Overview

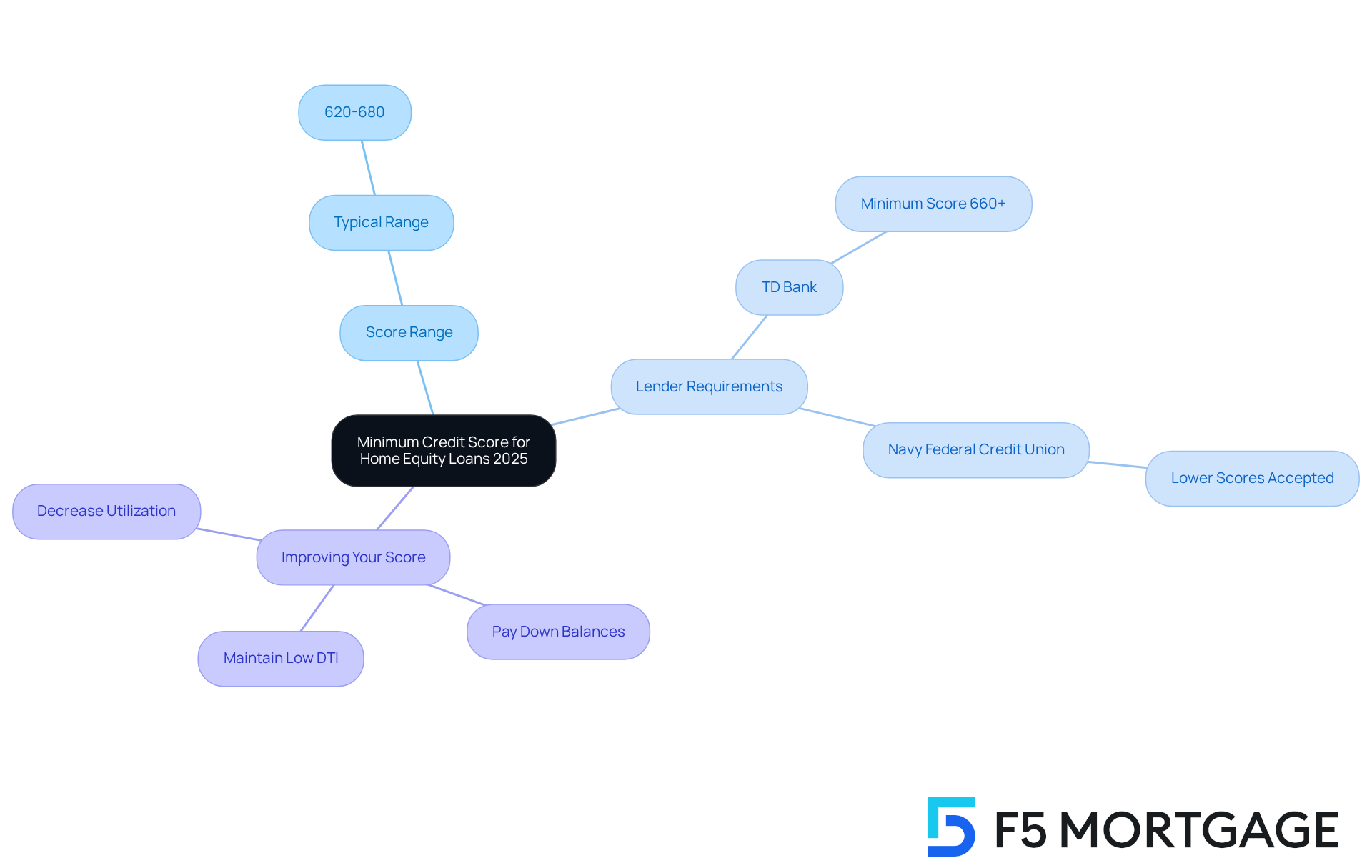

We understand how challenging navigating financial decisions can be, especially when it comes to securing a home equity loan. Typically, the minimum credit score required ranges from 620 to 680, depending on the lender’s criteria. Some institutions may even accept scores as low as 620, which can provide hope for those who are concerned about their credit standing.

Maintaining a healthy credit score is crucial, as it significantly impacts both your eligibility and the interest rates you may receive. We want you to know that borrowers with higher scores often have access to more favorable terms, which can make a substantial difference in your financial journey.

By focusing on improving your credit score, you empower yourself to make informed decisions that benefit your family. We’re here to support you every step of the way, ensuring you feel confident in your choices.

Introduction

Navigating the landscape of home equity loans can feel overwhelming, especially for families looking to make the most of their property’s value. We understand how challenging this can be. With the minimum credit score for home equity loans ranging from 620 to 680 in 2025, grasping the nuances of credit requirements is essential for securing favorable terms. In this article, we’ll explore vital insights and strategies that families can use to enhance their credit scores and boost their chances of loan approval.

But what if a family’s credit score falls short? It’s important to remember that you’re not alone in this journey. Exploring alternatives and overcoming challenges in this competitive lending environment can truly make a difference in achieving your financial goals. We’re here to support you every step of the way.

F5 Mortgage: Your Partner for Home Equity Loans and Credit Score Guidance

At F5 Mortgage LLC, we truly understand the complexities families face when navigating home equity financing. Our independent mortgage brokerage is dedicated to helping you every step of the way. Central to our approach is a genuine commitment to your satisfaction, achieved through personalized consultations and a diverse selection of financing options tailored just for you.

In 2025, we know how essential it is to maintain a healthy credit score, as the minimum credit score for home equity loan means even minor fluctuations can significantly impact your approval outcomes. With our extensive network of lenders, families can secure competitive rates and customized solutions that align perfectly with their unique financial situations. This strategic focus not only boosts your chances of financing approval but also ensures you feel supported throughout your property financing journey.

We leverage user-friendly technology to simplify the mortgage process, making it more accessible and less stressful for you. By emphasizing tailored service and drawing on our industry expertise, F5 Mortgage positions itself as a trusted ally for families looking to enhance their property value potential. Additionally, understanding the risks associated with residential value financing—like the implications of reduced appraisals or property issues—is crucial. We ensure you are well-informed about these aspects, empowering you to make confident decisions.

Our satisfied clients often share how personalized guidance has led to higher satisfaction levels, reinforcing our dedication to client education and support throughout the property financing process. We’re here to support you every step of the way, ensuring you feel understood and empowered in your journey.

