Overview

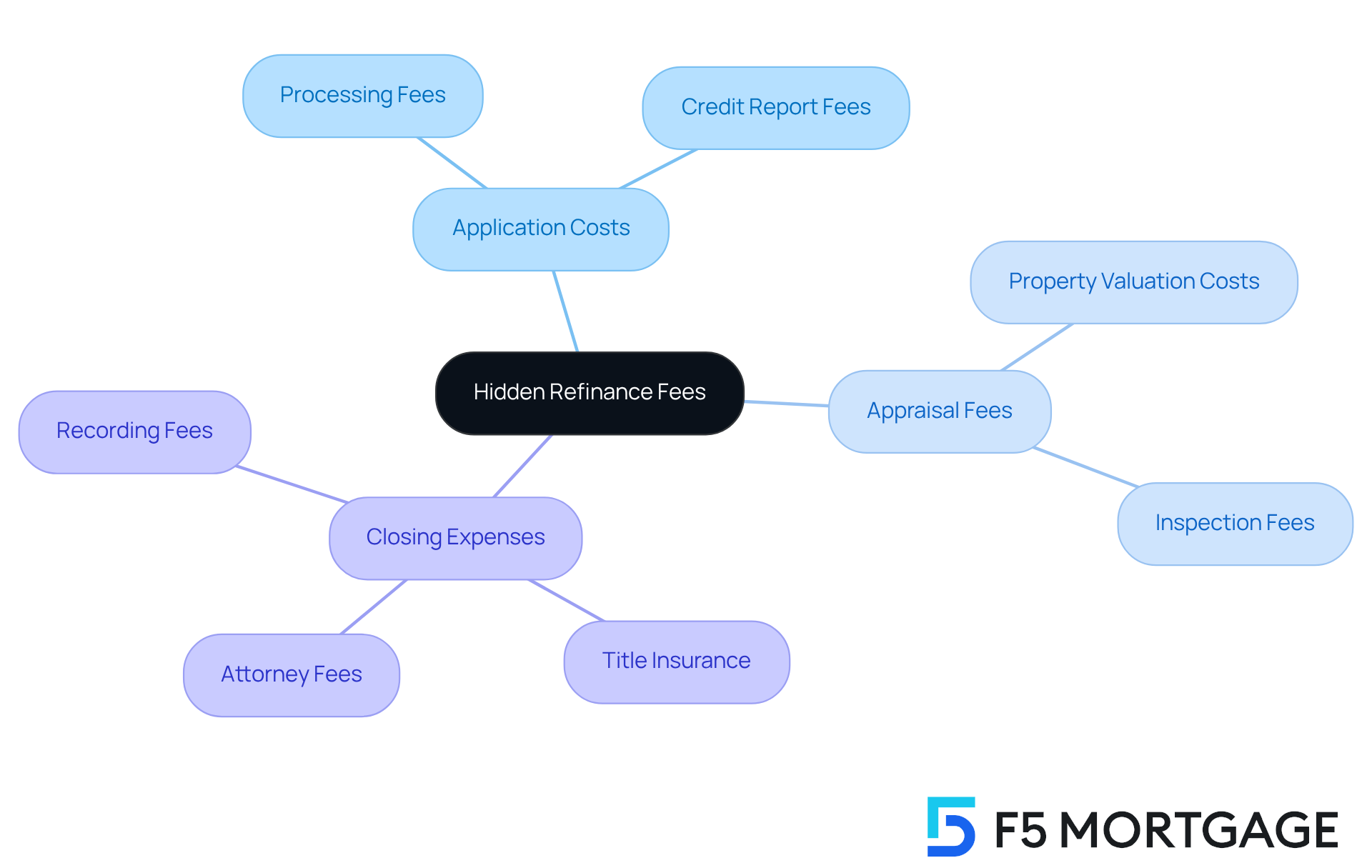

In the article titled “10 Hidden Refinance Fees Families Must Know Before Upgrading,” we explore a crucial question: what hidden fees might families encounter when refinancing their mortgage? We understand how challenging this process can be, and it’s essential to be informed. The article highlights various costs, including:

- Application fees

- Appraisal fees

- Closing costs

By emphasizing transparency, we aim to empower families to make informed decisions and avoid unexpected financial burdens during the refinancing journey. Remember, we’re here to support you every step of the way.

Introduction

Understanding the intricacies of mortgage refinancing can feel overwhelming for families. We know how challenging this can be, especially when hidden fees lurk beneath the surface. As homeowners strive to improve their living situations or secure better financial terms, the potential for unexpected costs—such as application fees and closing expenses—can quickly accumulate. This complicates financial planning and adds to the stress.

In this article, we delve into ten essential hidden refinance fees that families must be aware of. Our goal is to provide valuable insights that empower you to navigate the refinancing process with confidence. What if overlooking these fees could derail the financial benefits of refinancing? Let’s explore this together and ensure you’re well-informed every step of the way.

F5 Mortgage: Expert Guidance on Hidden Refinance Fees

At F5 Mortgage, we understand how challenging navigating the complex landscape of mortgage adjustment can be for households. Our commitment lies in fostering openness, enabling our clients to discover and understand the refinance fees that can significantly impact the overall expense of the process. These charges, often overlooked, may include:

- Application costs

- Appraisal fees

- Closing expenses

Costs that can accumulate quickly. By providing clear insights into these possible expenses, we empower families to make informed choices about their loan options.

Recent discussions in the mortgage sector highlight the importance of comprehending loan costs, particularly for families looking to enhance their homes. A recent study revealed that families might face unforeseen expenses that can escalate their loan restructuring costs. This makes it essential to collaborate with experienced mortgage brokers who can adeptly navigate these complexities. At F5 Mortgage, we ensure that our clients are not only informed about these charges but also understand their implications on the entire loan modification process.

The impact of hidden charges on refinance fees can be substantial. For instance, a seemingly low-interest rate may be offset by significant refinance fees, which could ultimately lead to higher monthly payments. This is why we emphasize the importance of transparency in all our transactions, ensuring that households are fully aware of their financial commitments.

Experts in the mortgage industry stress that transparency regarding costs is vital for borrowers. By fostering a culture of open dialogue, F5 Mortgage helps families avoid common pitfalls associated with loan restructuring. This approach allows them to confidently navigate their financial journey. Our dedication to transparency not only builds trust but also positions us as a reliable partner in achieving homeownership goals. To ensure a seamless refinancing experience, families should regularly review their loan options and consult with F5 Mortgage to stay informed about refinance fees and potential charges.

