Overview

This article is dedicated to helping you navigate the best sources for home equity loan rates in Canada. We understand how overwhelming this process can feel, and we’re here to support you every step of the way. You’ll discover various options, including:

- Personalized consultations from mortgage brokers

- Comparison tools from platforms like NerdWallet

- Official resources from Canada.ca

Each of these avenues emphasizes the importance of tailored financial advice, empowering you to make informed decisions that can lead to securing competitive rates. Remember, you’re not alone in this journey; there are resources available to guide you.

Introduction

Navigating the world of home equity loans in Canada can feel overwhelming. We understand how challenging it is, especially with fluctuating interest rates and so many options available. For homeowners looking to leverage their property’s value, knowing where to find the best rates is essential for making informed financial decisions.

This article explores seven key sources that offer competitive home equity loan rates, providing valuable insights and guidance for families striving to enhance their financial stability.

With so many choices out there, how can you ensure you’re choosing the right path for your unique needs? We’re here to support you every step of the way.

F5 Mortgage: Personalized Consultations for Competitive Home Equity Loan Rates

At F5 Mortgage, we understand how challenging the can be. Our tailored consultations empower clients to explore the diverse landscape of property financing options. Our dedicated representatives, driven by a passion for helping families realize their dreams, take the time to evaluate each client’s unique . This personalized approach allows us to recommend the and terms that truly fit their needs.

Currently, the home equity loan best rates in Canada for range from 7% to 12%, with favorable options available below 8% for a 10-year term. By streamlining the decision-making process, we aim to enhance , as reflected in our 5-star reviews on platforms like Google and Zillow. Many of our successful client stories highlight how our have led to positive financial outcomes, reinforcing the importance of partnering with a and financial goals.

As the residential collateral financing market in Canada evolves, the value of becomes increasingly clear. We’re here to , ensuring that your journey toward homeownership is as smooth and rewarding as possible.

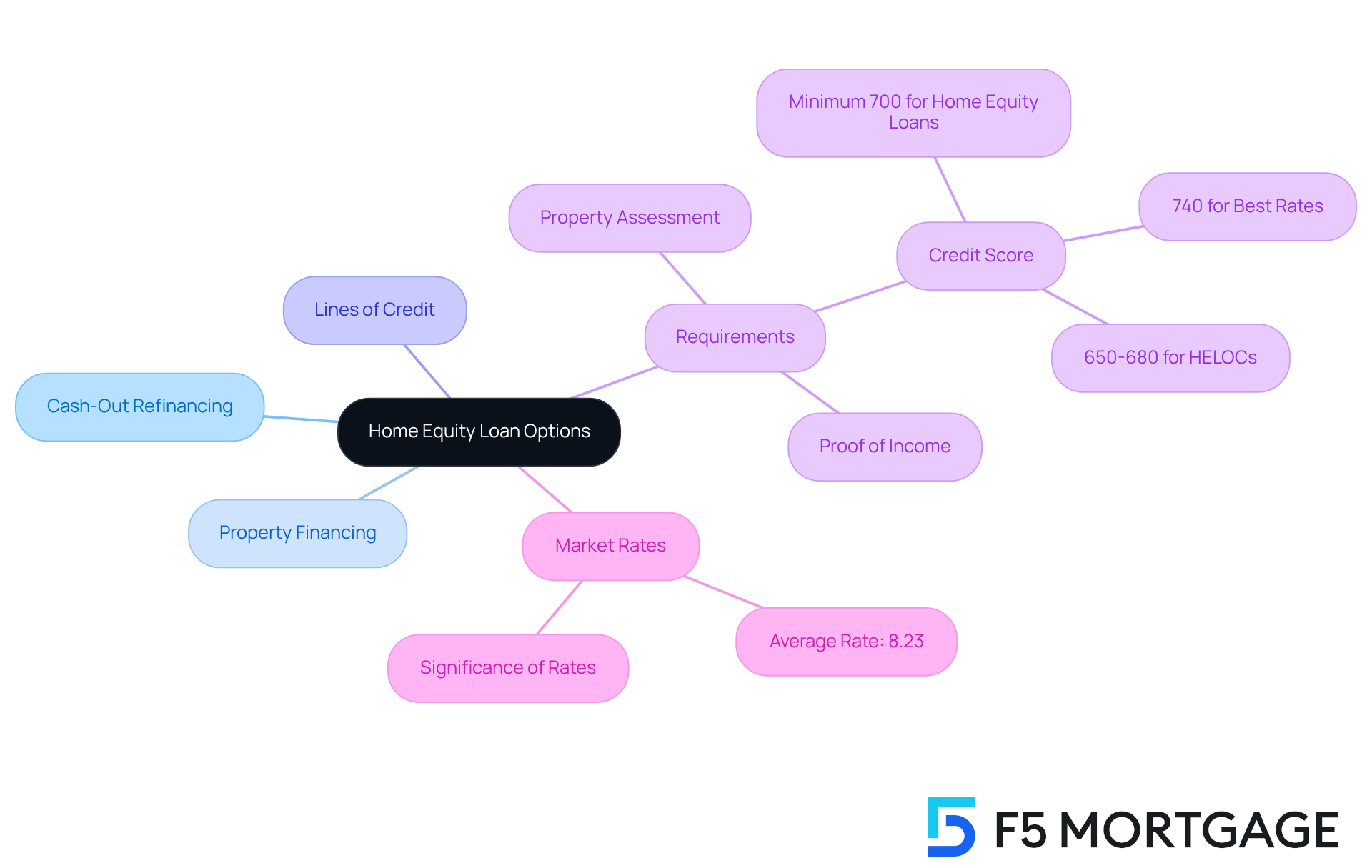

Bankrate: Comprehensive Guide to Home Equity Loan Requirements and Rates

At , we understand how challenging navigating in California can be. This option allows homeowners to refinance their existing mortgage for a higher amount than owed, giving them access to the difference in cash. For families looking to improve their homes, this can be a lifeline, enabling access to like renovations or .

But cash-out refinancing isn’t the only option. We encourage property owners to explore other avenues to access their resources, such as and lines of credit. To secure favorable interest rates, it’s important to maintain a and provide proof of income. Additionally, a property assessment is essential to determine the residence’s worth, which can influence the amount of assets available.

