Overview

This article highlights the FHA loan down payment requirements for 2025, addressing the concerns of many potential homebuyers. We understand how challenging navigating the mortgage process can be, especially when it comes to down payments.

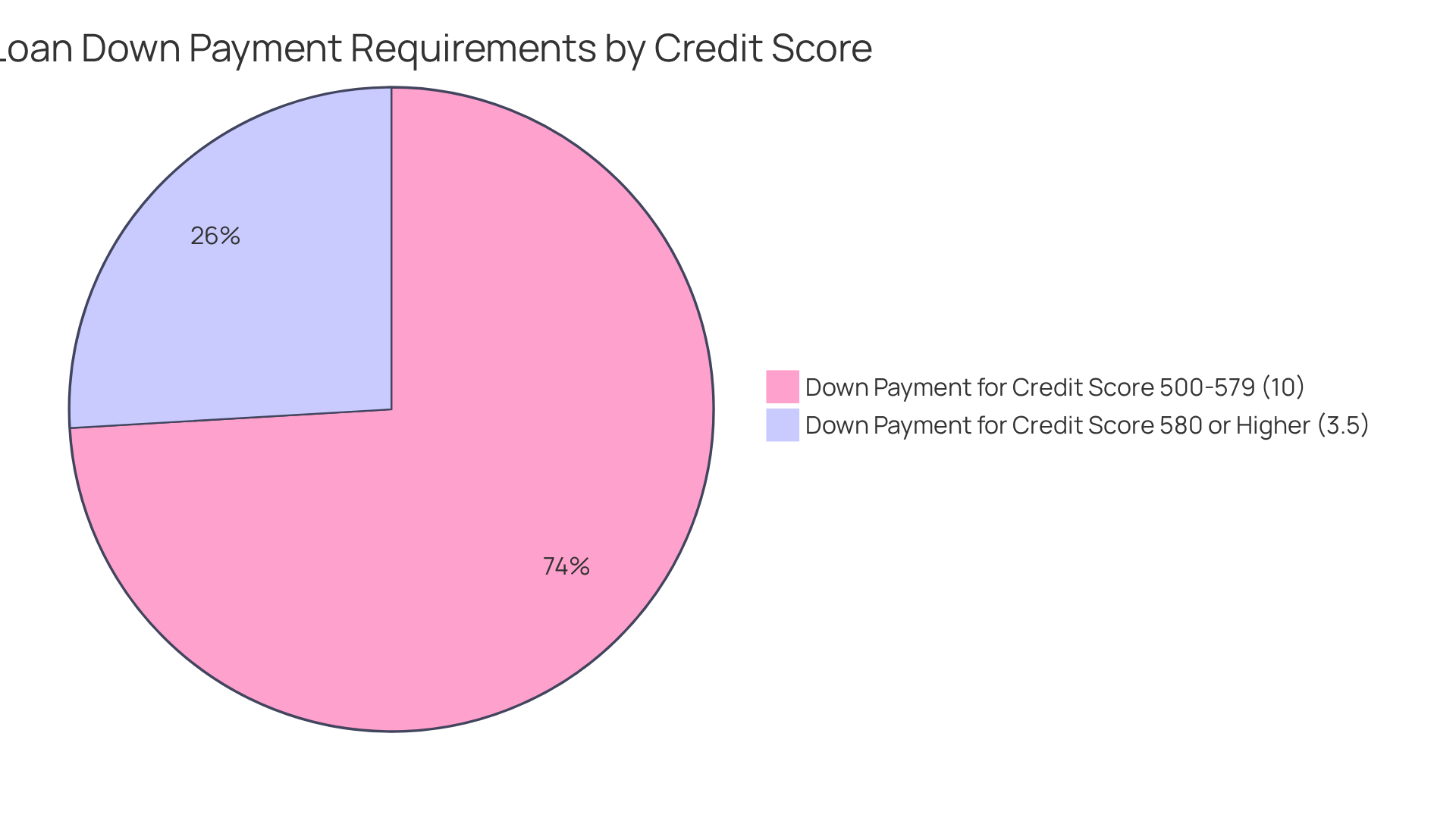

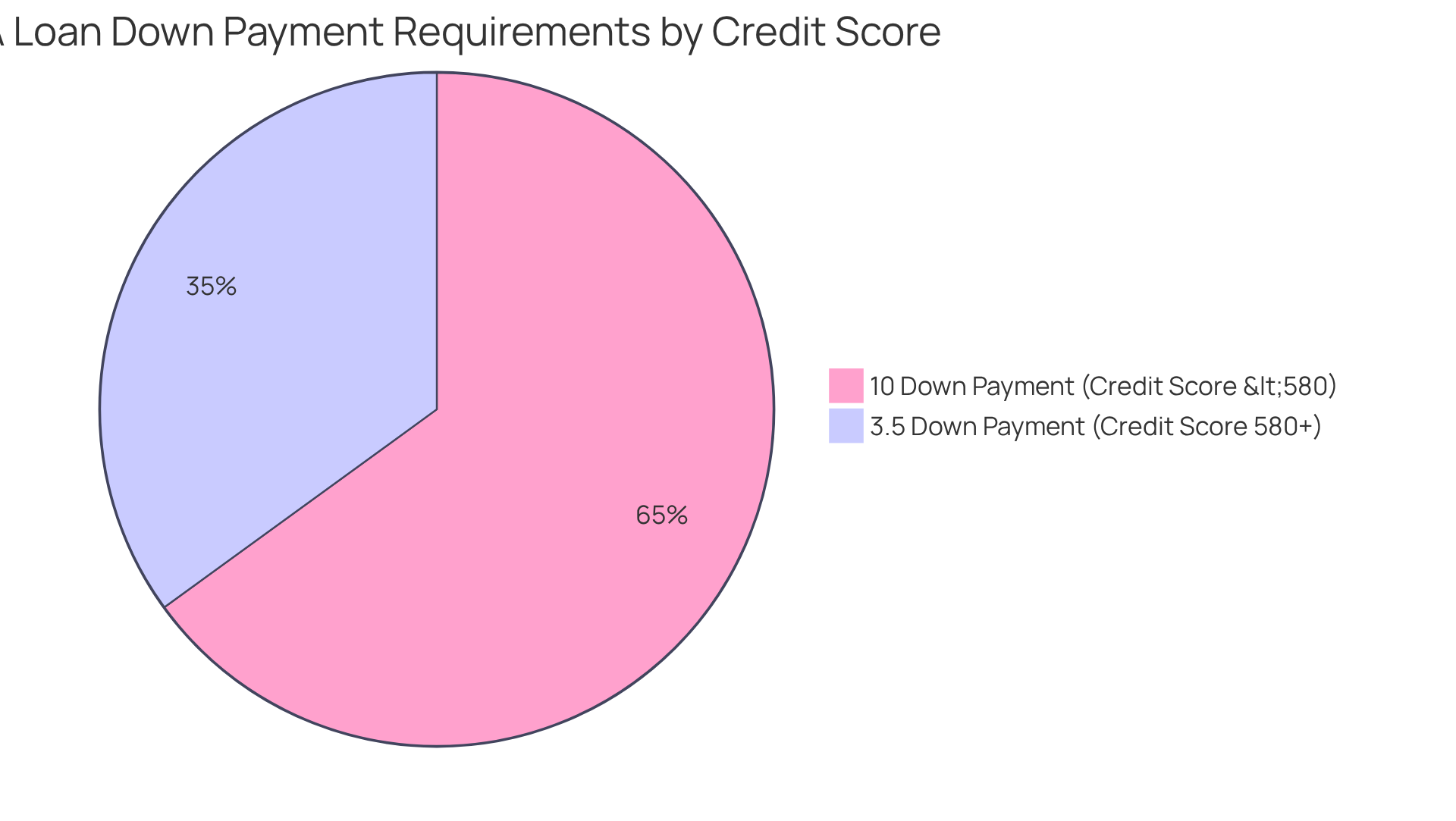

- Borrowers with a credit score of 580 or higher are required to provide a minimum down payment of 3.5%.

- For those with lower scores, the requirement increases to 10%.

