Overview

This article highlights the essential FHA inspection requirements that every homebuyer should be aware of to secure FHA financing. We understand how challenging navigating this process can be, and it’s crucial to ensure that properties meet safety, structural, and livability standards. Non-compliance can lead to loan denial or unexpected repairs, which can significantly impact your homebuying journey.

By familiarizing yourself with these requirements, you empower yourself to make informed decisions. Remember, we’re here to support you every step of the way. Ensuring your future home meets these standards not only protects your investment but also provides peace of mind as you embark on this exciting journey.

Introduction

Understanding the intricacies of FHA inspection requirements is essential for any homebuyer seeking FHA financing. We know how challenging this can be, but these inspections are vital. They ensure that properties meet the Federal Housing Administration’s safety and livability standards, protecting your investment in the long run.

Navigating the complexities of these requirements can feel overwhelming. What are the key factors that can make or break a successful FHA inspection? How can you prepare to meet these standards? In this article, we delve into the critical FHA inspection criteria, offering insights that empower you to approach the home-buying process with confidence. We’re here to support you every step of the way.

F5 Mortgage: Understanding FHA Inspection Requirements for Homebuyers

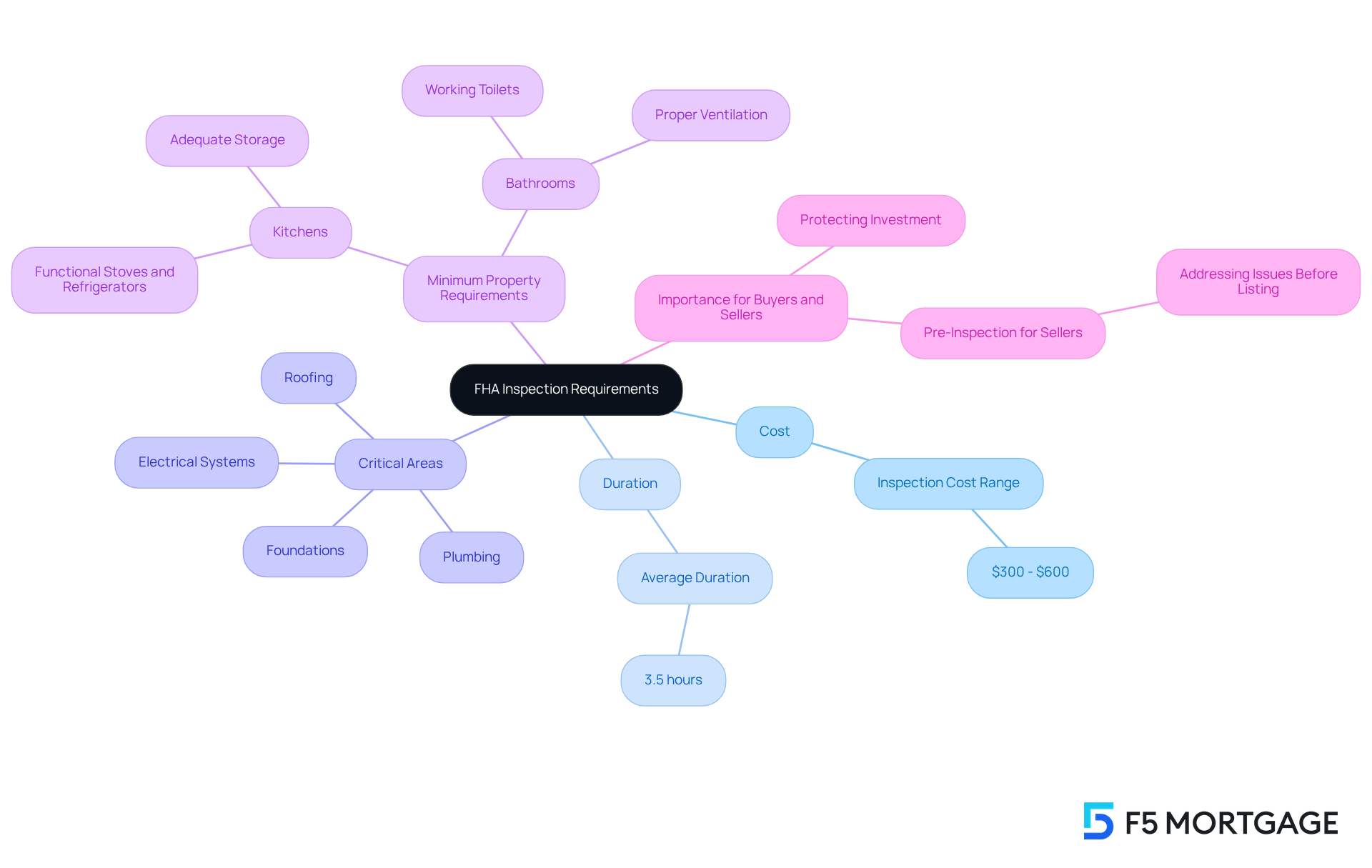

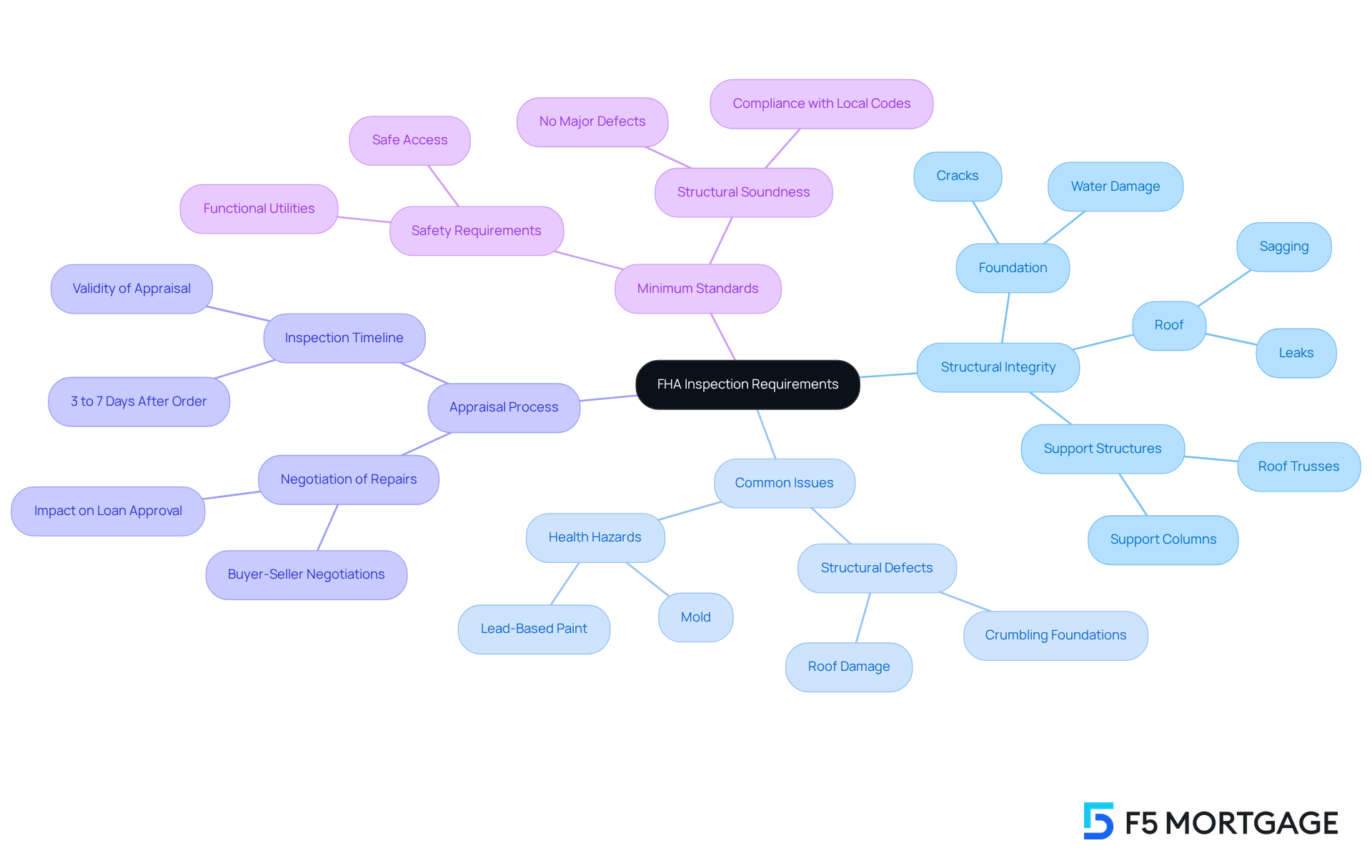

At F5 Mortgage, we understand how important it is for you to grasp [FHA inspection requirements](https://f5mortgage.com/loan-programs/fha-loans), which are essential for securing FHA financing. These evaluations are designed to ensure that buildings meet the safety, security, and structural criteria set by the Federal Housing Administration (FHA). It’s important to note that an FHA assessment can cost between $300 and $600 and typically lasts around 3.5 hours. During this time, evaluators will examine critical areas such as:

- Foundations

- Roofing

- Plumbing

- Electrical systems

On average, an FHA evaluation reveals about 8.5 potential concerns per asset, underscoring the significance of this process in safeguarding your investment.

Understanding FHA inspection requirements is crucial because properties must meet to qualify for FHA loans. For example, kitchens should have functional stoves, refrigerators, and adequate storage, while bathrooms need working toilets and proper ventilation. By familiarizing yourself with these standards, you can avoid potential complications during the loan approval process.

Real-life stories illustrate the importance of FHA evaluations in ensuring compliance. One couple, excited to buy their first home, attended the FHA inspection, which revealed a small leak in the attic and an aging furnace. This insight empowered them to make informed decisions about necessary repairs, ultimately protecting their investment.

Additionally, we encourage sellers to conduct pre-inspections to identify and address any significant issues before listing their homes. This proactive approach not only enhances the marketability of the property but also minimizes the risk of negotiations that could lower the sale price or jeopardize the transaction.

In summary, understanding FHA inspection requirements is vital for homebuyers who are pursuing FHA financing. It helps ensure that homes meet essential standards for safety and livability, facilitating a smoother mortgage approval process. We’re here to support you every step of the way, so don’t hesitate to reach out to F5 Mortgage for assistance in navigating these requirements.

Safety Standards: Key FHA Inspection Requirements for Properties

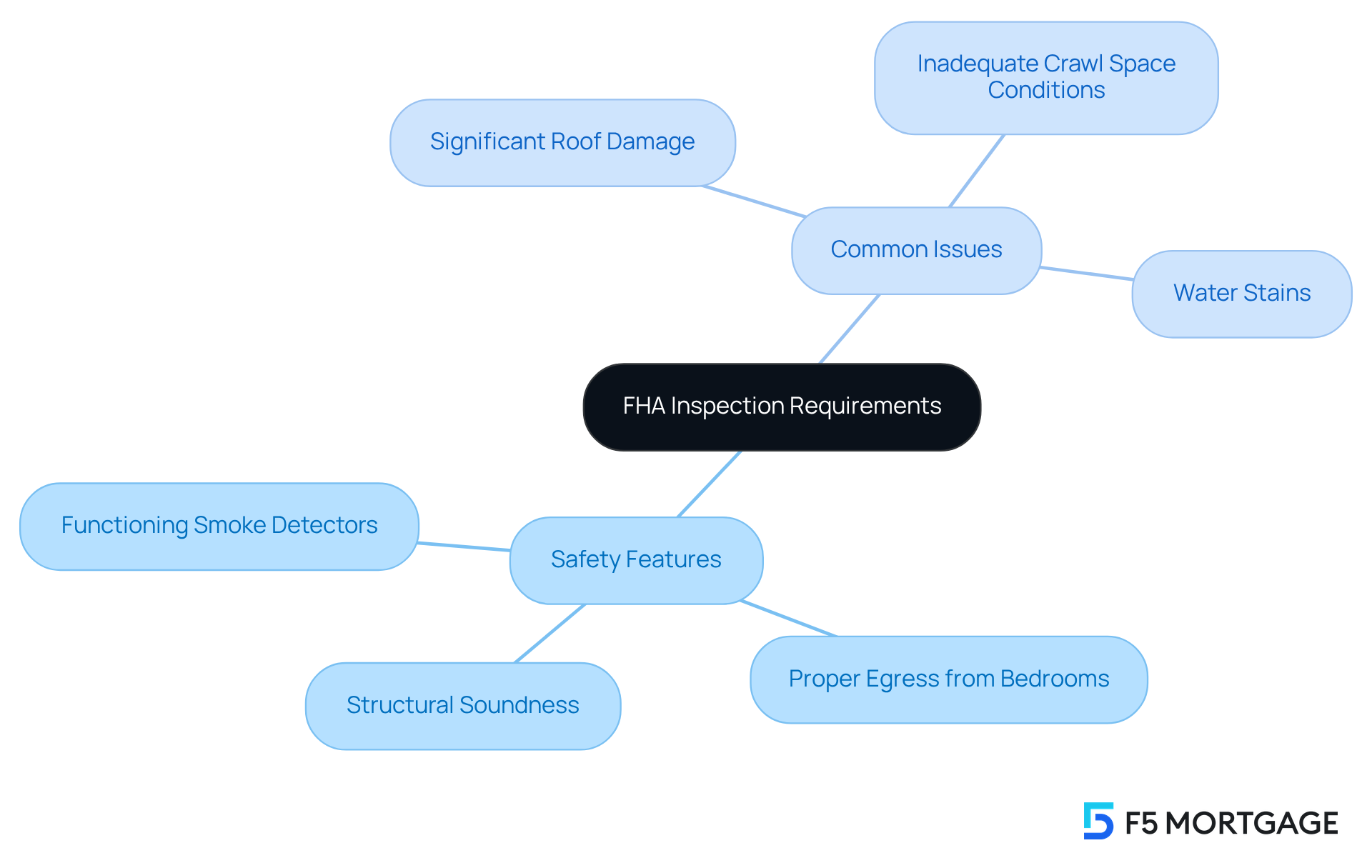

FHA evaluations are designed with your safety in mind. They require that buildings are free from dangers such as exposed wiring, mold, and structural flaws. Essential safety features, like functioning smoke detectors and proper egress from bedrooms, are vital for ensuring your family’s well-being.

