Overview

This article is dedicated to individuals earning an £80,000 salary who are looking to maximize their mortgage options. We understand how overwhelming this process can be, and we’re here to support you every step of the way. Within this comprehensive guide, you will discover:

- How to determine your borrowing capacity

- Understand the key factors affecting mortgage affordability

- Explore strategies to enhance your borrowing power

We know how crucial it is to consider:

- Your credit score

- Debt-to-income ratio

- The right mortgage type that aligns with your financial goals

By addressing these elements, you can feel more empowered in your journey. Let’s take a closer look at how you can navigate these decisions with confidence and clarity.

Introduction

Navigating the world of mortgages can feel overwhelming, especially for those earning an £80,000 salary. We understand how challenging this can be, and knowing how to maximize your borrowing potential is crucial for making informed financial decisions. This guide explores essential strategies and factors that influence mortgage affordability, empowering you to take control of your financial future.

With so many options and variables at play, we’re here to support you every step of the way. How can you ensure you are making the best choices for your unique situation?

Determine Your Borrowing Capacity on an £80,000 Salary

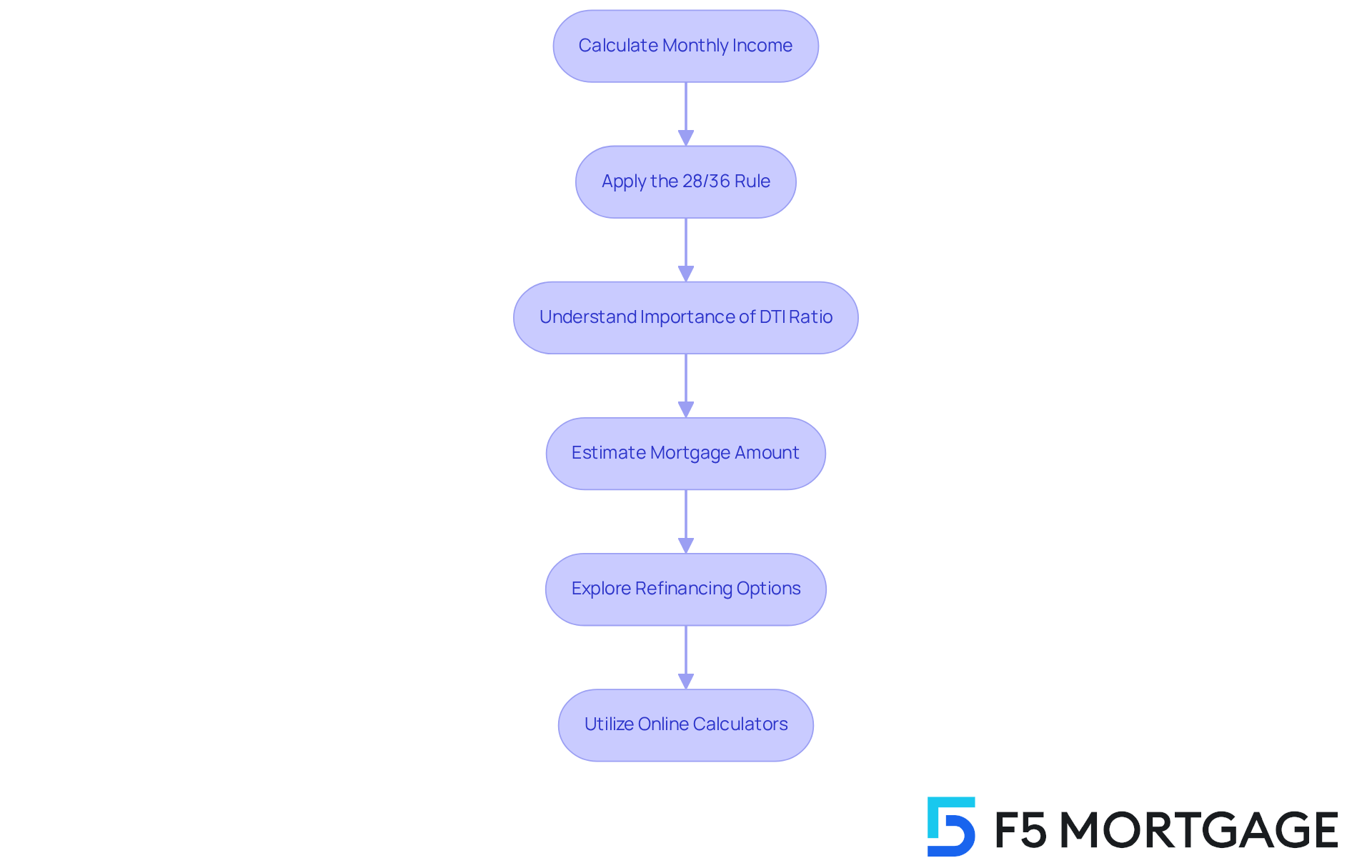

Determining your borrowing capacity on a salary of 80k can feel overwhelming, but we’re here to guide you through it. Follow these steps to gain clarity and confidence in your financial journey:

-

Calculate Your Monthly Income: Start by dividing your annual salary by 12. An 80k salary amounts to approximately £6,667 per month. Knowing your monthly income is the first step toward understanding your financial landscape.

-

