Overview

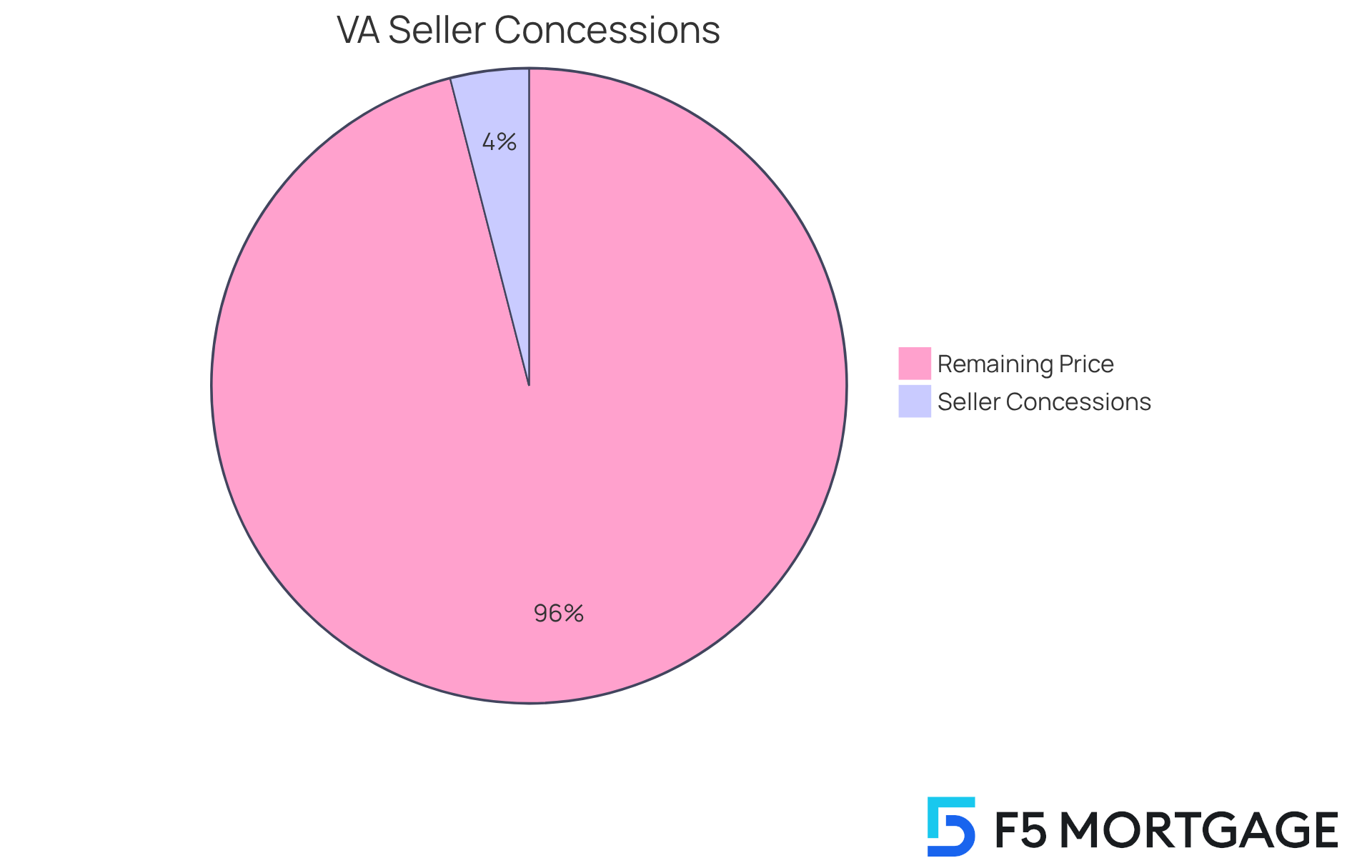

Max VA seller concessions allow sellers to contribute up to 4% of a home’s purchase price toward a buyer’s closing costs and other expenses. This significant support enhances affordability for families using VA loans. We know how challenging the home buying process can be, and this flexibility empowers buyers to negotiate for sellers to cover various costs. Ultimately, this reduces their financial burden, making homeownership more attainable, especially in competitive markets. We’re here to support you every step of the way.

Introduction

Max VA seller concessions serve as a vital financial resource for families navigating the often daunting landscape of homeownership. By allowing sellers to contribute up to 4% of a home’s purchase price toward closing costs and other expenses, these concessions can significantly ease the financial burden for buyers utilizing VA loans.

However, we know how complex these concessions can be, raising important questions:

- How can families maximize these benefits while staying within regulatory limits?

- Understanding the nuances of seller concessions not only empowers families to negotiate effectively but also enhances their overall affordability in a competitive housing market.

We’re here to support you every step of the way as you explore these options, ensuring you feel confident in your journey toward homeownership.

