Overview

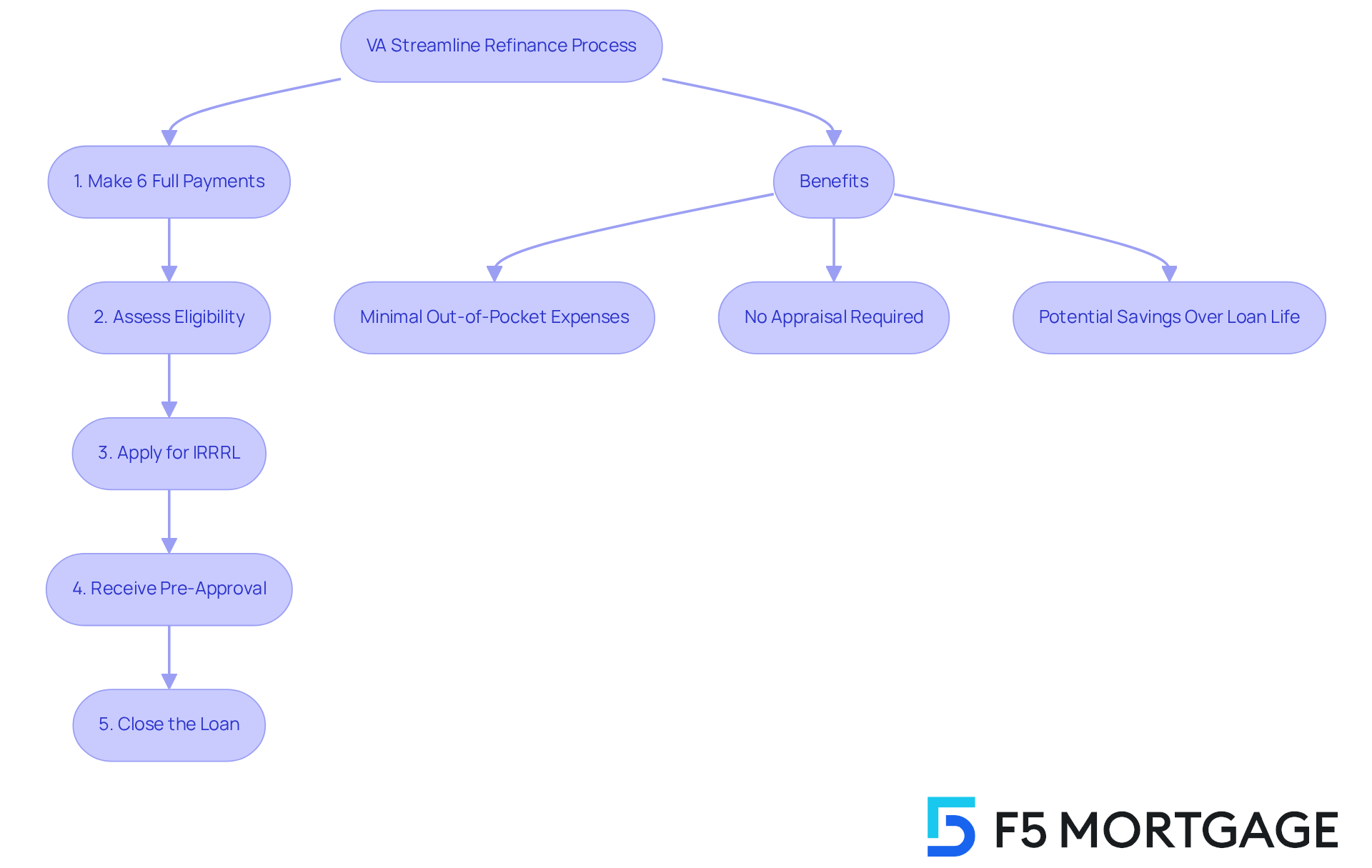

This article shines a light on the best VA streamline refinance rates available for families eager to upgrade their homes. We understand how important it is to find competitive options that suit your needs. The VA Interest Rate Reduction Refinance Loan (IRRRL) offers significant advantages, including:

- Minimal out-of-pocket expenses

- No appraisal requirements

These features not only simplify the refinancing process but also pave the way for considerable savings over time.

We know how challenging this can be, and we’re here to support you every step of the way. By exploring these options, you can feel confident in making informed decisions that benefit your family’s future.

Introduction

Navigating the world of VA streamline refinance rates can be overwhelming for veterans and their families. We understand how challenging this can be, especially as the landscape shifts towards more favorable conditions.

In this article, we will explore the top ten options available for families looking to upgrade their homes while capitalizing on these advantageous rates. By delving into tailored solutions and expert insights, you will discover how to optimize your refinancing journey effectively.

With so many choices available, how can you determine the best path forward to secure the most beneficial terms? We’re here to support you every step of the way.

F5 Mortgage: Competitive VA Streamline Refinance Rates and Personalized Service

At F5 Mortgage, we understand how important it is for veterans and their families to find the right mortgage solutions. That’s why we stand out in the VA streamline refinance rates market by offering competitive rates and a personalized approach to service. Our strong focus on client satisfaction means we customize our solutions to meet your unique needs. With our dedicated team, you can expect thorough assistance throughout the loan restructuring process, often securing pre-approval in under an hour. This commitment to exceptional service has already helped over 1,000 families access favorable loan options, reinforcing F5 Mortgage’s reputation as a trusted partner on the journey to homeownership.

As we look ahead to 2025, average rates are significantly decreasing, while VA streamline refinance rates are on the rise. This creates an ideal opportunity for veterans to explore new loan options. The VA Interest Rate Reduction Refinance Option (IRRRL) offers numerous benefits, including:

- Minimal out-of-pocket expenses, as borrowers can roll closing costs into their loan balance

- In most cases, no appraisal is required

These features not only simplify the mortgage process but also enhance affordability, potentially saving you tens of thousands over the life of your loan.

We’ve heard inspiring stories from veterans who have successfully restructured their loans through independent mortgage brokers, demonstrating the effectiveness of VA streamline refinance rates. Many have improved their loan terms and reduced their monthly payments without the hassle of extensive documentation. At F5 Mortgage, our commitment to personalized service and accessible technology ensures that you receive tailored support during your loan process, making it a compelling choice for those looking to improve their homes.

It’s important to remember that to qualify for a VA IRRRL, you must have made at least six full, consecutive monthly payments on your original loan. This requirement is crucial in ensuring that the restructuring process is beneficial for you. We know how challenging this can be, but we’re here to support you every step of the way.

