Overview

Navigating the world of homeownership can be daunting, especially when it comes to financing. This article explores the concept of 0 down mortgages, shedding light on how they work, their advantages, and their potential drawbacks. We understand how challenging it can be to save for a down payment, and 0 down mortgages offer a pathway for many families who may feel stuck.

While these options can increase accessibility for homebuyers with limited savings, it’s important to recognize the risks involved. Higher monthly payments and the possibility of financial distress if property values decline are crucial factors to consider. We’re here to support you every step of the way as you weigh your options.

Additionally, we’ll compare 0 down mortgages to 3% down payment options, helping you make informed decisions that align with your unique circumstances. Remember, careful consideration of your financial situation is key before proceeding. Together, we can find the best solution for your homeownership journey.

Introduction

Navigating the world of home financing can feel overwhelming, especially for first-time buyers eager to secure their dream home without the stress of a large down payment. We understand how challenging this can be.

Zero-down mortgages have emerged as a popular solution, providing a pathway to homeownership for those with limited savings. However, while these financing options present exciting opportunities, they also come with significant risks and considerations that potential borrowers must carefully evaluate.

What are the true costs of entering the housing market with no initial investment? How can you ensure that you make an informed decision amidst the allure of immediate homeownership?

We’re here to support you every step of the way as you explore your options.