Currently, market rates for , reflecting broader economic conditions. Notably, a significant portion—46%—of residential financing is allocated for property improvements. This highlights the common goal families have when utilizing these funds.

By understanding these factors and seeking from [F5 Mortgage](https://f5mortgage.com/7-reasons-local-mortgage-brokers-are-essential-for-families/), families can navigate the complexities of property financing with confidence. We’re here to support you every step of the way, empowering you to make tailored to your financial situation.

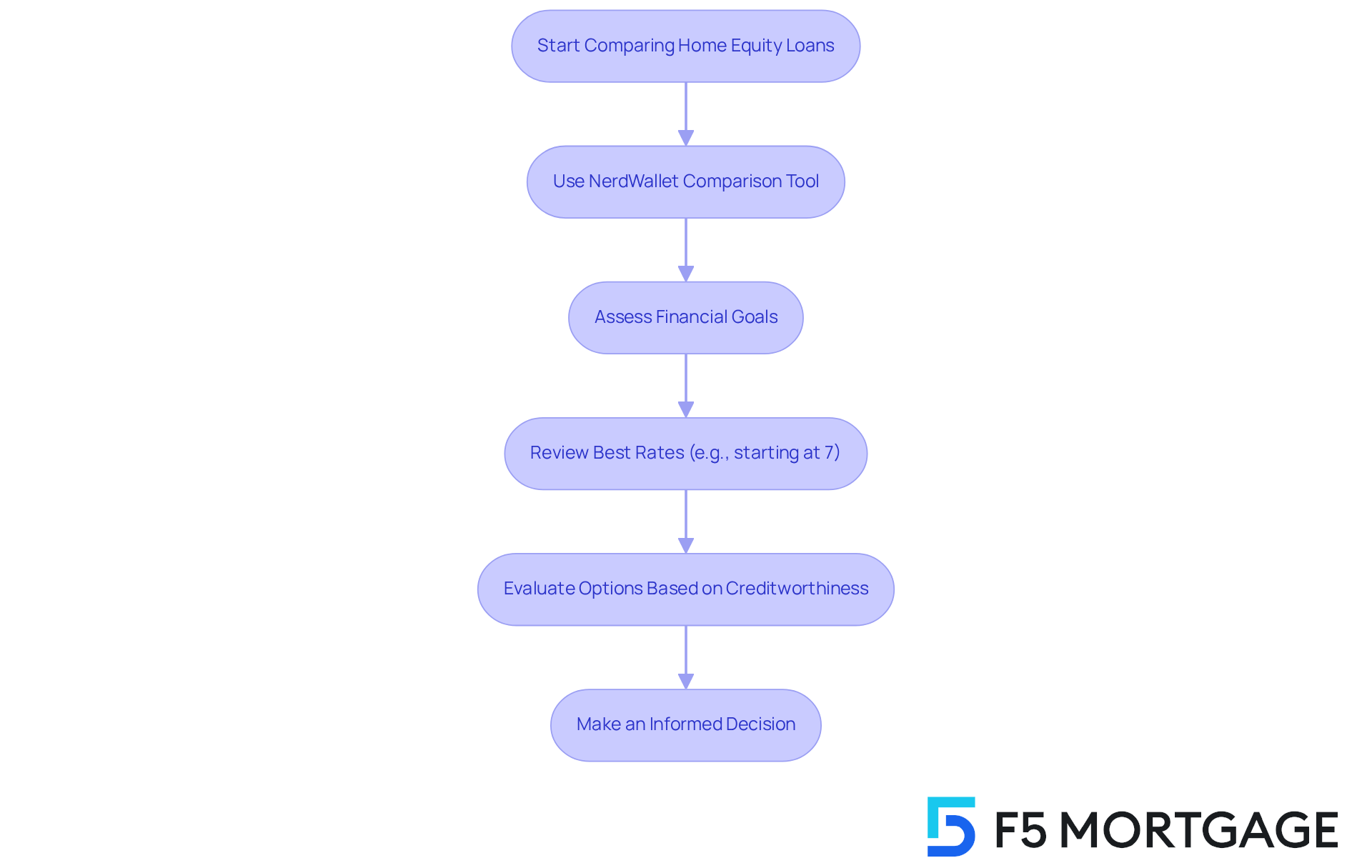

NerdWallet: Expert Comparisons of Home Equity Loans and Rates

NerdWallet serves as a vital resource for families aiming to compare various and options. We understand how overwhelming this process can be, and by providing side-by-side comparisons, it empowers borrowers to find the choices that best align with their . This platform is particularly helpful for families striving to maximize their while keeping costs manageable.

Experts in the industry emphasize that using can lead to . By actively comparing rates, families may uncover financing options that offer the home equity loan best rates with , depending on their creditworthiness and value ratios. Imagine the relief of finding a better deal that suits your needs!

Real-life examples illustrate how families have successfully leveraged for renovations or debt consolidation, ultimately enhancing their . We know that navigating the complexities of can be daunting, but by being informed and strategic, you can make choices that support your long-term financial well-being. Remember, we’re here to support you every step of the way.

Canada.ca: Official Resources for Home Equity Products and Services

Navigating the world of property-backed financial products can be daunting, but for Canadians like you. It offers comprehensive information on eligibility criteria, application procedures, and consumer rights, empowering you to . By utilizing these official resources, you can confidently maneuver through the intricacies of residential financing.

We understand that many Canadians are increasingly fascinated by the possibilities of their as a financial resource. Financial experts emphasize the importance of grasping the application process, including the appraisal and underwriting stages, which can significantly impact your borrowing experience. The lender will request a property appraisal to ascertain the current market value of your asset, revealing how much ownership you possess. This, in turn, influences your rates.

