Overview

Finding the right mortgage can feel overwhelming, especially for families navigating unique financial situations. The best broker mortgage offers tailored solutions that truly consider your needs. By assessing your specific circumstances and leveraging strong relationships with lenders, we work to secure favorable terms that can make a significant difference.

Working with a mortgage consultant can lead to remarkable savings and higher approval rates. This is particularly true for non-traditional workers and minority communities, who often face additional challenges in the mortgage process. We understand how challenging this can be, and we’re here to support you every step of the way.

Personalized service is key in navigating the mortgage process effectively. We believe that everyone deserves a chance to achieve their homeownership dreams, and we are committed to helping you find the best path forward. Let us guide you through this journey, ensuring you feel confident and empowered in your decisions.

Introduction

Navigating the intricate world of mortgage financing can feel overwhelming for families, especially in an ever-evolving market. We understand how challenging this can be. Recognizing the pivotal role of a mortgage broker can open doors to tailored solutions that fit your family’s unique financial landscape.

But with so many options available, how can you ensure you choose the right broker who truly meets your needs and maximizes your financial benefits? This guide delves into essential steps for selecting the best mortgage broker, empowering you to make informed decisions and embark on your home financing journey with confidence.

We’re here to support you every step of the way.

Understand the Role of a Mortgage Broker

Navigating the mortgage landscape can be overwhelming, and that’s where a mortgage consultant becomes an invaluable ally for families. They begin by taking a close look at your financial situation, allowing them to recommend tailored funding solutions that truly meet your needs. With strong relationships across a diverse range of lenders, these consultants can often secure better rates and terms than you might find on your own. This advantage is particularly significant in today’s market, where the value of home financing arrangements finalized by intermediaries surpassed $100 billion in the June 2024 quarter, underscoring their growing importance in residential financing.

For families, the advantages of working with a loan advisor are considerable. Research shows that consumers save an average of $10,662 over the life of their loans when partnering with independent mortgage advisors, according to a study by Polygon Research. This highlights the financial benefits of this approach. Additionally, consultants excel in supporting non-traditional workers and minority communities, achieving higher approval rates compared to retail lenders. This support is crucial for families seeking flexibility and guidance in their home financing journey.

Understanding the role of a loan consultant is essential for families aiming to choose the for making informed decisions about their home financing options. By choosing an agent who prioritizes your family’s needs and goals, you can navigate the complexities of mortgage financing with confidence and ease. For instance, F5 Mortgage has helped over 1,000 families, maintaining a customer satisfaction rate of 94%. This demonstrates how brokers can deliver personalized service that truly makes a difference.

