Overview

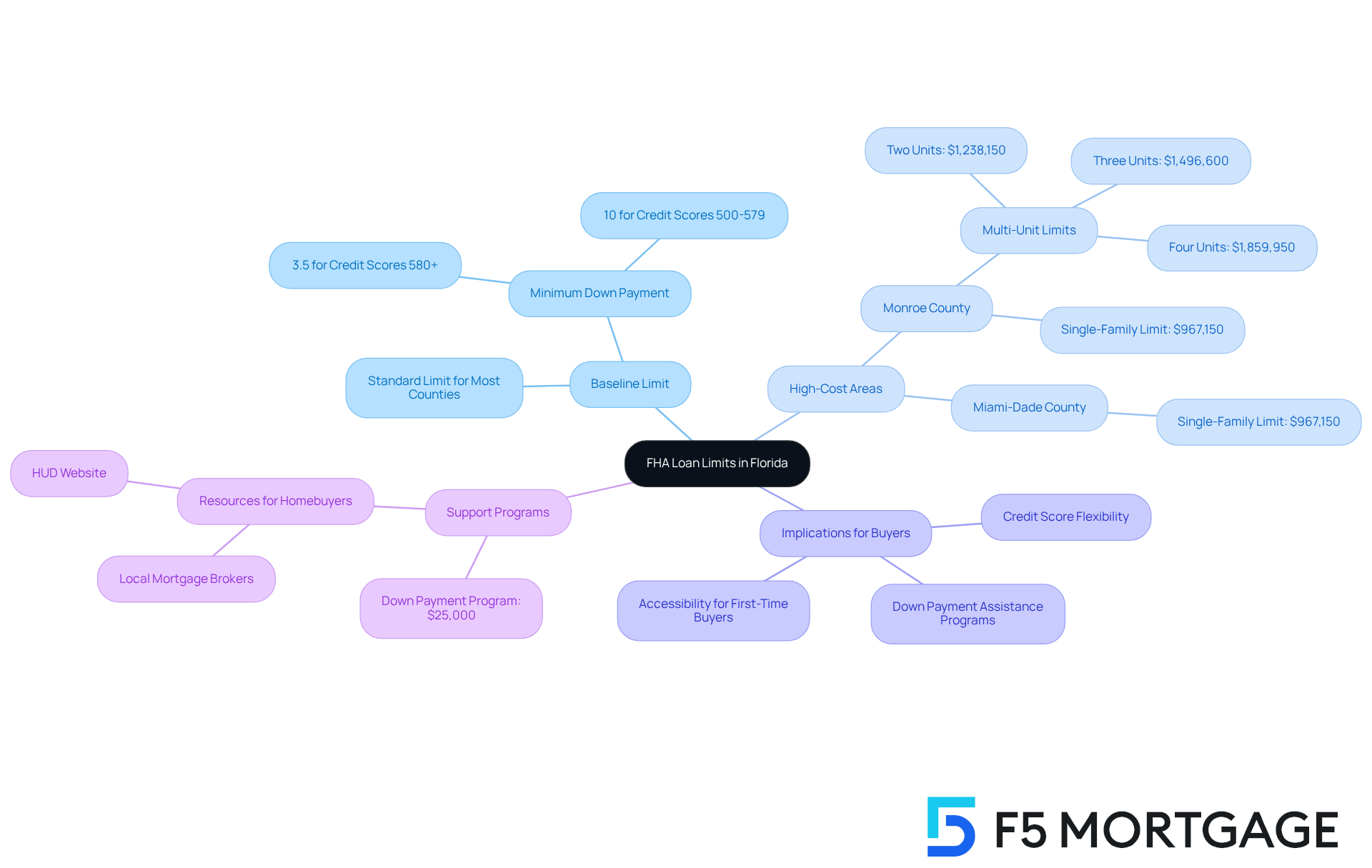

FHA loan limits in Florida are essential for homebuyers, as they establish the maximum amount that can be borrowed. For most counties, these limits are set at $524,225, while high-cost areas can go up to $967,150. We understand how challenging navigating these figures can be, especially for first-time homebuyers. These limits are determined based on local median home prices, which means they adapt to the varying costs of living across the state.

This flexibility is particularly beneficial for those with lower incomes or credit scores, as it opens up financing options that might otherwise seem out of reach. We know how important it is to find a home that fits your budget and lifestyle. By understanding these limits, you can take empowered steps toward securing the right financing for your needs. Remember, we’re here to support you every step of the way as you embark on this journey.