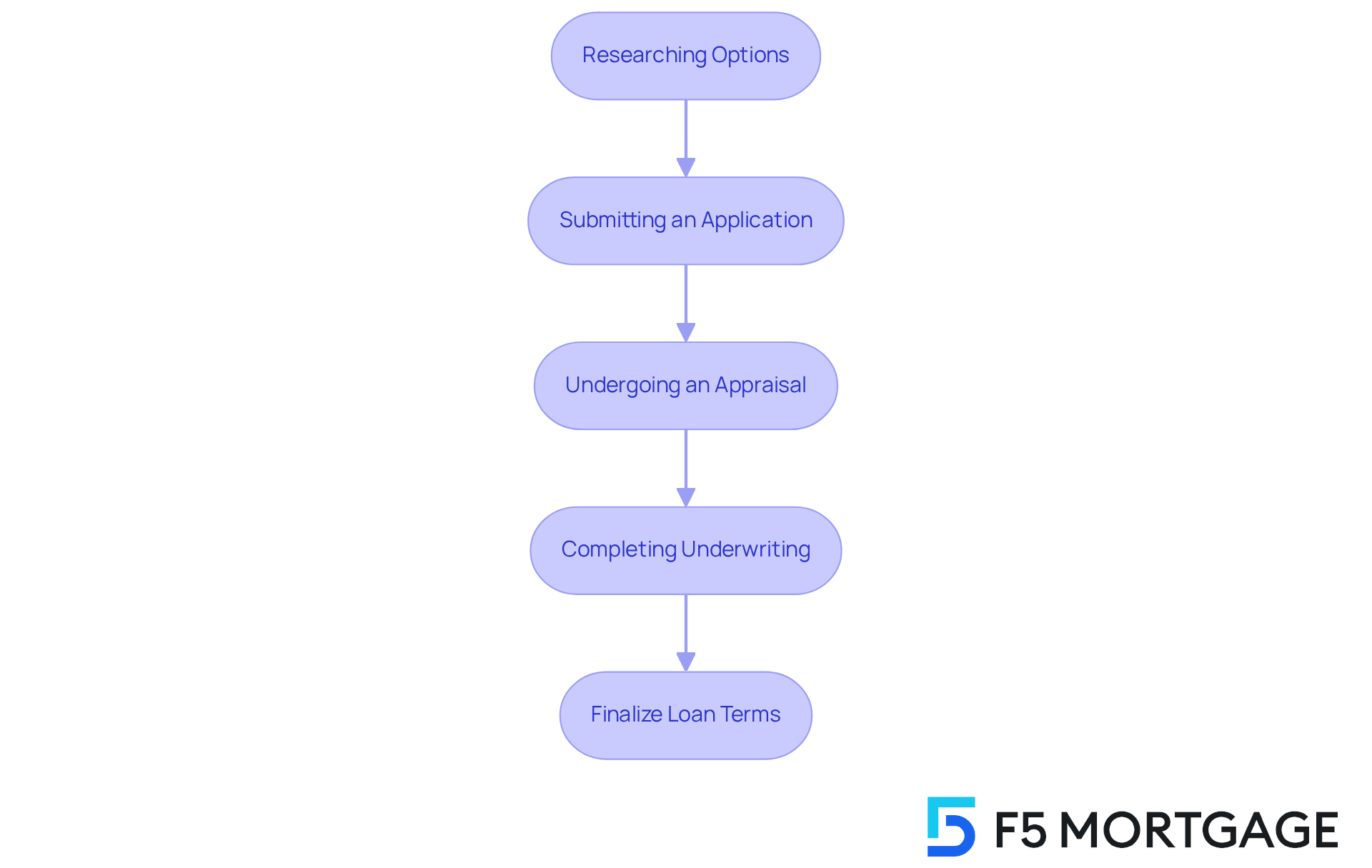

Understanding your is crucial, as it plays a significant role in securing . The involves several steps:

- Researching options

- Submitting an application

- Completing underwriting

By using Canada.ca, you not only improve your awareness but also ensure that you possess the and conditions for a best rates for your property financing.

We know how challenging this can be, but remember, we’re here to support you every step of the way.

