Overview

The main focus of this article is to provide essential facts about the 5/1 ARM loan, particularly how it can benefit families looking to upgrade their homes. We know how challenging it can be to navigate financial decisions, and this loan offers a promising solution. It highlights that this loan provides lower initial payments for the first five years, significantly easing financial burdens. This feature makes it an attractive option for families who plan to move or refinance within that timeframe. By understanding your needs and concerns, we aim to guide you through this process with compassion and support.

Introduction

Families seeking to upgrade their homes often find themselves facing the daunting task of financing their dreams while managing budgets and uncertainties about the future. We know how challenging this can be. Among the various mortgage options available, the 5/1 adjustable-rate mortgage (ARM) emerges as a compelling choice. It offers lower initial rates and predictable payments during its initial fixed period, which can be quite appealing.

However, as the market fluctuates and interest rates adjust, questions naturally arise:

- Is this loan truly the best fit for every family?

- Or does it carry hidden risks that could impact long-term financial stability?

Exploring the essential facts about the 5/1 ARM can provide clarity. We’re here to support you every step of the way, helping families make informed decisions in their home financing journey.

F5 Mortgage: Your Partner for 5/1 ARM Loans and Personalized Solutions

At F5 Mortgage LLC, we understand how challenging the mortgage process can be for families. As a leading independent loan brokerage, we are dedicated to providing competitive loan options tailored specifically for households, including the 5/1 arm loan, which is becoming increasingly popular.

Our commitment to personalized consultations empowers you with customized advice and access to a diverse array of loan options. We know that navigating financing can feel overwhelming, which is why we employ advanced technology to simplify the loan process. This approach not only enhances your experience but also aligns with the current trends in the mortgage sector, where independent brokers are gaining popularity for their personalized service and competitive pricing.

With an impressive customer satisfaction level of 94%, F5 Mortgage exemplifies the benefits of independent brokerage. We ensure that families receive the support they need during their home upgrade journey. Clients have shared their positive experiences, praising our outstanding service. One client expressed, ‘Alyssa & Jorge were both very patient with me & got me set up at prices I couldn’t believe,’ which highlights our commitment to your satisfaction.

This client-centric focus, combined with our expert guidance, positions F5 Mortgage as a trusted partner for families looking to upgrade their homes. We’re here to support you every step of the way, ensuring a stress-free experience and fast loan closing in under three weeks. Let us help you explore your financing options with confidence.

