Overview

This article shines a light on the current VA Interest Rate Reduction Refinance Loan (IRRRL) rates available for veterans, showcasing their competitive nature and the numerous benefits of refinancing through this program. We understand how important it is for veterans to find financial relief, and this program offers just that. By taking advantage of these lower interest rates, veterans could potentially save between $150 to $300 each month.

Moreover, the application process is designed to be streamlined and straightforward, alleviating some of the stress that often accompanies refinancing. Importantly, there’s no requirement for private mortgage insurance, making this an even more attractive option for former service members who are looking to improve their financial situation. We’re here to support you every step of the way as you navigate this opportunity.

Introduction

Navigating the complexities of mortgage refinancing can be overwhelming for veterans. We understand how challenging this can be, especially when it comes to the VA Interest Rate Reduction Refinance Loan (IRRRL). With current VA IRRRL rates offering competitive advantages, former service members have a unique opportunity to lower their monthly payments and enhance their financial stability.

However, you might be wondering: how can veterans effectively leverage these rates to their benefit amidst fluctuating market conditions and various eligibility criteria? This article delves into seven key insights that illuminate the current landscape of VA IRRRL rates. We’re here to support you every step of the way, empowering you to make informed decisions on your refinancing journey.

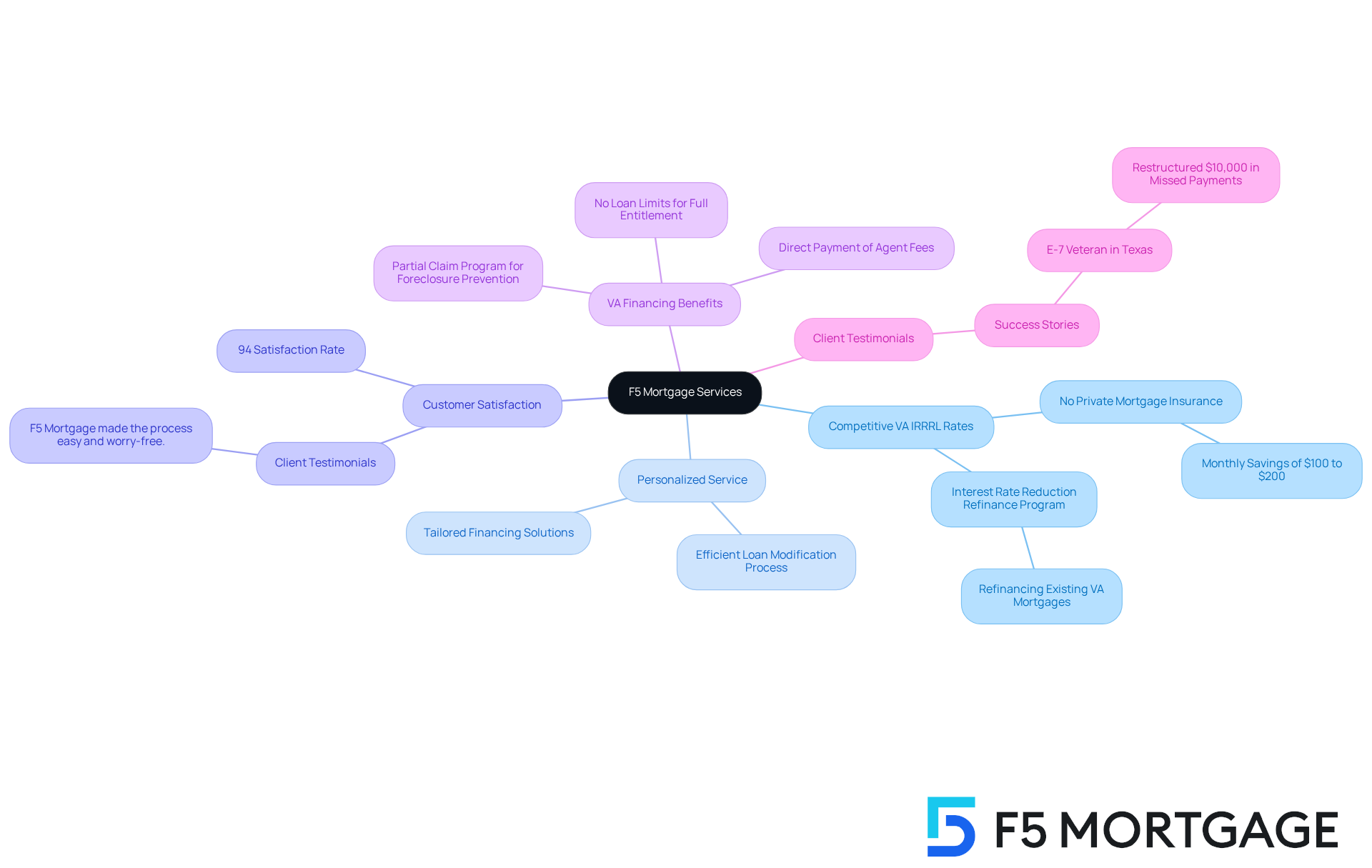

F5 Mortgage: Competitive VA IRRRL Rates and Personalized Service

F5 Mortgage stands out in the mortgage industry by offering exceptional personalized service along with competitive current VA IRRRL rates. As an independent broker, F5 Mortgage truly prioritizes the needs of former military personnel, providing tailored financing solutions that address their unique financial situations. We understand how challenging this can be, and our commitment to client contentment is evident in our remarkable of 94%. This demonstrates our proficiency in managing the complexities of VA financing.

In 2025, former service members can benefit from VA financing that does not require private mortgage insurance, leading to monthly savings of $100 to $200. The Interest Rate Reduction Refinance Program allows former service members to refinance existing VA mortgages at current VA IRRRL rates, enhancing affordability. For example, a successful case study illustrates how an E-7 former service member in Texas utilized the IRRRL to restructure $10,000 in missed payments, avoiding foreclosure and stabilizing their financial situation.

Moreover, the recent reforms under the VA Home Financing Program Reform Act have made VA financing options even more competitive. Veterans can now pay buyer’s agent fees directly, making their offers more appealing in competitive housing markets. This change, combined with the absence of loan limits for individuals with full entitlement, empowers them to make significant home purchases without the burden of a down payment.

F5 Mortgage offers an efficient loan modification process, ensuring that former service members receive the support they need during the loan adjustment experience. As one satisfied client shared, “F5 Mortgage made the process easy and worry-free. They walked through each step, ensuring we understood everything fully.” This dedication to personalized service means that veterans can confidently navigate their options and achieve their homeownership dreams.

Current VA IRRRL Rates: What Veterans Should Expect

Currently, the current VA IRRRL rates are remarkably competitive and often surpass traditional loan options. Veterans may notice fluctuations in these rates due to market dynamics, yet F5 Mortgage consistently offers some of the most available. For instance, recent trends indicate that the current VA IRRRL rates have ranged between 5.75% and 6.38%, while conventional refinancing rates have been higher, typically between 6.75% and 7.25%. This difference highlights the financial benefits of VA financing, especially for service members looking to lower their monthly payments.