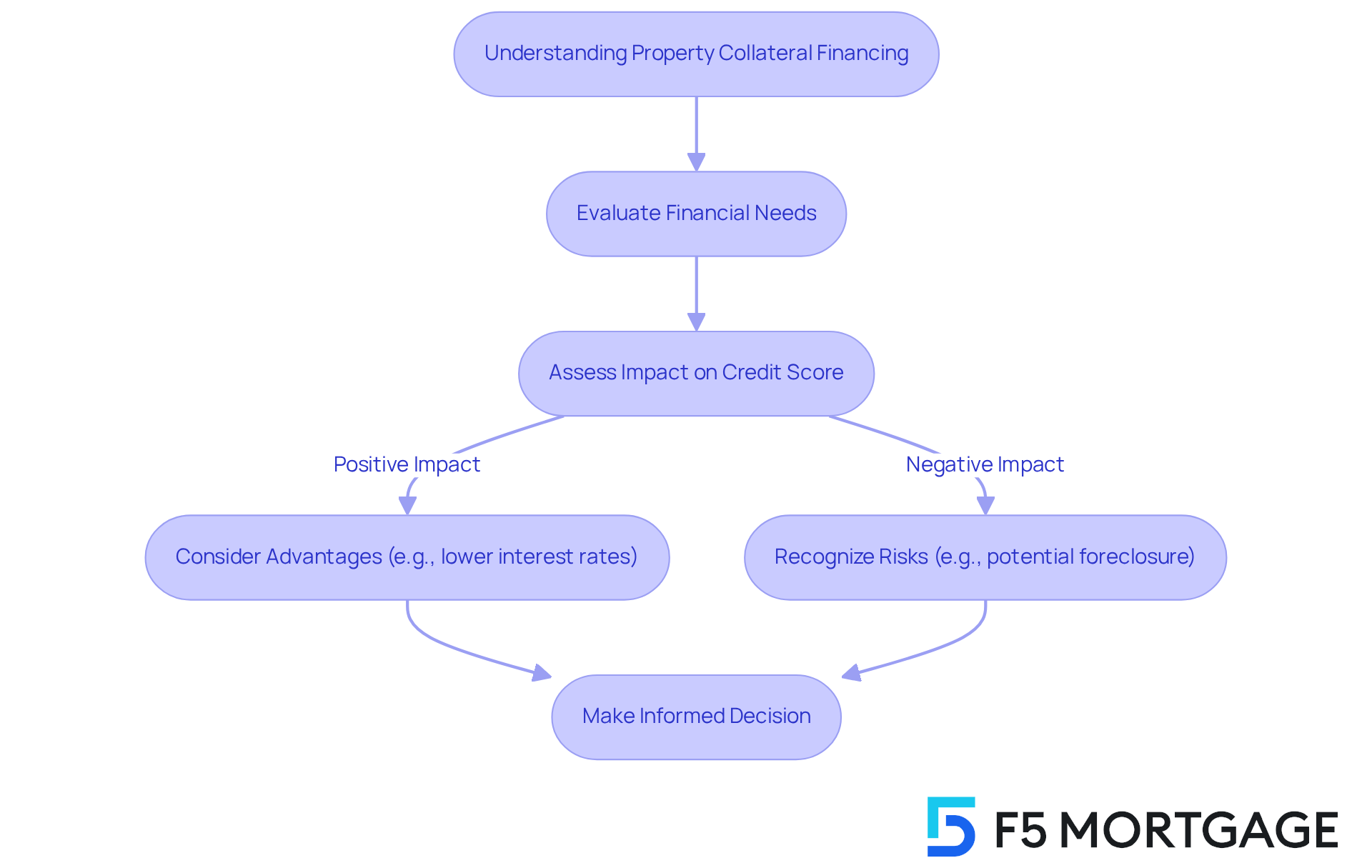

Equifax: Educational Insights on Home Equity Loans and Credit Impact

Equifax offers essential insights into how can impact credit ratings and overall . We understand how challenging it can be for borrowers to navigate these effects, which is why it’s crucial to make informed choices about utilizing property resources effectively. For instance, while may provide access to funds for renovations or , they can also lead to fluctuations in credit scores due to increased debt and changes in credit utilization ratios. Recognizing that timely payments can boost credit scores, while , is vital for maintaining .

Educational resources from Equifax empower clients to navigate the complexities of . We know that understanding both the potential advantages—like —and the associated risks, such as the possibility of foreclosure if payments are mishandled, is essential. Real-life stories illustrate how families have successfully leveraged property value while being mindful of their credit implications, highlighting the importance of a strategic approach to borrowing.

Financial instructors emphasize that while can be a valuable tool for enhancing financial well-being, it requires careful evaluation and oversight to avoid pitfalls. By staying informed and proactive, borrowers can maximize the benefits of property financing while minimizing risks. We’re here to .

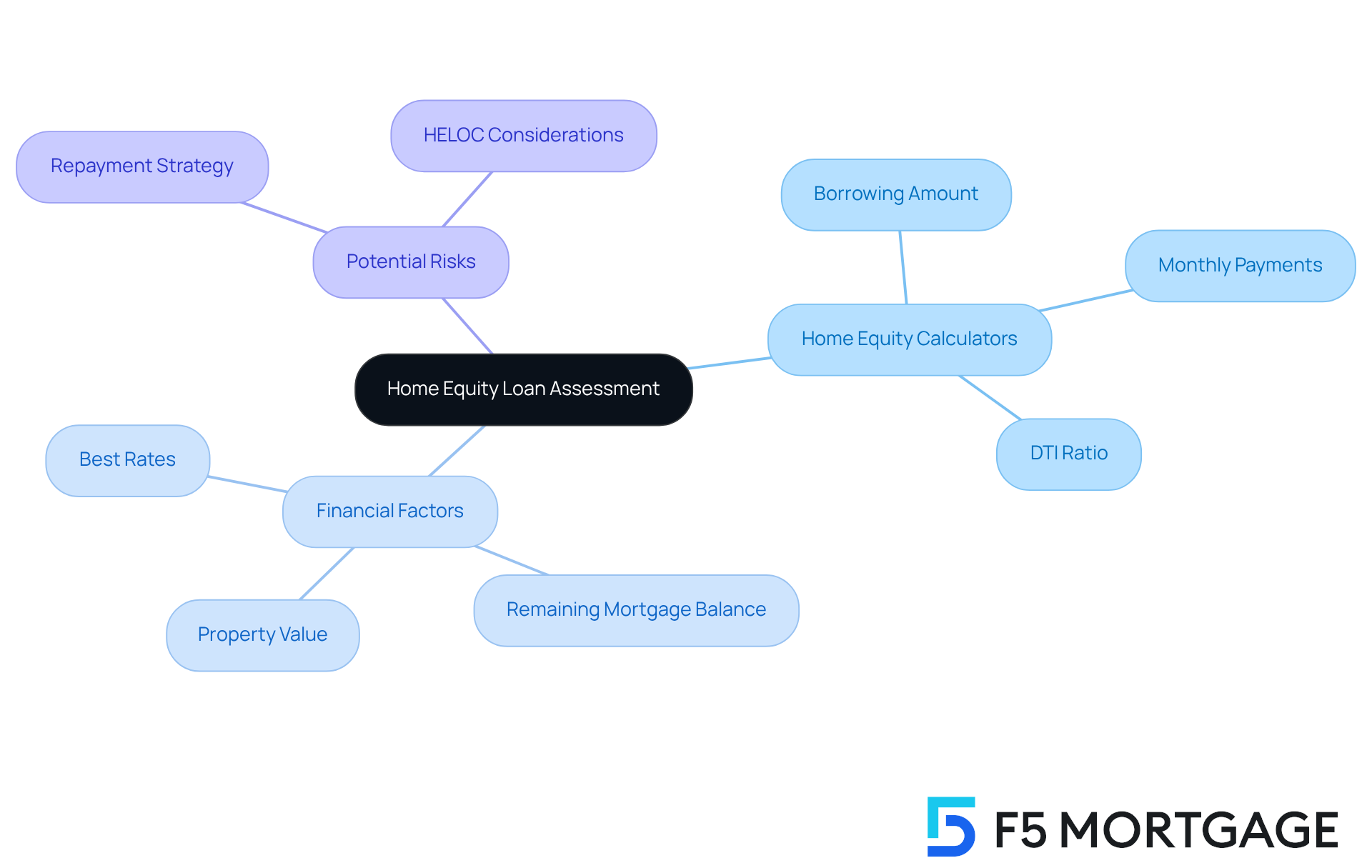

CIBC: Home Equity Calculators for Assessing Loan Options

At F5 Mortgage, we understand how important it is for families to effectively evaluate their loan options to find . Our is designed with you in mind. By simply providing your monetary information, you can gain estimates on possible borrowing amounts and monthly payments. This feature is essential for families looking to make informed choices about their financial futures. Remember, maintaining a healthy —ideally below 43%—is crucial for .