Identify Your Family’s Unique Mortgage Needs

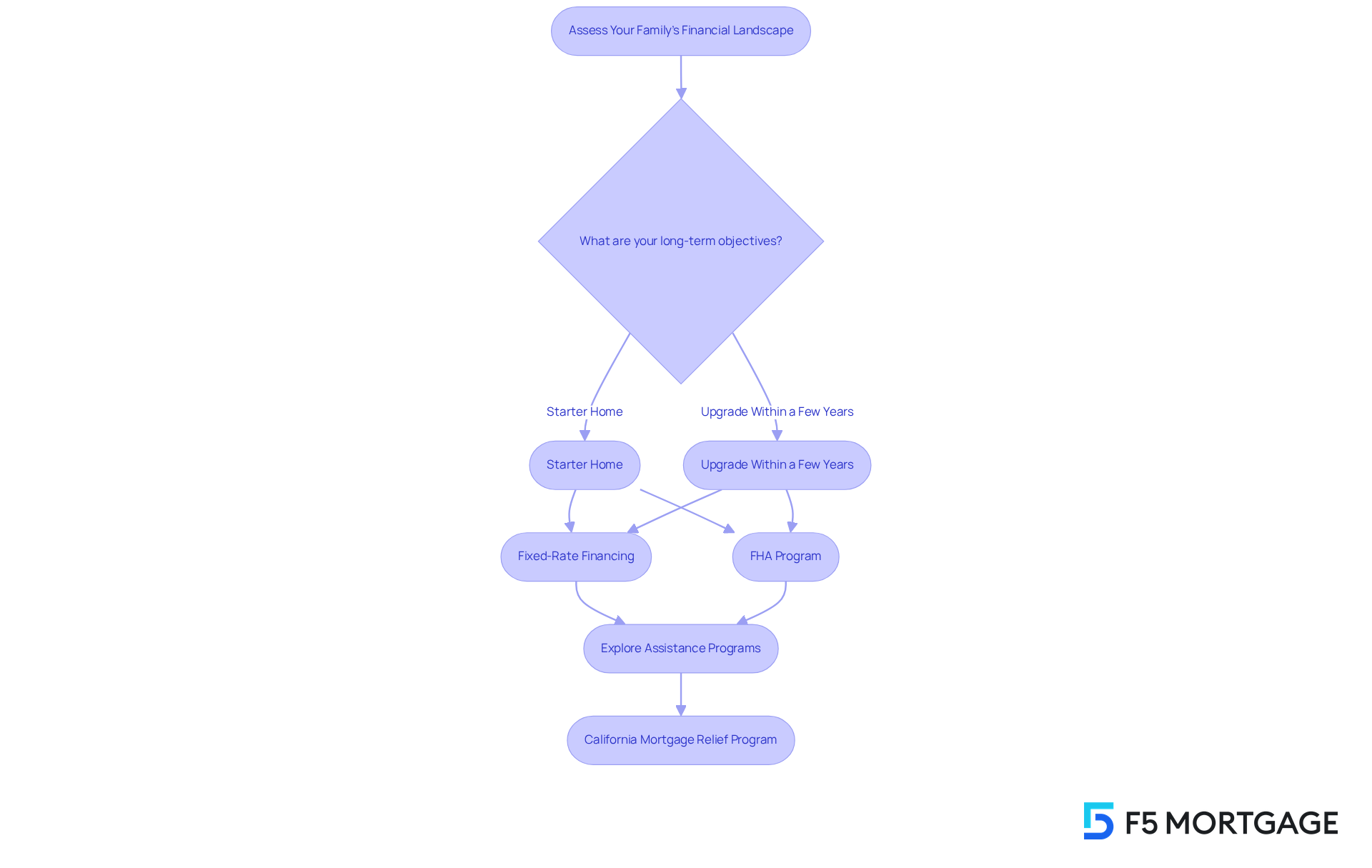

Begin by assessing your family’s financial landscape. We understand how overwhelming this can feel, but taking a moment to such as your income, credit score, and existing debts can provide clarity. As of 2025, the typical credit score for first-time homebuyers is approximately 720, which is crucial for obtaining favorable loan conditions.

Next, clarify your long-term objectives. Are you seeking a starter home, or do you plan to upgrade within a few years? This understanding will guide your decision between a fixed-rate financing option, an FHA program, or a VA program, tailored to your specific needs.

For many families, comparing the reliability of fixed-rate financing with the appealing down payment options offered through FHA programs is important. A fixed-rate loan provides predictable monthly payments, simplifying budgeting. On the other hand, FHA loans can be attractive for individuals with lower credit scores or limited savings. By clearly expressing your needs to your agent, you can navigate the loan process with confidence, making informed choices that align with your family’s financial goals.

Additionally, consider exploring assistance programs like the California Mortgage Relief Program. This initiative has provided vital support to families facing financial difficulties, ensuring they have access to the resources needed to secure their homes. Remember, we’re here to support you every step of the way.

