Overview

Navigating financial decisions can be overwhelming, especially for families. This article highlights seven key benefits of a fixed home equity loan that can truly make a difference in your financial journey. Imagine having stable monthly payments that provide peace of mind, along with lower interest rates that can ease your budget. Additionally, the tax deductibility of these loans can offer significant savings, allowing you to invest more in your family’s future.

Flexibility in loan amounts is another advantage that can cater to your specific needs. Whether you’re looking to undertake home improvements, consolidate debt, or enhance your long-term financial security, these benefits work together to support your family’s financial well-being. We understand how challenging this can be, and we’re here to support you every step of the way.

By considering a fixed home equity loan, you’re taking a proactive step towards managing your finances effectively. We encourage you to explore these options further and see how they can empower your family to achieve your financial goals.

Introduction

Families today encounter a range of financial challenges, from rising living costs to the pressing need for home improvements. We know how challenging this can be, and in this landscape, a fixed home equity loan emerges as a powerful tool. It offers stability and predictability in an otherwise uncertain financial environment. This article explores seven compelling benefits of choosing a fixed home equity loan, revealing how it can empower families to manage their finances more effectively and achieve long-term financial goals. But with so many options available, how can families determine if this financing solution is the right fit for their unique needs? We’re here to support you every step of the way.

F5 Mortgage: Competitive Fixed Home Equity Loan Solutions

At F5 Mortgage LLC, we understand how overwhelming property financing can feel. That’s why we offer a range of competitive fixed asset financing options designed specifically for households like yours. By partnering with over two dozen top lenders, we guarantee access to some of the lowest rates available in the market, ensuring you receive the best support possible.

Our tailored consultations are here to guide you through the intricacies of property financing, making the process seamless and stress-free. We know how challenging this can be, and our commitment to your satisfaction establishes F5 Mortgage as a reliable ally in achieving your financial goals. As families increasingly seek stable and predictable financing options for renovations and debt consolidation, a fixed home equity loan is one of the solutions we stand ready to assist with.

With average fixed home equity loan terms generally spanning five to 30 years, you can benefit from compared to unsecured funding. This makes our financing options an appealing choice for managing improvement projects and boosting your property value. We’re here to support you every step of the way, empowering you to make informed decisions for your family’s future.