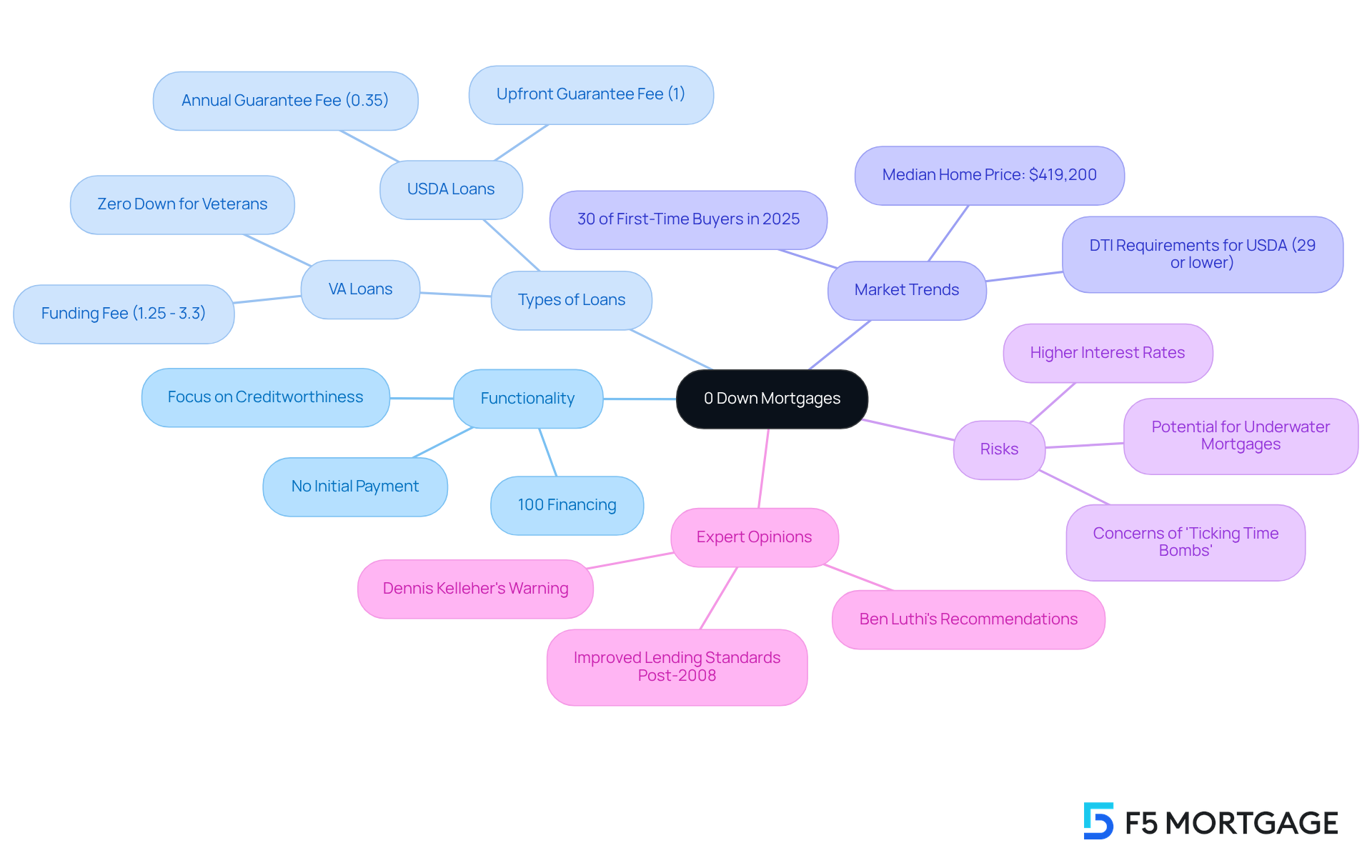

Define Zero-Down Mortgages and Their Functionality

A 0 down mortgage is a financing option that allows borrowers to cover the full purchase cost of a house without an initial payment. This makes it an appealing choice for first-time homebuyers or individuals with minimal savings who are interested in a 0 down mortgage. Often, these financial products come in the form of government-supported funding, such as VA financing for veterans and USDA assistance for qualifying rural properties. Importantly, these options focus on assessing the borrower’s creditworthiness and income instead of their savings, thus expanding access to homeownership.

In 2025, around 30% of first-time home purchasers are anticipated to opt for a 0 down mortgage. This indicates a rising trend in the market that could provide many with a chance to own a home. While these financial products remove the initial expense of a down payment, they may involve elevated interest rates and extra charges that can greatly influence the total expense of the financing. For instance, VA loans require a funding fee ranging from 1.25% to 3.3% of the loan amount. Additionally, USDA loans involve an upfront guarantee fee of 1% of the loan amount, along with an annual guarantee fee of 0.35%.

However, it’s essential to approach these options with caution. Experts warn that while no-down payment loans can facilitate home buying, they also involve risks. Dennis Kelleher, CEO of Better Markets, cautions that these loans could turn into ‘ticking time bombs’ if home prices do not keep increasing. This reflects concerns similar to those seen during the subprime loan crisis. Moreover, borrowers starting with no equity may find themselves underwater if housing prices decline, increasing the risk of financial distress.

Overall, a 0 down mortgage presents a viable pathway to homeownership for many. Yet, potential borrowers should carefully consider their financial situation and the long-term implications of such arrangements. We know how challenging this can be, and we’re here to support you every step of the way as you navigate this important decision.

