Overview

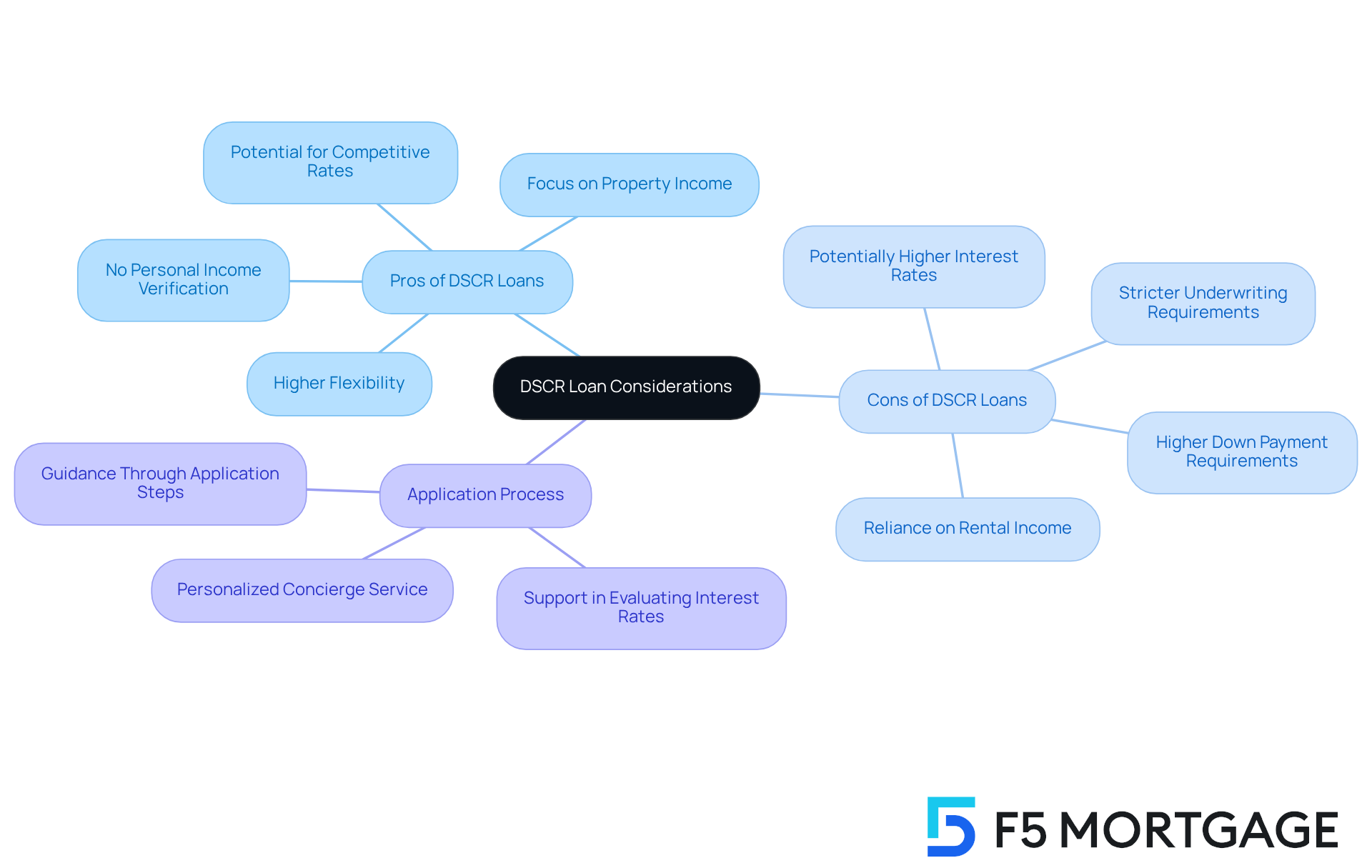

The title “10 DSCR Loan Pros and Cons Every Investor Should Know” raises an important question: what are the advantages and disadvantages of Debt Service Coverage Ratio (DSCR) loans for investors? We understand how challenging it can be to navigate financing options, and this article aims to shed light on both sides of the coin.

