Overview

The article titled “9 Essential Tips for VA Loan Refinance Success” aims to guide you through the VA loan refinancing process with compassion and understanding. We know how challenging this can be, and that’s why it’s crucial to have personalized consultations. Understanding eligibility requirements is key, as it helps you recognize both the benefits and drawbacks of refinancing. This knowledge empowers veterans like you to make informed financial decisions and achieve favorable loan terms.

Navigating this journey can feel overwhelming, but you are not alone. We’re here to support you every step of the way. By focusing on your unique situation and needs, we can help you explore the best options available. Remember, each step taken with care can lead to a more secure financial future. Take action today and equip yourself with the insights needed for a successful refinancing experience.

Introduction

Navigating the landscape of VA loan refinancing can feel overwhelming for many former service members. We understand how daunting the myriad of options and requirements can be. This article offers essential tips designed to simplify the refinancing process and empower veterans to achieve the best financial outcomes. With so much information available, how can you discern the most effective strategies for a successful refinance? Join us as we delve into these nine crucial tips that will help you maximize the benefits of VA loan refinancing while steering clear of common pitfalls.

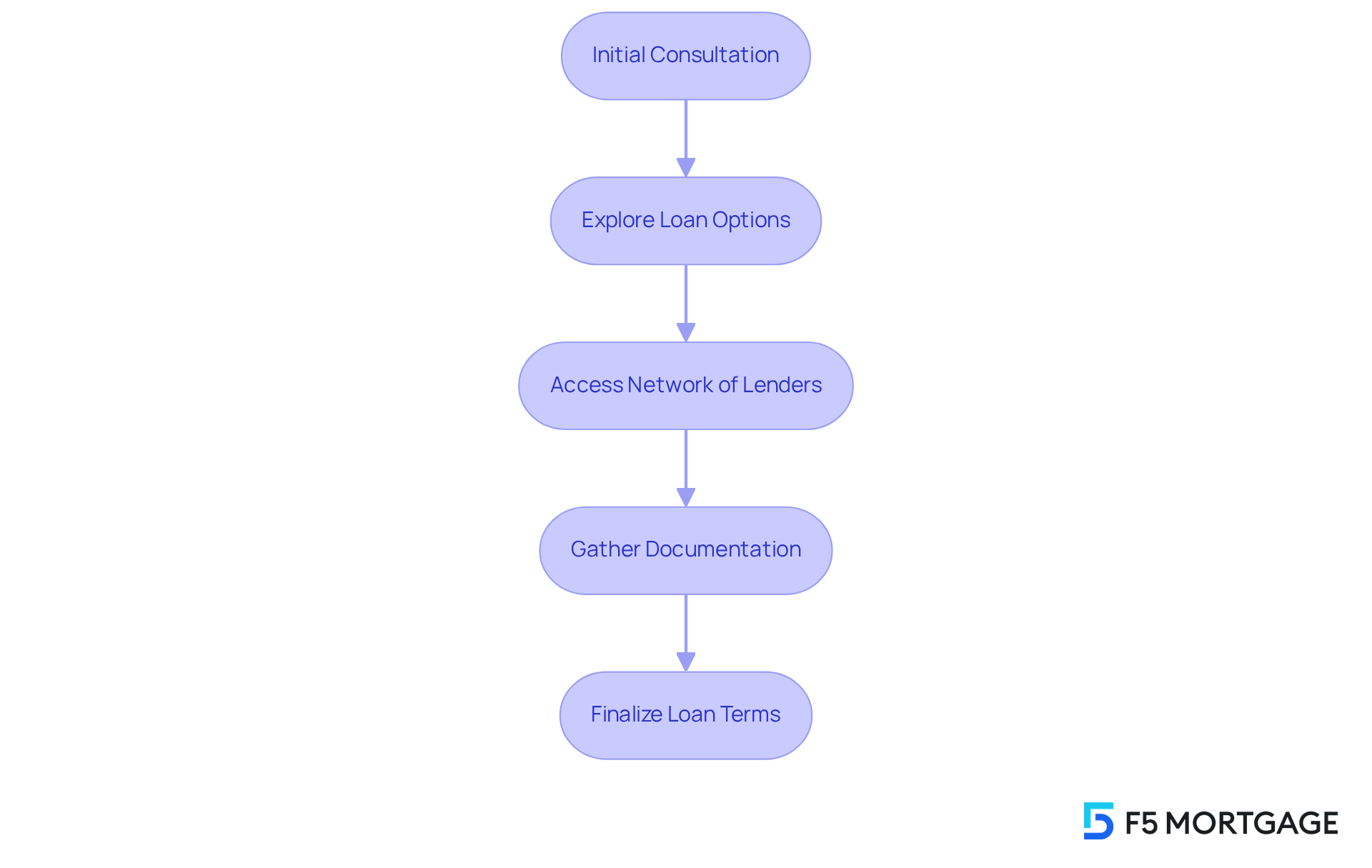

F5 Mortgage: Personalized VA Loan Refinancing Solutions

At F5 Mortgage, we understand how challenging it can be to navigate the complexities of VA loan refinance. That’s why we excel in providing customized solutions tailored to the unique needs of service members and their families. Our commitment to exceptional service means that we offer personalized consultations, allowing you to explore your loan options effectively.

This caring approach not only helps former service members secure the most advantageous rates and terms for a VA loan refinance but also simplifies the VA loan refinance process, making it more efficient. With access to a network of over two dozen premier lenders, we ensure that each client can find a that aligns with their financial goals.

Our successful case studies speak volumes about our dedication to personalized service. For instance, one individual was able to lower their monthly payments by $300 through a VA IRRRL, showcasing the tangible benefits of our consultations. As Shirley notes, “Our team can assist in gathering and examining all essential documentation, guaranteeing your application is thorough and precise.” This highlights the importance of customized consultations in achieving financial success.

We’re here to support you every step of the way, ensuring that you feel understood and empowered in your journey toward financial stability.

