Overview

This article highlights the essential FHA loan requirements that Texas families need to know to navigate the home financing process with confidence. We understand how challenging this can be, and we’re here to support you every step of the way. Key eligibility criteria are outlined, including:

- Credit score thresholds

- Down payment options

- Debt-to-income ratios

These factors collectively facilitate access to affordable homeownership for a diverse range of borrowers in Texas.

By recognizing these requirements, families can feel empowered to take the next steps toward homeownership. It’s important to understand that each element plays a crucial role in making homeownership a reality. With the right information, you can confidently approach the mortgage process and find the best options for your unique situation. Remember, we’re here to guide you through this journey, ensuring you have the resources and support you need.

Introduction

Navigating the path to homeownership can often feel like a daunting maze, especially for families in Texas seeking an FHA loan. We understand how overwhelming this process can be, with specific eligibility criteria and various financial nuances to consider. That’s why understanding the FHA loan requirements is essential for making informed decisions.

In this article, we break down the key aspects of FHA loans in Texas. We reveal not only the requirements but also the opportunities available to prospective buyers. What challenges do families face in this complex landscape? And how can they leverage the available resources to turn their homeownership dreams into reality? We’re here to support you every step of the way.

F5 Mortgage: Personalized FHA Loan Consultations in Texas

At F5 Mortgage, we understand how challenging the journey to homeownership can be for Texas families, particularly in navigating the FHA loan requirements Texas. That’s why we excel in offering customized consultations tailored to meet the FHA loan requirements Texas specifically for your needs. Our knowledgeable brokers are here to navigate the complexities of FHA financing and explain the FHA loan requirements Texas, ensuring you fully comprehend your options and can make well-informed decisions.

This tailored approach not only streamlines the mortgage process but also significantly boosts your satisfaction. With a remarkable of 94%, F5 Mortgage has established itself as a reliable partner in home financing. We believe in the effectiveness of personalized service, which helps families like yours secure their dream homes.

Our committed team, comprising experienced financial advisors who focus on different monetary scenarios, is dedicated to making you feel assured throughout your mortgage experience. Many clients have shared their stress-free experiences, often achieving quick closings in under three weeks. This is thanks to our user-friendly technology and no-pressure guidance, designed to support you every step of the way.

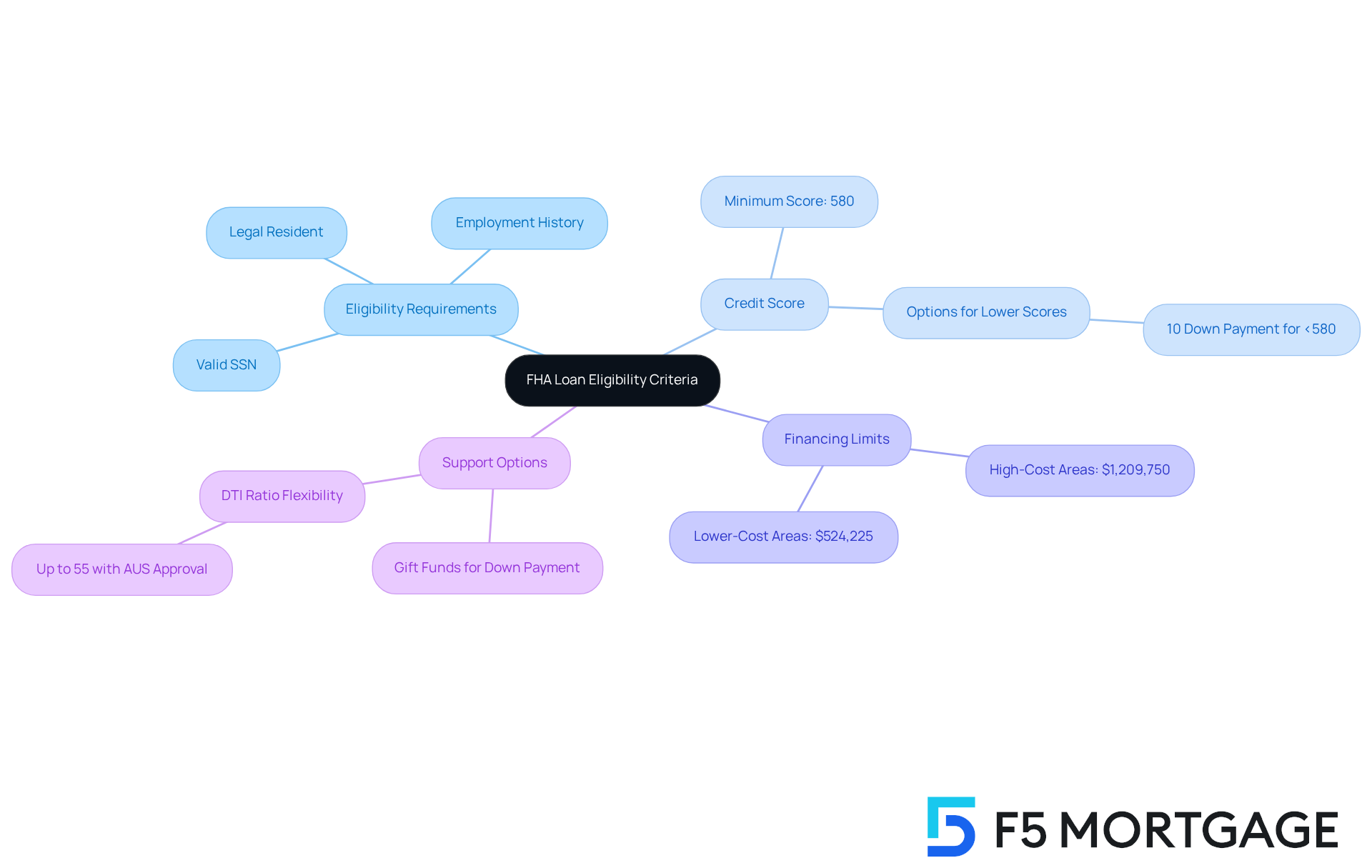

FHA Loan Eligibility Criteria: Key Requirements for Texas Borrowers

Qualifying for an FHA mortgage in Texas involves understanding the FHA loan requirements Texas, but we’re here to support you every step of the way. To begin your journey, it’s important to know that borrowers must meet the FHA loan requirements Texas. This includes:

- Being a legal resident of the U.S.

- Having a valid Social Security number.

- Demonstrating a consistent employment history.