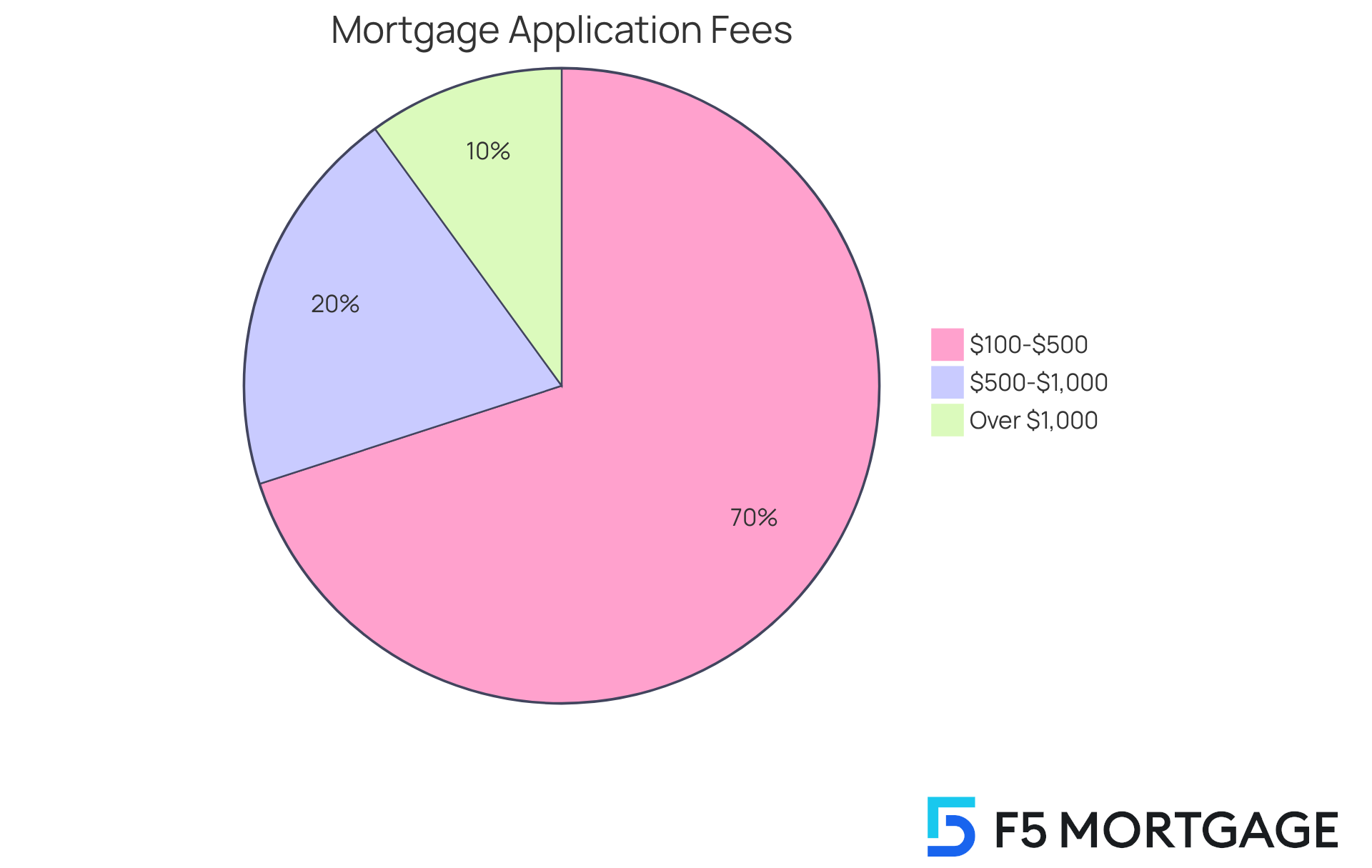

Application Fees: What You Might Pay Upfront

Understanding upfront mortgage application costs is crucial for your financial planning. These costs can vary significantly, typically ranging from $100 to $500, but they may even exceed $1,000 depending on the lender. These charges are essential as they cover the expenses related to handling your loan application and performing initial credit assessments.

We know how challenging this can be, and it’s important to recognize that not all financial institutions impose these charges. They are only necessary when formally applying for a mortgage. At F5 Mortgage, we emphasize openness and client empowerment. We ensure that you are aware of any charges beforehand to prevent unforeseen costs later in the process.

In today’s competitive market, some lenders may forgo these charges. We work diligently to find the best options for you. Furthermore, recognizing that these charges are typically nonrefundable can assist you in budgeting effectively.

Before applying for loans with application fees, consider checking your credit score. This proactive step can improve your chances of approval and potentially lower fees. By asking lenders about their fee structures, you can uncover significant savings and enjoy a smoother mortgage experience.

To maximize your savings, we encourage you to leverage F5 Mortgage’s advanced technology to compare options and negotiate better terms. We’re here to support you every step of the way.