Evaluate Broker Services and Client Satisfaction

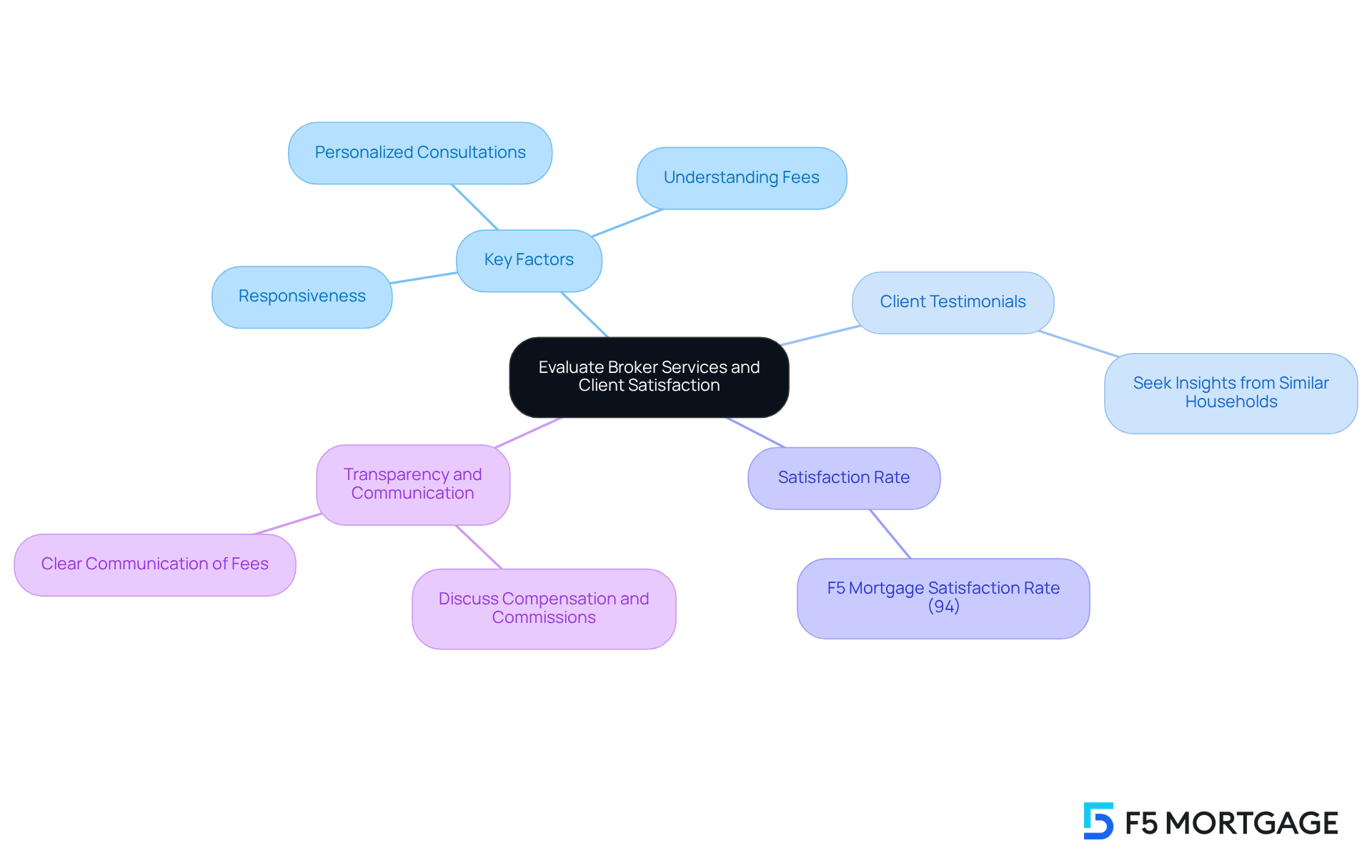

When choosing a , we know how challenging this can be. It’s crucial to conduct a thorough investigation into service options and client feedback. Evaluating how responsive an agent is to your inquiries and their readiness to address your questions is essential. A trustworthy representative will offer personalized consultations and maintain transparency regarding fees and processes.

Seek testimonials from households with similar needs; these can provide valuable insights into satisfaction levels. For instance, F5 Mortgage has assisted over 1,000 households and proudly claims a customer satisfaction rate of 94%. This statistic highlights the significance of client contentment when selecting a representative.

Furthermore, don’t hesitate to ask about agents’ compensation and commissions from lenders. This ensures you make informed decisions. By taking these steps, you can find an agent who aligns with your family’s principles and expectations, paving the way for a smoother financing experience. We’re here to support you every step of the way.

