private mortgage insurance (PMI) required, this option can be incredibly cost-effective. To qualify, borrowers need a Certificate of Eligibility, confirming their suitability for the financing. Additionally, homeowners can explore refinancing options like the VA Interest Rate Reduction Refinance Program (IRRRL) or a VA cash-out refinance, which can help lower rates or access home equity for various needs.

Jumbo Mortgages: If you’re considering a high-value property, jumbo mortgages may be necessary. These loans exceed the conforming borrowing limits set by Fannie Mae and Freddie Mac. They typically require elevated credit scores—commonly 700 or above—and larger down payments, reflecting their riskier nature. Families should be mindful of these requirements to ensure they meet lender criteria.

As we look ahead to 2025, the market share of FHA, VA, and jumbo products continues to grow, underscoring their importance in the housing finance landscape. For families seeking a 15-year fixed rate mortgage, it is crucial to understand these options for making informed financial decisions. Remember, we’re here to support you every step of the way.

Refinancing to a 15-Year Fixed Rate Mortgage: What You Need to Know

Refinancing to a fixed-term financing option can be a smart choice for homeowners looking to lower their interest costs and expedite repayment. We understand how important it is to make informed financial decisions, and this choice generally provides reduced interest rates compared to 30-year home loans. This enables property owners to save considerably throughout the duration of the financing. For instance, homeowners who refinance from a 30-year loan at 4.5% to a 15-year loan at 3.5% could save tens of thousands in interest payments.

However, we know how challenging it can be to navigate the costs associated with refinancing, which can range from 2% to 6% of the total mortgage balance. These costs include closing fees, appraisal fees, and other related expenses. Homeowners should carefully evaluate whether the potential savings on interest justify these upfront costs. For example, if refinancing results in a monthly payment increase of $300, as seen in some cases, it’s essential to ensure that the new payment aligns with your budget and financial goals.

