Overview

In today’s financial landscape, we understand how overwhelming it can be for families to navigate refinancing options. The current VA Interest Rate Reduction Refinance Loan (IRRRL) rates are crucial to consider. As of October 2025, the national average IRRRL rate stands at approximately 6.48%. However, some lenders are offering rates as low as 5.500%.

This presents a valuable opportunity for families looking to achieve significant savings in their monthly payments and overall mortgage costs. Evaluating these refinancing options can lead to a more manageable financial future. Remember, we’re here to support you every step of the way as you explore the best choices for your family’s needs.

Introduction

Navigating the complexities of refinancing can feel overwhelming, especially for military families striving to secure their financial futures. We understand how challenging this can be. The VA Interest Rate Reduction Refinance Loan (IRRRL) program presents a streamlined pathway to lower monthly payments and reduce interest rates, making it a compelling option for veterans.

However, with fluctuating rates and varying eligibility criteria, how can service members ensure they are making the best decision for their unique circumstances? This article delves into the current IRRRL rates, the benefits and drawbacks of the program, and essential insights that every veteran should consider when refinancing their home.

We’re here to support you every step of the way.

F5 Mortgage: Competitive VA IRRRL Rates and Personalized Service

At F5 Mortgage LLC, we understand how challenging navigating the world of VA refinancing can be for military service members and their families. That’s why we offer some of the most competitive rates available, specifically tailored to meet your unique financial circumstances. Our commitment to personalized service means that you will receive a mortgage solution designed just for you.

Our dedicated specialists are here to assist you every step of the way, ensuring that the loan restructuring process is smooth and worry-free. This focus on client satisfaction is reflected in our impressive customer satisfaction rate of 94%. In 2025, the current IRRRL rates for a VA streamline refinance are approximately 5.500% for a 30-year term, which can significantly lower your monthly payments.

The VA IRRRL program simplifies obtaining a new loan by eliminating the need for home appraisals and income verification. This makes it a viable choice for many families. Many former service members have shared successful loan modification experiences, highlighting the program’s advantages, such as reduced interest rates and the option to incorporate closing expenses into the mortgage.

By choosing F5 Mortgage, you can confidently navigate the refinancing landscape. We’re here to support you in securing favorable terms that enhance your financial stability. Let us help you take this important step towards a brighter financial future.

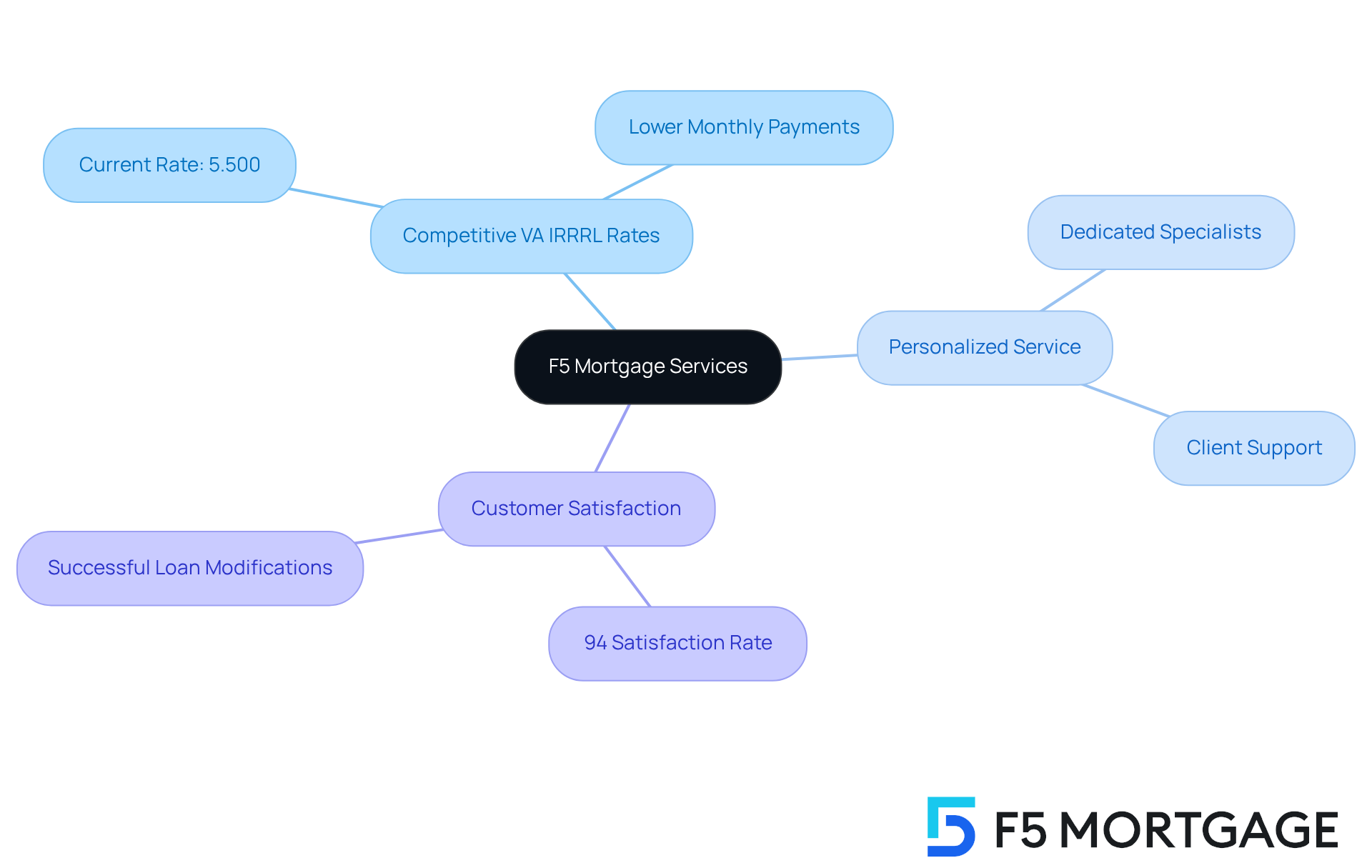

Current VA IRRRL Rates: What Veterans Should Expect

As of October 10, 2025, we understand that navigating the world of refinancing can be overwhelming. The national average for a 30-year VA Interest Rate Reduction Refinance Loan (IRRRL) reflects the current irrrl rates at approximately 6.48%, with an APR of 5.792%. However, it’s important to note that rates can fluctuate based on various factors, including the lender, credit score, and amount borrowed. Currently, some lenders are offering current irrrl rates as low as 5.500% for a 30-year streamline refinance.