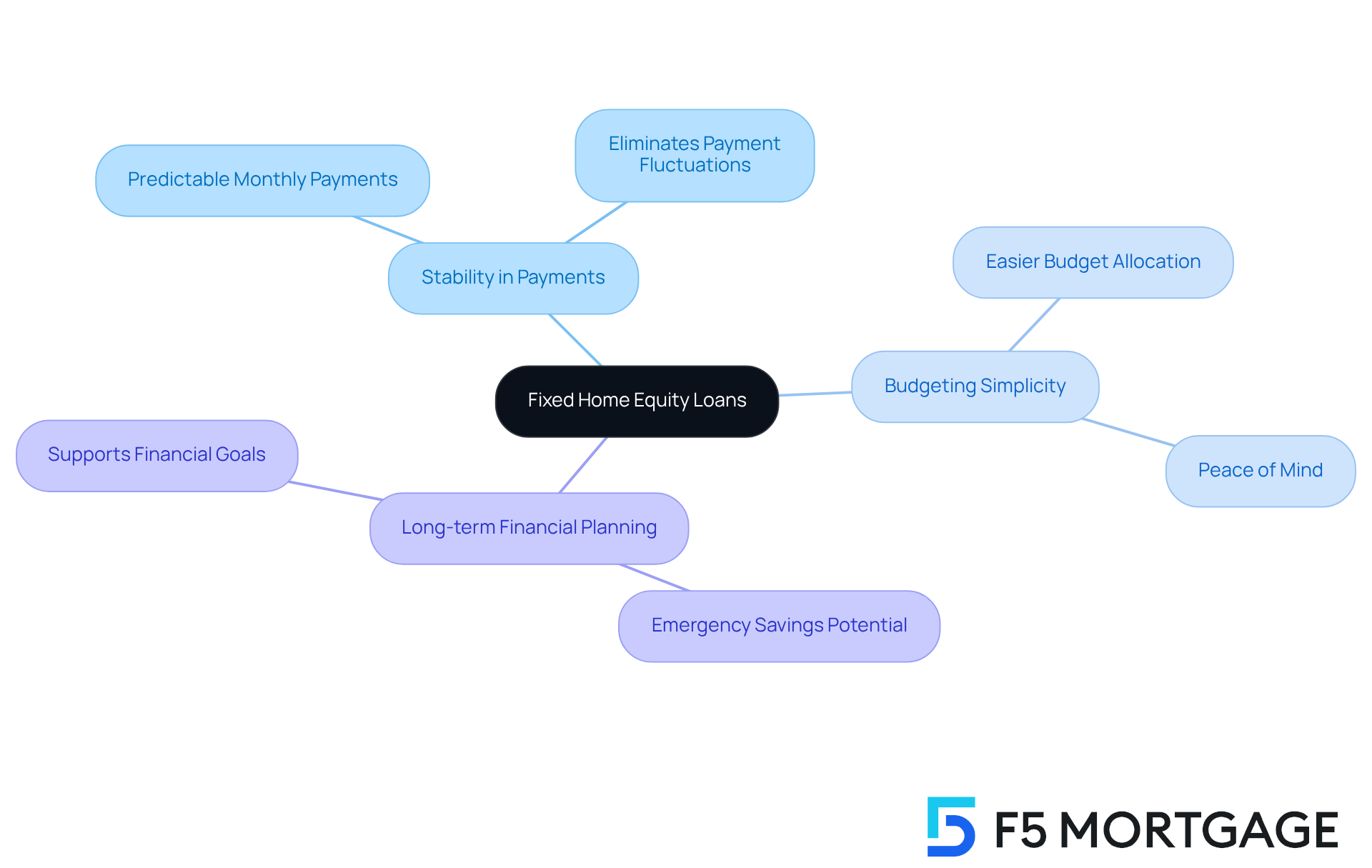

Stable Monthly Payments: Predictability with Fixed Rates

A key advantage of a fixed home equity loan is the stability it offers through consistent monthly payments. We know how challenging budgeting can be, especially when managing tight finances. Unlike variable-rate mortgages, allow homeowners to know exactly how much they will pay each month, simplifying the budgeting process. This predictability is particularly beneficial for households with a fixed home equity loan, as it enables them to allocate funds for essential expenses without the worry of unforeseen rises in payment obligations.

Financial consultants often emphasize that a fixed home equity loan enables families to adopt efficient budgeting strategies. Imagine being able to set aside a portion of your earnings for savings or emergencies, knowing your payment obligations will remain the same. This financial predictability not only assists in daily budgeting but also bolsters long-term financial strategies that may include a fixed home equity loan.

In a world filled with uncertainties, opting for a fixed home equity loan emerges as a wise option for families pursuing stability in their financial obligations. By choosing this path, you can approach your financial future with confidence, allowing you to focus on what truly matters—your family’s well-being and security.

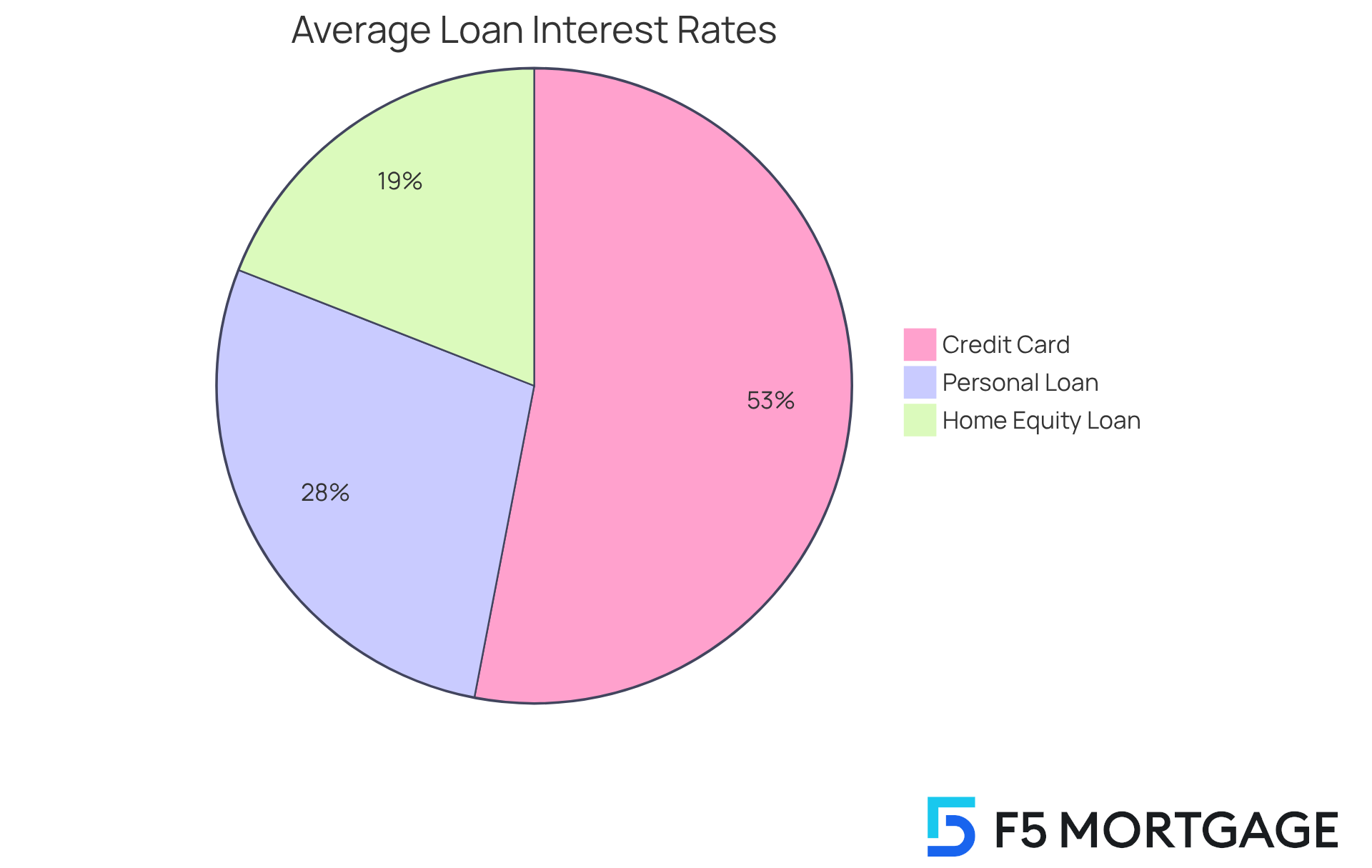

Lower Interest Rates: Cost-Effective Borrowing Options

A fixed home equity loan often offers lower interest rates compared to other borrowing options, such as personal loans or credit cards. Currently, the average interest rate for property loans is 8.40%, which is significantly better than the typical credit card rate of 23.37%. This , like a fixed home equity loan, allows families to access essential funds for various needs—from home renovations and education expenses to debt consolidation—without the burden of high-interest fees.