Apply the 28/36 Rule: This guideline helps you allocate your finances wisely. Ideally, no more than 28% of your gross monthly income should go toward housing costs—this includes mortgage payments, insurance, property taxes, and HOA fees. Additionally, aim to keep your total debt obligations under 36% of your income.

- Housing Expenses: 28% of £6,667 is about £1,867, which corresponds to an annual amount close to 80k.

- Total Debt Payments: 36% of £6,667 is about £2,400.

-

Understand the Importance of Your DTI Ratio: A maximum DTI ratio of 43% is often required for home loans. This means your total monthly debt payments should not exceed this percentage of your gross monthly income. Remember, a lower DTI can open doors to more competitive financing options, which is crucial when evaluating your choices with F5 Mortgage.

-

Estimate Your Mortgage Amount: Based on these figures, you can start to estimate what you can afford. If you plan to make a 20% deposit, you could consider homes priced between £300,000 and £400,000, depending on interest rates and loan terms. Keep in mind that higher interest payments can significantly affect your long-term financial commitments.

-

Explore Refinancing Options: If you already have a mortgage, think about refinancing options available through F5 Mortgage. FHA loans might offer more accessible terms for those with lower credit scores, while VA loans provide excellent conditions for military personnel. These options can help you secure better rates and lower monthly costs.

-

Utilize Online Calculators: Don’t hesitate to use loan calculators available on financial websites. Input your income, debts, and initial contribution for a tailored estimate. Remember, while the 36% DTI ratio is a guideline, many lenders, including F5 Mortgage, may consider higher ratios based on your unique financial situation.

We know how challenging this process can be, but with the right information and support, you can navigate it successfully. We’re here to support you every step of the way.