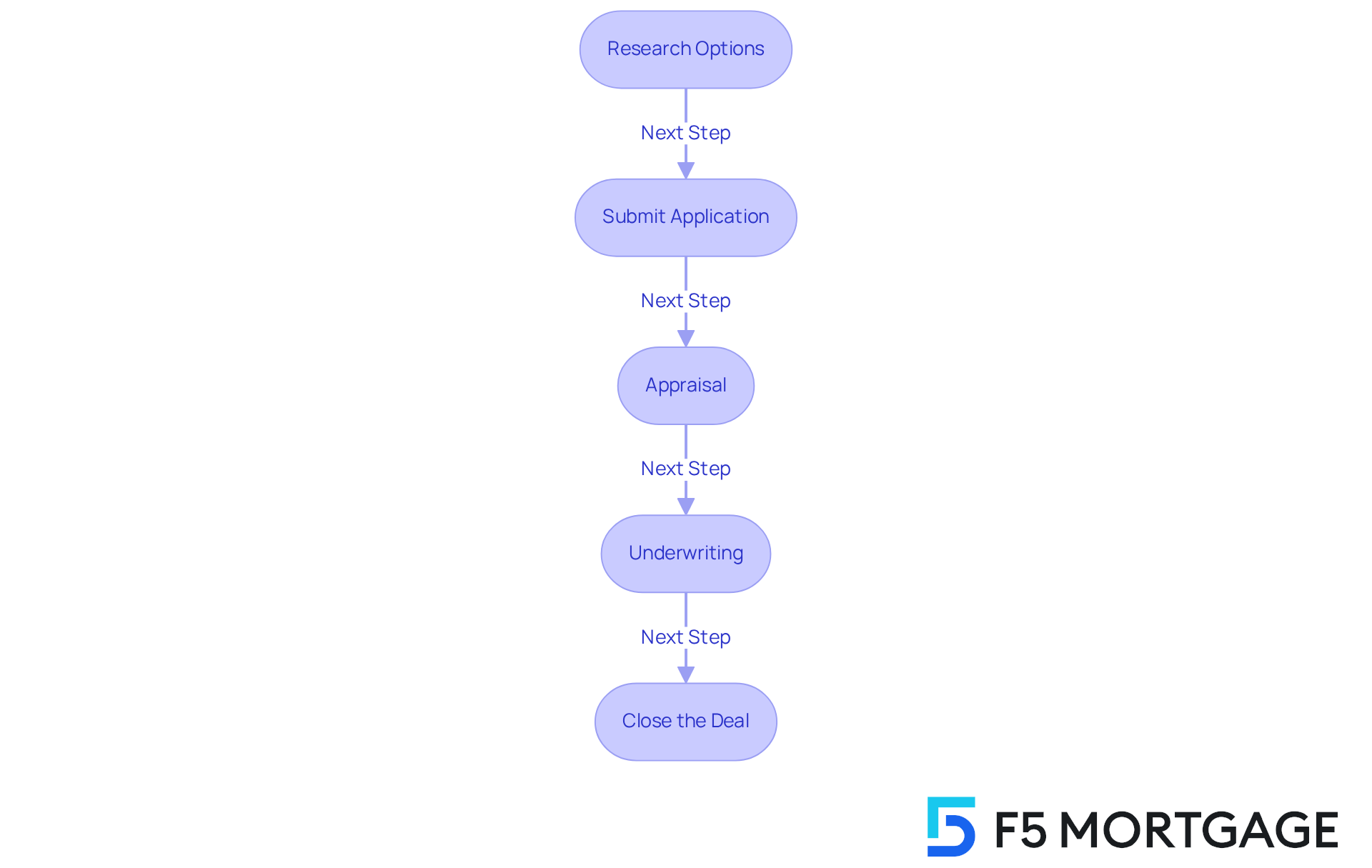

To begin the refinancing process, homeowners should first research their options. While refinancing with your current lender is one choice, comparing multiple lenders can help you find the best rates and terms. Next, you’ll need to submit a refinancing application, providing information about your property and financial documents. After this, an appraisal will evaluate your property’s current worth, and the lender will examine your application, credit history, debt-to-income ratio, and assets during the underwriting process.

Finally, once your application has been accepted, you can close the deal, sign the new documents, and pay closing costs. After the agreement is completed, your new lender will settle your initial loan, and your monthly payments will be directed to your new lender.

To enhance the advantages of refinancing to a shorter loan term, homeowners should contemplate methods such as boosting their credit score, raising their income to decrease the debt-to-income ratio, and comparing options for the best offers. By taking these steps, homeowners can position themselves to secure favorable terms and achieve their financial objectives more efficiently. If you’re considering refinancing, we’re here to support you every step of the way—start by gathering your financial documents and comparing offers from multiple lenders to find the best deal.