F5 Mortgage: Understanding VA Seller Concessions and Their Impact

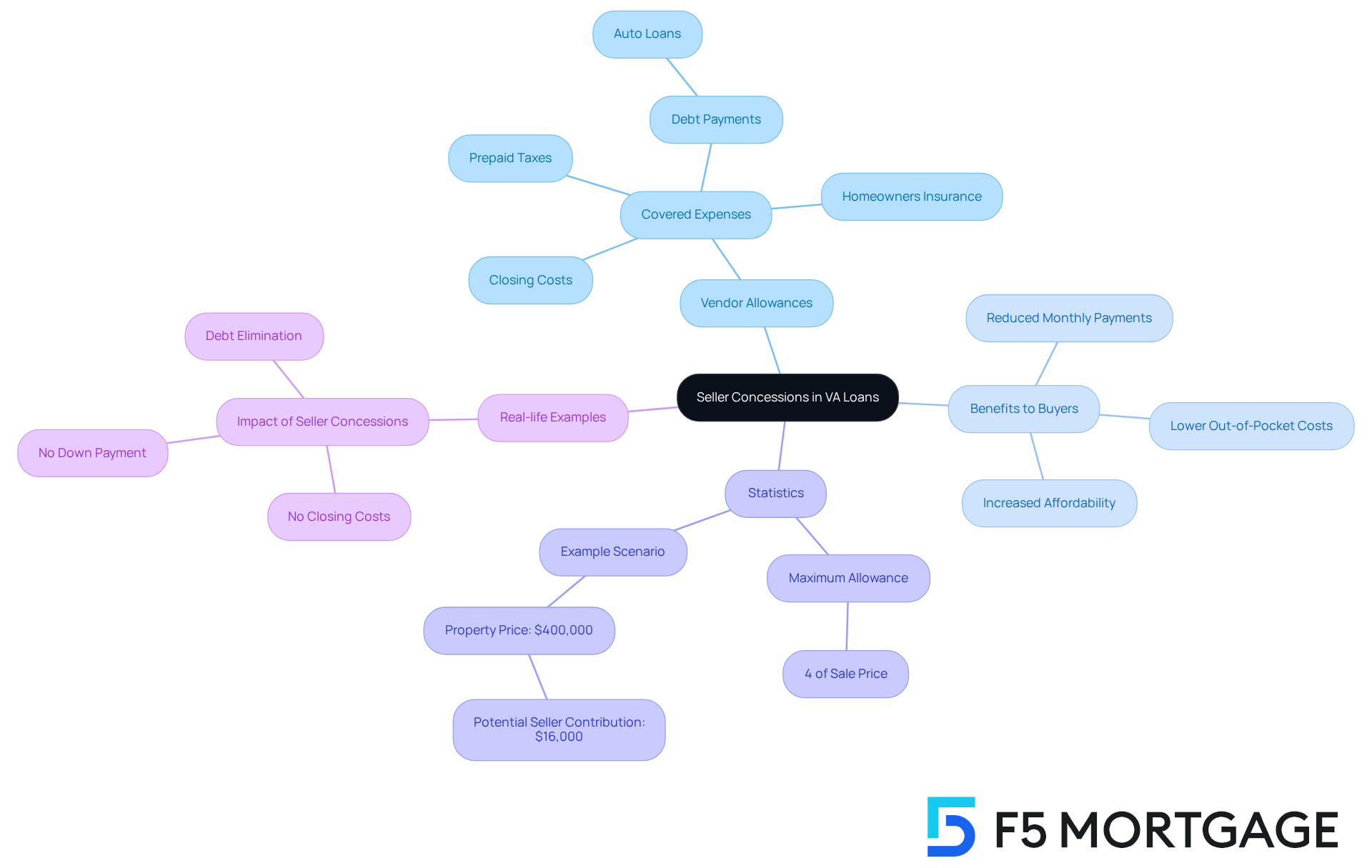

VA contributions offer vital financial support that vendors can provide towards a buyer’s closing expenses, significantly easing the financial burden of home buying for families. We understand how challenging this process can be, and these adjustments are particularly beneficial for individuals using VA loans, enhancing overall affordability and accessibility in the housing market.

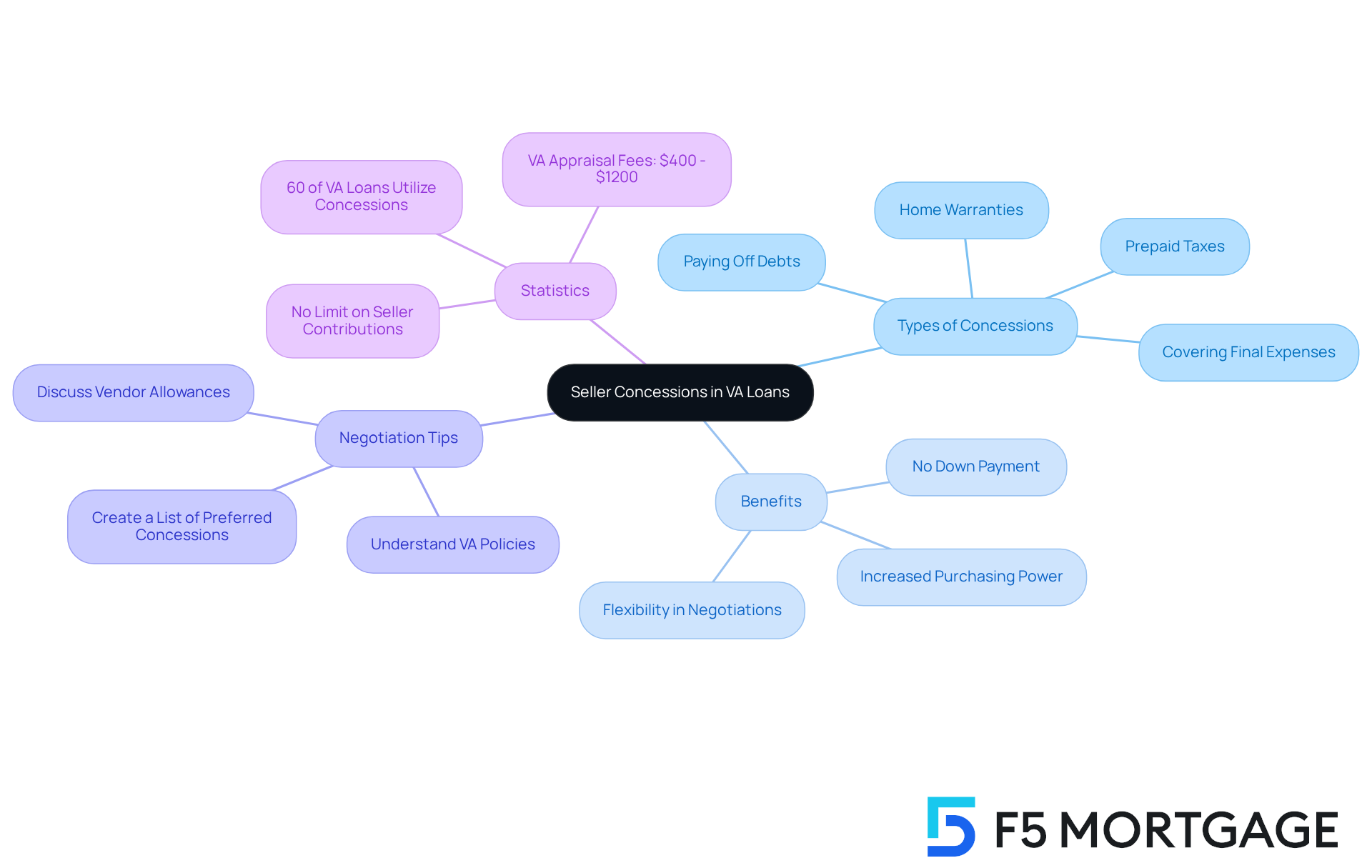

The VA limits the max VA seller concessions to 4% of the home’s purchase price, excluding typical closing expenses, which vendors can cover entirely. This flexibility empowers vendors to assist buyers with additional costs, such as prepaid taxes, insurance, or even settling personal debts.