Identify Key Factors Affecting Mortgage Affordability

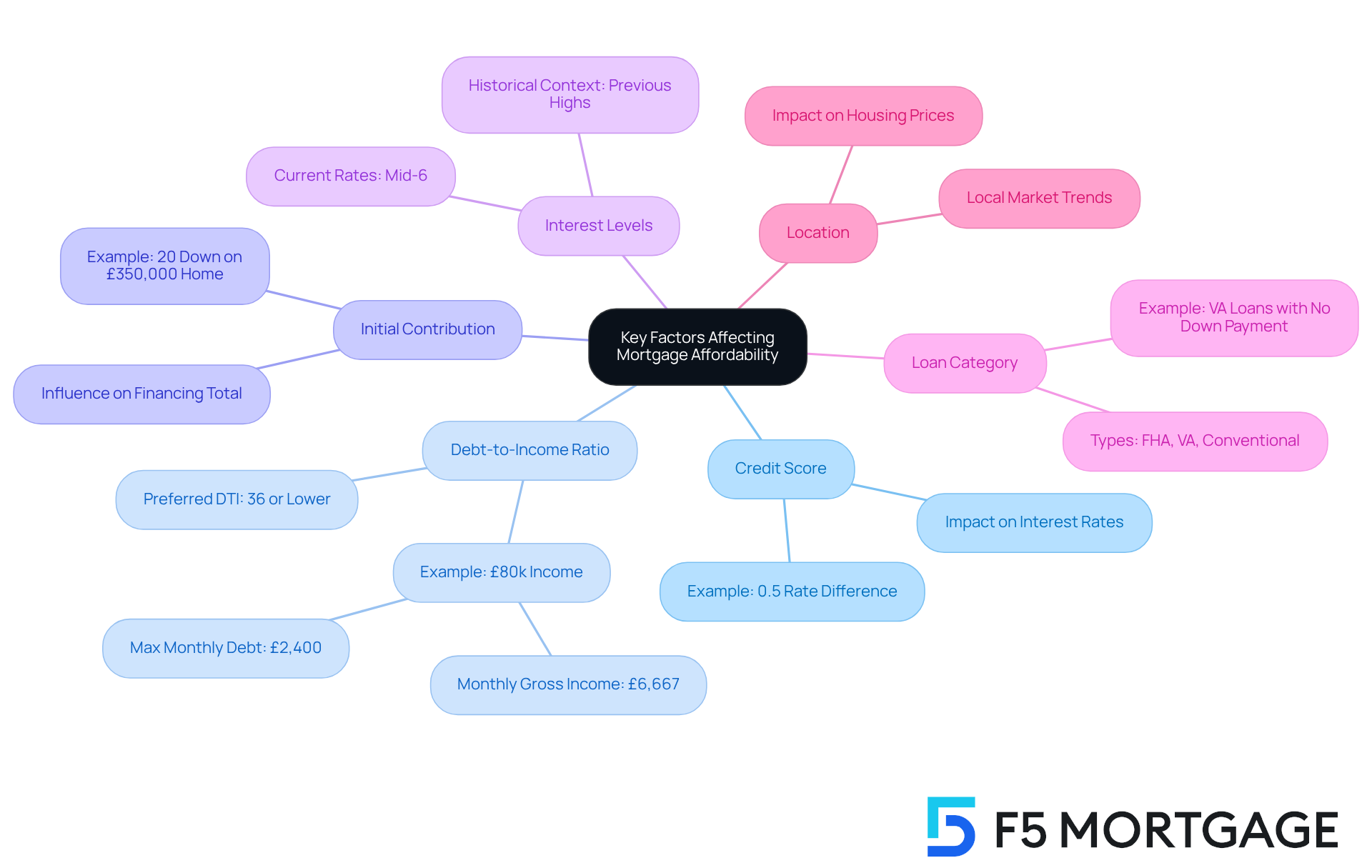

Several key factors significantly influence your mortgage affordability, and we know how challenging this can be. Understanding these elements can empower you to make informed decisions that align with your financial goals.

-

Credit Score: An elevated credit score can lead to more advantageous interest terms, which can reduce your monthly expenses and enhance your borrowing ability. For instance, a difference of just 0.5% in interest rates can result in substantial savings over the life of a loan.

-

Debt-to-Income Ratio (DTI): This ratio compares your monthly obligations to your gross monthly income. Lenders typically prefer a DTI of 36% or lower, as this indicates a manageable level of debt relative to income. If you make 80k each year, your monthly gross income is around £6,667. Ideally, your total monthly debt obligations should not surpass £2,400.