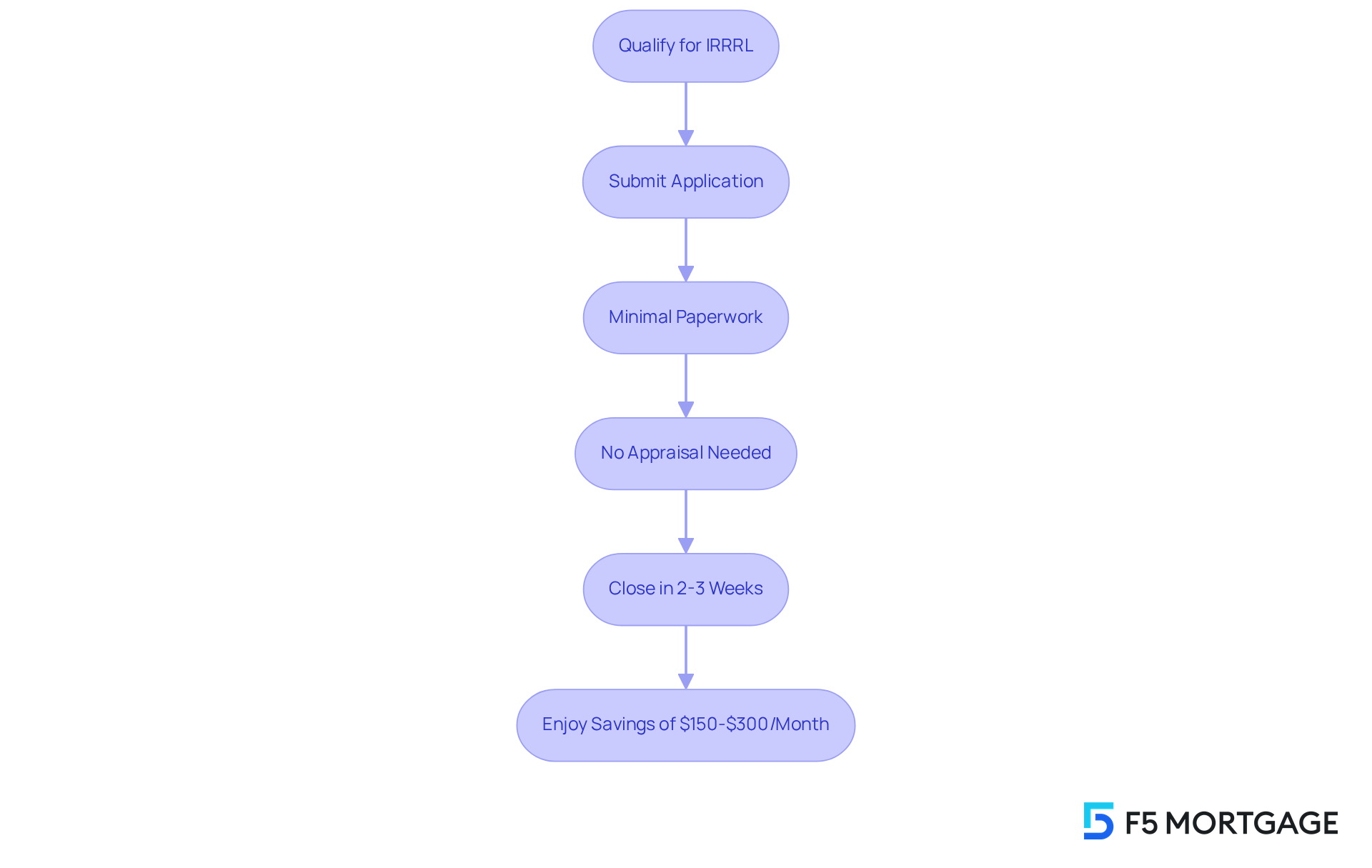

VA Interest Rate Reduction Refinance Loan (IRRRL): Simplified Refinancing for Veterans

The VA Interest Rate Reduction Refinance Loan (IRRRL) is thoughtfully designed to ease the loan process for our valued former service members. This program empowers qualified servicemen to utilize a VA loan refinance for their existing loans, allowing them to secure lower interest rates with minimal paperwork. One remarkable aspect of the IRRRL is that it usually does not require an appraisal or income verification, significantly simplifying what can often be a daunting process.

As a result, many former service members can complete the VA loan refinance journey in as little as 2 to 3 weeks, aligning perfectly with the average closing time for IRRRLs. This swift process enables them to enjoy substantial savings on their monthly payments, with those utilizing the IRRRL saving an average of $150 to $300 each month. Such savings can greatly enhance their financial flexibility and overall quality of life.

Financial consultants emphasize that the VA loan refinance, specifically the IRRRL, stands out as one of the most effective mortgage offerings available today. It is a truly appealing option for service members looking to reduce their mortgage expenses quickly and effortlessly through a VA loan refinance. To , veterans need to have an existing VA mortgage and confirm that they live or have lived in the home linked to that mortgage. We understand how challenging this can be, and we’re here to support you every step of the way.

