Overview

In today’s world, managing mortgage options can feel overwhelming. This article focuses on a powerful tool: the refinance mortgage payment calculator. It highlights ten essential features that can truly aid you in navigating your choices with confidence.

Imagine being able to:

- Customize your loan terms

- Receive real-time interest rate updates

- Access detailed payment breakdowns

These features are designed to empower you, making it easier to make informed financial decisions.

We understand how challenging this process can be, and we’re here to support you every step of the way. By utilizing these tools, you can optimize your refinancing strategies and take control of your financial future.

Let’s explore how these features can make a difference in your journey toward homeownership.

Introduction

Navigating the intricacies of refinancing a mortgage can often feel overwhelming, much like finding your way through a complex financial maze. We understand how challenging this can be, especially with fluctuating interest rates and a multitude of loan options available. That’s why many homeowners are turning to tools designed to simplify this process. Among these, the refinance mortgage payment calculator stands out as a vital resource. It offers users the ability to customize their loan terms, stay updated on market changes, and gain clarity on their financial commitments.

But what are the essential features that can turn a daunting refinancing journey into a more manageable experience? By exploring the ten key attributes of this calculator, we can reveal not only how it empowers homeowners but also how it effectively addresses the common challenges faced in today’s dynamic mortgage landscape. We’re here to support you every step of the way, guiding you toward a more confident refinancing process.

F5 Mortgage: User-Friendly Mortgage Payment Calculator

At F5, we understand how challenging navigating the mortgage process can be. That’s why we offer a refinance mortgage payment calculator designed with your experience in mind. This tool reflects our commitment to providing competitive rates and simplified loan solutions. The refinance mortgage payment calculator makes estimating monthly payments easy and accessible for both first-time homebuyers and seasoned investors.

The intuitive layout allows you to input your loan details quickly. We want to ensure you feel empowered to make informed decisions without the stress of complex calculations. With our user-friendly technology, we’re here to support you every step of the way.

Our goal is to guide you through the loan modification process, helping you secure the best rates. Imagine finalizing your loan in less than three weeks! We’re dedicated to making this journey as smooth as possible for you.

