Overview

The article titled “10 Best States to Buy a House for Budget-Conscious Families” seeks to address the challenges families face in finding affordable housing options. We understand how daunting this process can be, and this guide highlights states like:

- Ohio

- West Virginia

- Mississippi

These states are not just known for their low median home prices; they also offer community amenities and supportive housing initiatives that make them ideal for families looking for economical homeownership opportunities.

Imagine settling in a welcoming community where your budget stretches further. In Ohio, for instance, you can find charming neighborhoods with parks and schools nearby, making it easier for families to thrive. West Virginia offers stunning natural beauty and a close-knit atmosphere, while Mississippi combines affordability with rich cultural experiences.

We’re here to support you every step of the way as you navigate these options. By considering these states, you’re taking a proactive step toward securing a comfortable home for your family. Remember, affordable homeownership is within reach, and with the right information, you can make informed decisions that benefit your family in the long run.

Introduction

Amid rising housing costs and economic uncertainty, we know how challenging it can be for budget-conscious families to find an affordable home. This article explores the ten best states where families can secure budget-friendly housing options without sacrificing quality of life. As you navigate the complexities of homeownership, you may wonder: which states not only offer affordable homes but also provide a supportive community and enriching lifestyle? Join us as we discover the top contenders that strike the perfect balance between affordability and family-friendly living.

F5 Mortgage: Personalized Mortgage Solutions for Homebuyers

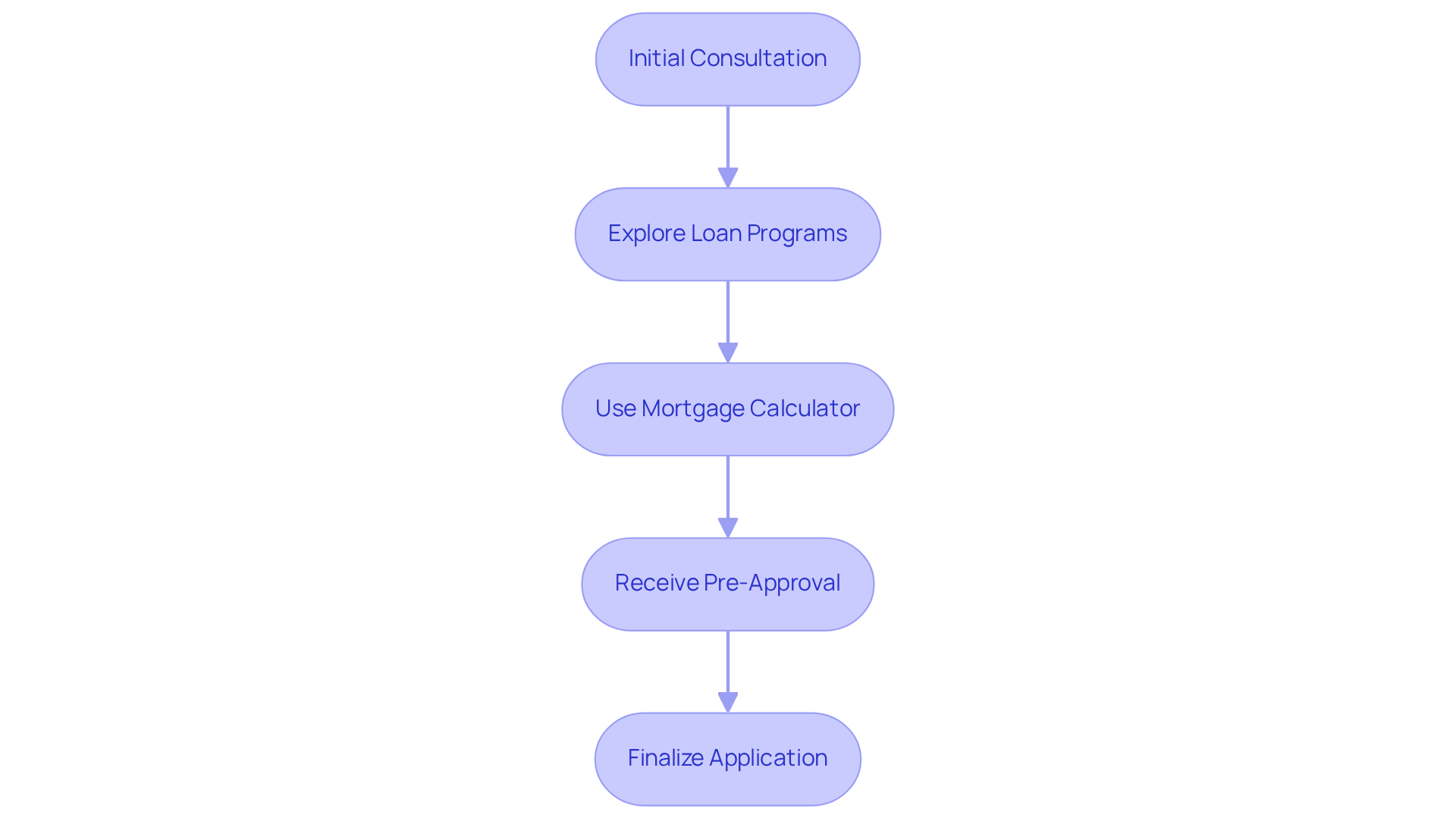

At F5 Mortgage LLC, we understand how challenging the can be for families. As a leading independent mortgage brokerage, we are dedicated to simplifying this journey for you. Our allow you to explore a variety of loan programs tailored to your unique financial circumstances. For instance, if you are self-employed, our specialized might be just what you need.