Minimum Credit Score Requirement for Home Equity Loans in 2025

In 2025, we understand that navigating property financing can be challenging, especially when it comes to qualifying scores. Typically, the minimum credit score for home equity loan needed lies between 620 and 680, depending on the lender. While some institutions may accept a minimum credit score for home equity loan as low as 620, others often require a minimum credit score for home equity loan of 680 or higher to secure more favorable terms.

For instance, TD Bank allows borrowers with scores as low as 660 to access property value credit. On the other hand, Navy Federal Credit Union may authorize service members for financing up to 100% of their property value, even with lower scores. This variability highlights the importance of shopping around and consulting multiple lenders to fully understand their specific requirements and identify the best options available.

It’s worth noting that the anticipated minimum credit score for home equity loan approval in 2025 is expected to remain close to 700. This indicates the competitive nature of the lending environment. Maintaining a good financial score is essential, as it not only affects your eligibility but also influences the interest rates available to you.

Enhancing your score through methods like decreasing utilization can significantly increase your likelihood of approval and lead to better financing terms. Remember, we’re here to support you every step of the way, empowering you to make informed decisions for your family’s future.

Strategies to Improve Your Credit Score for Home Equity Loan Approval

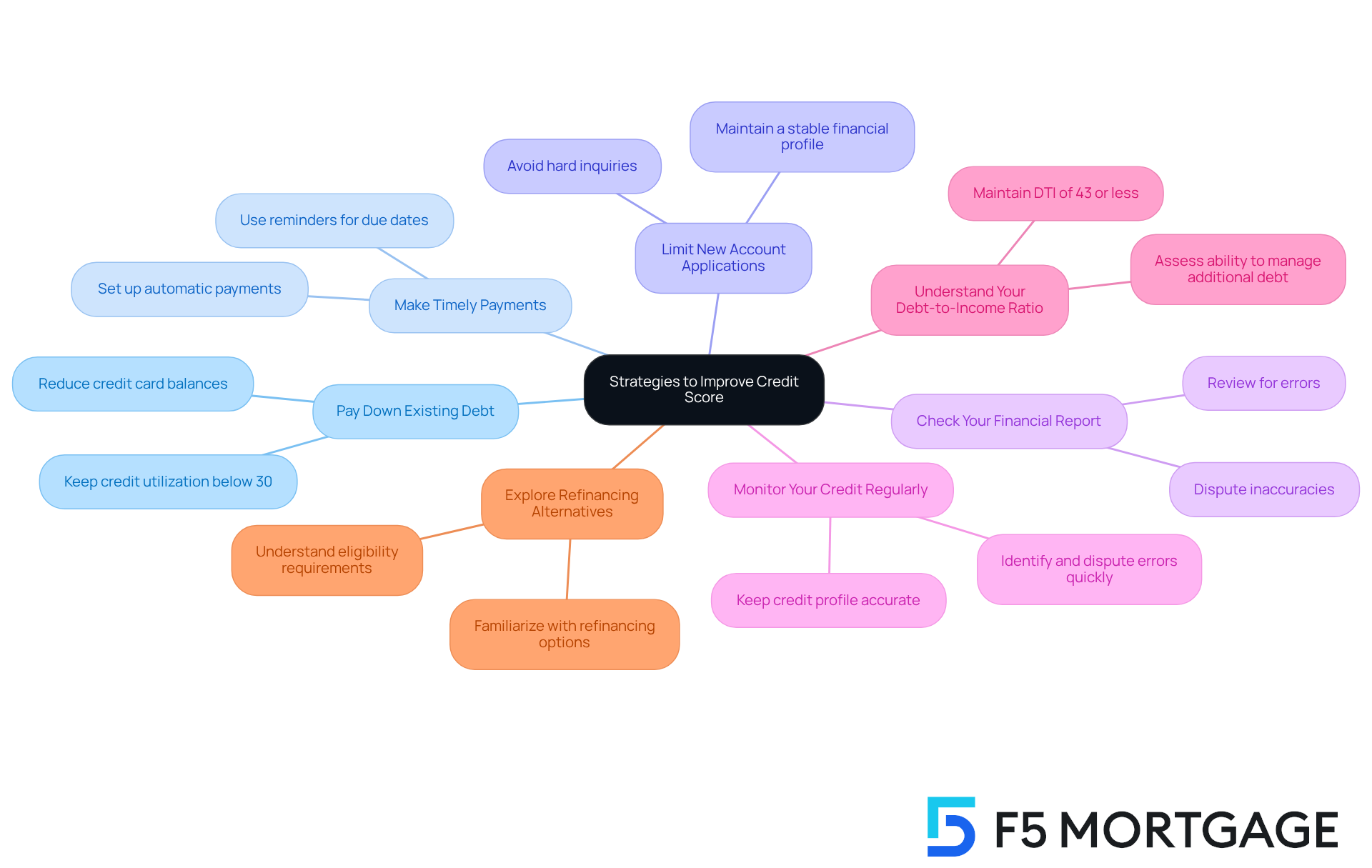

To enhance your credit score for home equity loan approval, consider implementing these supportive strategies:

- Pay Down Existing Debt: We know how challenging it can be to manage debt. Prioritize reducing credit card balances to lower your credit utilization ratio, ideally keeping it below 30%. This method can lead to significant improvements in your score, as many families have successfully increased their minimum credit score for home equity loan by focusing on debt reduction.

- Make Timely Payments: Regularly settling all invoices on time is crucial for developing a favorable payment history, which accounts for 35% of your score. Establishing automatic payments or reminders can help ensure you never miss a due date, giving you peace of mind.

- Limit New Account Applications: It’s wise to refrain from applying for new accounts, as each application can trigger a hard inquiry that temporarily lowers your score. To secure favorable borrowing conditions, it is essential to maintain a stable financial profile, particularly by knowing the minimum credit score for home equity loan, and we’re here to help you navigate this.

- Check Your Financial Report: Regularly reviewing your financial report for errors is a proactive step. Dispute any inaccuracies that could negatively impact your score. Fixing errors can lead to an average score improvement of about 16 points, which can help you reach the minimum credit score for home equity loan, significantly boosting your chances of financing approval.

