Overview

This article shines a light on the various down payment assistance options available for homebuyers in Ohio, aiming to alleviate the financial barriers that many families face on their journey to homeownership. We understand how challenging this can be, and we’re here to support you every step of the way.

It highlights essential programs that can make a significant difference, such as grants and loans offered by organizations like the Ohio Housing Finance Agency and F5 Mortgage. These initiatives provide crucial financial support to first-time buyers and families with limited resources, illustrating their positive impact on increasing homeownership rates across the state.

By exploring these opportunities, we hope to empower you with the knowledge needed to navigate the mortgage process confidently. Remember, you are not alone in this journey; there are resources available to help you achieve your dream of owning a home.

Introduction

Navigating the path to homeownership can often feel like an uphill battle, especially in a state where housing costs continue to rise. We understand how challenging this can be for many prospective buyers in Ohio. The dream of owning a home is often hindered by the daunting challenge of affording a down payment. However, there is hope. A wealth of down payment assistance options exists, specifically designed to ease this financial burden and open the door to homeownership.

What if the key to unlocking that dream lies in understanding and accessing these vital resources? We’re here to support you every step of the way.

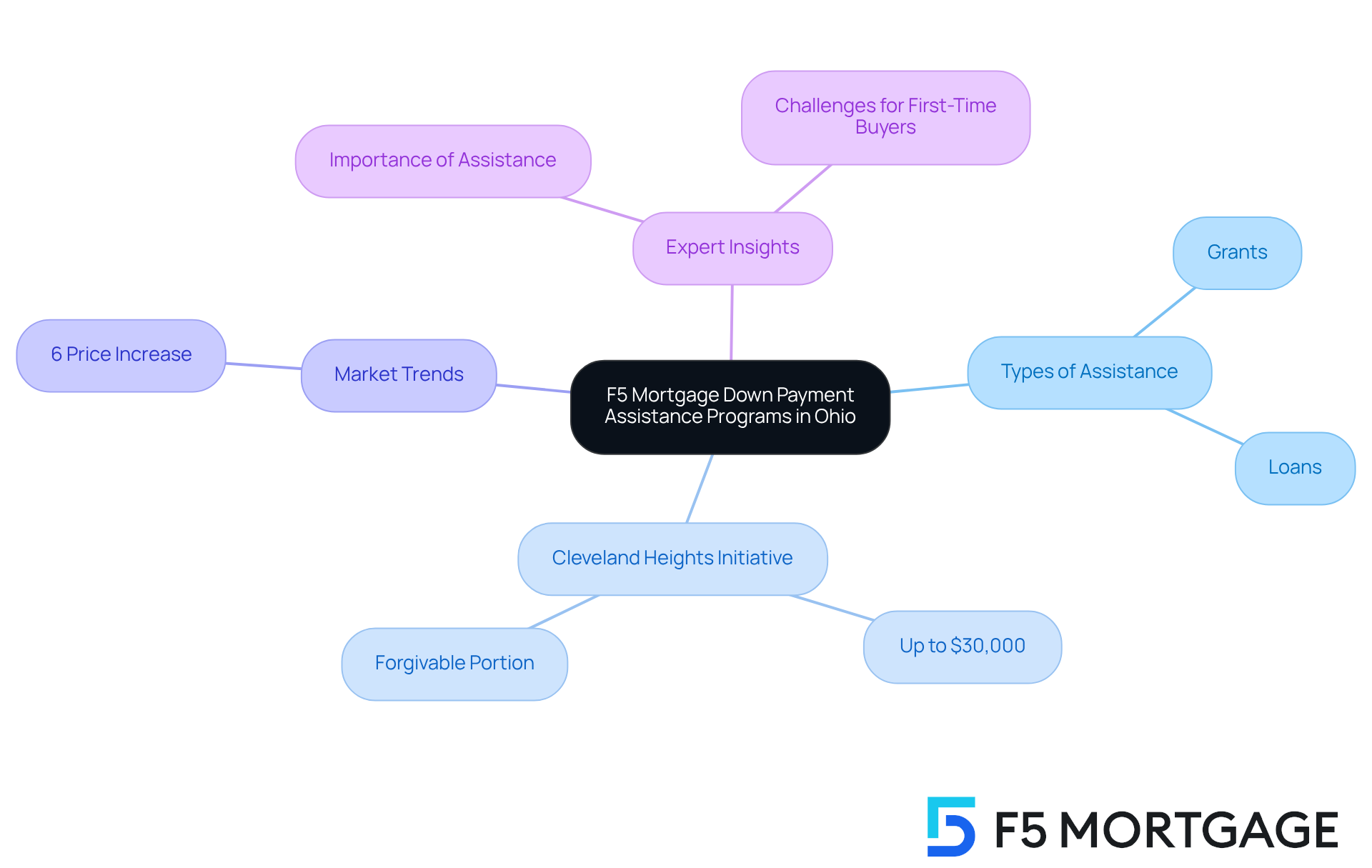

F5 Mortgage: Comprehensive Down Payment Assistance Programs in Ohio

At F5 Mortgage, we understand how challenging the journey to homeownership can be. That’s why we provide a variety of programs designed to help homebuyers in our state overcome . Our initiatives include both grants and loans that can cover down payments, closing costs, and other pre-closing expenses, significantly easing the financial burden of owning a home.

In 2025, to better meet the needs of and those facing rising home costs. For example, the in Ohio of up to $30,000 for single-family homes. A portion of these funds can even be forgiven over five years for qualifying households. This initiative, backed by the , aims to stimulate homeownership and foster community growth.

Data illustrates the effectiveness of these programs. The Housing Finance Agency has authorized funding for various housing projects, showcasing a commitment to enhancing affordable housing options. Additionally, the typical house price in Ohio has risen by more than 6% in the past year, underscoring the .

Experts highlight the vital role that down payment assistance Ohio plays in providing initial funding support to assist homebuyers. Many advocate for these initiatives as , particularly in a market where rising costs can deter prospective buyers. By offering , F5 Mortgage empowers clients to make informed decisions, ensuring a smoother path to homeownership. We’re here to support you every step of the way.

