Overview

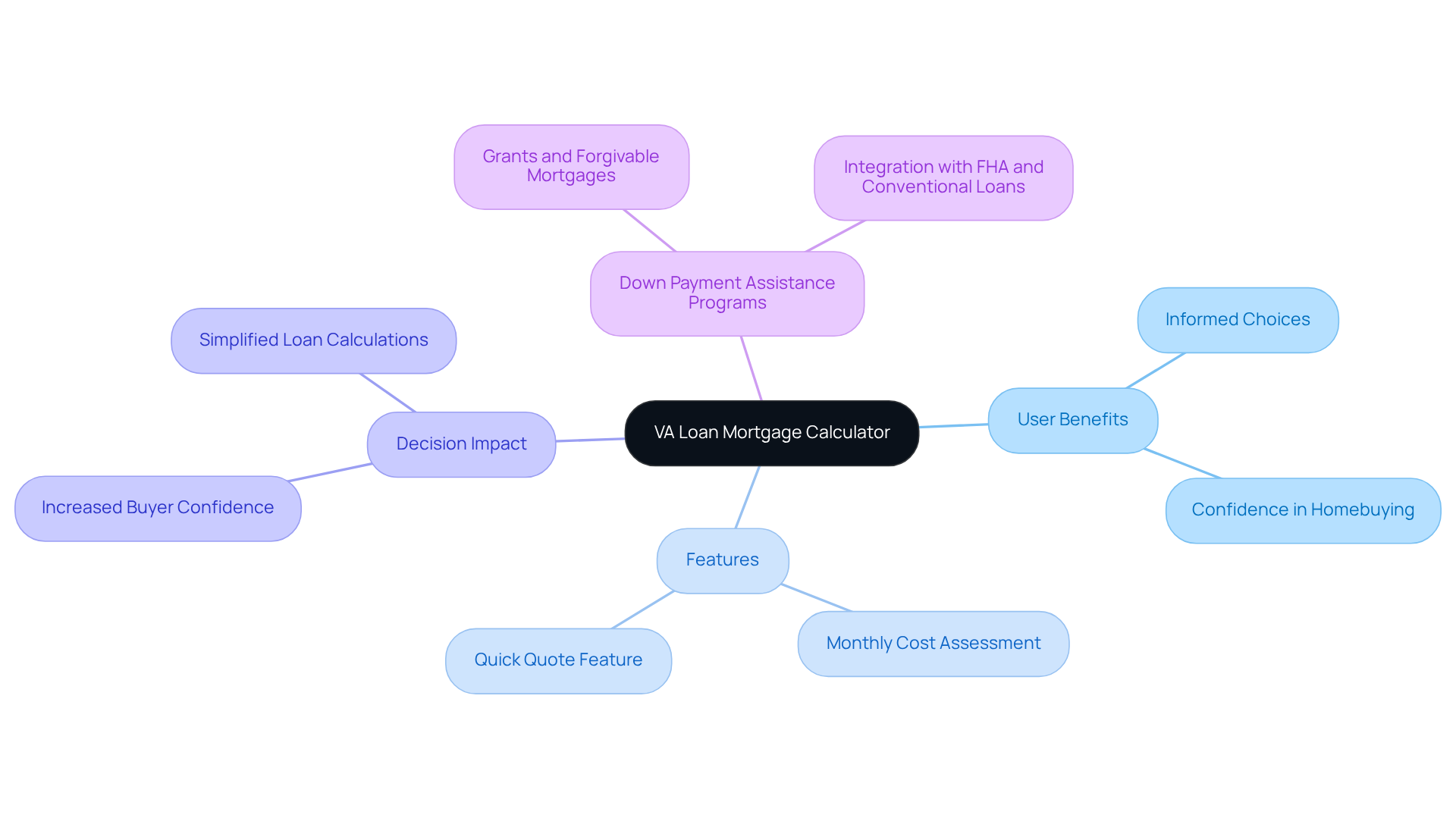

This article emphasizes the vital role of VA loan mortgage calculators in helping homebuyers navigate their financial options and responsibilities when purchasing a home. We understand how challenging this process can be, and these tools are designed to empower you. By simplifying complex calculations, they provide clarity on affordability, allowing you to feel more confident in your decision-making.

Imagine having a supportive guide that walks you through the intricacies of homebuying. These calculators not only enhance your understanding but also help you visualize your financial landscape. With their assistance, you can approach the homebuying journey with greater assurance, knowing that you are making informed choices.

Ultimately, we’re here to support you every step of the way. Embrace these calculators as your allies in the homebuying process, and take the first step toward your dream home with clarity and confidence.

Introduction

Navigating the labyrinth of home financing can be daunting, especially for first-time buyers eager to secure their dream homes. We know how challenging this can be. Fortunately, with the rise of VA loan mortgage calculators, homebuyers now have powerful tools at their disposal to simplify this complex process. These calculators not only demystify financial obligations but also empower users to make informed decisions about their purchasing power.

However, with so many options available, how can buyers determine which calculators truly offer the insights they need? We’re here to support you every step of the way as you explore your options in an increasingly competitive housing market.

F5 Mortgage: User-Friendly Mortgage Calculator

At F5 Mortgage, we understand that navigating the world of home financing can feel overwhelming, especially for first-time buyers. That’s why we offer an easy-to-use [VA loan mortgage calculator](https://f5mortgage.com/9-essential-va-loan-mortgage-calculators-for-homebuyers) designed to help you assess your monthly costs, including taxes and insurance. By simply entering the home price, deposit, interest rate, and loan duration, you can quickly gain clarity on your financial responsibilities.

This tool is particularly beneficial for those who may find the complexities of loan calculations daunting. It not only provides clear insights but also empowers you to make informed choices about your financing options. We proudly offer low down payment solutions, such as FHA, VA, and conventional loans, to support your journey toward homeownership.

