Overview

This article highlights nine essential down payment assistance programs available for homebuyers in Arizona, designed to make homeownership more accessible for low to moderate-income families. We understand how challenging this can be, and these programs, such as the Arizona Home Plus Program and the Home in Five Advantage initiative, offer tailored financial support options. These include grants and forgivable loans that can truly make a difference.

Through inspiring success stories, we showcase the positive impact these programs have on families overcoming financial barriers to homeownership. We’re here to support you every step of the way as you navigate these opportunities, empowering you to take action towards achieving your dream of owning a home.

Introduction

In Arizona, many aspiring buyers often feel that the dream of homeownership is just out of reach. Rising property costs and complex financing options can make this journey seem daunting. However, there is hope. A variety of down payment assistance programs exists, designed to bridge this gap and empower families to take that crucial step toward owning their homes.

As challenges persist in the housing market, you might be wondering: which assistance programs will provide the best support for homebuyers in 2025? How can you effectively navigate these opportunities to secure your future? We know how challenging this can be, and we’re here to support you every step of the way.

F5 Mortgage Down Payment Assistance Program: Tailored Solutions for Arizona Homebuyers

F5 Mortgage understands how challenging the journey to homeownership can be, especially for families in Arizona. That’s why we offer a customized initiative specifically designed to empower households. Our you through your options, ensuring you choose the most appropriate financial solutions for your unique situation.

We provide access to a variety of loan options, including , streamlining the purchasing process. This makes it easier for families throughout Arizona to navigate the complexities of property financing. Our efficient pre-approval process is often completed in less than an hour, allowing you to react swiftly in a competitive housing market.

Success stories from Arizona buyers highlight the transformative effect of our down payment support. Many households have found ownership possible, . We know that 46% of low- and middle-income borrowers face mortgage denials due to high debt-to-income ratios. This underscores the importance of the assistance we provide.

As we like to say at F5 Mortgage, ‘Our enable you to investigate a range of loan programs customized to your distinct financial situation.’ We’re here to support you every step of the way, helping you overcome challenges and . With our expertise and client-centered approach, you can with confidence and ease.

Arizona Home Plus Program: First-Time Homebuyer Assistance

The provides for , offering up to 5% of the purchase price to help with down payments and closing costs. This initiative is especially beneficial for low to moderate-income families who dream of owning a home. We understand how challenging this can be, and we’re here to support you every step of the way.

To qualify, applicants must meet specific income limits, ensuring that assistance reaches those who need it most. Additionally, completing a is required. This program equips participants with vital information about the responsibilities of homeownership.

Success stories abound, with many first-time buyers attributing their to this initiative. One pleased client shared, “Thanks to the Arizona Home Plus Program and the , I was able to buy my first residence and ensure a stable future for my loved ones.” Such testimonials highlight the program’s effectiveness in promoting .

While F5 Mortgage also provides information on in California, Texas, and Florida, their primary focus remains on the Arizona Home Plus initiative, unlocking for those in need.

Home in Five Advantage: Support for Arizona Families

The is a vital resource in Maricopa County. It provides of up to 5% of the property purchase price to help with down payment and closing costs. We understand how daunting the can be, and this initiative not only supports owning a home but also offers a , significantly easing the financial burden on new homeowners.

Many families have successfully utilized this initiative to overcome obstacles in acquiring a residence. This enables them to secure their ideal properties with lower initial expenses. One household shared their heartfelt experience, stating, ‘Thanks to the Home in Five Advantage initiative and down payment assistance az, we were able to purchase our without the daunting weight of a substantial down payment.’ By offering essential , including down payment assistance az, the Home in Five Advantage initiative plays a crucial role in making to those who need it most.

Furthermore, F5 Mortgage is here to help families explore various available in California, Texas, and Florida. Programs like the Golden State Finance Authority’s Open Doors initiative and the My Choice Texas Home initiative ensure that families can find options tailored to their needs. To qualify for assistance, applicants must meet a minimum credit score requirement of 640, helping to ensure that support is directed to those who can benefit the most. We know how challenging this process can be, and we’re here to support you every step of the way.