- Monitor Your Credit Regularly: By monitoring your credit report, you can quickly identify and dispute errors, ensuring your credit profile remains accurate and up-to-date. This vigilance is key to maintaining a healthy credit score.

- Understand Your Debt-to-Income Ratio: Keeping a debt-to-income (DTI) ratio of 43% or less is vital for approval. This ratio helps lenders assess your ability to manage additional debt, making it an important factor in your overall financial profile. A better DTI can lead to more competitive mortgage rates, especially when considering refinancing options available through F5 Mortgage.

- Explore Refinancing Alternatives: Familiarize yourself with the various refinancing options available in Colorado, such as conventional mortgages, FHA programs, and VA programs. Each option has different eligibility requirements and benefits that can help you secure a better mortgage rate.

By adopting these caring tactics, families can enhance their financial profiles and increase their chances of obtaining property refinancing while navigating the refinancing landscape in Colorado. We’re here to support you every step of the way.

Additional Requirements for Securing a Home Equity Loan

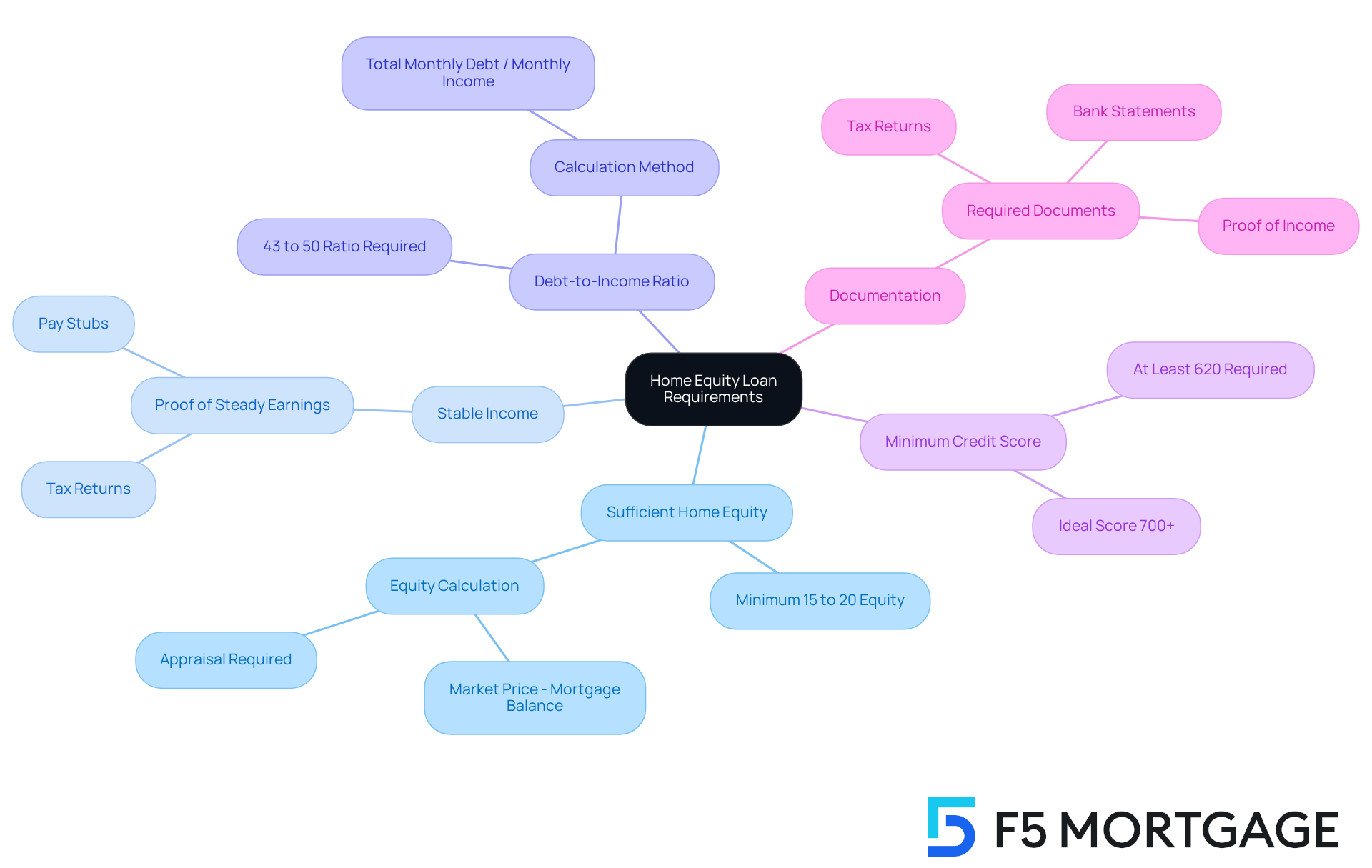

Obtaining a property-backed loan can feel overwhelming, but understanding the key eligibility criteria can make the process smoother. Here’s what you need to know:

- Sufficient Home Equity: Most lenders require that you have at least 15% to 20% equity in your home. This equity is calculated by subtracting your remaining mortgage balance from your home’s market price. An appraisal, ordered by the lender, will determine your property’s current market value, which is essential for understanding your equity and how it impacts your rates.

- Stable Income: We know how important it is to show a consistent income, as it reflects your ability to repay the debt. Lenders typically ask for proof of steady earnings through documents like pay stubs and tax returns.

- Debt-to-Income Ratio: A debt-to-income (DTI) ratio of 43% or lower is often required. This ratio indicates that your monthly debt obligations are manageable in relation to your income, assuring lenders that you can handle additional payments.

- Minimum Credit Score for Home Equity Loan: Most lenders look for a minimum credit score of at least 620 to qualify for a refinance. However, FHA mortgages may have lower score requirements.

- Documentation: Be prepared to provide thorough documentation to verify your financial situation. This may include tax returns, bank statements, and proof of income, all of which help lenders assess your overall financial health.

Understanding these prerequisites can significantly enhance your chances of securing a mortgage against your property’s value. We’re here to support you every step of the way, helping you utilize your home’s equity effectively.

Home Equity Loan Alternatives for Low Credit Scores

For families facing challenges with low credit scores, we understand how daunting it can feel to meet the minimum credit score for a home equity loan. Fortunately, there are several viable alternatives to traditional home equity loans that can provide much-needed financial support:

-

Personal Loans: Unsecured personal loans offer quick access to cash without the need for home equity. These financial aids can be especially advantageous for families seeking to address urgent costs or combine debts. Many families have successfully utilized personal loans to manage their financial needs, even with lower credit scores.