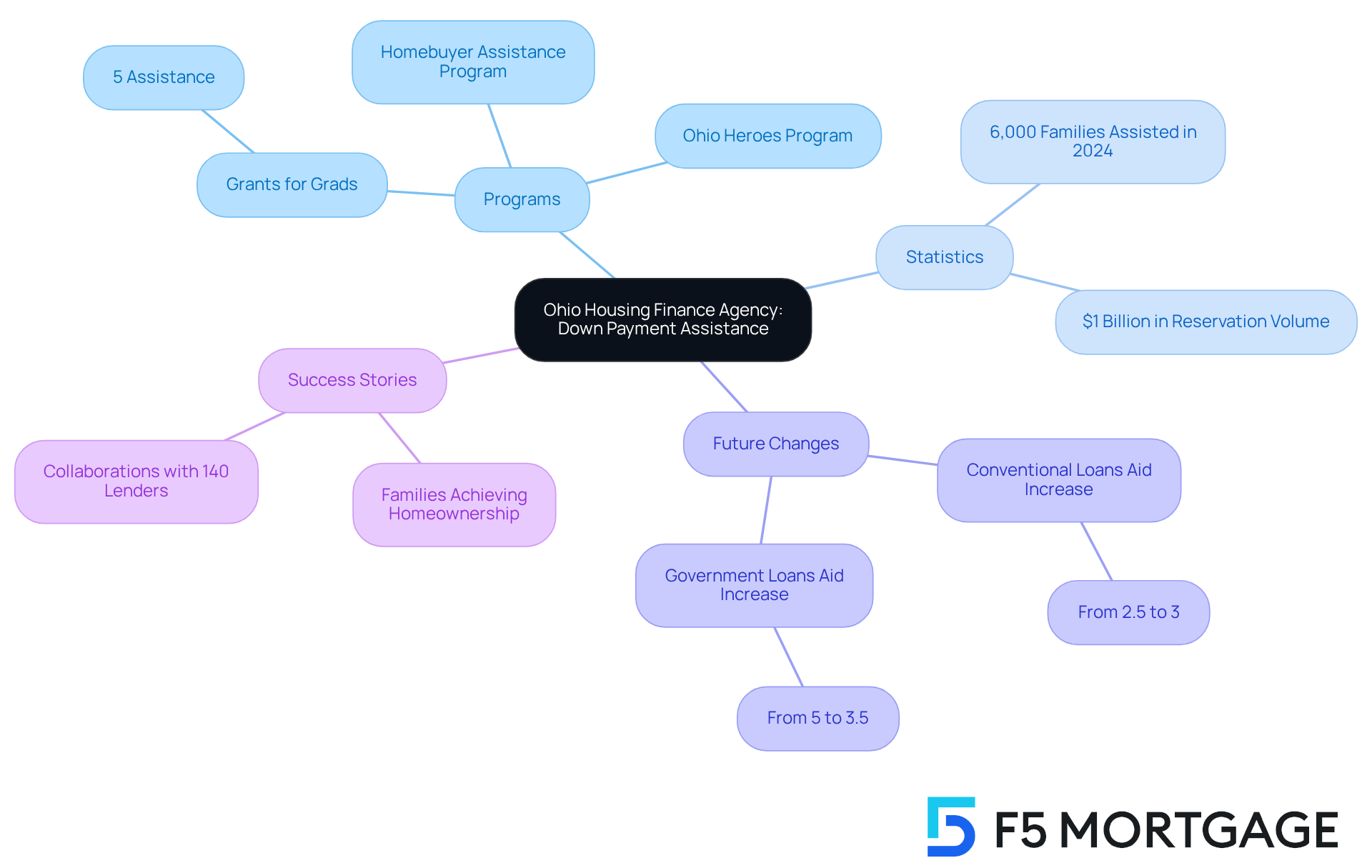

Ohio Housing Finance Agency: State-Sponsored Down Payment Assistance Options

The Ohio Housing Finance Agency (OHFA) understands the challenges many families face when it comes to . That’s why we provide a range of options specifically designed for qualified homebuyers, particularly those who are low- to moderate-income families. These initiatives provide crucial or repayable loans, significantly easing the burden of down payments and closing costs.

For example, participants in our can receive up to 5% of their home’s purchase price. This makes , especially for recent graduates stepping into the housing market.

In just 2024, OHFA assisted over 6,000 families in Ohio through down payment assistance in Ohio, showcasing the effectiveness of our initiatives in promoting homeownership. We’re committed to making homeownership a reality for more families, as evidenced by our recent enhancements to support levels. Effective July 1, 2025, we are for conventional loans and from 5% to 3.5% for government loans. This adjustment is in response to the growing demand for assistance, with reservation volumes surpassing $1 billion.

The success stories are inspiring. Numerous families credit OHFA’s programs for helping them acquire homes they once thought were out of reach. By throughout the state, we ensure that our , fostering a more inclusive housing market in the region.

We know how challenging this can be, and we’re here to support you every step of the way. Let us help you .