Arizona Department of Housing Programs: Diverse Assistance Options

The Arizona Department of Housing offers a variety of initiatives, including , specifically designed to assist homebuyers, with a particular focus on the . This program provides down payment assistance az in the form of grants of up to 10% of the loan amount, significantly reducing the . As we look ahead to 2025, this initiative continues to flourish, with an increasing number of participants benefiting from its generous support.

Moreover, the Arizona is Home initiative specifically targets in designated counties, offering down payment assistance az to ensure that diverse financial needs are met throughout the state. Success stories from participants highlight the initiative’s impact, showcasing how it has helped many families achieve their dream of . For instance, the Johnsons were able to purchase their first home thanks to the assistance they received.

In addition to these programs, on various , Texas, and Florida, including the and the . These efforts reflect Arizona’s commitment to making homeownership attainable and affordable for all residents through down payment assistance az. At the same time, F5 Mortgage’s expertise enhances the opportunities for families looking to improve their living situations. We understand how challenging this journey can be, and we’re here to .

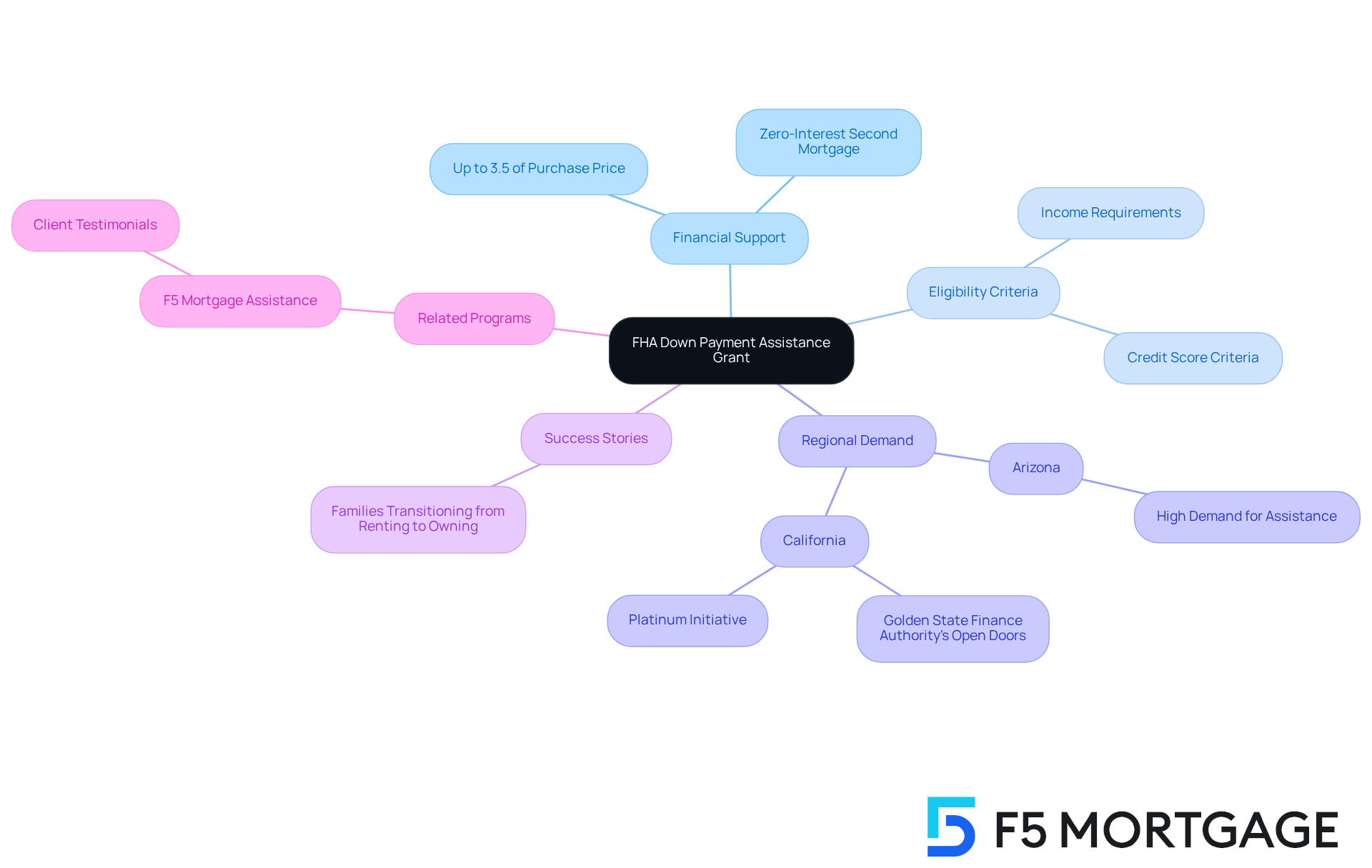

FHA Down Payment Assistance Grant: Financial Support for Homebuyers