By leveraging their property value, families can secure a fixed home equity loan, which provides funding at a lower cost and leads to considerable savings over time. We understand how important it is for families to manage their finances effectively, especially as we look toward 2025 and beyond. Financial specialists emphasize that a fixed home equity loan can be a smart choice for those aiming to navigate their financial landscape with confidence.

However, it’s crucial to be aware of the risks involved, such as the possibility of foreclosure if payments are missed. Additionally, property owners may benefit from tax deductions on interest paid for IRS-eligible renovations, which can further enhance the cost-effectiveness of this borrowing option. We’re here to support you every step of the way as you consider your financial choices.

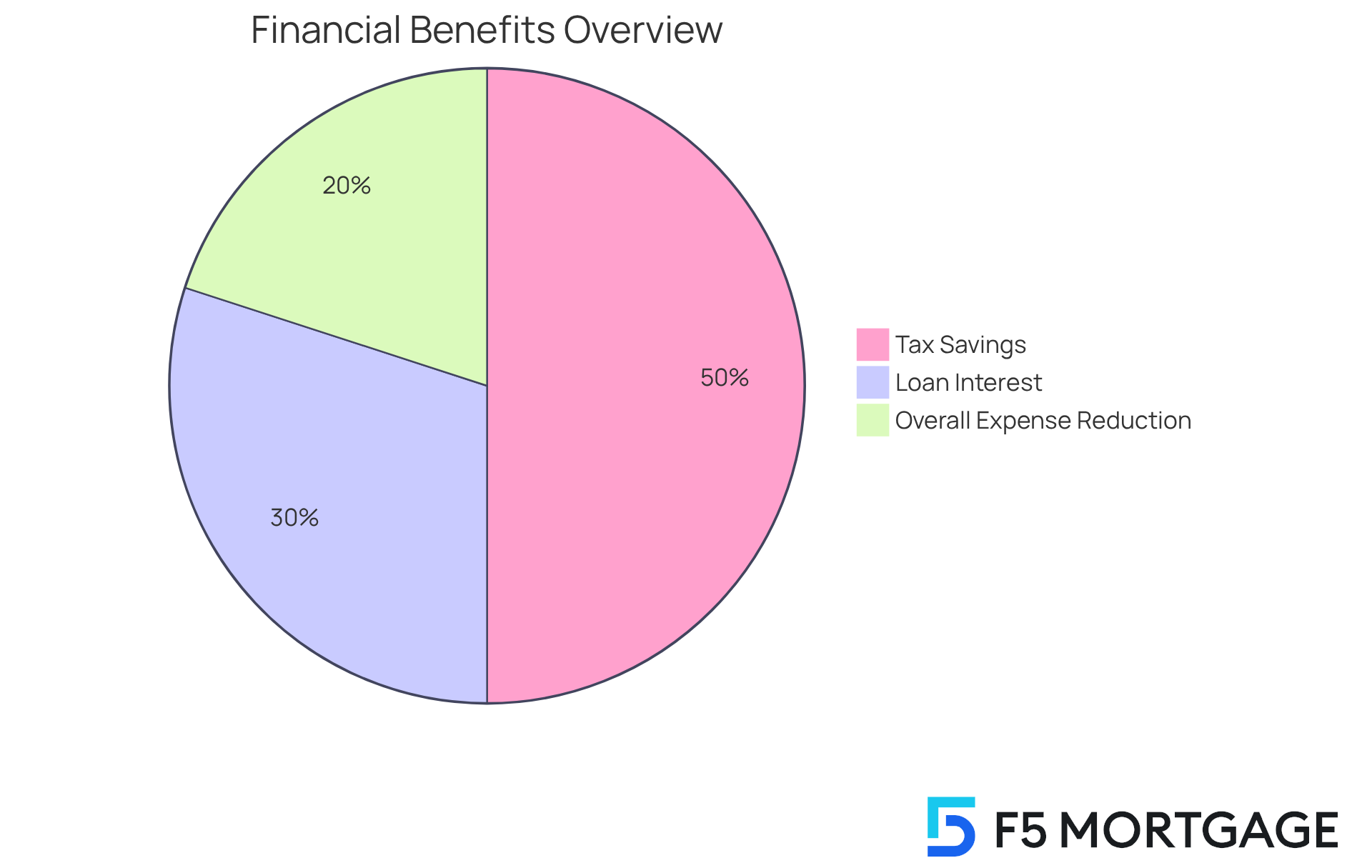

Tax Deductibility: Financial Advantages of Fixed Loans

A key financial benefit of a fixed home equity loan lies in its potential tax deductibility, which can be a significant relief for many property owners. We understand how overwhelming financial decisions can be, but knowing that you can often on these credits from your taxable income is a positive step. These deductions apply as long as the funds are designated for eligible expenses, such as property enhancements.

According to the Internal Revenue Service, property owners can deduct interest on acquisition debt up to $750,000 if incurred after December 15, 2017. This tax advantage can greatly lower the total expense of borrowing. For households looking to fund major projects or consolidate current debt, a fixed home equity loan can be an attractive option.

Imagine a family using property value financing for renovations; they can experience typical tax savings that enhance their financial flexibility. By utilizing these financial resources wisely, families not only improve their homes but also streamline their tax circumstances. We know how challenging this can be, and it’s important to recognize that a fixed home equity loan can strengthen your overall financial planning, making it a more attractive option for your future.