A minimum credit score of 580 is necessary to take advantage of the low down payment option of just 3.5%. If your credit score is below 580, don’t worry; a down payment of at least 10% is still an option. This flexibility allows families from diverse financial backgrounds to pursue their dream of homeownership.

In December 2024, FHA mortgages accounted for 29% of mortgage applications for new homes. This statistic highlights their popularity among first-time homebuyers and families seeking affordable financing alternatives. For those looking in high-cost areas of Texas, the maximum FHA financing amount is set at $1,209,750 for 2025, while lower-cost regions typically have a limit of $524,225 for single-unit residences.

We understand that managing finances can be challenging, which is why relatives can help by providing gift funds for down payments. This support can significantly ease the financial burden. Additionally, FHA financing can be extended to borrowers with a debt-to-income (DTI) ratio as high as 55%, provided they have Automated Underwriting System (AUS) approval. This makes FHA loans accessible to a broader range of applicants.

Understanding the FHA loan requirements Texas is crucial for families who aim to secure financing for their new home. It empowers you to navigate the mortgage process with confidence and clarity. Remember, preparing documentation for all sources of funds is essential for a smooth financing experience. We know how challenging this can be, but with the right information and support, you can .

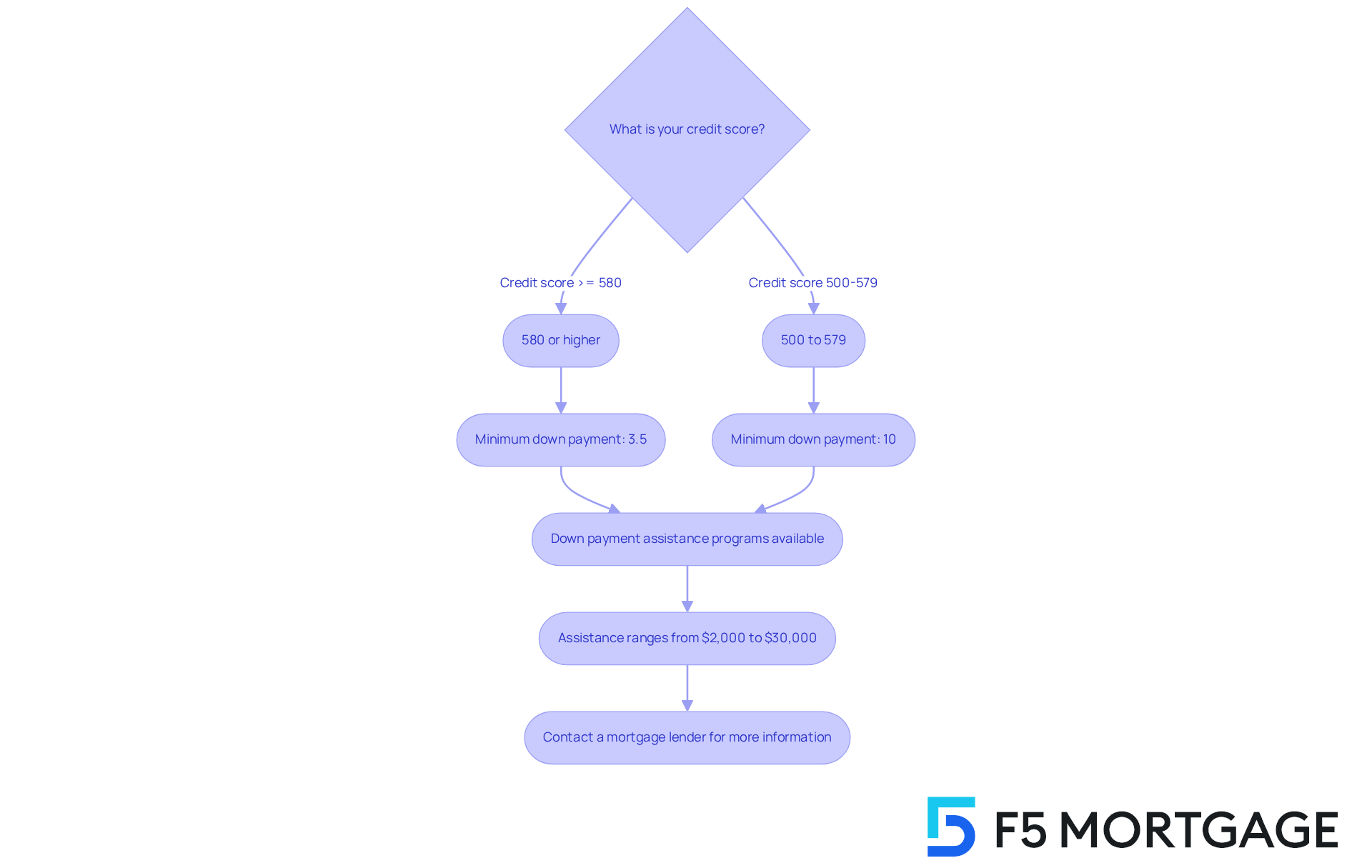

Down Payment Options: FHA Loan Down Payment Requirements in Texas

In our state, FHA loans require a minimum down payment of just 3.5% for borrowers with a credit score of 580 or higher. If your credit score falls between 500 and 579, a higher down payment of 10% is necessary. We understand how daunting this can feel, but the good news is that there are many down payment assistance programs designed to help eligible borrowers cover these costs. This support significantly enhances the accessibility of homeownership for families like yours.

With over 2,500 available through state and local governments, charities, and financial institutions, many first-time homebuyers qualify for assistance ranging from $2,000 to $30,000. This financial help can be crucial in overcoming the common hurdle of saving for a down payment, which often seems overwhelming. For instance, the Department of Housing and Community Affairs (TDHCA) offers the My Choice Home program, providing a 30-year, low-interest mortgage and up to 5% for down payment and closing assistance.

However, to access these programs, you typically need to meet the FHA loan requirements in Texas, which include a minimum credit score of 620 and certain income limits. As mortgage specialists often emphasize, these initiatives aim to make homeownership attainable for many families, allowing them to secure their dream homes with lower upfront costs. Real-life stories, like those of families benefiting from the State Affordable Housing Corporation’s initiatives, highlight the positive impact these programs have on the journey to homeownership.

If you’re considering your options for down payment assistance, we encourage you to reach out to a trusted mortgage lender. We’re here to support you every step of the way.

