Overview

Understanding the impact of a Home Equity Line of Credit (HELOC) on your credit score is crucial. We know how challenging this can be, as responsible management can enhance your score significantly. Conversely, poor management, such as missed payments, can lead to substantial declines.

It’s important to recognize that a hard inquiry during the application process may cause a temporary drop in your credit score. However, we’re here to support you every step of the way.

By making consistent, timely payments and maintaining a low balance relative to your credit limit, you can improve your overall creditworthiness.

Take control of your financial future with these empowering steps.

Introduction

Navigating the world of home equity lines of credit (HELOC) can feel like both an opportunity and a challenge for families eager to tap into their property’s value. We understand how daunting this process can be. While HELOCs offer a flexible borrowing option, they also come with implications for credit scores that can significantly impact financial health.

As families explore how to maximize the benefits of this financial tool, it’s important to recognize the potential risks associated with its use. What strategies can families employ to ensure they reap the rewards of a HELOC without jeopardizing their creditworthiness? We’re here to support you every step of the way.

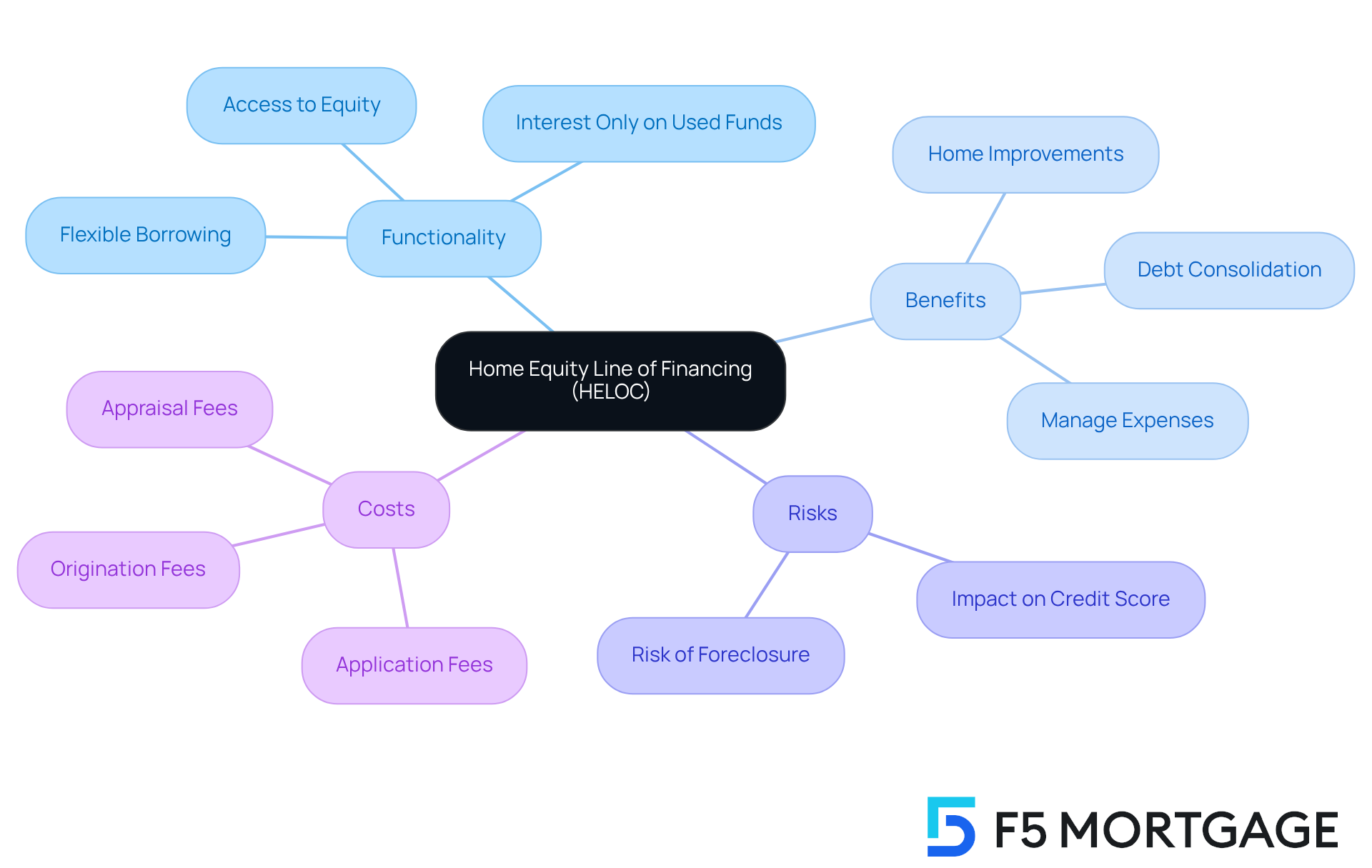

Define HELOC and Its Functionality

A Home Equity Line of Financing can be a valuable resource for homeowners, offering a flexible, revolving line of borrowing. It allows you to tap into the equity in your property, which is simply the difference between your home’s current market value and the outstanding mortgage balance. Think of it like a charge card; you can withdraw funds as needed, up to a set limit, and you only pay interest on what you use.

This flexibility makes a home equity line of financing particularly appealing for families looking to finance home improvements, consolidate debt, or manage unexpected expenses. Typically, homeowners can access about 80% to 85% of their home equity, with interest rates averaging around 7%. This is significantly lower than credit card rates, which can soar to about 20%.

However, it’s essential to remember that a home equity line of credit can impact your heloc credit score and is secured by your property. This means that failure to repay could lead to foreclosure, which underscores the importance of responsible management. We know how challenging financial decisions can be, and we’re here to support you every step of the way.

Additionally, it’s crucial to be aware of the costs associated with refinancing. These typically range from 2% to 5% of the loan amount and can include:

- Application fees between $75 and $500

- Origination fees of 0.5% to 1.5% of the loan amount

- Appraisal fees usually between $300 and $500

Understanding these costs will help you make informed decisions about leveraging your home equity effectively, which can positively impact your heloc credit score.