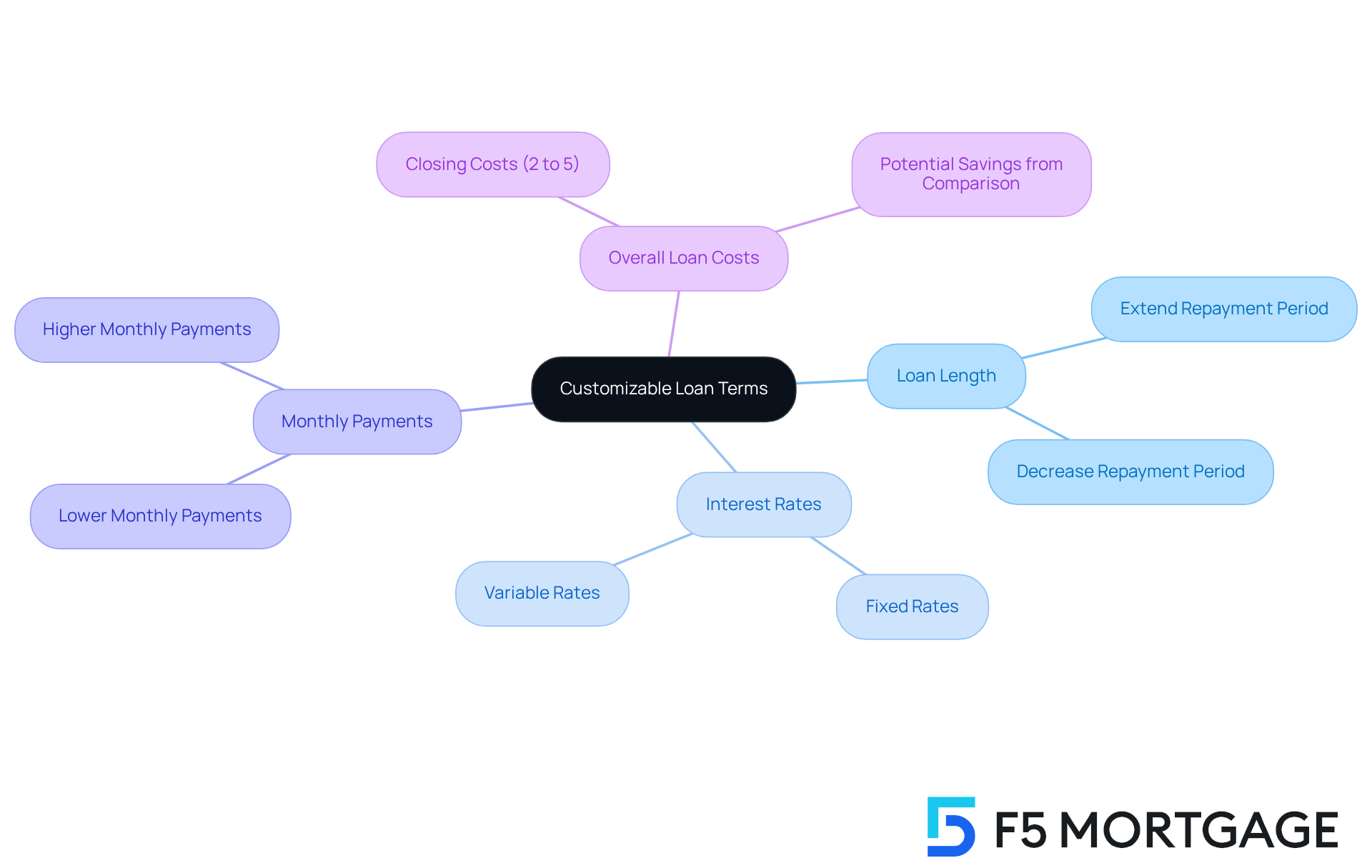

Customizable Loan Terms: Tailor Your Refinance Options

We understand how challenging it can be to navigate mortgage options, which is where a refinance mortgage payment calculator can help. The F5 Mortgage calculator empowers you to customize various loan terms, such as the length of the loan and interest rates. This flexibility allows you to explore different scenarios, helping you discover the most appropriate loan modification option for your unique situation.

By adjusting these parameters, you can visualize how changes affect your monthly payments and overall loan costs. Understanding these factors is crucial for making informed decisions. Furthermore, loan alternatives enable homeowners like you to:

- Extend your repayment period, lowering monthly costs

- Decrease it to settle your debt faster

If you purchased your home with a traditional loan and made a down payment of less than 20%, obtaining a new loan might also provide an opportunity to remove private insurance. This is especially relevant given the significant home appreciation rates in California. Financial specialists emphasize that utilizing a refinance mortgage payment calculator to customize refinance choices can lead to considerable savings. For instance, homeowners generally pay about $5,000 to refinance a home loan, and those who compare five lenders save an average of $3,000.

This capability not only enhances your loan restructuring experience but also aligns your mortgage options with your long-term financial objectives. We’re here to support you every step of the way as you make these important decisions.

Real-Time Interest Rate Updates: Stay Informed on Market Changes

F5 Mortgage’s calculator offers real-time updates on interest rates, ensuring you stay informed about market fluctuations. We know how challenging navigating these changes can be, especially if you’re considering a loan modification. This capability is crucial, as it allows you to secure favorable rates before potential increases.

When homeowners in California use a refinance mortgage payment calculator, they typically start by assessing their current mortgage terms and determining their financial goals. Whether your aim is to reduce monthly payments or access home equity, understanding the expenses related to loan modification is essential. This includes:

- Application fees

- Appraisal expenses

- Closing charges

These costs can vary significantly.