-

Initial Contribution: The amount of your initial contribution directly influences your financing total and whether you require private mortgage insurance (PMI). A larger initial deposit can greatly decrease your monthly expenses and remove PMI, which can increase your monthly costs by hundreds. For example, putting down 20% on a £350,000 home can save you thousands in interest over the life of the loan.

-

Interest Levels: Present market interest levels significantly influence your monthly mortgage cost. Reduced costs lead to decreased payments, making it crucial to secure a beneficial price when feasible. As of 2025, rates are hovering in the mid-6% range, a significant decrease from previous highs.

-

Loan Category: Various categories of financing, such as FHA, VA, and conventional options, come with differing requirements and advantages that can influence your affordability. For example, VA loans allow eligible veterans to purchase homes with no down payment, making homeownership more accessible.

-

Location: Housing prices vary widely by location, impacting what you can afford based on your salary. Understanding local market trends is crucial; for instance, some areas may experience flat or declining prices, while others may see significant appreciation.

By considering these factors, you can better navigate the loan landscape. Remember, we’re here to support you every step of the way as you make choices that align with your financial objectives.

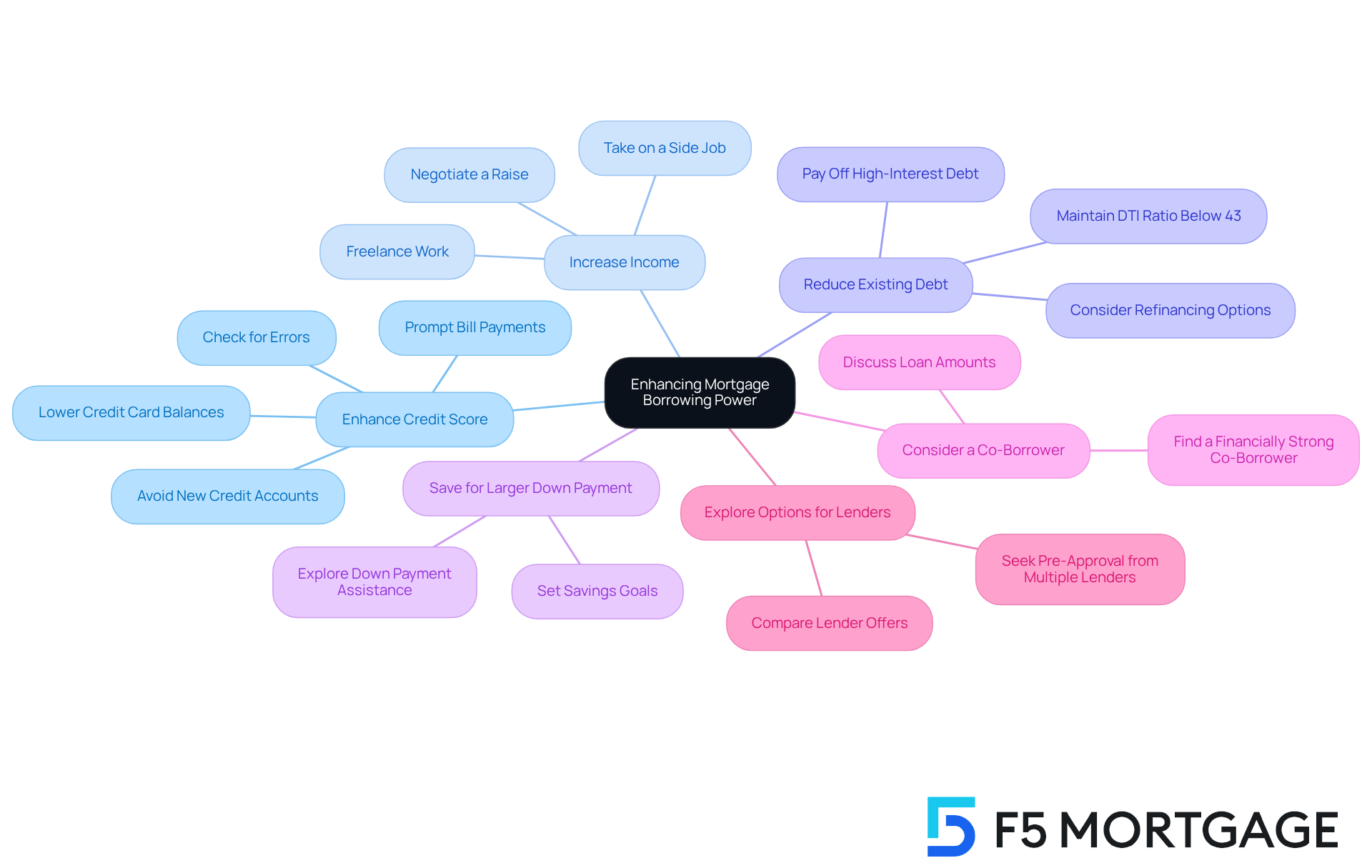

Explore Strategies to Enhance Your Mortgage Borrowing Power

To enhance your mortgage borrowing power, we understand how important it is to implement effective strategies. Here are some compassionate suggestions to guide you:

-

Enhance Your Credit Score: We know how challenging it can be to manage your credit. Prompt bill payments, lowering credit card balances, and avoiding the opening of new credit accounts before applying for a loan are crucial measures. A higher credit score can significantly lower your interest rates, making your mortgage more affordable. In fact, over one-third of Americans’ credit reports contain inaccurate or outdated information, which can suppress their credit scores and limit their financial opportunities.

-