Real-world examples showcase the advantages of these rates: many former service members have successfully transitioned from adjustable-rate mortgages (ARMs) to fixed-rate VA loans, securing more stable monthly payments and significant savings over time. The VA refinancing process is designed to be straightforward, requiring minimal documentation and no new appraisals in most cases, making it an accessible choice for qualified veterans.

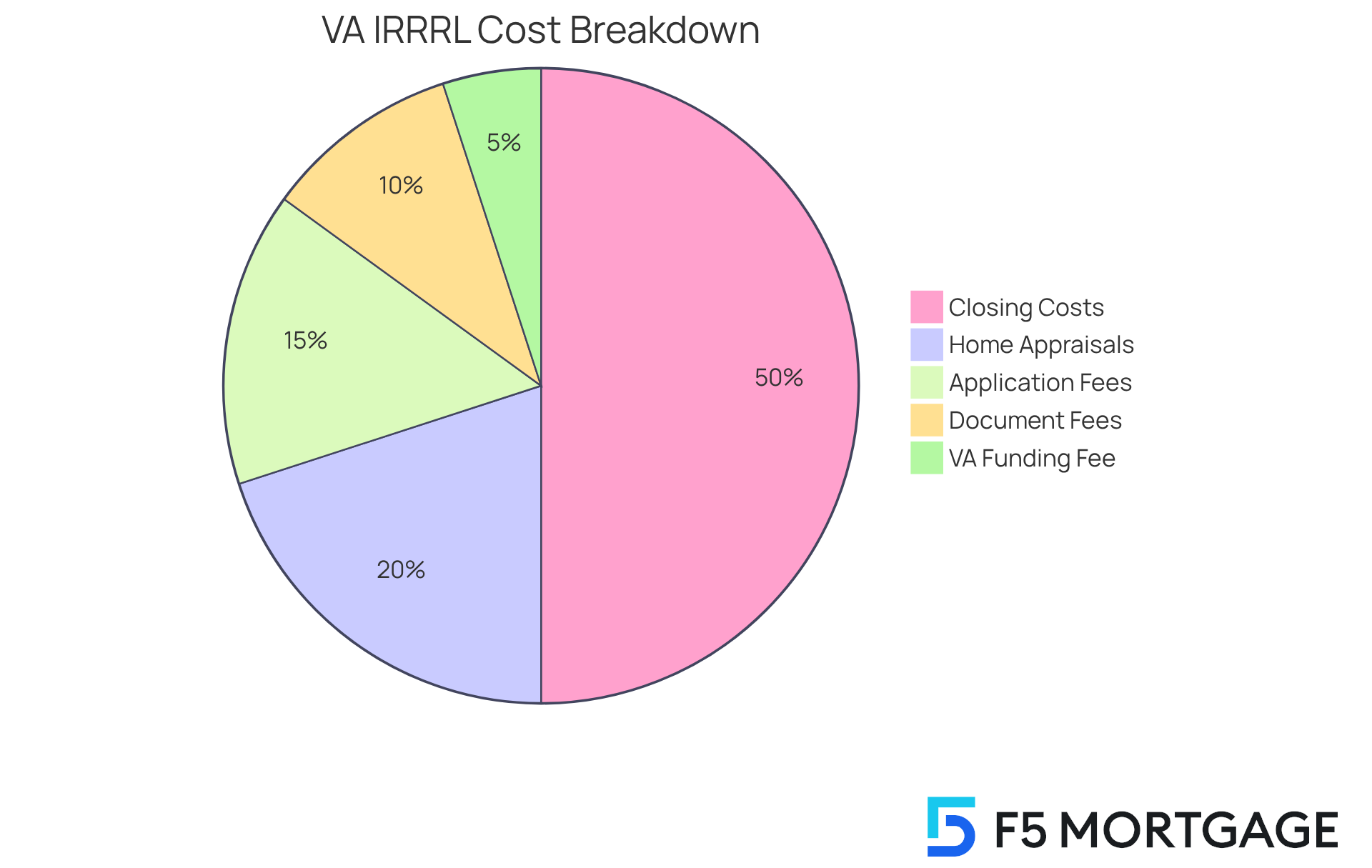

It’s important for veterans to be aware of the common expenses associated with the VA streamlined loan program. In Georgia, the costs can average around $2,727, which includes:

