Overview

Choosing a mortgage agency for your home upgrade can be a game-changer. We understand how overwhelming this process can feel, and that’s why personalized service is so important. Agencies like F5 Mortgage offer expert guidance tailored to your unique needs. This not only simplifies the financing process but also enhances your overall experience.

Imagine having access to competitive rates that truly benefit you. With a mortgage agency, you can find solutions that lead to significant cost savings compared to traditional lenders. We’re here to support you every step of the way, ensuring you feel confident in your decisions.

By opting for a mortgage agency, you’re not just getting a loan; you’re gaining a partner who understands your journey. Let’s navigate this together, making your home upgrade as smooth and rewarding as possible.

Introduction

Navigating the mortgage landscape can often feel overwhelming, especially for families looking to upgrade their homes. We understand how challenging this can be, and with more individuals seeking personalized financial guidance, the importance of partnering with a dedicated mortgage agency has never been clearer. This article explores the compelling reasons to choose a mortgage agency, highlighting how expert support, tailored solutions, and significant cost savings can transform your home financing experience.

What obstacles might arise when relying on traditional lenders? More importantly, how can a specialized mortgage agency turn those challenges into opportunities for your success? We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Solutions for a Seamless Experience

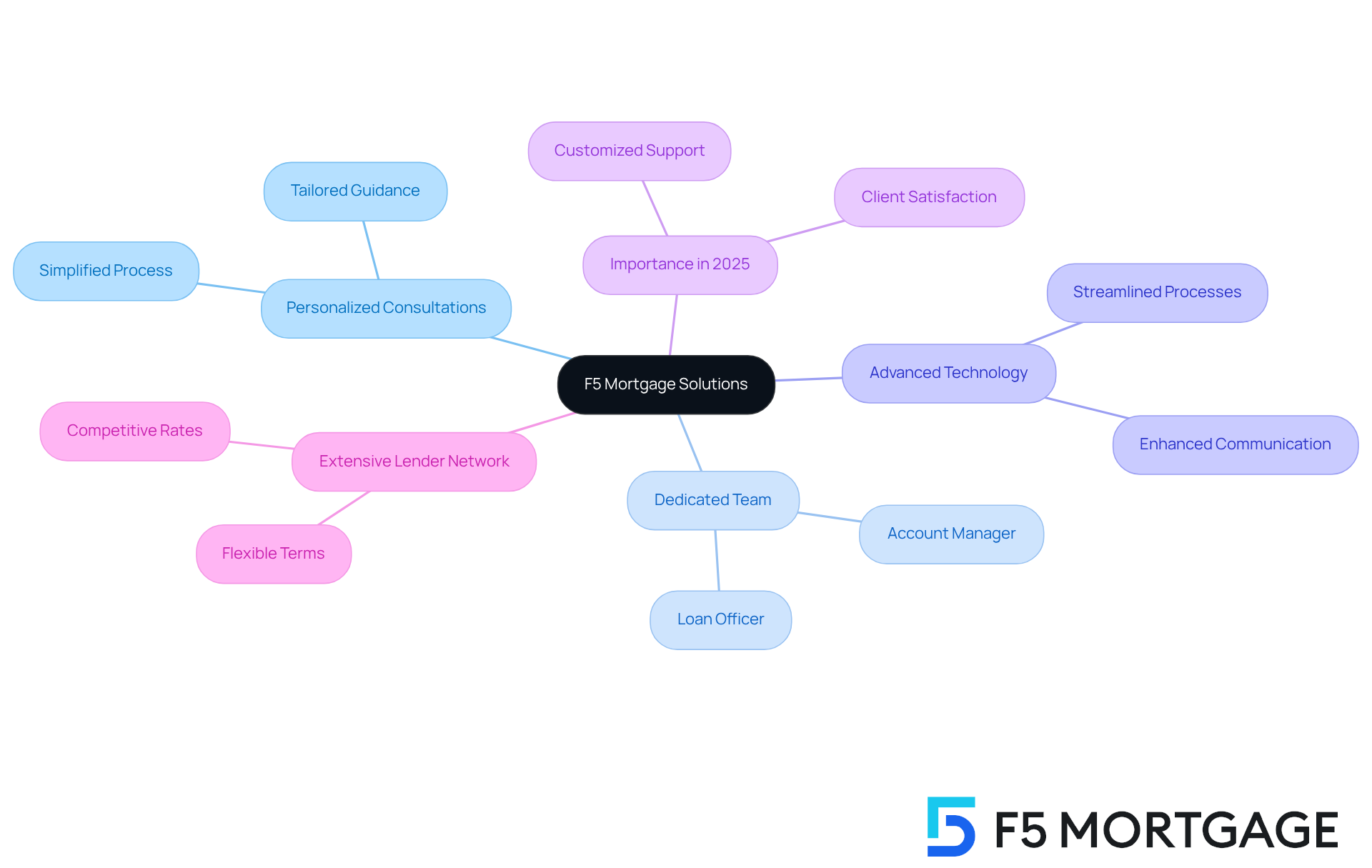

At F5 Home Loans, we understand how challenging it can be to navigate the mortgage agency process. That’s why we dedicate ourselves to tailored consultations through our mortgage agency that meet your unique needs. This personalized approach simplifies the home purchasing and refinancing journey with a mortgage agency, ensuring you receive the guidance and solutions that are right for you.

Our dedicated team at the mortgage agency, which includes a loan officer and an account manager, provides unparalleled support throughout the entire refinancing process. We know that navigating financing can feel overwhelming, but our mortgage agency utilizes advanced technology to simplify the complexities, allowing you to explore your options with confidence and ease.

In 2025, the importance of personalized financial guidance is more critical than ever. Clients increasingly seek customized support from industry specialists to enhance their overall experience and satisfaction. Additionally, our mortgage agency has an extensive network of over two dozen lenders, enabling us to offer competitive rates and flexible terms, making F5 an ideal choice for families looking to upgrade their homes.