Financial planners often emphasize the value of these tools. They help you visualize your borrowing capacity and repayment scenarios, allowing for a proactive approach that prevents overextending financially. Real-life examples show that families have successfully used these calculators to explore various , leading to more strategic planning and greater confidence in their decisions.

When considering , it’s vital to think about factors like current property value, remaining mortgage balance, and the home equity loan best rates available for borrowing. Our simplify this process, providing a clear view of your financial options. Notably, asset extraction accounted for 7% of durable and semi-durable goods consumption and 35% of renovation expenditures in Canada, underscoring the significance of residential assets in economic planning.

However, we want to remind families of the potential risks associated with . It’s essential to before obtaining a Home Value Line of Credit (HELOC). By leveraging these tools, you can navigate the complexities of property financing with greater ease, ultimately making choices that enhance your financial well-being. At F5 Mortgage, we are dedicated to providing competitive rates and personalized service, ensuring you have the support you need throughout the .

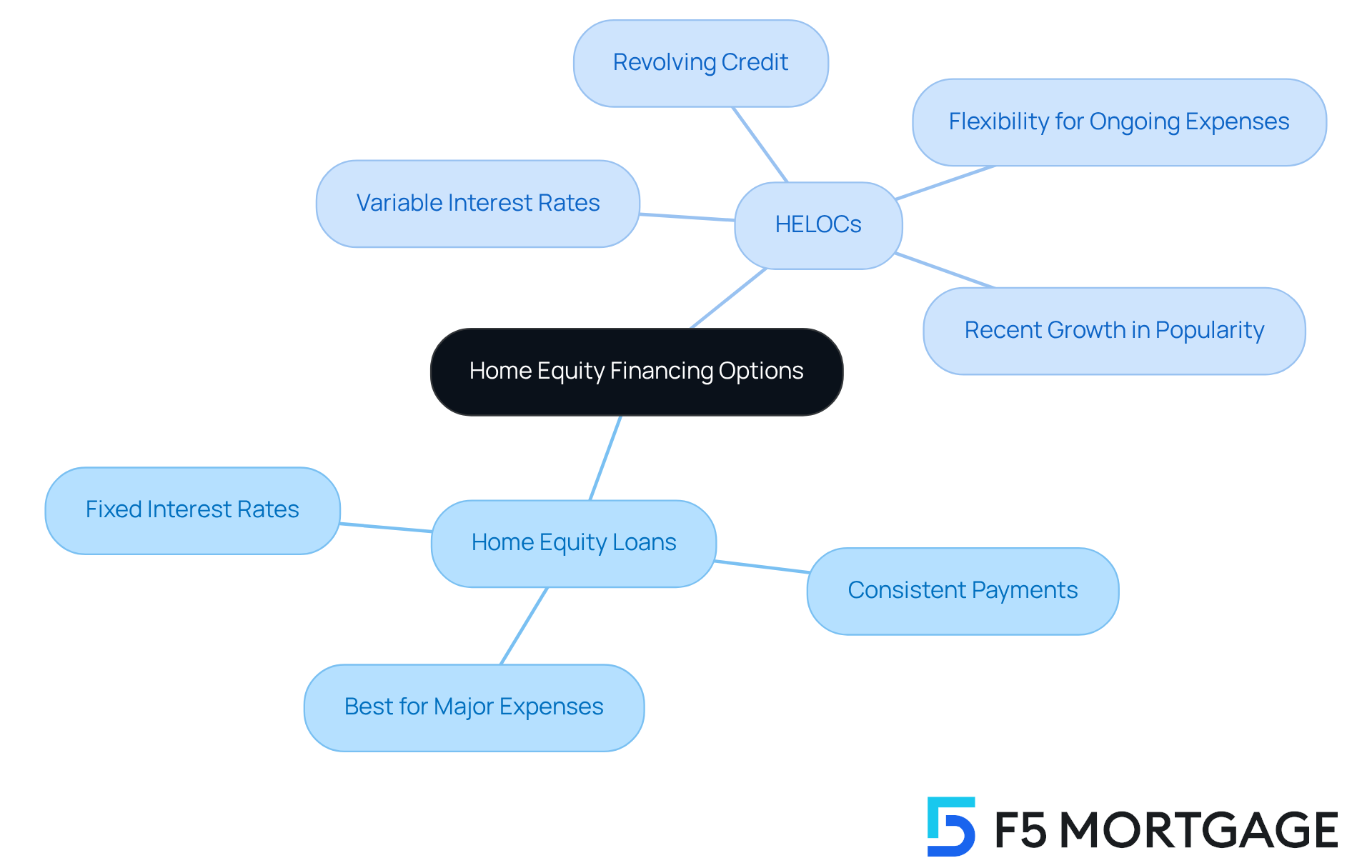

Consolidated Credit Canada: Side-by-Side Comparison of Home Equity Loans and HELOCs

At Consolidated Credit Canada, we understand that navigating and (HELOCs) can be challenging. That’s why we offer a to help you grasp the nuances of each option. Home value financing typically features and consistent monthly payments, making it an appealing choice for those who prefer a straightforward repayment structure. On the other hand, HELOCs provide a revolving credit option with , offering the flexibility to borrow as needed during the draw period.

Mortgage experts highlight the importance of recognizing these differences when deciding between the two products. For instance, you might opt for a to finance a significant renovation, benefiting from stable payments and a clear repayment schedule. Conversely, another individual may choose a HELOC for its adaptability, using it to manage ongoing expenses or unexpected costs.

Statistics show that many borrowers in Canada are gravitating towards HELOCs due to their . Recent data reveals that increased by 7.2% in 2024, reflecting a growing preference for this borrowing method. Additionally, the average tappable value per borrower has surged by nearly $102,000, providing homeowners with more opportunities to effectively utilize their assets.