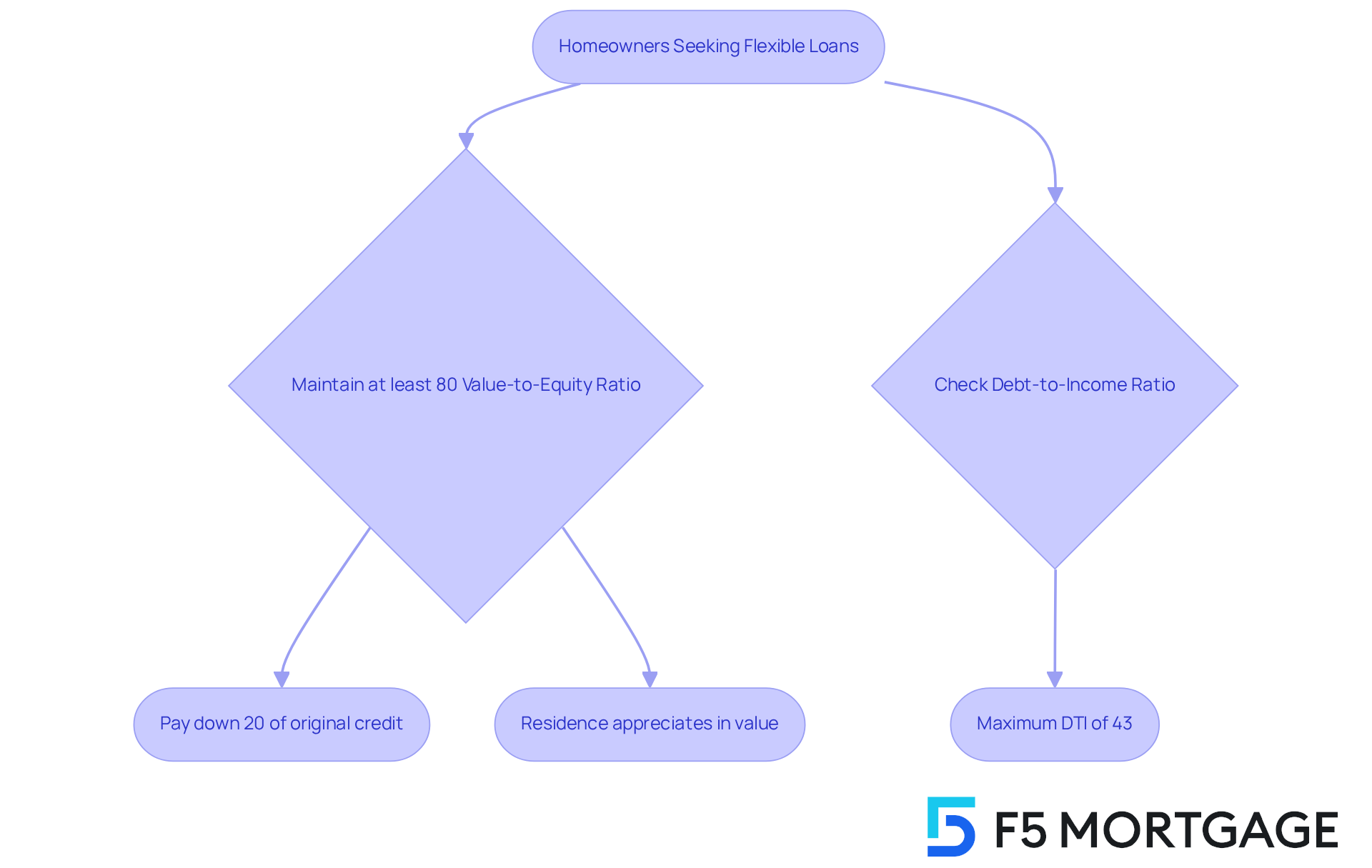

Flexible Loan Amounts: Tailored Financing for Homeowners

Fixed home equity loan financing offers property owners the flexibility to borrow sums that align with their unique financial situations. We understand how important it is for families to secure funding for various needs—whether it’s a modest sum for minor renovations or a larger amount for extensive property improvements. At F5 Mortgage, we specialize in tailoring financing options, ensuring that families can access the necessary funds without accumulating excessive debt.

To qualify for these credits, property owners typically need to maintain at least an 80% value-to-equity ratio. This means demonstrating that they have either paid down 20% of their original credit or that their residence has appreciated in value. Additionally, cash-out property value loans may have greater capital requirements. A maximum debt-to-income (DTI) ratio of 43% is generally necessary, which helps households secure more favorable mortgage rates.

This tailored approach not only supports responsible financial management but also empowers families to make informed decisions regarding their property assets. As financial expert Dave Ramsey highlights, achieving financial tranquility stems from living beneath one’s means, which aligns perfectly with the prudent use of property financing. We know how challenging this can be, and we’re here to .

Home Improvement Financing: Boosting Property Value

Utilizing a for property enhancement projects can significantly increase your property’s value. We know how important it is for families to create a comfortable living space. Many families undertake renovations, such as kitchen enhancements or bathroom updates, which not only improve their living areas but also greatly boost the property’s market value.

Research shows that homeowners can expect an average return on investment (ROI) of approximately 70% to 80% for kitchen remodels and around 60% to 70% for bathroom renovations. By strategically investing in your home through property financing, you can create a more enjoyable living environment while positioning yourself for a higher return when it’s time to sell.

Financial consultants often suggest such improvements as a way to increase property worth. Careful renovations can lead to significant appreciation in your home’s value. For households like Mr. and Mrs. S, who faced challenges in obtaining a loan from traditional banks, property financing through F5 Mortgage made it possible to finance major renovations, ultimately enhancing their property’s worth.