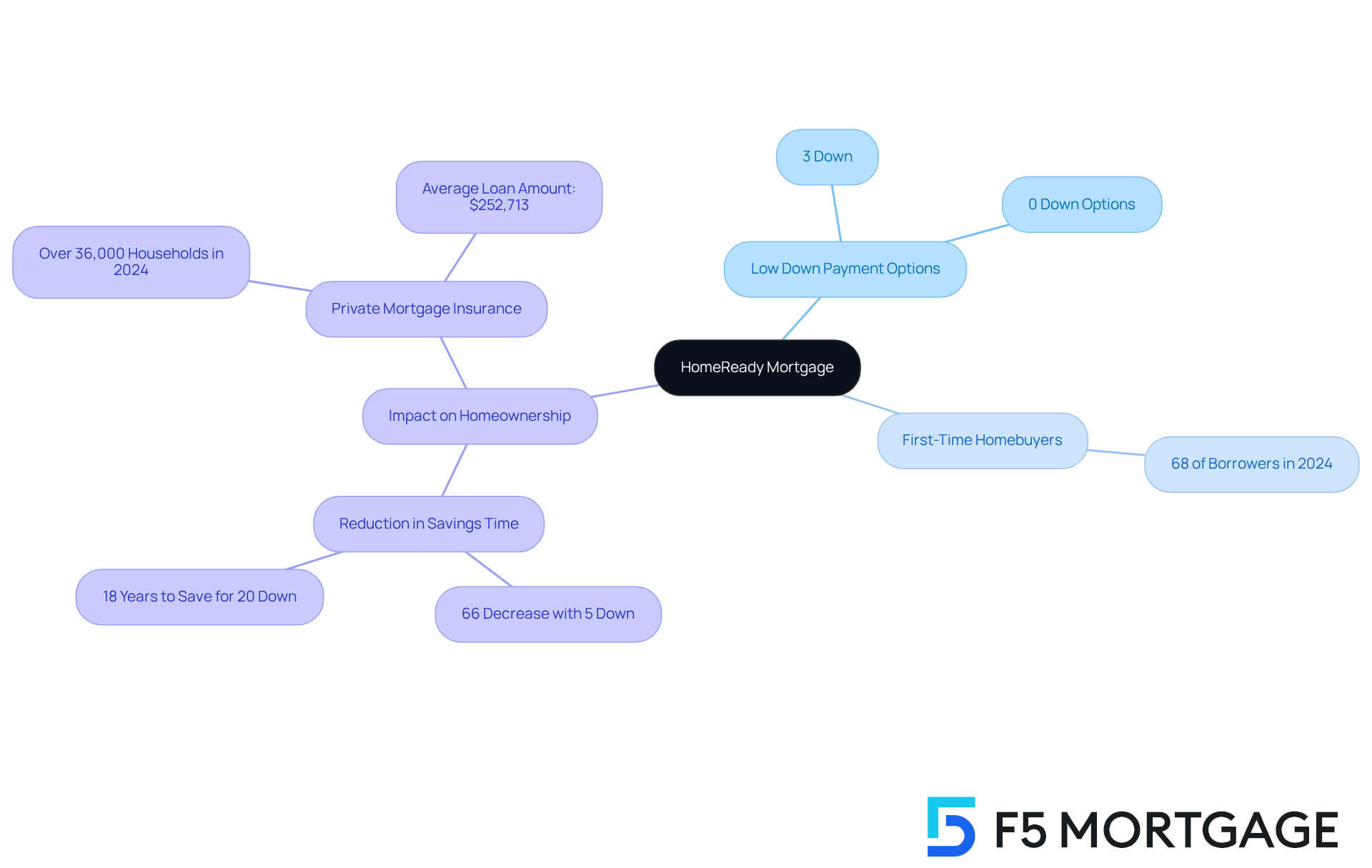

HomeReady Mortgage: Low Down Payment Solution for Ohio Homebuyers

The HomeReady Mortgage initiative is a wonderful option for residents of the Buckeye State who are seeking . Imagine being able to secure a mortgage with as little as 3% down—or even 0% down for certain loan options. This presents an appealing choice for and those with limited savings.

We understand how challenging the can be. This initiative not only makes it easier to own a home but also includes , catering to a broader range of financial situations. In fact, nearly 68% of borrowers in Ohio utilizing in 2024 were first-time homebuyers. This statistic highlights the program’s effectiveness in making homeownership more accessible.

Financial advisors emphasize that such significantly reduce the time it takes to save for a house. This means that down payment assistance Ohio makes the dream of owning a home more achievable for many residents. We’re here to support you every step of the way as you .

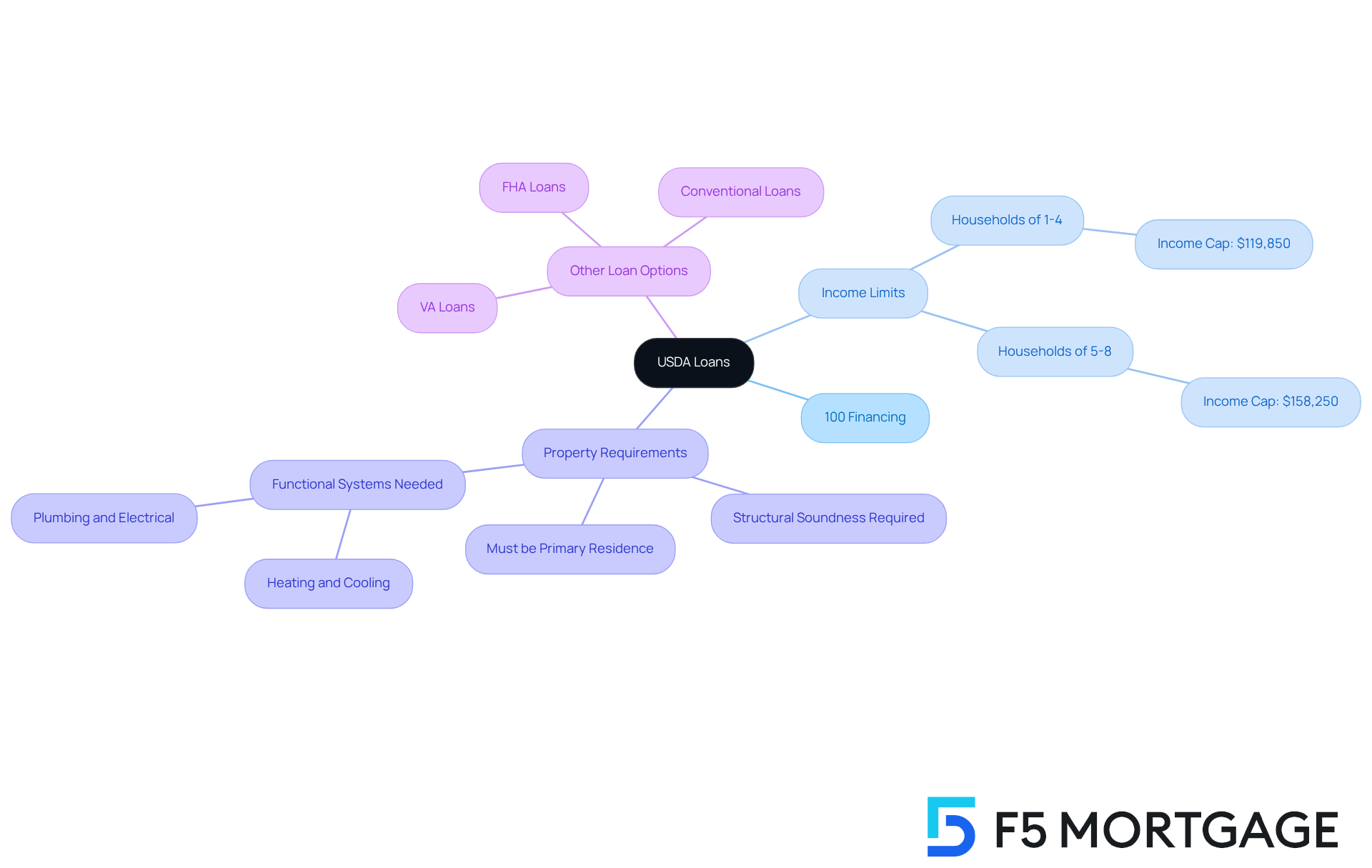

USDA Loans: No Down Payment Assistance for Rural Homebuyers in Ohio

USDA loans provide a remarkable opportunity for qualified rural homebuyers in the state by offering , thus eliminating the need for . This initiative is thoughtfully designed to promote homeownership in rural areas, making it more accessible for low- to moderate-income families. We understand that navigating the homebuying process can be daunting, so it’s important to know that to qualify, applicants must meet . For 2025, these limits cap at:

- $119,850 for households of 1-4

- $158,250 for households of 5-8

Additionally, the property must be located in a , which includes 97% of land in the U.S. that meets USDA eligibility criteria.

At F5 Mortgage, we take pride in facilitating this commitment to making through our , significantly lowering for many families. Alongside USDA loans, we also provide , catering to diverse borrower needs. Success stories abound, with numerous families in the state benefiting from down payment assistance in Ohio, enabling them to secure homes without the burden of initial expenses. Our clients have shared their satisfaction with the support they receive from F5 Mortgage throughout the process, highlighting our team’s expertise and dedication.