These requirements can significantly impact your journey to homeownership. Maintaining a good credit score is crucial, and we’re here to support you every step of the way.

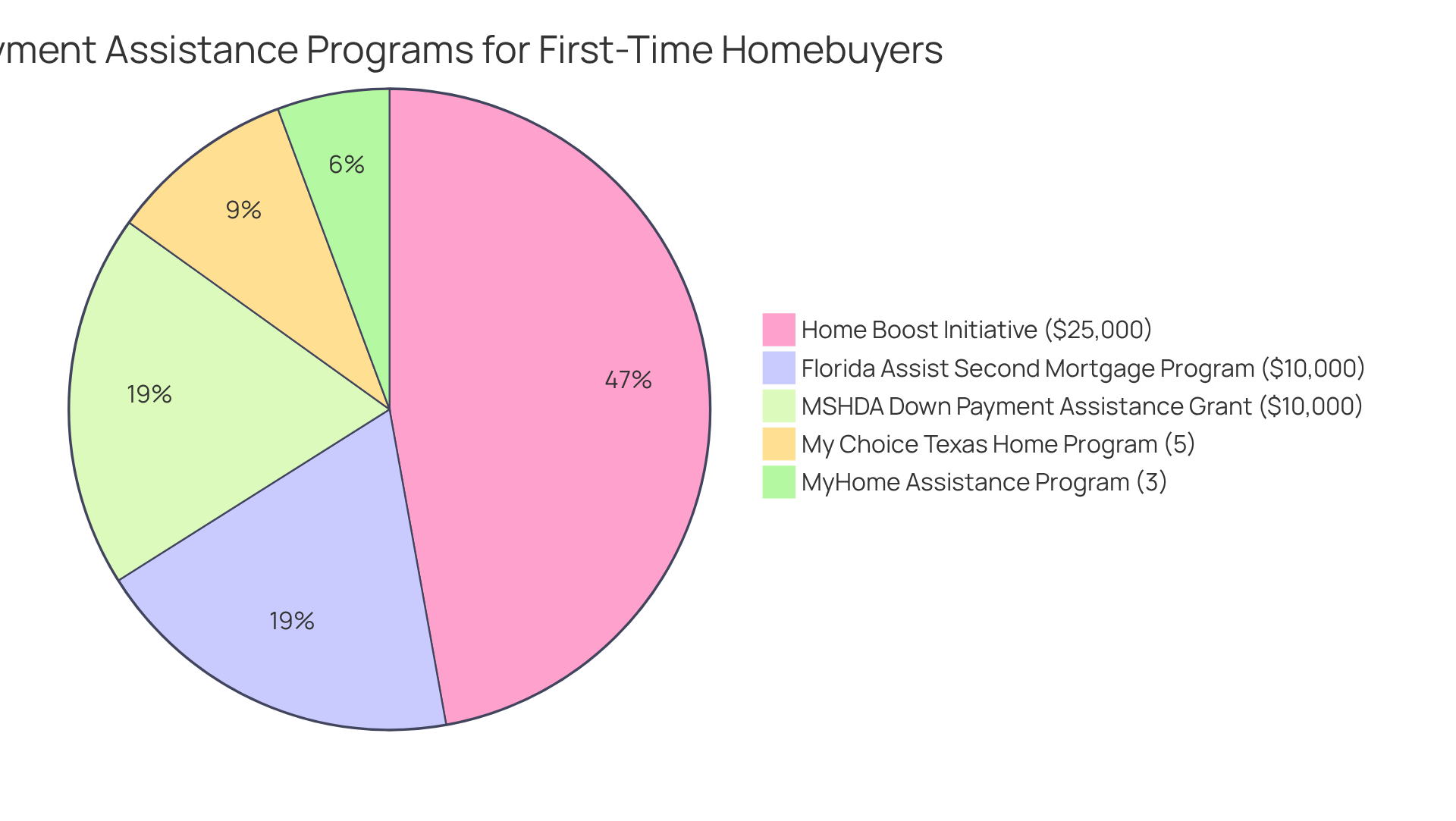

Additionally, there are down payment assistance programs available that can help ease the financial burden, making homeownership more attainable.

We encourage you to explore these options and consider how they can work for you. Remember, understanding your financial situation and the resources at your disposal is key to making informed decisions. You’re not alone in this process; there are solutions available to help you achieve your dream of owning a home.

