Overview

Navigating the home loan pre-approval process can feel overwhelming for families. We understand how challenging this can be, and we’re here to support you every step of the way. The article focuses on the essential steps involved in this process, emphasizing the importance of understanding and following them.

- Assessing your credit score is crucial. This step lays the foundation for your mortgage journey.

- Compiling the necessary documents will help streamline the process and keep things organized.

- Maintaining open communication with lenders is equally important, as it fosters a smooth and successful pre-approval experience.

By following these steps, you can enhance your chances of securing a favorable mortgage. Remember, you’re not alone in this journey, and with the right guidance, you can achieve your homeownership dreams.

Introduction

Navigating the home loan pre-approval process can feel like an overwhelming journey for families. We know how challenging this can be, often riddled with complexities and uncertainties. However, understanding the essential steps involved not only demystifies the process but also empowers families to secure the best mortgage options available. What if there was a clear roadmap that could guide you through each stage, from assessing credit scores to selecting the right lender?

This article outlines ten crucial steps that will help families confidently approach their home-buying journey. We’re here to support you every step of the way, ensuring you are well-prepared to turn your dreams into reality.

F5 Mortgage: Personalized Mortgage Consultations to Kickstart Your Pre-Approval Process

At F5 Mortgage, we understand how challenging the mortgage process can be. That’s why personalized mortgage consultations are at the heart of our pre-approval process. These consultations allow families to openly share their financial goals, budget constraints, and unique needs. By taking this tailored approach, we not only help identify the most suitable loan options but also equip you with the knowledge needed to navigate the complexities of securing a mortgage.

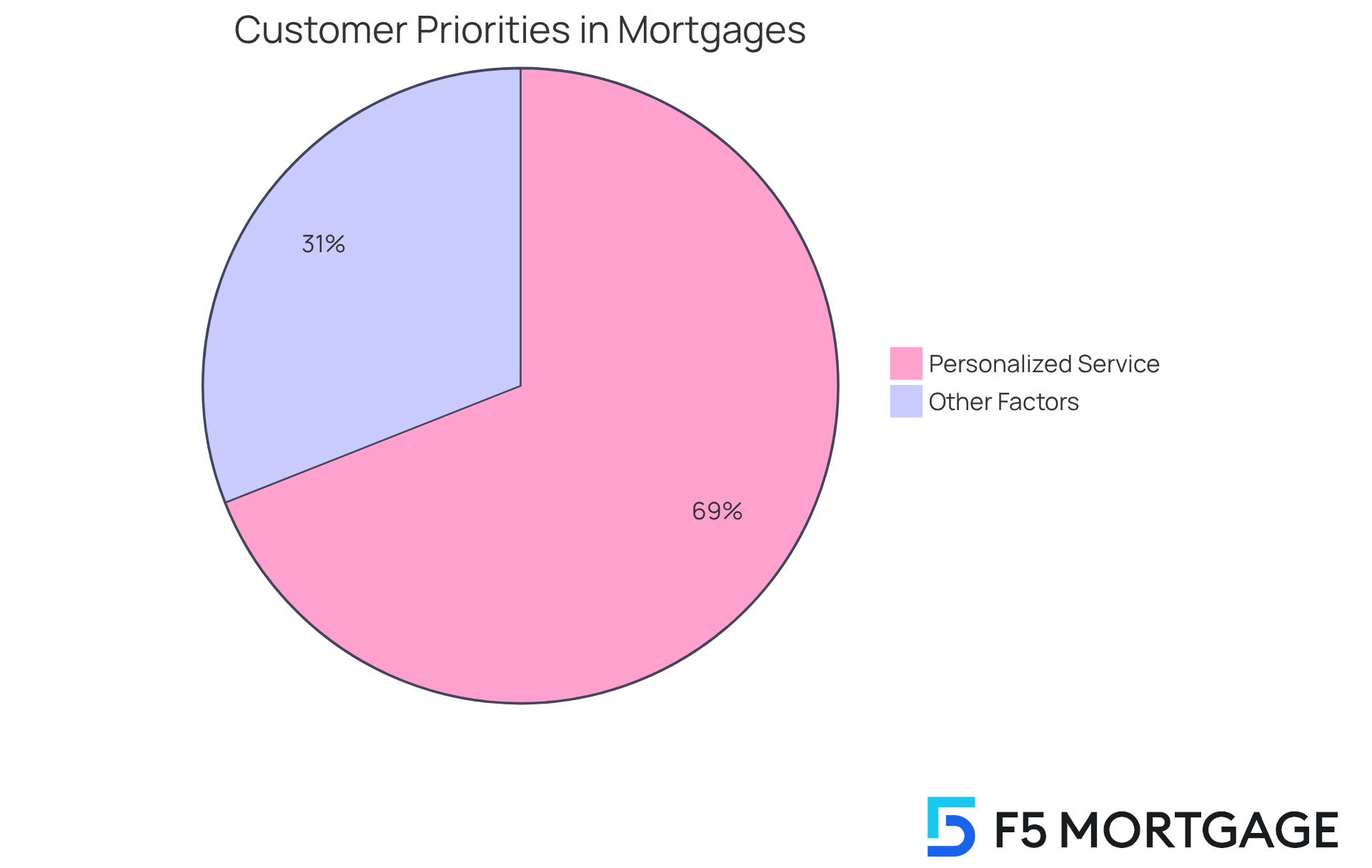

Our loan officers are dedicated to providing the ‘red carpet treatment,’ ensuring that you feel confident and well-informed as you embark on your home-buying journey. Research shows that 69% of mortgage customers prioritize personalized service over the lowest interest rates. This highlights the importance of tailored advice in building trust and satisfaction.