Impact of Interest Rates on 15-Year Fixed Rate Mortgages

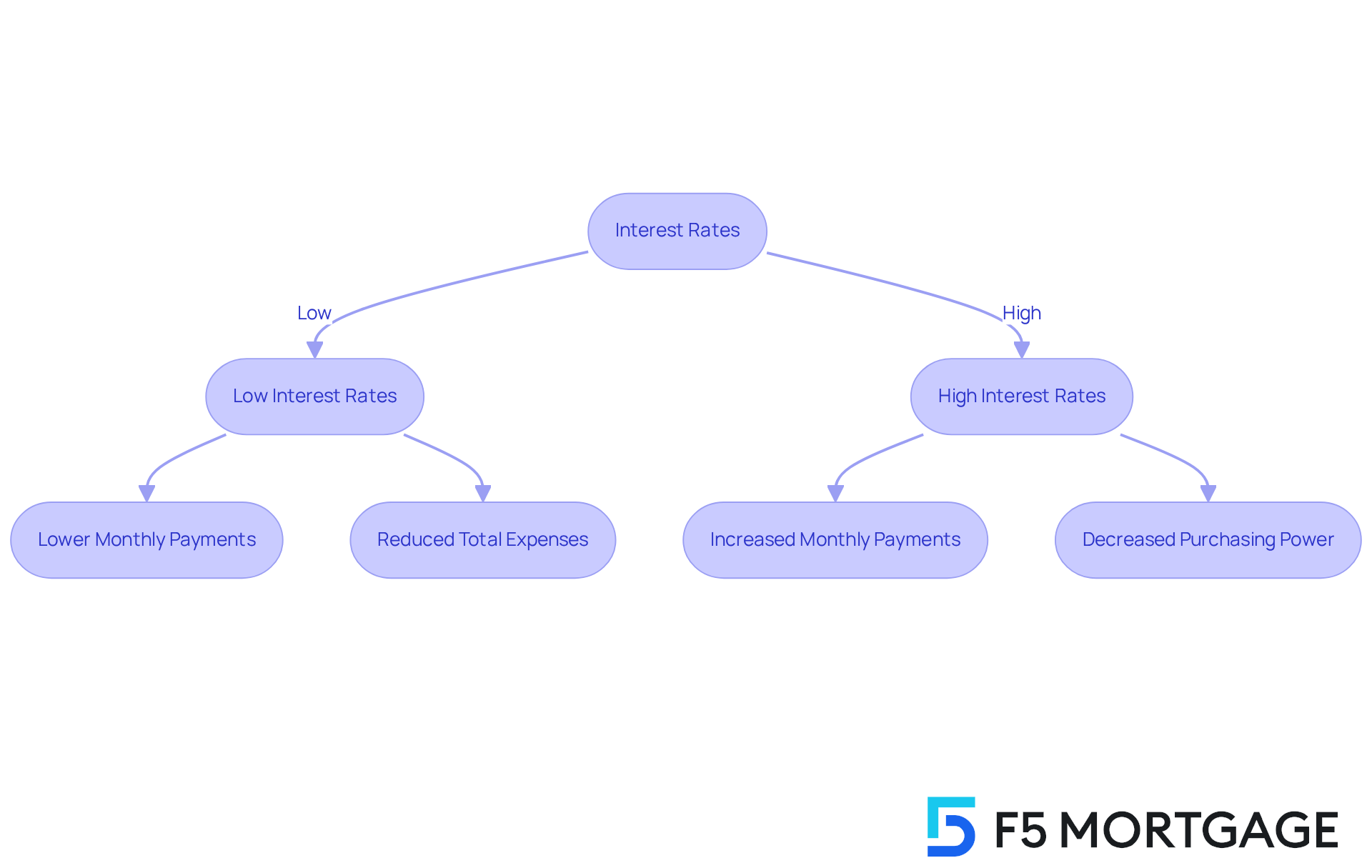

Understanding interest levels is crucial when assessing the affordability of a 15 year fixed rate mortgage. We know how challenging this can be. When interest levels are low, borrowers often find more favorable terms, leading to lower monthly payments and reduced total expenses. Currently, the interest rate for a 15 year fixed rate mortgage is at 5.60%. While this is a slight decrease from last week’s 5.69%, it remains above the long-term average of 5.25%. This minor decline reflects the fluctuations in the mortgage market, particularly regarding the 15 year fixed rate mortgage, that families should consider when making decisions.

As interest levels rise, monthly payments can increase significantly, impacting purchasing power. For instance, a 1% rise in interest can boost monthly payments by about 10%. It’s essential for prospective borrowers to keep a close eye on market trends. Economists predict that loan interest rates will remain between 6.5% and 7.5% for the foreseeable future. This highlights the importance of securing favorable terms when they are available.

Families who secured mortgages during periods of low interest often enjoyed substantial savings. During the last notable decline in prices, many households successfully refinanced their loans, reducing their monthly payments and freeing up funds for other expenses. This trend underscores the potential benefits of acting swiftly in a positive financial environment.

It is generally advised that homeowners plan to stay in their homes for at least five years to fully enjoy the financial advantages of homeownership. This period allows families to build equity and offset the costs associated with purchasing a home. Market conditions and the amount of equity accumulated can greatly influence this decision, making it essential for families to carefully assess their situation.

In summary, understanding the relationship between interest levels and loan payments is vital for potential borrowers looking into a 15 year fixed rate mortgage. By staying informed, reflecting on the timing of their loan choices, and possibly securing advantageous rates, families can navigate the complexities of obtaining a fixed-rate loan more effectively. Remember, consulting with a loan advisor can provide tailored insights based on your unique circumstances. We’re here to support you every step of the way.