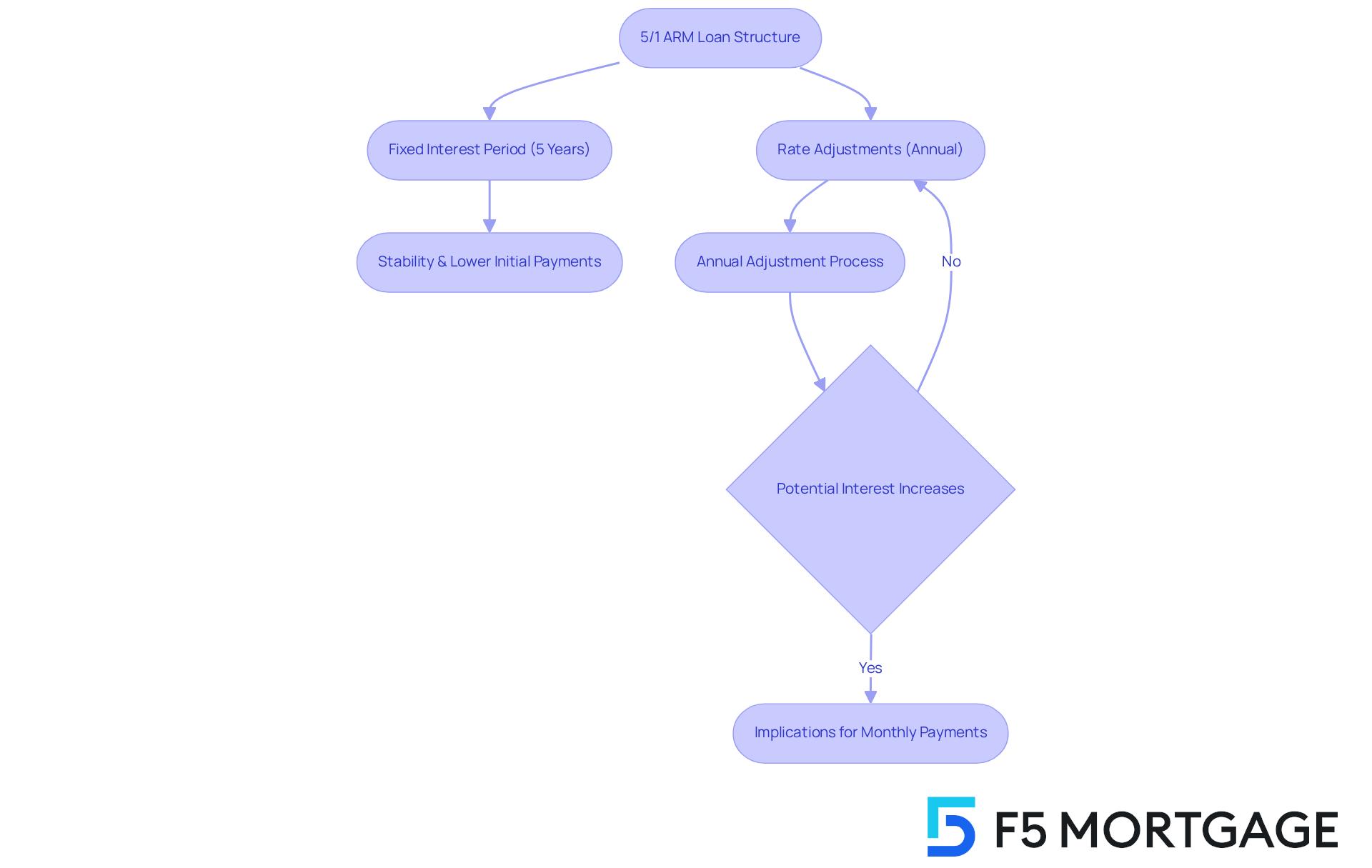

Understanding the 5/1 ARM Loan Structure and Rate Adjustments

A 5/1 arm loan can be an excellent choice for families aiming to manage their finances effectively. It offers a fixed interest percentage for the first five years, providing stability during that time. Afterward, the interest rate changes yearly based on market conditions. The ‘5’ indicates the fixed-term duration, while the ‘1’ signifies that the interest will adjust once per year thereafter. This structure allows borrowers to benefit from reduced initial payments, making it an appealing choice for those looking to enhance their homes without immediately committing to a long-term fixed interest option.

As of 2025, the average 5/1 ARM mortgage APR stands at 7.26%, which is competitive compared to the 30-year fixed mortgage percentage of 6.526%. Many families have successfully utilized the 5/1 arm loan to navigate their budgets, especially when they plan to sell or refinance before the adjustment period. For instance, a family that purchased their home with a 5/1 arm loan at a lower initial cost could save significantly on monthly payments. This savings can then be redirected toward home improvements or savings for future needs.

Understanding how interest adjustments work is crucial for prospective borrowers. After the initial five-year period, the interest rate on a 5/1 arm loan becomes variable, adjusting annually based on a benchmark index plus a lender margin, which typically ranges from 1.75% to 3.5%. While the initial payments are lower, families should be prepared for potential increases in their monthly responsibilities once the adjustment phase begins.

As families navigate the complexities of home financing, the flexibility offered by a 5/1 arm loan can be particularly beneficial in a fluctuating market. With loan costs declining for six consecutive weeks, many homebuyers are considering ARMs as a viable alternative to fixed loans, especially if they anticipate relocating or refinancing within a few years. F5 Mortgage offers attractive terms and user-friendly technology to simplify the refinancing process, often finalizing most loans in under three weeks. However, it’s important for potential borrowers to be aware of typical closing costs for refinancing, which can range from 2% to 5% of the loan amount, as these costs can affect overall affordability. We know how challenging this can be, and we’re here to support you every step of the way.