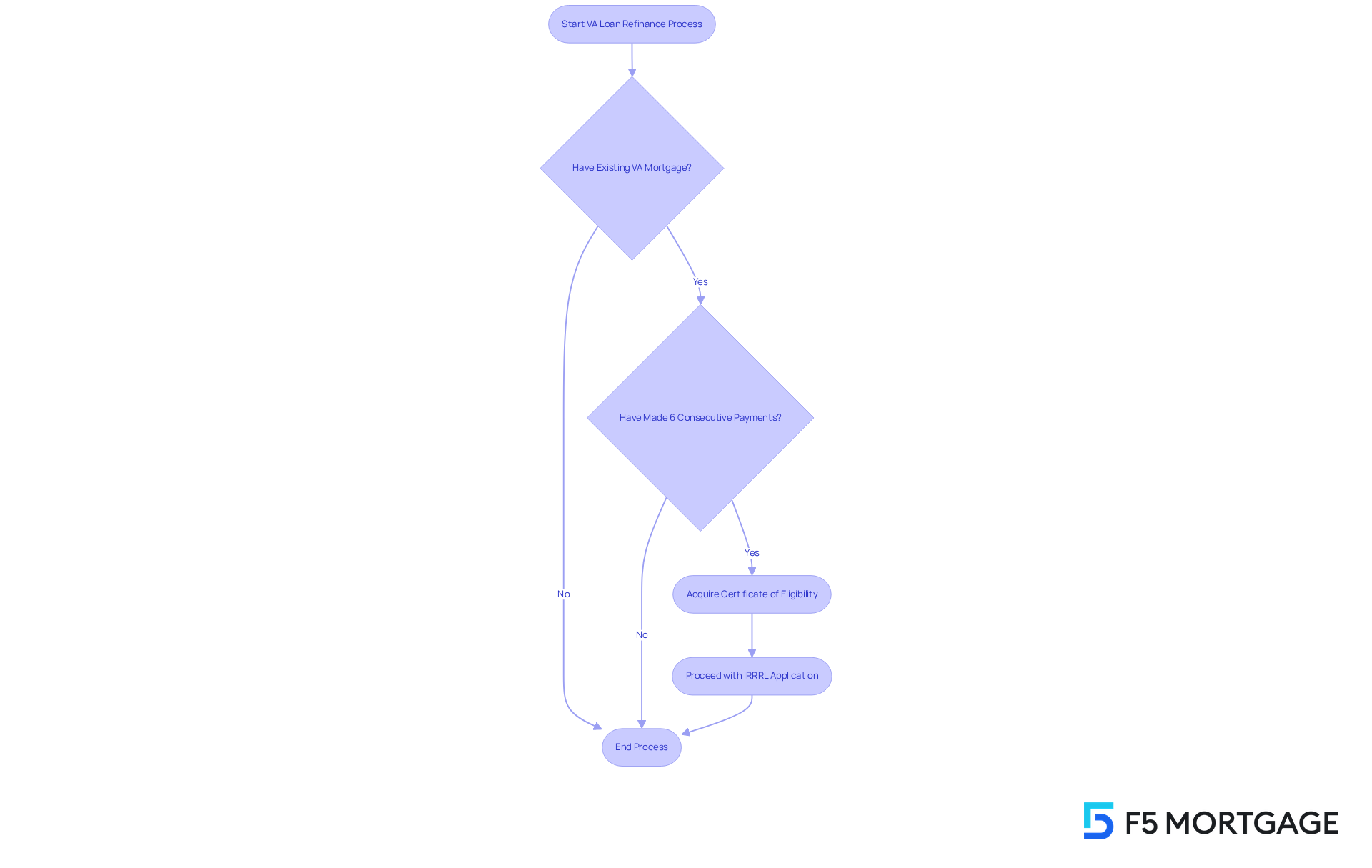

VA Loan Eligibility Requirements: Know Before You Refinance

Veterans contemplating a VA loan refinance often face specific eligibility criteria, and we understand how challenging this can be. To qualify for an Interest Rate Reduction Refinance Program (IRRRL), borrowers must have an existing VA mortgage and have made at least six consecutive monthly payments. It’s important that the financing is up to date, and that no payments have been overlooked in the past 12 months.

A crucial first step for former service members seeking a VA-backed loan is acquiring a Certificate of Eligibility. This certificate verifies their entitlement to the benefits. Comprehending these requirements is essential, as it empowers former service members to assess their readiness for a VA loan refinance and promotes a more seamless application process.

VA loan refinance options, known as IRRRLs, are typically simpler than other refinancing options, requiring less documentation and no appraisal. This makes them an appealing choice for service members. In fiscal 2024, over 416,000 VA-supported mortgages were provided, highlighting the program’s popularity among former service members.

However, misunderstandings about VA financing can present challenges. We encourage service members to connect with who can help navigate these obstacles effectively. Additionally, taking proactive measures—like reaching out to creditors or examining financing alterations—can assist in reducing foreclosure risks, especially in today’s economic climate. Remember, we’re here to support you every step of the way.

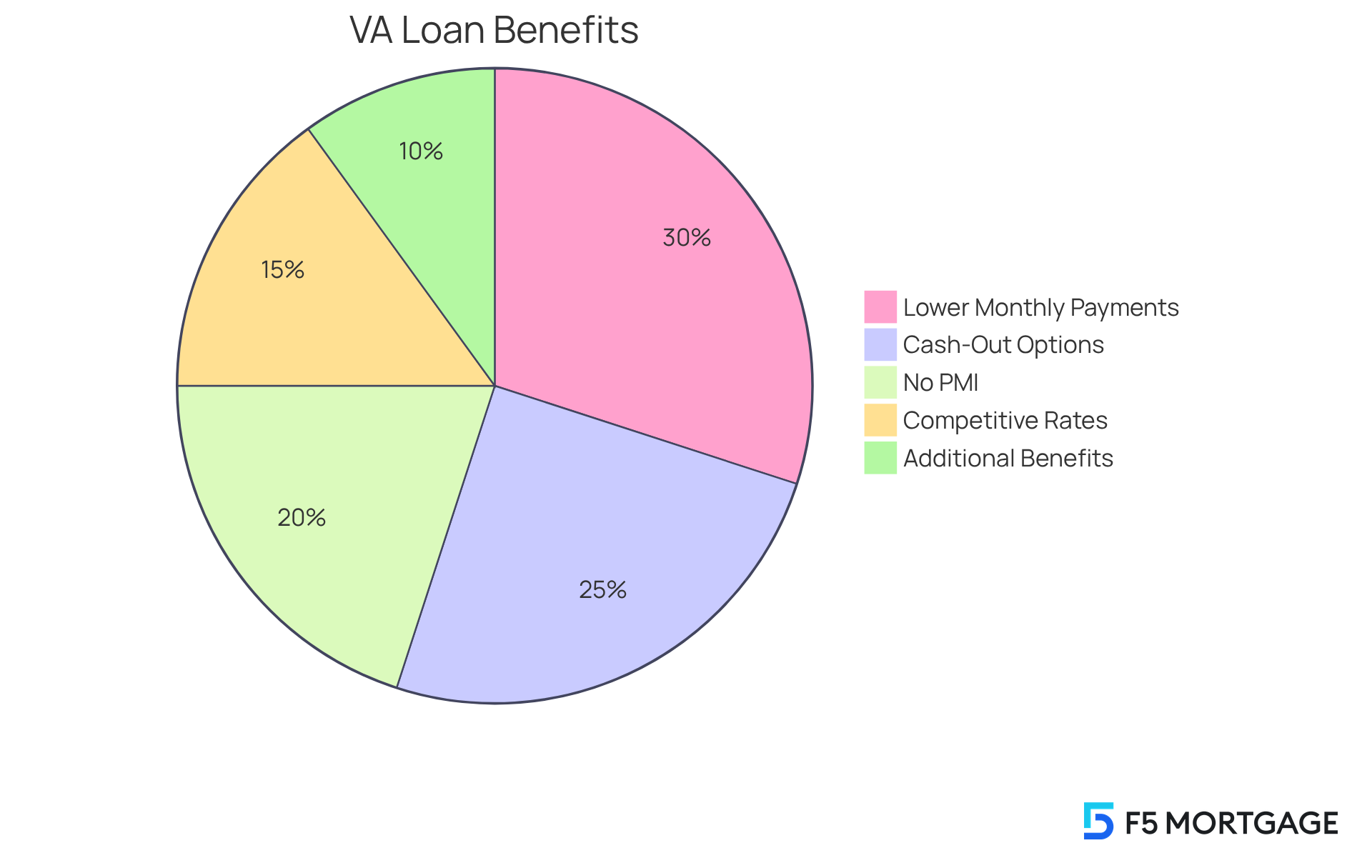

Benefits of VA Loan Refinancing: Financial Advantages for Veterans

Refinancing a VA loan brings numerous financial benefits through a VA loan refinance for our brave service members. One of the most significant advantages is the opportunity for markedly lower monthly payments, thanks to reduced interest rates. As of August 2025, the median interest rate for cash-out refinances is 3.62%, compared to 3.38% for non-cash-out options. This clearly illustrates the cost-saving potential available to service members.

Moreover, cash-out mortgage options allow former service members to tap into their home equity for essential needs, such as home improvements or debt consolidation. The median cash-out figure averages around $37,131, which can be effectively utilized for various purposes, enhancing the financial flexibility of those who have served.

The absence of private mortgage insurance (PMI) on VA mortgages further enhances affordability, making refinancing an appealing choice for many service members looking to improve their financial situation. This unique feature, combined with the VA’s backing, empowers lenders to offer , ultimately supporting servicemen and women in their journey toward financial stability. As Chad Moller, Communications Manager, shares, “The VA Home Loan is an amazing benefit that has helped more than 24 million Veterans achieve the dream of homeownership.”