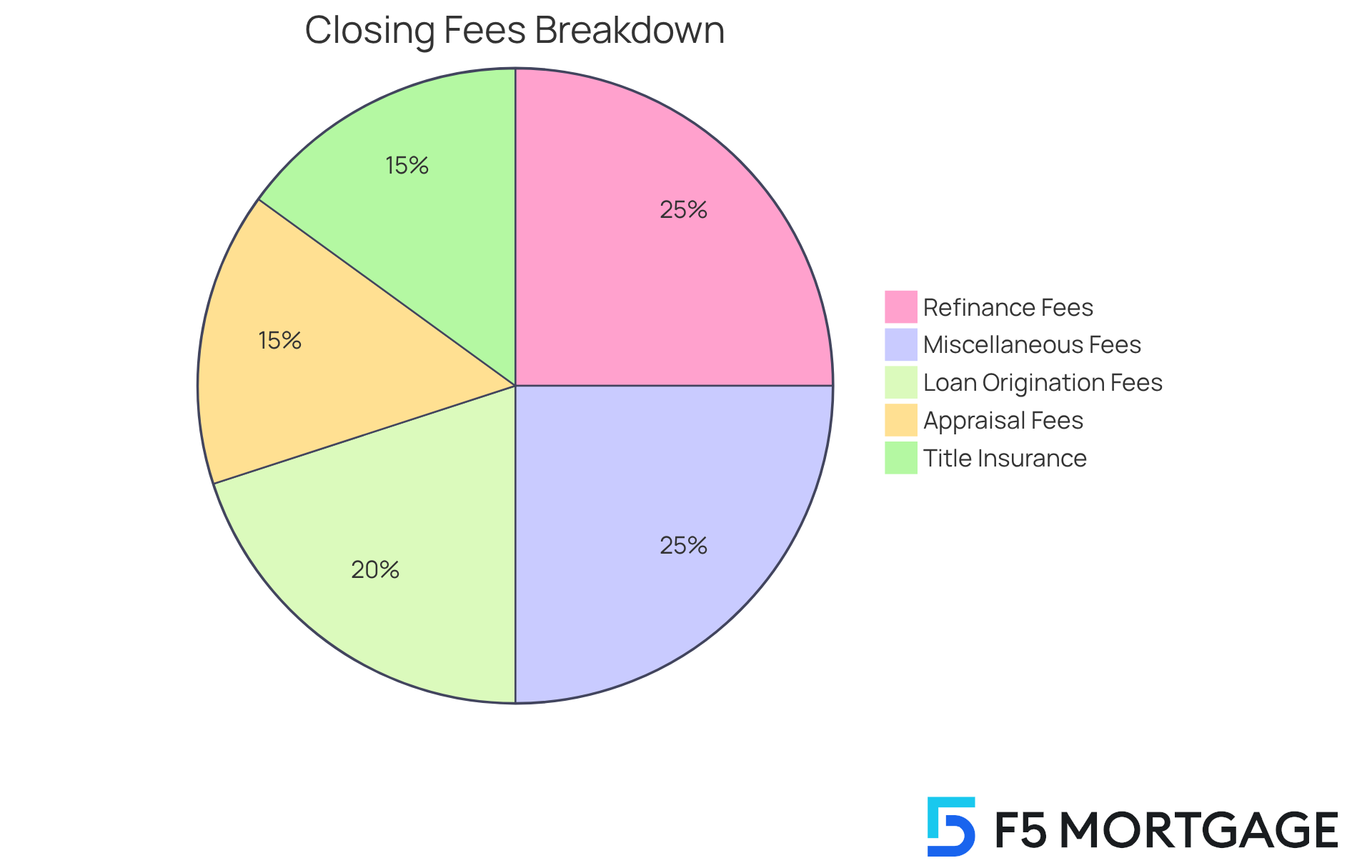

Closing Costs: The Fees You Can’t Ignore

Closing fees, also referred to as refinance fees, can feel overwhelming, often ranging from 2% to 5% of the loan amount. Families frequently encounter charges that can accumulate considerably. For instance, on a $300,000 home, closing expenses may range from $6,000 to $15,000. These expenses encompass various charges, including:

- Refinance fees

- Loan origination fees

- Appraisal fees

- Title insurance

- More

It’s essential for households to ask their lender for a detailed summary of the refinance fees associated with these expenses. This step can provide clarity on what they are paying for and help prevent potential overcharges. As Chris Maddox wisely points out, ‘Every homebuyer should comprehend the different expenses associated with purchasing a home.’

At F5 Mortgage, we understand how challenging this can be. That’s why we utilize cutting-edge technology to ensure clarity and offer competitive rates. Our goal is to assist families in managing these expenses efficiently, alleviating both stress and costs. This preparation is crucial throughout the loan restructuring process.

With our tailored assistance, we empower households to navigate these expenses confidently. We’re here to support you every step of the way, helping you make informed choices that align with your financial objectives, especially in the context of loan restructuring in Colorado.

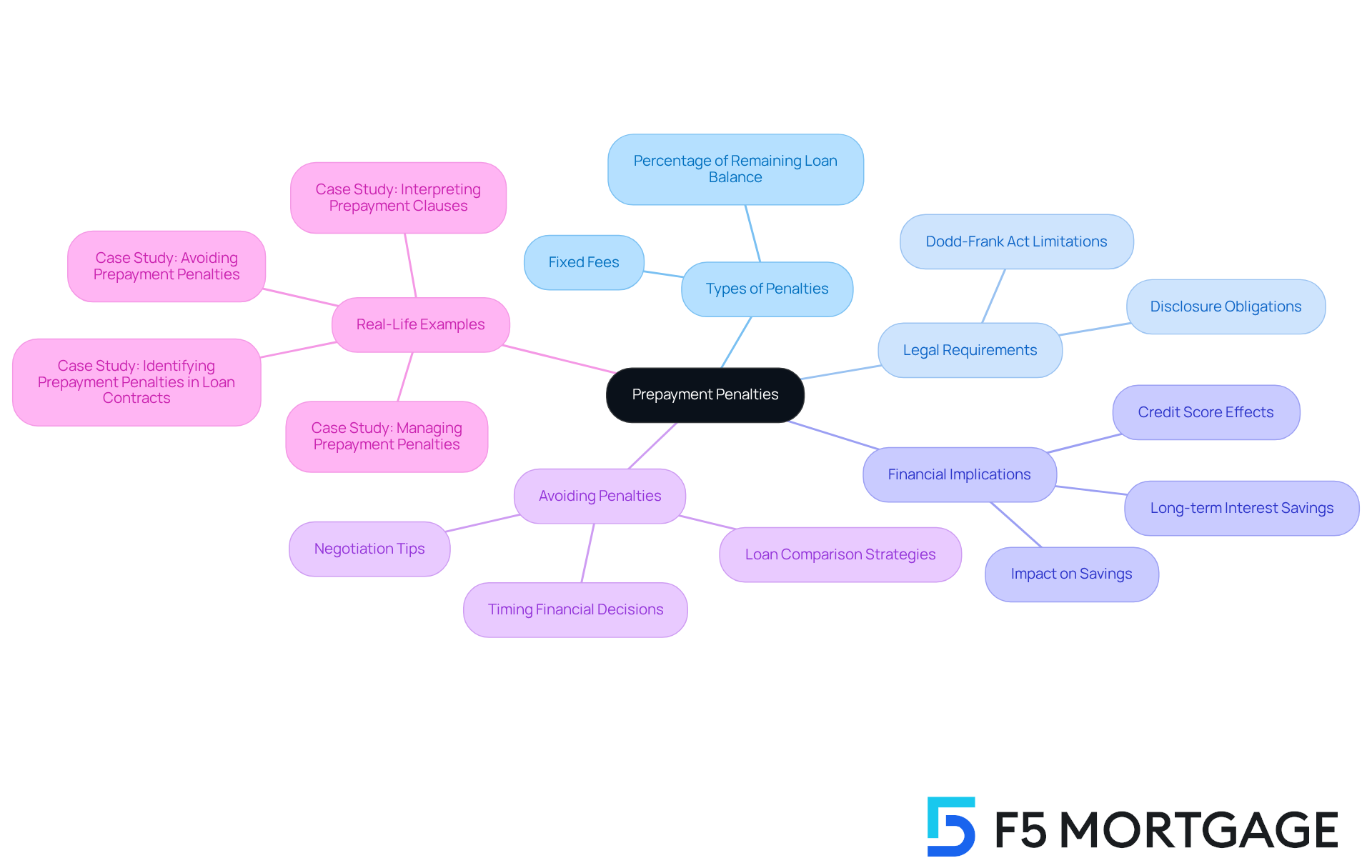

Prepayment Penalties: Avoiding Unexpected Charges

Prepayment penalties can feel daunting, especially when you’re trying to manage your mortgage effectively. These refinance fees are charged by some lenders if you pay off your mortgage early, whether through refinancing or selling your home. They can appear as a percentage of the remaining loan balance or as a fixed fee, which might significantly impact your overall savings. Understanding these penalties is crucial, particularly for families looking to improve their homes and enhance their financial well-being.

We know how challenging this can be, but federal law requires lenders to disclose any prepayment penalties upfront. So, it’s essential to inquire about refinance fees before finalizing a refinance. If a penalty is present, consider negotiating with your lender to waive or reduce it. The prepayment clause in your mortgage agreement will specify when a penalty might apply and the exact amount.