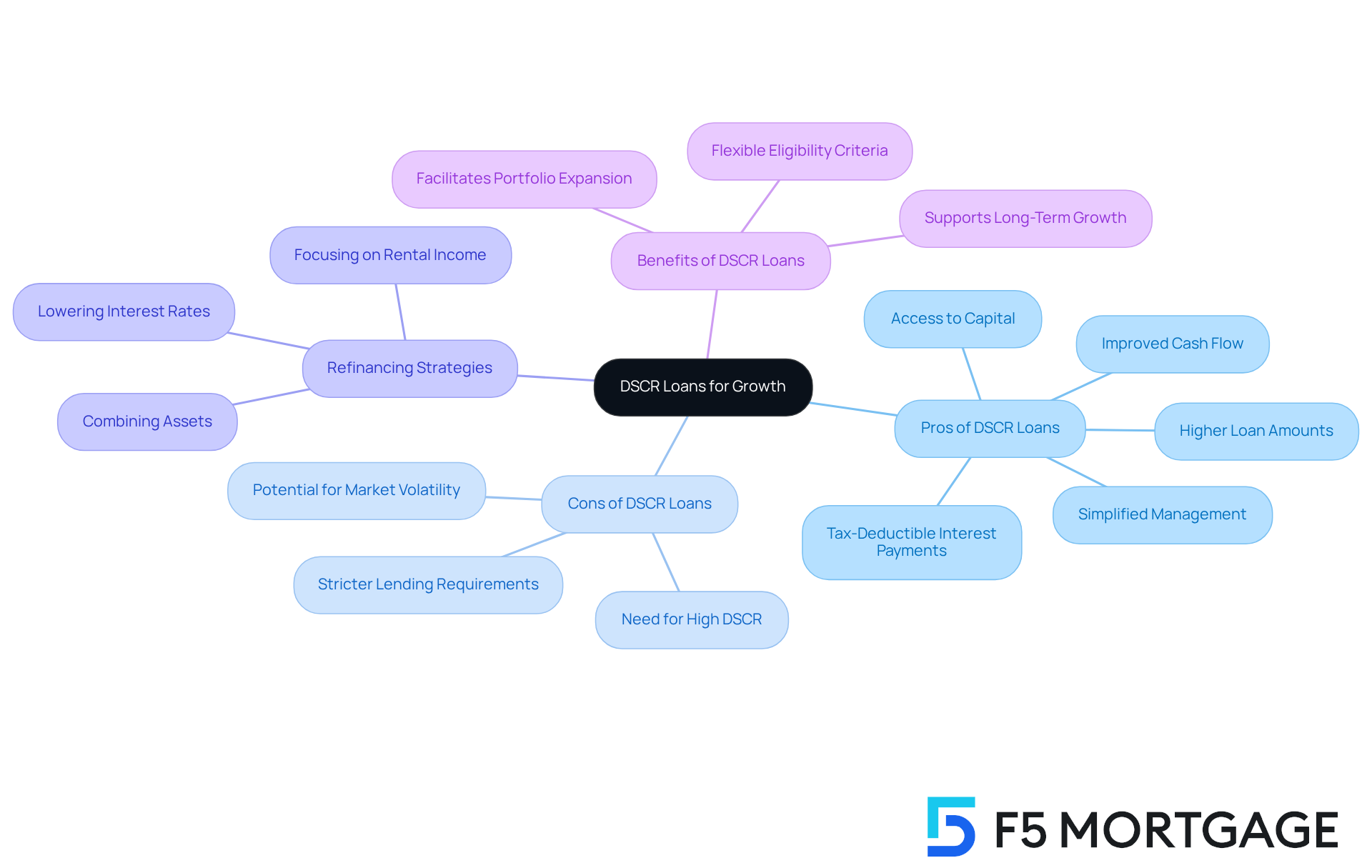

DSCR loans can offer significant benefits, such as:

- Improved cash flow

- Flexible qualification criteria, especially for self-employed individuals

These features can be a game-changer for many investors, providing opportunities that align with their financial goals. However, it’s essential to consider the potential drawbacks as well:

- Higher interest rates

- Market dependency risks

These factors require careful evaluation.

As you explore these options, we’re here to support you every step of the way. Making informed financing decisions is crucial, and understanding both the pros and cons of DSCR loans will empower you to choose the best path forward.

Introduction

Navigating the world of real estate financing can feel overwhelming, especially when it comes to understanding the nuances of Debt Service Coverage Ratio (DSCR) loans. We know how challenging this can be. These financing options offer the promise of increased cash flow and flexible qualification criteria, making them particularly appealing to investors, including those who are self-employed. However, with these advantages come challenges, such as higher interest rates and potential hidden fees.

How can investors effectively weigh the pros and cons of DSCR loans? It’s essential to ensure that your decisions align with your long-term financial goals. By taking a thoughtful approach, you can navigate this complex landscape with confidence and clarity.

F5 Mortgage: Tailored DSCR Loan Solutions for Investors

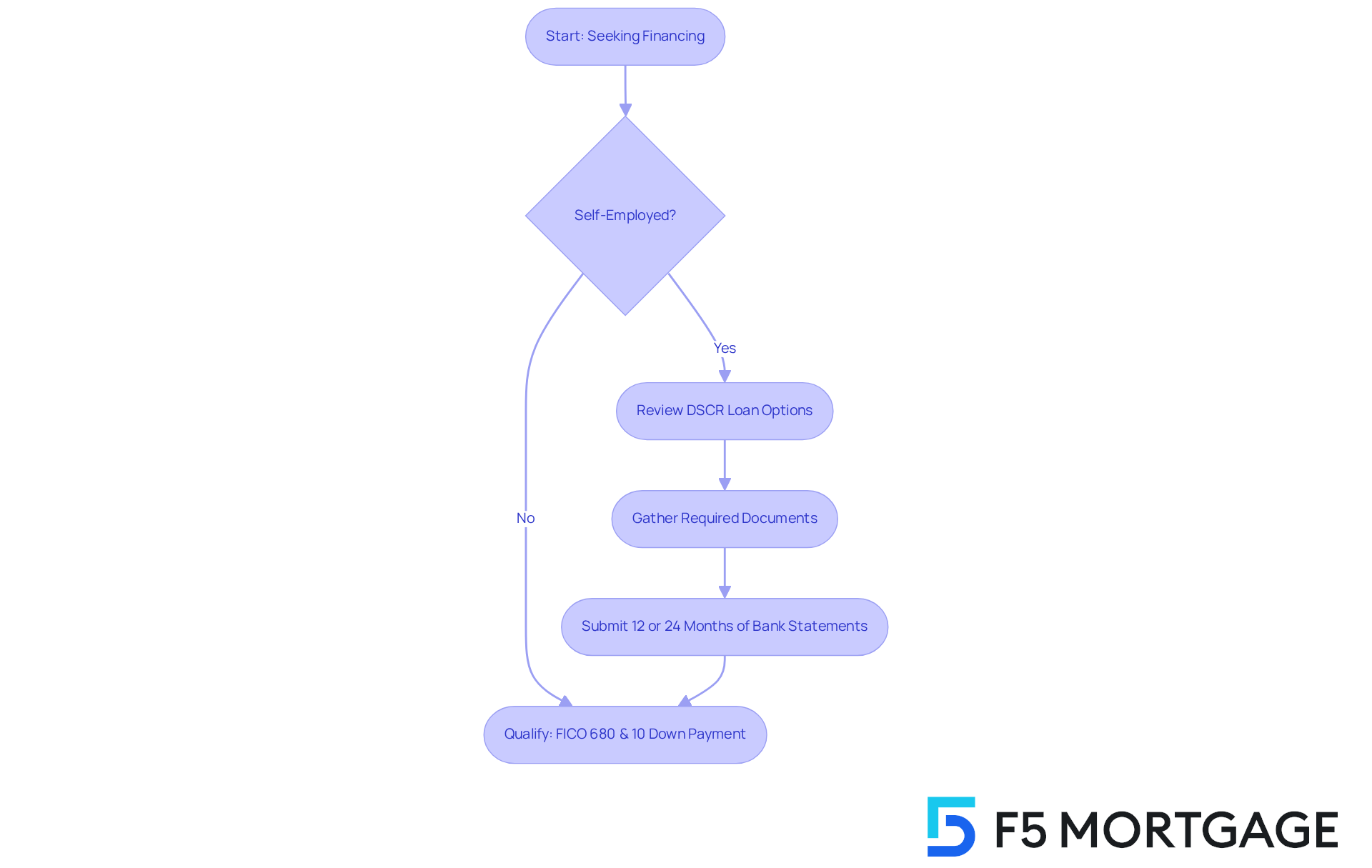

At F5 Mortgage, we understand how challenging it can be to navigate the complexities of financing, especially for real estate investors. That’s why we focus on offering customized financing solutions and discussing the DSCR loan pros and cons tailored specifically for you, including self-employed individuals facing intricate financial circumstances. By leveraging our extensive network of lenders, we provide financing options that align perfectly with your unique financial situation.

For our self-employed clients, we offer bank statement financing, which allows us to assess your earnings based on your business cash flow. We utilize either 12 or 24 months of bank statements to ensure a fair evaluation. To qualify, you’ll need:

- A minimum FICO score of 680

- A down payment of at least 10%

This personalized approach is designed to ensure you receive the best possible terms and conditions.

We’re here to support you every step of the way, making F5 Mortgage a trusted partner for those looking to invest in real estate. Our commitment to ethical standards, transparency, and client-centric mortgage solutions solidifies our reputation as a reliable choice for families upgrading their homes. Let us help you achieve your dreams with confidence.