-

Cash-Out Refinance: This option allows homeowners to refinance their existing mortgage for an amount greater than what they owe, enabling them to take the difference in cash. This can be a strategic move for families looking to leverage their property’s value while potentially securing a lower interest rate on their mortgage.

-

Shared Equity Agreements: These innovative arrangements allow property owners to access their equity in return for a portion of future appreciation in their property’s value. This option can be particularly appealing for families who wish to avoid traditional debt while still accessing funds for necessary expenses.

-

Government Programs: Various government initiatives exist to assist borrowers with low financial ratings, particularly first-time homebuyers. These programs often have a reduced minimum credit score for home equity loan requirements and can offer valuable resources for families navigating the financing landscape.

In today’s borrowing landscape, personal financing options have shown promising success rates for families with low financial ratings. Financial advisors emphasize that while personal credit options may carry higher interest rates compared to home equity lines, achieving the minimum credit score for a home equity loan can be a hurdle for those unable to utilize their home equity. As one advisor pointed out, ‘Improving your score can provide you with more financing alternatives, secure a lower interest rate, and enable you to make a smaller down payment.’ This highlights the importance of enhancing credit scores over time to increase borrowing potential. We’re here to support you every step of the way as you navigate these options.

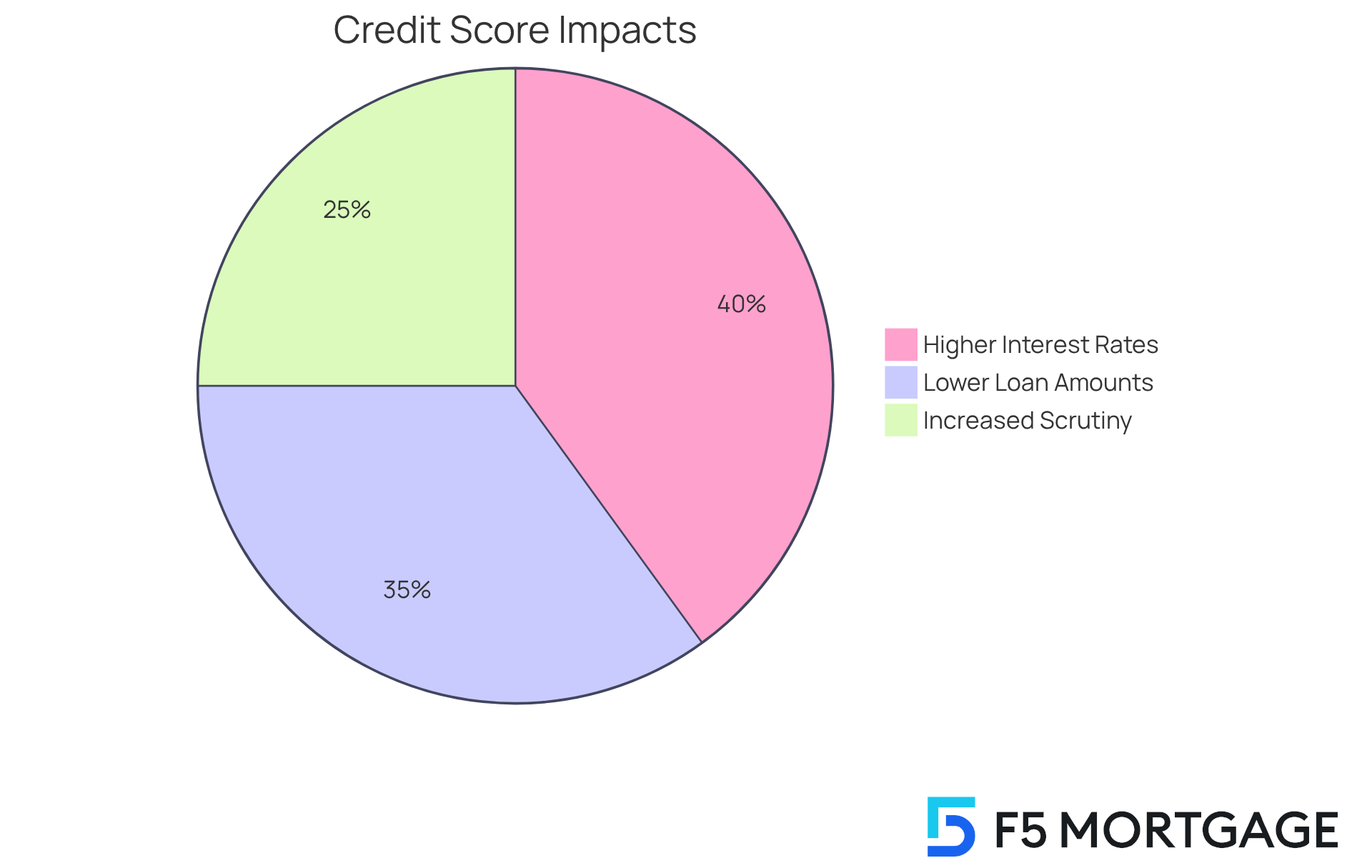

Impact of Poor Credit on Home Equity Loan Approval

Navigating the world of home financing can be daunting, especially when faced with a weak financial history. We understand how challenging this can be, as lenders often view applicants with a minimum credit score for home equity loan as higher risk. This perception can lead to several significant consequences for families seeking approval.

-

Higher Interest Rates: If you have poor credit, you might find yourself facing elevated interest rates. This can substantially increase the overall cost of your loan. For instance, individuals with a FICO score below 580 may encounter rates that are much higher than those offered to borrowers with scores above 700, highlighting that the minimum credit score for home equity loan can significantly affect the rates available.

-

Lower Loan Amounts: Lenders may limit the amount of equity available for borrowing, restricting the funds you can access. For example, a property owner with a score in the 300-600 range might qualify for an average amount of approximately $1,700, compared to $16,000 for those with scores exceeding 781.

-

Increased Scrutiny: Applications from individuals with poor credit often face more rigorous scrutiny. This can lead to longer approval times or even outright denial. Lenders typically require thorough documentation of income and employment stability, and they may impose stricter conditions on debt-to-income ratios, preferring ratios under 36% but sometimes accepting up to 50%, depending on the minimum credit score for home equity loan.