In recent years, thousands of USDA loans have been provided in the state through F5 Mortgage, underscoring the program’s profound impact on rural homebuyer assistance. This initiative not only supports individual families but also fosters growth and stability within rural communities. We know how challenging this can be, and we’re here to .

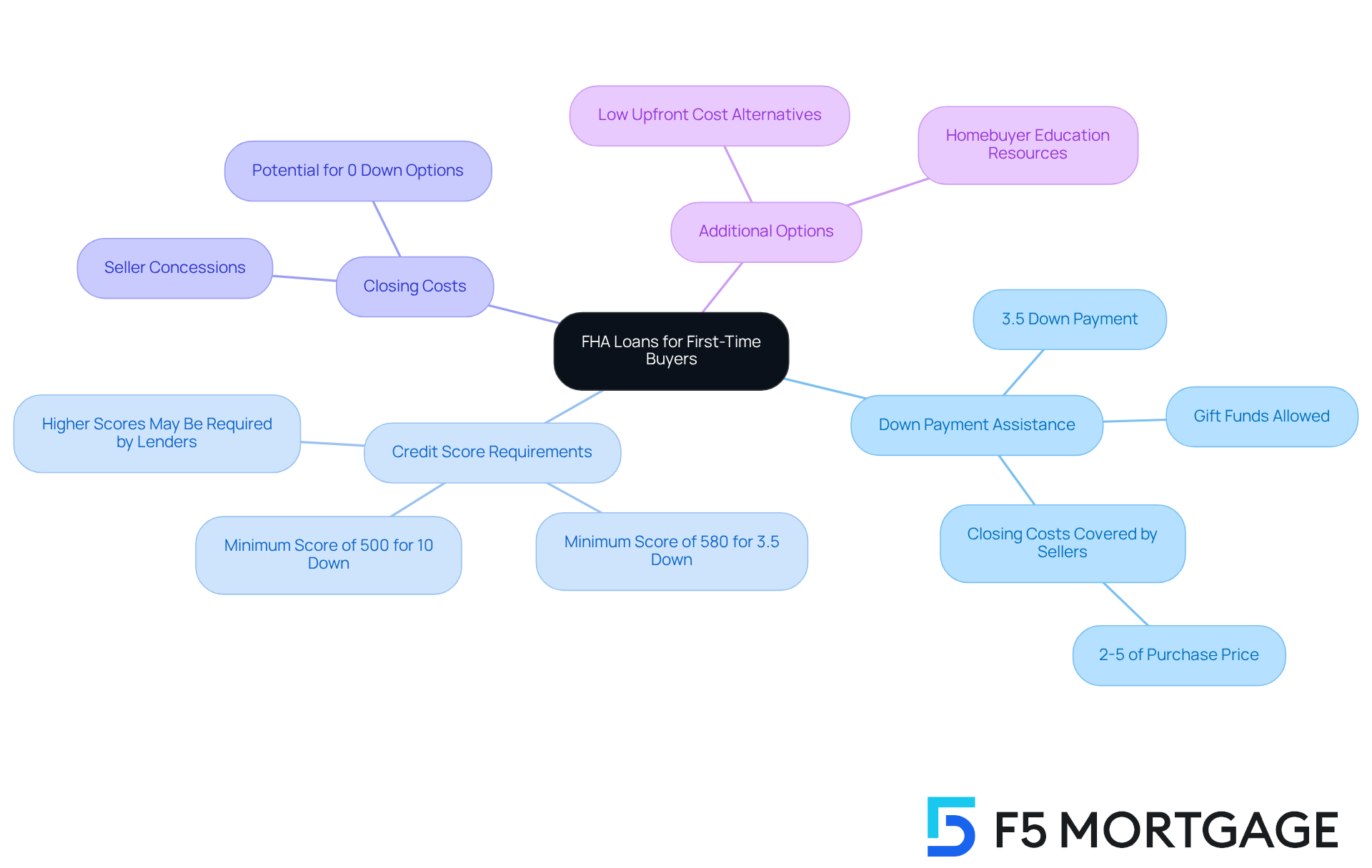

FHA Loans: Affordable Down Payment Assistance for First-Time Buyers

serve as a vital resource for , primarily because they offer with an appealing 3.5% . This minimal initial investment significantly lowers the entry barrier for those who may be facing challenges with limited savings, making the dream of more attainable. We understand how daunting this process can be, and FHA loans are designed with flexibility in mind. They feature lenient credit score requirements that enable a broader range of applicants to qualify. Specifically, borrowers with a credit score of 580 or higher can secure a loan with just a 3.5% deposit, while those with scores between 500 and 579 are required to contribute at least 10%.

Moreover, FHA loans allow home sellers to cover the buyer’s closing costs, which can range from 2-5% of the purchase price, further alleviating the . The trend of utilizing FHA loans is on the rise, reflecting their increasing popularity among those seeking affordable housing solutions. With an average initial contribution of approximately 3.5%, these loans not only facilitate access to homeownership but also empower buyers to navigate the market with confidence.

Additionally, the option to use gift funds for the down payment makes FHA loans even more appealing for individuals with limited cash reserves. For those considering extra assistance, F5 Mortgage offers several , including alternatives that may allow for 0% down, ensuring that do not hinder your journey to homeownership. To enhance your chances of securing , we recommend exploring available options, gathering necessary documentation, and working with a . We’re here to support you every step of the way.