Increased Cash Flow: The Financial Advantage of DSCR Loans

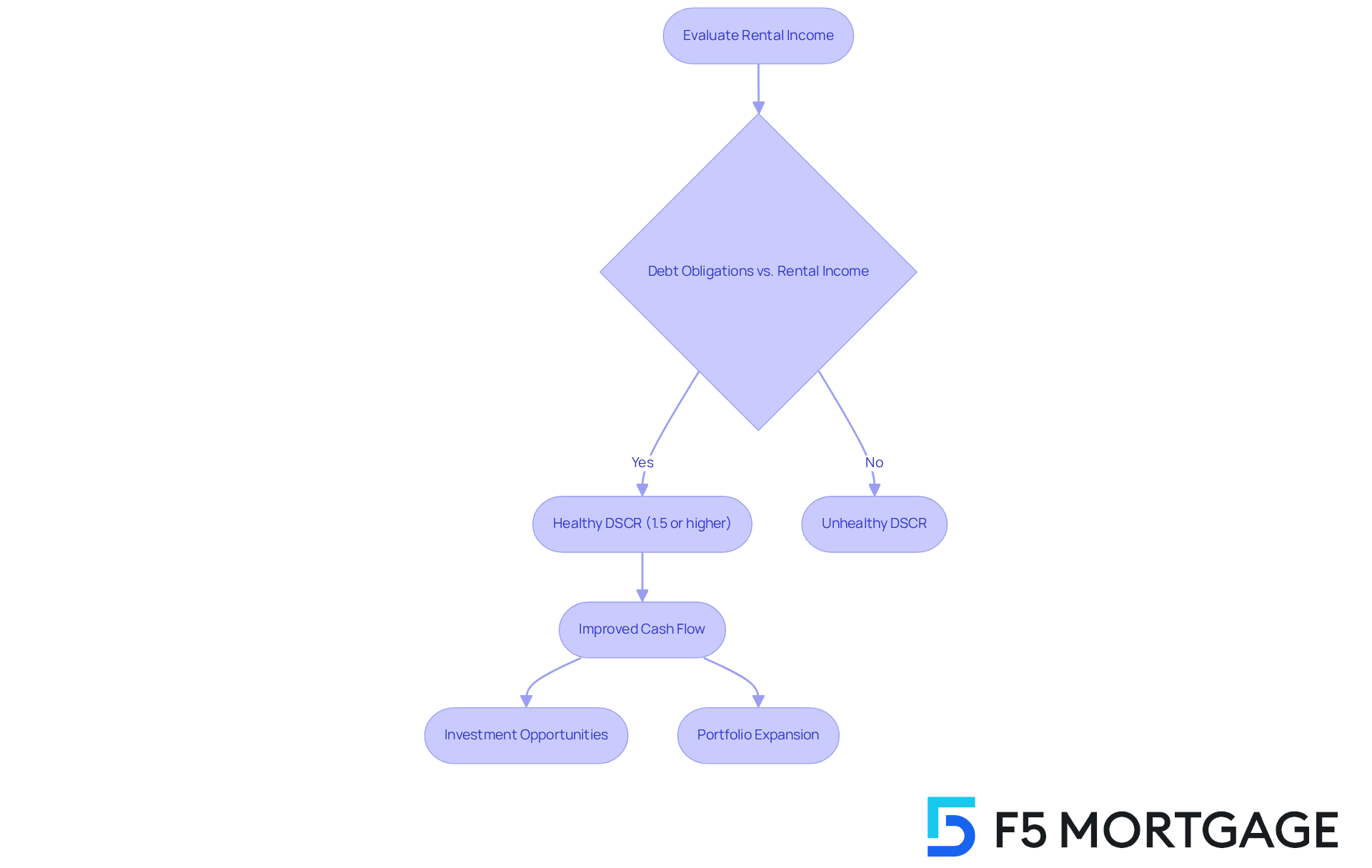

One of the most compelling advantages of debt service coverage ratio financing is its ability to improve cash flow for property investors. We understand how challenging it can be to navigate financing options, especially when conventional methods rely heavily on personal earnings verification. However, understanding the dscr loan pros and cons allows investors to assess a real estate’s revenue potential, enabling them to secure funding based on the rental income generated by the asset itself. This approach empowers investors to make the most of their cash flow, facilitating the purchase of additional properties and the expansion of their investment portfolios.

For instance, consider an asset that generates $150,000 in annual gross rental income against $100,000 in debt obligations. This results in a Debt Service Coverage Ratio of 1.5, which indicates a healthy cash flow situation. This flexibility is particularly beneficial for self-employed individuals or those managing multiple properties, as it bypasses the stringent income requirements typically associated with traditional financing.

Moreover, the approval process for debt service coverage ratio financing is streamlined, reducing paperwork and speeding up decision-making for investors. This efficiency translates into quicker access to capital, which is essential in the competitive real estate market. However, it’s important to be aware of the dscr loan pros and cons, which may include slightly higher interest rates compared to traditional investment financing. This is a consideration worth keeping in mind as you evaluate your funding options.

Success stories abound, with many investors—ranging from first-time buyers to seasoned property owners—reporting significant portfolio growth through the strategic use of debt service coverage ratio financing. Financial advisors emphasize that leveraging cash flow through these financing options can lead to enhanced investment opportunities, as they provide faster access to capital without the constraints of personal income verification. In fact, statistics show that a substantial number of debt service coverage ratio borrowers find themselves in a position to invest in multiple assets, greatly improving their overall cash flow and long-term financial stability.

Higher Interest Rates: A Consideration for DSCR Loan Borrowers

While we understand that the dscr loan pros and cons highlight numerous advantages of debt service coverage ratio financing, we also recognize your concerns about potentially elevated interest rates compared to conventional financing. Lenders may evaluate the dscr loan pros and cons, as they might see this type of financing as riskier due to its reliance on property income for repayment. However, at F5 Mortgage, we are here to support you every step of the way. We leverage technology to partner with over two dozen top lenders, ensuring that you receive ultra-competitive rates tailored to your unique needs.

Our personalized concierge service walks you through the application process, helping you evaluate interest rates and understand their impact on your overall investment strategy. We know how challenging this can be, but with F5 Mortgage, you can confidently manage the intricacies of debt service coverage ratio financing and understand the dscr loan pros and cons. Your financial health is our priority, and we are committed to helping you navigate this journey with assurance.