Common issues that could lead to a dwelling not meeting [FHA inspection requirements](https://f5mortgage.com/7-essential-fha-loan-florida-insights-for-2025-borrowers) include:

- Significant roof damage

- Inadequate crawl space conditions

- Water stains that may indicate leaks

Inspectors emphasize that homes must meet minimum standards, ensuring they are structurally sound and secure. For example, properties built before 1978 with peeling or chipping paint need to address lead-based paint hazards to comply with FHA regulations.

As one inspector wisely noted, ‘The purpose of an FHA assessment is to ensure the home is safe, livable, and prepared for FHA financing.’ Understanding the can empower homebuyers like you to navigate the FHA loan process more smoothly and avoid potential issues during assessments.

Typically, an FHA assessment lasts about 3.5 hours, highlighting approximately 8.5 potential concerns per unit. This thorough evaluation underscores the importance of ensuring your home is a safe haven for you and your loved ones. We know how challenging this process can be, and we’re here to support you every step of the way.

Property Condition Assessments: Essential FHA Inspection Criteria

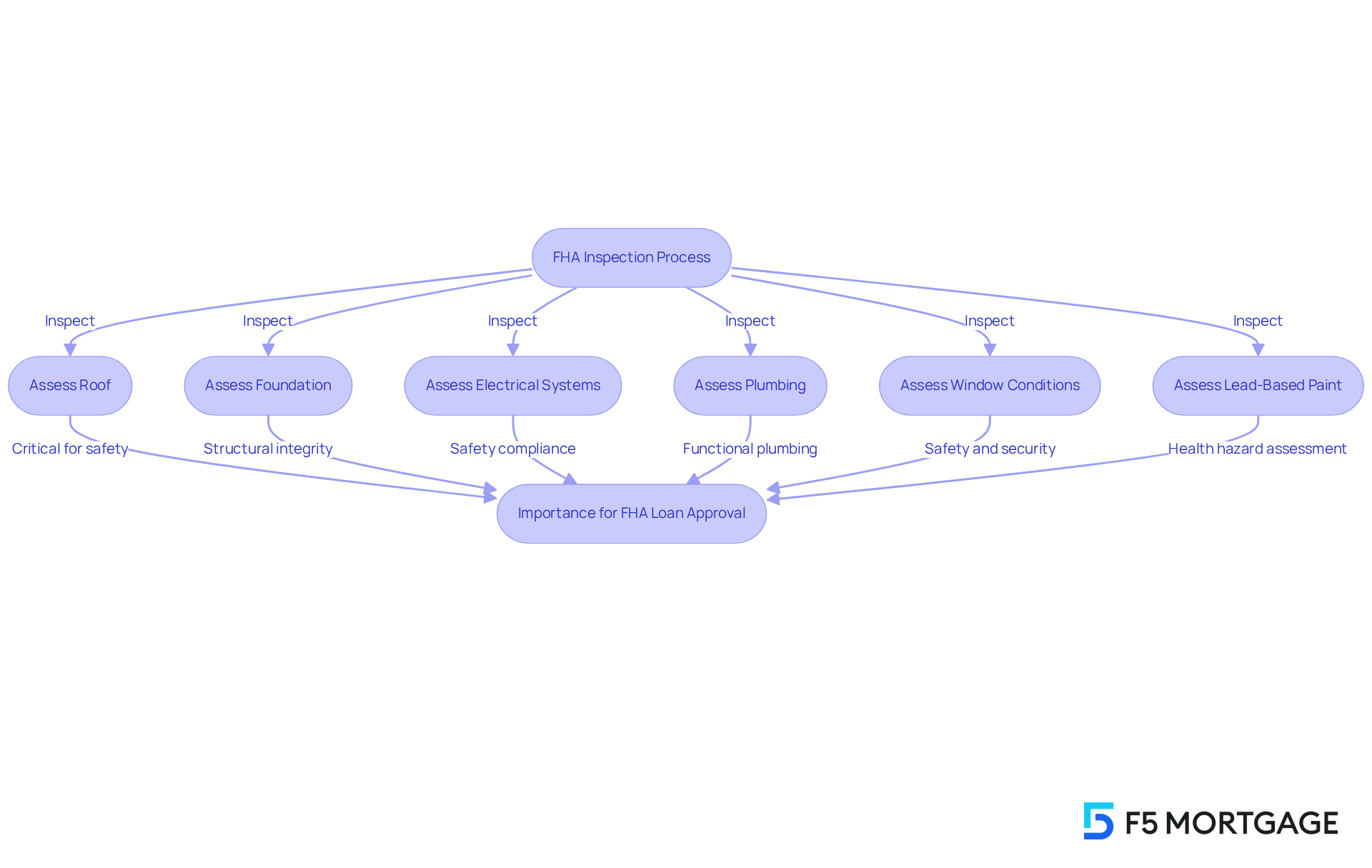

FHA inspections involve a thorough assessment of a building’s condition, focusing on critical elements like the roof, foundation, and overall structural integrity. We understand how daunting this process can feel, but inspectors are trained to identify signs of water damage, pest infestations, and other potential hazards that could compromise your home’s livability. For example, safety checks include ensuring that smoke detectors are functional and that there is adequate access for emergency responders. These evaluations are essential, as properties must meet the FHA inspection requirements to qualify for FHA loan approval.

Statistics show that many properties inspected may face condition-related issues impacting their eligibility for FHA financing. In fact, properties with significant flaws, such as a leaking roof or insufficient plumbing, must be repaired before the sale can proceed. The FHA evaluation checklist is comprehensive, covering aspects like electrical systems, window conditions, and the presence of lead-based paint. This ensures that all living areas are safe and functional.

Experts emphasize the importance of comprehensive evaluations of the roof and foundation, as these components are vital for the structural integrity of your home. A well-maintained roof not only protects the property but also plays a significant role in its overall appraisal value. Similarly, a sturdy foundation is crucial for preventing future structural problems, making it a central focus during evaluations.