Consequently, many former service members have successfully used cash-out refinancing to manage high-interest debt or cover significant expenses. This highlights the tangible benefits of a VA loan refinance, reminding us that we understand how challenging financial decisions can be, and we are here to support you every step of the way.

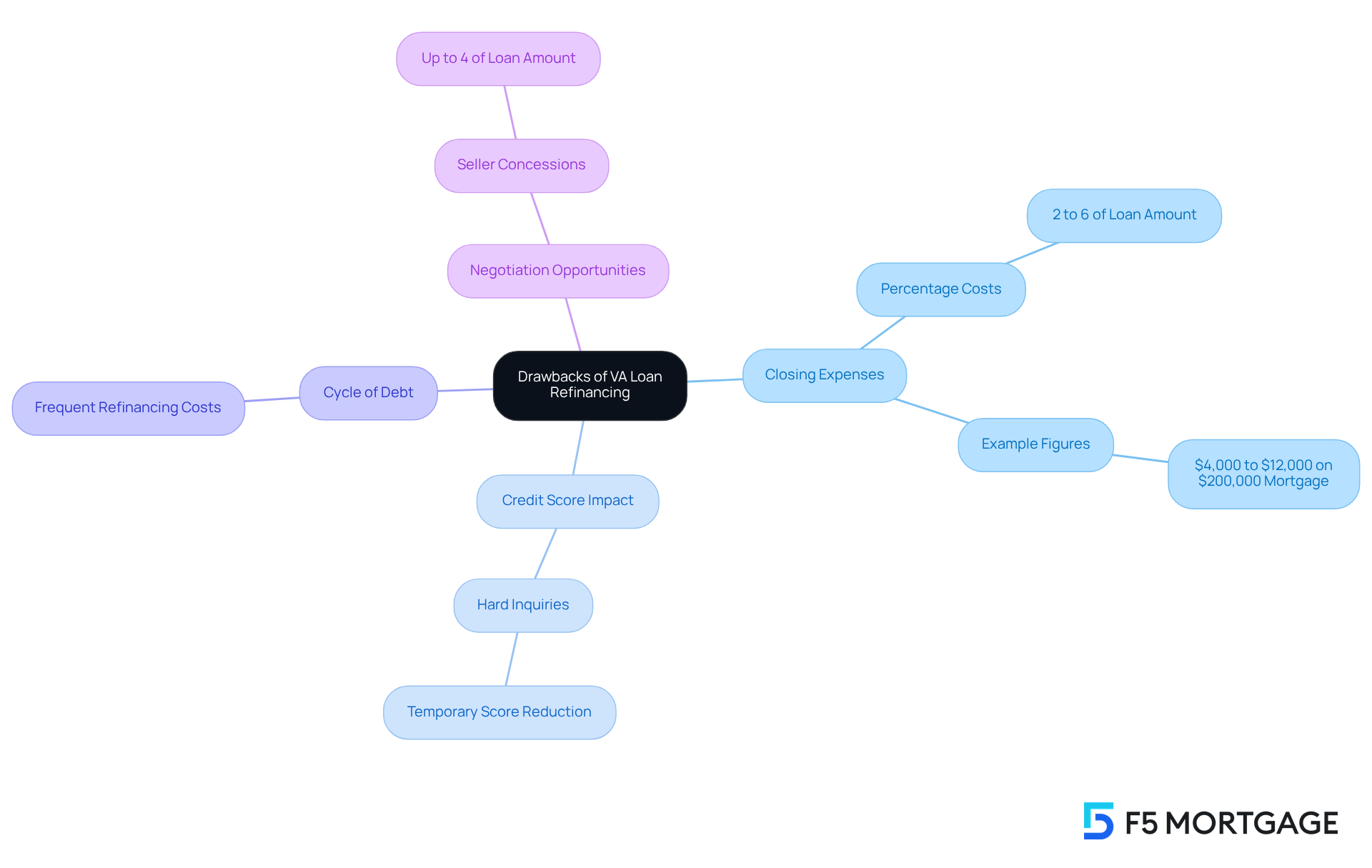

Drawbacks of VA Loan Refinancing: What to Consider

Refinancing a VA mortgage through a VA loan refinance can offer various benefits, but it’s essential for veterans to carefully consider the significant disadvantages involved. One key concern is the closing expenses, which typically range from 2% to 6% of the amount borrowed. For instance, on a $200,000 mortgage, closing costs could total between $4,000 and $12,000. This is a considerable expense that might diminish the financial advantages of refinancing. Moreover, veterans who refinance too often may end up paying more in fees than they save in interest, potentially negating the benefits of lower monthly payments.

Additionally, applying for a new loan can temporarily affect credit scores. Lenders conduct hard inquiries that may lower ratings, which is particularly relevant for veterans managing tight budgets or existing financial obligations. As advisor Matt Coveney wisely notes, ‘Grasping the complete range of closing expenses is essential; they can greatly influence the total savings from mortgage modification.’

It’s also crucial for veterans to recognize that frequent refinancing can lead to a cycle of debt. The costs associated with each new loan can outweigh the benefits. However, buyers can negotiate with sellers to cover some of these closing expenses, known as seller concessions, which can alleviate some financial pressure. Therefore, it’s vital to thoroughly evaluate these factors and consider the long-term implications before proceeding with a . Consulting with a financial advisor to weigh potential savings against costs can be a wise step in this journey.

We know how challenging this can be, and we’re here to support you every step of the way.

