Overview

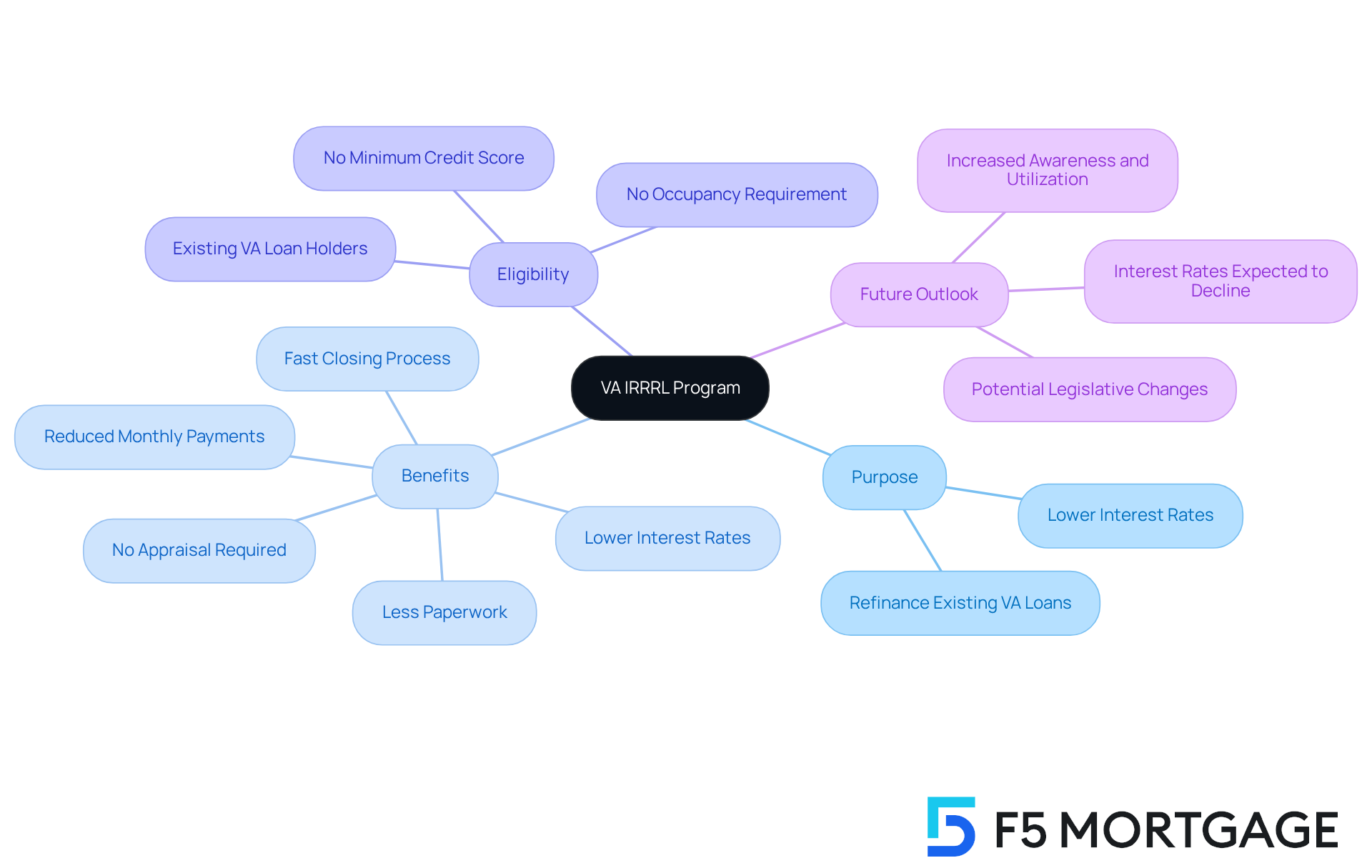

The VA IRRRL program, or Interest Rate Reduction Refinance Loan, is designed with you in mind, offering significant benefits for veterans and active-duty service members. We understand how overwhelming the mortgage process can be, and this program allows you to refinance existing VA-backed mortgages with reduced interest rates and minimal documentation requirements.