Evaluate the Pros and Cons of Zero-Down Mortgages

Evaluate the Pros and Cons of Zero-Down Mortgages

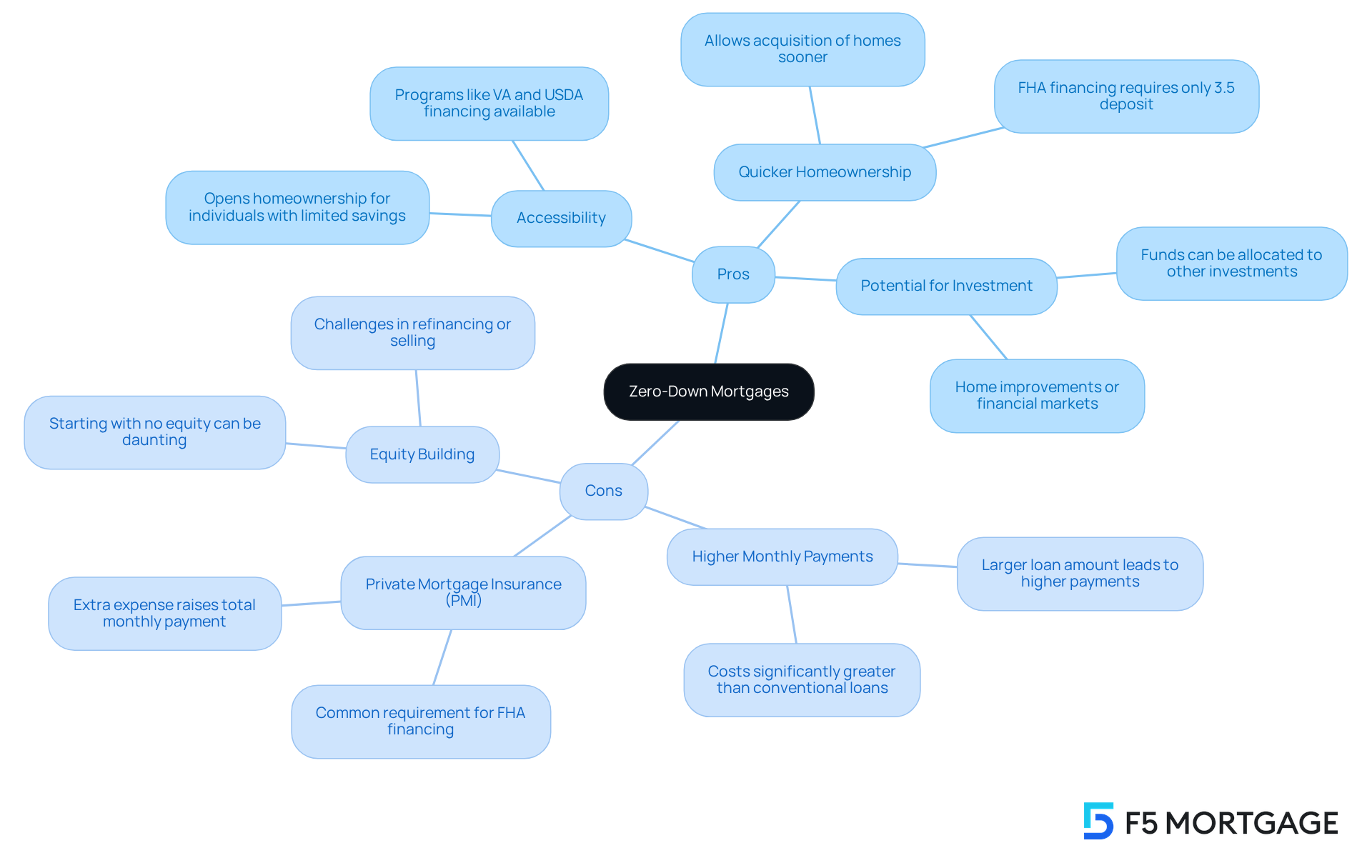

Pros of Zero-Down Mortgages:

-

Accessibility: We know how challenging it can be to save for a down payment. The 0 down mortgage option opens the door to homeownership for individuals with limited savings, allowing them to enter the housing market without the burden of a substantial down payment. Programs such as VA and USDA financing allow buyers to acquire homes with a 0 down mortgage, making homeownership more achievable.

-

Quicker Homeownership: Imagine being able to acquire a home sooner rather than later. These financial products allow purchasers to acquire homes earlier, removing the necessity to wait to gather funds for a deposit, which can frequently require years. For instance, FHA financing necessitates only a 3.5% deposit, enabling purchasers to proceed more swiftly.

-

Potential for Investment: By not tying up funds in an initial deposit, homebuyers can allocate their savings towards other investments, such as home improvements or financial markets, potentially yielding higher returns.

Cons of Zero-Down Mortgages:

-

Higher Monthly Payments: It’s important to understand that the absence of a down payment results in a larger loan amount, which translates to higher monthly payments compared to traditional mortgages. The typical monthly cost for a no-down financing option is considerably greater than that of conventional home loans, indicating the elevated amounts borrowed and related expenses.