Veterans United: Tailored VA Streamline Refinance Solutions for Veterans

At F5 Lending, we understand how challenging navigating financial options can be for veterans and active-duty service members. That’s why we are unwavering in our dedication to offering specialized solutions that simplify your refinancing journey with VA streamline refinance rates. With VA streamline refinance rates and flexible financing options, we empower you to optimize your benefits efficiently.

Our team of seasoned financing experts possesses extensive knowledge of VA mortgages, ensuring that you receive tailored assistance throughout the process. We know how important it is for veterans to reach their financial goals, and we are here to support you every step of the way.

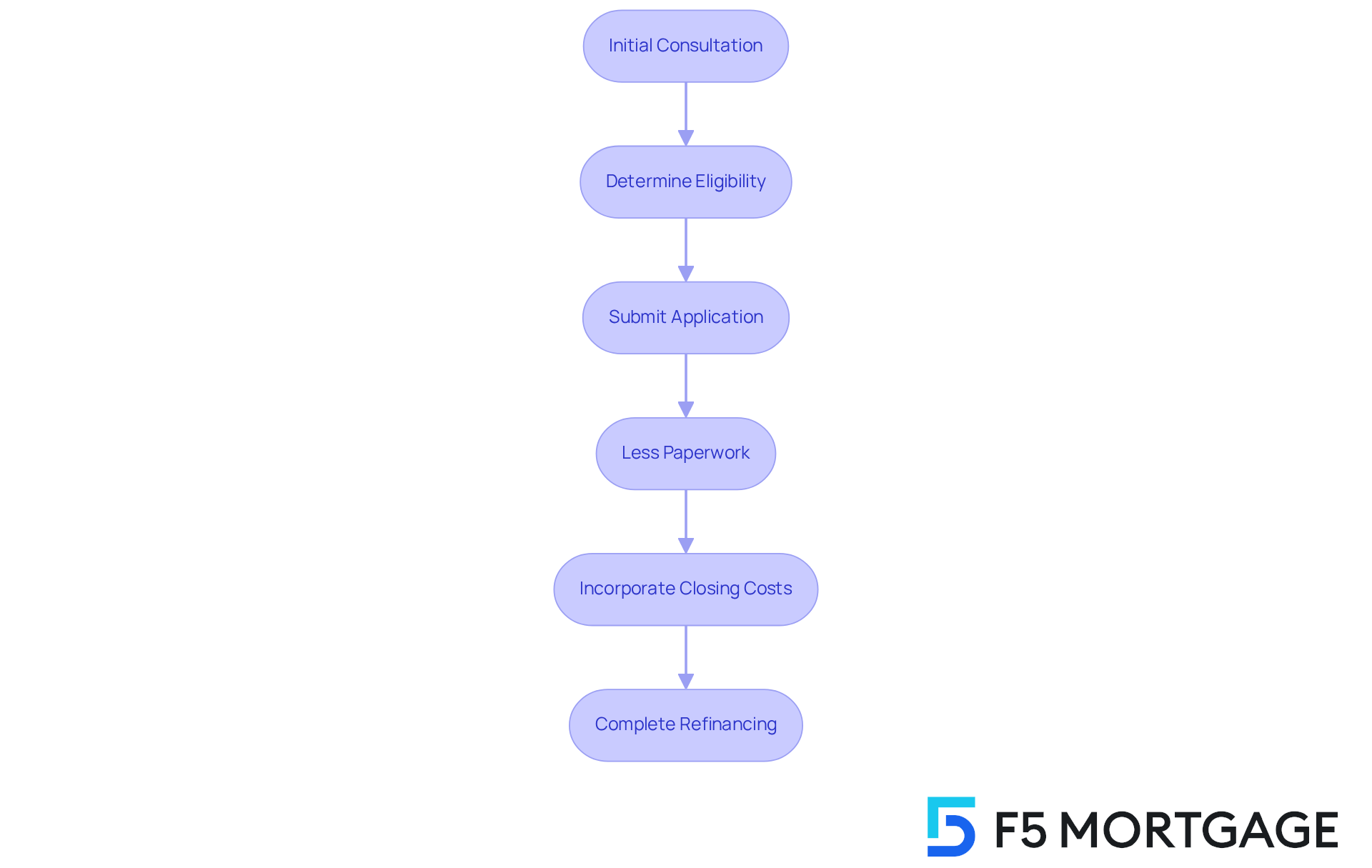

Our VA IRRRL procedure is designed to be straightforward, requiring less paperwork than traditional loan alternatives. Plus, you can incorporate closing expenses into the new loan without needing income verification, making it a convenient option for families looking to enhance their financial well-being through customized loan alternatives. Let us help you take the next step toward financial security.

Rocket Mortgage: Streamlined VA Refinance Process with Competitive Rates

At F5 Finance, we understand how important VA streamline refinance rates are for families looking to improve their financial situation. Our goal is to help you complete your refinancing swiftly and efficiently. Many families have successfully turned to F5 financing to lower their monthly payments, taking advantage of our competitive rates specifically tailored for veterans. Right now, F5 Home Loans is proud to offer some of the most attractive VA streamline refinance rates in the market, making us a top choice for those eager to upgrade their homes.