To maximize the benefits of a fixed home equity loan, it’s wise to compare rates and terms from various lenders, including F5 Mortgage, which offers competitive rates and personalized service. This approach not only improves your quality of life but also serves as a sound financial strategy for the long term. Consulting with a financial advisor can help you identify the best renovation projects that align with your financial goals.

Streamlined Application Process: Quick Access to Funds

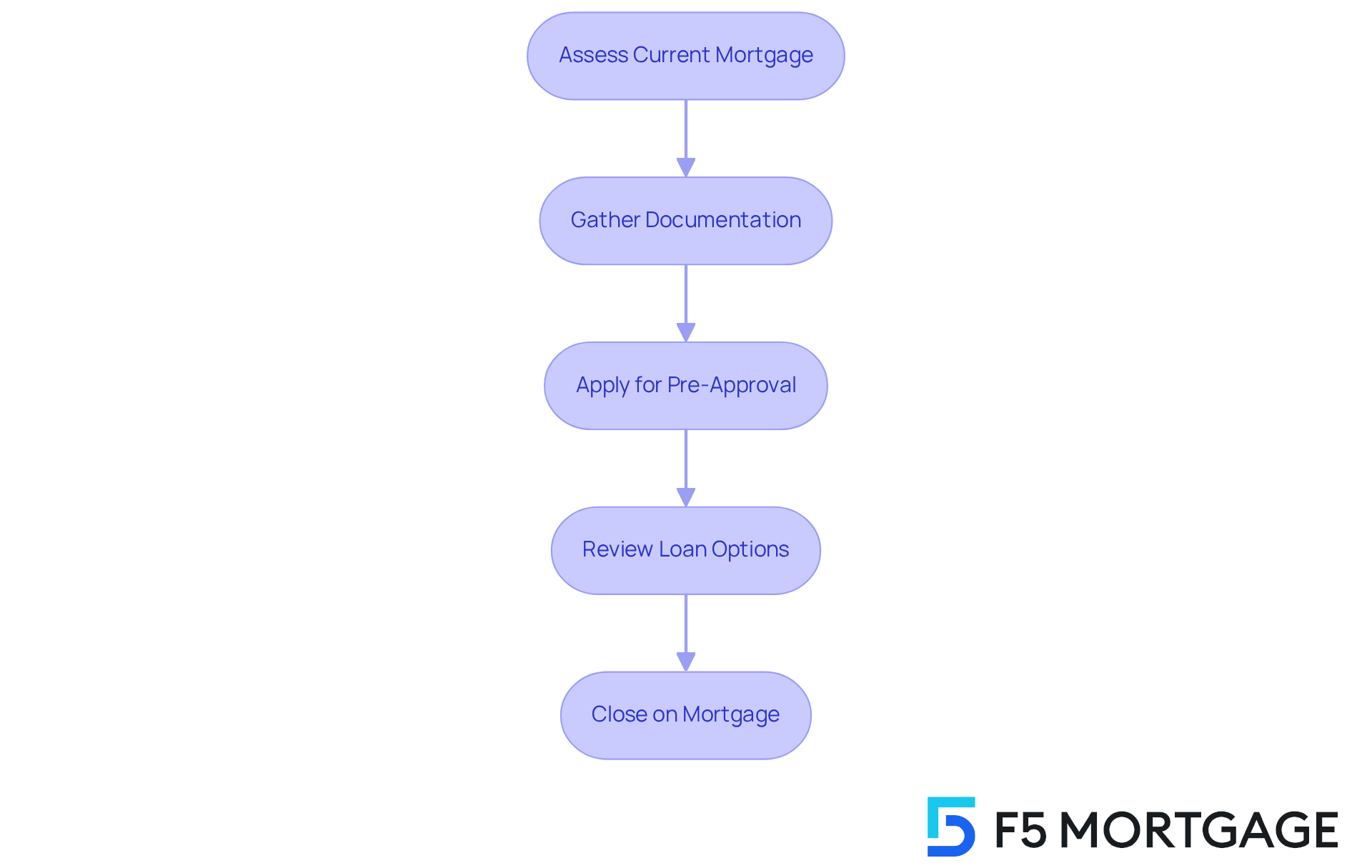

At F5 Mortgage, we understand how important it is for families to quickly and easily access funds through a fixed home equity loan. Our streamlined application process is designed with your needs in mind, making it simpler for you to navigate refinancing your mortgage in California.

Let’s break it down into manageable steps:

- Assess your current mortgage and financial situation.

- Gather the necessary documentation.

- Apply for pre-approval, often achievable in under an hour.

- Review your loan options and select the best terms that suit your needs.

- Close on your new mortgage.

This swift process is vital for families looking to undertake renovations or manage unexpected costs through a fixed home equity loan.

In 2024, the average closing-to-application pull-through rate for lines of credit secured by property (HELOCs) was 49%. This statistic highlights how effective our process can be. Additionally, the average tappable value per borrower has risen by almost $102,000, reflecting the growing financial leverage available to homeowners.

We know how challenging this can be, and understanding how to with a fixed home equity loan is crucial. This knowledge empowers households to make the most of their property’s worth without unnecessary delays. At F5 Mortgage, we are committed to providing you with swift access to funds, establishing ourselves as a trustworthy ally on your financial journey.