As the VA loan mortgage calculator becomes increasingly vital in the homebuying process, it significantly influences decision-making for first-time buyers. In fact, 38% of homebuyers report feeling more confident navigating the homebuying process without expert help, thanks to resources like the VA loan mortgage calculator. Additionally, our calculator helps you understand your financial responsibilities regarding down payment assistance programs, which are essential for many first-time purchasers.

Nicholas Hiersche, President of F5 Lending, emphasizes that down payment assistance initiatives open significant pathways to homeownership. This underscores the value of our VA loan mortgage calculator alongside these valuable resources. With our , you can obtain quick estimates for various loan scenarios, enhancing the overall utility of the VA loan mortgage calculator as you pursue homeownership.

If you’re seeking tailored support or wish to explore down payment options, we’re here to help. Reach out to F5 Mortgage today, and let us support you every step of the way.

Chase Home Affordability Calculator: Assess Your Buying Power

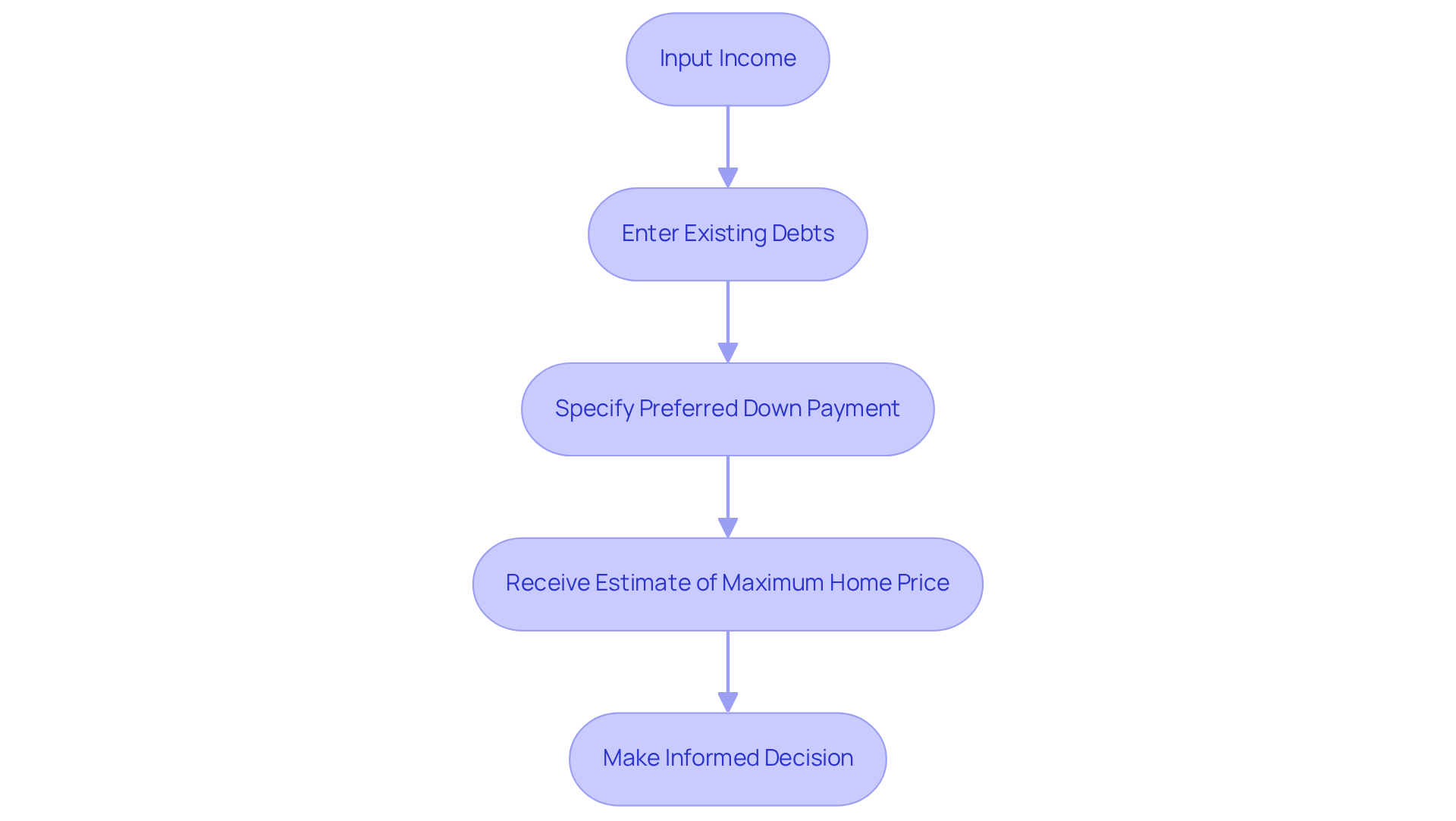

The Chase Home Affordability Calculator is a vital tool for homebuyers who are eager to understand their purchasing power. By entering their income, existing debts, and preferred down payment, users can receive a personalized estimate of the maximum home price they can afford. This calculator not only supports effective budgeting but also arms buyers with , fostering informed decision-making before they commit to a purchase.

We know how challenging the housing market can be, especially today when home prices have surged significantly. Financial experts emphasize the importance of utilizing affordability calculators to help navigate these waters. In 2025, average home prices are expected to remain elevated, making it crucial for buyers to fully understand their budgetary limits. The Chase Home Affordability Calculator stands out by offering features that account for various financial factors, such as taxes and insurance, ensuring a comprehensive evaluation of potential costs.

Success stories abound from homebuyers who have effectively used affordability calculators to steer their purchasing journey. These tools have empowered individuals to make informed choices, ultimately leading to successful homeownership despite the rising challenges in the market. By leveraging the insights offered by the Chase calculator, buyers can confidently embark on their home purchasing journey, equipped with a clear understanding of their financial capabilities.