We know that navigating mortgage options can feel overwhelming. That’s why our intuitive is here to empower you, helping you make informed decisions. By leveraging cutting-edge technology, we ensure competitive rates and terms, positioning ourselves as your invaluable ally in this intricate landscape of mortgage financing.

Imagine receiving —this is one of the many ways we enhance our services to meet your needs. Plus, we provide extensive resources, including a property buyer’s guide and , to support you throughout your .

When considering refinancing, it’s important to know how to . Start by determining your , then calculate your monthly savings. Divide the costs by the savings to find out how long it will take to recoup your expenses.

We recognize the common challenges you face, such as and complicated paperwork. At F5 Mortgage, we are committed to enhancing your overall experience and fostering confidence in your financial choices. Our goal is to ensure a smooth and stress-free process from application to closing.

Take the first step toward your mortgage journey today by applying online or over the phone. We’re here to support you every step of the way!

Ohio: The Most Affordable State for Homebuyers

Ohio shines as a beacon for families seeking , with a median property price that is notably lower than the national average. This affordability allows households to secure spacious homes in , creating an excellent opportunity for investment. As we look ahead to 2025, the state is committed to enhancing its through various initiatives aimed at expanding . Notably, projects like the Lofts at 40 Long and The Heights on Main are set to introduce over 200 new units for families, supported by significant funding from the .

Families in Ohio enjoy a designed with their needs in mind—well-maintained parks, reputable schools, and lively community events that foster a sense of belonging. These features not only enrich the quality of life but also enhance the appeal of the real estate market. Real estate experts highlight that Ohio’s commitment to affordable housing, combined with its diverse options, positions it as one of the for families seeking economical . As the region continues to address housing needs, it stands as a nurturing environment for families looking to establish themselves in a resource-rich community. We know how challenging this can be, and we’re here to .

West Virginia: Low Home Prices and Great Value

West Virginia is celebrated for its breathtaking natural scenery and , which makes it one of the for budget-minded families. We understand how challenging it can be to find the perfect home, and this state is among the best states to buy a house, offering a —from charming historic homes to modern developments—all at competitive prices. Families can enjoy a slower pace of life while still having access to , which can be found in the best states to buy a house, making it an ideal place to settle down.

At F5 Mortgage, we’re proud to have numerous on platforms like Google and Zillow, reflecting our commitment to your satisfaction. Our expert team is here to support you every step of the way as you navigate the . We offer access to , such as FL Assist and the MI Home Loan program, which can significantly enhance affordability.

With , you can explore various . Contact us today to learn more about how we can assist you in making West Virginia one of the best states to buy a house.