- Application fees ranging from $75 to $500

- Home appraisals between $225 and $700

- Document preparation fees that can vary from $50 to $600

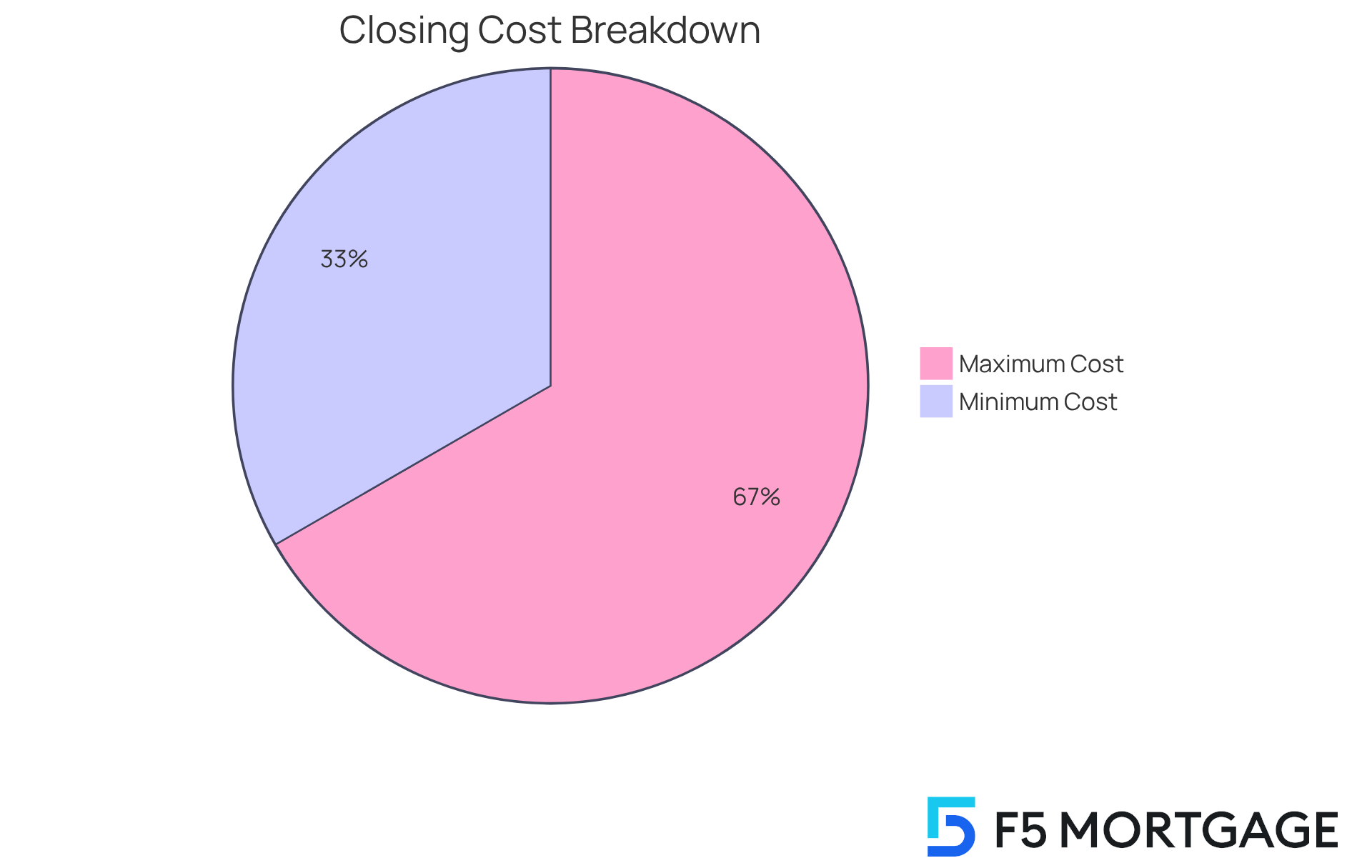

Additionally, the VA funding fee, typically set at 0.5% for most borrowers, can be rolled into the loan balance, impacting the overall cost of refinancing. Closing costs for a VA IRRRL usually range from 3% to 5% of the loan amount and can also be financed into the final loan amount, reducing upfront expenses.

To maximize savings, former service members are encouraged to monitor the current VA IRRRL rates closely and connect with a knowledgeable mortgage broker. This proactive approach can help them lock in favorable terms and ensure they are making the most informed financial decisions regarding their home financing. As the U.S. Department of Veterans Affairs states, the VA Home Loan program provides qualified homeowners with a simple way to take advantage of lower rates and decrease their monthly mortgage payment. F5 Mortgage is dedicated to transforming the mortgage financing experience by utilizing technology to provide competitive rates and a hassle-free service, ensuring that former service members can achieve homeownership with outstanding support.

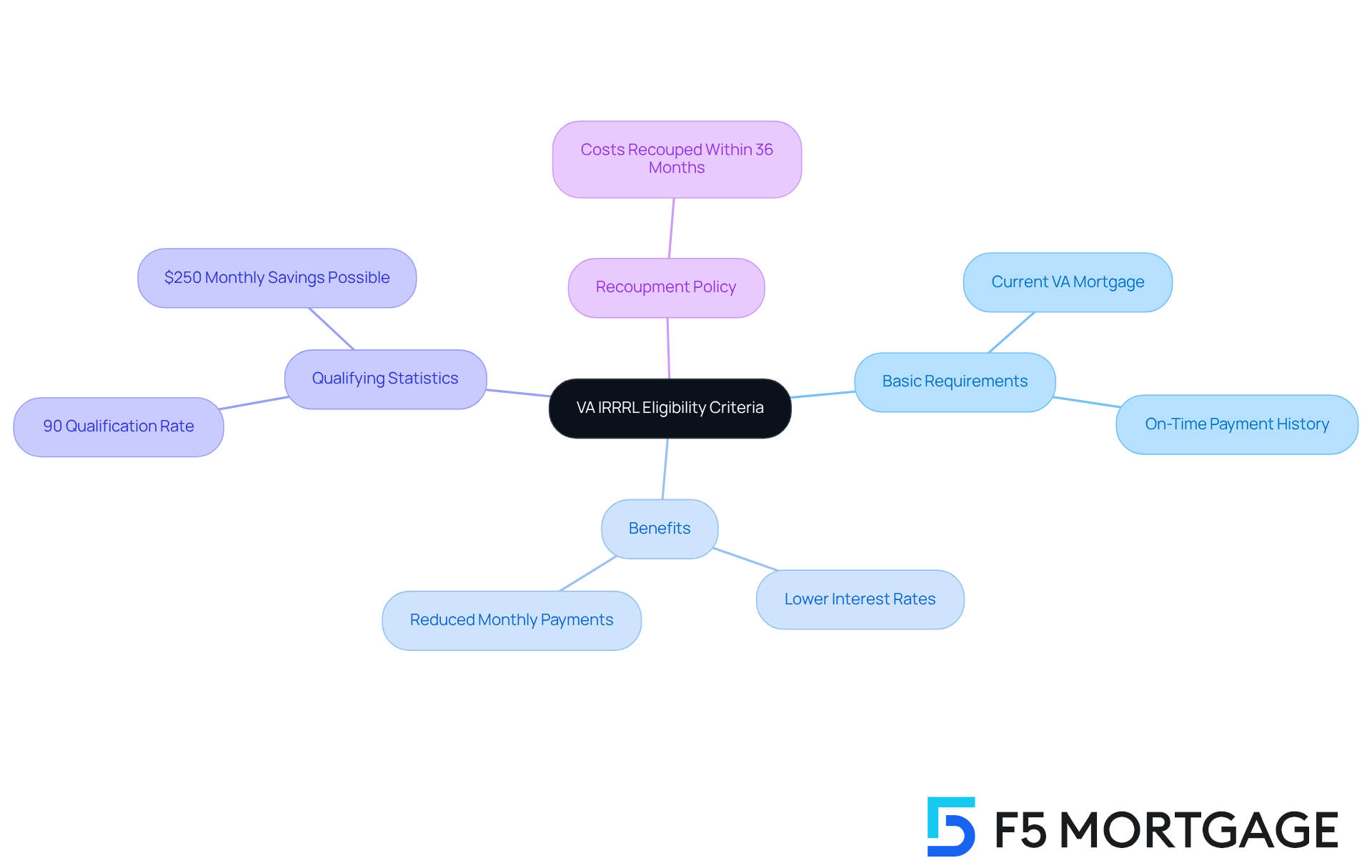

Eligibility Criteria for VA IRRRL: Who Can Apply?

If you’re a service member looking for financial relief, you may be eligible for a VA Interest Rate Reduction Refinance Mortgage (IRRRL) given the current VA IRRRL rates. To qualify, you must currently have a VA mortgage and maintain a history of on-time payments. This loan restructuring process is designed to offer you tangible benefits, such as a lower interest rate in line with current VA IRRRL rates or reduced monthly payments.

In fact, approximately 90% of former service members with existing VA loans qualify for this simplified loan option. This makes it a popular choice for property owners who are eager to save money. We understand how important it is to make informed financial decisions, and can help you navigate your specific eligibility criteria and explore the best loan modification options tailored to your financial goals.

Additionally, it’s important to note that:

- The VA requires all refinance-related costs to be recouped within 36 months.

- This ensures that your refinancing decision is not only beneficial but also financially sound.

Remember, we’re here to support you every step of the way as you consider this valuable opportunity.