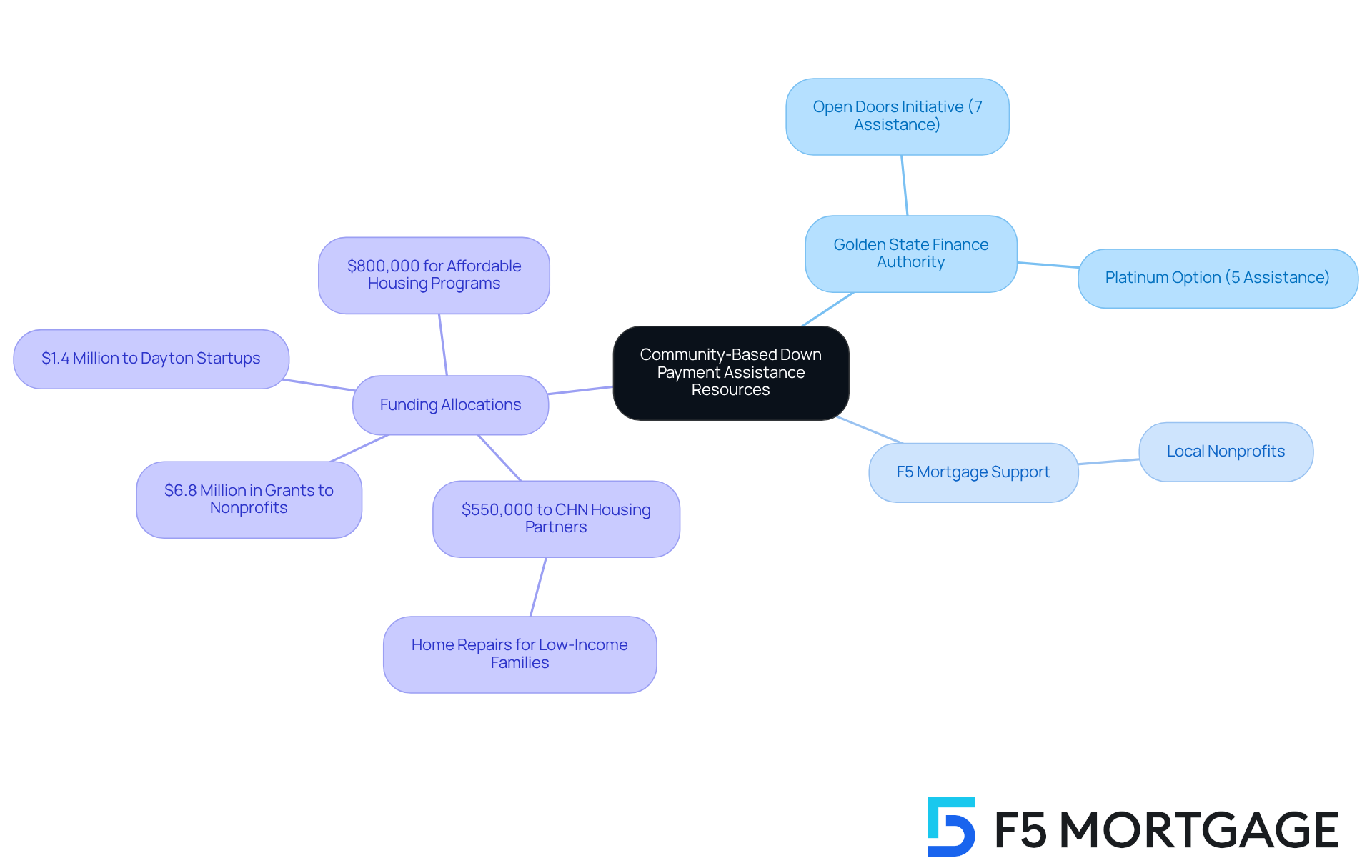

Local Nonprofits: Community-Based Down Payment Assistance Resources

In California, we understand how challenging it can be for low- to moderate-income families to achieve their dream of . Many initiatives are dedicated to providing , helping families overcome . For example, the Golden State Finance Authority’s Open Doors initiative offers up to 7% of the primary loan amount toward closing costs, while the Platinum option provides up to 5%.

At , we’re here to support you every step of the way, guiding you through these options to ensure you access the . The impact of these is significant; they not only alleviate but also empower families with the knowledge needed to navigate the housing market with confidence.

By partnering with and leveraging resources available through F5 Mortgage, potential homeowners can discover additional [down payment assistance Ohio](https://f5mortgage.com/loan-programs/down-payment-assistance/south-carolina) and funding opportunities that may not be available through traditional lending avenues. This collaborative approach fosters a more , ultimately contributing to the stability and growth of communities across California.

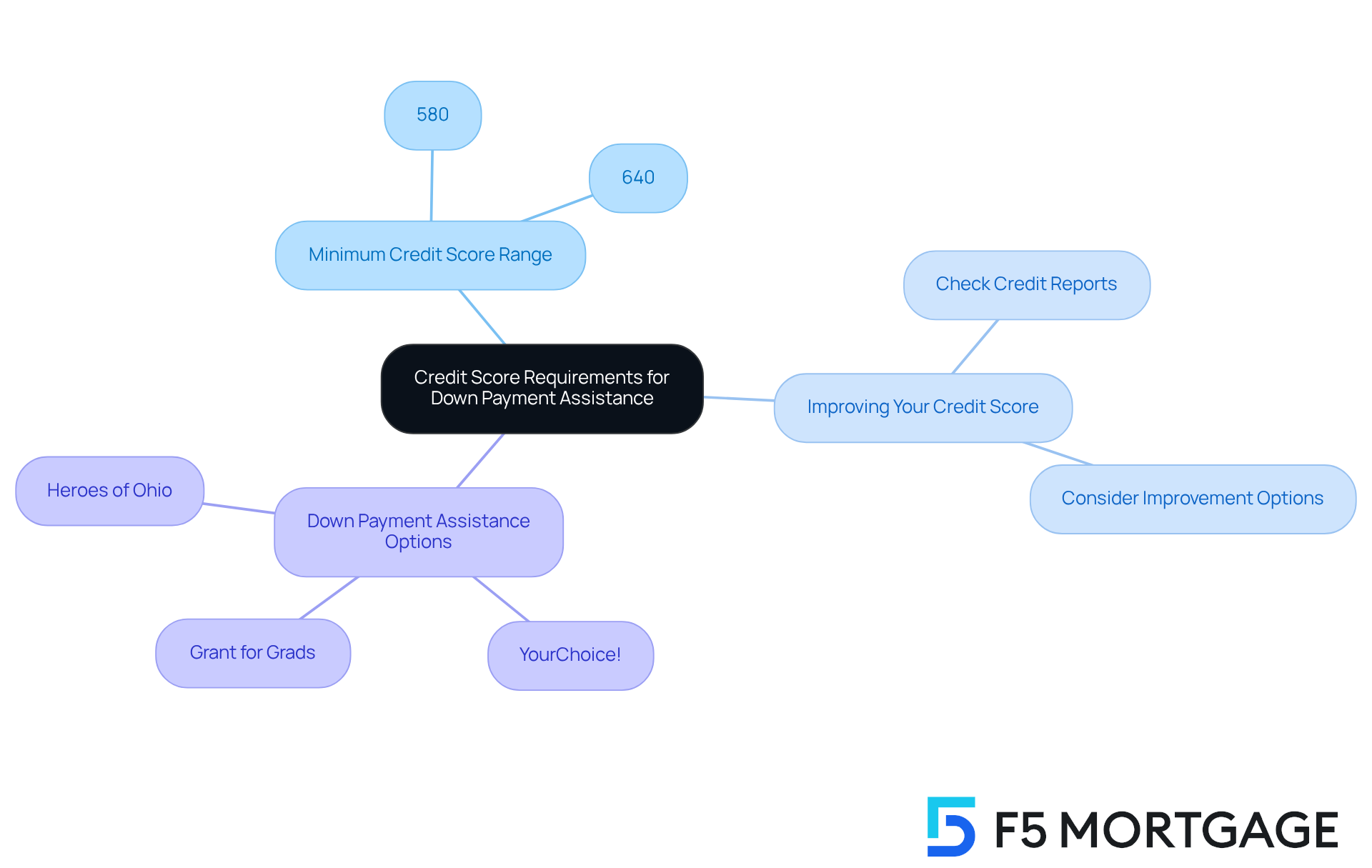

Credit Score Requirements: Key to Accessing Down Payment Assistance

Understanding is essential for anyone seeking in the state. We know how challenging this can be, and it’s important to realize that most offerings require a , typically ranging from 580 to 640, depending on the type of loan. If your score isn’t where you want it to be, take the time to check your credit reports and consider ways to improve your score. A higher credit score can lead to and increase your chances of approval.