Mississippi: Affordable Housing for Families

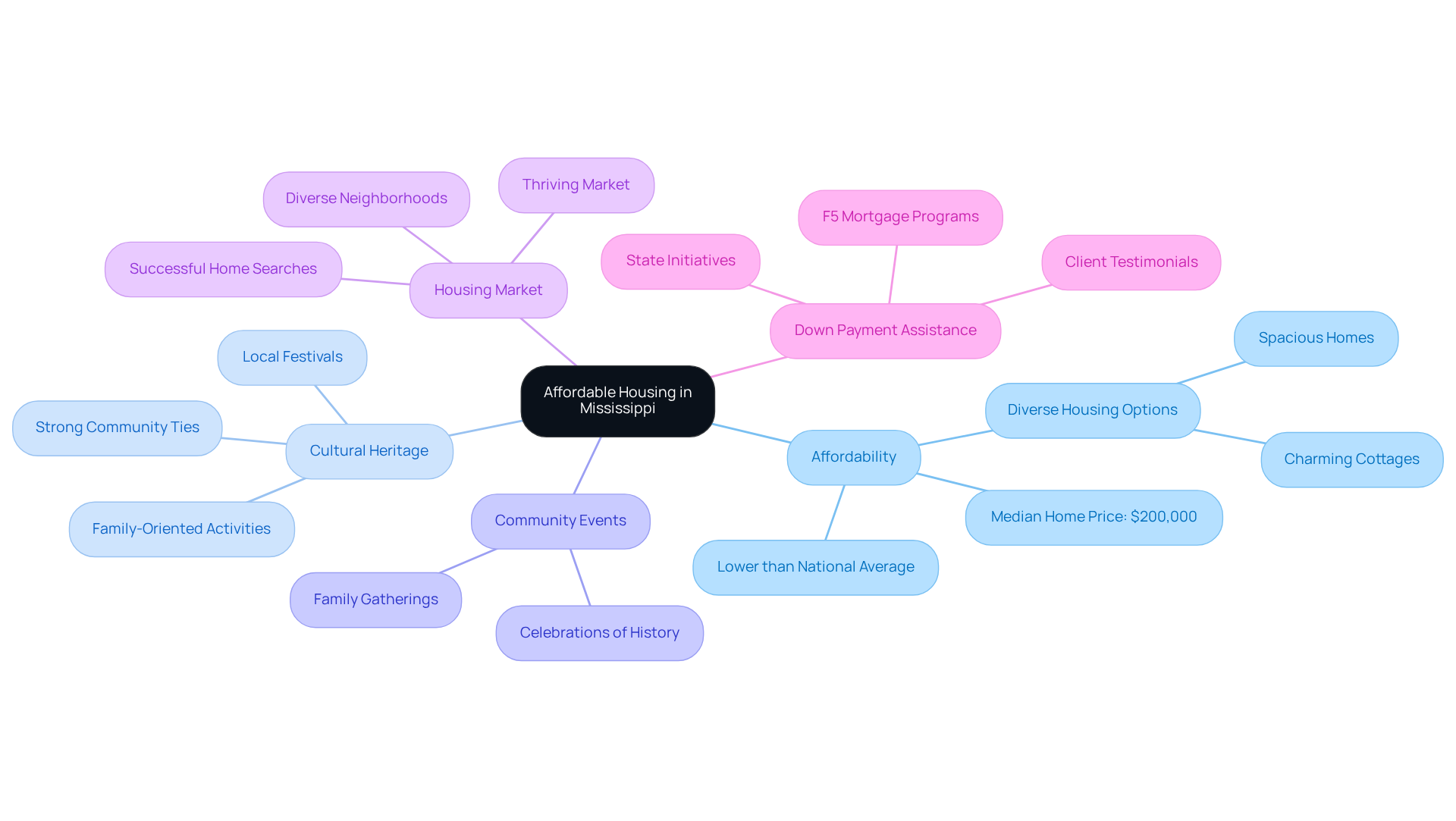

Mississippi stands out as one of the most seeking property ownership. With a median housing price significantly lower than the national average, this affordability opens the door to a range of housing choices. From charming cottages to spacious homes, families can explore options without stretching their budgets. In fact, recent statistics show that the in Mississippi is around $200,000, making it an appealing choice for those who are budget-conscious.

But it’s not just about affordability; Mississippi’s vibrant cultural heritage enriches family life. The region is known for its strong community ties, featuring numerous that foster a sense of belonging. Local festivals and community gatherings celebrate the rich history and traditions of the area, providing families with opportunities to connect and create lasting memories.

Housing analysts have observed that Mississippi’s housing market is thriving, with many families successfully finding their ideal homes. The diverse neighborhoods cater to various lifestyles, ensuring that families can discover a . Additionally, the emphasis on affordable living is supported by state initiatives aimed at assisting families with down payments and homebuyer education. F5 Mortgage offers several that can help families in Mississippi, enhancing their purchasing power. Many clients have praised F5 Mortgage for their , with one satisfied customer stating, “The team at F5 Mortgage made the so simple and hassle-free!”

In summary, Mississippi not only offers affordable housing options but also a nurturing environment where families can flourish. If you’re interested in exploring , we invite you to contact F5 Mortgage today. Let us help you achieve your —we’re here to support you every step of the way.