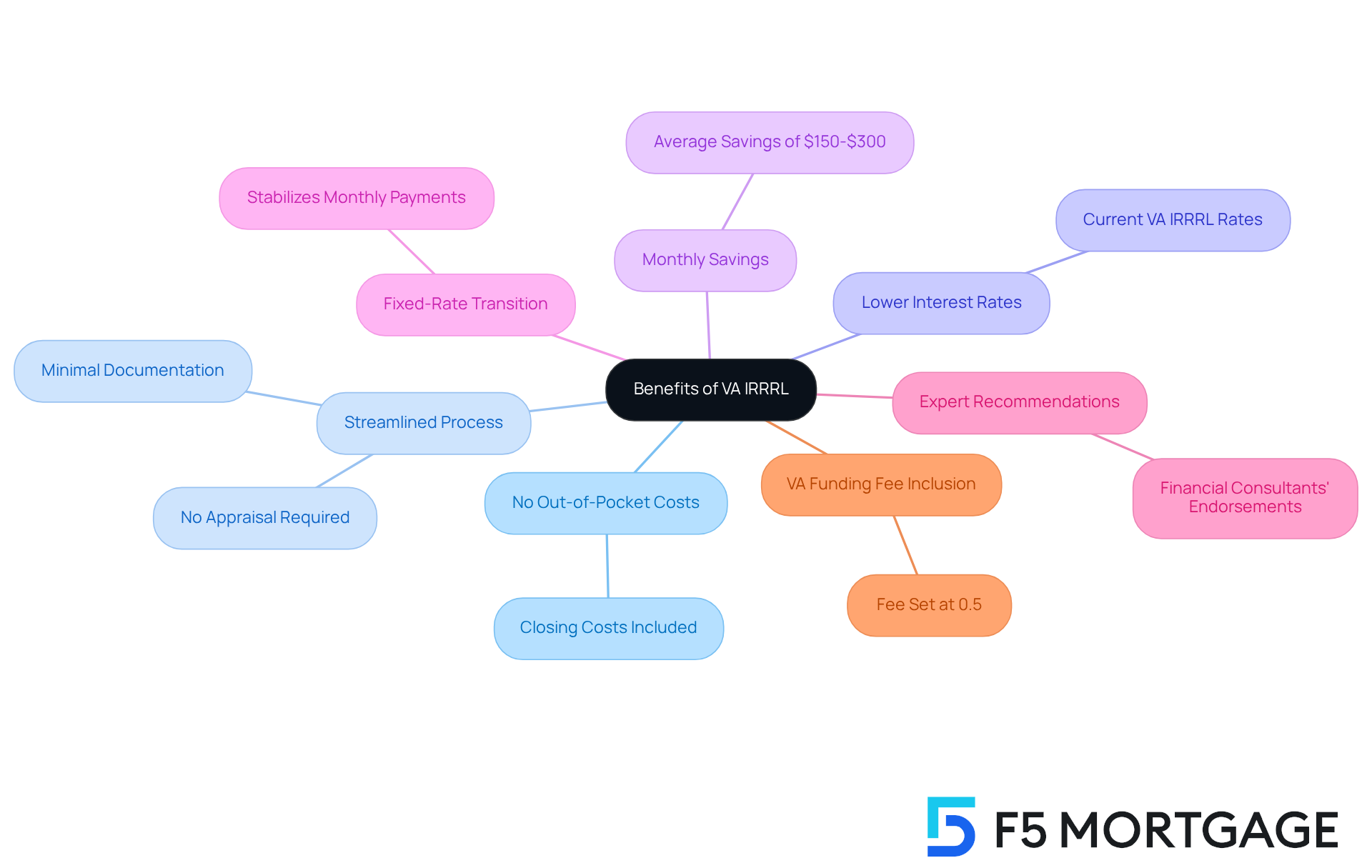

Benefits of VA IRRRL: Why Choose This Refinancing Option?

The VA IRRRL program offers numerous advantages that make it an appealing option for veterans looking to refinance. One of its standout features is the absence of out-of-pocket costs, which allows borrowers to include closing expenses in the financing. Furthermore, the process is streamlined—requiring no appraisal and minimal documentation—significantly reducing the time and effort involved in refinancing. At F5 Mortgage, we’re here to support you every step of the way, ensuring you receive dedicated assistance throughout this process.

Veterans can enjoy due to the current VA IRRRL rates, leading to substantial savings over the life of the loan. Many former service members report saving between $150 to $300 each month through this program, alleviating financial strain and enhancing overall quality of life. Additionally, transitioning from an adjustable-rate mortgage to a fixed-rate mortgage stabilizes monthly payments, providing peace of mind.

Expert insights emphasize the importance of the VA loan program, with many financial consultants recommending it as a wise choice for service members eager to benefit from the current VA IRRRL rates. This program is designed to ensure that former service members achieve a net tangible advantage, making it a responsible option for restructuring debt. Moreover, the VA funding fee, typically set at 0.5%, can be included in the loan, clarifying the expenses associated with the refinance option. Overall, the VA program not only simplifies the loan process but also empowers service members to secure improved financial futures with the support of F5 Mortgage.