Eligibility Requirements for a 15-Year Fixed Rate Mortgage

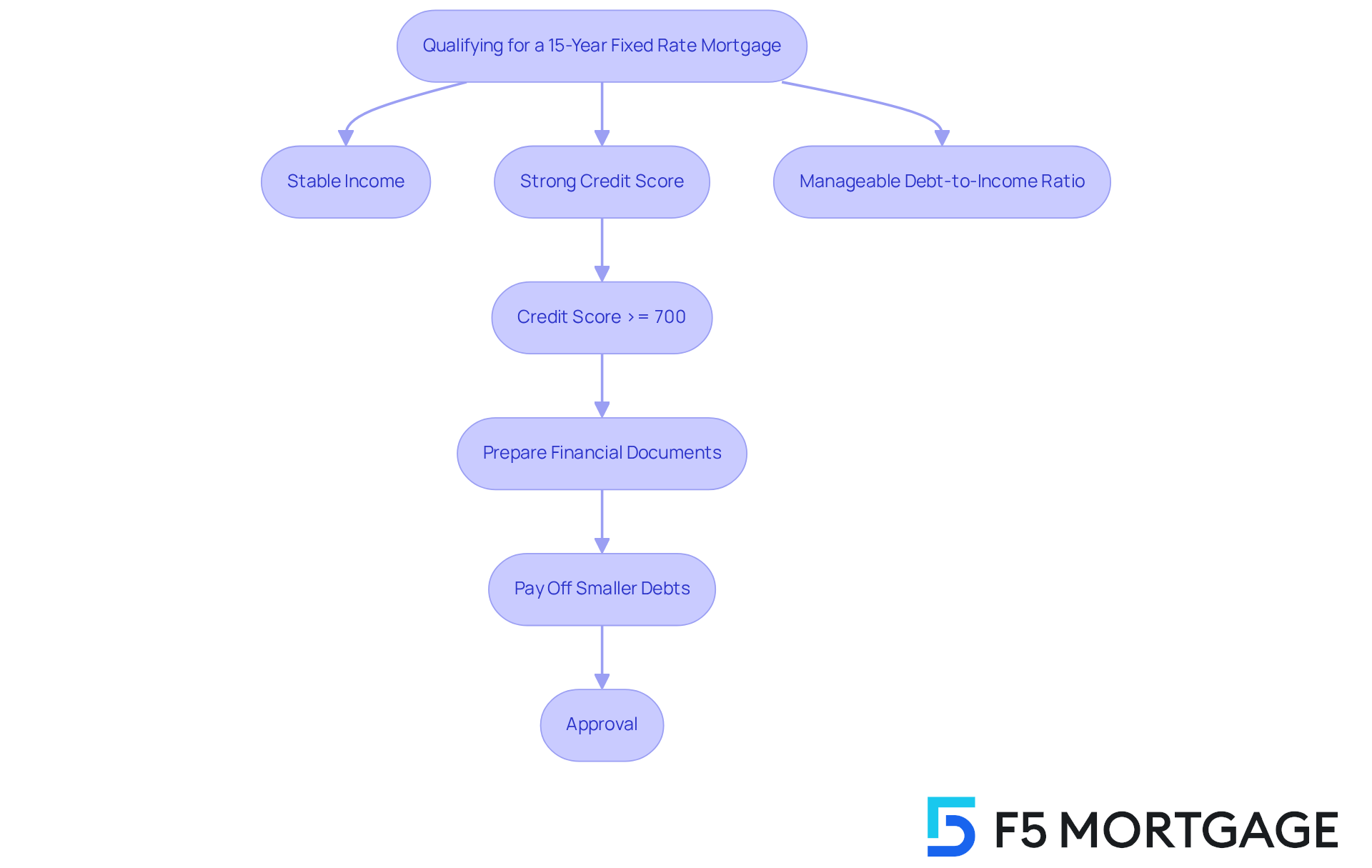

We know how challenging it can be to navigate the mortgage process. To qualify for a 15 year fixed rate mortgage, borrowers typically need to demonstrate:

- A stable income

- A strong credit score

- A manageable debt-to-income ratio

Lenders often prefer applicants with a credit score of at least 700, as this significantly improves the chances of securing favorable rates. Additionally, having a steady employment history, ideally with the same job or company for at least two years, is crucial for demonstrating financial reliability.

Down payments can vary based on the loan type, but many lenders require at least 3% to 20% of the home’s purchase price. Families that meet these criteria often include first-time homebuyers who have maintained consistent employment and have worked to improve their credit scores. For instance, a household with a credit score of 720 and a debt-to-income ratio under 36% is well-situated to qualify for a 15 year fixed rate mortgage.