Understanding these elements is crucial for families maneuvering through the property value loan landscape. They can significantly impact both the approval process and the financial implications of borrowing against property value. Additionally, lenders will request a property appraisal to assess the current market value of your residence, revealing how much ownership you possess and influencing your rates.

To improve your chances of approval, consider enhancing your credit scores to meet the minimum credit score for home equity loan before applying. Alternatively, explore options like cash-out refinancing. When shopping for lenders, it’s essential to compare rates and terms to secure the best deal. We’re here to support you every step of the way, and consider working with F5 Mortgage for competitive rates and personalized service that meets your needs effectively.

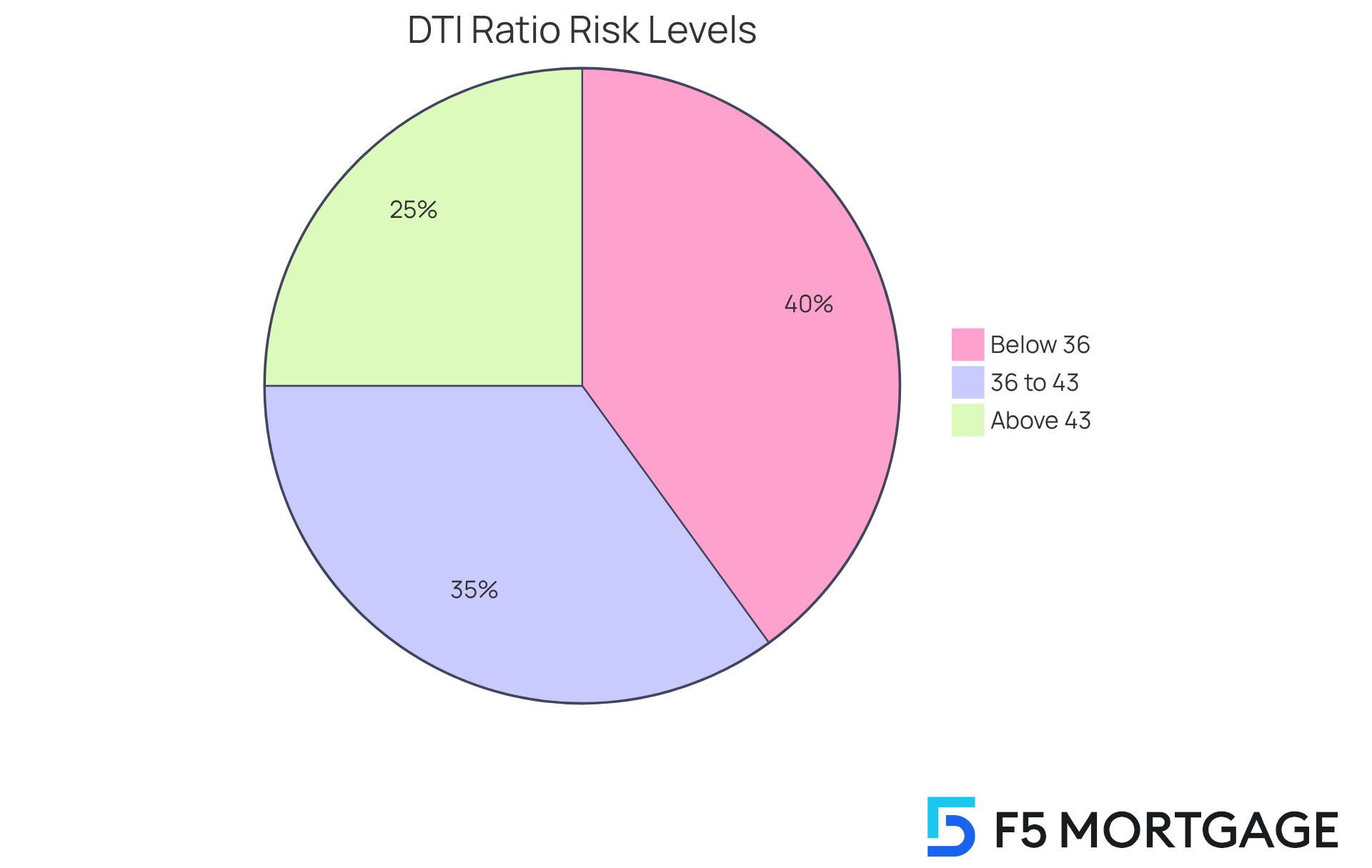

Importance of Debt-to-Income Ratio in Home Equity Loan Applications

The debt-to-income (DTI) ratio is crucial in home equity credit applications, acting as a vital indicator of a borrower’s financial well-being. This ratio measures the percentage of monthly income dedicated to debt payments. Lenders often prefer a DTI ratio of 43% or lower, suggesting that borrowers have sufficient income to manage additional debt responsibly. A lower DTI ratio not only boosts approval chances but can also lead to better conditions, such as reduced interest rates.

For families striving to improve their DTI ratios, taking proactive steps can yield significant benefits. For instance, by reducing existing debts or increasing their income through side jobs, many families have successfully lowered their DTI ratios, thereby enhancing their chances for more favorable financing terms. Statistics reveal that borrowers with a DTI ratio below 36% are often seen as lower risk, which can lead to higher approval rates and more competitive financing offers.

As we look ahead to 2025, the standards for property-backed financing remain stringent, with most lenders still favoring a DTI ratio of 36% or lower. This preference highlights the importance of effective debt management. Families aiming to secure a property-backed financing option should focus on reducing their DTI ratio, as this significantly influences their approval chances and the overall terms of their financing. By understanding and optimizing their DTI, borrowers can position themselves more favorably in the eyes of lenders, ultimately helping them achieve their financial goals. We know how challenging this can be, and we’re here to support you every step of the way.