Introduction

Navigating the complexities of homeownership can feel overwhelming, especially for first-time buyers in Florida who are exploring their financing options. We understand how challenging this can be.

FHA loans, backed by the Federal Housing Administration, have emerged as a lifeline for many families, offering lower down payments and flexible credit requirements. However, it’s crucial to grasp the specific FHA loan limits in Florida, which vary significantly from county to county. By understanding these limits, potential homeowners can maximize their purchasing power and take meaningful steps toward securing their dream homes in a competitive market.

We’re here to support you every step of the way.

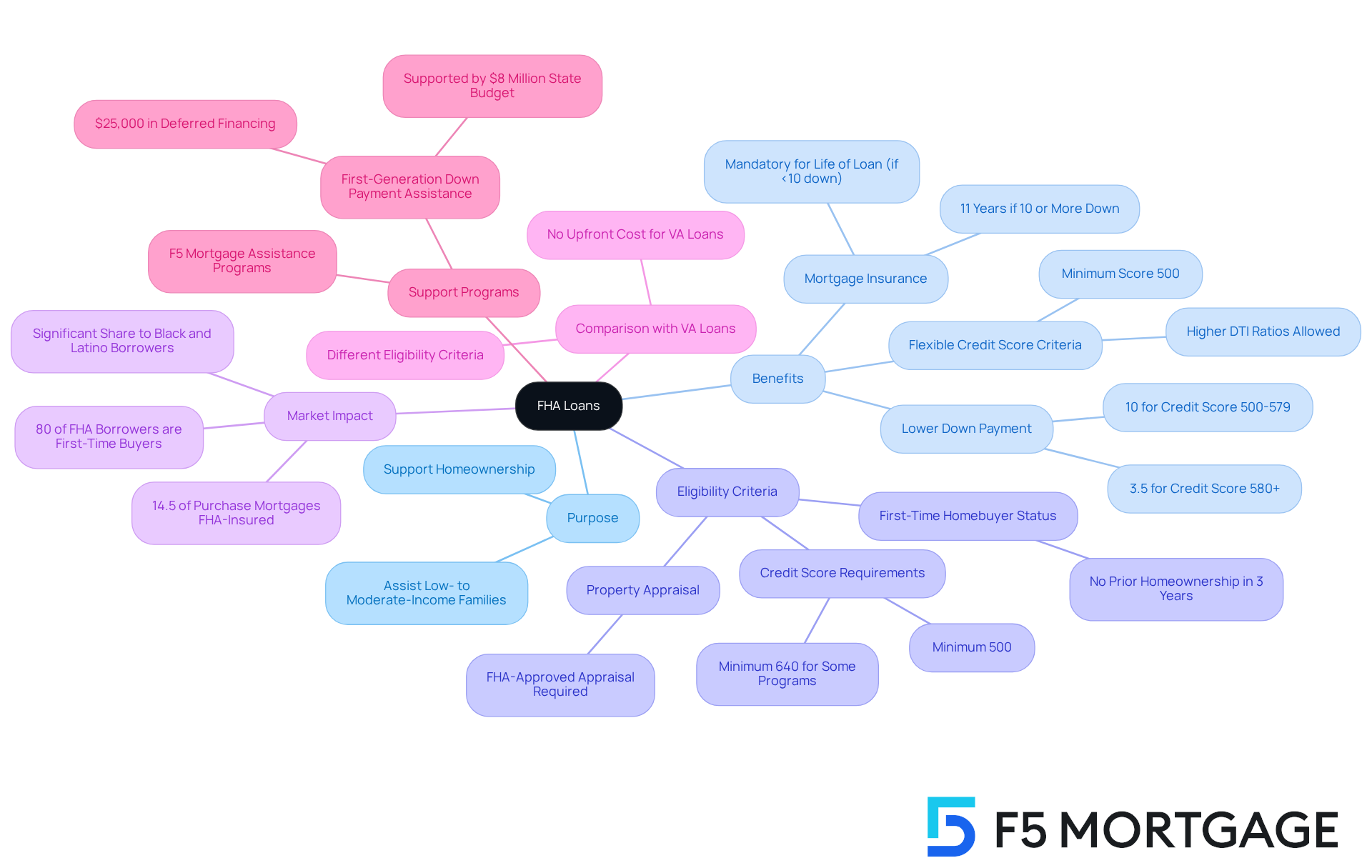

Define FHA Loans and Their Purpose

FHA mortgages, or Federal Housing Administration mortgages, are government-supported financial products specifically created to help low- to moderate-income families achieve their dream of homeownership. In 2025, approximately 14.5% of purchase mortgages were FHA-insured, highlighting their significance in the mortgage market. One of the main benefits of [FHA financing](https://f5mortgage.com/loan-programs/fha-loans) is its reduced upfront cost, which can be as low as 3.5% for borrowers with a credit score of 580 or above. This accessibility is essential for first-time homebuyers who often face financial obstacles, as many traditional financing options require a minimum down payment of 3% and a higher credit score of at least 620.