Introduction

Navigating the world of FHA loans can feel overwhelming, especially as requirements change from year to year. In 2025, with a minimum down payment of just 3.5% for those with a credit score of 580 or higher, the door to homeownership is more open than ever. Yet, many prospective buyers may not fully grasp the nuances and benefits of these loans, which can greatly influence their financial journey.

We understand how challenging this can be for first-time homebuyers and moderate-income families. How can you leverage these insights to overcome obstacles and secure your dream home? We’re here to support you every step of the way.

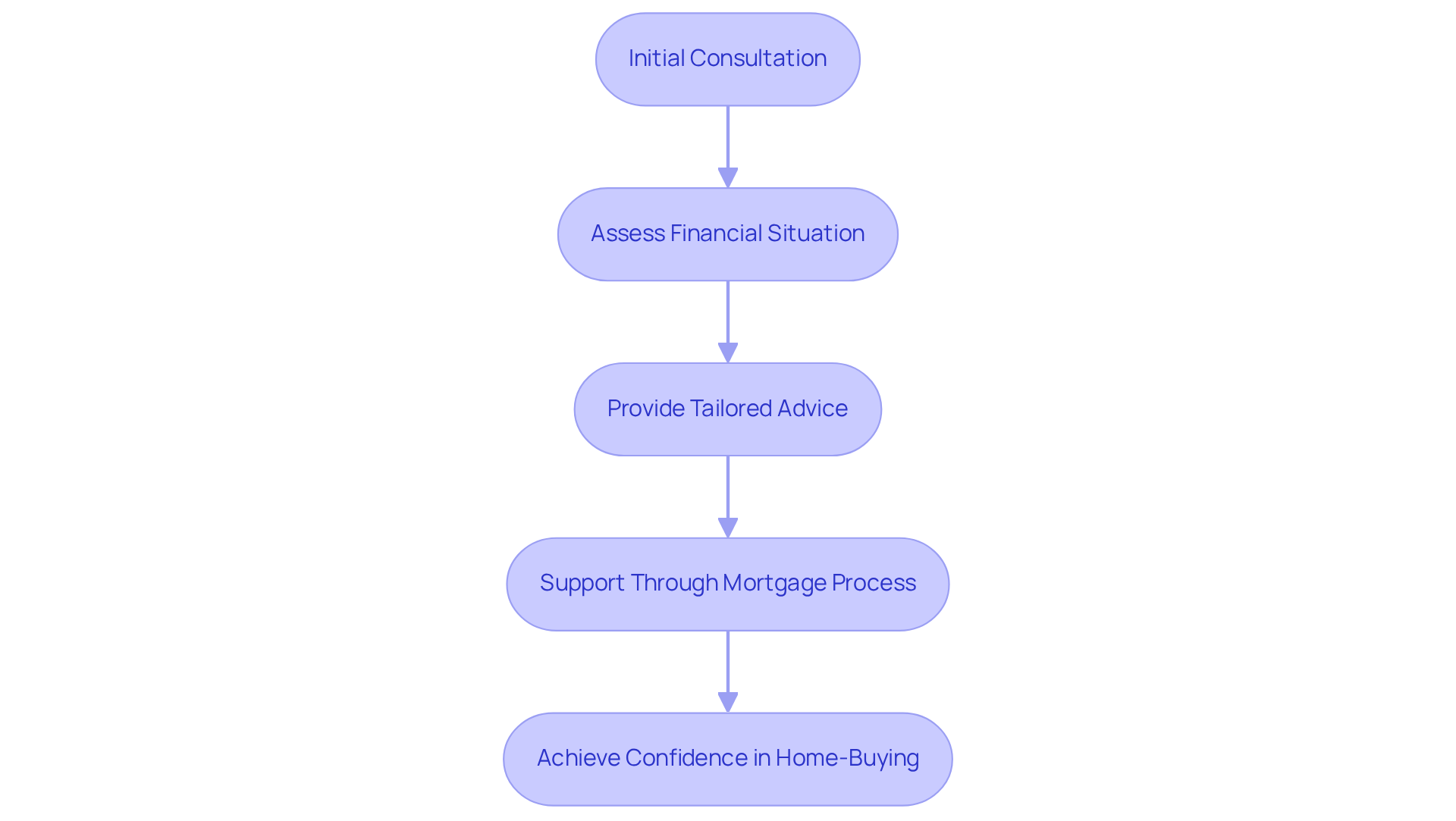

F5 Mortgage: Personalized FHA Loan Consultations for Down Payment Guidance

At F5 Mortgage, we understand how challenging navigating can be. That’s why we offer designed to improve your . By taking the time to assess your unique financial situation, we provide personalized advice on achieving the for individuals with a .

This customized approach not only empowers you with the knowledge you need but also fosters a supportive environment throughout . We’re here to support you every step of the way, ensuring you feel valued and understood. As a result, you’ll be better equipped to make , leading to increased confidence in your home-buying journey.

Our emphasis on significantly contributes to your overall satisfaction, allowing you to with greater ease. We know how important it is to feel supported during this process, and we are committed to being your trusted partner.

FHA Loan Down Payment Requirements for 2025: What Borrowers Must Know

In 2025, the requires a for borrowers with a credit score of 580 or higher. For those with scores between 500 and 579, the initial contribution requirement increases to 10%. Understanding these criteria is crucial for potential homebuyers, as they and their ability to secure financing and purchase a home. For example, a borrower aiming to buy a $300,000 house would need to save $10,500 for a 3.5% deposit with a score of 580 or above. Conversely, a borrower with a score between 500 and 579 would need to save $30,000 for a 10% deposit.

Statistics show that a significant percentage of borrowers meet the , particularly who benefit from the program’s flexibility. The FHA’s lenient borrowing standards have made homeownership more accessible, especially for low- to moderate-income families. Additionally, many lenders have lowered their minimum score requirements, potentially allowing an extra 100,000 families each year to qualify for FHA financing.

Grasping the FHA loan down payment requirements is essential as you organize your finances and navigate the . A higher credit score not only reduces the initial amount needed but also leads to . Therefore, we encourage prospective homebuyers to keep an eye on their and explore ways to improve them.