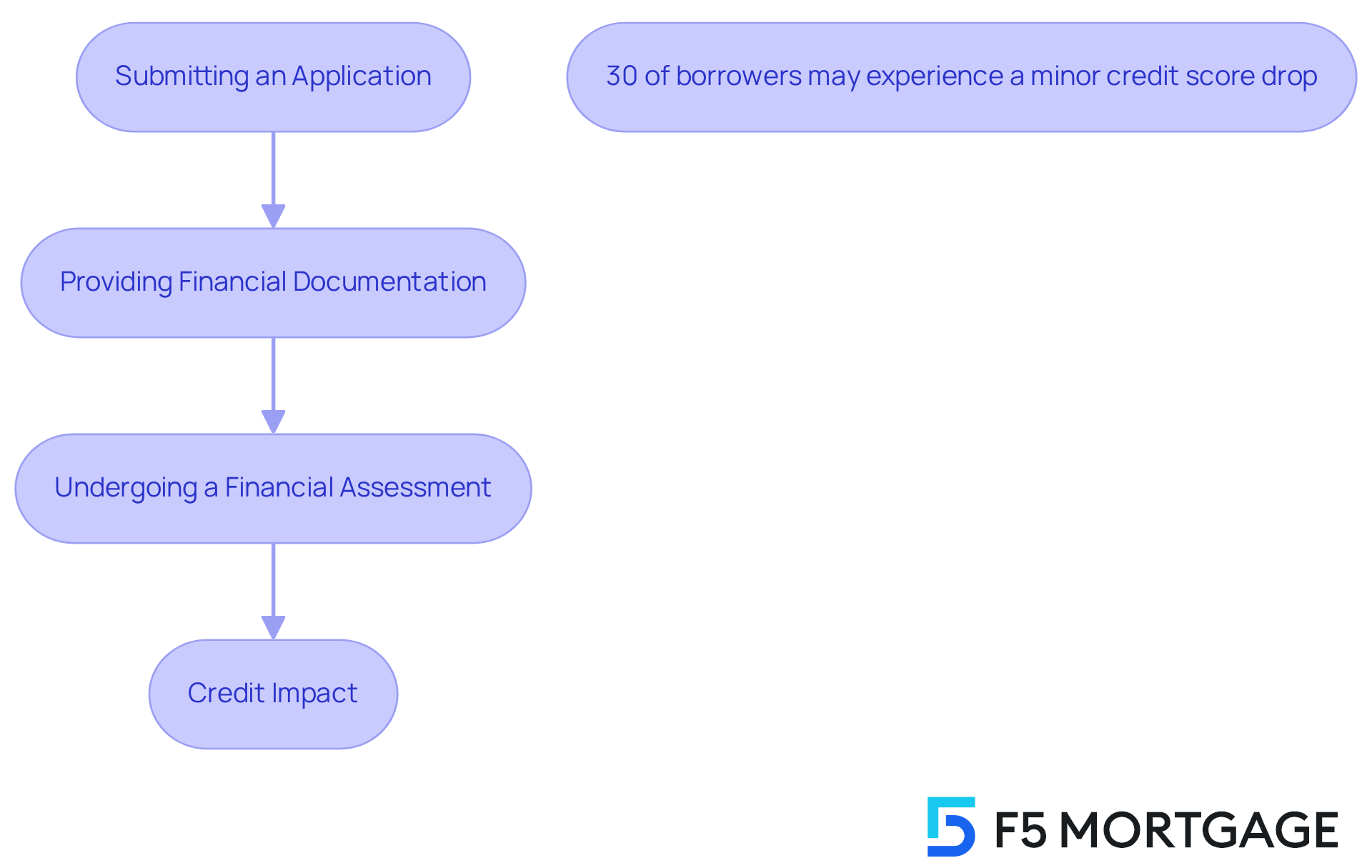

Examine the Application Process and Initial Credit Impact

Applying for a Home Equity Line of Loan can feel overwhelming, and we understand how challenging this process can be. It involves several key steps:

- Submitting an application

- Providing necessary financial documentation

- Undergoing a financial assessment

During this journey, lenders will perform a hard inquiry on your credit report, which may lead to a temporary decline in your heloc credit score—often just a few points. In fact, studies show that around 30% of borrowers experience this initial rating drop after applying for a HELOC. However, it’s important to know that this decline in your heloc credit score is typically minor and brief, especially if you continue to practice sound financial habits, such as making timely payments and managing your existing debts responsibly.

As you navigate this process, remember that lenders assess your financial reliability based on various factors, including your credit rating, income, existing debt levels, and your heloc credit score. A crucial aspect of this evaluation is your debt-to-income (DTI) ratio, which should ideally be below 43% for competitive mortgage solutions. For instance, families with a strong financial history and a low DTI often find the application process smoother and less impactful on their credit score.

To simplify your journey, getting your financial documents organized ahead of time can be incredibly helpful. This preparation can assist in reducing any potential adverse effects on your creditworthiness. By understanding these dynamics, you can approach the home equity line of credit application process with greater confidence and clarity. Remember, we’re here to support you every step of the way.