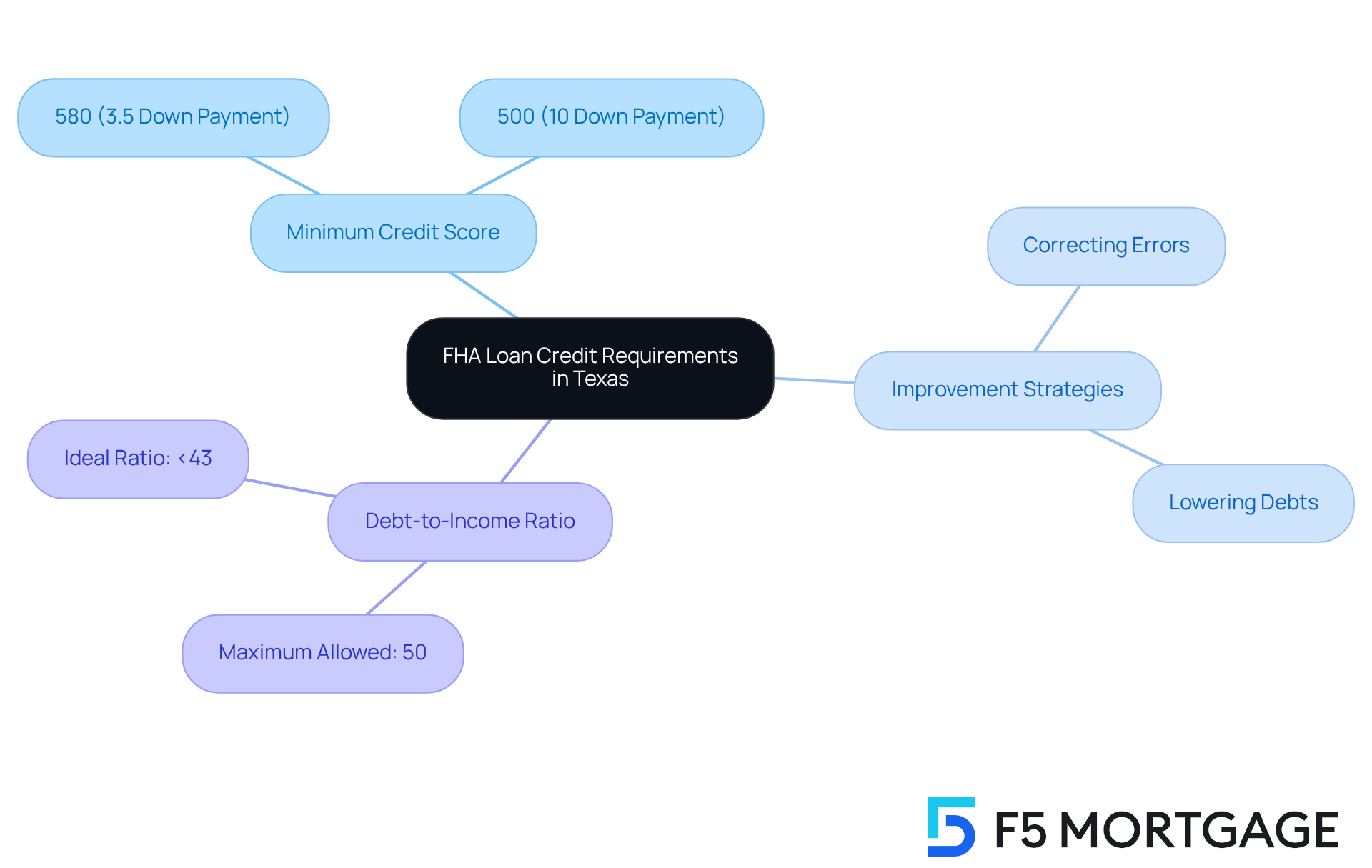

Credit Score Standards: FHA Loan Credit Requirements in Texas

In Texas, we understand how challenging it can be to qualify for a mortgage given the FHA loan requirements Texas. Generally, a minimum credit score of 580 is required to access the favorable 3.5% down payment option. However, if your credit score is as low as 500, you can still secure financing, though it may come with a higher down payment of 10%. This flexibility makes particularly appealing for families with less-than-perfect credit.

It’s essential to consistently check your credit scores and take proactive steps to enhance them. Higher scores can significantly improve your eligibility and the conditions of your loan. For instance, many applicants have successfully boosted their credit scores by:

- Correcting errors on their reports

- Lowering outstanding debts

This has led to more favorable financing proposals.

Experts recommend maintaining a debt-to-income ratio below 50%, ideally under 43%, as this can result in more competitive mortgage rates. Additionally, consider strategies like paying down larger balances to strengthen your overall financial profile. By understanding the FHA loan requirements Texas has and actively working to meet them, families can better position themselves for successful homeownership through FHA financing. We’re here to support you every step of the way.