To give yourself the best opportunity to qualify, explore the available options for in Ohio, such as:

- YourChoice!

- Grant for Grads

- Heroes of Ohio

Collecting all essential documents, such as , will also help streamline your application process. Remember, like F5 Mortgage can provide valuable guidance every step of the way. We’re here to in navigating this journey.

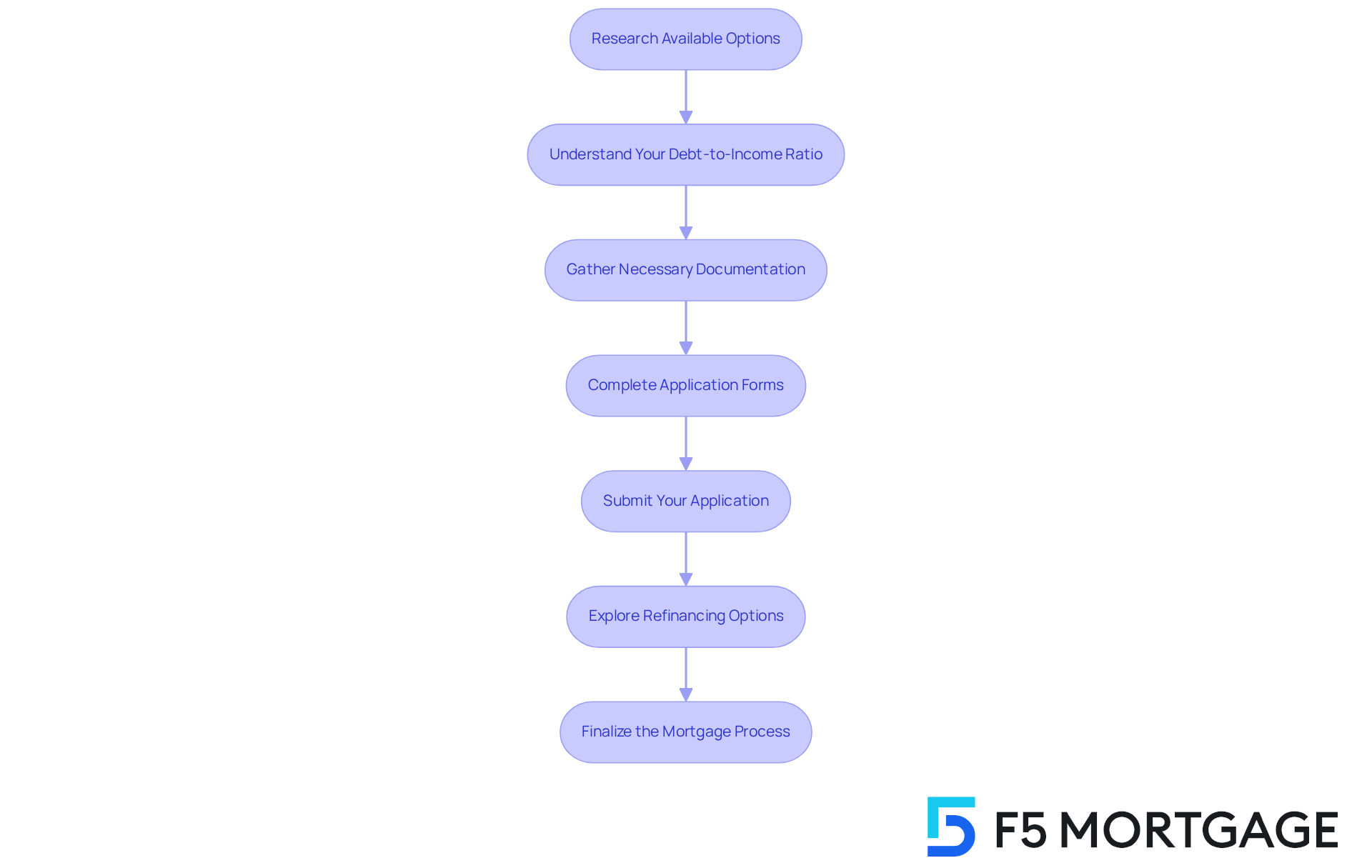

Application Process: Steps to Secure Down Payment Assistance in Ohio

Obtaining requires a methodical strategy to ensure a seamless application process. We understand how challenging this can be, and we’re here to support you every step of the way. Here are the essential steps to follow:

- Research Available Options: Start by investigating different down payment assistance initiatives. This will help you determine which one aligns best with your financial circumstances and . Programs like the (OHFA) offer tailored options for both , such as down payment assistance in Ohio.

- : Before applying, it’s crucial to understand your DTI ratio, which is the percentage of your monthly income that goes toward paying debts. A lower DTI ratio can improve your chances of mortgage approval and may lead to better mortgage rates. Aim for a DTI ratio below 43% to meet most lenders’ requirements.

- : Compile essential documents, including income verification, credit history, and any other required financial information. Being organized is key, as many applicants face delays due to incomplete submissions.

- Complete Application Forms: Fill out the application forms for your selected program accurately. Ensure that all information is up-to-date and reflects your current financial status.

- Submit Your Application: Once your application is complete, submit it to the appropriate agency or lender. Be prepared to wait for approval, as processing times can vary.

- Explore : If you already have a mortgage, consider refinancing options that may be available to you. Refinancing can assist in reducing your interest rate and monthly costs, making homeownership more economical.

- : After receiving approval, collaborate with your lender to finalize the mortgage details. This step is vital for securing your home purchase or refinancing.

Being organized and proactive throughout this process can significantly enhance your chances of success. For instance, families who have successfully navigated applications for down payment assistance Ohio often cite thorough preparation and timely submissions as key factors in their positive outcomes. Programs such as the Grants for Grads and local Heroes have also shown success in aiding individuals from different professions attain homeownership, highlighting the effectiveness of these support initiatives. Furthermore, it’s crucial to recognize that effective July 1, 2025, the will shift to 3% for conventional loans and 3.5% for government loans. Staying informed about these updates is essential for .

