Overview

A credit score of 700 is more than just a number; it represents a valuable financial asset that can significantly impact your life. We understand how important it is to have a reliable borrowing history, as it opens doors to securing loans at favorable interest rates. This can enhance your overall financial opportunities, making a real difference for you and your family.

Imagine being able to enjoy lower monthly payments, increasing your chances of getting accepted for rental applications, and having greater negotiating power when it comes to loans. These benefits contribute to your financial well-being, allowing you to focus on what truly matters in life.

We know how challenging navigating the financial landscape can be, but achieving a 700 credit score can empower you. Take this step towards improved financial health, and remember, we’re here to support you every step of the way.

Introduction

Achieving a credit score of 700 is often seen as a significant milestone in personal finance, laying a solid foundation for your financial health. This score not only reflects a reliable borrowing history but also opens doors to numerous opportunities, such as securing loans at favorable rates and enhancing rental applications.

However, we understand that many individuals grapple with the question: what truly makes a 700 credit score a valuable asset? By exploring the nuances behind this benchmark, we can illuminate its profound impact on your financial decisions and long-term goals. Remember, we’re here to support you every step of the way.

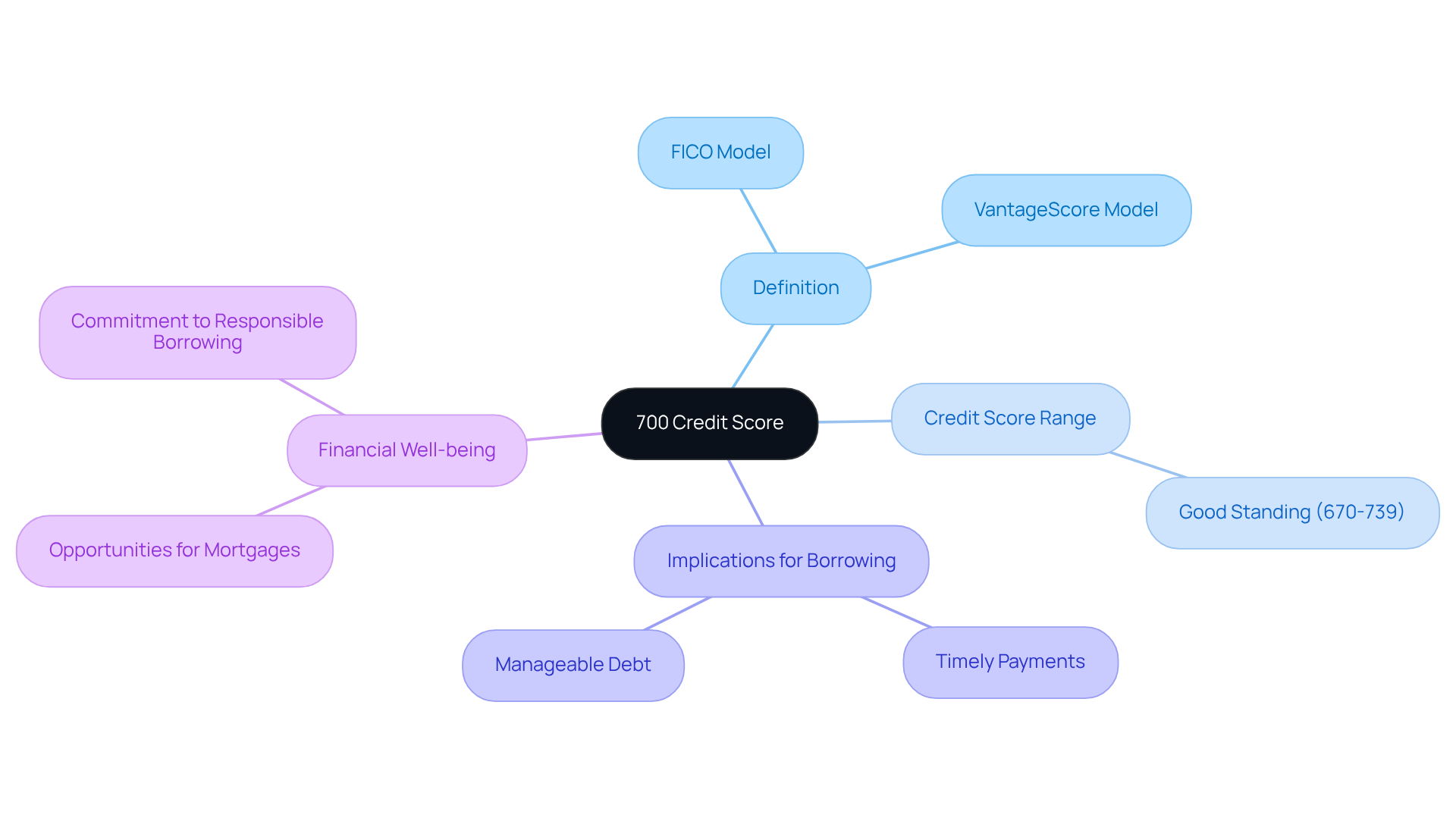

Defining a 700 Credit Score

According to well-known assessment models like FICO and VantageScore, a rating of 700 is often seen as a ‘good’ rating. This rating reflects a dependable borrowing history, which means there’s a lower risk for lenders. Specifically, a score of 700 raises the question of whether a 700 credit score is good, as it falls within the range of 670 to 739, categorized as good standing. Achieving this rating demonstrates a pattern of timely payments, a manageable level of debt, and a diverse mix of financial products. This establishes it as a vital benchmark for financial well-being.

We know how important it is to feel secure in your financial journey. Reaching a score of 700 is not just a number; it raises the question of whether a 700 credit score is good, as it represents your commitment to responsible borrowing. It’s a step towards greater opportunities, whether you’re looking to secure a mortgage or simply improve your financial health. Remember, every effort you make in managing your finances contributes to this achievement, and we’re here to support you every step of the way.