Increase Your Income: Exploring opportunities to boost your income can be empowering. Whether it’s taking on a side job or negotiating a raise, even small increases in income can enhance your borrowing power. For instance, a family who took on freelance work was able to improve their debt-to-income (DTI) ratio, making them more attractive candidates for lenders. Remember, a maximum DTI ratio of 43% is usually necessary for home financing, so managing your current debt in relation to your income is essential.

-

Reduce Existing Debt: Concentrating on settling high-interest obligations, such as credit cards or personal debts, can significantly improve your financial position. By decreasing your DTI, you not only enhance your likelihood of loan approval but also create a more stable financial future. Keeping your credit utilization ratio below 30% is advisable, as it accounts for 30% of your credit score. Additionally, refinancing alternatives, like FHA programs offered by F5 Mortgage, can provide more accessible terms for individuals with lower credit scores and less strict DTI criteria.

-

Save for a Larger Down Payment: Saving for a larger down payment can be a game changer. It reduces the borrowed amount and can eliminate the necessity for private mortgage insurance (PMI), making your mortgage more affordable in the long run. This strategy is especially beneficial for those seeking improved borrowing conditions.

-

Consider a Co-Borrower: Adding a co-borrower with a strong financial profile can enhance your chances of approval and potentially allow for a larger loan amount. This option is particularly useful for first-time homebuyers or those with limited credit history.

-

Explore Options for Lenders: Remember, various lenders provide different terms and conditions. By comparing offers, you can find the best deal that suits your financial situation. It’s a good idea to seek pre-approval from various lenders to obtain the most advantageous financing conditions and terms. Consider working with F5 Mortgage for competitive rates and personalized service; they can help you navigate the refinancing options available in Colorado.

We’re here to support you every step of the way as you take these important steps toward enhancing your mortgage borrowing power.

Choose the Best Mortgage Type for Your Financial Situation

Choosing the right loan type can feel overwhelming, but it’s essential to understand your financial circumstances and goals. We know how challenging this can be, so let’s explore some common mortgage options together:

-

Fixed-Rate Mortgages: These loans offer a steady interest rate and consistent monthly payments throughout the loan term. This stability can be a great comfort, especially in fluctuating economic conditions.