For households, the financial implications of prepayment penalties can be substantial. If you plan to pay off your mortgage within the first three years, you may face a penalty that could erase potential savings. In fact, prepaying your mortgage might lead to a temporary drop in your credit score due to a reduced credit mix and a shorter credit history. However, if you’re beyond three years into your mortgage and have the financial means, paying it off can save you decades of interest payments, making it a beneficial step if it’s financially feasible.

To avoid unexpected charges, families should carefully review loan estimates and disclosure documents for details about prepayment penalties. It’s wise to compare loans, as some lenders, like F5 Mortgage, offer mortgage options without such fees. Timing your financial decisions is also critical; waiting until after the first three years of your loan can help you avoid penalties if you plan to sell or refinance.

Real-life stories highlight the importance of understanding prepayment penalties. For example, families who overlooked the refinance fees in their loan agreements faced unanticipated expenses when they attempted to refinance. By negotiating terms and fully grasping the implications of prepayment penalties, borrowers can make informed decisions that align with their long-term financial goals. Furthermore, considering how long you intend to keep your home before it becomes profitable can further guide your choices regarding prepayment penalties and loan modification options.

Appraisal Fees: Budgeting for Home Valuation

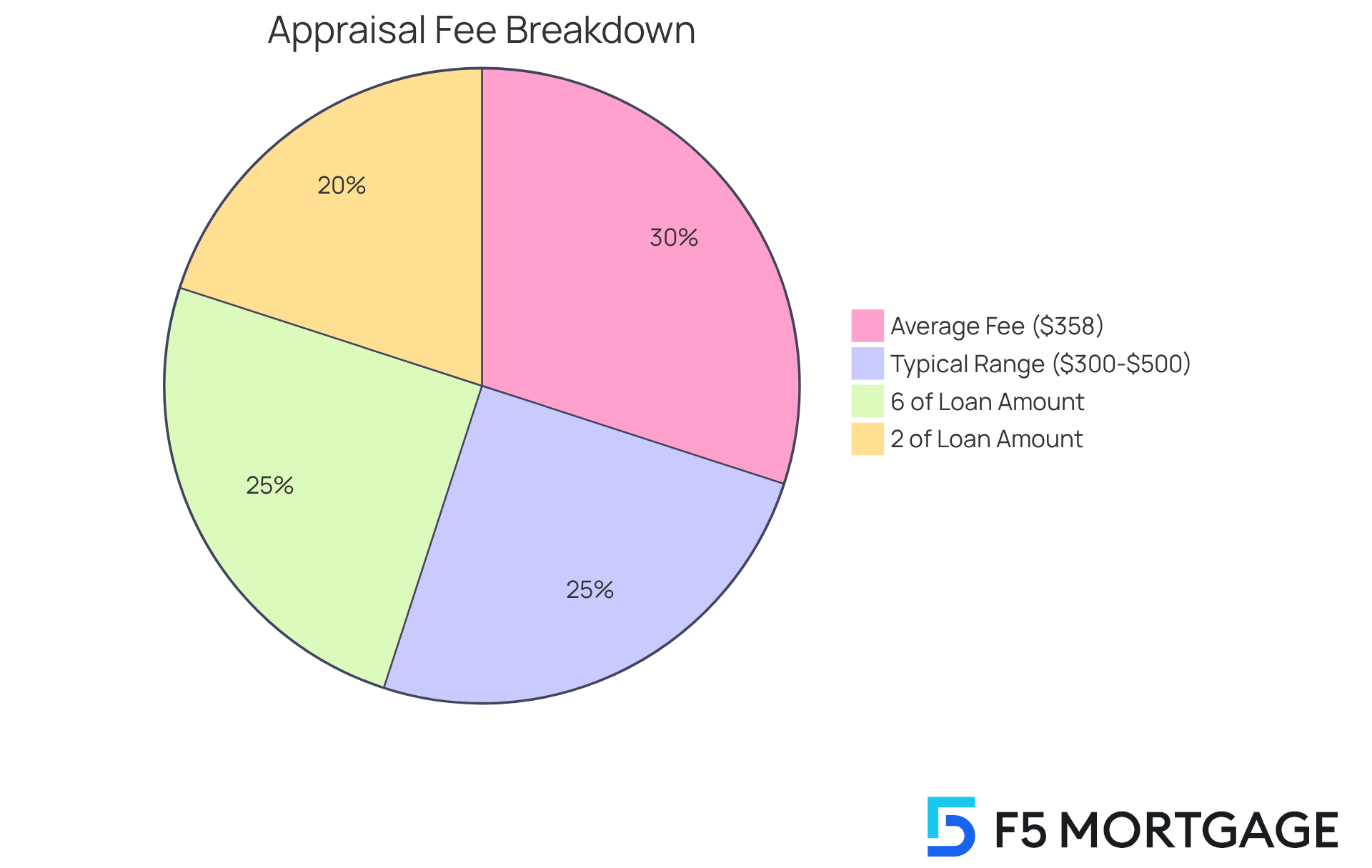

Understanding appraisal costs is essential for families navigating the mortgage process. Typically ranging from $300 to $500, these fees can be influenced by factors such as your property’s location and size. We know how challenging it can be to manage these expenses, but planning for evaluation fees can help prevent unexpected financial burdens.

On average, the appraisal fee for a single-family home is about $358, though this can vary significantly based on local market conditions. It’s wise to allocate a budget that accounts for these charges, as they can represent a notable portion of the overall costs associated with your new loan—generally between 2% and 6% of the loan amount. By grasping the fee structure, including appraisal costs, families can negotiate better terms with lenders.

Moreover, calculating your break-even point can provide clarity on how long it will take to recover the costs of restructuring through potential savings in monthly payments or interest rates. By planning ahead and incorporating these expenses into your budget for loan modification, you can navigate this process more smoothly and make informed financial decisions. We’re here to support you every step of the way.