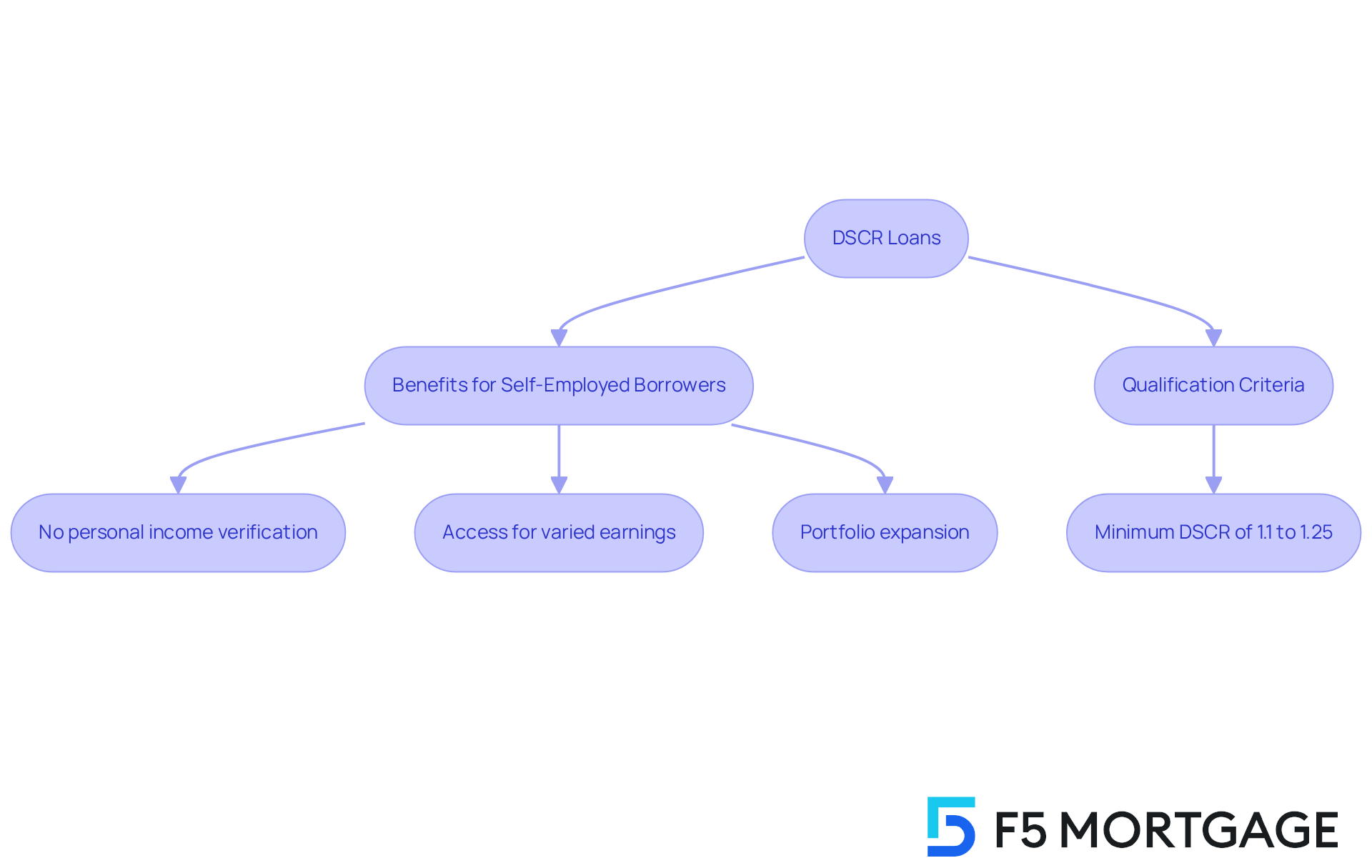

Flexible Qualification Criteria: Accessing Financing with DSCR Loans

These types of financing are truly commendable for their adaptable qualification standards, making them especially appealing to a diverse group of investors. Unlike conventional loans, which often place heavy emphasis on personal earnings and credit ratings, DSCR loans focus on the revenue generated by the property itself. This shift in focus enables self-employed individuals and those with non-traditional income sources to secure financing more easily, effectively broadening the pool of potential borrowers.

For self-employed investors, the ability to bypass personal earnings verification is a significant advantage. With debt service coverage ratio financing, lenders assess the property’s cash flow rather than the borrower’s financial history. This allows individuals with varied earnings to qualify based on the rental revenue potential of their investments. This is particularly beneficial for those who may have been self-employed for less than two years or who possess substantial tax deductions that obscure their true financial strength.

Demographically, self-employed individuals represent a crucial segment of the market accessing debt service coverage ratio financing. These borrowers frequently encounter obstacles with traditional financing due to stringent income verification requirements. However, these financial products provide a pathway for them to develop and expand their real estate portfolios without the constraints imposed by traditional mortgages.

Numerous successful funding examples illustrate how self-employed investors leverage debt service coverage ratio financing to acquire multiple assets. For instance, investors can qualify for additional financing as long as each property demonstrates adequate cash flow, facilitating rapid portfolio growth. This flexibility is underscored by lenders who emphasize that debt service coverage ratio financing allows borrowers to focus on the investment’s income-generating potential, rather than their individual financial situations.

It is essential to understand that lenders typically seek a minimum debt service coverage ratio of 1.1 to 1.25 for approval, indicating a solid financial buffer. While the DSCR loan pros and cons enhance accessibility for self-employed borrowers, they may also pose challenges such as higher interest rates and larger down payments compared to traditional mortgages.

In summary, these financing options not only improve accessibility for self-employed borrowers but also empower them to navigate the complexities of real estate investment with greater confidence and ease. We know how challenging this can be, and we’re here to support you every step of the way.