Successful mortgage consultations significantly enhance client satisfaction. In fact, customers report a 30% increase in their perception of their lender as a trusted financial partner when they receive personalized guidance. This commitment to individualized support is especially crucial for first-time homebuyers and self-employed individuals, who often face unique challenges in the lending environment.

At F5 Mortgage, we’re here to support you every step of the way, ensuring a smooth and efficient approval experience. Together, we can make your home-buying dreams a reality.

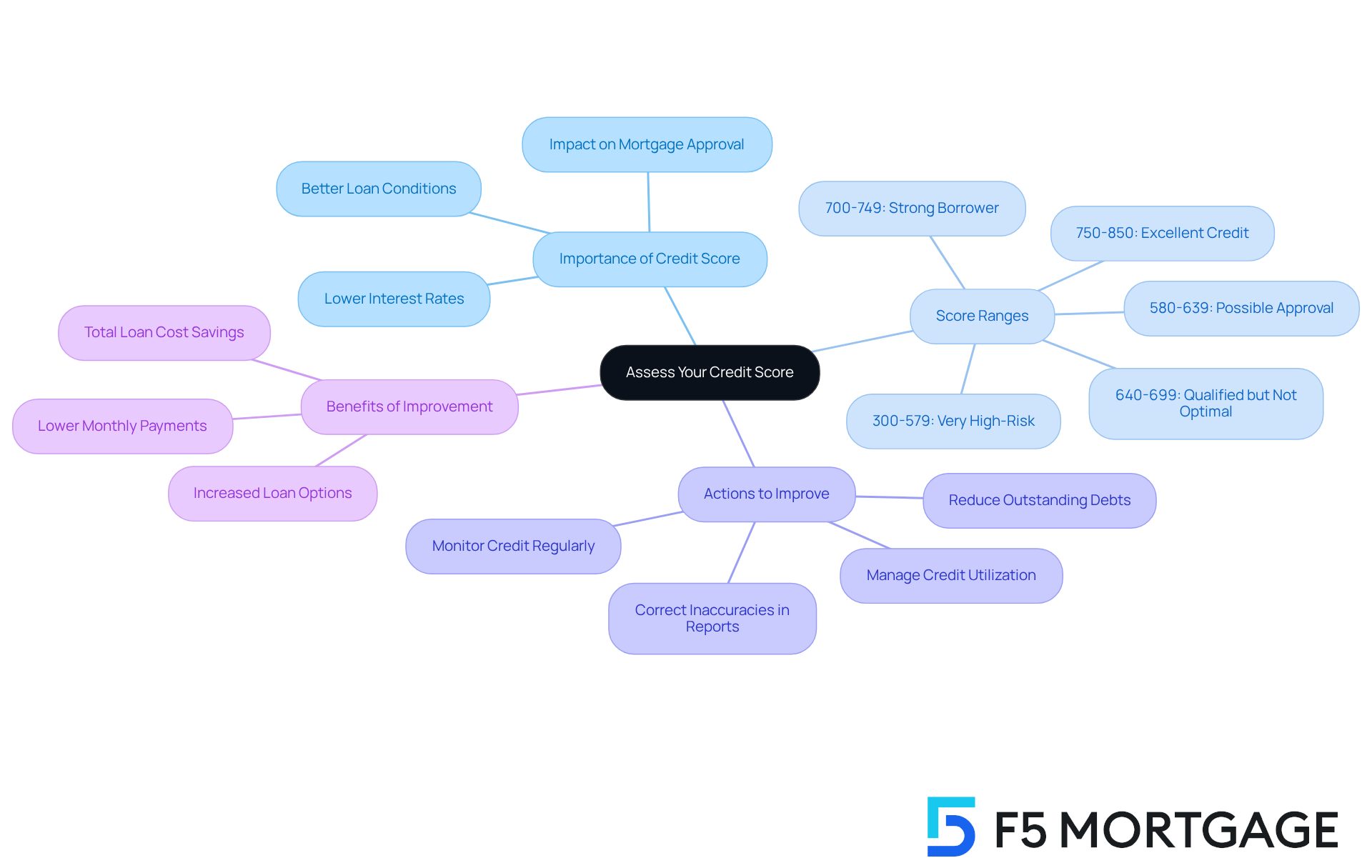

Assess Your Credit Score: A Critical Step Before Mortgage Pre-Approval

Before seeking prior approval, it’s essential for households to take a moment to assess their credit scores. We understand how daunting this can be, but a higher score often leads to better loan conditions and lower interest rates. Clients can easily access their credit reports from major bureaus to spot any discrepancies or areas that might need improvement.

For example, a credit score of 740 or higher usually qualifies borrowers for the best mortgage rates. On the other hand, scores below 620 can significantly limit options. Research shows that improving your credit score by just 20-30 points can lower monthly payments and total loan costs, resulting in considerable savings over the life of a mortgage.

Families looking to enhance their scores can take proactive steps. This includes:

- Reducing outstanding debts

- Correcting inaccuracies in their reports

- Managing credit utilization effectively

Remember, monitoring your credit and making informed financial decisions are crucial for successfully completing the home loan pre-approval process to secure favorable mortgage rates.

By prioritizing credit health, families can greatly improve their chances during the home loan pre-approval process to obtain a favorable mortgage. This not only makes home purchasing easier but also more affordable. We’re here to support you every step of the way as you navigate this important journey.