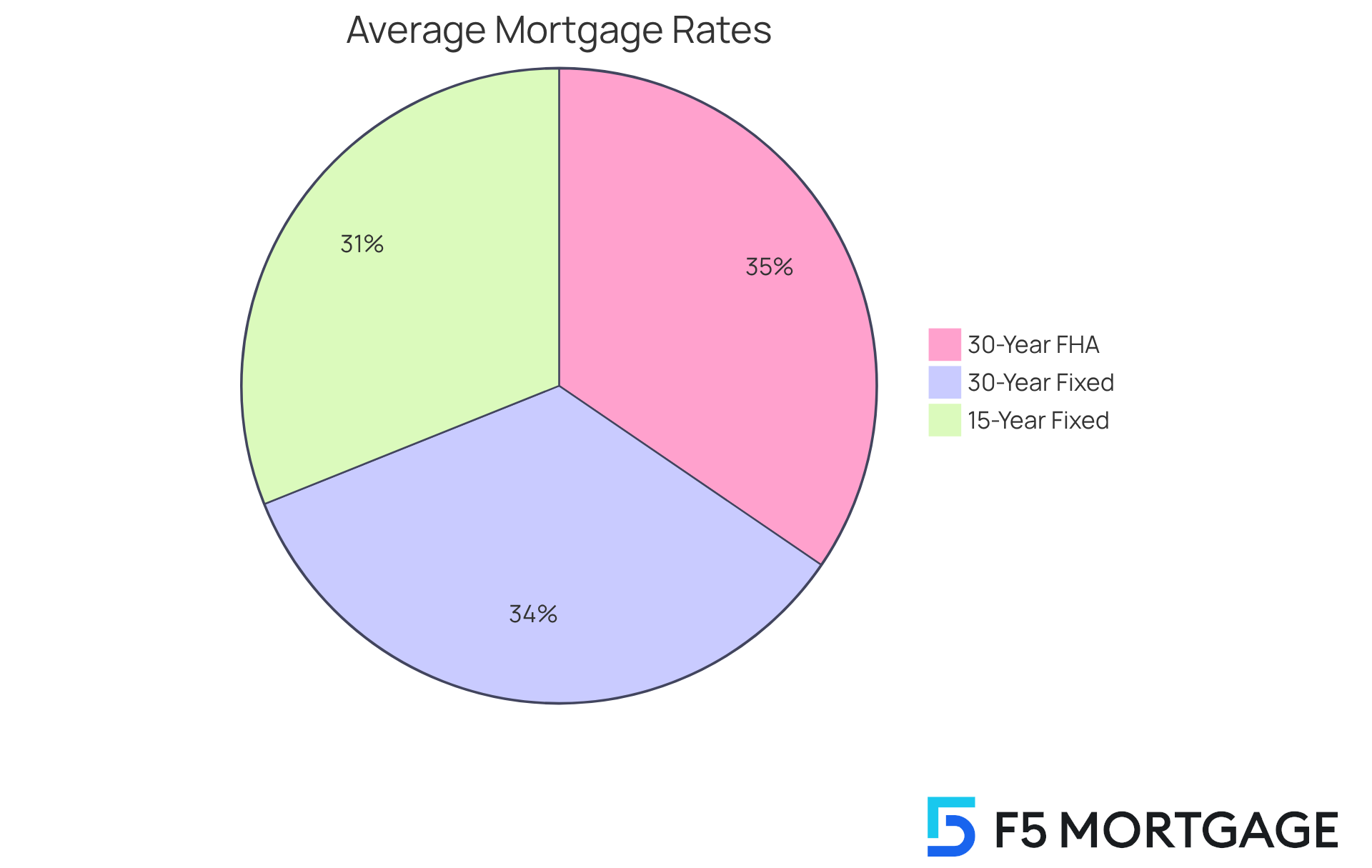

Currently, 30-year fixed rates average around 6.65%, while 15-year fixed rates sit at 6.01%, and the 30-Year Fixed Rate FHA is at 6.68%. Having access to the latest information can significantly influence your decisions. Mortgage analysts emphasize that timely updates can lead to substantial savings over the life of a loan. As one expert noted, ‘If you find a rate that will save you money, then it’s a good idea to lock it in so you don’t risk missing out if rates jump.’

In fact, refinance applications have risen by 42% compared to the same period last year, highlighting the growing interest in loan modification. By utilizing these insights, you can strategically manage your loan options with a refinance mortgage payment calculator, potentially securing lower rates and enhancing your financial results. Consistently reviewing the refinance mortgage payment calculator for updates or seeking advice from a loan consultant can further enhance your financial strategies. We’re here to support you every step of the way, making the process smoother and more advantageous with F5 Lending.