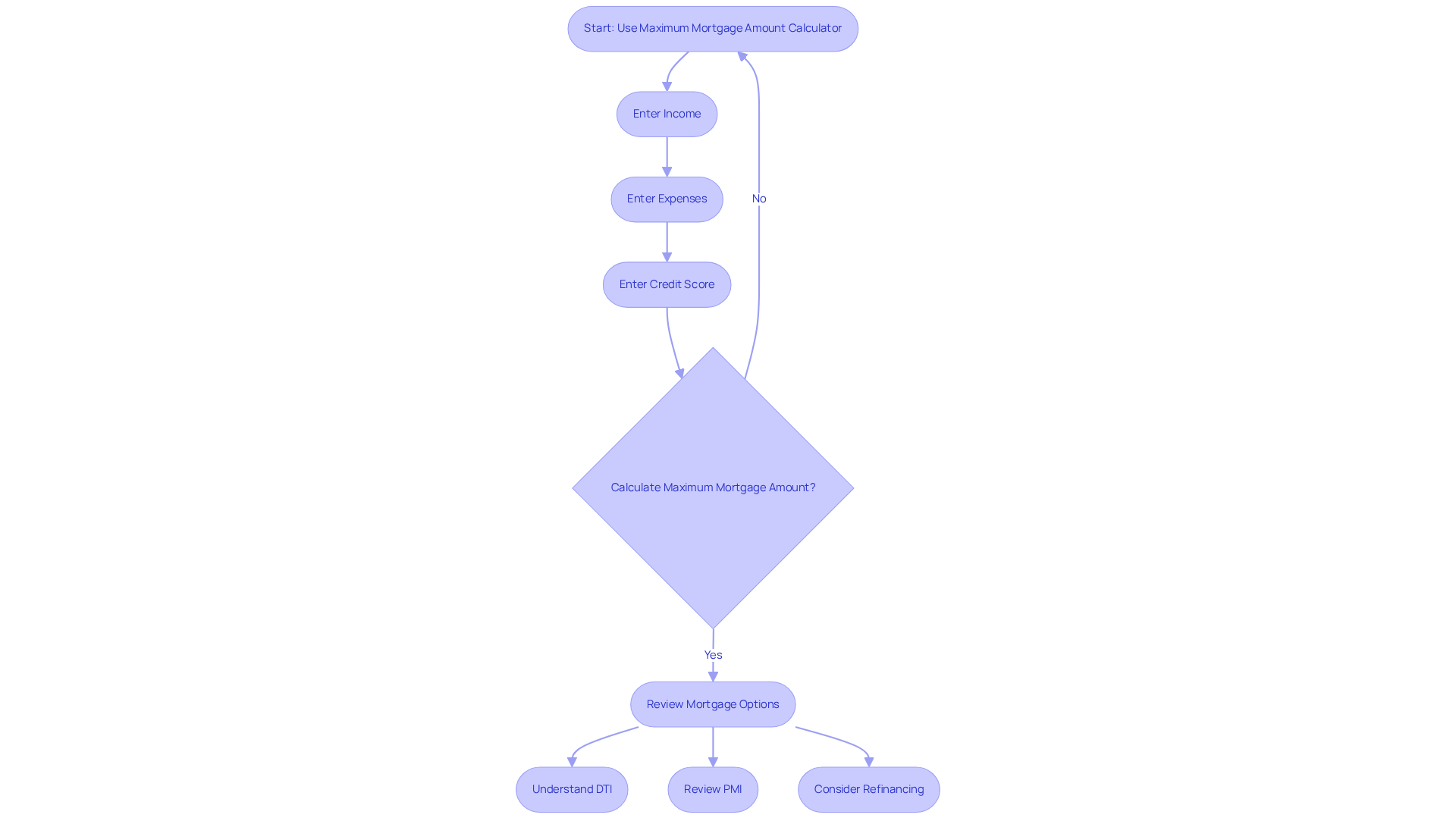

RBC Royal Bank: Maximum Mortgage Amount Calculator

At F5 Mortgage, we understand how challenging it can be to navigate the world of home financing. That’s why we provide an extensive Maximum Mortgage Amount Calculator designed to help you assess how much you can borrow based on your unique economic situation. By entering details like your income, expenses, and credit score, you can gain a clear understanding of your borrowing limits.

This tool is especially helpful for families looking to enhance their homes. It empowers you to maximize your purchasing power while staying within your budget. We know that comprehending the implications of private loan insurance (PMI) and debt-to-income (DTI) ratios is essential for making informed decisions.

For instance, if you purchased your home with a conventional loan and put down less than 20%, refinancing could allow you to remove PMI. This is particularly relevant given the high home appreciation rates in California, which can significantly improve your loan-to-value (LTV) ratio. Moreover, with a maximum DTI ratio of 43% generally needed for home loans, utilizing F5’s resources can assist your family in navigating refinancing options efficiently.

We’re here to support you every step of the way, helping you explore that may better meet your financial needs. Let’s take this journey together, ensuring you feel empowered and informed as you make decisions for your family’s future.