However, it’s crucial to be aware of the potential risks associated with HELOCs, such as variable interest rates that can result in . By clarifying the distinctions in terms, interest rates, and repayment structures, Consolidated Credit Canada is here to support you every step of the way, empowering you to make informed decisions that align with your financial goals and enhance your property borrowing experience.

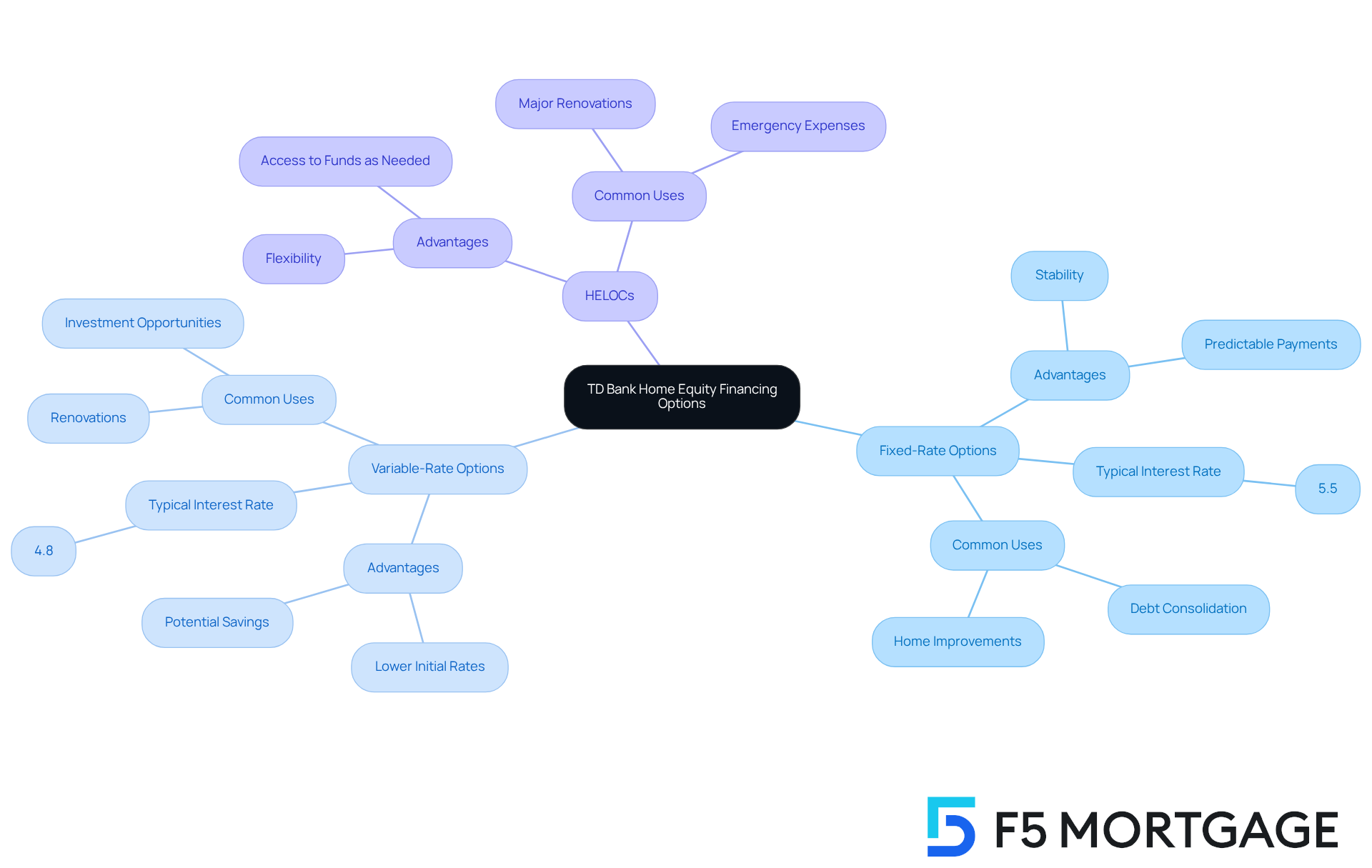

TD Bank: Diverse Home Equity Financing Options for Borrowers

TD Bank offers a wide range of , including , , and the through . This variety allows borrowers to that best fits their financial situation and risk preferences. For example, fixed-rate financing provides stability with consistent monthly payments, making it ideal for those who appreciate predictability in their budgeting. Conversely, variable-rate credits may offer lower initial rates, appealing to borrowers willing to take on some risk for potential savings.

We understand that can feel overwhelming. Recent data indicates that the typical interest rate for fixed-rate residential financing in Canada is around 5.5%, while variable-rate alternatives are slightly lower, averaging 4.8%, which highlights the importance of finding home equity loan best rates. This difference can significantly affect overall borrowing costs, especially for larger loans. Additionally, TD Bank allows , making it a considerable advantage for those looking for home equity loan best rates to maximize their equity.

Real-life stories highlight how families are utilizing these products effectively. For instance, a family in Ontario tapped into a HELOC to finance a major renovation, enhancing their property’s value while enjoying the flexibility to draw funds as needed. Notably, 54% of participants with a HELOC or HE Loan have used it for renovations, showcasing the popularity of these options for home improvements. Another family opted for a fixed-rate mortgage to , benefiting from and a lower overall interest rate.

By providing a diverse array of property financing products, TD Bank ensures that clients can find tailored solutions that align with their unique financial goals, whether they wish to renovate, consolidate debt, or explore investment opportunities. However, it’s essential for potential borrowers to consider the associated fees and the geographic limitations of TD Bank’s services, as they primarily cater to East Coast residents. Remember, we’re here to support you every step of the way in your financial journey.