Arkansas: Budget-Friendly Homes with Quality Living

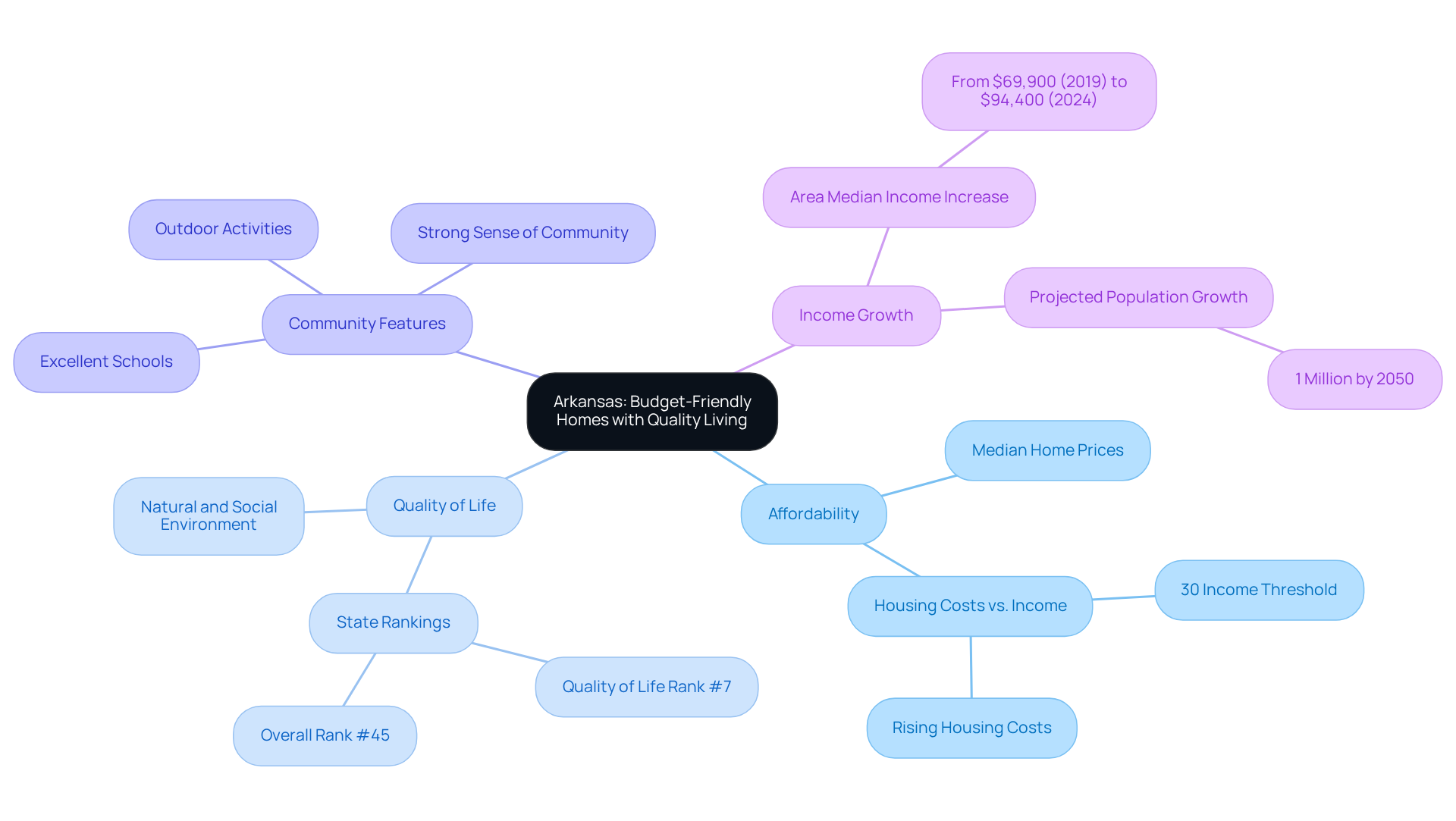

Arkansas stands out as a wonderful place for looking for and a . With a median home price significantly lower than the national average, spacious homes in welcoming neighborhoods. This region offers a rich variety of outdoor activities, excellent schools, and a , fostering an environment where families can truly thrive.

We know how challenging can be. Recent statistics show that Arkansas ranks #7 in the , reflecting its . However, the state faces challenges, as have led to more families spending over 30% of their income on housing. Despite these hurdles, the area median income for a household of four has increased from $69,900 in 2019 to $94,400 in 2024, indicating a potential for improved affordability.

Experts emphasize that Arkansas is among the best states to buy a house because of its unique combination of affordability and quality living, making it an attractive choice for families. The state’s commitment to enhancing community resources and further solidifies its reputation as a desirable place to live. As families weigh their options, Arkansas remains an appealing choice for those who value affordable homes without compromising on quality of life.