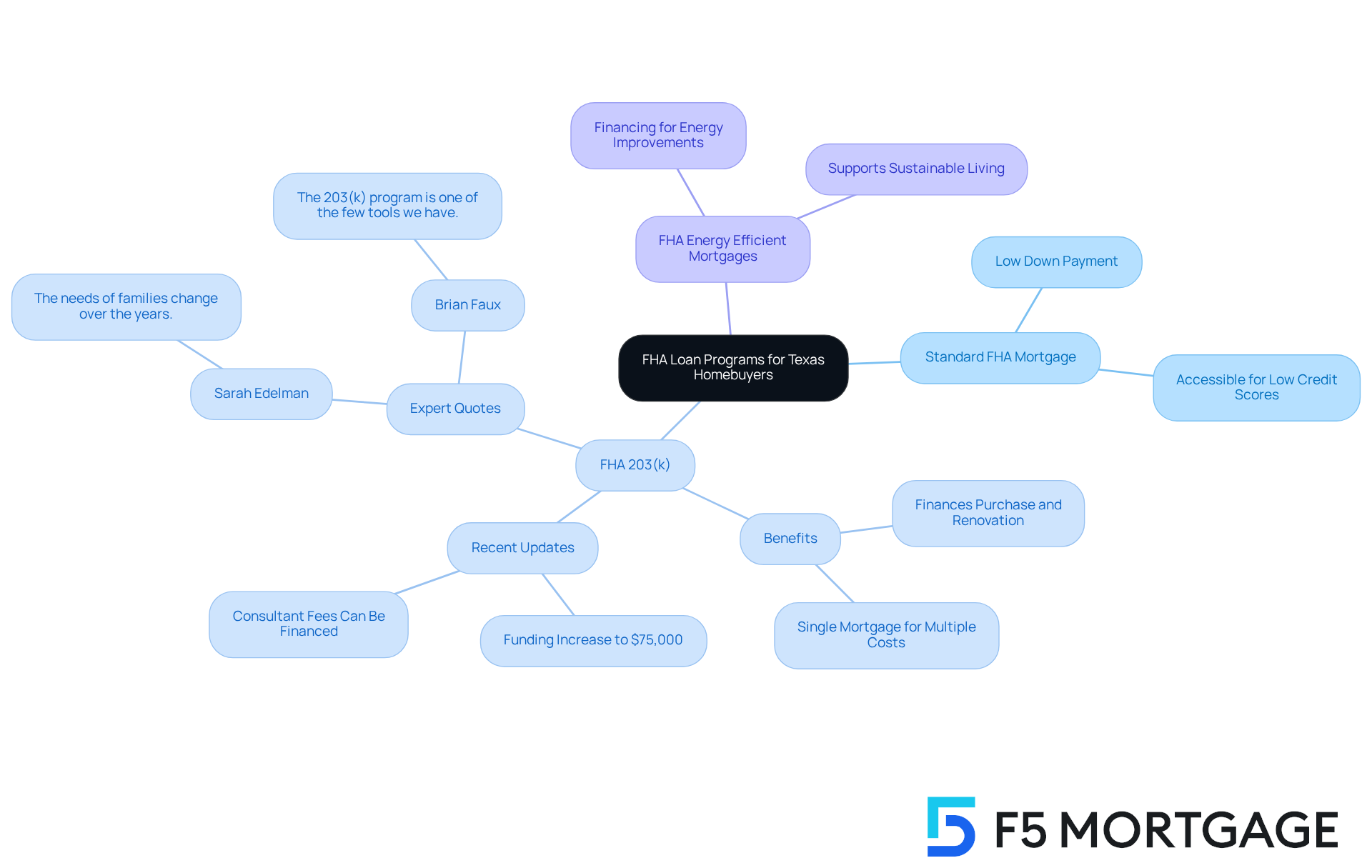

Types of FHA Loan Programs: Options for Texas Homebuyers

Texas homebuyers have access to a variety of FHA financing programs that align with the FHA loan requirements Texas, designed to meet their specific needs. Among these, the standard FHA mortgage, FHA 203(k) options for home renovations, and FHA Energy Efficient Mortgages stand out. If you’re aiming to buy a residence that needs renovations or improvements, the FHA 203(k) program is especially beneficial. This program allows you to finance both the purchase and renovation costs through a single mortgage, making it an attractive option for enhancing your living space.

Recent updates to the FHA 203(k) program have made it even more accessible. For instance, the highest funding for overall renovation expenses under the Limited 203(k) program has increased from $35,000 to $75,000. This change enables you to tackle larger renovation projects that can significantly improve your living conditions. Moreover, the ability to finance 203(k) consultant fees within the mortgage amount alleviates financial pressure, especially for first-time buyers managing multiple costs during home construction.

Mortgage experts highlight the many benefits of the FHA 203(k) financing. Sarah Edelman, Deputy Assistant Secretary for Single Household Housing at HUD, emphasizes that these mortgages are crucial for families needing to modify their homes as their needs evolve over time. Furthermore, Brian Faux from HUD notes that the program is a vital tool in addressing the affordable housing supply crisis, increasing the availability of affordable housing in the market.

In Texas, approximately 20% of homebuyers are utilizing financing that meets FHA loan requirements Texas, reflecting a growing recognition of its benefits. This trend underscores the importance of these financial aids in helping families not only acquire homes but also create environments that meet their changing requirements. We know how challenging this can be, and we’re here to .