We’re here to support you every step of the way, ensuring that your journey is as smooth and rewarding as possible.

Expert Guidance: Navigating Mortgage Options with Professional Brokers

Navigating the loan landscape can feel overwhelming, and we know how challenging this can be. However, partnering with a professional mortgage agency like those at F5 Mortgage can significantly ease the process. Brokers possess extensive knowledge of various financing products, allowing them to effectively guide clients through the intricacies of options provided by a mortgage agency. They assess individual financial situations to identify the most suitable loan types, ensuring a more streamlined and informed decision-making experience.

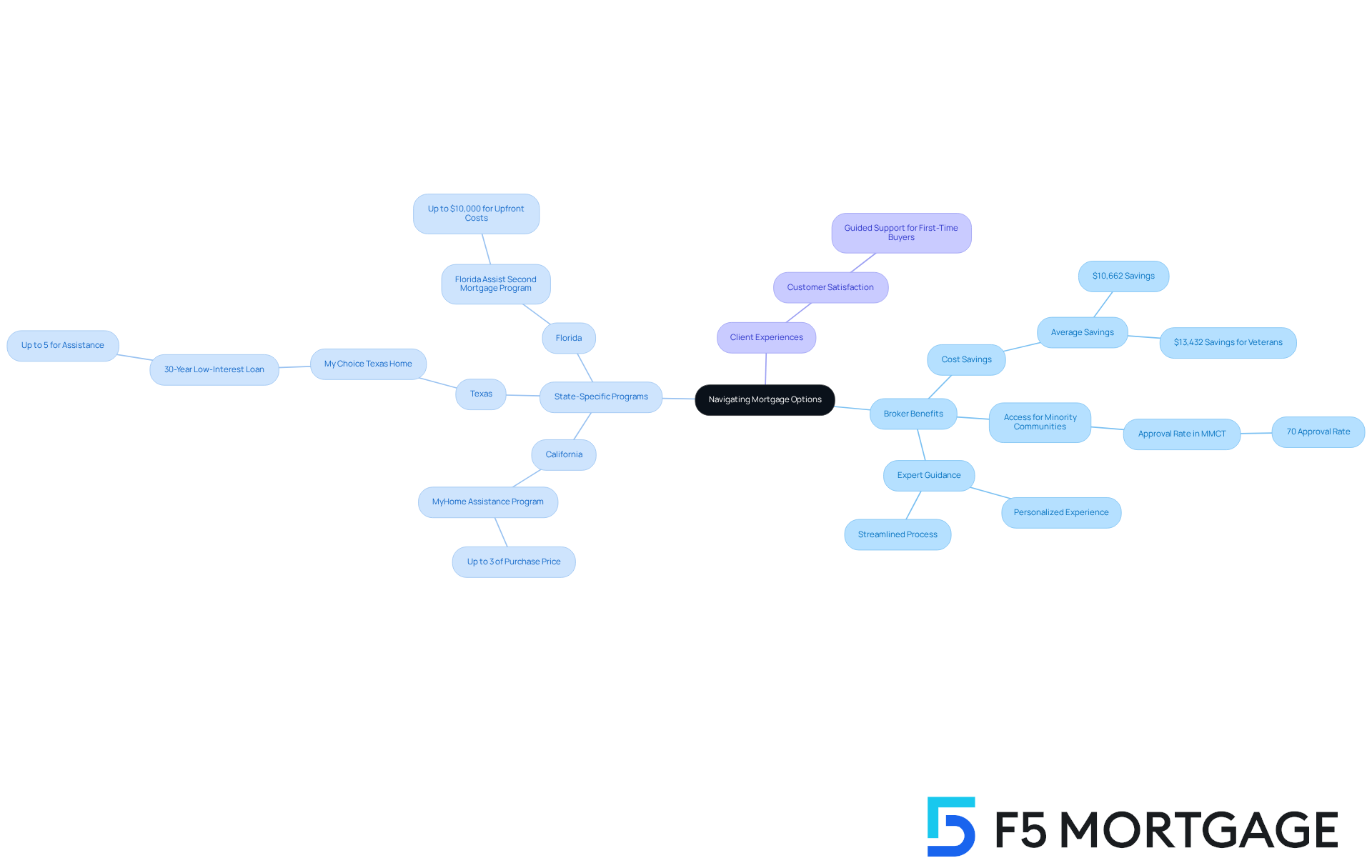

F5 Lending offers a variety of down payment assistance programs tailored to meet the needs of homebuyers in California, Texas, and Florida. For instance, the MyHome Assistance Program from the California Housing Finance Authority provides up to 3% of the home’s purchase price. In Texas, the My Choice Texas Home program offers a 30-year, low-interest-rate loan with up to 5% for down payment and closing assistance. Florida’s options, such as the Florida Assist Second Mortgage Program, can provide up to $10,000 for upfront costs, enhancing home buying opportunities for families looking to upgrade.