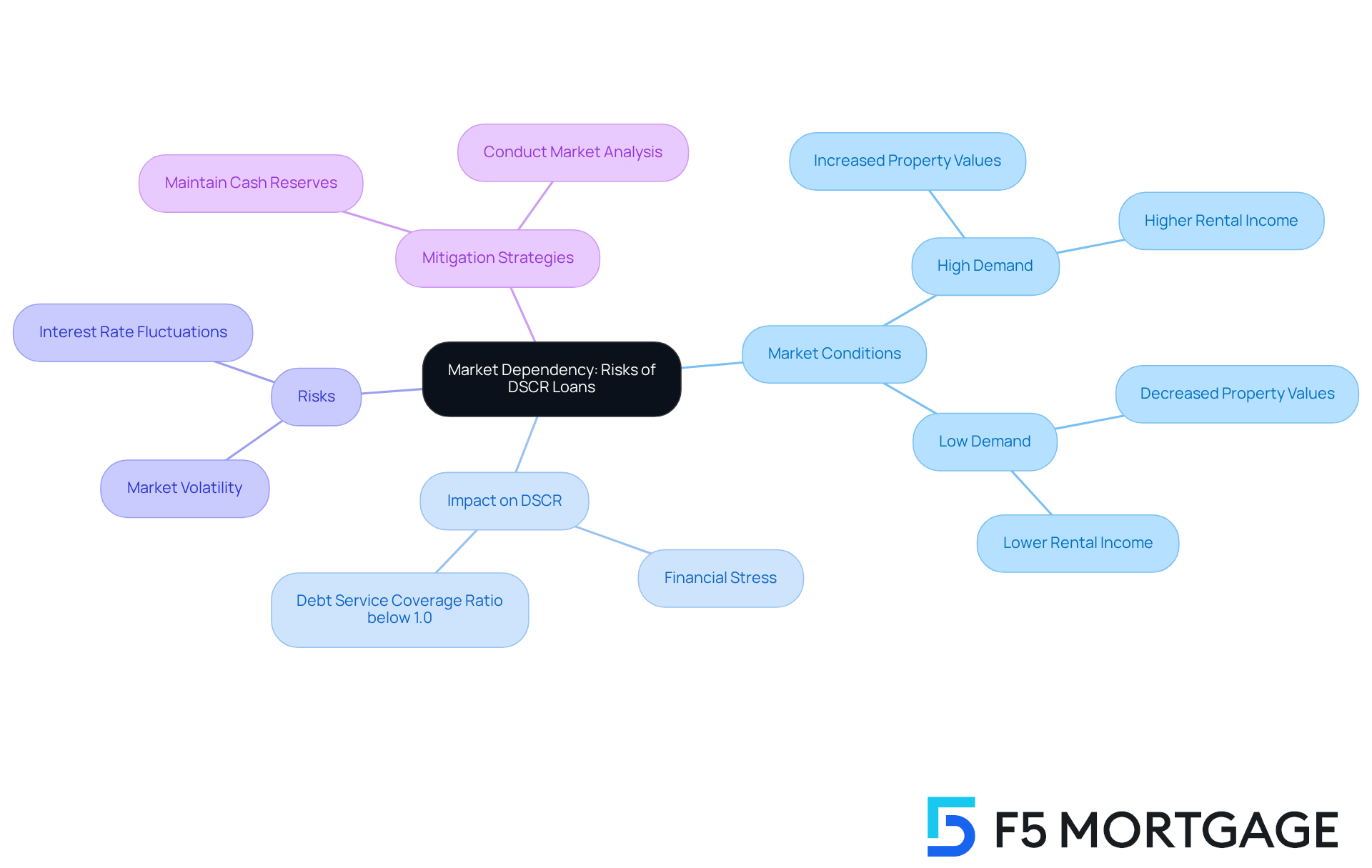

Market Dependency: Risks of DSCR Loans in Fluctuating Markets

Investors, we understand how significant market dependency can feel when it comes to DSCR financing. In fluctuating markets, real estate values and rental earnings can change dramatically, directly affecting your ability to meet debt obligations. For instance, during economic downturns, reduced real estate earnings may limit your capacity to make loan payments, potentially leading to financial stress. A Debt Service Coverage Ratio below 1.0 indicates that earnings may not be sufficient to manage debt, which can be particularly concerning in unstable times.

Recent statistics show that high property demand can drive up property values, leading to increased rental income and a healthier debt service coverage ratio. Conversely, low demand can have the opposite effect. This is why conducting thorough market analysis and risk evaluations to assess the DSCR loan pros and cons is essential before engaging in debt service coverage ratio financing. Real estate analysts emphasize that understanding these dynamics can empower you to navigate the complexities of real estate financing and make informed decisions aligned with your financial goals.

Moreover, it’s important to understand the DSCR loan pros and cons when refinancing DSCR financing, as market conditions can significantly impact your options. To mitigate these risks, we encourage you to maintain cash reserves and stay informed about market trends. Remember, we’re here to support you every step of the way as you make these important decisions.

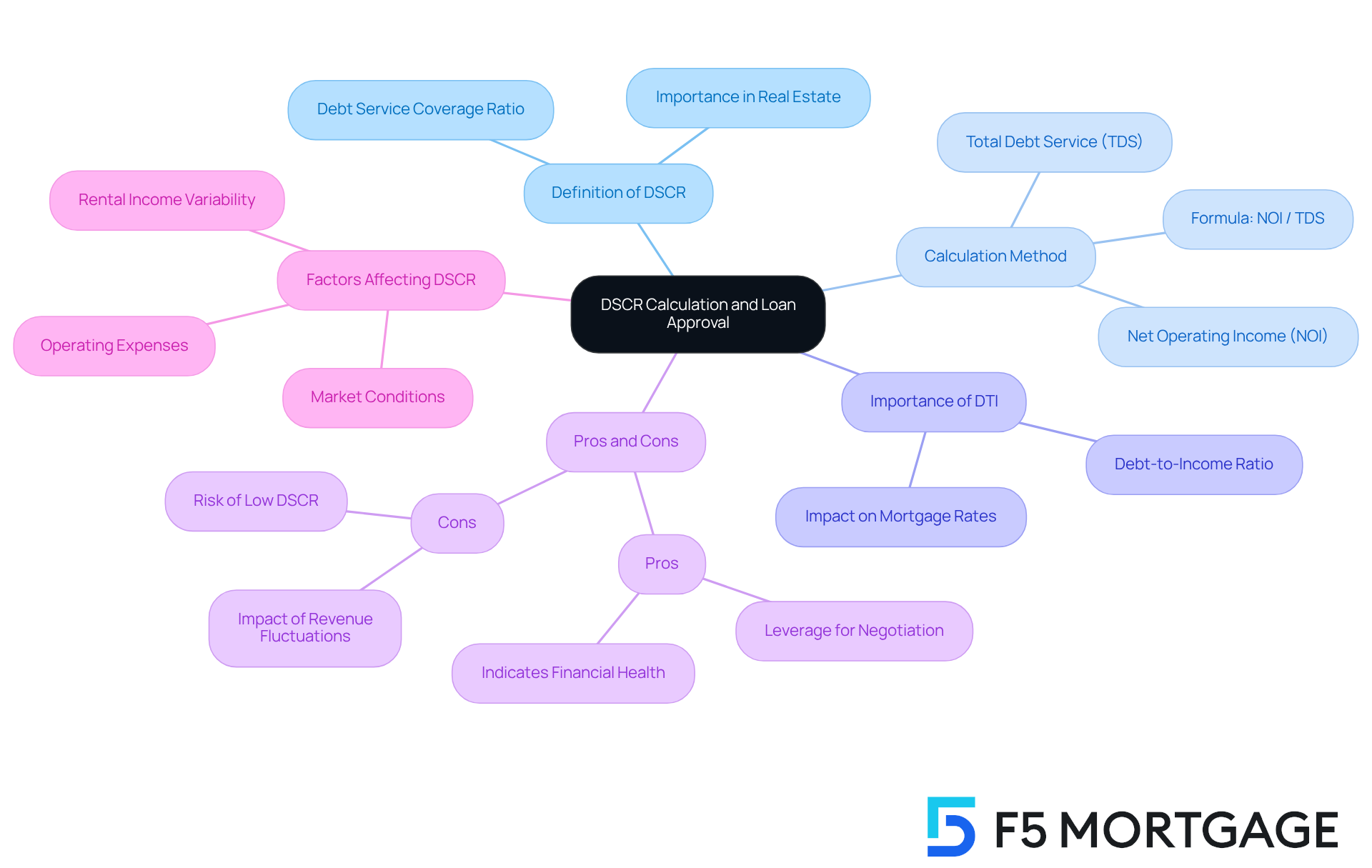

Understanding DSCR Calculation: Key to Loan Approval

Understanding the dscr loan pros and cons is crucial for investors who are seeking financing approval. We know how challenging this can be, and this ratio is determined by dividing the asset’s net operating revenue by the total debt obligations, which includes all payment dues. A debt service coverage ratio exceeding 1 indicates that the asset generates enough earnings to meet its debt responsibilities, highlighting one of the important dscr loan pros and cons that lenders closely evaluate when granting loans.