Mortgage Insurance Premiums: FHA MIP Requirements in Texas

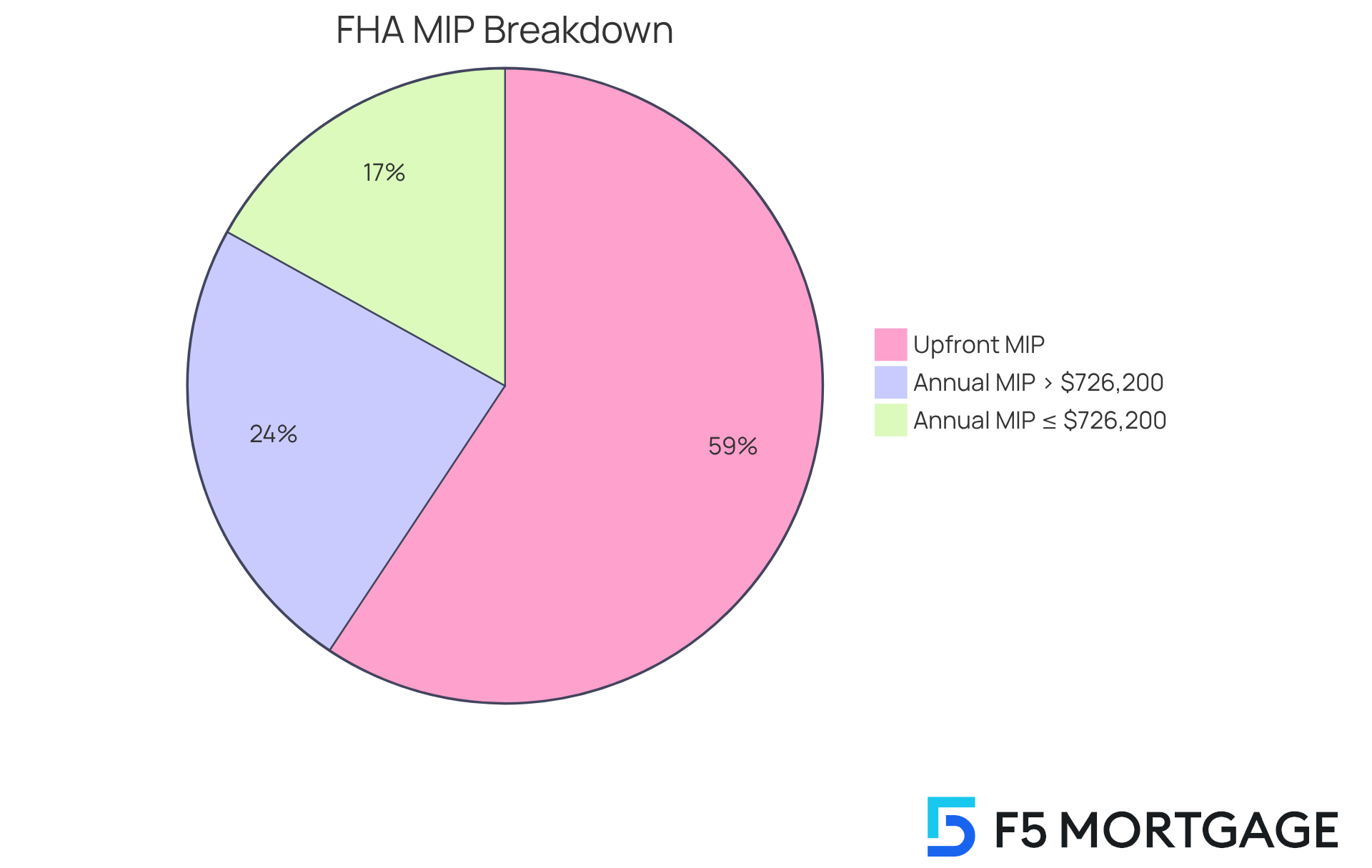

Navigating FHA financing can feel overwhelming, especially when it comes to understanding mortgage insurance premiums (MIP). These premiums are essential for protecting lenders against defaults, but they can also impact your budget significantly. The upfront MIP is usually 1.75% of the mortgage amount, and the good news is that it can be rolled into the mortgage itself.

In addition to the upfront cost, borrowers will face an annual MIP that varies based on the mortgage amount and down payment percentage. For instance, in 2025, FHA mortgages of $726,200 or more will have an annual MIP of 0.70% for 11 years. Conversely, for mortgages of $726,200 or less with a down payment of 10% or more, the annual MIP drops to 0.50% for the same duration. Understanding the FHA loan requirements in Texas is crucial for Texas families, as it enables a more accurate assessment of total mortgage expenses.

The yearly MIP continues throughout the financing period unless a 10% down payment is made, which allows for cancellation after 11 years. We know how challenging this can be, and financial advisors stress the importance of including MIP in your overall homeownership costs. This factor can significantly influence your monthly payments and long-term financial planning.

As Chad Faith, a production trainer, wisely notes, “If you’re determined to utilize an FHA mortgage, be sure to factor MIP into your budget.” By staying informed about MIP obligations, households can make more confident decisions when budgeting for their FHA loans. We’re here to support you every step of the way, so consider to gain a clearer understanding of how MIP will impact your overall mortgage budget.

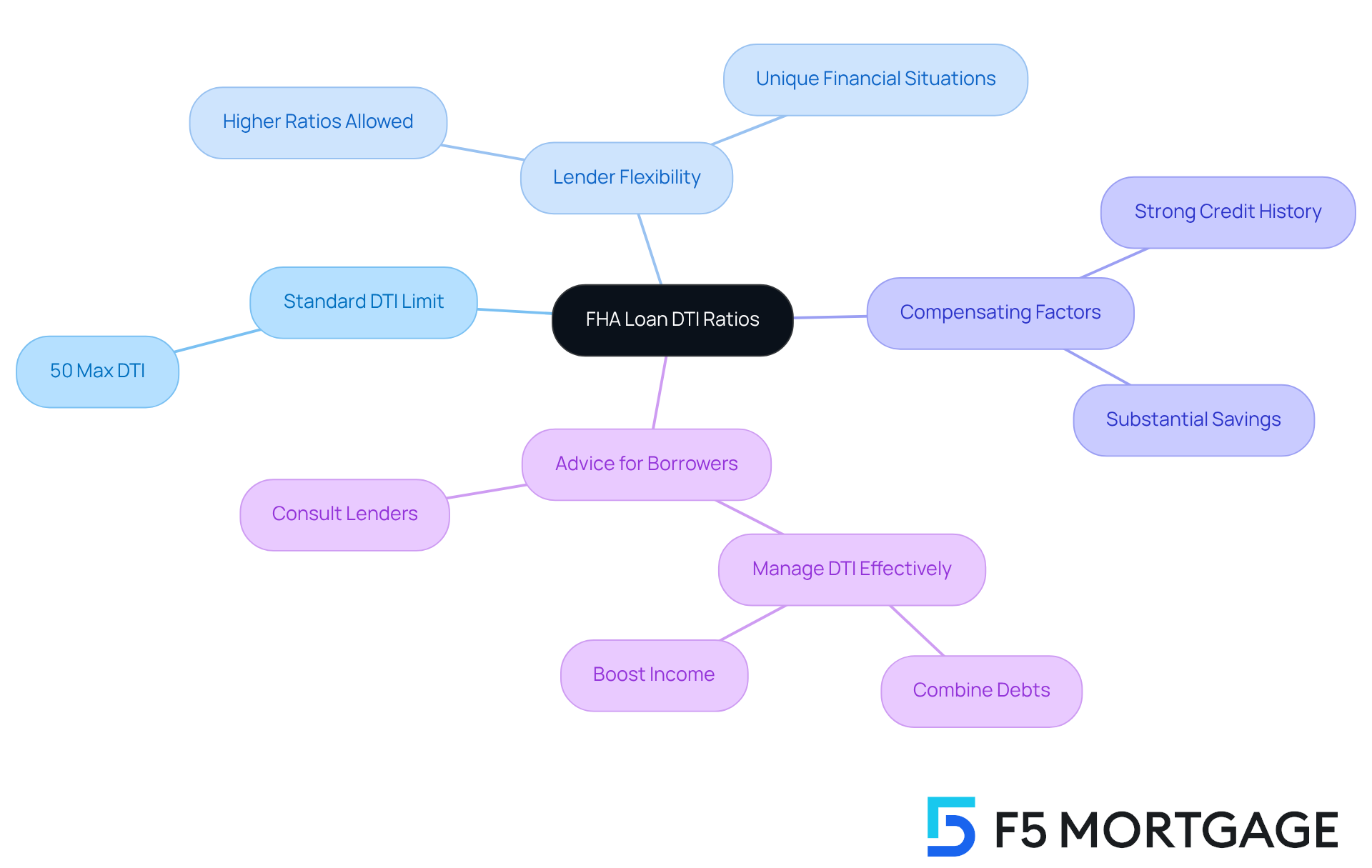

Debt-to-Income Ratios: FHA Loan Guidelines for Texas Borrowers

Navigating the mortgage process can feel overwhelming, especially when it comes to understanding debt-to-income (DTI) ratios. FHA guidelines typically allow a DTI ratio of up to 50% for borrowers, meaning no more than half of their gross monthly income should go towards debt payments. Yet, we know how challenging this can be. Some lenders may even allow higher ratios if there are compensating factors, such as a strong credit history or substantial savings. This flexibility is particularly beneficial for families facing high-interest rates and complex paperwork in the home financing journey.