FHA financing also offers more flexible credit score criteria, allowing borrowers with scores as low as 500 to qualify, though this comes with a higher down payment of 10%. This flexibility enables individuals with limited savings or less-than-perfect credit histories to secure financing. By guaranteeing these loans, the FHA reduces the risk for lenders, thus making it easier for borrowers to qualify.

Recent developments show that FHA financing continues to play a vital role in expanding homeownership opportunities. For instance, over 80% of FHA borrowers last year were first-time homebuyers, with a significant portion being Black and Latino borrowers. This trend underscores the FHA’s commitment to providing .

In contrast, VA financing also offers low upfront cost options, enabling qualified veterans and active-duty service members to acquire homes with no initial cost necessary. This makes VA financing an appealing option for those who qualify.

Additionally, down payment assistance initiatives, like the First-Generation Down Support program, provide $25,000 in deferred financing backed by $8 million in state budget allocations. These programs aim to help first-time buyers manage initial expenses, further improving the accessibility of homeownership. F5 Mortgage also offers various financial assistance programs designed to help families move into their new homes.

It is important to note that FHA mortgage insurance is necessary for the duration of the financing if the down payment is less than 10%. This is a critical aspect for potential borrowers to consider. Furthermore, properties acquired with an FHA financing option must undergo an appraisal by an FHA-approved expert to satisfy minimum property standards.

Overall, while FHA mortgages have been pivotal in increasing homeownership rates across the United States since their inception in 1934, they also face challenges, including potential stigma in competitive markets. As Adrianne Todman, HUD Agency Head, stated, “Under the Biden-Harris Administration, we have expanded access to homeownership,” reflecting the ongoing efforts to support families striving to achieve their homeownership dreams.

Explore FHA Loan Limits in Florida

In Florida, we understand how daunting the home-buying process can be, especially when it comes to navigating [[FHA loan limits in Florida](https://lendingtree.com/home/fha/fha-loan-limits-in-florida)](https://f5mortgage.com/7-essential-fha-loan-florida-insights-for-2025-borrowers). For 2025, the FHA loan limits in Florida are established at a baseline of $524,225 for most counties, with elevated amounts reaching up to $967,150 in high-cost areas like Monroe County. These boundaries are carefully established based on the median home prices in each county, reflecting the unique conditions of local housing markets.

For instance, in counties with higher property values, such as Miami-Dade, the limits are adjusted to accommodate the increased cost of living. This flexibility is crucial for families looking to make a home in these vibrant communities. FHA mortgages are particularly appealing to first-time homebuyers due to their low initial contribution of just 3.5% and adaptable credit criteria. This approach significantly enhances the accessibility of homeownership, making it a comforting choice for many prospective borrowers.

Moreover, we recognize that credit scores can be a concern. FHA loans accept lower credit scores compared to traditional financing, which opens doors for those who may feel discouraged. To further support families, F5 Mortgage offers down payment assistance programs that can enhance the affordability of these loans, contributing to numerous client success stories in the community.

If you’re considering a home purchase, we encourage you to check the specific restrictions for your county. Resources like the HUD website or local mortgage brokers can provide valuable insights. Understanding the is crucial for making informed decisions regarding your home purchase and financing options. Remember, we’re here to support you every step of the way as you embark on this exciting journey.