The FHA Grant offers vital financial support to eligible homebuyers, providing up to 3.5% of the purchase price to help cover down payment costs. This assistance is particularly beneficial for who often encounter difficulties in saving enough for a down payment. To qualify for this grant, applicants must meet specific income and credit criteria, ensuring that this support reaches those who need it most.

In Arizona, the demand for is significant, with many first-time buyers successfully utilizing to secure their homes. Recent success stories highlight families transitioning from renting to owning, thanks to the . On average, the support from FHA grants can greatly reduce the upfront costs of purchasing a home, making homeownership more achievable.

As the housing market continues to evolve, programs like down payment assistance az remain essential for assisting first-time buyers, particularly in competitive markets where down payment requirements can feel overwhelming. In California, initiatives such as the Golden State Finance Authority’s Open Doors initiative and the Platinum Initiative offer additional support, providing up to 7% and 5% of the primary loan amount toward closing costs, respectively. This showcases the , which can guide homebuyers in navigating these programs effectively.

from clients who have benefited from their expertise in securing down payment assistance. Clients express their gratitude for the , highlighting how F5 Mortgage helped them comprehend their options and successfully navigate the complexities of home financing. With F5 Mortgage’s expertise, homebuyers can explore various to their specific needs, enhancing their chances for successful property ownership.

