Overview

This article is here to support you in effectively using the FHA payment calculator to estimate your mortgage payments. We understand how daunting this process can be, and we aim to guide you through the necessary steps and information needed for accurate calculations. It’s crucial to grasp key factors such as:

- Loan amount

- Interest rates

- Mortgage insurance premiums

These elements work together to empower you to make informed financial decisions and budget wisely for your homeownership costs.

We know how challenging this can be, but by understanding these factors, you can take control of your financial future. Start by gathering the relevant information, and remember, each step you take brings you closer to your dream home.

Our goal is to ensure that you feel confident and informed as you navigate this journey. We’re here to support you every step of the way, helping you to make the best choices for your family’s needs.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially when considering the various tools available to prospective buyers. We understand how challenging this can be. Among these tools, the FHA payment calculator shines as a vital resource, helping borrowers gain clarity on their mortgage obligations by factoring in essential elements like loan amount, interest rates, and insurance premiums. Yet, many individuals may feel unsure about how to effectively utilize this powerful tool.

What if there was a straightforward way to master the FHA payment calculator, ensuring accurate estimates and informed financial decisions? This guide not only demystifies the calculator’s features but also provides step-by-step instructions to empower you in your home-buying journey. We’re here to support you every step of the way.

Understand the FHA Payment Calculator

The fha payment calculator serves as an essential tool for borrowers looking to understand their periodic mortgage payments on FHA financing. We know how important it is to assess your financial commitments, and this calculator takes into account several key factors, such as the loan amount, interest rate, loan term, property taxes, homeowners insurance, and mortgage insurance premiums (MIP). By using this calculator effectively, you can gain valuable insights into your potential recurring obligations, which is crucial for budgeting and financial planning.

Key Features of the FHA Payment Calculator:

- Loan Amount: This is the total amount you intend to borrow, directly influencing your monthly payment. For 2025, the FHA borrowing limit is $524,225 for single-family residences in most areas, potentially reaching $1,209,750 in more expensive regions.

- Interest Rate: The annual percentage rate (APR) applied to your loan affects the overall cost of borrowing.

- Loan Term: The repayment period, typically 15 or 30 years, influences the amount of your recurring charges.

- Property Taxes and Insurance: These estimated expenses can significantly impact your regular financial obligations, making it crucial to factor them into your calculations.

- MIP: FHA mortgages require mortgage insurance, which is included in your monthly charge and can vary from 0.15% to 0.75% of the principal sum. Additionally, an upfront mortgage insurance premium (UFMIP) of 1.75% of the borrowed amount is required.

Understanding these elements empowers you to evaluate how your financial circumstances will affect your mortgage costs. For instance, with the lowest initial contribution of 3.5% for FHA mortgages, you can see how different deposit amounts influence your monthly responsibilities. The fha payment calculator updates dynamically with changing rates, offering real-time estimates that assist you in making informed decisions regarding your mortgage options. This tool is particularly beneficial as it allows borrowers to compare various financing terms, down payments, and interest rates side by side, ensuring you select the best option for your financial needs.

It’s also important to remember that FHA loans are not just for first-time homebuyers; anyone meeting the requirements can qualify through an FHA-approved lender. Moreover, the calculator includes educational FAQs about FHA rules, enhancing your understanding of the mortgage process. We’re here to as you navigate this journey.