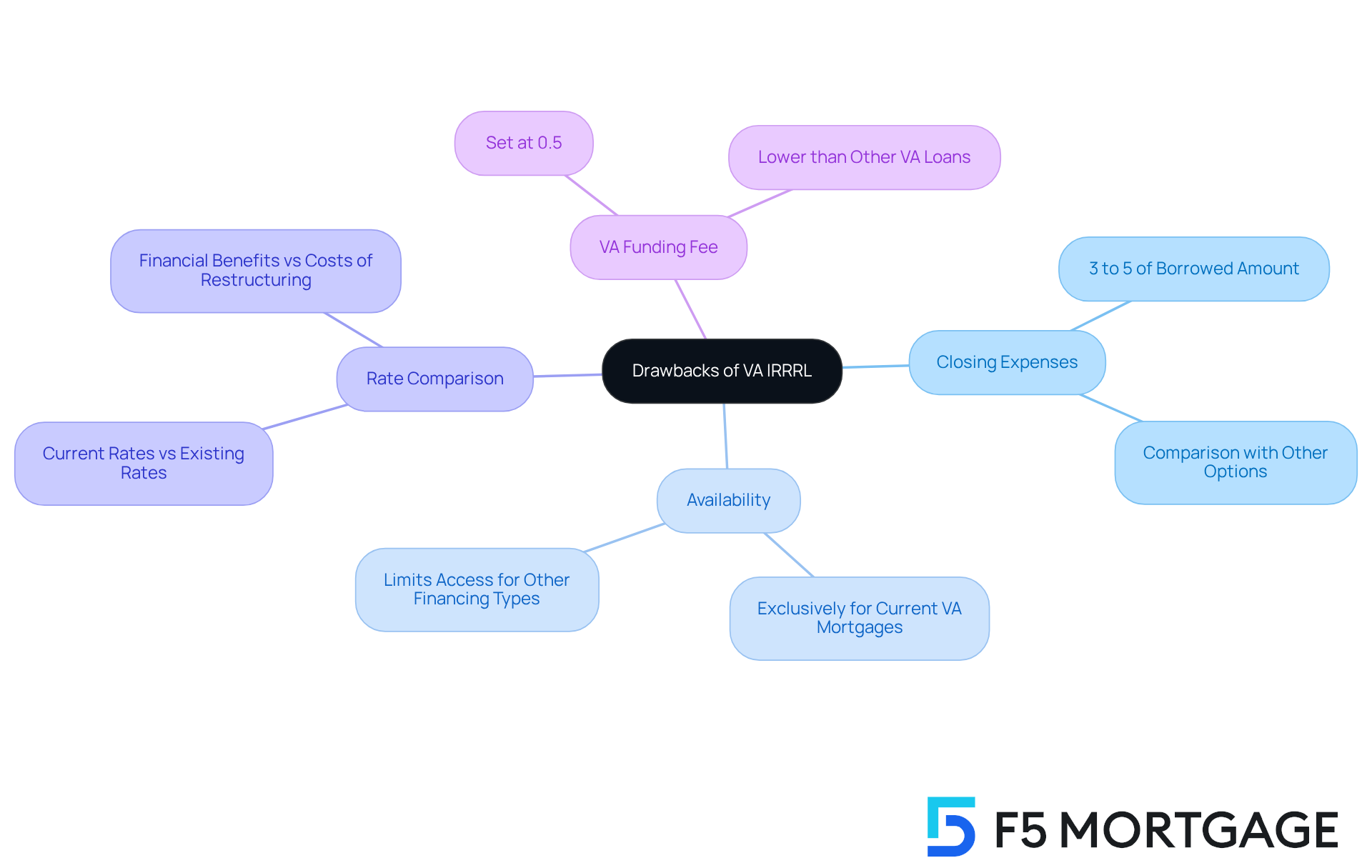

Drawbacks of VA IRRRL: What to Consider Before Refinancing

While the VA IRRRL program offers numerous advantages, we understand how important it is for former service members to consider its drawbacks. One major issue is that closing expenses for VA IRRRLs typically range from 3% to 5% of the amount borrowed. This can sometimes exceed those associated with other options for obtaining funds. Additionally, the program is exclusively available for current VA mortgages, which may limit access for veterans with different types of financing.

If the current VA IRRRL rates do not show a significant decrease compared to the existing rate, the financial benefits might not outweigh the costs of restructuring. We know how challenging this can be, and it’s essential for veterans to be aware that the is set at 0.5%. While this is lower than fees for other VA loans, it can still contribute to the overall expense.

Therefore, it is crucial for veterans to thoughtfully assess these factors. Seeking guidance from financial advisors can empower them to decide whether refinancing through the VA program is the right choice for their individual financial circumstances. We’re here to support you every step of the way.

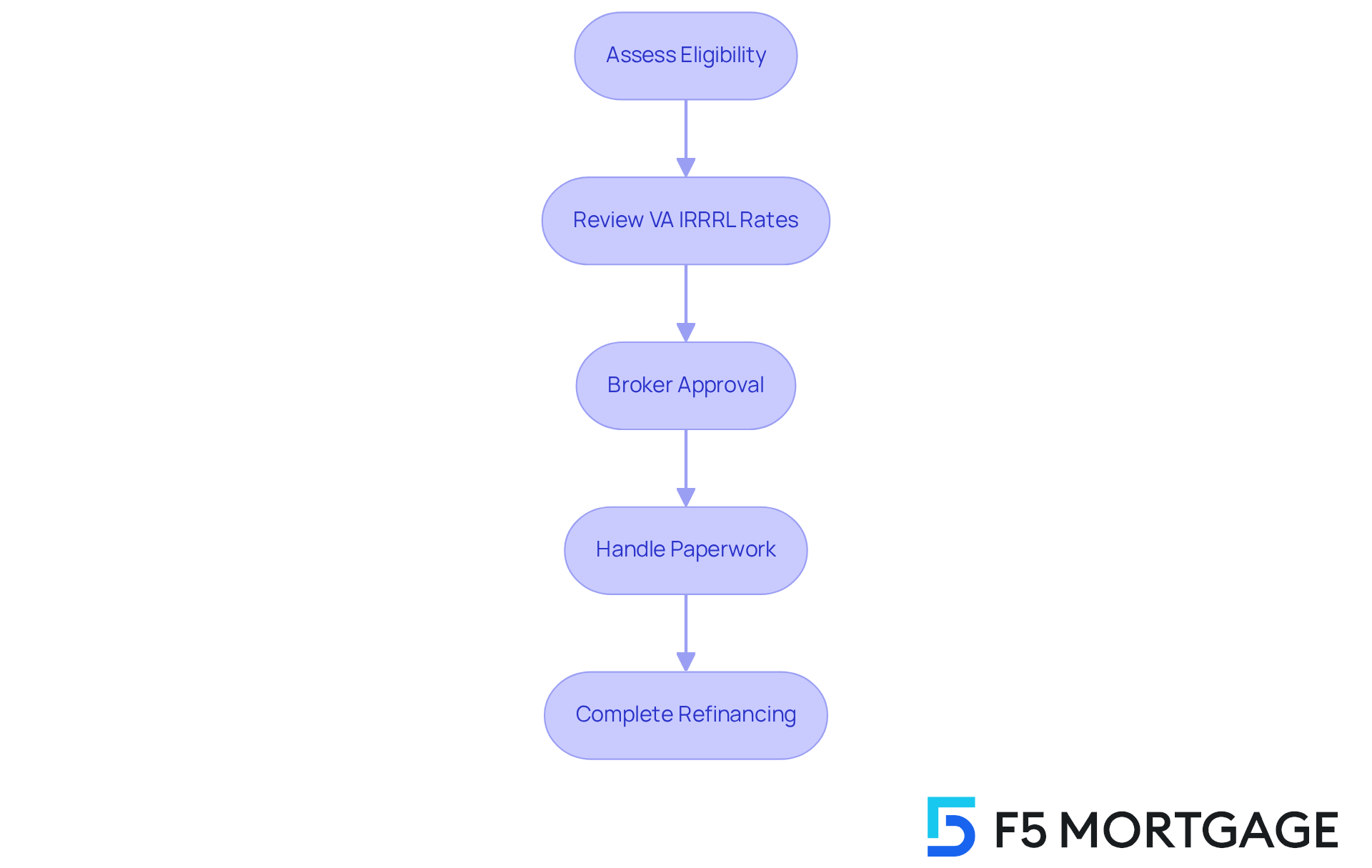

Streamlined Process of VA IRRRL: How It Works

Navigating the VA IRRRL process can feel overwhelming, but it’s designed with simplicity and efficiency in mind. We understand how important it is for veterans to secure . By reaching out to a mortgage broker like F5 Mortgage, you can begin assessing your eligibility and reviewing the current VA IRRRL rates for your financing options.