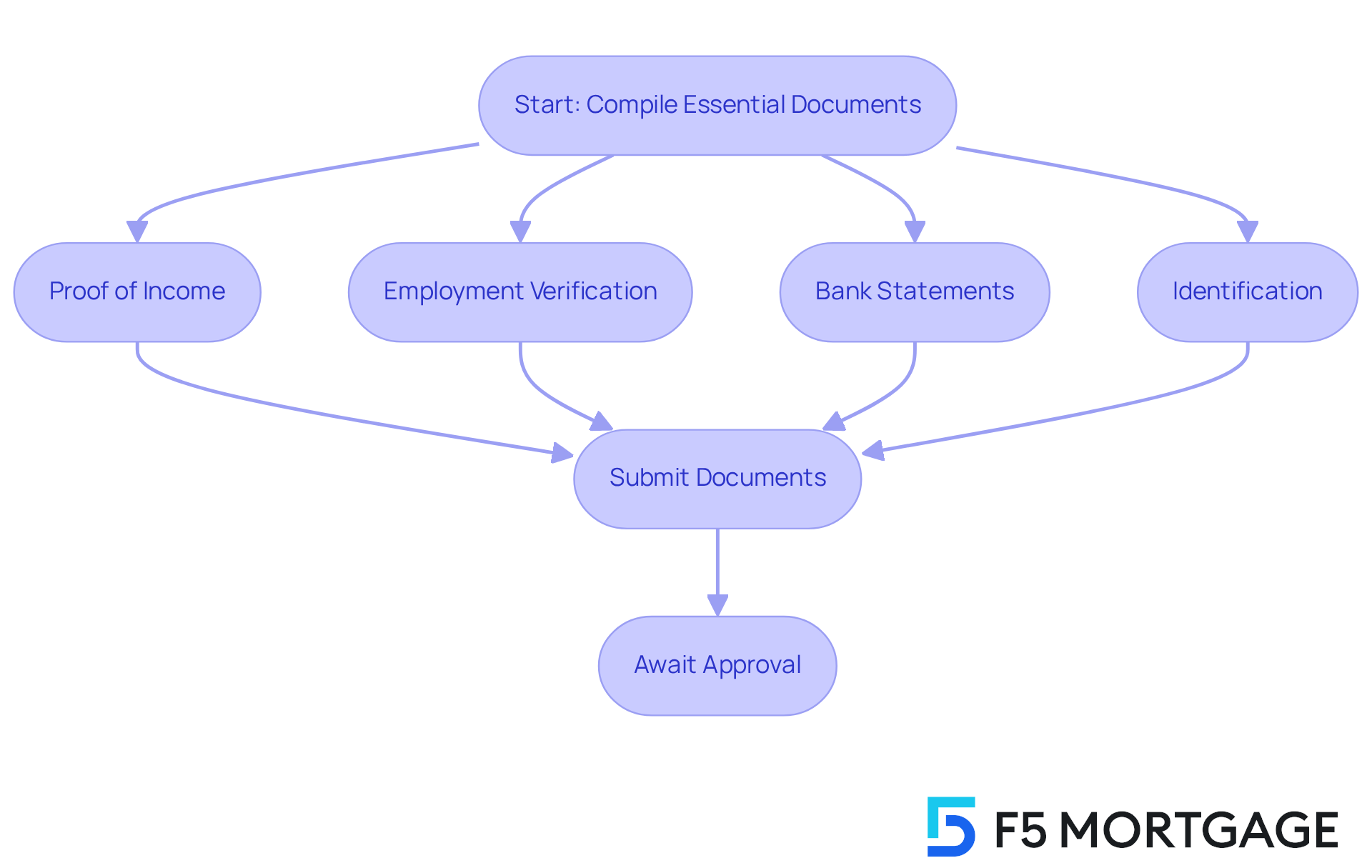

Compile Essential Documents: Key Requirements for Mortgage Pre-Approval

Compiling essential documents is a pivotal step in the home loan pre-approval process, and we understand how challenging this can be. Families should prepare a comprehensive set of items, including:

- Proof of income such as pay stubs and tax returns

- Employment verification

- Bank statements

- Identification

This preparation not only streamlines the home loan pre-approval process but also indicates to lenders that the borrower is organized and committed to securing a mortgage.

Typically, households may take a few days to collect these documents, depending on their financial situation. By ensuring thoroughness and honesty in their submissions, borrowers can avoid complications that might delay approval. Additionally, understanding the latest requirements for the home loan pre-approval process—such as the need for a stable credit history and a clear debt-to-income ratio—can further enhance their chances of success. This proactive approach enables households to navigate the mortgage landscape with confidence, ultimately facilitating a smoother home-buying experience.

Furthermore, families in Colorado have various refinancing options available through F5 Mortgage. These include:

- Conventional loans

- FHA loans

- VA loans

FHA loans, backed by the government, are accessible to homeowners with lower credit scores, typically requiring a minimum score of 580. VA loans provide advantageous mortgage rates and an efficient application procedure for military personnel and their partners. These options provide additional pathways to securing favorable mortgage terms, and we’re here to support you every step of the way.