Iowa: Affordable Homes in Family-Friendly Communities

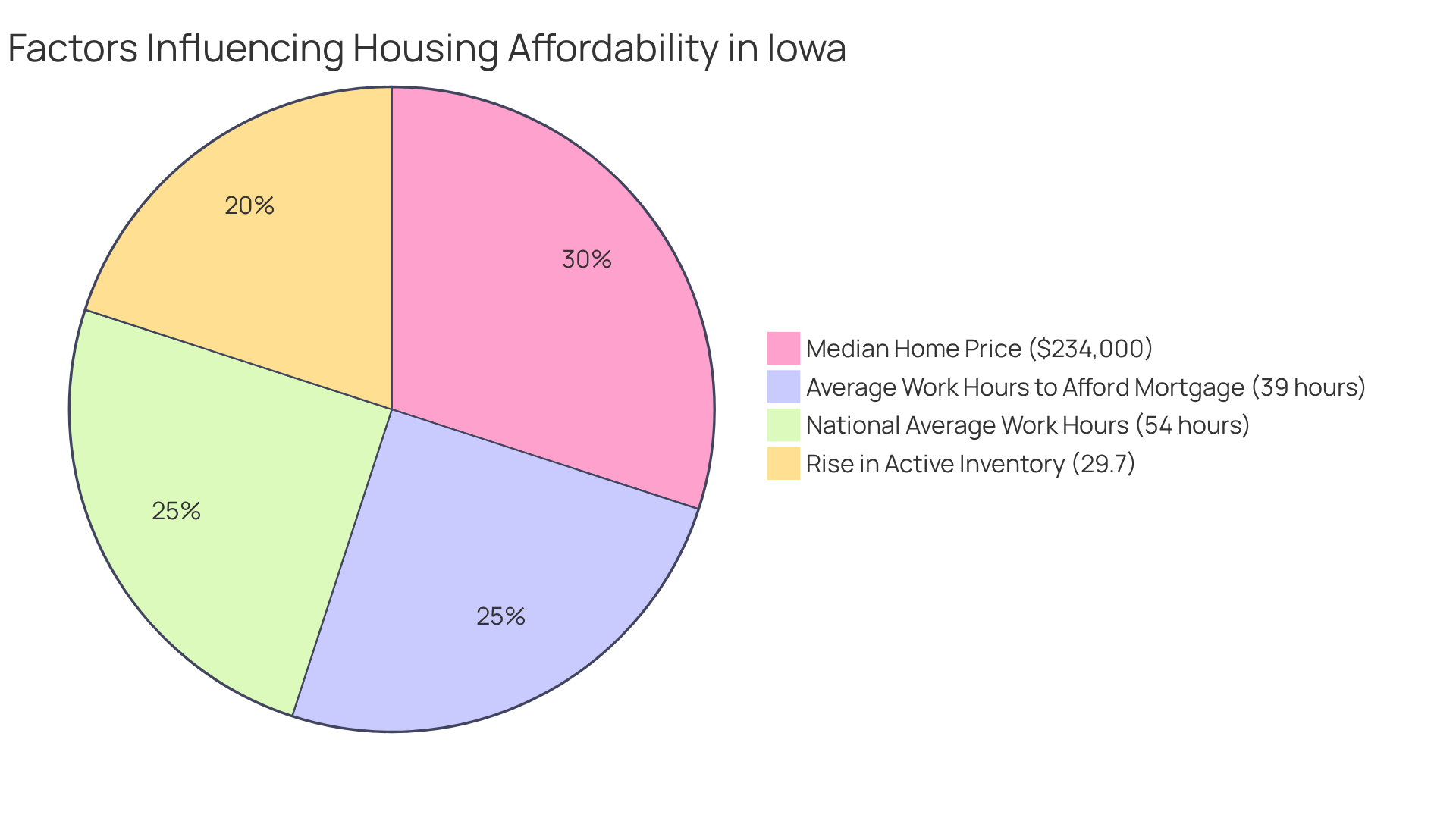

Iowa is recognized as one of the best states to buy a house for families seeking . We understand how challenging it can be to find the right community, and Iowa offers a robust educational system that consistently ranks among the best in the nation. This is a significant draw for families. With low crime rates and a wealth of parks and recreational facilities, Iowa provides a without the financial strain often associated with housing costs. As of 2024, the median sales price for homes has risen to $234,000, making it accessible for compared to national averages.

Housing analysts highlight that Iowa’s family-friendly communities are characterized by and facilities designed for children. For instance, Ankeny, recently ranked #18 in U.S. News & World Report’s Best Places to Live, exemplifies this trend with its vibrant community life and . Moreover, the region has seen a remarkable 29.7% rise in total active inventory, providing families with more choices—an essential factor for those contemplating homeownership.

Additionally, the average Iowan only needs to work 39 hours per month to afford a new mortgage payment on a typical single-family home. This is significantly lower than the national average of 54 hours. Such affordability, combined with the state’s commitment to increasing , makes Iowa one of the best states to buy a house for families looking to establish themselves and thrive. We’re here to support you every step of the way, and with F5 Mortgage’s technology-driven approach, families can access and . This empowers them to make informed decisions and achieve homeownership with ease.