-

Private Mortgage Insurance (PMI): Most no-down-payment mortgages require PMI, an extra expense that raises the total monthly payment and can greatly affect affordability. This is especially pertinent for FHA financing, where insurance on the property is frequently necessary.

-

Equity Building: Starting with no equity can be daunting. Homeowners begin their journey with no equity, making it challenging to refinance or sell without incurring losses, especially in a declining market. This lack of equity can lead to financial strain if home values decrease.

Financial advisors emphasize the importance of understanding these implications before proceeding with a 0 down mortgage, particularly in fluctuating market conditions. Jeff Ostrowski, a housing market analyst, observes, “If you’re in an area where home prices are still increasing, a no-down-payment option can be a good decision,” but warns that buyers should take local market conditions into account. While these loans can facilitate homeownership for many, they also carry risks that must be carefully considered. Furthermore, deposit assistance programs offered by F5 Mortgage in regions such as California, Texas, and Florida can offer additional help for purchasers seeking to reduce their initial expenses.

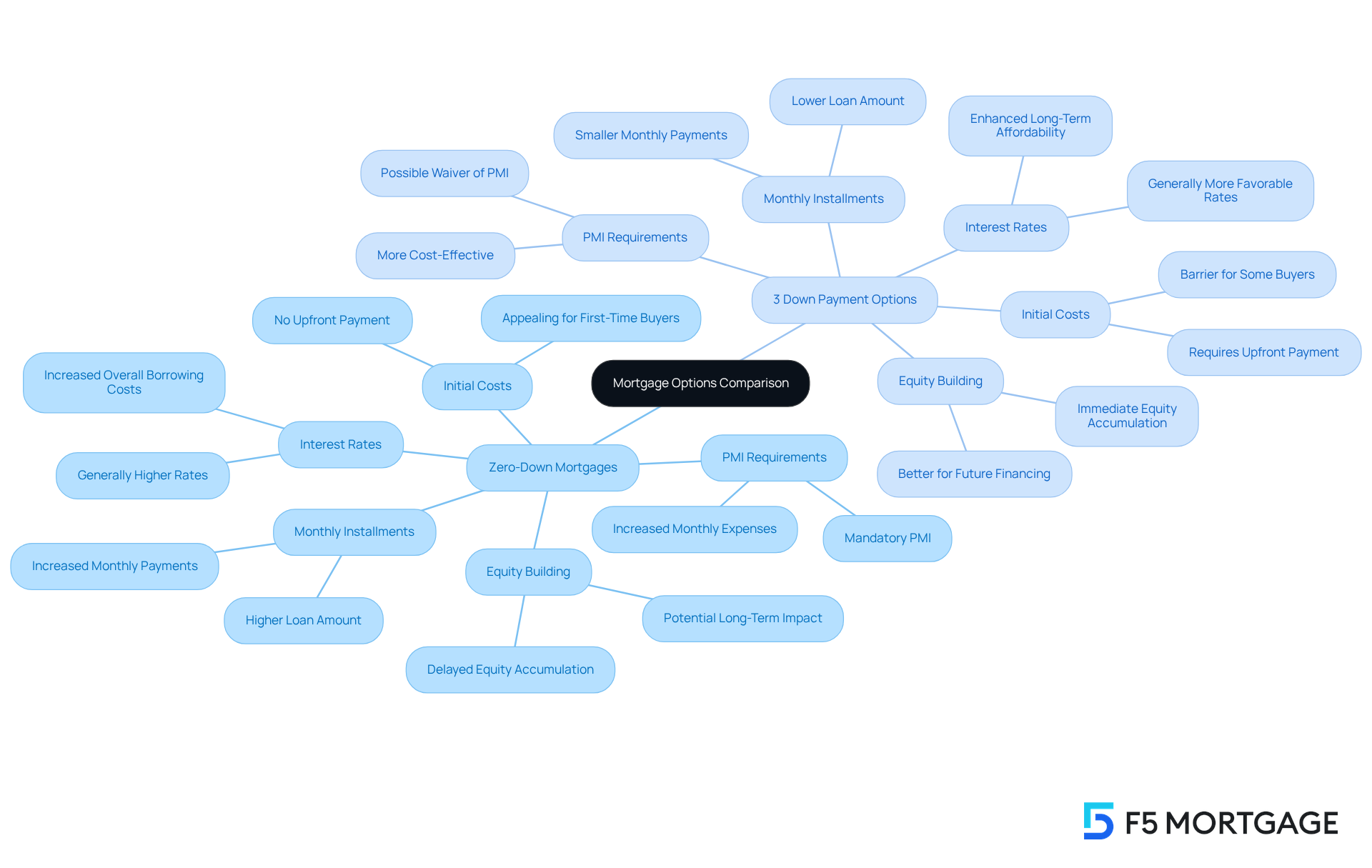

Compare Zero-Down Mortgages with 3% Down Payment Options

When evaluating zero-down mortgages against 3% down payment options, several critical factors come into play that we understand can be quite challenging:

- Initial Costs: Zero-down mortgages eliminate the need for an upfront payment, making them attractive for first-time buyers who may lack savings. In contrast, a 3% deposit requires buyers to have some funds available, which can feel like a barrier. At F5 Mortgage, we’re here to support you every step of the way, helping you navigate these options effectively to find a solution that fits your financial situation.

- Monthly Installments: Opting for a 3% down payment leads to a reduced loan amount, resulting in smaller monthly installments compared to a no-down payment option. This can significantly impact your monthly budget and overall financial planning. With competitive rates from F5 Mortgage, we aim to enhance your affordability.

- Equity Building: With a 3% deposit, homeowners start accumulating equity right away, which can be beneficial for future refinancing or selling. In contrast, 0 down mortgage loans delay equity accumulation, which may potentially impact long-term financial stability. Additionally, a 3% initial deposit may enhance your chances of approval for home financing, assisting you in building equity more rapidly compared to a 0% deposit.