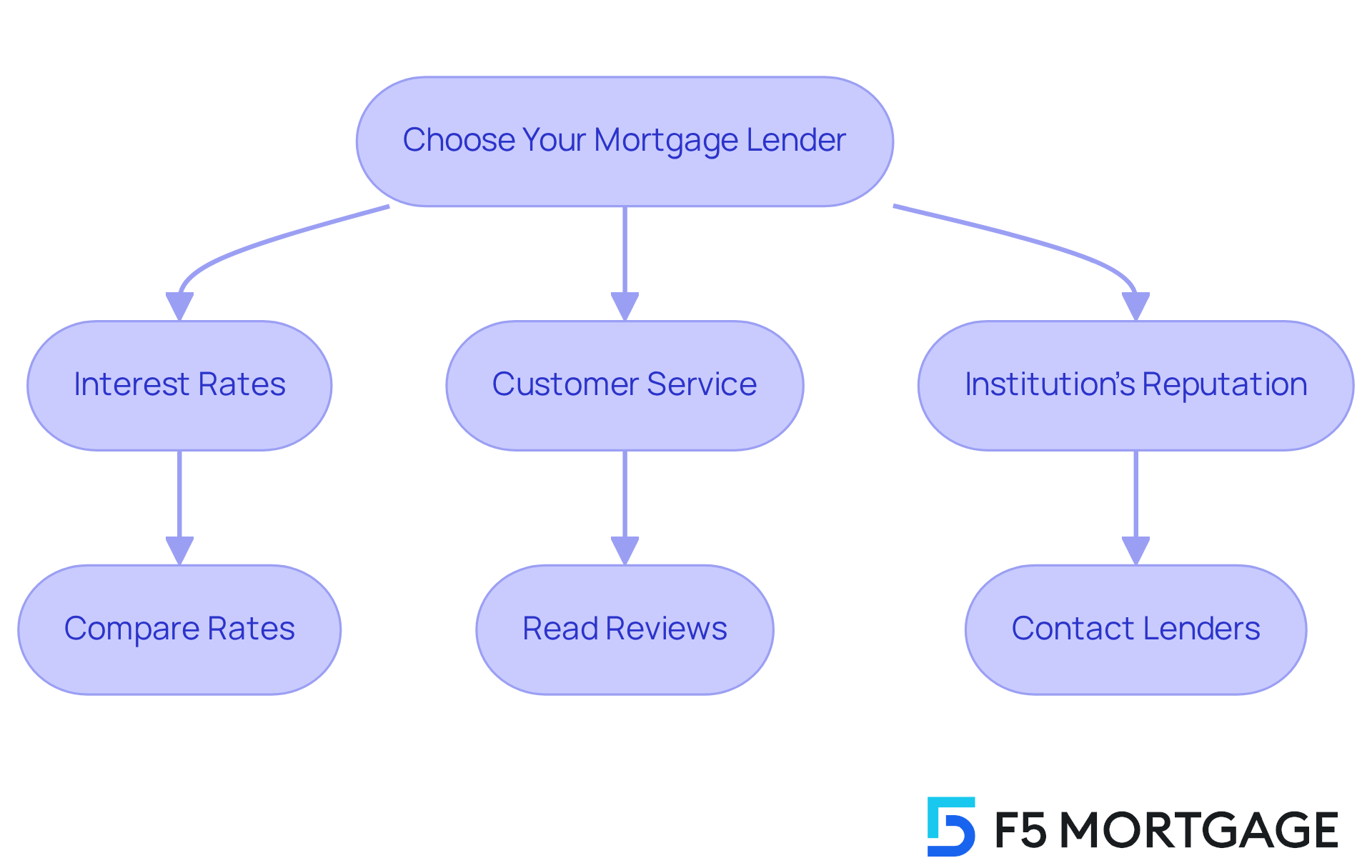

Select Your Lender: How to Choose the Right Mortgage Provider for Pre-Approval

Choosing the right financial institution is crucial for a smooth pre-approval process. We understand how overwhelming this can be, and it’s important for families to consider several key factors, such as:

- Interest rates

- Customer service

- The institution’s reputation

By comparing rates, costs, and terms, households can ensure that their choices align with their financial needs.

As an independent broker, F5 Mortgage is here to support you every step of the way, offering access to a variety of financial institutions. This allows families to compare options efficiently. Working with a lender who understands the unique challenges you face can significantly enhance your experience.

Research shows that independent mortgage brokers often secure better loan terms than borrowers might find on their own. They can negotiate favorable conditions, including:

- Lower interest rates

- Flexible repayment options

This advantage is especially beneficial for families navigating the complexities of home financing. Remember, we’re here to help you find the best path forward.