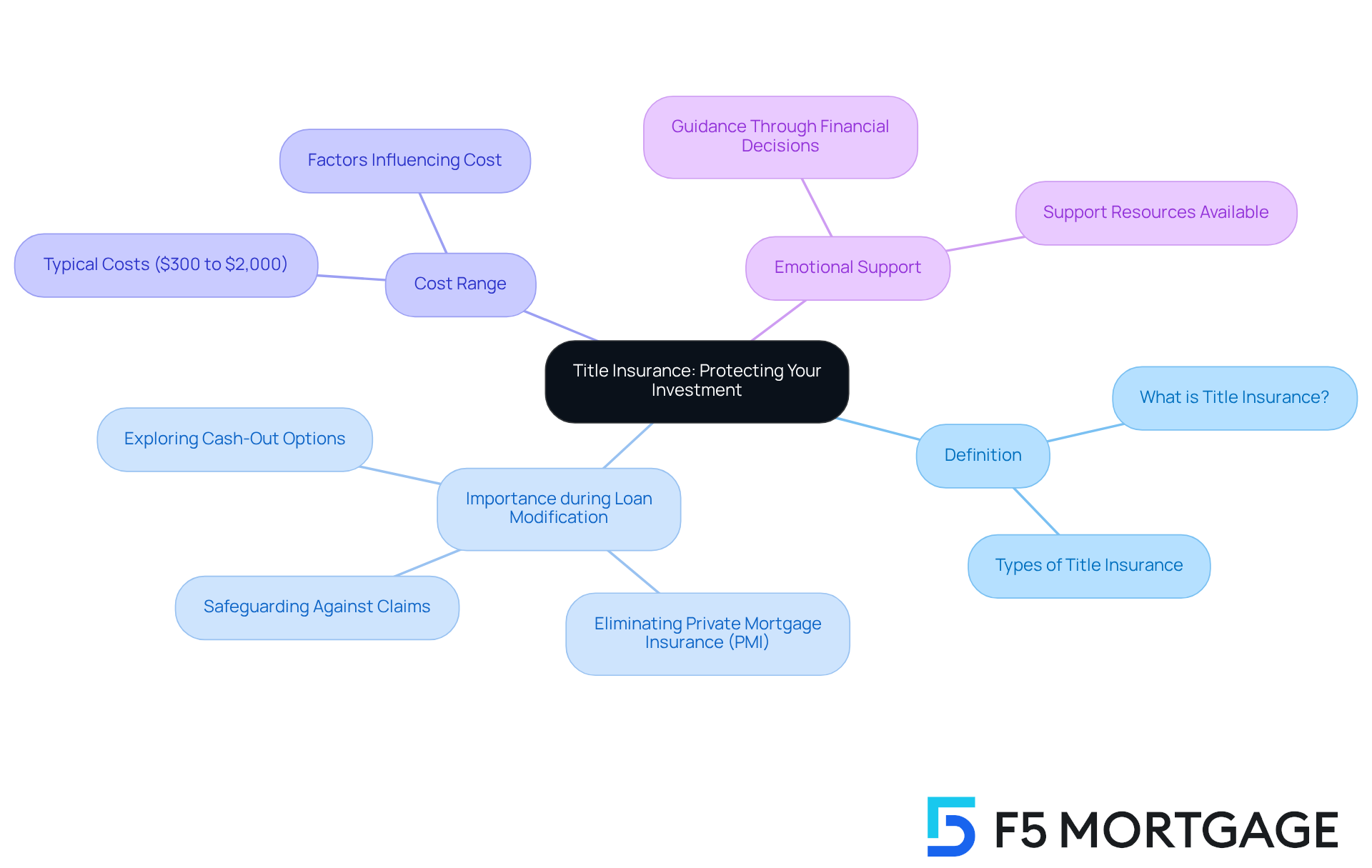

Title Insurance: Protecting Your Investment

Title insurance is a vital safeguard for homeowners, protecting against potential claims related to their property. This becomes especially significant during the loan modification process. If you’re considering restructuring your loan—perhaps to eliminate private mortgage insurance (PMI) or explore cash-out options—understanding the role of title insurance is essential.

The cost of title insurance can vary widely, typically ranging from $300 to $2,000. While this charge may seem daunting, it is a crucial investment in safeguarding your financial future. By ensuring that any claims against your property are addressed, you can navigate the financial landscape with greater confidence.

We know how challenging this can be, but remember, you’re not alone in this journey. We’re here to support you every step of the way as you make informed decisions about your home and finances.

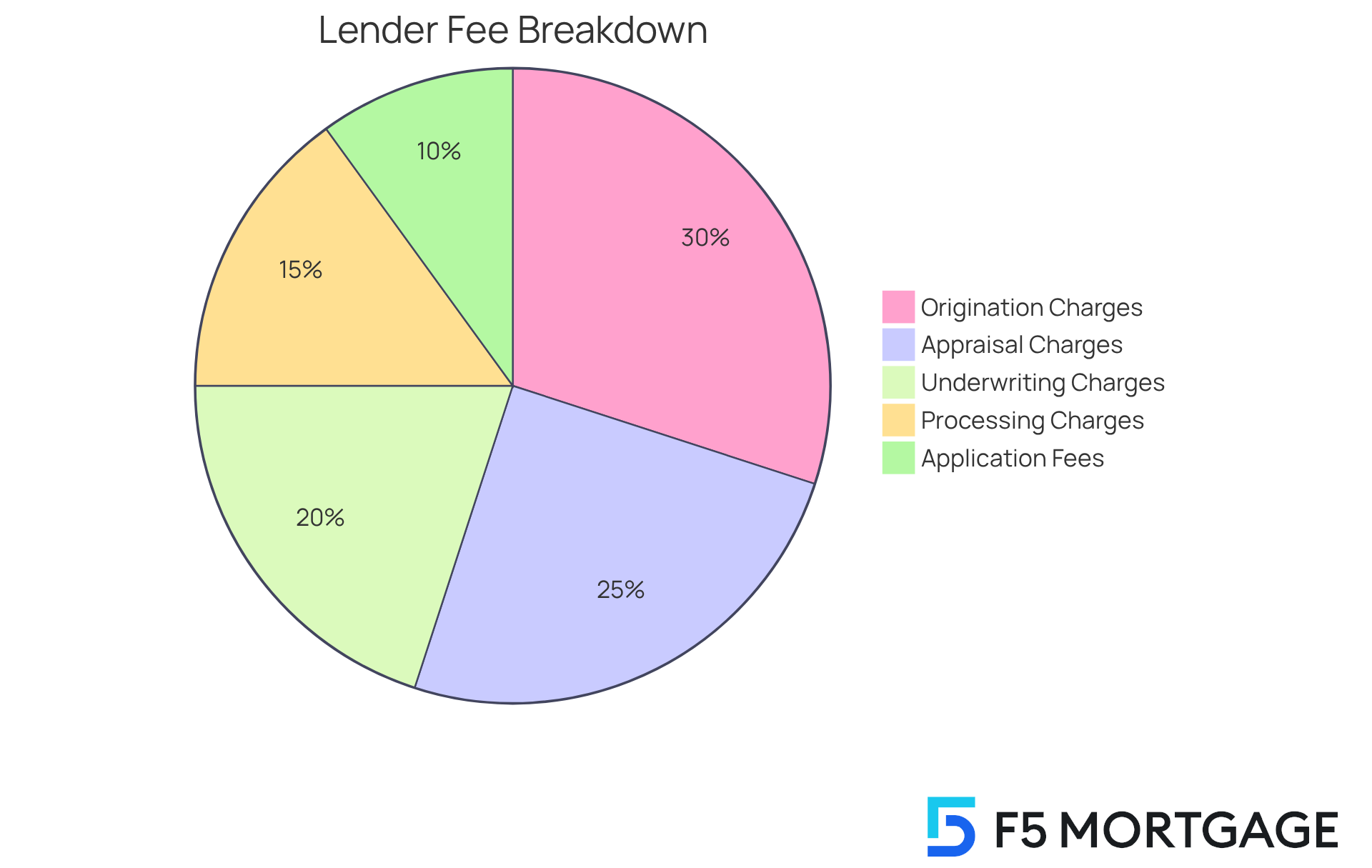

Lender Fees: What to Expect from Your Mortgage Provider

Lender costs are an essential part of the loan modification process, encompassing various charges such as origination costs, underwriting charges, and processing costs. We understand how overwhelming these costs can feel, especially when they vary from 0.5% to 1.5% of the loan amount. This variation can significantly impact the total expense of refinancing. For instance, on a $200,000 loan, these charges could total between $1,000 and $3,000, which can be a substantial amount for any family.