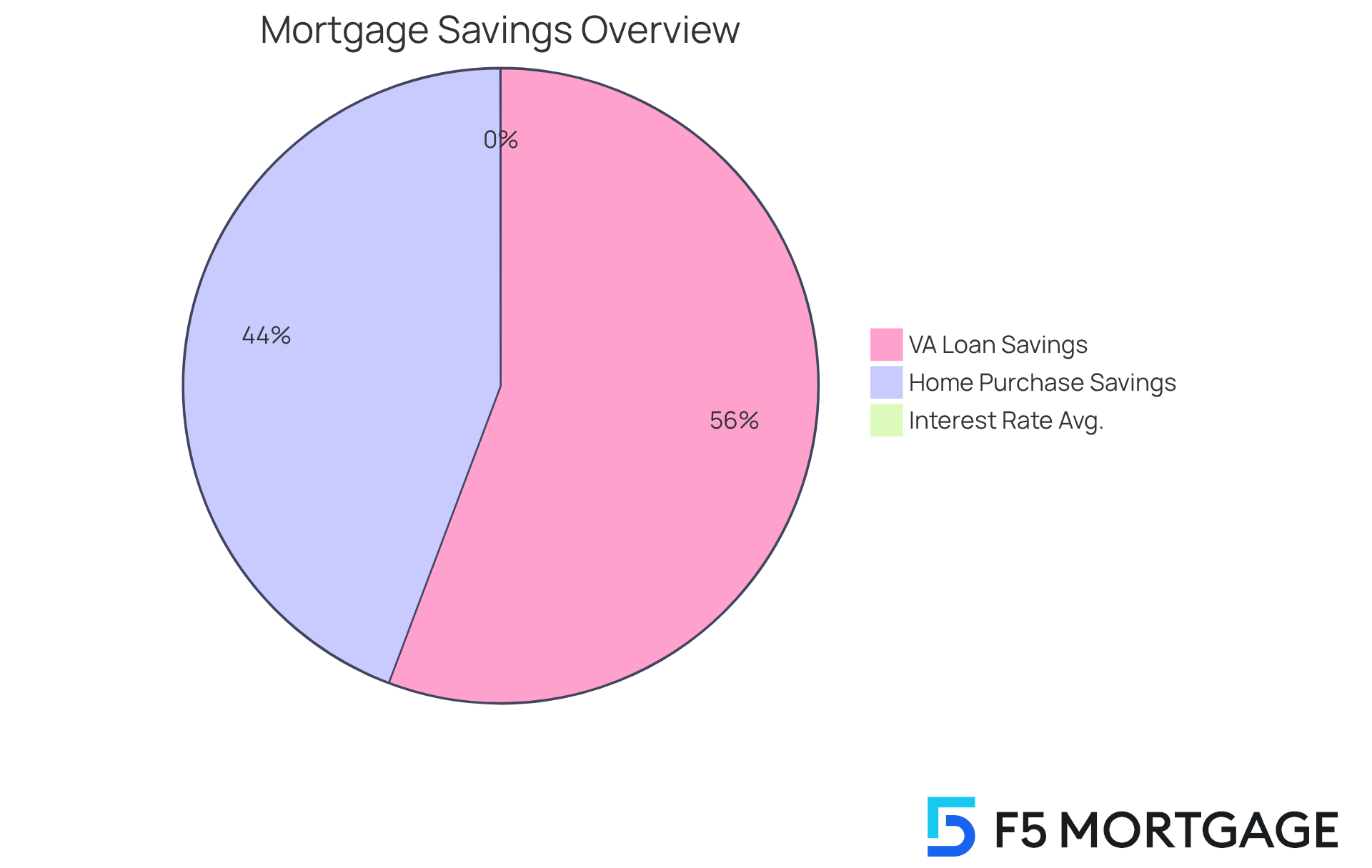

Recent studies reveal that borrowers collaborating with independent mortgage brokers save an average of $10,662 over the duration of their financing compared to those who utilize retail lenders. This substantial saving underscores the value that a mortgage agency provides, particularly in negotiating favorable terms and securing lower interest rates. For example, veterans using VA financing through brokers save around $13,432 per transaction, emphasizing the economic benefits of expert assistance.

Moreover, brokers excel in reaching minority communities, boasting a higher approval rate of 70% for loans in Majority Minority Census Tracts compared to 58% for retail lenders. This illustrates their efficiency in offering access to loan choices for underserved communities.

In a rapidly evolving market, the expertise of a mortgage agency is more crucial than ever. They streamline the financing procedure by collecting estimates, negotiating conditions, and reducing closing expenses, ultimately saving customers time and money. As one pleased customer observed, “The loan officer guided me step by step through the process, making me feel supported as a first-time homebuyer.” This client-centric approach not only enhances customer satisfaction but also ensures that clients are well-informed about their financing options. As the home loan sector continues to shift, the broker channel remains a reliable resource for homebuyers seeking personalized and efficient service.

Cost Savings: Access Competitive Rates and Diverse Loan Programs

Collaborating with a mortgage agency can significantly ease your journey toward homeownership, as seen with F5 Mortgage. We understand how challenging this process can be, and partnering with a broker offers you access to competitive rates and a diverse range of financing options. Brokers have the expertise to negotiate on your behalf, often securing more favorable terms than what traditional lenders provide. This can lead to substantial cost savings over the life of your mortgage, making your dream of owning a home more attainable.

In 2025, the average interest rate for home purchase consumers through the wholesale channel is 6.58%, slightly lower than the 6.60% found in the nonbank retail sector. Moreover, borrowers who work with a mortgage agency can save an average of $10,662 during their financing period. For VA loan borrowers, the savings are even more significant, averaging $13,432 per loan when collaborating with a mortgage agency. These figures highlight the financial advantages of choosing this route.

We know how important it is to find the right support in this journey. Brokers not only offer competitive rates but also provide personalized service tailored to your unique financial situation. By leveraging their connections with various lenders, they can present you with a variety of options that align with your specific needs. This ultimately enhances the home purchasing process, making it more efficient and economical. Remember, we’re here to support you every step of the way.