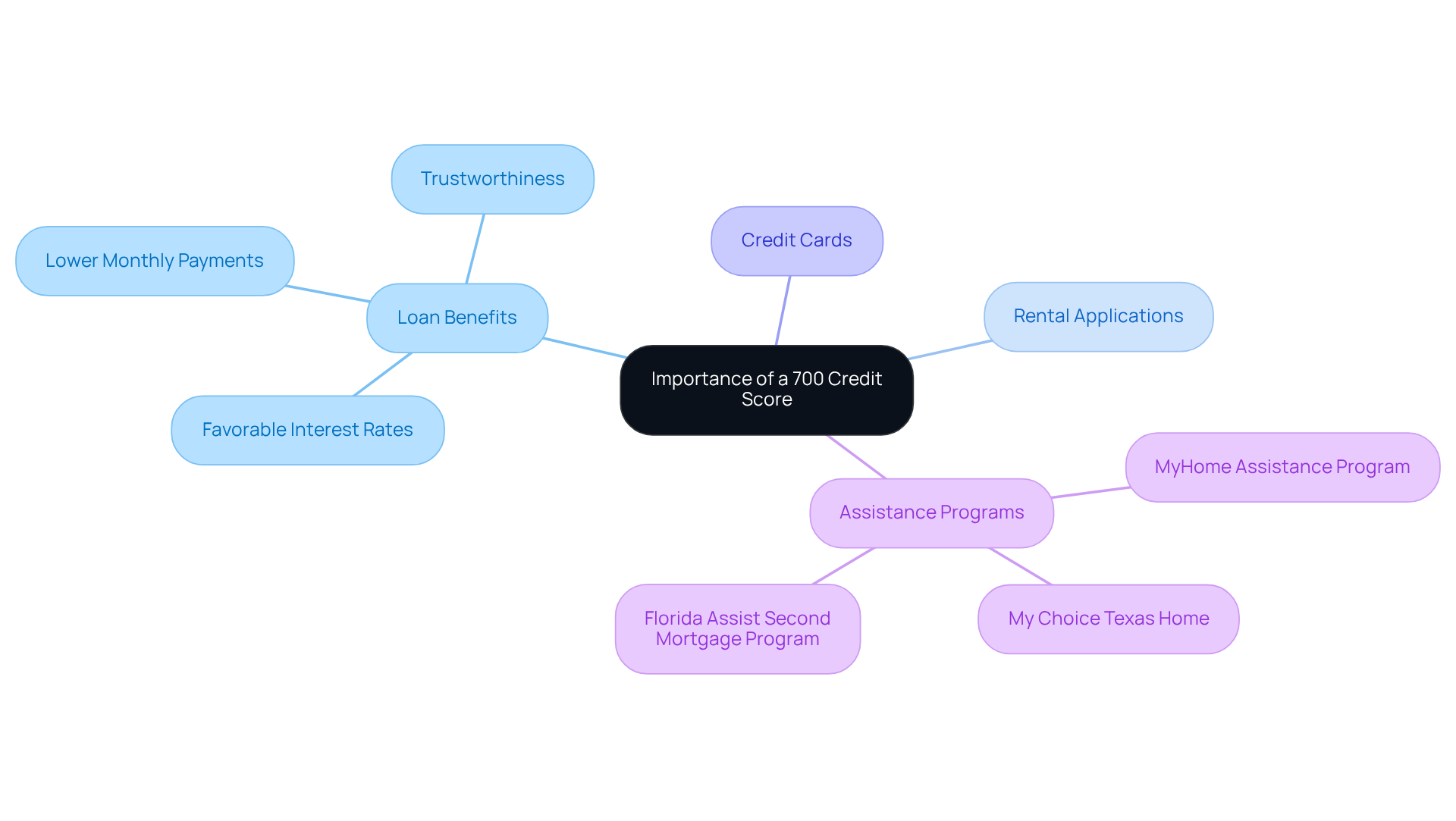

The Importance of a 700 Credit Score in Financial Health

One might wonder, is a 700 credit score good for many reasons? It significantly enhances your ability to secure loans, including mortgages, at favorable interest rates. Lenders view borrowers with a rating of 700 as trustworthy, which can lead to lower monthly payments and reduced overall borrowing costs. We understand how important this can be for your financial well-being.

Moreover, having a favorable financial rating simplifies the acceptance process for rental applications and credit cards, providing you with greater monetary flexibility. For families looking to upgrade their homes, F5 Mortgage offers a variety of down payment assistance programs. For instance, the MyHome Assistance Program in California provides up to 3% of the home’s purchase price, while the My Choice Texas Home program offers up to 5% for down payment and closing assistance.

In Florida, you can benefit from programs like the Florida Assist Second Mortgage Program, which can provide up to $10,000 for upfront costs. Determining if a 700 credit score is good is essential for achieving long-term financial goals, such as homeownership and investment opportunities. This is particularly important when combined with F5 Mortgage’s commitment to transparency and customer-focused, technology-driven services. We’re here to support you every step of the way as you navigate your financial journey.