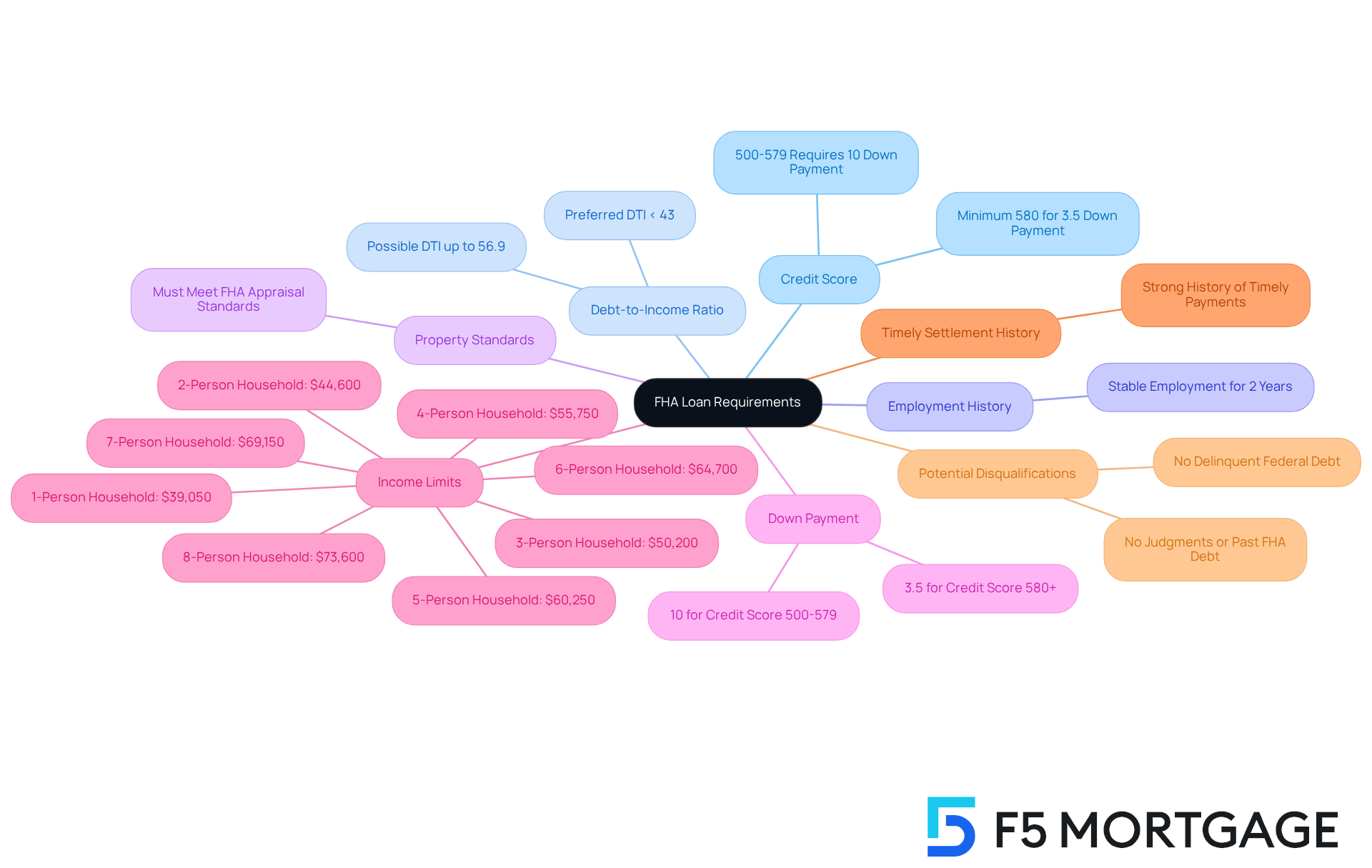

Detail FHA Loan Requirements for Borrowers

Qualifying for an FHA loan can feel overwhelming, but understanding the requirements can empower you on your journey to homeownership. Here are the essential criteria to keep in mind:

- Credit Score: To secure a down payment of just 3.5%, a minimum credit score of 580 is necessary. If your score falls between 500 and 579, don’t worry! You can still qualify, but you’ll need to provide a .

- Debt-to-Income Ratio: Generally, lenders prefer a debt-to-income (DTI) ratio of no more than 43%. However, under certain circumstances, some may allow a DTI as high as 56.9%, providing you with greater flexibility.

- Employment History: A stable employment history of at least two years is typically required, showcasing your ability to maintain consistent income.

- Property Standards: The property you wish to buy must meet safety and livability standards, assessed through an FHA appraisal. This ensures it’s a sound investment for you and the lender.

- Down Payment: As mentioned earlier, a minimum down payment of 3.5% is required for those with a credit score of 580 or higher, making homeownership more attainable.

- Income Limits: Income limits vary based on household size, with specific thresholds set for 1-person households at $39,050, 2-person households at $44,600, and up to $73,600 for 8-person households.

- Timely Settlement History: Having a strong history of timely payments is encouraged before applying for an FHA mortgage, as it demonstrates your creditworthiness and reliability.