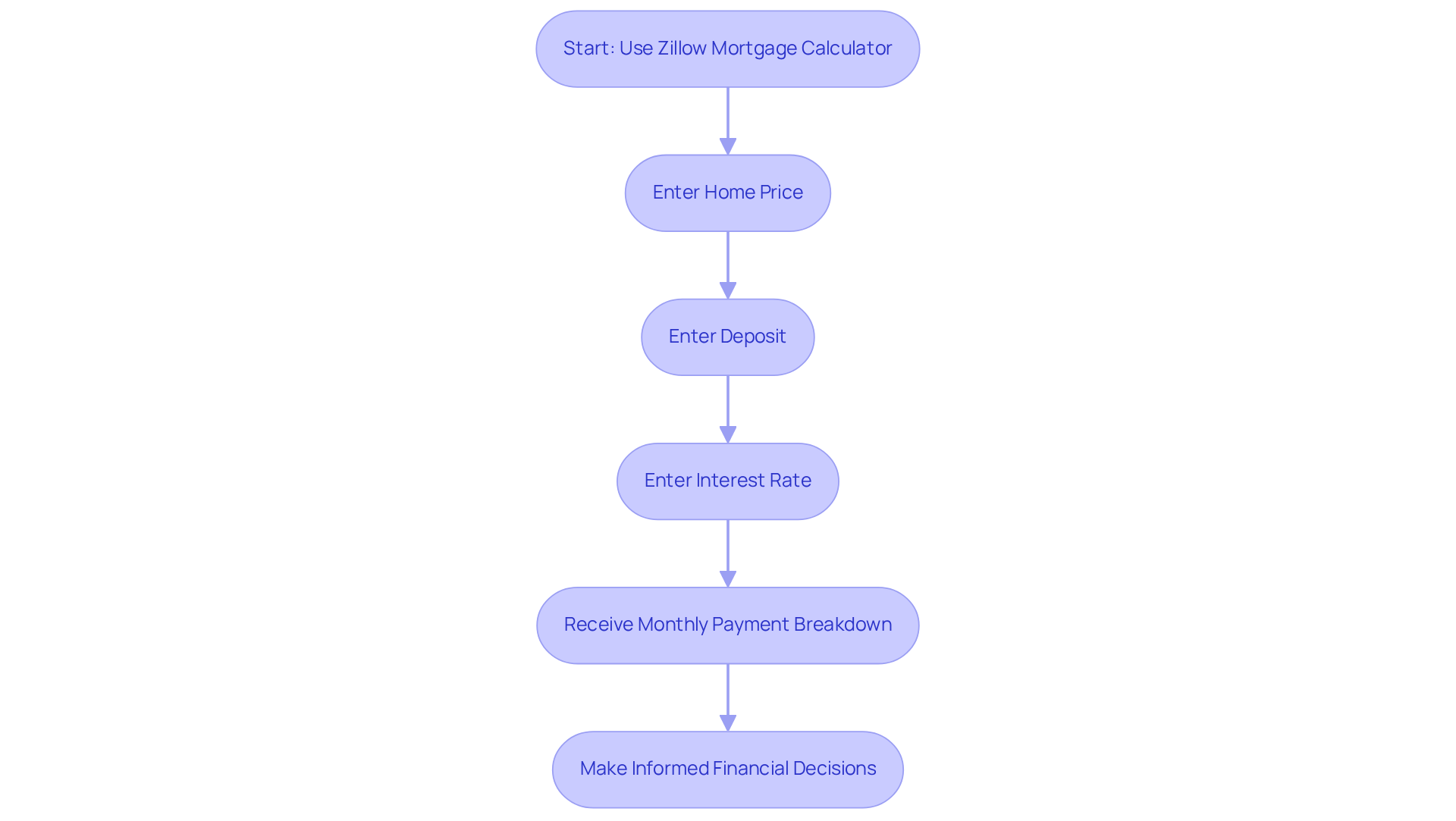

Zillow Mortgage Calculator: Comprehensive Payment Estimator

Zillow’s is a vital resource for home purchasers, offering a thorough assessment of total loan costs, including principal, interest, property taxes, and insurance. By entering key details like home price, deposit, and interest rate, users can receive a clear breakdown of their monthly responsibilities. This capability is particularly crucial in 2025, as the national median loan cost for conventional applicants stands at $2,056. While this marks a decrease from previous months, it still requires careful budget planning.

We understand how daunting the home-buying process can be, especially as buyers now face an average increase of $17,000 in income needed to afford a typical home. Financial experts emphasize that tools like the VA loan mortgage calculator empower homebuyers to make informed decisions. They allow families to visualize the total cost of homeownership and effectively budget for their future.

Real-life examples illustrate the calculator’s usefulness; many homebuyers have successfully managed their obligations by using this tool to assess their affordability and prepare for additional expenses related to homeownership. As the housing market evolves, understanding these financial implications becomes increasingly essential. Thus, Zillow’s VA loan mortgage calculator serves as an invaluable resource for potential homeowners, guiding them through each step with compassion and clarity.

CMHC Mortgage Calculator: Understand Your Mortgage Options

The Canada Mortgage and Housing Corporation (CMHC) offers a helpful Calculator designed to support users in understanding their financing options. By entering their financial details, users can simulate different scenarios, adjusting for various interest rates and loan terms. This tool is especially valuable for Canadian homebuyers in 2025, as it simplifies the often complex financing landscape, empowering them to make informed decisions.

We know how challenging navigating the housing market can be. Recent insights show that 70% to 75% of home loan consumers feel confident they secured the best financing deal for their needs. This highlights the importance of tools like the CMHC calculator in fostering that confidence. Financial advisors emphasize that understanding loan alternatives is crucial, particularly in a market where 65% of first-time buyers are stretching their budgets to purchase homes.

Consider the story of one client who faced the daunting loan landscape. They utilized the CMHC tool to compare potential monthly payments across various loan terms. This approach clarified their financial obligations and helped them identify the most suitable loan option for their situation.

As we approach 2025, average interest rates and loan terms remain critical factors for homebuyers. The VA loan mortgage calculator allows users to explore these variables, ensuring they are well-equipped to make sound financial decisions in a competitive housing market. With the recent introduction of for insured mortgages, understanding how these choices impact down payments and overall mortgage financing has never been more important. We’re here to support you every step of the way.