This variance underscores the importance for veterans to actively evaluate their options. Even a minor decrease in interest rates can lead to significant savings over the life of the mortgage. For instance, a reduction of just 0.5% could save borrowers tens of thousands of dollars in interest payments. We understand how challenging this can be, and staying informed about the current irrrl rates is crucial.

Understanding how these rates can impact your overall refinancing costs is essential for the financial well-being of families looking to optimize their mortgage terms. We’re here to support you every step of the way as you explore your options.

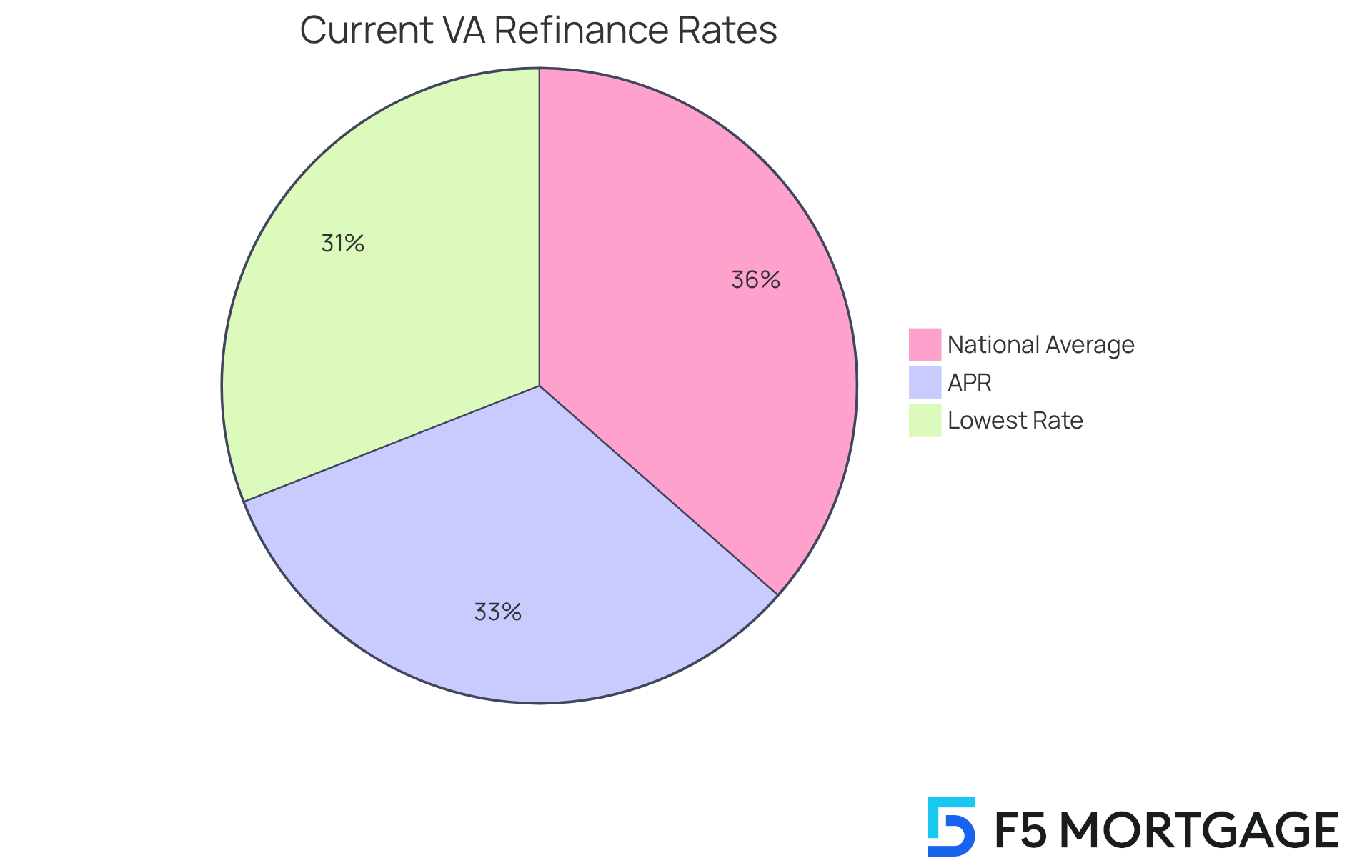

Eligibility Criteria for VA IRRRL: Who Can Apply?

If you’re considering the VA Interest Rate Reduction Refinance Program (IRRRL), it’s important to know that you must already have a VA-backed mortgage. To qualify, you need to be current on your mortgage payments and have made at least six consecutive payments on your original loan. This program is tailored specifically for former service members, offering a streamlined refinancing option that minimizes documentation requirements.

In 2025, a significant number of former service members are eligible for the VA refinancing program, highlighting its ongoing commitment to supporting military families. Many veterans transitioning from active duty to civilian life find this program particularly beneficial, as it allows them to refinance at lower rates without the hassle of extensive paperwork.

Experts agree that the VA refinancing program is especially advantageous for former service members looking to lower their current IRRRL rates or switch from an adjustable-rate mortgage to a fixed-rate option. This flexibility not only helps with financial management but also boosts long-term savings potential. Ultimately, the VA program stands out as one of the most accessible loan solutions available, ensuring that former service members can fully utilize their benefits. We know how challenging this process can be, and we’re here to support you every step of the way.