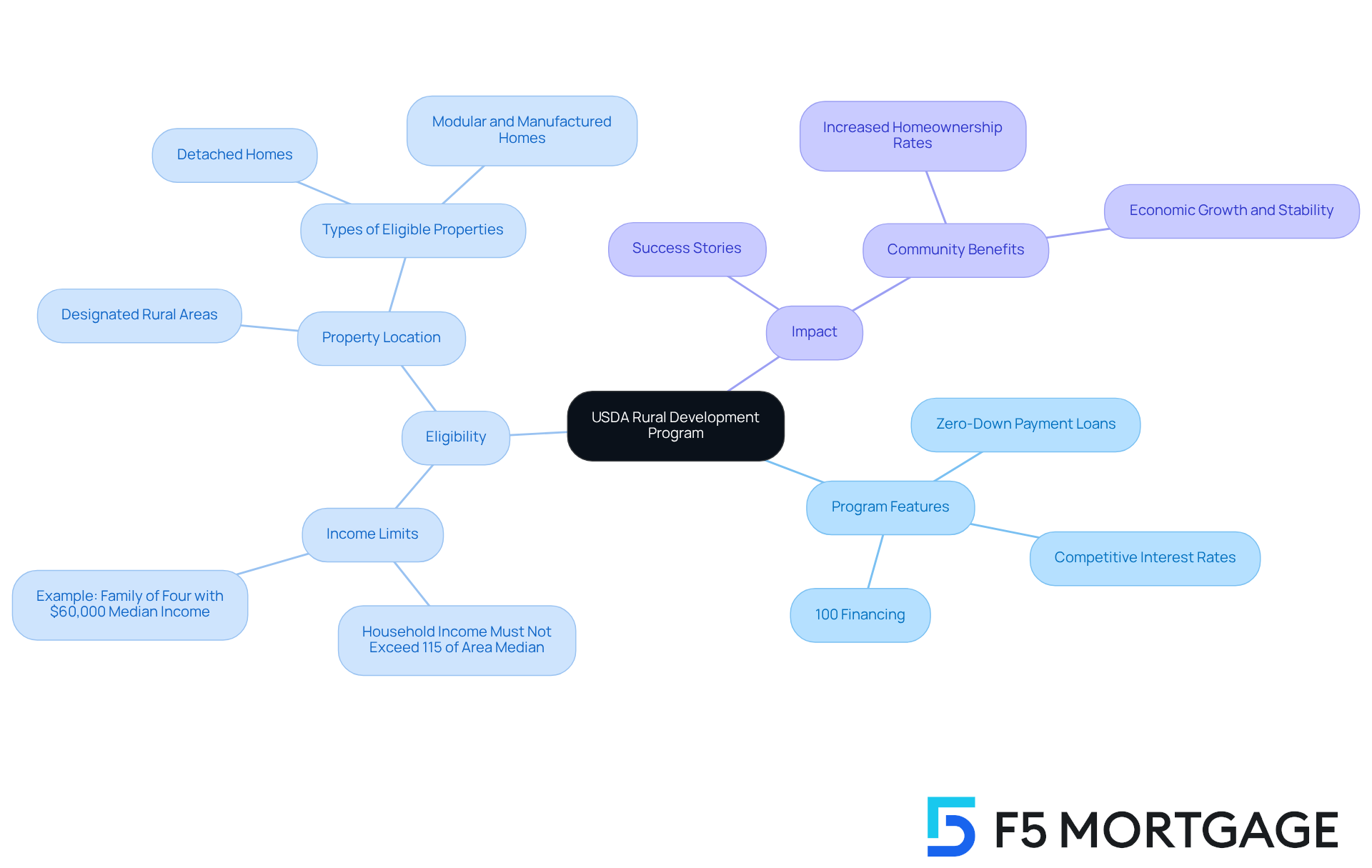

USDA Rural Development Program: Assistance for Rural Homebuyers

The is here to help homebuyers in designated rural areas by offering and . We understand how challenging it can be to find , especially in less populated areas. This initiative is specifically designed to promote homeownership, making it an ideal choice for families looking to establish roots outside urban centers.

Eligibility for these loans is based on household income and property location, ensuring that support reaches those who need it most. Many success stories highlight the program’s unique features. For example, a family of four in a rural county with a median household income of $60,000 can qualify for a if their total income is $69,000 or less. This accessibility has significantly contributed to rising property ownership rates in rural regions, allowing families to fund 100% of their residence’s purchase cost without the burden of a down payment.

In Arizona, the impact of az loans is particularly remarkable. As of 2025, these loans have become a vital resource for in rural areas, fostering economic growth and stability. This initiative not only alleviates the but also empowers families to achieve their housing dreams, ultimately enhancing the quality of life in rural communities. We’re here to support you every step of the way as you .