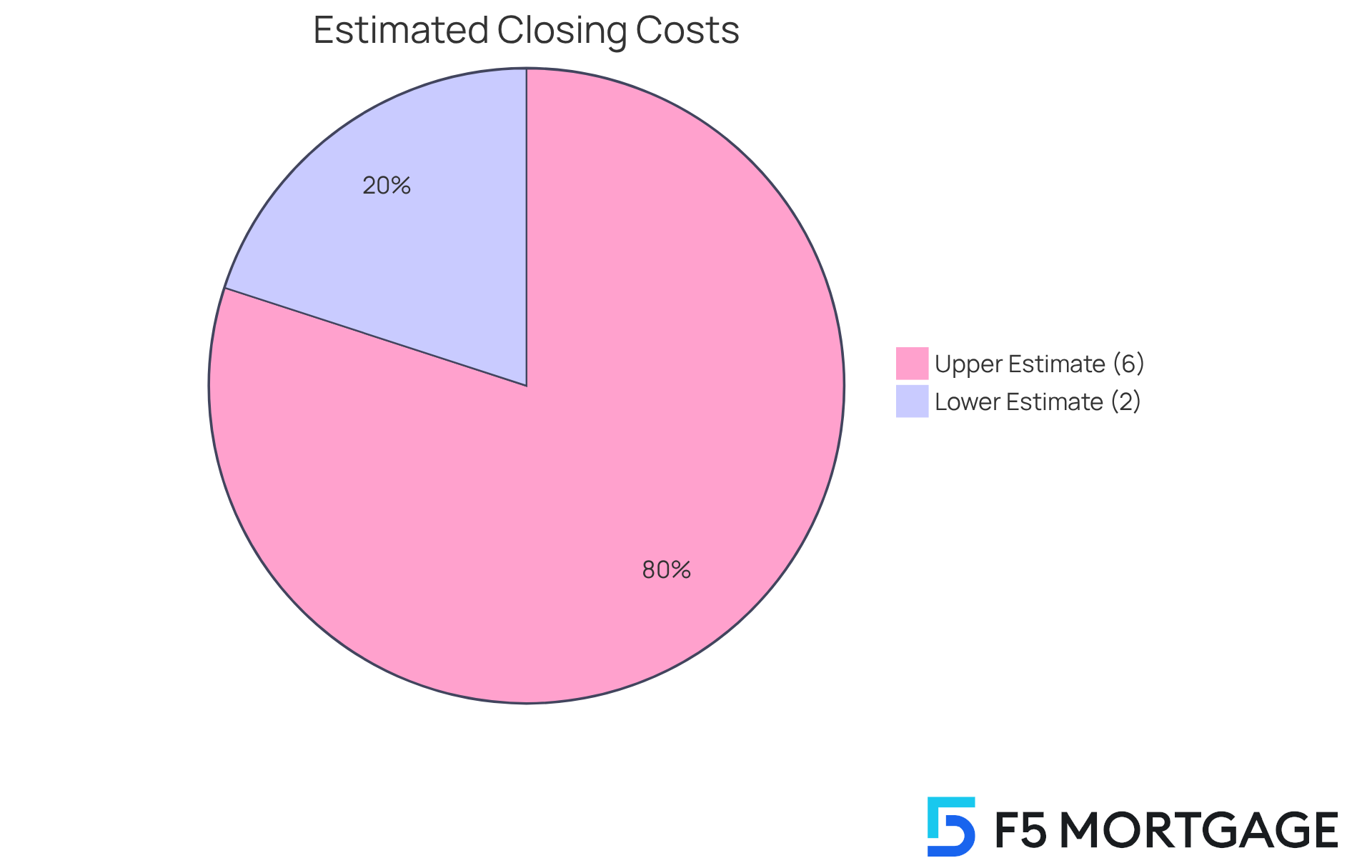

Estimated Closing Costs: Understand Your Total Financial Commitment

Navigating the world of loans can be overwhelming, especially when it comes to understanding closing expenses. The F5 Loan calculator provides an essential tool for estimating these costs, which can significantly impact your journey toward securing a new loan. By offering a detailed breakdown of these expenses, F5 Mortgage helps you grasp your total financial commitment.

We know how challenging this can be, as studies show that many borrowers are unaware of the full scope of closing costs, typically ranging from 2% to 6% of the loan amount. For instance, if you’re restructuring a $300,000 home loan, you might face expenses between $6,000 and $15,000. Financial advisors emphasize that understanding these costs is crucial for effective budgeting and making informed decisions about your loan options.

Real-life examples highlight how the refinance mortgage payment calculator has successfully assisted families in assessing their commitments, leading to more strategic choices for restructuring loans. By utilizing the refinance mortgage payment calculator, you can confidently navigate the complexities of restructuring your loans, ensuring you’re well-prepared for the financial implications ahead. Remember, we’re here to support you every step of the way.