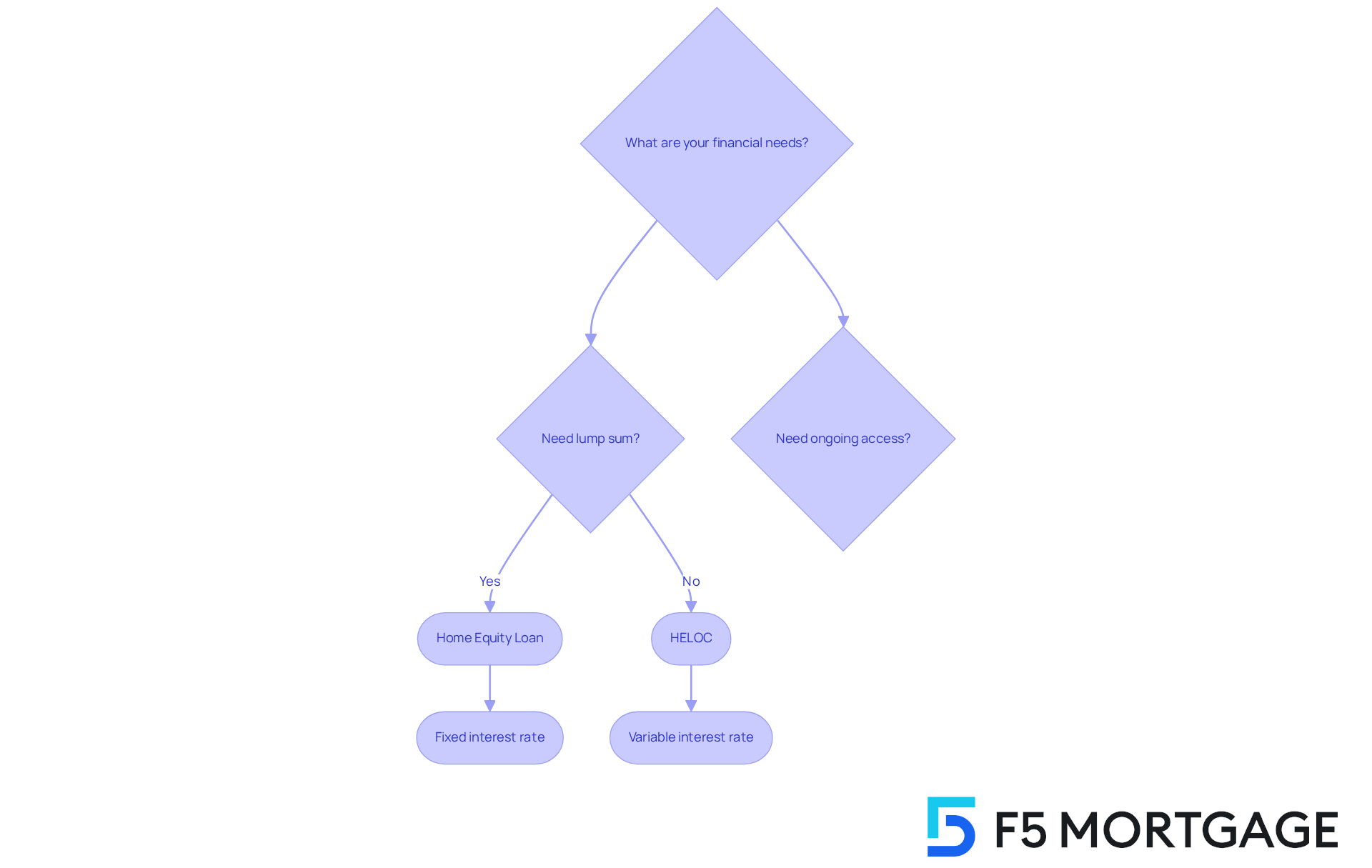

Home Equity Loans vs. HELOCs: Key Differences Explained

Home equity loans and home equity lines of credit (HELOCs) are two popular options for accessing home equity, each catering to different financial needs. We understand how important it is to make the right choice for your family’s future.

Home Equity Loans: These loans provide a lump-sum payment with fixed interest rates. Borrowers receive a one-time amount that is repaid over a predetermined term. As of September 2025, the average rate for a 10-year equity loan is approximately 8.36%. This makes it a reliable option for those who prefer consistent payments, offering peace of mind.

HELOCs: In contrast, HELOCs function as revolving lines of credit, allowing you to withdraw funds as needed, much like a credit card. These typically come with variable interest rates, which can fluctuate based on market conditions. Currently, average HELOC rates are around 8.05%. This adaptability can be beneficial for families who may require access to funds occasionally for renovations or other costs.

When choosing between a property-backed credit option and a HELOC, it’s essential to evaluate your financial objectives and situations. For instance, a household preparing for a major renovation may opt for a HELOC to access funds as required. Meanwhile, another household aiming for a set amount for a specific project might favor a second mortgage for its consistency.

Financial advisors emphasize the importance of understanding these differences. As one specialist observes, “Selecting between a property-backed financing option and a HELOC relies on your financial circumstances and how you intend to utilize the funds.” This insight highlights the necessity of evaluating personal needs before making a decision.

In real-world scenarios, families often weigh their options based on current interest rates and their long-term financial plans. For example, a household with a low-rate primary mortgage might find a second mortgage attractive to preserve their current rate while obtaining necessary funds. Conversely, those anticipating fluctuating expenses may lean towards a HELOC for its adaptability.

Ultimately, grasping the subtleties of residential asset financing and HELOCs can empower families to make knowledgeable choices that align with their financial goals. We’re here to support you every step of the way as you navigate these important decisions.