Ultimately, understanding the is crucial for homebuyers, as it directly influences the approval process for FHA loans. With a minimum down payment requirement of just 3.5%, FHA loans are designed to be accessible for many buyers. By grasping what inspectors are looking for, you can better prepare for the assessment and address any potential issues beforehand, paving a smoother path to homeownership.

Furthermore, it’s important to note that FHA evaluations typically occur after conditional loan approval, with the average assessment lasting about 3.5 hours. The cost of an FHA evaluation ranges from $300 to $600, which is a significant factor for prospective purchasers. We know how challenging this can be, but we’re here to support you every step of the way.

Utilities and Mechanical Systems: FHA Inspection Essentials

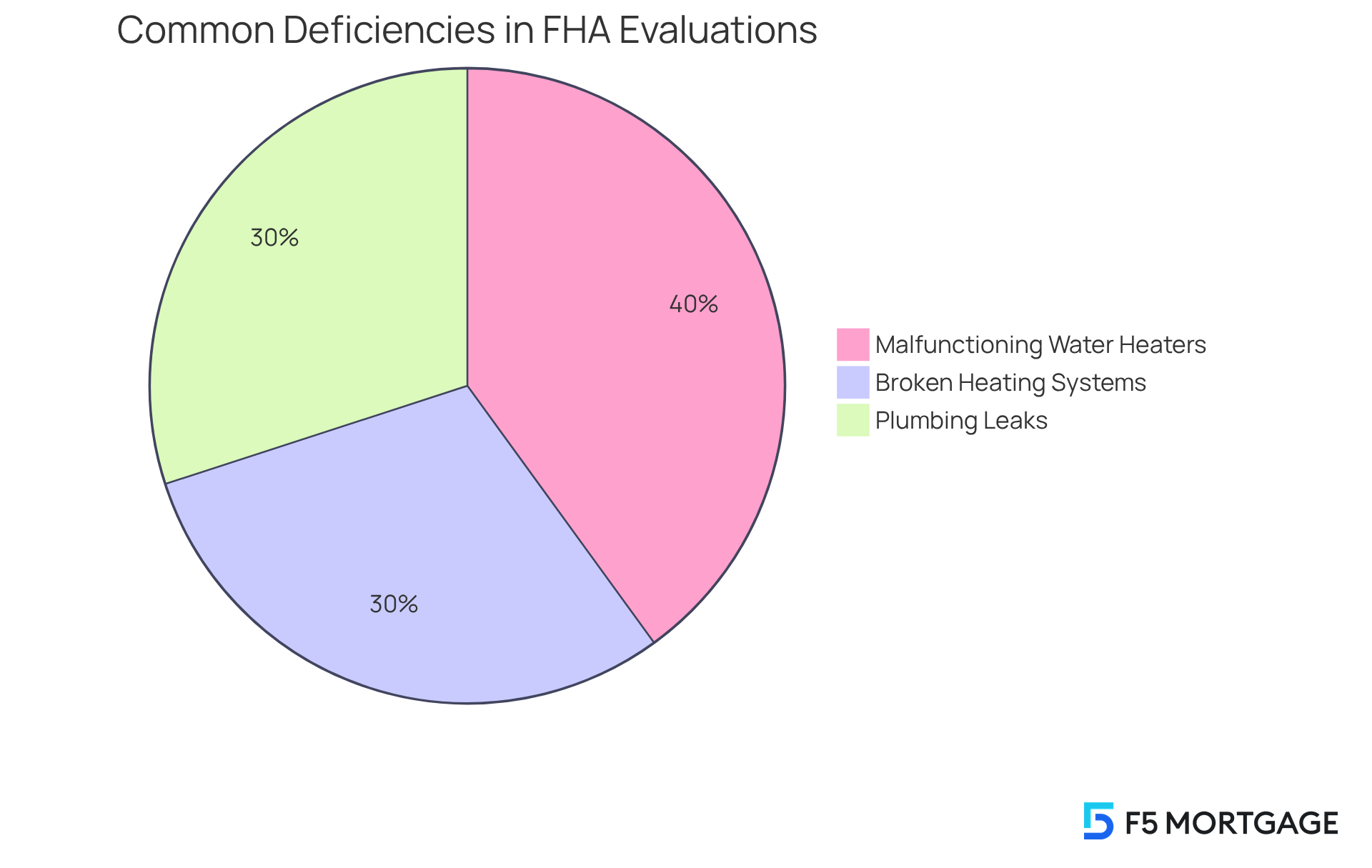

When it comes to FHA evaluations, we understand how important it is for families to ensure that all utilities—water, electricity, and gas—are fully operational. Inspectors will thoroughly evaluate heating and cooling systems, plumbing, and electrical systems to confirm their functionality. Unfortunately, any shortcomings in these areas can lead to an , potentially delaying the loan process significantly. In fact, statistics reveal that nearly 20% of properties examined face issues with heating or plumbing systems, which highlights the critical role these elements play in the FHA evaluation process.

Common deficiencies often include:

- Malfunctioning water heaters

- Broken heating systems

- Plumbing leaks

We know how challenging this can be, and that’s why it’s essential to confirm that all utilities are functioning properly to meet the FHA inspection requirements before an evaluation. Taking this proactive approach can not only facilitate the home-buying process but also help avoid unforeseen delays that can add stress to your journey.

Moreover, addressing any appraisal repairs noted during the evaluation is crucial for keeping the loan process on track. By being proactive and attentive to these details, you empower yourself to navigate this process with confidence. Remember, we’re here to support you every step of the way.

Structural Integrity: Critical FHA Inspection Requirements

[FHA inspection requirements](https://f5mortgage.com/loan-programs/fha-loans/georgia) focus on ensuring structural soundness, a vital aspect for guaranteeing the safety and livability of your home. Inspectors carefully assess the foundation, walls, and roof for any signs of damage or instability. Common structural issues that may lead to a failed inspection include:- Significant cracks in the foundation

- Sagging roofs

- Evidence of water damage

For instance, buildings facing major structural concerns, such as crumbling foundations or roof damage, often face considerable challenges during the FHA appraisal process. This can lead to delays in loan approval until essential repairs are made.

Moreover, FHA inspection requirements stipulate that properties must be free from hazards that could jeopardize financing. This means ensuring that all , including roof trusses and support columns, are in good condition. Safe access through public or private roads is also required, along with functional utilities that comply with local regulations. If an appraisal uncovers these red flags, it prompts necessary negotiations between buyers and sellers to address the issues before moving forward with the loan.