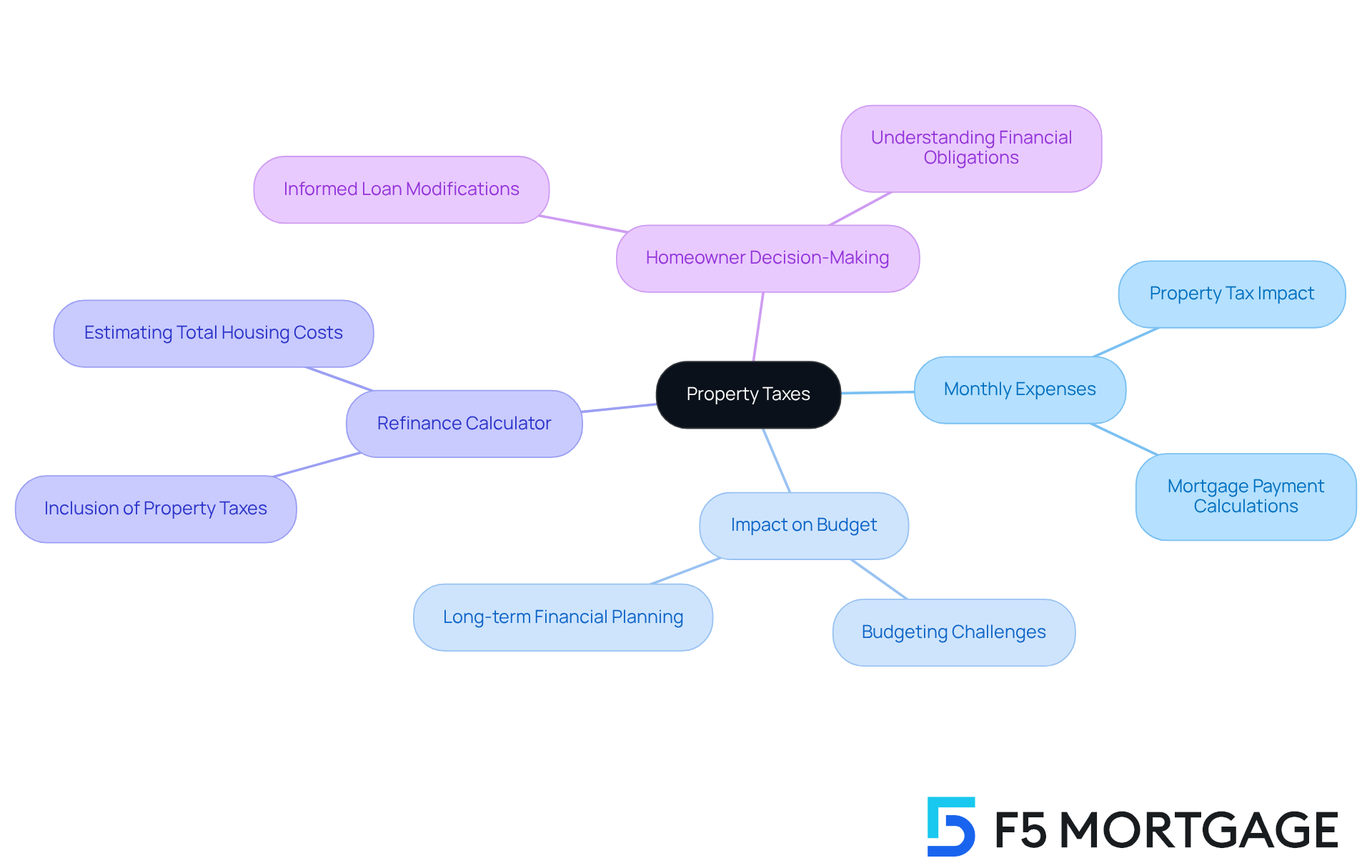

Property Taxes: Incorporate All Monthly Expenses

At F5 Mortgage, we understand how challenging it can be to navigate the complexities of home financing. That’s why our refinance mortgage payment calculator is thoughtfully designed to include property taxes when estimating monthly payments. This crucial feature helps you accurately assess your total housing costs. By comprehending how property taxes affect your monthly budget, you can make informed decisions about loan modifications.

For many homeowners, property taxes can significantly influence monthly mortgage payments, often adding hundreds of dollars to what you need to budget. We’re here to support you every step of the way. By collaborating with F5 Mortgage, California homeowners benefit from our dedicated team approach, ensuring that all aspects of mortgage adjustment, including property taxes, are considered in your planning.

As an independent broker, we are committed to finding the lowest refinance rates available, streamlining the process, and making it easier for you to explore your options. This comprehensive method ensures that you won’t be surprised by unforeseen costs, promoting better budgeting and stability.

Using a refinance mortgage payment calculator that includes property taxes helps homeowners gain a clearer understanding of their obligations. This clarity leads to more strategic refinancing choices, empowering you to take control of your financial future.

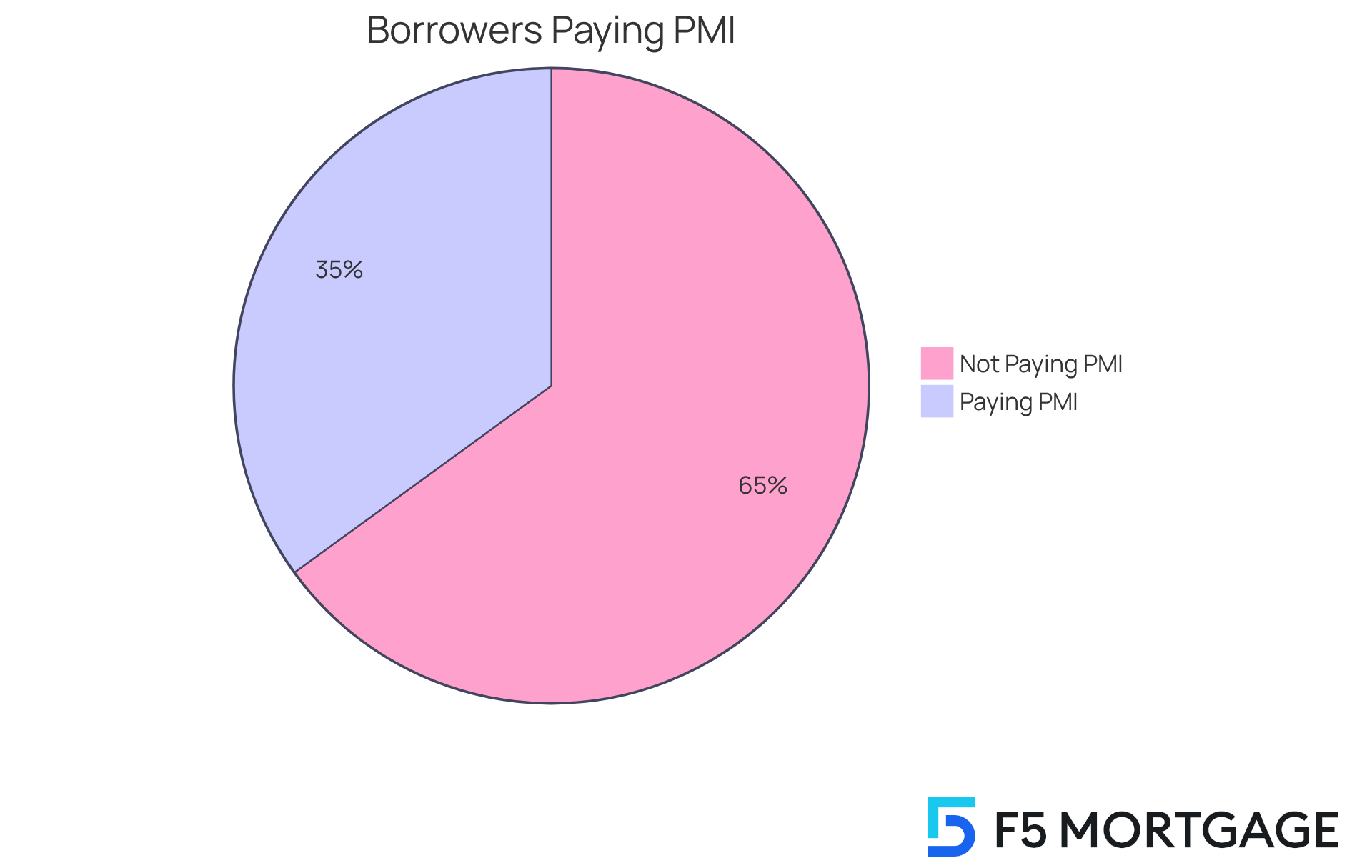

PMI Calculations: Factor in Additional Costs for Accurate Estimates

Navigating the mortgage process can be overwhelming, especially for those making a down payment of less than 20%. We understand how challenging this can be, and that’s why our calculator incorporates Private Mortgage Insurance (PMI) calculations. By including PMI, you can clearly see how this additional expense influences your monthly payments. This transparency is crucial, as it allows you to grasp the complete picture of your financial commitments and plan your budget effectively.