Once you’re approved, the broker will handle all the paperwork, ensuring a seamless transition to your new loan. Imagine having the entire refinancing process completed in under 30 days! This quick turnaround allows service members to enjoy the benefits of lower interest rates and reduced monthly payments without unnecessary delays.

At F5 Mortgage, our mortgage specialists emphasize that this efficient method not only saves you time but also enhances your financial security. We know how challenging this can be, and we’re here to support you every step of the way. Choosing to [refinance your current VA IRRRL rates](https://valoansflorida.com/va-streamline-refinance) could be one of the best decisions for your financial future.

VA IRRRL Closing Costs: What to Expect

Navigating closing expenses for VA IRRRL mortgages can feel overwhelming, but understanding the details can make a significant difference. Typically, these expenses range from 0.5% to 3% of the amount borrowed, which includes various fees such as lender charges, title insurance, and recording fees. One of the most notable benefits for former service members is the ability to incorporate these expenses into the financing. This option can greatly reduce out-of-pocket costs at closing, easing some of the financial burden.

For instance, if a servicemember is restructuring a $300,000 loan, the closing costs could vary between $1,500 and $9,000, depending on the specific fees involved. Many former service members find success in managing these costs by discussing their options with mortgage brokers. These professionals can provide tailored advice that takes individual circumstances into account, ensuring that veterans feel supported throughout the process.

We know how challenging this can be, which is why is crucial. Industry professionals often recommend reviewing the Loan Estimate provided by lenders. This proactive approach not only aids in budgeting but also ensures that veterans are well-informed about their financial obligations during the restructuring process. Remember, you are not alone in this journey; we’re here to support you every step of the way.

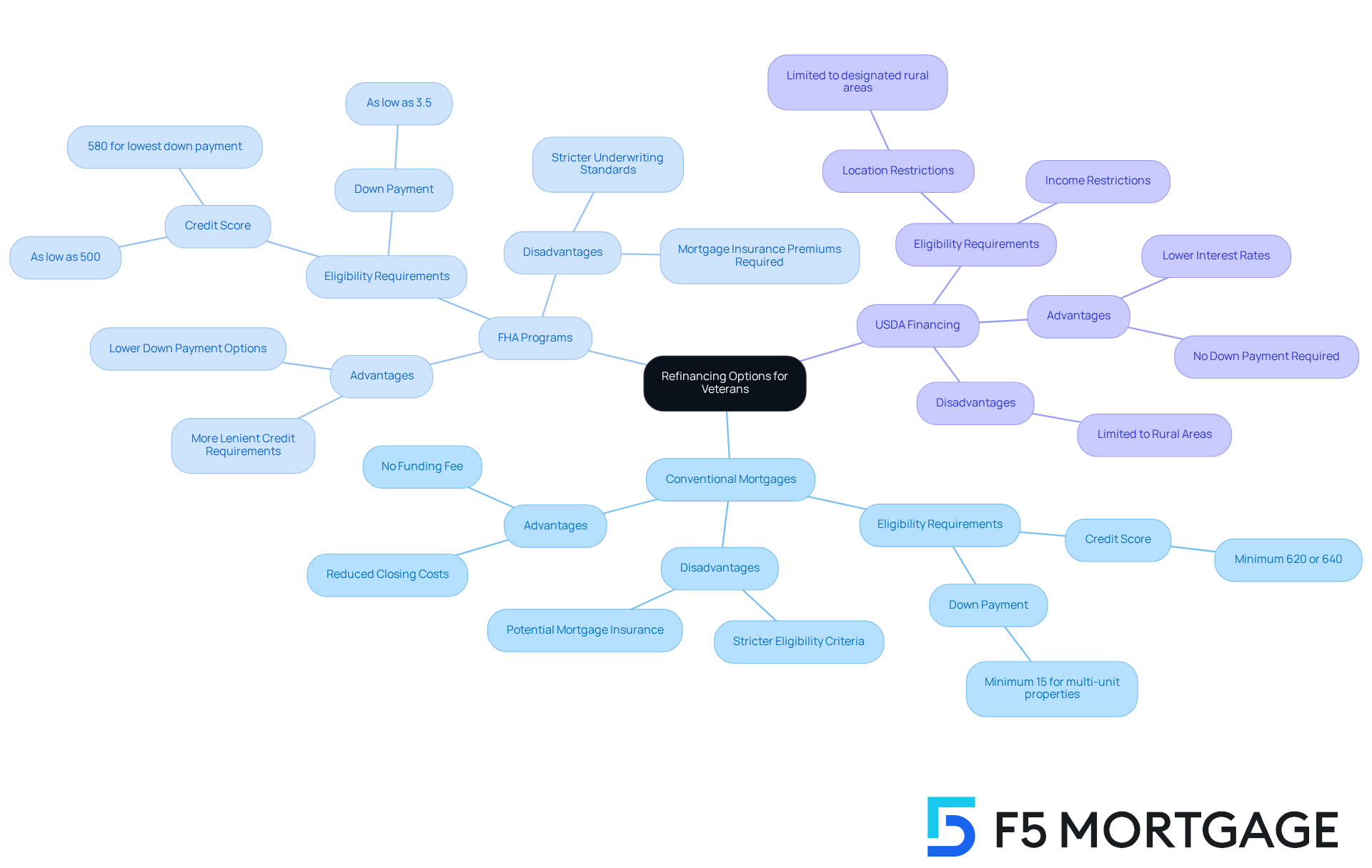

Alternatives to VA IRRRL: Other Refinancing Options for Veterans

Veterans, we understand that exploring refinancing options can feel overwhelming. Beyond the VA Interest Rate Reduction Refinance Program (IRRRL), there are several alternatives available to you, including:

- Conventional mortgages

- FHA programs

- USDA financing

Each of these options comes with its own eligibility requirements and advantages, and we’re here to help you navigate them.

For instance, traditional financing options often have reduced closing expenses, making them appealing for those of you with excellent credit. On the other hand, FHA financing is designed for borrowers with lower credit scores, offering a valuable pathway to homeownership for individuals who might otherwise find it challenging to qualify.

USDA loans, while limited to specific rural areas, provide no down payment choices, further enhancing accessibility for qualified individuals. We know how challenging this can be, but can empower you to make informed decisions. Together, we can ensure you choose the financial solution that aligns best with your unique situation and long-term goals.