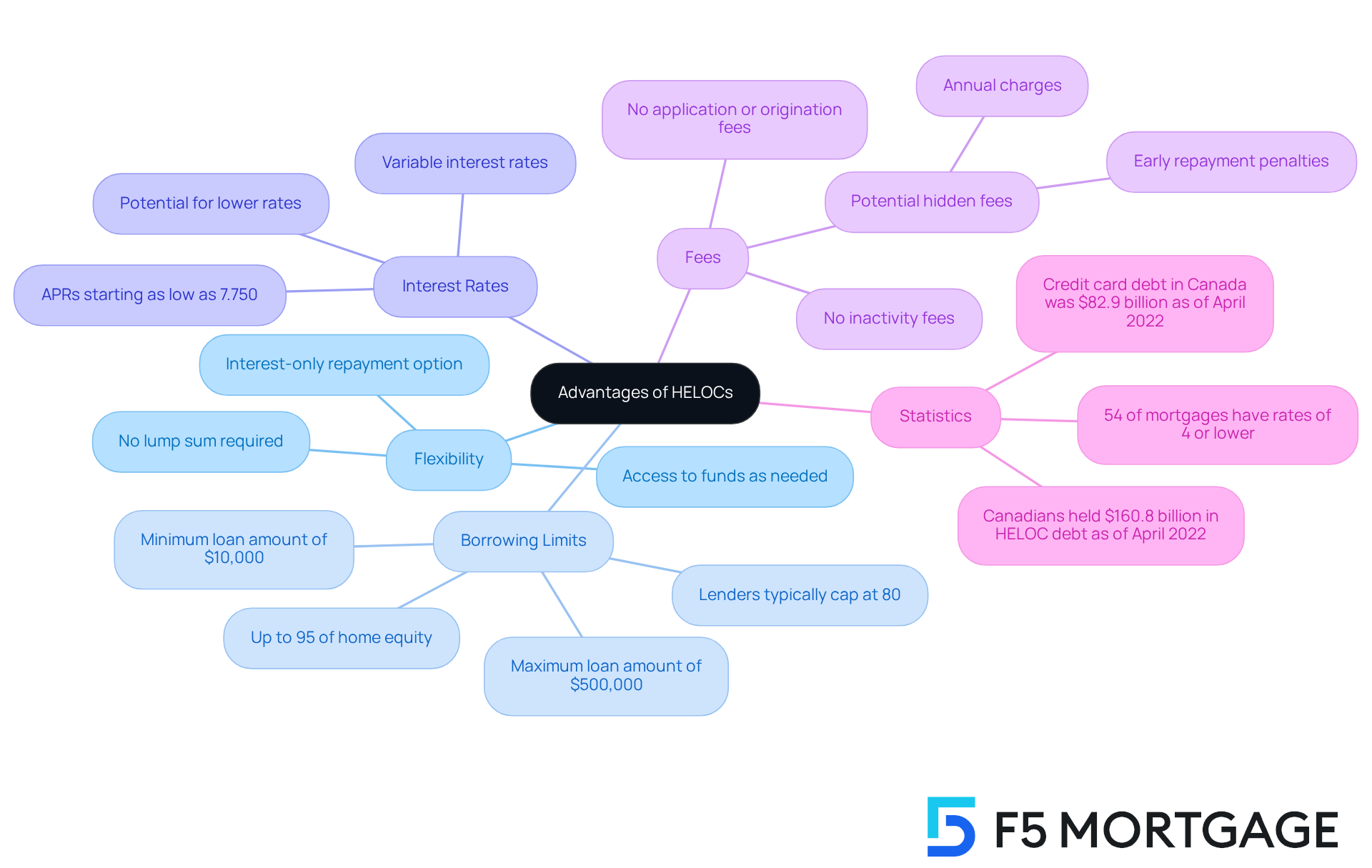

Vancity: Advantages of Home Equity Lines of Credit (HELOCs)

Home value lines of credit (HELOCs) provide a unique advantage for borrowers, allowing them to rather than requiring a lump sum loan. This flexibility can be a game-changer for families managing ongoing expenses or embarking on renovation projects. Many homeowners have successfully turned to HELOCs to , enhancing their living spaces and increasing in the process.

In Canada, the average borrowing amount through HELOCs can reach up to 95% of a home’s equity. However, most lenders typically cap HELOCs at 80% of total equity to mitigate risk. This makes HELOCs a viable option for those looking to leverage their investments wisely.

Understanding the associated with HELOCs is crucial, as they often feature variable rates. This can lead to , especially when used strategically for consolidating high-interest debt or funding education expenses. The versatility of a HELOC allows homeowners to manage their cash flow efficiently, providing a financial safety net for unexpected expenses.

While HELOCs generally have no application, origination, or inactivity fees, it’s important to be aware of potential , such as annual charges or early repayment penalties, when evaluating options. The interest-only repayment choice offered for HELOCs enhances economic flexibility, allowing homeowners to tailor their payments to their financial situation.

With Canadians holding $160.8 billion in as of April 2022, it’s clear that these products are a favored choice for families looking to enhance their financial planning while maintaining access to their property value. We know how challenging navigating these options can be, and we’re here to support you every step of the way.