Gather Necessary Information for Calculation

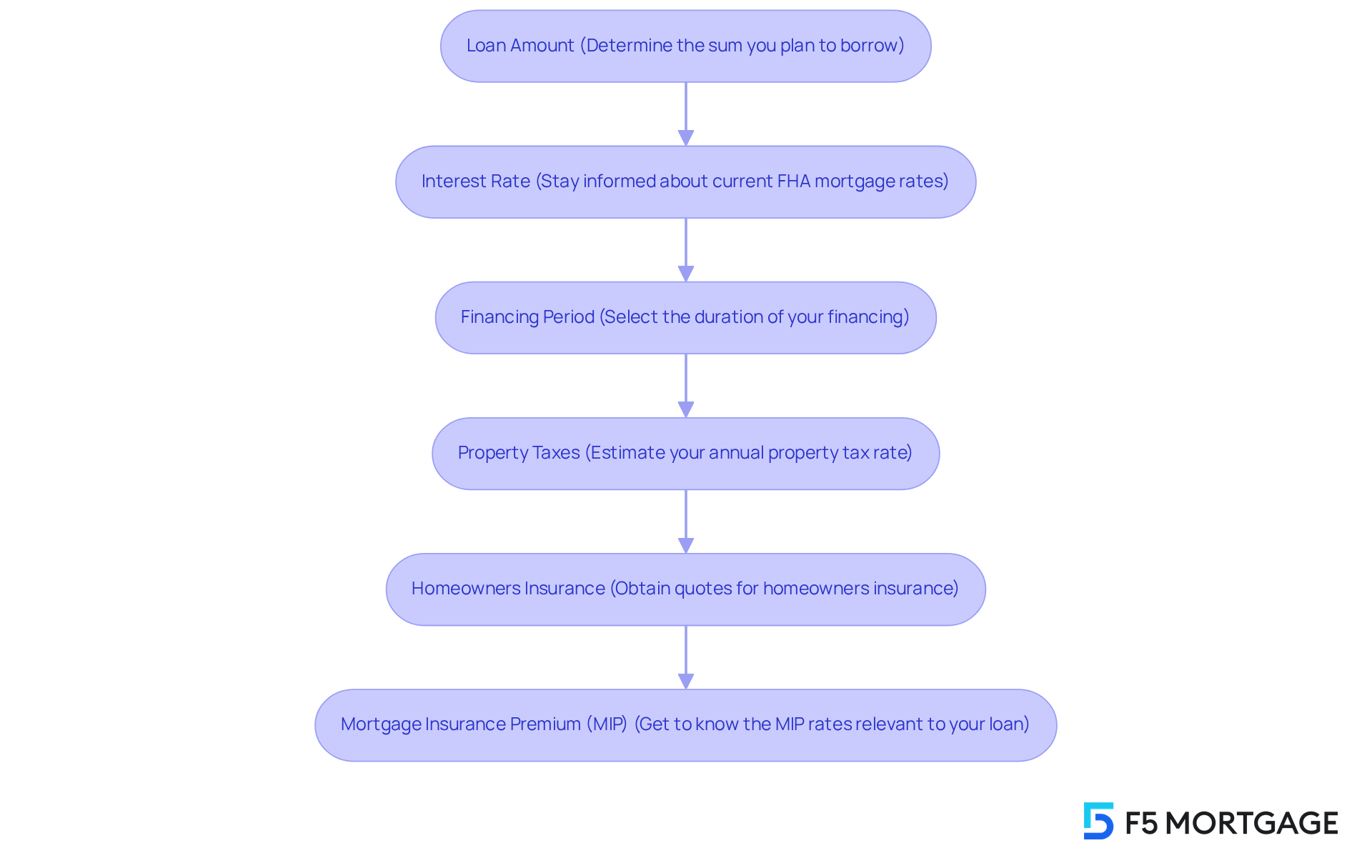

To effectively utilize the , it is essential to gather specific information that will allow for precise calculations of your potential mortgage expenses. Here’s what you need to prepare:

- Loan Amount: Determine the sum you plan to borrow, typically the home’s purchase price minus your initial contribution. In 2025, the typical initial deposit for FHA mortgages is around 3.5% of the purchase price, making it attainable for numerous families.

- Interest Rate: Stay informed about current FHA mortgage interest rates, which as of July 2025, are around 6.74%. This rate can greatly influence your regular costs, so it’s wise to consult with lenders or financial sites for the most precise figures. As noted by financial expert Glen Luke Flanagan, “When applying for a mortgage, it’s typically best to have a DTI of 36% or below, though you may be approved with a DTI as high as 43%.”

- Financing Period: Select the duration of your financing, with typical choices being 15 or 30 years. The option you choose will influence your recurring charge and the overall interest paid throughout the duration of the loan.

- Property Taxes: Estimate your annual property tax rate based on local tax assessments. This information is generally accessible on your local government’s website and is crucial for determining your total cost each month.

- Homeowners Insurance: Obtain quotes for homeowners insurance to estimate your monthly premium. This cost is frequently incorporated into your mortgage charge and varies based on coverage and location.

- Mortgage Insurance Premium (MIP): Get to know the MIP rates relevant to your loan, which can vary depending on the loan amount and initial deposit. Comprehending these rates is essential, as they will be included in your regular charge.

By organizing this information beforehand, you can simplify the calculation process with an FHA payment calculator and obtain a clearer understanding of your possible regular expenses. This preparation will assist you in making informed choices as you navigate your home buying journey. Remember, F5 Mortgage LLC has successfully assisted over 1,000 families, reinforcing the importance of being well-prepared in this process. We’re here to support you every step of the way.