Imagine not having to worry about a home appraisal or income verification. These key advantages streamline the refinancing process, making it easier for you to enhance your financial stability. By meeting the eligibility criteria, you can take a step towards a more secure future.

This program is here to support you every step of the way, helping you navigate these challenges with confidence. We know how important it is for you to feel empowered in your financial decisions, and the VA IRRRL program is a valuable tool to assist you on this journey.

Introduction

The VA Interest Rate Reduction Refinance Loan (IRRRL) program stands as a beacon of financial opportunity for veterans and active-duty service members. It offers a streamlined path to lower mortgage rates and reduced monthly payments, addressing the financial challenges many face. With its unique advantages—such as no need for home appraisals and minimal documentation—this program simplifies the refinancing process, making it more accessible than traditional methods.

However, we understand that many may wonder: what are the specific eligibility requirements and benefits that make the VA IRRRL program a compelling choice in today’s fluctuating interest rate landscape? We’re here to support you every step of the way as you navigate these important decisions.

Defining the VA IRRRL Program: Purpose and Overview

The VA IRRRL program, commonly known as the VA Interest Rate Reduction Refinance Program or VA Streamline Refinance, is a valuable option specifically designed for veterans and active-duty service members who already have a VA-backed mortgage. We understand how overwhelming the mortgage process can be, and this program aims to help you refinance your existing loans, allowing you to secure and reduce your monthly mortgage payments.

Unlike traditional loan adjustment methods, the Interest Rate Reduction Refinancing Loan simplifies the experience by eliminating the need for a home evaluation and extensive paperwork. This makes it a more accessible option for qualified borrowers. Imagine being able to take advantage of declining interest rates without the usual complexities of refinancing. The VA IRRRL program is particularly beneficial during times when interest rates are falling, enabling veterans to seize favorable market conditions.

Notably, there is no minimum credit score requirement for this loan program, which further enhances its accessibility. As we look ahead to 2025, when interest rates are expected to decline, we encourage you to explore this refinancing option. It could be a significant step toward reducing your costs and enhancing your financial security. Remember, we’re here to support you every step of the way on this journey.