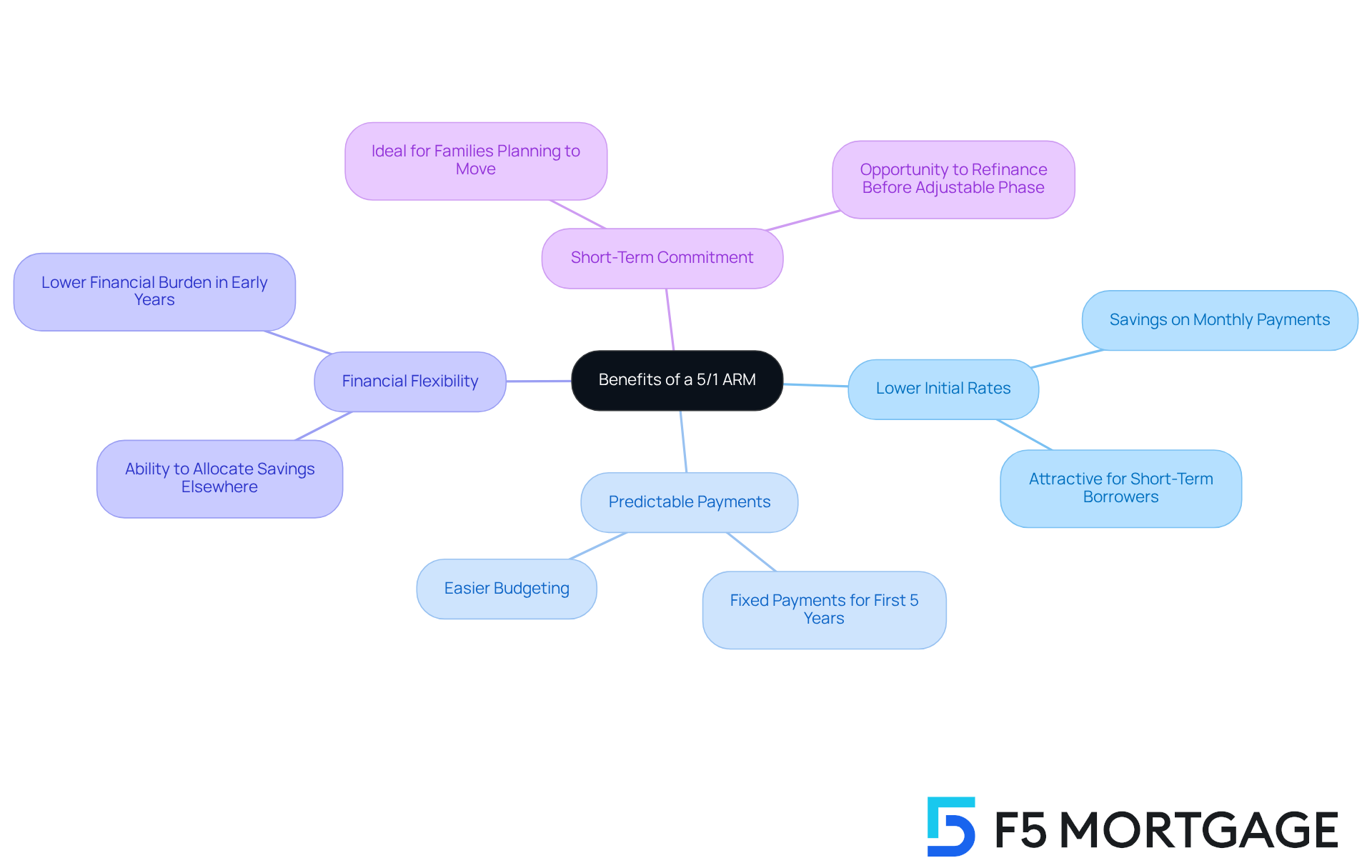

Benefits of a 5/1 ARM: Lower Initial Rates and Predictable Payments

A key advantage of the 5/1 arm loan is its lower initial interest compared to conventional fixed-rate mortgages. This can lead to significant savings on monthly payments during the first five years, which we know can be a relief for many families. This introductory fee is frequently considerably lower than fixed-rate alternatives, allowing households to manage their budgets more efficiently and simplifying the handling of additional costs.

For instance, as of September 2025, the average rate for a 5/1 arm loan is approximately 7.26%. This rate is particularly attractive for families looking to lessen their financial burden in the short term. The predictability of payments during the fixed-rate period further enhances budgeting capabilities. Families can organize their finances with assurance, knowing their loan payments will remain consistent for the initial five years.

This stability is especially beneficial for those who anticipate moving or refinancing before the adjustable phase begins. It allows them to enjoy lower costs without a long-term commitment. Furthermore, numerous households have reported substantial savings by choosing a 5/1 arm loan. For example, a household that obtains a 5/1 arm loan with an introductory percentage of 4% might witness their monthly payment drop compared to what it would be with a fixed-rate mortgage.

This enables them to allocate the difference towards other important areas, such as education or home enhancements. This financial flexibility makes the 5/1 arm loan an appealing choice for families looking to upgrade their homes, particularly in a fluctuating economic landscape where managing expenses is crucial. We’re here to support you every step of the way as you navigate these important decisions.

Risks of a 5/1 ARM: Understanding Rate Caps and Future Increases

While a 5/1 arm loan can offer reduced initial costs, it is essential to recognize the inherent risks involved. After the first five years, the interest rate adjusts annually, which may lead to significantly higher monthly payments. To help manage this risk, interest caps are typically put in place. These caps limit how much your payments can increase at each adjustment and over the life of the loan. Understanding these caps is crucial for borrowers, as they provide insight into potential future payments and assist families in preparing for any financial changes that may arise. For instance, families who initially benefit from lower payments might face challenges if their costs increase sharply after the adjustment phase. This highlights the importance of thorough financial planning when considering a 5/1 arm loan.

To better prepare for potential rate increases, we know how challenging this can be, so families should consider the following actionable tips:

- Review the terms of the rate caps on your mortgage to understand the maximum potential increases.

- Monitor market trends and Freddie Mac’s updates to stay informed about loan costs.

- Consult with a financing expert, such as F5 Mortgage, to explore competitive rates and personalized service, especially if rate increases are a concern.

By taking these steps, families can navigate the complexities of a 5/1 arm loan more effectively and make informed decisions about their mortgage financing. We’re here to support you every step of the way.