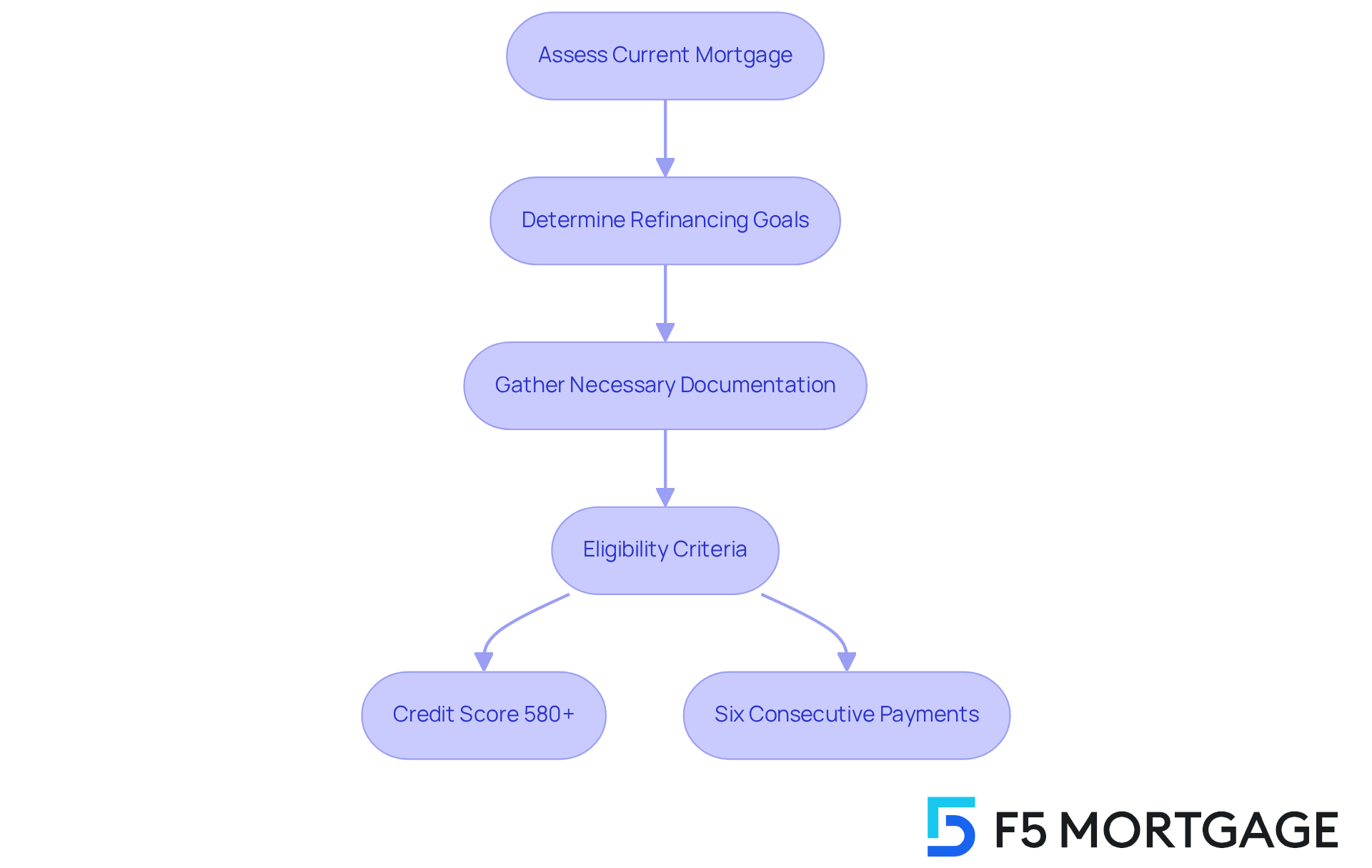

Navigating the refinancing process in California may seem daunting, but we are here to support you every step of the way. It involves several essential steps, such as:

- Assessing your current mortgage

- Determining your refinancing goals

- Gathering the necessary documentation

Our team at F5 Mortgage guides families through this journey, ensuring you fully understand the costs involved, including closing fees and potential strategies for removing private mortgage insurance. Typically, standard closing fees range from 2% to 5% of the financing amount, varying depending on the lender and specific financing conditions. Additionally, families can explore options for removing private mortgage insurance by leveraging home equity and refinancing into a conventional mortgage once they reach a certain equity threshold.

We also utilize innovative technology at F5 Financing that significantly reduces paperwork and accelerates the approval process, creating a user-friendly online experience. This efficiency shines through in the average closing duration for VA refinancing, which is estimated at about 57 days—an impressively competitive timeframe in the industry. As more veterans seek to enhance their financial situations, F5 stands out as a trustworthy ally in navigating the complexities of VA streamline refinance rates. To qualify for a VA loan through F5, borrowers must meet specific eligibility criteria, including a minimum credit score of 580 and having made six consecutive monthly payments on their existing loan. Furthermore, our commitment to outstanding customer support reinforces our reputation as a reliable lender for veterans.

Loan Pronto: Expert Guidance on VA Streamline Refinance Options

At F5 Financing, we understand how challenging it can be for households to consider their refinancing options. Our experienced team excels in providing expert advice on VA streamline refinance rates, specifically the VA Interest Rate Reduction Refinance Loan (IRRRL) program. We are dedicated to helping you navigate the benefits and requirements of this program, ensuring you feel supported every step of the way.

With a focus on individualized consultations, we empower families to make informed choices about their refinancing approaches. Our commitment to outstanding customer service has led to many success stories, showcasing how households have effectively lowered their monthly payments and improved their loan conditions.

As we look to 2025, the benefits of the VA IRRRL program include the VA streamline refinance rates, which offer reduced interest rates and simplified procedures. This makes F5 an invaluable resource for veterans seeking to enhance their homes. We know that making financial decisions can be daunting, but we’re here to support you through this process, helping you achieve your goals with confidence.