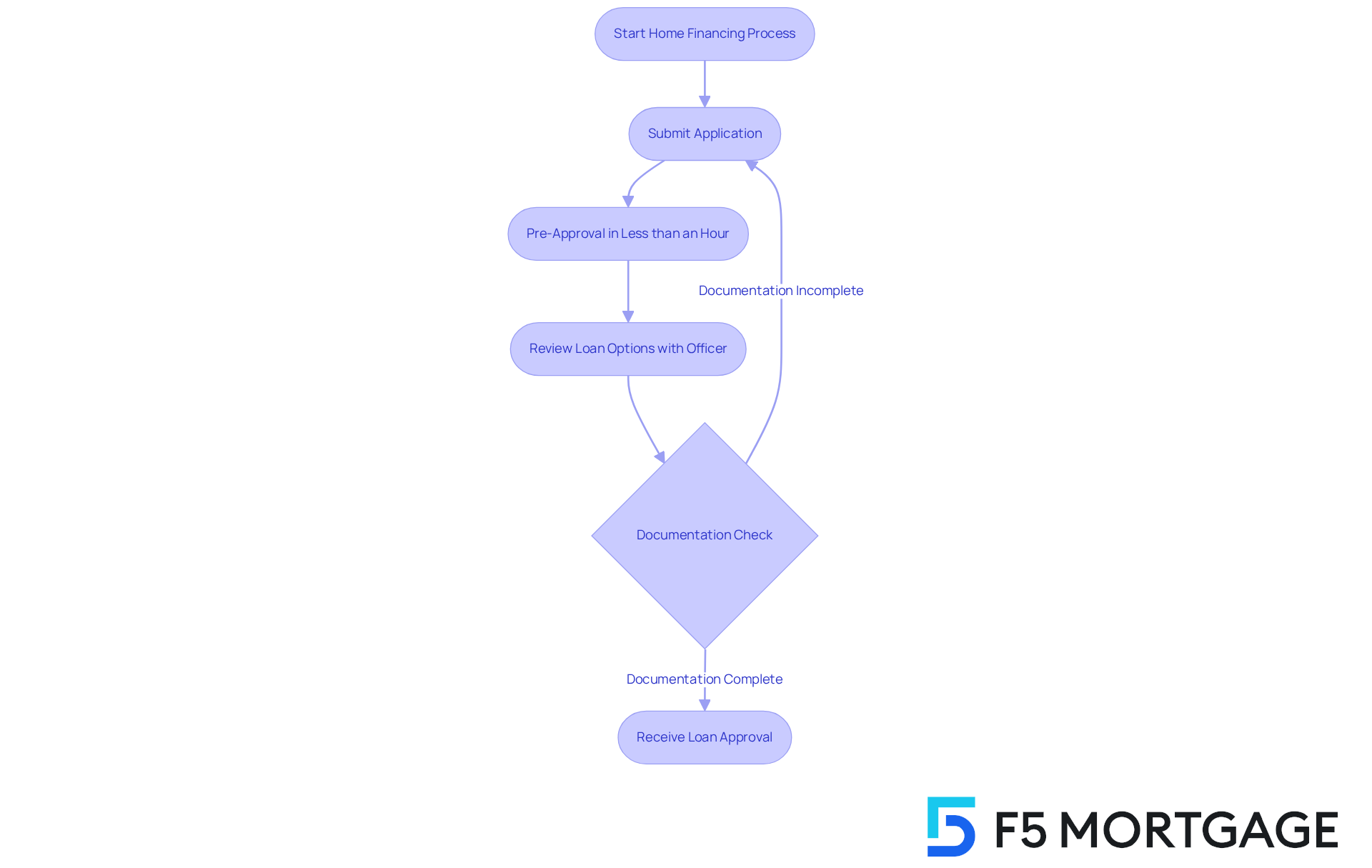

Streamlined Process: Simplifying Your Mortgage Application Journey

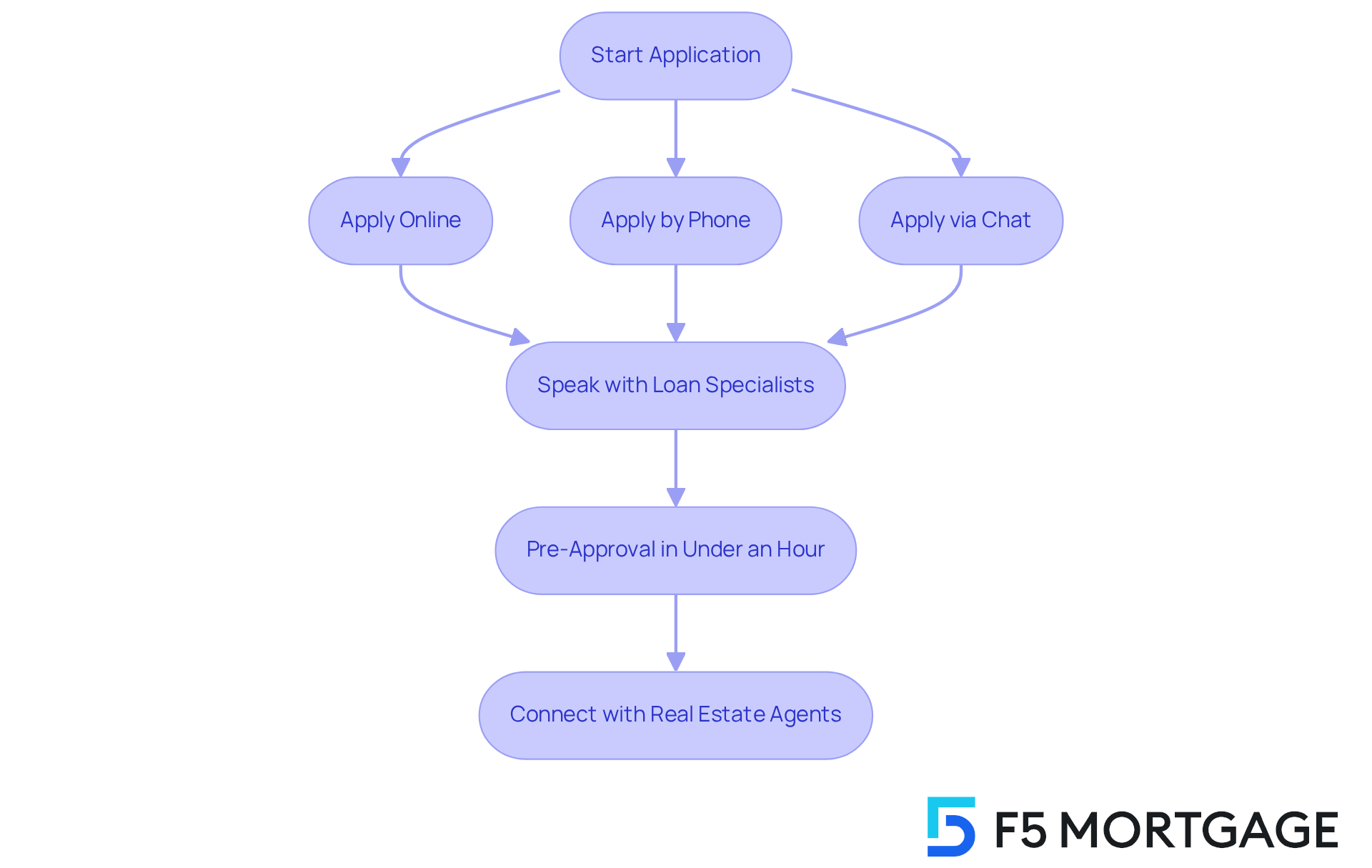

At F5 Home Loans, we understand how overwhelming the mortgage agency loan application process can be. That’s why we take pride in offering a streamlined experience that minimizes paperwork and reduces waiting times. You can apply online, by phone, or through chat, ensuring a convenient experience tailored to your needs.

Imagine speaking with our caring loan specialists at the mortgage agency who are dedicated to customizing loans to meet your personal objectives. With our support, you can anticipate pre-approval in under an hour. This efficiency not only saves you precious time but also enhances your overall experience, making your journey to homeownership less stressful.

Moreover, we are here to assist you every step of the way. We connect you with leading real estate agents who can help you locate and acquire your ideal residence. Our goal is to ensure you receive the best loan offers available from our mortgage agency, making your homeownership dreams a reality.

Dedicated Advocacy: Your Interests Come First with a Mortgage Agency

When you choose a mortgage agency like F5 Mortgage, you gain a dedicated advocate who prioritizes your interests above all else. We understand how challenging the mortgage process can be, and our clients consistently express their satisfaction with the personalized service and expert guidance offered by our mortgage agency. For instance, Ruth Vest praised our team, stating, “F5 handled my financial needs exceptionally well,” highlighting how our loan officer, Jeff, worked out an acceptable loan package tailored to her situation.

Similarly, first-time homebuyer Marqis Lamar felt like family as John Cagle patiently walked him through the entire process, ensuring he understood every step. He shared, “John really made me feel like family with how patient, educational, and kind he was.” Unlike conventional lenders, the loan brokers at the mortgage agency F5 work solely for you, making sure that your needs and preferences steer every decision.

This customer-focused approach fosters trust and confidence, making the process with the mortgage agency more transparent and supportive. Pleased customers like Joe Simms echo this sentiment, finding the process easy and worry-free. He stated, “Jeff and his team are outstanding to work with.”

Select F5 Financing for a seamless and customized borrowing experience. We’re here to support you every step of the way, where our dedication to outstanding service and personalized solutions truly distinguishes us from the competition.