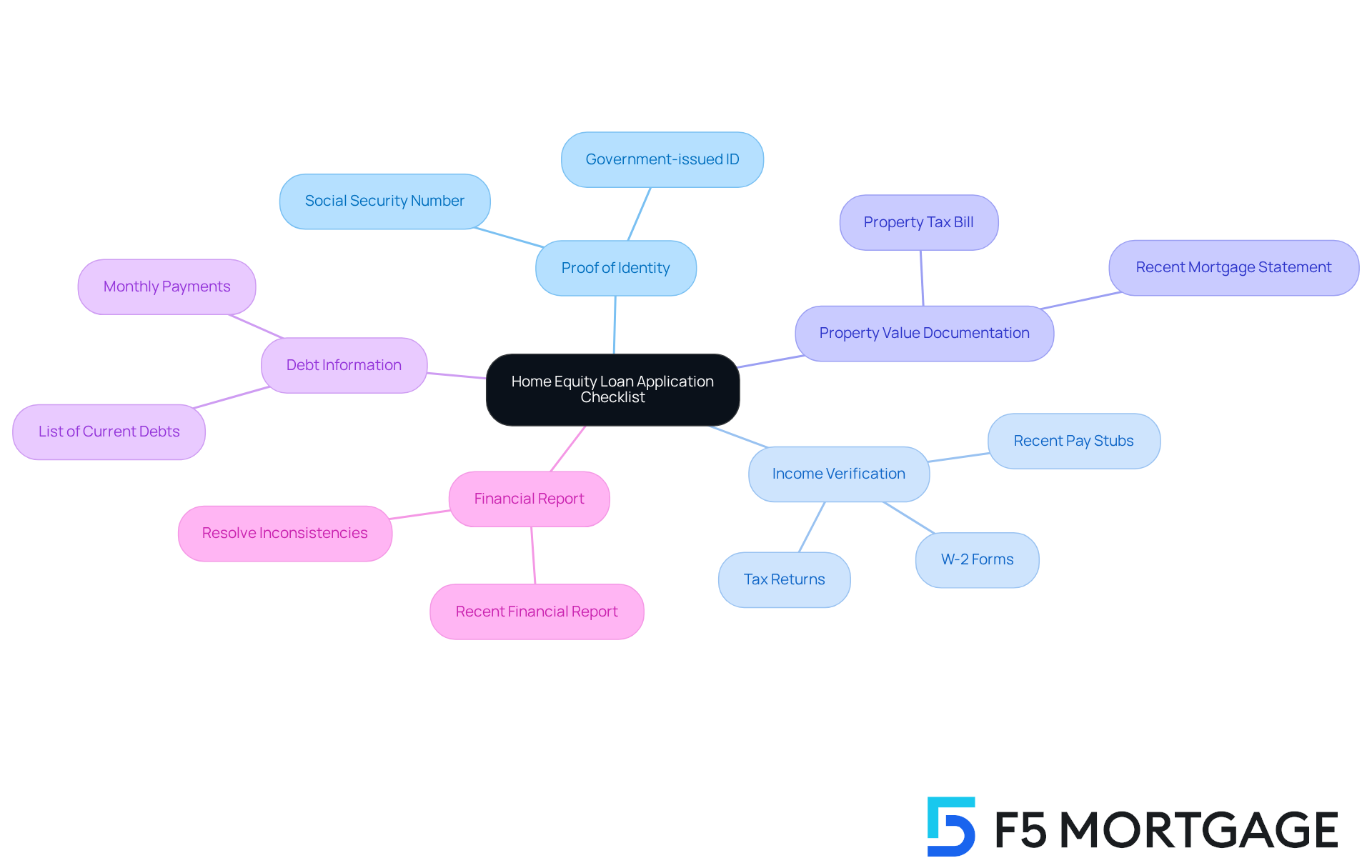

Checklist for Applying for a Home Equity Loan

When applying for a home equity loan, we understand how overwhelming this process can feel. To help families navigate this journey with ease, it’s essential to prepare the following documents:

- Proof of Identity: A government-issued ID and Social Security number are necessary to verify your identity.

- Income Verification: Recent pay stubs, W-2 forms, or tax returns demonstrate stable income, which is vital for your application.

- Property Value Documentation: A recent mortgage statement and property tax bill assist in determining your current stake in the residence.

- Debt Information: A comprehensive list of current debts and monthly payments is crucial for assessing your debt-to-income ratio.

- Financial Report: Obtaining a recent financial report allows you to examine and resolve any inconsistencies that may influence your application.

Families often face common documentation issues, such as missing pay stubs or outdated tax returns, which can delay the application process. To avoid these pitfalls, we encourage you to gather all necessary documents well in advance. For instance, the Johnson family effectively prepared for their property financing application by organizing their financial documents and ensuring their financial report was accurate. This proactive approach led to a seamless approval process.

By being meticulous and prepared, you can navigate the property financing application with confidence. Remember, we’re here to support you every step of the way, helping you secure the funds you need for your financial goals.