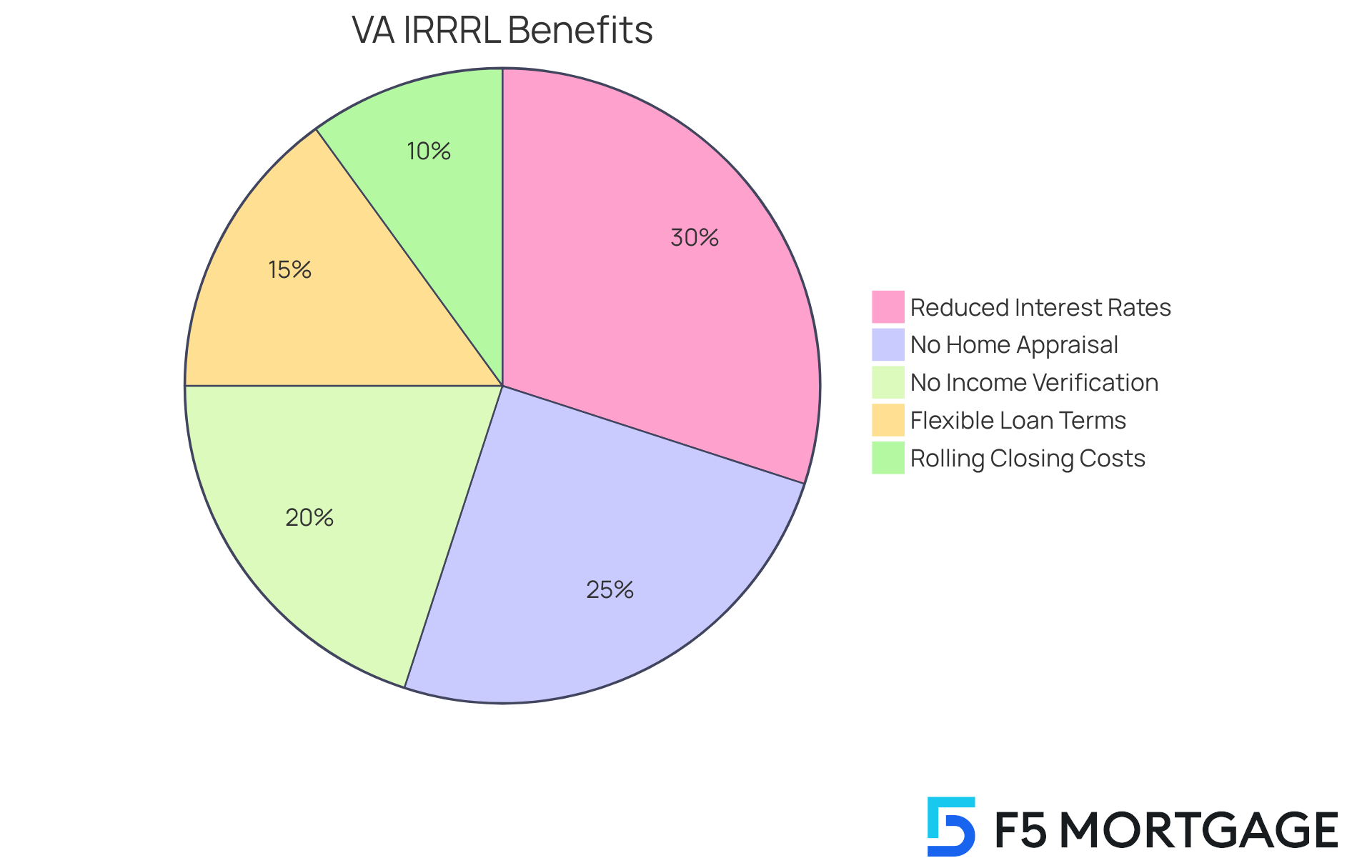

Key Benefits of the VA IRRRL Program for Borrowers

The va irrrl program offers several significant benefits for borrowers, designed to ease the refinancing journey and address your needs.

- No Home Appraisal Required: Imagine skipping the time and costs associated with home appraisals. This feature , showcasing F5 Mortgage’s commitment to providing fast and flexible solutions that truly matter to you.

- No Income or Employment Verification: We understand that gathering extensive documentation can be overwhelming. With this simplified process, quicker approvals are possible, significantly reducing the time you spend waiting and enhancing your overall experience.

- Reduced Interest Rates: By refinancing to a lower interest rate, you can see a noticeable decrease in your monthly costs. This leads to considerable savings over time. Plus, with the VA funding fee at just 0.5%, compared to higher fees on other VA financing options, this makes the choice not only economically feasible but also competitive.

- Flexible Loan Terms: You have the option to switch from an adjustable-rate mortgage (ARM) to a fixed-rate loan. This ensures more stability in your monthly payments, protecting you from fluctuating rates, especially beneficial in the current Colorado market.

- Rolling Closing Costs into the Loan: Many borrowers can finance their closing costs, making the refinancing process more affordable upfront. This aligns perfectly with F5 Mortgage’s goal of helping families achieve homeownership, which we know is so important to you.

These benefits together create an attractive option for veterans looking to improve their financial circumstances by utilizing the va irrrl program. As Laura Grace Tarpley wisely noted, “The main objective of a streamlined refinance is to obtain a lower interest rate and decrease your monthly costs.” Numerous cases illustrate how veterans have successfully lowered their monthly payments and overall financial burdens through this streamlined refinancing option, reinforcing the effectiveness of the va irrrl program and highlighting the exceptional service provided by F5 Mortgage. We’re here to support you every step of the way.