Follow the Step-by-Step Calculation Process

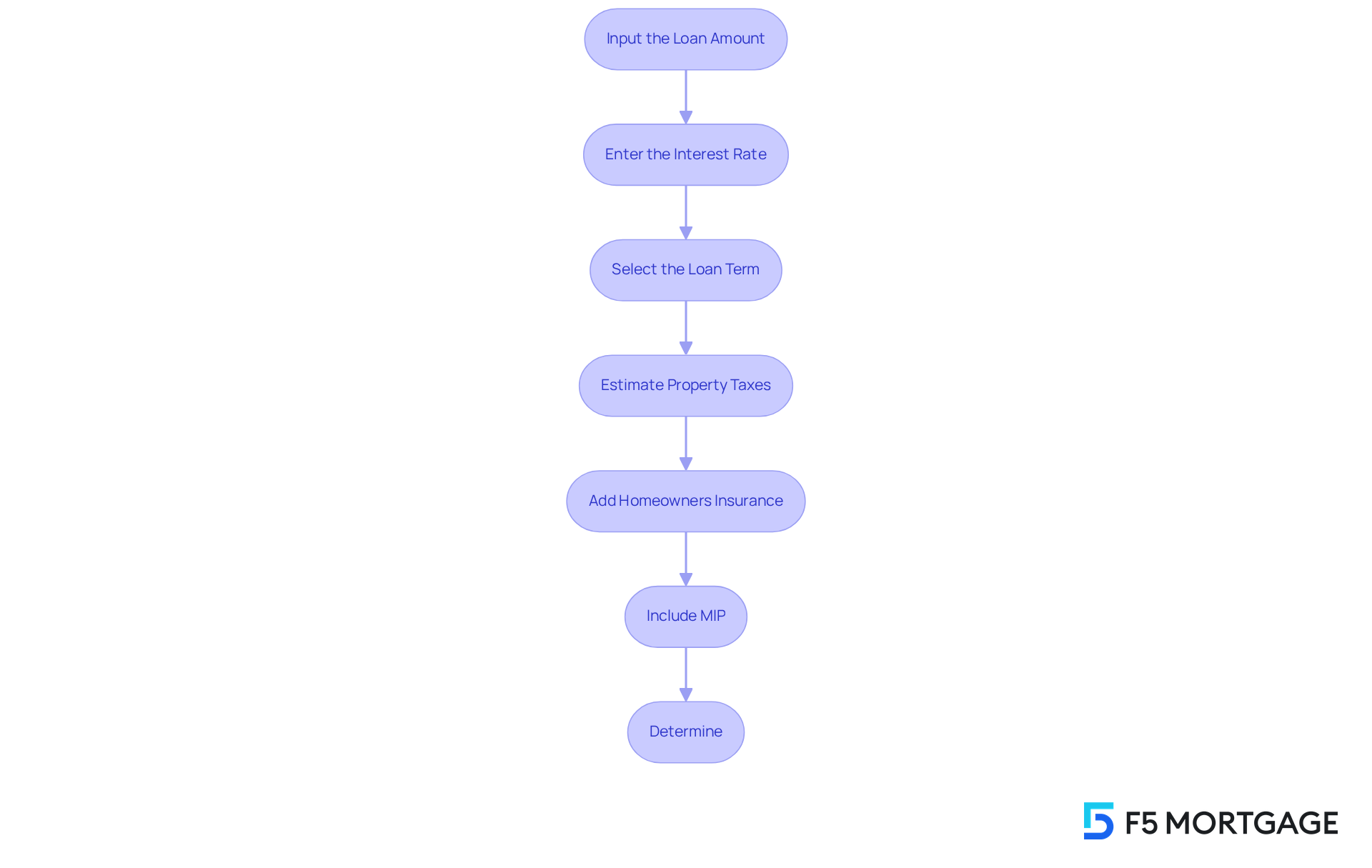

Estimating your monthly payment can feel daunting, but using the FHA payment calculator, we’re here to support you every step of the way. By following these straightforward steps, you can gain clarity on your financial obligations:

- Input the Loan Amount: Start by entering the total amount you plan to borrow. For example, if you’re purchasing a home for $300,000 and making a $10,000 down payment, your borrowing amount will be $290,000.

- Enter the Interest Rate: Next, input the current interest rate for FHA mortgages. If this rate is 3.5%, simply enter 3.5.

- Select the Loan Term: Choose the duration of your loan. If you decide on a 30-year term, select that option.

- Estimate Property Taxes: Input your estimated annual property tax amount. For instance, if your property taxes total $3,600 per year, enter $300 (which is $3,600 divided by 12).

- Add Homeowners Insurance: Enter your estimated premium for homeowners insurance. If your annual premium is $1,200, input $100.

- Include MIP: Don’t forget to enter the mortgage insurance premium for the month. For example, if your MIP is $150 per month, input that amount.