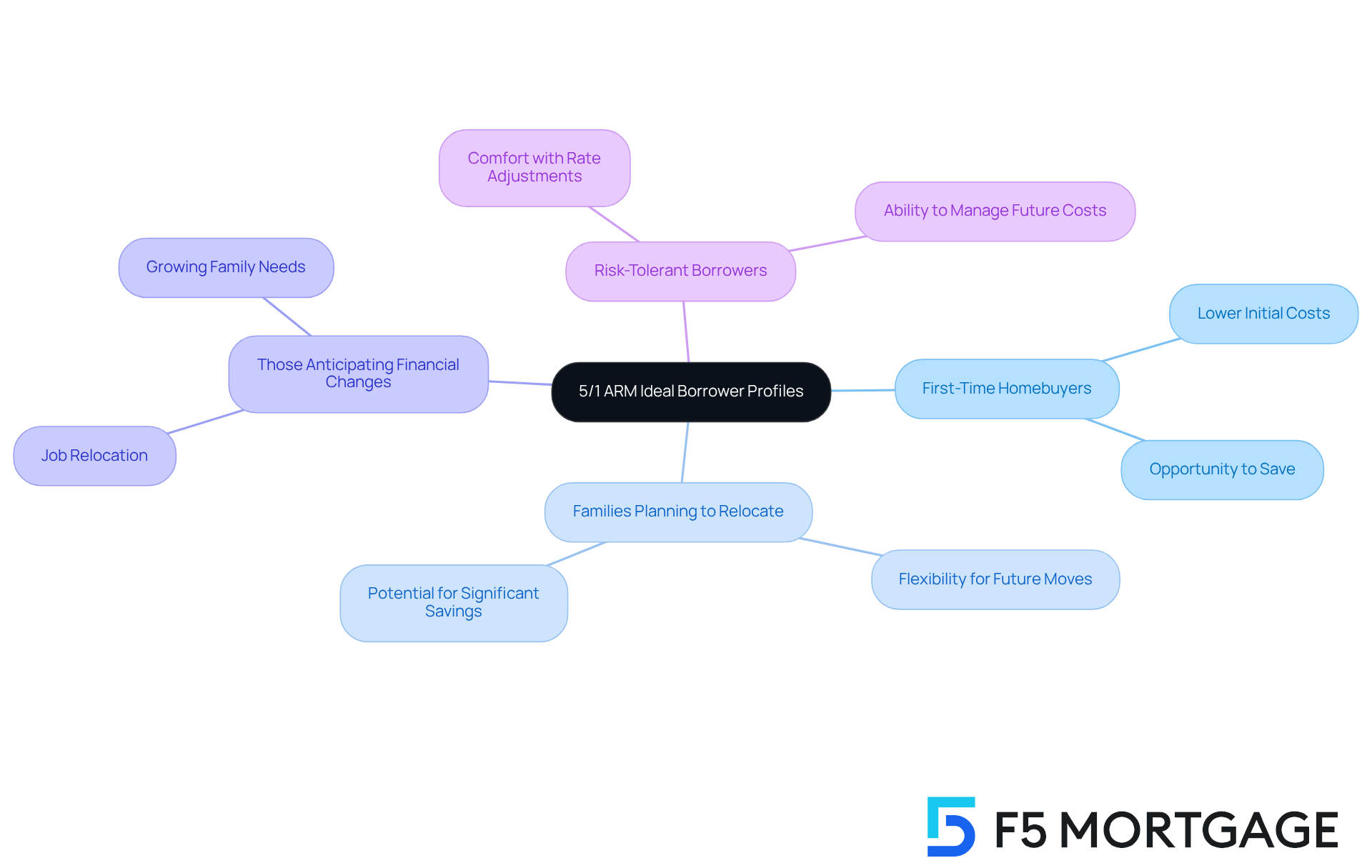

Who Should Consider a 5/1 ARM? Ideal Borrower Profiles

The 5/1 arm loan can be a wonderful option for families who plan to relocate or refinance within the first five years. If you’re a first-time homebuyer or looking to improve your living situation, this mortgage type might just be what you need. In 2025, many first-time homebuyers opted for a 5/1 arm loan, drawn in by the lower initial costs.

For those anticipating changes in their financial circumstances—like job relocations or growing families—this mortgage can be particularly appealing. If you feel comfortable with a bit of risk and can manage potential future cost increases, a 5/1 arm loan could be a good fit for you. Families who have taken advantage of 5/1 ARMs often share stories of significant savings during the initial fixed-rate period, allowing them to focus on other financial goals.

Overall, if you’re planning to sell or refinance before the adjustment period, the 5/1 arm loan can be a strategic choice. We understand that navigating the mortgage process can be daunting, but we’re here to support you every step of the way.