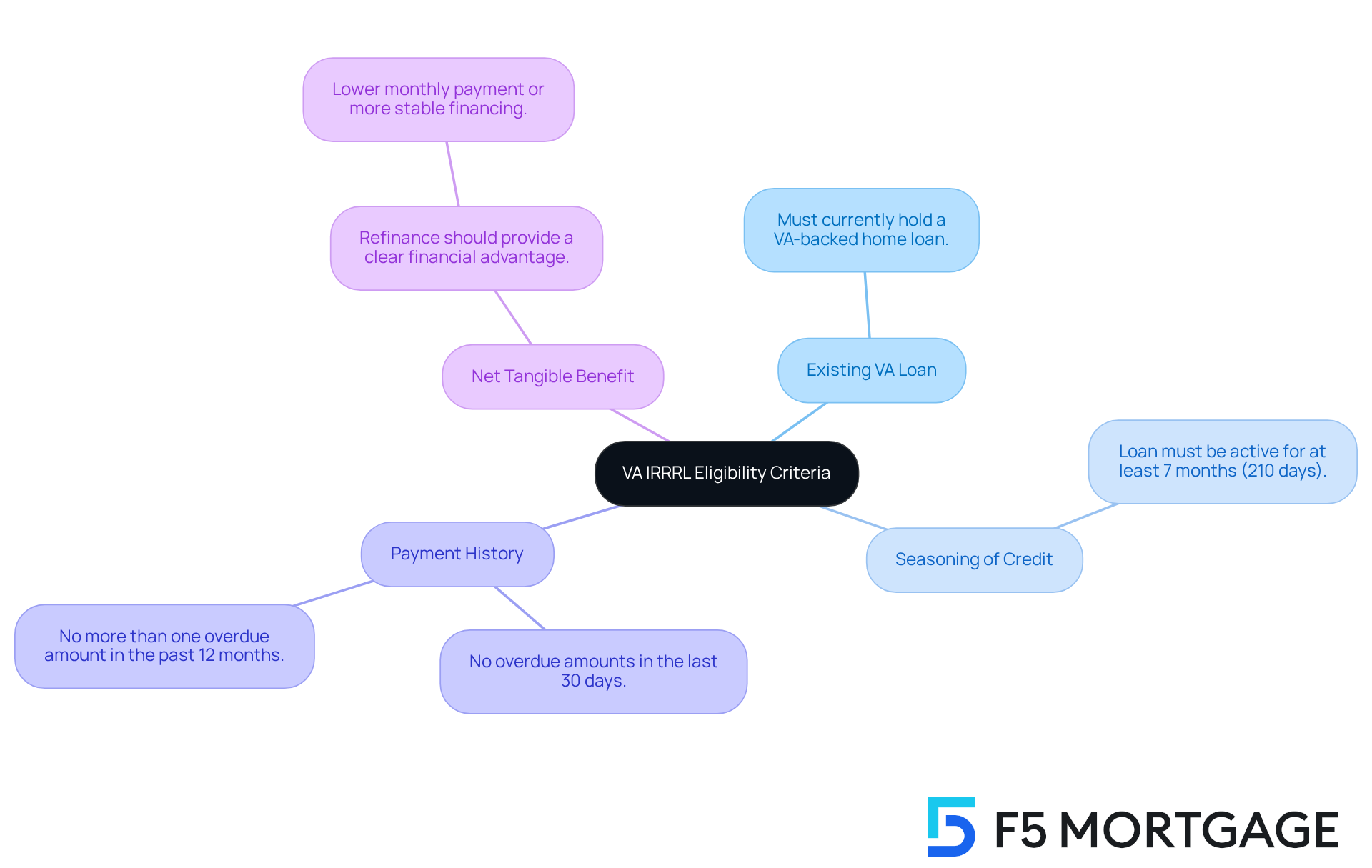

Eligibility Criteria for the VA IRRRL Program

Navigating the VA IRRRL program can seem daunting, but we are here to support you every step of the way. To qualify, borrowers need to meet several essential eligibility criteria that can truly make a difference in your financial journey:

- Existing VA Loan: You must currently hold a VA-backed home loan.