To ensure transparency, it’s vital to ask your lender for a comprehensive itemization of all charges. This step not only helps you compare offers effectively but also assists in identifying any hidden costs that may arise. Common refinancing fees include:

- Application Fees: Ranging from $250 to $500, these fees cover the initial processing of your loan application.

- Origination Charges: Typically between 0.5% and 1.5% of the loan amount, these are included in the refinance fees that compensate the lender for processing the loan.

- Underwriting Charges: Refinance fees can differ significantly and are applied for evaluating the loan application and assessing risk.

- Processing Charges: These include refinance fees that cover the administrative costs associated with managing your loan.

- Appraisal Charges: Typically ranging from $300 to $700, these are included in the refinance fees for evaluating the property’s worth.

Comprehending refinance fees is crucial for households seeking to refinance, as they can accumulate rapidly. For example, if a family is restructuring a $250,000 mortgage, they could encounter total lender charges ranging from $1,250 to $3,750. By evaluating various lenders and discussing charges, families can potentially save hundreds, if not thousands, of dollars.

We know how challenging this can be, which is why expert opinions suggest that homeowners should always obtain quotes from at least two lenders to ensure they are getting the best deal. This practice not only aids in recognizing competitive rates but also illuminates different fee structures, empowering families to make informed choices regarding their options for restructuring. We’re here to support you every step of the way.

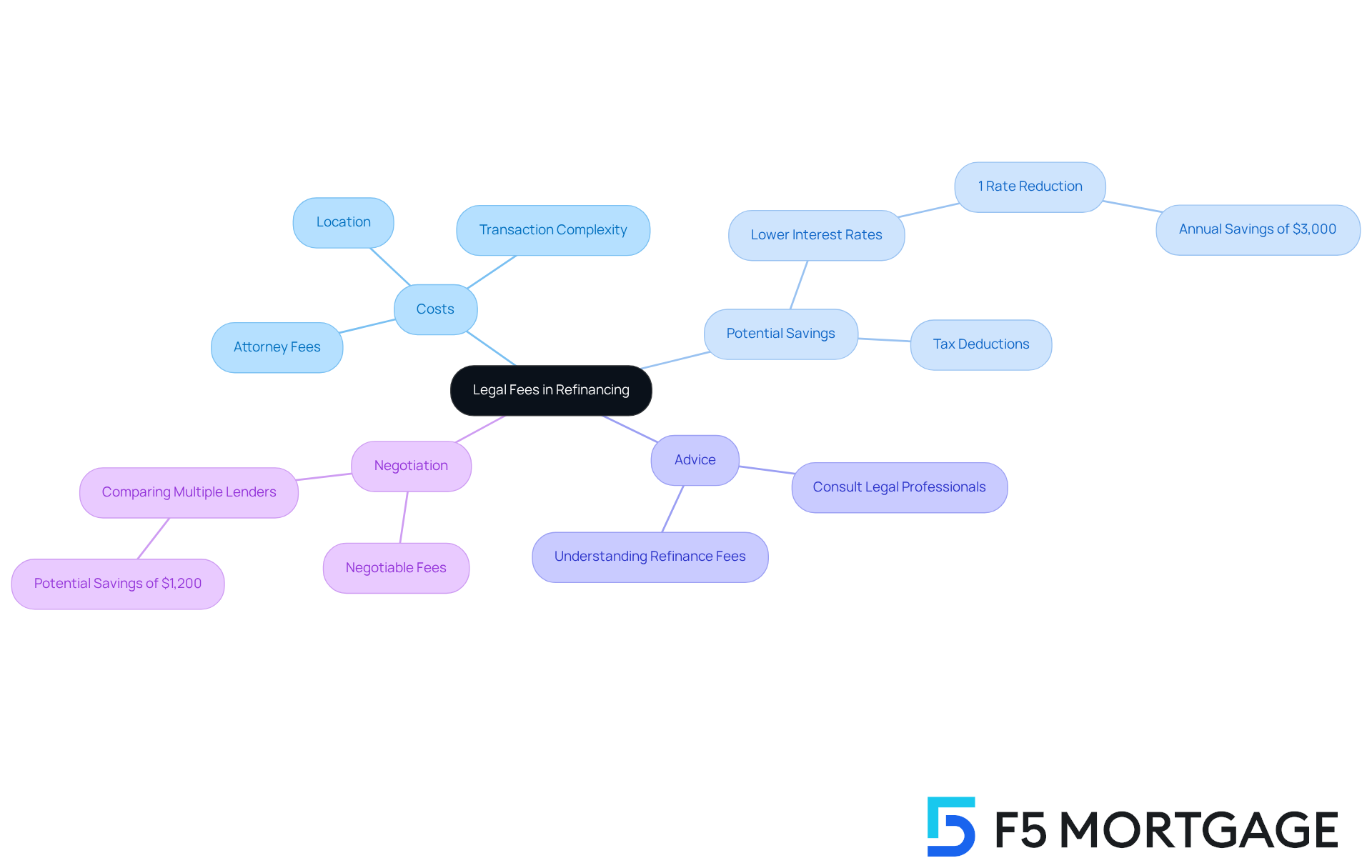

Legal Fees: Navigating the Costs of Refinancing

Legal costs can weigh heavily on families as they navigate the loan restructuring process, particularly when it comes to examining documents or addressing potential conflicts. These expenses can vary widely based on factors such as location, transaction complexity, and attorney fees. For instance, homeowners adjusting a $300,000 mortgage might encounter legal costs around $3,000. However, this investment can lead to substantial savings, potentially saving nearly $3,000 annually by securing a 1% lower interest rate. Understanding the nuances of legal costs is vital for families as they embark on this journey.

We understand how challenging this can be, which is why it’s essential for families to consult a legal professional early in the process of understanding refinance fees. This step helps clarify potential costs, such as refinance fees, and ensures compliance with relevant laws. Legal specialists emphasize that these charges should be viewed as a commitment to financial security rather than just another expense. As one legal expert insightfully noted, “Legal costs, while appearing merely as another expense, are truly an investment in the security and future of your financial standing.” A lawyer’s review can uncover hidden fees or unfavorable terms in loan agreements that may lead to costly mistakes down the line.