- Potential Disqualifications: Be mindful that applicants must not have delinquent federal debt, judgments, or debt from past FHA-insured mortgages, as these can disqualify you from securing FHA financing.

These requirements are designed to help ensure that you can manage your mortgage payments effectively while also protecting lenders from potential defaults. In 2025, the average credit score of FHA borrowers reflects a growing trend towards inclusivity. Many individuals successfully meet these criteria despite past credit challenges, proving that even those recovering from financial difficulties can find pathways to homeownership through FHA financing.

Moreover, if you reside in Colorado, there are various refinancing options available to explore different mortgage types, potentially improving your financial situation. Understanding the income thresholds for down payment assistance programs in Ohio can also provide valuable insights for first-time homebuyers looking to enhance their purchasing power. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Analyze the Impact of FHA Loan Limits on Home Buying

The [FHA loan limits in Florida](https://f5mortgage.com/understanding-fha-loan-limits-in-florida-for-homebuyers) significantly impact home purchasing, as they set the maximum amount a borrower can secure. We know how challenging it can be for prospective buyers, especially in areas with lower thresholds, where they may feel limited to more affordable homes. For instance, if a home is valued at $650,000 but the FHA loan limit is $500,000, buyers might need to make a substantial down payment. This situation can force them to explore other financing options or adjust their expectations.

On the other hand, in high-cost regions, higher thresholds allow buyers to consider more expensive properties without exceeding FHA guidelines. This flexibility is particularly beneficial for first-time homebuyers who may not have large savings for down payments. Understanding the FHA loan limits in Florida helps buyers effectively , ensuring they focus on properties within their financial reach.