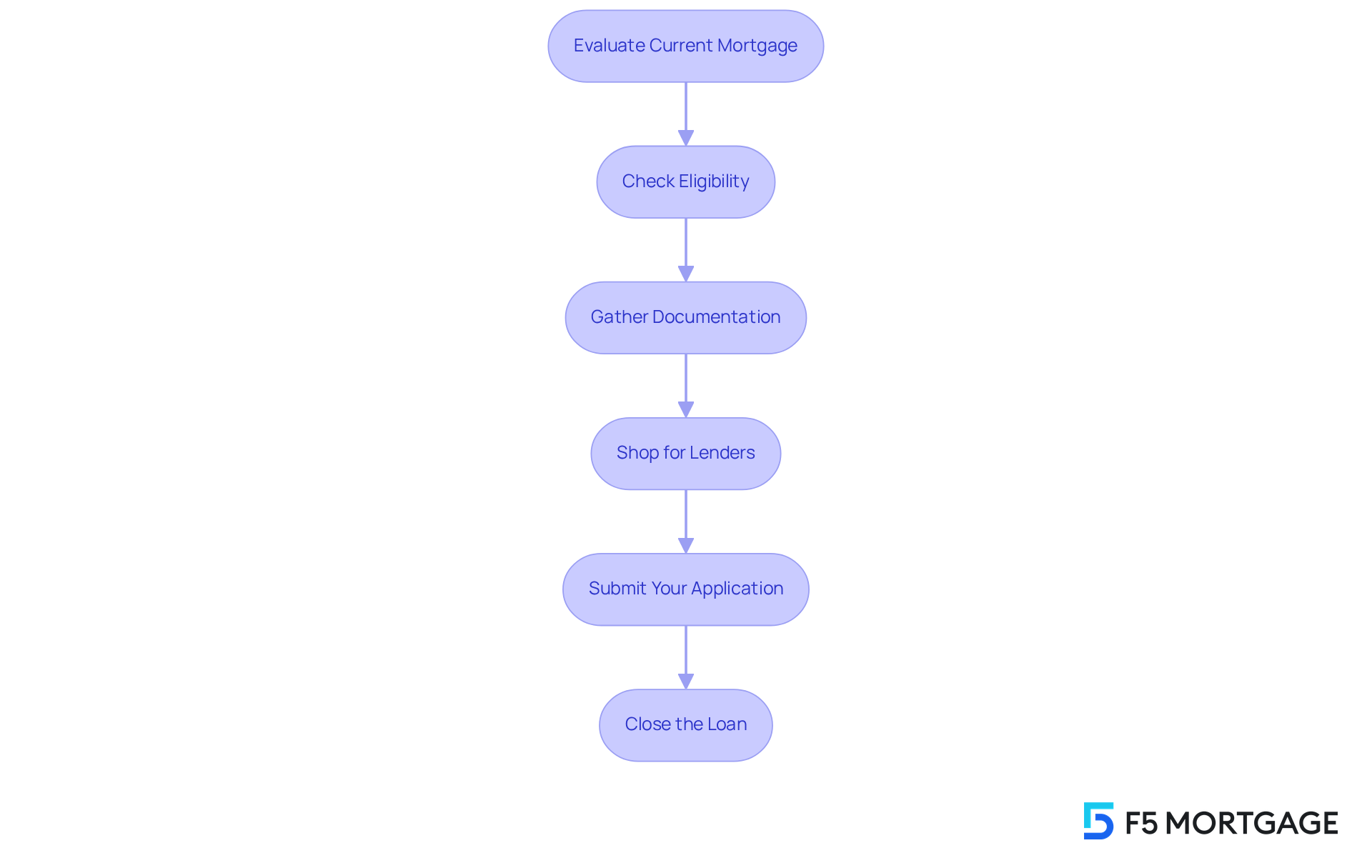

Step-by-Step Guide to VA Loan Refinancing: Navigating the Process

Navigating the VA loan refinancing process can feel overwhelming, but it can be straightforward if you follow these essential steps:

- Evaluate Your Current Mortgage: Begin by examining the conditions of your current VA mortgage and defining your goals for restructuring. Understanding your current interest rate and payment structure will help you determine the .

- Check Eligibility: We know how important it is to confirm that you meet the eligibility requirements for the Interest Rate Reduction Refinance Loan (IRRRL) program. Typically, this involves having an existing VA mortgage that has been open for at least seven months.

- Gather Documentation: Prepare the necessary documents, such as your Certificate of Eligibility (COE), proof of income, and any other financial statements that may be required. Common documentation includes recent mortgage statements and income verification. Having these documents ready can expedite the application process and reduce stress.

- Shop for Lenders: Take the time to compare rates and terms from various lenders. As of May 2025, VA refinance rates range from 5.375% to 6.75%. This step is crucial, as different lenders may have varying requirements and fees. Look for lenders that provide competitive rates and advantageous terms, and be cautious of hidden charges or unfavorable borrowing conditions. Chris Birk, Vice President of Mortgage Insight, observes, “The VA loan refinance program offers eligible homeowners an easy method to benefit from reduced rates and lower their monthly mortgage payment.”

- Submit Your Application: Once you’ve selected a lender, complete the application process. Ensure that all information is accurate and that you provide any additional documentation requested by the lender. Remember, we’re here to support you every step of the way.

- Close the Loan: After your application is approved, review and sign the closing documents. Closing costs for VA Streamline Refinancing typically range from 1% to 3% of the loan amount. This final step will complete your financial restructuring process, allowing you to enjoy the benefits of lower monthly payments or a more favorable interest rate.

By adhering to these steps, former service members can simplify their loan process and work towards achieving their financial objectives efficiently. We understand that this journey can be challenging, but with the right guidance, you can navigate it successfully.