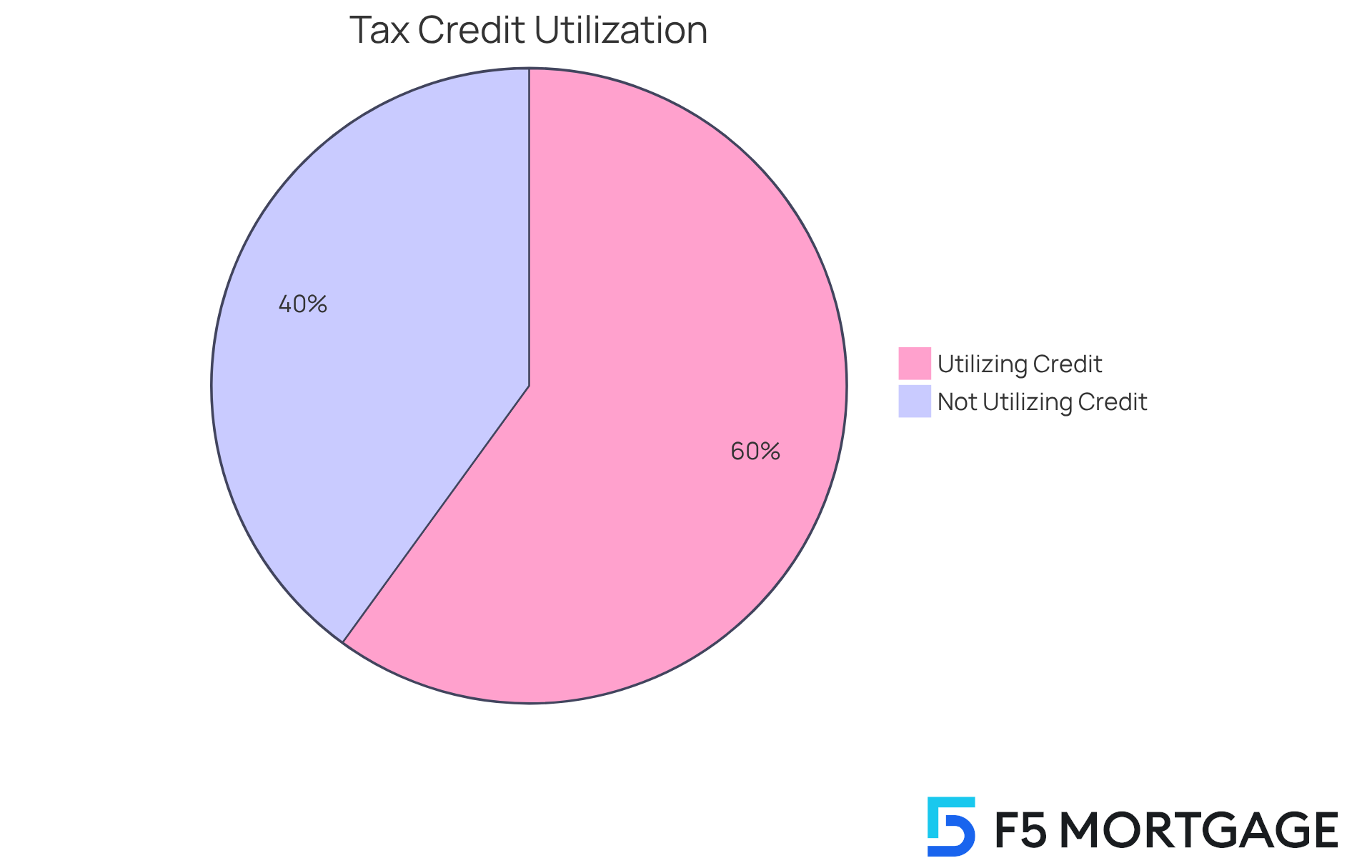

Arizona First-Time Home Buyer Tax Credit: Financial Incentive for New Buyers

The offers a for new buyers, enabling them to claim a credit of up to $2,000 on their state taxes. We understand how daunting the can be, especially when facing financial hurdles. This program is thoughtfully designed to , specifically targeting individuals who meet certain . By taking advantage of this credit, first-time buyers can significantly , making the dream of owning a home more attainable.

As we look ahead to 2025, in Arizona can anticipate average tax savings that will enhance their purchasing power. Numerous success stories highlight the , with many purchasers sharing that it was crucial in their ability to secure their ideal homes. One buyer expressed, “This credit made all the difference in my property-buying journey, allowing me to invest more in my new residence.”

The financial advantages of the Arizona First-Time Home Buyer Tax Credit are evident: it not only alleviates immediate tax burdens but also fosters long-term for new homeowners. As the saying goes, ‘A house is made of bricks and beams. A dwelling is built of hopes and dreams.’ This credit plays a pivotal role in transforming those aspirations into reality, supporting families every step of the way.