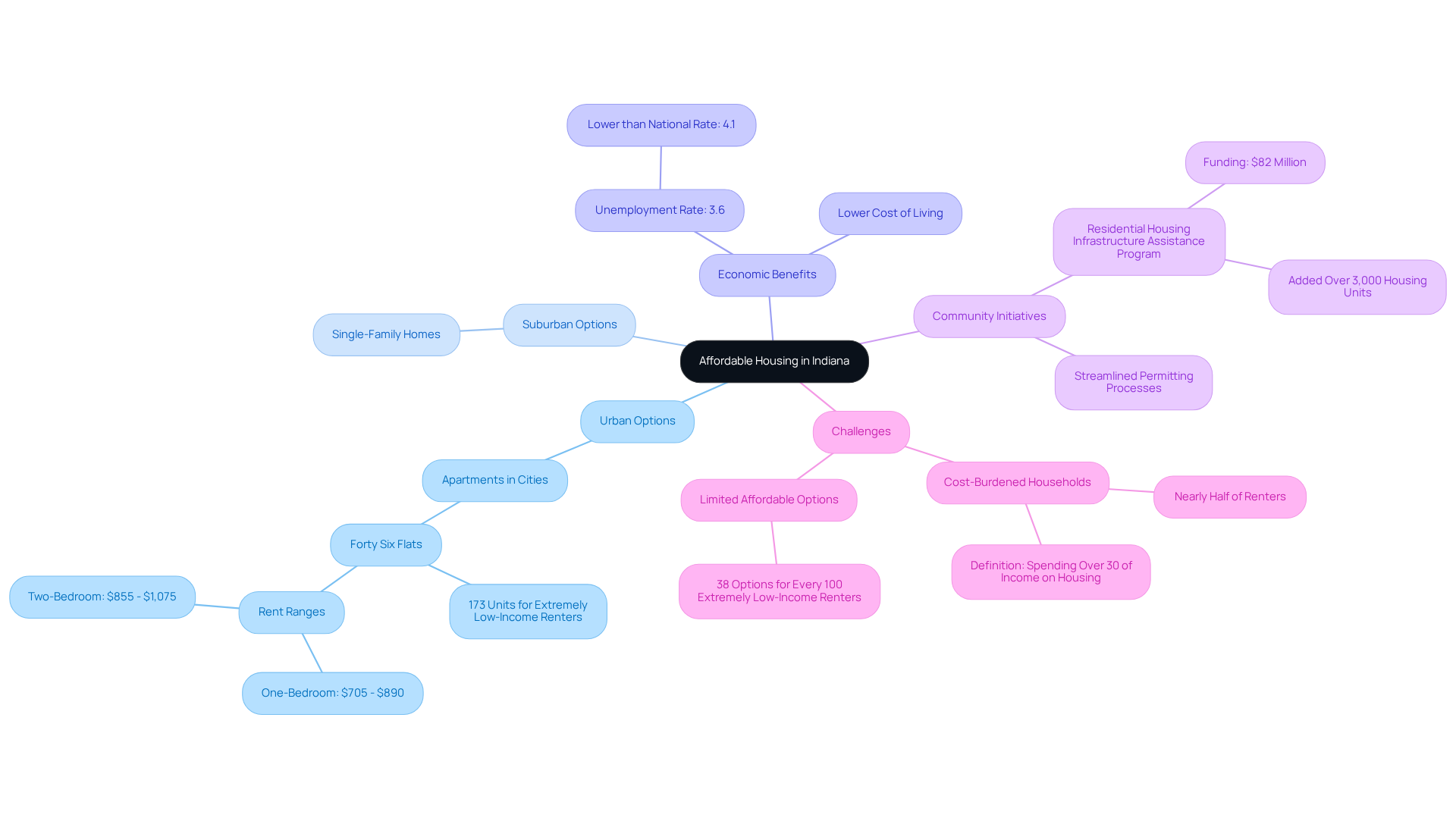

Indiana: Diverse Affordable Housing Options

Indiana offers a wide array of , catering to households with diverse needs and preferences. Whether you’re looking for urban apartments in vibrant cities or spacious single-family homes in peaceful suburbs, the state provides choices that suit various lifestyles. Importantly, Indiana’s cost of living is significantly lower than the national average, making it an appealing destination for . As of June 2025, Indiana’s unemployment rate stands at 3.6%, which is lower than the national rate of 4.1%. This suggests a that fosters stability for households.

Families can explore budget-friendly neighborhoods near Indianapolis, where aim to provide 173 units of for extremely low-income tenants. This initiative is part of a broader effort to address the housing needs of families, especially those who are —defined as spending over 30% of their income on shelter. With nearly half of all renters in Indiana facing such challenges, the state is actively working to improve the availability of .

Real estate experts highlight the significance of Indiana’s , noting that have successfully added thousands of housing units in recent years. These efforts not only encourage community development but also ensure that families can find safe, high-quality homes without straining their finances. Overall, for families seeking affordable living in a nurturing environment.

Kentucky: Low Cost of Living and Affordable Homes

Kentucky is considered one of the best states to buy a house for families looking for affordable homes and a low cost of living. Here, you’ll find a diverse range of , all available at competitive prices. As of May 2025, the median sales price for homes in Kentucky reached $279,000, reflecting a 6% increase month-over-month. This still offers significant value for those who are budget-conscious.

We know how important community is for families, and Kentucky offers a rich cultural heritage. Vibrant communities celebrate local traditions and foster a strong sense of belonging. Plus, the state is recognized for its outdoor recreational options, providing ample space for families to engage in activities that promote a healthy lifestyle.

Moreover, the remains advantageous compared to national averages. This makes it easier for families to manage their finances while enjoying a high quality of life. Recent data shows that homes are spending an average of just 13 days on the market, highlighting the demand for well-priced properties in sought-after neighborhoods.

Housing analysts suggest that Kentucky’s . Recent developments have increased the availability of new listings by 6.3% month-over-month. This trend, along with the state’s commitment to community and culture, positions Kentucky as one of the best states to buy a house for families aiming to establish their roots in an affordable and welcoming environment.