Moreover, in Ohio can offer financial support ranging from a few thousand dollars to over $30,000. These programs may provide funding that is either repaid or forgiven over time, as well as grants that require no repayment. This support can significantly lessen the initial costs for home purchasers, making FHA financing an even more attractive option. We’re here to as you embark on this important journey.

Minimum Credit Score for FHA Loans in 2025: Impact on Down Payments

In 2025, a is required to qualify for the beneficial of 3.5%. We understand how daunting this can be, especially for those with . Unfortunately, they face a higher initial expense, needing a . This highlights the vital importance of maintaining a , as it significantly impacts the for .

To ease the burden of a larger FHA loan down payment, potential borrowers should actively seek ways to before applying for an . Simple steps can make a big difference. For instance:

- Settling bills promptly

- Lowering credit utilization rates

- Avoiding excessive inquiries

As credit experts remind us, even minor adjustments in in financing conditions and deposit requirements. We’re here to support you every step of the way, making homeownership more attainable for you and your family.

Down Payment Assistance Programs for FHA Loans: Options for First-Time Homebuyers

Are you a feeling overwhelmed by the financial demands of ? You’re not alone, and there are various designed to ease this burden. These initiatives often provide grants or low-interest loans to help cover the minimum 3.5% .

For example, in California, the offers up to 3% of the home’s purchase price. In Texas, the My Choice Texas Home program can provide as much as 5% for both down payment and closing costs. Florida also has several options, such as the Florida Assist Second Mortgage Program, which offers up to $10,000 for upfront expenses.

Moreover, programs like the can give first-generation homebuyers up to $25,000 for down payment and closing costs. The is another valuable resource, offering up to $10,000 for eligible buyers. Many families have successfully navigated these programs to secure their homes, and we know how challenging this can be.

At F5 Mortgage, we’re here to support you every step of the way. Our team is ready to help you explore these options, providing and access to a variety of financing programs that can enhance your homeownership opportunities. Our clients have expressed their gratitude, with reviews highlighting the expertise and compassionate support offered by the throughout the process.

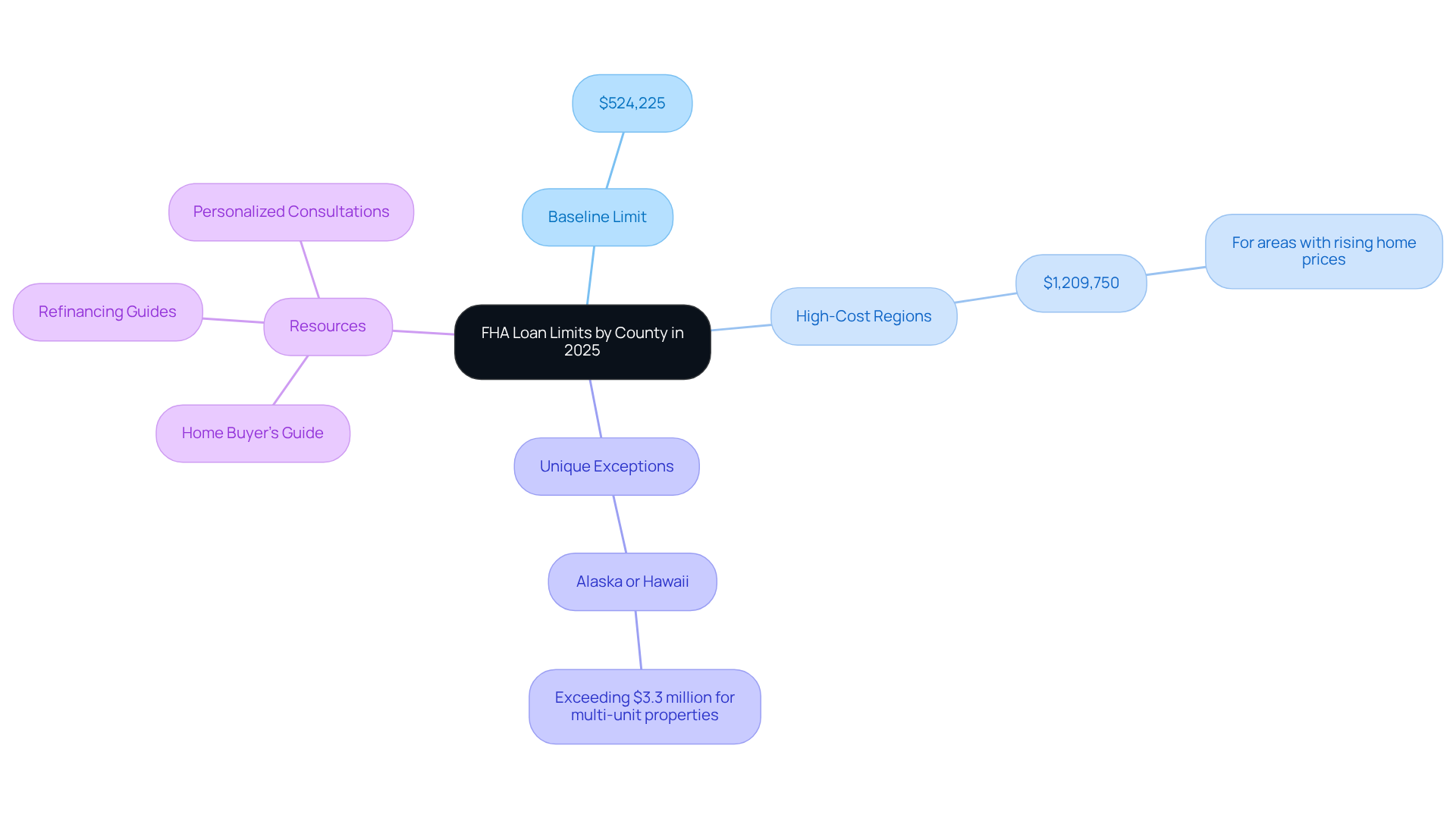

FHA Loan Limits by County in 2025: Understanding Your Borrowing Capacity

In 2025, will vary significantly by county, with a baseline limit set at $524,225 for single-family residences in most areas. In high-cost regions, this limit can soar to $1,209,750, reflecting the FHA’s commitment to adjusting alongside rising home prices. These limits are crucial for borrowers, as they determine the , directly influencing purchasing power. For instance, in unique exception regions like Alaska or Hawaii, homebuyers may qualify for financing exceeding $3.3 million for multi-unit properties. This is especially important for those looking to invest in larger residences or rental assets.