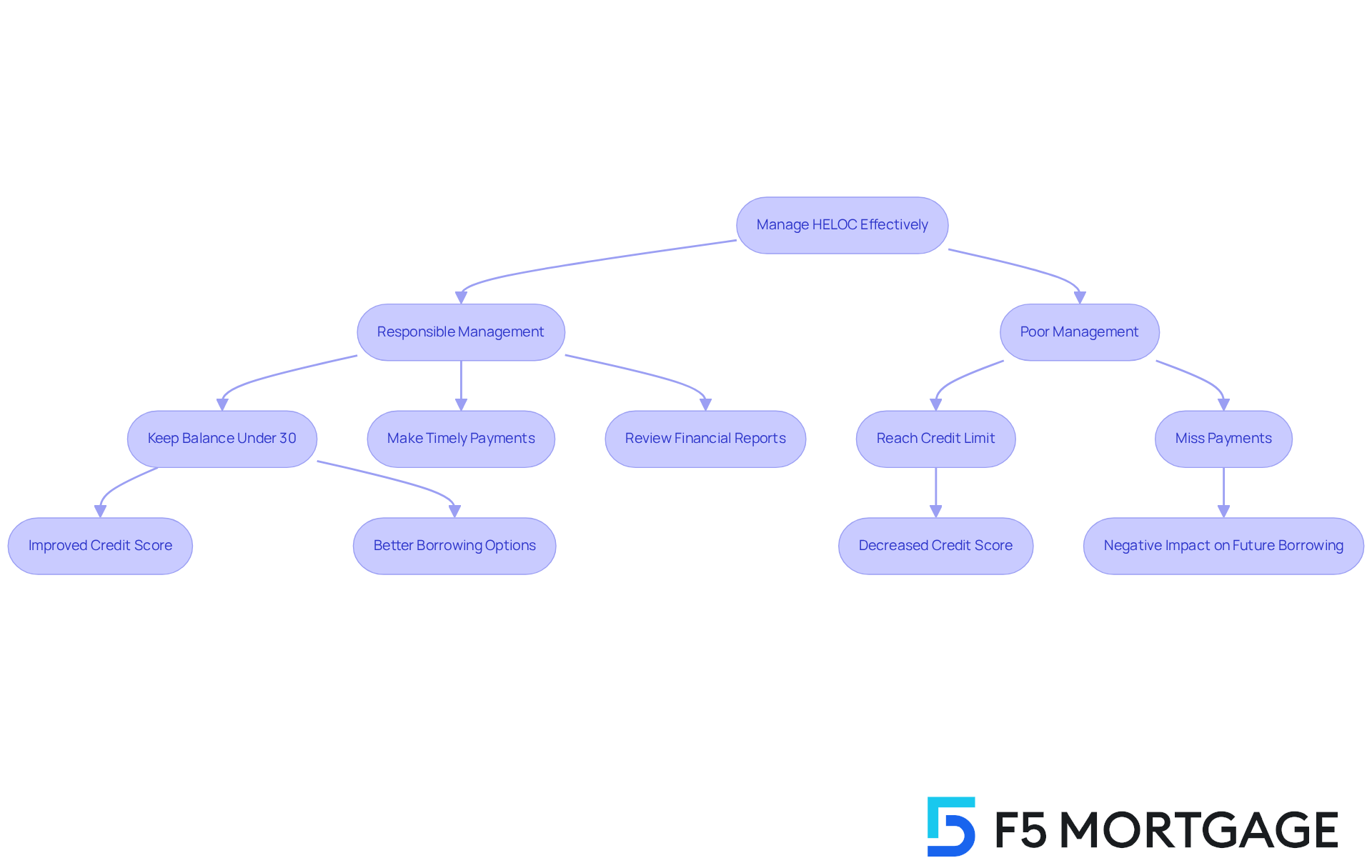

Analyze the Ongoing Effects of HELOC Usage on Credit Scores

Once a Home Equity Line of Financing is set up, its continued use can greatly impact your HELOC credit score. We know how important this is for families, and responsible management—such as keeping a low balance in relation to the limit and ensuring timely payments—can lead to enhancements in your credit rating. On the other hand, reaching the limit of your home equity line of credit or missing payments can significantly decrease your HELOC credit score. It’s essential to recognize that requesting a home equity line of credit usually entails a hard inquiry, which can reduce your HELOC credit score by a few points.

Credit usage, defined as the ratio of borrowing utilized to total available borrowing, is a critical factor in scoring. To promote a healthy financial rating, families should aim to maintain their home equity line balance under 30% of the limit, which will positively impact their HELOC credit score. For example, if your family has a home equity line of credit with a $50,000 limit, strive to keep a balance of no more than $15,000. A mid-600s HELOC credit score could be sufficient to qualify for a HELOC, making it vital for families to evaluate their HELOC credit score eligibility.

Many HELOCs only require interest payments during the initial draw period, which typically lasts about 10 years. This aspect can affect your borrowing utilization strategies, enabling families to manage their finances more effectively. Consistently reviewing financial reports is crucial for families to keep track of their financial well-being and make informed monetary choices. Specialists highlight that prompt reimbursements on a home equity line of credit not only assist in establishing a favorable repayment history but can also enhance the HELOC credit score and improve overall financial profiles. Remember, missed or late payments on a home equity line of credit will adversely affect your HELOC credit score if reported to financial agencies, emphasizing the importance of maintaining a positive payment history.