With expected to stay in the 6.5% range, families can evaluate their financial options more effectively. , with 5-star ratings from satisfied clients, offers valuable resources, including a and . These programs help families navigate the purchasing process with confidence, providing low and attractive offers. We’re here to support you every step of the way in realizing your dream of homeownership in Kentucky.

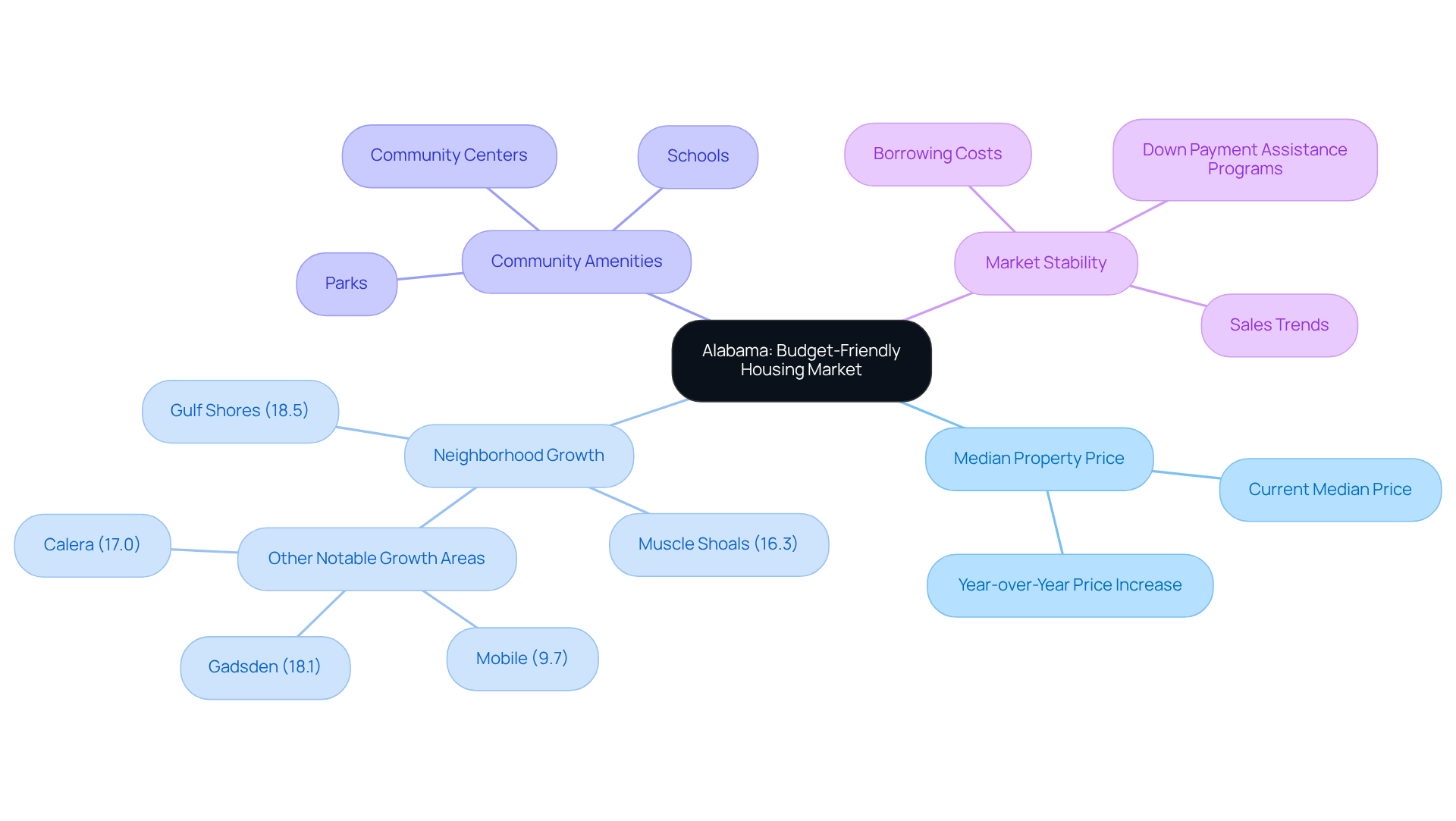

Alabama: Budget-Friendly Housing Market

Alabama stands out as an economical real estate market, offering a diverse selection of properties that appeal to . With a , many buyers find it attainable. Notably, neighborhoods like Gulf Shores and Muscle Shoals have experienced impressive sales price growth, with increases of 18.5% and 16.3%, respectively. This reflects the rising demand for .

Families can explore various neighborhoods that provide , such as parks, schools, and community centers. For instance, Mountain Brook and Homewood are recognized as some of the most competitive cities in Alabama, known for their vibrant community life and family-oriented facilities.