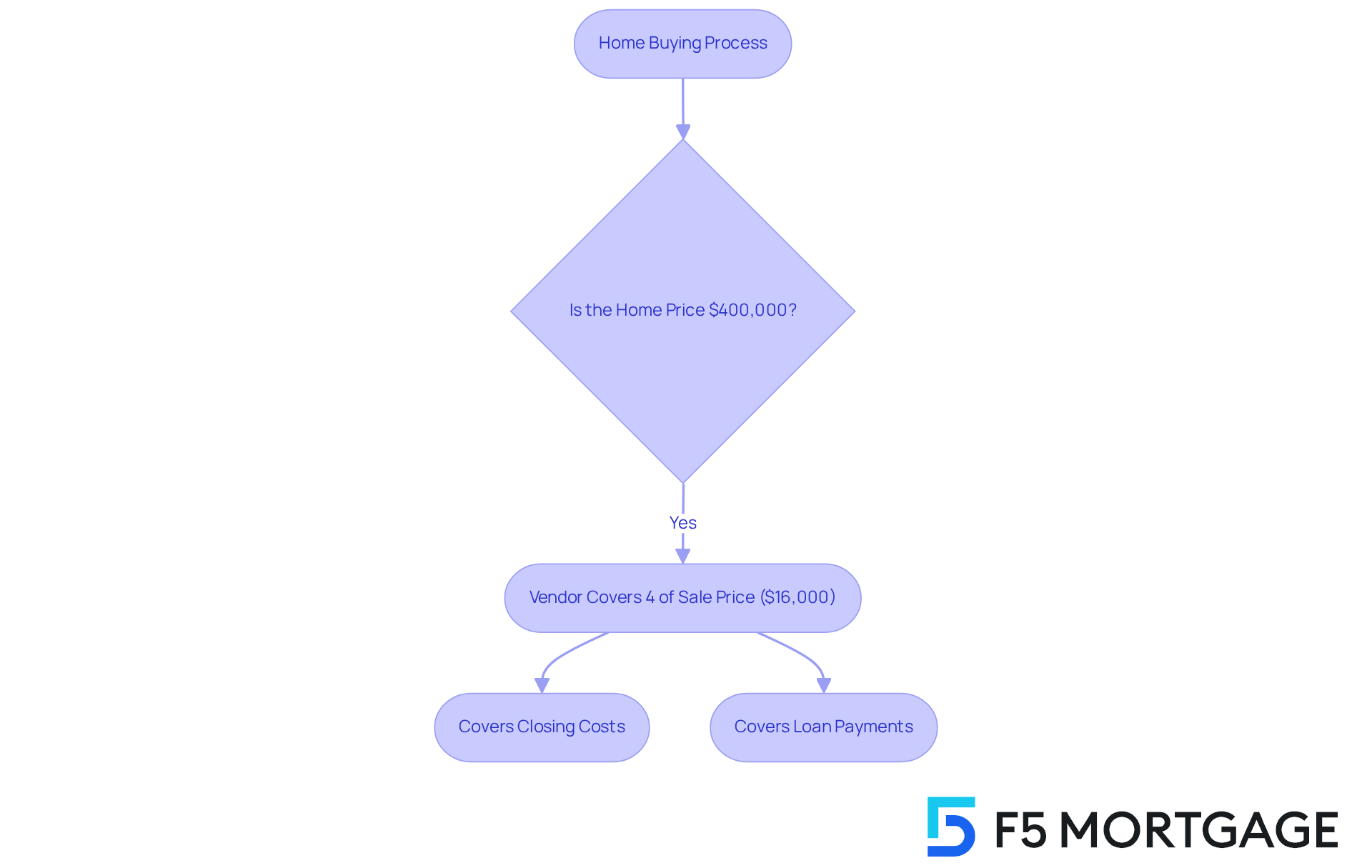

Consider a real-world example: a buyer purchasing a $400,000 home could benefit from seller incentives that cover all closing fees and provide an additional $8,000 towards an auto loan, resulting in no expenses at settlement. The impact of these concessions on home affordability is profound. By lowering upfront costs, families can allocate their resources more effectively, making homeownership a more achievable goal. Moreover, the ability to negotiate max VA seller concessions can be especially advantageous in a buyer’s market, where vendors may be more willing to offer adjustments to close a deal.

Experts emphasize the importance of understanding max VA seller concessions to maximize benefits. Chris Birk, Vice President of Mortgage Insight at Veterans United, states, ‘VA contributions from the vendor are financial aids that cover expenses beyond typical closing fees, such as settling debts, reducing interest rates, or addressing the VA funding charge.’ With the right guidance, families can navigate the complexities of VA loans and leverage vendor concessions to , ultimately creating a more manageable financial situation.

This strategic approach not only enhances the affordability of VA loans but also empowers families to make informed decisions in a competitive housing market. We’re here to support you every step of the way.

Maximum Seller Concessions on VA Loans: Key Limits Explained

For VA loans, sellers can offer max VA seller concessions of up to 4% of the home’s purchase price toward closing costs and other expenses. Understanding this limit is crucial for families, as it defines the maximum amount for max VA seller concessions that can be negotiated in the purchase agreement. Staying within this boundary is essential; exceeding it could complicate the loan approval process. We know how challenging this can be, which is why having an informed agent can significantly impact your success in negotiating these agreements.

When families actively engage in discussions about , they often find themselves in a stronger position to secure favorable terms. For instance, imagine a family purchasing a $400,000 home. They could negotiate for the seller to cover all typical closing costs, thereby maximizing the max VA seller concessions allowance. This understanding not only facilitates smoother transactions but also empowers families to make informed decisions throughout their homebuying journey. We’re here to support you every step of the way.

How Seller Concessions Work in VA Loans: A Comprehensive Overview

Vendor allowances in VA loans provide a valuable opportunity for vendors to cover specific transaction-related expenses, such as closing fees, prepaid taxes, and homeowners insurance. This arrangement significantly enhances affordability for veterans and active-duty service members, allowing them to negotiate concessions that can lower their out-of-pocket expenses. For instance, imagine a scenario where a property sells for $400,000. The owner might agree to cover all closing costs and even pay off an $8,000 auto loan for the buyer. This effectively removes closing expenses and down payment requirements, making homeownership more attainable. Additionally, this arrangement allows the buyer to save $200 a month by eliminating the auto loan payment, further easing their financial burden.