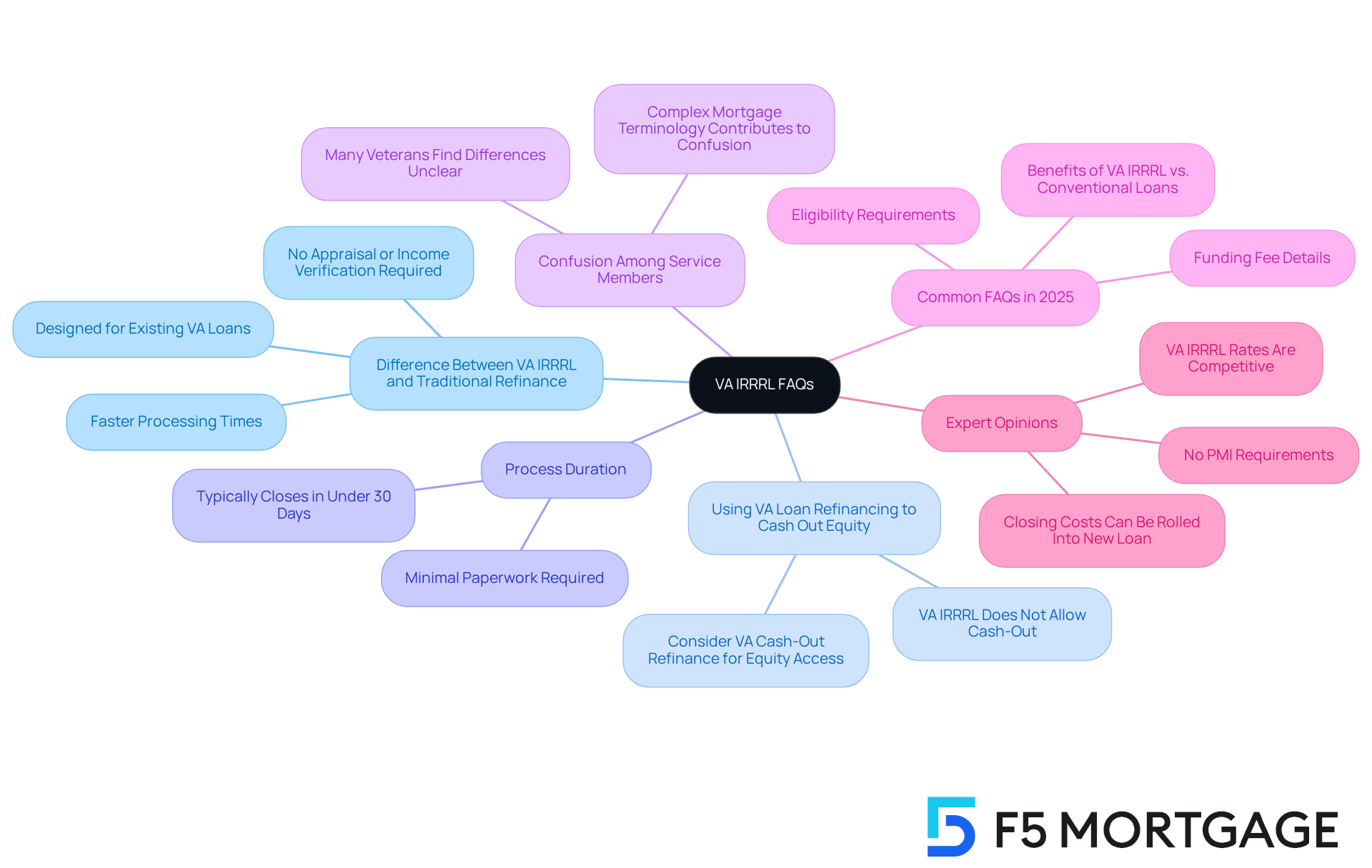

FAQs About VA IRRRL: Common Questions Answered

Veterans often have questions about the , particularly regarding how it differs from conventional refinancing. We understand how challenging this can be, so here are some key inquiries and their answers:

- What is the difference between VA IRRRL and a traditional refinance? The VA IRRRL, or Interest Rate Reduction Refinance Loan, is specifically designed for veterans with existing VA loans, particularly considering the current VA IRRRL rates. It offers a simplified process that typically requires no appraisal or income verification, making it faster and more convenient than conventional loan options, which often involve more extensive documentation and longer processing times.

- Can I use VA loan refinancing to cash out equity? Unfortunately, the VA IRRRL does not allow for cash-out refinancing. It is intended solely for lowering interest rates or transitioning from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. If you’re looking to access home equity, consider the VA Cash-Out Refinance option, which allows you to borrow against your home equity.

- How long does the process take? The VA IRRRL process is remarkably quick, with many loans closing in under 30 days due to the minimal paperwork required. This efficiency is a significant advantage for veterans who want to refinance swiftly at current VA IRRRL rates.

- What percentage of service members are confused about VA loan refinancing compared to traditional refinancing? A substantial number of veterans find the differences between VA IRRRL and traditional refinancing unclear, often due to the complexities of mortgage terminology and the specific requirements of each program. We’re here to support you in navigating these details.

- What are some common FAQs about VA refinancing in 2025? As of 2025, veterans frequently ask about eligibility requirements, the funding fee (typically 0.5% of the loan amount), and the benefits of refinancing through the VA IRRRL compared to conventional loans.

- What do mortgage experts say about VA refinancing options? Experts emphasize that the current VA IRRRL rates make the VA IRRRL one of the simplest and fastest mortgage products available, allowing veterans to reduce their monthly payments with minimal hassle. They highlight the program’s unique benefits, such as no private mortgage insurance (PMI) requirements and the ability to roll closing costs into the new loan.

Understanding these aspects of the VA refinancing program can empower former service members to make informed decisions about their refinancing options, ensuring they fully leverage the benefits available to them.