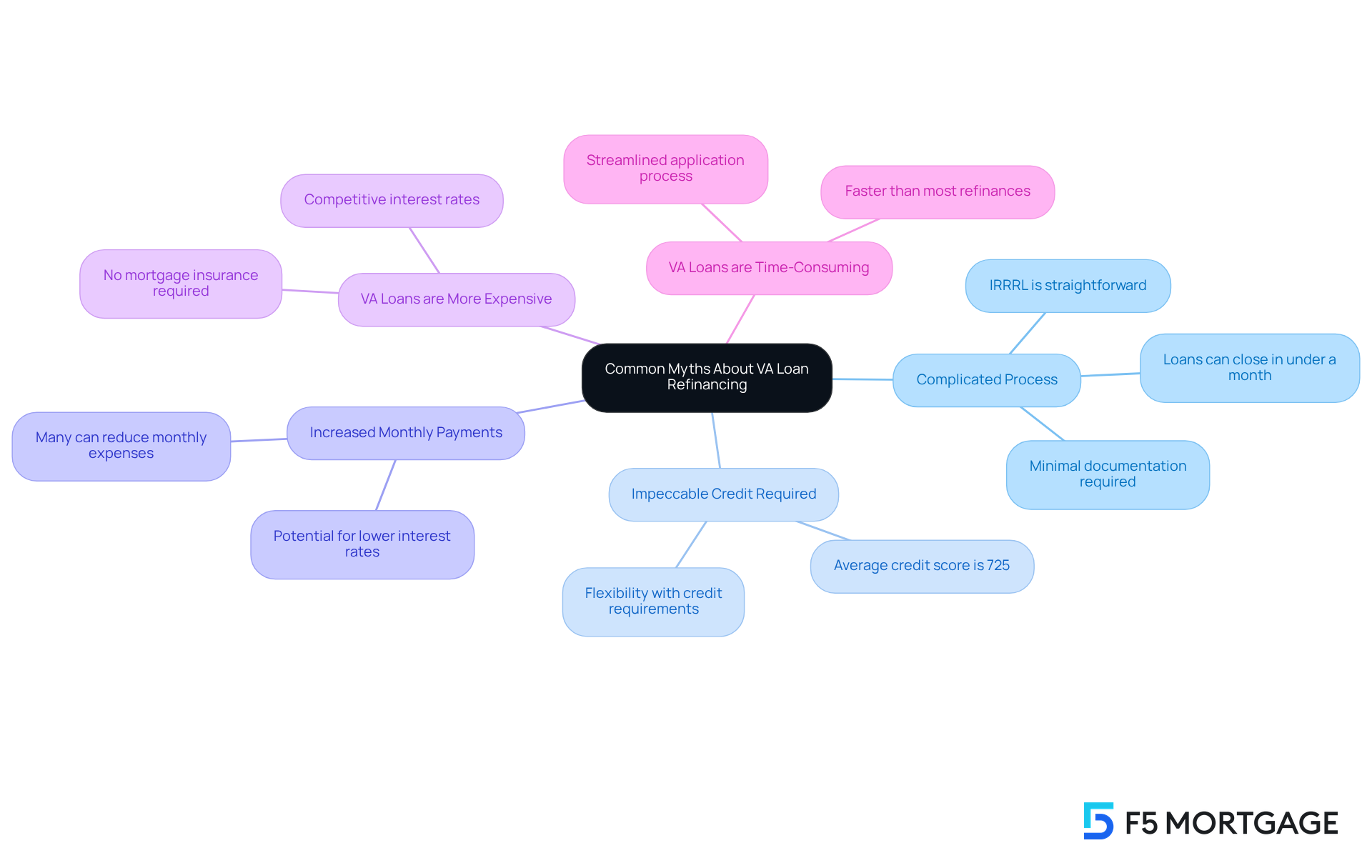

Common Myths About VA Loan Refinancing: Debunking Misconceptions

Many veterans face myths about VA mortgage restructuring that can lead to unnecessary hesitation. A common concern is the belief that the loan restructuring process is overly complicated and time-consuming. In reality, the Interest Rate Reduction Refinance Loan (IRRRL) process is designed to be straightforward, often requiring minimal documentation and allowing many loans to close in under a month. We know how challenging this can be; studies show that about 60% of former service members think , which can prevent them from exploring beneficial alternatives.

Another prevalent misconception is that impeccable credit is required for loan modification. However, many lenders show flexibility with credit requirements, making it more accessible for a wider range of borrowers. It’s important to understand that restructuring does not always lead to increased monthly payments. In fact, with the potential for lower interest rates, many former service members discover they can significantly reduce their monthly expenses. As one experienced individual shared, ‘Navigating the loan modification process was simpler than I anticipated, and I managed to reduce my payments considerably.’

By dispelling these misconceptions and understanding the realities of VA loan refinance, former service members can approach the process with confidence and clarity. To start, we encourage you to consult with a knowledgeable mortgage broker who can guide you through the options available. We’re here to support you every step of the way.

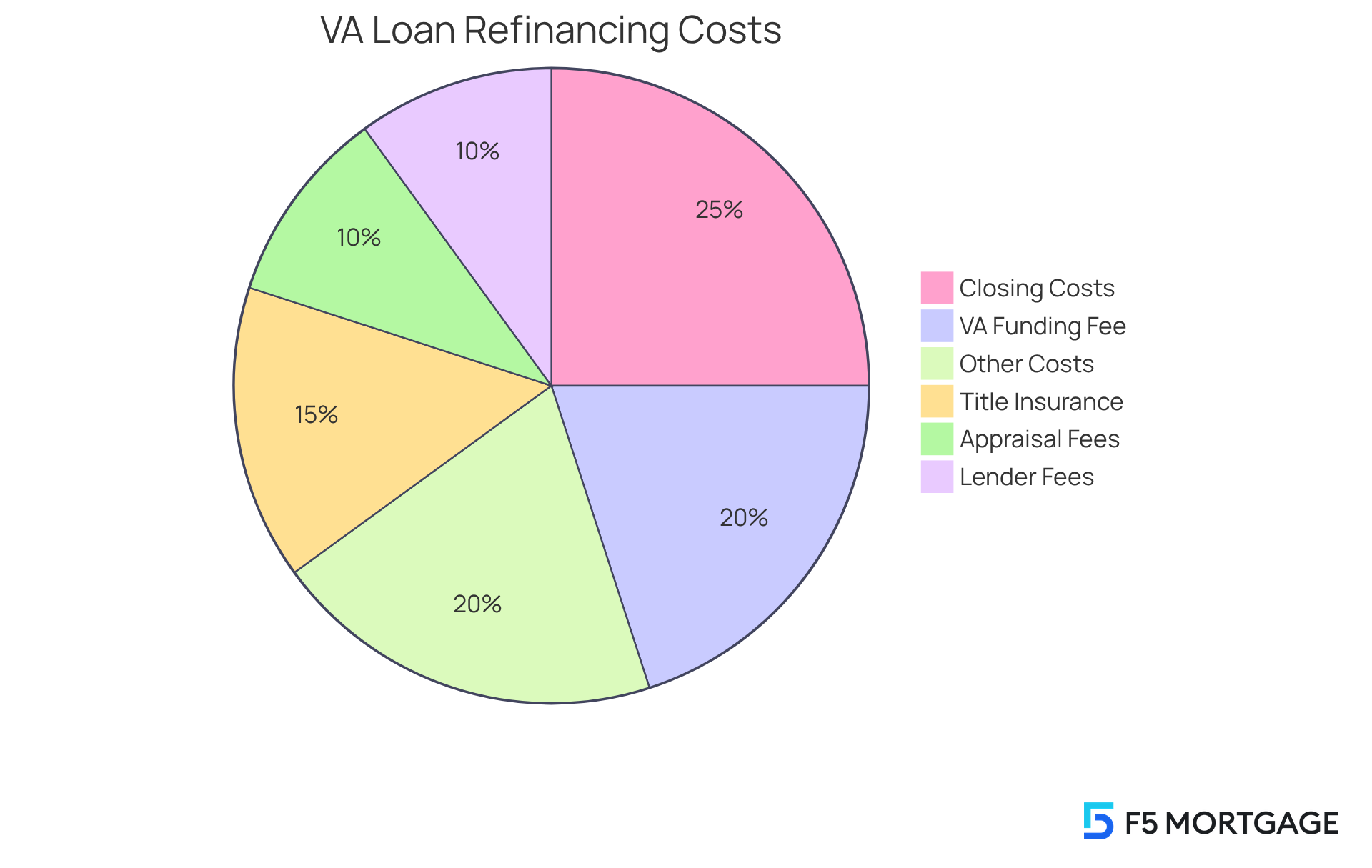

Understanding VA Loan Refinancing Costs: Budgeting for Your Refinance

Understanding the expenses associated with a is crucial for those who have served. Key expenses to consider include:

- Closing costs, which can range from 1% to 6% of the total loan amount

- The VA funding fee, currently set at 0.5% for Interest Rate Reduction Refinance Loans (IRRRLs)

We know how challenging this can be, and it’s important to note that some former service members may qualify for exemptions from the VA funding fee, potentially reducing their overall costs significantly.