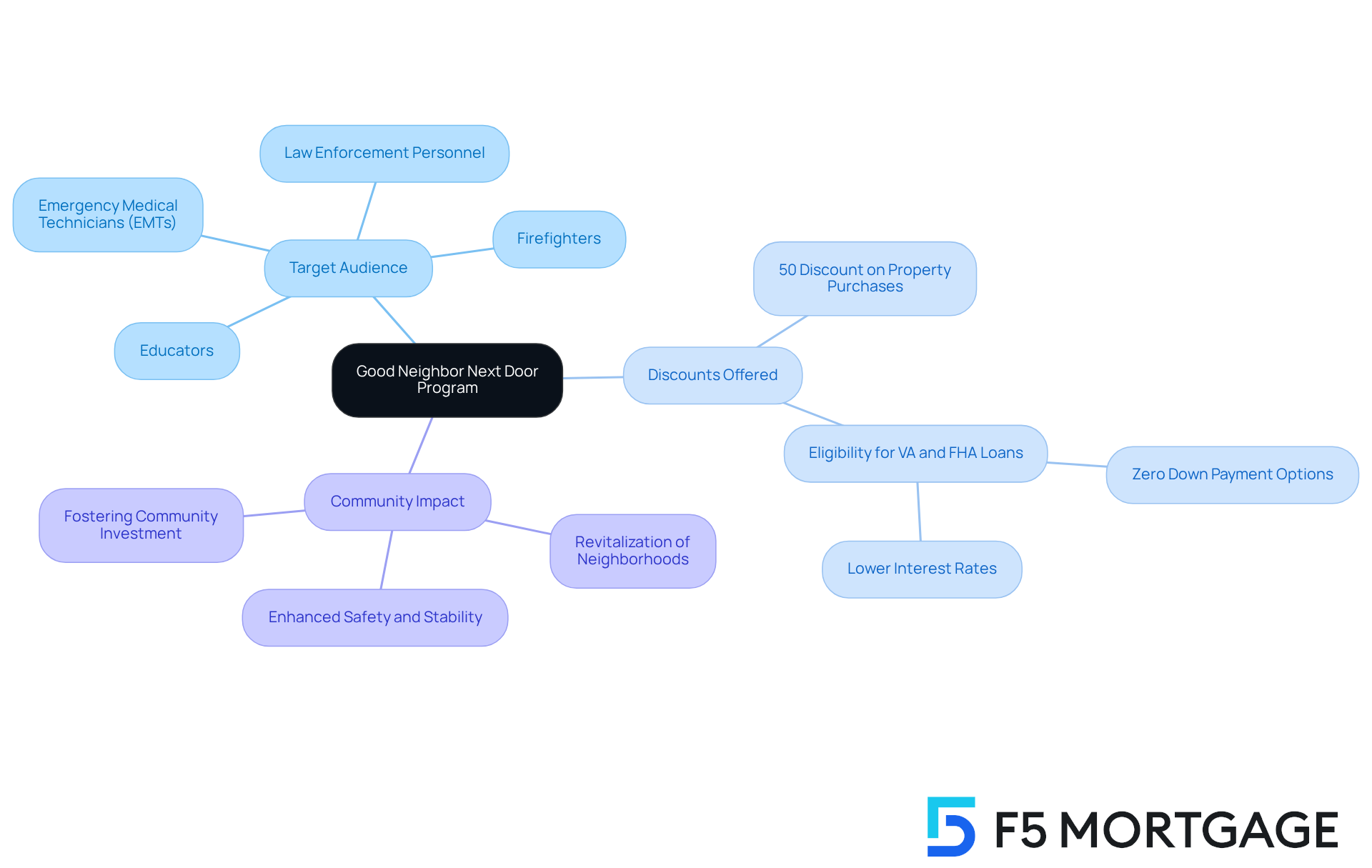

Good Neighbor Next Door Program: Community Service Incentives

The is here to help educators, law enforcement personnel, firefighters, and emergency medical technicians by offering significant discounts on . We understand how challenging it can be to find , and this program allows qualified individuals to receive up to a 50% discount on the listed prices of properties located in revitalization zones. This initiative not only makes more accessible for these vital community service professionals but also plays a crucial role in .