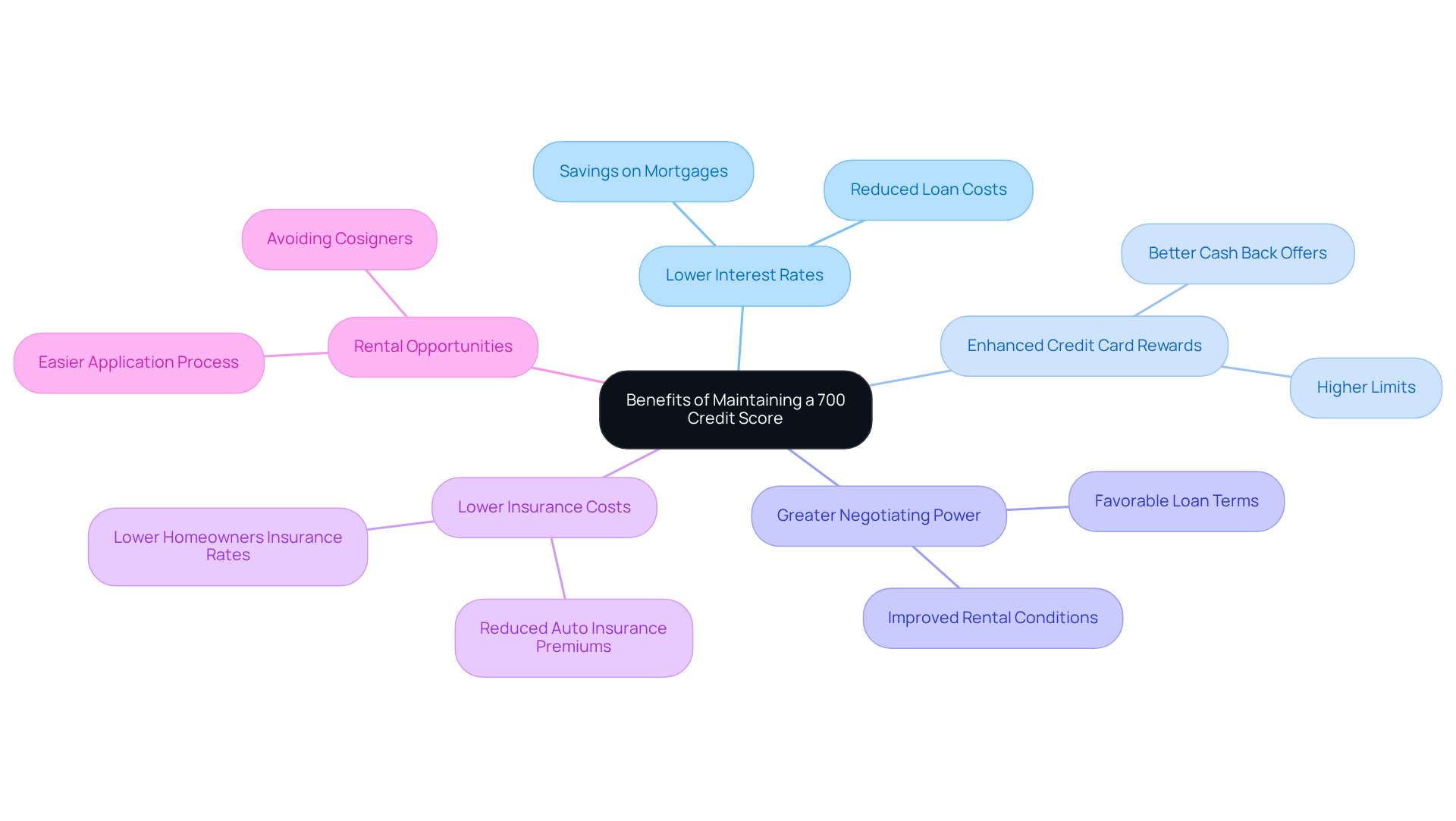

Benefits of Maintaining a 700 Credit Score

The question of whether maintaining a 700 rating is a 700 credit score good can truly transform your financial landscape. We understand how challenging it can be to navigate the complexities of loans and credit, but knowing if a 700 credit score is good can offer significant advantages. Many wonder if a 700 credit score is good, as individuals with this rating often qualify for reduced interest rates on loans and credit cards, potentially saving thousands of dollars over time. For instance, imagine a 1% reduction in interest rates on a $300,000 mortgage—this could save you over $200 each month, leading to substantial savings over 30 years.