Many lenders consider the dscr loan pros and cons, requiring a minimum debt service coverage ratio of 1.2 to ensure that properties produce at least 20% more revenue than their debt obligations. Additionally, the Debt-to-Income (DTI) ratio, which compares an individual’s total debt to their income, plays a significant role in this process. A better DTI can lead to more competitive mortgage rates, making it essential for investors to maintain a strong ratio.

As financial professionals emphasize, the dscr loan pros and cons highlight that a high DSCR offers leverage for borrowers to negotiate terms, such as interest rates, duration, and down payments. It’s also important to understand home equity criteria; many lenders require homeowners to maintain at least an 80% home-to-value ratio. This means they must have paid down at least 20% of their original loan amount or that their home has appreciated in value.

Keep in mind that variations in rental revenue or occupancy levels can greatly affect the dscr loan pros and cons, particularly regarding the debt service coverage ratio. This highlights the importance of careful revenue forecasts. Precise asset evaluations are also vital in the debt service coverage ratio calculation process, as they help ensure that income forecasts align with the asset’s market value, ultimately influencing mortgage rates.

To enhance your funding strategy, regularly assess your DTI and consider the dscr loan pros and cons in relation to your debt service coverage ratio. We’re here to support you every step of the way, so consider seeking expert guidance to refine your application.

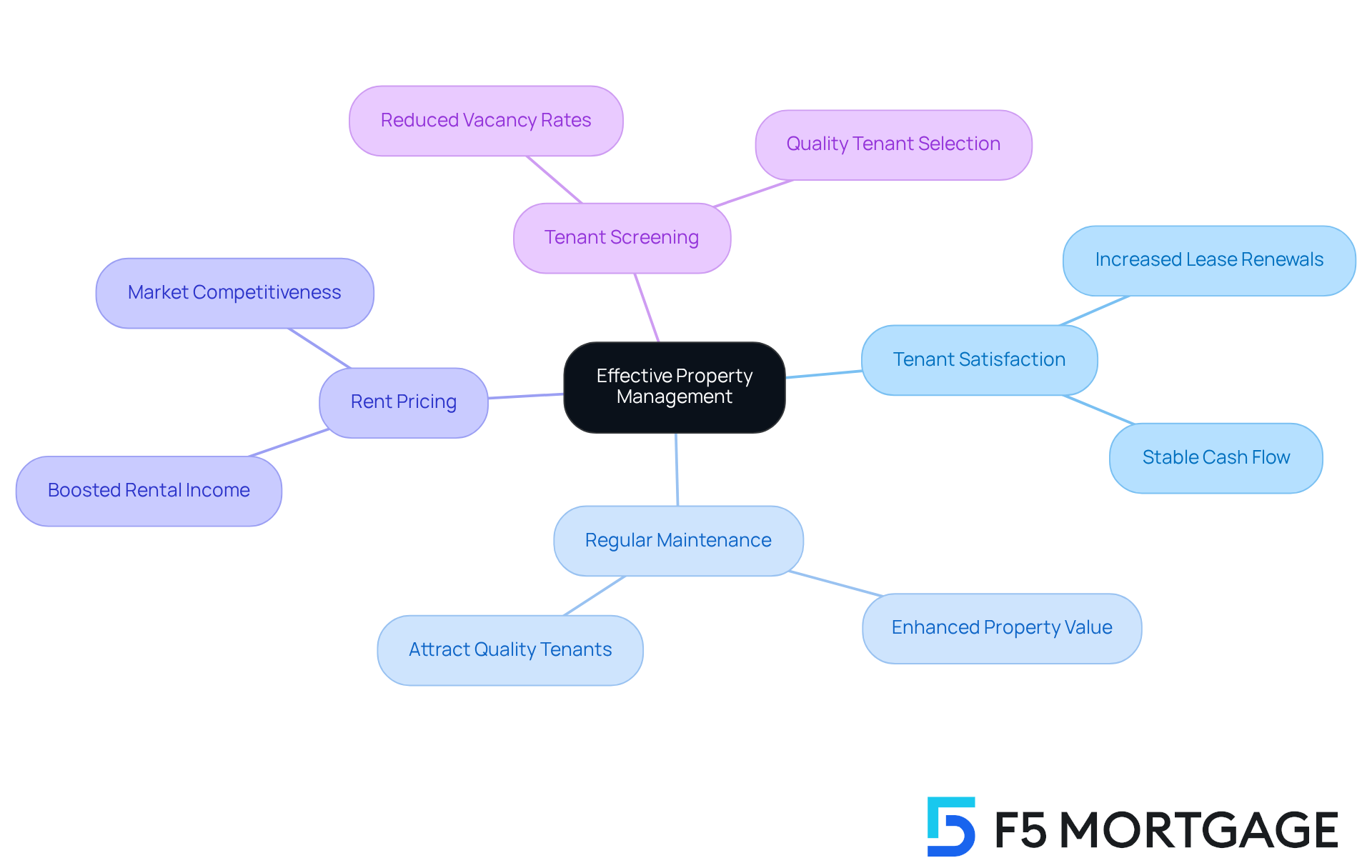

Effective Property Management: Enhancing DSCR Loan Viability

Effective asset management is essential for understanding the DSCR loan pros and cons to ensure the success of DSCR loans. We understand how important it is to maintain your investments. By holding assets to high standards and ensuring tenant satisfaction, investors can significantly boost rental income while minimizing vacancies. Research shows that happy tenants are more likely to renew their leases. In fact, studies indicate that tenant satisfaction can increase lease renewals by as much as 30%, which directly supports stable cash flow.

Implementing strong management strategies—like regular maintenance, thoughtful rent pricing, and comprehensive tenant screening—not only enhances revenue potential but also elevates the overall investment profile. This proactive approach helps you meet your debt obligations, positioning you favorably for future financing opportunities.

As George Despotopoulos, an expert in real estate investment, wisely stated, ‘Maximizing rental income requires a blend of effective tenant management and property upkeep, ensuring that both the property and its occupants thrive.’ By focusing on these vital aspects, you can improve your debt service coverage ratios, which will help you understand the DSCR loan pros and cons, paving the way for a more sustainable financial future. We’re here to support you every step of the way.