Calculator.net: Versatile Loan Calculator for VA Loans

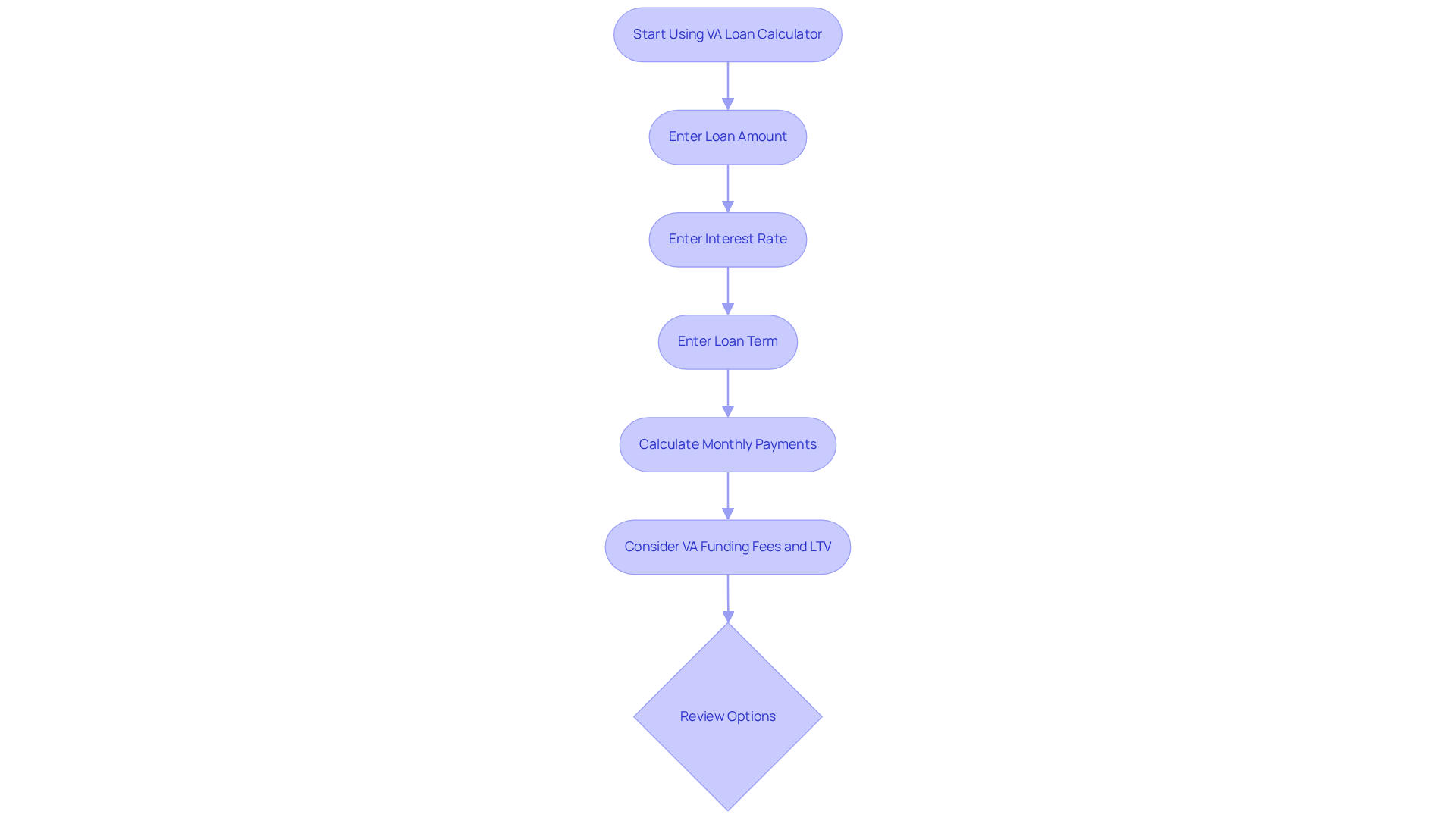

Calculator.net provides a robust VA loan mortgage calculator specifically designed for VA loans, enabling users to enter their loan amount, interest rate, and loan term to accurately estimate monthly payments. This tool is particularly beneficial for veterans and servicemembers, as it includes that account for VA funding fees and other unique aspects of VA loans. We know how challenging understanding these monetary obligations can be for borrowers. Chad Moller, Communications Manager at F5, emphasizes that utilizing a VA loan mortgage calculator can significantly enhance a veteran’s ability to navigate their financing options effectively. This aligns with F5’s commitment to transparency and client empowerment.

The Calculator.net VA Loan Calculator not only streamlines the estimation process but also empowers users to take charge of their economic futures. This reflects F5’s technology-focused, consumer-oriented strategy for competitive rates and hassle-free service. Additionally, veterans should be aware that financing 100% LTV may lead to higher interest rates. Therefore, using a VA loan mortgage calculator becomes an essential tool for informed decision-making, ensuring that you are well-equipped to make the best choices for your financial future.