Statistics show that vendor allowances can reach up to 4% of the sale price, alongside typical closing expenses, providing significant financial assistance. For a $400,000 property, this means that sellers could contribute as much as $16,000 towards the buyer’s expenses, significantly alleviating their financial strain. However, it’s important to understand that vendors are not obligated to provide these allowances; this is a matter open for discussion between the buyer and vendor.

Real-life case studies illustrate the positive impact of vendor allowances on home purchasing expenses. Consider a seasoned buyer who benefits from seller incentives. Not only do they avoid closing costs, but they also reduce monthly expenses by eliminating existing debts, such as auto loans. This strategic use of compromises can , making it more manageable and less stressful.

Financial advisors emphasize the importance of understanding these agreements, as they can play a crucial role in enhancing VA loan affordability. By utilizing seller incentives, veterans can navigate the challenges of home purchasing with greater confidence and financial stability. Remember, a purchase agreement is necessary to submit a closing expense assistance request, which is an essential step in the process. We know how challenging this can be, and we’re here to support you every step of the way.

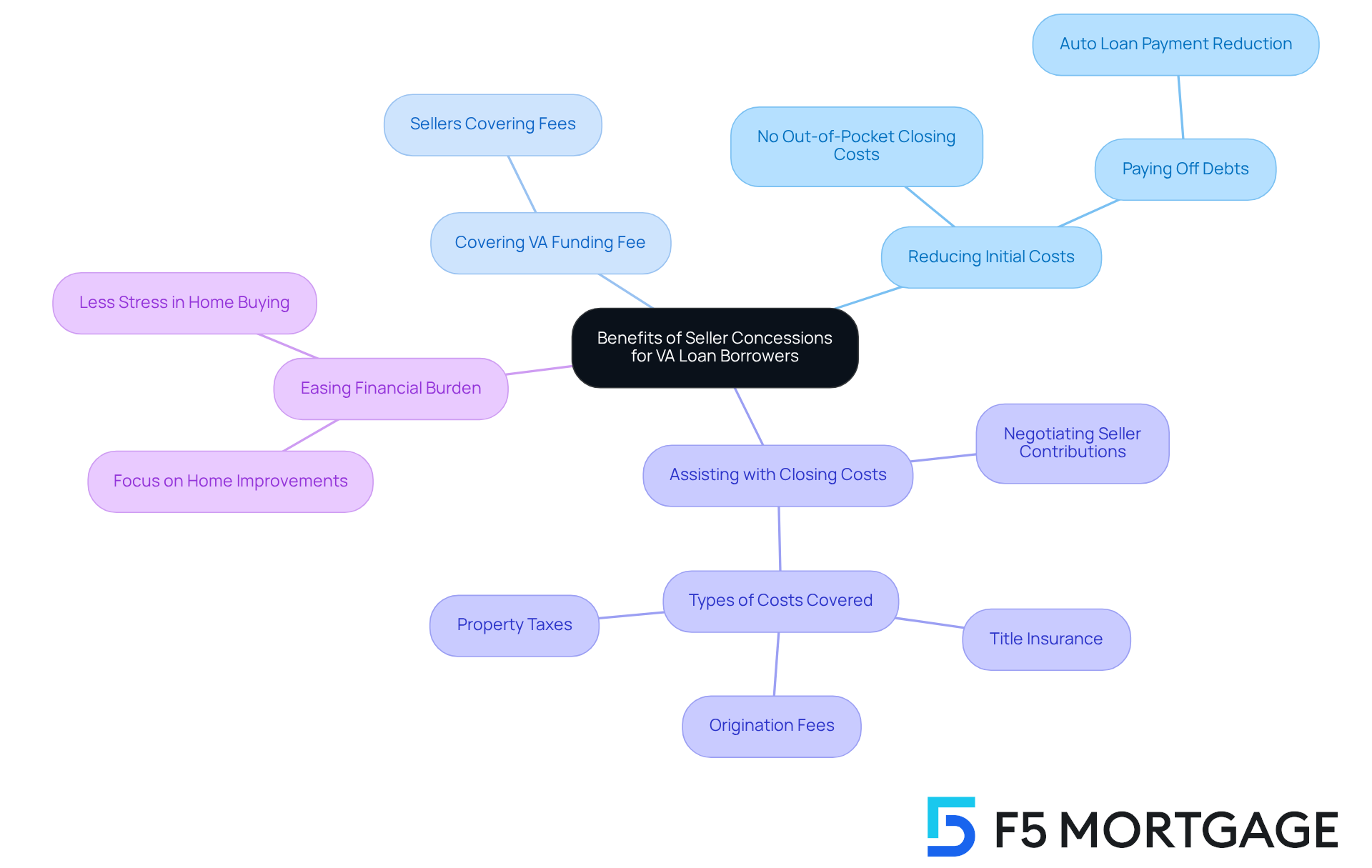

Benefits of Seller Concessions for VA Loan Borrowers

Max VA seller concessions provide significant benefits for VA loan borrowers, primarily by reducing initial costs and enhancing affordability. We understand how challenging this can be, and that’s why it’s essential to know that sellers can contribute to various expenses through max VA seller concessions of up to 4% of the loan amount. This can include max VA seller concessions, such as covering the VA funding fee or assisting with closing costs. Such flexibility allows families to allocate their resources toward other necessary expenses, like relocation costs or home improvements, ultimately easing the financial burden of homeownership.

For instance, imagine a family purchasing a home valued at $400,000. By negotiating with the seller, they could potentially have all closing fees covered, resulting in no out-of-pocket expenses at closing. Additionally, if the seller agrees to pay off an $8,000 auto loan, the family not only saves on immediate costs but also reduces their monthly financial obligations by $200. This scenario illustrates how max VA seller concessions can transform the home buying experience, making it more attainable and manageable for families.

Utilizing seller concessions empowers families to navigate the complexities of homeownership with greater financial ease. This way, they can focus on settling into their new home rather than feeling overwhelmed by upfront costs. As Alley Cohen shared, “Everything went very smoothly!” and Bryce Leonard strongly recommends F5 Mortgage for their expertise, it’s clear that individuals can rely on the support offered. With the additional advantages of F5 Mortgage’s , families can enhance their home buying opportunities and achieve homeownership sooner, all while enjoying competitive rates and personalized service.