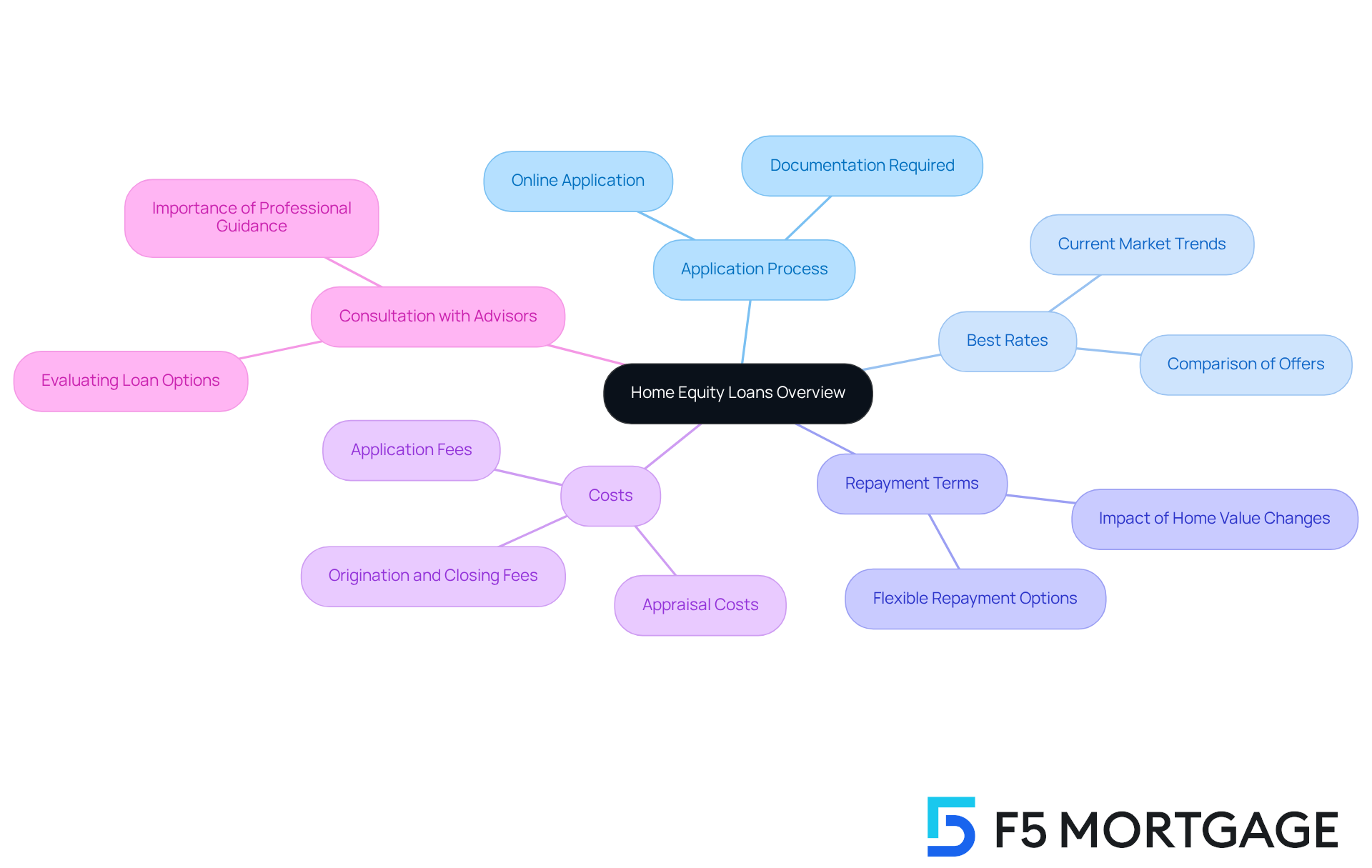

Nesto.ca: In-Depth Overview of Home Equity Loans in Canada

At , we understand how challenging it can be to navigate the world of equity loans and refinancing options. That’s why we serve as an essential resource, offering a that covers everything from to the and repayment terms. By grasping the nuances of these financial products, borrowers can feel more empowered in their decisions.

Imagine reducing your —all while securing the home equity loan best rates and terms available. Many families have tapped into substantial value; in fact, the typical homeowner has around $212,000 in accessible value, contributing to the staggering $17.6 trillion in property value among U.S. mortgage holders. We know how important it is to be well-informed during the , especially as lenders become more aggressive with their offerings.

Utilizing F5 Mortgage means you can approach your with confidence. We’re here to support you every step of the way, ensuring you make choices that align with your financial goals. However, it’s also crucial to consider the expenses related to these financial products. Understanding the detailed breakdown of —including application fees, origination charges, and appraisal costs—will help you fully comprehend the .

We encourage you to compare different loan options, especially the home equity loan best rates, and . By taking these steps, you can make informed decisions that will benefit you and your family in the long run.

Conclusion

Exploring the landscape of home equity loans in Canada reveals a wealth of options that cater to diverse financial needs. We know how challenging this can be, and understanding various financing avenues is crucial. From personalized consultations at F5 Mortgage to comprehensive guides provided by platforms like Bankrate and NerdWallet, this knowledge empowers homeowners to make informed decisions that align with their financial goals and circumstances.

Throughout this journey, key insights emerge regarding the competitive rates available and the significance of maintaining a healthy credit score. Leading institutions such as TD Bank and Vancity offer various products, but it’s essential to evaluate your personal financial situation. We’re here to support you every step of the way, especially when considering the implications of borrowing against home equity. With current rates averaging between 7% and 12%, favorable opportunities exist for homeowners to leverage their property value for renovations, debt consolidation, or other significant expenses.

Ultimately, securing the best home equity loan rates in Canada is not just about finding the lowest interest rate; it’s about making strategic financial decisions that enhance long-term stability and growth. By utilizing the resources and tools available, such as calculators and expert comparisons, you can navigate this complex terrain with confidence. Embracing informed choices will undoubtedly lead to better financial outcomes, empowering families to realize their dreams and improve their quality of life.

Frequently Asked Questions

What services does F5 Mortgage offer to clients?

F5 Mortgage provides personalized consultations to help clients explore various property financing options, focusing on recommending home equity loans with the best rates and terms tailored to individual financial situations.

What are the current home equity loan rates in Canada?

The current home equity loan rates in Canada for residential financing range from 7% to 12%, with favorable options available below 8% for a 10-year term.

How does F5 Mortgage ensure client satisfaction?

F5 Mortgage enhances client satisfaction by streamlining the decision-making process and offering personalized consultations, which is reflected in their 5-star reviews on platforms like Google and Zillow.

What is cash-out refinancing, and how can it benefit homeowners?

Cash-out refinancing allows homeowners to refinance their existing mortgage for a higher amount than owed, providing access to the difference in cash. This can be beneficial for significant expenses like home renovations or debt consolidation.

What are the requirements to secure favorable interest rates for home equity loans?

To secure favorable interest rates, it is important to maintain a credit score of at least 700, provide proof of income, and conduct a property assessment to determine the residence’s worth.

What is the average market rate for residential financing currently?

The average market rate for residential financing currently stands at around 8.23%.

How can comparison tools like NerdWallet assist families in finding home equity loans?

Comparison tools like NerdWallet allow families to compare various home equity loan rates and options side-by-side, helping them find financing choices that align with their financial goals and potentially uncover better deals.

What common uses do families have for funds obtained through property financing?

A significant portion of residential financing, approximately 46%, is allocated for property improvements, highlighting that families often use these funds for renovations or debt consolidation.