In 2025, approximately 35% of borrowers will be required to pay PMI, particularly those with lower down payments. Comprehending how PMI affects your monthly payments is essential, especially for first-time homebuyers navigating the intricacies of financing. For instance, if you have a $400,000 mortgage with a 10% down payment, you might face a PMI payment of around $365 monthly. This extra expense can greatly influence total affordability, and it’s important to consider it in any loan modification decision.

Loan brokers emphasize that using a refinance mortgage payment calculator to precisely calculate PMI is crucial for making informed financial decisions. It directly impacts both your monthly payments and your options when using a refinance mortgage payment calculator. We’re here to support you every step of the way, ensuring you feel empowered to make the best choices for your financial future.

User-Friendly Interface: Simplify Your Mortgage Calculations

At F5 Home Loans, we understand how daunting the mortgage process can be, especially for first-time homebuyers. That’s why our Loan calculator features a user-friendly interface designed to simplify the calculation process. With straightforward instructions and an intuitive layout, you can navigate the tool effortlessly, reducing confusion and frustration.

We know how challenging this can be, particularly when faced with unfamiliar loan terminology and complex calculations. By emphasizing simplicity and clarity, our calculator empowers you to make informed financial choices with confidence, enhancing your overall financing experience.

Moreover, we are proud to offer ultra-competitive rates while utilizing advanced technology to improve the loan process. This ensures that you receive the best possible service without the pressure of hard sales tactics. As Jon Bolt wisely states, ‘The best products don’t focus on features, they focus on clarity.’

Research shows that observing user actions can reveal valuable insights into usability, reinforcing the importance of effective design. So, if you’re looking to simplify your loan calculations, the refinance mortgage payment calculator guarantees a seamless experience, supported by our exceptional service and competitive rates. We’re here to support you every step of the way.