Mortgage brokers emphasize the importance of preparing financial documents, such as tax returns and pay stubs, to showcase income stability. They also recommend paying off smaller debts to enhance overall creditworthiness. By following these actions, prospective borrowers can greatly enhance their likelihood of approval for a 15 year fixed rate mortgage. Remember, we’re here to support you every step of the way as you work towards your homeownership goals.

Choosing the Right Lender for Your 15-Year Fixed Rate Mortgage

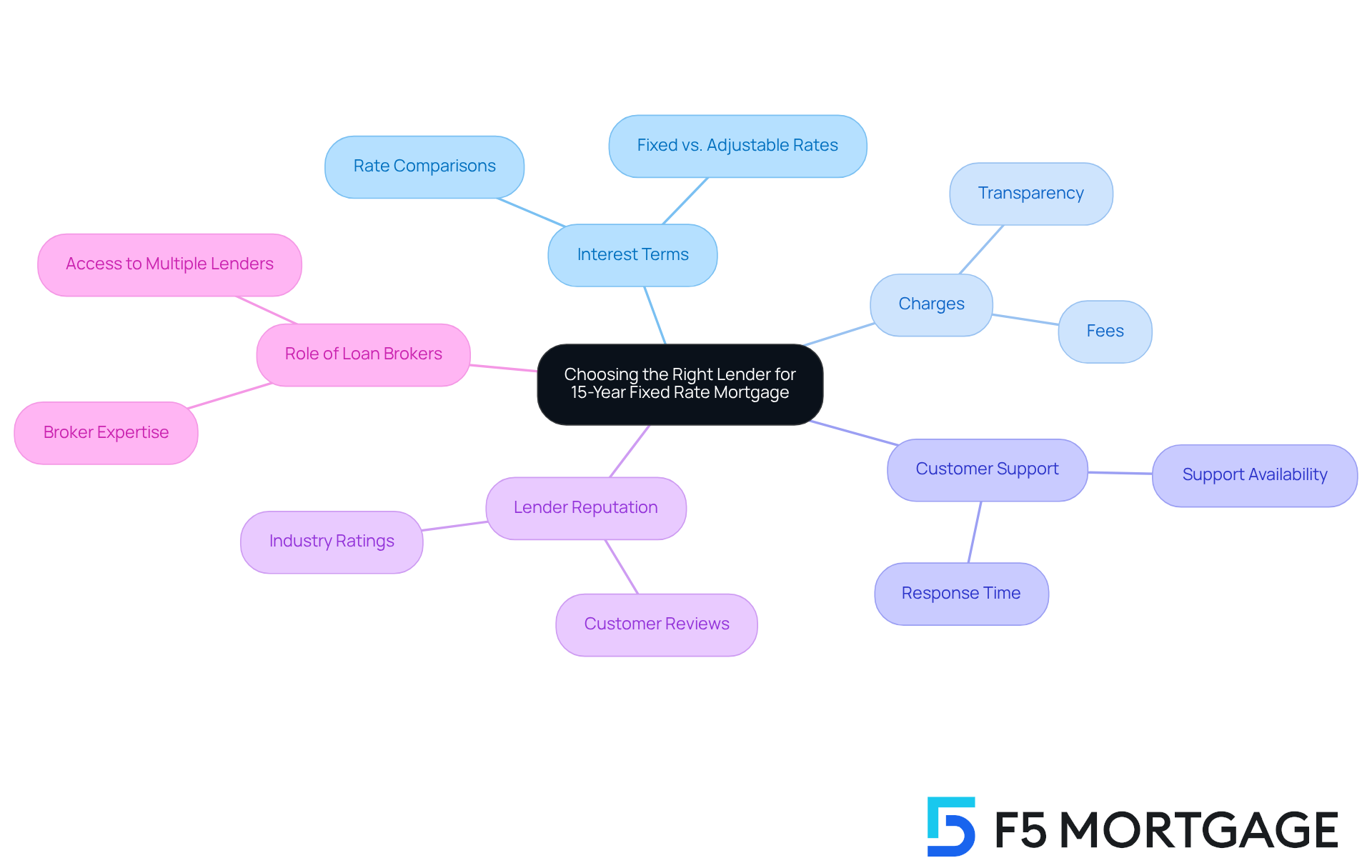

Choosing the right lender for a 15 year fixed rate mortgage can feel overwhelming. We know how challenging this can be, and it’s important to thoughtfully evaluate key elements like interest terms, charges, customer support, and the lender’s reputation. Prioritizing lenders that are transparent in their processes and have a track record of positive customer experiences can make a significant difference. Financial specialists emphasize the importance of lender ratings and customer support, as these factors can greatly influence your home loan journey. For instance, a lender willing to provide clear details about charges and fees can help you avoid unexpected expenses down the road.