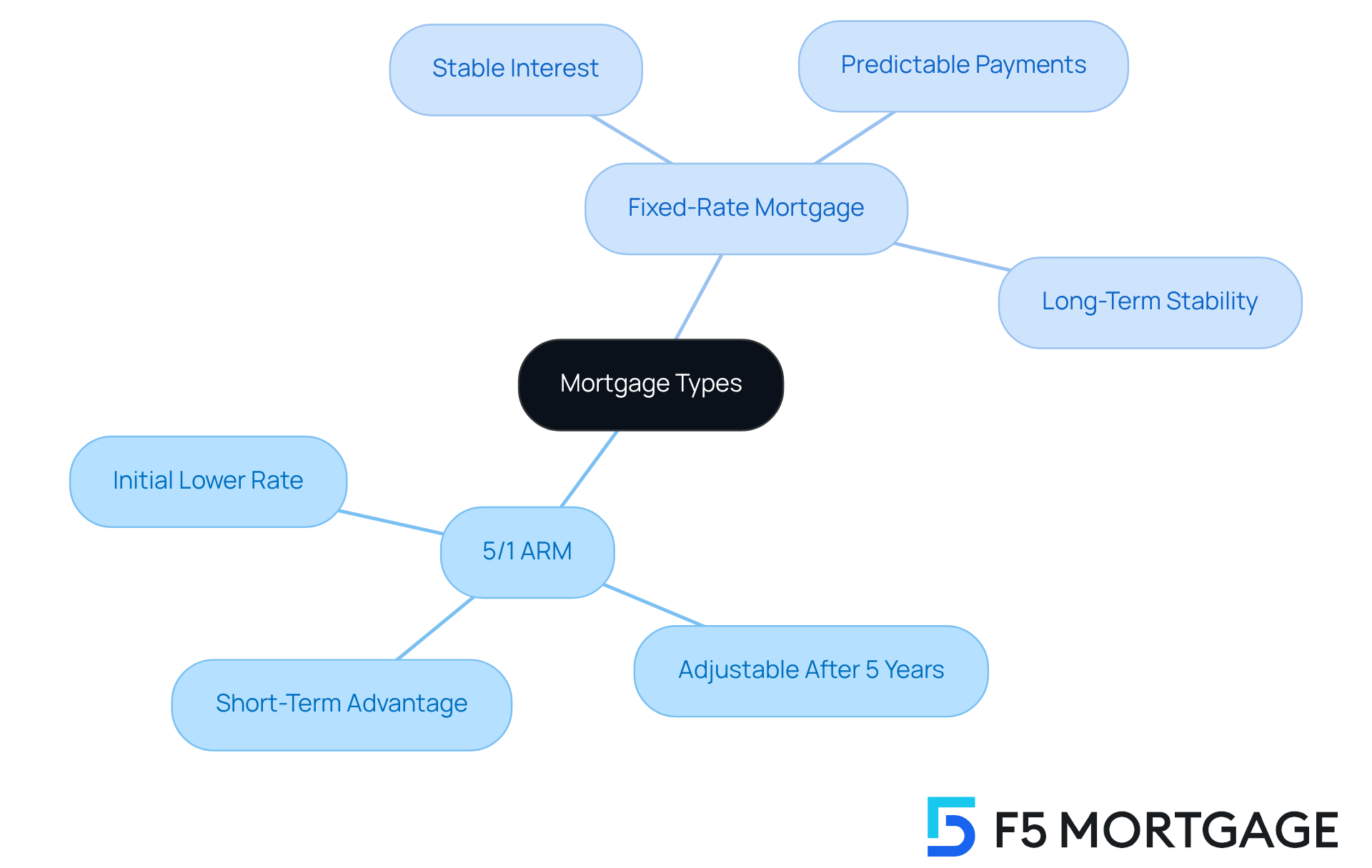

5/1 ARM vs. Fixed-Rate Mortgages: Key Differences Explained

The essential difference between a 5/1 arm loan and a fixed-interest loan lies in their interest structures. A fixed-rate mortgage offers a stable interest percentage throughout the loan duration, ensuring predictable monthly payments. In contrast, a 5/1 arm loan starts with a lower initial interest percentage that remains fixed for the first five years, after which it adjusts yearly based on market conditions. This initial lower charge can lead to decreased payments, making it an appealing choice for families looking to save money upfront.

However, the adjustable nature of the 5/1 arm loan introduces uncertainty regarding future payments. After the initial period, costs can rise significantly, potentially resulting in higher monthly payments that may strain your budget. For instance, if the starting percentage is set at 6.11%, it could increase to 8.11% or more after five years, impacting affordability.

When deciding between these loan types, it’s important to thoughtfully assess your long-term intentions for the property. Families who anticipate moving or refinancing within a few years might find a 5/1 arm loan advantageous due to its lower initial payments. On the other hand, those planning to stay in their homes for an extended period may prefer the stability of a fixed-interest loan, which protects them from future increases.

Ultimately, understanding the implications of rate adjustments and evaluating your personal financial situation are crucial steps in making an informed choice between a fixed-rate mortgage and a 5/1 arm loan. We know how challenging this can be, and we’re here to support you every step of the way.