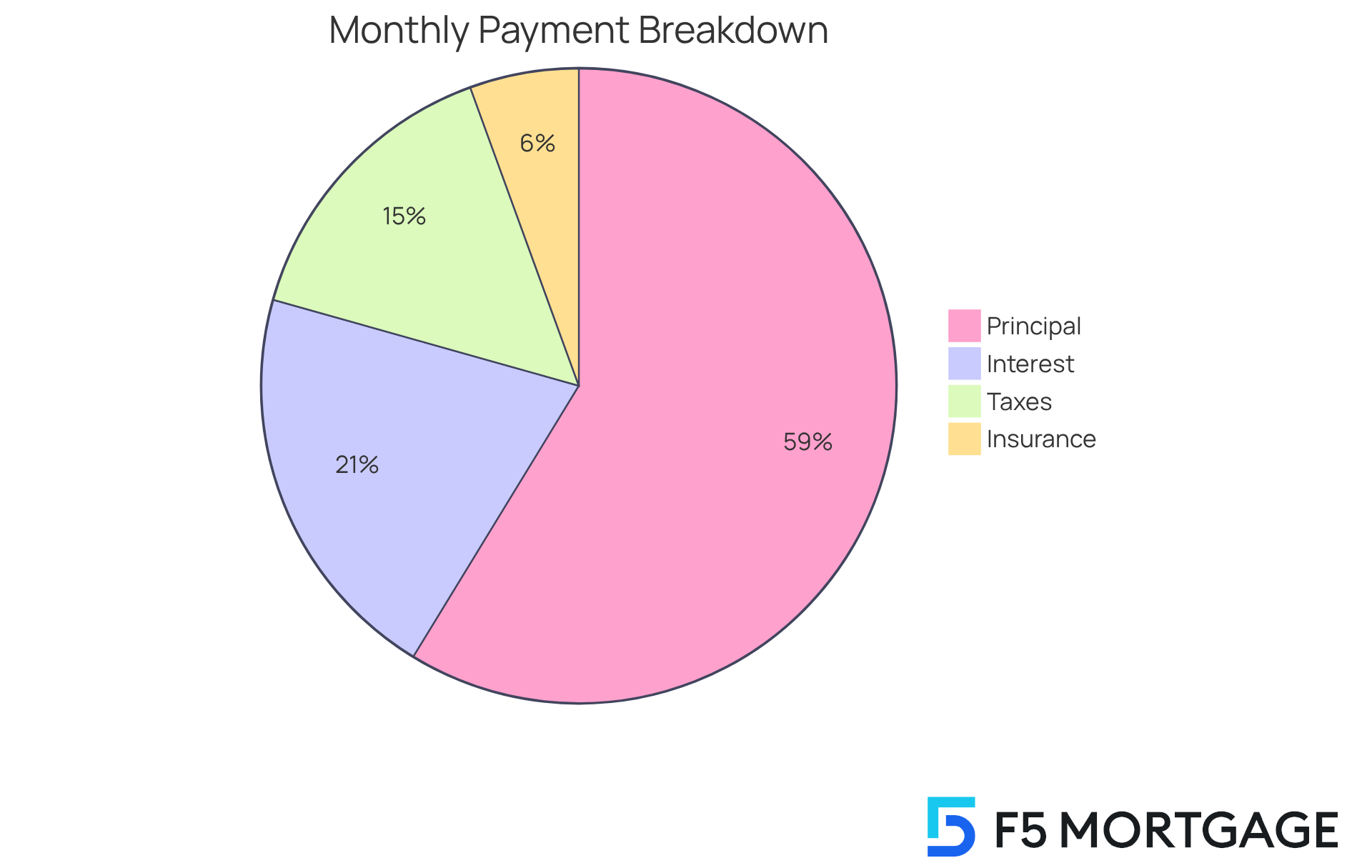

Detailed Payment Breakdown: Clarity in Monthly Obligations

The loan calculator provides a detailed analysis of your monthly payments, including principal, interest, taxes, and insurance (PITI). We understand how important transparency is for you as a borrower. It allows you to see exactly how much you are contributing to each part of your mortgage. Comprehending this breakdown is essential; it not only aids in budgeting but also helps uncover possible savings or adjustments in your financial strategies.

For instance, understanding how property taxes and insurance premiums affect your total expenses can empower you to make informed choices about your down payment. As financial advisors often emphasize, grasping the complexities of PITI is vital for your long-term financial well-being and effective loan management. We’re here to support you every step of the way, ensuring you feel confident in your decisions.

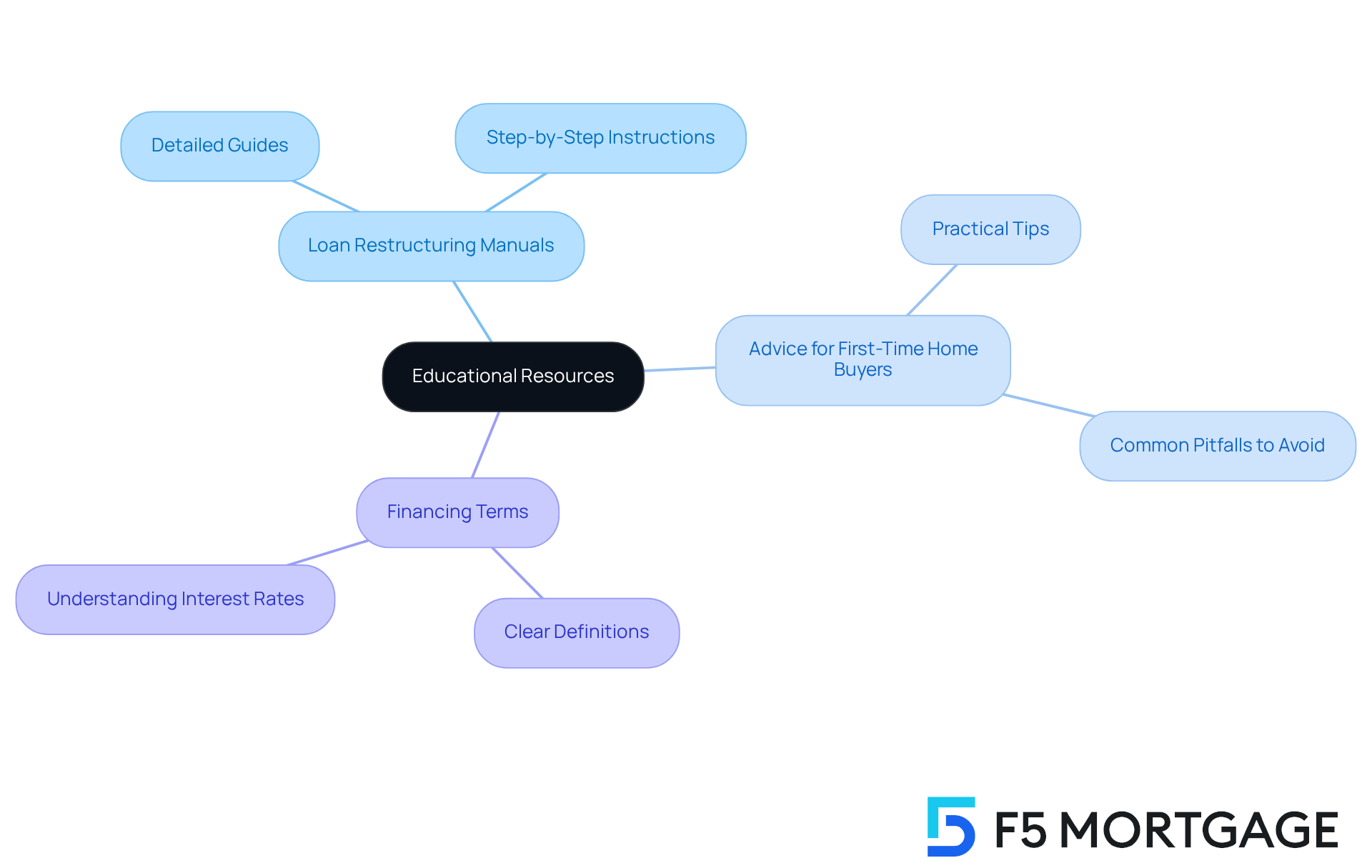

Educational Resources: Empower Yourself with Knowledge

At F5 Mortgage, we understand how overwhelming the loan modification process can be. That’s why we provide a wide range of educational materials designed to improve your comprehension and ease your journey. Our resources include:

- Detailed manuals on loan restructuring

- Practical advice for first-time home purchasers

- Clear descriptions of financing terms

For instance, when you receive an approval, it means that a lender has evaluated your financial details and sees you as a fitting candidate for a mortgage. This approval offers insights into your potential loan amount, interest rate, and monthly payments.

By offering these tools, F5 Mortgage empowers you to navigate the complexities of refinancing with confidence, including the use of a refinance mortgage payment calculator. We know how important it is to make informed decisions that align with your economic objectives. As T. Harv Eker wisely notes, effective money management is crucial for economic success, and it all starts with understanding your options.

Moreover, the National Association of State Boards of Education highlights that many employees lack adequate involvement in retirement plans, underscoring the necessity for financial literacy. By prioritizing education, F5 Mortgage not only assists you in achieving your homeownership dreams but also fosters a culture of financial readiness. This culture can lead to long-term stability and success, and we’re here to support you every step of the way.

Mobile Accessibility: Calculate Anywhere, Anytime

The F5 Loan calculator is thoughtfully designed for seamless mobile accessibility, allowing you to perform calculations anytime and anywhere. We understand how busy life can be, especially for families and individuals who may struggle to find time for traditional computing. By offering a mobile-friendly platform, F5 Mortgage ensures you stay informed and can make prompt decisions regarding your loan options.

With our dedicated team approach, you can access expert support throughout the refinancing process. We’re here to help you understand all associated costs and leverage your home equity effectively. Mobile mortgage tools not only enhance convenience but also enable you to utilize a refinance mortgage payment calculator on the go, making it easier to manage your finances amidst your hectic schedule. Remember, we’re here to support you every step of the way.

Conclusion

The refinance mortgage payment calculator is a vital tool that eases the often overwhelming process of mortgage refinancing. By offering customizable loan terms, real-time interest rate updates, and a comprehensive breakdown of payments, it empowers homeowners to make informed financial decisions tailored to their unique situations. This calculator not only enhances understanding but also encourages strategic planning, ensuring that borrowers can navigate their refinancing journey with confidence.

Throughout this article, we explored key features of the F5 Mortgage refinance calculator, such as the ability to:

- Adjust loan parameters

- Estimate closing costs

- Incorporate property taxes

- Calculate PMI

Each of these components plays a crucial role in helping borrowers visualize their financial commitments and discover the best options available to them. Additionally, the user-friendly interface and mobile accessibility make it easier than ever for individuals to manage their mortgage calculations on the go.

In conclusion, leveraging a refinance mortgage payment calculator is not merely about crunching numbers; it’s about empowering yourself with knowledge and clarity. By utilizing such tools, homeowners can unlock significant savings and make decisions that align with their long-term financial goals. Embracing these resources nurtures a culture of financial literacy, ultimately leading to greater stability and success in homeownership. We know how challenging this can be, and it’s time to take control of your mortgage journey and explore the benefits that a refinance mortgage payment calculator can offer.

Frequently Asked Questions

What is the purpose of the F5 Mortgage refinance mortgage payment calculator?

The F5 Mortgage refinance mortgage payment calculator is designed to help users easily estimate their monthly payments and navigate the mortgage process, providing a user-friendly experience for both first-time homebuyers and seasoned investors.

How can users customize their loan terms using the F5 Mortgage calculator?

Users can customize various loan terms, such as the length of the loan and interest rates, allowing them to explore different scenarios and discover the most appropriate loan modification options for their unique situations.

What financial advantages can homeowners gain by using the refinance mortgage payment calculator?

Homeowners can potentially lower their monthly costs by extending their repayment period, settle their debt faster by decreasing it, and possibly remove private insurance if they refinance after home appreciation, especially relevant in California.

How does the F5 Mortgage calculator provide real-time interest rate updates?

The calculator offers real-time updates on interest rates, helping users stay informed about market fluctuations that can affect their loan modification decisions and allowing them to secure favorable rates.

What costs should homeowners be aware of when considering loan modification?

Homeowners should consider various expenses related to loan modification, including application fees, appraisal expenses, and closing charges, which can vary significantly.

What are the current average interest rates for fixed-rate mortgages?

As of now, the average 30-year fixed rate is around 6.65%, the 15-year fixed rate is at 6.01%, and the 30-Year Fixed Rate FHA is at 6.68%.

How can timely updates on interest rates influence mortgage decisions?

Timely updates can lead to substantial savings over the life of a loan, as homeowners can lock in favorable rates before potential increases, which is crucial for effective financial planning.

What has been the trend in refinance applications recently?

Refinance applications have risen by 42% compared to the same period last year, indicating a growing interest in loan modification among homeowners.