It’s important to understand that FHA inspection requirements clarify that FHA appraisals are not substitutes for home evaluations; both serve distinct roles in the home-buying journey. Experts emphasize that proactively addressing common structural problems can lead to a smoother appraisal process and better meet FHA inspection requirements, thereby enhancing the chances of FHA loan approval. Additionally, the FHA amendatory clause safeguards buyers’ earnest money in the event of appraisal issues, offering further reassurance during the transaction. By ensuring that properties meet the FHA’s Minimum Standards, including resolving health and safety risks like lead-based paint and mold, buyers can navigate the mortgage process with greater confidence and ease.

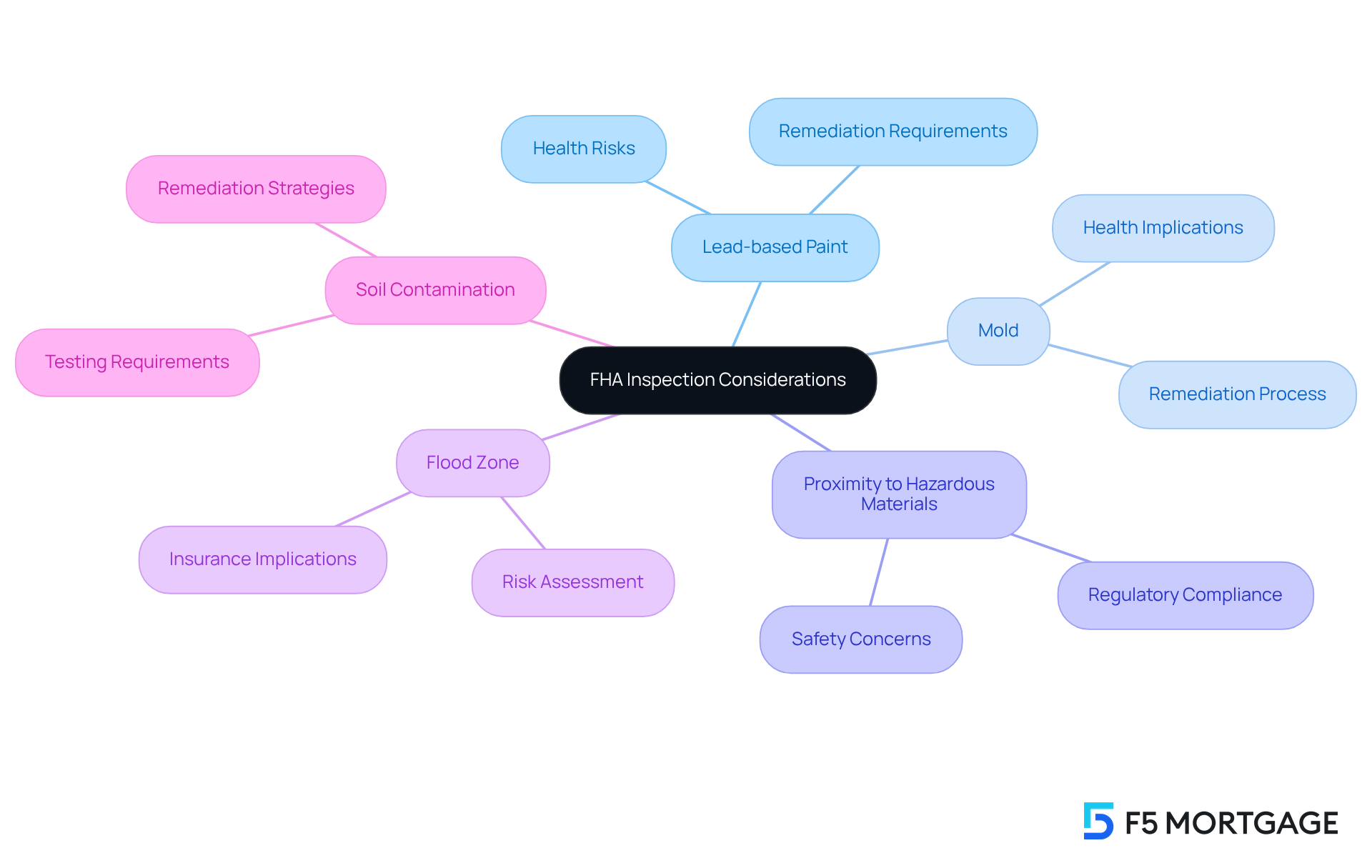

Environmental Factors: FHA Inspection Considerations

When it comes to , we understand how important it is to consider the environmental factors that could affect both the property and its residents. Inspectors carefully examine potential hazards such as:

- Lead-based paint

- Mold

- Proximity to hazardous materials

If a property is situated in a flood zone or an area with soil contamination, it may face additional scrutiny. Addressing these environmental concerns is crucial for successfully meeting the FHA inspection requirements, and we’re here to assist you every step of the way.