- PMI Requirements: PMI requirements for a 0 down mortgage generally include private insurance (PMI), which increases monthly expenses. Some 3% down payment financing options may not require PMI, depending on the lender and specific terms, making them a more cost-effective choice. The additional expense of PMI for no-down-payment mortgages can significantly influence overall affordability.

- Interest Rates: Generally, 0 down mortgage financing options may carry higher interest rates, increasing the overall cost of borrowing over time. In contrast, loans with a down payment often secure more favorable rates, enhancing affordability in the long run. At F5 Mortgage, our personalized service ensures that you can compare rates effectively to find the best deal.

In 2025, the average purchase cost for a home in the U.S. was around $503,800. This makes the decision between these financing options particularly important for buyers navigating a competitive market. Understanding these financial implications is crucial for making informed decisions that align with your individual circumstances and long-term goals. F5 Mortgage has assisted more than 1,000 families in realizing their homeownership aspirations, featuring a customer satisfaction rate of 94%. This highlights the significance of selecting the appropriate financing option, and we know how challenging this can be.

Outline Eligibility Requirements and Application Steps for Zero-Down Mortgages

Eligibility Requirements:

- Credit Score: We understand that navigating credit scores can be daunting. Most lenders typically require a minimum credit score of around 620, though this can vary based on the lender and specific loan programs. In 2024, approximately 71.2% of consumers maintained a good credit score (670 or higher), which is crucial for securing favorable mortgage terms.

- Income Verification: To ease your journey, borrowers must provide proof of income, which can include pay stubs, tax returns, or bank statements. This documentation helps demonstrate your ability to repay the debt.

- Debt-to-Income Ratio: Lenders will evaluate your debt-to-income ratio to ensure you can manage monthly payments effectively. A lower ratio signifies improved financial health and enhances your chances of credit approval.