Bankrate: Up-to-Date VA Streamline Refinance Rates and Market Insights

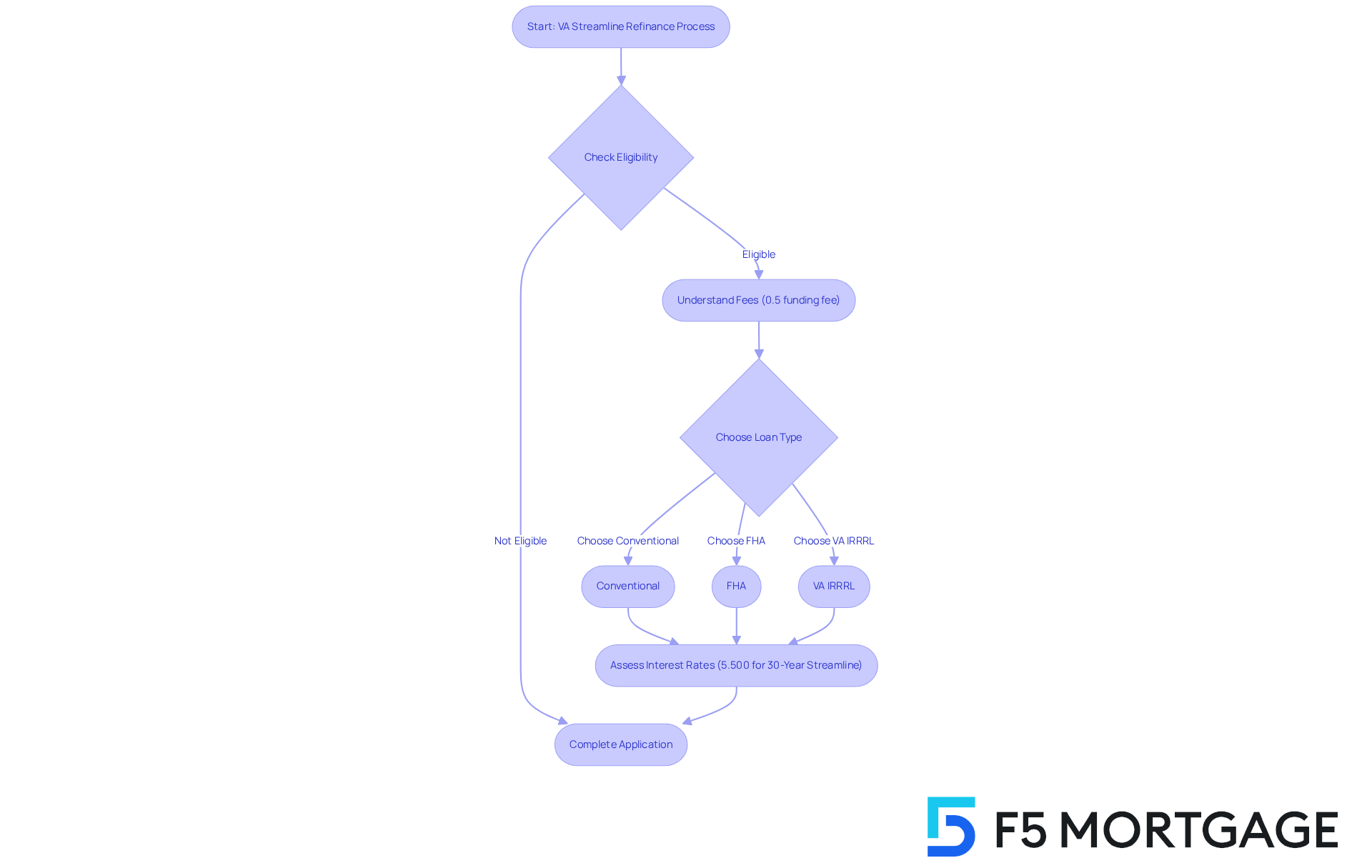

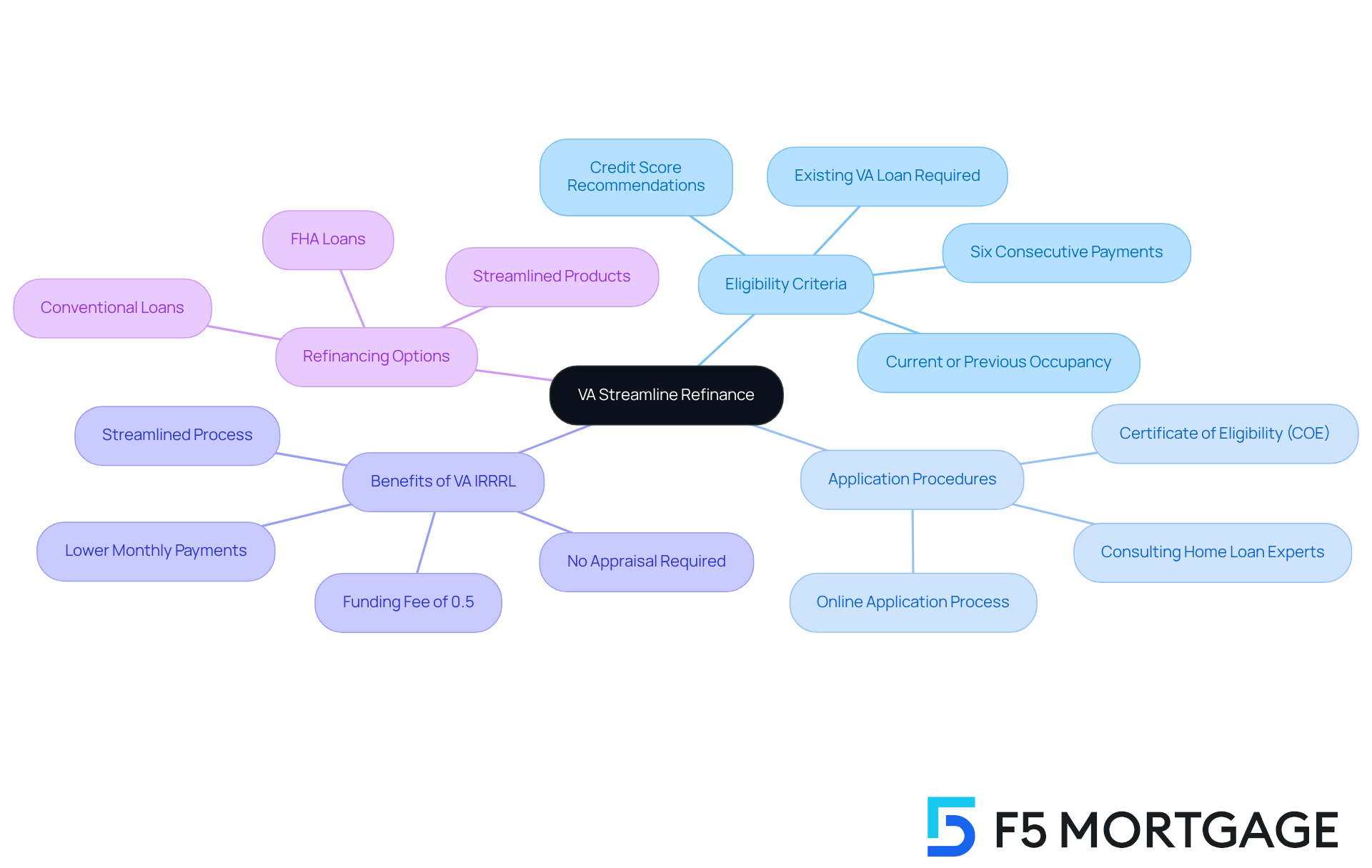

F5 Mortgage is a vital resource for households looking into VA streamline refinance rates and market insights in Colorado. We understand how challenging navigating these options can be, and we are here to support you every step of the way. With a range of restructuring choices available, including conventional, FHA, and the VA IRRRL, families can benefit from competitive rates and customizable financial solutions tailored to their needs.