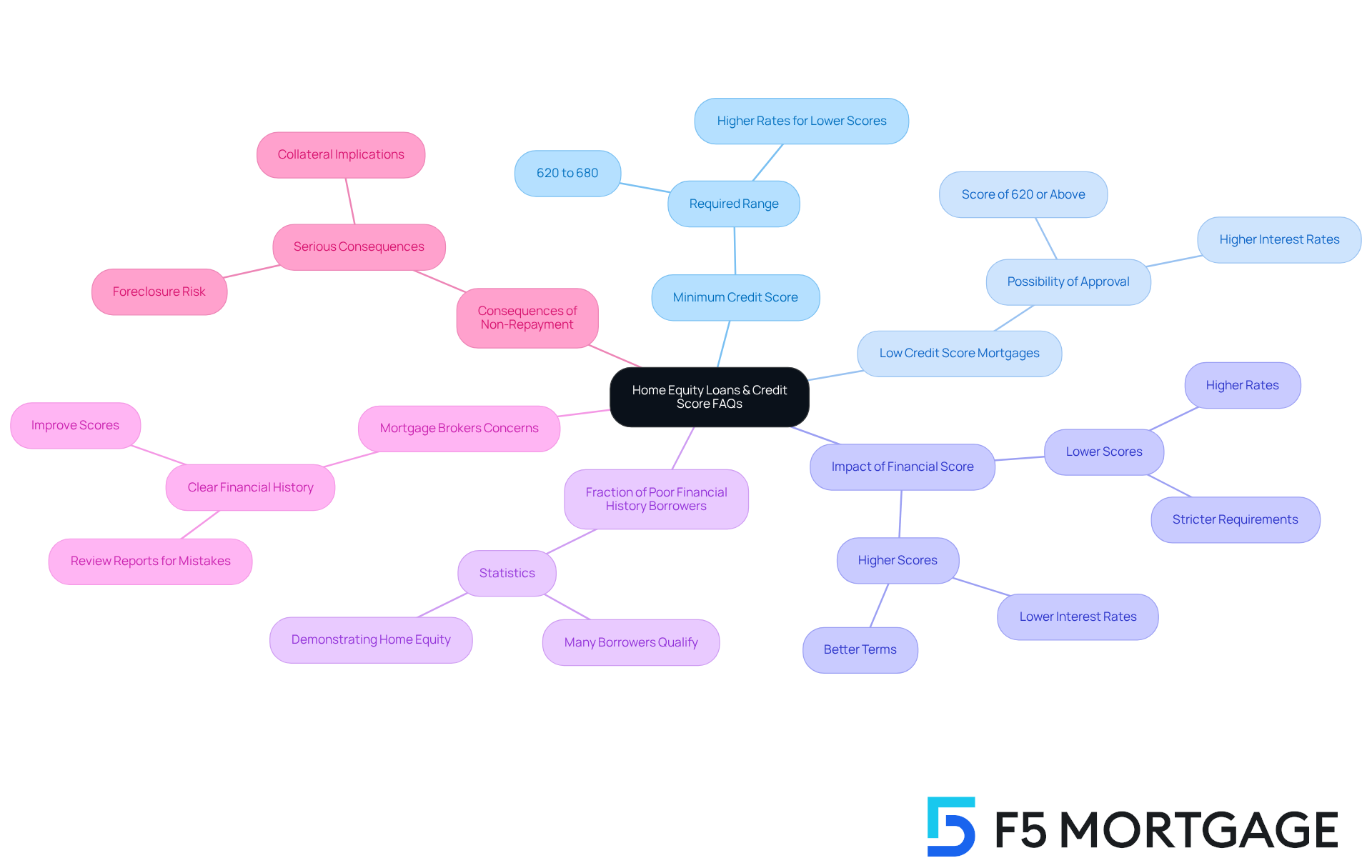

FAQs About Home Equity Loans and Credit Score Requirements

Here are some frequently asked questions regarding home equity loans and credit score requirements:

-

What is the minimum credit score needed for a home equity loan? We understand that navigating credit requirements can be daunting. Generally, the minimum credit score for a home equity loan is required to be between 620 and 680, depending on the lender’s criteria. While some lenders may allow lower scores, the minimum credit score for a home equity loan often results in higher interest rates. It’s essential to recognize that residential value financing options and HELOCs typically have elevated score prerequisites compared to conventional mortgage financing.

-

Can I obtain a mortgage against my property with a low credit score? While it may feel challenging, it is possible to obtain a property-backed financing option with a score of 620 or above. However, be prepared for elevated interest rates and potentially stricter terms. Many borrowers with scores below 620 manage to secure home equity financing by demonstrating sufficient home equity or choosing smaller amounts, which can help alleviate lender concerns.

-

How does my financial score influence my borrowing conditions? We know how important it is to understand how your score affects your options. An elevated score generally results in reduced interest rates and more advantageous borrowing terms. Conversely, a lower score can lead to higher rates and stricter requirements, making it essential for borrowers to comprehend their financial standing before applying.

-

What fraction of individuals with poor financial history obtain property financing? While specific statistics differ, many borrowers with scores below 620 still manage to secure home equity financing. By demonstrating sufficient home equity or opting for smaller amounts, they can often alleviate lender concerns.

-

What common concerns do mortgage brokers have regarding borrowing scores? Mortgage brokers frequently emphasize that a clear financial history is crucial for obtaining better loan terms. They recommend prospective borrowers review their reports for mistakes and consider methods for enhancing their scores, such as lowering utilization and making prompt payments. As Darren Tooley, a certified mortgage advisor, notes, “One item that can often boost your score in a short period is paying down credit card balances, ideally under 10% of the credit limit.”

-

What occurs if I do not repay a mortgage secured by my property? We want to ensure you understand the stakes. Failing to repay a home equity loan can lead to serious consequences, including foreclosure, as the home serves as collateral. Therefore, it’s essential for borrowers to assess their financial situation carefully before taking on this type of debt.

Conclusion

Navigating the complexities of home equity loans can feel overwhelming, but understanding credit score requirements and alternative financing options can provide clarity. Maintaining a healthy credit score, typically between 620 and 680, is crucial for securing favorable terms on home equity loans. We know how challenging this can be, but families can enhance their chances of approval by implementing strategies such as:

- Reducing debt

- Making timely payments

- Monitoring their credit reports

Key insights include:

- Recognizing the importance of the debt-to-income ratio

- Understanding how poor credit impacts loan approval

- Exploring various alternatives available for those with lower credit scores

Additionally, thorough documentation and preparation are essential when applying for a home equity loan, ensuring families are well-equipped to navigate the lending landscape.

Ultimately, the ability to leverage home equity can significantly enhance a family’s financial situation. By focusing on improving credit scores and understanding the nuances of different loan options, borrowers can position themselves for success. Embracing these strategies not only opens doors to financing opportunities but also empowers families to make informed decisions that align with their long-term financial goals. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage offers home equity loans and credit score guidance, providing personalized consultations and a diverse selection of financing options tailored to families’ unique financial situations.

What is the minimum credit score required for home equity loans in 2025?

The minimum credit score for home equity loans in 2025 typically ranges between 620 and 680, depending on the lender. Some lenders may accept scores as low as 620, while others may require scores of 680 or higher for better terms.

How can I improve my credit score for home equity loan approval?

To improve your credit score, you can pay down existing debt, make timely payments, limit new account applications, check your financial report for errors, monitor your credit regularly, understand your debt-to-income ratio, and explore refinancing alternatives.

Why is maintaining a good credit score important for home equity loans?

Maintaining a good credit score is essential because it affects your eligibility for loans and influences the interest rates available to you. A higher score increases your chances of approval and securing favorable terms.

What strategies can help lower my credit utilization ratio?

Prioritizing the reduction of credit card balances can help lower your credit utilization ratio. Ideally, you should keep it below 30% to see significant improvements in your credit score.

How does timely payment affect my credit score?

Timely payments are crucial for building a favorable payment history, which accounts for 35% of your credit score. Setting up automatic payments or reminders can help ensure you never miss a due date.

What is the significance of the debt-to-income (DTI) ratio?

Keeping a debt-to-income ratio of 43% or less is vital for loan approval, as it helps lenders assess your ability to manage additional debt. A better DTI can also lead to more competitive mortgage rates.

How often should I check my financial report?

You should regularly review your financial report for errors and dispute any inaccuracies, as fixing them can lead to an average score improvement of about 16 points, boosting your chances of financing approval.

What refinancing options are available through F5 Mortgage?

F5 Mortgage offers various refinancing options, including conventional mortgages, FHA programs, and VA programs, each with different eligibility requirements and benefits.