Statistics show that many lenders are increasingly , reflecting a growing trend to assist borrowers with unique financial situations. For instance, borrowers with DTI ratios over 50% have successfully qualified for FHA financing, provided they present compensating factors. This is a hopeful sign for families looking to achieve their homeownership dreams.

Mortgage brokers emphasize the importance of managing DTI ratios effectively. One broker shared, ‘Combining debts or boosting income through side jobs can greatly improve a household’s likelihood of meeting [FHA loan requirements in Texas](https://f5mortgage.com/understanding-fha-loan-limits-in-florida-for-homebuyers) to obtain an FHA mortgage.’ Grasping these guidelines and actively overseeing your financial well-being is essential. Remember, we’re here to support you every step of the way as you work towards your homeownership goals.

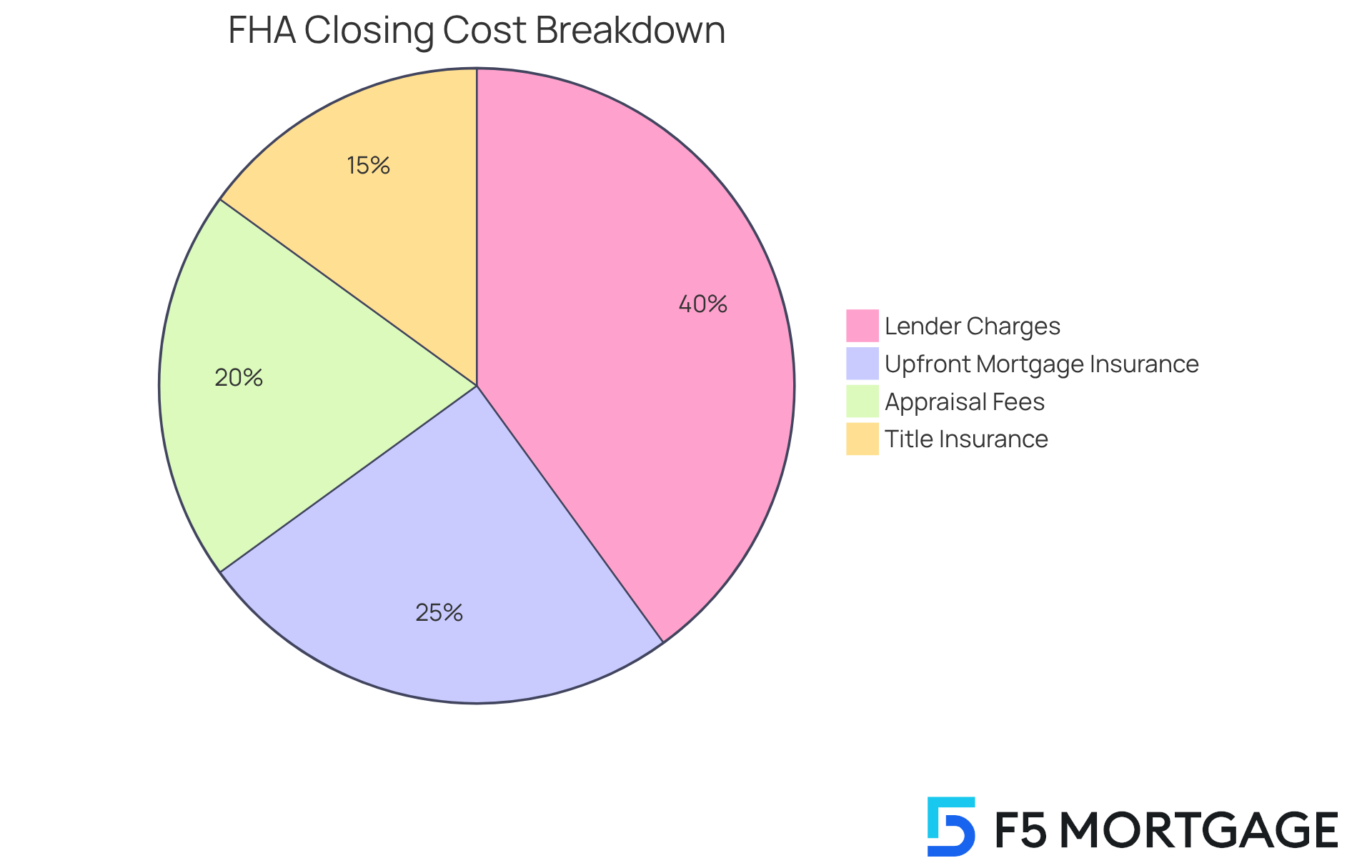

Closing Costs Overview: FHA Loan Closing Costs in Texas

In the state, we understand how daunting closing costs can be under [FHA loan requirements in Texas](https://f5mortgage.com/loan-programs/dscr-loans/texas), typically ranging from 2% to 6% of the loan amount. This translates to significant expenses that homebuyers must prepare for. These costs encompass various fees, including lender charges, appraisal fees, and title insurance. For instance, on a $300,000 home, closing costs could amount to approximately $12,000. This includes essential fees like the upfront mortgage insurance premium and third-party service charges.

To help manage these expenses effectively, we encourage borrowers to create a detailed budget that accounts for both closing costs and the . Additionally, negotiating with sellers for concessions can be a strategic way to alleviate some of the financial burden. Motivated sellers may contribute up to 6% of the purchase price toward closing costs, providing a valuable opportunity for buyers to reduce their out-of-pocket expenses.

Statistics show that many borrowers in the state actively negotiate closing costs, with a notable percentage successfully obtaining concessions from sellers. This practice not only makes homeownership more attainable but also highlights the importance of understanding the various components of closing costs. Real estate experts emphasize that being knowledgeable about these costs can empower households to make improved financial choices during the home buying process.

Overall, budgeting for the FHA loan requirements in Texas involves careful planning and consideration of all potential closing costs. By leveraging seller contributions and negotiating effectively, families can navigate the complexities of closing costs and move closer to achieving their homeownership goals. Remember, we’re here to support you every step of the way.