Collaborating with a loan broker, such as F5 Mortgage, can be a game changer. Brokers have access to a wide range of lenders and can guide you through the complexities of financing options. This approach not only simplifies the process but also enhances your chances of finding a lender that aligns with your financial goals. Many families have successfully leveraged the expertise of loan brokers to secure favorable terms and rates, enriching their overall home-buying experience.

Looking ahead to 2025, the top lenders for 15 year fixed rate mortgage are recognized for their competitive rates and excellent customer service ratings. These lenders are definitely worth considering as you navigate this important decision. Remember, we’re here to support you every step of the way.

Conclusion

A 15-year fixed rate mortgage is a wonderful option for families striving for financial stability and the dream of homeownership. With lower interest rates and predictable monthly payments, this mortgage type allows borrowers to build equity more quickly, leading to significant savings over time. At F5 Mortgage, we are committed to providing tailored solutions, ensuring families receive the support they need as they navigate the complexities of the mortgage landscape.

Key insights reveal the many advantages of 15-year fixed rate mortgages. These include:

- Reduced overall interest costs

- Faster equity accumulation

- The peace of mind that comes with fixed payments

While we understand that potential drawbacks, such as higher monthly payments and budget constraints, can be concerning, being informed about the various types of loans, eligibility requirements, and the impact of interest rates can empower families to make confident decisions. Moreover, choosing the right lender is crucial, as it can greatly influence both the experience and financial outcomes.

In conclusion, the journey toward homeownership is a significant milestone, and opting for a 15-year fixed rate mortgage can be a strategic step toward achieving long-term financial security. We encourage families to explore their options, consult with mortgage professionals, and stay informed about market trends to make the best choices for their unique situations. By taking proactive steps and leveraging the expertise of trusted partners like F5 Mortgage, families can confidently embark on their home financing journey and secure a brighter financial future.

Frequently Asked Questions

What is a 15-year fixed rate mortgage?

A 15-year fixed rate mortgage is a loan that allows families to repay the principal over a term of fifteen years at a stable interest rate, ensuring consistent monthly payments for budgeting.

What are the key features of a 15-year fixed rate mortgage?

Key features include lower overall interest costs compared to longer-term loans, a faster path to home equity due to higher monthly payments, and predictable payments from a fixed interest rate.

How does a 15-year fixed rate mortgage benefit borrowers financially?

Borrowers typically pay less interest over the life of the loan, accumulate equity more quickly, and can plan their finances with fixed monthly payments, enhancing financial stability.

What is the average interest rate for a 15-year fixed rate mortgage as of September 2025?

The average interest rate for a 15-year fixed rate mortgage is 5.60%, which is lower than the 6.50% average for a 30-year loan.

What are some potential drawbacks of a 15-year fixed rate mortgage?

Potential drawbacks include higher monthly payments and less budget flexibility, which may pose challenges for some families.

How can refinancing from a 30-year loan to a 15-year loan benefit homeowners?

Refinancing can significantly lower total interest payments, allow homeowners to settle their home sooner, and potentially eliminate private insurance if they initially made a down payment of less than 20%.

What role does F5 Mortgage play in the mortgage process?

F5 Mortgage provides tailored service and a variety of financing choices, focusing on client education and personalized assistance to help families navigate the mortgage process effectively.

What is the customer satisfaction rate for F5 Mortgage?

F5 Mortgage boasts an impressive customer satisfaction rate of 94%, reflecting their commitment to fostering successful partnerships with families.

How can families explore customized loan solutions with F5 Mortgage?

Families can reach out to F5 Mortgage to explore customized loan solutions and refinancing alternatives that suit their unique financial needs.