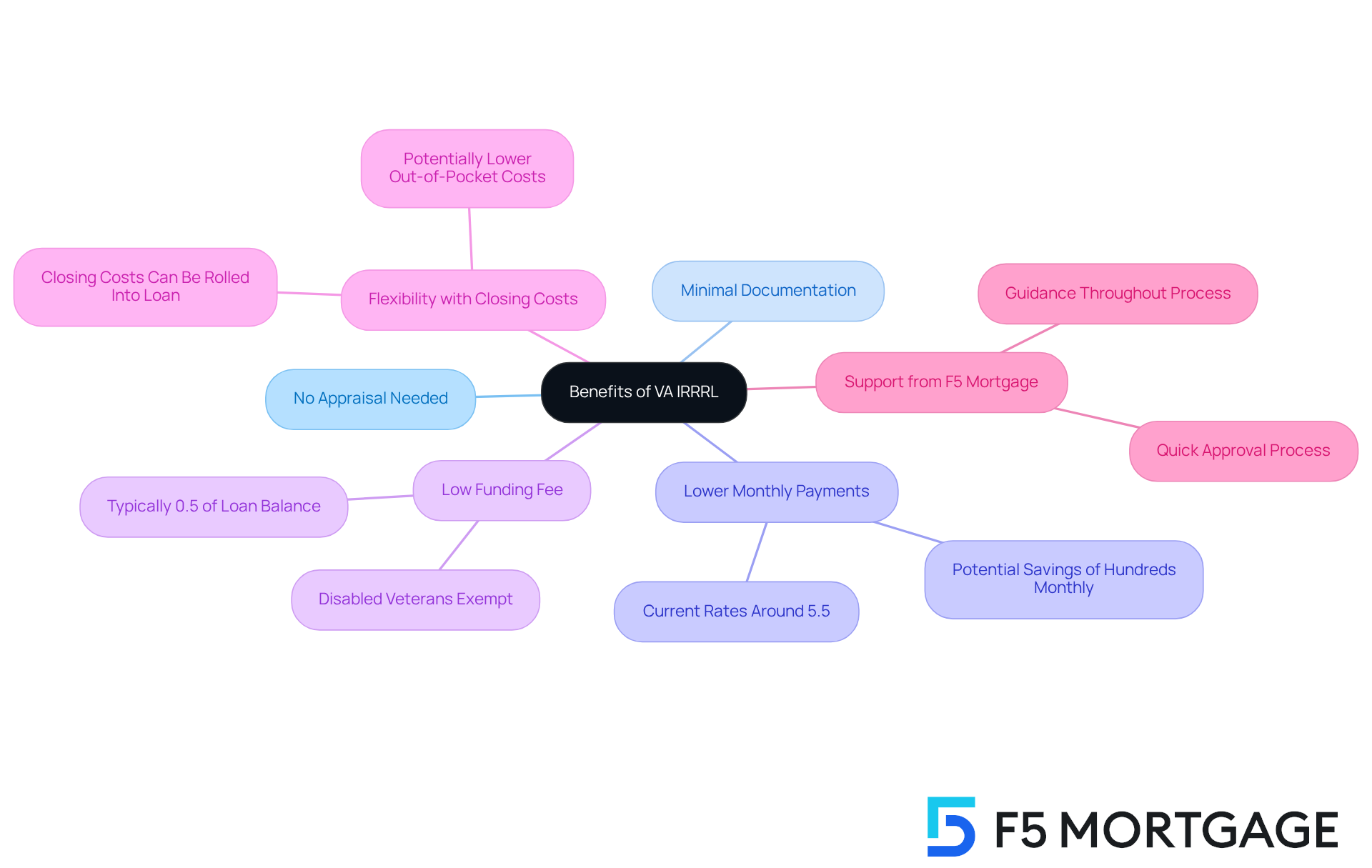

Benefits of VA IRRRL: Why Choose This Refinancing Option?

The VA IRRRL program offers numerous advantages for veterans who are looking to simplify their refinancing experience with F5 Mortgage. We understand how overwhelming this process can be, which is why this program eliminates the need for an appraisal and requires minimal documentation. This makes for a swift and efficient refinancing journey.

This program is especially beneficial for those seeking to lower their monthly payments while transitioning to a more stable financing arrangement. With the funding fee for IRRRLs typically set at just 0.5% of the loan balance, it stands out as a cost-effective alternative to other VA loan options that may come with higher fees. Disabled servicemen are exempt from this fee, making it even more affordable.

Many former service members have successfully reduced their monthly expenses through this refinancing program, often saving hundreds of dollars each month. As of September 2025, the current IRRRL rates are around 5.5%, a decrease from previous years, presenting a favorable opportunity for refinancing.

Experts emphasize that the IRRRL is designed to provide significant financial assistance, allowing service members to enjoy reduced interest rates without the burden of extensive documentation. Moreover, F5 Mortgage, as a dedicated broker, is here to support you throughout the refinancing process, ensuring that you can explore your options efficiently.

The program also offers flexibility regarding closing costs, which can be included in the new loan. This feature enhances affordability and enables service members to achieve greater financial stability on their homeownership journey. For more information on how to start the VA refinancing process, we encourage veterans to consult with a VA-approved lender or visit the U.S. Department of Veterans Affairs website.