Statistics reveal that homeowners who seek legal assistance during the loan modification process often gain stronger negotiating power, which can result in better terms and significant long-term savings. In fact, those who compare multiple lenders and seek legal advice may save over $1,200 per year on average. Additionally, certain expenses related to loan restructuring could be tax-deductible, and legal consultants can help clients navigate these benefits.

As households consider restructuring in 2025, understanding the details of legal expenses and knowing when to seek expert advice is crucial for making informed decisions and protecting their financial interests. It’s also important to identify the break-even point for mortgage restructuring—when the savings from the process exceed the refinance fees. This knowledge can empower families to determine the best timing for their financial restructuring choices. Lastly, property owners should remember that many expenses are negotiable, allowing them to manage their costs effectively.

Mortgage Discharge Fees: Understanding the Costs

When you settle your current mortgage, you may encounter refinance fees, typically ranging from $100 to $500. These charges can vary based on your lender and state regulations, making it crucial to factor them into your loan calculations. We know how challenging it can be to keep track of all these expenses, especially since households often overlook refinance fees, which can accumulate significantly when combined with other restructuring costs.

In 2025, the typical closing expenses for a single-family residence are expected to be around $6,800. This highlights the importance of planning for all related charges. Understanding these expenses can help families avoid unexpected financial strains during the loan restructuring process. Additionally, it’s generally recommended that homeowners consider living in their home for at least five years before refinancing to ensure financial stability.

Being proactive about these fees can lead to better financial planning and savings in the long run. Families should also think about negotiating seller concessions to help cover some of these closing costs. Cash-out mortgage restructuring can be advantageous as well, allowing homeowners to modify their loan for a greater sum than what they owe. This provides access to home equity for significant expenses, especially when the new interest rate is lower than the existing mortgage rate. We’re here to support you every step of the way as you navigate these important decisions.