Understanding these limits is vital for making informed decisions in the . At F5 Mortgage, we know how challenging this can be, and we are here to help you navigate how these limits apply to your specific situation. This way, you can effectively strategize your . With the FHA’s yearly changes, staying informed about is essential. We provide the necessary resources, including:

- A

- Refinancing guides

- to support you on your journey toward homeownership

Apply for your today and access the advantages of and simplified refinancing alternatives!

FHA Mortgage Insurance Premiums: What They Mean for Your Down Payment

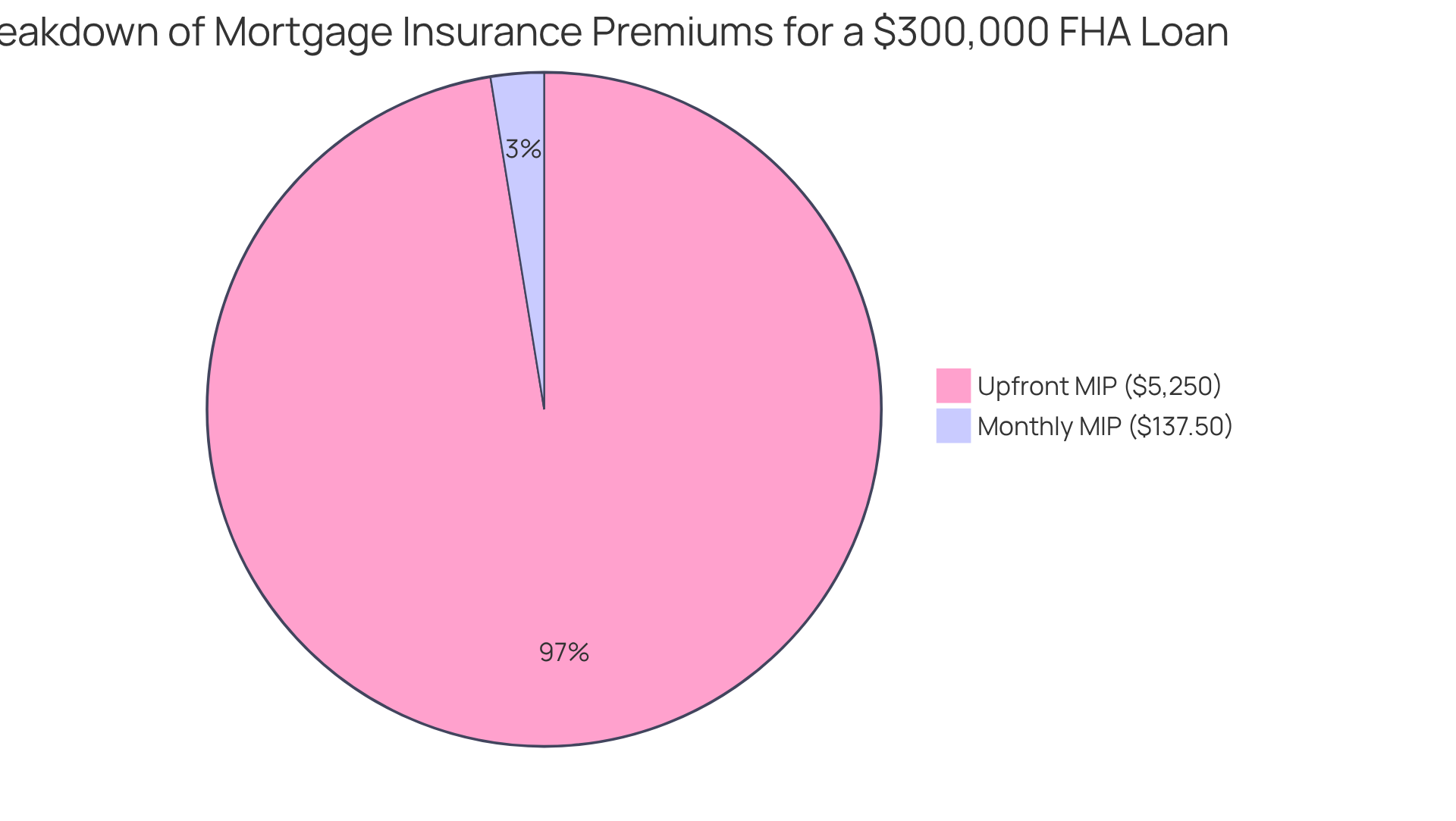

Navigating FHA financing can feel overwhelming, especially when considering the contribution of (MIP). These premiums significantly impact the total cost of homeownership, and we know how challenging this can be. In 2025, the upfront MIP is set at 1.75% of the mortgage amount, while the annual MIP varies between 0.15% and 0.75%, depending on the mortgage amount and value ratio. It’s essential to understand that these premiums protect lenders but can also .

For instance, if you’re looking at a $300,000 mortgage, the upfront MIP would be $5,250, with a potential monthly MIP of around $137.50 at a 0.55% rate. It’s crucial to meticulously include these costs in your financial plans as you assess your and overall affordability. Remember, you’re not alone in this; many families face similar concerns.

Moreover, from relatives or friends to assist with the FHA loan down payment, providing greater flexibility for those with limited savings. every step of the way. We offer and budgeting tools to help you navigate these complexities. Our team assists Colorado homeowners in understanding the , ensuring you feel confident in your decisions.

By selecting the right refinance option and evaluating your financial circumstances, you can that align with your homeownership goals. For those considering an FHA mortgage, can be a crucial step toward achieving your dream of homeownership.