Families who manage their loan balances efficiently can anticipate enhancements in their ratings over time, usually within a few months of prudent usage. This proactive strategy not only helps in attaining improved financial ratings but also positions families advantageously for future borrowing possibilities. Ending a home equity line of financing in good standing enables the account to remain on your financial report for up to 10 years, positively impacting your borrowing history. We’re here to support you every step of the way as you navigate these important financial decisions.

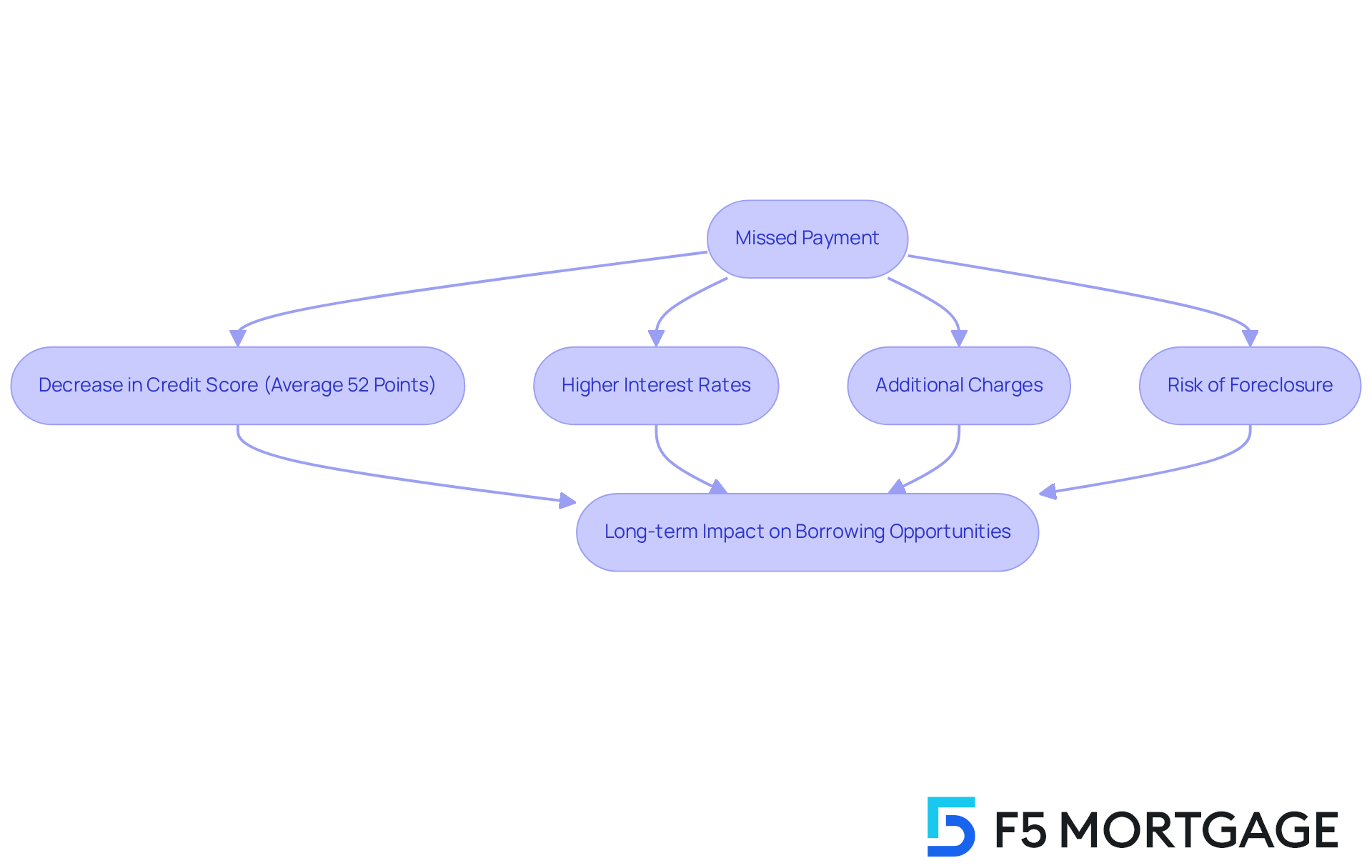

Discuss the Consequences of Non-Repayment and Credit Score Risks

Prompt settlements on a Home Equity Line of Credit (HELOC) are crucial for your financial well-being. We know how challenging this can be, and neglecting these responsibilities can significantly impact your overall financial security and HELOC credit score. Just one missed installment can lead to an average decrease of 52 points in your HELOC credit score, with variations that may range from 50 to over 100 points depending on your credit history.

Moreover, overdue transactions often result in higher interest rates and additional charges, intensifying the financial pressure you may already be facing. In severe cases, ongoing non-repayment can lead to foreclosure, as the home equity line of credit is secured by your property. Statistics reveal that missing several payments can have serious consequences; for instance, four missed obligations typically lead to default and can cause a dramatic drop of over 98 points in your HELOC credit score. This decline not only affects your current creditworthiness but also complicates future borrowing opportunities, particularly concerning your HELOC credit score.

To help navigate these challenges, we encourage families to prioritize their budgets and ensure that HELOC obligations are met. Consider setting up automatic transfers to avoid missed due dates. Additionally, reaching out to your lenders to explore options like forbearance can provide a proactive approach if you’re facing financial difficulties.

Understanding these risks is essential for families considering the use of a HELOC. By maintaining timely payments and being proactive in your financial management, you can safeguard your HELOC credit score and overall financial health. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of a Home Equity Line of Credit (HELOC) is essential for families looking to leverage their home equity responsibly. A HELOC can be a powerful financial tool, providing homeowners with access to funds for various needs while also influencing their credit scores. By navigating the application process and managing ongoing usage wisely, families can maximize the benefits of a HELOC, ensuring their financial stability remains intact.