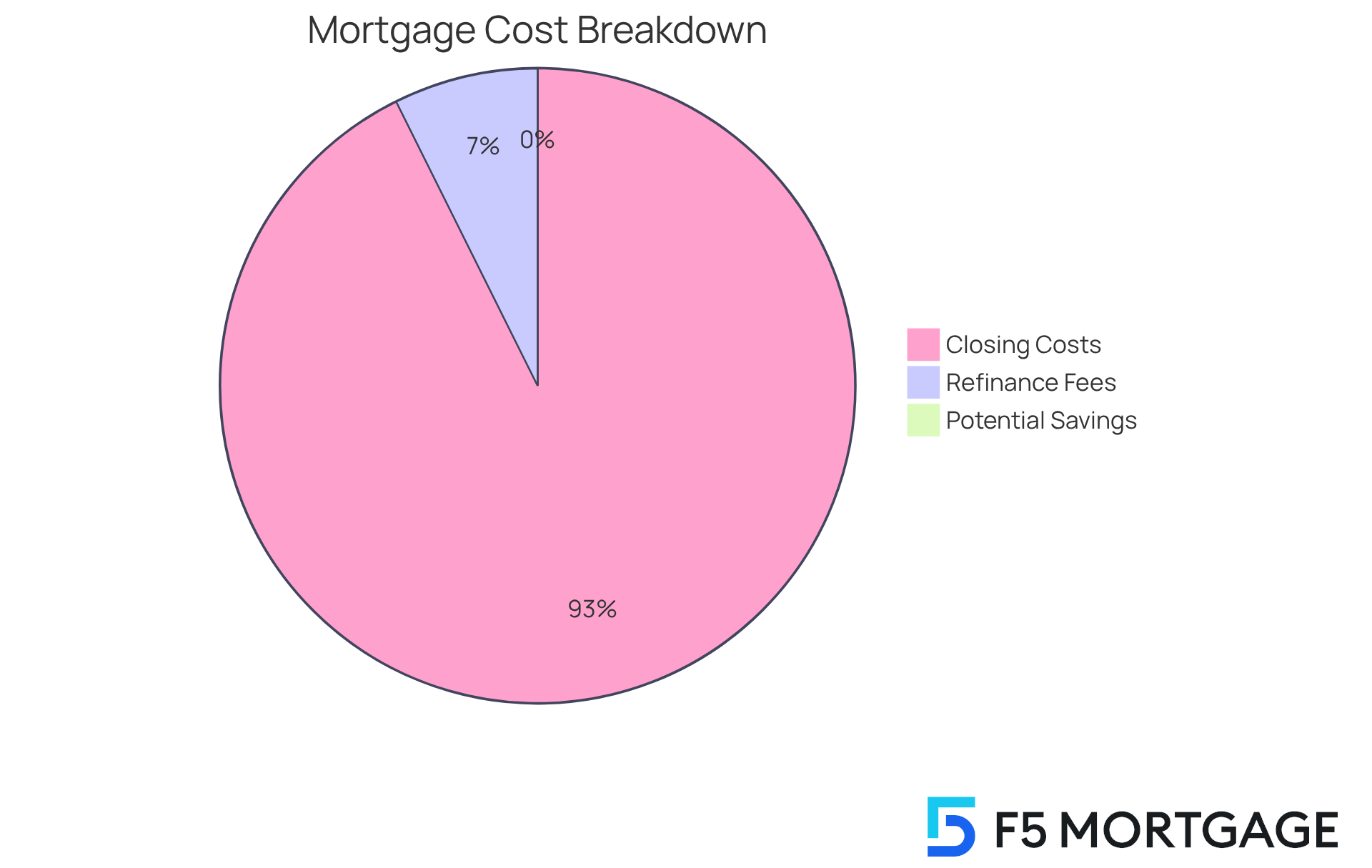

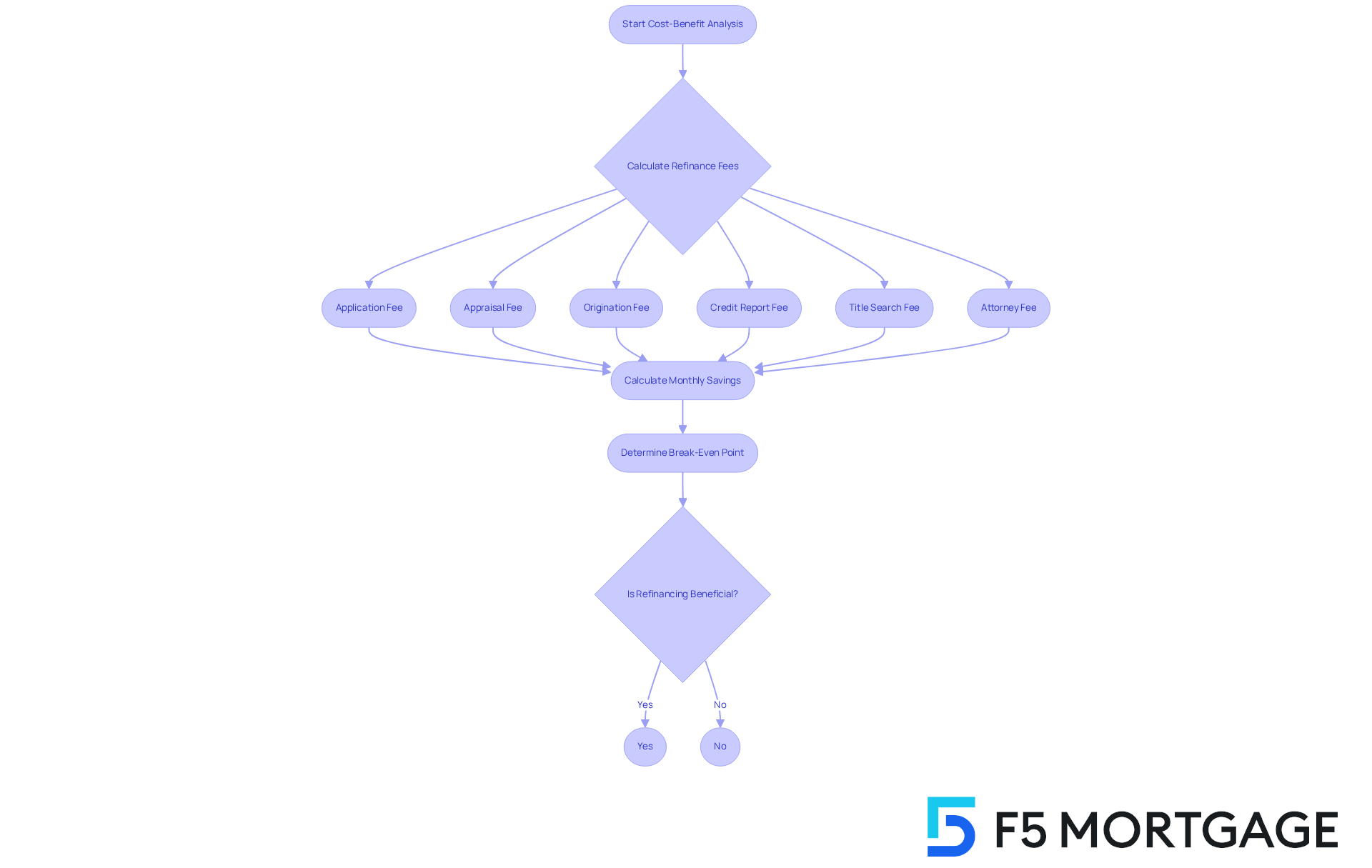

Cost-Benefit Analysis: Weighing Fees Against Savings

If you’re a family contemplating refinancing, it’s crucial to undertake a comprehensive cost-benefit analysis. We know how challenging this can be, so let’s break it down together. This process involves meticulously calculating all associated refinance fees, which typically range from 2% to 6% of the loan amount. Common fees include:

- Application fees (between $75 and $500)

- Appraisal fees (usually between $300 and $500)

- Origination fees (between 0.5% and 1.5% of the loan amount)

- Credit report fees (around $35)

- Title search and insurance (between 0.5% and 1% of the loan amount)

- Attorney fees (starting at $500)

By comparing these expenses with the possible savings from obtaining a lower interest rate, you can make a more informed decision. For instance, adjusting a $400,000 mortgage from a 7% interest rate to 6% could lower monthly payments by about $198. A further decrease to 5.75% could save an extra $129 each month.

It’s essential to consider the break-even point, where your savings exceed the expenses incurred. To compute this, start by identifying your total loan restructuring expenses, including all closing fees and charges. Then, calculate your monthly savings by subtracting the new monthly payment from the current monthly payment. Ultimately, dividing the overall expenses by the monthly savings will show how many months it will take to reach equilibrium. If the expenses of the loan reallocation surpass the expected savings, it might not be a wise financial decision. It’s also important to consider your plans for staying in the home; restructuring is most advantageous for those who intend to remain long enough to recover the upfront expenses.

Real-world examples illustrate this point: households that received multiple rate quotes often saved over $1,200 annually, demonstrating the financial advantages of strategic refinancing. Additionally, with the recent spike in mortgage refinance demand due to decreasing interest rates, we encourage you to evaluate your current mortgage rates against new options. By weighing the refinance fees against potential savings, you can make informed decisions that align with your long-term financial objectives. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the world of mortgage refinancing can feel overwhelming, particularly when hidden fees seem to lurk around every corner. We understand how crucial it is for families to grasp these costs while aiming to enhance their homes without encountering unexpected financial burdens. By illuminating various refinance fees—ranging from application and appraisal costs to closing expenses and prepayment penalties—households can make informed decisions that align with their financial aspirations.

This article has shed light on essential fees that families should be mindful of. Application fees can vary widely, while closing costs can add up to thousands of dollars. Additionally, prepayment penalties often go unnoticed. Each of these charges can significantly influence the overall cost of refinancing, underscoring the importance of transparency and thorough research when selecting a mortgage lender. By engaging with knowledgeable brokers and comprehending the implications of each fee, families can sidestep common pitfalls and ensure a smoother refinancing journey.

Ultimately, being proactive about understanding and negotiating refinance fees can yield considerable savings and foster a more secure financial future. We encourage families to conduct a comprehensive cost-benefit analysis, weighing potential savings against the various fees involved. By doing so, they can confidently navigate the refinancing process, ensuring that their decisions bolster their long-term financial well-being. Taking the time to educate oneself about these hidden costs isn’t just beneficial; it’s a vital step toward achieving homeownership goals and financial stability.

Frequently Asked Questions

What are hidden refinance fees that borrowers should be aware of?

Hidden refinance fees can include application costs, appraisal fees, and closing expenses, which can accumulate quickly and significantly impact the overall expense of the refinancing process.

Why is it important to understand loan costs when refinancing?

Understanding loan costs is essential because unforeseen expenses can escalate loan restructuring costs, making it crucial to collaborate with experienced mortgage brokers who can navigate these complexities.

How can hidden charges affect monthly payments?

A low-interest rate may be offset by significant refinance fees, leading to higher monthly payments, which is why transparency regarding these charges is emphasized.

What upfront costs should borrowers expect when applying for a mortgage?

Upfront mortgage application costs typically range from $100 to $500, but they can exceed $1,000 depending on the lender, covering expenses related to handling the loan application and initial credit assessments.

Are application fees always necessary when applying for a mortgage?

No, not all financial institutions impose application fees, and they are only necessary when formally applying for a mortgage.

What are closing costs, and how much can they range?

Closing costs, also known as refinance fees, can range from 2% to 5% of the loan amount. For a $300,000 home, these costs may range from $6,000 to $15,000 and include various charges such as refinance fees, loan origination fees, appraisal fees, and title insurance.

How can borrowers ensure they understand the closing costs associated with their loan?

Borrowers should ask their lender for a detailed summary of the refinance fees to gain clarity on the expenses they are paying and to help prevent potential overcharges.

What role does F5 Mortgage play in assisting families with refinancing?

F5 Mortgage emphasizes transparency and client empowerment, helping families understand refinance fees, manage expenses efficiently, and make informed choices throughout the loan restructuring process.