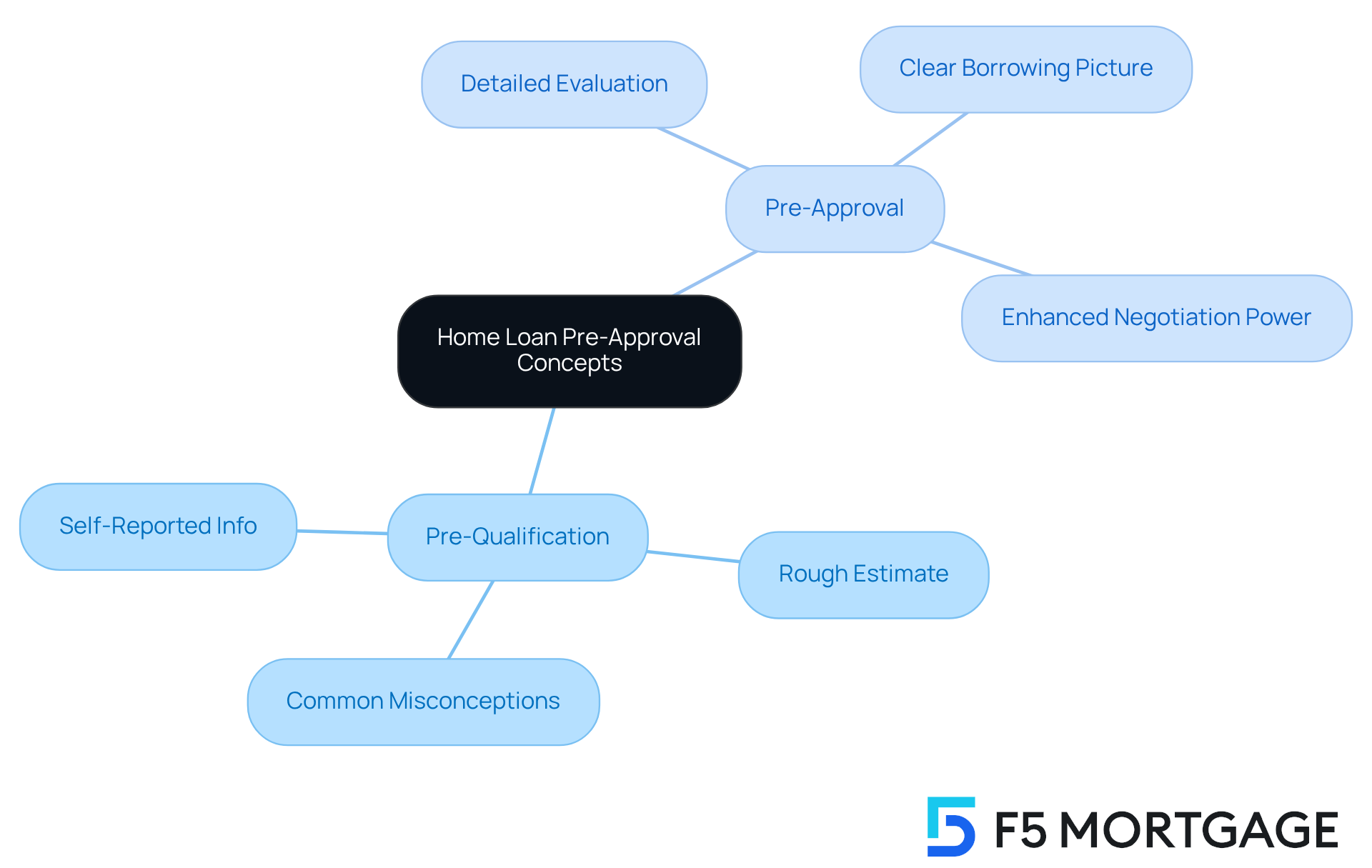

Differentiate Pre-Qualification from Pre-Approval: Know Your Options

Understanding the difference between pre-qualification and pre-authorization is crucial for families embarking on the home loan pre approval process. Pre-qualification acts as a preliminary assessment based on self-reported financial information, providing a rough estimate of borrowing capacity. On the other hand, pre-authorization involves a detailed evaluation of financial documents by the lender, leading to a clearer picture of how much a household can borrow. This process not only fosters trust with sellers but also empowers families to make informed decisions in a competitive market.

We know how challenging this can be, and statistics show that many homebuyers are unclear about these terms. A significant number believe that pre-qualification guarantees a loan, which can lead to missed opportunities or financial strain. For instance, families who successfully navigate the initial approval stage often express feeling more confident and prepared. Case studies reveal that individuals who secure prior approval are in a stronger position to negotiate with sellers.

Ultimately, obtaining advance authorization is a strategic step that can simplify the home loan pre approval process. It offers families a clearer financial pathway and enhances their chances of securing their dream home. We’re here to support you every step of the way as you take this important journey.