Throughout this article, we shared key insights regarding the:

- Application process

- Initial credit impacts

- Ongoing effects of HELOC usage on credit scores

We know how challenging this can be. While applying for a HELOC may lead to a temporary dip in credit scores, responsible management—such as maintaining low balances and making timely payments—can enhance credit ratings over time. We also discussed the consequences of non-repayment, highlighting the importance of meeting obligations to avoid severe penalties, including foreclosure.

Ultimately, we encourage families to approach HELOCs with a clear strategy and a focus on financial responsibility. By staying informed and proactive, you can protect your credit scores and pave the way for future borrowing opportunities. The significance of understanding how a HELOC affects credit scores cannot be overstated; it plays a vital role in maintaining overall financial health and security. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Financing (HELOC)?

A Home Equity Line of Financing (HELOC) is a flexible, revolving line of credit that allows homeowners to borrow against the equity in their property, which is the difference between the home’s current market value and the outstanding mortgage balance.

How does a HELOC work?

A HELOC functions like a charge card, enabling you to withdraw funds as needed up to a set limit, and you only pay interest on the amount you use.

What are the typical uses for a HELOC?

Homeowners commonly use a HELOC for financing home improvements, consolidating debt, or managing unexpected expenses.

How much equity can homeowners typically access through a HELOC?

Homeowners can usually access about 80% to 85% of their home equity through a HELOC.

What are the average interest rates for a HELOC?

The average interest rates for a HELOC are around 7%, which is significantly lower than credit card rates that can reach about 20%.

What are the risks associated with a HELOC?

A HELOC is secured by your property, meaning that failure to repay can lead to foreclosure, which emphasizes the importance of responsible management.

What costs should homeowners be aware of when refinancing with a HELOC?

Homeowners should consider costs that typically range from 2% to 5% of the loan amount, including application fees ($75 to $500), origination fees (0.5% to 1.5% of the loan amount), and appraisal fees ($300 to $500).

How can a HELOC impact your credit score?

A HELOC can impact your credit score, making it essential to manage it responsibly to avoid negative consequences.