Refinancing Opportunities: Leveraging DSCR Loans for Growth

We understand how challenging it can be to navigate the world of real estate financing. When considering your expansion needs, it’s important to evaluate the dscr loan pros and cons, as they offer substantial refinancing prospects that you can strategically utilize. As real estate values rise and rental earnings grow, many investors find themselves in a favorable position to refinance existing debts under improved conditions. This refinancing can unlock valuable capital, allowing for further investments or renovations that enhance both asset value and rental potential.

For instance, experienced investors have effectively employed debt service coverage ratio financing to combine multiple assets under one agreement. This not only simplifies management but also enhances cash flow, making it easier to focus on what truly matters. Typically, refinancing through debt service coverage ratio financing can release significant funds, empowering you to grow your portfolio without the limitations of personal credit barriers, which highlights the dscr loan pros and cons.

By concentrating on the revenue generated by your properties rather than personal financial profiles, these financing options enable you to seize growth opportunities and strengthen your overall financial position. We’re here to support you every step of the way as you explore these opportunities for your future.

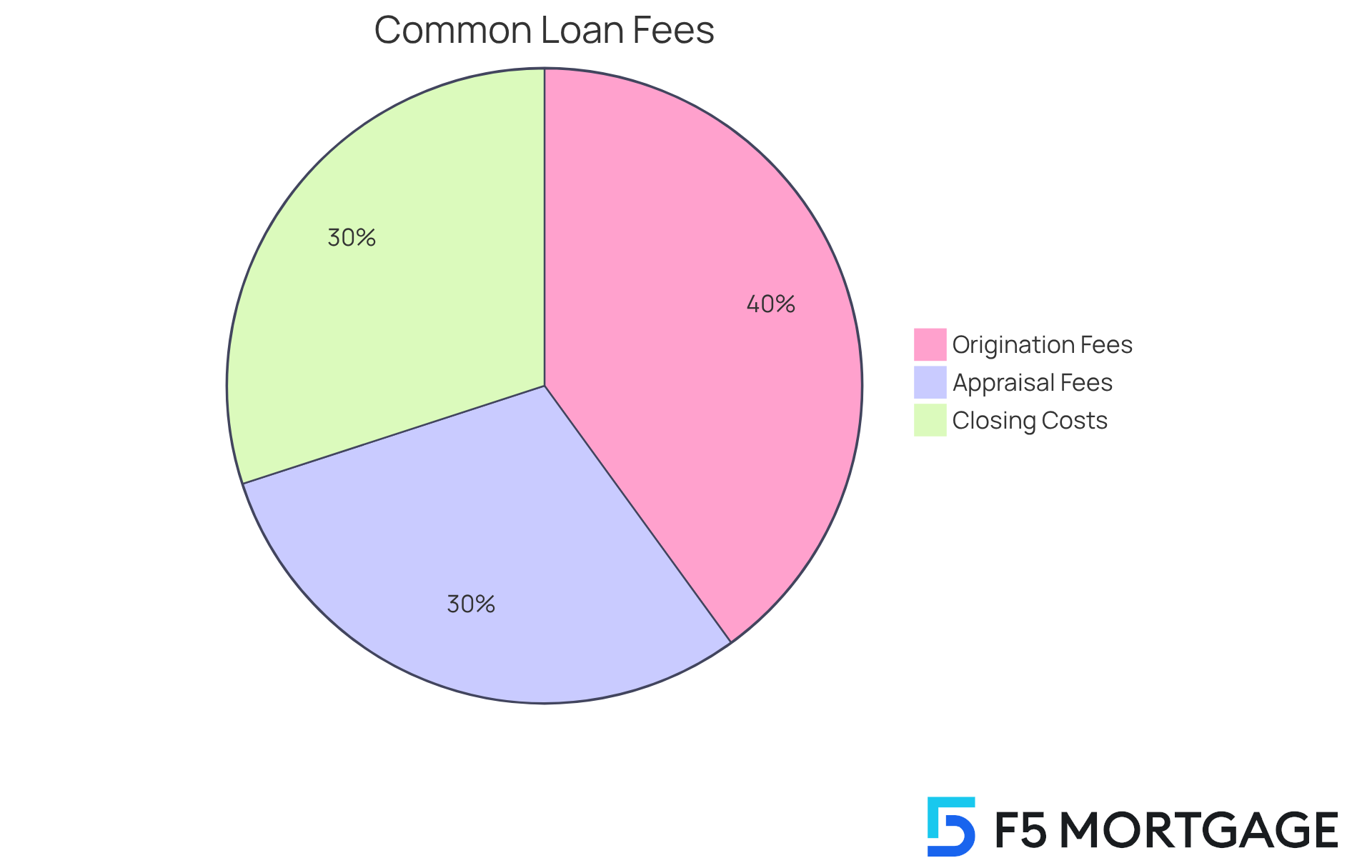

Hidden Fees: Navigating Costs Associated with DSCR Loans

Investors, we know how challenging it can be to navigate the complexities of debt service coverage ratio financing. It’s important to stay alert to potential concealed charges that can significantly impact your overall borrowing expenses. Common fees, such as:

- Origination fees

- Appraisal fees

- Closing costs

may not always be clearly communicated at the beginning of the process.

A recent survey revealed that many borrowers are unaware of these costs, highlighting the necessity for diligence. To help you through this, we encourage you to meticulously review your financing documents. Don’t hesitate to ask lenders about any additional expenses that may arise. This proactive approach will empower you with a comprehensive understanding of your financial obligations, ultimately aiding you in making better investment decisions. Remember, we’re here to support you every step of the way.