How to Apply for a VA IRRRL: Step-by-Step Guide

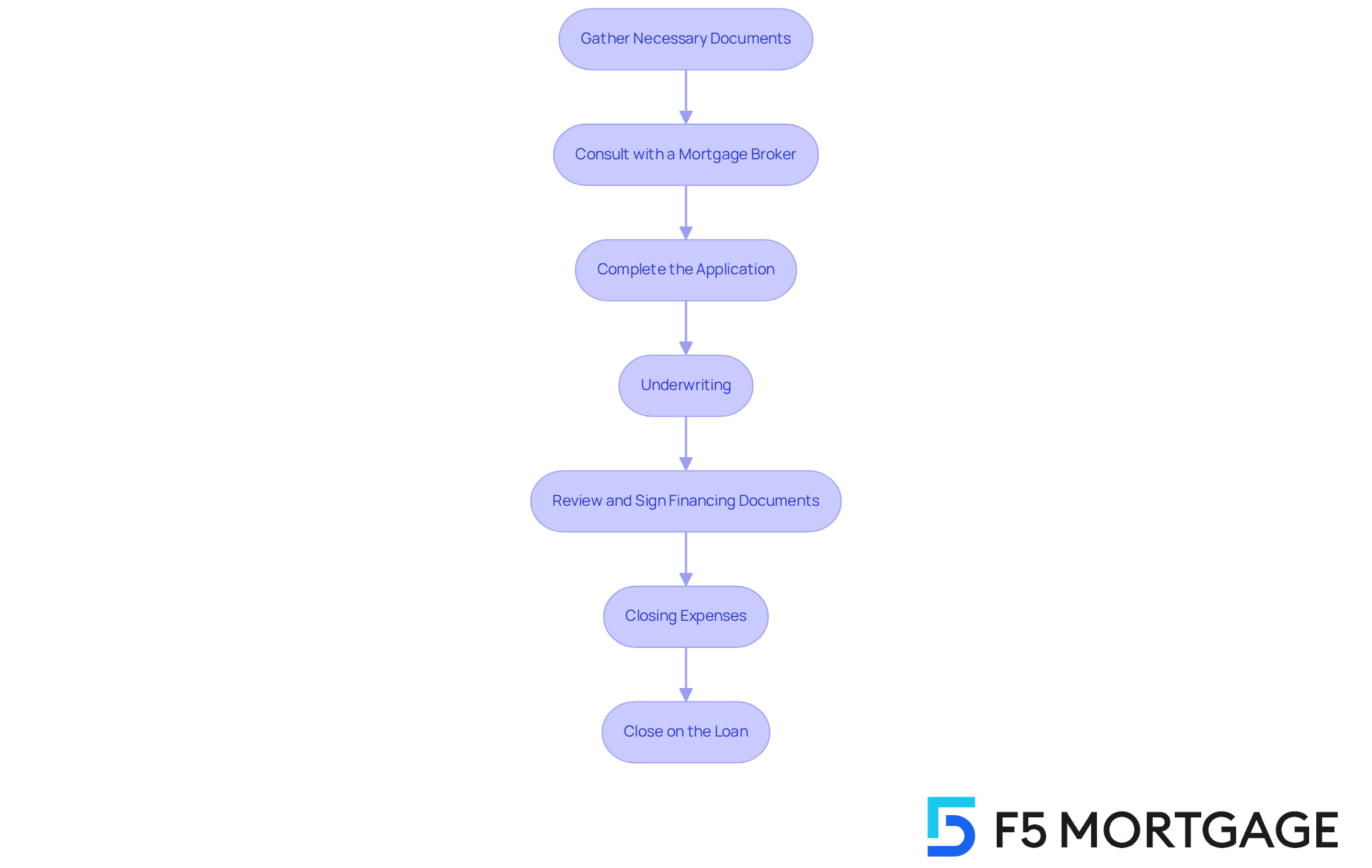

Applying for a VA IRRRL can be a straightforward journey, and as a former service member, you can navigate it with confidence. We understand how important this process is for you, so here’s a step-by-step guide designed to simplify your application:

- Gather Necessary Documents: Start by collecting essential paperwork, including your Certificate of Eligibility (COE), recent mortgage statements, and any documentation related to your existing loan. This process typically takes veterans an average of one to two weeks, depending on individual circumstances.

- Consult with a Mortgage Broker: Reach out to a mortgage broker, such as F5 Mortgage, to discuss your eligibility and explore available options. Brokers can provide valuable insights into current VA IRRRL rates and assist you in understanding the benefits of refinancing, ensuring you feel supported every step of the way.

- Complete the Application: With your broker’s assistance, fill out the application form. The VA IRRRL process is designed to be efficient, often requiring minimal documentation—no income or employment verification is needed unless your new mortgage payment increases by over 20%. We know how challenging paperwork can be, and we’re here to help.

- Underwriting: After submitting your application, the lender will review your financing request, credit history, debt-to-income ratio, and other requirements to complete the credit approval process. An appraisal may also be conducted to assess your property’s current value, ensuring everything is in order.

- Review and Sign Financing Documents: Once your application is processed, take the time to carefully examine the financing documents. Ensure that all terms are clear and that you understand your new payment structure. This is an important step in feeling secure about your decision.

- Closing Expenses: Be prepared to cover closing expenses, which can differ based on your financing terms and lender requirements. Understanding these expenses is essential for a comprehensive view of your , and we’re here to clarify any questions you may have.

- Close on the Loan: After signing, the closing process typically takes just a few weeks, allowing you to start enjoying the benefits of lower monthly payments quickly. This can be a significant relief, and we’re excited for you to experience it.

This streamlined approach not only simplifies the refinancing journey but also empowers veterans like you to take advantage of favorable loan terms without the usual hurdles associated with traditional refinancing options. Remember, we’re here to support you throughout this process.

Conclusion

Navigating the landscape of VA IRRRL rates can be a transformative experience for veterans seeking financial relief through refinancing. We understand how challenging this can be. This article highlights the exceptional benefits of the VA Interest Rate Reduction Refinance Loan, emphasizing how these tailored solutions cater specifically to the needs of former service members. By leveraging competitive current VA IRRRL rates, veterans can significantly reduce their monthly payments, avoid private mortgage insurance, and streamline their refinancing process.

Key insights reveal that the VA IRRRL program stands out due to its:

- Low costs

- Minimal documentation requirements

- Ability to roll closing expenses into the loan

With many veterans successfully transitioning to fixed-rate loans and enjoying substantial savings, the advantages are clear. The process is designed to be efficient, allowing for quick approvals and a hassle-free experience. This makes it an attractive option compared to conventional loans.

Ultimately, the significance of the VA IRRRL program cannot be overstated. It provides a vital opportunity for veterans to enhance their financial stability and achieve their homeownership goals. Those considering refinancing should take proactive steps to explore their options. We encourage you to consult with knowledgeable mortgage brokers and stay informed about current VA IRRRL rates. By doing so, veterans can make empowered decisions that pave the way for a brighter financial future. We’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage is an independent broker that specializes in providing personalized mortgage services, particularly for former military personnel. They offer competitive VA Interest Rate Reduction Refinance Loan (IRRRL) rates and tailored financing solutions to meet the unique financial needs of veterans.

What are the benefits of the VA IRRRL program?

The VA IRRRL program allows former service members to refinance existing VA mortgages at current competitive rates, potentially saving them $100 to $200 monthly by eliminating the need for private mortgage insurance. It also simplifies the refinancing process with minimal documentation and no new appraisals in most cases.

What are the current VA IRRRL rates?

Current VA IRRRL rates range between 5.75% and 6.38%, which are generally more competitive than conventional refinancing rates that typically range from 6.75% to 7.25%.

What costs are associated with the VA IRRRL program?

Common costs associated with the VA IRRRL program can average around $2,727 in Georgia, including application fees ($75 to $500), home appraisals ($225 to $700), and document preparation fees ($50 to $600). The VA funding fee is usually 0.5% and can be rolled into the loan balance. Closing costs typically range from 3% to 5% of the loan amount.

Who is eligible for the VA IRRRL program?

To be eligible for the VA IRRRL program, applicants must currently have a VA mortgage and a history of on-time payments. Approximately 90% of former service members with existing VA loans qualify for this program.

What is the requirement regarding refinancing costs?

The VA requires that all refinance-related costs be recouped within 36 months to ensure that the refinancing decision is financially beneficial.

How does F5 Mortgage ensure customer satisfaction?

F5 Mortgage is committed to client contentment, demonstrated by their 94% customer satisfaction rate. They provide personalized service and support throughout the loan modification process to help veterans navigate their options confidently.