- Property Type: 0 down mortgage loans are often limited to specific property categories, such as primary residences or certain rural properties, to reduce risk for lenders. Additionally, refinancing alternatives are accessible for various types of financing, including government programs such as FHA, VA, and USDA options. Borrowers with FHA loans can consider cash-out refinances, simple refinances, or streamlined refinances, depending on their needs.

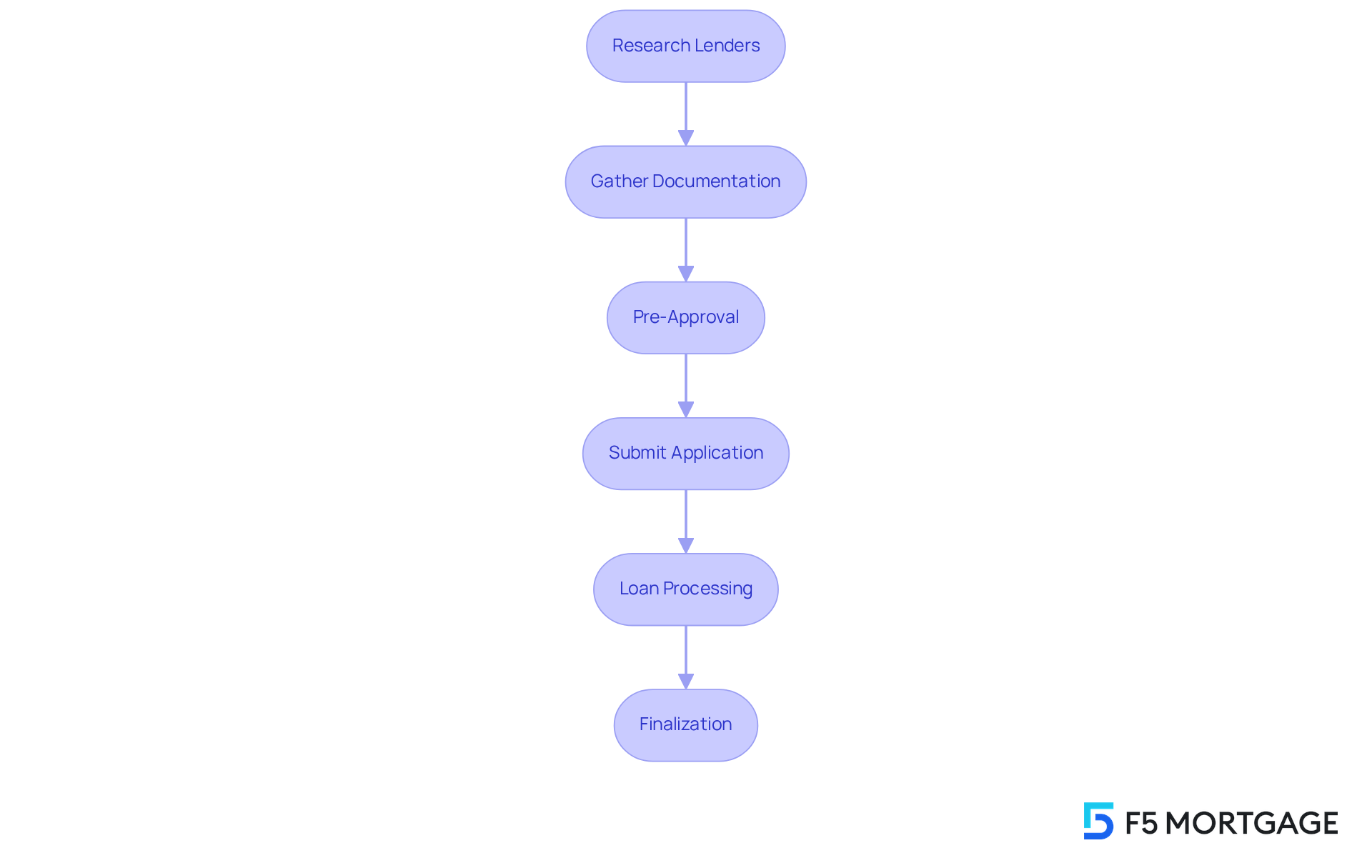

Application Steps:

- Research lenders that provide a 0 down mortgage financing option. We encourage you to compare their terms, interest rates, and eligibility criteria to find the best fit for your needs. F5 Mortgage partners with numerous lenders to help you discover the best deals.