Finalize Your Choice and Begin the Mortgage Process

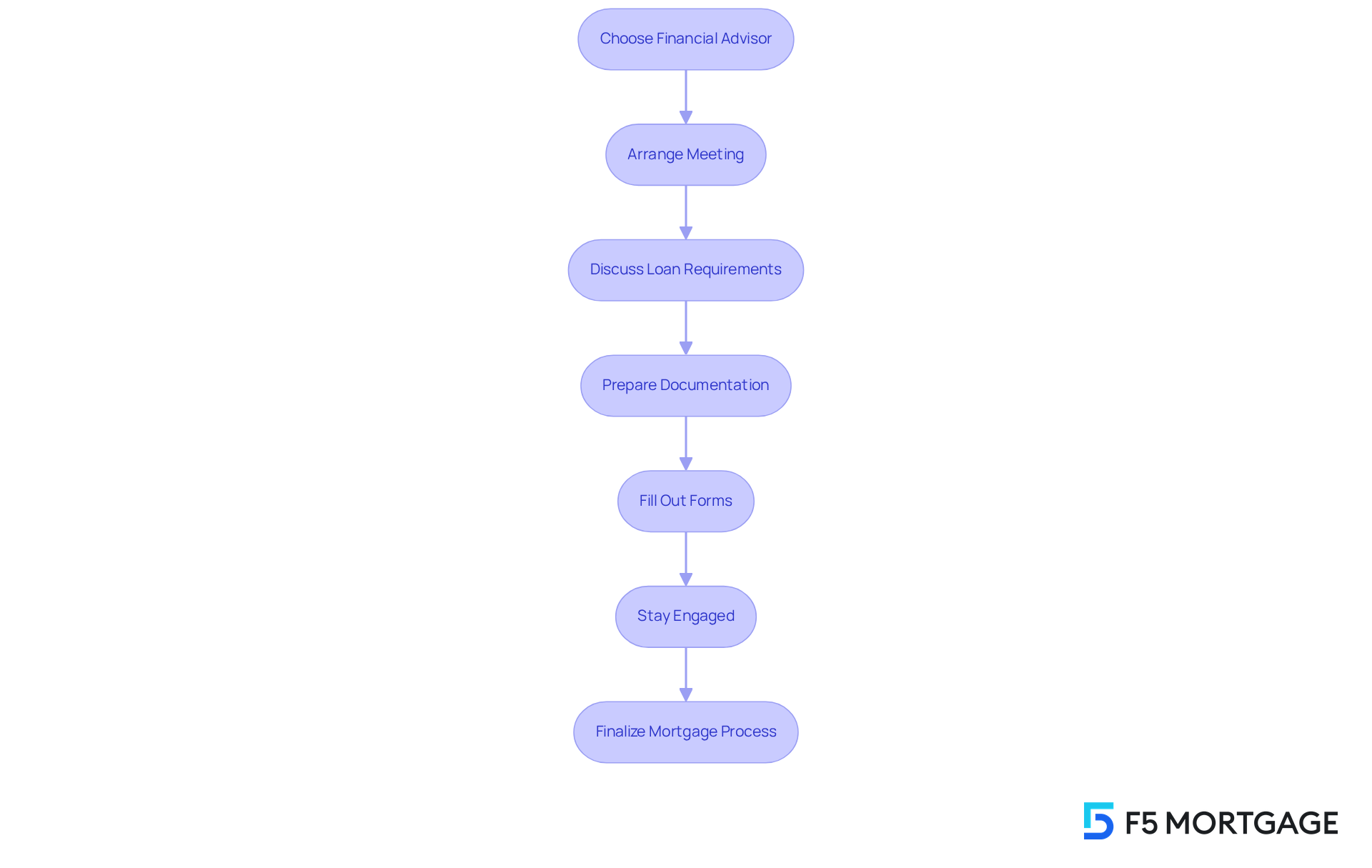

Once you’ve chosen a financial advisor, it’s important to arrange a meeting to discuss your loan requirements in detail. We know how challenging this can be, so prepare the necessary documentation, such as:

- Proof of income

- Tax returns

- Credit history

Your financial advisor will be there to assist you throughout the , helping you fill out forms and sending them to lenders. Stay engaged during this time—ask questions and seek clarification whenever you need it.

With the best broker mortgage by your side, you can confidently and easily navigate the mortgage landscape. F5 Mortgage is dedicated to ensuring clients receive exceptional service, boasting a customer satisfaction rate of 94%. As one satisfied client, Rose, noted, “It’s just that peace of mind that she gives us.”

Additionally, F5 Mortgage prides itself on a fast closing process, with most loans closing in less than three weeks. This efficiency further enhances your overall experience, making the journey smoother and more reassuring. We’re here to support you every step of the way.

Conclusion

Navigating the mortgage landscape can feel overwhelming for families. However, with the right mortgage broker, this experience can transform into a more manageable and beneficial journey. We understand how challenging this can be, and by recognizing the essential role of a mortgage consultant, families can access tailored solutions that align with their unique financial situations and long-term goals. This partnership not only simplifies the process but also offers significant financial advantages, making it a wise choice for those seeking to purchase a home.

Key insights from this article underscore the importance of assessing your family’s financial landscape. Identifying specific mortgage needs and thoroughly evaluating broker services are crucial steps. Independent mortgage advisors often provide better rates and higher approval rates for non-traditional workers, highlighting the value of their expertise. Furthermore, a focus on client satisfaction, as demonstrated by F5 Mortgage’s impressive track record, emphasizes the necessity of choosing a broker who prioritizes your family’s needs and offers transparent, personalized service.

In conclusion, taking the time to find the best mortgage broker can profoundly impact your home financing journey. We encourage families to actively engage in the process, ask questions, and seek clarification to ensure informed decisions. With the right guidance and support, securing a mortgage that meets your family’s needs is not only achievable but can also lead to lasting financial benefits. Embrace the opportunity to partner with a trusted mortgage broker and pave the way towards a successful homeownership experience.

Frequently Asked Questions

What is the role of a mortgage broker?

A mortgage broker, or consultant, helps families navigate the mortgage landscape by assessing their financial situation and recommending tailored funding solutions. They leverage relationships with various lenders to secure better rates and terms.

How can a mortgage broker benefit families financially?

Families can save an average of $10,662 over the life of their loans when working with independent mortgage advisors, according to a study by Polygon Research. This indicates significant financial advantages in choosing to work with a mortgage broker.

Who benefits the most from using a mortgage consultant?

Mortgage consultants particularly support non-traditional workers and minority communities, achieving higher approval rates compared to retail lenders. This assistance is crucial for families seeking flexibility and guidance in home financing.

Why is it important to understand the role of a loan consultant?

Understanding the role of a loan consultant helps families make informed decisions about their home financing options and choose a broker who prioritizes their needs and goals.

Can you provide an example of a successful mortgage broker?

F5 Mortgage is an example of a successful mortgage broker, having helped over 1,000 families and maintaining a customer satisfaction rate of 94%, demonstrating the personalized service that brokers can offer.