- Seasoning of Credit: Your initial financing should have been active for at least 7 months (210 days) before applying for the IRRRL.

- Payment History: It’s important to be up to date on your mortgage dues, with no overdue amounts in the last 30 days and no more than one overdue amount within the past 12 months.

- Net Tangible Benefit: The refinance should provide a clear financial advantage, like a lower monthly payment or a more stable financing arrangement.

These criteria are thoughtfully designed to ensure that the program effectively reaches those who will benefit the most from it. For example, veterans who meet these requirements can significantly lower their monthly payments, making homeownership more affordable and stress-free. We understand how challenging this can be, and adhering to these is crucial for maximizing the benefits of the VA IRRRL program. This way, veterans can secure favorable terms without the hassle of extensive documentation or appraisal processes.

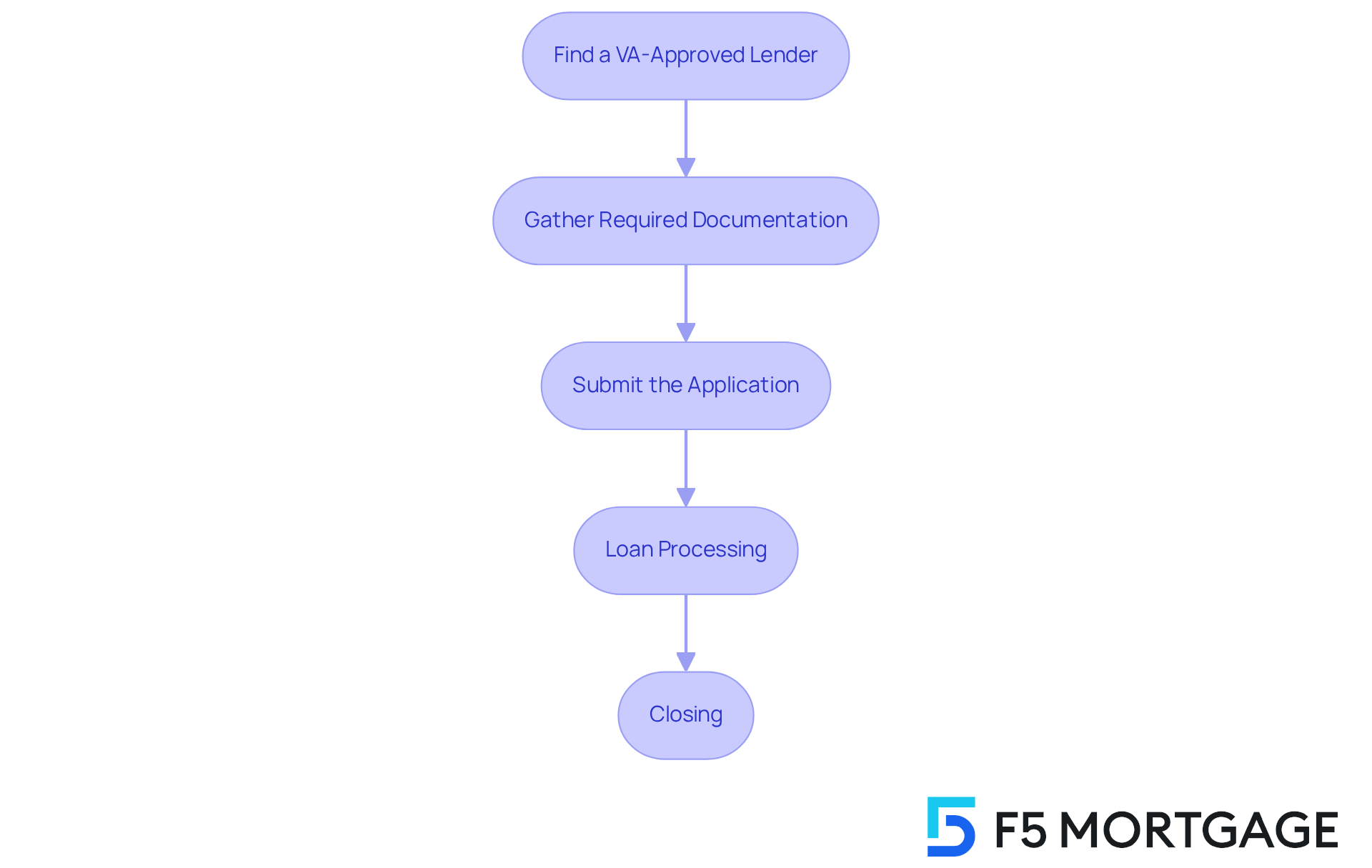

Navigating the Application Process for VA IRRRL

Navigating the application process for the VA Interest Rate Reduction Refinance Loan (VA IRRRL) can feel overwhelming, but we’re here to support you every step of the way. By following these straightforward steps, you can simplify the journey and enhance your financial stability.

- Find a VA-Approved Lender: Start by selecting a lender who is experienced in VA financing. Their expertise will guide you through the loan modification process effectively, alleviating some of the stress you may feel.

- Gather Required Documentation: While the refinancing process is designed to be streamlined, you will need to compile some basic information. This includes your current loan details and proof of eligibility. We know how challenging this can be, but having your documents ready will make the next steps smoother.

- Submit the Application: Once your documents are prepared, it’s time to submit your application to the lender for review. This is an important step, and it’s natural to feel a mix of anticipation and anxiety.

- Loan Processing: The lender will then assess your application, verify your eligibility, and evaluate the financial benefits of refinancing. Remember, this stage is crucial in determining how much you can save.

- Closing: If approved, you will proceed to closing, where you will sign the necessary paperwork. The entire process is typically completed quickly, often within 30 days, thanks to the reduced documentation requirements.

By following these steps, veterans can efficiently take advantage of the VA IRRRL program, which is designed to simplify refinancing and enhance financial stability. You’re not alone in this process; we’re committed to helping you .