BMO Mortgage Payment Calculator: Estimate Your Monthly Payments

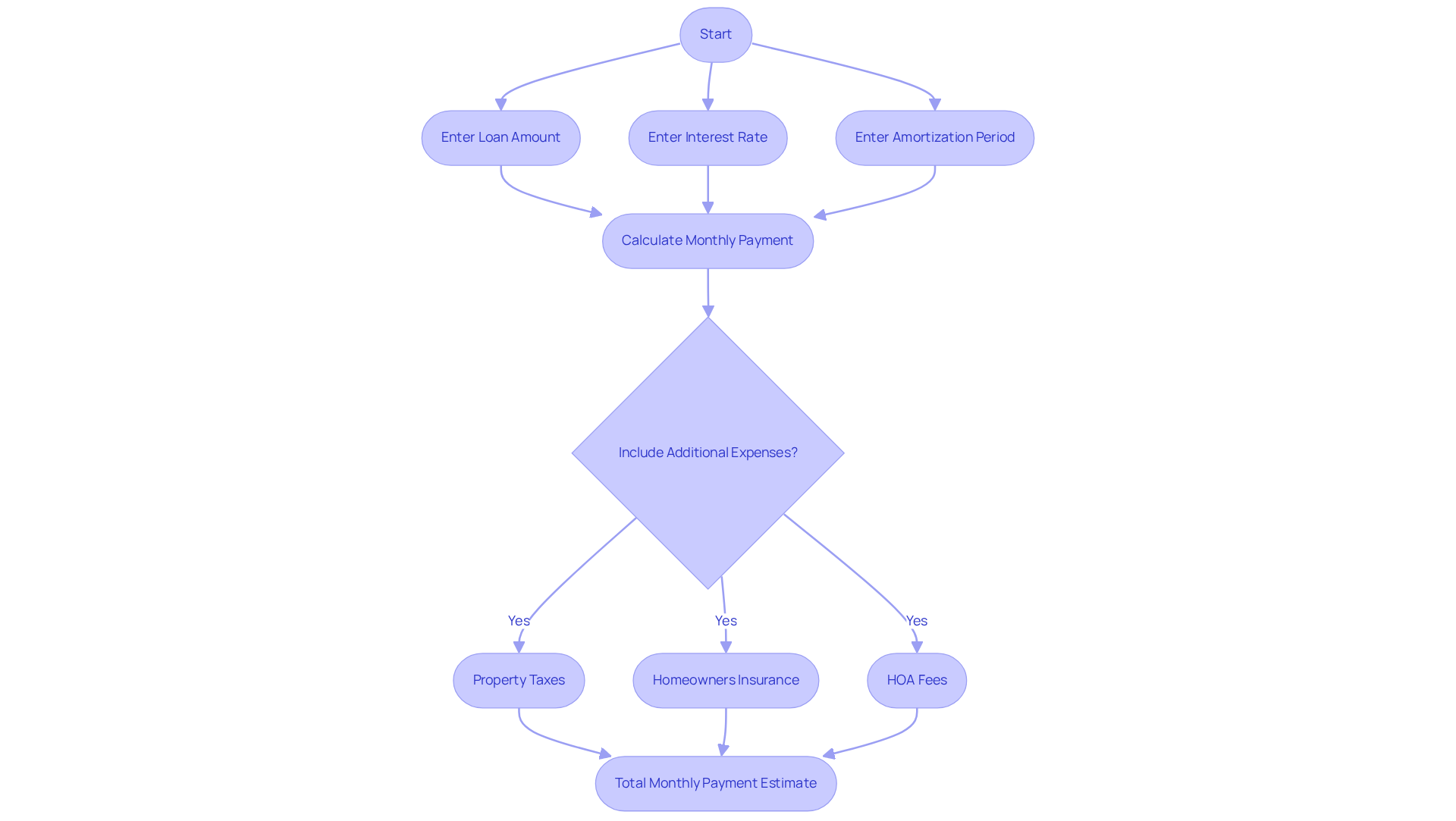

F5 Mortgage’s Loan Repayment Calculator serves as a crucial tool for homebuyers eager to estimate their monthly loan obligations accurately. By simply entering the loan amount, interest rate, and amortization period, users can swiftly determine their expected monthly payments, helping to ensure that their mortgage aligns comfortably within their overall budget.

For example, imagine a first-time homebuyer contemplating a $300,000 loan at a 6.5% interest rate over 30 years. They would find that their estimated monthly payment hovers around $1,896. This calculation is instrumental in helping buyers grasp their financial commitments, allowing them to plan effectively.

We understand how overwhelming the mortgage process can be, which is why financial advisors strongly encourage potential homebuyers to utilize such calculators to before making any commitments. To truly maximize the benefits of F5’s calculator, it’s essential for users to factor in additional expenses like:

- Property taxes

- Homeowners insurance

- Possible HOA fees

These costs can significantly influence the total monthly outlay.

By taking these factors into account, homebuyers can empower themselves to make informed choices that resonate with their long-term financial goals. This includes exploring refinancing options to adjust loan terms and potentially eliminate PMI, thereby enhancing their overall economic strategy. Remember, we’re here to support you every step of the way as you navigate this important journey.

CIBC Mortgage Affordability Calculator: Evaluate Your Finances

The [VA loan mortgage calculator](https://f5mortgage.com/understanding-the-va-irrrl-program-key-benefits-and-eligibility) is an invaluable tool for potential buyers, helping them assess their financial situation and determine how much financing they can realistically manage. By entering their income, expenses, and desired down payment, users receive a clear estimate of their affordability range. This clarity is essential, especially considering that 100.6 million U.S. households struggle to afford the of $459,826. We know how challenging this can be for families looking to upgrade their homes.

It’s crucial for first-time homebuyers to understand the various mortgage options available. For instance, FHA loans require as little as 3.5% down, while VA loans offer 0% down for eligible veterans, and conventional loans may ask for 3% to 5% down. Real-world examples show how clients have successfully set realistic expectations using affordability calculators. Families planning to upgrade their homes in 2025 can benefit from understanding average affordability ranges, which are influenced by current economic conditions and rising home prices. Financial experts emphasize that using a VA loan mortgage calculator helps buyers avoid the pitfalls of overextending themselves financially, particularly in an environment where 76.4 million households find it difficult to afford a $300,000 home. As Daniel Rethazy, senior vice president of personal lending, wisely states, “Using affordability calculators empowers buyers to make informed decisions and avoid economic strain.”

The VA loan mortgage calculator not only provides a clear economic picture but also empowers users to make informed choices. By using this tool, prospective purchasers can navigate the complexities of the loan landscape with confidence, ensuring they select a home that aligns with their financial capabilities. Additionally, understanding the debt-to-income (DTI) ratio, ideally kept below 43%, can enhance their chances of loan approval and assist them in choosing the right refinancing options if necessary.