Common Types of Seller Concessions in VA Loans

Seller concessions in VA loans can significantly ease the financial burden on homebuyers. Imagine being able to cover final expenses, pay for home warranties, and assist with prepaid property taxes and insurance. For instance, if a property is sold for $400,000, a vendor might agree to cover all final expenses and even settle an $8,000 auto loan for the buyer. This means no final charges and no down payment necessary. Such vendor allowances can truly make homeownership more attainable.

We know how challenging this can be, and families should be aware that there is toward closing costs, which relates to [max VA seller concessions in a VA loan](https://veteransunited.com/futurehomeowners/what-is-the-va-seller-concession-rule). This opens up opportunities for negotiation that can be incredibly beneficial for you. Importantly, these contributions do not count toward the VA’s 4% vendor allowance limit, which allows for greater flexibility in negotiations concerning max VA seller concessions. Additionally, providers can cover the VA funding fee, which is especially advantageous for veterans with a disability rating of 10% or higher, as they may be exempt from this fee.

According to real estate specialist Chris Birk, understanding the subtleties of vendor allowances is essential for purchasers. He highlights that discussing these compromises can lead to a more advantageous purchase contract, enabling families to seek specific support from vendors. For example, households can request providers to cover expenses related to termite inspections or repairs for well and septic systems, which are often required by the VA depending on the location.

In reality, a notable portion of VA loan transactions include vendor allowances. Research suggests that roughly 60% of VA loans take advantage of these allowances. By approaching negotiations with a clear understanding of what can be requested, families can utilize these compromises to enhance their purchasing power and secure a better deal. To maximize their advantages, households should create a list of preferred compromises before engaging in discussions with vendors.

Understanding the 4% Rule for VA Seller Concessions

Navigating the home buying process can be overwhelming, and the 4% guideline for [max VA seller concessions](https://f5mortgage.com) provides a valuable resource for families. This regulation allows for max VA seller concessions, enabling vendors to contribute up to 4% of the home’s sale price toward the buyer’s closing fees and other associated expenses. By adhering to this guideline, families can negotiate more effectively, ensuring they maximize their benefits while remaining compliant with max VA seller concessions.

Imagine a buyer acquiring a house for $400,000; the vendor could cover all closing expenses and even settle an $8,000 auto loan. This means no initial expenses for the buyer, significantly easing the financial burden of homeownership. We know how challenging this can be, and understanding the 4% rule can empower families in their journey.

Having an informed real estate professional by your side can also improve negotiations. They assist in navigating the intricacies of vendor allowances, ensuring that all contributions are correctly categorized under VA regulations. As Chris Birk, Vice President of Mortgage Insight, notes, “The vendor can cover the VA funding fee for the buyer, decreasing the buyer’s initial expenses.” This highlights the adaptability of the VA vendor support regulation, which is a vital aspect of the home buying process.

Furthermore, by comparing rates, costs, and terms with lenders like F5 Mortgage, families can ensure they receive competitive rates and personalized service. We’re here to support you every step of the way, .

Negotiating Seller Concessions: Tips for VA Loan Borrowers

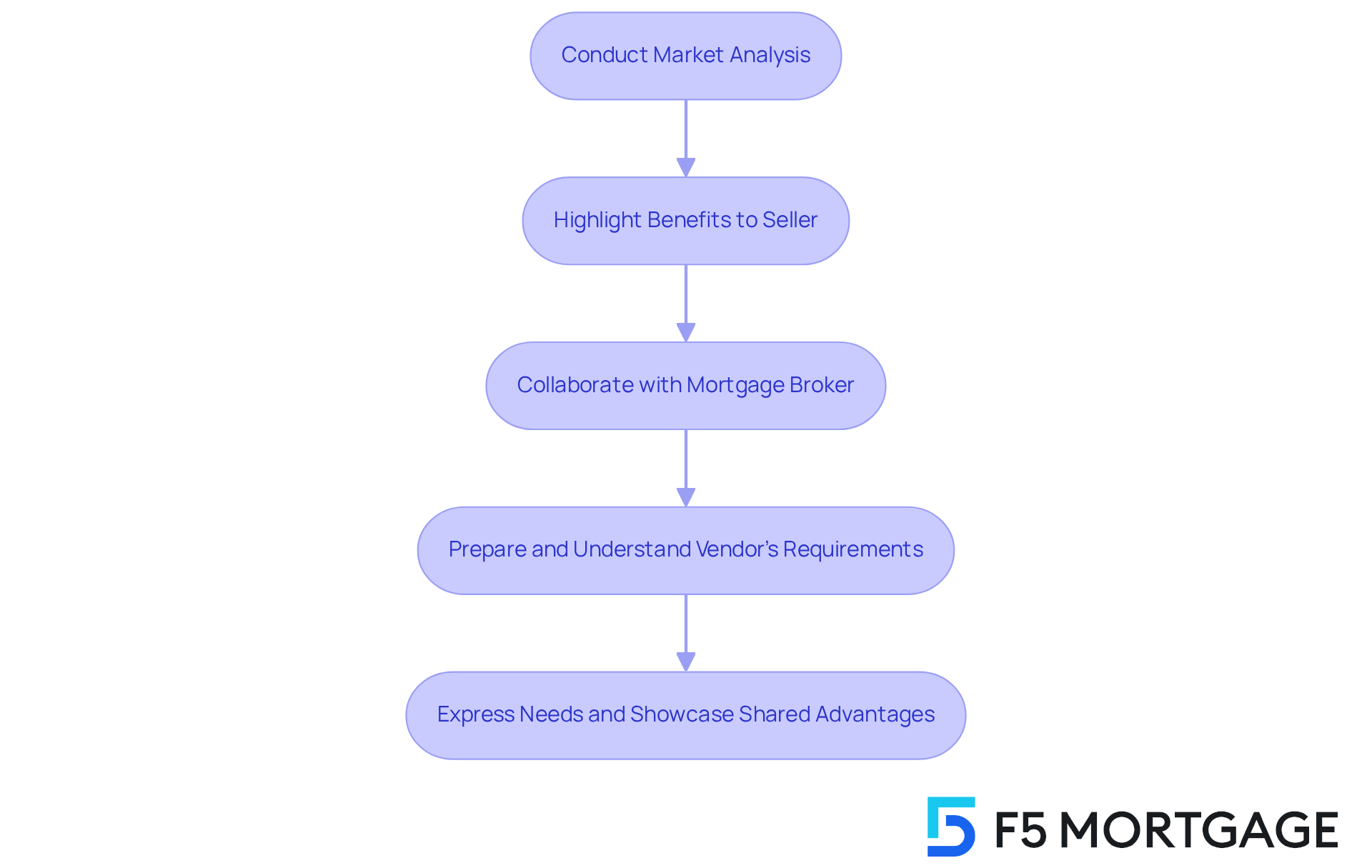

Negotiating vendor allowances can feel daunting, but with the right approach, VA loan borrowers can navigate this process successfully. Start by conducting a thorough market analysis to support your requests. Understanding and comparable sales can provide a solid foundation for your negotiations.