In addition to these, you might encounter other costs such as:

- Title insurance

- Appraisal fees (if applicable)

- Lender fees

For example, on a $400,000 home purchase, closing costs could vary from $4,000 to $24,000, depending on factors like location and lender-specific fees. To alleviate financial pressure, it’s wise for former service members to actively plan for these expenses, ensuring a smoother VA loan refinance process.

As Alex Chen, a Loan Officer, emphasizes, “The key takeaway is that while these costs are significant, the VA program provides unique and powerful ways to manage them, putting you in control of your financial journey.” By planning ahead and perhaps seeking advice from a financial officer to understand your specific circumstances, you can navigate the process of obtaining a new mortgage with confidence and ease.

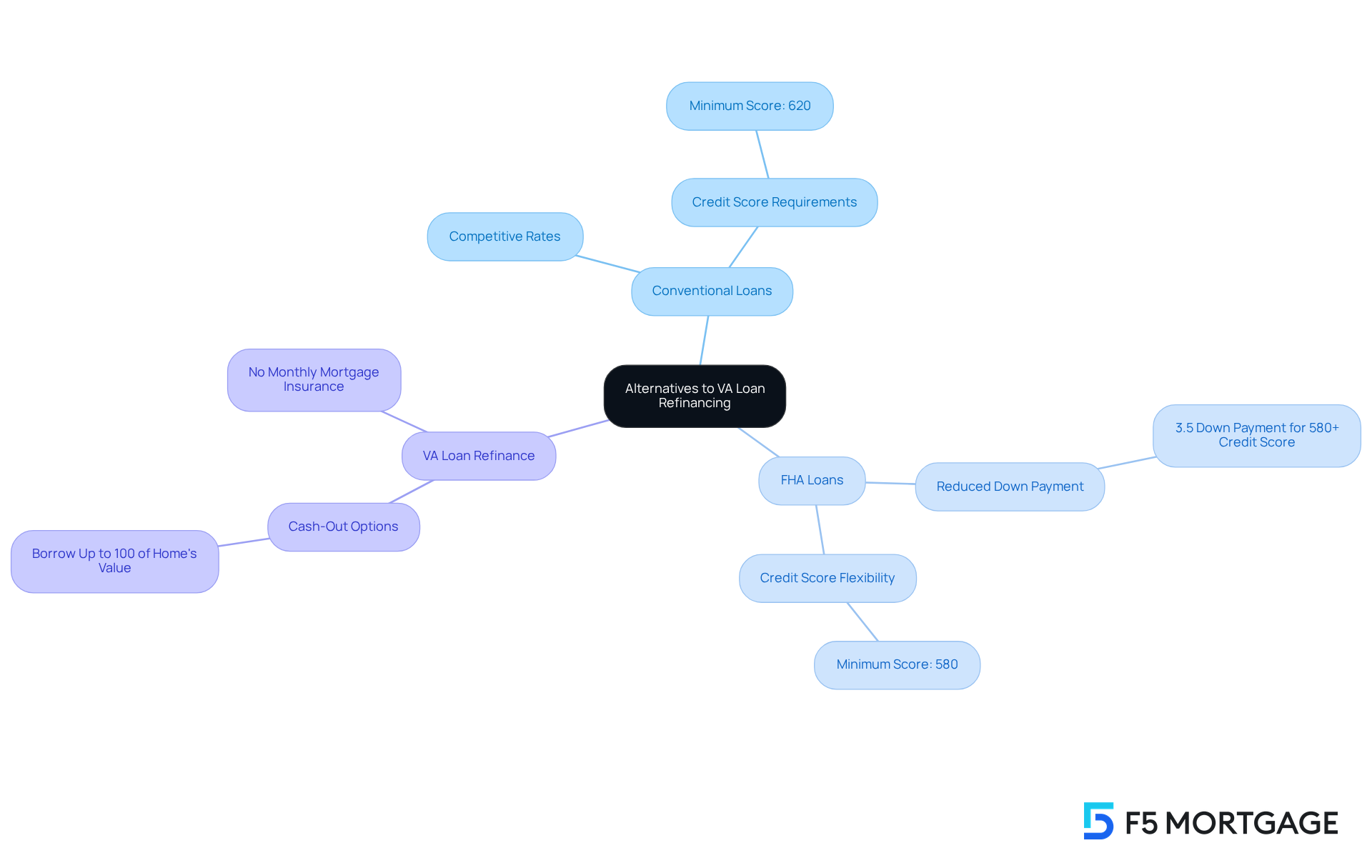

Alternatives to VA Loan Refinancing: Exploring Other Options

While a VA loan refinance is a popular option among former military personnel, exploring alternatives such as conventional and can also be beneficial. We know how challenging it can be to navigate these choices, and it’s important to understand that traditional financing often offers competitive rates, especially for borrowers with strong credit profiles. This makes them an appealing choice for those who meet the criteria. On the other hand, FHA mortgages provide valuable support for former service members seeking reduced down payment standards, which can ease the financial burden of homeownership.

In 2023, statistics reveal that approximately 825,000 FHA mortgages were initiated compared to nearly 490,000 VA mortgages. This highlights the growing preference for FHA options among service members, particularly when facing credit challenges or concerns about the VA funding fee. FHA loans typically require a minimum credit score of 580 for a 3.5% down payment, while conventional loans may necessitate a score of around 620. This flexibility opens doors for individuals from various economic backgrounds to access home financing.

Moreover, former service members might consider a VA loan refinance as a cash-out refinancing alternative to access their home equity for other financial needs, such as debt consolidation or home improvements. The VA loan refinance allows eligible service members to borrow up to 100% of their home’s value, providing significant financial flexibility. Unlike FHA loans, VA loans do not require monthly mortgage insurance, which can further influence your decision.

Ultimately, it is crucial for former service members to evaluate these alternatives based on their unique financial situations and long-term goals. Consulting with mortgage professionals can provide valuable insights into the benefits and drawbacks of each option. We’re here to support you every step of the way, ensuring that veterans make informed decisions tailored to their needs.