The warm climate and rich cultural heritage further enhance Alabama’s appeal, fostering a strong sense of community among residents. As economist David Hughes observes, ‘the , indicating that borrowing costs are becoming more manageable.’ This is promising for families seeking to settle down in a nurturing environment.

With an increasing number of homes available and a , Alabama is considered one of the for budget-minded buyers looking for their perfect dwelling. Moreover, families can benefit from provided by . These programs enable homebuyers to explore low down payment options, making homeownership more achievable.

Don’t miss out on the opportunity to explore your options! We know how challenging this can be, so reach out to F5 Mortgage today to discover more about how we can support you in your property purchasing journey.

Tennessee: Affordable Homes with Cultural Appeal

Tennessee is recognized as one of the for families seeking in vibrant communities rich in culture and history. We understand how important it is to find a place that feels like home, and Tennessee is considered one of the best states to buy a house due to its diverse selection of housing options at competitive prices, making it attainable for . Residents can immerse themselves in Tennessee’s celebrated music scene, partake in lively festivals, and enjoy numerous outdoor activities that truly enrich communal life.

Tennessee is considered one of the best states to buy a house due to its significantly low cost of living, which allows families to stretch their budgets further while enjoying a . For instance, the Blue Creek Development initiative is working hard to address the considerable lack of in the region, providing for working families. This initiative is a crucial step towards closing the affordable shelter gap, ensuring that families can thrive without facing financial strain.

Moreover, housing analysts highlight Tennessee as one of the best states to buy a house, emphasizing that the state’s rich heritage and make it an attractive choice for families. With numerous and a welcoming atmosphere, Tennessee ranks among the best states to buy a house for those looking to balance affordability with a fulfilling lifestyle. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Ohio, West Virginia, Mississippi, Arkansas, Iowa, Indiana, Kentucky, Alabama, and Tennessee stand out as the top states for budget-conscious families in search of affordable housing solutions. Each of these states brings unique advantages, from low median home prices to vibrant community amenities, making them ideal for families eager to establish roots without stretching their finances too thin. The focus on affordability, quality of life, and community support highlights the importance of making informed choices in the home-buying journey.

As we explore these states, key insights reveal diverse housing markets and initiatives aimed at enhancing family living. Ohio takes the lead with its commitment to affordable housing projects, while West Virginia and Mississippi offer a wealth of options for budget-minded buyers. Arkansas and Iowa not only showcase affordability but also a high quality of life, while Indiana, Kentucky, Alabama, and Tennessee further enhance their appeal with strong community ties and rich cultural experiences. Together, these factors create an environment where families can thrive and enjoy a fulfilling lifestyle.

We understand that the journey to homeownership can feel daunting, but gaining insight into affordable housing options empowers families to make confident decisions. As the demand for budget-friendly homes continues to grow, exploring these states offers a pathway to stability and comfort. Engaging with resources like F5 Mortgage can provide invaluable support, ensuring families have the tools they need to navigate this critical phase of their lives. Embrace the opportunity to find a home that fits both your budget and your family’s needs, and take the first step towards a brighter future today.

Frequently Asked Questions

What services does F5 Mortgage offer to homebuyers?

F5 Mortgage offers personalized mortgage consultations, a variety of loan programs tailored to individual financial circumstances, and an intuitive mortgage calculator to help users make informed decisions.

How does F5 Mortgage assist self-employed individuals?

F5 Mortgage provides specialized Bank Statement Loans designed specifically for self-employed individuals, catering to their unique financial situations.

What is the typical time frame for receiving pre-approval from F5 Mortgage?

F5 Mortgage can provide pre-approval in under an hour, enhancing the homebuying experience for clients.

What resources does F5 Mortgage provide to support homebuyers?

F5 Mortgage offers extensive resources, including a property buyer’s guide and refinancing manuals, to assist clients throughout their mortgage journey.

How can one calculate the break-even point when refinancing?

To calculate the break-even point, determine your refinancing costs and monthly savings, then divide the costs by the savings to find out how long it will take to recoup your expenses.

Why is Ohio considered an affordable state for homebuyers?

Ohio has a median property price that is notably lower than the national average, allowing families to secure spacious homes in safe neighborhoods and invest in affordable living options.

What initiatives are being implemented in Ohio to enhance affordable housing?

Ohio is committed to enhancing its residential landscape through initiatives that include projects like the Lofts at 40 Long and The Heights on Main, which aim to introduce over 200 new housing units.

What amenities can families in Ohio expect?

Families in Ohio can enjoy well-maintained parks, reputable schools, and lively community events, all contributing to a rich quality of life and enhancing the appeal of the real estate market.

What makes West Virginia an attractive option for homebuyers?

West Virginia is known for its breathtaking natural scenery and affordable housing, offering a variety of home options at competitive prices, making it ideal for budget-minded families.

What assistance does F5 Mortgage provide for families in West Virginia?

F5 Mortgage offers access to down payment assistance programs, such as FL Assist and the MI Home Loan program, to enhance affordability for homebuyers in West Virginia.