- Determine: Finally, click the calculate button to view your estimated recurring charge. The calculator will provide a breakdown of principal, interest, taxes, insurance, and MIP.

By following these steps, you can estimate your monthly mortgage payment with confidence. FHA financing, which represented over 20% of purchase mortgages in 2024, offers flexible options that make it a popular choice for many homebuyers. The FHA mortgage limit for 2025 is $524,225 for a single-family residence, and in high-cost areas, it reaches $1,089,300. Understanding how to effectively use the can help you avoid common pitfalls in budgeting for your new home.

As Nicholas Hiersche, President of The Mortgage Calculator, wisely states, “FHA mortgages remain one of the most affordable paths to homeownership. Our aim is to eliminate uncertainty by providing borrowers a data-rich overview of precisely what their costs will appear as—before they ever complete an application.

Troubleshoot Common Calculation Issues

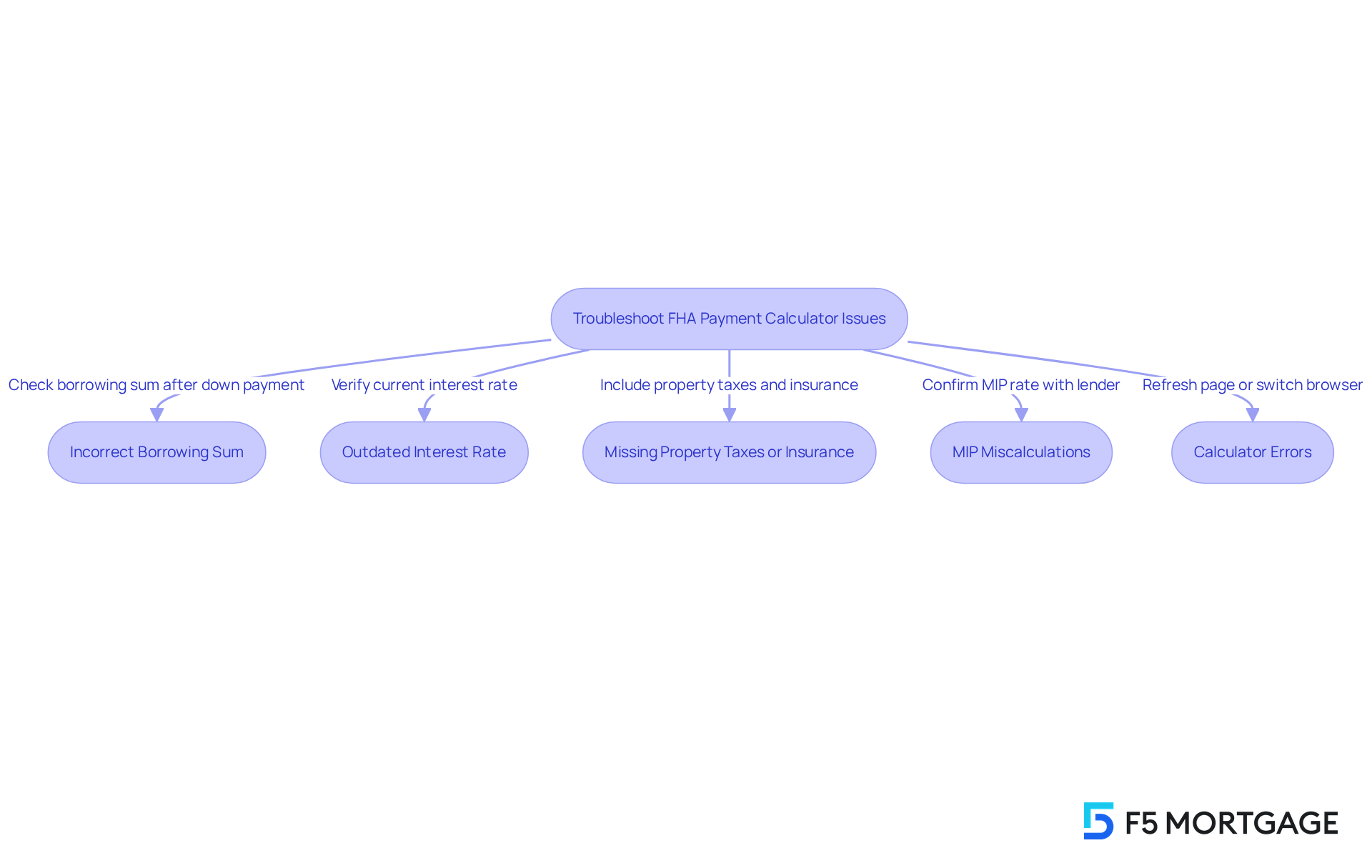

When utilizing the fha payment calculator, we understand how challenging it can be to navigate potential issues. Here’s how to troubleshoot them effectively:

- Incorrect Borrowing Sum: It’s essential to verify that you are entering the accurate borrowing sum after considering your down payment. Remember, the lowest down payment necessary for FHA financing is 3.5%. Double-check your calculations to prevent mistakes, as even a minor error can lead to significant differences in your estimated costs.