Impact of Down Payment Assistance: Boosting Homeownership Rates in Ohio

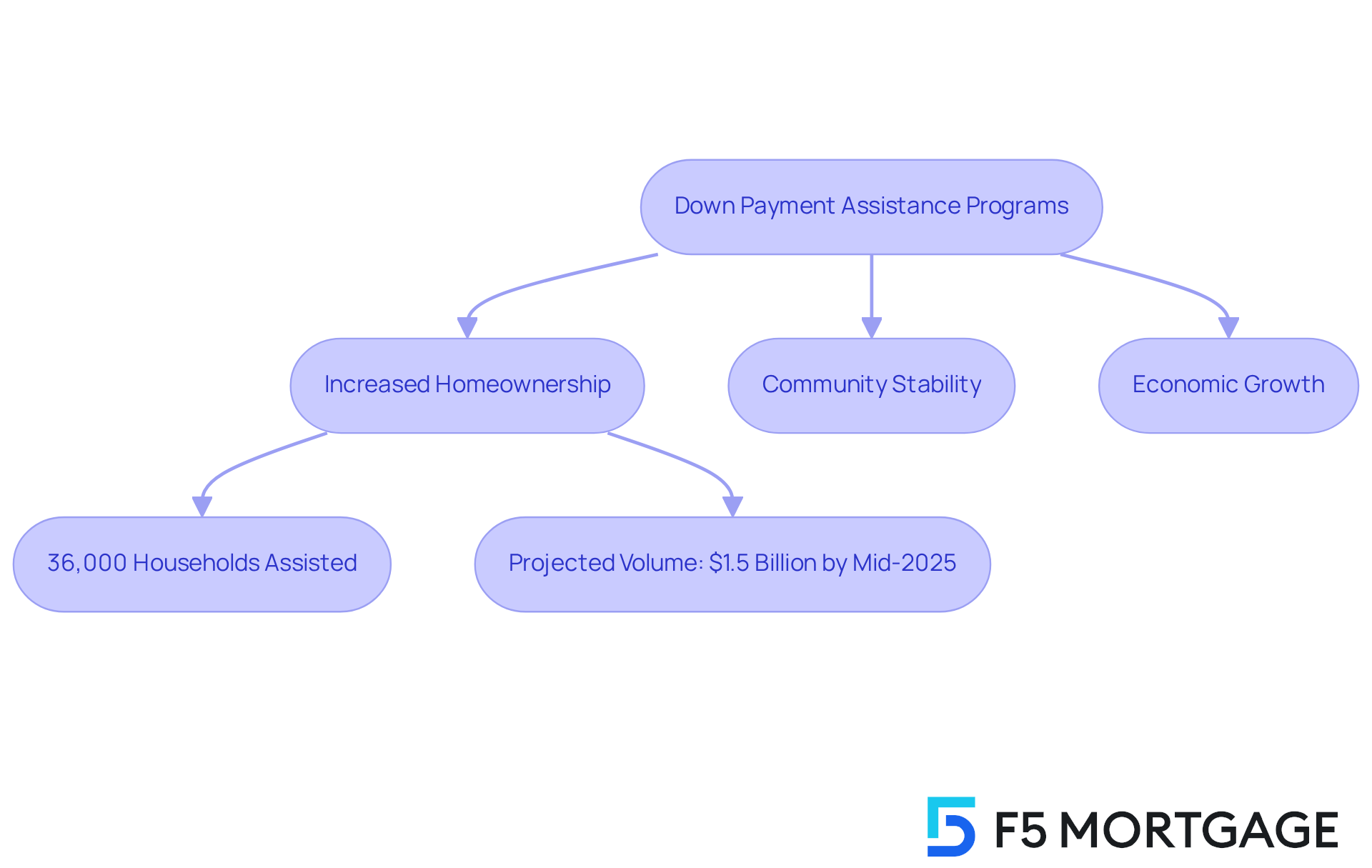

programs are vital in enhancing across the state. We understand how challenging can be, and initiatives like [down payment assistance Ohio](https://f5mortgage.com) are designed to empower more families to secure their homes. This not only fosters community stability but also stimulates economic growth. Research shows that increased homeownership leads to improved neighborhood conditions, as homeowners tend to invest in their properties and engage in community activities.

For instance, the state has seen a remarkable rise in homeownership rates, with over 36,000 households benefiting from through that allows down payments as low as 3%. There are countless success stories, including families who have transitioned from renting to owning thanks to these supportive initiatives. The Housing Finance Agency has reported a notable increase in demand for its , particularly down payment assistance in Ohio, with projections indicating that the volume will exceed $1.5 billion by mid-2025.

This increase underscores the crucial role of down payment assistance Ohio in shaping a prosperous future for the communities in Ohio. We’re here to support you every step of the way as you .