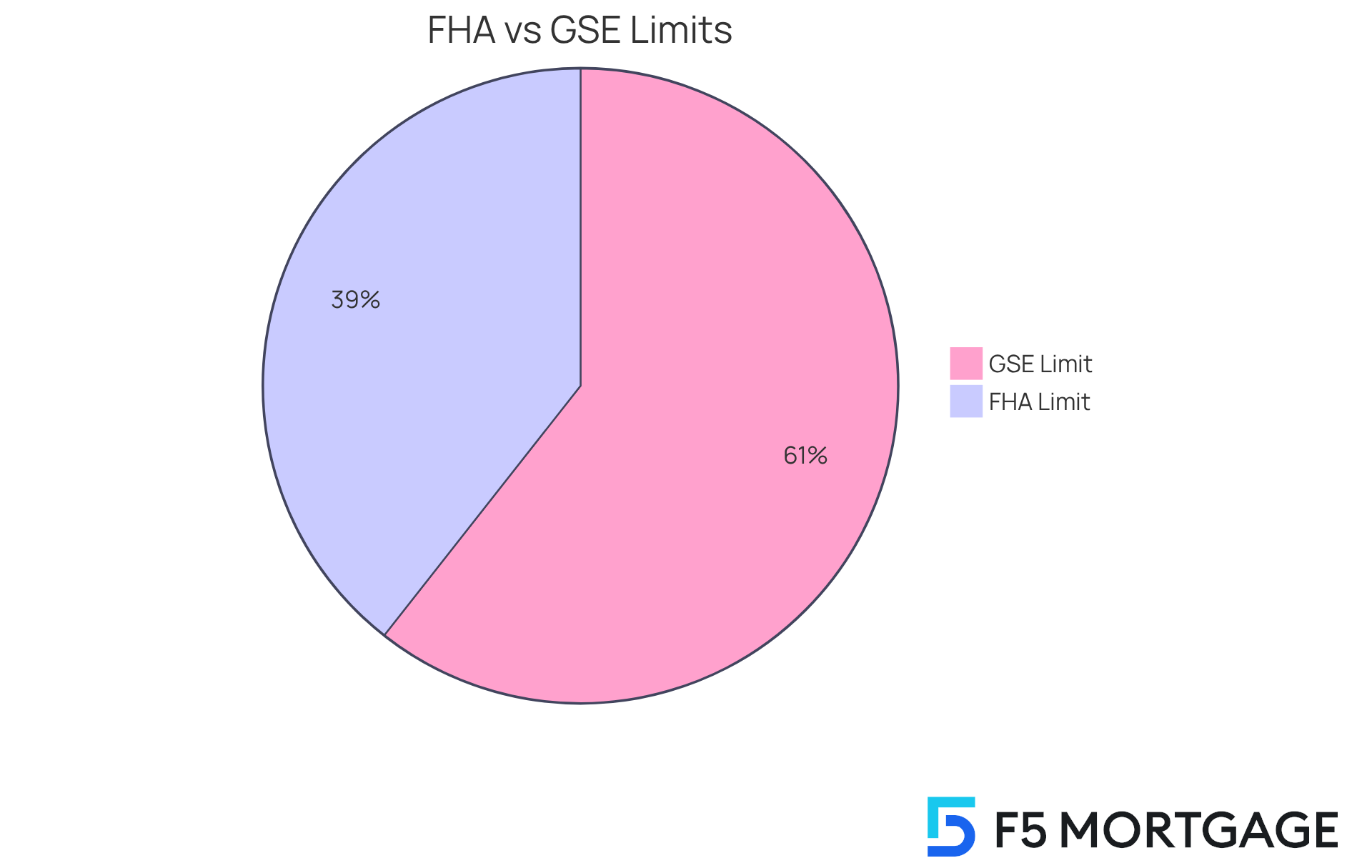

As the housing market evolves, staying informed about the FHA loan limits in Florida can empower buyers to make timely decisions and secure favorable financing options. The FHA loan limits in Florida for single-family homes are set at $524,225 for 2025, while GSE-conforming borrowing limits are increasing to $806,500, allowing buyers to explore a broader range of properties.

Additionally, with home prices projected to rise by 3.0% from September 2023 to September 2024, it is crucial to grasp these constraints to navigate the current market. The optimal debt-to-income (DTI) ratio of 43% or lower for FHA financing also plays a vital role in determining borrowing potential. As the FHA states, ‘These loan limits provide clarity on the maximum loan amount available in a specific area, allowing borrowers to assess their options and make informed decisions about purchasing a home.’ We’re here to support you every step of the way as you embark on this journey.

Conclusion

Understanding FHA loan limits is essential for prospective homebuyers in Florida. These limits significantly influence the affordability and accessibility of homeownership. FHA loans serve as a vital resource for low- to moderate-income families, offering reduced down payment requirements and flexible credit criteria. By highlighting the current FHA loan limits for 2025, we can see how these financial tools empower individuals to navigate the often-daunting home-buying process.

FHA loans play a crucial role in promoting homeownership, especially among first-time buyers and underserved communities. The specific loan limits across various counties in Florida illustrate how these limits adapt to local market conditions. Additionally, we outline the essential requirements for qualifying for an FHA loan, ensuring potential borrowers are well-informed and prepared to take the next steps.

Ultimately, understanding FHA loan limits and their implications fosters informed decision-making for homebuyers. As the housing market continues to evolve, staying updated on these limits can significantly enhance your purchasing power and financial planning. For those considering homeownership in Florida, leveraging the benefits of FHA financing opens doors to new opportunities and supports your journey toward achieving the dream of owning a home. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What are FHA loans and their purpose?

FHA loans, or Federal Housing Administration mortgages, are government-supported financial products designed to assist low- to moderate-income families in achieving homeownership.

What is the significance of FHA loans in the mortgage market?

In 2025, approximately 14.5% of purchase mortgages were FHA-insured, indicating their importance in providing accessible financing options for homebuyers.

What are the benefits of FHA financing?

FHA financing offers reduced upfront costs, with down payments as low as 3.5% for borrowers with a credit score of 580 or above, making it accessible for first-time homebuyers.

What credit score criteria does FHA financing allow?

FHA financing allows borrowers with credit scores as low as 500 to qualify, though this requires a higher down payment of 10%.

Who benefits from FHA loans?

Over 80% of FHA borrowers last year were first-time homebuyers, with a significant portion being Black and Latino borrowers, highlighting the FHA’s commitment to underserved communities.

How does FHA financing compare to VA financing?

While FHA financing offers low upfront costs, VA financing allows qualified veterans and active-duty service members to acquire homes with no initial cost necessary.

Are there any down payment assistance programs available?

Yes, programs like the First-Generation Down Support provide $25,000 in deferred financing to help first-time buyers manage initial expenses.

What is required if the down payment is less than 10%?

FHA mortgage insurance is necessary for the duration of the financing if the down payment is less than 10%.

What property requirements must be met for FHA financing?

Properties acquired with FHA financing must undergo an appraisal by an FHA-approved expert to meet minimum property standards.

What challenges do FHA loans face in the market?

FHA loans may encounter potential stigma in competitive markets, despite their significant role in increasing homeownership rates since 1934.