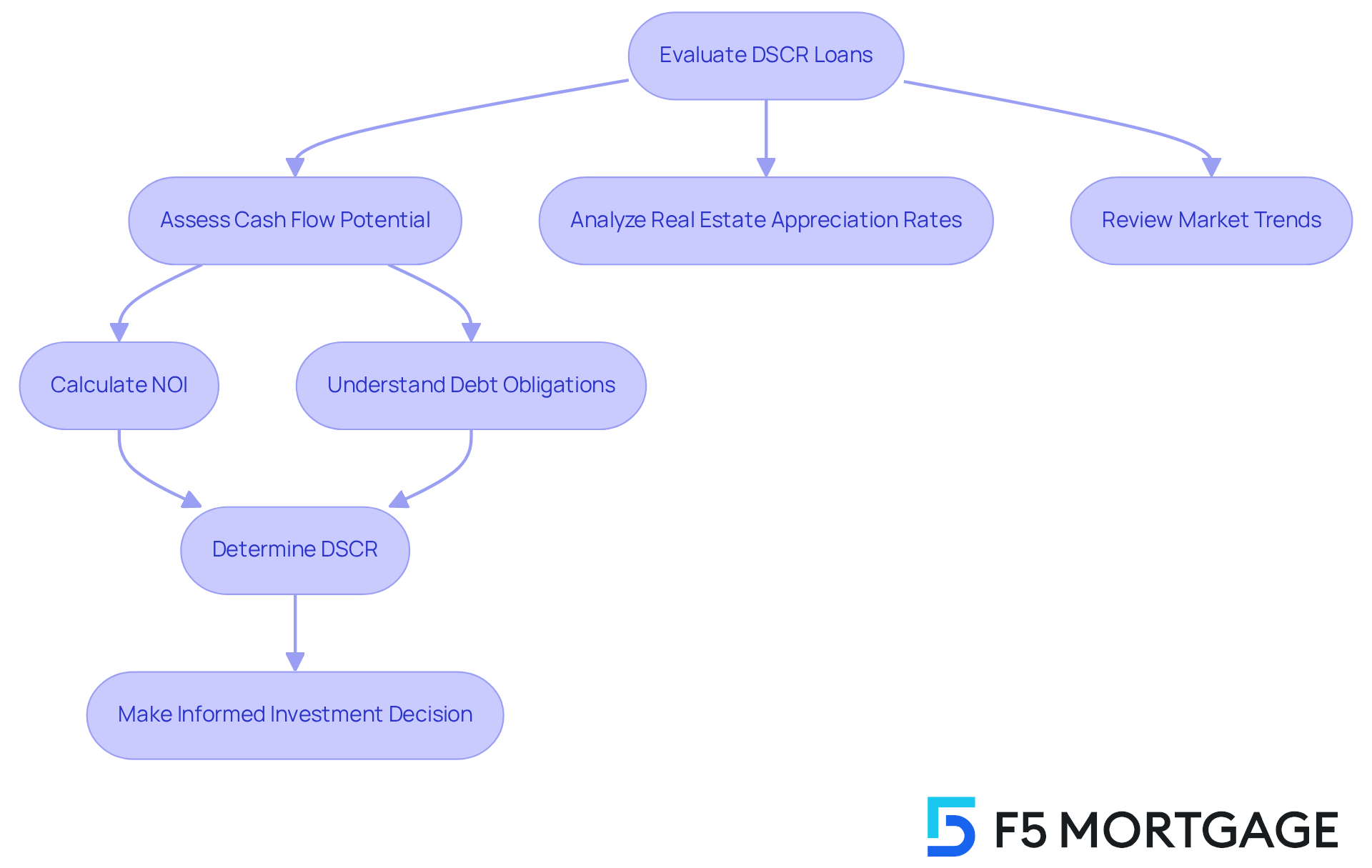

Long-Term Investment Strategy: Evaluating DSCR Loan Impact

Investors evaluating the DSCR loan pros and cons often face significant decisions that can impact their financial futures. We understand how challenging this can be, and it’s essential to carefully assess how these financing options align with your long-term investment strategies and overall financial objectives. Key factors to examine include:

- Cash flow potential

- Real estate appreciation rates

- Prevailing market trends

For instance, consider a property producing a net operating revenue (NOI) of $120,000 against annual debt obligations of $100,000. This scenario results in a debt service coverage ratio of 1.20, indicating positive cash flow that can facilitate additional investments. By strategically assessing these factors, you can utilize debt service coverage ratio financing to enhance your portfolio, ensuring sustainable growth and stability in your real estate endeavors.

Financial planners often emphasize the importance of integrating DSCR loans into a broader investment strategy by considering the DSCR loan pros and cons. These loans can provide you with flexibility and access to capital, illustrating the DSCR loan pros and cons, particularly as they do not require the stringent income verification typically needed by conventional loans. This approach not only opens the door to immediate investment opportunities but also positions you to capitalize on future market shifts. Remember, we’re here to support you every step of the way as you navigate these options.

Conclusion

Understanding the intricacies of debt service coverage ratio (DSCR) loans is essential for real estate investors looking to optimize their financing strategies. We know how challenging this can be, and these loans present unique advantages. Improved cash flow and flexible qualification criteria allow investors to secure funding based on the income generated by their properties rather than their personal financial profiles. However, it is crucial to weigh these benefits against potential drawbacks, including higher interest rates and market dependency risks that could impact financial stability.

Key insights from the article emphasize the importance of effective property management and thorough market analysis to maximize the advantages of DSCR loans. By maintaining high tenant satisfaction and conducting careful evaluations of rental income against debt obligations, investors can enhance their cash flow and ensure they meet their financial commitments. Furthermore, understanding the nuances of DSCR calculations and being aware of hidden fees can significantly influence the overall success of an investment strategy.

In conclusion, leveraging DSCR loans can be a powerful tool for growth in a competitive real estate landscape. We encourage investors to assess their long-term financial goals and consider how these loans fit into their broader investment strategies. By staying informed about market trends and seeking expert guidance, investors can navigate the complexities of DSCR financing with confidence. Together, we can pave the way for sustainable growth and enhanced financial security.

Frequently Asked Questions

What is F5 Mortgage’s focus in terms of financing solutions?

F5 Mortgage specializes in offering customized financing solutions for real estate investors, including tailored DSCR (Debt Service Coverage Ratio) loan options.

What financing option does F5 Mortgage offer for self-employed individuals?

F5 Mortgage offers bank statement financing for self-employed clients, which assesses earnings based on business cash flow using either 12 or 24 months of bank statements.

What are the qualifications needed for bank statement financing at F5 Mortgage?

To qualify for bank statement financing, you need a minimum FICO score of 680 and a down payment of at least 10%.

How do DSCR loans improve cash flow for property investors?

DSCR loans allow investors to secure funding based on the rental income generated by the property, rather than personal earnings, which enhances cash flow and facilitates the purchase of additional properties.

Can you provide an example of how DSCR loans work?

For example, if an asset generates $150,000 in annual gross rental income and has $100,000 in debt obligations, the Debt Service Coverage Ratio would be 1.5, indicating a healthy cash flow situation.

What is the approval process like for DSCR financing?

The approval process for DSCR financing is streamlined, reducing paperwork and speeding up decision-making, which allows for quicker access to capital.

Are there any downsides to DSCR loans?

One downside is that DSCR loans may have slightly higher interest rates compared to traditional investment financing, which should be considered when evaluating funding options.

How does F5 Mortgage help clients with interest rates on DSCR loans?

F5 Mortgage partners with over two dozen top lenders to offer ultra-competitive rates tailored to clients’ unique needs and provides a personalized concierge service to help evaluate interest rates.

What do financial advisors say about leveraging cash flow through DSCR financing?

Financial advisors emphasize that leveraging cash flow through DSCR financing can enhance investment opportunities and provide faster access to capital without the constraints of personal income verification.

What has been the experience of borrowers using DSCR loans?

Many borrowers, from first-time buyers to seasoned property owners, report significant portfolio growth through the strategic use of DSCR financing, improving their overall cash flow and long-term financial stability.