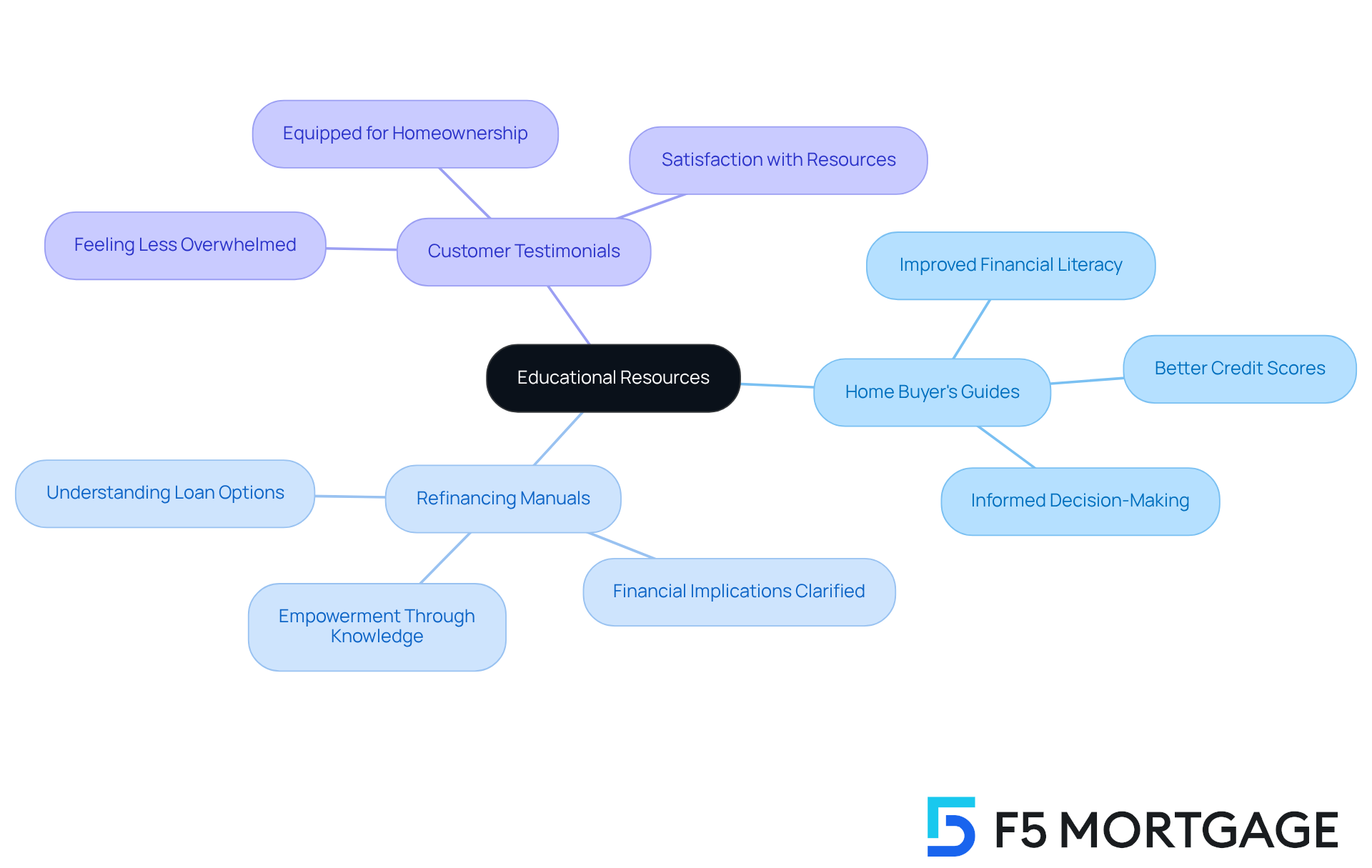

Educational Resources: Empowering Clients with Knowledge and Tools

At our mortgage agency, F5 Mortgage, we understand how overwhelming the mortgage process can be. That’s why we believe that knowledgeable customers are empowered individuals. We offer a rich array of educational resources, including detailed home buyer’s guides and refinancing manuals. These tools are designed to demystify the mortgage process, clarify the various loan options available from the mortgage agency, and elucidate the financial implications of each choice. This comprehensive approach not only enhances your understanding but also fosters confident decision-making.

Research shows that individuals who engage with educational materials experience significant improvements in their financial literacy, which is crucial for navigating the complexities of home financing. For example, effective financial education programs can lead to better credit scores and reduced delinquency rates among borrowers. By providing you with knowledge, F5 empowers you to make informed decisions that align with your financial objectives.

Moreover, endorsements from our customers highlight the transformative impact of these resources. Many share that they feel less overwhelmed and more equipped to pursue their homeownership dreams after utilizing the guides we offer. This commitment to customer education not only enhances satisfaction but also positions F5 as a reliable ally in your journey toward homeownership with the support of a mortgage agency. We are here to support you every step of the way.

Personalized Service: Tailoring Solutions to Unique Financial Situations

At F5 Lending, we understand that each individual faces unique financial situations. Our brokerage is dedicated to providing tailored services that meet your personal needs, whether you are a first-time homebuyer, a family looking to upgrade, or a self-employed individual. By customizing loan solutions to fit your specific circumstances, we ensure that you receive optimal options aligned with your financial goals. This personalized approach not only enhances your borrowing experience but also fosters greater customer loyalty and satisfaction.

Clients have expressed their heartfelt appreciation for the exceptional service provided by F5, contributing to our impressive 5-star ratings on platforms like Lending Tree, Google, and Zillow. For instance, Bryce Leonard shared, “Awesome work. I appreciated receiving assistance with my loan through F5. Highly recommend to anyone who is looking for true experts.” Alley Cohen echoed this sentiment, stating, “Everything went very smoothly!” Jason Smith, despite initial confusion, praised our team for their guidance, saying, “They helped me so much along the way.” These testimonials highlight how our commitment to understanding each borrower’s distinct financial situation leads to faster approvals and improved conditions.

Moreover, we are proud to offer down payment assistance programs in California, Texas, and Florida, further supporting families in achieving their homeownership dreams. Data shows that personalized mortgage solutions from a mortgage agency significantly enhance the overall experience for clients, making it easier to navigate the complexities of home financing. With a focus on tailored services, F5 demonstrates how expert solutions can effectively support first-time homebuyers and families looking to upgrade their homes.

To explore your options and see how F5 can assist you, enter your zip code for custom rate quotes or contact one of our experts today. We’re here to support you every step of the way.

Fast Approvals: Accelerating Your Path to Homeownership

In today’s fast-paced real estate landscape, we know how challenging securing timely financing can be. At F5 Mortgage, we are dedicated to providing rapid approvals, allowing you to navigate the home buying process with confidence. Clients like Ruth Vest have shared their positive experiences, stating, “F5 delivered. My loan officer, Jeff, worked out an acceptable loan package, and Jorge was easy to work with, ensuring all documentation was in order.”

With our streamlined application process, you can anticipate pre-approval in less than an hour. This efficiency is crucial, especially in competitive markets where delays can lead to missed opportunities. As Joe Simms remarked, “Jeff and his team made the process easy and worry-free, walking through each step to ensure full understanding.”

Industry experts emphasize that quick financing not only enhances your buying experience but also significantly impacts your chances of securing your desired property. For instance, as loan rates fluctuate, the ability to act quickly can mean the difference between securing your dream home or losing it to another buyer.

At F5, our commitment to speed ensures that you are well-prepared to seize opportunities as they arise. We understand the importance of selecting a mortgage agency that prioritizes efficiency in the financing process. Alyssa and Jorge’s focus on detail and support for first-time home buyers, as noted by Artie Kamarhie, who said, “They have an incredible attention to detail & guided me as a first-time home buyer step by step,” further illustrates the personalized support we provide. This makes F5 a top choice for families seeking to upgrade their residences.