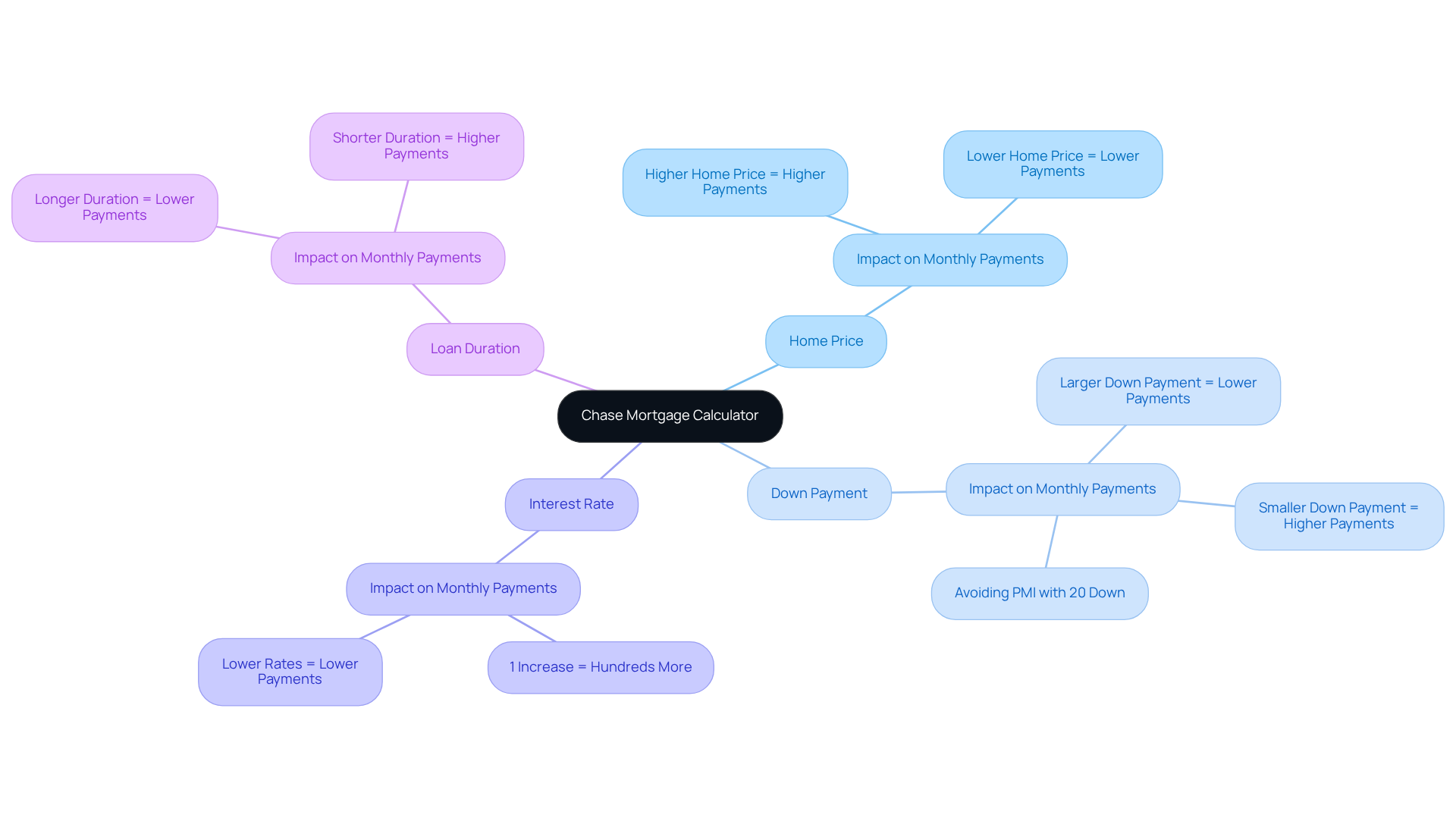

Chase Mortgage Calculator: Detailed Payment Insights

Navigating the world of home financing can be overwhelming, and we understand how challenging this can be. The Chase Loan Calculator is here to help you gain valuable insights into your financial obligations. This tool allows you to by factoring in essential elements like home price, down payment, interest rate, and loan duration. For homebuyers like you, understanding how these factors impact your mortgage costs is crucial for making informed financial choices.

As we move into 2025, it’s more important than ever to grasp these financial dynamics. Even slight adjustments in interest rates or initial contributions can significantly affect your monthly payments. For example, did you know that a 1% increase in interest rates can raise your monthly payments by hundreds of dollars? This highlights the importance of utilizing calculators like this one to stay informed.

Real-life stories show how homebuyers have successfully managed their financial obligations by leveraging the detailed insights offered by the Chase Mortgage Calculator. With exciting updates and new features introduced in 2025, this tool continues to empower you, ensuring you are well-equipped to make sound financial decisions.

By thoroughly understanding payment factors, you can better assess your economic preparedness. This knowledge empowers you to make strategic choices that align with your long-term objectives. Remember, we’re here to support you every step of the way.