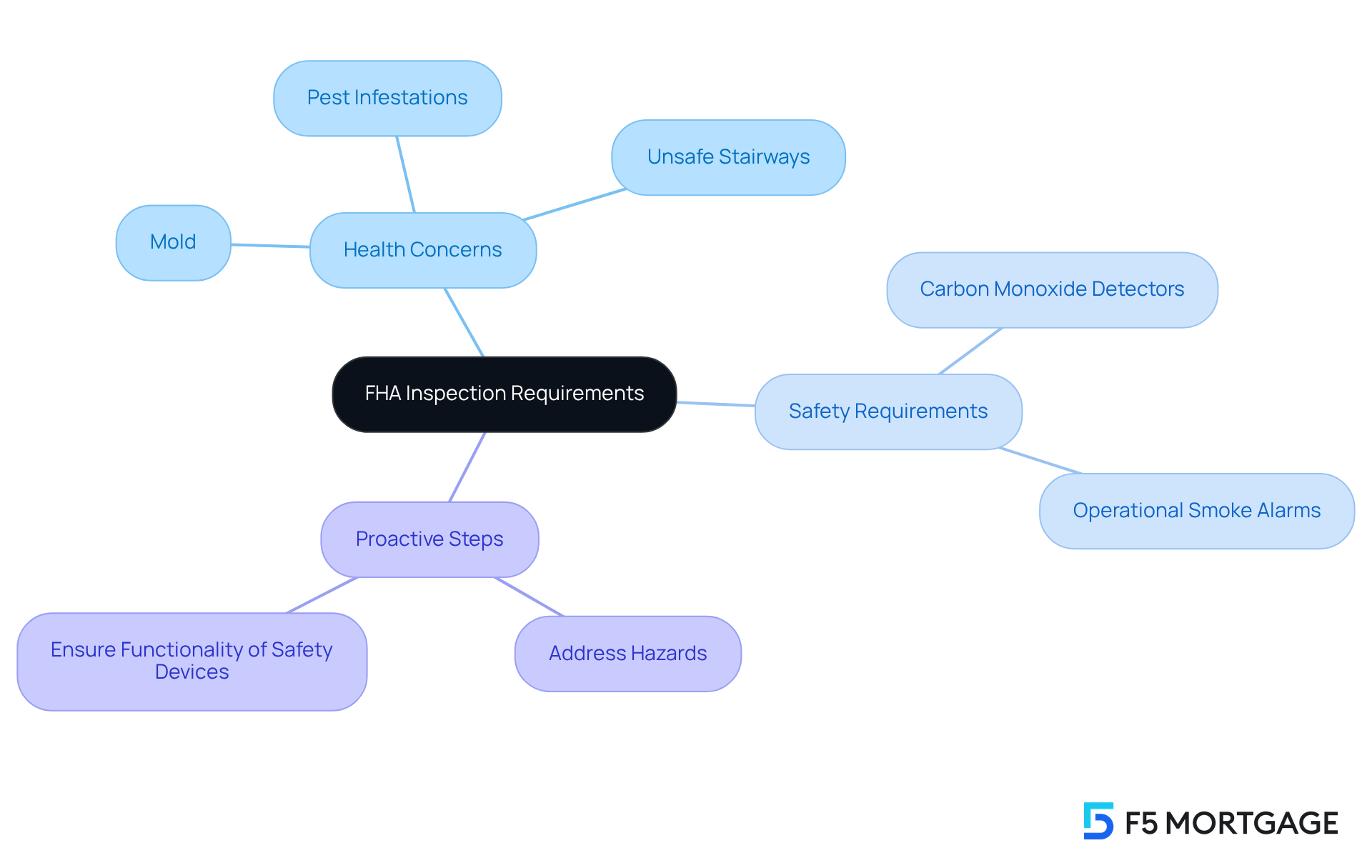

Health and Safety Issues: FHA Inspection Requirements

Health and safety concerns are paramount during FHA evaluations, and we understand how crucial it is for families to feel secure in their homes. Inspectors diligently assess properties for potential dangers, including:

- Mold

- Pest infestations

- Unsafe stairways

A vital aspect of these evaluations is the requirement for carbon monoxide detectors and operational smoke alarms, essential for safeguarding residents.

Did you know that approximately 67% of homebuyers in the U.S. opt for FHA evaluations? Unfortunately, many of these properties encounter health-related issues, underscoring the importance of addressing these concerns to ensure a safe living environment. Moreover, properties that fail to meet can significantly delay the loan approval process. In fact, over 15% of potential risks identified during evaluations can lead to failures, impacting the timeline for securing financing.

Expert insights reveal that mold and pest infestations are common red flags that can threaten a property’s eligibility for FHA financing. Additionally, homes built before 1978 must include a lead-based paint disclosure, adding another layer of health and safety considerations. Ensuring compliance with the FHA inspection requirements is not just crucial for passing the FHA evaluation; it also helps foster a safe and healthy environment for residents.

To prepare for the FHA inspection requirements, we encourage homeowners to take proactive steps. Address any visible hazards, and ensure that all safety devices, such as smoke alarms and carbon monoxide detectors, are installed and functioning. We know how challenging this can be, but taking these actions will help you feel more secure and ready for the evaluation process.

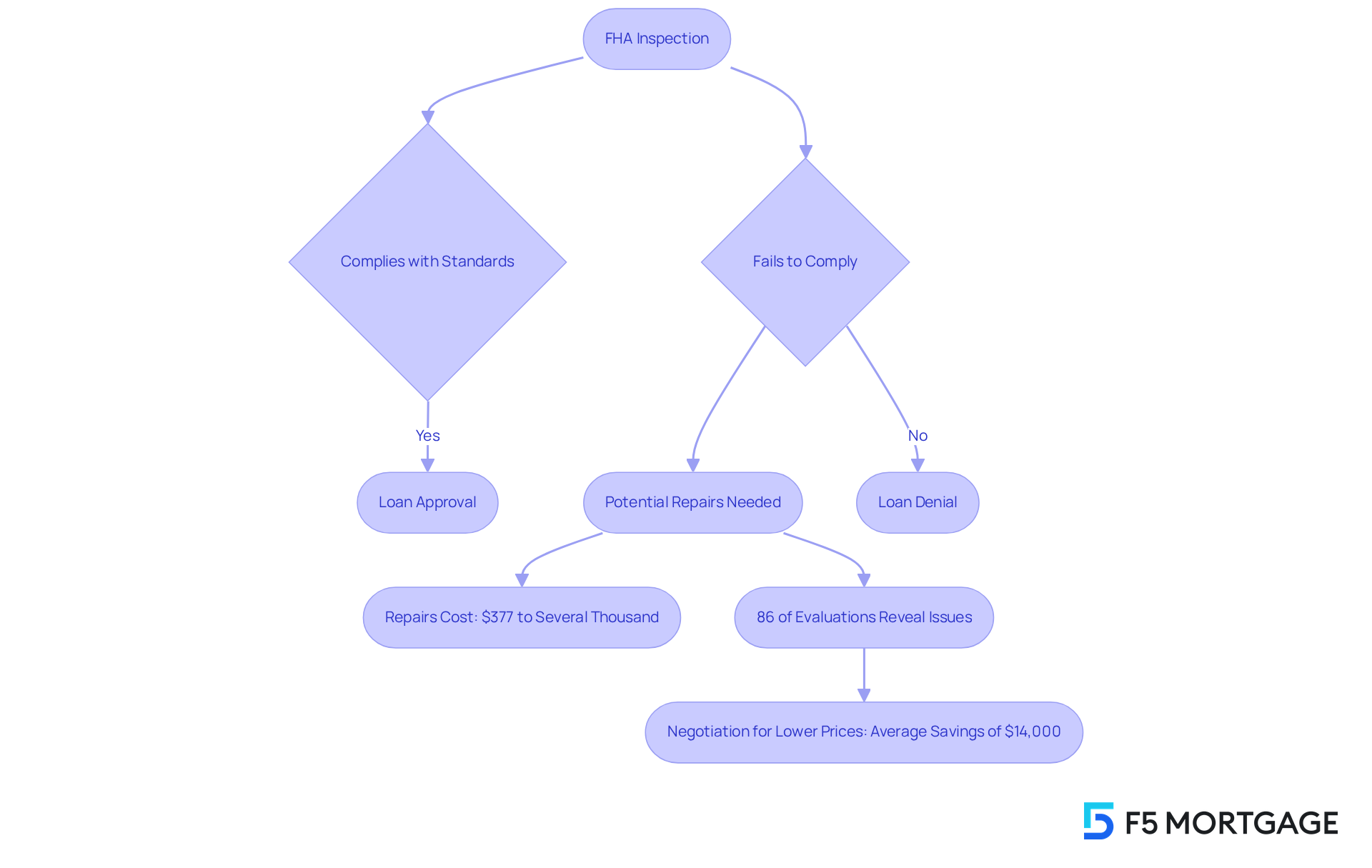

Consequences of Non-Compliance: FHA Inspection Failures

Failing to meet FHA evaluation standards can be a daunting experience for homebuyers. We understand how stressful it can be when non-compliance leads to loan denial or the need for costly repairs before approval, potentially delaying closing. For instance, consider a couple whose FHA loan was initially at risk due to a small leak and an aging furnace. Thankfully, after addressing these issues, they secured their loan, underscoring the importance of early intervention.