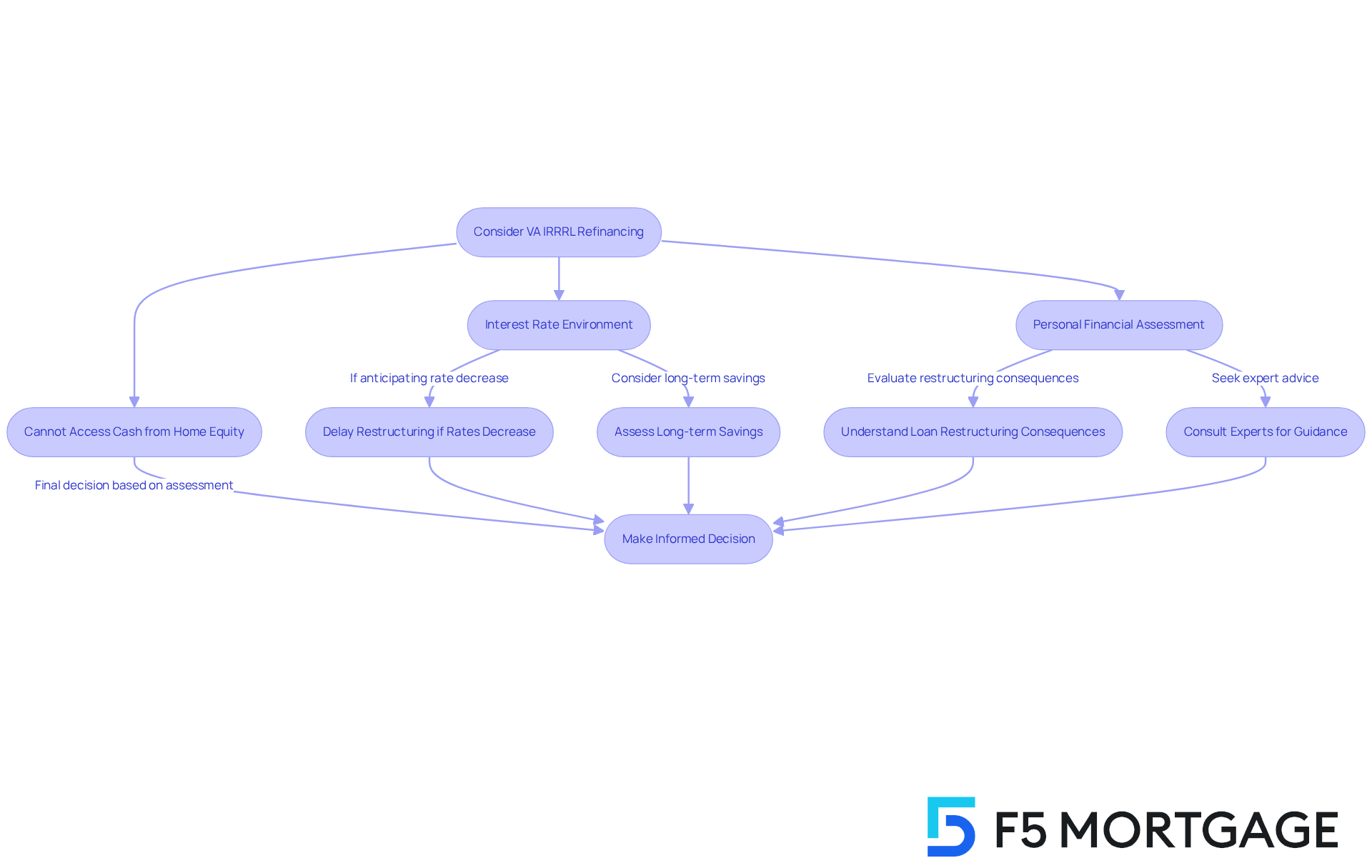

Drawbacks of VA IRRRL: What to Consider Before Refinancing

While the VA refinancing program offers numerous benefits, it’s important to consider potential drawbacks with care. One significant limitation is that the IRRRL cannot be used to access cash from home equity; it strictly serves to refinance existing VA loans. In a fluctuating interest rate environment, veterans might find it wise to delay restructuring their loans if they anticipate further rate decreases. This could lead to improved long-term savings.

Assessing personal financial situations and aligning loan modification choices with long-term objectives is essential. We know how challenging this can be, and experts stress the importance of understanding the consequences of loan restructuring. As one expert puts it, ‘you need to ensure that the deal makes sense not just today but tomorrow, too.’

Additionally, the average waiting period for VA refinancing in 2025 is expected to be more efficient, usually allowing for faster processing compared to conventional refinancing options. Ultimately, former service members should carefully weigh these factors to make informed decisions that best suit their financial futures. Remember, we’re here to support you every step of the way.