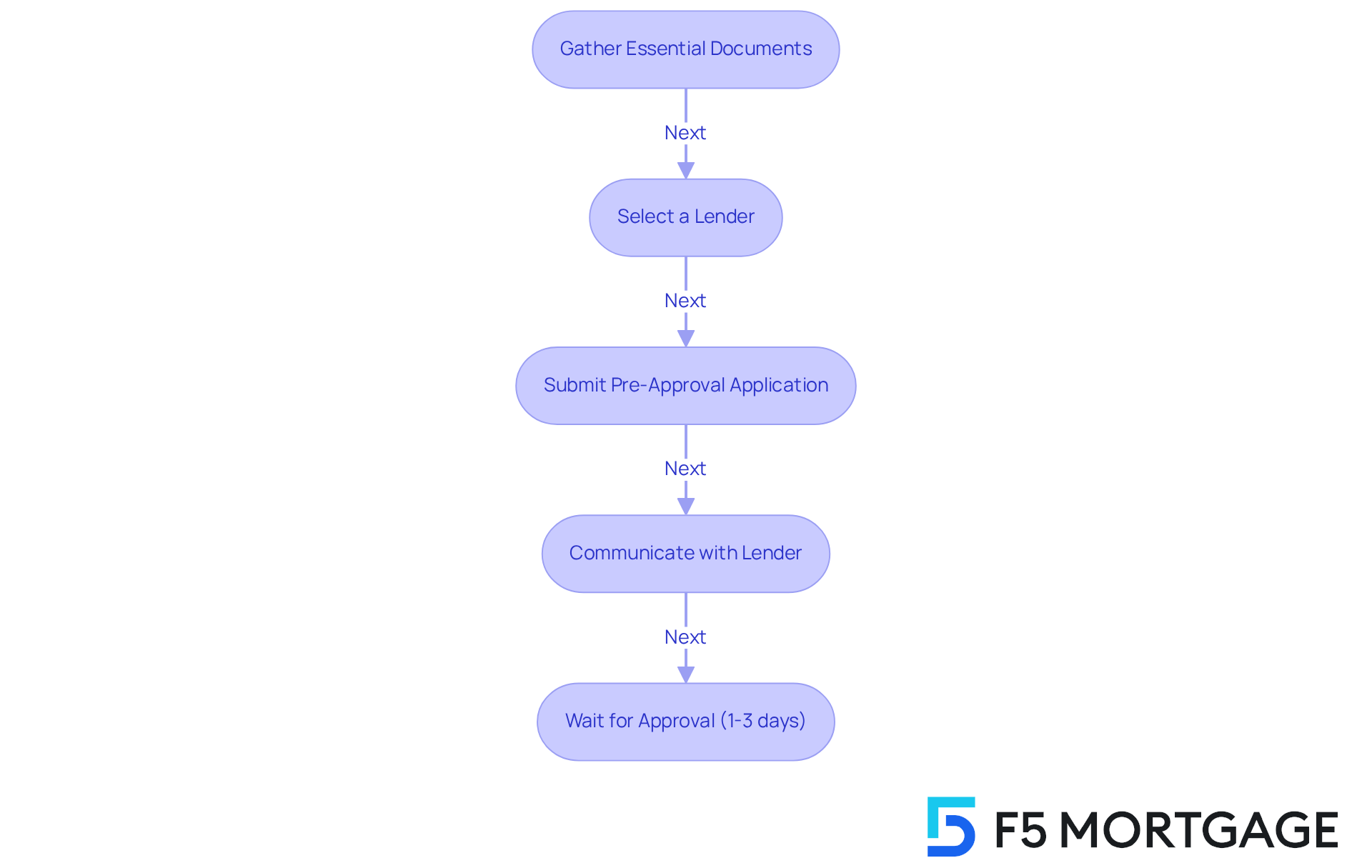

Submit Your Pre-Approval Application: Steps to Take and What to Expect

Once families have gathered their essential documents and selected a lender, the next step is to submit the pre-approval application. At F5 Mortgage, we understand how important this moment is, and we offer convenient options to apply—whether online, by phone, or through chat. This flexibility allows families to tailor a loan that aligns with their specific goals and needs.

The home loan pre-approval process typically involves completing a detailed application form and attaching necessary documents such as proof of income, credit reports, and bank statements. We know how critical accuracy and completeness are; any discrepancies can lead to delays, which can be frustrating. That’s why maintaining open communication with your financial institution during this phase is so important. This proactive approach not only helps address any potential issues quickly but also keeps families informed about the status of their application, ensuring a smoother transition into the next steps of their home buying journey.

Lenders usually assess approval requests within one to three days, so it’s helpful for families to be prepared for this timeframe. It’s also essential to acknowledge that a hard inquiry on credit during this process may result in a minor decrease in credit scores. We encourage households to consider this when applying.

To simplify the process, families can organize their financial documents in a dedicated folder and review their credit reports for any errors before submission. This preparation can help avoid common pitfalls that might delay approval. Remember, we’re here to support you every step of the way.

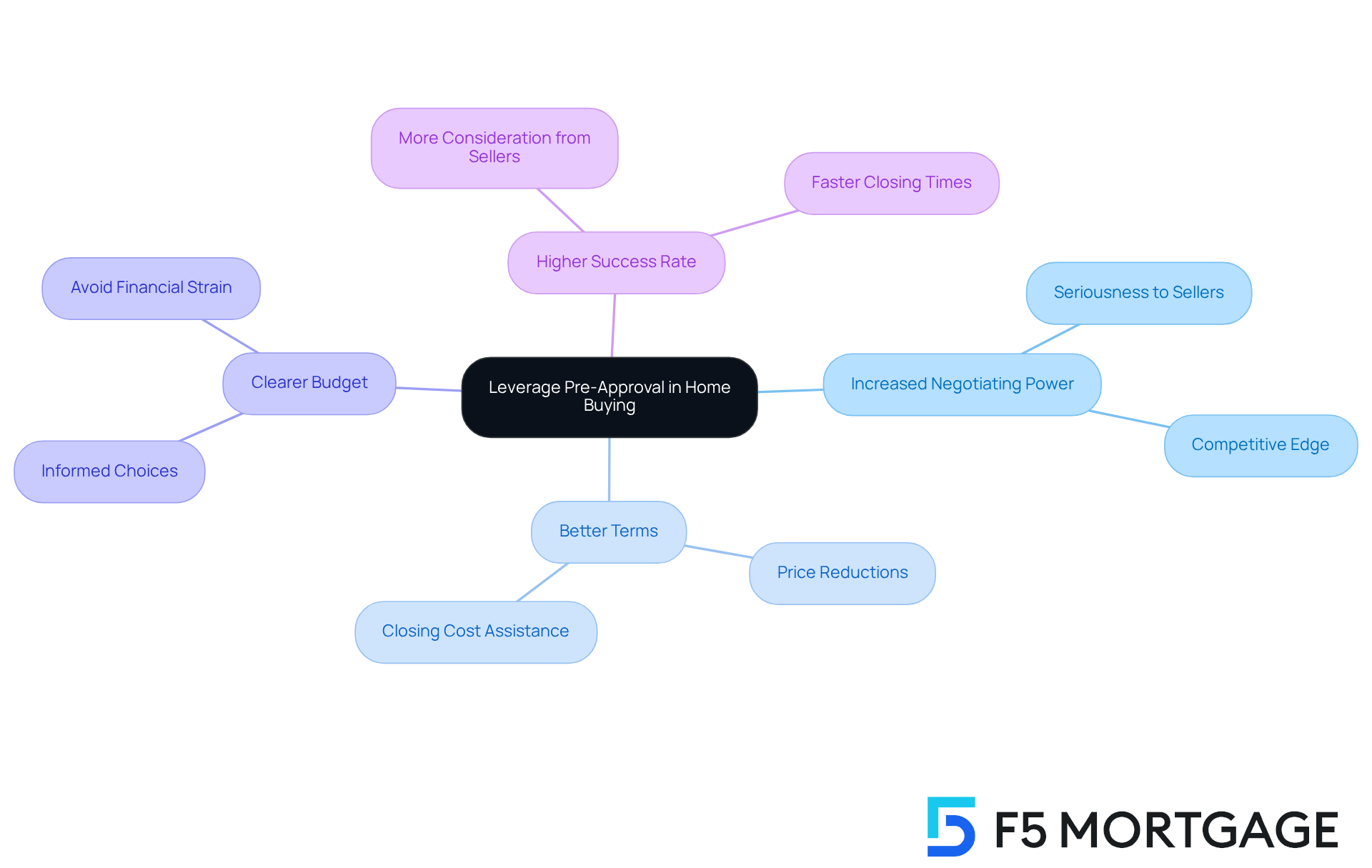

Leverage Pre-Approval: How It Strengthens Your Home Buying Position

An initial approval letter is an invaluable resource for families entering the home purchasing market and engaging in the home loan pre approval process. It not only shows sellers that you are serious and financially prepared, but it also boosts your negotiating power in competitive situations. In fact, homes bought through the home loan pre approval process often enjoy a higher success rate, as sellers are more likely to consider offers from buyers who have already secured funding.