Conclusion

The VA Interest Rate Reduction Refinance Loan (IRRRL) program serves as a vital resource for veterans and active-duty service members who seek to improve their financial situation. This program offers a streamlined refinancing process, enabling eligible borrowers to secure lower interest rates and reduce their monthly mortgage payments without the usual complexities of traditional refinancing methods.

We understand how challenging navigating financial options can be. The key benefits of the VA IRRRL program include:

- The absence of home appraisals

- No income verification requirements

- The ability to roll closing costs into the loan

These features mean that only those who will truly benefit can access its advantages. By meeting the eligibility criteria, qualified veterans can significantly enhance their financial stability and enjoy the peace of mind that comes with lower monthly payments.

This program represents a unique opportunity for veterans to take control of their financial futures. With interest rates projected to decline in the coming years, now is the perfect time to explore this refinancing option. By leveraging the benefits of the VA IRRRL program, veterans can achieve substantial savings and secure a more stable and affordable homeownership experience. Embracing this opportunity could lead to a brighter financial future, making it essential for eligible borrowers to consider this advantageous program. We’re here to support you every step of the way.

Frequently Asked Questions

What is the VA IRRRL program?

The VA IRRRL program, or VA Interest Rate Reduction Refinance Program, is designed for veterans and active-duty service members who have a VA-backed mortgage. It helps them refinance existing loans to secure lower interest rates and reduce monthly mortgage payments.

How does the VA IRRRL program simplify the refinancing process?

The VA IRRRL program simplifies refinancing by eliminating the need for a home evaluation and extensive paperwork, making it more accessible for qualified borrowers.

When is the VA IRRRL program particularly beneficial?

The program is especially beneficial during times of declining interest rates, allowing veterans to take advantage of favorable market conditions.

Is there a minimum credit score requirement for the VA IRRRL program?

No, there is no minimum credit score requirement for the VA IRRRL program, which enhances its accessibility for borrowers.

Why should borrowers consider the VA IRRRL program in the future?

Borrowers should consider the VA IRRRL program as interest rates are expected to decline in 2025, providing an opportunity to reduce costs and enhance financial security.