Moreover, a strong financial rating not only opens the door to lower rates but also enhances your credit card rewards. Think about the possibilities: higher limits and better cash back or travel points can further boost your financial flexibility. Additionally, when considering if a 700 credit score is good, it empowers you with greater negotiating power when seeking loans, allowing you to secure more favorable terms.

Looking ahead to 2025, individuals with a rating of 700 or above are likely to enjoy even lower interest rates, making financial products and services more accessible. It’s important to note that a rating of 620 is often the minimum required to qualify for an apartment, highlighting the importance of maintaining a favorable rating for rental applications. Furthermore, favorable ratings can lead to reduced auto insurance costs in certain states, showcasing the extensive benefits of upholding a positive financial standing.

Overall, the financial advantages linked to a credit score that is a 700 credit score good can profoundly impact your economic well-being. By opening doors to better loan conditions, lower insurance costs, and enhanced rental opportunities, you can take significant steps toward a more secure financial future. Remember, we’re here to support you every step of the way as you work toward achieving and maintaining this important goal.

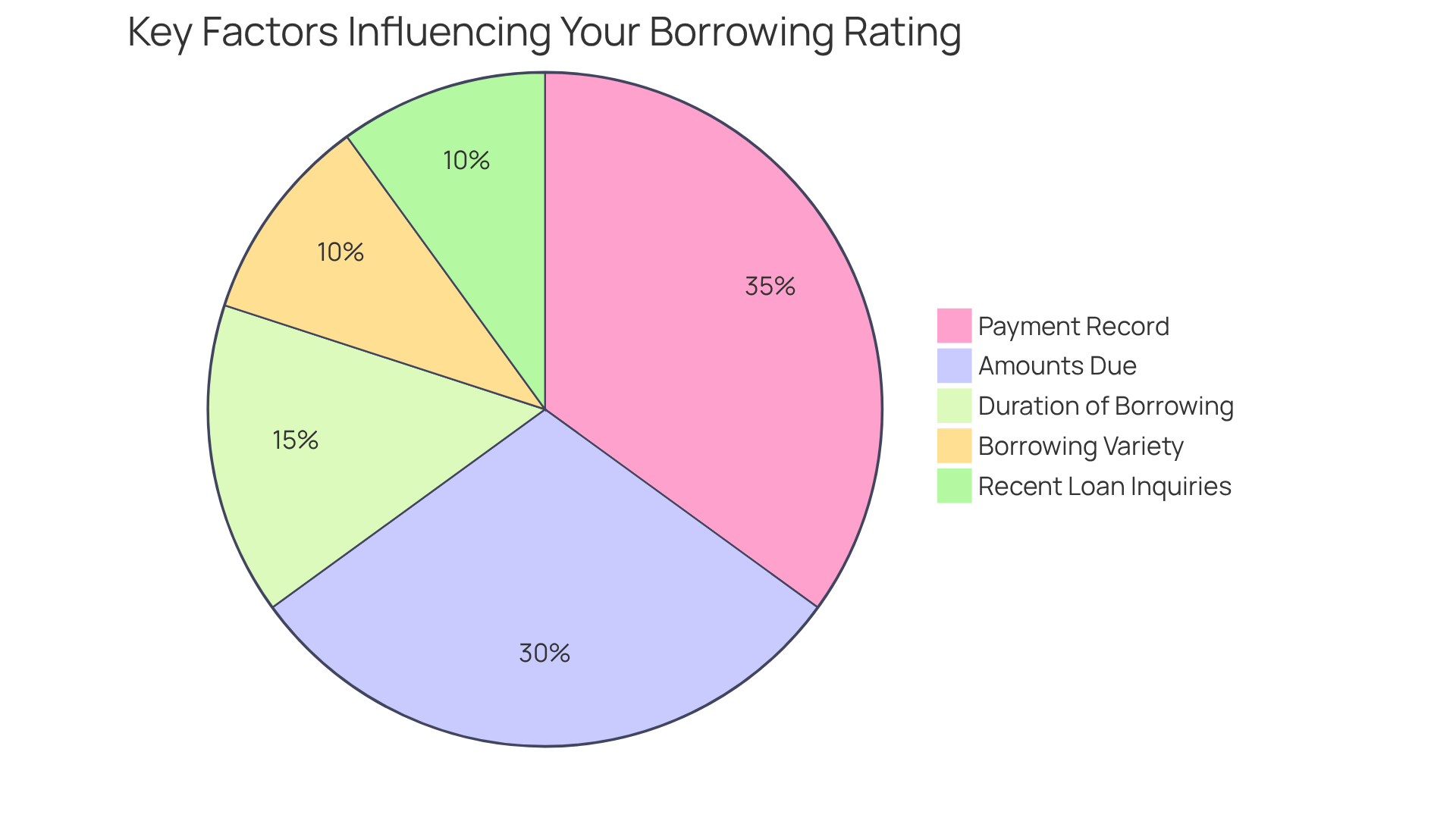

Key Factors Influencing Your Credit Score

Understanding your borrowing rating can feel overwhelming, but we’re here to support you every step of the way. Several essential elements come into play, including:

- Your payment record

- Amounts due

- Duration of your borrowing background

- Borrowing variety

- Recent loan inquiries

Among these, your payment history is the most significant factor, making up about 35% of your rating. Prompt payments on loans and credit cards are crucial for maintaining a favorable rating.

It’s important to keep your amounts owed, or utilization ratio, ideally below 30% of your available funds. This can help you feel more in control of your credit health. Additionally, the duration of your borrowing history accounts for approximately 15% of your rating, with longer histories often being more beneficial. A varied borrowing mix, which includes installment loans and revolving accounts, can also positively influence your rating.

However, be mindful that new loan inquiries can temporarily reduce your score. It’s wise to limit applications for new accounts to protect your rating. By understanding these factors, you can take proactive steps toward improving your credit health and achieving your financial goals.