Currently, interest rates for a 30-Year Streamline (IRRRL) Refinance are approximately 5.500%. This information provides crucial insights into market trends that can greatly influence your decisions regarding loan modification. For instance, transitioning from adjustable-rate to fixed-rate financing can save you thousands in interest over time.

Moreover, it’s important to note that the VA IRRRL has a funding fee of 0.5%. Understanding this fee is essential for grasping the overall expense of the refinancing process. The streamlined nature of the IRRRL means that it does not require an appraisal or credit underwriting package, making it easier for you as a borrower.

To qualify for an IRRRL, you must be current on your mortgage payments and in good standing with your lender. Additionally, eligibility for VA loans necessitates fulfilling certain service-related criteria, which F5 can assist you in reviewing. By providing comprehensive analysis and statistics on VA streamline refinance rates, F5 Mortgage helps families make informed decisions regarding their loan options.

It’s crucial to recognize that the VA IRRRL does not permit cash-out refinancing, which could limit your choices when evaluating your financial needs. However, closing expenses can be included in the mortgage, allowing you to refinance without any initial payments. We are dedicated to helping you find the best solutions for your family’s financial future.

PennyMac: Comprehensive VA IRRRL Refinancing Products and Resources

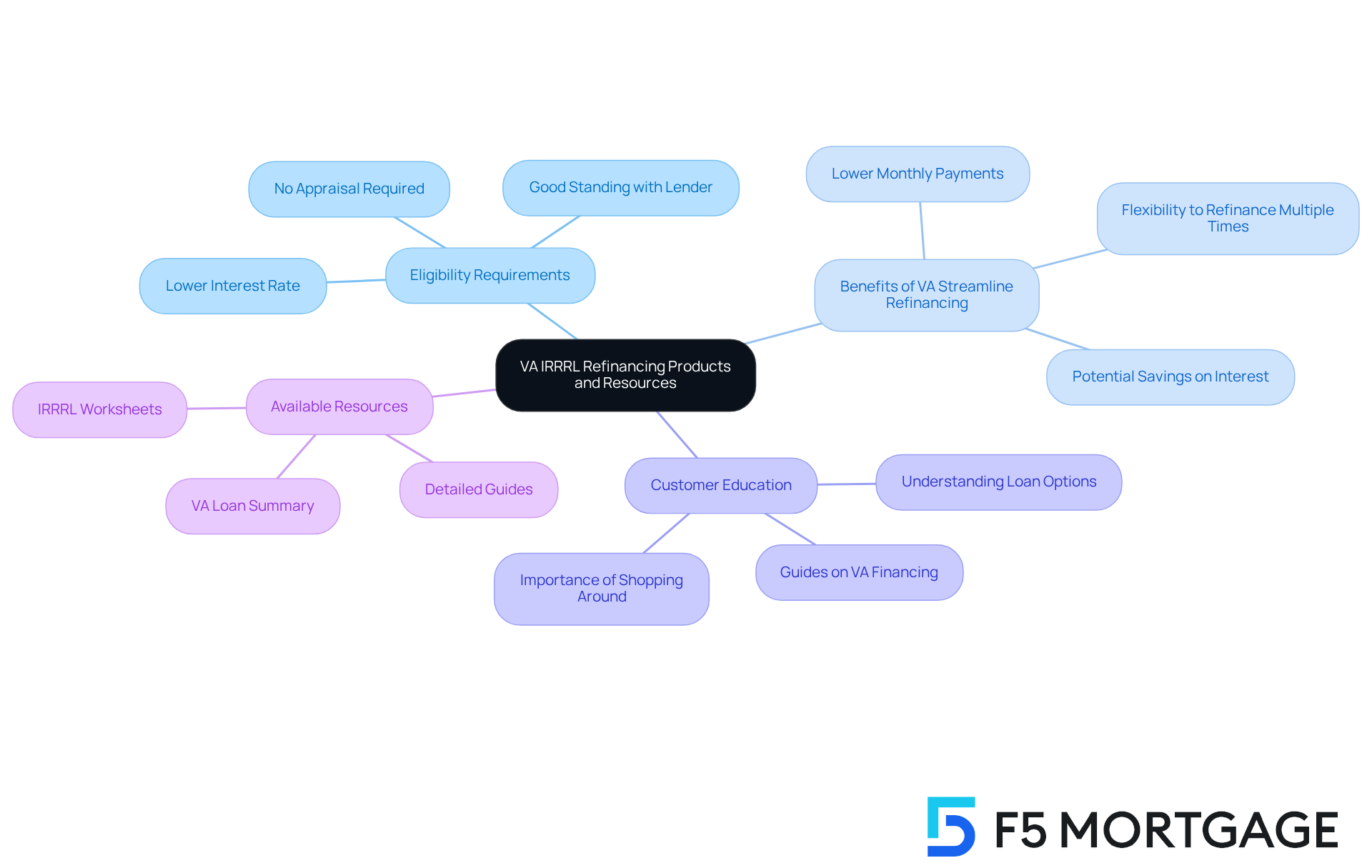

F5 Financing provides a robust selection of products and resources for veterans and their families, including VA streamline refinance rates through the VA Interest Rate Reduction Refinance Loan (IRRRL). We understand how important it is to have competitive rates and a variety of loan options, which is why F5 Mortgage aims to simplify the loan process. Our goal is to help households achieve their financial dreams with ease. By prioritizing customer education, we empower clients to make informed decisions about their financial options, fostering confidence throughout the journey.

Understanding the VA streamline refinance rates is crucial for families considering a loan modification through the VA IRRRL program. This streamlined process, which aligns with VA streamline refinance rates, eliminates the need for a home appraisal or extensive credit checks, making it easier for borrowers to qualify. To be eligible, borrowers must ensure their new interest rate is lower than their current rate and maintain good standing with their lender. Additionally, while closing costs and the VA funding fee can be incorporated into the new financing, it’s essential for borrowers to understand how these costs relate to VA streamline refinance rates, as they can accumulate interest over time.

F5 Home Financing provides vital resources, including detailed guides on VA financing options and the process of adjusting loan terms, which significantly impact decision-making. We know how challenging it can be to navigate these choices, and by educating clients on the benefits of converting adjustable-rate loans to fixed-rate loans, families can potentially save thousands in interest payments. The flexibility of the VA streamline refinance rates allows veterans to refinance multiple times, taking advantage of favorable market conditions without limits.