Myths vs. Facts: Debunking Common Misconceptions About Down Payment Assistance

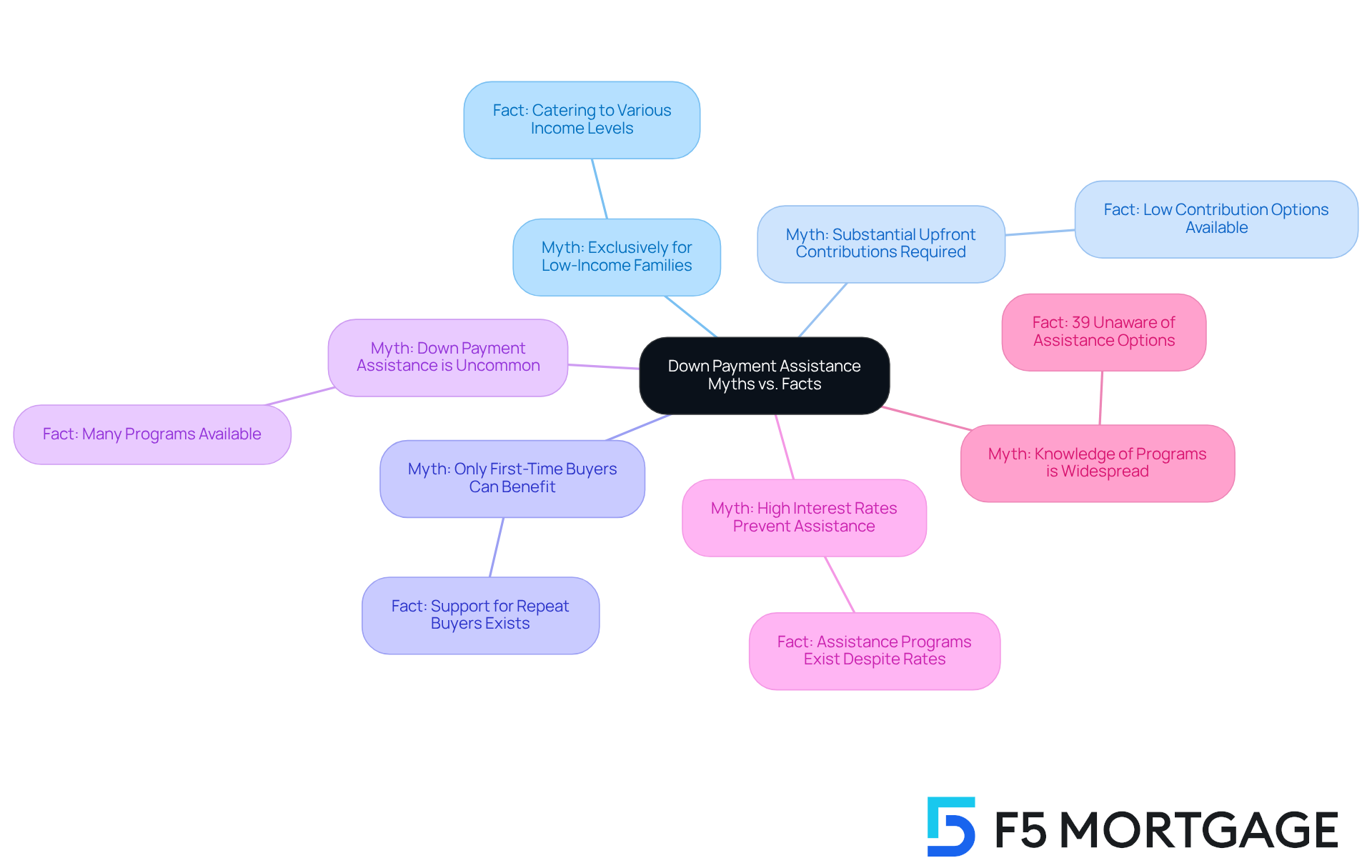

Many myths surrounding can discourage potential homebuyers from exploring their options. A is that this support is exclusively for low-income families. In truth, numerous initiatives cater to a variety of income levels. Some programs even require minimal to no upfront costs, making homeownership more attainable for a broader audience. For instance, about 40% of down payment assistance initiatives also support repeat buyers, demonstrating that these resources are not limited to first-time purchasers.

Another widespread belief is that are necessary to qualify for assistance. However, several initiatives, including , allow contributions as low as 3.5%, while USDA and VA loans may not require any initial costs at all. This flexibility can significantly alleviate the .

It’s essential to educate potential buyers about these realities, as many are unaware of the resources available to them. A recent survey revealed that nearly 39% of individuals do not know about down payment assistance options, highlighting the need for increased awareness. By dispelling these myths, homebuyers can feel empowered to take advantage of the support available to them, ultimately facilitating their journey toward homeownership.

To improve your chances of qualifying for down payment assistance in Ohio, it’s crucial to , such as:

- YourChoice!

- Grant for Grads

- Ohio Heroes

Additionally, and getting can greatly enhance your application. Be sure to gather all necessary documentation, including proof of income, tax returns, and employment verification. like F5 Mortgage can provide invaluable guidance throughout the application process. For further assistance, potential buyers are encouraged to consult local real estate agents or financial advisors to explore available down payment assistance in Ohio.

Conclusion

Down payment assistance programs in Ohio offer a vital opportunity for aspiring homeowners to overcome financial hurdles and realize their dream of owning a home. By providing various forms of support—such as grants, loans, and community initiatives—these programs cater to a wide array of financial situations, making homeownership more accessible for many residents.

We understand how challenging it can be to navigate the path to homeownership. Key options like F5 Mortgage’s comprehensive assistance programs, the Ohio Housing Finance Agency’s targeted resources, and USDA loans for rural buyers have been highlighted throughout this article. Each initiative plays a crucial role in promoting homeownership, especially for first-time buyers and low- to moderate-income families. It’s important to grasp credit score requirements and the application process, as these factors significantly affect your chances of securing assistance.

The impact of down payment assistance in Ohio reaches beyond individual families; it nurtures community growth and stability, stimulates economic development, and ultimately contributes to a higher quality of life. By dispelling myths and raising awareness about available resources, potential homebuyers can feel empowered to explore their options. Engaging with knowledgeable lenders and utilizing various assistance programs can help you transition successfully from renting to owning, reinforcing the belief that homeownership is within reach for many.

We’re here to support you every step of the way as you embark on this journey. Take the time to explore these opportunities, and remember that you are not alone in this process. Together, we can make your dream of homeownership a reality.

Frequently Asked Questions

What types of down payment assistance programs are available in Ohio?

Ohio offers a variety of down payment assistance programs, including grants and loans to help cover down payments, closing costs, and other pre-closing expenses for homebuyers.

How much down payment assistance can homebuyers receive through the Cleveland Heights initiative?

The Cleveland Heights initiative provides down payment assistance of up to $30,000 for single-family homes, with a portion of these funds potentially forgivable over five years for qualifying households.

What is the purpose of the American Rescue Plan Act (ARPA) in relation to down payment assistance in Ohio?

The ARPA supports initiatives like the Cleveland Heights down payment assistance program, aiming to stimulate homeownership and foster community growth.

How has the typical house price in Ohio changed recently, and why is this significant?

The typical house price in Ohio has increased by more than 6% in the past year, highlighting the importance of initial funding through down payment assistance to help potential buyers achieve homeownership.

What role does the Ohio Housing Finance Agency (OHFA) play in down payment assistance?

The OHFA provides a range of down payment assistance options specifically designed for qualified homebuyers, particularly low- to moderate-income families, through grants or repayable loans.

How much assistance can participants receive through the Grants for Grads program?

Participants in the Grants for Grads program can receive up to 5% of their home’s purchase price.

How many families did OHFA assist in 2024 through down payment assistance?

OHFA assisted over 6,000 families in Ohio through down payment assistance in 2024.

What changes are being made to the assistance levels offered by OHFA effective July 1, 2025?

Effective July 1, 2025, OHFA will increase aid from 2.5% to 3% for conventional loans and from 5% to 3.5% for government loans in response to growing demand.

What is the HomeReady Mortgage initiative, and how does it benefit Ohio homebuyers?

The HomeReady Mortgage initiative allows Ohio residents to secure a mortgage with as little as 3% down, or even 0% down for certain options, making homeownership more accessible for first-time buyers and those with limited savings.

What percentage of borrowers utilizing private mortgage insurance in Ohio were first-time homebuyers in 2024?

Nearly 68% of borrowers in Ohio utilizing private mortgage insurance in 2024 were first-time homebuyers, indicating the effectiveness of programs like HomeReady in facilitating homeownership.