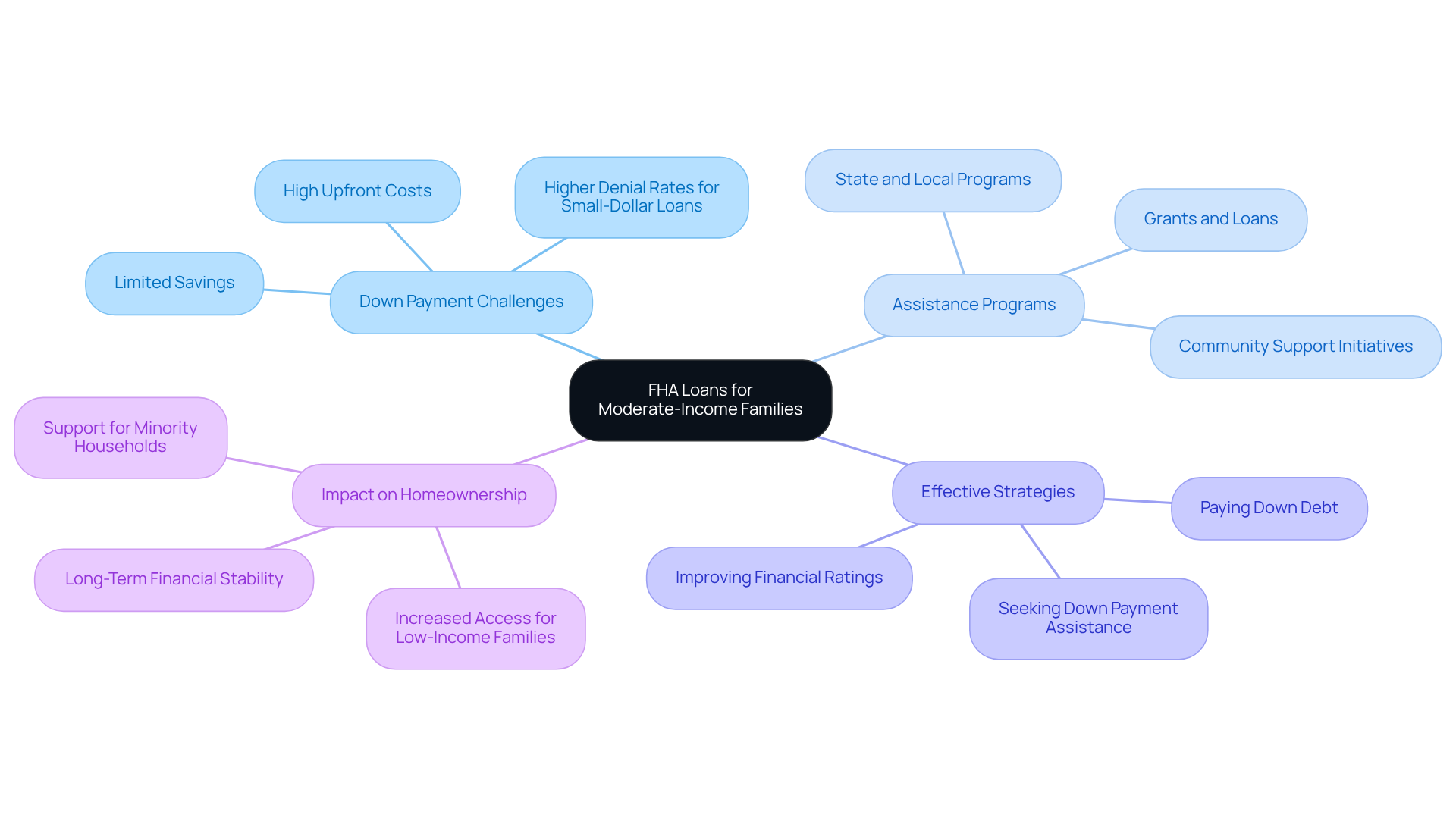

FHA Loans for Moderate-Income Families: Navigating Down Payment Challenges

FHA loans present a wonderful opportunity for moderate-income families, primarily due to their lower upfront costs compared to traditional loans. However, many households encounter significant hurdles in gathering the necessary funds for an FHA loan down payment. We know how challenging this can be. Research indicates that programs providing can play a crucial role in overcoming these obstacles, significantly impacting the ability of low-income and minority families to achieve . At , we’re here to support you every step of the way, providing essential resources and guidance on these programs to help families navigate the complexities of initial costs.

To further assist moderate-income families, it’s essential to explore the various available at state and local levels. These programs often provide funding and and closing expenses, making homeownership more attainable. Housing advocates emphasize the importance of these resources, highlighting that they can significantly enhance the chances of securing an FHA mortgage.

For families with moderate incomes utilizing , effective strategies include:

- Actively seeking

- Improving financial ratings while saving for a deposit

By leveraging these resources and approaches, families can break through financial barriers and move closer to realizing their dreams of homeownership.