-

Adjustable-Rate Mortgages (ARMs): Initially, ARMs present lower interest rates that may change after a set period. While they can save you money at first, it’s important to plan for potential increases in payments down the line. Rest assured, there are interest adjustment caps to help protect you from drastic rate hikes.

-

FHA Financing: Designed for low-to-moderate-income borrowers, FHA financing is backed by the Federal Housing Administration. With lower upfront costs and more lenient credit requirements, it makes homeownership a reality for many individuals with limited financial resources.

-

VA Financing: Available exclusively to veterans and active-duty military personnel, VA financing often requires no down payment and offers favorable terms. This can be a wonderful option for those who qualify. Additionally, there are refinancing options like the VA Interest Rate Reduction Refinance Loan (IRRRL) to help reduce costs and monthly payments, as well as VA cash-out refinancing to meet various financial needs.

-

Jumbo Mortgages: For properties that exceed conventional borrowing limits, jumbo mortgages come with stricter credit standards and potentially higher interest rates. They cater to higher-priced housing markets and luxury properties.

-

Interest-Only Mortgages: These loans allow you to pay only the interest for an initial period, providing some short-term financial relief. However, it’s crucial to prepare for the significantly higher payments that will follow once the interest-only phase ends.

As you evaluate these options, take a moment to reflect on your financial goals, risk tolerance, and long-term plans. We’re here to support you every step of the way as you identify the mortgage type that aligns best with your needs.

Conclusion

Maximizing mortgage options on an £80,000 salary can feel overwhelming, but with a strategic approach, you can navigate your financial landscape with confidence. Understanding the factors that influence your borrowing capacity is key. By following these steps, you can gain clarity on your financial situation and make informed decisions that align with your homeownership goals.

It’s essential to calculate your monthly income and adhere to the 28/36 rule. Understanding your debt-to-income ratio is also crucial. Remember, your credit score, initial contributions, and local market conditions significantly impact your mortgage affordability. Exploring various mortgage types—from fixed-rate to FHA and VA loans—will help you find the best fit for your unique circumstances.

We know how challenging this journey can be, but it’s important to approach securing a mortgage with confidence and knowledge. By implementing strategies to enhance your borrowing power, such as improving your credit score and reducing existing debt, you can position yourself for success in the competitive mortgage landscape. Taking proactive steps today can pave the way for a more secure financial future, making homeownership a tangible reality for you and your family.

Frequently Asked Questions

How do I calculate my monthly income based on an £80,000 salary?

To calculate your monthly income, divide your annual salary by 12. An £80,000 salary amounts to approximately £6,667 per month.

What is the 28/36 rule in relation to borrowing capacity?

The 28/36 rule suggests that no more than 28% of your gross monthly income should go toward housing costs, which include mortgage payments, insurance, property taxes, and HOA fees. Additionally, your total debt obligations should be kept under 36% of your income.

How much can I allocate for housing expenses on an £80,000 salary?

Based on an £80,000 salary, 28% of your monthly income (£6,667) is about £1,867, which is the amount you should ideally allocate for housing expenses.

What is the maximum debt-to-income (DTI) ratio for home loans?

A maximum DTI ratio of 43% is often required for home loans, meaning your total monthly debt payments should not exceed 43% of your gross monthly income.

What mortgage amount can I estimate based on my income?

If you plan to make a 20% deposit, you could consider homes priced between £300,000 and £400,000, depending on interest rates and loan terms.

What refinancing options are available if I already have a mortgage?

If you already have a mortgage, you can explore refinancing options such as FHA loans, which may offer more accessible terms for those with lower credit scores, and VA loans, which provide excellent conditions for military personnel.

How can online calculators assist me in estimating my borrowing capacity?

Online loan calculators can help you input your income, debts, and initial contribution to provide a tailored estimate of what you can afford.

Can lenders consider higher DTI ratios than the recommended 36%?

Yes, while the 36% DTI ratio is a guideline, many lenders, including F5 Mortgage, may consider higher ratios based on your unique financial situation.