- Gather Documentation: Preparing necessary documents, including income verification and credit history, can streamline your application process, making it less overwhelming.

- Pre-Approval: Applying for pre-approval is a crucial step to understand how much you can borrow. This not only clarifies your budget but also strengthens your position when making an offer on a home.

- Submit Application: Complete the loan application with your chosen lender, ensuring all required documentation is included to avoid delays. Remember, F5 Mortgage will be there to assist you throughout this process.

- Loan Processing: Your lender will review your application, conduct an appraisal, and finalize the loan terms. This stage may involve additional requests for information or clarification, and we’re here to support you through it.

- Finalization: Once approved, you’ll attend the closing meeting to sign documents and complete the loan. This final step in securing your 0 down mortgage allows you to move forward with your home purchase, and F5 Mortgage will guide you through this important moment.

Conclusion

Navigating the world of zero down mortgages presents a unique opportunity for aspiring homeowners. We understand how challenging it can be to save for a traditional down payment, and this financing option allows individuals to purchase a home without the burden of an upfront payment. This makes it especially appealing for first-time buyers or those with limited savings. However, while these loans can facilitate homeownership, they also come with potential risks and costs that need careful consideration.

Throughout this article, we’ve highlighted key insights, including:

- The accessibility of zero down mortgages

- The importance of understanding the associated higher monthly payments

- The implications of private mortgage insurance

- A comparison with 3% down payment options that sheds light on how these two choices can impact long-term financial stability and equity accumulation

- The eligibility requirements and application steps, emphasizing the need for careful planning and consideration

Ultimately, the decision to pursue a zero down mortgage should not be taken lightly. We encourage potential borrowers to thoroughly assess their financial situation, market conditions, and long-term goals. By doing so, you can make informed choices that align with your aspirations for homeownership. Embracing this knowledge empowers you to navigate the complexities of the mortgage landscape confidently, ensuring that you find the best financing solution tailored to your unique needs.

Frequently Asked Questions

What is a zero-down mortgage?

A zero-down mortgage is a financing option that allows borrowers to purchase a house without making an initial payment. It is particularly appealing for first-time homebuyers or individuals with limited savings.

Who typically qualifies for a zero-down mortgage?

Zero-down mortgages are often available through government-supported programs, such as VA financing for veterans and USDA assistance for qualifying rural properties. These options assess the borrower’s creditworthiness and income rather than their savings.

What is the anticipated trend for zero-down mortgages in 2025?

In 2025, it is expected that around 30% of first-time home purchasers will choose a zero-down mortgage, indicating a growing trend in the market.

What are some potential costs associated with zero-down mortgages?

While zero-down mortgages eliminate the initial down payment, they may come with higher interest rates and additional fees. For example, VA loans require a funding fee ranging from 1.25% to 3.3% of the loan amount, and USDA loans involve a 1% upfront guarantee fee and a 0.35% annual guarantee fee.

What risks are associated with zero-down mortgages?

Experts warn that zero-down mortgages can pose risks, including the potential for borrowers to become ‘underwater’ if home prices decline, leading to financial distress. There are concerns that these loans could become problematic if housing prices do not continue to rise.

What should potential borrowers consider before opting for a zero-down mortgage?

Potential borrowers should carefully evaluate their financial situation and the long-term implications of taking on a zero-down mortgage, as it can significantly impact their financial health and homeownership experience.