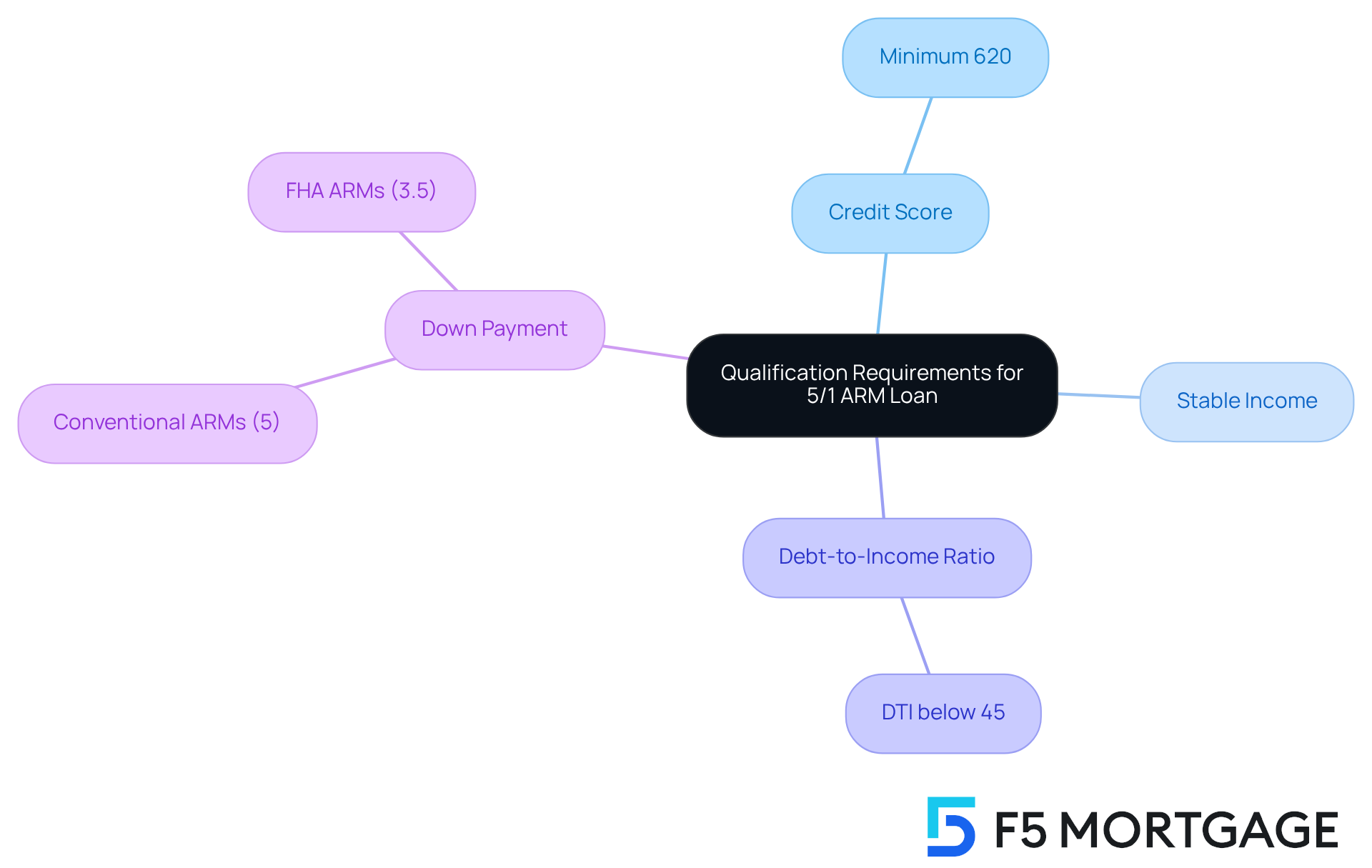

Qualification Requirements for a 5/1 ARM Loan

We understand how challenging it can be to navigate the mortgage process, especially when considering a 5/1 arm loan. To qualify, borrowers typically need:

- A minimum credit score of 620

- A stable income

- A debt-to-income (DTI) ratio below 45%

While most lenders require a down payment of at least 5% for conventional ARMs, FHA ARMs may allow for a minimum of 3.5% down.

Comprehending these criteria is essential for families seeking to secure a 5/1 arm loan, as it helps them organize their financial documentation efficiently. By maintaining a strong credit history, reducing existing debt, and ensuring consistent income, families can enhance their chances of approval.

Additionally, we recommend pre-qualification to clarify affordability and streamline the application process. This proactive step allows families to approach lenders with confidence, knowing they are prepared to take the next steps toward homeownership.

Debunking Myths: Common Misconceptions About 5/1 ARMs

Many misconceptions cloud the perception of the 5/1 arm loan, particularly the idea that it is inherently riskier than fixed-rate loans. While it’s true that ARMs can pose risks due to potential increases in costs, they also offer substantial savings during the initial fixed period. Many families choose a 5/1 arm loan to benefit from lower initial payments, particularly in a high-interest environment where fixed-rate options may seem less affordable.

At F5 Mortgage, we understand how challenging this can be. We provide adaptable mortgage options and a swift pre-qualification process, enabling families to acquire their dream home more quickly. Another common misconception is the belief that prices will consistently increase after the fixed period. In reality, costs can decline based on market conditions, offering borrowers opportunities for reduced payments.

Recent surveys indicate that around 70% of ARM holders express regret over their choice, primarily due to rising rates; however, this sentiment does not reflect the experiences of all borrowers. Approximately 8% of borrowers actively select ARMs for their unique benefits, illustrating that these loans can be advantageous for households who intend to move or refinance within the fixed-rate period.

Real-life examples show how families have successfully utilized a 5/1 arm loan to manage their finances effectively. By understanding these myths and the actual mechanics of ARMs, families can make informed decisions that align with their financial goals. As the mortgage landscape evolves, we’re here to support you every step of the way. It’s essential to consult knowledgeable mortgage advisors at F5 Mortgage, who are dedicated to providing personalized support and ensuring customer satisfaction throughout the home buying process.