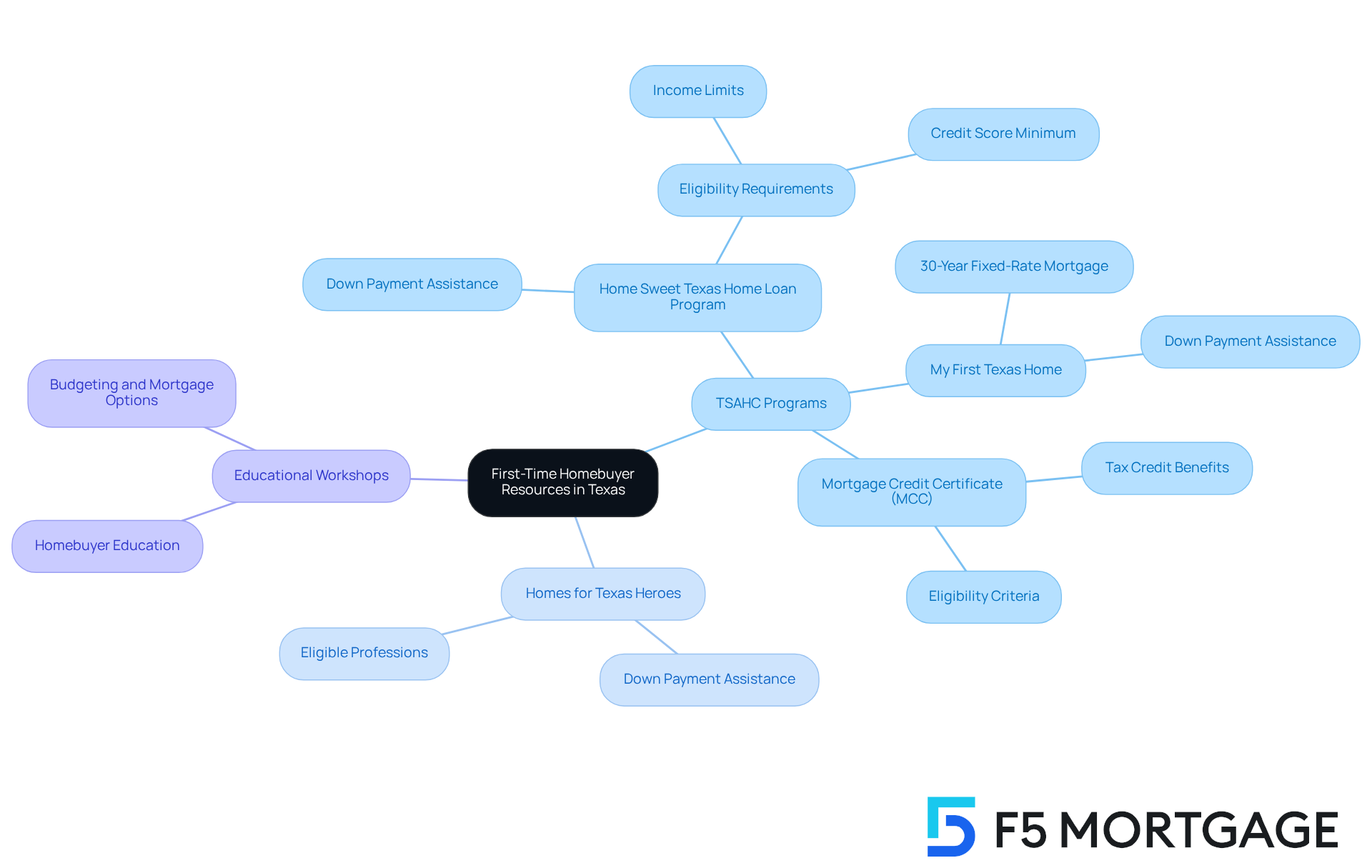

First-Time Homebuyer Resources: FHA Loan Assistance in Texas

Navigating the journey to homeownership can be daunting, especially for first-time buyers. Fortunately, the state offers a wealth of resources designed to support you every step of the way. From down payment assistance programs to educational workshops, there are numerous options available to help ease your financial burdens.

The State Affordable Housing Corporation (TSAHC) plays a crucial role in this process. They provide grants and loans aimed at easing the financial pressures of buying your first home. One of the standout programs is Homes for Texas Heroes. This initiative offers of up to 5% for eligible professionals, including teachers, first responders, and military personnel. To qualify, applicants must meet specific income limits and complete a homebuyer education course.

Another valuable resource is the My First Home in Texas program, which provides up to 5% in interest-free down payment support. This assistance enables households to secure a mortgage with reduced initial expenses, making it particularly beneficial in a competitive housing market where many first-time buyers struggle to save for a substantial down payment.

Additionally, the Mortgage Credit Certificate (MCC) program allows first-time homebuyers to recover a portion of the mortgage interest paid, leading to considerable long-term savings.

Educational workshops further enhance your success by equipping you with essential knowledge about the home buying process. These workshops cover topics such as budgeting, understanding mortgage options, and navigating the application process. By participating, you can significantly improve your confidence and decision-making skills. We know how challenging this can be, and many potential buyers are unaware of the assistance programs available to them. This highlights the importance of these educational resources in promoting informed homeownership.

By utilizing these programs and workshops, families can overcome financial challenges and realize their dream of homeownership in the state.