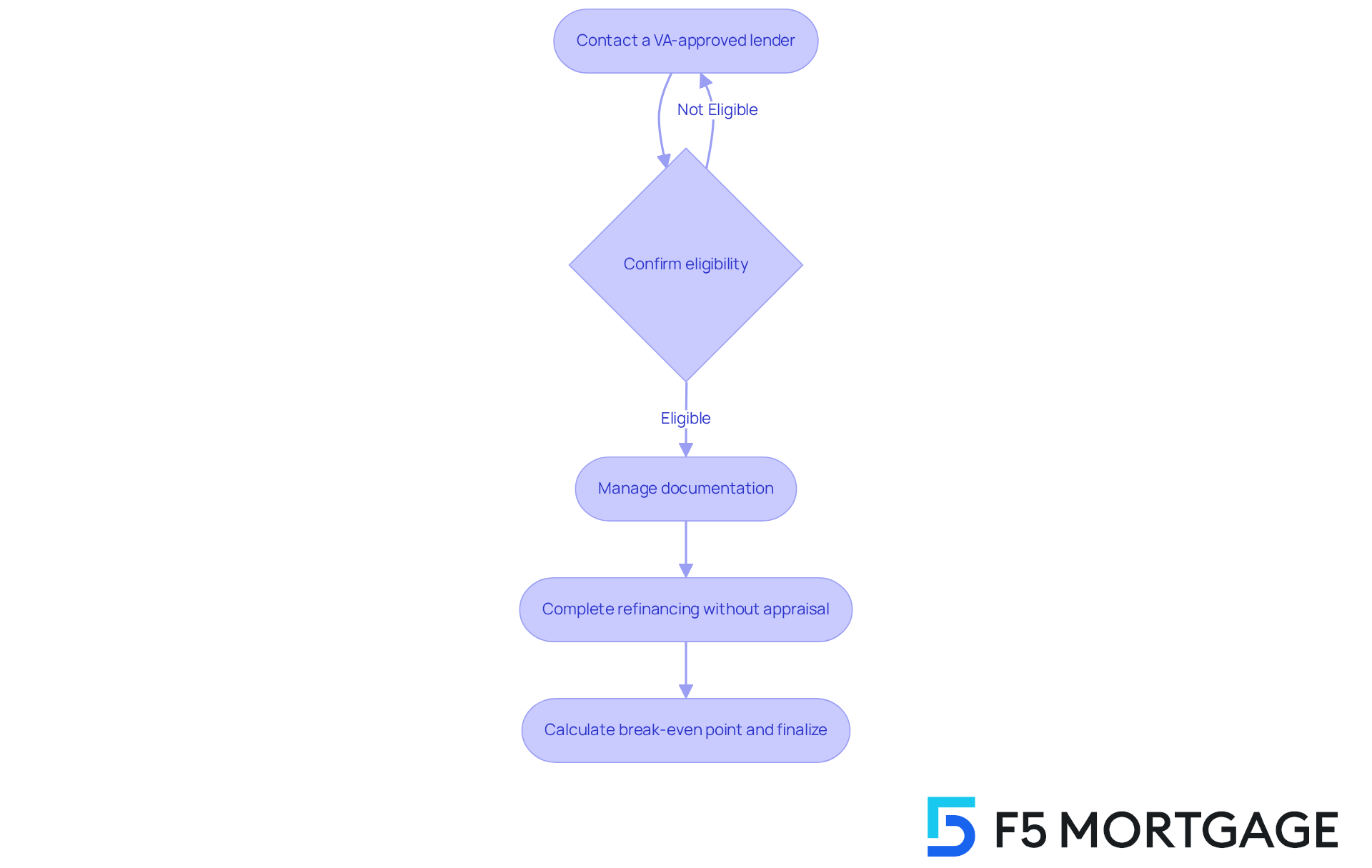

Streamlined Process of VA IRRRL: How It Works

The VA IRRRL process is designed with efficiency and simplicity in mind, making it easier for former service members to refinance through F5 Mortgage. We understand how overwhelming this journey can feel, so the first step is to reach out to a VA-approved lender. Together, you can discuss your current loan and your restructuring goals. Once your eligibility is confirmed—like ensuring your last three payments were made on time—your lender will assist you in managing the necessary documentation, which is significantly less than traditional borrowing methods.

Importantly, many former service members can complete the refinancing without the need for an appraisal or extensive paperwork. This leads to quicker approvals and closings, often within 30 days or less. We know how valuable your time is, and this efficient method not only saves time but also alleviates stress. It’s a compelling choice for those looking to lower their monthly payments or shift to a more stable financing product considering the current IRRRL rates.

For instance, consider the story of a Navy ex-service member who recently refinanced a $250,000 VA loan at a 6.5% interest rate to a new rate of 5%. This change lowered their monthly payment from $1,580 to just $1,342, all without incurring any out-of-pocket expenses. Such examples highlight the real benefits of the VA IRRRL process, showing how it can help service members achieve their financial goals with minimal hassle at the current IRRRL rates.

It’s also essential to note that a 0.5% funding fee is typically associated with VA IRRRLs, which can be added to the total amount. By understanding and calculating your break-even point, veterans can make informed decisions about refinancing. We’re here to support you every step of the way, ensuring you choose the best options available through F5 Mortgage.

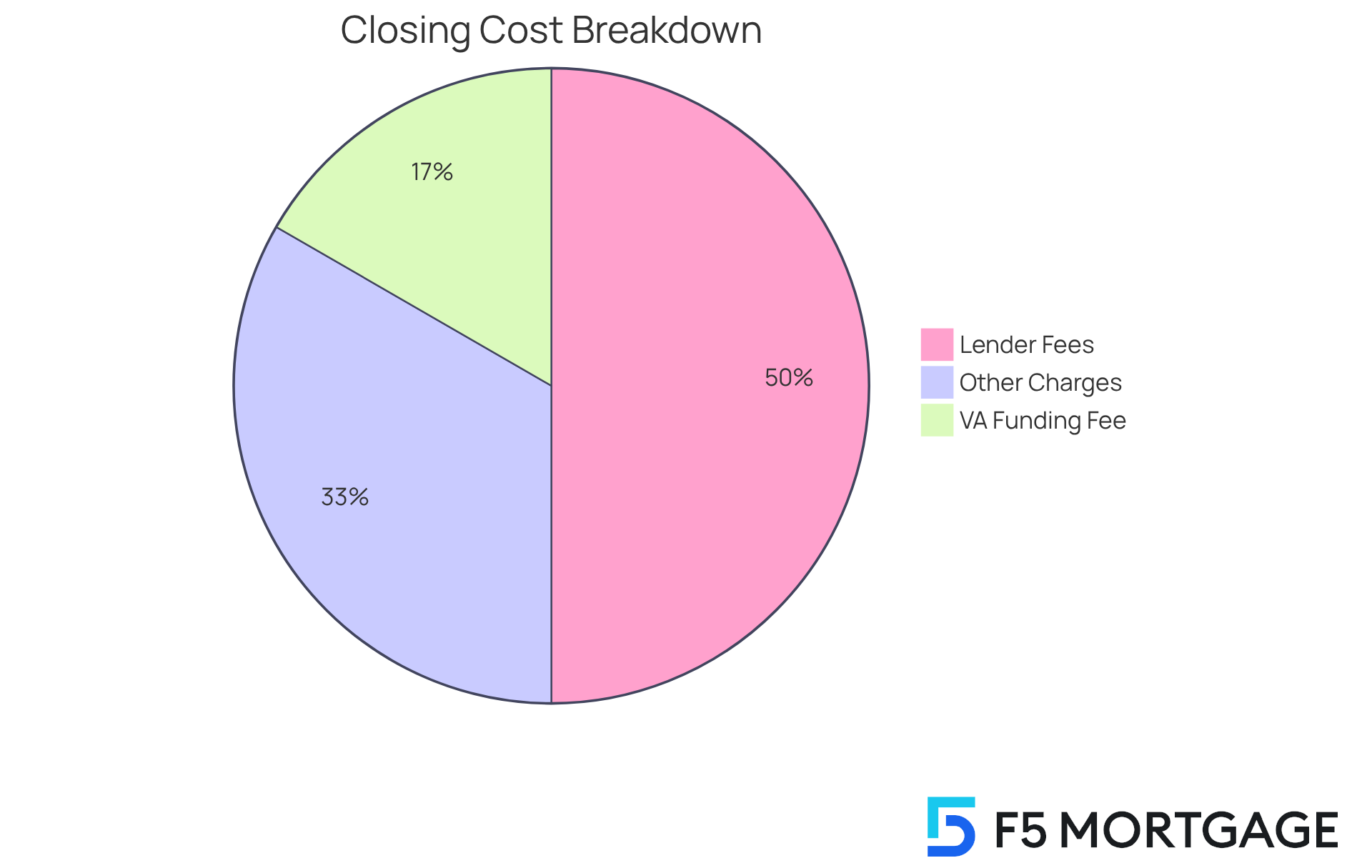

VA IRRRL Closing Costs: What to Expect

Closing expenses for a VA Interest Rate Reduction Refinance Program (IRRRL) typically range from 1% to 3% of the borrowed amount. In Georgia, these expenses may include the VA funding fee of 0.5%, lender fees, and other related charges, averaging around $2,727. For instance, if a veteran is restructuring a $300,000 debt, the closing expenses could vary from $3,000 to $9,000.