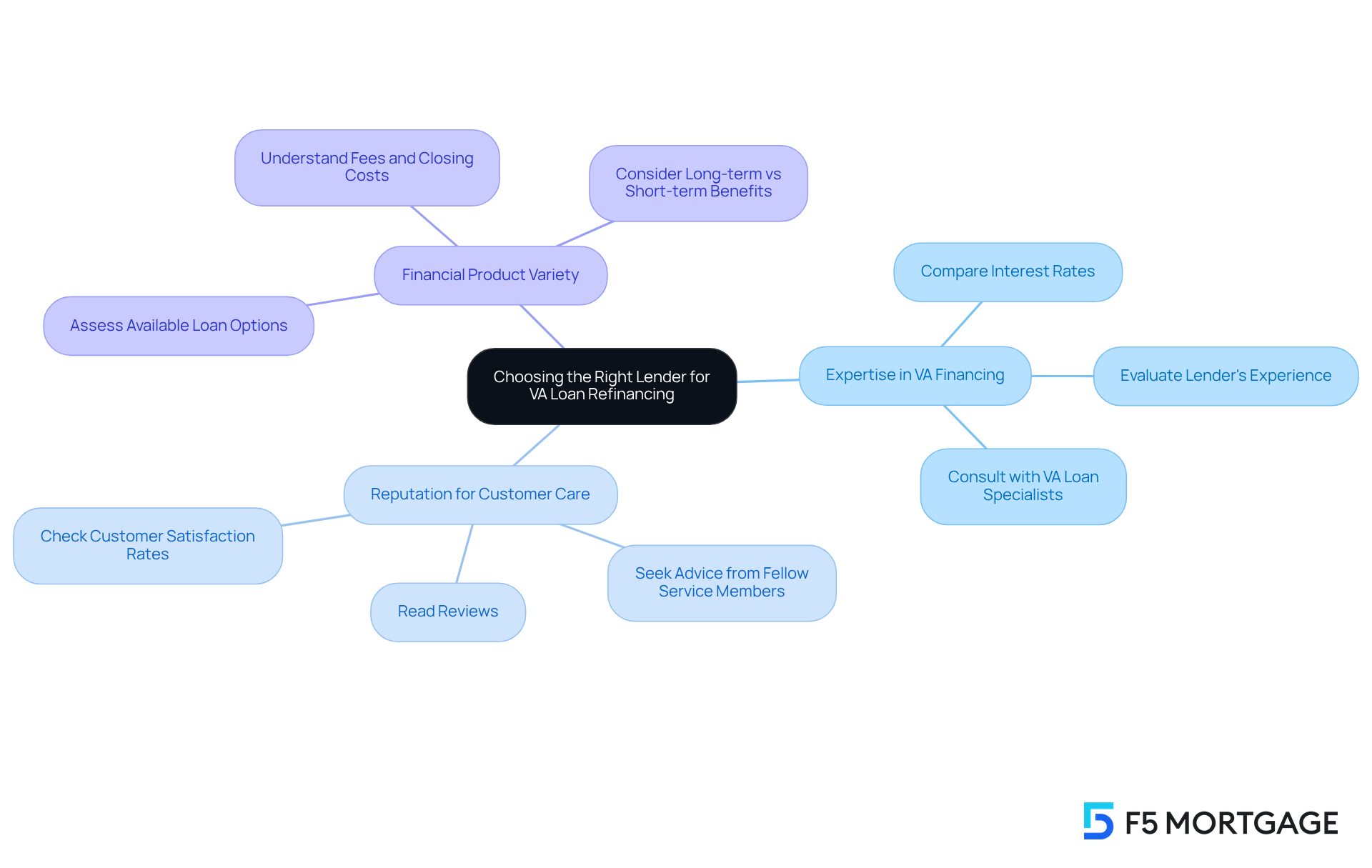

Choosing the Right Lender for VA Loan Refinancing: Key Considerations

Selecting the right lender for a VA loan refinance is crucial for ensuring a positive experience. We understand how challenging this can be, so it’s important for veterans to consider several key aspects:

- The lender’s expertise in VA financing

- Their reputation for customer care

- The variety of financial products they offer

In FY 2017, the VA guaranteed over 190,000 home loans under the IRRRL program, highlighting the significance of choosing a knowledgeable lender.

Additionally, comparing interest rates, fees, and closing costs among different lenders is essential. Reading reviews and seeking advice from fellow service members can provide valuable insights into the lender’s reliability and service quality. Remember, we’re here to support you every step of the way.

Furthermore, be cautious of misleading advertising; for instance, the VA prohibits lenders from promoting the deferral of payments as a benefit. By taking the time to research and compare your options, and perhaps consulting with a VA loan specialist, you can effectively find a lender that aligns with your VA loan refinance goals.

Conclusion

Navigating the VA loan refinance process opens up significant opportunities for veterans seeking financial relief. We understand how challenging this can be, and it’s essential to grasp:

- Eligibility requirements

- The benefits of the VA Interest Rate Reduction Refinance Loan (IRRRL)

- The need for careful consideration of costs and potential drawbacks

By leveraging personalized services, service members can tailor their refinancing journey to meet their unique financial goals.

Key insights reveal the streamlined nature of the IRRRL, which simplifies the refinancing process and can lead to substantial monthly savings. Additionally, being aware of common misconceptions empowers veterans to approach refinancing with confidence, ensuring they make informed decisions. Understanding the costs involved, such as closing expenses and the VA funding fee, is crucial for successful budgeting.

Ultimately, we encourage veterans to explore all available options, including alternatives to VA loan refinancing, to find the best fit for their circumstances. By taking proactive steps and consulting with knowledgeable lenders, former service members can navigate the complexities of refinancing and secure a more stable financial future. Embracing these strategies not only paves the way for immediate savings but also contributes to long-term economic well-being, reinforcing the invaluable benefits of VA loan refinancing.

Frequently Asked Questions

What services does F5 Mortgage provide for VA loan refinancing?

F5 Mortgage offers personalized VA loan refinancing solutions tailored to the unique needs of service members and their families, including customized consultations to explore loan options effectively.

How does F5 Mortgage ensure clients receive advantageous rates for VA loan refinancing?

F5 Mortgage has access to a network of over two dozen premier lenders, helping clients find financing options that align with their financial goals and secure the most advantageous rates and terms.

What is the VA Interest Rate Reduction Refinance Loan (IRRRL)?

The VA IRRRL is a program designed to help former service members refinance their existing VA loans to secure lower interest rates with minimal paperwork, often without requiring an appraisal or income verification.

How quickly can former service members complete the VA loan refinance process using the IRRRL?

Many former service members can complete the VA loan refinance journey in as little as 2 to 3 weeks, which is aligned with the average closing time for IRRRLs.

What are the potential monthly savings for veterans using the IRRRL?

Veterans utilizing the IRRRL can save an average of $150 to $300 each month on their mortgage payments, enhancing their financial flexibility.

What are the eligibility requirements for the VA loan refinance (IRRRL)?

To qualify for the IRRRL, borrowers must have an existing VA mortgage, have made at least six consecutive monthly payments, and ensure that all payments are up to date with no missed payments in the past 12 months.

What is a Certificate of Eligibility and why is it important for VA loan refinancing?

A Certificate of Eligibility verifies a veteran’s entitlement to VA loan benefits and is a crucial first step for those seeking a VA-backed loan refinance.

Why are VA loan refinance options considered simpler than other refinancing options?

VA loan refinance options, particularly IRRRLs, typically require less documentation and do not necessitate an appraisal, making them an appealing choice for service members.

How popular are VA-supported mortgages among former service members?

In fiscal 2024, over 416,000 VA-supported mortgages were provided, highlighting the program’s popularity among former service members.

What should service members do if they face challenges with VA financing?

Service members are encouraged to connect with informed lenders who can help navigate misunderstandings about VA financing and take proactive measures to reduce foreclosure risks.