For instance, families that present a pre-authorization letter can negotiate better terms, such as price reductions or assistance with closing costs. These improvements can be crucial in securing your dream home. In today’s competitive housing market, where multiple offers are common, having this letter can truly be the differentiator that leads to a successful purchase.

Moreover, the benefits of prior authorization extend beyond simply navigating the home loan pre approval process. It provides families with a clearer picture of their budget, enabling informed choices and helping to avoid potential financial strain. With the right preparation and an approval letter in hand, families can navigate the home buying process with confidence, ultimately leading to quicker and more favorable outcomes. We know how challenging this can be, and we’re here to support you every step of the way.

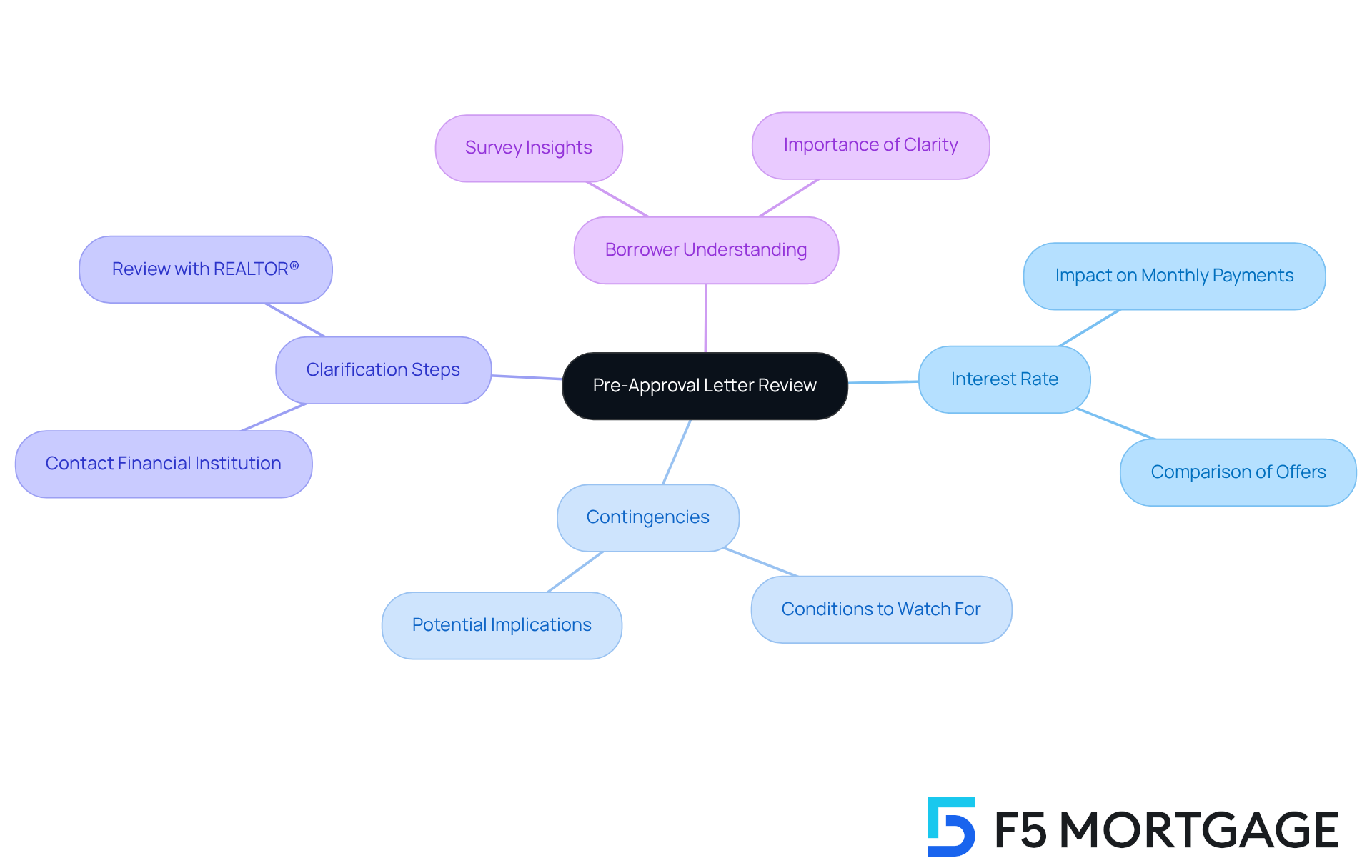

Review Your Pre-Approval Letter: Understand the Terms and Conditions

Upon receiving the authorization letter, we know how overwhelming it can feel. Households must take the time to thoroughly review its contents. This critical document specifies the maximum loan amount, interest rate, and any conditions that must be satisfied during the home loan pre-approval process before final approval. A recent survey revealed that almost 60% of borrowers do not completely grasp the conditions of their approval in advance. This highlights the necessity for a careful examination.