We understand that upfront costs can be a concern. Fortunately, many lenders offer options to roll these costs into the loan, significantly reducing the need for immediate cash. This approach can lead to potential monthly savings of $142.95 compared to conventional loan restructuring.

It’s essential for former service members to have detailed discussions with their lenders about closing costs and the importance of recouping these costs within 36 months of refinancing. This proactive approach can empower you to plan better financially and enjoy a smoother refinancing experience.

As Dan Green wisely notes, ‘The VA program provides a simple option for service members seeking to refinance their existing VA loan under better conditions.’ Additionally, most VA IRRRLs close in under 30 days, making this option particularly appealing.

We recommend that homeowners consider staying in their house for at least five years to ensure that the investment pays off, keeping in mind factors like the housing market and rental prices. We know how challenging this can be, but we’re here to support you every step of the way.

Alternatives to VA IRRRL: Other Refinancing Options for Veterans

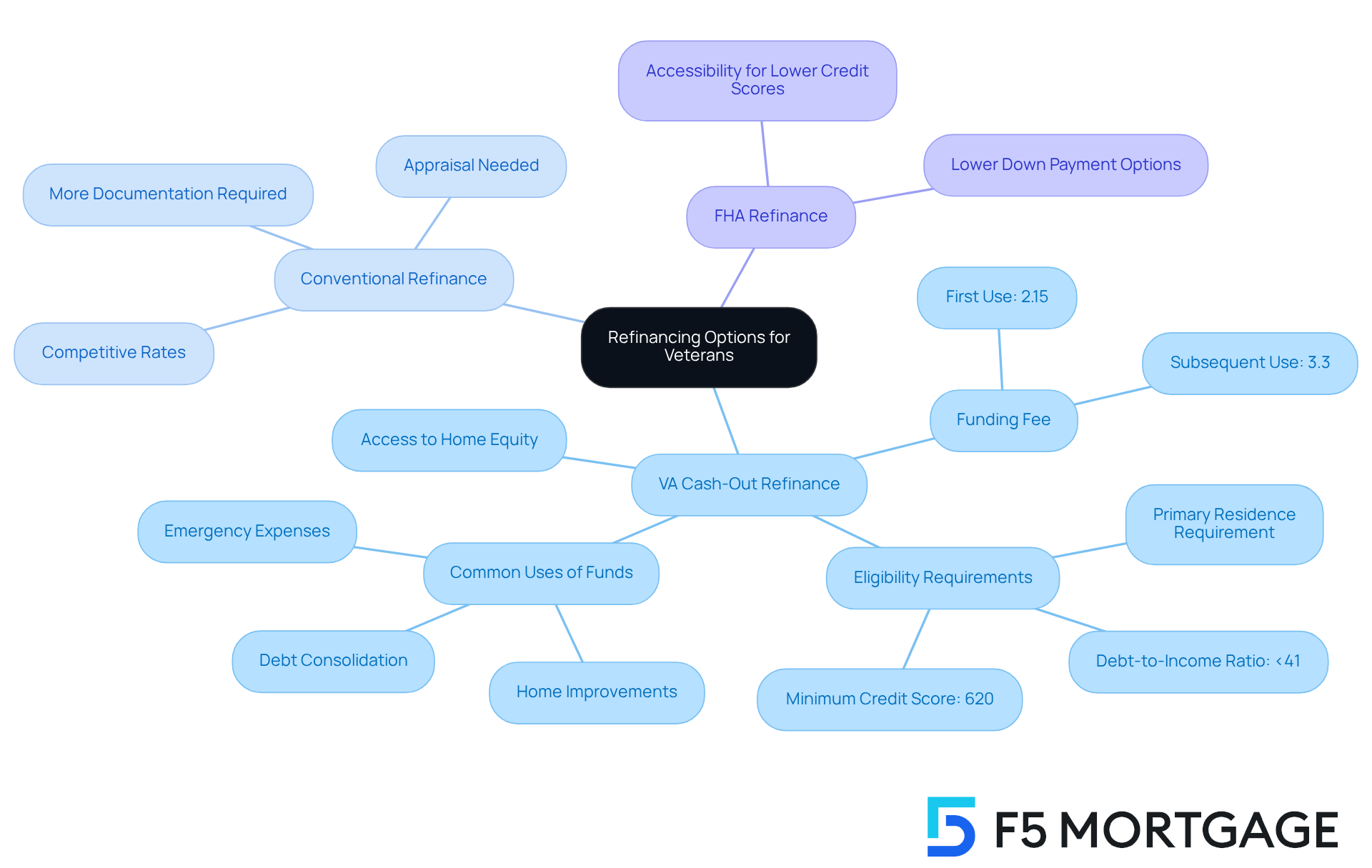

Veterans seeking to refinance have several options available beyond the VA IRRRL, particularly the VA Cash-Out Refinance. This option allows you to access your home equity for cash, which can be utilized for various financial needs, such as home improvements or debt consolidation. In 2025, qualified service members can refinance up to 100% of their home’s appraised value, offering significant financial flexibility. However, it’s important to carefully consider the associated costs, including a funding fee that ranges from 2.15% to 3.3%, depending on whether it’s your first use of this benefit.

On the other hand, a conventional refinance may present competitive rates but often requires more documentation and an appraisal, which can complicate the process. FHA refinance loans are particularly accessible for homeowners with lower credit scores, making them a viable option for many veterans. Each refinancing option has its unique advantages and disadvantages. For instance, while the VA Cash-Out Refinance provides immediate access to cash, the VA IRRRL focuses on lowering monthly payments without cashing out equity.

Statistics reveal that many former service members are opting for the Cash-Out Refinance, especially given the current IRRRL rates. For example, an experienced family in Houston with $150,000 in equity could leverage this option to consolidate debt and finance renovations, highlighting its practical benefits. We understand that navigating these choices can be daunting, and experts suggest that former service members evaluate their financial circumstances and long-term objectives carefully before making a decision. The right option can lead to significant savings and enhanced financial stability, and we’re here to support you every step of the way.