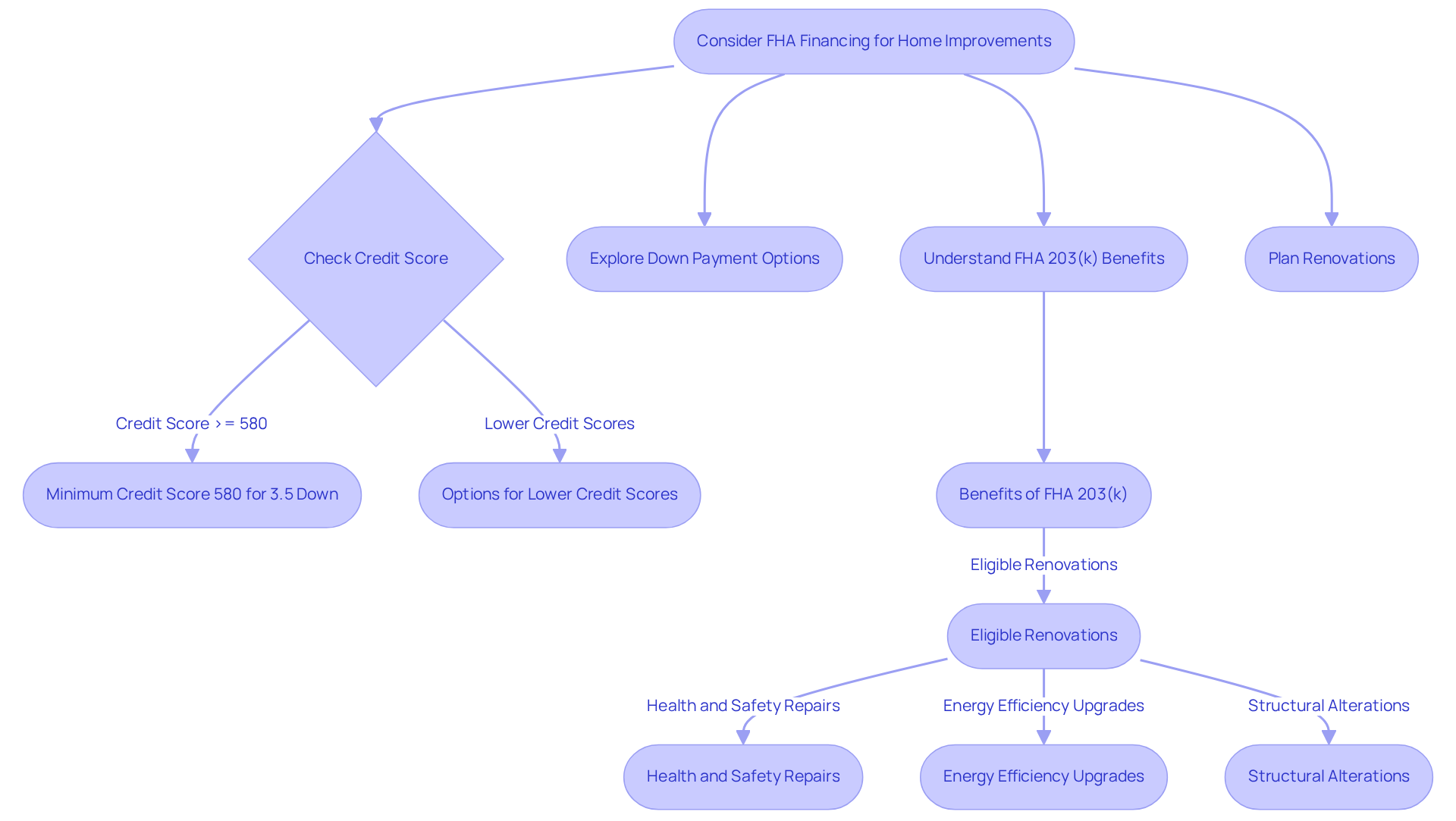

Using FHA Loans for Home Improvements: Down Payment Considerations

serves a dual purpose, allowing families to not only acquire homes but also fund essential renovations through programs like the FHA 203(k) option. This creative funding choice enables buyers to combine the costs of purchasing and remodeling a property into one mortgage, requiring just a for individuals with a credit score of at least 580. For those with lower credit scores, a larger initial amount may be necessary, yet the program remains accessible to many, especially with ‘s offerings that feature options for as little as 3% or even 0% upfront for specific financing.

The is particularly beneficial for families looking at fixer-uppers or those wishing to make significant improvements to their new homes. Eligible renovations can range from crucial health and safety repairs to energy efficiency upgrades, making it a versatile choice for enhancing property value and livability. Renovations can include structural alterations and improvements that meet FHA’s Minimum Property Requirements, ensuring your new home is not only beautiful but also safe and efficient.

At F5 Mortgage, we understand how overwhelming the details of renovation financing can be. Our team is here to help you navigate these options, ensuring you fully comprehend the implications of and the overall funding process. With a strong commitment to , F5 Mortgage has earned 5/5 star reviews on platforms like Lending Tree, Google, and Zillow, showcasing our expertise in helping families secure the best mortgage solutions. Homeowners have successfully funded and through , demonstrating how this program can transform a house into your dream home while responsibly managing financial commitments.

In summary, utilizing FHA financing for not only simplifies the funding process but also empowers buyers to invest in properties that may need a little extra care. This approach ultimately leads to a more fulfilling homeownership experience, and we’re here to support you every step of the way.

Common Misconceptions About FHA Loan Down Payments: What You Should Know

Many potential borrowers often face misunderstandings about , such as the belief that a 20% deposit is necessary. We know how challenging this can be. In reality, allow as low as 3.5% for eligible borrowers. Additionally, some individuals think that only can access FHA financing, which is not true. Research shows that a significant number of borrowers are unaware of these , highlighting the need for education in the mortgage process.

At F5 Mortgage, we understand that flexibility is crucial. We offer a , including standard options like fixed-rate and adjustable-rate mortgages, as well as unique solutions tailored to meet distinct borrower needs. We also have a vast network of agents, recognized as the best in their areas, and we’d be happy to introduce you if you’re looking for assistance.

By addressing these misconceptions, in their understanding of FHA financing and the FHA loan down payment requirements. For and to explore the various options available, consider reaching out to F5 Mortgage. We’re here to support you every step of the way, helping you .