- Outdated Interest Rate: If your projected monthly charge seems unusually high or low, it’s important to ensure you are using the most recent interest rate. With the , fluctuations can impact your calculations. Always check with lenders or reliable financial websites for the latest rates to stay informed.

- Missing Property Taxes or Insurance: If your total amount appears incorrect, make sure you have included estimates for property taxes and homeowners insurance. These expenses can significantly influence your monthly budget, and overlooking them can lead to underestimating your financial responsibilities.

- MIP Miscalculations: Ensure you are using the correct Mortgage Insurance Premium (MIP) rate based on your borrowing amount and down payment. The upfront MIP for FHA loans is typically 1.75%, but this can vary. Consulting with your lender for precise figures is advisable to avoid any surprises.

- Calculator Errors: If you find that the calculator is not functioning properly, try refreshing the page or switching to a different browser. Technical issues can sometimes arise due to browser compatibility, and a simple refresh may resolve the problem.

By being aware of these common issues and knowing how to address them, you can ensure a smoother experience when utilizing the fha payment calculator. This ultimately leads to more accurate estimates and more informed financial decisions. We’re here to support you every step of the way.

Conclusion

Utilizing the FHA payment calculator is a crucial step for anyone navigating the complexities of FHA financing. This tool not only simplifies the calculation of monthly mortgage payments but also empowers borrowers to make informed decisions about their financial commitments. By understanding the various components—such as loan amount, interest rate, loan term, property taxes, homeowners insurance, and mortgage insurance premiums—users can accurately assess their potential obligations and budget effectively.

We know how challenging this can be, and throughout the guide, we’ve shared key insights on gathering the necessary information for precise calculations. Following a straightforward step-by-step process and troubleshooting common issues can make a significant difference. Each of these elements plays a crucial role in ensuring that borrowers have a clear understanding of their financial landscape, ultimately leading to more confident home-buying decisions.

In summary, mastering the FHA payment calculator not only demystifies the mortgage process but also equips potential homeowners with the knowledge needed to navigate their financial futures. Embracing this tool can transform the often daunting task of mortgage planning into a manageable and informed journey. As the landscape of home financing continues to evolve, leveraging resources like the FHA payment calculator will remain essential for making sound financial choices in the pursuit of homeownership.

Frequently Asked Questions

What is the purpose of the FHA payment calculator?

The FHA payment calculator helps borrowers understand their periodic mortgage payments on FHA financing by considering factors such as loan amount, interest rate, loan term, property taxes, homeowners insurance, and mortgage insurance premiums (MIP).

What key factors does the FHA payment calculator take into account?

The calculator takes into account the loan amount, interest rate, loan term, property taxes, homeowners insurance, and mortgage insurance premiums (MIP).

What is the FHA borrowing limit for 2025?

The FHA borrowing limit for 2025 is $524,225 for single-family residences in most areas, and it can reach up to $1,209,750 in more expensive regions.

How does the interest rate affect my mortgage payments?

The annual percentage rate (APR) applied to your loan affects the overall cost of borrowing, which in turn impacts your monthly mortgage payments.

What are the typical loan terms for FHA loans?

The typical loan terms for FHA loans are 15 or 30 years, which influence the amount of your recurring charges.

Why is it important to consider property taxes and insurance in the FHA payment calculator?

Property taxes and homeowners insurance can significantly impact your regular financial obligations, making it crucial to factor them into your calculations for accurate budgeting.

What is mortgage insurance premium (MIP) and how does it affect payments?

MIP is required for FHA mortgages and is included in your monthly charge, varying from 0.15% to 0.75% of the principal amount. Additionally, there is an upfront mortgage insurance premium (UFMIP) of 1.75% of the borrowed amount.

Can the FHA payment calculator help with financial planning?

Yes, by using the calculator, borrowers can gain insights into their potential recurring obligations, which is crucial for budgeting and financial planning.

Is the FHA payment calculator beneficial for comparing different mortgage options?

Yes, the calculator allows borrowers to compare various financing terms, down payments, and interest rates side by side to help select the best option for their financial needs.

Who can qualify for an FHA loan?

FHA loans are not just for first-time homebuyers; anyone meeting the requirements can qualify through an FHA-approved lender.