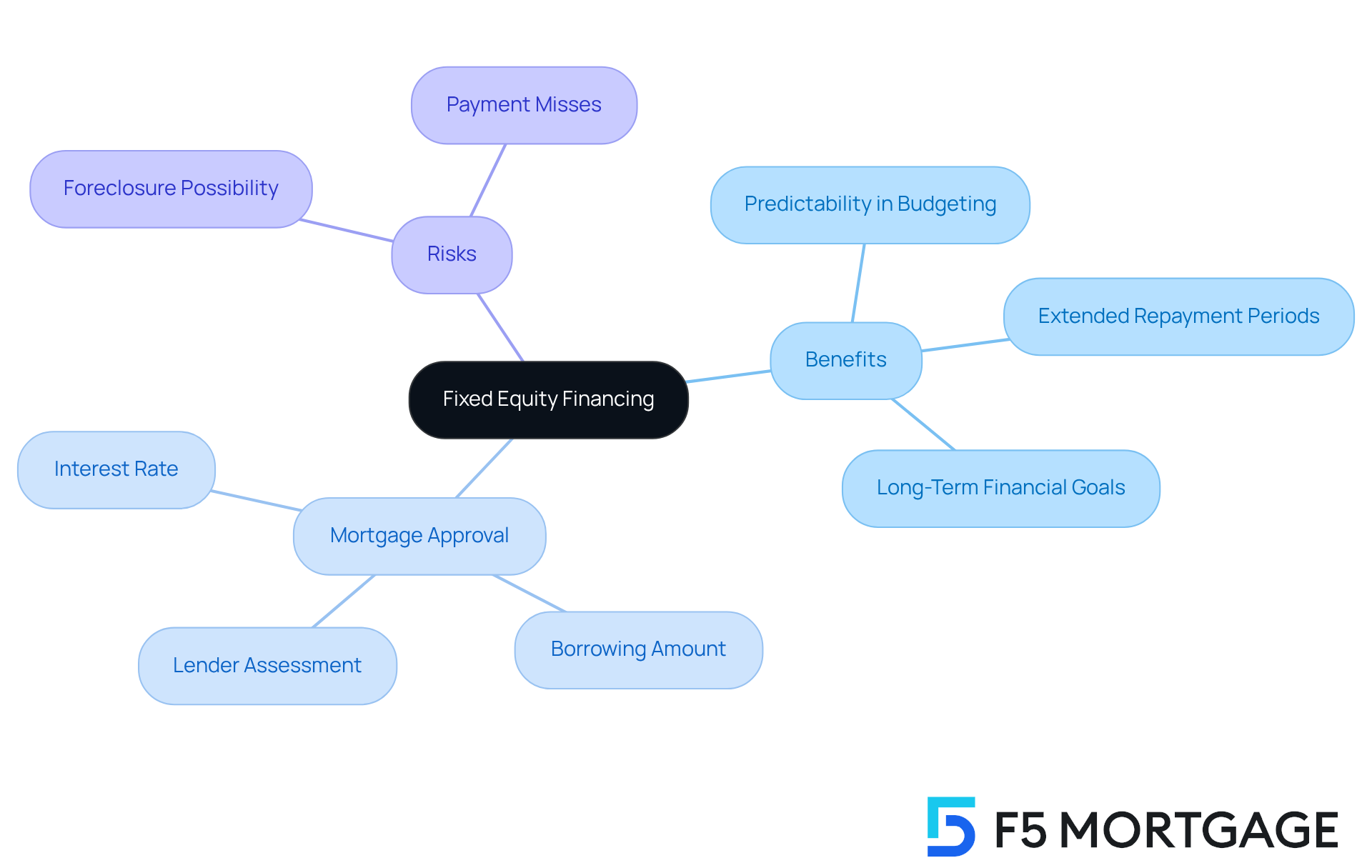

Long-Term Financing: Security for Future Planning

Fixed equity financing provides households with the comforting benefit of extended repayment periods. This ensures steady monthly installments throughout the financing term, allowing homeowners to plan their finances with confidence. We understand how important predictability is for effective budgeting, especially when faced with the uncertainty of fluctuating interest rates.

Such stability is essential for families striving to manage their finances wisely while preparing for upcoming expenses, like education costs or property renovations. Many families using fixed-rate financing share stories of enhanced financial planning results, as they can allocate their resources more effectively over time. With , households can strategically pursue their long-term financial goals, making a fixed home equity loan a wise choice for those seeking stability in their financial planning.

Understanding mortgage approval is also crucial. It signifies that a lender has determined, based on the financial information provided, that an individual is a suitable candidate for a mortgage. This approval usually includes an estimate of the borrowing amount, interest rate, and potential monthly payments, all of which can significantly influence a household’s decision-making process.

While there are risks associated with these financial agreements—such as the possibility of foreclosure if payments are missed—we encourage households to focus on the benefits. Consulting with a mortgage professional or utilizing a mortgage calculator can provide valuable insights tailored to your unique circumstances. Remember, we’re here to support you every step of the way.