The typical cost of a property assessment is $377, and necessary repairs can vary significantly, ranging from a few hundred to several thousand dollars, depending on the severity of the problems found. This financial burden, coupled with the potential for extended closing times, can add to the stress buyers face. In fact, 86% of home evaluations reveal issues that need attention, and 46% of buyers use these findings to negotiate lower sale prices, often saving an average of $14,000.

Furthermore, those facing evaluation failures might consider an FHA 203k rehab loan, which allows them to roll repair costs into the loan total. Therefore, understanding the implications of FHA inspection requirements and assessment failures is crucial for homebuyers. This knowledge empowers you to navigate the FHA loan process effectively and avoid unexpected expenses. We’re here to .

FHA Inspection Timeline: What Homebuyers Should Expect

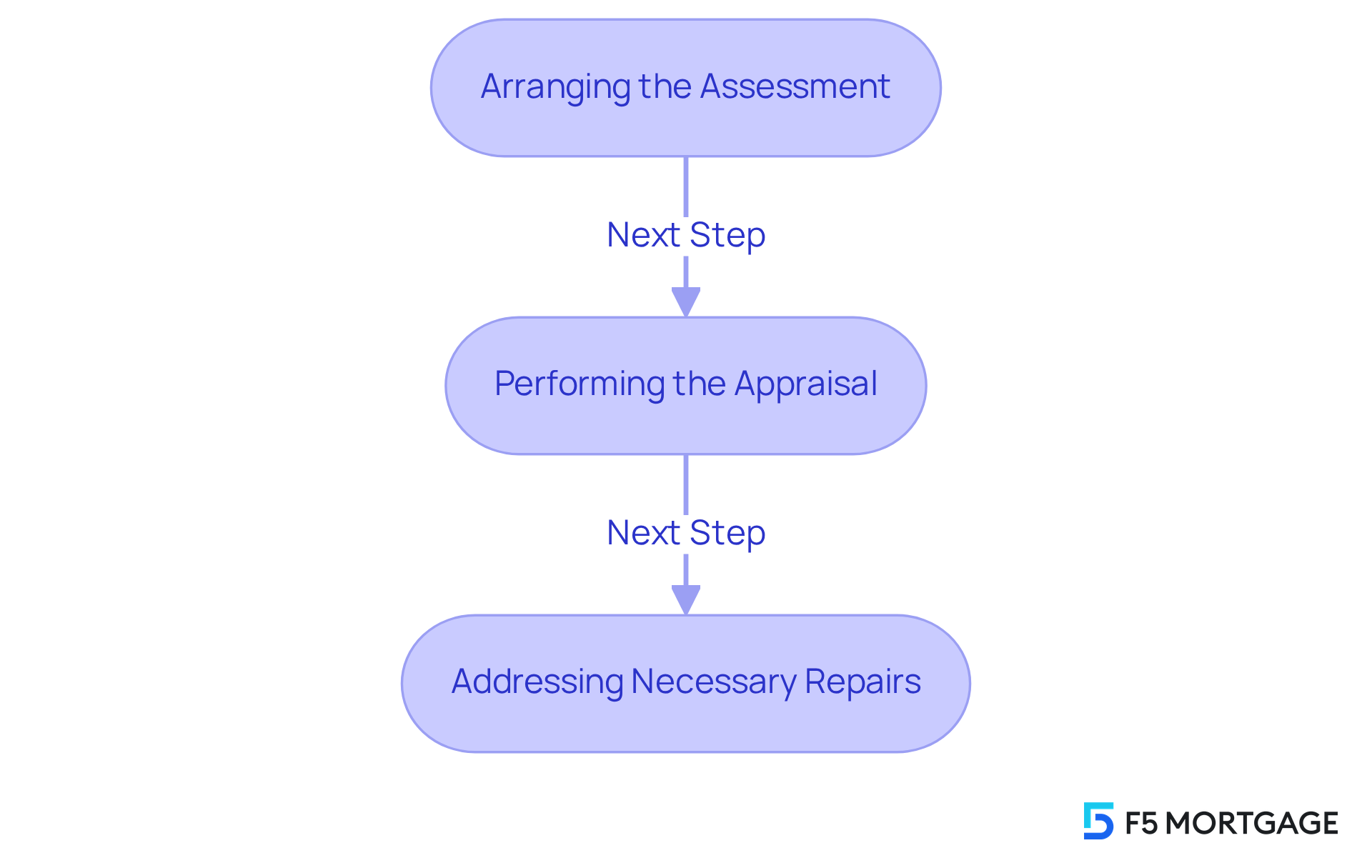

Navigating the FHA evaluation timeline can feel overwhelming, but we’re here to support you every step of the way. Typically, this timeline spans two to four weeks and includes several key stages:

- Arranging the assessment

- Performing the appraisal

- Addressing any necessary repairs

We understand that various factors can influence this timeline. The availability of inspectors, the complexity of repairs—like electrical or plumbing issues—and the responsiveness of all parties involved can all play a role.

To ensure a smooth property purchase or refinancing experience, it’s important to plan ahead. We encourage buyers to remain proactive in coordinating with their lender and throughout the process. By doing so, you can alleviate some of the stress and make informed decisions that empower your journey toward homeownership.