By fostering a sense of belonging and community investment among participants, the program encourages . Imagine the positive impact this can have on local communities, enhancing safety and stability. We’re here to support you every step of the way as you consider this opportunity to contribute to the of your neighborhood.

Homeownership Voucher Program: Accessibility for Low-Income Families

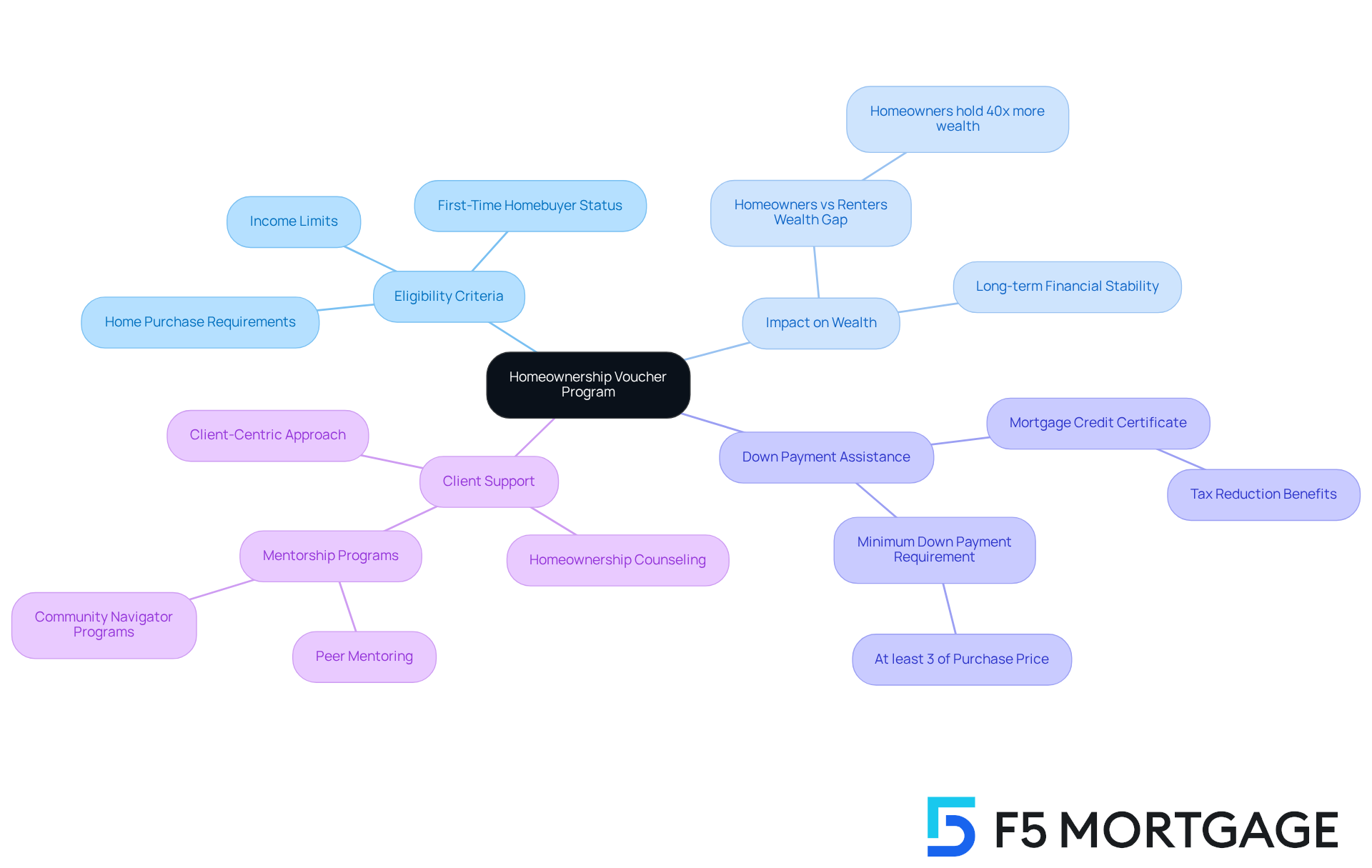

The is a lifeline for low-income households, allowing them to use housing vouchers to purchase a home. We understand how challenging the transition from renting to owning can be, and this initiative offers the to make that dream a reality. To ensure that help reaches those who need it most, participants must meet specific eligibility criteria, including .