Annual FHA Loan Limits: Updates for Texas Borrowers

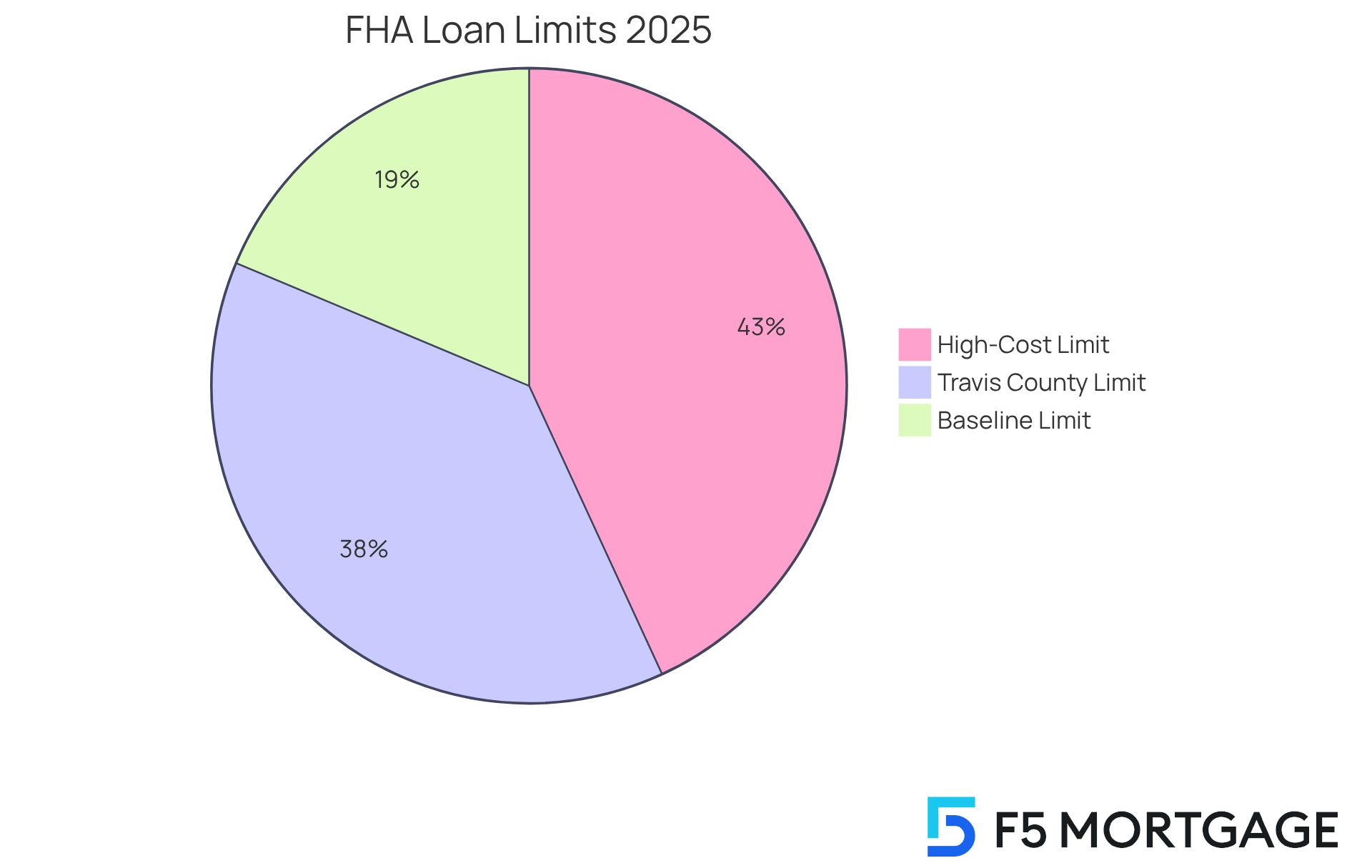

In 2025, the [FHA loan requirements Texas](https://f5mortgage.com) are thoughtfully designed to accommodate the diverse housing markets across counties. The baseline limit for single-family homes is set at $524,225. In high-cost areas, this limit can reach as much as $1,209,750 for single-unit properties. Understanding the FHA loan requirements Texas is crucial for prospective borrowers, as these requirements determine the maximum amount available for purchasing a home in specific areas. For instance, in Travis County, the FHA borrowing limit for a single unit is $1,071,300, reflecting the area’s higher median home prices. This flexibility empowers families to navigate the competitive housing market more effectively.

The impact of these borrowing restrictions is significant; they provide households with limited savings the opportunity to access homeownership options that might otherwise seem out of reach. The FHA loan requirements in Texas stipulate a minimum down payment of just 3.5%, which is especially appealing for first-time homebuyers and those looking to upgrade. Moreover, borrowers can utilize gift funds to cover 100% of their down payment and closing costs, as long as the source of these funds is verified, further alleviating financial stress.

Mortgage specialists emphasize that these increased limits enhance buying capacity, allowing families to explore larger homes or properties in desirable areas. As Craig Wales notes, the FHA’s adjustments to borrowing limits aim to improve homeownership accessibility, particularly for individuals who may face challenges qualifying for traditional financing. With a clear , families can strategically position themselves in the housing market, ensuring they make informed decisions that align with their financial aspirations. Furthermore, statistics show that these adjustments have positively influenced home purchases, enabling more families to realize their dreams of homeownership.

Conclusion

Understanding the FHA loan requirements in Texas is crucial for families aspiring to achieve homeownership. We know how challenging this can be, and this article highlights how these requirements create pathways for diverse financial situations, making it easier for many to secure the financing they need. By familiarizing themselves with the eligibility criteria, down payment options, and available assistance programs, prospective homebuyers can navigate the complexities of the mortgage process with confidence.

Key insights include:

- The importance of maintaining a good credit score

- The flexibility of down payment assistance programs

- The various types of FHA loans available to meet specific needs

Additionally, understanding mortgage insurance premiums and managing debt-to-income ratios are crucial factors that influence overall affordability. These elements collectively empower Texas families to make informed decisions and take meaningful steps toward purchasing their dream homes.

Ultimately, the journey to homeownership can feel daunting, but with the right knowledge and support, it becomes attainable. Families are encouraged to explore the resources available, such as personalized consultations and assistance programs, to ease their financial burdens. By leveraging these tools, they can successfully navigate the FHA loan landscape and turn their homeownership dreams into reality.

Frequently Asked Questions

What services does F5 Mortgage provide for FHA loans in Texas?

F5 Mortgage offers personalized consultations to help Texas families navigate FHA loan requirements, ensuring they understand their options and can make informed decisions.

What is the customer satisfaction rate at F5 Mortgage?

F5 Mortgage has a customer satisfaction rate of 94%, indicating a high level of reliability and service quality in home financing.

What are the key eligibility criteria for obtaining an FHA loan in Texas?

To qualify for an FHA loan in Texas, borrowers must be legal residents of the U.S., have a valid Social Security number, and demonstrate a consistent employment history.

What is the minimum credit score required for an FHA loan with a low down payment?

A minimum credit score of 580 is required to qualify for the low down payment option of 3.5%. If the credit score is between 500 and 579, a down payment of at least 10% is necessary.

What are the maximum FHA financing amounts for different areas in Texas?

For high-cost areas in Texas, the maximum FHA financing amount is set at $1,209,750 for 2025, while lower-cost regions typically have a limit of $524,225 for single-unit residences.

Can relatives assist with down payments for FHA loans?

Yes, relatives can provide gift funds for down payments, which can significantly ease the financial burden for borrowers.

What is the maximum debt-to-income (DTI) ratio allowed for FHA financing?

FHA financing can be extended to borrowers with a DTI ratio as high as 55%, provided they have Automated Underwriting System (AUS) approval.

What are the down payment requirements for FHA loans in Texas?

FHA loans require a minimum down payment of 3.5% for borrowers with a credit score of 580 or higher, and a 10% down payment for those with credit scores between 500 and 579.

Are there down payment assistance programs available for FHA loan borrowers?

Yes, there are over 2,500 down payment assistance programs available, offering support ranging from $2,000 to $30,000 to eligible borrowers.

What is the My Choice Home program offered by TDHCA?

The My Choice Home program provides a 30-year, low-interest mortgage and up to 5% for down payment and closing assistance to eligible borrowers in Texas.