It’s important to highlight the benefits of compromises to the seller. For instance, you might point out how a quicker sale can benefit them or how it reduces buyer risk. These insights can significantly strengthen your negotiation position.

Collaborating with an experienced mortgage broker can also be incredibly helpful. They can offer tailored insights and strategies that align with the unique circumstances of your transaction. Real estate experts often emphasize the importance of preparation. Effective negotiators are not only knowledgeable about their position but also understand the vendor’s requirements.

By clearly expressing your needs and showcasing the shared advantages of compromises, you empower yourself. This approach can greatly enhance your chances of obtaining favorable terms. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Tax Ramifications of VA Seller Concessions: What You Should Know

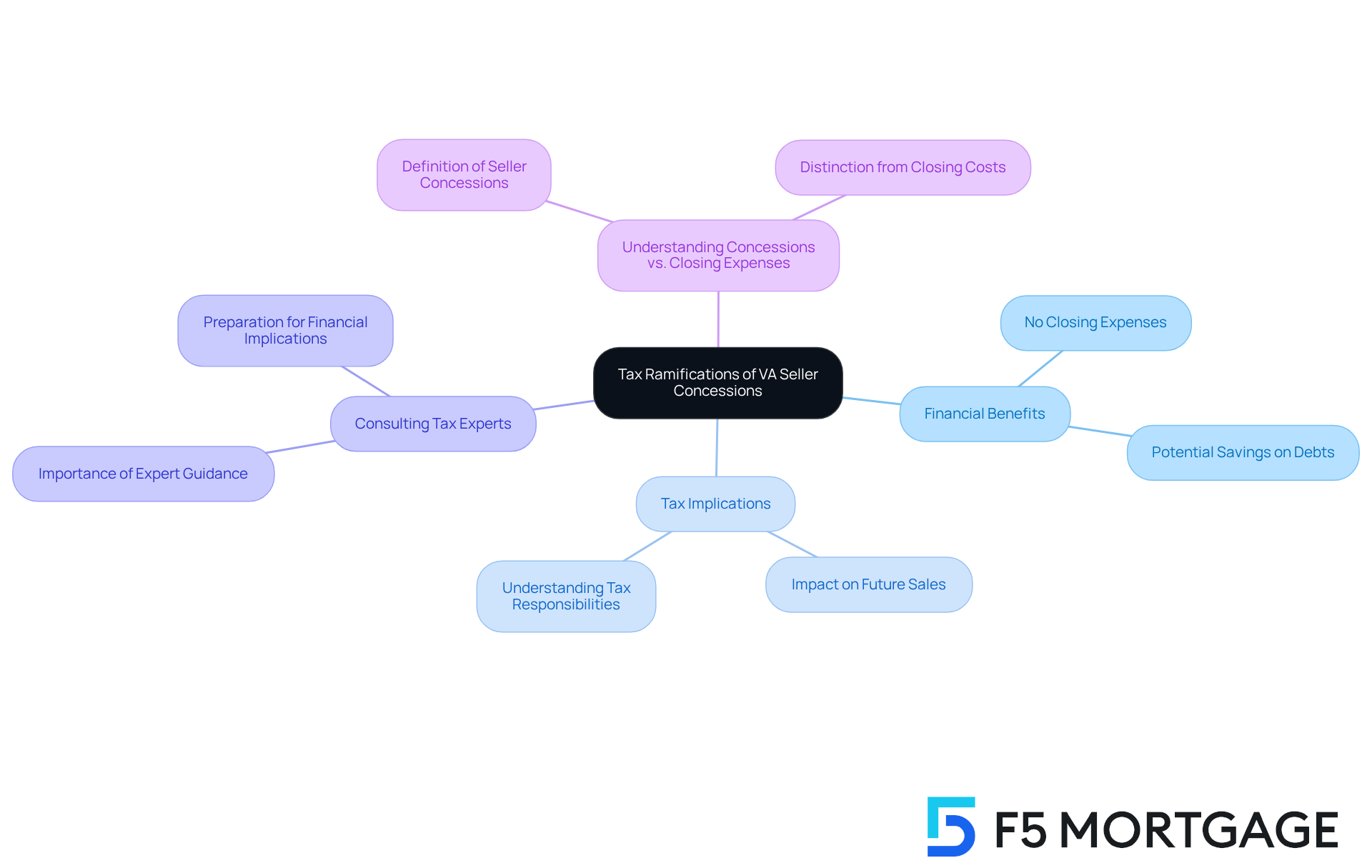

VA provider incentives are often not considered taxable earnings for the buyer, which can be a significant advantage. Imagine selling a property for $400,000 and receiving $8,000 in vendor allowances. In this case, the VA purchaser would face no closing expenses, highlighting the financial benefits these allowances can bring. However, we know how challenging it can be to navigate these financial waters, so it’s vital for families to consult a tax expert. Understanding how these allowances might is crucial, especially if they plan to sell the property in the future.

Chris Birk, Vice President of Mortgage Insight, points out that “items outside typical closing expenses that the provider agrees to cover for the buyer are referred to as concessions.” Recognizing these implications can help families make better financial choices. Additionally, it’s important to understand the difference between closing expenses and vendor allowances, as this distinction can affect the buyer’s tax responsibilities in relation to max VA seller concessions when selling the property.

To effectively navigate these complexities, we encourage families to seek guidance from tax experts. This preparation can ensure they are ready for any future financial implications, empowering them to make informed decisions every step of the way.