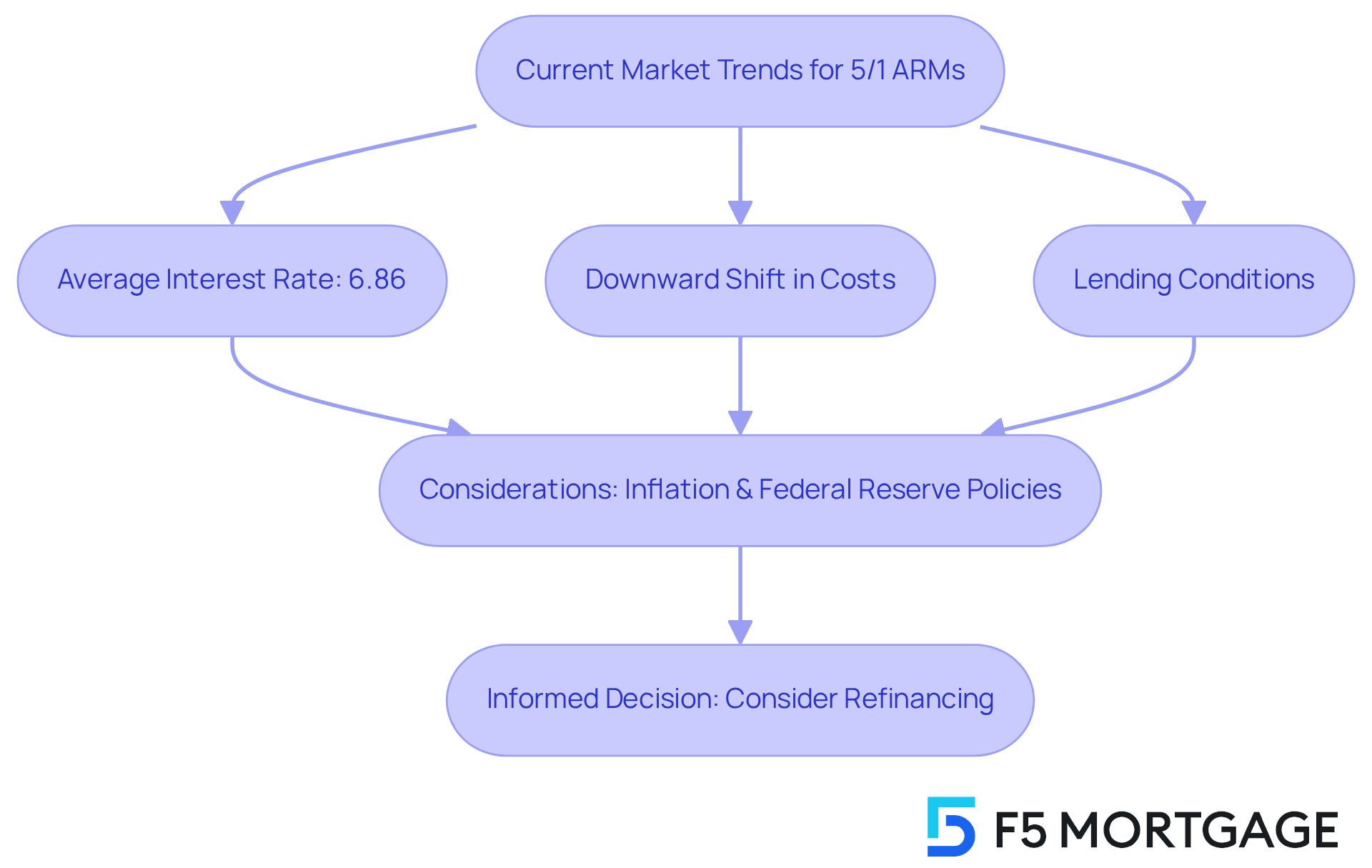

Current Market Trends for 5/1 ARMs: What Borrowers Should Know

As of September 2025, we know that the average interest percentage for a 5/1 arm loan is approximately 6.86%. With market trends suggesting a slight downward shift in costs, this could be a favorable moment for families who are contemplating a 5/1 arm loan. Present lending conditions for 30-year and 15-year fixed loans are decreasing, making refinancing a strategic choice for homeowners aiming to reduce their monthly payments.

However, it’s essential for borrowers to remain aware of economic indicators, such as inflation and Federal Reserve policies. These elements can significantly influence loan costs. By understanding these trends, along with the potential benefits of refinancing, families can make informed decisions regarding their home financing. We’re here to support you every step of the way as you navigate these choices.