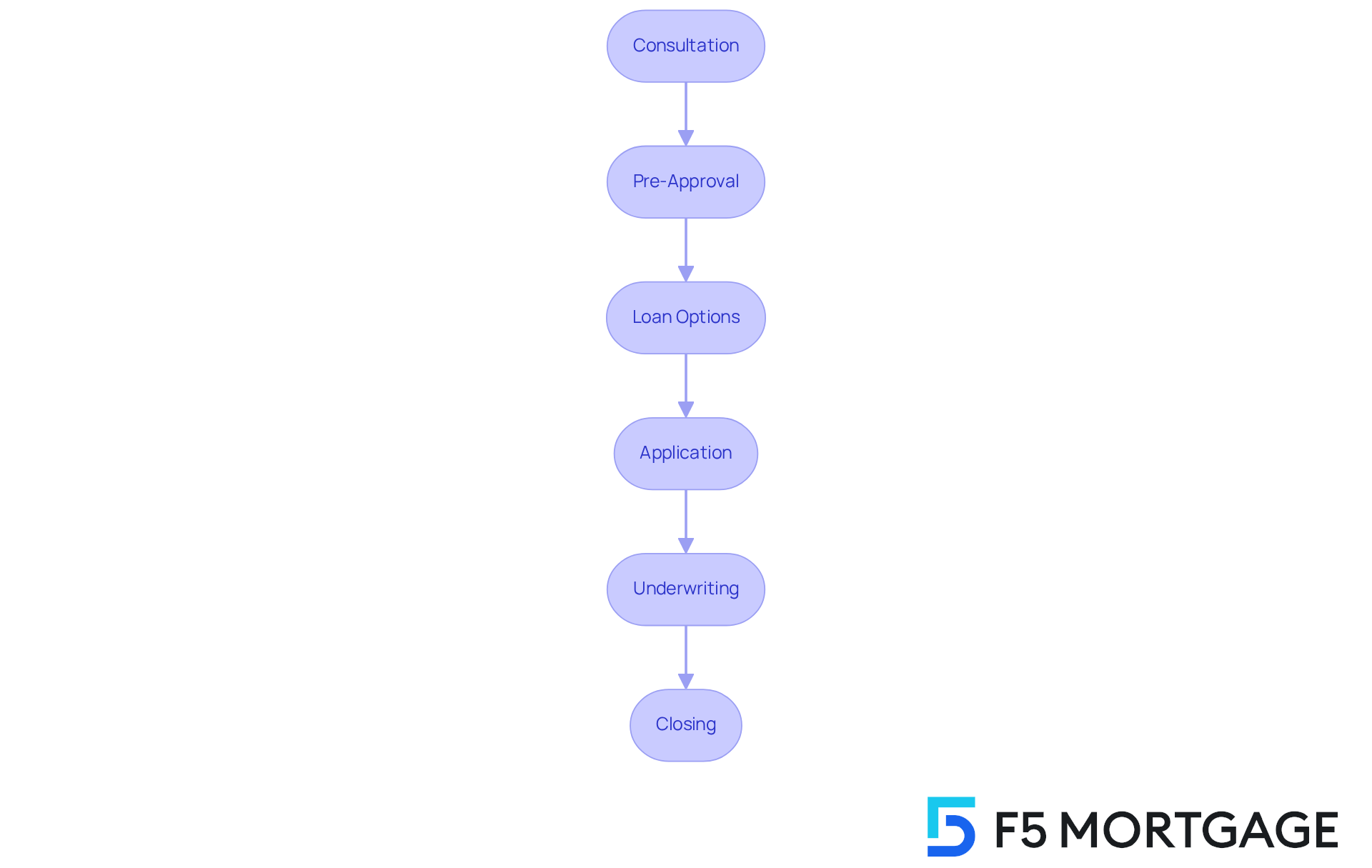

Comprehensive Support: From Consultation to Closing

At our mortgage agency, F5 Mortgage, we understand how daunting the journey to homeownership can be. That’s why we are dedicated to providing thorough support from your very first consultation to the closing of your loan. Our clients benefit from expert advice at every step of the financing process offered by our mortgage agency, which empowers them to make informed choices with confidence. This proactive assistance provided by a mortgage agency significantly alleviates stress and uncertainty, transforming the journey into a rewarding experience.

Many clients share that they feel more secure in their decisions after receiving personalized consultations from their mortgage agency that clarify complex terms and options. This guidance is crucial; in fact, 94% of families aided by F5 express satisfaction with their experience, underscoring the effectiveness of our support.

Our loan experts emphasize the importance of having a knowledgeable mortgage agency as your partner by your side. They highlight that understanding the steps involved—from pre-approval to closing—enables buyers to navigate the mortgage agency process smoothly, ultimately leading to successful home purchases. At F5 Lending, our mortgage agency offers a range of loan options tailored to meet various customer needs, ensuring that each individual feels empowered throughout their financing journey.

Additionally, we connect our customers with leading real estate agents in their region, enhancing the collaborative home-buying experience. This commitment to customer education and assistance is what truly distinguishes F5 Finance from other mortgage agencies. Remember, we’re here to support you every step of the way.