How F5 Mortgage Supports Clients in Navigating VA Seller Concessions

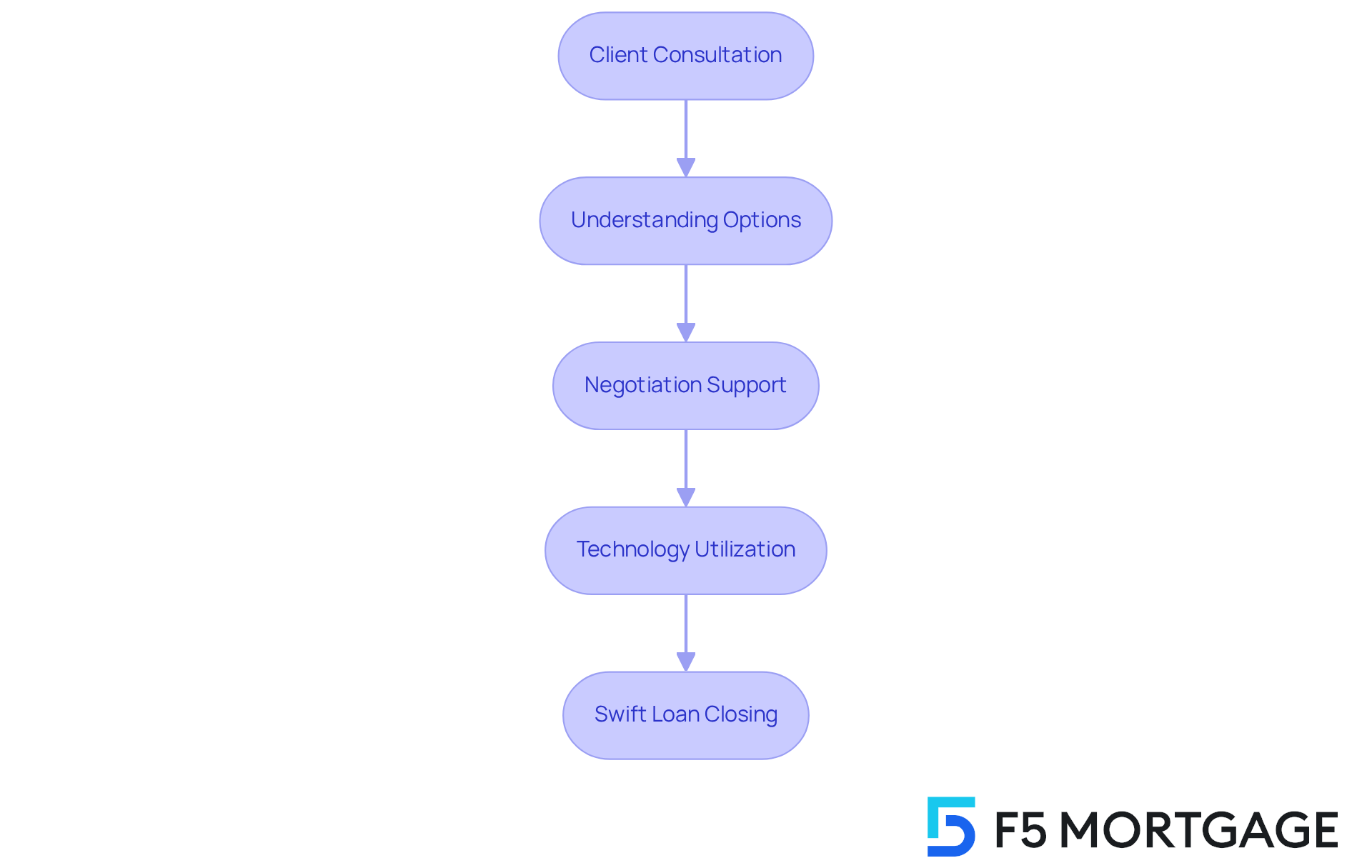

At F5 Mortgage, we understand how challenging navigating max VA seller concessions can be. That’s why we offer comprehensive support through personalized consultations and a variety of tailored services. With over a decade of experience, our dedicated loan officers, like Jeff Bozimowski, focus on that meet the unique financial needs of families, including those who are self-employed or facing special circumstances.

Our skilled team is here to help families understand their options, negotiate effectively, and ensure compliance with VA loan guidelines. By leveraging user-friendly technology, we streamline the mortgage process, allowing families to feel confident and informed.

We know how important it is for you to make the best decisions for your needs. Our commitment to client education and no-pressure guidance empowers families, leading to swift loan closings in less than three weeks. We’re here to support you every step of the way.

The Importance of Seller Concessions in Your VA Loan Journey

Max VA seller concessions are crucial in the VA loan process, assisting families in significantly reducing their initial expenses and improving their chances of homeownership. By effectively utilizing max VA seller concessions, borrowers can navigate the often complex mortgage landscape, leading to a more fulfilling home buying experience.

Imagine a family purchasing a home valued at $400,000. Through open discussions, the seller agrees to cover all closing costs and pay off an $8,000 auto loan. This arrangement allows the buyer to achieve homeownership without any closing costs, no down payment, and a debt-free settlement, highlighting the financial benefits of seller concessions.