Research shows that housing vouchers can significantly impact low-income families, facilitating their journey to homeownership and enhancing financial stability. In fact, households that successfully navigate this program often experience , with homeowners typically holding up to 40 times the wealth of renters.

In addition to the Homeownership Voucher Program, California offers various . For instance, the Mortgage Credit Certificate in Los Angeles County provides a dollar-for-dollar reduction of the buyer’s federal income tax liability. This tax advantage can greatly improve the affordability of owning a home for families.

At F5 Mortgage, we pride ourselves on our . Our 5-star reviews from satisfied customers reflect our expertise and unwavering support throughout the . We know how important it is for families to , and our commitment to is evident in everything we do. We’re here to .

Conclusion

Navigating the path to homeownership in Arizona can feel overwhelming, especially for first-time buyers and families with low to moderate incomes. We understand how challenging this can be. Fortunately, a variety of down payment assistance programs are available to make this dream more attainable. Initiatives like the F5 Mortgage Down Payment Assistance Program and the Arizona Home Plus Program are designed to provide essential financial support, ensuring that homeownership is within reach for many aspiring buyers.

In this article, we’ve highlighted key programs that showcase their unique benefits and eligibility criteria. For instance, the Home in Five Advantage initiative offers forgivable second mortgages, while the Arizona First-Time Home Buyer Tax Credit helps alleviate tax burdens. These resources empower families to overcome financial hurdles and take meaningful steps toward homeownership. Success stories from participants illustrate the positive impact of these programs, showing how they facilitate the transition from renting to owning a home.

Ultimately, the significance of these down payment assistance programs cannot be overstated. They provide immediate financial relief and foster long-term stability and community growth. For those considering homeownership in Arizona, exploring these options is a vital step toward achieving that goal. With the right support and resources, the dream of owning a home can indeed become a reality for many families, paving the way for a brighter future.

Frequently Asked Questions

What is the F5 Mortgage Down Payment Assistance Program?

The F5 Mortgage Down Payment Assistance Program is a customized initiative designed to empower Arizona homebuyers by providing personalized consultations and access to various loan options, including FHA and VA loans, to help families navigate property financing.

How does the F5 Mortgage program assist with the home buying process?

The program streamlines the purchasing process and offers an efficient pre-approval process that can be completed in less than an hour, enabling buyers to act quickly in a competitive housing market.

Who can benefit from the Arizona Home Plus Program?

The Arizona Home Plus Program is aimed at first-time homebuyers, particularly low to moderate-income families, providing up to 5% of the purchase price for down payments and closing costs.

What are the qualifications for the Arizona Home Plus Program?

Applicants must meet specific income limits and complete a buyer education program that provides essential information about homeownership responsibilities.

What is the Home in Five Advantage initiative?

The Home in Five Advantage initiative offers down payment assistance of up to 5% of the property purchase price for low and moderate-income households in Maricopa County, along with a forgivable second mortgage option.

How does the Home in Five Advantage initiative help families?

It helps families secure their ideal properties with lower initial expenses, making homeownership more accessible and reducing financial burdens.

What are the eligibility requirements for the Home in Five Advantage initiative?

Applicants must meet a minimum credit score requirement of 640 to qualify for assistance.

Does F5 Mortgage provide information on down payment assistance programs outside of Arizona?

Yes, F5 Mortgage also offers information on down payment assistance initiatives in California, Texas, and Florida, while primarily focusing on helping families navigate Arizona-specific programs.