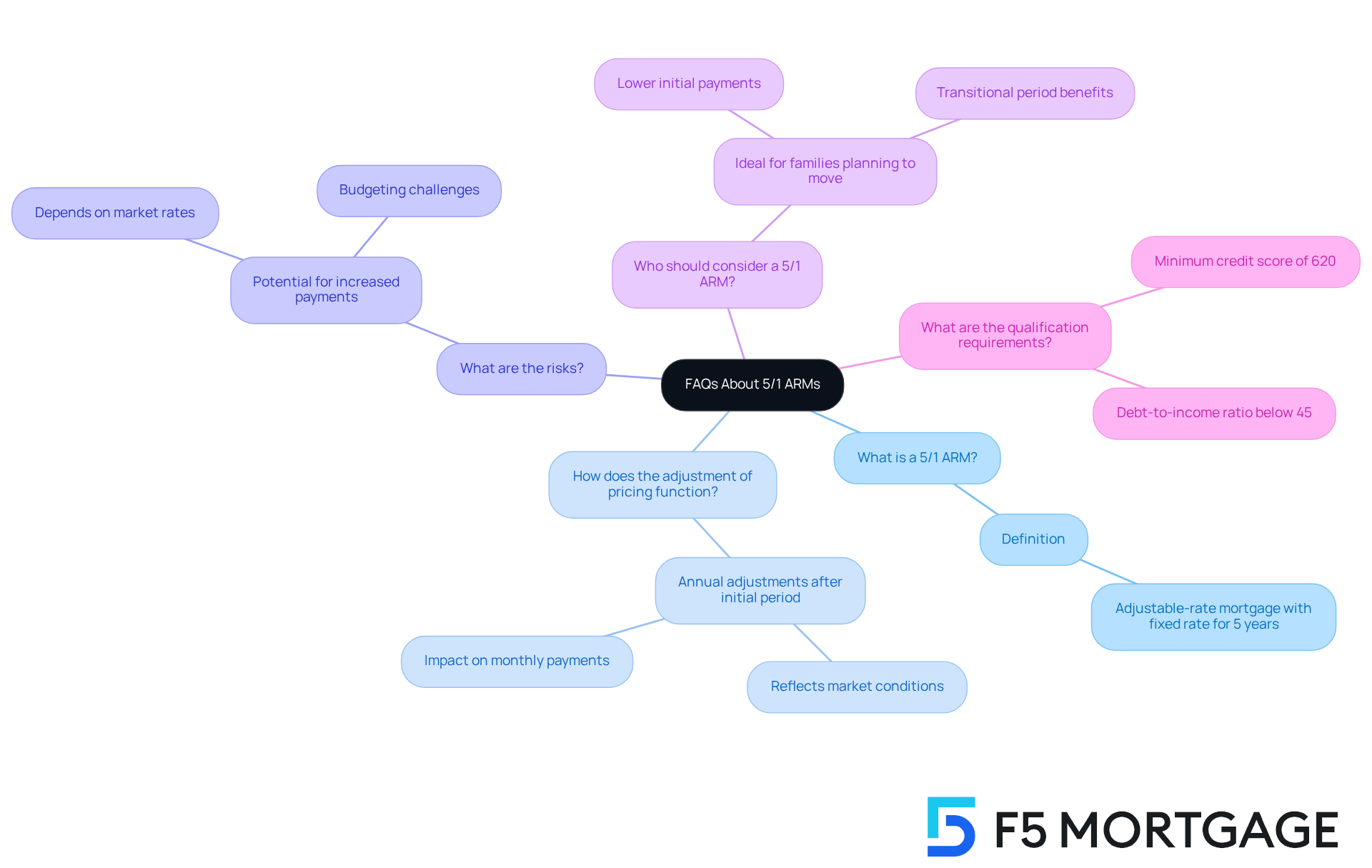

FAQs About 5/1 ARMs: Quick Answers to Common Questions

-

What is a 5/1 ARM? A 5/1 arm loan is an adjustable-rate mortgage that offers a fixed interest charge for the first five years. After this period, the interest rate adjusts annually, reflecting changes in the market.

-

How does the adjustment of pricing function? After the initial fixed period, your interest rate may vary based on market conditions, typically changing once a year. We know how important it is to understand these fluctuations, as they can impact your monthly payments.

-

What are the risks? One of the main risks associated with a 5/1 arm loan is the potential for increased monthly payments once the fixed-rate period ends. This change depends on market rates, and we’re here to support you in navigating these uncertainties.

-

Who should consider a 5/1 ARM? Families who plan to move or refinance within five years may find the 5/1 arm loan to be particularly beneficial. It can offer lower initial payments, allowing you to allocate your resources wisely during this transitional period.

-

What are the qualification requirements? Generally, to qualify for a 5/1 arm loan, you will need a minimum credit score of 620 and a debt-to-income (DTI) ratio below 45%. Understanding these requirements can help you prepare for the mortgage process with confidence.

Conclusion

Understanding the nuances of a 5/1 ARM loan is essential for families looking to upgrade their homes while managing their finances effectively. This mortgage option, with its initial fixed rate and potential for lower monthly payments, offers a strategic advantage for those who anticipate moving or refinancing within the first five years. By leveraging the benefits of this loan structure, families can enjoy financial flexibility and significant savings during the initial period, making it a compelling choice in today’s housing market.

Throughout this article, we’ve highlighted the structure of the 5/1 ARM loan, its benefits of lower initial rates, and the associated risks of future rate adjustments. We know how challenging it can be to navigate these options, so understanding rate caps and market trends is crucial. This knowledge empowers borrowers to make confident decisions. Moreover, we’ve discussed ideal borrower profiles, showcasing how this loan can cater to various family needs and financial situations.

In conclusion, families considering a 5/1 ARM loan should weigh their long-term plans and financial circumstances carefully. By staying informed about market trends and the intricacies of adjustable-rate mortgages, you can make educated decisions that align with your financial goals. Engaging with a trusted partner like F5 Mortgage can further simplify the process, ensuring a smooth journey towards homeownership and financial stability. Embrace the opportunity to explore how a 5/1 ARM loan can support your aspirations for a better living situation while managing your budget effectively.

Frequently Asked Questions

What is F5 Mortgage LLC?

F5 Mortgage LLC is an independent loan brokerage that offers competitive loan options tailored for households, including the increasingly popular 5/1 ARM loan.

What is a 5/1 ARM loan?

A 5/1 ARM loan is a type of mortgage that has a fixed interest rate for the first five years, after which the interest rate adjusts annually based on market conditions.

What are the benefits of a 5/1 ARM loan?

The main benefits include lower initial interest rates compared to fixed-rate mortgages, predictable payments for the first five years, and the potential for significant savings on monthly payments.

How does the interest rate adjustment work for a 5/1 ARM loan?

After the initial five-year fixed period, the interest rate becomes variable and adjusts annually based on a benchmark index plus a lender margin, which typically ranges from 1.75% to 3.5%.

What is the average interest rate for a 5/1 ARM loan as of 2025?

As of 2025, the average 5/1 ARM mortgage APR is approximately 7.26%.

How quickly can F5 Mortgage close loans?

F5 Mortgage can often finalize most loans in under three weeks, providing a fast and efficient loan closing process.

What should potential borrowers be aware of regarding closing costs for refinancing?

Typical closing costs for refinancing can range from 2% to 5% of the loan amount, which can affect overall affordability.

How does F5 Mortgage ensure customer satisfaction?

F5 Mortgage maintains a customer satisfaction level of 94% by providing personalized consultations, expert guidance, and a commitment to meeting clients’ needs throughout the mortgage process.