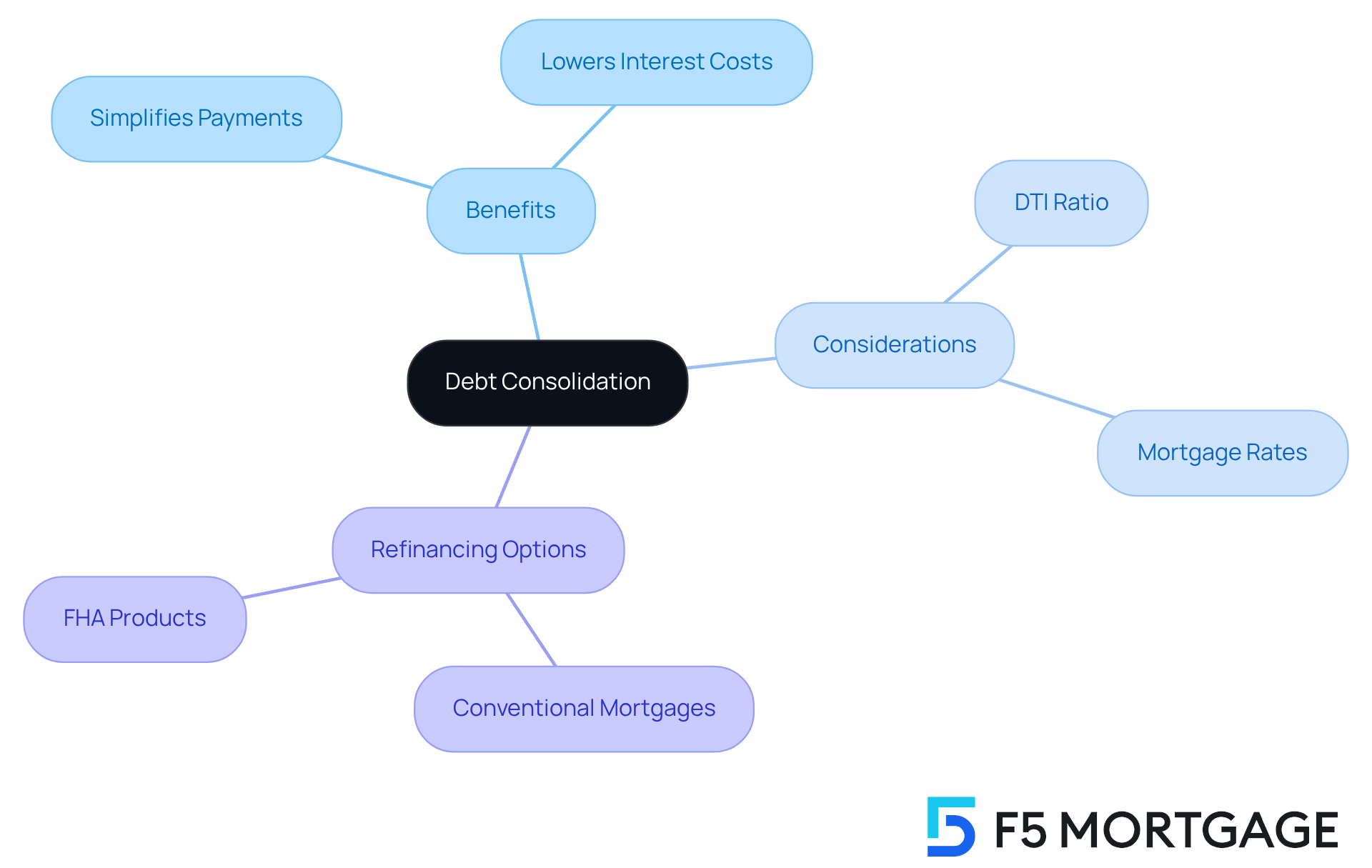

Debt Consolidation: Simplifying Financial Management

We understand how challenging managing multiple debts can be for families. A fixed home equity loan provides a way to consolidate high-interest obligations into a single, lower-interest solution. This strategy not only simplifies your financial management by reducing the number of monthly payments but also has the potential to lower overall interest costs.

By merging your debts through a property-backed financing option, you can enhance your cash flow and strive for greater financial stability. It’s essential to consider your debt-to-income (DTI) ratio when applying for a home equity line; typically, a maximum DTI of 43% is required for housing financing. An improved DTI can lead to more competitive mortgage rates, making it crucial for families to evaluate their current debts and income.

At F5 Mortgage, we’re here to support you every step of the way. We offer a range of refinancing choices in Colorado, including:

- Conventional mortgages with stricter eligibility criteria

- FHA products that are more attainable for those with lower credit scores

These options can assist families in managing their financial obligations effectively, paving the way for a more secure future.