FAQs About VA IRRRL: Common Questions Answered

We know how important it is to understand your options when it comes to the VA Interest Rate Reduction Refinance Loan. Here are some common questions that many veterans have:

-

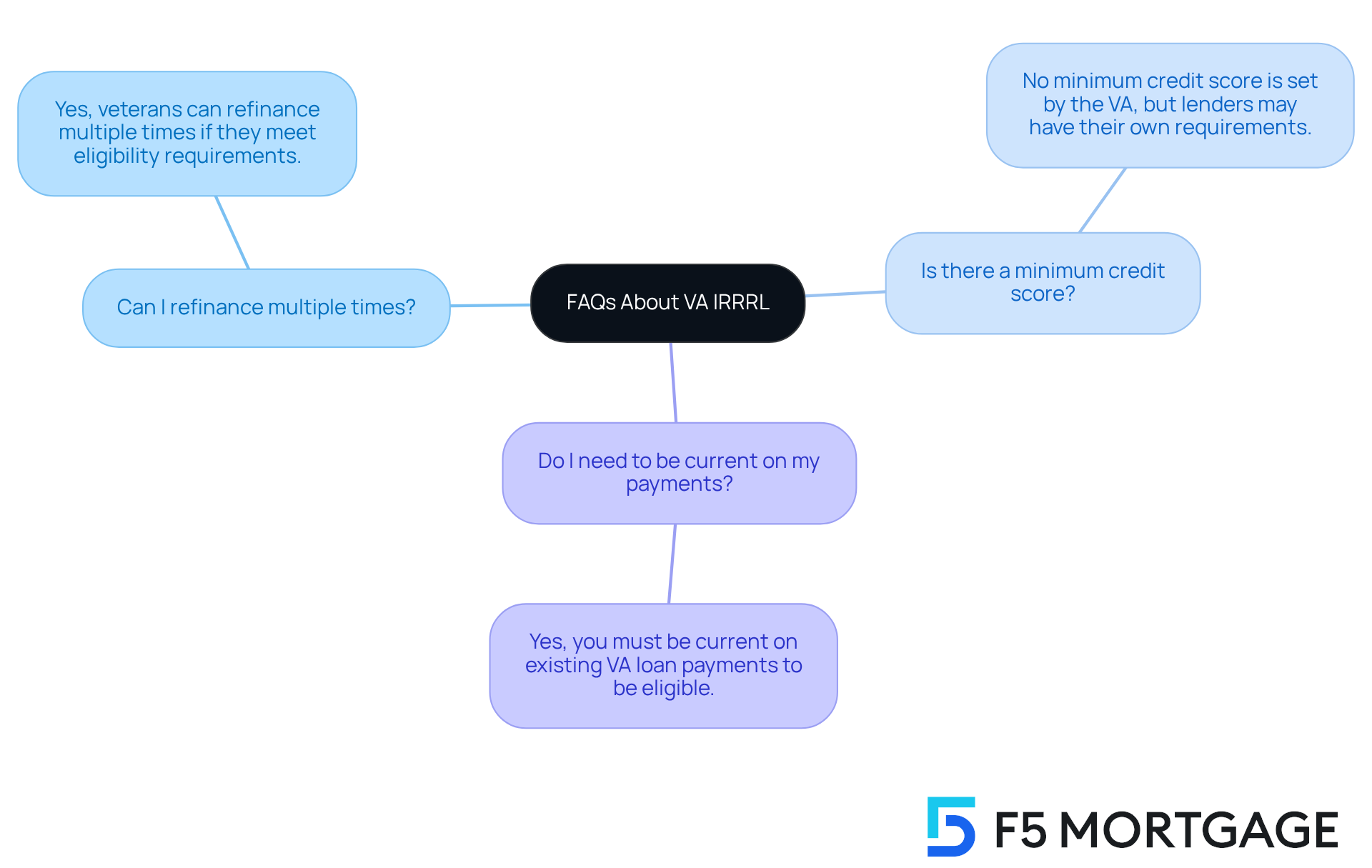

Can I refinance multiple times? Yes, former service members can take advantage of this program several times, provided they meet the eligibility requirements. In fact, many veterans have successfully restructured their loans multiple times to secure better rates, demonstrating the flexibility of this option.

-

Is there a minimum credit score? While the VA does not set a minimum credit score for refinancing, individual lenders may have their own requirements. Generally, having a higher credit score can improve your chances of approval and favorable terms. If you’re considering a loan modification with F5 Mortgage, a good credit score can lead to competitive rates.

-

Do I need to be current on my payments? Yes, to be eligible for the program, you must be current on your existing VA loan payments. This ensures that borrowers are in good standing before obtaining a new loan, which is a common requirement among most lenders.

We’re here to support you every step of the way as you navigate these options.