itools Mortgage Qualifier Tool: Determine Your Eligibility

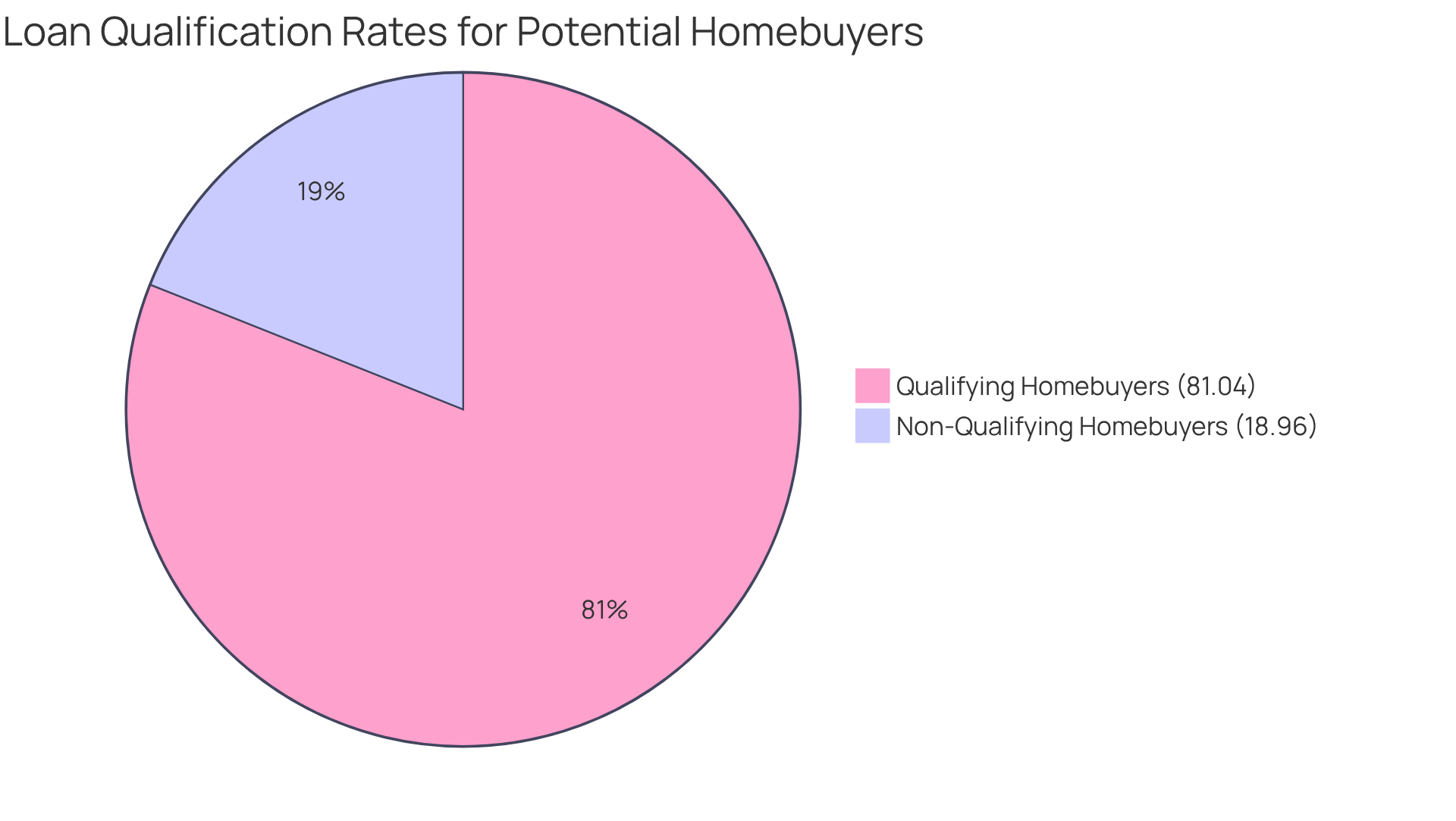

The itools Mortgage Qualifier Tool is a valuable resource for families looking to evaluate their loan eligibility based on their unique financial situations. By simply entering details like income, debts, and other relevant information, users can receive an initial assessment of their loan qualifications. This tool is particularly important for prospective homebuyers, as it empowers them to before officially applying for a loan. This preparation can significantly enhance their readiness for the application process.

In 2025, it is anticipated that the average eligibility rate for potential homebuyers using loan qualifiers will be around 81.04%. This promising figure indicates a supportive approval environment. Financial experts emphasize that utilizing tools like this can simplify the loan application process, helping families recognize their strengths and identify areas for improvement. For instance, clients who have successfully used the itools Qualifier Tool often report increased confidence in their applications, leading to higher approval rates and more favorable loan terms.

By leveraging the itools Mortgage Qualifier Tool, prospective homebuyers can navigate the complexities of mortgage financing with greater ease. This ensures they are well-equipped to make informed decisions and secure the best possible outcomes on their journey to homeownership. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Navigating the complexities of home financing can feel overwhelming, especially for first-time homebuyers. We understand how challenging this can be. That’s why we’re excited to highlight nine essential VA loan mortgage calculators that can simplify this process for you. By leveraging these tools, you can gain a clearer understanding of your financial responsibilities, assess your purchasing power, and make informed decisions that align with your long-term goals.

Throughout our discussion, we provided key insights on various calculators, including the user-friendly F5 Mortgage calculator, the comprehensive Chase Home Affordability Calculator, and the versatile Calculator.net VA loan calculator. Each tool offers unique features tailored to different aspects of your homebuying journey, such as estimating monthly payments, evaluating maximum borrowing amounts, and determining loan eligibility. We also emphasized the importance of understanding down payment assistance programs and the implications of debt-to-income ratios. These calculators empower you to navigate the mortgage landscape with confidence.

In conclusion, utilizing these mortgage calculators is not just about crunching numbers; it’s about equipping yourself with the knowledge necessary to make sound financial decisions in a competitive housing market. As home prices continue to rise, understanding affordability and financing options is more important than ever. By embracing these tools, you can take control of your homebuying journey, ensuring that your choices foster financial stability and long-term success. Remember, the path to homeownership is within reach, and with the right resources at hand, it can be a rewarding experience. We’re here to support you every step of the way.

Frequently Asked Questions

What is the purpose of the F5 Mortgage VA loan mortgage calculator?

The F5 Mortgage VA loan mortgage calculator is designed to help users assess their monthly costs, including taxes and insurance, by entering details such as home price, deposit, interest rate, and loan duration.

How can the F5 Mortgage calculator benefit first-time buyers?

The calculator simplifies complex loan calculations, providing clear insights that empower first-time buyers to make informed choices about their financing options, which can boost their confidence in the homebuying process.

What types of loans does F5 Mortgage offer?

F5 Mortgage offers low down payment solutions, including FHA, VA, and conventional loans, to support homeownership.

How does the Chase Home Affordability Calculator assist homebuyers?

The Chase Home Affordability Calculator allows users to enter their income, existing debts, and preferred down payment to receive a personalized estimate of the maximum home price they can afford, aiding in effective budgeting.

Why is it important for buyers to use affordability calculators in the current housing market?

Given the rising home prices, affordability calculators help buyers understand their budgetary limits, enabling them to make informed decisions before committing to a purchase.

What factors does the Chase Home Affordability Calculator consider?

The calculator accounts for various financial factors, such as taxes and insurance, to provide a comprehensive evaluation of potential costs.

What is the function of the Maximum Mortgage Amount Calculator provided by F5 Mortgage?

The Maximum Mortgage Amount Calculator helps users assess how much they can borrow based on their income, expenses, and credit score, providing clarity on their borrowing limits.

How can understanding PMI and DTI ratios help homebuyers?

Knowing the implications of private loan insurance (PMI) and debt-to-income (DTI) ratios is essential for making informed decisions, especially regarding refinancing options and maximizing purchasing power.

What support does F5 Mortgage offer to families looking to enhance their homes?

F5 Mortgage provides resources and guidance to help families explore various loan types and navigate refinancing options, ensuring they feel empowered and informed in their financial decisions.