Through extensive customer education and tailored resources, F5 not only enhances the loan experience but also improves outcomes for families as they navigate the complexities of VA loan processes. This unwavering commitment to client support establishes F5 Mortgage as a trusted partner in realizing homeownership dreams.

Military.com: Essential Information on VA Streamline Refinancing for Service Members

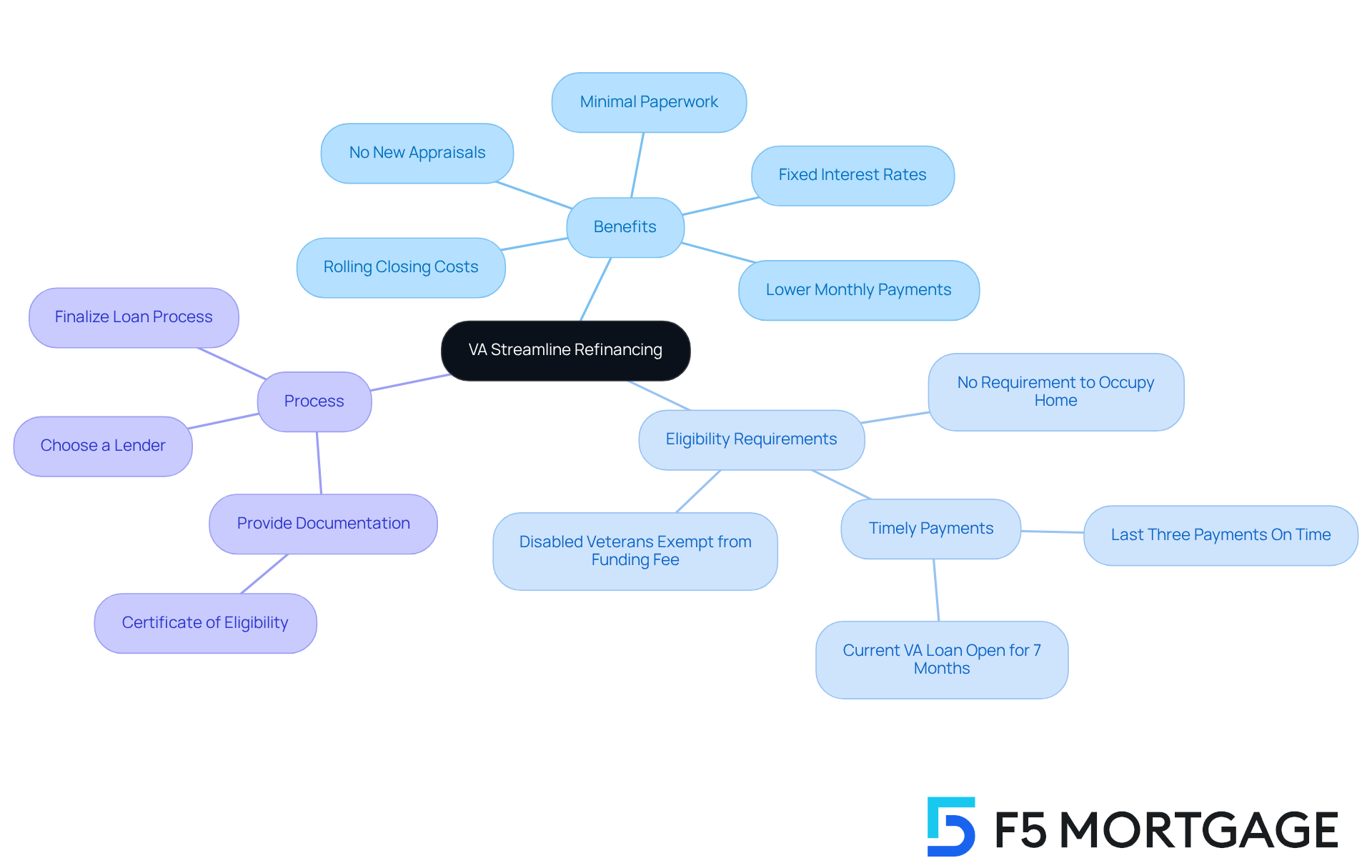

At Military.com, we understand how overwhelming it can be for service members to navigate VA streamline refinance rates. Our articles delve into the many advantages of the VA streamline refinance rates program, which is specifically designed for veterans looking to refinance existing debts. With minimal paperwork and often no out-of-pocket expenses, this program can significantly ease your financial burden.

Imagine being able to lower your monthly payments while securing fixed interest rates—all without the hassle of new appraisals in most cases. We’re here to help you understand the eligibility requirements, including the importance of having made your last three payments on time and the possibility of rolling closing costs into your new loan amount.

By providing tailored information, Military.com empowers households to manage the loan process efficiently. We know how challenging this can be, and our goal is to ensure you optimize your VA benefits and achieve the financial stability you deserve. Let us support you every step of the way.

The Mortgage Reports: Detailed Guidelines and Current VA Streamline Rates

At The Mortgage Reports, we understand how crucial it is for families to navigate the complexities of VA streamline refinancing. This resource provides comprehensive guidelines and up-to-date rates, ensuring you feel supported every step of the way. Our articles explore essential aspects, such as eligibility requirements, which state that borrowers must have an existing VA loan and be current on their payments. This clarity helps you grasp the necessary steps to qualify for the VA Interest Rate Reduction Refinance Loan (IRRRL).

Currently, VA streamline refinance rates are generally lower than traditional loan options, presenting a significant opportunity for savings. For example, the VA IRRRL allows homeowners to refinance without the hassle of appraisals or extensive documentation, simplifying the process and making it more accessible. We know how challenging this can be, but case studies reveal that families who utilize these guidelines often find themselves in improved financial situations. They can secure lower monthly payments and more stable interest rates.

By staying informed through resources like The Mortgage Reports, you can confidently embark on your loan adjustment journey. We’re here to support you in maximizing your savings and achieving your homeownership dreams. Remember, you are not alone in this process; we are here to guide you through every step.