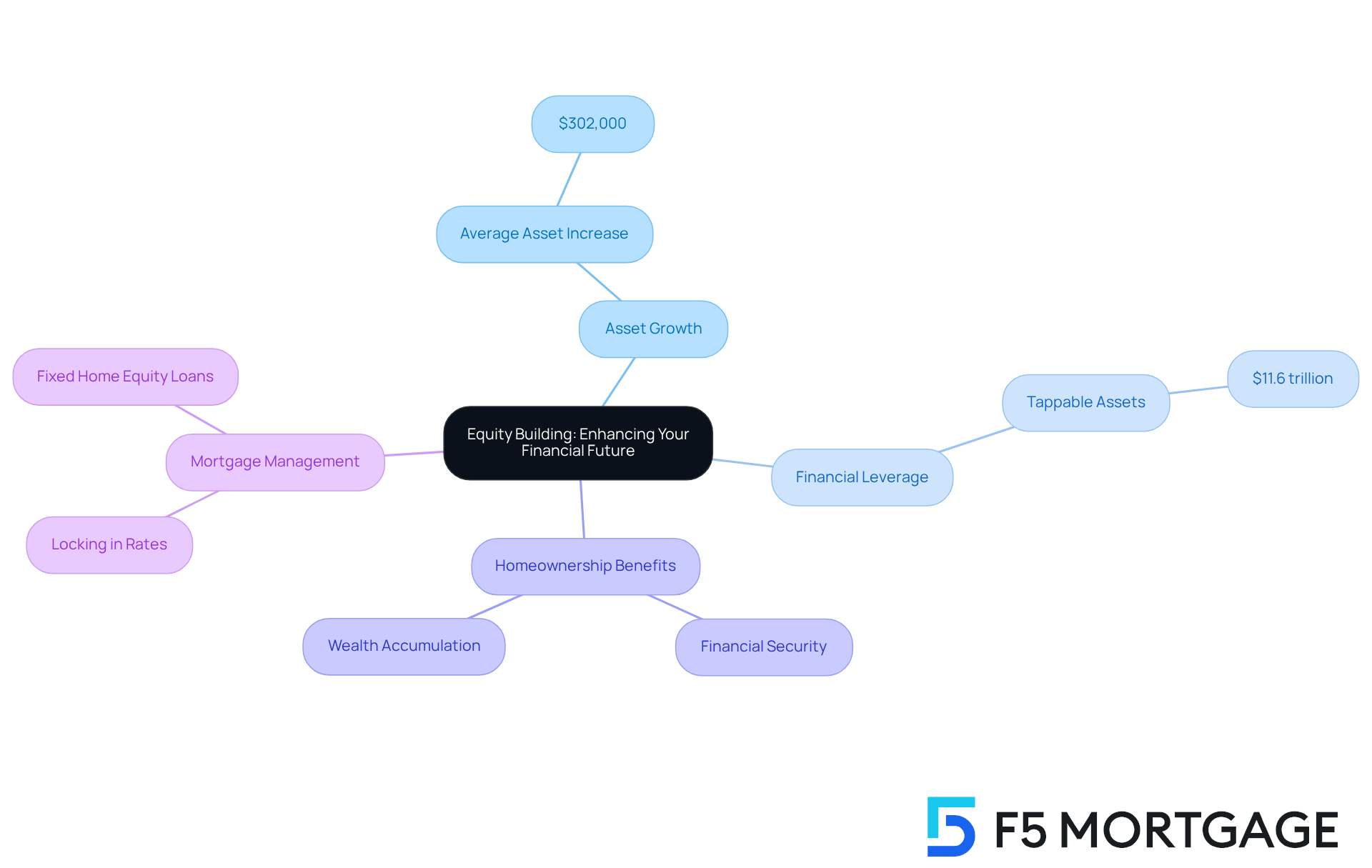

Equity Building: Enhancing Your Financial Future

Secured property financing offers families prompt access to essential resources while supporting long-term asset growth. We understand how challenging it can be to navigate financial decisions, but as homeowners diligently make payments, they increase their ownership stake in their property. This fosters greater financial security and opens up future opportunities. For instance, households utilizing property value financing have seen significant asset growth, with the average property owner acquiring approximately $302,000 in assets as of Q1 2025.

This financial leverage empowers families to invest in renovations, consolidate debt, or cover unexpected expenses, ultimately enhancing their financial future. With among mortgage-holding homeowners reaching a remarkable $11.6 trillion, the potential for wealth accumulation through strategic use of these loans is substantial. Homeownership not only provides a stable living environment; it also serves as a critical asset for building wealth over time.

Once your application is approved, locking in your mortgage rates with F5 Mortgage protects you from market fluctuations during the processing period, further securing your financial position. By understanding and effectively managing a fixed home equity loan, families can create a solid foundation for their financial aspirations. We’re here to support you every step of the way as you embark on this journey.

Conclusion

A fixed home equity loan serves as a valuable financial tool for families seeking stability and predictability in their financial planning. By securing a fixed-rate loan, families can benefit from consistent monthly payments, lower interest rates compared to other borrowing options, and potential tax deductibility. These factors contribute to a more manageable financial landscape.

Throughout this article, we have highlighted the key advantages of fixed home equity loans. They facilitate home improvements that enhance property value, provide flexible loan amounts tailored to individual needs, and simplify debt consolidation efforts. The streamlined application process ensures that families can access funds quickly, enabling them to address urgent financial needs or invest in long-term projects with confidence.

Ultimately, leveraging a fixed home equity loan can empower families to build equity, improve their living spaces, and secure their financial futures. We know how challenging this journey can be, but embracing the benefits of these loans can lead to greater financial stability and the fulfillment of personal goals. Engaging with a trusted mortgage partner like F5 Mortgage can further enhance this experience, providing the necessary support and expertise to help you make informed decisions. We’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage offers a range of competitive fixed asset financing options, including fixed home equity loans, designed to assist households in property financing.

How does F5 Mortgage ensure competitive rates for its loans?

F5 Mortgage partners with over two dozen top lenders, guaranteeing access to some of the lowest rates available in the market.

What is the typical loan term for a fixed home equity loan?

The average fixed home equity loan terms generally span from five to 30 years.

What are the advantages of a fixed home equity loan?

A fixed home equity loan provides stability through consistent monthly payments, lower interest rates compared to unsecured funding, and predictability in budgeting.

How does a fixed home equity loan help with budgeting?

It allows homeowners to know exactly how much they will pay each month, simplifying the budgeting process and enabling better financial planning.

What are the current average interest rates for fixed home equity loans?

The average interest rate for property loans is currently 8.40%, which is significantly lower than the typical credit card rate of 23.37%.

What purposes can a fixed home equity loan be used for?

It can be used for various needs, including home renovations, education expenses, and debt consolidation.

What should borrowers be aware of when considering a fixed home equity loan?

Borrowers should be aware of the risks, such as the possibility of foreclosure if payments are missed, and they may also benefit from tax deductions on interest paid for eligible renovations.

How can F5 Mortgage assist families in their financial decisions?

F5 Mortgage offers tailored consultations to guide families through the intricacies of property financing, helping them make informed decisions for their financial future.