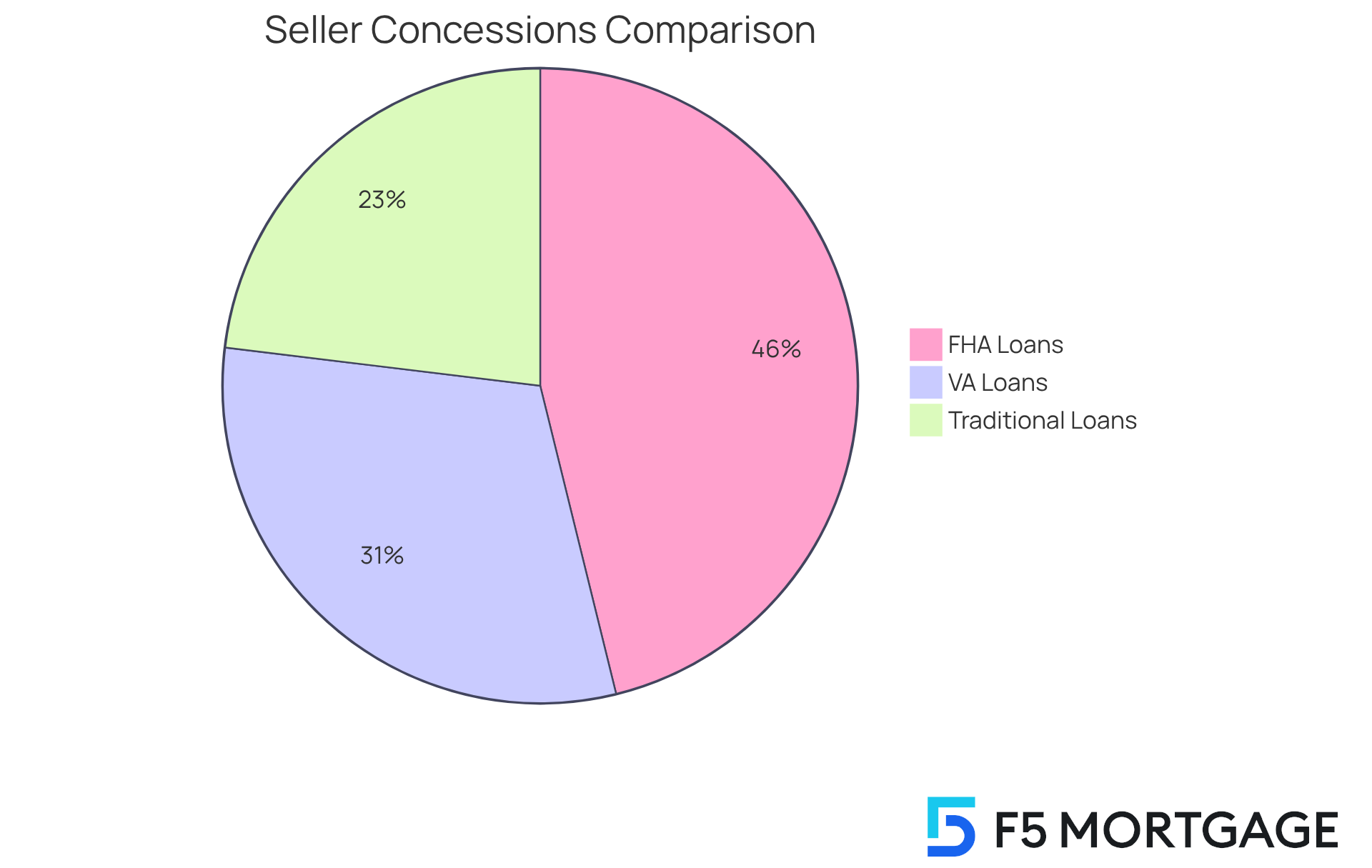

The VA’s seller assistance policy, which offers support up to the max VA seller concessions of 4% of the sale price, aims to help veterans reach their homeownership dreams. This flexibility can significantly improve affordability, making it easier for families to manage their financial commitments. In comparison, traditional loans only allow for 3% in concessions, while FHA loans permit up to 6%, emphasizing the max VA seller concessions that illustrate the unique advantages of VA loans.

Mortgage specialists emphasize that proactively discussing seller allowances during negotiations can greatly benefit buyers. Understanding these concessions empowers families to make , positively influencing homeownership rates. As families navigate the housing market, leveraging seller incentives can be a strategic choice, especially in competitive environments where every financial advantage counts.

Real-life examples further illustrate the impact of seller allowances on home buyers. In a slower market, a family purchasing a $400,000 property with seller incentives can save significantly on monthly expenses, making homeownership more achievable and sustainable. By recognizing the potential of seller concessions, families can turn their home buying journey into a more attainable reality.

Conclusion

Max VA seller concessions play a pivotal role in enhancing the affordability of homeownership for families utilizing VA loans. By allowing sellers to contribute up to 4% of the home’s purchase price towards closing costs and other expenses, these concessions significantly alleviate the financial challenges faced by buyers. This unique advantage not only smooths the path to homeownership but also empowers families to make informed decisions in a competitive housing market.

Throughout the article, key insights highlight the importance of understanding the limits and benefits of seller concessions. We know how challenging this can be. From enabling negotiations that can cover all closing costs to providing additional financial support for personal debts, these concessions can truly transform the home buying experience. Real-world examples illustrate how families can leverage these allowances to achieve homeownership without the burden of upfront expenses, making it a more attainable goal.

In conclusion, recognizing and utilizing max VA seller concessions can be a game changer for families navigating the complexities of the housing market. By engaging in proactive discussions with sellers and seeking guidance from knowledgeable mortgage professionals, families can maximize their benefits. This ultimately leads to greater financial stability and a smoother transition into their new homes. Embracing the potential of these concessions is not just a strategic choice; it is a vital step towards realizing the dream of homeownership.

Frequently Asked Questions

What are VA seller concessions?

VA seller concessions are financial contributions that sellers can provide to help cover a buyer’s closing costs and other expenses when using a VA loan. This support significantly eases the financial burden of home buying for families.

What is the maximum amount of seller concessions allowed for VA loans?

The maximum seller concessions for VA loans is up to 4% of the home’s purchase price, excluding typical closing costs, which sellers can cover entirely.

How can seller concessions impact home affordability?

Seller concessions can lower upfront costs, allowing families to allocate their resources more effectively. This makes homeownership a more achievable goal by reducing the overall financial burden at the time of purchase.

Can seller concessions cover expenses beyond closing costs?

Yes, seller concessions can cover expenses beyond typical closing costs, such as prepaid taxes, homeowners insurance, and even settling personal debts like auto loans.

How can buyers maximize their seller concessions?

Buyers can maximize seller concessions by negotiating with the seller to cover all typical closing costs and staying within the 4% limit of the home’s purchase price.

What are the potential benefits of negotiating seller concessions in a buyer’s market?

In a buyer’s market, sellers may be more willing to offer concessions to close a deal, providing buyers with greater opportunities to negotiate favorable terms and reduce their overall costs.

What is the importance of understanding seller concessions for families?

Understanding seller concessions is crucial for families as it allows them to negotiate effectively, secure favorable terms, and enhance the affordability of their VA loans, ultimately leading to a more manageable financial situation.

Do sellers have to provide concessions?

No, sellers are not obligated to provide concessions; it is a matter of negotiation between the buyer and seller.

What is required to request closing expense assistance?

A purchase agreement is necessary to submit a request for closing expense assistance, which is an essential step in the process of utilizing seller concessions.