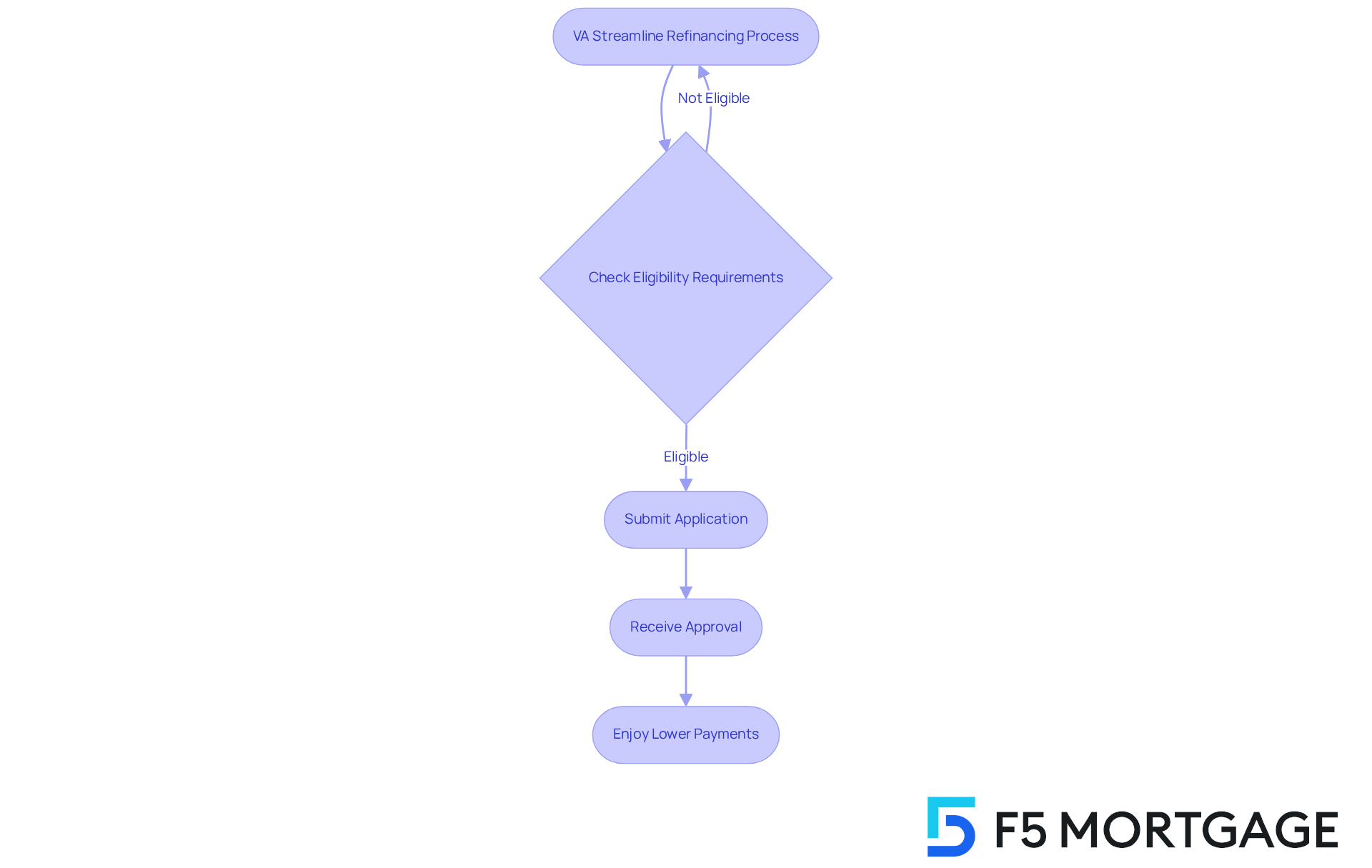

VA.gov: Official Resource for VA Streamline Refinance Information and Eligibility

At VA.gov, we understand how important it is for veterans and service members to find reliable information about VA streamline loan processes. This platform serves as a comprehensive resource, providing essential details on eligibility criteria, such as the requirement of making six consecutive monthly payments on the original VA mortgage before restructuring. We also walk you through the application procedures and highlight the benefits of the VA Interest Rate Reduction Refinance Loan (IRRRL) program, including the fact that no appraisal is typically required, making the process easier for you.

Additionally, the funding fee of 0.5% of the loan amount can be rolled into the new loan, which helps to minimize those upfront costs that can often feel overwhelming. By utilizing the information available on VA.gov, families can stay updated with the latest guidelines, empowering them to make informed decisions regarding their loan options. We also emphasize the average processing times for VA streamline refinance rates, ensuring that you understand the timeline involved in your financial journey.

Using official resources like VA.gov can significantly impact your loan modification decisions, as it equips you with the knowledge needed to navigate the complexities of the VA IRRRL program effectively. Moreover, we encourage households to explore various refinancing options offered by F5 Mortgage, including:

- Conventional

- FHA

- Streamlined products

to find the most suitable choice for their unique financial situations. Remember, we’re here to support you every step of the way.