Conclusion

Achieving a 700 credit score is not just a number; it represents a significant milestone in personal finance, laying a strong foundation for your financial stability and opportunities. This score reflects a history of responsible borrowing and opens doors to better interest rates, favorable loan terms, and enhanced financial flexibility. Understanding the implications of a 700 credit score highlights its importance as a valuable asset in navigating the complexities of your financial decisions.

Throughout this article, we’ve explored the many benefits of maintaining a 700 credit score. From securing lower mortgage rates to improving your rental application prospects, individuals with this score enjoy a range of financial advantages. Key factors influencing credit scores, such as payment history and credit utilization, play a crucial role in achieving and sustaining this rating. This underscores the importance of proactive financial management.

In conclusion, a 700 credit score is a gateway to financial empowerment. By prioritizing responsible credit practices and understanding the factors that influence your credit health, you can significantly enhance your economic well-being. Embracing the journey toward maintaining a strong credit score can lead to substantial long-term savings and opportunities. It’s a crucial focus for anyone looking to secure their financial future, and remember, we’re here to support you every step of the way.

Frequently Asked Questions

What does a 700 credit score signify?

A 700 credit score is often seen as a ‘good’ rating, indicating a dependable borrowing history and a lower risk for lenders.

What range is a 700 credit score categorized in?

A 700 credit score falls within the range of 670 to 739, which is categorized as good standing.

What factors contribute to achieving a 700 credit score?

Achieving a 700 credit score demonstrates a pattern of timely payments, a manageable level of debt, and a diverse mix of financial products.

Why is a 700 credit score considered important?

A 700 credit score is a vital benchmark for financial well-being, representing a commitment to responsible borrowing and opening up greater opportunities for loans and financial health improvements.

How can I improve my credit score to reach 700?

Improving your credit score involves managing your finances responsibly, making timely payments, maintaining a manageable level of debt, and having a diverse mix of financial products.