How to Apply for a VA IRRRL: Step-by-Step Guide

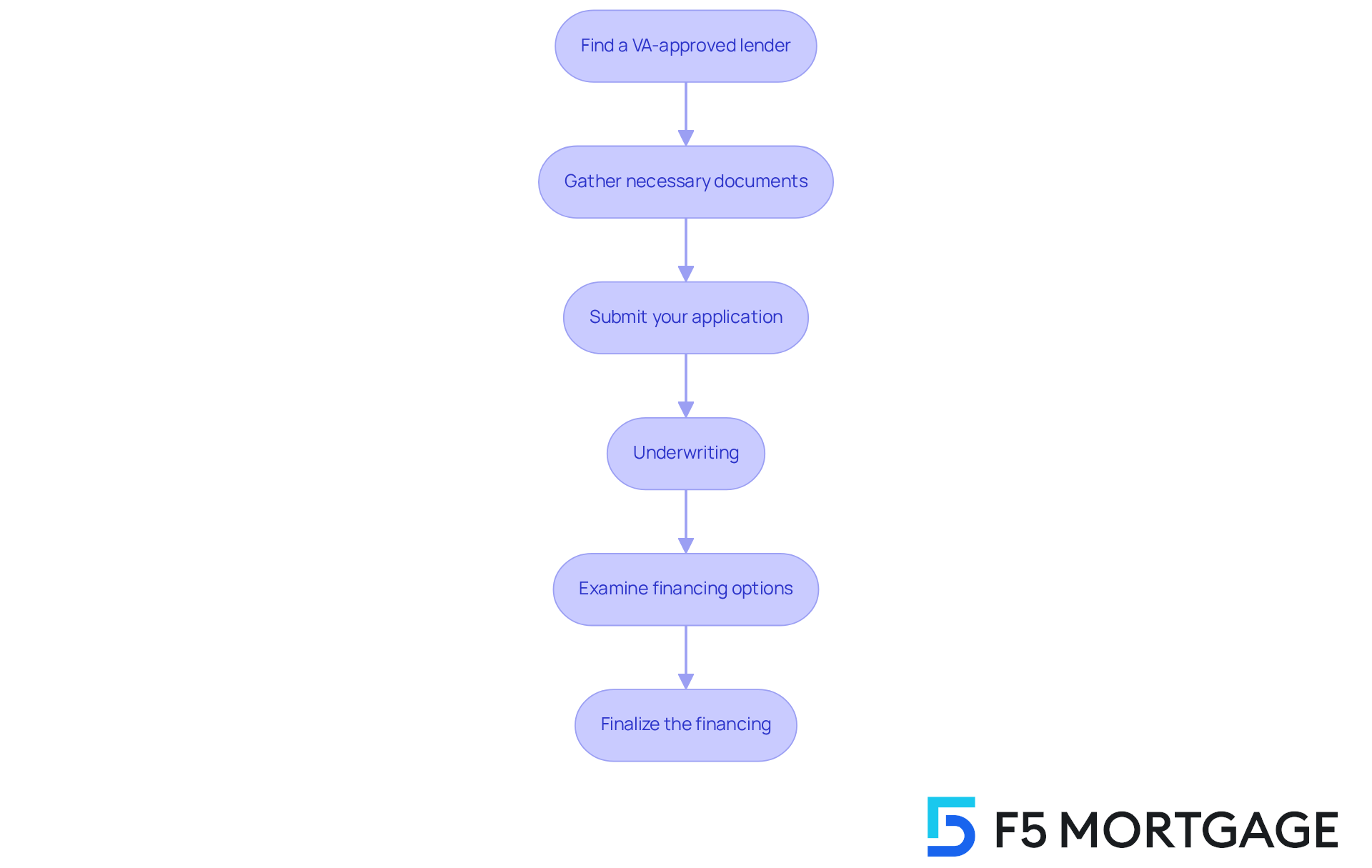

Applying for a VA IRRRL can feel overwhelming, but we’re here to support you every step of the way. This process is designed to ease the loan modification for veterans, allowing you to focus on what matters most. Follow these essential steps:

- Find a VA-approved lender: Start by exploring lenders who specialize in VA financing. Their expertise can make a significant difference in your refinancing experience.

- Gather necessary documents: Collect your current credit information, including payment history, and any required identification. This will help streamline your application.

- Submit your application: Work closely with your chosen lender to complete the application process efficiently. Ensure that all information is accurate and complete.

- Underwriting: Once your application is submitted, the lender will review your financing application, credit history, debt-to-income ratio, and other requirements to complete the credit approval process.

- Examine financing options by having open discussions with your lender about the current irrrl rates and the terms available. Understanding your choices is crucial.

- Finalize the financing: After approval, complete the necessary documents to finish the refinancing process.

This streamlined approach typically allows for closing in under 30 days, making it an attractive option for veterans looking to lower their monthly payments or switch to a fixed-rate mortgage under current irrrl rates. Additionally, be aware that closing costs typically range from 3% to 5% of the loan amount, and the VA funding fee for IRRRLs is typically 0.5% of the loan amount. We know how challenging this can be, but with the right support, you can navigate this process with confidence.

Conclusion

Navigating the intricacies of VA refinancing through the IRRRL program can significantly enhance financial stability for veterans and their families. We know how challenging this can be, and this article has explored the current landscape of IRRRL rates, highlighting the importance of understanding both the benefits and drawbacks of this refinancing option. With current rates around 5.500% for a 30-year term, families have a unique opportunity to lower their monthly payments and secure more favorable mortgage terms.

Key insights discussed include:

- The streamlined nature of the VA IRRRL process, which simplifies refinancing by eliminating the need for appraisals and extensive documentation.

- Veterans must be current on their mortgage payments and have made at least six payments on their original loan to qualify.

- The program offers significant advantages, such as reduced interest rates and the ability to roll closing costs into the loan.

- Potential drawbacks like the inability to access home equity should be carefully considered.

Ultimately, the VA IRRRL program presents a valuable opportunity for veterans to optimize their mortgage terms and achieve long-term savings. By staying informed about current VA IRRRL rates and understanding eligibility criteria, veterans can make informed decisions that align with their financial goals. We’re here to support you every step of the way. Engaging with a knowledgeable lender can further streamline this process, ensuring that service members and their families can confidently navigate their refinancing journey.

Frequently Asked Questions

What is F5 Mortgage’s approach to VA refinancing?

F5 Mortgage LLC offers competitive VA IRRRL rates tailored to the unique financial circumstances of military service members and their families. They provide personalized service and support throughout the loan restructuring process.

What are the current VA IRRRL rates as of October 2025?

As of October 10, 2025, the national average for a 30-year VA IRRRL is approximately 6.48%, with an APR of 5.792%. However, some lenders are offering rates as low as 5.500% for a 30-year streamline refinance.

What are the benefits of the VA IRRRL program?

The VA IRRRL program simplifies obtaining a new loan by eliminating the need for home appraisals and income verification. It allows for reduced interest rates and the option to incorporate closing expenses into the mortgage, making it a viable choice for many families.

What are the eligibility criteria for the VA IRRRL program?

To qualify for the VA IRRRL program, you must already have a VA-backed mortgage, be current on your mortgage payments, and have made at least six consecutive payments on your original loan.

Who can benefit from the VA refinancing program?

The VA refinancing program is particularly beneficial for former service members, especially those transitioning from active duty to civilian life, as it offers a streamlined refinancing option with minimal documentation requirements.

How can refinancing with F5 Mortgage impact my financial stability?

By choosing F5 Mortgage, you can secure favorable refinancing terms that can enhance your financial stability, potentially lowering your monthly payments and overall mortgage costs.

Why is it important for veterans to evaluate their refinancing options?

Evaluating refinancing options is crucial because even a minor decrease in interest rates can lead to significant savings over the life of the mortgage, potentially saving borrowers tens of thousands of dollars in interest payments.