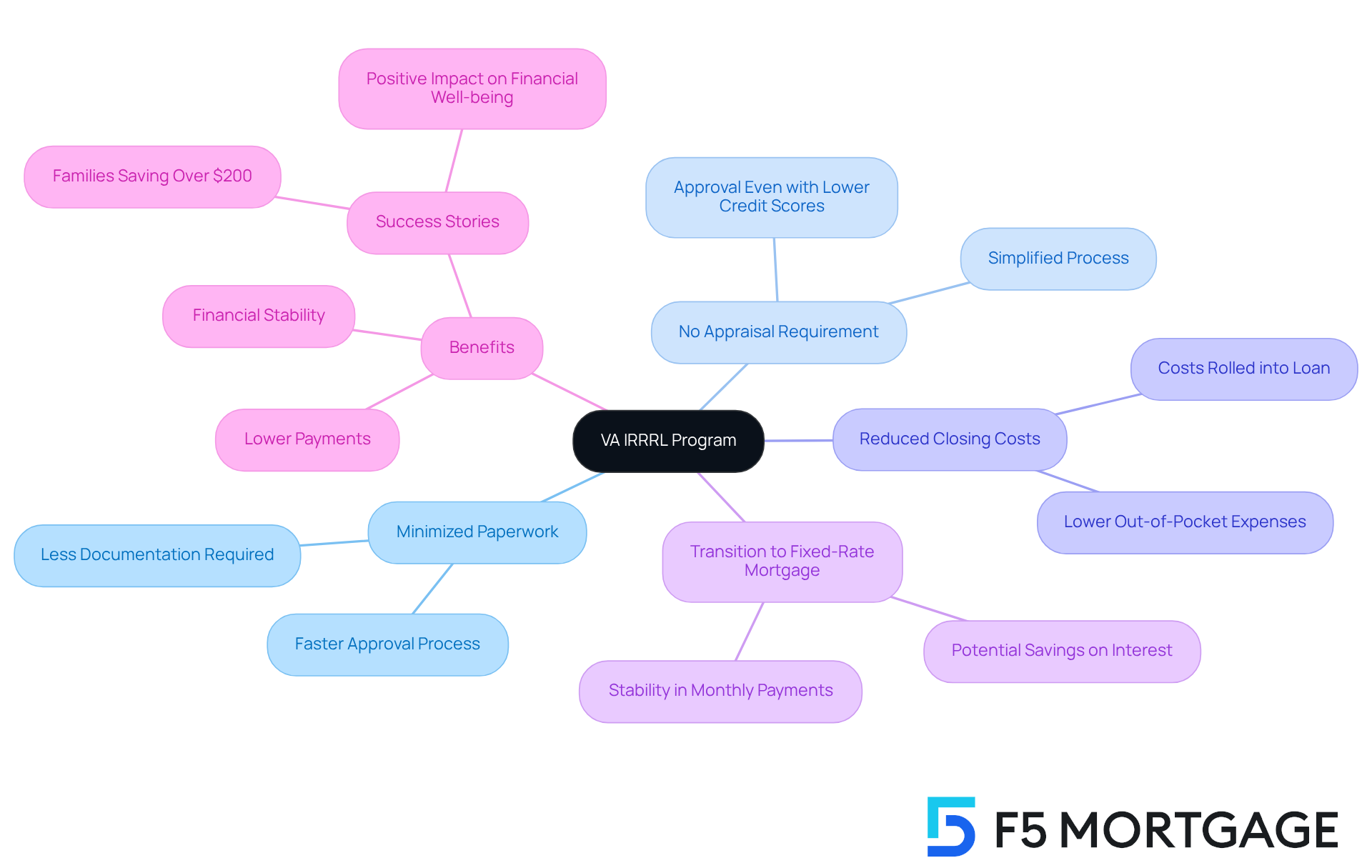

Understanding VA IRRRL: Key Details and Benefits of the Streamline Refinance Program

The VA Interest Rate Reduction Refinance Loan (IRRRL) is thoughtfully designed for veterans and service members who are looking to benefit from VA streamline refinance rates to refinance their existing VA loans. This program minimizes paperwork and offers lower VA streamline refinance rates, providing relief for many. One of the standout features of the VA streamline refinance rates program is the elimination of the appraisal requirement, significantly speeding up the process. Additionally, borrowers enjoy reduced closing costs with VA streamline refinance rates, making this option a financially savvy choice.

Families have the opportunity to transition from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing more stability in their monthly payments. This is especially beneficial for those who may have faced fluctuating payments in the past. Typically, households utilizing the VA streamline refinance rates can expect a decrease in their monthly payments, leading to substantial savings over time.

Success stories abound, with numerous families reporting significant reductions in their monthly obligations after taking advantage of VA streamline refinance rates through the VA IRRRL. For example, a household that made the switch from an ARM to a fixed-rate mortgage saw their monthly payments drop by over $200. This allowed them to redirect those funds toward other essential expenses, easing their financial burden.

Understanding these key details empowers families to leverage the VA IRRRL program effectively. We know how challenging this can be, and we’re here to support you every step of the way, enhancing your financial well-being and making homeownership more manageable.

Conclusion

The VA streamline refinance program offers a wonderful opportunity for veterans and their families to improve their financial situation. By focusing on the VA Interest Rate Reduction Refinance Loan (IRRRL), this program simplifies the refinancing process, reduces paperwork, and often removes the need for appraisals. With competitive rates and the option to roll closing costs into the new loan, families can significantly lower their monthly payments and achieve long-term savings.

Throughout this article, we have highlighted various lenders such as:

- F5 Mortgage

- Veterans United

- Rocket Mortgage

- Others

for their personalized services and competitive VA streamline refinance rates. It’s crucial to maintain good standing on existing loans, make at least six consecutive monthly payments, and consider transitioning from adjustable-rate to fixed-rate mortgages. These factors work together to create a smoother refinancing experience and a more secure financial future for veterans.

Reflecting on the importance of these refinancing options, it’s clear that understanding and utilizing the VA IRRRL program can lead to significant benefits. We encourage families to explore their options, utilize available resources, and take proactive steps toward enhancing their financial well-being. By staying informed and seeking expert guidance, veterans can navigate the complexities of refinancing with confidence, ultimately paving the way for a more stable and affordable homeownership experience.

Frequently Asked Questions

What is F5 Mortgage’s approach to VA streamline refinance rates?

F5 Mortgage offers competitive VA streamline refinance rates with a personalized approach to service, focusing on client satisfaction and customizing solutions to meet individual needs.

How quickly can I expect pre-approval with F5 Mortgage?

F5 Mortgage can often secure pre-approval in under an hour, providing thorough assistance throughout the loan restructuring process.

What are the benefits of the VA Interest Rate Reduction Refinance Option (IRRRL)?

The VA IRRRL offers minimal out-of-pocket expenses, as borrowers can roll closing costs into their loan balance, and in most cases, no appraisal is required.

What is the qualification requirement for a VA IRRRL?

To qualify for a VA IRRRL, you must have made at least six full, consecutive monthly payments on your original loan.

How does F5 Lending support veterans in the refinancing process?

F5 Lending provides specialized solutions and tailored assistance throughout the refinancing journey, ensuring veterans can optimize their benefits efficiently.

What paperwork is required for a VA IRRRL through F5 Lending?

The VA IRRRL process is designed to require less paperwork than traditional loans, allowing borrowers to incorporate closing expenses into the new loan without needing income verification.

What steps are involved in the refinancing process with F5 Finance?

The refinancing process involves assessing your current mortgage, determining your refinancing goals, and gathering the necessary documentation.

What are the typical closing fees for VA refinancing?

Standard closing fees typically range from 2% to 5% of the financing amount, depending on the lender and specific financing conditions.

What is the average closing duration for VA refinancing with F5?

The average closing duration for VA refinancing with F5 is estimated at about 57 days, which is competitive in the industry.

What eligibility criteria must borrowers meet to qualify for a VA loan through F5?

Borrowers must meet specific eligibility criteria, including a minimum credit score of 580 and having made six consecutive monthly payments on their existing loan.