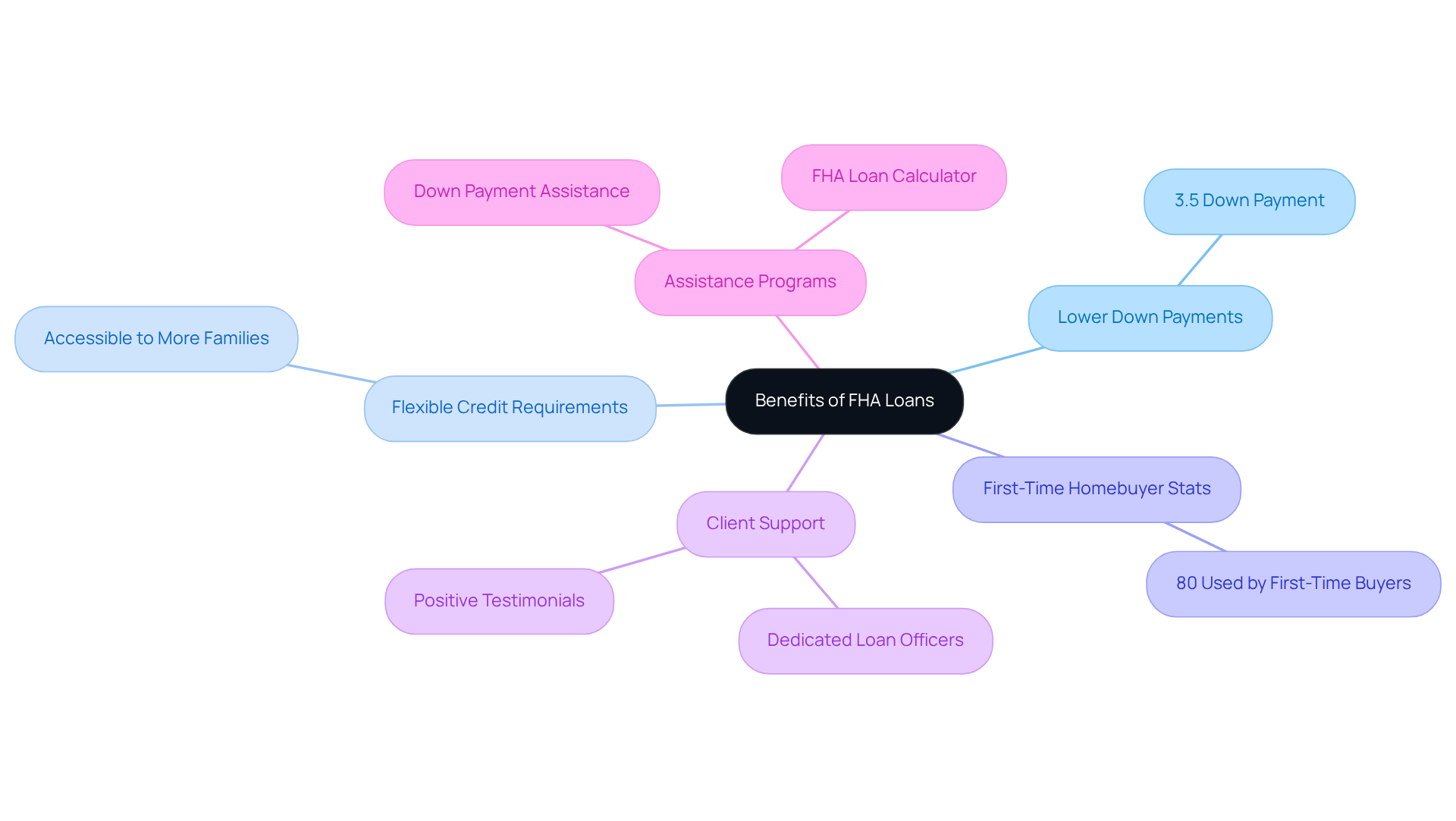

Benefits of FHA Loans: Making Homeownership Accessible with Lower Down Payments

offer significant benefits, especially for and those with lower credit scores. With the possibility of securing a mortgage through an , these options make for many individuals and families. The further enhance accessibility, allowing a wider range of buyers to qualify. In fact, over 80% of FHA mortgages are used by first-time homebuyers, showcasing their vital role in helping families enter the housing market. By taking advantage of these benefits, to pursue their homeownership dreams with confidence.

Many families have successfully realized their dreams through FHA financing, guided by who support them throughout the process. Cole Austin, a first-time homebuyer, expressed, “The team was incredibly patient and knowledgeable, making the entire experience smooth and enjoyable.” This commitment to ensures that potential homeowners feel informed and prepared as they navigate their mortgage journey. Clients like Ruth Vest have praised F5 Mortgage for their outstanding customer service, stating, “F5 handled my financial needs exceptionally well, and the team was on the ball with all documentation.”

F5 Mortgage also offers , significantly enhancing home buying opportunities. These programs allow clients to make more competitive offers and reduce their mortgage costs, making homeownership even more attainable. With a user-friendly FHA Loan Calculator, clients can estimate their monthly payments based on various factors, aiding their financial planning. This client-centric approach to home financing exemplifies F5 Mortgage’s dedication to supporting families on their path to homeownership.

Conclusion

FHA loans offer a wonderful opportunity for prospective homebuyers, especially in 2025. With a minimum down payment requirement of just 3.5% for those with a credit score of 580 or higher, these loans can significantly ease the journey to homeownership for many individuals and families. Understanding these requirements, along with the available assistance programs, is crucial for navigating the complexities of the home-buying process.

We understand how important it is to maintain a good credit score, as it directly influences your down payment amount and overall loan terms. Thankfully, various down payment assistance programs can alleviate financial burdens, making homeownership more attainable. This is especially true for first-time buyers and moderate-income families. Furthermore, the FHA’s flexible borrowing standards and mortgage insurance options provide additional support for those looking to secure a home.

Ultimately, the benefits of FHA loans extend beyond just lower down payments; they empower families to achieve their homeownership dreams. As the landscape of FHA financing continues to evolve, we encourage potential borrowers to stay informed and seek personalized guidance. By leveraging available resources and consulting with experts, you can navigate the challenges of home buying with confidence and clarity, paving the way for a successful journey toward homeownership.

Frequently Asked Questions

What is F5 Mortgage’s approach to FHA loan consultations?

F5 Mortgage offers personalized consultations to help individuals understand FHA funding deposit requirements and achieve the minimum 3.5% down payment for those with a credit score of 580 or above.

What are the FHA loan down payment requirements for 2025?

In 2025, the FHA loan down payment requires a minimum of 3.5% for borrowers with a credit score of 580 or higher. For those with scores between 500 and 579, the down payment requirement increases to 10%.

How much would a borrower need to save for a down payment on a $300,000 house?

A borrower with a credit score of 580 or above would need to save $10,500 for a 3.5% down payment. Conversely, a borrower with a score between 500 and 579 would need to save $30,000 for a 10% down payment.

Why is understanding FHA loan down payment requirements important?

Understanding these requirements is crucial for potential homebuyers as they significantly impact the ability to secure financing and purchase a home.

How do credit scores affect FHA loan down payments?

A higher credit score not only reduces the initial down payment amount required but also leads to better interest rates and loan terms.

What assistance programs are available for down payments in Ohio?

Down payment assistance programs in Ohio can provide financial support ranging from a few thousand dollars to over $30,000, which may be repaid or forgiven over time, as well as grants that require no repayment.

What is the minimum credit score required for FHA loans in 2025?

The minimum credit score required to qualify for the 3.5% down payment FHA loan option is 580.

What can potential borrowers do to improve their credit scores before applying for an FHA mortgage?

Borrowers can improve their credit scores by settling bills promptly, lowering credit utilization rates, and avoiding excessive inquiries.

How does F5 Mortgage support borrowers throughout the mortgage process?

F5 Mortgage provides tailored consultations, empowering clients with knowledge and fostering a supportive environment, ensuring they feel valued and understood during their home-buying journey.