Imagine families evaluating various pre-approval letters, striving to understand the consequences of each offer. Key aspects to concentrate on include:

- The interest rate, which can greatly influence monthly payments

- Any contingencies that may affect the home loan pre-approval process

If any terms seem unclear, we encourage households to reach out to their financial institution for clarification. This understanding is essential for setting realistic expectations and effectively planning the next steps in the home-buying journey. Remember, we’re here to support you every step of the way.

Prepare for Closing: Final Steps After Mortgage Pre-Approval

After completing the home loan pre approval process, families should focus on preparing for the closing stage, a vital step toward homeownership. This preparation involves:

- Finalizing the home search

- Conducting necessary inspections

- Ensuring that all financial documents are meticulously organized

We know how challenging this can be, so staying in close communication with the lender is essential to address any last-minute requirements or changes that may arise. Proactive involvement during this phase can significantly reduce the risk of delays, which statistics indicate are common in the closing stage due to incomplete documentation or last-minute financial alterations.

For example, households that have effectively managed the closing process often emphasize the importance of having all necessary documents ready, including:

- Proof of income

- Asset documentation

- Personal identification

This thorough preparation not only streamlines the process but also positions buyers as serious contenders in a competitive market. In fact, homes in areas like Kansas City frequently see offers from pre-approved buyers prioritized by sellers, underscoring the value of being well-prepared.

Moreover, it’s crucial for families to be aware that the home loan pre approval process typically results in letters that generally expire after 120 days, making prompt action essential. Interacting with local financial institutions that understand the market dynamics can further enhance the likelihood of a smooth closing. By following these steps and adopting a proactive strategy, families can navigate the closing process with confidence, ensuring a successful transition into their new home.

![]()

Follow Up with Your Lender: Maintain Communication Throughout the Pre-Approval Process

We understand how challenging the home loan pre-approval process can be during the pre-approval stage. It’s essential for households to maintain consistent communication with their financial institution. At F5 Mortgage, we are here to support you every step of the way. Think of us as your personal concierge, assisting you with the application, discussing your objectives, and helping you find the best financing option tailored to your needs.

This open line of communication ensures you stay updated on your application status. You can promptly address any questions or concerns that arise. We understand that navigating the home loan pre-approval process can be daunting, but we’re here to make it smoother and more efficient by working directly with the lender on your behalf.

Additionally, our commitment to you doesn’t end at closing. We offer post-closing support to assist you with any questions or direct you to the correct contact. Remember, we are here for you, ready to help you overcome any challenges that may come your way.

Conclusion

Navigating the home loan pre-approval process can feel overwhelming for families, but understanding the essential steps can empower them to make informed decisions. We know how challenging this can be. By emphasizing the importance of personalized consultations, assessing credit scores, and compiling necessary documents, families can lay a solid foundation for a successful mortgage application. Each stage—from selecting the right lender to understanding the nuances of pre-approval letters—plays a crucial role in positioning families for homeownership.

Key insights from the article highlight how tailored guidance from mortgage professionals, like those at F5 Mortgage, can greatly enhance client satisfaction and trust. Families are encouraged to prioritize their credit health, gather essential documentation, and differentiate between pre-qualification and pre-approval. These actions not only streamline the process but also enhance negotiating power in a competitive housing market.

Ultimately, the home loan pre-approval process is not just about securing financing; it’s about laying the groundwork for a successful home-buying experience. Families are urged to approach this journey with confidence, leveraging the resources available to them for a smoother transition into homeownership. By taking proactive steps and maintaining open communication with lenders, families can navigate this complex landscape and turn their home-buying dreams into reality. We’re here to support you every step of the way.

Frequently Asked Questions

What is the purpose of personalized mortgage consultations at F5 Mortgage?

Personalized mortgage consultations at F5 Mortgage are designed to help families share their financial goals, budget constraints, and unique needs, allowing for tailored advice and suitable loan options while navigating the mortgage process.

How does F5 Mortgage ensure a positive experience for clients during the mortgage process?

F5 Mortgage provides a ‘red carpet treatment’ through dedicated loan officers who aim to make clients feel confident and well-informed throughout their home-buying journey.

Why is personalized service important in the mortgage process?

Research indicates that 69% of mortgage customers prioritize personalized service over the lowest interest rates, emphasizing the role of tailored advice in building trust and satisfaction.

How does personalized guidance impact client satisfaction at F5 Mortgage?

Successful mortgage consultations can increase clients’ perception of their lender as a trusted financial partner by 30%, particularly benefiting first-time homebuyers and self-employed individuals.

What should families do before seeking mortgage pre-approval?

Families should assess their credit scores, as a higher score can lead to better loan conditions and lower interest rates. They can obtain their credit reports from major bureaus to identify any discrepancies.

What credit score is typically required for the best mortgage rates?

A credit score of 740 or higher usually qualifies borrowers for the best mortgage rates, while scores below 620 can significantly limit loan options.

What steps can families take to improve their credit scores?

Families can improve their credit scores by reducing outstanding debts, correcting inaccuracies in their reports, and managing credit utilization effectively.

What essential documents are required for mortgage pre-approval?

Key documents needed for mortgage pre-approval include proof of income (pay stubs and tax returns), employment verification, bank statements, and identification.

How can families prepare for the mortgage pre-approval process?

By compiling necessary documents and ensuring thoroughness and honesty in their submissions, families can streamline the pre-approval process and demonstrate their commitment to securing a mortgage.

What refinancing options are available through F5 Mortgage in Colorado?

F5 Mortgage offers various refinancing options, including conventional loans, FHA loans (for those with lower credit scores), and VA loans (for military personnel and their partners).