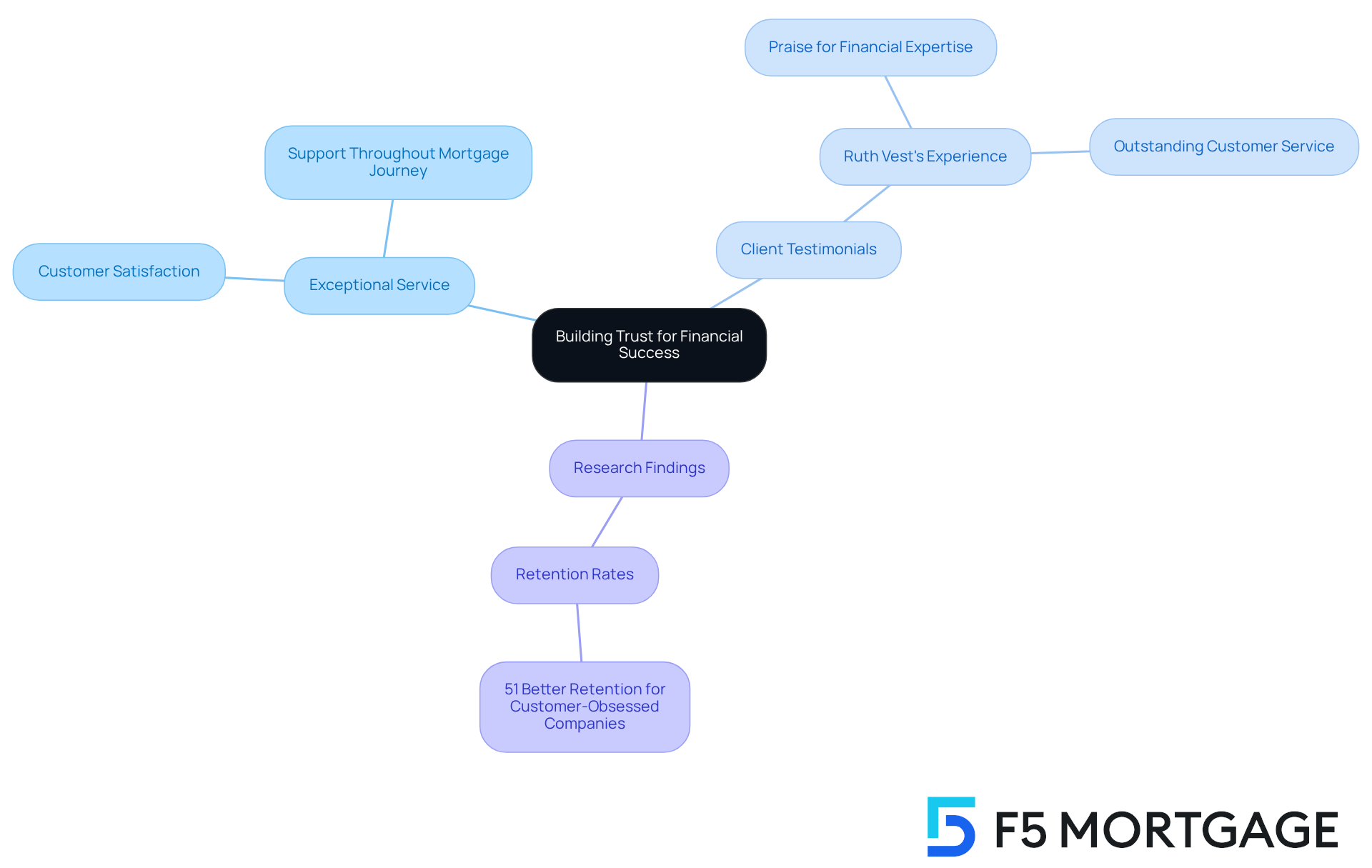

Long-Term Relationships: Building Trust for Future Financial Success

At F5 Mortgage, we understand that the journey to home financing can be daunting. Our mission extends beyond merely closing loans; it’s about cultivating lasting connections with our customers. By prioritizing exceptional service and genuine customer satisfaction, we aim to build a strong foundation of trust and loyalty. This commitment to relationship-building ensures that you feel supported throughout your mortgage journey and beyond, empowering you in your future financial endeavors.

Clients like Ruth Vest have shared their positive experiences, praising our team for their financial expertise and outstanding customer service. Ruth said, “F5 handled my financial needs exceptionally well… Even my title company stated that F5 was on the ball.” Such testimonials reflect our dedication to being there for you.

Research from Forrester highlights that organizations emphasizing trust and nurturing customer relationships experience significantly higher retention rates. In fact, customer-obsessed companies report 51% better retention compared to their counterparts. This loyalty not only enhances client satisfaction but also positions F5 as a trusted mortgage agency in navigating the complexities of home financing. We’re here to support you every step of the way.

Conclusion

Choosing a mortgage agency like F5 Mortgage comes with numerous benefits that simplify the home financing process and provide personalized support tailored to your unique needs. We understand how challenging this can be, and by prioritizing your interests and leveraging our extensive industry knowledge, we help to demystify the complexities often associated with securing a home loan. This approach not only enhances your overall experience but also fosters a sense of trust and confidence.

Throughout this article, we’ve highlighted the advantages of working with a mortgage agency, including:

- Expert guidance in navigating loan options

- Access to competitive rates

- A commitment to cost savings

Our emphasis on personalized service ensures that you receive tailored solutions that align with your specific financial situation. Additionally, our streamlined application process and comprehensive support from consultation to closing illustrate the value of partnering with a dedicated mortgage agency.

Ultimately, the significance of selecting a mortgage agency lies in the long-term relationships built on trust and satisfaction. As you embark on your homeownership journey, having a reliable advocate by your side can make all the difference. By prioritizing education, personalized service, and efficient processes, F5 Mortgage empowers you to make informed decisions that lead to successful home purchases. Embrace this opportunity to enhance your home financing experience by choosing a mortgage agency that truly values your needs and goals.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage is a mortgage agency that provides personalized mortgage solutions, including tailored consultations for home purchasing and refinancing. They offer guidance and support through a dedicated team, utilizing advanced technology to simplify the mortgage process.

How does F5 Mortgage ensure a personalized experience for clients?

F5 Mortgage focuses on tailored consultations that meet individual needs, providing clients with expert guidance throughout the refinancing process. Their team includes a loan officer and an account manager who offer support and utilize technology to make the process easier.

What types of down payment assistance programs does F5 Mortgage offer?

F5 Mortgage offers various down payment assistance programs in California, Texas, and Florida. For example, the MyHome Assistance Program in California provides up to 3% of the home’s purchase price, while Texas’s My Choice Texas Home program offers a low-interest-rate loan with up to 5% assistance. Florida’s Florida Assist Second Mortgage Program can provide up to $10,000 for upfront costs.

How can working with a mortgage broker save money for borrowers?

Borrowers who collaborate with independent mortgage brokers save an average of $10,662 over the duration of their financing compared to those using retail lenders. For veterans utilizing VA financing through brokers, the savings can average around $13,432 per transaction.

What is the approval rate for loans in minority communities through brokers compared to retail lenders?

Brokers have a higher approval rate of 70% for loans in Majority Minority Census Tracts, compared to 58% for retail lenders, highlighting their effectiveness in serving underserved communities.

What are the financial advantages of working with a mortgage agency like F5 Mortgage?

Working with F5 Mortgage can lead to access to competitive rates, diverse loan programs, and substantial cost savings. The average interest rate through wholesale channels is slightly lower than in the nonbank retail sector, and brokers can negotiate favorable terms that save clients money over the life of their mortgage.

How does F5 Mortgage support clients throughout the mortgage process?

F5 Mortgage provides ongoing support through a dedicated team that guides clients step by step, ensuring they feel supported and informed about their financing options. They streamline the process by collecting estimates, negotiating conditions, and reducing closing costs.