FAQs: Common Questions About FHA Inspection Requirements

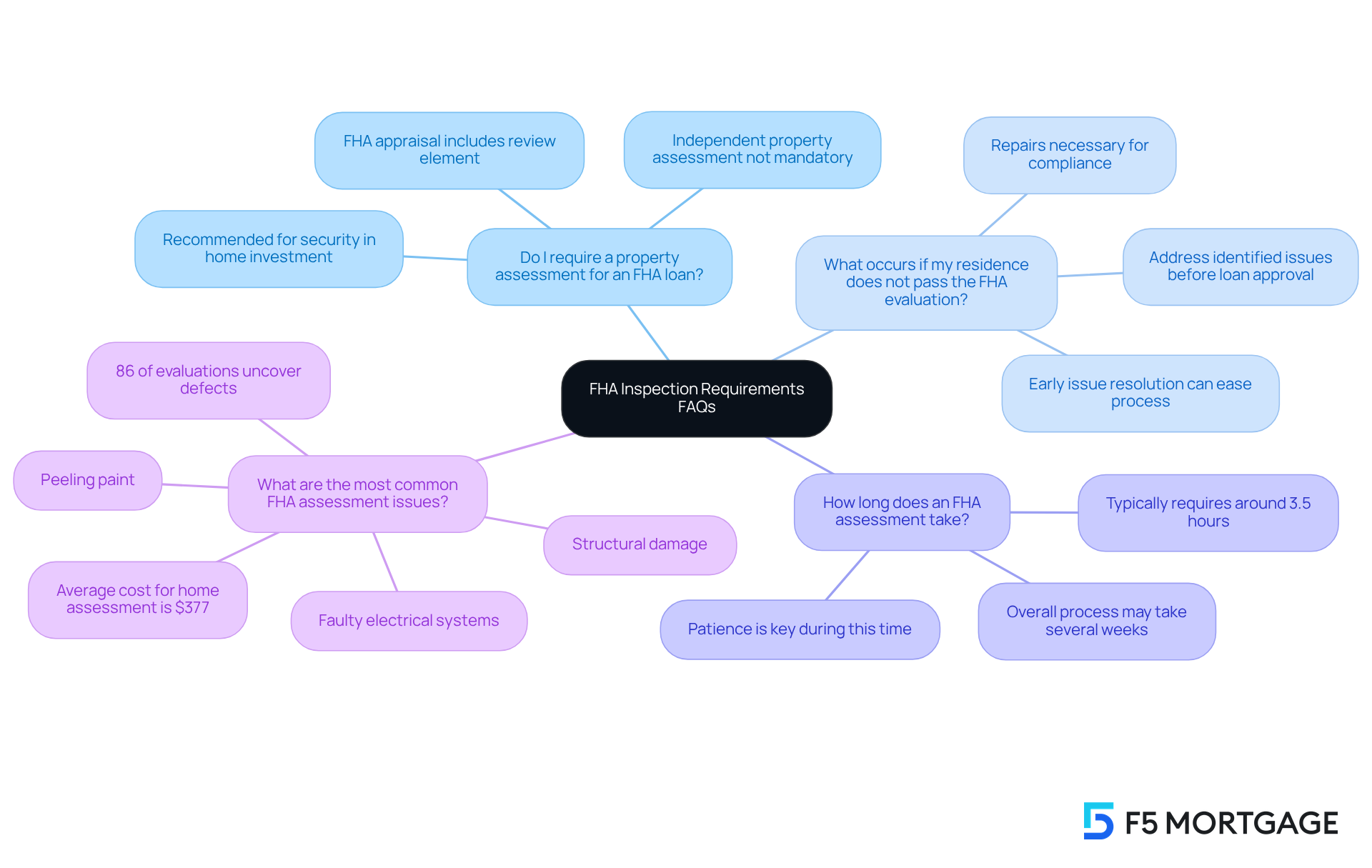

- Do I require a property assessment for an FHA loan? While an FHA appraisal includes a review element, an independent property assessment isn’t mandatory, yet we strongly recommend it. FHA inspection requirements are essential for homes financed through the Federal Housing Administration, ensuring that properties meet minimum safety and livability standards. We know how important it is for you to feel secure in your home investment.

- What occurs if my residence does not pass the FHA evaluation? If your residence does not pass the evaluation, you will need to address the identified issues before the loan can be approved. This may involve repairs to ensure compliance with the FHA inspection requirements, which are crucial for both safety and livability standards for buyers and lenders. We understand how stressful this can be, but tackling these issues early can make the process smoother.

- How long does an FHA assessment take? An FHA evaluation typically requires around 3.5 hours, but the overall process may take several weeks to complete due to scheduling and potential repairs. Patience is key during this time, and we’re here to support you every step of the way.

- What are the most common FHA assessment issues? Common issues that can affect a property include peeling paint, faulty electrical systems, and structural damage, which are all part of the FHA inspection requirements. Notably, 86% of property evaluations uncover some defects, so addressing these concerns in advance can help ensure a more seamless assessment process. Additionally, the average cost for a home assessment is approximately $377, which is an important consideration for buyers. We encourage you to to learn more about the property and its condition, empowering you to make informed decisions.

Conclusion

Understanding FHA inspection requirements is essential for homebuyers seeking FHA financing. These evaluations ensure that properties meet safety, security, and structural standards. We know how challenging this can be, but familiarity with these requirements not only facilitates a smoother mortgage approval process but also empowers you to make informed decisions about your investment.

Throughout this article, we’ve highlighted key points, including:

- The importance of addressing potential issues before an inspection.

- The critical nature of safety and structural evaluations.

- The financial implications of failing to meet FHA standards.

Real-life examples illustrate how proactive measures can protect you from unexpected costs and delays, reinforcing the need for thorough preparation.

Ultimately, navigating the FHA inspection process is a vital step toward homeownership. By understanding and addressing the FHA inspection requirements, you can avoid complications and ensure your property is safe and compliant. Taking these steps not only enhances your likelihood of securing financing but also contributes to a healthier and more secure living environment. Embrace this journey with confidence, and remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are FHA inspection requirements?

FHA inspection requirements are evaluations designed to ensure that properties meet safety, security, and structural criteria set by the Federal Housing Administration (FHA) to qualify for FHA financing.

How much does an FHA inspection cost and how long does it take?

An FHA inspection typically costs between $300 and $600 and lasts about 3.5 hours.

What critical areas are examined during an FHA inspection?

During an FHA inspection, evaluators examine critical areas such as foundations, roofing, plumbing, and electrical systems.

What is the significance of the Minimum Property Requirements (MPR)?

Properties must meet Minimum Property Requirements (MPR) to qualify for FHA loans, ensuring that essential features like functional kitchens and bathrooms are present.

Can you provide an example of how an FHA inspection can help homebuyers?

An FHA inspection can reveal potential issues, such as a leak in the attic or an aging furnace, allowing homebuyers to make informed decisions about necessary repairs and protect their investment.

Why should sellers consider pre-inspections?

Sellers should conduct pre-inspections to identify and address significant issues before listing their homes, which can enhance marketability and minimize risks during negotiations.

What safety standards must properties meet during FHA inspections?

Properties must be free from dangers such as exposed wiring, mold, and structural flaws, and must have essential safety features like functioning smoke detectors and proper egress from bedrooms.

What common issues might prevent a property from passing an FHA inspection?

Common issues include significant roof damage, inadequate crawl space conditions, and water stains that may indicate leaks.

What are some specific elements evaluated during an FHA inspection?

The evaluation covers aspects such as the condition of the roof, foundation, electrical systems, window conditions, and the presence of lead-based paint.

When do FHA evaluations typically occur in the loan process?

FHA evaluations typically occur after conditional loan approval, ensuring that the property meets the necessary standards for financing.